508-

5/6/2020-mh

Ready-Now ➔ Future-Ready

The U.S. Postal Service

Five-Year Strategic Plan

FY2020-FY2024

2 Ready-Now ➔ Future-Ready — The U.S. Postal Service Five-Year Strategic Plan FY2020-FY2024

Page intentionally left blank

The U.S. Postal Service Five-Year Strategic Plan FY2020-FY2024 — Ready-Now ➔ Future-Ready 3

Contents

Contents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3

Letter From the Postmaster General and the Chairman of the Board of Governors . . . . . . . . . . . . .5

Executive Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7

Purpose of This Document

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7

Postal Service Mission . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7

Vision for 2024

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7

Current Business Environment and Key Trends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .8

U.S. Postal Service’s Mission, Current Business Conditions, and Vision for the Future . . . . . . . . . . 10

Mission — Bind the Nation Together. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .10

Governance

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Overview of the U.S. Postal Service Today. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .10

Our Vision for 2024 — A Financially Sustainable Postal Service

that Delivers Products and Services that Customers Value in a Digital Economy . . . . . . . . . . . . . .17

USPS Ready-Now – Future-Ready Goals and Key Strategies for FY2020-FY2024 . . . . . . . . . . . . . 20

Goal 1: Deliver World-Class Customer Experiences . . . . . . . . . . . . . . . . . . . . . . . . . . . .20

Goal 2: Equip, Connect, Engage, and Empower Employees to Best Serve USPS Customers

. . . . . . . 22

Goal 3: Innovate Faster to Deliver Value

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .23

Goal 4: Invest in Our Future Platforms . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

Goal 5: Support the Legislative and Regulatory Changes to Enable This Vision . . . . . . . . . . . . . . 28

How We will Measure Success . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

Conclusion: Delivering Excellent Service Today Is the Key to Future Success

. . . . . . . . . . . . . . . 33

Appendices

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

Appendix A: USPS National Performance Assessment System . . . . . . . . . . . . . . . . . . . . . . 35

Appendix B: Postal Service Strategic Planning Stakeholder Outreach Efforts . . . . . . . . . . . . . . . 37

Appendix C: Postal Service Products and Services

. . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

Appendix D: Selected Links to Learn More or Provide Feedback . . . . . . . . . . . . . . . . . . . . . 41

Additional Information

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .43

Trademarks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

Year References . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .43

4 Ready-Now ➔ Future-Ready — The U.S. Postal Service Five-Year Strategic Plan FY2020-FY2024

Page intentionally left blank

The U.S. Postal Service Five-Year Strategic Plan FY2020-FY2024 — Ready-Now ➔ Future-Ready 5

Letter From the Postmaster General and the Chairman of the Board of Governors

Nearly every person in America experiences the Postal

Service brand every day — by saying hello to their mail

carrier; passing postal vehicles on the street; visiting

a Post Ofce or usps.com; using a USPS mobile

application; conducting mailing and shipping business;

or just by the simple act of reading one’s mail.

This daily brand experience — and the value the Postal

Service delivers — continue to evolve for our residential

and business customers as we provide more services

and offerings that keep pace with their ever-changing

needs. From fueling America’s e-commerce economy

with next-day and Sunday delivery, to delivering digital

and mobile tools like Informed Delivery, or providing

real-time mailing data that allows senders to improve

the efciency of their marketing, the organization is

always on a transformative journey to better serve the

nation.

This ve-year strategic plan describes the next stage

in our organizational journey. It provides Congress, the

Administration, postal stakeholders, and the American

public with a clear understanding of our mission, our

business, our nancial condition, and the strategies

that will carry the organization forward over the next ve

years. The title “Ready-Now — Future-Ready” reects

a mindset that shapes postal decision-making: prepare

relentlessly for today’s opportunities and those ahead.

In this document, we discuss the core strategies

necessary for the Postal Service to be a nancially

sustainable organization that delivers services the

American public values in an increasingly digital

economy. We also identify the initiatives we plan to

implement to achieve the following goals:

Goal 1. Deliver world-class services and customer

experiences.

Goal 2. Equip, connect, engage, and empower

employees to serve our customers.

Goal 3. Innovate faster to deliver value.

Goal 4. Invest in future platforms.

Goal 5. Pursue legislative and regulatory changes

necessary to achieve nancial sustainability.

You will also nd a discussion of the current nancial

challenges facing the organization. The most signicant

issue facing the Postal Service today is that our

business model is unsustainable. This is due to

increasingly conicting mandates to be self-funding,

compete for customers, and meet universal service

obligations under highly regulated and legislated

constraints. Resolving these conicting mandates

requires a national public policy discourse that hinges

on a basic question for the American public: What

would you like the Postal Service to become and how

would you like to pay for it?

Because the Postal Service is an independent

entity of the executive branch, the Postal Service

today operates like a large business, but with

a public service mission. Our mission and our

role in America’s economy and society remain

indispensable — but we can only continue to

compete effectively and meet the high expectations

of the public with an improved business model.

Surveys continue to nd the Postal Service is America’s

most trusted and well-regarded government entity. The

633,000 men and women of the Postal Service — who

live, work, and serve in every community in America

— earn that trust every day through regular delivery

services that are secure, reliable, affordable, and

universal. We intend to continue to earn their trust and

high regard over the next ve years.

We hope you nd this strategic plan informative and

useful. The goals and strategic initiatives identied in

this ve-year plan are subject to change by the Board of

Governors as changes in strategy become necessary or

business conditions warrant. Thank you for your interest

and engagement in the future of the Postal Service.

Megan J. Brennan

Postmaster General and Chief Executive Ofcer

United States Postal Service

Robert M. Duncan

Chairman, Board of Governors

United States Postal Service

6 Ready-Now ➔ Future-Ready — The U.S. Postal Service Five-Year Strategic Plan FY2020-FY2024

Page intentionally left blank

The U.S. Postal Service Five-Year Strategic Plan FY2020-FY2024 — Ready-Now ➔ Future-Ready 7

Executive Summary

Purpose of This Document

The Postal Service’s Five-Year Strategic Plan, covering

the scal years (FYs) 2020 to 2024, is intended to

provide our stakeholders, including the President,

Congress, the American people, our employees,

business partners, and customers with the following:

A comprehensive mission statement covering the

major operations of the Postal Service.

An identication of the key factors external to the

Postal Service and beyond our control that could

signicantly affect the achievement of our overall

goals and objectives.

A description of the Postal Service’s overall goals

and objectives, aligned with National Performance

Assessment (NPA) goals and annual performance

targets.

1

A description of the program evaluations used

in establishing or revising overall goals and NPA

system objectives.

This document satises the reporting requirements

articulated in 39 United States Code (USC) Section

2802. The goals and strategic initiatives identied in

this ve-year plan are subject to change bythe Board

of Governors(BOG) as changes in strategy become

necessary or business conditions warrant.

Postal Service Mission

The Postal Service is an essential part of the fabric of

our great country and continues to serve a vital role in

our society and in the economy. The Postal Service is a

basic and fundamental service provided to the people

by the government of the United States, with a mission

to provide prompt, reliable, and efcient services to our

customers in all areas and all communities. By providing

universal mailing and shipping services to all Americans,

regardless of where they live, we help to bind the

nation together through the delivery of the personal,

educational, literary, and business correspondence

of the people, and we help to make the fruits of the

American economy accessible to everyone through our

package delivery offerings.

1

The FY2020 Integrated Financial Plan (IFP) information contained in this document

will be revised if needed upon approval by the Board of Governors.

