As time enriches value, collaboration enhances efficiency.

With 26 years of experience in cross-border investment and

asset management, CEL remains steadfast, resonating with the era and

advancing in harmony with diverse sectors.

Our journey is marked by resilience and a commitment

to excellence, steering us towards new horizons

in cross-border asset management.

COVER STORY

UNITED IN EXCELLENCE

MOVING IN TANDEM WITH THE ERA

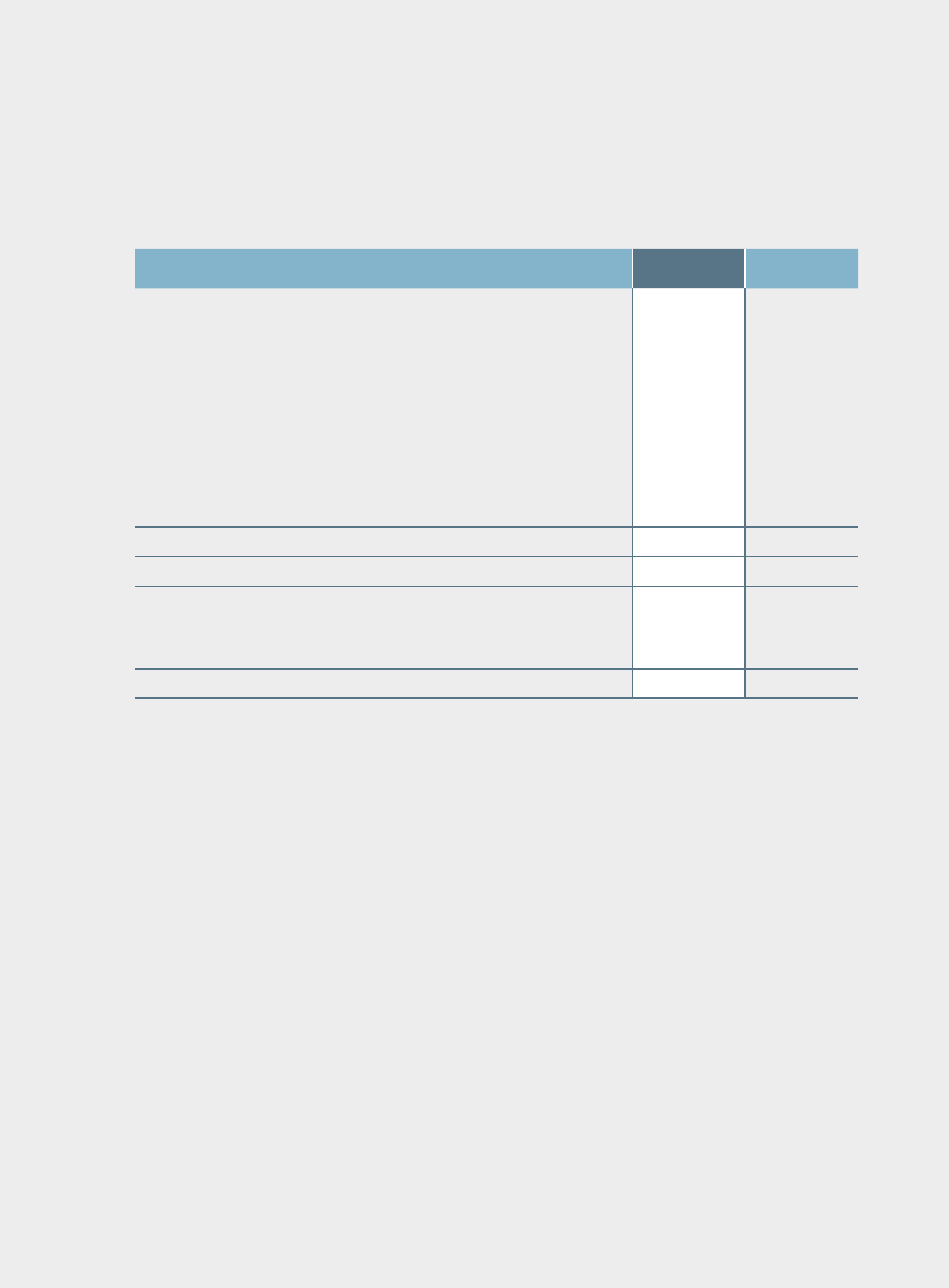

93 Independent Auditor’s Report

99 Consolidated Statement of Profit or Loss

100 Consolidated Statement of Comprehensive Income

101 Consolidated Statement of Financial Position

103 Consolidated Statement of Changes in Equity

104 Consolidated Statement of Cash Flows

105 Notes to the Financial Statements

190 Financial Summary

191 Particulars of Major Properties

192 Corporate Information

TABLE OF CONTENTS

FINANCIAL

SECTION

8

20

67

10

24

76

14

41

88

Company Overview

Chairman’s

Statement

Risk Management

Report

2023 Business

Development Highlights

Management Discussion

and Analysis

Directors’ Report

2023 Review

Corporate Governance

Report

Directors and

Senior Management

MOVING IN HARMONY

WITH THE TIMES

In step with the times, CEL proactively engages with the

new development trend, nurturing innovative productive

forces to fuel high-quality growth with dynamic energy.

UNITY

AND COLLABORATION

Leveraging high-efficiency teamwork and extensive

investment experience, CEL’s esteemed business team

creates enduring value for shareholders and investors.

ADVANCING

TOWARDS EXCELLENCE

With robust strategic determination and a visionary

investment approach, CEL focuses on its core business,

navigating through industry cycles and embarking on a

new journey in cross-border asset management.

COMPANY OVERVIEW

8

China Everbright Limited (“CEL” or the “Company”, together with its subsidiaries, collectively the

“Group”) is a leading cross-border asset management and Private Equity (“PE”) investment company in

China, and a listed company in Hong Kong with asset management and investment of private funds as the

core businesses. With more than 26 years of experience in cross-border asset management and PE

investment, CEL has been assessed as one of the top PE firms in China several times. China Everbright

Group Ltd. (“Everbright Group”) is the largest shareholder of the Company, indirectly holding 49.74% of

the shares of CEL.

For Fund Management Business, as at 31 December 2023, total assets under management (“AUM”)

1

of

CEL reached approximately HK$126.2 billion with 73 funds. CEL has a diverse assets management

product portfolio covering primary market funds, secondary market funds, Fund of Funds and Secondary

Funds, nurturing many promising enterprises with high growth potential alongside with investors. CEL is

positioned to serve the “Dual Circulation” new development pattern, leveraging its competitive edge on

equity investment to provide direct financing and contribute to the development of the real economy.

For Principal Investments Business, CEL has nurtured China Aircraft Leasing Group Holdings Limited

(“CALC”), the largest independent aircraft operating lessor in China; nurtured China Everbright Senior

Healthcare Company Limited (“Everbright Senior Healthcare”), a renowned senior healthcare industrial

group in China with consolidating multiple mid-to-high-end senior healthcare enterprises; and invested in

Chongqing Terminus Technology Co., Ltd. (“Terminus”), a company cultivating in the Artificial Intelligence

(“AI”) and Internet of Things (“IoT”) industry. Meanwhile, CEL also invests in financial assets to achieve a

balance in return and liquidity in its Principal Investments Business in due course. In addition, CEL holds a

portion of the equity interests of China Everbright Bank Company Limited (“China Everbright Bank”) and

Everbright Securities Company Limited (“Everbright Securities”) as Cornerstone Investments.

1

Total assets under management refer to the committed capital of fund investors (including CEL as an investor) in the case of

primary market investment and Fund of Funds market investment, and refer to the net asset value of funds in the case of

secondary market investment.

