1

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

DRAFT

AUGUST 2021

2

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

TABLE OF CONTENTS

Introduction ................................................................................................................................................. 3

Homeowner Needs and Engagement ..................................................................................................... 4

2.1 DATA-DRIVEN NEEDS ASSESSMENT ....................................................................................... 4

2.2 PUBLIC PARTICIPATION AND COMMUNITY ENGAGEMENT ............................................... 16

Program Design ........................................................................................................................................ 18

3.1 PROGRAM STRUCTURE .............................................................................................................. 18

3.2 CONTINUED ASSESSMENT OF HOMEOWNER NEEDS ........................................................ 20

3.3 ELIGIBILITY REQUIREMENTS ..................................................................................................... 21

3.4 TARGETING AND PRIORITIZATION ........................................................................................... 22

3.5 APPLICATION PROCESS ............................................................................................................. 22

3.6 PAYMENT PROCESS .................................................................................................................... 22

3.7 MARKETING AND OUTREACH EFFORTS ................................................................................. 23

3.8 BEST PRACTICES AND COORDINATION WITH HAF PARTICIPANTS ................................ 23

Performance Goals ................................................................................................................................. 24

Readiness ................................................................................................................................................. 25

5.1 STAFFING AND SYSTEMS .......................................................................................................... 25

5.2 PROGRAM ADMINISTRATION .................................................................................................... 25

5.3 CALL CENTER................................................................................................................................ 26

5.4 APPLICATION PROCESSING ...................................................................................................... 26

5.5 SYSTEM SOLUTION ..................................................................................................................... 27

5.6 PILOT PROGRAM .......................................................................................................................... 27

Administrative & Program Budget ......................................................................................................... 28

3

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

Introduction

The Alabama Housing Finance Authority (“AHFA”) will be administering the Homeowner

Assistance Fund (“HAF”) program for the state of Alabama. The HAF program was established to

mitigate financial hardship associated with the coronavirus pandemic by providing funds to eligible

entities for the purpose of preventing homeowner mortgage delinquencies, defaults, foreclosures,

loss of utilities or home energy services, and displacements of homeowners experiencing financial

hardship after January 21, 2020 (“Financial Hardship”).

The American Rescue Plan Act (“ARPA”) was signed into law on March 11, 2021, setting aside a

total of $1.9 trillion in federal funding for coronavirus pandemic related expenses and needs.

Approximately $9.9 billion in federal funding was set aside for states, territories, and tribal

governments to administer HAF programs assisting low-to-moderate income homeowners. AHFA

has developed this proposed plan (the “Plan”) for evaluation by U.S. Treasury (“Treasury”)

outlining the program design and strategy for distribution of Alabama’s $125.6 million allocation.

1

States were required to submit a Notice of Funds Request by April 25, 2021 and enter into a

Financial Assistance Agreement with Treasury to receive funding. In addition, states were given

the option to opt-in and receive 10 percent of their allocation up front to fund and administer a

pilot program. The state of Alabama submitted its notice and agreement for their total allocation

of $125,695,705. By Act No. 2021-443, the Alabama Legislature appropriated the HAF funds to

the Alabama Department of Finance to be subdelegated to AHFA to administer the state program.

Additionally, AHFA opted-in for the 10 percent up-front allocation and has chosen to administer a

pilot program which will be summarized within the Plan. States are required to submit their

implementation plan or a letter outlining when the implementation plan will be submitted. AHFA

submitted a letter to Treasury on June 24, 2021 acknowledging its intent to submit the Plan no

later than September 30, 2021, pending additional guidance, FAQs, and/or commentary by

Treasury regarding the specific regulatory requirements for HAF spending and programing.

AHFA and the state of Alabama stand ready to launch the HAF program upon Treasury’s approval

and look forward to assisting the state’s most vulnerable homeowners. AHFA is available to

provide additional details or answer questions as needed by Treasury.

1

U.S. Department of the Treasury, “Data and Methodology for State and Territory Allocations,” April 2021,

https://home.treasury.gov/system/files/136/HAF-state-territory-data-and-allocations.pdf

1

4

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

Homeowner Needs

and Engagement

2.1 DATA-DRIVEN NEEDS ASSESSMENT

AHFA has conducted a data-driven needs assessment to estimate the impact of the COVID-19

pandemic on homeowners across the state. AHFA obtained data from the U.S. Census Bureau,

AHFA’s own servicing portfolio of US Department of Agriculture (“USDA”), Federal Housing

Administration (“FHA”), and Department of Veteran Affairs (“VA”) loans, CoreLogic MarketTrends

reports for loan performance, and Centers for Disease Control and Prevention indexes to assess

the impact on employment rates and income loss for homeowners in the state. As of June 30,

2021, the state of Alabama reported 551,918 COVID cases which has added additional burdens

to homeowners in Alabama for those who have not been able to work, experienced death in the

family, or assisted with loved ones who contracted COVID-19.

2

According to the U.S. Bureau of

Labor Statistics, the state’s unemployment rate peaked at 13 percent.

3

Loss of employment

income was reported for 45 percent of households with 37 percent of the total comprised of

individuals within Socially Disadvantaged groups.

4

A socially disadvantaged individual, as defined per U.S. Treasury guidance, are those whose

ability to purchase or own a home has been impaired due to diminished access to credit on

reasonable terms as compared to others in comparable economic circumstances, based on

disparities in homeownership rates in the HAF participant’s jurisdiction as documented by the U.S.

Census. The impairment must stem from circumstances beyond their control. Indicators of

impairment under this definition may include being a (1) member of a group that has been

subjected to racial or ethnic prejudice or cultural bias within American society; (2) resident of a

majority-minority Census tract; (3) individual with limited English proficiency; (4) resident of a U.S.

territory, Indian reservation, or Hawaiian Home Land, or (5) individual who lives in a persistent-

poverty county, meaning any county that has had 20% or more of its population living in poverty

over the past 30 years as measured by the three most recent decennial censuses.