We are also required to fulll this universal service

obligation (USO), and meet other statutory obligations,

in a self-sufcient manner, by covering our costs through

revenues generated from the sale of our products and

services. To help ensure the funding needed to meet the

USO, the law establishes the Private Express Statutes

and the mailbox access rule, which together comprise

the postal monopolies. Since any obligation must be

matched by the capability to meet that obligation, the

USO, the Private Express Statutes, and the mailbox

access rule are inextricably linked.

Vision for 2024

In 2024, we envision a nancially sustainable Postal

Service that enables all Americans to connect,

businesses to grow, and communities to thrive in

an increasingly digitally-connected world, including

individuals in rural or urban communities that are

digitally underserved. Specically we envision a Postal

Service grounded in its core public service mission

of providing universal, affordable, high-quality mail

and parcel delivery to all Americans, and expanding

that public service mission to include the provision

of essential e-government services. We envision a

business model that enables the exibility to best serve

the changing needs of our customers and respond to

marketplace trends, including continued and signicant

declines in mail volumes due to electronic diversion and

continued, but lower growth, in parcel deliveries due to

increased last-mile competition. We envision a Postal

Service that is an employer of choice able to attract,

retain, and develop high-quality, customer-focused

employees. And nally, we envision that the Postal

Service will maintain its position as the world’s most

efcient and affordable postal operator and the most

trusted federal agency.

To realize this vision, we intend to make the following

broad transformations over the next ve years:

Transform our services from only providing a physical

delivery into a service that also enables a digital

connection and provides other value-added services.

Transform our last-mile operations from the most

efcient last-mile mail delivery service provider into

the most efcient local logistics and e-commerce

delivery platform.

8 Ready-Now ➔ Future-Ready — The U.S. Postal Service Five-Year Strategic Plan FY2020-FY2024

Transform our middle-mile operations from a xed

processing and transportation network into an

adaptive and resilient national and international

logistics ecosystem.

One thing will remain the same: we will maintain the

trust of the American people by delivering excellent

services every day.

The Postal Service cannot realize this vision alone.

Though this ve-year plan lays out our efforts to make

this vision a reality, creating a nancially sustainable

Postal Service requires changes to existing laws and

regulations as well as new agreements with our labor

unions. Ultimately, Congress determines the contours

of the Postal Service’s statutory business model and

therefore has the unique authority to enable this vision

or direct the Postal Service toward a different vision.

We will continue to do all that we can within our current

authorities to effectively manage the Postal Service

while we work with the Administration, Congress, and

the Postal Regulatory Commission (PRC) to identify

options and implement the necessary changes that will

enable nancial sustainability and best meet the needs

of the American public.

Current Business Environment

and Key Trends

To fulll our USO in 2019, we provided access

through 26,362 Postal Service-managed Post Ofces;

4,960 stations, branches, and carrier annexes; and

55,000 other access points comprising a network of

commercial outlets which sell stamps on our behalf.

Many of our services can also be accessed through our

website, usps.com. On an average day, our 633,000

employees processed and delivered 471 million

mailpieces to nearly 160 million delivery points, utilizing

approximately 204,000 delivery vehicles, 8,500 pieces

of automated processing equipment, and a variety of

transportation methods to move mail and packages

through this large network, including contracted

highway and air transportation.

Over the last decade, the Postal Service has deployed

market-leading innovations in the mail and parcel

delivery services and improved productivity. We

pioneered Sunday package delivery and became a

leader in providing last-mile package delivery services.

These innovations and product expansions have

enabled us to more than double package revenues

(to $22.8 billion in FY2019) and more than triple the

contribution provided by packages to institutional costs

(to 24.7 percent in FY2019). Innovations, such as

Informed Delivery, are enhancing the utility of mail as an

advertising medium in the digital age and are used by

more than 20 million Americans.

We are consistently rated the most favorable and

trusted U.S. federal agency (a 2019 Pew Opinion Poll

reported 90 percent of Americans have a favorable

view of the Postal Service) and the most affordable and

efcient postal operator across the world’s 20 largest

economies (G20 economies). Oxford Consulting reports

in 2012 and 2017, Delivering the Future: How the G20’s

Postal Services Are Meeting the Challenges of the 21st

Century, ranked us the highest overall rated postal

provider and noted that we deliver more parcels and

letters per full-time equivalent employee than any other

G20 Post.

The Postal Service operates in a very dynamic and

competitive mail and package delivery marketplace.

Total volume of First-Class Mail and Marketing Mail has

declined by 34 percent (approximately 66 billion pieces)

since 2007 due to the proliferation of electronic bill

presentment and payment, social media platforms, and

e-mail. Package volumes, which have almost doubled

since 2007 and have been the Postal Service’s primary

source of revenue growth, began to demonstrate

slowing growth beginning in 2017, with growth ceasing

entirely in the last two quarters of 2019, as commercial

customers insourced more of their last-mile deliveries.

These trends are projected to continue over the next

ve years.

The following statutory and regulatory constraints have

limited our ability to respond to market forces:

A Consumer Price Index-based price cap for mail

products, representing 67 percent of revenues,

results in prices that are insufcient to provide

adequate revenue to pay for xed universal service

obligation costs and other legally mandated costs

amid secular volume declines.

The universal service obligation to maintain six-day-

a-week mail delivery to all geographies and to keep

unprotable retail locations open results in a large

proportion of costs being devoted to delivery and

retail operations that deliver less mail to an ever-

increasing number of delivery points.

The U.S. Postal Service Five-Year Strategic Plan FY2020-FY2024 — Ready-Now ➔ Future-Ready 9

Federally-mandated retiree and employee benet

programs result in high benet costs that are

growing faster than the rate of ination.

In combination, these factors have led to a large

nancial decit. Since 2007, we have suffered 13 years

of consecutive net losses, totaling $77.8 billion. Our

nancial challenges reect the simple dynamic that our

largely xed and mandated costs continue to rise at a

faster rate than the revenues we are able to generate

in the competitive marketplace. Though the lump-sum

and amortization expenses for prefunding retiree health

benets (RHB) (excluding normal costs) account for

approximately 74 percent of our cumulative net losses

over the last 13 years, these losses were partially offset

by revenue growth from growing package volumes,

a temporary exigent price increase for mail, and cost

reductions. As we look to the next ve years with the

prospect of continued price caps on mail, increased

competition for package deliveries, and rising USO

costs, resolving only the RHB funding issue will not ll

our projected nancial gap.

Our nancial condition can be improved, and the Postal

Service can continue to be self-reliant. The Postal

Service’s problems are readily identiable, and their

solutions are implementable. While it is incumbent

upon Congress and the PRC to address structural and

business model deciencies before the decit grows

even larger and requires more drastic and politically

difcult solutions, the Postal Service will continue to

implement all cost-reduction and revenue-generation

measures available under existing law.

Postal Service Ready-Now — Future-Ready Plan

for FY2020-FY2024

This strategic plan describes our mission, vision, and

strategic goals, and how they are enabled by our

strategic initiatives, NPA metrics, and related annual

performance targets. This plan also describes in greater

detail our current and projected challenges, denes how

the Postal Service will respond to these challenges, and

identies where we will need support from Congress

and the PRC.

While our nancial challenges remain signicant, we

remain committed to building our vision of the Postal

Service. Therefore, while we work with external

stakeholders, Congress, the Administration and the

PRC, we will continue to do everything within our

authority to make our vision a reality and to continue to

deliver excellent and efcient services to every customer

every day. That is why we titled our plan, Ready-Now

— Future-Ready. Our ability to prepare for an uncertain

tomorrow while delivering excellent services today

requires that we focus on the following ve strategic

goals:

Goal 1. Deliver world-class services and customer

experiences.

