RESEARCH ON BUYING

AND SELLING HOMES

Research paper number BIS/283

October 2017

Contents

Summary ________________________________________________________________ 3

Context ________________________________________________________________ 3

Survey Design __________________________________________________________ 4

Key findings – successful purchases and sales _________________________________ 4

Survey of failed transactions _______________________________________________ 9

1. Introduction __________________________________________________________ 11

2. Use of traditional estate agents __________________________________________ 16

Key findings ___________________________________________________________ 16

Who uses a traditional estate agent? ________________________________________ 17

Who does not use a traditional agent? _______________________________________ 19

3. Marketing properties and finding a property to buy __________________________ 21

Key findings ___________________________________________________________21

The seller experience ____________________________________________________ 22

The buyer experience ___________________________________________________ 31

4. From o

ffer to completion _______________________________________________ 38

Accept

ing the offer ______________________________________________________ 39

Taki

ng the property off the market __________________________________________ 40

Buyers

’ and sellers’ concerns after the offer was accepted _______________________ 41

Will

ingness to Enter a Legal Commitment ____________________________________ 44

Survey

s and valuations __________________________________________________ 48

Renegoti

ating the offer ___________________________________________________ 50

Delays

and their impacts _________________________________________________ 52

5. Satisf

action with the home buying and selling process ______________________ 56

Key findings ___________________________________________________________56

Estate agents __________________________________________________________ 57

Satisfaction with other services ____________________________________________ 60

Length and complexity of the process _______________________________________ 63

6. Failed

transactions ____________________________________________________ 68

Key findings ___________________________________________________________68

Research design _______________________________________________________ 69

Reasons

for failure ______________________________________________________ 70

The cost of a failed transaction to buyers and sellers

___________________________ 72

2

Summary

Context

Buying or selling a home is often claimed to be among the most stressful of life

experiences. The process can be lengthy, uncertain and carry unexpected costs,

especially if the sale collapses, and is often criticised for not being as efficient,

effective, or consumer friendly as it could be. Despite high numbers of successful

transactions (last year there were over 1 million

1

residential property transactions),

many consumers are thought to have poor experiences when transactions take too

long to complete, or are subject to a difficult renegotiation midway through the

process.

Moreover, many transactions fall through before they can complete. Various

anecdotal sources put the fall through rate at between one quarter and one third

2

,

implying that the total number of transactions that collapse before completion could

be in the region of 400,000. When this happens any costs incurred in progressing

the transaction (e.g. legal, survey etc.) are effectively lost to consumers, and in many

cases these can be high.

The transaction is also characterised by low levels of trust between all parties, with

estate agents often coming in for the most criticism about their practices. Indeed, the

Homeowners Alliance reported that only 20% of homeowners and aspiring

homeowners trust agents when buying or selling a home, a far lower level than for

conveyancers, surveyors or mortgage lenders

3.

They have also criticised the sector

for the lack of transparency about their commission and other fees.

4

Since 2008, estate agents have been required to register with government approved

Ombudsman schemes, who uphold codes covering practices and transparency of

fees. However, during the passage of the Consumer Rights Bill and the Consumer

and Competition Landscape reforms during 2013 and 2014, concerns were again

raised in Parliament and the media about estate agents. Anecdotal examples were

given of misleading and aggressive practices designed to close a deal; agents

encouraging gazumping by continuing to market properties after offers have been

accepted and encouraging ‘ghost gazumping’ where the seller demands a higher

price between offer and exchange

5

.

1

HM Revenue and Customs UK Property Transactions Count – Feb 2016

www.gov.uk/government/uploads/system/uploads/attachment_data/file/500443/UK_Tables_Feb_20

16__cir_.pdf

2

www.quickmovenow.com/news/house-sale-fall-through-rate-increases-q2-2015/

3

Home Owners Alliance (2013) Connecting with the concerns of homeowners and aspiring

homeowners

4

Homeowners Alliance (2014) Why the mystery?

5

BBC (2014) Ghost gazumping: Buyer’s peril from rising house prices 25

th

July 2014

3

At the same time there were an unprecedented number of complaints regarding the

buying and selling of property. The largest scheme, The Property Ombudsman Ltd,

reported a 25% increase in sales complaint enquiries between 2012 and 2013

despite only a 5% increase in the number of sales agent offices affiliated with the

scheme

6

. Since then, complaint levels have stabilised but the Property Ombudsman

figures show that consumers continue to complain typically about communication

failure (20%); misleading sales details or advertising (12%); a failure in the agent’s

duty of care (10%) and commission fees (9%)

7

.

Survey Design

The Department for Business Innovation and Skills (BIS) commissioned TNS BMRB

to conduct a survey of the experience of recent home buyers and sellers to obtain a

detailed and measured understanding of the scale and nature of detriment in the

home buying and selling sector.

We conducted online interviews with around 2,000 people who had bought or sold a

residential property in England or Wales in the two years prior to March 2015. This

could have been their own home, a second home, a buy to let property or a probate

sale. The survey covered the entire ‘journey’ from the initial marketing or property

search, to negotiating an offer and all aspects of the conveyancing prior to

completing the sale.

For an additional part of the study, we also explored the experience of failed

transactions, both among those in our survey sample who had experienced a

purchase or sale fall through in the run up to their successful transaction plus a

further group of 600 respondents who had experienced a transaction failure without

then going on to successfully buy or sell.

Key findings – successful purchases and sales

Use of traditional estate agents

Although some sellers are turning to online agents with lower fixed fees or selling

entirely privately, the majority are still using ‘traditional’ estate agents with a high

street presence to market their homes. This is mainly a consumer preference and

people have concerns over using alternative methods for home buying and selling:

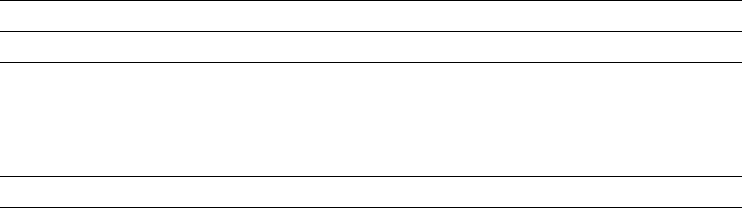

• Most sellers (83%) sold through a traditional estate agent rather than selling

privately (10%), through an online agent (5%) or by auction (1%).

• Older sellers and those involved in the complexities of an onward chain were

more likely to use a traditional agent.

• Those choosing a traditional agent tended to say that they simply prefer to do

it that way (63%), but some were concerned that it would be hard to

6

The Property Ombudsman (2014) Annual Report 2013

7

The Property Ombudsman (2015) Annual Report 2014

4

communicate without an agent to assist (20%) or that something would go

wrong with the process otherwise (20%).

• Buyer behaviour was generally determined by how the seller marketed the

property they wanted to buy, again, 83% of buyers purchasing their home

through a traditional estate agent.

The remainder of this survey concentrated on those who had used a traditional

estate agent as the focus of this study.

Marketing a property and finding a property to buy

Sellers

Previous experience of selling a home was the key factor determining how much

control sellers took of the process of marketing their home through an estate agent.

• Most (75%) sellers asked more than one estate agent to value their home but

nearly all (94%) opted for a sole agency contract when they put the property

on the market. Although one in ten (12%) of those opting for sole agency

would have rather appointed multiple agents, they were put off by the higher

fees.

• Experienced sellers were more likely to negotiate the terms of their contracts

(typically fees or length of contract) (42%) than first time sellers (30%).

• Similarly experienced sellers were more likely to change agents to achieve a

sale (18% compared to 13%), most commonly because they believed they

were not getting enough viewings. Similarly, those in a chain and often under

pressure to complete a deal were more likely to change agents (21%) than

those with no onward purchase (15%)

• Around two thirds (66%) sold their home on a percentage commission basis,

whilst one in five (18%) paid a flat fee, sometimes still broadly linked to the

price of their property.

Buyers

The experience for buyers inevitably reflected the local housing market with

considerable reports, particularly among first time buyers, with a sense of being short

of time and feeling pressure to make offers sooner or higher than they wanted to in

property hotspots.

Overall, buyers found information they received from estate agents helpful. There

was a high degree of interest in viewing a surveyor’s valuation or survey upfront but,

as has previously been found, only a minority would rely on this information without

commissioning their own report.

• Three in ten (30%) buyers only viewed the property they went on to buy once

before making an offer.

• One in five (20%) buyers would have liked another viewing but this was not

noticeably higher among those who had only one viewing. Instead, first time

buyers (29%) and those buying in London (28%) were the most likely to feel

they didn’t view the property as much as they would have liked.

• Among those who would have liked to view the property again, nearly one in

three (29%) simply felt there wasn’t time before needing to make an offer and

5

similarly, nearly one in four (24%) reported that the estate agent had told them

there was a lot of interest in the property.