CHINA EVERBRIGHT LIMITED

ANNUAL REPORT 2023

9

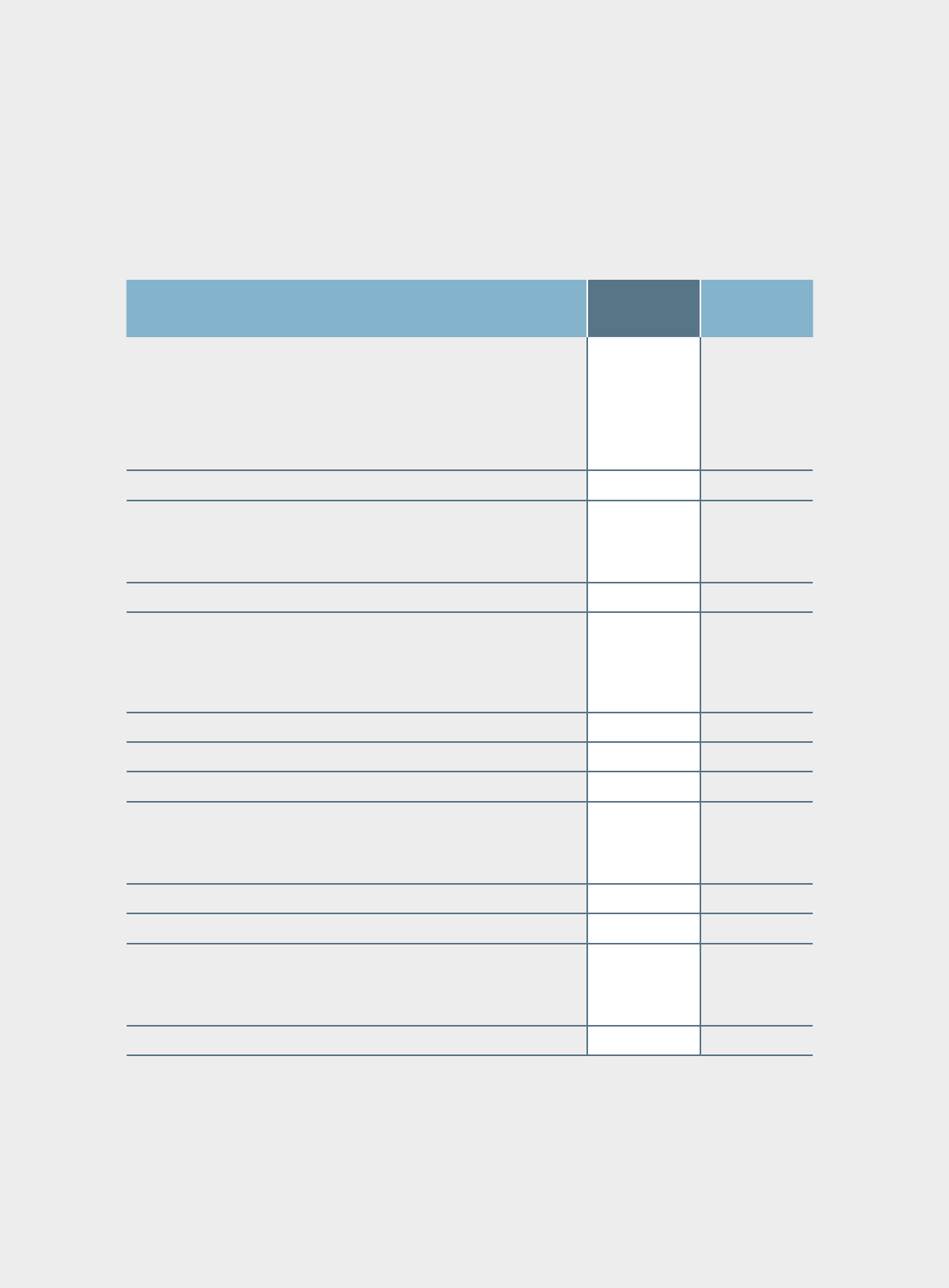

49.74%

Divesied funds including primary market funds (including

real estate private funds under EBA Investments),

secondary market funds and Fund of Funds

Invests in both domestic and overseas markets, including

USD and RMB-denominated products

Total assets under management amounting to

approximately HK$126.2 billion, of which seed capital

committed by CEL accounts for approximately 27%, with an

amount of approximately HK$33.6 billion

Key Investee Companies: focusing on aircraft full life-cycle

services, senior healthcare services and AIoT

Financial Investments: nancial investments in equity,

debts and structured products

Cornerstone Investments: a portion of the equity interests

in China Everbright Bank and Everbright Securities

The total asset value of the Principal Investments Business

amounting to approximately HK$32.1 billion

2023 BUSINESS DEVELOPMENT HIGHLIGHTS

10

REVIEW OF BUSINESS HIGHLIGHTS IN 2023

In 2023, China’s private equity continued to slump under pressures. Amid a complex and volatile internal and external

environment, foreign capital outflow accelerated due to various factors, including high interest rates, and a lack of investor

confidence, resulting in a historic low in the overall market valuation. The slump in the capital market affected the overall

performance of the Company, especially unrealised losses from valuation declines. Despite the depressed market, the

Company actively addressed adverse factors, conducted strategic transformation and advanced layout for future business, and

therefore achieved stabilization and improvements in many aspects. During the reporting period, CEL continued to accelerate

its transformation towards an “Asset-light” strategy, steadily furthering the establishment and fundraising of new funds. CEL

successfully completed the establishment of CEL Yixing Fund () and the registration of CEL Kunshan Fund (

) . Meanwhile, CEL fully exited from projects with exceptional exit opportunities, exiting HK$7.458 billion in aggregate and

recorded overall gains of approximately HK$2.776 billion. Among these, exits from the CEL Global Investment Fund and the

Walden CEL Global Fund brought in performance fee of HK$153 million and HK$175 million, respectively. During the year under

review, with a focus on core responsibilities and business, the Company optimised its investment layout with its principle of

“grasping new developing opportunities, implementing new development concepts, constructing new development patterns

and promoting high-quality development” ( ). As such, CEL was able to adjust its existing portfolio and optimise

incremental investments. During the reporting period, the Company’s Fund Management Business turned losses into profits

due to the improvement in performance and increased valuation of some investment projects. As of the end of 2023, there are

235 post-investment projects among the primary market funds under management, covering high-growth industries such as

healthcare, new energy, semiconductors and high-end manufacturing.

During the reporting period, CEL focused on its core responsibilities and businesses, reinforced in fundraising, investment,

management and exit business, strengthened internal control and continued to improve risk resistance capacity. CEL also

promoted its high-quality development through gradual transformation and achieved significant progress in the following areas:

Core business

Proceeding fundraising steadily: Despite difficulties in fundraising, CEL Yixing Fund

was newly established and raised funds of HK$1.324 billion successfully. The new

fund will mainly focus on industries including energy conservation, environmental

protection, integrated circuit, and new energy, with a vision to serving the economy of

the Yangtze River Delta region.

Achieving a notable gain from exits: Recouped HK$7.458 billion in total from the exit

business including Ambrx, Henan BCCY Environmental Energy, Reactor

Microelectionics, Haitai New Energy, Three’s Company Media and XPENG Motors,

realising an overall gain of approximately HK$2.776 billion against costs, and recorded

a multiple on invested capital (MOIC) of approximately 1.6 x.

Winning multiple authoritative awards: CEL secured several annual industry awards,

including “TOP8 Best Return State-Owned Direct Investment Institutions of 2023”

(2023 TOP8), “TOP10 Private Equity Investment Institutions

Most Coveted by LPs in China”( LP TOP10), “TOP30

Best PE Institutions in the Guangdong-Hong Kong-Macao Greater Bay Area”(

PE TOP30), and “TOP20 Best Market-oriented Fund of Funds in China”

(TOP20).

Project reserves

Supporting the development of innovation and technology in Hong Kong: The

incubator at China Everbright Hong Kong Innovation Centre introduced 7 new

enterprises and attracted the first foreign enterprise, exceeding the annual target. It

also successfully held the “New Opportunities in Hong Kong’s Innovation and

Technology & Everbright’s New Development Strategy” seminar.

CHINA EVERBRIGHT LIMITED

ANNUAL REPORT 2023

11

Serving key regional development: CEL strengthened its layouts in key industries

in line with major regional developments. Continuous efforts were made to deepen

the layouts in the Beijing-Tianjin-Hebei region, the Yangtze River Delta and the

Guangdong-Hong Kong-Macao Greater Bay Area, driving the high-quality

development of these regions.

Serving national strategies: CEL placed an emphasis on major national strategic

areas such as technology, green development, manufacturing, and strategic

emerging industries, increased investment in the real economy. CEL further

promoted the deep integration of business chains and expanded new economic

growth opportunities.

Operational capability

Optimizing debt structure: In the third quarter of 2023, CEL successfully issued the

first and second tranches of medium-term notes with a total issuance scale of RMB6

billion. The second tranche of medium-term notes represented the Company’s first

perpetual bonds issued domestically, completing the replacement of overseas US

dollar-denominated perpetual capital securities, continuously optimising the capital

structure.

Enhancing corporate governance: CEL strengthened and improved various risk

control and corporate governance frameworks, aimed at building a more robust and

effective corporate governance structure. CEL also enhanced efficiency and safety

during decision-making and business processes, ensuring the long-term stable

development of the enterprise.

Environmental, social and

governance (ESG)

Fulfilling social responsibilities: Focused on Hong Kong’s “grassroots families” and

“youth groups”, CEL organised volunteer activities such as “Grassroots School

Sports Fun Day” ( ), “Grassroots Schools STEM Day” (

STEM ), Mid-Autumn Festival gift bag distribution under the theme of “A Joyful

Mid-Autumn Festival for Family Reunion” (), and “Everbright’s Care

for the Community” ( ). CEL fully supported the Hong Kong

delegation’s participation in the first National Student (Youth) Games held in Guangxi,

promoting the development of sports in Hong Kong.

Improving ESG management policy continuously: CEL continued improving and

optimising the ESG management policy by issuing separate and self-contained ESG

reports to disclose information in relation to responsible investment and TCFD. CEL’s

MSCI ESG rating was promoted to BBB level, achieving continuous improvement in

ESG ratings.