Goal 2. Equip, connect, engage, and empower

employees to serve our customers.

Goal 3. Innovate faster to deliver value.

Goal 4. Invest in future platforms.

Goal 5. Pursue legislative and regulatory changes

necessary to achieve nancial sustainability.

These ve Ready-Now — Future-Ready goals will

drive everything we do. We will measure our progress

against them using our NPA performance measurement

system and incent employee efforts through our pay-

for-performance (PFP) system. A focus on the customer

experience — delivered by an equipped, connected,

engaged, and empowered workforce — enables us to

innovate faster and invest strategically in our future to

meet the needs of our customers and the communities

we serve. We will publish our progress against the

goals contained in this plan, describe lessons learned,

and identify how we plan to improve every year in

our “Annual Performance Plan” as part of the Postal

Service’s Annual Report to Congress. The strategic

initiatives identied in the USPS Five-Year Strategic

Plan for FY2020–FY2024 are subject to change

by the Board of Governors if revisions in strategy

become necessary or business conditions warrant.

10 Ready-Now ➔ Future-Ready — The U.S. Postal Service Five-Year Strategic Plan FY2020-FY2024

U.S. Postal Service’s Mission, Current Business

Conditions, and Vision for the Future

Mission — Bind the Nation Together

Title 39 Section 101(a) of the USC states that the

United States Postal Service shall be operated as a

basic and fundamental service provided to the people

by the Government of the United States, authorized by

the Constitution, and created by an Act of Congress.

The Postal Service shall have as its basic function

the obligation to provide postal services to bind the

nation together through the personal, educational,

literary, and business correspondence of the people. It

shall provide prompt, reliable, and efcient services to

patrons in all areas and shall render postal services to all

communities. The costs of establishing and maintaining

the Postal Service shall not be apportioned to impair the

overall value of such service to the people. The Postal

Service shall provide a maximum degree of effective and

regular postal services to rural areas, communities, and

small towns where Post Ofces are not self-sustaining.

The central tenet of this statutory public service mission

is a universal service obligation (USO) to provide

prompt, reliable, and efcient postal services to all

Americans, regardless of where they live. The Postal

Service is also required to fulll its universal service

mission, and meet its other statutory obligations, in a

self-sufcient manner, by covering its costs through

revenues generated from the sale of its products and

services. To help ensure the funding needed to meet

the USO, the law establishes the Private Express

Statutes and the mailbox access rule, which together

comprise the postal monopolies. Since any obligation

must be matched by the capability to meet that

obligation, the USO, the Private Express Statutes, and

the mailbox access rule are inextricably linked.

Governance

The U.S. Postal Service was established under the

provisions of the Postal Reorganization Act (the

Reorganization Act) of 1970, Public Law 91-375, 84

Stat. 719, as amended by the Postal Accountability and

Enhancement Act of 2006 (PAEA), Public Law 109-435,

120 Stat. 3198, as an independent establishment of

the executive branch of the Government of the United

States, under the direction of a Board of Governors

(BOG), with the Postmaster General (PMG) as its Chief

Executive Ofcer. The Board of Governors of the Postal

Service (the Board) directs the exercise of its powers

through management that is expected to be honest,

efcient, economical, and mindful of the competitive

business environment in which the Postal Service

operates. The Board is authorized to consist of 11

members: nine Governors appointed by the President

(with the advice and consent of the Senate, to

represent the public interest generally), the Postmaster

General, and the Deputy Postmaster General.

Overview of the U.S. Postal Service Today

The Postal Service delivers a unique service to the

American people and the economy alike by delivering

mail and packages throughout the United States.

In fullling its mandate, the Postal Service provides

services across all regions and to all areas of the

United States irrespective of population density or

socioeconomics, including rural areas, small towns,

and urban areas where Post Ofces are not necessarily

nancially self-sustaining. USPS does not receive tax

dollars and relies solely on the sale of postage, products

and services to fund its operations.

To fulll our USO in 2019, we provided access

through 26,362 Postal Service-managed Post Ofces;

4,960 stations, branches, and carrier annexes; and

55,000 other access points comprising a network of

commercial outlets which sell stamps on our behalf.

Many of our services can also be accessed through

our website, usps.com. On an average day in 2019,

our 633,000 employees processed and delivered 471

million mailpieces to nearly 160 million delivery points,

utilizing approximately 204,000 delivery vehicles,

8,500 pieces of automated processing equipment,

and a variety of transportation methods to move mail

and packages through this large network, including

contracted highway and air transportation.

The Postal Service is a powerful marketing and

communications partner for businesses across

diverse sectors in the United States, including retail,

health care, real estate, and nancial services.

USPS fullls the essential function of delivering bills,

statements, correspondence, packages, catalogs,

and a wide range of marketing materials on behalf

The U.S. Postal Service Five-Year Strategic Plan FY2020-FY2024 — Ready-Now ➔ Future-Ready 11

of these companies, thus facilitating millions of

daily transactions for virtually every commercial

entity in America, as well as providing the means

for remitting payments for millions of consumers.

Additionally, through its shipping services, the Postal

Service is a partner to consumers, and to both

brick-and-mortar and online retailers in growing

their businesses to meet rising consumer delivery

expectations from e-commerce. The Postal Service’s

last-mile resources deliver to every address to

satisfy the requirement of the USO, thus enabling

all Americans, no matter how remote their location,

to have access to parcel delivery, and to therefore

participate fully in today’s e-commerce economy.

The Postal Service is consistently rated the most

favorable and trusted U.S. federal agency (a 2019

Pew Opinion Poll reported 90 percent of Americans

have a favorable view of the Postal Service) and the

most affordable and efcient postal operator across

the G20 economies. In 2012 and 2017, the Oxford

Consulting report, Delivering the Future: How the G20’s

Postal Services Are Meeting the Challenges of the 21st

Century, ranked the Postal Service the highest overall

rated postal provider and noted that it delivers more

parcels and letters per full-time equivalent than any

other G20 Post.

Postal Service Offerings, Classication, and Pricing

The Postal Service generates revenues primarily by

offering mail and parcel delivery services to domestic

and international markets. It monitors and reports

revenue by mail classes, products, and shapes.

Appendix C contains a description of USPS current

services and the historical mail volumes and revenues

by category of service. Prices and fees are established

by the Postal Service’s Governors and are subject to a

review process by the Postal Regulatory Commission

(PRC). The Postal Service offers two categories of

products, which are classied for regulatory purposes

as Market-Dominant services and Competitive

services. Each category is subject to different pricing

requirements established by statute and PRC

regulation.

Market-Dominant services account for approximately

67 percent of the Postal Service’s annual operating

revenues. Such services include, but are not limited to,

First-Class Mail, Marketing Mail, Periodicals, and certain

parcel services. Price increases for these services are

currently generally subject to a price cap based on the

Consumer Price Index for All Urban Consumers (CPI-U),

though the PRC has the authority to revise or eliminate

the price cap and create an alternative regulatory

structure for Market-Dominant services. Reclassication

of services from Market-Dominant to Competitive

requires PRC approval.