• As well as property descriptions and measurements, nearly all buyers found

further information such as the level of interest in the property; the seller’s

position or answers to their specific questions when given helpful when

provided.

• Only flood risk reports and Energy Performance Certificates were less likely to

be considered helpful among those that were shown them (found helpful by

67% and 63% of buyers respectively).

• In the minority of cases were a current surveyor’s valuation and/or survey of

the property was available (14%), buyers were very likely to find this

information helpful (83% and 89% respectively). There was also most interest

in receiving this type of information from those who did not receive it.

• Despite this interest, only 50% of buyers would be prepared both to rely on an

independent survey and valuation provided by the seller as a basis to

exchange contracts rather than commission their report.

• Nearly two thirds of buyers (63%) reported the estate agents encouraging

them to offer on the property, including around one in four being told it was

priced for a quick sale (26%) or there was a lot of interest in the property

(24%).

• Buyers in property hotspots such as London and the South East were most

likely to be told there had already been an offer on the home (26% in both

regions) with Londoners being put under further pressure hearing that

someone else was about to offer on the property (21%).

• Clearly advice will follow the nature of the local housing market but of those

buyers that received these types of messages from agents, nearly one in four

(39%) felt that they had put in an offer sooner or at a higher level, or both,

than they wanted to.

• Inexperienced first time buyers were most vulnerable to this pressure with

47% regretting the speed or level of their offer, compared to 36% of

experienced buyers.

6

From offer to completion

Despite some concerns about marketing or finding a property, the conveyancing

period from offer acceptance to completion carried most of the stress, frustration and

uncertainty for both buyers and sellers, with low levels of trust between all parties.

Many experienced delays to the process and some incurred costs as a result.

• The vast majority of offers were made in the conventional way via the estate

agent. Only a small minority (2% of buyers and 3% of sellers) reported using

the sealed bid process.

• Whilst over half of agents (56%) did not offer the seller any particular advice

about whether to accept the offer, just over four in ten (42%) told the seller

either that it was likely to be the best price they would get or that no other

offers were likely.

• Experienced sellers were better at establishing information about the

prospective buyer from the agent at the time of offer, such as their financial

circumstances or whether the buyer was in a position to move.

• There were discrepancies in reports of whether the home was taken off the

market after the offer was accepted. Nearly nine in ten buyers (88%) believed

this had occurred with their property, often making it a condition of their offer,

but only just over three quarters of sellers (77%) reported doing so.

• Buyers continued to be concerned that a survey would reveal something

unexpected about the property (35%) while sellers worried that the buyer

would change their mind and withdraw their offer (46%).

• Nearly four in ten (39%) of buyers reported paying for a full structural survey

on the home as well as a further 41% saying they commissioned a

homebuyer’s report. Those who didn’t tended to be more experienced buyers

who considered they could rely on their own knowledge and experienced to

evaluate the property.

• Mistrust between the buyer and the seller was a characteristic of the process

after offer. Thirty three per cent of buyers were concerned that their seller

would change their mind and would not sell 46% of sellers said that they had

concerns that buyers would change their mind and would not buy. A quarter

(26%) were concerned that buyer would lower their price in the mid-process

• Despite concerns from buyers, only 2% reported the seller demanding a

higher price after they had accepted the offer whilst nearly one in five (18%) of

buyers reduced their offer, usually because of something identified in the

survey or a lower than expected mortgage lender’s valuation.

• For many (38% of buyers and 41% of sellers) the time taken from offer to

exchange of contracts took longer than they expected. First time buyers, who

might have had unrealistic expectations, were only slightly more likely to

report delays (40%) than experienced buyers (37%).

• Over those who experienced delays, around four in ten incurred additional

costs as a result, such as paying for rented accommodation or putting their

possessions into storage. This amounts to about one in seven of all buyers

and sellers incurring additional costs because of delays in the process.

Average cost for delays might be in the region of £500-£750.

• Buyers were more frustrated with the impact on their intended completion

date with over half of those affected (57%) saying their completion date had to

be put back compared to nearly four in ten (39%) of sellers. But this still

7

amounts to over one in seven sellers and one in four buyers not achieving

their planned completion date.

• Those experiencing delays tended to hold the other party’s solicitor or

licensed conveyancer responsible with nearly half (47%) of buyers blaming

the seller’s solicitor as did 58% of sellers did the buyer’s solicitor.

Satisfaction with the process

Consistent with previous home buying and selling research

8

, the most common

frustration among home buyers and sellers was with the length of time that the

conveyancing process takes and satisfaction with the services received during the

process reflected this.

• Satisfaction with estate agents was high (81% among buyers and 84% among

sellers) whilst consumers were most likely to express dissatisfaction with the

other party’s solicitor; with 32% of sellers and 28% of buyers dissatisfied with

the other party’s solicitor.

• Only about one third of sellers and one fifth of buyers who were dissatisfied

with their estate agent went on to complain. Most said they didn’t think it was

worth complaining or they just wanted to move on. Attitudes were similar

among those dissatisfied with solicitors, surveyors or EPC providers.

• Whilst only a minority of home buyers or sellers found the process particularly

complicated, those that did tended to have issues with solicitors (24%) rather

than estate agents (9%).

• Taking the whole experience into account, over half of buyers (51%) and

nearly four in ten sellers (39%) said that if they were buying or selling this

home again they would negotiate harder on the sale price. Nearly one in four

buyers (24%) would have quotes for any work that needing doing before

making an offer. Those who hadn’t commissioned a survey or homebuyer’s

report were very likely to say they would do next time whilst some first time

buyers (15%) had learned to arrange their mortgage before making an offer.

• Given the low levels of dissatisfaction, a notable proportion (24%) of sellers

still felt that if they had their time again they would use a different estate

agent. Rather than the quality of service this seemed most related to the one

third of sellers who considered estate agents offered poor or very poor value

for money.

• Nearly three quarters (74%) of buyers and 68% of sellers had at least one

suggestion to improve the home buying and selling system. The most

common area identified for improvement was a faster service from solicitors

(34% of buyers and 31% of sellers).

• Many buyers were also seeking more information about the home and its

condition up front whilst nearly four in ten (38%) of sellers wanted to make

offers legally binding and seventeen per-cent of buyers said more legal

commitment upfront would have improved the process.

8

DCLG (2007) HIP Baseline Research: Main Report

8

Survey of failed transactions

In the survey among those who had experienced a failed transaction, the same

issues of uncertainty, lack of trust and blame of other parties found in the main study

were amplified.

• Buyers who’d experienced a purchase fall through were more likely to point to

problems identified in the survey as the cause of the failure than personal

reasons (15%), whereas sellers were more likely to consider it was the

buyers’ personal circumstances that cause them to withdraw (37%).

• Although buyers were less likely to experience failure, when they did, they

were more likely to incur costs (56%) than sellers (44%). Most commonly

this was on survey or valuation fees (74%) whereas sellers were more likely

to have spent money on solicitors’ fees.

• Although estimates are approximate, of those who experienced transaction

failure, about one in four buyers (24%) and sellers (25%) had incurred wasted

costs of more than a £1,000. Where a transaction failure incurred costs, the

average might be between £650 and £740.

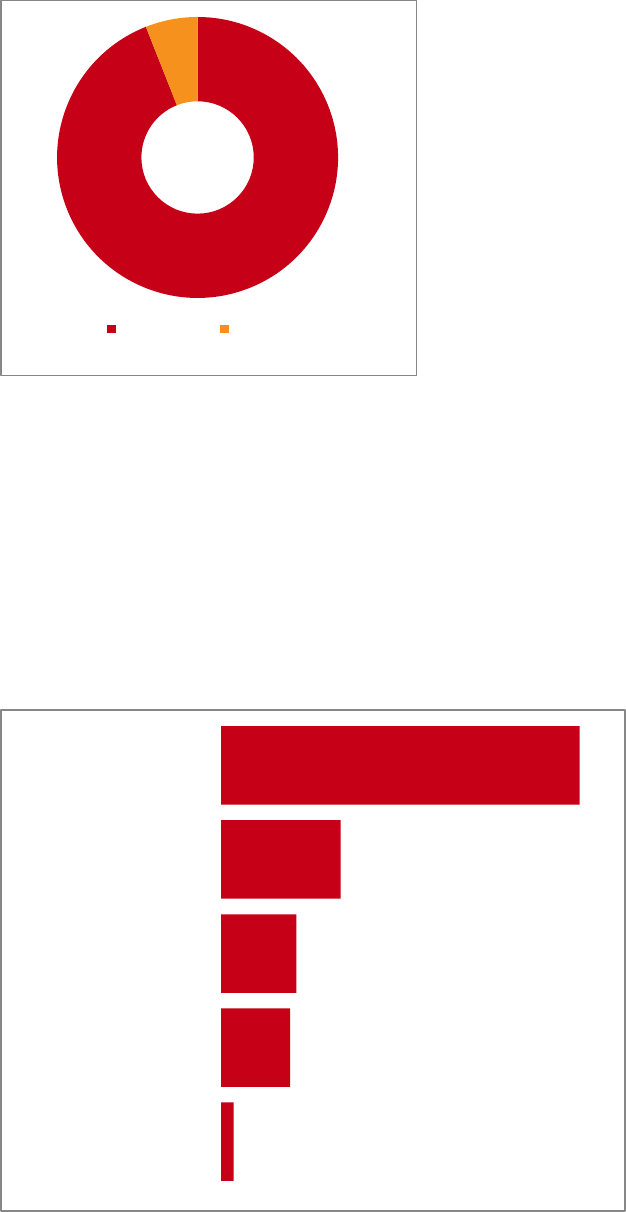

The diagram on the next page outlines some of the key findings that were drawn out

from this research.

