TSD 100

Business Taxes

TSD 100 | Business Taxes Rev. August 2023 | West Virginia Tax Division

This publication provides general information and is not meant to be a substitute for tax laws or regulations.

Businesses must obtain a business registration certicate from the Tax Division before engaging in any business

activity in the state. Operating a business without a certicate is a serious offense and can be subject to a ne of

$100.00 per day for each day a business operates without properly registering. An additional penalty of $50.00

per month or fraction thereof may be imposed for conducting business prior to receiving a business registration

certicate or conducting business after a certicate has expired or is ceased.

• Upon registration, a tax account will be established for the business, and the appropriate tax reporting forms

will be provided.

• There are special licensing or bonding requirements for certain types of businesses, including employment

agencies, collection agencies, telemarketers, motor carriers and transient vendors.

• A separate certicate is required for each business location and must be displayed at all times.

• A business registration certicate is permanent until the business is relocated, closed, or until the certicate

is suspended, revoked or cancelled by the Tax Commissioner.

Registration Required

To register a business with the Tax Division

visit the WV One Stop Business Portal or

complete an “Application for Registration Certicate”

(Form WV/BUS APP) and pay a $30.00 registration fee.

Corporate Registration

To register a Corporation with the West Virginia Secretary of State, visit the WV One Stop Business Portal at

Business4.wv.gov. Corporate registration with the Secretary of State is NOT a substitute for a business

registration certicate from the Tax Division.

Corporation Net Income Tax

Any non-exempt corporation (domestic or foreign) that engages in business or that derives income from property,

activity or other sources in West Virginia is subject to the corporation net income tax.

• The starting point in computing West Virginia taxable income is the federal taxable income of the corporation.

The tax rate is 6.5%.

• For tax periods prior to January 1, 2022, multistate corporations are required to allocate certain types of

nonbusiness income to West Virginia and apportion their remaining income based on a three-factor formula

consisting of property, payroll and double-weighted sales factors. Beginning January 1, 2022, the

apportionment of income will be based on a single sales factor.

• Any taxpayer engaged in a unitary business with one or more other corporations must electronically le a

combined report that includes the income, allocation, and apportionment of income of all corporations that

are members of the unitary business.

Water's Edge reporting is required unless the taxpayer elects to report on a worldwide basis.

A taxpayer electing to report on a worldwide basis is required to do so for a period not less than ten

years.

• Estimated tax payments are required for every corporation that reasonably expects its West Virginia taxable

income to exceed $10,000. Estimated payments are due on the 15th day of the fourth, sixth, ninth and twelfth

months of the tax year. The annual return is due on the 15th day of the fourth month following the close of the

tax year.

2

TSD 100 | Business Taxes

Rev. August 2023 | West Virginia Tax Division

Pass-through entities must le the income tax informational return for S corporations and partnerships. Use Form

WV/SPF-100 for tax years 2019 and earlier and Form WV/PTE-100 for tax years 2020 and after. These forms are

also used to report and pay West Virginia withholding tax for nonresident shareholders or partners in a West

Virginia S corporation or partnership.

Income Tax for S Corporations & Partnerships

Personal Income Tax

• The personal income tax is imposed on the West Virginia taxable income of

resident individuals, estates and trusts.

Self-employed persons and sole proprietors who are not subject to

business taxes are taxed on business income to the extent that this

income is includable in federal adjusted gross income.

Nonresident individuals, estates and trusts are also subject to the tax on

the income they receive from West Virginia sources.

• The West Virginia personal income tax is a federal conformity statute, meaning that any term used in the State

income tax law has the same meaning as when it is used in a comparable context in federal income tax law.

• The starting point in determining West Virginia taxable income is federal adjusted gross income, with state law

providing increasing and decreasing modications.

• Marginal income tax rates range from 2.36% on taxable income under $10,000 to 5.12% on taxable income

over $60,000.

• The annual tax return is due on April 15. An extension of time granted to le the federal income tax return

automatically extends the time for ling the State tax return but does not extend the time for payment of any

tax due.