2

Centers for Disease Control and Prevention “United States COVID-19 Cases and Deaths by State over

Time,” July 2021,

https://data.cdc.gov/Case-Surveillance/United-States-COVID-19-Cases-and-Deaths-by-

State-o/9mfq-cb36/data

3

U.S. Bureau of Labor Statistics “Local Area Unemployment Statistics,” June 2021,

https://www.bls.gov/lau/#tables

4

U.S. Census Bureau Household Pulse Survey (Week 6)

2

5

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

Housing Discrimination

According to a 2021 survey by the National Association of Realtors the following homebuyers

across the nation have experienced discrimination in real estate transactions:

5

• Hispanic home buyers (one percent)

• Asian/Pacific Islander home buyers (five percent)

• Black/African American (seven percent)

Additionally, the

2021 Snapshot of Race

and Home Buying in America

,

Native

Americans and all other minorities

represent only 2% of homebuyers

collectively. AHFA recognizes this disparity

in homeownership rates and acknowledges

that these individuals fall within the

definition of socially disadvantaged and will

ensure these homeowners are included in

targeted outreach efforts.

AHFA recognizes that these individuals fall

within the definition of socially

disadvantaged and will ensure these

homeowners are included in targeted

outreach efforts.

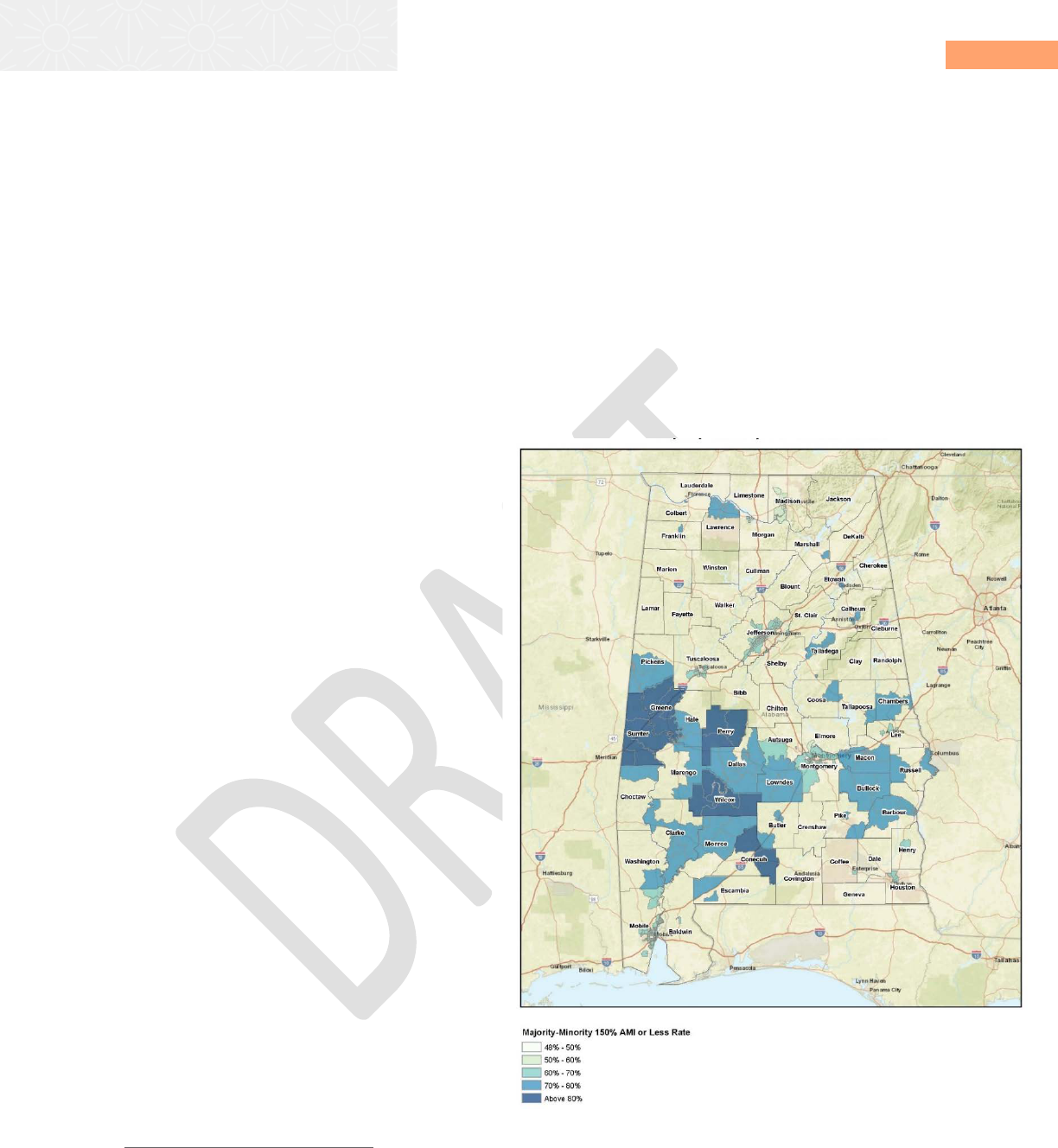

Majority-Minority Census Tracts

In addition to total owner-occupied

households, AHFA assessed needs across

the state by majority-minority census tracts

which make up part of the socially

disadvantaged population. AHFA obtained

data from ACS and compared AMI limit

rates per county to determine homeowners

that reside in majority-minority census

tracts to be 170,619.

6

Exhibit 1 depicts the

census tracts that are majority-minority

populated throughout the state.

5

National Association of Realtors Research Group “2021 Snapshot of Race and Home Buying in

America,” February 2021

6

U.S. Census Bureau's American Community Survey (ACS) 2015-2019 5-year estimates, Table(s)

B03002

EXHIBIT 1

OWNER-OCCUPIED HOUSEHOLDS

- 150% AMI OR LESS

MAJORITY-MINORITY US CENSUS

6

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

Limited English Proficiency Households

AHFA inspected data sources from Data USA to identify certain populations with limited English

proficiency, noting 3.59% of the population speaks Spanish only, and less than one percent of the

population speaks Chinese only, and Korean only. As of 2019, the most prevalent non-English

language spoken in the state is Spanish. AHFA understands that individuals in this group are

included within the socially disadvantaged group. Exhibit 2 illustrates the composition of non-

English speakers within the state where Spanish accounts for 65% of all non-English speakers.

7

AHFA will use this information to inform its public communications, targeted marketing and

outreach and program materials.