Competitive services, such as Priority Mail, Priority

Mail Express, First-Class Package Services, Parcel

Select, Parcel Return Service, and some types of

International mail, have greater pricing exibility and

are not limited by a price cap. By law, prices for each

Competitive service must be set so that each service

covers its “attributable costs” (meaning the Postal

Service’s costs attributable to such service through

reliably identied causal relationships), and Competitive

services collectively must contribute an appropriate

share to the institutional costs of the Postal Service

(meaning the Postal Service’s costs that cannot be

attributed to specic products). The appropriate share

is determined by a formula, and is currently 8.8 percent

for FY2019, as determined by the PRC. In general, the

Postal Service attempts to set its prices for Competitive

services at rates that maximize contribution.

Current Business Conditions

Over the last decade, the Postal Service has deployed

market-leading innovations in the mail and parcel

delivery services and improved productivity. We have

been pioneers in Sunday package delivery and became

a leader in providing last-mile package delivery services.

These innovations and product expansions have

enabled us to more than double package revenues

(to $22.8 billion in FY2019) and more than triple the

contribution that packages provide to cover institutional

costs (to 24.7 percent in FY2018). Innovations, such as

Informed Delivery, are enhancing the utility of mail as an

advertising medium in the digital age and are used by

more than 20 million Americans.

Over the same period, we have implemented

aggressive cost controls that have resulted in signicant

cost savings even as delivery points grew by over 9

million. We have reduced the total number of career

employees by more than 84,000 by restructuring

delivery routes, reducing lobby hours at 13,000

underutilized retail ofces, and consolidating mail

processing at more than 360 facilities. In addition,

we negotiated labor agreements which allowed

us to increase our non-career workforce and to

12 Ready-Now ➔ Future-Ready — The U.S. Postal Service Five-Year Strategic Plan FY2020-FY2024

introduce a lower-tier wage schedule for new career

employees, which we have maintained through

subsequent contracts. We have negotiated health

benets contributions with our unions that bring many

of our employees to parity with the rest of the federal

government. Through the dedication and hard work of

our employees, we have accomplished all of this while

consistently being rated the most favorable and trusted

federal agency and the most efcient and affordable

postal operator in the industrialized world.

However, the combination of unfavorable market

dynamics, legal restrictions on price increases and cost

reductions, an expanding universal service requirement,

and growing employee pension and health benet

funding requirements have put the Postal Service in an

unsustainable nancial condition.

Since 2007, we have suffered 13 years of consecutive

net losses totaling $77.8 billion, with an $8.8 billion net

loss in 2019 alone. Of those losses, $54.8 billion were

directly attributable to Postal Service Retiree Health

Benets Fund (PSRHBF) lump sum payments that

were due between 2007 and 2016. An additional $8.7

billion was attributable to PSRHBF normal cost and

amortization payments due between 2017 and 2019,

and $8.2 billion due to amortization expenses for the

Civil Service Retirement System (CSRS) and Federal

Employee Retirement System (FERS). Altogether, these

retirement-related lump sum payment requirements

totaled $76.3 billion from 2007-2019, or roughly 98

percent of losses. Even when PSRHBF normal costs

are excluded, PSRHBF lump-sum payments, plus

FERS, CSRS, and PSRHBF amortization expenses total

$65.5 billion, or 84 percent of 2007–2019 losses.

Although the vast majority of the recent net losses are

attributable to the retirement benet-related lump sum

payments, structural changes in the marketplace have

had a signicant impact on our nancial results. These

include declines in high-contribution mail volume, a

rigid rate structure on Market-Dominant products which

limits our ability to raise prices, limited product freedom

which inhibits our ability to introduce new products, and

high legislatively-mandated costs.

Unfortunately, growth in the packages business and

signicant cost reductions have not been enough to

forestall 13 consecutive years of net losses. As a result,

we have been forced to default on PSRHBF prefunding

payments, PSRHBF normal cost, and PSRHBF,

CSRS, and FERS amortization payments. We have

an underfunded balance sheet, signicant debt, and

insufcient cash to weather unforeseen cyclicality or

changes in business conditions.

Growing Package Revenues and Cost Reductions Are

Insufficient to Offset Growing Mandated Costs

Our revenues have declined almost 5 percent over

the last 13 years, with a growing proportion coming

from Package Services (from 13 to 32 percent) as

shown in Exhibit 1. Since the low point in 2012, our

total revenues have grown almost 9 percent, when

revenue gains from Package Services began offsetting

the declines in mail revenues. Package revenue growth

was driven primarily by volume growth due to the

affordability and scope of our last-mile delivery services.

Mail revenue losses have been due to declines in

mail volumes. The greatest volume decline has

been experienced in First-Class Mail, our most

protable product, where volumes have declined

by more than 40 billion pieces, or 43 percent,

since 2007. Marketing Mail, which comprises the

majority of our mail volumes, declined by more than

27 billion pieces (26 percent) from 2007 to 2018,

mainly due to the increasing diversion of advertising

spending from Marketing Mail to digital media

(the internet, email, mobile, or social media).

The U.S. Postal Service Five-Year Strategic Plan FY2020-FY2024 — Ready-Now ➔ Future-Ready 13

Exhibit 1. Trend in Total USPS Revenue by Product

Also between 2007 and 2019, the number of delivery

points (excluding Post Ofce Boxes, or PO Boxes)

increased by 10 percent, or 12.8 million. During this

same time, pieces delivered per delivery point fell

by 39 percent, and revenue per delivery point fell by

14 percent, but cost per delivery point fell only by 9

percent. In 2019, our large physical footprint required

to serve the 160 million delivery points six days a

week amounted to 31,000 Post Ofces, stations,

and branches with approximately 633,000 total

employees. Additionally, approximately 36 percent of

retail locations are retained (as required by law) despite

being unprotable. As a result of a combination of these

factors and price caps on 67 percent of our revenues,

we lost over $62 per delivery point served in 2019.

This is due to the fact that the signicant and growing

institutional costs driven by the USO and our large

retirement-related liabilities are incurred regardless of

the volume delivered.

CPI Price Cap Has Resulted in Undersized Revenues for an

Oversized Universal Mail Delivery Service

The price cap on Market-Dominant products

signicantly disadvantages the Postal Service; relatively

low postage rates and a lack of pricing exibility are

key contributors to our nancial situation. As a result,

in 2019 the Postal Service lost about 6.1 cents for

every piece delivered and that gap will widen in the

future, as costs will continue to grow, especially for

mandated federal benets programs, while revenue

growth is constrained by the Consumer Price

Index (CPI) price cap and competitive dynamics.

The Postal Service has the lowest price relative to

comparable international posts. As shown in Exhibit

2, our First-Class Mail single-piece postage rates are

dramatically below the average of other comparable

global posts. Further evidence of the Postal Service’s

inadequate pricing can be seen by comparing margins

of earnings before taxes (EBT) of the Postal Service to

those of the most comparable global posts. The Postal

Service’s average EBT margin over the past ve years

was negative 7 percent, in sharp contrast to the break-

even or positive EBT margins for our foreign post peers

charging higher rates for products comparable to

First-Class Mail.

14 Ready-Now ➔ Future-Ready — The U.S. Postal Service Five-Year Strategic Plan FY2020-FY2024

Exhibit 2. Rate Comparison of the Postal Service to Other Global Posts

A Competitive Landscape Across all Services

Notwithstanding the regulatory classication of

Postal Service products as Market-Dominant and

Competitive, we compete for business across all

of our different market segments. A wide variety of

communications media channels compete for the

same types of transactions and communications that

are conducted using our mail delivery services. These

channels include, but are not limited to, newspapers,

telecommunications, television, email, social

networking, and electronic funds transfers.

