INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 1 -

INSTRUCTIONS AND GUIDELINES

AUSTRALIA-UNITED STATES FREE TRADE AGREEMENT

FILE NO: 2008/041987-01

AUSTRALIA-UNITED STATES FREE TRADE

AGREEMENT

April 2009

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 2 -

T

HIS

I

NSTRUCTION AND

G

UIDELINE REFERS TO

:

P

RACTICE

S

TATEMENT

N

O

:

2009/13

P

UBLISHED DATE

:

4

M

ARCH

2009

A

VAILABILITY

:

Internal and External

S

UBJECT

: Origin issues as they relate to the Australia-United States Free

Trade Agreement.

P

URPOSE

: To specify the rules that need to be satisfied under the Australia-

United States Free Trade Agreement which are used to determine if

a good is a United States originating good and therefore eligible for

the free or preferential duty rate under the Agreement.

O

WNER

:

National Director Trade

C

ATEGORY

: Operational Procedures

C

ONTACT

:

Mail: Director Valuation and Origin

Trade Services Branch

Australian Customs Service

Customs House

5 Constitution Avenue

CANBERRA ACT 2600

Phone: (02) 6275 6556

Fax: (02) 6275 6477

Email: origin@customs.gov.au

The electronic version published on the intranet is the current Instruction and

Guideline.

S

UMMARY OF

M

AIN

P

OINTS

This Instruction and Guideline outlines all the rules of origin under the Australia-United

States Free Trade Agreement.

I

NTRODUCTION

This Instruction and Guideline deals with origin issues as they relate to the Australia-United

States Free Trade Agreement (AUSFTA). This agreement was done at Washington DC, the

United States of America (US), on 18 may 2004 and came into force on 1 January 2005.

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 3 -

Table of Contents

Division 1: Customs Instructions and Guidelines - AUSFTA ........................................... 4

Division 2: Legislation ............................................................................................. 5

Division 3: Overview of the AUSFTA .......................................................................... 6

Division 4: Principles of Rules of Origin ...................................................................... 8

Division 5: Goods Wholly Obtained or Produced Entirely in the US............................... 12

Division 6: Goods produced entirely in the US or in the US and Australia exclusively

from originating materials ...................................................................... 16

Division 7: Goods (except clothing and textiles) produced entirely in the US or in

the US and Australia from non-originating materials.................................. 19

Section 1: Statutory provisions and overview .......................................................... 19

Section 2: First requirement – change in tariff classification....................................... 24

Section 3: Second requirement – regional value content ........................................... 31

Section 4: Third Requirement ................................................................................ 43

Section 5: Summary of Section 153YE .................................................................... 44

Section 6: Goods that are chemicals, plastics or rubber ............................................ 45

Division 8: Goods that are clothing or textiles produced entirely in the US or in

the US and Australia from non-originating materials.................................. 50

Section 1: Statutory provisions and overview .......................................................... 50

Section 2: First requirement – change in tariff classification....................................... 55

Section 3: Second Requirement ............................................................................. 62

Section 4: Summary of Section 153YH.................................................................... 63

Section 5: Clothing and textiles classified to Chapter 62............................................ 64

Section 6: Treatment of sets ................................................................................. 67

Division 9: Other US originating goods .................................................................... 71

Section 1: Standard accessories, spare parts and tools ............................................. 71

Section 2: Packaging materials and containers......................................................... 74

Section 3: Consignment provisions ......................................................................... 75

Division 10: Origin Advice Rulings............................................................................. 77

Section 1: Provision of binding origin advice rulings.................................................. 77

Section 2: Application for origin rulings form ........................................................... 81

Section 3: Origin Advice Rulings - information requirements...................................... 82

Division 11: Fungible goods and materials ................................................................. 84

Appendix 1: AUSFTA Product Specific Rule Table. This table is available as a separate

document

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 4 -

Division 1: Customs Instructions and Guidelines - AUSFTA

1. Coverage of Instructions and Guidelines

1.1. This Instruction and Guideline deals only with origin issues as they relate to the Australia-

United States Free Trade Agreement (the Agreement or AUSFTA). This Agreement was

done at Washington DC, United States of America (US), on 18 May 2004 and came into

force on 1 January 2005.

2. Abbreviations

The following abbreviations are used throughout this Instruction and Guideline:

Agreement Australia-United States Free Trade Agreement

AUSFTA Australia-United States Free Trade Agreement

AUSFTA Tariff Regulations Customs Tariff Regulations 2004

AUSFTA Regulations

Customs (Australia-US Free Trade Agreement)

Regulations 2004

CTC change in tariff classification

Customs Act Customs Act 1901

HS Harmonized System

ROO (ROOs) Rule(s) of Origin

RVC regional value content

US United States of America

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 5 -

Division 2: Legislation

1. General Outline of Legislation

The ROO requirements of AUSFTA are contained within the following provisions:

• Combined Australian Customs Tariff Nomenclature and Statistical Classification

“Introduction”

pages 1 and 2 (Application of Rates of Duty)

• Customs Tariff Act 1995

Part 1 - Preliminary: sections 3, 9, 11, 12, 13, and 14

Part 2 - Duties of Customs: sections 16, 18 and 19

Schedule 4 (general and preferential rates for concessional items)

Schedule 5 (US originating goods)

• Customs Act 1901

Division 1C of Part VIII (sections 153Y to 153YL) – “US originating goods”

• Customs (Australia—US Free Trade Agreement) Regulations 2004

• Customs Tariff Regulations 2004

2. Operation of Legislation

The Agreement was implemented into Australian legislation by the following legislation:

• US Free Trade Agreement Implementation Act 2004 (incorporated into the Customs Act);

• Customs (Australia—US Free Trade Agreement) Regulations 2004

(the AUSFTA regulations);

• US Free Trade Agreement Implementation (Customs Tariff) Act 2004 (incorporated into

the Customs Tariff Act); and

• Customs Tariff Regulations 2004 (AUSFTA Tariff Regulations).

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 6 -

Division 3: Overview of the AUSFTA

1. Geographical Area Covered by the AUSFTA

The Agreement covers the following geographical areas:

1.1. with respect to Australia:

the territory of the Commonwealth of Australia:

(i) excluding all external territories other than the Territory of Norfolk Island, the

Territory of Christmas Island, the Territory of Cocos (Keeling) Islands, the Territory

of Ashmore and Cartier Islands, the Territory of Heard Island and McDonald Islands,

and the Coral Sea Islands Territory; and

(ii) including Australia’s territorial sea, contiguous zone, exclusive economic zone and

continental shelf.

1.2. with respect to the US:

(i) the customs territory of the US which includes the 50 states, the District of

Columbia and Puerto Rico;

(ii) the foreign trade zones located in the US and Puerto Rico; and

(iii) any areas beyond the territorial seas of the US within which, in accordance with

international law and its domestic law, the US may exercise rights with respect to

the seabed and subsoil and their natural resources.

2. Overview of Goods Covered by the AUSFTA

1.1. All goods imported into Australia from the US are covered by the AUSFTA. Preferential

rates of duty applicable to US originating goods commenced on 1 January 2005.

1.2. Section 16 of the Customs Tariff Act 1995 (the Customs Tariff) provides that the rate of

customs duty for US originating goods is Free on 1 January 2005 unless the tariff

classification is specified in Schedule 5.

1.3. Annex 2B of AUSFTA requires that the rates of customs duty for certain US originating

goods are to be phased to Free over a specified period. Schedule 5 to the Customs Tariff

sets out the timing of those phasings and the rates of customs duty that will apply to US

originating goods at each step of that phasing.

1.4. The phasing of rates of customs duty on US originating textile and apparel goods are in

line with Australia’s general phasing of customs duty on textiles, clothing and footwear,

i.e. 2005, 2010 and 2015. Generally the rates are either 8% (2005), 3% (2010) and

Free (2015) or 15.5% (2005), 8% (2010) and Free (2015).