The Company’s Panda Bonds insurance terms during the year in 2023 are set out in the table below:

Issuance date Financing arrangements and uses of proceeds Issuance size

(RMB)

September 2023 Issuance of 2023 perpetual medium term notes, the proceeds from which

after deducting the underwriting fees for the first year were used to

redeem the US$300 million senior perpetual capital securities of the

Company.

2 billion

August 2023 Issuance of 2023 first tranche medium term notes, the proceeds from

which (after deducting the underwriting fee for the first year) were used

for the repayment of the Company’s indebtedness and the related interest

expenses.

4 billion

12

2023 Business Development Highlights | Continued

TOTAL AMOUNT OF INCOME

(HK$ hundred million)

(LOSS)/INCOME FROM INVESTMENTS

(HK$ hundred million)

INCOME FROM CONTRACTS

WITH CUSTOMERS

(HK$ hundred million)

DIVIDEND PAYOUT RATIO

(%)

2019 2020 2021 2022

55.19

55.92

59.85

(44.84)

2023

16.61

2019 2020 2021 2022

6.12

5.40

6.59

8.43

2023

7.92

2019 2020 2021 2022

36.2%

36.5%

38.0%

2023

N/A

N/A

2019 2020 2021 2022

37.24

43.38

43.15

(58.86)

2023

(4.89)

CHINA EVERBRIGHT LIMITED

ANNUAL REPORT 2023

13

BASIC (LOSS)/EARNINGS PER SHARE

(HK$)

(LOSS)/PROFIT ATTRIBUTABLE TO

SHAREHOLDERS OF THE COMPANY

(HK$ hundred million)

GEARING RATIO

#

(%)

TOTAL EQUITY ATTRIBUTABLE TO

SHAREHOLDERS OF THE COMPANY

(HK$ hundred million)

2019 2020 2021 2022

70.7%

63.9%

68.4%

86.9%

2023

95%

2019 2020 2021 2022

415.91

454.37

469.36

344.89

2023

309.90

Note:

#

It is calculated as interest-bearing debt (including bank loans + notes payable + bonds payable)/total equity.

2019 2020 2021 2022

1.33

1.34

1.53

(4.42)

2023

(1.14)

2019 2020 2021 2022

22.7

22.64

25.73

(74.43)

2023

(19.23)

2023 REVIEW

14

BUSINESS DEVELOPMENT

In 2023, in the face of complex internal and

external environment, CEL took the initiative to

respond and actively develop, achieving stability

while making progress, showing a trend of

stabilization and recovery in many aspects, and

the Company’s foundation for high-quality

development has been further consolidated.

Important Business Developments

Xiao i Robot, a leading Chinese cognitive intelligence company

invested by the Venture Capital and New Energy Fund Department

of CEL, was officially listed on NASDAQ in the United States.

The first phase of Fund-of-Funds (that is Investment Series

Fund-of-Funds) has been fully funded, reflecting a substantial progress of the

cooperation between CEL and the Yixing Municipal Government in the field of funds.

Guangzhou CEL Guangzhou-Hong Kong-Macao Youth Venture

Fund “Guangzhou CEL Fund-of-Funds” managed by CEL Fund-

of-Funds jointly organized the Guangzhou Government and

Enterprise Seminar, “Working Together to Develop the Future

with Technologies”, with the Guangzhou Science and

Technology Bureau, which helped accurately connecting

investment projects with the government investment promotion

policies, implementing the national strategy of the Guangdong-

Hong Kong-Macao Greater Bay Area, and assisting the high-

quality development of Guangzhou.

CHINA EVERBRIGHT LIMITED

ANNUAL REPORT 2023

15

CEL successfully issued the first and second tranches of medium-term notes in 2023 and continued to

optimize its capital structure.

“Kunshan Fund”, a fund of ( ) under CEL in Kunshan Development

Zone, has completed the first paid-in capital contribution and registration with the Asset Management

Association of China, marking the completion of the establishment of Kunshan Fund.

4Paradigm, China’s largest platform-centric artificial intelligence solution provider invested by CEL’s New

Economy Fund, was officially listed on the Hong Kong Stock Exchange.

Dekon Food and Agricultural Group invested by CEL’s

Consumer Fund was officially listed on the Mainboard of the

Hong Kong Stock Exchange.

MSCI, the international authoritative index agency, announced the 2023

ESG (environmental, social and governance) rating results of CEL. With

its continued excellent performance in ESG, CEL’ s MSCI ESG jumped to

BBB level, achieving continuous improvement.

CEL sponsored the activity organized by the Hong

Kong Young Scientists Association, “Millions of

Youths Seeing the Motherland — Thousands of

Doctors Travel to China”.

16

2023 REVIEW | Continued

CEL organized employee representatives to visit the

“Photo Exhibition to Commemorate the 45th Anniversary

of Reform and Opening Up and the 10th Anniversary of

the Joint Construction of the Belt and Road Initiative”

held in the Hong Kong Convention and Exhibition Center.

CEL actively responded to the call of the Hong Kong SAR

government and actively participated in the youth

development program, “Strive and Rise Programme” by

inviting 100 students and mentors to watch the Hong Kong

Ballet’s “La Bayadère” performance to promote art and

culture and expand the horizons of Hong Kong youth.

CEL and HandsOn, a local social enterprise,

organized the first “Grassroots School Sports

Fun Day” and the second “Grassroots Schools

STEM Fun Day” to encourage students to

exercise and study hard, cultivate their interest in

science, and grow up actively and healthily.

CEL continues to care for the community and grassroots

families, and organized a volunteer team to donate

material packages to households in subdivided housing in

Kwun Tong District.

CHINA EVERBRIGHT LIMITED

ANNUAL REPORT 2023

17

AWARDS AND HONOURS IN 2023

In 2023, CEL and its professional funds won a

number of authoritative awards and honours in

the industry, affirming CEL’ s status as an

industry-leading cross-border asset

management and investment institution.

Awards Received by the Company

CEL was awarded the title of “Top 8 State-owned Direct

Investment Institutions in 2023” by China-fof.com.

CEL was awarded the titles of “Top 30 Private Equity Funds in the

Guangdong-Hong Kong-Macao Greater Bay Area” and “Top 100

State-owned Investors” by ChinaVenture for 2023.

CEL was selected among the “Top 50 Influential PE Investment

Institutions in China”, “Top 50 Influential State-owned Investment

Institutions in China” and “Top 100 Influential Investment

Institutions in China” by China Venture Capital Research Institute

(“CVCRI”) for2023.

18

2023 REVIEW | Continued

CEL was ranked the 7th in “Top 10 Investment Institution Soft Power GP in 2023” by

FOFWEEKLY.

Received the title of “2023 Best Returns State-owned Market-oriented

FoFs Top 7” by china-fof.com.

Awards Received by CEL’s Professional Funds

CEL Fund-of-Funds (“FoF”):

Received the titles of “Top 20 Chinese FoFs”, “Top

30 Most Popular FoFs Among GPs” and “Top 30

Venture Capital LPs in China” from ChinaVenture

in 2023.

Received the title of “China’s most GP-focused market-based

FoF” from 36kr.com.

Received the title of “Top 20 Best Market-Based FoFs in

China in 2022-2023” from Chinese Venture.

CHINA EVERBRIGHT LIMITED

ANNUAL REPORT 2023

19

CEL New Economy Fund received the title of “Soft Power Ranking

of Investment Institutions — New Economy TOP20” from

FOFWEEKLY.

Funds managed by China Everbright Assets Management Limited, a secondary market fund

management platform:

Everbright Convertible Opportunities Fund received the “Best Asian (excluding Japan) Fixed-

income Hedge Fund (3-year)”, “Best Asian (excluding Japan) Fixed-income Hedge Fund (5-

year)” and “Asian (excluding Japan) Fixed-income Hedge Fund (5-year)” awards from Insights

& Mandates.

Corporate Social Responsibility and Human Resources Awards

CEL and China Everbright Charitable Foundation were

awarded the “Caring Company” and “Caring

Organisation” logos for the 13th consecutive year.

Awarded the “Happy Company 5 years+”

logo for the 9th consecutive year.

Awarded the “Sport-Friendly Action”

Decal for the 4th consecutive year.

Won the Bronze Award of the “Privacy-Friendly Awards 2023” from

the Office of the Privacy Commissioner for Personal Data, Hong Kong

for the first time.

CHAIRMAN’S STATEMENT

20

decided to transform towards engaging in fund management

business in 2010. This decision enabled the Company to

record a rapid growth as it diligently consolidated its resilient

development cornerstone. In 2023, China’s private equity

investment industry encountered various challenges in terms

of fundraising, investment and exit, with increasing entry

barriers and accelerating sector differentiation and

realignment. Against this backdrop, the operations of the

Company improved compared to 2022, although overall

profitability was still materially impacted. Facing difficulties

and challenges such as insufficient demand from the

macroeconomy and a complex and volatile external

environment, the Company remained confident and

committed. With a focus on its principal asset management

business, the Company adhered to its prudent approach for

serving the “Dual-Circulation” new development pattern,

promoting high-quality development of investee companies

and fully supporting the national strategies and the real

economy. After years of rapid growth, CEL is at a critical

period of adjustment characterised by multiple overlapping

phases. This adjustment involves reviewing and optimising

the sustainable development of existing businesses, and

exploring the inherent and potential expansion of asset

management business.