EXHIBIT 2 COMPOSITION OF NON-NATIVE ENGLISH SPEAKERS

Indian Tribes and Reservations

The state of Alabama recognizes the nine tribes within the state: (1) Cher-O-Creek Intra Tribal

Indians, (2) Cherokee Tribe of Northeast Alabama, (3) Echota Cherokee Tribe of Alabama, (4) Ma-

Chis Lower Indian Tribe of Alabama, (5) MOWA Band of Choctaw Indians, (6) Piqua Shawnee

Tribe, (7) Poarch Band of Creek Indians, (8) Southeastern Mvskoke Nation, and (9) United

Cherokee Ani-Yun-Wiya Nation. Any enrolled citizen of these tribes within the state shall be

recognized as Native American. AHFA recognizes these individuals meet the definition of socially

disadvantaged and will included in targeted outreach efforts.

7

Data USA “Non-English Speakers,” August 2021, https://datausa.io/profile/geo/alabama#demographics

7

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

AHFA notes that two Indian reservations are in Alabama: (1) Poarch Band of Creek Indians and

(2) MOWA Band of Choctaw Indians and have a total of five owner-occupied households

8

and

eight owner-occupied households,

9

respectively.

Persistent Poverty Counties

Further makeup of the socially disadvantaged population includes homeowners that reside in a

persistent poverty county. AHFA obtained data from the Congressional Research Service and

identified the following counties as persistent poverty counties: Barbour, Bibb, Bullock, Butler,

Choctaw, Conecuh, Dallas, Escambia, Greene, Hale, Lowndes, Macon, Marengo, Monroe, Perry,

Pickens, Pike, Sumter, and Wilcox.

10

AHFA assessed the owner-occupied households that are

150% AMI or less that are included with these counties as shown within Exhibit 3.

11

EXHIBIT 3 PERSISTENT POVERTY COUNTIES

8

My Tribal Area “Poarch Creek Reservation and Off-Reservation Trust Land, AL-FL,” August 2021,

https://www.census.gov/tribal/?st=01&aianihh=2865

9

My Tribal Area “MOWA Choctaw Reservation (state), AL,” August 2021,

https://www.census.gov/tribal/?st=01&aianihh=9240

10

Congressional Research Service “The 10-20-30 Provision: Defining Persistent Poverty Counties”

February 24, 2021

11

U.S. Census Bureau's American Community Survey (ACS) 2015-2019 5-year estimates, Table(s)

B25003, B25003B, B25003C, B25003D, B25003E, B25003F, B25003G, B25003H, B25003I, December

2020

8

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

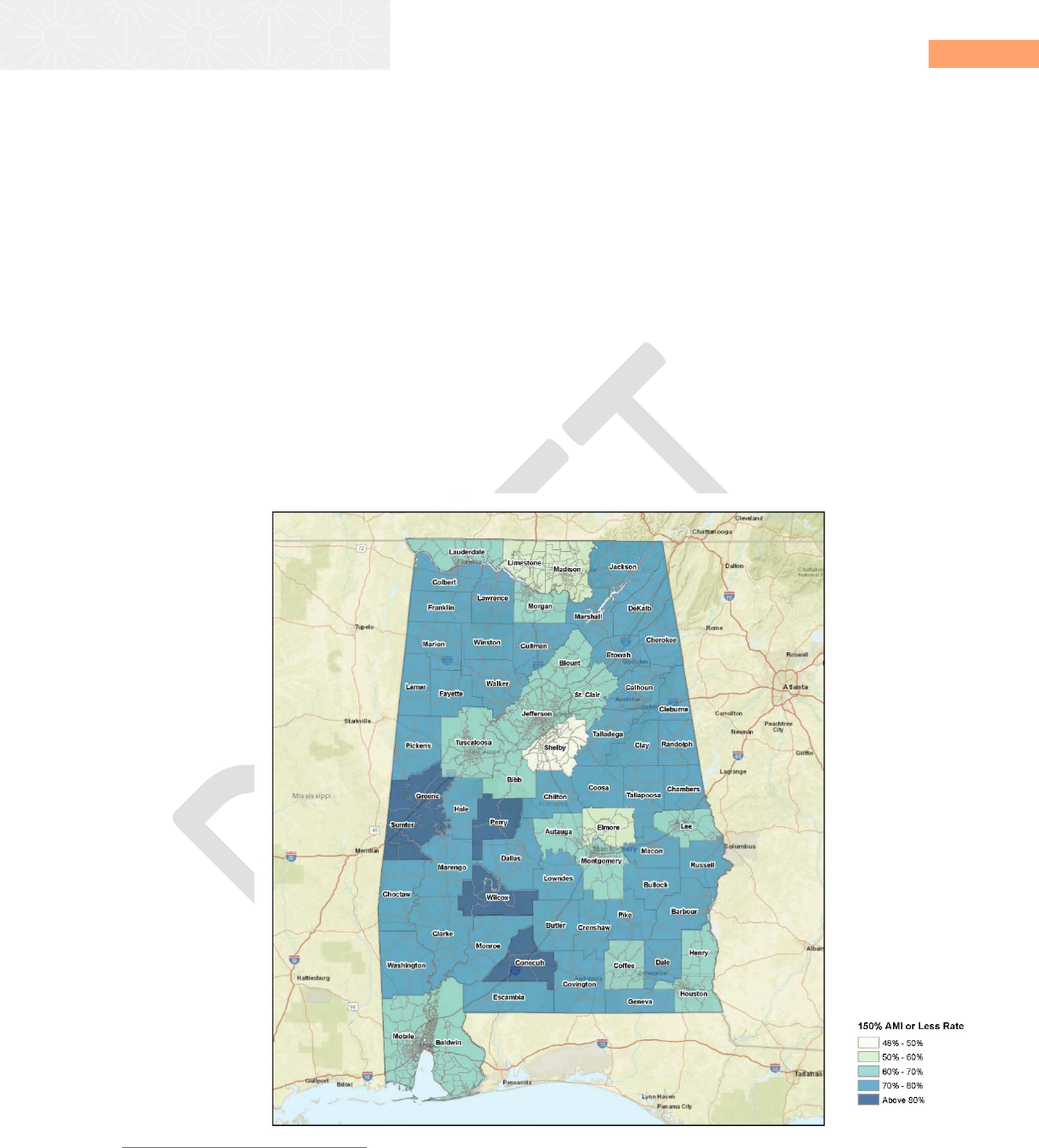

Homeowners who experienced hardships and job loss during this period increased the need for

assistance. Pursuant to Treasury guidelines, homeowners with total household income less than

150% AMI, as determined by HUD, is one of the eligibility requirements under the Homeowner

Assistance Fund. AHFA incorporated this income limit into the data analysis of the needs

assessment when determining target populations and potentially eligible homeowners across the

state. AHFA obtained data from the American Community Survey (“ACS”) and identified

1,284,748 owner-occupied households within the state.