The most signicant competitor for First-Class

Mail is digital communication, including electronic

mail, and other digital technologies such as online

bill payment and presentment. For Marketing

Mail, digital forms of advertising, including email,

digital mobile advertising and social media, are

the most signicant forms of competition.

The package and express delivery business is highly

competitive, with both national and local competitors.

The primary competitors of our Shipping and Package

services are FedEx and United Parcel Service, Inc.

(UPS), as well as other national, regional, and local

delivery companies and crowd-sourced carriers, many

of which are also customers of the Postal Service for its

last-mile services.

The Postal Service’s Shipping and Package business

competes on the basis of the breadth of our service

network, convenience, reliability, and affordability of the

service provided. Although the Postal Service competes

with FedEx, UPS, Amazon, and others when shipping

packages long distances, our existing door-to-door

The U.S. Postal Service Five-Year Strategic Plan FY2020-FY2024 — Ready-Now ➔ Future-Ready 15

delivery mandate has historically proven cost-effective

for competitors to outsource many of their last-mile

deliveries to the Postal Service. The growth in our

Competitive products revenue over the past ve years

is largely attributable to our Parcel Select product,

which provides last-mile delivery for parcels deposited

deep into our network (typically at the delivery unit).

However, the Postal Service has more recently seen

increased competition in last-mile delivery from both

current customers and traditional competitors. The

major Parcel Select customers are actively building out

their own last-mile delivery capabilities to enable them

to divert volume away from the Postal Service. This

resulted in a decline in package growth over the last

two quarters of FY2019.

As other customers insource last-mile delivery

operations in the most protable geographies, our unit

costs increase thereby escalating competition and

reducing reliance on the Postal Service’s network. To

the extent these programs expand, the Postal Service

believes that it could see increasingly negative trends in

package volumes.

Key Forecasted Trends

The rapidly changing business conditions under which

the Postal Service competes, coupled with the evolving

needs of our customers, require us to adapt in order

to maintain our relevance to the American consumer

and to strengthen our business. The next ve years are

likely to usher in dramatic technological, social, and

environmental changes that will fundamentally change

the way we live, work, and relate to one another. We

are seeing rapid technological advances across many

areas that include articial intelligence, advanced

energy storage devices, next-generation broadband,

autonomous machines, augmented reality, social

networks, internet of things, and quantum computing.

Beyond the dramatic technology advancements, we

are facing continued and signicant environmental and

demographic changes. Experts forecast that every year

the United States will experience more extreme weather

events. In addition, the Census Bureau estimates

that the United States will continue to see population

growth, but with more growth in citizens older than 65

than younger than 18 over the next ve years. Beyond

the trends that are established and signicant, these

technological, social, and environmental changes will

drive changes in ways that we do not yet understand.

Over the next ve years, the three trends described in

the following paragraphs are expected to become more

pronounced and will signicantly impact our current

business model.

Delivery Points Grow and Mail Volumes Decline

The transition from print to digital communications and

business transactions will continue. Businesses will

continue to conduct more transactions electronically

with consumers, putting continued downward pressure

on First-Class Mail volume, which currently provides the

greatest contribution toward covering our institutional

costs. Digital advertising currently captures more than

50 percent of advertiser spend and is forecast to

continue to increase almost 10 percent each year, while

the portion captured by direct mail (postage costs only)

is expected to decline by almost 5 percent per year.

Our forecasts for delivery points (excluding PO Boxes)

assume a growth of 5 percent, or 6.9 million delivery

points by 2024, as shown in Exhibit 3. Meanwhile, our

baseline forecast for total mail volume anticipates a

decline of 18 percent over the same period, leading to

a decrease in revenue per delivery point of 4 percent.

This will continue to cause declines in daily pieces per

delivery point, which has gone from 3.8 in 2014 to 3.3

in 2019, and is forecast to drop to 2.6 daily pieces per

delivery point by 2024.

Although our baseline forecast shows continued

decreases in the demand for mail delivery services,

there will still be signicant demand and the expectation

that all United States residents will retain the ability

to send and receive mail delivery services from

their homes and businesses. We believe there is

an opportunity to reposition the value of mail with

businesses, retailers, and marketers by integrating

digital features with the physical delivery experience

to enhance their omni-channel communication and

marketing campaigns. Successfully repositioning mail

as a value-added feature to digital communication

opens new opportunities to retain existing customers

and reach new ones.

16 Ready-Now ➔ Future-Ready — The U.S. Postal Service Five-Year Strategic Plan FY2020-FY2024

Exhibit 3. Delivery Point (not including PO Boxes) and Mail Volume Forecasts

Source: USPS baseline mail volume forecast assumes CPI-U price cap and 6-day-a-week mail delivery.

Note: Daily pieces per delivery point = deliveries per day/delivery points (based on 302 delivery days per year). Delivery points exclude PO Boxes.

Competition Increases for Last-Mile

Package Delivery Services

We believe that the growth in domestic mobile

e-commerce sales will continue to outpace the growth

in brick-and-mortar retail sales. Historically, the growth

in domestic e-commerce sales has correlated well

with the growth in the number of domestic parcel

shipments. We see this relationship changing in the

future as consumers buy more expensive items online

and e-commerce companies combine more products

within a single shipment.

In addition, we envision more downward pressure on

the growth of parcel volumes shipped via the Postal

Service due to continued growth in competition in rst-

and last-mile delivery services, especially from large

retailers and other domestic carriers using part-time

on-demand workers.

The following trends will continue to fundamentally

transform the prole of the shipping market.

Consumer demand for accelerated shipping and

retailer investment in supply chains will lead to strong

growth in the one-day and local shipping markets

and increase demand for local entry.

The two-day and regional markets will remain

relevant for shippers with fewer distribution centers

and stabilize demand for competitive network

products.

The distance that parcels travel for delivery will

continue to decline and the 3-day+/national markets

will shrink.

Marketplaces will continue to rely on network

products but will face increasing pressure for delivery

in two days.

The U.S. Postal Service Five-Year Strategic Plan FY2020-FY2024 — Ready-Now ➔ Future-Ready 17

Package volumes, which have more than doubled

since 2010 and have been the Postal Service’s primary

source of revenue growth, began to demonstrate

slowing growth beginning in 2017, as customers began

to insource more of their last-mile deliveries. Year-over-

year growth declined from a high of 16.2 percent in the

rst quarter of 2016 to negative 2.4 percent in fourth

quarter of 2019. As such, we forecast that package

volumes delivered through the Postal Service network

may decline slightly in 2020 and 2021 and grow

modestly thereafter.

In response to these trends, the Postal Service

has a parcel strategy that underpins our forecast.

The strategy is to grow product value by both

enhancing our offerings and keeping prices

competitive. In summary, the core elements of

our parcel strategies are to continue to leverage

the strength of our last-mile delivery services by

expanding Sunday deliveries, expanding same-day

and next-day deliveries, enhancing return services

for business and consumers, and enhancing our

end-to-end network to meet the growing demand

for low cost, reliable, ground shipping. Continuing

to grow protable parcel delivery operations is key

to supporting the revenue forecast in the baseline.

Absent Legislative and Regulatory Changes, USPS

Financial Losses will Continue

Despite continued innovations across our existing

service offerings, expanded digital offerings, and

implementation of aggressive cost controls, we project

continued annual losses over the next ve years

assuming no legislative or regulatory reform. Volume is

expected to decline while revenues stay relatively at

due to a price cap and other marketplace trends.