In 2023, affected by the dampened and unbalanced economic

recovery around the world amidst complicated and ever-

changing regional situations, the global economic

development decelerated for the third consecutive year. It

remains a significant challenge for the world’s major

economies to effectively strike a balance between “curbing

inflation” and “sustaining economic stability”. At the annual

meeting of the World Economic Forum in 2024, Børge

Brende, the president of the World Economic Forum, stated

that China, with its enormous market capacity, would

continue to be a major engine for global economic growth.

Looking back on 2023, China’s economy picked up a steady

development momentum, with stable improvement in supply

and demand, efficient transformation and upgrade, overall

stability in employment and prices, effective protection of

people’s livelihood, and solid progress in high-quality

development. The GDP achieved a year-on-year growth of

5.2%, successfully meeting the main anticipated target.

Being a cross-border asset management and private equity

investment company growing alongside Hong Kong, CEL has

weathered many market cycles and challenges over the past

26 years and continued to enhance its core competitiveness,

laying a solid foundation for its development. The Company

has embarked on the private equity business since 2004 and

Laying the foundation for

development, steering the course of

transformation steadily,

and advancing firmly on the path of

high-quality development

CHINA EVERBRIGHT LIMITED

ANNUAL REPORT 2023

21

FACILITATING STRATEGIC TRANSFORMATION TO

STIMULATE A VARIETY OF DEVELOPMENT

FORCES

A robust development foundation is key to the Company’s

continuous growth and resilience against market fluctuations.

In 2023, the entire staff of CEL made arduous efforts as the

Company maintained its strategic direction and further

promoted innovations with an aim to remain stable amidst

cyclical changes of the industry. The Company concentrated

its efforts on its asset management business while expanding

its development concepts in 2023. Focusing on developing

fund business, raising proceeds, identifying highlight

performance and branding, the Company strived to refine,

strengthen and optimise its asset management business.

Efforts were made to explored light asset business directions

with development foundations and potential. The Company

also deepened its reforms in the asset management sector

and explored ways to increase the asset management scale

of primary and secondary markets at home and abroad.

Leveraging its advantages in venture capital and equity

investments, the Company expanded the reserve of projects

with core competitiveness. It also guided more financial

resources towards promoting technological innovation,

advanced manufacturing, green development and other areas,

enabling its investment portfolio to focus on industries that

feature competitive advantages and potential for growth.

Operating fundamentally within the asset management

sector, the Company carried out in-depth research on industry

investment strategies and bolstered its analysis of business,

industries and enterprises to enhance its investment and

research capabilities. This approach enabled the Company to

seize long-term investment yields while mitigating risks

associated with cross-cycle investments. Committed to

supporting the implementation of both “bringing in” and

“going out” policies, the Company captured major

opportunities presented by the high level of financial liberation

and the internationalisation of Renminbi. This commitment

was part of a continuous drive of the Company to enhance its

comprehensive financial service capabilities.

ANCHOR IN ASSET MANAGEMENT TO PROMOTE

EFFICIENT FINANCIAL DEVELOPMENT

Despite the adverse conditions of the asset management

sector, the Company was able to achieve several major

accomplishments. Firstly, the Company overcame significant

fundraising pressure and launched new funds with proceeds

of approximately HK$1.324 billion. It steadily promoted the

establishment of several new funds including the Zhejiang

Manufacturing Sub-Fund and CEL Infrastructure Investment

Fund II. Secondly, the Company prudently captured the

windows of investing in new energy, semiconductors and

other industries and identified high-quality investment

projects such as IOPSILION and Ganzhou HPY, which were

awarded national awards. Thirdly, its three investee

companies, namely Dekon Food and Agriculture, Fourth

Paradigm and Xiao-i Robot, were successfully listed,

strengthening the effectiveness of its financial services for

the real economy. Fourthly, the Company was presented with

a number of authoritative industry awards and continuously

received recognition from the industry, including 2023 Top 8

Best Returns State-owned Direct Investment Institutions,

2023 Top 50 Influential State-owned Investment Institutions

in China and 2023 Top 100 Influential Investment Institutions

in China. Its FoFs business also received the honour of

“China’s most GP-focused market-based FoF”.

In terms of strategic layout in China, CEL has also recorded

satisfactory performance. In the Guangdong-Hong Kong-

Macao Greater Bay Area, China Everbright Hong Kong

Innovation Centre surpassed its annual objective for corporate

integration, which marked a significant milestone with the

settlement of the first foreign enterprise within the zone. The

Company successfully co-hosted the Hong Kong Science and

Technology Seminar ( ) and the Guangzhou

Government and Enterprise Seminar (). It also

established the Hengqin project group, promoting the

construction of the talent training base of China Everbright in

the South China region. In the Yangtze River Delta region, the

CEL Yixing Industrial Investment FoFs (

) was established in collaboration with the Yixing

Government, successfully securing the initial phase of funding

amounting to RMB1.2 billion. The first closing of CEL

Kunshan Fund was also completed, with the initial phase of

funding amounting to RMB300 million. In the central and

western regions, investment deployment for new materials,

lithium batteries, advanced manufacturing and other sectors

was expedited. Along the “Belt and Road” region, CALC, a

key investee company of CEL, delivered two ARJ21 aircraft

from COMAC to Indonesia, supporting the international

business expansion of China’s domestic aircraft industry.

22

Chairman’s Statement | Continued

SUPPORTING PUBLIC WELFARE INITIATIVES AND

ACTIVELY PARTICIPATING IN CHARITABLE

ACTIVITIES TO BENEFIT THE COMMUNITY

For the benefit of the community and with a commitment to

public welfare, CEL coordinates charitable activities and fulfills

its social responsibilities. In terms of charitable activities for

the community, CEL focuses its efforts on grassroots families

and youth groups in Hong Kong. Volunteer teams of the

Company are gathered on a quarterly basis to visit grassroots

schools and communities. Their volunteer activities include

“Grassroots School Sports Fun Day” ( ),

“Grassroots School STEM Day” ( STEM ), Mid-

Autumn Festival gift bag distribution under the theme of “A

Joyful Mid-Autumn Festival for Family Reunion” (“

” ) and “Everbright’s Care for the

Community” ( ). The Company actively

participates in the Strive and Rise Programme, a youth

development campaign, in which it has recommended its

employees to take part as mentors and invited Hong Kong

students and teachers to watch performances by the Hong

Kong Ballet. It fully supported the Hong Kong delegation

participating in the 1st National Student (Youth) Games held

in Guangxi in November, promoting the development of

sports in Hong Kong. In terms of social responsibility, the

Company continuously deepens assistance for targeted

groups and supports rural revitalisation. Further building on its

achievements in poverty alleviation, the Company has

launched and promoted various rural revitalisation measures,

and organised activities to facilitate the distribution of

agricultural products and enhance the income of farmers.

Regarding its care for employees, the Company organises

cultural activities such as craft making, parent-child activities,

cultural heritage campaigns and other special cultural events

in celebration of major festivals such as Spring Festival,

Women’s Day, Mother’s Day, Youth Day, Children’s Day and

Mid-Autumn Festival. To mark the “919” CEL Day (“919”

), the Company hosted celebration activities across

offices in five regions to foster an entrepreneurial spirit.

DEEPENING ESG STRATEGIES TO APPLY

CONCEPTS TO PRACTICE

CEL has always placed great emphasis on sustainable

development and social responsibility. It has published

reports regarding its sustainable development for 12

consecutive years since 2011. Based on the concept of long-

term sustainable development, the Company has established

an ESG committee with a top-down structure to carry out

ESG governance work in an integrated and systematic

manner and incorporate ESG principles into the business

decision-making process of the Company. The ESG

committee also fully participates in fulfilling the goal of

“Green Everbright” of Everbright Group and implementing

the “carbon peak and neutrality” strategy of China. As a

leading cross-border asset management enterprise in China,

the Company has gradually incorporated ESG principles into

its management decision-making process and further

enhanced its ESG management level. Highly recognised by

rating agencies, the Company achieved a two-notch upgrade

in MSCI ESG ratings to BBB. This reflects that the ESG

management of CEL has been regarded highly by the capital

market, and affirms the long-term investment value of the

Company.

STEPPING UP RISK PREVENTION EFFORTS WITH

PRUDENT MEASURES TO MITIGATE POTENTIAL

RISKS

In 2023, the Company continued to improve its compliance

management capabilities and took the initiative to adapt to

more rigorous and stringent financial regulations in general.

Its structure was further streamlined for better internal

control and compliance management to ensure that its

business development complies with regulations. The

Company strengthened and refined various risk control and

corporate governance frameworks, aiming to build a more

robust corporate governance structure while improving its

decision-making efficiency and the security of its business

procedures. In addition, with optimised organisational

structure, well-established work mechanisms and more

effective information technology initiatives, the Company

maintained an efficient decision-making and organisational

operation mechanism. Project exit measures were also

bolstered to maximise cash flow and increase cash reserves.

strengthen asset-liability maturity alignment management,

develop contingency plans in a timely manner, and enhance

risk resistance capabilities.