• An earned income exclusion is available for low-income taxpayers - individuals, heads of households and

married couples who have federal adjusted income of $10,000 or less if ling jointly, $5,000 or less if ling

separately, for the taxable year. “Earned income” includes wages, salaries, tips and other employee

compensation, including net income from self-employment.

• Persons who have West Virginia taxable income not subject to income tax withholding may be required to

make estimated tax payments. These payments are due on the 15th day of April, June and September of the

tax year, and January of the following year.

• Individuals who have made total payments of $50,000 during the preceding tax year may be required to le

and pay their West Virginia taxes electronically.

Withholding Tax

• Any employer who pays any wage or salary subject to the West Virginia personal income tax must deduct and

withhold the tax from such wages or salaries and remit the tax withheld to the Tax Division.

• An employer must remit the withheld tax on or before the 15th day of the succeeding month.

• Quarterly returns are due on or before the last day of the month following the end of the quarter.

• Employers who withhold less than $600 annually or employ certain domestic and household employees must

continue to le the annual return and pay the withheld amount annually and are not required to le a quarterly

return. For these employers only, the due date for the annual return is January 31st of the year succeeding

the year for which the withholdings are deducted and withheld.

• Beginning January 1, 2019, the threshold amount for electronic ling increased to $50,000.

• In addition, an employer must le a year-end reconciliation (Form WV/IT-103) of tax withheld separate from

the employer's quarterly return on or before January 31st following the close of the year for which the

withholdings are deducted or withheld. This form must be led with all withholding tax statements (W2s).

• Employers must furnish employees two copies of the withholding tax statement on or before January 31st.

Any employer who is required to le a withholding return for 25 or more employees/payees or uses a payroll

service must le all data by electronic media. Failure to do so can result in a penalty of $25.00 per employee for

whom the return was not led electronically. Those ling for 24 or fewer employees are encouraged, but are not

required, to le information electronically using MyTaxes. For additional withholding information, see Publication

TSD-381

For additional personal

income tax information,

see Publications

TSD-411, TSD-413,

TSD-418, TSD-432,

and TSD-443.

3

TSD 100 | Business Taxes

Rev. August 2023 | West Virginia Tax Division

Sales and Use Tax

• The consumers sales and service tax and the use tax require vendors to collect a tax from purchasers and to

remit all receipts to the Tax Division.

• The tax is imposed on the sale, lease or rental of tangible personal property and certain services but does not

apply to food and food ingredients intended for “human consumption”. All sales are presumed to be subject to

the tax unless an exemption is clearly established.

• Vendors who fail to collect the tax are personally liable for payment of the tax. Beginning July 1, 2021, a

vendor may assume or absorb the tax as long as the full amount of the tax is remitted to the Tax Division. “Tax

included” must be shown on the invoice.

• The State sales tax rate is 6%. The sales tax to be collected on any particular transaction is based on a

rounding system. The purchase price is multiplied by 6%, carried to the third decimal place and rounded up to

the next whole cent when the third decimal place is greater than four and rounded down to the lower whole

cent when the third decimal place is four or less.

• Certain businesses and organizations are allowed exemptions from the tax when they make purchases for use

or consumption in their exempt business activities. There are three ways in which these exemptions may be

claimed: (1) use of a tax exemption certicate; (2) a direct pay permit; or (3) a refund or credit of tax paid.

Tax exemption certicates can be provided by the purchaser on certain exempt transactions. Other

businesses may claim their exemption by applying to the Tax Division and being granted a direct pay

permit.

Persons granted direct pay permits pay sales tax on their taxable purchases directly to the Tax

Division.

The acceptance of a properly executed exemption certicate or proof of direct pay status from a

purchaser relieves the vendor of the duty to collect the sales tax.

All other persons must pay sales tax on purchases to the vendor and then apply for a refund or credit

of tax paid on their exempt purchases from the Tax Division.

• The use tax and the consumers sales and service tax laws are complementary. The State use tax rate is 6%.