Our nancial challenges reect the dynamic that our

largely xed and mandated costs continue to rise at a

faster rate than the revenues we are able to generate

in a highly competitive marketplace. Without more

exibility to respond to the changing market in an

economically rational way, we expect to run out of

liquidity by 2021 if we pay all our nancial obligations

— and by 2024 even if we continue to default on our

year-end, lump sum retiree health-benet and pension

related payments.

Our Vision for 2024 — A Financially

Sustainable Postal Service that Delivers

Products and Services that Customers

Value in a Digital Economy

In 2024, we envision a Postal Service that enables

all Americans to connect, businesses to grow, and

communities to thrive in an increasingly digitally-

connected world, including individuals in rural or urban

communities that are digitally underserved.

Specically we envision a Postal Service grounded in

its core public service mission of providing universal,

affordable, high-quality mail and parcel delivery to

all residents of the United States, and expanding

that public service mission to include the provision

of essential e-government services. We envision a

business model that enables the exibility to best serve

the changing needs of our customers and respond

to marketplace trends, including continued and

signicant declines in mail volumes due to electronic

diversion and continued but lower growth in parcel

deliveries due to increased last-mile competition.

We envision a Postal Service that is an employer

of choice able to attract, retain, and develop high-

quality, customer-focused employees. And nally,

we envision that the Postal Service will maintain its

position as the world’s most efcient and affordable

postal operator and the most trusted federal agency.

Broad Transformations Required to Achieve

this Vision

The following paragraphs summarize the broad

transformations we intend to make over the next ve

years to realize this vision.

Transform from Deriving Value Solely by Providing a

Physical Delivery into an Organization that Launches

New Products and Services that Add Value Through a

Digital Connection

We envision transforming from an organization that

generates its revenues from the physical transport,

processing, and delivery of letters, ats, periodicals,

and parcels into one that also generates signicant

revenues from offering digital and other value-added

features that enhance the value of our physical delivery

services. Although our projections suggest continued

decreases in the demand for mail delivery services,

there will still be signicant demand and the expectation

18 Ready-Now ➔ Future-Ready — The U.S. Postal Service Five-Year Strategic Plan FY2020-FY2024

that all residents of the United States will retain the

ability to send and receive mail delivery services

from their homes and businesses. We believe there

is an opportunity to reposition the value of mail with

businesses, retailers, and marketers by integrating

digital features with the physical delivery experience

to enhance their omni-channel communication and

marketing campaigns. Successfully positioning mail as

a value-added feature to digital communication opens

new opportunities to retain existing customers and

reach new ones.

A key strategy for mitigating the volume decline of

our mail delivery services is the enhancement of our

Informed Delivery platform with features to attract a

wider user base, enable it to operate on all major smart

devices, and seamlessly connect to key e-commerce

and social platforms. Another initiative will provide

businesses that purchase mail and package delivery

services with the ability to communicate with their

customers via the Informed Delivery digital platform.

This will allow businesses to combine key features of

digital and social communication platforms with the

visceral experience of a physical delivery.

We will also leverage our infrastructure, retail locations,

vehicles, and information architecture to explore new

digital products and services that help the American

public to securely communicate, exchange goods, and

connect to essential e-government services.

Transform from Being the Most Efficient Last-Mile Mail

Delivery Service Provider into the Most Efficient Local

Logistics and E-commerce Delivery Platform

We envision transforming from operating the most

efcient mail delivery service to operating the most

efcient, frictionless, and secure local logistics platform

that will provide all residents of the United States, every

small and medium business, and every community with

the maximum degree of access to participate in the

ever-increasing e-commerce economy. A key to this

vision is the enhancement of our local processing and

delivery network to enable retailers and other logistics

companies the capability to deliver e-commerce

orders securely and affordably within 24 hours from

local businesses and within two calendar days from

businesses located within the contiguous United

States. To enable this, we will build out our platform to

enable exible and frictionless returns from every home

and expand seven-day-a-week parcel delivery service.

This transformation will be enabled by our ability to

equip our employees with the latest technologies and

predictive analytics tools, connect our employees to our

customers, and empower our employees to deliver the

best customer experience at every touchpoint.

Transform From Operating a Fixed Network to

Managing a Faster, More Efficient and More Resilient

Logistics Ecosystem

Over the next ve years, we envision embarking on a

broad transformation from operating a xed processing

and transportation network to managing an adaptive

domestic and international integrated processing

and transportation logistics ecosystem that is faster,

more visible, more efcient, more automated, digitally

integrated, and supported by more public-private

partnerships. This logistics ecosystem will enable

our local delivery platforms to provide our customers

with efcient and visible end-to-end transportation,

sorting, and warehousing solutions across the country

and across the world. Two key elements required to

successfully achieve this transformation will be the

ability to effectively deploy autonomous and big data

technologies at scale and to form new and innovative

partnerships that unleash the innovation capacity of

private companies to meet the needs of our customers.

One Thing Will Remain the Same: We will Sustain the Trust

of the American People

No matter what the future holds, one thing will remain

the same: we will sustain the trust of the American

people by delivering excellent and secure services

every day. We were the most trusted and favorably

rated federal agency in 2019. We will continue

to work very hard to sustain that position of trust

over the next ve years. We envision leveraging

our services to enable people and companies to

more securely interact within the digital economy.

Creating a Financially Sustainable Postal Service

Requires Legislative and Regulatory Changes

We cannot realize this vision alone. Most of our

efforts to enable this vision over the long run require

changes to existing laws and regulations and new

agreements with our labor unions. Congress has the

authority to enable this vision or to direct the Postal

Service toward a different vision. Therefore, we will

continue to do all that we can to effectively manage

the Postal Service within our current authorities while

we work with Congress, the Administration, and

the PRC to identify and implement legislation and

The U.S. Postal Service Five-Year Strategic Plan FY2020-FY2024 — Ready-Now ➔ Future-Ready 19

regulations that enable nancial sustainability while

best meeting the needs of the American public. The

following sections lay out our ve Ready-Now —

Future-Ready strategic goals and, for each, the key

strategic initiatives we will undertake over the next ve

years. Our plan focuses on those initiatives that are

within our control, but also identies the areas we will

work on to inform the public debate and decisions

from Congress, the Administration, and the PRC.