CHINA EVERBRIGHT LIMITED

ANNUAL REPORT 2023

23

2023 was an extraordinary year. The Company has made its

utmost effort to deliver remarkable and hard-earned track

record. Recently, several international organisations and

commercial institutions have successively raised their growth

forecasts for China, casting a “vote of confidence” in the

economy of the China. CEL firmly believes that with the

steady improvement of the Chinese economy and the

continuous optimisation of the capital market environment,

the private equity industry in China will successfully navigate

through the current difficult period. CEL, with its professional

investment team, unique cross-border platform advantages,

sophisticated investment experience in industry and project

reserves, will continue to strictly follow market rules and

policy directions. Striving to closely align with national

strategies, the Company insists on serving the national

strategies and the real economy. It will further enhance its

project management and risk control capabilities in order to

capture opportunities during in the industry’s recovery phase

and achieve high-quality development.

Laying the foundation for development means remaining

resilient amidst changes, staying clear-headed in the face of

challenges, and maintaining sharpness in competition. This

foundation represents the past of CEL and also sets the tone

for future development. The focus of the Company is on

stability, establishing a solid base before making

breakthroughs, adhering to core responsibilities and

businesses, and continuously advancing its transformation

towards light-asset, high-quality development. As a participant

in the capital market, CEL remains firmly optimistic about

China’s economy. It will actively contribute to the financial

strength of the new era and place an emphasis on cross-

border investment and asset management. In pursuit of long-

term growth potential of specific industries from the

perspective of China, the Company will strive to integrate its

business and finance to serve the high-quality development

of China’s economy, share the development benefits of

China, and continuously create greater value for shareholders.

Yu Fachang

CHAIRMAN

22 March 2024

24

MANAGEMENT DISCUSSION & ANALYSIS

In 2023, CEL actively addressed complex and

volatile market, focused on core

responsibilities and businesses, reinforced in

fundraising, investment, management and

exit, strengthened internal control, improved

risk resistance capacity and conducted

strategic transformation actively, so as to

promote high-quality development.

CHINA EVERBRIGHT LIMITED

ANNUAL REPORT 2023

25

REVIEW AND ANALYSIS

Macro-economic and Industry Review

Global economy experienced a downshift of growth rate in 2023, with a declining growth rate for two consecutive years.

Developed economies saw a significant slowdown, while growth rates of emerging economies remained at a similar level

compared to 2022. Under the spillover effect of the Federal Reserve’s interest rate hikes, the spot exchange rate of the

Renminbi (“RMB”) against the US dollar (“USD”) fell by 1,406 points in 2023, representing a decline of 2.02%. Benefiting from

the post-pandemic recovery of the supply chain, global inflation is cooling down in an orderly manner. Although the economic

growth has slowed, it remains resilient. Faced with a complex and volatile internal and external environment, China has

tightened its macro-control, adhering to the overall principle of seeking progress while maintaining stability. With various

measures in place, the economic recovery in China has gradually improved. The growth rate of export-oriented economies such

as the Asia-Pacific region has gradually stabilized, providing important support for the global economic recovery. As the effects

of macroeconomic policies gradually unfold, China shows an ongoing economic recovery, driving a revival in trade with relevant

partners with major anticipated goals achieved. The Gross Domestic Product (GDP) reached RMB126 trillion, representing an

increase of 5.2% compared to 2022.

Reviewing the performance of major global stock markets in 2023, the Nasdaq index showed a gain of 44.2%, the highest

among major global stock indices; the Nikkei 225 gained 28.2% during the year, ranking second with the largest annual increase

since 2013; the Italian FTSE MIB index gained 28.0%, ranking third. The Chinese capital market was relatively weak, affected

by multiple factors such as the Federal Reserve’s monetary policy, geopolitical situations, and expectations of internal and

external economic. The Shanghai Composite Index fell by 3.7% during the year, and the ChiNext Index fell by more than 19.4%

during the year; the Hong Kong Hang Seng Index fell by 13.8% for the fourth consecutive year; the Hang Seng Technology

Index fell by 8.8% for the third consecutive year.

The China’s equity investment market continued to slump in 2023 due to macroeconomic influences. According to China

Venture (), the number of funds decreased by 4.7% year-on-year, with the fundraising market continuing its downturn

for years, with the subscribed capital of newly established funds decreasing by 9.4% year-on-year. The expansion and

penetration for the Government guiding funds was accelerated. Investment activities also slowed, decreasing by 12% year-on-

year in 2023. As for sectors that remained active, electronic information segment saw a 35% increase in investment cases. In

terms of exits, 415 Chinese enterprises successfully went public domestically and abroad through IPOs, while the exit rate of

return dropped to 374%.

26

Management Discussion & Analysis | Continued

FINANCIAL PERFORMANCE IN 2023

Income

Key income items

(in HK$ hundred million) 2023 2022 Change

Income from contracts with customers,

mainly including: 7.92 8.43 (6%)

— Management fee income 1.82 2.66 (32%)

— Performance fee and

consultancy fee income 3.77 3.90 (3%)

Net loss from investments,

mainly including: (4.89) (58.86) 92%

— Interest income 6.60 5.64 17%

— Dividend income 9.92 21.24 (53%)

— Realised (loss)/gain on investments (0.13) 0.46 N/A

— Unrealised loss on investments (21.28) (86.34) 75%

Income/(loss) from other sources 11.02 (0.75) N/A

Share of profits less losses of associates 2.31 6.17 (63%)

Share of profits less losses of joint ventures 0.25 0.17 47%

Total amount of income 16.61 (44.84) N/A

During the reporting period, the Group’s income from contracts with customers decreased by 6% as a result of, among others,

a decrease in net asset value of secondary market funds and certain funds entering into the exit period. In addition, total

amount of income

2

of HK$1,661 million in 2023 turned around since net loss from investments decreased significantly, whereas

a loss of HK4,484 million was recorded over the same period last year.

The year-on-year change in income was mainly due to the following factors:

(1) In 2023, the Group’s income from contracts with customers was HK$792 million, representing a decrease of HK$51

million when compared with the same period last year. Specifically, management fee income was HK$182 million,

representing a decrease of HK$84 million when compared with the same period last year. It was mainly because of

newly established funds still in fundraising stage, cessation of management fee from certain funds since entering into

exit period, redemption of secondary market funds from certain investors, and exit of certain funds, leading to the decline

in AUM as well as the decline in management fee income. Additionally, performance fee and consultancy fee income

were HK$377 million, representing a decrease of HK$13 million when compared with the same period last year.

2

Total amount of income is calculated as income from contracts with customers + net loss from investments + income/(loss) from other

sources + share of profits less losses of associates + share of profits less losses of joint ventures. “Total amount of income” is a measure

used by the management of the Group for monitoring business performance and financial position. It may not be comparable to similar

measures presented by other companies.

CHINA EVERBRIGHT LIMITED

ANNUAL REPORT 2023

27

(2) The Group’s net loss from investments was HK$489 million, whereas net loss from investments of HK$5,886 million

was recorded during the same period last year. Specifically, dividend income was HK$992 million, representing a year-on-

year decrease of HK$1,132 million, which was mainly due to a non-recurring dividend income of approximately of HK$812

million incurred from exit in early 2022. Realised loss on investments was HK$13 million, whereas realised gain from

investments of HK$46 million was recorded during the same period last year. Unrealised loss on investments was

HK$2,128 million, representing a significant reduction of loss by HK$6,506 million as compared with the same period last

year. The loss was mainly because (i) in Principal Investments Business, the unrealised loss of HK$1,799 million recorded

from financial investments (as at the end of 2022, the carrying value of financial investments was HK$8,640 million)

mainly due to valuation decline of certain investment projects; and recorded an unrealised loss of HK$448 million from

the decrease in valuation of Key Investee Companies (as at the end of 2022, the carrying value of the Key Investee

Companies was HK$2,793 million); (ii) in Fund Management Business, unrealised loss on primary market investments

was HK$93 million which was mainly as a result of decrease in market value or valuation of certain projects invested (as

at the end of 2022, the carrying value of primary market investment was HK$15.509 billion); as affected by the increase

in market price, the secondary market investments recorded an unrealised gain of approximately HK$150 million (as at

the end of 2022, the carrying value of secondary market investments was HK$4,054 million); unrealised gain on FoFs

investments was HK$62 million (as at the end of 2022, the carrying value of FoFs investments was HK$7,646 million).

(3) During the reporting period, the Group’s share of profits less losses of associates was HK$231 million, representing a

decrease of HK$386 million when compared with the same period last year. The loss attributable to Everbright Jiabao

increased by HK$601 million when compared with the same period last year, while the profit attributable to Everbright

Securities increased by HK$193 million when compared with the same period last year.