9

.

10

1. Introduction

Objectives

The Department for Business Innovation and Skills (BIS) commissioned TNS BMRB

to conduct a survey of the experience of recent home buyers and sellers in England

and Wales to obtain a detailed and measured understanding of the scale and nature

of detriment in the home buying and selling sector.

The survey was designed to provide current evidence of the consumer journey

through buying and selling a home, to analyse the causes of transactions falling

through, delays and impact of the delays and failed transactions in the process. We

also explored consumers’ satisfaction with the service they received from estate

agents, solicitors and other services they encountered and whether, if dissatisfied,

they had gone on to complain about the service. We explored what consumers

found most frustrating about the process and, if they had suffered detriment, asked

about both the financial and personal impact.

Methodology

We used the TNS Online Panel to identify respondents who had either bought or

sold a residential property in the two years prior to March 2015 or who had an offer

accepted or accepted an offer but did not go on to complete the transaction

9

. This

could include their own home, a second home, a buy to let property or a probate

sale.

Those respondents who had both bought and sold (or tried to buy and seller) were

randomly assigned to either our surveys of buyers or sellers to minimise respondent

burden.

Table 1- 1 shows the composition of the total sample achieved for the survey of

successful buyers and sellers as well as the additional respondents who had tried

unsuccessfully to buy or sell a home. We discuss the sample of failed transactions

in more detail in Chapter 5.

9

Fieldwork was conducted between March 10

th

and March 26

th

2015

11

Table 1- 1 Sample composition

Number of

interviews

Successful buyers

1185

Successful sellers

920

Unsuccessful buyers

130

Unsuccessful sellers

123

Total interviews

2358

In our survey of successful purchases, about one in four respondents were first time

buyers, but it is notable that despite the rising average age of first purchase, nearly

one third of under 35s had previously bought a home.

Table 1- 2 Successful buyers by age and whether first time buyer

Age

25-34

35-44

45-54

54-64

65+

Total

%

%

%

%

%

%

First time buyer

68

21

8

3

2

24

Experienced

buyer

32

79

92

97

98

76

Base*

284

292

228

249

132

1185

*All successful buyers

In our survey of successful sales, 22% of sellers were selling a property for the first

time. Not surprisingly, sellers had an older age profile than buyers but still, over one

in four of the under 35s (27%) in the survey had previous experience of selling a

home.

12

Table 1- 3 Successful sellers by age and whether first time seller

Age

25-34

35-44

45-54

54-64

65+

Total

%

%

%

%

%

%

First time seller

73

32

25

11

9

22

Experienced

seller

27

68

75

89

91

78

Base*

86

148

208

295

183

920

*All successful sellers

The age of the buyers and sellers also reflected the characteristics of home buyers

and sellers across the regions of England and Wales. Most buyers and sellers of

properties in London (68% and 53% respectively) were under 45, whilst most buyers

and sellers in the South West, for example, were over 45 (61% and 86%

respectively) (Tables 1- 4 and 1- 5).

In much of our analysis, we explore how the experience of buying and selling varies

by age, experience and region as well as other relevant factors. It is important,

therefore, to bear in mind first that not all younger buyers and sellers have little

experience of the market and, secondly, that the age profile of buyers and sellers

varies considerably by region.

13

Table 1- 4 Age of buyers by region

Region

N.East

N.West

Yorks.

E.Mids

W.Mids

E.Eng

Lon

S.East

S.West

Wales

Total

Age

%

%

%

%

%

%

%

%

%

%

%

25-44

39

55

50

41

50

53

68

42

39

43

59

45+

61

45

50

59

50

47

32

58

61

58

41

Base*

62

132

127

80

123

148

124

157

148

80

1181

*All successful buyers except four with missing information.

Table 1- 5 Age of sellers by region

Region

N.East

N.West

Yorks.

E.Mids

W.Mids

E.Eng

Lon

S.East

S.West

Wales

Total

Age

%

%

%

%

%

%

%

%

%

%

%

25-44

25

19

30

28

29

23

53

21

14

12

25

45+

75

81

70

72

71

77

47

79

86

88

75

Base*

56

101

94

69

96

101

97

133

106

66

919

*All successful sellers except one with missing information.

14

For those taking part in the full survey (who had bought or sold through a traditional

estate agent), results were weighted by region and property value using Land

Registry data available from March 2013 to February 2015. There is no means to

weight further by the characteristics of consumers in this sector as only the

characteristics of those applying to mortgage lenders are available

10

.

Similarly with no national data on failed transactions, the second survey of

unsuccessful attempts to buy or sell a home is based on unweighted data.

Glossary of terms

We define below the terms that we use throughout this report.

• Home: The residential property being bought or sold. It may be the

respondent’s home, second home, a buy to let property or probate sale.

• Traditional estate agent: An estate agent with a high street as well as online

presence.

• Successful buyer: Respondents who completed a sale in the two years prior

to the survey. If they completed more than one sale we asked them about

their most recent transaction.

• Successful seller: Respondents who completed a sale in the two years prior

to the survey. If they completed more than one sale we asked them about

their most recent transaction.

• First time buyer: Respondents whose most recent transaction in the

previous two years was their first purchase of a home.

• First time seller: Respondents who sold their home in the past two years and

who did not sell any other property before or after this sale.

• Experienced buyer: Respondents who had bought a home prior to the

transaction discussed in the survey.

• Experienced seller: Respondents who had sold a home prior to the

transaction discussed in the survey.

• Failed transaction: When a sale/purchase falls through after the offer has

been accepted.

• Failed Buyer: A buyer who experienced a failed transaction

• Failed Seller: A seller who experienced a failed transaction

• Solicitor: For brevity we use this term inclusively to mean solicitor or licensed

conveyancer.

10

For example the Council of Mortgage Lenders provides data on the whether a borrower is a first

time buyer and distribution of mortgage lending but there is no equivalent data on the characteristics

of cash buyers who are believed to account for nearly 40% of purchases in 2015.

www.nationwide.co.uk/~/media/MainSite/documents/about/house-price-index/May_2015.pdf

15

2. Use of traditional estate agents

Key findings

• Over four out of five buyers and sellers bought or sold a home that was

marketed by a traditional estate agent (83%).

• Older sellers and those involved in the complexities of an onward chain were

more likely to use a traditional agent.

• Those using traditional agents to sell their home tended to say they simply

prefer to do it that way (63%), but some were concerned that it would be hard

to communicate without an agent to assist (20%) or that something would go

wrong with the process otherwise (20%).

• Younger sellers who used a traditional agent were less likely to hold a strong

preference for this choice but were more likely to feel they lacked the

experience necessary to do otherwise.

• Buyers’ channel of purchase tended to be driven by the choice of the seller of

the home they wanted to buy, but there is some evidence that older buyers

were more likely to have found their property through a traditional agent.

• Around 10% of buyers and sellers completed their transaction privately with

around one in five (20%) of this group selling to a friend or relative.

• About one in twenty (5%) sellers used an online estate agent with higher levels

among younger sellers.

16

Who uses a traditional estate agent?