20 Ready-Now ➔ Future-Ready — The U.S. Postal Service Five-Year Strategic Plan FY2020-FY2024

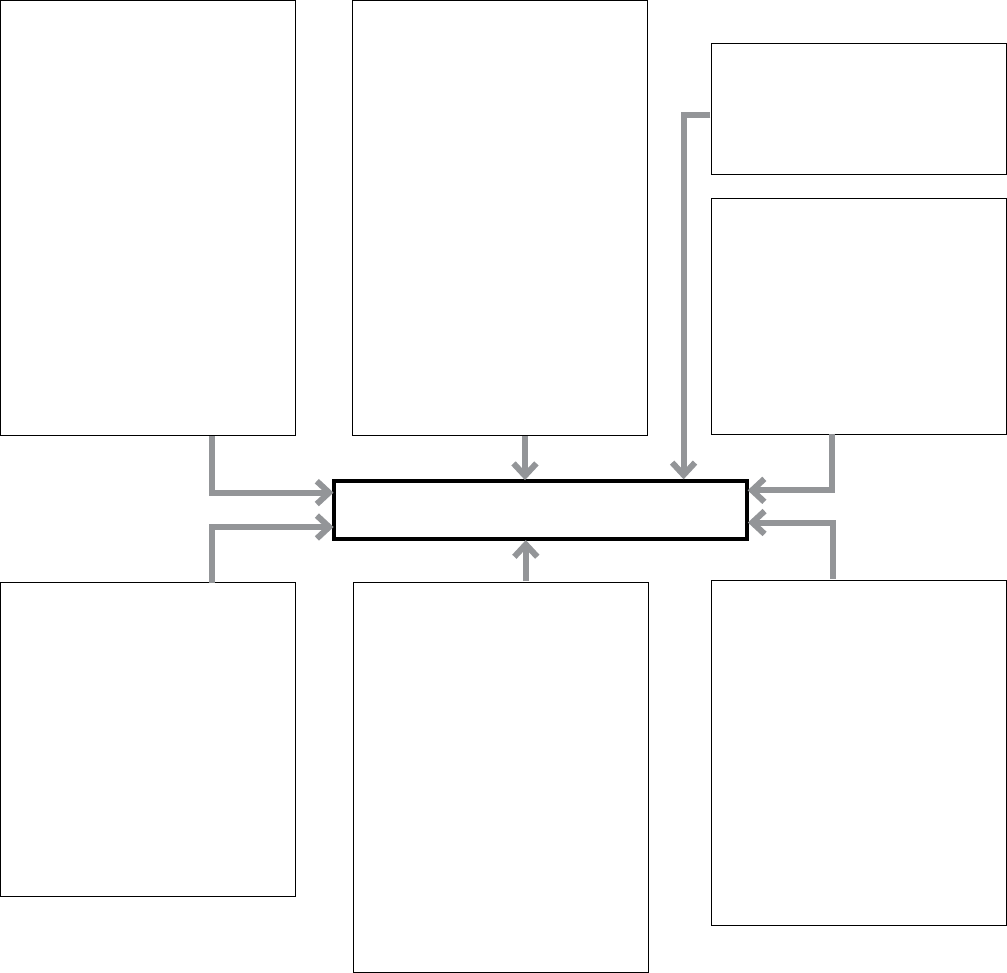

USPS Ready-Now – Future-Ready Goals and Key

Strategies for FY2020-FY2024

No matter what the future holds, we believe we must

deliver excellent services every day while we work with

Congress, the PRC, and key stakeholders to make this

vision a reality. We cannot expect to sustain the trust of

the American public or win new business if we deliver

poor customer service and experiences today. That is

why we titled our Strategic Plan, Ready-Now — Future-

Ready. The term Ready-Now reminds us that our ability

to build new Future-Ready capabilities depends on our

ability to continue to deliver excellent services today

and every day.

To accomplish this vision, we have laid out the following

Ready-Now — Future-Ready strategic goals and key

initiatives to help focus all that we do.

Goal 1: Deliver World-Class

Customer Experiences

Goal Description

We will endeavor to build a Postal Service culture that

focuses on delivering services that provide excellent

customer experiences in order to encourage loyal

customers and sustain the trust of the American

people. We believe that continued growth in

e-commerce, customer demands for faster services,

and advances in autonomous technologies will result

in delivery services continuing to be more competitive

and commoditized in the future. Although we will

strive to be the low-cost leader for delivery of mail

and parcels, we also see consumers more frequently

choosing businesses based not only on price, but also

based on the quality of the overall experience provided

and the trust that the business has earned from

previous customer interactions. Only by maintaining

an obsessive focus on delivering services that provide

excellent customer experiences and sustain the trust of

the American people will the Postal Service continue to

keep existing customers and earn new ones.

A critical part of our efforts will be to look beyond only

delivering excellent experiences at different touchpoints

to looking at the end-to-end customer journey with

us from the perspective of each of our residential and

commercial customer segments. By looking at the

entire customer journey, we will be best able to develop

excellent customer experiences across all our services

and channels.

The key initiatives described in the following paragraphs

include the following:

Improving the way we acquire new customers.

Helping customers select the right products

and services.

Improving how we collect customer feedback.

Improving how we resolve customers’ issues.

Key Strategies and Initiatives

Improve Visibility and Control of Mail and Package Delivery

Services for Residential and Small Business Customers

We will continue to work to provide a seamless

experience for sending and receiving mail and

packages. Efforts related to this initiative include further

enhancements of our Informed Delivery platform.

Informed Delivery is a notication service that gives

residential consumers and small business customers

the ability to digitally preview their letter-sized mailpieces

and manage packages that are scheduled to arrive

soon. Informed Delivery makes mail more convenient

by allowing users to view what is coming to their

mailboxes whenever, wherever — even while traveling

— on a computer, tablet, or mobile device. Informed

Delivery benets the entire household, ensuring that

everyone has visibility into mail and package delivery

each day. Informed Delivery allows users to take action

before important items reach their mailboxes.

We will continue to enable users of the Informed

Delivery smart phone application to do more, including

providing carriers instructions on where to leave or pick

up packages, notifying the Postal Service to hold mail,

or scheduling redelivery of packages.

Improve the Commercial Mailer, Shipper Onboarding, and

Payment Experience

Commercial mailers and shippers are the Postal

Service’s largest customer segment. We will continue

our efforts to create a frictionless mailing and shipping

entry and payment experience. The Postal Service

continues to modernize the payment experience by

The U.S. Postal Service Five-Year Strategic Plan FY2020-FY2024 — Ready-Now ➔ Future-Ready 21

enabling a single, secure, self-service online account

management and payment system. To encourage

widespread adoption, we will do the following:

Promote initiatives designed to streamline

the acceptance, induction, and verication of

commercial mailings.

Enhance programs designed to streamline the

acceptance and verication of commercial parcels to

improve functionality and availability.

Leverage electronic documentation, package

barcodes, and digital visibility to simplify the process

of accepting, verifying, and returning parcels to

merchants.

Optimize the network of Business Solutions Centers

to provide world-class, one-stop, solution-oriented

customer service by identifying the best mailing

solutions for customers’ commercial mailing

needs through consultation, diagnostics, research,

recommendations, and hands-on assistance.

Expand our capability to expedite and streamline

the returns payment process, charging mailers for

returns only when the return packages are received

and weighed by our automation equipment.

Improve Retail Customer Experiences Through Expanded

Self-Service

Though our customers prefer more and more to do

business online, we will continue efforts to provide an

excellent customer experience at our brick-and-mortar

retail Post Ofces. Efforts will include initiatives that

effectively integrate our physical, digital, and alternative

access retail channels and will make doing business

with us simple and convenient for all our customers.

We will make package mailing and delivery more

convenient by expanding 24-hour access self-service

kiosks and our network of parcel locker solutions.

We will continue to invest in improving retail channel

experiences for all customers with a special focus on

small business customers, rural customers, online

customers, and package customers.

Enable a Seamless Cross-Border Experience for Customers

In support of the new Universal Postal Union

agreement, the Postal Service will continue to assess

and enhance the current International Systems

architecture and develop an integrated and optimized

ecosystem that drives business value and growth,

increases efciency, and improves customer experience

for international mail and packages.

Deliver a World-Class Customer Care and Issue

Resolution Experience

We will continue to improve the customer care center

experience by the following:

Reducing wait times for calls.

Implementing new customer inquiry channels, such

as live agent chat, and increasing rst-call resolution

by closing agent knowledge gaps.

We are working to improve the claims process by doing

the following:

Understanding the customer journey.

Redesigning the customer interface.

Improving backend systems.

We will continue to enhance and improve overall

customer satisfaction for the issue resolution

experience by doing the following:

Using customer experience (CX) and operational

data to target critical issues.

Optimizing the case routing process to resolve

customer issues more quickly.

Better equipping our employees with skills for

effective case management.

We are also enhancing customer self-service

capabilities across our digital channels (such

as usps.com, social media, mobile) to address

customer issues and reduce the volume of

calls to the Customer Care Centers.