Income from Key Business Segments

Income from key business segments

(in HK$ hundred million) 2023 2022

— Income/(loss) from Fund Management Business 10.01 (23.49)

— Income/(loss) from Principal Investments Business 6.60 (21.35)

Total amount of income/(loss) 16.61 (44.84)

By business segment, the income from Fund Management Business of the Group during the reporting period was HK$1,001

million, whereas a loss of HK$2,349 million was recorded during 2022. Compared with a floating loss of HK$5,047 million in

2022, an unrealised gain of Fund Management Business of HK$119 million was recorded in 2023, due to the good performance

and increased valuation of certain investment projects held by the funds. Thus the income from Fund Management Business

improved significantly. The income from Principal Investments Business was HK$660 million (a loss of HK$2,135 million in

2022), in which the unrealised loss decreased to approximately HK$2,247 million from HK$3,587 million in 2022, it was

principally due to the further decline in market value and annual valuation of principal investment projects compared with last

year affected by market. In addition, the dividend income from China Everbright Bank and share of profit of Everbright Securities

in 2023 was HK$1,212 million in aggregate, representing an increase of HK$151 million as compared with the same period last

year.

28

Management Discussion & Analysis | Continued

Earned Management

3

Fee Income

(in HK$ hundred million)

As

presented in

the financial

report

Elimination

of management

fee income from

consolidated

funds

Management

fee income

received by

associates/joint

ventures

Other

accounting

adjustments

Earned

Management

Fee Income

(a) (b) (c)

Primary market 1.56 0.73 1.57 0.10 3.96

Secondary market 0.13 0.25 – 0.06 0.44

FoFs 0.13 1.11 – 0.07 1.31

Management fee income 1.82 2.09 1.57 0.23 5.71

For the purpose of resource allocation and business performance evaluation, the management of the Group adopts Earned

Management Fee Income as an additional financial measurement indicator. Earned Management Fee Income refers to the

management fee income received by the Group as a fund manager in accordance with relevant agreements of fund

management.

During the reporting period, management fee income as presented in the financial report was HK$182 million. After making

adjustments

4

between the Earned Management Fee Income recognised by the Group for the reporting period and the

management fee income presented in accordance with the Hong Kong Financial Reporting Standards (the total amount of three

adjustments was HK$389 million), Earned Management Fee Income of the Group was HK$571 million, representing a year-on-

year decrease of 26.8%. Specifically, Earned Management Fee Income of primary market was HK$396 million, representing a

year-on-year decrease of 32%; Earned Management Fee Income of secondary market was HK$44 million, representing a year-

on-year decrease of 38%; and Earned Management Fee Income of FoFs was HK$131 million, representing a year-on-year

increase of 6%. The decrease in management fee income was mainly due to combined factors, such as newly established

funds still in fundraising stage, cessation of management fee from those funds entering into exit period, decline in AUM of

secondary market funds as a result of decrease in net assets, and the exit of certain funds.

Profit in Key Business Segments

(in HK$ hundred million) 2023 2022 Change

Profit/(loss) from Fund Management Business 2.76 (38.10) N/A

Loss from Principal Investments Business: (1.89) (31.93) 94%

— Key investee companies (5.41) (12.23) 56%

— Financial investments (8.60) (30.45) 72%

— Cornerstone investments 12.12 10.75 13%

Less: Unallocated corporate expenses, taxes and profit

attributable to holders of senior perpetual capital securities (20.10) (4.40) >100%

Loss attributable to shareholders of the Company (19.23) (74.43) 74%

3

The Earned Management Fee Income is a measure used by the management of the Group for monitoring business performance and

financial position. It may not be comparable to similar measures presented by other companies.

4

The adjustments between the Earned Management Fee Income recognised by the Group for the current reporting period and the

management fee income presented in accordance with the Hong Kong Financial Reporting Standards include (a) elimination of

management fee income from consolidated funds: the Group acts as both the fund manager and the major limited partner in certain funds,

where the management fee paid by the fund and the management fee income received by the fund manager is eliminated when

consolidating into the Group’s consolidated financial statements; (b) management fee income received by associates/joint ventures: (i) the

Group acts as the joint fund manager through the establishment of a joint venture with a third party, and the management fees received

by such joint venture are presented as the Group’s share of profits from the joint venture; (ii) Everbright Jiabao, an associate of the Group,

holds 51% interest in EBA Investments, which is included in Everbright Jiabao’s scope of consolidation. The Group holds the remaining

49% interest in EBA Investments through another subsidiary and such interest is accounted for as financial assets. The management fee

income of EBA Investments is reflected in the share of profits of associates of the Group; and (c) other accounting adjustments.

CHINA EVERBRIGHT LIMITED

ANNUAL REPORT 2023

29

During the reporting period, the loss attributable to shareholders of the Company was HK$1,923 million, whereas loss of

HK$7,443 million was recorded last year. Reasons for loss:

(1) Gain from Fund Management Business was HK$276 million, whereas loss of HK$3,810 million was recorded last year,

mainly because the income of investment projects held by funds turned around and amounted to HK$119 million

compared with the floating loss of HK$5.047 billion in the same period of 2022 due to increase in the valuation of such

projects.

(2) Loss from Principal Investments Business was HK$189 million, whereas loss of HK$3,193 million was recorded last year.

It was mainly due to the decrease of HK$1.340 billion in the unrealised loss of investment projects held by the end of

2023 compared with the same period last year, and an increase in the profit and income contribution from the Group’s

equity interests of Everbright Securities and China Everbright Bank respectively, offsetting the decrease in the valuation

of certain projects invested.

Dividends

Per share

(HK$) 2023 2022 Change

Loss per share (1.14) (4.42) 74%

Interim dividend per share 0.15 0.15 –

Final dividend per share 0.10 0.15 (33%)

Total dividend per share 0.25 0.30 (17%)

Loss after tax attributable to shareholders of the Company for the period was HK$1,923 million, and net cash inflow from

operating activities and investing activities was HK$3,177 million and HK$1,704 million, respectively. In the reporting period, the

Group recorded a significant reduction on loss, while the liquidity being sufficient and the overall financial, business and

operating conditions remaining solid. Following the practice of sharing the Company’s operating results with shareholders, the

Board declared final dividend of HK$0.10 per share for 2023 (2022 final dividend: HK$0.15 per share).

30

Management Discussion & Analysis | Continued

Key Financial Ratios

Key Financial Data

5

2023 2022 Change

Gearing ratio

6

95.0% 86.9% +8.1 ppt

Net gearing ratio

7

86.4% 81.2% +5.2 ppt

Debt-to-asset ratio

8

57.1% 55.2% +1.9 ppt

Current ratio

9

109.5% 109.8% -0.3 ppt

The Group executed refined cost control to reduce carbon emissions at the operation level and boosted operating efficiency

through technological and electronic methods. Operating costs

10

for 2023 amounted to HK$907 million, representing a year-on-

year decrease of 1.4%.

As at the end of December 2023, the gearing ratio of the Group was 95.0%, representing an increase of 8.1 ppt compared to

the end of 2022. This was mainly attributable to, among others, the exchange difference arising from the translation of financial

statements due to the depreciation of RMB against the HKD, the decline in share price of its holdings in China Everbright Bank

and the distribution of dividends. As at the end of December 2023, cash reserve of the Group increased. If netting off the

available cash of HK$2,927 million (HK$2,143 million of available cash as at the end of 2022), net gearing ratio increased by 5.2

ppt to 86.4% as compared with the end of 2022. As at the end of December 2023, the Group’s total equity decreased to

HK$34.1 billion from HK$37.9billion as at the end of last year, leading to an increase in the gearing ratio passively. Total interest-

bearing liability at the end of December 2023 was HK$32.4 billion, representing a decrease of HK$500 million from HK$32.9

billion at the end of last year.

As at the end of December 2023, the Group had cash and cash equivalents of approximately HK$9.6 billion and unutilised

available bank facilities of approximately HK$14.1 billion, representing sufficient liquidity and a solid financial condition.

5

Gearing ratio, debt-to-asset ratio and current ratio are the measures used by the management of the Group for monitoring business

performance and financial position. These may not be comparable to similar measures presented by other companies

6

The gearing ratio is calculated as interest-bearing debt (including bank loans + bonds payable)/total equity x 100%

7

Net gearing ratio is calculated as (interest-bearing debt – available cash)/total equity

8

Debt-to-asset ratio is calculated as total liabilities/total assets x 100%

9

The current ratio is calculated as current assets/current liabilities x 100%

10

Operating costs include staff costs, depreciation and amortisation expenses and other operating expenses

CHINA EVERBRIGHT LIMITED

ANNUAL REPORT 2023

31

BUSINESS PERFORMANCE IN 2023

Fund Management Business

The total AUM of CEL’s funds reached approximately HK$126.2 billion as at 31 December 2023, representing a decrease of

approximately HK$39.2 billion compared to the end of last year. During the reporting period, one new fund was established,

with proceeds of approximately HK$1.324 billion. The decrease in AUM was mainly attributable to, firstly, the adjustment of

statistical criteria and withdrawal due to maturity of certain funds; secondly, the AUM of secondary market funds decreased

due to the impact of redemptions and the decrease in net asset value; and thirdly, the decline in the exchange rate of RMB

against HKD, resulting in a decrease in AUM in Hong Kong dollar terms.