1.5. For certain US originating footwear goods, the rate of customs duty phases by 1

percentage point each year from 2005, when the rate will be 9%, until 2014 when the

rate will be Free. Other footwear will be Free from 2005. These phasing rates apply only

to goods prescribed in the AUSFTA Tariff regulations.

1.6. Certain alcohol, tobacco and petroleum products have had the 5% customs duty removed

in accordance with the Agreement. However, Schedule 5 of the Customs Tariff still

imposes a customs duty on those products which are US originating goods at a rate

equivalent to the excise duty imposed on domestically produced goods under the Excise

Tariff Act 1921.

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 7 -

1.7. Certain US originating passenger motor vehicle goods have phasing rates of customs duty

imposed. The rates are 8% (2005), 6.5% (2006), 5% (2007), 3% (2008), 1.5% (2009)

and Free (2010).

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 8 -

Division 4: Principles of Rules of Origin

1. Explanation of concept of US originating good

1.1. ROO are necessary to provide objective criteria for determining whether imported goods

are eligible for the preferential rates of duty available under AUSFTA.

1.2. AUSFTA grants benefits to a variety of goods that “originate” in the US, or in the US and

Australia. “Originating” is a term used to describe goods that meet the requirements of

Article 5.1 of the Agreement. Article 5.1 establishes which goods originate in the US, or

in the US and Australia, and precludes goods from other countries from obtaining those

benefits by merely passing through Australia or the US.

1.3. The ROO define the methods by which it can be ascertained that a particular good has

undergone sufficient work or processing, or has been subject to substantial

transformation, to obtain the benefits under AUSFTA.

1.4. Article 5.1 states that:

For the purposes of this agreement, originating good means:

(a) A good wholly obtained or produced entirely in the territory of

one or both of the Parties;

(b) A good covered by the rules in Annex 5-A, for which each of the

non-originating materials used in the production of the good

undergoes an applicable change in tariff classification as set out

in Annex 5-A (Product-Specific Rules of Origin) as a result of

production occurring entirely in the territory of one or both of the

Parties, and which satisfies all other applicable requirements;

(c) A good covered by the rules in Annex 4-A (Textile and Apparel

Specific Rules of Origin), for which each of the non-originating

materials used in the production of the good undergoes an

applicable change in tariff classification set out in Annex 4-A as a

result of production occurring entirely in the territory of one or

both of the Parties, and has satisfied all other applicable

requirements of this Chapter, Chapter 4 (Textiles and Apparel)

and Annex 4-A;

(d) A good that has been produced entirely in the territory of one or

both of the Parties exclusively from originating materials; or

(e) A good otherwise provided as an originating good under this

Chapter.

1.5. Non-originating goods or materials are those which originate from outside Australia or the

US or which are produced in Australia or US but, because of a high level of offshore

material used to produce them, do not meet the ROO.

2. Harmonized System of tariff classification

2.1. Product specific ROO are based on tariff classifications under the internationally accepted

Harmonized System (HS). The HS organises products according to the degree of

production, and assigns them numbers known as tariff classifications. The HS is arranged

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 9 -

into 97 chapters covering all products. Each chapter is divided into headings. Headings

can be divided into subheadings, and subheadings are divided into tariff classifications.

Example:

Chapter 62 ……..…...Articles of apparel and clothing accessories, not knitted

or crocheted

Heading 6209..………..…....................Babies’ garments and clothing

accessories

Subheading 6209.10……..…………………..Of wool or fine animal hair

Tariff classification 6209.10.20…..…........….Clothing accessories

2.2. As shown above, Chapter means the two-digit Chapter number. Headings are identified

with a four-digit number, subheadings have a six-digit number, and tariff classifications

have an eight-digit number. Subheadings give a more specific description than headings,

and tariff classifications give a more specific description than subheadings.

2.3. Under the HS, the Chapter, heading, and subheading numbers for any good are identical

in any country using the HS. However, the last two digits of the tariff classification are

not harmonized - each trading nation individually assigns them.

2.4. The product specific rules in Annex 4A and 5A of the Agreement are organised using the

HS classification numbers. Therefore, importers determine the HS classification of the

imported good and use that classification to find the specific ROO in the applicable Annex

to the Agreement. If the good meets the requirements of the ROO and all other

requirements of the Agreement, it is an originating good.

3. Change in Tariff Classification (CTC)

3.1. When a ROO is based on a CTC, each of the non-originating materials used in the

production of the goods must undergo the applicable change as a result of production

occurring entirely in the US or in the US and Australia.

3.2. This means that the non-originating materials are classified to one tariff classification

prior to processing and classified to another upon completion of processing. This

approach ensures that sufficient transformation has occurred within the US or Australia to

justify a claim that the good is a legitimate product of the US or of the US and Australia.

The exact nature of the CTC required for a specific good can be found by referring to the

product specific rule in Appendix 1 of this Instruction and Guideline.

Example: product specific rule requiring a CTC

Newsprint (HS 4801) is produced in the US from mechanical wood pulp (4701)

imported from Brazil.

The product specific rule for 4801-4816 is:

A change to heading 4801 through 4816 from any other chapter.

In the production of newsprint in the US, from wood pulp imported from Brazil, the

CTC is from 4701 to 4801.

The product specific rule for 4801 requires a CTC from any other chapter. As 4701

is a different chapter from 4801, the good satisfies the CTC requirement and is

therefore a US originating good.

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 10 -

4. Regional Value Content (RVC)

4.1. For a proportion of goods, the CTC rule is supported by a local content threshold

component called the RVC requirement. The purpose of the RVC is to ensure that a good

is produced with a specified proportion of the final value of the good coming from the US

or from the US and Australia.

4.2. The RVC requirement can take the form of either an additional requirement to the

specified CTC, or can provide an optional test, allowing the product to meet an easier CTC

if the threshold is reached.

4.3. Article 5.4 of the Agreement provides three formulas to determine RVC, the Build-Down

Method, the Build-Up Method and the Net Cost method.

4.4. Section 3 of Division 7 of this Instruction and Guideline provides a full explanation of

RVC.

5. Classes of originating goods under AUSFTA

5.1. The classes of US originating goods under AUSFTA are dealt with in Division 5 to 9 of this

Instruction and Guideline as outlined below:

• goods wholly obtained or produced entirely in the US (Division 5);

• goods produced entirely in the US or in the US and Australia exclusively from

originating materials (Division 6);

• goods (except clothing and textiles) produced entirely in the US or in US and

Australia from non-originating materials or from non-originating materials and

originating materials (Division 7);

• goods that are clothing or textiles produced entirely in the US or in US and Australia

from non-originating materials or from non-originating materials and originating

materials (Division 8);

• goods that are clothing or textiles classified to Chapter 62 of the HS (Division 8,

Section 5); and

• other US originating goods (Division 9).

5.2. In deciding whether goods are US originating goods, the following concepts are also

explained in this Instruction and Guideline as follows:

• Transformation test - goods except clothing and textiles (Division 7, Section 2);

• Accumulation - goods except clothing and textiles (Division 7, Section 2);

• De minimis rule - goods except clothing and textiles (Division 7, Section 2);

• RVC (Division 7, Section 3);

• Goods that are chemicals, plastic or rubber (Division 7, Section 6);

• Yarn forward rule for clothing and textiles (Division 8, Section 1);

• Transformation test - for clothing and textiles (Division 8, Section 2);

• Accumulation - for clothing and textiles (Division 8, Section 2);

• De minimis - for clothing and textiles (Division 8, Section 2);

• Treatment of sets (Division 8, Section 6);

• Accessories, spare parts and tools (Division 9, Section 1);

• Packaging materials and containers (Division 9, Section 2);

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 11 -

• Consignment provisions (Division 9, Section 3); and

• Fungible goods and materials (Division 11).

6. Origin Advice Rulings

Written advice on any origin matter will be provided in the form of an Origin Advice Ruling.