12

Of these homeowners, AHFA assessed

the income levels per homeowner and by county to determine that 860,233 of the homeowners

are 150% AMI or less. Further analysis shows us that of these homeowners that are 150% AMI or

less, 162,486 hold mortgages that are in good standing and 26,441 hold troubled loans as detailed

in the following Sections. Exhibit 4 below identifies the owner-occupied households that are 150%

AMI or less by county for the state.

EXHIBIT 4 OWNER-OCCUPIED HOUSEHOLDS - 150% AMI OR LESS

12

U.S. Census Bureau's American Community Survey (ACS) 2015-2019 5-year estimates, Table(s)

B25003, B25003B, B25003C, B25003D, B25003E, B25003F, B25003G, B25003H, B25003I, December

2020

9

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

Loan Performance Data

AHFA recognizes that homeowners may not have experienced delinquencies but have maintained

good standing on their mortgages by other means. AHFA obtained ACS data and assessed for

borrowers that are 150% AMI and less and noted 162,486 homeowners that have loans in good

standing. These homeowners are determined to meet the income requirement and will be

assessed for eligibility for prospective mortgage payments.

AHFA assessed homeowner needs across the state and identified 26,441 troubled loans that

range from 30 days past due to foreclosure.

13

AHFA obtained FHA data for Real Estate Owned

(“REO”) properties and determined that 719 properties were foreclosed from January 2020 to

May 2021 indicating a portion of the state’s post-foreclosure homes.

14

Exhibit 5 below indicates

the breakout of delinquencies by category.

EXHIBIT 5

Total State Need

30 and 60 days past due 2,885

90+ days past due 22,744

Foreclosures 812

Total Need

26,441

To further assist homeowners, AHFA assessed the potential for lien extinguishment. Based on an

extrapolation of Alabama loans serviced by AHFA, compared to CoreLogic Market Trends data

15

,

AHFA identified an estimate of 2,661 (or approximately 10 percent of total need) loans in need of

lien extinguishment.

16

13

U.S. Census Bureau American Community Survey (ACS) 2015-2019 5-year estimates, Tables B25009,

B25010, B19019, Special Reference 102100 (3857), December 2020

14

U.S. Department of Housing and Urban Development’s Real Estate Owned (REO) “FHA Single Family

REO Properties for Sale,” July 2021. Foreclosure data includes all foreclosures and post-foreclosures until

termination. The state was not able to obtain current data on USDA, VA, and other loan types for post-

foreclosure evictions.

15

CoreLogic Market Trends Report, “Market Trends Data by State,” January 2021

16

Atlanta Fed calculations using Black Knight’s McDash Flash daily mortgage performance data (available

with a two-day lag), U.S. Census Bureau 2017 FIPS Codes

10

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

AHFA assessed the degrees of delinquencies across the state to identify concentrated areas of

homeowner needs by county. The below graphic, Exhibit 6, indicates the counties across the state

where high rates of delinquencies from 30 days to foreclosures occurred. Delinquency rates were

highest in the following counties: Montgomery, Autauga, Elmore, Tuscaloosa, Shelby, St. Clair,

Blount, Morgan, Madison, and Limestone.

EXHIBIT 6 DELINQUENCY RATES BY COUNTY

11

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

AHFA analyzed information for 26,441 loans as the total state need based on ACS data.

Additionally, the state assessed the data as it relates to homeowners with household incomes less

than 150% AMI based on the median household size of three (3) persons in owner-occupied

dwelling units.

17

AHFA further segmented this population into four (4) target populations:

1. Homeowners with incomes less than 100% AMI (not categorized as socially

disadvantaged).

2. Socially disadvantaged homeowners with incomes less than 100% AMI.

3. Socially disadvantaged homeowners with incomes between 100% AMI and 150% AMI;

and

4. Homeowners with incomes between 100% AMI and 150% AMI (not categorized as socially

disadvantaged).

Of the total 26,441 troubled loans, AHFA determined that approximately 19,283 loans fit into one

of the four target populations.

18

Exhibit 7 below shows the breakdown of target populations.

19

EXHIBIT 7

Target Populations

Loan Count

Less than 100% AMI (Not Socially Disadvantaged) 8,154

Less than 100% AMI & Socially Disadvantaged 6,681

100% - 150% AMI & Socially Disadvantaged 2,003

100% - 150% AMI (Not Socially Disadvantaged) 2,445

Potentially Eligible

19,283

17

Area median income varies based on location and household size. ACS data includes income ranges

for tract levels but does not include income ranges per household size. Our analysis used the 3-person

income limits to estimate the percentage of AMI for households in the ACS data.

18

Target populations were determined based on US Treasury guidance. Our analysis compared

household income ranges from 2019 ACS data by county to determine the percent of owner-occupied

households that were equal to or less than 150% of AMI for a 3-person household to obtain the number of

loans that could be potentially eligible based on income level. Our analysis further segmented all loans

equal to or less than 150% AMI into the loans equal to or less than 100% AMI. Our analysis applied this

population of loans by income levels to the percentages of homeowners for each county to determine

loans included within the socially disadvantaged target groups for 100% - 150% AMI and equal to or less

than 100% AMI.

19

U.S. Census Bureau American Community Survey (ACS) 2015-2019 5-year estimates, Tables

B19013B, B19013C, B19013D, B19013E, B19013F, B19013G, B19013H, B19013I, B19049, B19053,

B25009, B25010, B19019, December 2020

12

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

Exhibit 8 shows the makeup of the 19,283 potentially eligible homeowners segmented by income

and socially disadvantaged target populations. Of the total state need of 26,441 loans, 73 percent

are potentially eligible for assistance.

Each targeted population has

been mapped to show the

geographic concentration. The

first target population is

homeowners who are not

categorized as socially

disadvantaged but have income

less than 100% of AMI. Exhibit 9

outlines the concentrated

counties within the state where

homeowners in this target

population are located.