We realize these initiatives are only part of the solution.

Creating great customer experiences requires that we

equip, connect, engage, and empower our employees

to best serve our customers. This element is so

important that it is the focus of our second Ready-Now

—Future-Ready goals.

22 Ready-Now ➔ Future-Ready — The U.S. Postal Service Five-Year Strategic Plan FY2020-FY2024

Goal 2: Equip, Connect, Engage, and

Empower Employees to Best Serve

USPS Customers

Goal Description

We will endeavor to enhance the Postal Service’s role

as a preferred U.S. employer, offering stable jobs with

more exible compensation and benets packages to

attract and retain highly qualied employees who are

best equipped, connected, engaged, and empowered

to serve our customers and to identify and implement

new innovative products and services.

Our employees are our greatest asset and have a

vested interest in a strong Postal Service. They are

our most passionate and articulate advocates for our

customers. The core value we deliver to the American

people is and will continue to be enabled by our

employees. Although we envision a smaller number

of Postal Service employees, a workforce comprised

of healthy, enthusiastic, engaged employees who are

better connected to each other and to our customers

will continue to be the foundation for bringing this

vision to life.

Key Strategies and Initiatives

Our efforts are aimed to enhance the Postal Service’s

status as an “employer of choice” that hires the

most effective employees, and develops, equips, and

empowers them to best serve our customers, and

implements programs to keep them safe and healthy.

Key initiatives include those described in the

following paragraphs.

Align Employee Leadership, Development, and Incentive

Programs to Delivering Excellent Customer Experiences

We will continue to implement a comprehensive

process for developing our leadership and employee

skills necessary to deliver great customer experiences

in this competitive environment and increasingly

digital world. This will include efforts to rene training

requirements and career paths for employees. To

better understand the changing training needs and

demographics of our workforce, we will develop

predictive models and data-driven approaches for

assessing our talent pipeline. We will evolve our

Human Resources (HR) services platform to be a

single stop for all HR needs for employees while

continuing to modernize and improve HR processes

and technologies to drive employee access and

platform adoption. Finally, we will continue to rene

and adapt our employee Pay-for-Performance (PFP)

systems to ensure that we incent and reward the best

performance. Altogether, these efforts will improve

leadership and employee readiness to drive the culture

changes necessary for long-term success.

Equip, Connect, Engage, and Empower Employees to Better

Serve USPS Customers

Informed and connected employees are better able to

serve our customers and drive better business results.

USPS efforts to enable this initiative include

the following:

Involving our employees in designing new

technologies and processes to help them do their

jobs better.

Deploying our Informed Mobility and Informed Facility

tools to better inform and connect plant and Post

Ofce employees.

Leveraging those technologies to enable our

employees to better communicate with each other

and with our customers.

The Postal Service collects a great deal of information

about our operations, transportation assets, equipment

status, location of mail and packages, and customer

feedback. We will continue to expand and enhance the

sharing of the right information, at the right time, with the

right frontline employees though our Informed Facility

and Informed Mobility technology platforms.

Informed Facility — Informed Facility is our facility-

based content delivery platform capable of rapidly

providing information to frontline employees via facility-

based interactive displays. These displays are located

throughout our processing plants and Post Ofces

and provide a diverse selection of facility performance

information, employee feedback, and real-time customer

feedback.

Informed Mobility — Our Informed Mobility effort is

designed to equip our plant and Post Ofce supervisors

with mobile devices and smart applications that enable

them to maintain visibility and control facility operations

as they move about operations while interacting directly

with employees and customers.

Equip, Connect, Engage, and Empower Employees to Improve

Employee Safety and Well-Being

Over the next ve years, we will continue to build upon

The U.S. Postal Service Five-Year Strategic Plan FY2020-FY2024 — Ready-Now ➔ Future-Ready 23

our current excellent safety programs to create the safest

and healthiest environment possible for our employees.

Postal Service efforts to enhance safety programs

include the following:

Rening training for new employees.

Deploying new equipment with additional smart

safety features.

Equipping employees with smart devices.

Empowering employees to identify, record, and

report safety concerns in real time with the goal of

reducing all accidents (motor vehicle and industrial).

By providing the tools and resources employees need,

we will empower our employees to play a more active

role in creating a safer work environment. Our efforts

will improve employee availability, enhance customer

service, create an overall more engaged employee

base, and reduce our total operating expense.

Goal 3: Innovate Faster to Deliver Value

Goal Description

For our business to grow, we must create new solutions

that meet the rapidly changing needs of our customers.

Customer needs, business conditions, and technologies

are changing faster than ever. The Postal Service has

been a leader in embracing new technologies for the last

245 years. The rate of change over the next ve years

will be more rapid than ever and we must keep pace. We

must accelerate our testing of new approaches to better

serve our customers’ changing needs by integrating mail

into their digital lives.

We will accelerate innovations to sustain mail volumes

for delivery of domestic First-Class Mail, Marketing Mail,

and Flats by improving in-home reliability, enhancing

USPS digital value-add services, and leading the

adoption of digital features across the mailing industry.

We will test digital services to increase the loyalty of

current customers while developing deeper relationships

with digitally connected customers who may not fully

appreciate the value of mail. We must anticipate the

impact of digital technologies on how businesses interact

with their customers domestically and abroad, with the

growing expectation that any service, such as mailing

and shipping, must seamlessly support and integrate

digital technologies.

We will accelerate innovations to improve the

parcel delivery and return experience and enhance

the Postal Service’s parcel delivery digital and value-

added services.

We will accelerate innovations to grow domestic digital

service revenues from federal agencies by leveraging

retail, delivery, network, and IT platforms with a focus

on in-person digital identity verication services,

address and geospatial data services, and digital or

e-government services.

Building on our long and bold history of innovation, we

will continue to explore advances in technology and

adapt to the changing marketplace. The faster we move

innovations from an idea to actually delivering a new

service that customers value will be the key for us to

enable stable and protable revenue.

Key Strategies and Initiatives

Lead the Adoption of Digital Features Across the Mail

Industry to Enhance the Value of Physical Mail

The Postal Service continues to drive innovations that

give consumers more control over the mail they receive,

make direct mail simple to send, enable multimedia

touch points, and reinforce the resiliency of mail as

a trusted, effective communications channel. Mail

continues to be the primary revenue source for the

Postal Service, so sustaining mail revenue by offering

mail products and features our customers value is

essential to our success.

We will ensure mail remains relevant and viable by

merging physical mail with digital features. We will

continue to expand the following initiatives:

Increase the functionality of our Informed

Delivery application.

Promote new digitally enhanced mail solutions.

Create solutions to help mail drive e-commerce.

Develop digital promotions to accelerate adoption of

digital features across the mailing industry.

For example, in mailing campaigns linked through

our Informed Delivery platform, customers

receive detailed mail campaign data (such as

density and email statistics, email open rates,

and click-through rates) to provide insights into

campaign reach and results to help demonstrate

the return on investment of their campaigns.

Retargeted Direct Mail — Retargeted Direct Mail helps

mailers handle online shopping cart abandonment.

24 Ready-Now ➔ Future-Ready — The U.S. Postal Service Five-Year Strategic Plan FY2020-FY2024

When e-commerce consumers nd items they want,

put them in the virtual shopping cart for purchase, and

then leave the site without completing the transaction,

Retargeted Direct mail helps e-commerce customers

close the sale by providing additional incentives through

the mail to drive purchase actions.

Next Generation Campaign — We are also leveraging