The Rulings exist to advise Australian importers, US producers and US exporters on specific

issues relating to the origin of their goods for the purposes of determining eligibility for

preferential duty rates for goods imported into Australia (Division 10).

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 12 -

Division 5: Goods Wholly Obtained or Produced Entirely in

the US

1. Statutory Provisions

1.1. Section 153YB of the Customs Act contains provisions relating to goods wholly obtained

or produced entirely in the US:

153YB Goods wholly obtained or produced entirely in the US

(1) Goods are US originating goods if they are wholly obtained or produced entirely in

the US.

(2) Goods are wholly obtained or produced entirely in the US if, and only if, the goods

are:

(a) minerals extracted in the US; or

(b) plants grown in the US, or in the US and Australia, or products obtained from

such plants; or

(c) live animals born and raised in the US, or in US and Australia, or products

obtained from such animals; or

(d) goods obtained from hunting, trapping, fishing or aquaculture conducted in the

US; or

(e) fish, shellfish or other marine life taken from the sea by ships registered or

recorded in the US and flying the flag of the US; or

(f) goods produced exclusively from goods referred to in paragraph (e) on board

factory ships registered or recorded in the US and flying the flag of the US; or

(g) goods taken from the seabed, or beneath the seabed, outside the territorial

waters of the US by the US or a person of the US, but only if the US has the

right to exploit that part of the seabed; or

(h) goods taken from outer space by the US or a person of the US; or

(i) waste and scrap that

(i) has been derived from production operations in the US; or

(ii) has been derived from used goods that are collected in the US and that

are fit only for recovery of raw materials; or

(j) recovered goods derived in the US and used in the US in the production of

remanufactured goods; or

(k) goods produced entirely in the US exclusively from goods referred to in

paragraphs (a) to (i) or from their derivatives.

1.2. In determining whether goods are wholly obtained or produced entirely in the US, the

following definitions in section 153YA will also need to be considered:

produce means grow, raise, mine, harvest, fish, trap, hunt, manufacture, process,

assemble or disassemble. Producer and production have corresponding meanings.

recovered goods means goods in the form of individual parts that:

(a) have resulted from the complete disassembly of goods which have passed their

useful life or which are no longer useable due to defects; and

(b) have been cleaned, inspected or tested (as necessary) to bring them into

reliable working condition.

remanufactured goods means goods that:

(a) are produced entirely in the US; and

(b) are classified to:

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 13 -

(i) Chapter 84, 85 or 87 (other than heading 8418, 8516 or 8701 to 8706),

or to heading 9026, 9031 or 9032 of Chapter 90, of the Harmonized

System; or

(ii) any other tariff classification prescribed by the regulations; and

(c) are entirely or partially comprised of recovered goods; and

(d) have a similar useful life, and meet the same performance standards, as new

goods:

(i) that are so classified; and

(ii) that are not comprised of any recovered goods; and

(e) have a producer’s warranty similar to such new goods.

1.3. According to Section 153YA, the term “used” referred to in Section 153YB means “used

or consumed in the production of goods.”

1.4. The definition of “person of the US” in section 153YA and the corresponding reference

in Annex 1-A to Chapter 1 of the Agreement are also relevant in determining if goods are

wholly obtained or produced entirely in the US. Those definitions, respectively, are:

person of the US means a person of a Party within the meaning, in so far as it

relates to the US, of Article 1.2 of the Agreement.

And:

person of a party means a national or an enterprise of the party.

2. Policy and Practice – Wholly Obtained Goods

Section 153YB determines that goods are US originating goods if they are wholly obtained or

produced entirely in the US because the goods fall into one of the following categories:

• minerals extracted in the US (for example, silver mined in the US); or

• plants grown in the US, or in the US and Australia, or products obtained from such plants

(for example fruit from fruit trees); or

• live animals born and raised in the US, or in the US and Australia, or products obtained

from such animals (for example, cows and hens, and milk or eggs from those animals);

or

Example:

Chickens are incubated and raised in Mexico and exported to the US at an age of 6

weeks.

Any eggs laid by those chickens in the US are NOT US originating goods as the

laying hens were not born and raised in the US (see paragraph 153YB(2)(c)).

• goods obtained from hunting, trapping, fishing or aquaculture conducted in the US; or

• fish, shellfish or other marine life taken from the sea by ships registered or recorded in

the US and flying the flag of the US (for example tuna caught by a US registered fishing

vessel); or

• goods produced exclusively from goods referred to immediately above on board factory

ships registered or recorded in the US and flying the flag of the US (for example, tuna

that is processed and stored aboard a US registered ship servicing a fleet of fishing

vessels); or

• goods taken from the seabed, or beneath the seabed, outside the territorial waters of the

US by the US or a person of the US, but only if the US has the right to exploit that part of

the seabed; or

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 14 -

• goods taken from outer space by the US or a person of the US; or

• waste and scrap (see policy and practice at #3 below) that has either:

been derived from production operations in the US; or

been derived from used goods that are collected in the US and that are fit only for

the recovery of raw materials; or

• recovered goods (see policy and practice at #4 below) derived in the US and used in the

US in the production of remanufactured goods (see policy and practice at #5 below); or

• goods produced entirely in the US exclusively from goods referred to in the points above,

or from their derivatives.

3. Policy and practice - waste and scrap

3.1. There are two categories of waste and scrap which qualify as “goods wholly obtained or

produced entirely in the US” under section 153YB.

3.2. The first category is waste and scrap that results from production or manufacturing

operations in the US.

Example #1: waste and scrap

Galvanised pipe imported into the US from Japan is used in the production of elbows

and flanges.

The off-cuts and metal filings resulting from such a production process in the US are

waste and scrap that is fit only for the recovery of raw materials. Therefore, under

subparagraph 153YB(2)(i)(i), the off-cuts and filings are considered to be “wholly

obtained” goods and thus are US originating goods.

3.3. The second category is waste and scrap that has been derived from used goods that are

collected in the US and those goods are fit only for the recovery of raw materials.

Example #2: waste and scrap

Insulated copper wire is recovered in the US from scrap telephone or electrical

cables. This scrap wire is, vide paragraph 153YB(i)(ii), considered to be US

originating regardless of where the cable was produced.

4. Policy and Practice - Recovered Goods

4.1. This provision relates to goods that are in the form of individual parts that have been

obtained from the complete disassembly of goods which have passed their useful life, or

which are no longer usable due to defects.

4.2. To be considered to be US originating goods, such parts must have been cleaned,

inspected or tested (as necessary) to bring them to a reliable working condition.

Example: recovered goods

A coin-operated CD playing jukebox, imported from Japan, has passed its useful life

and is faulty. It is disassembled in the US, and the individual components are

cleaned, tested and brought to working condition.

These individual components are now “recovered goods” if they are used in the

production of remanufactured goods.

5. Policy and Practice - Remanufactured Goods

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 15 -

5.1. This provision covers goods produced entirely in the US from either 100% recovered

goods or from a combination of recovered goods and other originating materials. Those

remanufactured goods must have a similar useful life and meet the same performance

standards as new goods of that kind. They must also have a producer’s warranty similar

to new goods of that kind.

5.2. An additional restriction to this provision is that it applies only if the remanufactured

goods are classified to Chapter 84, 85 or 87 (other than headings 8418, 8516 or 8701 to

8706), or to headings 9026, 9031 or 9032.

Example: remanufactured goods

The “recovered goods” from the jukebox in the example above are used, in

conjunction with other originating materials, to produce another jukebox (classified

to 8519.99.00 in the Australian tariff) which the producer supplies to purchasers

with a warranty similar to a new jukebox.

This “remanufactured” jukebox is, by virtue of the definition of “remanufactured

goods” in section 153YA and paragraph 153YB(2)(j), considered to be a US

originating good.