Delinquency rates were highest

in Jefferson, Madison,

Montgomery, and Mobile

counties with upwards of 25

percent delinquency rates.

EXHIBIT 8 TARGET POPULATIONS

EXHIBIT 9

HOMEOWNERS WITH INCOME

LESS THAN 100% AMI

13

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

AHFA determined the target population for homeowners with income equal to or less than 100%

AMI (based on ACS 2019 data) to assess the need of delinquent loan payment amounts. Exhibit

10 indicates the breakdown of homeowners equal to or less than 100% AMI. Within the total

19,283 potentially eligible loans, 8,154 are included within this target group.

EXHIBIT 10

INCOME LEVELS LESS THAN 100% AMI

Loans

Dollar Amount

30 and 60 days past due 1,075 $ 12,892,093

90+ days past due 6,776 $ 77,980,913

Foreclosures 303 $ 1,819,146

Total

8,154

$ 92,692,152

Exhibit 11 below depicts potentially eligible homeowners who fall under socially disadvantaged as well

as income less than 100% of AMI. Counties holding the highest degrees of delinquencies are Jefferson,

Madison, Montgomery, and Mobile with delinquency rates from 17 percent up to 34 percent.

SOCIALLY DISADVANTAGED

HOMEOWNERS WITH INCOME

LESS THAN 100% AMI

EXHIBIT 11

14

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

AHFA determined the target population of socially disadvantaged homeowners with income less

than 100% AMI (based on ACS 2019 data) to assess the need of delinquent loan payment

amounts. Exhibit 12 indicates the breakdown of socially disadvantaged homeowners with incomes

equal to or less than 100% AMI. Within the total 19,283 potentially eligible loans, 6,681 loans are

included within this target group.

EXHIBIT 12

INCOME LEVELS 100% AMI AND LOWER

Loans

Dollar Amount

30 and 60 days past due 543 $ 6,507,576

90+ days past due

5,985

$ 77,748,549

Foreclosures

153

$ 918,255

Total

6,681

$ 85,174,380

The third target population to

assess is the homeowners who

are classified as socially

disadvantaged and have

incomes between 100% - 150%

of AMI. AHFA determined the

income levels (based on ACS

2019 data) and overlayed

demographic information of

these homeowners to

determine who would be

categorized as socially

disadvantaged. Exhibit 13

outlines the counties within the

state that show the degrees of

need for socially disadvantaged

homeowners with income levels

between 100% - 150% AMI.

Jefferson County has the

highest degree of need in the

state with 23 other counties that

have up to 13 percent

delinquency rates.

SOCIALLY DISADVANTAGED

HOMEOWNERS WITH INCOME

LESS THAN 150% AMI

EXHIBIT 13

15

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

AHFA determined the target population for socially disadvantaged homeowners with income

between 100% - 150% AMI (based on ACS 2019 data) to assess the need of delinquent loan

payment amounts. Exhibit 14 indicates the breakdown of need for socially disadvantaged

homeowners between 100% - 150% AMI. Within the total 19,283 potentially eligible loans, 2,003

loans are included within this target group.

EXHIBIT 14

INCOME LEVELS 100% - 150% AMI

Loans

Dollar Amount

30 and 60 days past due 163 $ 1,950,838

90+ days past due 1,794 $ 23,307,428

Foreclosures

46

$ 275,274

Total Need

2,003

$ 25,533,540

The fourth target

population to assess is the

homeowners with incomes

between 100% - 150% AMI

(based on ACS 2019) but

are not classified as

socially disadvantaged.

Exhibit 15 outlines the

counties within the state

that show the degrees of

need for homeowners with

income levels between

100% - 150% AMI.

Jefferson, Madison, and

Shelby counties indicate

the highest levels of

delinquencies in this group

of upwards of 15 percent.

Homeowners with Income

Less than 150% AMI

EXHIBIT 15

16

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

AHFA determined the target population for homeowners with income between 100% - 150% AMI

(based on ACS 2019 data) to assess the need of delinquent loan payment amounts. Exhibit 16

indicates the breakdown of need for homeowners between 100% - 150% AMI. Within the total

19,283 potentially eligible loans, 2,445 loans are included within this target group.

EXHIBIT 16

INCOME LEVELS 100% - 150% AMI

Loans

Dollar Amount

30 and 60 days past due

322

$ 3,864,786

90+ days past due

2,032

$ 23,377,086

Foreclosures 91 $ 545,343

Total

2,445

$ 27,787,215

Based on the preceding data analysis, AHFA has considered 8,684 socially disadvantaged

homeowners less than 150% AMI as this population experienced the highest employment income

loss during the pandemic. Additionally, within the total 19,283 potentially eligible loans, AHFA

identified 10,599 delinquent homeowners not categorized as socially disadvantaged with income

levels less than 150% AMI.

2.2 PUBLIC PARTICIPATION AND COMMUNITY ENGAGEMENT

Public participation for the proposed HAF plan will be presented for review and comment in a

public hearing format and direct solicitation from organizations that primarily serve low-,

moderate-income households, members of groups that have been subjected to racial or ethnic

prejudice or cultural bias within American society, residents of majority-minority Census tracts,

Indian Reservations, persistent poverty counties and individuals with Limited English Proficiency.

The public hearing will be in-person, and will be conducted in a location, format, and time-of-day

that are reasonably accessible to all citizens (particularly low-income and moderate-income

citizens). Elected officials, public agencies, community groups, and interested parties will be

notified of such public hearing(s) via the publication of a notice in a newspaper of general

circulation within the state of Alabama, by the posting of a notice on the AHFA website, email

message(s) that are sent to interested parties, or by such other manner(s) as may be requested

or required. A two (2) week public notice period will be given for such a public hearing, and a

public comment period that may last for a minimum period of five (5) days to a maximum period

of thirty (30) days will be provided after the conclusion of the public hearing.

To supplement the public hearing, AHFA has already or will directly solicit feedback from HUD

housing counseling agencies, legal assistance organizations, local and tribal governments, and

homeowner-related trade organizations. The draft HAF will be posted, and these organizations will

17

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

be given an opportunity to participate by sending comments directly to AHFA and/or attending

and commenting during the public hearing.