The source of funding of CEL’s funds is extensive, where external investors are primarily institutional investors, with a

diversified institutions covering commercial banks, insurance companies, family offices, government agencies and others. In

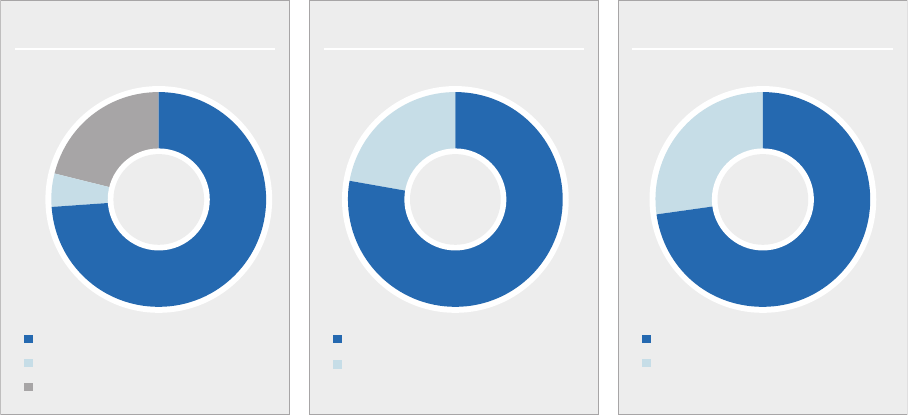

terms of currency, funds denominated in RMB and non-RMB currencies were equivalent to approximately HK$98.832 billion

and HK$27.388 billion, accounting for 78% and 22% of the total amount, respectively. In terms of the nature of funds, the

Company’s Fund Management Business included 43 primary market funds, 21 secondary market funds and discretionary

accounts, and 9 FoFs products.

During the reporting period, CEL tailored to the circumstances to make prudent investment decisions to exit from prevailing

projects. The Fund Management Business made capital contributions of approximately HK$420 million to a total of 17 projects,

and exited, fully or partially, from 82 projects, recording a cash inflow of approximately HK$4.584 billion.

78% 73%

27%22%21%

5%

74%

Primary market fund

Secondary market fund

FoFs

AUM denominated in RMB External capital

CEL’s seed capital

BY FUND

BUSINESS SEGMENTS

BY CURRENCY BY SOURCE OF CAPITAL

AUM denominated in

non-RMB currencies

32

Management Discussion & Analysis | Continued

Primary Market Funds

As at 31 December 2023, 43 primary market fund products were under the management of CEL, with an aggregate AUM

equivalent to approximately HK$93.3 billion, investing in various industries including semiconductors, industrial internet and

high-end manufacturing. CEL also actively explored potential opportunities in AI, new materials and other sectors. By currency,

amounts equivalent to approximately HK$71.5 billion and approximately HK$21.8 billion were denominated in RMB and other

currencies, accounting for 77% and 23% of the total amount, respectively. During the reporting period, CEL combined transfer,

IPO and other diversified exit channels, exiting projects including Ambrx, Henan BCCY Environmental Energy, Reactor

Microelectronics, Haitai New Energy, Three’s Company Media and XPENG Motors to generate a favorable return on investment

and cash inflow for the Company.

Leveraging the diversified fund structure and leading full value chain capabilities, CEL’s primary market fund maintained a cross-

border portfolio from the “Perspective of China”, and invested in new industries and fields with relative low risk and high

efficiency by collaborating with multiple GPs. During the reporting period, CEL was honored with various awards, including

“2023 TOP50 Influential PE Investment Institutions in China” by China Venture Capital Research Institute, the “TOP50 Best

Hard-Tech Private Equity Investment Institutions ( TOP50)” by Jiazi Gravity, and the “2023 China

Best State-owned investment institutions TOP100” by China Venture.

Secondary Market Funds

As at 31 December 2023, CEL’s secondary market business managed a total of 21 funds and discretionary accounts with AUM

in terms of net worth of approximately HK$6.1 billion. In terms of product categories, fixed-income products and equity

products accounted for 95% and 5% of the total AUM respectively.

By leveraging on its investment capabilities, CEL’s secondary market funds have built a one-stop portfolio with years of cross-

border experience, which covers Asian credit bond hedge funds, Asian convertible bond hedge fund, offshore Greater China

equity hedge fund, onshore A+H shares long-only strategies funds (including private fund managers and institutional investors)

and investment advisory business. CEL has a well diversified fixed income products covering offshore funds, QFII managed

accounts, offshore managed accounts and asset securitization products. Everbright Convertible Opportunities Fund, a flagship

Asian convertible bond product, delivered sound results during the reporting period. The fund received the “Best Asian Ex-

Japan Hedge Fund (5-year)”, “Best Asian Ex-Japan Fixed-Income Hedge Fund (3-year)”, and “Best Asian Ex-Japan Fixed-

Income Hedge Fund (5-year)” awards by the 2023 I&M Professional Investment Award, demonstrating the recognition of the

Company’s investment capability and comprehensive strength by independent ranking agencies. Everbright Income Focus

Fund, a public bond fund in Hong Kong being an investment advisor, which was awarded a five-star rating (the highest rating)

by an authoritative fund rating agency, for overall rating and in five-year rating, for its superior performance and risk-adjusted

returns.

Fund of Funds

CEL’s FoFs not only invested in external funds with proven track records and robust governance, but also invested in funds

launched and managed by the Company, and co-invested or directly invested in equity projects. As at 31 December 2023, the

FoFs team managed 9 FoFs with an AUM equivalent to approximately HK$26.816 billion. The Company’s FoFs business has

established an investment matrix primarily targeting information technology, biopharmaceuticals, consumption and

entertainment, and technology manufacturing, with active collaborations with well-established major (white horse) managers,

emerging and promising (dark horse) managers, and leading managers in specialized sectors across both domestically and

internationally. As at 31 December 2023, there were 95 invested projects (sub-funds and direct investment projects) under the

FoFs, and a total of 147 investees in the underlying projects of invested sub-funds and direct investment projects under the

FoFs were listed. During the reporting period, 19 new enterprises were listed, all of which came from the underlying projects of

sub-funds. CEL’s FoFs team also promoted the listing declaration and exit of direct investment projects, dedicating to bring

excellent returns to investors.

CEL’s FoFs won industry recognition and various awards, further enhancing its brand and influence in the industry. During the

reporting period, the Company’s FoFs were awarded the “Most Popular LP among Equity Investment Institutions” by the 7th

Equity Investment Golden Bull Award, “2023 Best Returns State-owned Market-oriented FoFs TOP20” China FoF, “2022-2023

Best Market-Oriented Chinese FoFs TOP20” by China Bridge, and “2023 TOP20 Best Chinese FoFs”, “TOP30 Most Popular

Chinese FoFs Among GPs” and “2023 TOP30 Venture Capital LPs in China” by ChinaVenture.

CHINA EVERBRIGHT LIMITED

ANNUAL REPORT 2023

33

Real Estate Investment and Asset Management Business

As at 31 December 2023, CEL held 29.17% equity interest in Everbright Jiabao, an A-share listed company (stock code:

600622.SH), as its largest shareholder. Everbright Jiabao managed 54 projects through EBA Investments, including 21

investment management projects with a managed fund scale of approximately RMB24.443 billion (equivalent to approximately

HK$26.97 billion) and AUM of approximately RMB46.756 billion (equivalent to approximately HK$51.59 billion). In 2023,

Everbright Jiabao/EBA Investments adhered to the overall strategy of stable operation and continued to optimise the operating

condition of projects under management and endeavoured to boost the operating and management standards of projects. As at

the end of 2023, EBA Investments and its subsidiaries managed a total of 21 consumption infrastructure projects of IMIX Parks

in mainland China through fund investment or entrusted management, primarily located in consumption center cities in various

municipalities and provinces in China. In addition, EBA Investments continued to expand the business of real estate

construction and management projects under the brand of “”, and expanded and reserved a number of projects during

the year.

In 2023, EBA Investments was ranked first in the “Top 10 Enterprises in terms of Comprehensive Strength among China Real

Estate Funds” jointly appraised by the China Enterprise Evaluation Association, Property Research Institute of Tsinghua

University and Beijing China Index Academy for the ninth consecutive years. It was also honoured as one of the “China’s TOP

10 Real Estate Funds in terms of Competitive Strengthens” by the BRICS Forum for the eighth consecutive years. EBA (Beijing)

Investment Management Co., Ltd. ( ( ) ), a wholly-owned subsidiary of EBA Investments, was

listed for the third time on the Class A list of private equity fund managers by the Insurance Asset Management Association of

China.

Principal Investments Business

CEL strives to achieve the following 3 objectives through its principal investments: (1) Key Investee Companies: investing in

and fostering enterprises with synergy between industry and finance and promising development prospects; (2) Financial

Investments: maintaining flexible liquidity management through investment in structured financing products and obtaining

stable interest income; capitalizing on the co-investment opportunities brought by the Fund Management Business and

participating in equity and related financial investments to obtain investment returns; (3) Cornerstone Investments: holding a

portion of the equity interest in China Everbright Bank and Everbright Securities to obtain stable dividends and investment

returns.