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 16 -

Division 6: Goods produced entirely in the US or in the US

and Australia exclusively from originating

materials

1. Statutory provisions

1.1. Section 153YC of the Customs Act contains provisions relating to goods produced entirely

in the US or in the US and Australia from originating materials:

153YC Goods produced entirely in the US or in the US and Australia exclusively

from originating materials

Goods are US originating goods if they are produced entirely in the US, or entirely in

the US and Australia, exclusively from originating materials.

1.2. In determining whether goods are produced entirely in the US or in the US and Australia

from originating materials the following definitions in section 153YA will also need to be

considered:

originating materials means:

(a) goods that are used in the production of other goods and that are US

originating goods; or

(b) goods that are used in the production of other goods and that are Australian

originating goods; or

(c) indirect materials.

Example: This example illustrates goods produced from originating materials.

Pork sausages are produced in the US from US cereals, Hungarian frozen

pork meat and Brazilian spices.

The US cereals are originating materials since they are goods used in the

production of other goods (the sausages) and they are US originating

goods under Subdivision B.

The Hungarian frozen pork meat and Brazilian spices are non-originating

materials since they are produced in countries other than the US and

Australia.

Australian originating goods means goods that are Australian originating goods

under a law of the US that implements the Agreement.

indirect materials means:

(a) goods used in the production, testing or inspection of other goods, but that are

not physically incorporated in the other goods; or

(b) goods used in the operation or maintenance of buildings or equipment

associated with the production of other goods;

including;

(c) fuel; and

(d) tools, dies and moulds; and

(e) lubricants, greases, compounding materials and other similar goods; and

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 17 -

(f) gloves, glasses, footwear, clothing, safety equipment and supplies for any of

these things; and

(g) catalysts and solvents.

2. Policy and practice - combination of Australian and US originating materials

If Australian originating materials are imported into the US and used in the production of a

good also incorporating US originating materials, the good produced is a US originating goods

in accordance with section 153YC of the Customs Act because of paragraph (b) of the

definition of “originating materials” above.

Example: goods produced in the US using a combination of Australian and

US originating materials

A US producer imports tanned sheep leather (classified to 4105.30.00) from

Australia. This leather is an Australian originating material.

The leather is used in the US to produce handbags and wallets using a number of US

originating materials (metal clasps, plastic zippers, cotton thread, etc).

The finished handbags and wallets (classified within heading 4202) are US

originating goods because they are produced from originating materials.

3. Policy and practice – US originating materials

Section 153YC replicates the effect of paragraph 153YB(2)(k) to the extent that if a good is

produced entirely in the US from a good referred to in paragraph 153YB(2)(a) to paragraph

153YB(2)(i), inclusive (in other words, from wholly obtained US goods), then that good is a US

originating good in accordance with paragraph (a) of the definition of “originating materials”

above.

4. Policy and practice - goods produced in the US using a combination of

originating materials

4.1. Section 153YC is broader than paragraph 153YB(2)(k) because, in addition to the above

production scenarios, it also allows the production of goods to occur from materials that

are originating materials because they have met the requirements of the “Schedule 1

tariff table” or the “Schedule 2 tariff table”.

4.2. Full explanations of the operation of the “Schedule 1 tariff table” and the “Schedule 2

tariff table” are contained in Division 7 and Division 8, respectively, of this Instruction

and Guideline.

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 18 -

Example: goods produced in the US using a combination of originating

materials

Spectacles

(classified to 9004.90.00)

produced in the US from

the goods below

Spectacle frames

(falling within 9003.19)

(produced in the US from

plastic (Chapter 39)

imported from Japan and

from metal (Chapter 73)

imported from China)

Plastic lenses

(falling within 9001.50)

(produced in the US from

resin (Chapter 39) imported

from Japan)

In this example, the spectacle frames and the plastic lenses are originating

materials as they meet the criteria specified in the “Schedule 1 tariff table” (see

Division 7 of this Instruction and Guideline).

As the materials used in the production of the spectacles are originating materials,

the spectacles are, in accordance with section 153YC, also considered to be US

originating goods.

5. Policy and practice – indirect materials

5.1. All “indirect materials” which fall within the meaning conferred by paragraphs (a) and (b)

in the definition of that term, used in the production of “originating materials”, are

themselves considered to be originating materials regardless of the origin of those

indirect materials.

5.2. The list of indirect materials given in paragraphs (c) to (g) in the definition is not to be

construed as an exhaustive list of such materials.

Example: indirect materials

Tools and safety equipment, produced in Brazil, are used by workers in the US

during the production of the spectacles in the above example. Such tools and safety

equipment meet the conditions imposed by paragraphs (a) and (b) of the definition

of “indirect materials” and are thereby considered to be “indirect materials”.

The use of such indirect materials in the production of goods in the US is permitted

by virtue of paragraph (c) of the definition of “originating materials” and such

goods are deemed to be US originating materials.

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 19 -

Division 7: Goods (except clothing and textiles) produced

entirely in the US or in the US and Australia from

non-originating materials

Section 1: Statutory provisions and overview

1. Statutory provisions

1.1. Section 153YE of the Customs Act contains provisions relating to goods produced entirely

in the US or in the US and Australia from non-originating materials only, or from a

combination of non-originating materials and originating materials:

153YE Goods (except clothing and textiles) produced entirely in the US or in

the US and Australia from non-originating materials

(1) Goods are US originating goods if:

(a) a tariff classification (the final classification) that is specified in

column 2 of the Schedule 1 tariff table applies to the goods; and

(b) they are produced entirely in the US, or entirely in the US and

Australia, from non-originating materials only or from non-originating

materials and originating materials; and

(c) if any of the following 3 requirements apply in relation to the goods—

that requirement is satisfied.

First requirement

(2) Subject to subsection (3), the first requirement applies only if a change in

tariff classification is specified in column 3 of the Schedule 1 tariff table

opposite the final classification for the goods. The first requirement is that:

(a) each of the non-originating materials satisfies the transformation test

(see subsection (8)); or

(b) the following are satisfied:

(i) the total value of all the non-originating materials, that do not

satisfy the transformation test (see subsection (8)), does not

exceed 10% of the customs value of the goods;

(ii) if one or more of the non-originating materials are prescribed for

the purposes of this paragraph—each of those non-originating

materials satisfies the transformation test (see subsection (8)).

Note 1: Paragraph 2(b) relates to Article 5.2 (De Minimis) of the

Agreement.

Note 2: The value of the non-originating materials is to be worked out in

accordance with the regulations: see subsection 153YA(2).

(3) However, the first requirement does not apply if:

(a) an alternative requirement to the change in tariff classification is also

specified in column 3 of the Schedule 1 tariff table opposite the final

classification for the goods; and

(b) that alternative requirement is satisfied.

Second requirement

(4) Subject to subsection (5), the second requirement applies only if a regional

value content requirement is specified in column 3 of the Schedule 1 tariff

table opposite the final classification for the goods. The second

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 20 -

requirement is that the goods satisfy that regional value content

requirement.

(5) However, the second requirement does not apply if:

(a) an alternative requirement to the regional value content requirement

is also specified in column 3 of the Schedule 1 tariff table opposite the

final classification of the goods; and

(b) that alternative requirement is satisfied.

(6) The regulations may prescribe different regional value content

requirements for different kinds of goods.

Third requirement

(7) The third requirement is that the goods satisfy any other requirement that

is specified in, or referred to in, column 3 of the Schedule 1 tariff table

opposite the final classification for the goods.

Transformation Test

(8) A non-originating material satisfies the transformation test if:

(a) it satisfies the change in tariff classification that is specified in column

3 of the Schedule 1 tariff table opposite the final classification for the

goods; or

(b) it does not satisfy the change in tariff classification mentioned in

paragraph (a), but it was produced entirely in the US, or entirely in

the US and Australia, from other non-originating materials, and each

of those materials satisfies the transformation test (including by one

or more applications of this subsection).