This survey was primarily concerned with the experience of buying and selling a

property through a traditional estate agent with a high street presence. Among our

initial sample of all home buyers and sellers, 83% had completed their transaction

using the services of a traditional estate agent, about one in 10 (10%) had bought or

sold privately and one in 20 (4% of buyers and 5% of sellers) used an online only

agent. A small number of properties were bought through other channels such as

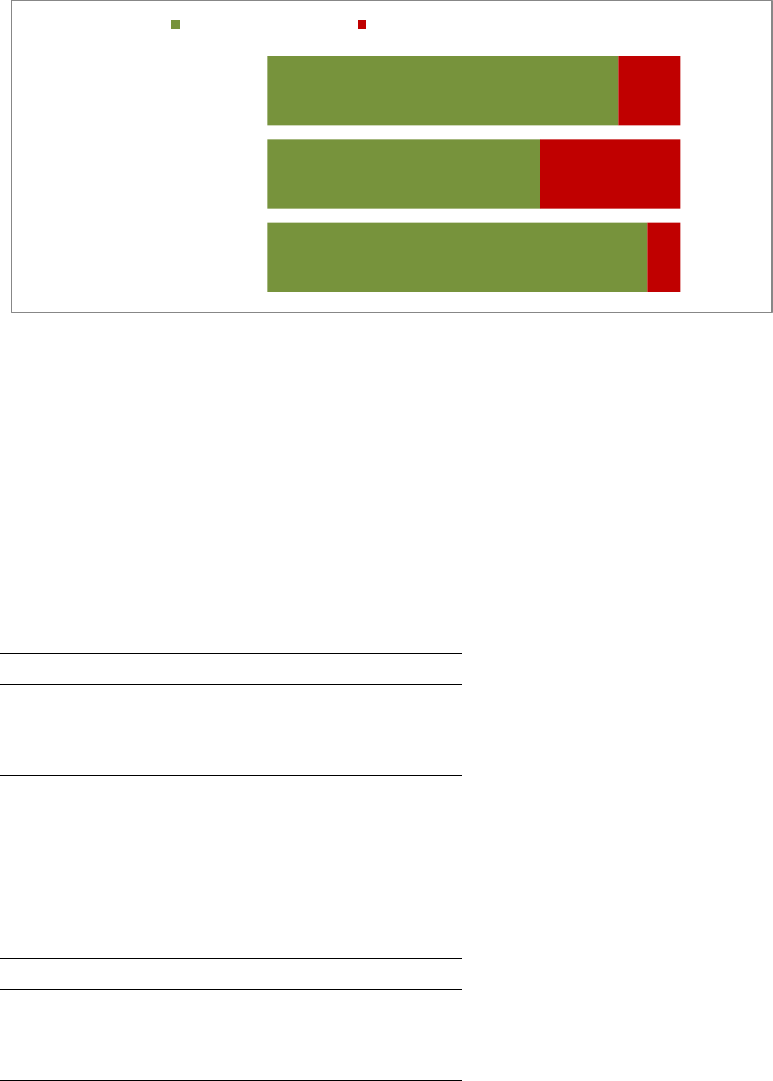

new build homes bought directly from a developer (Figure 2.1)

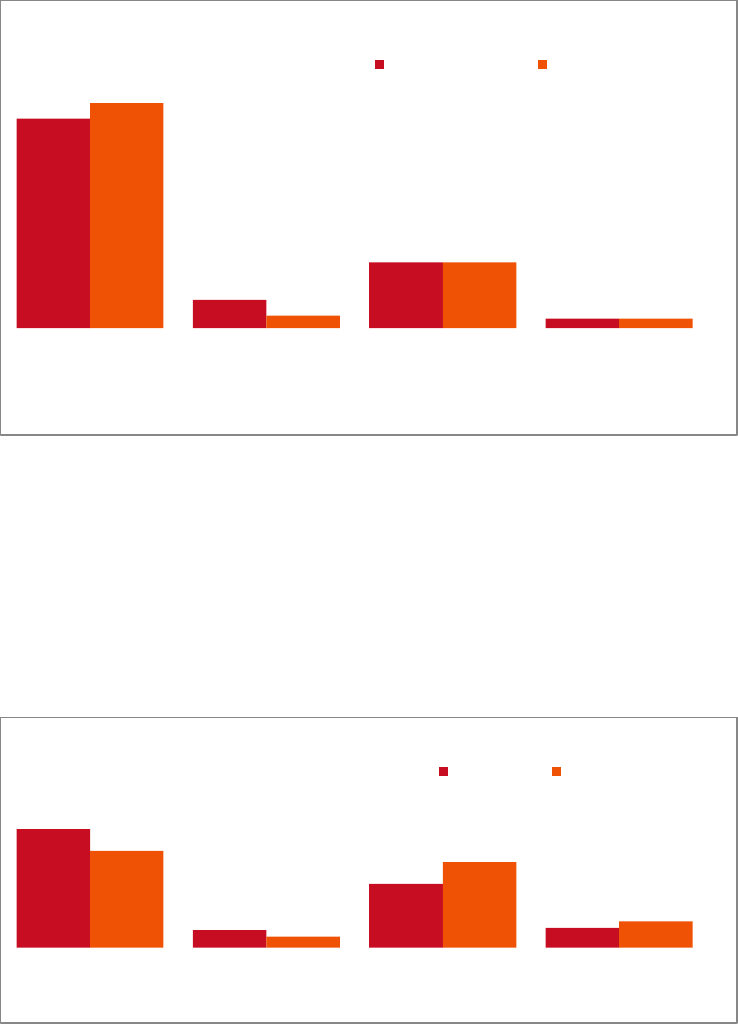

Figure 2- 1 Method of home buying and selling (%)

Unweighted base: all successful buyers (1185)

Unweighted base: all successful sellers (920)

Source: Q21: Did you buy your home through a…?

Source: Q32. Did you sell the property through…?

Differences are most pronounced among sellers given that they determine the

channel by which the property is marketed. Older sellers were more likely to have

used a traditional agent (85% of those aged 45 or older compared to 79% of those

under 45). Sellers with an onward chain, who may be under more pressure to find a

buyer and complete the sale, were also more likely to sell through a traditional agent

(88% compared to 80% of those not in a chain). Although numbers are small, there

appeared to be higher use of private sales in Yorkshire and Humberside as well as

Wales (Table 2-1).

83

4

10

1

2

83

5

10

1 1

Traditional

estate agent

Online estate

agent

Private sale Auction Other

Buyers Sellers

17

Table 2- 1 Methods of home selling across regions

N.East

N.West

Yorks.

E.Mids

W.Mids

E.Eng

Lon

S.East

S.West

Wales

Total

%

%

%

%

%

%

%

%

%

%

%

High street agent

with a branch or

branches

86

83

71

88

82

86

89

86

88

79

83

An online estate

agent with no

branches

4

6

5

7

6

7

7

3

3

5

5

Private sale

9

11

18

3

1

6

1

8

8

14

10

An auction

2

0

3

1

0

0

1

1

0

3

1

Other

0

0

2

0

1

1

1

2

1

0

1

Base*

56

101

94

69

96

101

97

133

106

66

920

*Successful sellers who sold a property in the specified region

Source: Q95: Did you sell your property through…?

Differences among buyers were smaller and were generally driven by the choice of

the seller of the property they wanted to buy, but there was a slightly higher tendency

to buy through a traditional agent among older buyers (84% of over those aged 45 or

over compared to 81% of under 45s).

Reasons for choosing a traditional estate agent

When asked why they used a traditional agent rather than selling another way,

nearly two thirds (63%) of this group of sellers simply reported that they preferred to

do so, but one in five were concerned that something was ‘more likely to go wrong’

or that it would be ‘harder to communicate’ if they managed the process differently

(20% each). Buyer preferences were less strong, again reflecting the fact that the

choice of sales channel has been made by the seller of the home they want to buy.

Only just over one third (36%) of those who bought through a traditional agent had a

clear preference for this method, but there were shared concerns about

communication (20%) and whether the process would be secure without a traditional

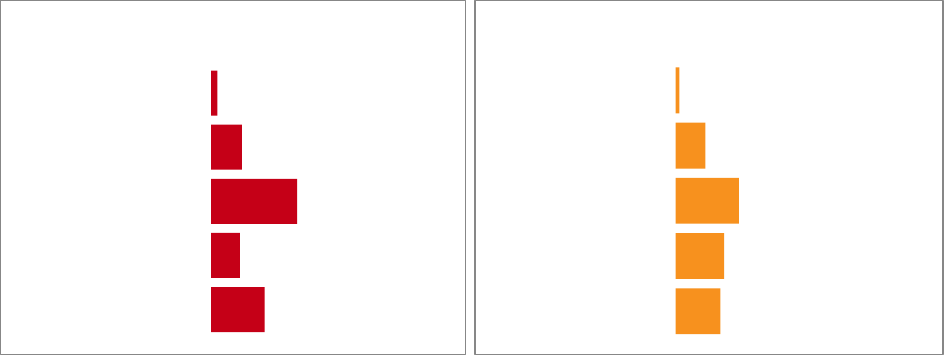

agent (18%) (Figures 2- 2 and 2- 3)

18

Unweighted Base: Successful buyers who used a traditional estate agent (979) and successful sellers

who used a traditional estate agent (765)

Source: Q96: Why did you decide not to use another way to sell your home? (Multi coded)

Source: Q22: Why did you decide not to use another way to buy your home? (Multi coded)

Although younger sellers and buyers were more likely to choose non-traditional

channels overall (19% of sellers under 44 and 21% of buyers under 44 did not use a

traditional agent compared to 16% of sellers and 15% of buyers aged 45 and over),

those who did use a traditional agent were more likely to cite their lack of experience

in the market as a factor affecting their choice rather than a positive preference for

traditional agents more common among older sellers. Three in ten sellers under 35

(30%) mentioned that they used a traditional agent because they had little

experience in the housing market compared to only 3% of those aged 65 or older.