As at 31 December 2023, the Principal Investments Business managed 62 post-investment projects with an aggregate carrying

amount of approximately HK$32.1 billion. Among these projects, the total carrying amount of equity interest held in CALC,

Everbright Senior Healthcare and Terminus was approximately HK$4.7 billion; the fair value of Financial Investments was

approximately HK$9.2 billion; the fair value of the Cornerstone Investments in China Everbright Bank was HK$5.0 billion, and

the carrying amount of Everbright Securities accounted as an associate was HK$13.2 billion.

Principal investments

(in HK$ hundred million) 2023 2022

— Key Investee Companies 47 55

— Financial Investments 92 113

— Cornerstone Investments 182 181

Total 321 349

34

Management Discussion & Analysis | Continued

Key Investee Companies

CALC

As at 31 December 2023, CEL held 38.08% of the equity interest in CALC (stock code: 1848.HK), as the largest shareholder.

CALC is a one-stop full life-cycle solutions provider for global airlines. CALC’s scope of business includes regular operations

such as aircraft operating leasing, leaseback after purchase, aircraft asset portfolio transactions and asset management, and

value-added services such as fleet planning, fleet upgrading, aircraft maintenance, repair and overhaul, aircraft disassembling

and recycling and aircraft parts selling. It also elevates aircraft asset value through flexible aircraft asset management. At the

same time, CALC has the advantages of dual-platform financing, leasing and transaction channels, as well as a strong capability

and rich experience in financing both domestically and abroad. As at 31 December 2023, CALC had a fleet of 192 aircraft with

an increase of 16 aircraft from the end of 2022, consisting of 165 owned aircraft and 27 managed aircraft. CALC’s owned and

managed aircraft are leased to 41 airlines in 20 countries and regions.

Everbright Senior Healthcare

Everbright Senior Healthcare seized the development opportunities in China’s healthcare industry. In addition to effectively

responding to the epidemic and fully safeguarding the health of the elderly residents and staff, it constantly optimised the three-

level elderly service model featuring institutional, community-based, and home-based elderly services, improved the ability of

“Medical + Senior Healthcare”, “Insurance + Senior Healthcare” and “Service + Senior Healthcare”, and became a first-class

healthcare service provider in China with strong presence and competitiveness in the senior healthcare segment. During the

reporting period, Everbright Senior Healthcare has 190 institutional and community service centers covering more than 50 cities

across the country, forming a deployment covering the Beijing-Tianjin-Hebei region, Yangtze River Delta, and Chengdu-

Chongqing Economic Circle, with approximately 32,000 beds under management. Everbright Senior Healthcare has a good

brand reputation in the market in terms of professional senior healthcare services, stringent quality control, convenient services,

and diversified senior healthcare experiences, has been highly acclaimed by its customers, its peers and the government.

According to the “Integrated Business Enterprises in the Impactful Healthcare Industry for 2023” published by Guandian in

2023, it continued to rank the top position in the industry.

Terminus

During the reporting period, Terminus focused on high-growth business opportunities, continuously exploring new business

scenarios and models. Its three laboratories made breakthrough research progress, with over twenty papers being included in

top international academic conferences such as CVPR, ICCV and T-PAMI. It also released two new international and group

standards. Furthermore, it joined hands with the Hong Kong University of Science and Technology (Guangzhou) to establish the

Joint Research Center for Digital World, aiming to promote the major research and applications of Artificial Intelligence of things

(AIoT). In partnership with the Chongqing Institute of Green and Intelligent Technology, Chinese Academy of Sciences,

Terminus established the Chongqing key laboratory of big data and intelligent computing. The laboratory focuses on basic and

key technological researches based on an application-oriented approach, driven by the major technological needs of national

and Chongqing’s economic and social development. Terminus was recognised as one of the Top 100 IoT Enterprises in 2023 by

the China Internet Weekly, a key academic journal supervised by the Chinese Academy of Sciences, in collaboration with the

eNet Research Institute (eNet). It topped the list of the most commercially promising companies in the new energy and

carbon neutrality sector released by the Jazz Year (), a technological business think tank in China. It was also named

among the “Top 50 AIGC Application Scenario Innovations of 2023” ( 2023 AIGC Top50 ) by EqualOcean (

).

CHINA EVERBRIGHT LIMITED

ANNUAL REPORT 2023

35

Financial Investments

CEL’s financial investments funded by its own capital cover the following aspects: (1) based on the investment/co-investment

opportunities brought by the Group’s funds and extensive business network, investing in the equity or debt of unlisted

companies; (2) investing in structured financing products with a balance in return and liquidity. As at 31 December 2023, CEL’s

financial investments amounted to HK$9.2 billion in various sectors including real estate, new economy and technology, artificial

intelligence, high-end manufacturing, and green investments, with the aggregate carrying value of the top 10 projects

amounting to HK$6.5 billion.

Cornerstone Investments

As at 31 December 2023, the carrying amount of a certain portion of equity interests in Everbright Securities and China

Everbright Bank held by the Group as cornerstone investments each accounted for more than 5% of the Group’s total assets

and the two investments were regarded as significant investments of the Group. These two cornerstone investments held by

the Group accounted for in aggregate 53.3% and 22.9% of the Group’s net assets and total assets, respectively.

Everbright Securities (601788.SH)

Established in 1996 with headquarters in Shanghai, Everbright Securities is one of the first 3 innovative pilot securities firms

approved by the China Securities Regulatory Commission. As at 31 December 2023, the Group held 956 million A-shares in

Everbright Securities, representing 20.73% of its total share capital, with an investment cost of HK$1,497 million. Everbright

Securities is accounted for as an associate of the Group. The carrying value of the shares held by the Group was HK$13.2

billion, accounting for 38.6% and 16.5% of the Group’s net assets and total assets respectively. Based on the closing price of

RMB15.42 per share as at 31 December 2023, the fair value of the shares in Everbright Securities held by the Group was

HK$16.3 billion. During the reporting period, the Group’s share of profit from Everbright Securities as an investment in associate

was HK$881 million, representing a year-on-year increase of 28.0%.

China Everbright Bank (601818.SH)

Established in August 1992, China Everbright Bank is a national joint-stock commercial bank approved by the State Council and

the People’s Bank of China. As at 31 December 2023, the Group held 1.57 billion A-shares in China Everbright Bank,

representing 2.66% of the total share capital of China Everbright Bank, with an investment cost of HK$1,407 million. The shares

in China Everbright Bank held by the Group are accounted for as equity investments designated at fair value through other

comprehensive income. Based on the closing price of RMB2.90 per share as at 31 December 2023, the carrying amount and

fair value of the shares in China Everbright Bank held by the Group amounted to HK$5.0 billion, accounting for 14.8% and 6.3%

of the Group’s net assets and total assets respectively. During the reporting period, the Group’s income from China Everbright

Bank was HK$331 million, representing a year-on-year decrease of 11.2%.

OUTLOOK

Looking forward to 2024, as the adverse effects of supply disruption subsiding, the economy is less likely to face a hard landing.

The global economy is expected to demonstrate greater resilience subject to a balanced risk. However, due to factors such as

the slow exit from tight monetary policies, sluggish global trade and intensified geopolitical risks, economic growth is expected

to remain slow. Macroeconomic outlook reports for 2024 from various international institutions generally predict a slowdown in

global economic development. According to latest World Economic Outlook released by the International Monetary Fund in

January, China’s economic growth rate is estimated to be 4.6% for 2024, representing an upward revision of 0.4 percentage

points from its previous forecast. It also reflects the carry-over effect of stronger-than-expected economic growth of China in

2023. This is underpinned by the sustained effects of macroeconomic policies, full implementation of the “14th Five-Year

Plan”, support for the private economy, the development of emerging industries such as new energy, as well as other

favourable factors which may alleviate the downward pressure on China’s macroeconomy. Overall demand of China is expected

to recover and expand while the macroeconomic environment will continue to be subject to relatively relaxed policies, resulting

in the likelihood of normalised growth performance across all sectors. As external and internal positive factors for the currency

market continue to emerge, it may lay the basis and conditions for the appreciation of RMB against the USD. With the

deepening of the new development pattern and the continuous focus on new industry momentum, industries are expected to

enter a phase of balanced growth, driving to an optimistic expectation and promoting a positive economic cycle.

36

Management Discussion & Analysis | Continued

In light of the above, CEL will capitalise on the favourable conditions in 2024 to further promote its high-quality growth. With a

focus on its asset management business, the Company will develop in line with the “Dual Circulation” new development

pattern, consistently bolster the core competitiveness of asset management, and persist in transitioning towards “Asset-light”

strategy.

In terms of fundraising, CEL’s focus will be on establishing a multi-channel financing mechanism catering to

advantageous industries to enhance the quality of fundraising. By establishing diversified sources of funds, optimising the