Note 1: Paragraph (8)(b) relates to paragraph 2 of Article 5.3

(Accumulation) of the Agreement.

Note 2: Subsection (8) operates in a recursive manner; a non-originating

material may satisfy the transformation test in its own right, or it

may satisfy it because each non-originating material used to

produce it satisfies the transformation test (whether because each

of those materials does so in its own right, or because each non-

originating material used to produce the material does so), and so

on.

1.2. In determining whether goods (except clothing and textiles) are produced entirely in the

US or in the US and Australia from non-originating materials only or from a combination

of non-originating and originating materials, the following definitions in section 153YA will

also need to be considered:

Agreement means the Australia-United States Free Trade Agreement done at

Washington DC on 18 May 2004, as amended from time to time.

Note: The text of the Convention is set out in Australian Treaty Series 1988

No. 30. In 2004 this was available in the Australian Treaties Library of the

Department of Foreign Affairs and Trade, accessible on the Internet

through that Department’s world-wide web site.

customs value, in relation to goods, has the meaning given by section 159.

fuel has its ordinary meaning. This ordinary meaning includes electricity which

would not otherwise be covered by the definition of “goods” in section 4 of the

Customs Act.

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 21 -

indirect materials means:

(a) goods used in the production, testing or inspection of other goods, but that are

not physically incorporated in the other goods; or

(b) goods used in the operation or maintenance of buildings or equipment

associated with the production of other goods;

including

(c) fuel; and

(d) tools, dyes and moulds; and

(e) lubricants, greases, compounding materials and other similar goods; and

(f) gloves, glasses, footwear, clothing, safety equipment and supplies for any of

these things; and

(g) catalysts and solvents.

non-originating materials means goods that are not originating materials.

originating materials means:

(a) goods that are used in the production of other goods and that are US

originating goods; or

(b) goods that are used in the production of other goods and that are Australian

originating goods; or

(c) indirect materials.

Schedule 1 tariff table means the table in Schedule 1 to the Customs

(Australia-United States Free Trade Agreement) Regulations 2004.

1.3. Value is further defined in subsection 153YA(2), which states:

Value of goods

(2) The value of goods for the purposes of this Division is to be worked out in

accordance with the regulations. The regulations may prescribe different

valuation rules for different kinds of goods.

2. Policy and practice - general

2.1. Section 153YE of the Customs Act sets out the general rules for determining whether a

good (except clothing and textiles) is a US originating good, namely those goods that are

produced entirely in the US, or entirely in the US and Australia, from non-originating

materials only, or from non-originating materials and originating materials.

2.2. Goods are US originating goods if all the requirements of subsection 153YE(1) have been

met. The first two requirements of this subsection, simply put, are:

• that the tariff classification of the goods as entered on a customs entry corresponds

with a heading or subheading in Column 2 of the Schedule 1 tariff table; and

• production of the final good occurred entirely in the US or in the US and Australia.

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 22 -

2.3. The Schedule 1 tariff table is that table in Part 2 of Schedule 1 to the AUSFTA regulations.

Schedule 1 incorporates the product specific rules for goods other than clothing and

textiles. The product specific rules specify the CTC requirement, RVC and any other

requirements for the purpose of determining whether a good (other than clothing and

textiles) is a US originating good.

2.4. Column 1 of the Schedule 1 tariff table rules sets out the Chapter reference of goods in

the HS. Column 2 lists tariff classifications at the heading or subheading level, and

Column 3 sets out the product specific rule relevant to the tariff classification in Column

2.

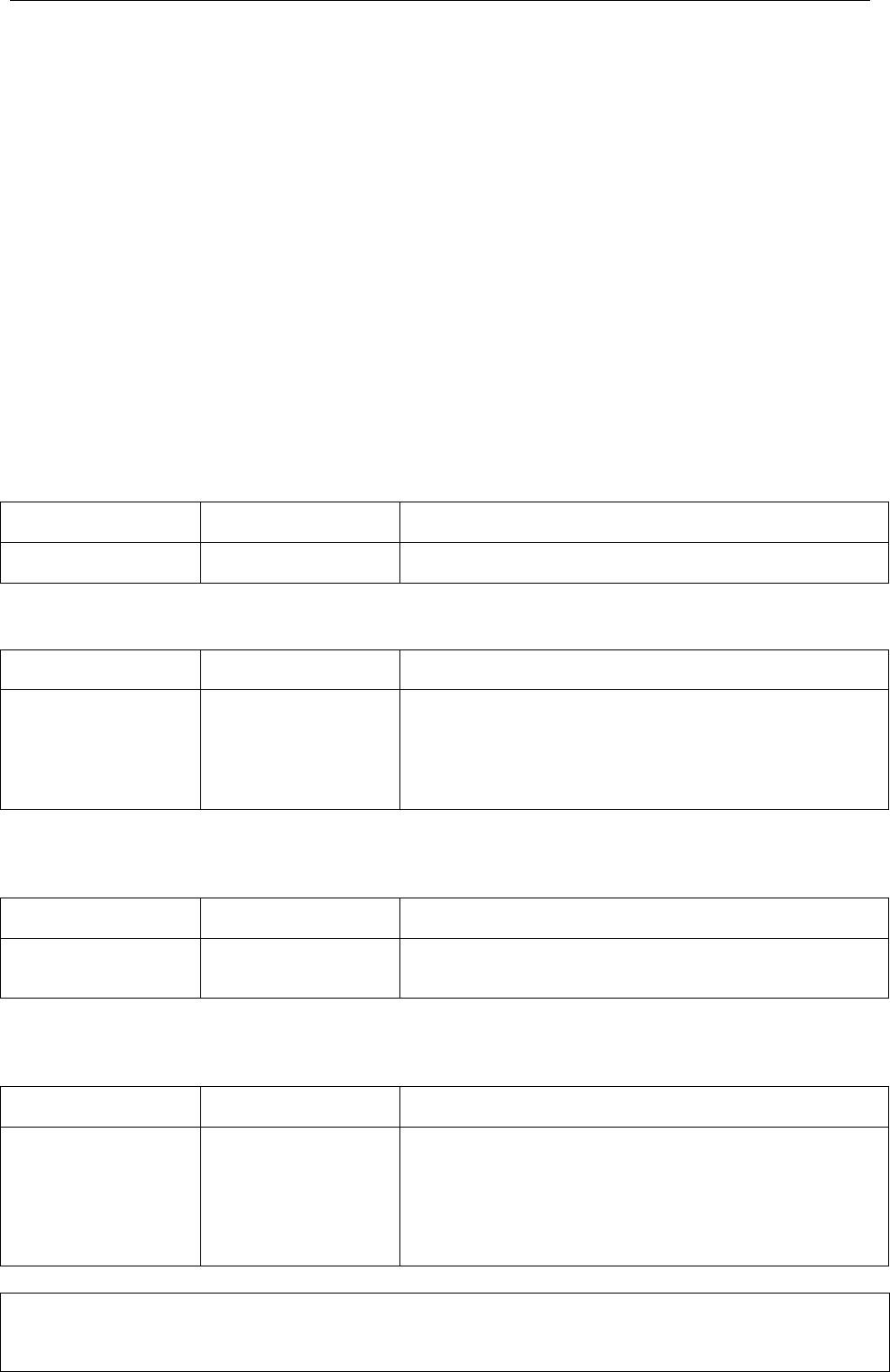

2.5. Some examples to illustrate the different types of rules appearing in the Schedule 1 tariff

table are:

SINGLE RULE

• Simple rule = change of tariff classification only

The rule may be at the heading level or at the subheading level and it may specify a

change to a chapter, heading or subheading.

Column 1

Chapter

Column 2

Tariff Classification

Column 3

Product specific requirements

Chapter 1

Live animals

0101 – 0106 A change to heading 0101 through 0106 from any other

chapter.