But only four in ten of this younger group (39%) said they preferred to use a

traditional agent compared to nearly seven in ten (69%) of those aged 65 or over.

The stronger preference for traditional agents by both sellers and buyers who were

in a chain were borne out by their concerns that using other means ‘might be less

secure’ (23% of sellers and 22% of buyers compared to 14% of sellers and 15% of

buyers who were not in a chain). Sellers in a chain were also concerned about the

difficulties of communicating up and down the chain without a traditional agent

working for them; with 26% reporting that it would be ‘harder to communicate’ if they

used non-traditional methods compared to 15% of those not in a chain.

Who does not use a traditional agent?

Nearly one in five of our initial sample (17%) did not buy or sell their property using a

traditional agent. One in ten (10%) achieved a private sale and one in twenty (5%)

used an online agent. Only 1% of respondents bought or sold at auction. Younger

36

23

19

19

18

15

0

Prefer to use a

traditional agent

The method I used

was the only option

available to me

Might be less secure

Might be harder to

communicate

Little experience

More likely to go

wrong

Other

Buyers

63

20

20

18

8

4

Prefer to use a

traditional agent

Might be harder to

communicate

More likely to go

wrong

Might be less secure

Little experience

Other

Sellers

Figure 2- 2 Why buyers did not

decide to use another way to buy

their home (%)

Figure 2- 3 Why sellers did not decide

to use another way to sell their home

(%)

19

sellers were more likely to used online agents (6% of those under 45 compared to

3% aged 45 or over) than older age groups.

Reasons for not using a traditional agent

Respondents who sold privately quite often had a buyer in mind that removed the

need to market the property; one in five sold their property to a friend or relative or at

least had a private buyer ready (12%). Buyers in this group again had less strong

preferences with indeed nearly one in four (24%) who had bought privately reporting

that they still prefer to use a traditional agent (Figure 2-4 and 2-5).

Unweighted Base: Successful buyers who bought

their home through a private sale (114)

Unweighted Base: Successful sellers who sold their home through a private sale (89)

Source: Q96: Why did you decide not to use another way to sell your home? (Multi coded)

Source: Q22: Why did you decide not to use another way to buy your home? (Multi coded)

24

9

8

8

8

8

5

Prefer to use a

traditional agent

Bought from

family/friend

The method I used

was the only option

available to me

More likely to go

wrong

Little experience

I would not trust the

details provided

Other

Buyers

20

12

10

8

6

4

Bought from

family/friend

Had a private

buyer

The method I used

was the only

available to me

Concerned that

fees would need to

be paid upfront

More likely to go

wrong

Other

Sellers

Figure 2- 5 Why private buyers did not

buy a home another way (%)

Figure 2- 4 Why private sellers

did not decide to sell their home

another way (%)

20

3. Marketing properties and finding a

property to buy

Key findings

Sellers

• Most (75%) sellers asked more than one estate agent to value their home

but nearly all (94%) opted for a sole agency contract when they put the

property on the market. Although one in ten (12%) of those opting for sole

agency would have rather appointed multiple agents, they were put off by

the higher fees.

• Experienced sellers were more likely to negotiate the terms of their contracts

(typically fees or length of contract) (42%) than first time sellers (30%).

• Similarly experienced sellers were more likely to change agents to achieve a

sale (18% compared to 13%), most commonly because they believed they

were not getting enough viewings. Similarly, those in a chain and often

under pressure to complete a deal were more likely to change agents (21%)

than those with no onward purchase (15%)

• Around two thirds (66%) sold their home on a percentage commission basis,

whilst one in five (18%) paid a flat fee, sometimes still broadly linked to the

price of their property.

Buyers

• Three in ten (30%) buyers only viewed the property they went on to buy

once before making an offer.

• One in five (20%) buyers would have liked another viewing but this was not

noticeably higher among those who had only one viewing. Instead, first

time buyers (29%) and those buying in London (28%) were the most likely to

feel they didn’t view the property as much as they would have liked.

• Among those who would have liked to view the property again, nearly one in

three (29%) simply felt there wasn’t time before needing to make an offer

and similarly, nearly one in four (24%) reported that the estate agent had told

them there was a lot of interest in the property.

• As well as property descriptions and measurements, nearly all buyers found

further information such as the level of interest in the property; the seller’s

position or answers to their specific questions when given helpful when

provided.

• Only flood risk reports and Energy Performance Certificates were less likely

to be considered helpful among those that were shown them (found helpful

by 67% and 63% of buyers respectively).

• In the minority of cases were a current surveyor’s valuation and/or survey of

the property was available (14%), buyers were very likely to find this

information helpful (83% and 89% respectively). There was also most

interest in receiving this type of information from those who did not receive a

survey.

21

This chapter discusses the experience of marketing a property or finding a property

to buy among those who eventually completed their transaction using a traditional

estate agent.

The seller experience

Choosing an agent

When preparing to market their property, three quarters of sellers (75%) obtained a

valuation from more than one estate agent (Figure 3- 1) but over nine in ten (94%)

then initially appointed one agent on a sole agency contract (Figure 3- 2)

Figure 3- 1 Number of agents who valued the property

Base: all successful sellers who used a traditional agent (765)

Source: Q97: When you were preparing to sell your home, how many estate agents did you get to

value your home?

24%

36%

34%

5%

1 2 3 4

• Nearly two thirds of buyers (63%) reported the estate agents encouraging

them to offer on the property, including around in four being told it was

priced for a quick sale (26%) or there was a lot of interest in the property

(24%).

• Buyers in property hotspots such as London and the South East were

most likely to be told there had already been an offer on the home (26%

in both regions) with Londoners being put under further pressure hearing

that someone else was about to offer on the property (21%).

• Clearly advice will follow the nature of the local housing market but of

those buyers that received these types of messages from agents, nearly

one in four (39%) felt that they had put in an offer sooner or at a higher

level, or both, than they wanted to.

• Inexperienced first time buyers were most vulnerable to this pressure with

47% regretting the speed or level of their offer, compared to 36% of

experienced buyers.

22

Figure 3- 2 Whether home was sold with sole or multiple agents

Base: all successful sellers who used a traditional agent (765)

Source: Q98: And did you initially instruct an agent or agents as…?

Of those who chose a sole agent, over one in ten (12%) would have rather used

multiple agents to sell their homes. When we asked why they used sole agency

despite this preference, unsurprisingly, over half (57%) were motivated by the lower

fees but nearly three in ten (29%) felt they were not offered the option of a multiple

agency contract by their agent.

Base: All successful sellers

who directed a sole agent

but would rather have instructed multiple (85)

Source: Q:100 Why did you choose sole agency? (Multi coded)

94%

6%

Sole agent Multiple Agent

57

19

12

11

2

The commission/fee

was lower

The estate agent did

not offer me the

option of multiple

agents

I would rather only

deal with one agent,

even if meant fewer

viewings

The estate agent

advised me against

using multiple agents

Other

Figure 3- 4 Why sellers chose sole agency (%)

23

Although cost may determine the dominance of sole agency contracts in the market,

it is not the greatest determinant of the final choice of agent. Over half of sellers

reported that they took reputation into account when choosing their agent (53%)

rather than choosing the agent with the lowest fees (31%). Sellers also selected

agents on the basis of proximity to their home (34% citing ‘located very near to my

home’ as a reason for their choice). (Table 3-1)..

Table 3- 1 Reasons for choosing an estate agent

%

They have a good reputation

53

They are located very near to my home

34

They charged the lowest fees/commission

31

They have a high level of professionalism

25

I was confident in the speed they could sell my property

20

They gave me the highest valuation

17

They have a large branch network

15

They were recommended to me

14

They belong to a professional body or a scheme with a code of conduct

14

I used them to buy this home

9

Other

1

Base*

765

*All successful sellers who used a traditional estate agent

Source: Q101: thinking of the agent you initially instructed to sell your home,

what made you decide to use them? (Multi coded)

First time sellers were more likely to choose the agent that gave them the highest

valuation (26% giving this reason for their choice) than those with more experience

in the market (15% saying this was a factor) and had a stronger preference for the

agent that charged the lowest fees (38% compared to 29% of more experience

sellers). Experienced sellers were more likely to consider the speed with which they

thought the agent could sell the property to be important (21%) than first time sellers

(15%).