AHFA has directly engaged the following organizations:

• HUD Approved Housing Counseling Agencies, such as:

- Community Service Programs of West Alabama

- Legal Services of Alabama

- Community Action Partnership of Huntsville/Limestone & Madison Counties

- Center for Fair Housing

• Association of County Commissions of Alabama

• Alabama League of Municipalities

• The Alabama Indian Affairs Commission

• Alabama Association of Habitat for Humanity Affiliates

The draft HAF plan will be available to those individuals with Limited English Proficiency and for

those with a disability. To achieve this goal, AHFA will post the plan in English, Spanish, Korean

and in an Americans with Disabilities Act (“ADA”) accessible format.

18

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

Program Design

3.1 PROGRAM STRUCTURE

AHFA will administer the HAF plan as Mortgage Assistance Alabama (“MAA”). The program will

provide financial assistance for 100 percent of an eligible homeowner’s delinquent mortgage

payments, a COVID-19 related forbearance, and all other mortgage-related expenses (including

subordinate liens, if applicable), and up to 12-months of future mortgage payment assistance

during the time of their eligibility, all subject to a cap (“Program Cap”) of $50,000. The Program

also provides funding to assist homeowners with loan modifications and lien extinguishments. The

qualifying hardship must have occurred after January 21, 2020.

Program Cap:

Based on historical performance of the Hardest Hit program in the state of Alabama, AHFA

determined that the participation rate of applicants was 24% of all eligible homeowners. Taking

this rate of participation from Hardest Hit into consideration, AHFA determined that setting

$50,000 as the Program Cap will allow the program to best serve eligible borrowers.

The MAA program will consist of two components – Mortgage Payment Assistance, and Loan

Modification, each of which is described further below.

1) MORTGAGE PAYMENT ASSISTANCE:

The Mortgage Payment Assistance program is available to eligible homeowners who have a

qualifying Financial Hardship, and/or have a COVID-19 related forbearance.

MAA will provide a single payment to a homeowner’s servicer(s) to bring the homeowner current

on his or her delinquent mortgage(s) or payoff a COVID-19 related forbearance. The initial

payment must fully reinstate the homeowner’s account or pay off the partial claim. If the total

amount needed to bring the homeowner current or pay off the partial claim exceeds the Program

Cap, the homeowner must provide the necessary shortfall amount, if acceptable to the loan

servicer. Once the homeowner is brought current or the partial claim is paid off, MAA may provide

monthly mortgage payments to the homeowner’s servicer(s) including principal, interest, and

escrow expenses for up to 12 months. However, total assistance for the homeowner may not

exceed the Program Cap.

3

19

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

Homeowners who do not have a mortgage or are not past due on their mortgage payments may

be eligible if they have experienced a Financial Hardship. MAA may provide monthly mortgage

payments to the homeowner’s servicer(s) including principal, interest, and escrow expenses for

up to 12 months. However, total assistance for the homeowner may not exceed the Program Cap.

For homeowners in active foreclosure, legal services will be provided if legal representation has

not already been retained. Legal and counseling services will not count towards an Applicant’s

overall program cap award amount.

2) LOAN MODIFICATION PROGRAM:

The Loan Modification Program is available for homeowners who have an eligible Financial

Hardship.

The Loan Modification Program will provide funds to assist homeowners to obtain a loan

modification of their mortgage loan or to extinguish the first mortgage. Homeowners eligible for

lien extinguishment under the Loan Modification Program must be on a fixed income. A one-time

disbursement of funds, not to exceed the Program Cap, will be made to the mortgage servicer to

recast the loan, fill a financial gap that limits a homeowner’s eligibility for a loan modification, or to

extinguish the first mortgage lien.

Program Exclusions:

The following items represent program exclusions for both the Mortgage Payment Assistance

program and the Loan Modification program:

1) Mortgage loans on second homes, vacant properties, or investment properties.

2) Home Affordable Modification Program (HAMP) trial period payments; and

3) Homeowners who are actively participating in another federally funded mortgage

assistance program administered by a local housing authority, municipality, or other

authorized agency.

The MAA program will not offer utility assistance, such as electric, gas, water, or internet, due to

existing assistance programs serving low-, and moderate-income and elderly households in the

state of Alabama. Instead, the MAA program will focus the limited HAF funding to provide financial

assistance to bring homeowners current on their mortgage and stabilize their housing.

20

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

For residents in need of utility assistance, below is a non-exhaustive list of relief programs:

1. Alabama Low-Income High Energy Assistance Program (LIHEAP) – This program assists

low-income Alabama residents with the high cost of home energy. Funding is provided

from the Low-Income Home Energy Assistance Program (LIHEAP) block grant through the

U.S. Department of Health and Human Services.

2. Project SHARE - A program in partnership with the Salvation Army, Project SHARE helps

pay the wintertime energy bills of low-income Alabamians who are age 60 or older and/or

disabled. During the summer, people with medical emergencies also may be assisted, if

funds are available.

3. The Alabama Business Charitable Trust Fund - Alabama Power stockholders created the

nonprofit ABC Trust in 1992 to supplement energy assistance efforts. The trust works with

local community action agencies to help cover the cost of heating and cooling for low-

income families and those struggling with temporary financial problems.

4. Community Action Association of Alabama - Represents the twenty (2) community action

agencies that provide social services to low- and moderate-income families in all 67

counties of the state of Alabama.

3.2 CONTINUED ASSESSMENT OF HOMEOWNER NEEDS

The MAA program will initially target HAF funds to bring eligible homeowners current on their

mortgage payments inclusive of principle, interest, and escrow (taxes and insurance, if

applicable), and stabilize housing. Although this is the primary focus of the program, AHFA

recognizes there are additional homeowner needs throughout the state, therefore, during the first

year of the program AHFA will monitor program performance, review additional data as it becomes

available and continue to assess the needs of Alabama households.

Continued homeowner assessment will examine needs for:

1. Payment assistance for delinquent property taxes

2. Payment assistance for homeowner, flood, and mortgage insurance

3. Payment assistance for homeowner association fees, liens, condominium association fess

or common charges

4. Homeowner Displacement Prevention, including home repairs, overcrowding alleviation

and title clearance

5. Reverse Mortgage Assistance

At the conclusion of additional homeowner needs assessments, and the availability of funds, AHFA

will determine the addition or subtraction of program design elements.

21

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

3.3 ELIGIBILITY REQUIREMENTS

Pursuant to Treasury guidelines, AHFA will assess the eligibility of all applicants based on the

prescribed requirements below.