• Simple rule = RVC only

Column 1

Chapter

Column 2

Tariff Classification

Column 3

Product specific requirements

Chapter 87

Vehicles other than

railway or tramway

rolling-stock, and

parts and

accessories thereof

8706 No change in tariff classification is required, provided

that there is a regional value content of not less than 50

percent based on the net cost method.

• Simple rule with exceptions = change of tariff classification except from certain

classifications

Column 1

Chapter

Column 2

Tariff Classification

Column 3

Product specific requirements

Chapter 9

Coffee, tea, mate

and spices

0901.22 A change to subheading 0901.22 from any other

subheading except from subheading 0901.21

• Simple rule with provisions = change of tariff classification provided certain

requirements have been met

Column 1

Chapter

Column 2

Tariff Classification

Column 3

Product specific requirements

Chapter 18

Cocoa and cocoa

preparations

1806.10 A change to subheading 1806.10 from any other

heading, provided that such products of 1806.10

containing 90 percent or more by dry weight of sugar do

not contain non-originating material that is sugar of

Chapter 17 and that products of 1806.10 containing less

than 90 percent by dry weight of sugar do not contain

more than 35 percent by weight of non-originating

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 23 -

material that is sugar of Chapter 17.

CHOICE OF RULE

• Choice of rule = simple change of tariff classification rule or a simple change of tariff

classification rule with provisions

Column 1

Chapter

Column 2

Tariff Classification

Column 3

Product specific requirements

Chapter 27

Mineral fuels,

mineral oils and

products of their

distillation;

bituminous

substances;

mineral waxes

2707

Either:

(a) a change to subheading 2707.10 through 2707.99

from any other heading; or

(b) a change to subheading 2707.10 through 2707.99

from any other subheading, provided that the good

resulting from such change is the product of a

chemical reaction.

• Choice of rule = simple change of tariff classification rule or a RVC only

Column 1

Chapter

Column 2

Tariff Classification

Column 3

Product specific requirements

Chapter 81

Other base metals;

cermets; articles

thereof

8106

Either:

(a) a change to subheading 8106 from any other

chapter; or

(b) no change in tariff classification is required,

provided that there is a regional value content of

not less than 35 percent based on the build-up

method or 45 percent based on the build-down

method.

• Choice of rule = simple change of tariff classification rule or a simple change of tariff

classification rule with RVC

Column 1

Chapter

Column 2

Tariff Classification

Column 3

Product specific requirements

Chapter 83

Miscellaneous

articles of base

metal

8311.10 – 8311.30

Either:

(a) a change to subheading 8311.10 through 8311.30

from any other chapter; or

(b) a change to subheading 8311.10 through 8311.30

from any other subheading, provided that there is

a regional value content of not less than 35

percent based on the build-up method or 45

percent based on the build-down method.

MULTIPLE RULE

• Multiple rule = simple change of tariff classification rule with the addition of a RVC

requirement

Column 1

Chapter

Column 2

Tariff Classification

Column 3

Product specific requirements

Chapter 81

Other base metals;

cermets; articles

thereof

8112.19 A change to subheading 8112.19 from any other

subheading, provided that there is a regional value

content of not less than 35 percent based on the build-

up method or 45 percent based on the build-down

method.

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 24 -

3. The requirements

3.1. As stated in paragraph 4 of part 2 above, Column 3 of the Schedule 1 tariff table sets out

the product specific rule relevant to the tariff classification in Column 2.

3.2. The product specific requirement will specify one or more requirements and each

requirement specified must be satisfied for the good to be a US originating good. If the

ROO provides a choice of rule, only the requirements of the choice selected have to be

satisfied.

3.3. If any requirement is not satisfied, the good is not a US originating good.

3.4. These rules are specifically referred to in the Act as “requirements” and are termed the

first requirement, the second requirement and the third requirement.

3.5. Provided the criteria specified in paragraph 153YE(1)(a) and 153YE(1)(b) are satisfied,

and the criteria specified in 153YE(1)(c) is also satisfied, the good will be a US originating

good (if all other requirements of Division 1C are also satisfied). The third criterion, as

detailed in paragraph 153YE(1)(c), is the satisfying of the three requirements detailed in

Section 2, Section 3 and Section 4 of this Division respectively, if they apply to the

goods.

Section 2: First requirement – change in tariff classification

1. First requirement

1.1. Subsection 153YE(2) of the Customs Act states that the first requirement applies only if

there is a CTC requirement specified in Column 3 of the Schedule 1 tariff table.

1.2. The concept of CTC applies only to non-originating materials and means that non-

originating materials that are sourced from outside or within the US or Australia which

are used to produce another good, must not have the same classification under the HS as

the final good into which they are incorporated. This means that the tariff classification

of the final good (after the production process) must be different to the tariff

classification of each non-originating material (before the production process). This

approach ensures that sufficient transformation of the materials has occurred within the

US, or within the US and Australia, to justify the claim that the goods are US originating

goods.

Example:

Frozen pork (HS 0203) is imported into the US from Hungary and combined with

spices from the Caribbean (HS 0907-0910) and cereals produced in the US to make

pork sausages (HS 1601).

The applicable CTC (or product specific) rule for a good of 1601 is:

A change to heading 1601 through 1605 from any other chapter.

As the frozen meat is classified to Chapter 2 and the spices to Chapter 9, the non-

originating materials meet the transformation (CTC) requirement (the cereal is the

produce of the US and is therefore an originating material and is not required to

change in classification). The pork sausages are therefore US originating goods.

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 25 -

1.3. Subsection 153YE(3) identifies the circumstances in which the first requirement does not

apply. This means that if Column 3 allows a choice of rules and that choice is a

requirement that does not include a CTC and that requirement has been satisfied, then

the first requirement does not apply.

Example: the product specific rule for 8106

Either:

(a) a change to heading 81.06 from any other chapter; or

(b) no change in tariff classification is required, provided that

there is a regional value content of not less than

35 percent based on the build-up method or 45 percent

based on the build-down method.

Explanation: If the goods meet the RVC requirement then, vide subsection

153YE(3), they do not have to meet the transformation test.

2. Transformation test – general outline

2.1. Subsection 153YE(8) sets out the transformation test for the purposes of subsection

153YE(2).

2.2. Broadly speaking, the transformation test is the CTC and, if required, the accumulation

requirements of the Agreement. Non-originating materials satisfy the transformation test

if:

• it satisfies the CTC that is specified in Column 3 of the Schedule 1 tariff table opposite

the final classification of the goods; or

• it does not satisfy the CTC required above, but it was produced entirely in the US, or

entirely in the US and Australia, from other non-originating materials, each of which

satisfies the transformation test (including by one or more applications of subsection

153YE(8)). This is called accumulation.

2.3 The CTC requirement and accumulation that form the transformation test are addressed

in detail below.

3. Transformation test - CTC

3.1. Paragraph 153YE(8)(a) directly addresses the transformation test.

3.2. Non-originating materials used directly in producing a good will satisfy the transformation

test if they satisfy the CTC requirement that is specified in Column 3 of the Schedule 1

tariff table opposite the final classification for the goods.

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 26 -

Explanation:

An example on page 24 addressed the production of pork sausages in the US from

imported frozen pork (HS 0203) which is combined with imported spices (HS 0907-

0910) and cereals produced in the US to make pork sausages (HS 1601).

The applicable product specific rule for a good of 1601 is:

A change to heading 1601 through 1605 from any other chapter.

The non-originating materials satisfy the CTC requirement and therefore meet the

transformation test and the pork sausages are to be US originating goods.

4. Transformation test - accumulation

4.1. If non-originating materials do not satisfy the specified CTC test for the final good, it is

still possible for the first requirement to be satisfied if the material was produced entirely

in the US, or entirely in the US and Australia, from other non-originating materials and

each of those materials satisfies the same transformation test for the final good.

4.2. Paragraph 153YE(8)(b) gives effect to the accumulation provisions contained in

paragraph 2 of Article 5.3 of the Agreement and applies when the non-originating

materials that are used directly in the production of the final good do not satisfy the

required transformation test.