24

Switching agents

Nearly one in five (17 per cent) sellers changed estate agent before they eventually

completed their sale. Thirteen per cent changed from one sole agency contract to

another, with the remaining 4% switching between sole and multiple agency

contracts or changing their agents on a multiple agency contract.

Experienced sellers were slightly more likely to switch (18%) than first time sellers

(13%) but younger sellers were more likely to change than older age groups (22% of

those aged under 45 compared to 15% of those aged 45+). Whilst age and

experience in the housing market were clearly correlated, younger consumers who

do have experience in the housing market were appearing to exercise more choice

not only over whether to use a traditional agent at all, but also over whether to stay

with that agent if they were not receiving the service they would expect.

Although numbers are too small to report it is not surprisingly that sellers who had

complained about their estate agent were most likely to switch, but switching was

also more common among those who may be more likely to feel under pressure to

find a buyer such as those in a chain (21% compared to 13% among those not in a

chain) or those who perceived that prices were falling in their local area (23%

compared to 13% who felt they rising).

The most common reason cited for changing agents was because they were ‘not

getting enough viewings’ (54%) or had not received any offers (45%). (Table 3- 2).

Table 3- 2 Reasons for changing estate agent

%

I was not getting enough viewings

54

I did not receive any offers

45

I was receiving poor service from the previous agent(s)

37

I did not receive any offers that were high enough

22

Other

4

Base*

128

*Successful sellers using a traditional estate agent who changed their agent

Source: Q103: Why did you change estate agents? ((Multi coded)

For those that did switch, the majority found it easy or very easy (90%) with only

around one in ten reporting it to be difficult or very difficult.

25

Information provided by the estate agent

We asked sellers about the type of information that they recall receiving from the

estate agent that successfully sold their property Nearly all (93%) recall receiving

confirmation of at least one aspect of their contract with the agent but respondents

had relatively low recall of terms such as the length of the contract (45%) or whether

any charges that might be incurred if they take the property off the market (41%).

(Table 3- 3).

Table 3- 3 Information received from the agent

%

Their terms of business (whether sole selling rights, sole agency etc.)

66

A scale of their charges for a successful sale

58

The length of their contract with you

45

Their fees or charges should the property be taken off the market without a

sale

41

A breakdown of the different components of their fees and charges

38

None of the above

7

Base* 765

*All successful sellers who used a traditional estate agent

Source: Q109: When originally discussing the arrangement for selling your home, did

the agent give you information or tell you about any of the following? (Multi coded)

Negotiating the contract with an estate agent

Less than four in ten sellers (39%) successfully negotiated any terms of their

contract with the agent that went on to sell their property such as its length or fees.

First time sellers were least likely to negotiate any terms (30%) compared to those

with experience of selling (42%). But it is experience rather than age that is driving

this difference. Indeed, younger sellers overall were more likely to negotiate on

terms (50% of the under 45s) than those aged over 45 (35%).

Sellers who felt that prices were increasing were in a stronger position given the

likely competition among agents locally, with 42% negotiating terms, than those who

felt prices were falling (34%). Also sellers entering into a chain were more likely to

negotiate (44%) than those with no onward purchase (35%). Over four out of five

(82%) of those not in a chain were aged over 45 (compared to 69% of those that

were) and we can speculate that these older sellers may be less prepared to

negotiate.

Where sellers did negotiate terms it was most commonly the fee (31% of all sellers)

although over one in ten (11%) changed the length of their contract. (Table 3- 4).

26

Table 3- 4 Terms that sellers negotiated with estate agents

%

A lower fee

31

Length of the contract

11

Charges if the property is taken off the market without a sale

7

Other

2

None

61

Base*

765

*All successful sellers who used a traditional estate agent

Source: Q111: Did you negotiate a lower fee with the agent from the one they

initially offered?; Q111: did you negotiate any other terms of your contract with

the estate agent? (Multi coded)

Sellers in London and the South East were more likely to have negotiated a lower

fee (38% and 40% respectively) largely reflecting the more buoyant market in these

regions and those selling properties in London were also more likely to have

negotiated the length of their contract (17%). Considering that the average value of

properties sold in London was £356,492 and the South East £296,150, compared to

a national average of £266,043, it is not surprising that these sellers were more price

sensitive. Less than one in four first time sellers (24%) had negotiated on their fees

but again this was the inverse of the age differences where the under 45s were more

likely to negotiate (37%) than those over 45 (29%).

27

Contract Length

Only two thirds of sellers (66%) could recall the length of their contract with their

agent. Of those that could give a duration, two thirds (66%) had a contract of seven

or more weeks (Figure 3- 6).

Figure 3- 3 Length of contract with estate agent

Base: All successful sellers who used a traditional agent and knew how long their

contract had been (506)

Source: Q112: And how long was your contract with the estate agent?

The vast majority (94%) of those sellers who could remember the length of their

contract were happy to accept that length of time.

Fees paid to the agent

Two thirds (66%) of sellers agreed to pay their agent a percentage of the achieved

sale figure as commission whilst 18% agreed a flat fee whether linked to their

property value or not.

Table 3- 5 Type of fees paid to the agent

%

A percentage of the achieved sale price

66

A pre-defined flat fee irrespective of the value of your home

16

A pre-define flat fee that was linked to the value of your home

17

Other

1

Base*

765

*All successful sellers who used a traditional estate agent

Source:Q105: Thinking of the agent that eventually sold your property, did you

agree to pay them..?

2%

2%

10%

19%

66%

<1 week 1-2 weeks

3-4 weeks 5-6 weeks

7+ weeks

28

First time sellers were notably more likely to sell on the basis of a flat fee that was

not explicitly linked to the eventual sale value (25%) than experienced buyers (14%).

The reasons are not clear from the data but may reflect some practices of minimum

fees charged by agents for selling lower value properties.

Of those that agreed to pay a percentage and could recall the amount, over half

(52%) paid between 1.0 and 1.4% commission with few paying 2% or more (Figure

3- 4)

Figure 3- 4 Agreed percentage of final sale paid as fee to agent (where able to

recall)

Base: all successful sellers who had used a traditional agent and had agreed to pay them

a percentage of the achieved sale value and could recall what this was (430)

Source: Q107: Can you remember the percentage of commission you agreed to pay?

9%

52%

33%

6%

>1.0% 1.0-1.4 1.5-1.9% 2%+

29

Of those who agreed a fixed fee, and could recall the amount, over half (57%)

reported paying up to £1500 for their sale. By December 2013, the average house

price in the UK had reached £250,000

11

for which a 1% commission would therefore

be £2,500. As percentage commission has become more competitive between

agents, fixed fees are sometimes now charged for the sale of lower value properties.

Table 3- 6 Value of fee paid to agent

Value of fee paid

%

<=£1,000

39

£501-£1,000

19

£1,001-£1,500

18

£1,501-£2,000

16

£2,001-£2,500

8

£2,501-£3,000

5

£3,001-£4,000

7

£4,001+

6

Base*

259

*All successful sellers using a traditional agent who agreed

to pay their agent a fixed fee

Source: Q108: Can you remember the fee you agreed to

pay?

Nearly all fees (97%) were paid on completion of the sale with only a small minority

entering into other agreements.

11

Office for National Statistics (2014) House Price Index December 2013 release

www.ons.gov.uk/ons/rel/hpi/house-price-index/december-2013/stb-december-2013.html

30

The buyer experience

Viewing the property

Three in ten (30%) buyers only viewed the property they bought once before making

an offer and over half (53%) viewed it twice with no noticeable differences between

first time buyers (31%) and more experienced purchasers (29%).

Instead perception of the market had some influence, with those perceiving prices to

be rising more likely to make a decision after one viewing (31%) compared to those

who consider them to be falling (26%). This was consistent with some regional

variation in the speed of decision reflecting housing market hotspots such as the

South East (34%), East of England (33%) and London (31%) as well as other areas

of the county such as Yorkshire and the Humber (31%).

Also those buying a flat or apartment (whether purpose built or converted) were

more likely to make a decision after one viewing (34%) compared to those buying

any type of house (29%). This was more pronounced when looking at the size of the

property, with 42% of those buying a studio or one bedroom property making an offer

after only one viewing compared to 29% of those buying a property with two or more

bedrooms.

Figure 3- 5 Number of viewings before making an offer

Base: all successful buyers who used a traditional agent (979)

Source: Q26 Can you recall how many times you viewed this property before making an offer?

One in five buyers (20%) would have preferred to view the property more before

making their offer although interestingly this was not noticeably higher among those

who had only had one viewing. Instead first time buyers, who lacked experience in

30%

53%

14%

2%

1%

1 2 3 4 5+

31

the market, were more likely to want to see the property again (29%) than those who

had bought before (17%).

Reflecting the pressure on the market, buyers in London were most likely to say they

would have like to have seen the property again (28%), as did buyers in the East of

England (27%). Those in the South East seem less concerned with only 16%

wishing they had seen the property again, although base sizes mean this should be

interpreted with caution.