The use tax is imposed on the use in this State of tangible personal property or services on which the West

Virginia sales tax has not been paid.

Foreign vendors doing business in this State must collect the tax on sales to their West Virginia

customers and remit the full amount of tax collected to the Tax Division.

A credit against the use tax is allowed for the amount of sales tax legally imposed by and paid to

another state.

The purchaser of property and services subject to the use tax is liable for the tax until it has been paid

to the vendor or paid directly to the Tax Division.

West Virginia has entered into reciprocal enforcement agreements with other states to ensure that

sales and use taxes are paid to the state to which they are due.

Price X 6% Tax Amount

$10.99 .600 $ .60

$29.99 1.799 $ 1.80

$66.74 4.004 $ 4.00

4

NonResident Sale of Real Estate

• A nonresident individual or nonresident entity transferring an interest in real property located in West Virginia

must have West Virginia income tax withheld unless the transaction is otherwise exempt from the income tax

withholding requirement.

• The person responsible for closing must le “Return of Income Tax Withholding for Nonresident Sale of Real

Property” (Form WV/NRSR) with the Tax Division.

• The amount withheld is equal to 2.5% of the total sale price less expenses or 6.5% of the estimated capital

gain.

Municipal Taxes

West Virginia municipalities have the authority to levy local sales and use taxes in their respective jurisdictions.

Municipal sales tax may be imposed by the municipality where the tangible personal property or taxable service is

delivered. Municipal sales and use tax is collected by the Tax Division and is reported on Form WV/CST-200CU

Schedule M.

In addition, certain cities may impose local registration taxes, license fees and other fees not collected by the Tax

Division. The major source of revenue for most West Virginia cities is a broadly based municipal business and

occupation tax. This tax is imposed on the privilege of engaging in certain business activities within the

municipality. The measure of the tax is gross receipts with no deductions for

the cost of doing business. There are different tax rates for different types of

business activities, and rates may vary from city to city.

Before beginning business, representatives of the proposed business should

contact the ofces of the cities in which they will be doing business to

determine each municipality’s requirements.

A growing number of West

Virginia municipalities impose

local sales & use taxes.

For a list of these municipalities,

visit our website at

www.tax.wv.gov

Business and Occupation Tax

• Public utilities, electric power generators and natural gas storage operators are subject to the business and

occupation tax. This tax is generally based upon gross receipts (public utilities), taxable generation capacity

(electricity generators) or net dekatherms (gas storage).

• Estimated tax payments are required.

Taxpayers whose tax liability exceeds $12,000 per year must pay in monthly installments.

Taxpayers with annual tax liabilities of less than $12,000 must le quarterly.

• Returns are due as follows:

Gas storage returns are due on the 20th day of the month following the close of the reporting period.

All other returns are due by the end of the month following the close of the reporting period, except

the monthly return for the month of May is due on or before June 15th.

TSD 100 | Business Taxes

Rev. August 2023 | West Virginia Tax Division

• All vendors must register with the WV Tax Division. Upon registration, a sales and use tax account will be

established, and the appropriate tax reporting form (WV/CST-200CU) will be supplied to the vendor.

Vendors who collect sales tax in excess of $250 a month must remit the tax monthly. If the average

monthly remittance is no greater than $250, the vendor may le on a quarterly basis. If the annual

aggregate sales and use tax to be remitted is $600 or less, the vendor may le only an annual return.

Returns are due the 20th day of the month following the close of the reporting period.

A sales and use tax return must be led even if no tax is collected or due. Returns may be led online

at MyTaxes.