4.3. In producing the final good that is to be imported into Australia, a US producer may use

materials that have been produced in the US by another producer. The components of

these materials may have been produced by yet another producer in the US or imported

into the US.

4.4. In such circumstances, it is necessary to examine each step in the production process of

each non-originating material that occurred in the US or Australia in order to determine

whether a step satisfied the required CTC rule for the final good directly from that step to

the final good. If this does occur, the material will be an originating material and the

final good may be a US originating good (subject to satisfying all other requirements).

4.5. It is possible that the required CTC may not be satisfied at any step in the production

process from the imported materials to the final good, which may mean that the final

good is non-originating.

4.6. The example overleaf illustrates the concept where the non-originating material does not

satisfy the transformation test but the materials from which it is produced do

(subparagraph 153YE(7)(b) refers).

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 27 -

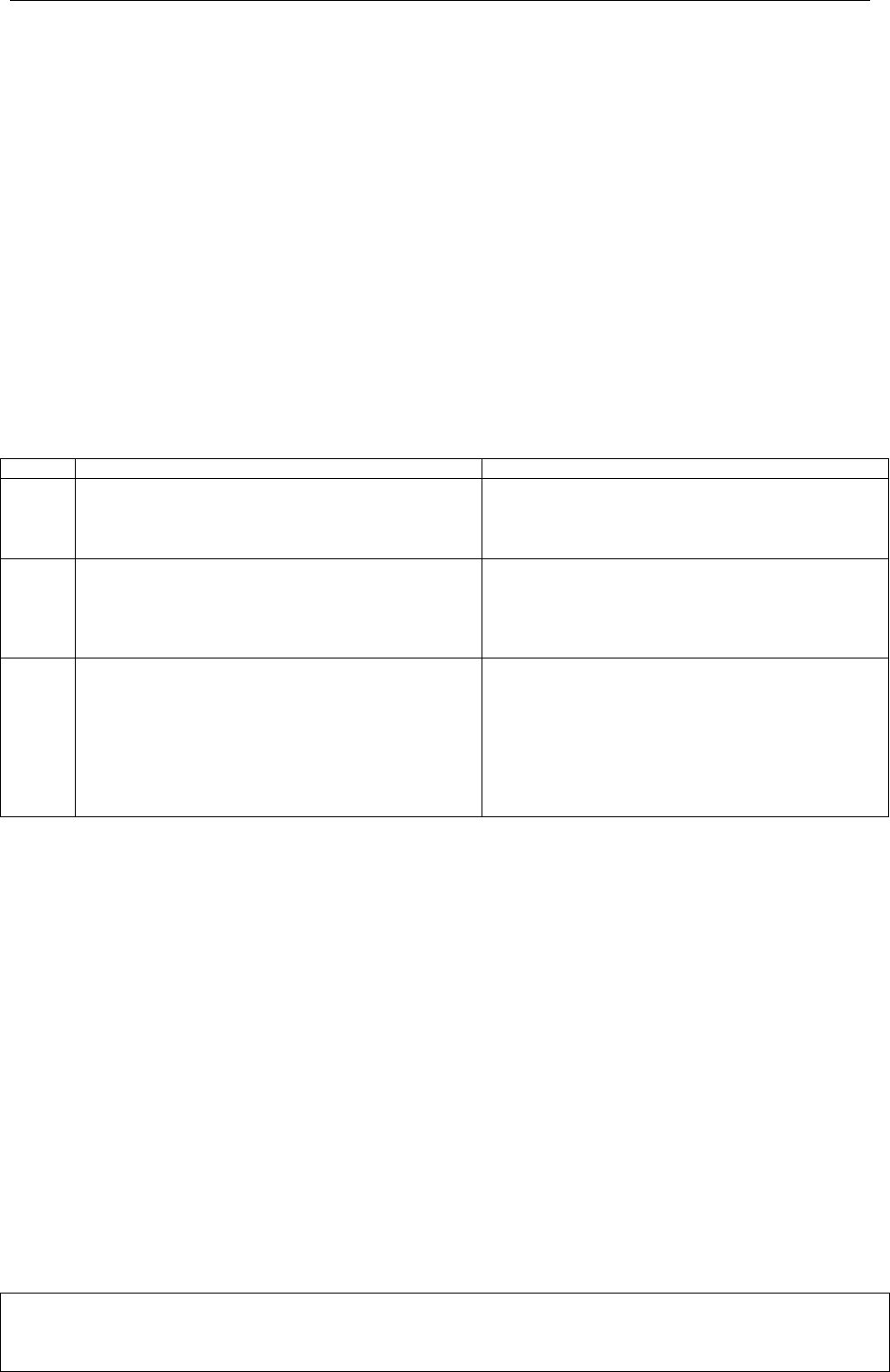

Example: accumulation

A US bakery produces chocolate-coated cakes (HS 1905) entirely in the US.

For the purposes of this example, the materials used are:

non-originating chocolate (HS 1806)

non-originating cake mix (HS 1901.20), produced entirely in the US from a

combination of

o originating ingredients (including wheat flour, wheat starch and

butterfat

o non-originating milk powder

This scenario is as shown below:

The product specific rule for cakes of 1905 is:

A change to heading 1902 through 1905 from any other chapter.

The non-originating chocolate and the non-originating cake mix must satisfy the

transformation test.

Applying paragraph 153YE(8)(a), the chocolate satisfies the required CTC as it is a

change from Chapter 18 to heading 1905. The cake mix however does not satisfy

the transformation test as there is no change of Chapter.

Because the cake mix was produced in the US, 153YE(8)(b) allows the

transformation test for 1905 (the final goods) to be applied against the materials

that produced the non-originating cake mix.

The originating ingredients do not have to satisfy the transformation test because

the transformation test is only applied to non-originating materials. Therefore, for

the cake mix to satisfy the transformation test the non-originating milk powder

must satisfy the requirement of a change to heading 1905 from any other Chapter.

The milk powder does this as it changes from Chapter 4 to heading 1905.

Summary:

the chocolate satisfies the transformation test vide 153YE(8)(a)

the cake mix satisfies the transformation test vide 153YE(8)(b)

Therefore the chocolate-coated cake is US originating because all the non-

originating materials used to produce it satisfy the requirements of 153YE.

Chocolate-coated cake

(HS 1905)

Non-originating cake

mix (HS 1901.20)

Non-originating

chocolate (HS 1806)

Originating

ingredients

Non-originating milk

powder (HS 0402)

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 28 -

4.7. The following example, contained in the Explanatory Memorandum to the US Free Trade

Agreement Implementation Bill 2004, demonstrates accumulation and the operation of

paragraph 153YE(8)(b).

Example: the following diagram relates to the production of particular goods that

occurred entirely in the US. The diagram and the accompanying text illustrate the

application of subsection 153YE(8).

G o o ds

N o n -o riginating

m aterial 1

N o n -orig in atin g

m aterial 2

N o n-o rig inatin g

m aterial 4

N o n -orig in atin g

m aterial 3

N on-orig in ating

m aterial 5

The goods are produced from non-originating materials 1 and 2.

First application of subsection 153YE(8)

Non-originating materials 1 and 2 must satisfy the transformation test. Under

paragraph 153YE(8)(a), non-originating material 1 does satisfy the relevant CTC.

Under paragraph 153YE(8)(b), non-originating material 2 does not satisfy the

relevant CTC, but it has been produced by non-originating materials 3 and 4.

Second application of subsection 153YE(8)

Non-originating materials 3 and 4 must satisfy the transformation test. Under

paragraph 153YE(8)(a), non-originating material 3 does satisfy the relevant CTC.

Under paragraph 153YE(8)(b), non-originating material 4 does not satisfy the

relevant CTC, but it has been produced by non-originating material 5.