Homeowner Eligibility

To qualify as an eligible homeowner, the homeowner must:

1. Provide written attestation to having experienced a Financial Hardship, and describe the

nature of the Financial Hardship (for example, job loss, reduction in income, or increased

costs due to healthcare or the need to care for a family member); and

2. Have a total household income less than 150% AMI as determined by HUD.

Mortgage Eligibility

To qualify as an eligible mortgage, the mortgage must be a:

1. First Mortgage

2. Second Mortgage

3. Loan Secured by Manufactured Housing (Real Estate or Dwelling)

4. Contracts for Deed or Land Contract

Income Determination and Verification Requirements

For the purposes of determining income eligibility, AHFA will use HUD’s definition of “annual

income” as defined in 24 CFR §5.609.

AHFA will utilize one of two approaches for a homeowner’s income eligibility determination:

1. Written attestation together with supporting documentation. The homeowner will provide

a written attestation as to household income together with supporting documentation of

income including, but not limited to paystubs, W-2s, or other wage statements, IRS Forms

(1040, 1065, 1099), tax filings, depository institution statements demonstrating regular

income, or a written attestation from an employer; or

2. Written attestation plus a reasonable fact-specific proxy for household income. The

homeowner will provide a written attestation as to household income, and AHFA will use

a proxy for the homeowner’s income verification. If the household is in a census tract with

any of the following distress and/or low-income designations, the household will be

presumed to meet income verification requirements:

a. FHFA Duty to Serve designations of Areas of Concentrated Poverty.

b. FFIEC designations of distressed, underserved, poverty, remote rural and/or

unemployment.

c. HUD designations of Racial and/or Ethnic Areas of Concentrated Poverty; or

22

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

d. HUD designations of Qualified Census Tracts for use in the Low-Income Housing

Tax Credit (“LIHTC”) Program.

AHFA may provide waivers or exceptions to these documentation requirements, as reasonably

necessary, to accommodate extenuating circumstances, such as disabilities, practical challenges

related to the pandemic or a lack of technological access by homeowners when alternative

documentation or income verification is not available. AHFA will make the required income

determination based on alternative documentation.

3.4 TARGETING AND PRIORITIZATION

AHFA will target and prioritize funding to the following populations through the allocation of the

budget for each group. AHFA will assign 60 percent of the program budget for applications where

household income is less than 100% of AMI. AHFA will prioritize the remaining percentage of the

program budget for applications where:

1. Household income is greater than 100% of AMI but less than 150% AMI and are Socially

Disadvantaged; or

2. Have a mortgage from FHA, VA, or USDA.

3.5 APPLICATION PROCESS

A secure portal will be provided for intake of homeowner applications. The portal will allow

interested homeowners to access and apply on their own, or complete certain portions of the

application via phone through a call center. AHFA will also support a paper application process

for those homeowners needing that accommodation. Regardless of the chosen method, each

applicant will experience a user-friendly and easily digestible application process. AHFA will

leverage our extensive experience in other housing programs in designing an application to meet

compliance and eligibility criteria, while working to reduce the documentation burden to the

applicant, as recommended by Treasury. The application processing team will evaluate and

review applications as they are submitted. Applicants will be contacted directly should additional

documentation or explanation be needed to process the application.

3.6 PAYMENT PROCESS

Payments from the MAA program will be made in the form of a grant on behalf of the homeowners

directly to loan servicers and other entities, depending on the type of expenditure. AHFA plans to

use the Common Data File (“CDF”) to communicate with servicers and validate the loan

information. AHFA has significant experience with the CDF from the Hardest Hit Fund (“HHF”)

program and intends to leverage that experience for the MAA payment process.

23

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

3.7 MARKETING AND OUTREACH EFFORTS

AHFA understands that a broad and comprehensive marketing and outreach campaign will be

necessary to effectively target eligible homeowners across the state. AHFA intends to build and

maintain a dedicated MAA website and social media presence to disseminate information and

materials. These resources will be accessible to those homeowners with limited English

proficiency, such as Spanish, Korean and to those individuals with a disability. To support the

digital marketing and outreach campaign, AHFA intends to utilize paid and earned media,

including advertisements on television, radio, print media, as well as direct mail and advertising.

AHFA will also engage its community partners, such as community development corporations,

housing counseling agencies, credit union associations and/or trade associations to further

disseminate information on the MAA program.

To ensure the MAA program reaches targeted populations, AHFA will take an additional step by

providing program materials in multiple languages and accessible formats, such as Spanish and

Korean and formats accessible to those with a disability, conducting additional outreach and

marketing efforts, such as information dissemination through strategic partnerships, local

information sessions, mobile or remote intake drives, to the following groups and geographic

areas:

1. Strategic outreach through partnerships with organizations that have historically served

low-, and moderate-income populations, and socially disadvantaged populations,

2. Additional outreach to targeted geographic areas, including:

a. Majority-minority Census tracts,

b. Persistent poverty counties, and

c. Indian reservations

3.8 BEST PRACTICES AND COORDINATION WITH HAF PARTICIPANTS

AHFA will leverage its successful experience with the HHF program, in addition to its extensive

experience administering other affordable housing finance programs for single- and multifamily

housing programs. Additionally, AHFA has been participating in regular coordination conference

calls with the National Council of State Housing Agencies and other State Housing Finance

Agencies.

24

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

Performance Goals

AHFA will leverage the MAA program funds to reduce the number of mortgages in forbearance,

delinquent and in default, provide mortgage payment assistance, and provide loan modifications

for low-to-moderate income households and socially disadvantaged populations. To measure

these outcomes, AHFA will track performance through the evaluation of households served and

dollar amount of assistance committed towards the following measures:

Program Design

Element

Metric Goal

Mortgage

Payment and

Reinstatement

Assistance

•

Number of homeowners assisted.

o Number of homeowners assisted with

income less than 100% AMI.

o Number of socially disadvantaged

homeowners assisted.

• Dollar amount of mortgage payment assistance

provided.

o Dollar amount provided to homeowners

with income less than 100% AMI

o Dollar amount provided to socially

disadvantaged homeowners.