• Taxpayers paying more than $25,000 in the prior tax year are required to le and pay electronically. Payments

can be made on our MyTaxes website at mytaxes.wvtax.gov. If you prefer to have your funds transferred

directly, you may otherwise apply for Electron Funds Transfer (EFT). Apply online or complete the Electronic

Funds Transfer Application (Form WV/EFT-5), and mail to:

WV Tax Division, RD-EFT

PO Box 11895

Charleston, WV 25339-1895

5

Excise Taxes

The State imposes excise taxes on certain products. Excise taxes are normally paid by the manufacturers or

distributors of these products and the tax is then included in the sales price. Wholesalers, retailers and others who

purchase any of these products on which the excise tax has not been paid must report these purchases and pay

the tax. State excise taxes are imposed on gasoline and special fuels, alcohol, tobacco products, soft drinks and

soft drink syrups and powders, and medical cannabis. Appropriate tax accounts for persons subject to these

excise taxes will be established when they register with the West Virginia Tax Division.

TSD 100 | Business Taxes

Rev. August 2023 | West Virginia Tax Division

Severance Taxes

Unemployment Tax

• The severance tax is imposed on the privilege of engaging or continuing in the activity of severing, extracting,

reducing to possession and producing for sale, prot or commercial use any natural resource product. Certain

types of processing and treatment of natural resources are also subject to the tax.

• The measure of the tax is the total gross value of the natural resource products severed. In the case of a

processor who purchases natural resources and processes them into commercially usable products, the tax

base is the value added by processing.