Figure 3- 6 Viewed property once and whether would have liked to have viewed

property again by region (%)

12

Base: All buyers who used a traditional agent – North East (45), North West (102), Yorkshire and the

Humber (104), East Midlands (71), West Midlands (103), East of England (118), London (104), South

East (139). South West (130), Wales (61)

Source: Q26 Can you recall how many times you viewed this property before making an offer?

Source: Q27 Would you have preferred to view the property further before making an offer?

Among those who would have liked to view the property again, there was a sense of

pressure with 29% feeling they did not have time to go back again before offering

and 24% making a decision because the agent told them there was a lot of interest

in the property.

12

Due to low base sizes, some scores should be treated with caution

18

21

31

35

17

33

31

34

30

37

14

18

22

17

20

27

28

16

15

21

N.East N.West Yorks. E.Mids W.Mids East

Eng.

Lond S.East S.West Wales

Viewed property once Would like to have viewed again

32

Table 3- 7 Reasons for buyers not viewing the property again

%

I did not have the time to go and view the property again

29

I offered because the estate agent told me there was a lot of interest in the

property

24

I did not feel comfortable asking for another viewing

22

I was worried about prices going up generally

20

I offered because the estate agent set a deadline to decide

13

I was worried the seller would put the price up

12

My partner didn’t want to view the property again

9

Other

11

Base*

195

*All successful sellers who used a traditional agent and would have liked to view their property again

Source: Q28: Why were you not able to view the property again? (Multi coded)

Information from the agent

We asked buyers what information they recall receiving when they viewed the

property they went on to buy and, for those that did receive it, whether they found it

helpful. Whilst the reporting of receiving essential information such as the asking

price and a property description appears rather low this may be due to respondent

interpretation. With most buyers initially inspecting properties on property sale

portals they may consider that they got the information from the portal, although it

had, of course, been uploaded by the agent.

As well as the essential information, we asked buyers what other types of

information the agent provided alongside the viewings. Around half recalled the

agent answering their questions at the time of viewings (56%) as well as confirming

how long the property had been on the market (49%) and details of the seller’s

position (46%). Fifty five per cent recalled having been provided with an Energy

Performance Certificate (despite it being a legal requirement) although many may

have recalled this as part of the property description. Most buyers found the

information they recalled receiving helpful (Figure 3-7).

33

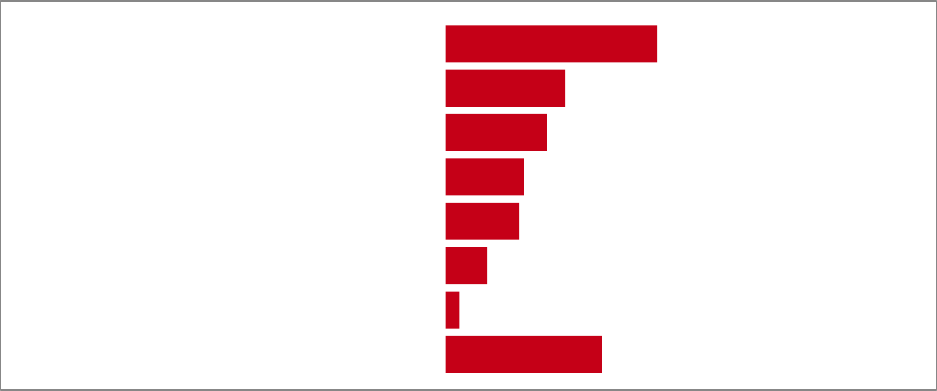

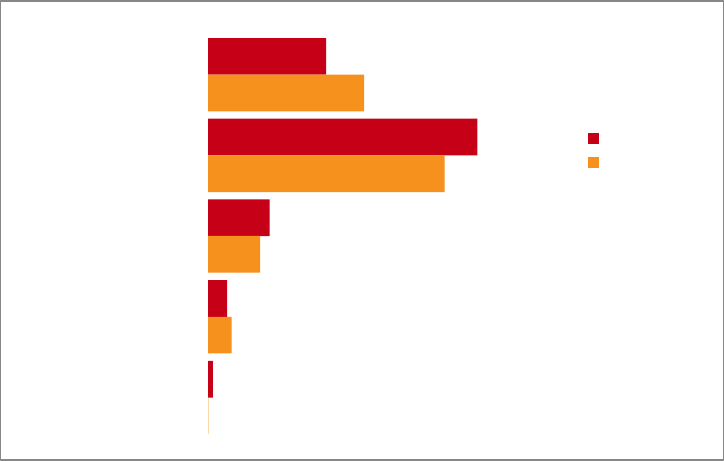

Figure 3- 7 Whether information provided by the agent and, of those recalling

receiving this information, whether found it helpful (%)

Base: all buyers who used a traditional estate agent (979), all buyers who received information: a

(773), b (659), c (601), d (545), e (543), f (484), g (456), h (346), i (182), j (151), k (140), l (132), m

(113), n (116), o (61), p (16).

Source: Q23 When viewing this property what information did the estate agent and/or seller give to

you?

Source: Q24: and how much did you feel this information helped you make an informed decision

about whether to offer on this property?

79

67

62

56

55

49

46

35

19

16

14

14

12

12

6

2

87

92

87

89

63

77

84

75

86

86

83

89

67

86

70

40

a) The asking price

b)A property description with measurements

and photos

c)A floorplan

d)Answering questions when accompanying on

a viewing

e)The EPC

f)How long the property had been on the

market

g)Details of whether the seller needs to buy a

property in order to move

h)Interest in the property to date

i)Details of any service charges and ground

rent on the property

j)Any previous asking price

k)A surveyor's valuation of the property

l) A surveyor's report on the condition of the

property

m)A flood risk report

n)How many years are left on the lease

o)Further information about the leasehold

p)other

Received Found Helpful

34

Figure 3- 8 Information buyers would have liked to have received (%)

Base: successful buyers who used a traditional agent and did not receive information: a (206), b (320), c

(378), d (434), e (436), f (495), g (523), h (633), i (797), j (828), k (839), l (847), m (866), n (863), o (918).

Source: Q25: Would you have liked to receive any of these types of information at the time of viewing the

property

We also asked the buyers whether the agent gave them any advice or information that

may have influenced their decision to offer (Table 3- 8). Around one in four were told that

the property was priced for a quick sale (26%) or that there had been a lot of interest in the

property (23%). One in five buyers (20%) were told there had already been an offer on the

property.

26

25

29

23

36

41

26

42

17

35

53

58

29

10

17

a)The asking price

b)A property description with measurements

and photos

c)A floorplan

d)Answering questions when accompanying

on a viewing

e)The EPC

f)How long the property had been on the

market

g)Details of whether the seller needs to buy

a property in order to move

h)Interest in the property to date

i)Details of any service charges and ground

rent on the property

j)Any previous asking price

k)A surveyor's valuation of the property

l)A surveyor's report on the condition of the

property

m)A flood risk report

n)How many years are left on the lease

o)Further information about the leasehold

Would have liked to receive

35

Table 3- 8 Advice given to buyers by agents

%

The seller wants a quick sale so it’s a good price

26

There was a lot of interest in the property

23

There had already been an offer on the property

20

That there aren’t many properties like this on the market

15

Someone was about to make an offer on the property

13

That you should make a sealed bid

1

None of the above

37

Base*

979

*All successful buyers who used a traditional agent

Source: Q29: Before you made your offer did the estate agent tell you or do any

of the following? (Multi coded)

Advice from agents tended to follow expected regional patterns. Over one third of buyers

in London (36%) were told there was a lot of interest in the property and over one quarter

in both London and the South East (26%) were informed there had already been an offer.

Londoners were put under further pressure being more likely to be told that someone was

about to make an offer (21%). Buyers in Yorkshire and Humber were more likely to be told

the property was priced for a quick sale (34% compared to only 21% in London).

Clearly advice will reflect the nature of the local market but we did ask whether

respondents felt that as a result of these statements they made an offer sooner than they

would have liked or at a higher level than they had planned. Of those who had received

these types of advice from agents, nearly four in ten (39%) made took one of these

actions; being told that someone else was about to make an offer was most likely to affect

the buyers’ behaviour.

36

Figure 3- 9 Whether made a higher/sooner offer following the advice from agents

13

(%)

Base: Successful buyers who were using traditional agents and were told: The seller wants a quick price so

it’s a good price (257), There was a lot of interest in the property (217), There (had already been an offer on

the property (196), That there aren’t many properties like this on the market (138), Someone was about to

make an offer on the property (120)

Source: Q30 Do you think any of these comments made you put in an offer [sooner,higher] than you wanted

to?