Third application of subsection 153YE(8)

Non-originating material 5 must satisfy the transformation test. Under

paragraph 153YE(8)(a), non-originating material 5 does satisfy the relevant CTC.

Final result

The result of the 3 applications of subsection 153YE(8) is that non-originating

material 2 does satisfy the transformation test.

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 29 -

5. De minimis

5.1. The first requirement also provides that a good can be a US originating good without

meeting the requirement of paragraph 153YE(2)(a) if the good meets the requirement of

paragraph 153YE(2)(b). This is termed the de minimis rule.

5.2. The de minimis rule for the purposes of paragraph 153YE(2)(b) applies only to goods

listed in the Schedule 1 tariff table. The de minimis rule as it applies to goods covered in

the Schedule 2 tariff table (clothing and textiles) is addressed at Section 2 of Division 8 of

this Instruction and Guideline.

5.3. Although the requirement of a CTC is a very simple principle, it necessitates that all non-

originating materials undergo the required change. A very low percentage of the

materials used to produce a good may not undergo the required CTC, thus preventing the

goods from being a US originating good. Therefore, the Agreement incorporates a de

minimis provision that allows a good to qualify as a US originating good provided the

total value of all non-originating materials that do not satisfy the transformation test,

used to produce the good does not exceed 10% of the customs value of the final good.

5.4. The de minimis provision does not apply to all non-originating materials that may be used

to produce a good listed in the Schedule 1 tariff table.

5.5. Regulation 5.1 of the AUSFTA regulations, in accordance with subparagraph

153YE(2)(b)(ii), prescribes certain non-originating materials (i.e. the exceptions to the de

minimis rule).

5.6. The effect of prescribing a material is that each non-originating material prescribed, even

though it may meet the de minimis requirement, must also satisfy the transformation

test.

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 30 -

Example: de minimis rule for goods other than textiles and apparel

A US company produces wristwatches (HS 9102) for export to Australia. It

produces the watches from textile watch straps made in China (HS 9113) combined

with US originating watch movements of HS 9108 and US originating cases of HS

9111 which are both made in the US and are originating materials because they

have met the requirement of 153YE(1). The value of a strap is $6 while the customs

value of the finished watch is $100.

The product specific rule for tariff headings 9102–9107 states:

Either:

(a) a change to heading 9102 through 9107 from any other chapter;

or

(b) a change to heading 9102 through 9107 from heading 9114,

provided that there is a regional value content of not less than 35

percent based on the build-up method or 45 percent based on the

build-down method.

Only the non-originating materials need to satisfy the transformation test – in this

case, the textile watch straps. The straps do not satisfy either of the indicated

changes in tariff classification. The value of all non-originating materials used to

produce the watches is $6, and this represents 6% of the customs value of the

finished good. Therefore the de minimis rule can be applied to the non-originating

watch straps to determine them to be originating.

The result is that the watches are now considered to be made from 100% US

originating materials, i.e.

US watch movement = US originating vide 153YC

US watch cases = US originating vide 153YC

watch straps ex China = US originating vide 153YE(2)(b)(i).

Therefore, the watch is considered to be a US originating good.

Example: de minimis rule for goods other than textiles and apparel

A small ornament of worked vegetable carving material (HS 9602) has been

produced from an assortment of worked vegetable carving materials (9602). 95%

by value of these worked vegetable carving materials are of US origin. 5% by value

of these worked vegetable carving materials was imported.

The product specific rule for tariff headings 9601–9605 is:

A change to heading 9601 through 9605 from any other chapter.

In this example the ornament was produced entirely in the US.

Paragraph 153YE(2)(a) does not apply as the imported non-originating worked

vegetable carving materials do not satisfy the transformation test as there has

been no CTC.

However, as the total value of all non-originating materials does not exceed 10% of

the customs value of the goods (the imported worked vegetable carving materials

represent only 5% of the customs value), the first requirement is met because of

the de minimis provisions of subparagraph 153YE(2)(b)(i).

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 31 -

Section 3: Second requirement – regional value content

1. Statutory provisions

1.1. In calculating the RVC of goods, the definition of value in subsection 153YA(2) of the

Customs Act is relevant. This provision states:

Value of goods

(2) The value of goods for the purposes of this Division is to be worked out in

accordance with the regulations. The regulations may prescribe different

valuation rules for different kinds of goods.

1.2. The definition of customs value in section 153YA provides:

customs value, in relation to goods, has the meaning given by section 159.

1.3. Also relevant are subsections (1), (4), (5) and (6) of section 153YE which state:

153YE Goods (except clothing and textiles) produced entirely in the US or in

the US and Australia from non-originating materials

(1) Goods are US originating goods if:

(a) a tariff classification (the final classification) that is specified in

column 2 of the Schedule 1 tariff table applies to the goods; and

(b) they are produced entirely in the US, or entirely in the US and

Australia, from non-originating materials only or from non-originating

materials and originating materials; and

(c) if any of the following 3 requirements apply in relation to the goods—

that requirement is satisfied.

(2) ……

(3) ……

Second requirement

(4) Subject to subsection (5), the second requirement applies only if a regional

value content requirement is specified in column 3 of the Schedule 1 tariff

table opposite the final classification for the goods. The second

requirement is that the goods satisfy that regional value content

requirement.

(5) However, the second requirement does not apply if:

(a) an alternative requirement to the regional value content requirement

is also specified in column 3 of the Schedule 1 tariff table opposite the

final classification of the goods; and

(b) that alternative requirement is satisfied.

(6) The regulations may prescribe different regional value content

requirements for different kinds of goods.

(7) ……

1.4. The AUSFTA regulations, at Parts 2 and 3, prescribe the different RVC requirements as

follows:

Customs and Border Protection Instructions and Guidelines - AUSFTA

INTERNAL AND EXTERNAL USE

BCS

C

LASSIFICATION

: STRATEGIC MANAGEMENT – Policy - Guidelines

File Number: 2008/041987-01

- 32 -

Part 2 Regional value content requirement (build-up method and build-

down method)

2.1 Regional value content

(1) For the purposes of the Schedule 1 tariff table, this Part explains how

regional value content is determined using the build-down method

and the build-up method.

Note For this Part, the value of materials is worked out using Part 4.

(2) In this Part, RVC means regional value content.

2.2 Build-down method

(1) The build-down method is the formula:

RVC = adjusted value – value of non-originating materials x 100

adjusted value

where:

adjusted value means the customs value of the goods, as worked

out under Division 2 of Part VIII of the Act.

value of non-originating materials means the value of non-

originating materials that are acquired and used in the production of

the goods.

Note See Part 4 for further information about how to work out the

value of materials.

(2) RVC is to be expressed as a percentage.

2.3 Build-up method

(1) The build-up method is the formula:

RVC = value of originating materials x 100

adjusted value

where:

adjusted value means the customs value of the goods, as worked

out under Division 2 of Part VIII of the Act.

value of originating materials means the value of originating

materials that are acquired, or self-produced, and used in the

production of the goods.

Note See Part 4 for further information about how to work out the

value of materials.

(2) RVC is to be expressed as a percentage.

Part 3 Regional value content requirement (net cost method)

3.1 Definitions for Part 3

In this Part:

automotive component means a good classified in:

(a) subheading 8408.20, 8407.31, 8407.32, 8407.33 or 8407.34 in the

Harmonized System; or

(b) heading 8409, 8706, 8707 or 8708 in the Harmonized System.

class of motor vehicles means any of the following classes of motor

vehicles:

(a) motor vehicles classified in subheading 8701.10, 8701.20, 8701.30–

8701.90, 8703.21–8703.90, 8704.10, 8704.21, 8704.22, 8704.23,

8704.31, 8704.32 or 8704.90 in the Harmonized System;

(b) motor vehicles classified in heading 87.05 or 87.06 in the Harmonized

System;

(c) motor vehicles for the transport of 16 or more persons, classified in

subheading 8702.10 or 8702.90 in the Harmonized System;