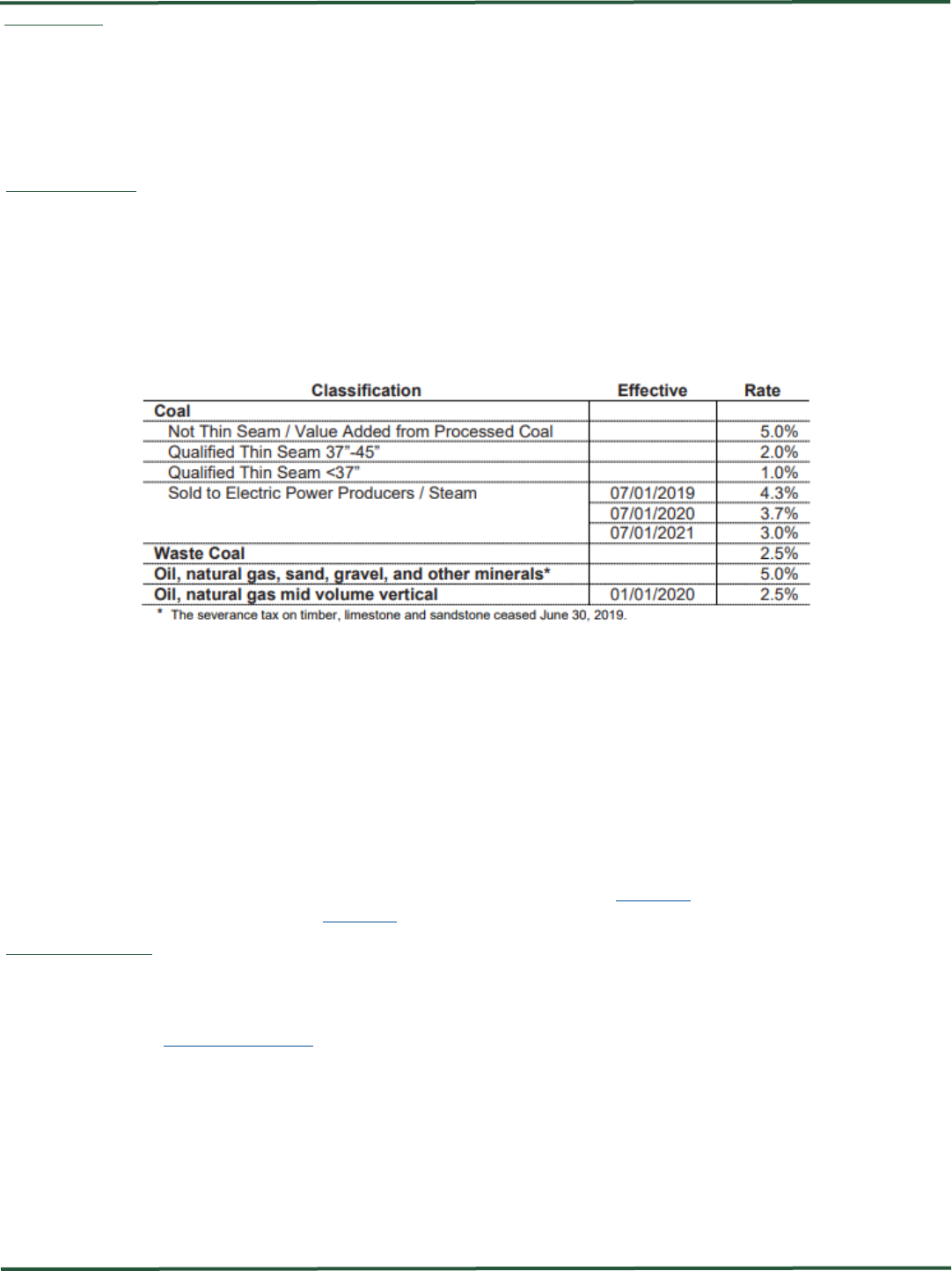

• The severance tax rates are:

• All taxpayers are allowed a $500 annual exemption to the severance tax, but the exemption is pro-rated to

reflect that portion of the year that the taxpayer was actually engaged in business.

• Estimated tax payments are required. Taxpayers must pay in monthly installments. All tax returns and

payments are due at the end of the month following the close of the reporting period, except the monthly

return for the month of May is due on or before June 15th.

• An annual minimum severance tax of 75 cents per ton is imposed on coal that is sold or delivered for sale,

prot or commercial use. A special two cents per ton tax is imposed on producers of coal. The measure of the

tax is “tons of clean coal” that were produced by the seller of the coal and sold during the reporting period. An

additional tax is levied on coal at $0.35 cents per $100 to benet local governments which is included in the

rate table above.

• For additional information on coal severance taxes, see Publication TSD-210. For additional information on

timber severance, see Publication TSD-211.

When a business registers with the Tax Division, we provide appropriate information to Workforce West Virginia.

Workforce West Virginia provides employers with the necessary forms and instructions concerning the

Unemployment Tax. For information concerning employment security taxes, please visit the WV One Stop

Business Portal at Business4.wv.gov or contact:

Workforce West Virginia

1321 Plaza East Shopping Center

Charleston, WV 25301

Telephone: (304) 558-2677

6

For more information, you can:

• Call a Taxpayer Services

Representative at

(304)558-3333 or

toll-free at (800) 982-8297

• Go Online to tax.wv.gov

Business Investment Credits

For information on the advantages of doing business in West Virginia contact:

West Virginia Development Ofce

1900 Kanawha Boulevard, East Capitol Complex

Building 6, Room 553

Charleston, WV 25305

Telephone: (304) 558-2234

TSD 100 | Business Taxes

Rev. August 2023 | West Virginia Tax Division

Property Taxes

• In West Virginia, property taxes are levied by the State, county governments, county boards of education

and municipalities and are collected by the sheriffs of each of the 55 counties.

• Each county and municipality can impose its own rates of property taxation within the limits set by the West

Virginia Constitution. The West Virginia Legislature sets the current levy rate of tax used by all county boards

of education statewide. However, the total tax rate for county boards of education may differ from county to

county due to excess levies.

• There are four classes of property in West Virginia, and the levy rates vary by class and location of the

property within each county.

• If you have questions concerning property taxes on specic property, you should contact the county

assessor of the county in which the property is located.

• The State provides a wide range of tax credits to encourage business development and increase employment

opportunities. Some of the tax credits provided are: Industrial Expansion and Revitalization Credit for Electric

Power Producers (W.Va. Code § 11-13D); Coal Loading Facilities Credit (W.Va. Code §11-13E); Economic

Opportunity Tax Credit (W.Va. Code §11-13Q); Manufacturing Investment Tax Credit (W.Va. Code §11-13S).

• For additional information on various West Virginia tax credits, see Publication TSD-110.