First time buyers were more vulnerable to these pressure statements with 47% regretting

the speed and/or level of their offer compared to 36% of experienced buyers.

Fees paid by buyers

Nearly three in ten (28%) of buyers reported being charged a fee by the seller’s agent for

arranging the purchase. Although the question was clear that this excluded fees for

additional services such as mortgage advice or surveyors recommended by the agent, or

for the sale of their own property, it appears that buyers have included additional fees in

their response. Of those charged a fee, over two thirds (67%) were aware of it up front,

although awareness was lower among first time buyers (60%). The median level of fees

was £600.

13

The statement ‘that you should make a sealed bid’ is not included due to low base size

20

27

21

17

35

22

6

13

19

8

20

12

5

10

8

5 5 5

The seller

wants a quick

price so it’s a

good price

There was a lot

of interest in

the property

There had

already been

an offer on the

property

That there

aren’t many

properties like

this on the

market

Someone was

about to make

an offer on the

property

Total

Higher only Sooner only Both

37

4. From offer to completion

K

Key findings

• The vast majority of offers were made in the conventional way via the estate

agent. Only a small minority (2% of buyers and 3% of sellers) reported using

the sealed bid process. Over half of agents (56%) did not offer the seller any

particular advice about whether to accept the offer, whilst 41% told the seller

that it was likely to be the best price they would get or that no other offers were

likely.

• Experienced sellers were better at establishing information about the

prospective buyer from the agent at the time of offer, such as their financial

circumstances (68% compared to 58% of first time sellers) or whether the

buyer was in a position to move (64% compared to 51%)

• Properties were generally likely to have been taken off the market after the

offer was accepted but buyers were more likely to believe this had happened

(88%) than sellers reported to be the case (77%).

• Even after the offer was accepted, most buyers (70%) and sellers (66%)

continued to have at least one concern about whether they would definitely

make it to completion stage.

• Buyers were most commonly worried that a survey would reveal something

unexpected (35%) and sellers tended to be concerned that the buyer would

change their mind and withdraw their offer (46%)

• Two in five (41%) buyers commissioned a homebuyer’s report. Those who

didn’t tended to be more experienced buyers who considered they could rely

on their own knowledge and experienced to evaluate the property.

• For many (38% of buyers and 41% of sellers) the process took longer than they

expected. As well as the stress and worry, particularly if the parties were in a

chain, around four in ten (38% of buyers and 42% of sellers) incurred costs as

a result of the delay.

• At this stage it was most common to hold the other party’s solicitor responsible

for the delays. Nearly half (47%) of buyers considered the seller’s solicitor to

be responsible, as did 58% of sellers believe about the buyer’s solicitor.

• Half of buyers (50%) said they would be willing to enter a legal commitment

upfront to agree on a schedule for exchanging contracts with the seller if

independent survey and valuation information was available up front. Sellers

were more enthusiastic with 70% willing to enter into this type of contract.

38

This chapter focuses on the experience of both buyers and sellers between making or

receiving the successful offer and completing the transaction. Again the sample is

restricted to only those who bought or sold using a traditional estate agent.

Accepting the offer

We asked sellers about the offer that they accepted on their home and any advice that

they received from their estate agent at the time. In total, over half (56%) of sellers said

that their agent did not offer any particular advice over whether or not to accept the offer,

whilst nearly four in ten (39%) encouraged the seller to accept saying no other offers were

likely or that it was likely to be the best offer they would receive. One in twenty sellers

(5%) accepted an offer despite the agent advising them to decline and wait for a better

offer.

Table 4- 1- Advice offered to buyers by the estate agent for the accepted offer

%

Encouraged to accept, saying no other offers were likely

5

Encouraged to accept, saying it was best offer likely to receive

34

Encouraged to decline, saying other offers were likely

2

Encouraged to decline, saying you could get a better offer

3

Not offer any particular advice

56

Base*:

765

*All successful sellers who used a traditional estate agent

Souce: Q122: And did the agent…?

Most sellers (90%) received some level of information about the buyers’ circumstances at

the time of the offer. Nearly three quarters (73%) were made aware whether the buyer

was in a chain or not and two thirds (66%) received information about the buyers’ financial

circumstances. First time sellers were less likely to elicit this type of information from their

agent than those with more experience (Table 4- 2).

Table 4- 2 Information given to sellers by agents by whether first time seller

First Time

Seller

Experienc

ed Seller

%

%

Information on the financial circumstances of the buyer

58

68

Information whether the buyer was in a chain

70

74

Information on whether the buyer was in a position to move – under offer/renting

51

64

Any personal information demonstrating the buyers’ commitment to move

25

35

Other information about the buyer

14

18

None

15

9

Base

174*

591**

*Successful sellers who used a traditional estate agent and who did not sell a house before

**Successful sellers who used a traditional estate agent and who sold more than one house

Source:Q123: And when advising you of the offer did the agent provide you any of the

following? (Multi coded)

39

Agents were also more likely to confirm if the buyer was in a position to move if the seller

was in a chain (66%) than if not (56%).

Four per cent of sellers reported that they became aware at some point that an offer from

a potential buyer had not been passed on to them by their estate agent which, for those

that have agreed to comply with the Property Ombudsman Code of Practice for

Residential Estate Agents

14

would be a breach of the Code. Reports were higher among

first time sellers (9%) and although base sizes are small, there appeared to a higher

perception of this practice among younger sellers.

Taking the property off the market

Half of the buyers in our survey (50%) said they made it a condition of their offer that the

property was taken off the market once their offer was accepted but only 23% of sellers

reported receiving this condition as part of the offer. Similarly almost nine out of ten (88%)

buyers believed the property was taken off the market after their offer was accepted but

only just over three quarters (77%) of sellers reported doing so.

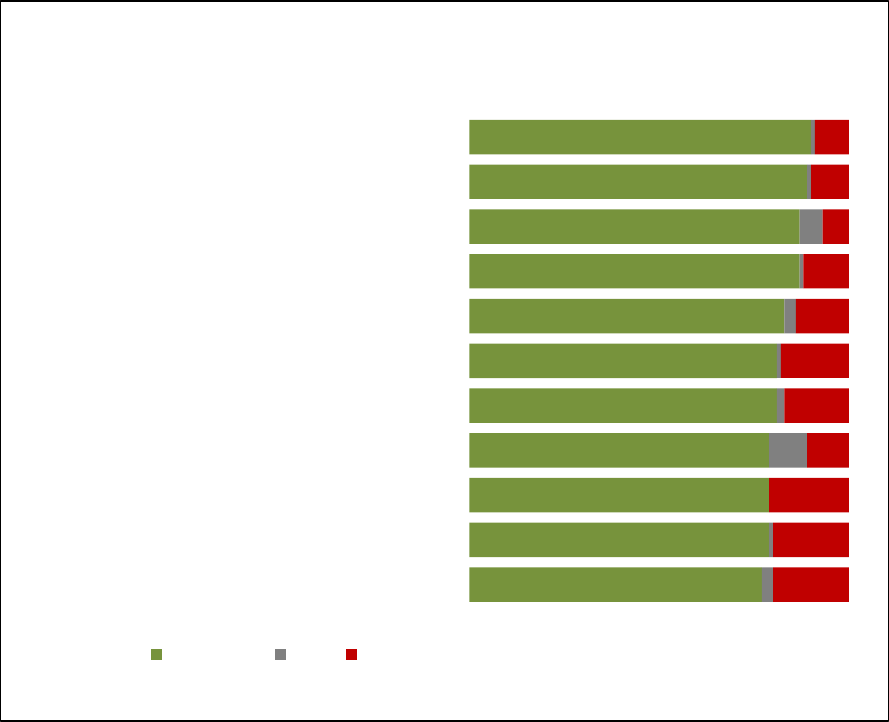

Figure 4- 1 Whether the property was taken off the market

Unweighted base: all successful sellers who used a traditional estate agent (765)

Unweighted base: all successful buyers who used a traditional estate agent (979)

Source: Q121. Did the estate agent take the property off the market once you had accepted the offer?

Source: Q32. Did the estate agent take the property off the market once your offer had been accepted?

Buyers in property hotspots such as London, the South East and East of England were

slightly more likely to make it a condition of their offer that the property should be taken off

14

The Property Ombudsman Code of Practice for Residential Estate Agents

http://www.tpos.co.uk/downloads/TPOE27-

3%20Code%20of%20Practice%20for%20Residential%20Estate%20Agents.pdf

50%

38%

12%

Yes – made it a condition of my offer

Yes – Agent did it anyway

No

Buyers

23%

54%

23%

Yes – buyer made it condition of their

offer

Yes – Agent did it anyway

No

Sellers

40

the market (59%, 55% and 52% respectively) as were those in a chain (54% compared to

43% of those who were not).

Buyers’ and sellers’ concerns after the offer was accepted

Buyers’ concerns