• Number of mortgages reinstated

• Dollar amount paid for mortgage reinstatement

• Number of days spent to provide assistance

•

Assist 3,000 homeowners

o Assist 1,300 LMI

homeowners

o Assist 1,400 socially

disadvantaged

homeowners

• Commit $70M dollars of

mortgage payment assistance

o $42M dollars to LMI

o $28M dollars to socially

disadvantaged

• 45 days to provide assistance

Mortgage

Principal and

Interest Rate

Reduction

Assistance

•

Number of mortgages refinanced

o Homeowners with income less than 100%

AMI

o Socially disadvantaged homeowners

• Dollar amount paid for mortgage refinance

o Homeowners with income less than 100%

AMI

o Socially disadvantaged homeowners

•

Assist 1,300 homeowners

o Assist 500 LMI

homeowners

o Assist 600 socially

disadvantaged

homeowners

• Commit $30M dollars to

refinance mortgages

o $18M for mortgage

refinancing for

homeowners with income

less than 100% AMI

o $12M for mortgage

refinancing for socially

disadvantaged

homeowners

Homeowner

Displacement

Prevention

• Number of mortgages in foreclosure prevented

• Prevent 400 homeowner

foreclosures

The MAA program, utilizing HAF dollars, could reduce the total state homeowner delinquencies

by up to 27 percent. Additionally, AHFA’s Plan is projected to reduce loan delinquencies for the

potentially eligible homeowners (based on income requirements) by up to 46 percent.

4

25

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

Readiness

Since 1980, AHFA has been creating housing opportunities for low-to-moderate income

households in Alabama through the affordable financing of single- and multifamily housing. AHFA

provides capital, technical expertise, builds private and public partnerships, matching AHFA

resources with those of lenders, builders, local governments, and housing developers throughout

the state. AHFA has an experienced staff and a history of successfully implementing housing

programs in collaboration with other Alabama state agencies and external partners. The

implementation and execution of the MAA program will include a combination of AHFA employees

and outside contractors.

5.1 STAFFING AND SYSTEMS

In addition to its internal staffing, AHFA has engaged HORNE LLP (“HORNE”) and HOTB Software

Solutions, LLC (“HOTB”) to assist in the program planning and administration. Both HORNE and

HOTB have been working closely with AHFA to develop the Plan and configure the system to

prepare for program launch. HORNE will be responsible for certain functions in the program

administration, while HOTB will provide the system solution for the program, which will be

CounselorDirect. CounselorDirect will also be used for the pilot program. The call center will utilize

Five9 system, which is described further below. Staff has been hired and trained for the pilot

program and will remain for the larger program. Additional staff will be trained and dedicated to

the program prior to the launch of the larger program.

5.2 PROGRAM ADMINISTRATION

AHFA will utilize staff from within the agency for the underwriting, CDF, and payment processes.

The staff assigned to these functions have significant and relevant experience administering the

state’s HHF program, which will provide immediate value to the MAA program.

HORNE will provide case management staff for the MAA program. HORNE has over 15 years of

experience in administering federal funding, including relevant experience in administering

housing programs as well as experience in federal funding related to the coronavirus pandemic.

With over 1,900 employees, HORNE stands ready to deploy resources immediately and ramp up

resources as the program needs demand. HORNE has already deployed a team of project

management and subject matter experts to assist AHFA in development of the Plan and pilot

program.

Standard Operating Procedures (“SOPs”) are being finalized for the pilot program. The SOPs for

the pilot program are the starting point for the larger program. Program Management is actively

developing the SOPs for the larger program in preparation of training and launch of the program,

5

26

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

which will continue to be finalized as additional guidance is provided by Treasury. The team is

prepared to finalize or modify SOPs quickly based on feedback or comments received from

Treasury.

5.3 CALL CENTER

HORNE will manage the call center for the MAA program. Professional, compassionate, and

empathetic service is a top priority for the call center and for customer service management. A

turnkey solution, including a robust cloud contact technology – Five9 – has been deployed for the

program. Launching the call center prior to the commencement of the MAA program allows

potential applicants and interested parties to have early access to program information.

Five9 is a proven technology solution that can route, manage, and provide reporting data for all

contacts each day. The system’s capacity is only limited by the number of Customer Service

representatives (“CSR”) answering calls. HORNE has significant experience with Five9 from

similar programs, allowing the team to use best practices in configuring and launching the solution

for the MAA program.

CSRs have received extensive training prior to the call center launch, which included training on

high quality and empathetic customer service, the Five9 system, and initial information on the

program. As the program requirements mature, additional training will be provided on the program

guidelines. The CSRs will also be trained on CounselorDirect prior to launch of the pilot program.

Staffing levels were determined based on HORNE’s experience in other federally funded

coronavirus relief programs as well as anticipated call volumes. The current staffing model can

support up to 600 calls per day. The Five9 technology has the capability of tracking call volume

and anticipating staffing levels based on call volume. The call center manager will be closely

monitoring the volumes to determine if staffing levels are appropriate to meet the demand.

5.4 APPLICATION PROCESSING

Application processing will be supported by a team of CSRs, case managers, as described above,

and underwriters. Staffing levels were estimated based on the number of anticipated applications

but will be scaled to meet the demands of the program as additional data becomes available.

Training for the pilot program is set to begin in early August, which includes training on

CounselorDirect and SOPs, as well as extensive training on the program details and overall HAF

guidance released by Treasury. As the program matures and the Plan is approved by Treasury,

the project management team will work to modify training material, as necessary. Best practices

from the pilot program as well as other relevant programs, such as HHF, are being used in the

development of training material. Once the training materials are finalized for the larger program,

27

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

the team will go through an additional training for any additions and modifications from the pilot

program.

5.5 SYSTEM SOLUTION

AHFA has chosen HOTB as the software provider, utilizing CounselorDirect, for the MAA program

implementation. Established in 2008, HOTB Software Solutions is the leading software provider

for HAF programs, Emergency Rental Assistance programs and the HHF. With more than a

decade of experience, HOTB systems have appropriated more than $6 billion in program

assistance across 14 state government agencies. Through its digital solution, HOTB facilitates

online intake, application processing, underwriting, grant award, stakeholder communication, CDF

automation, cash management, payment processing and reporting.

CounselorDirect will be used for the Pilot Program. AHFA and HORNE will have received training

on the operation of the CounselorDirect software for the Pilot Program. Additional training will be

provided prior to go-live for the additional resources added to the team. Training delivery will be

provided by CounselorDirect.

5.6 PILOT PROGRAM

AHFA is currently administering several single- and multifamily affordable housing programs, in

addition to successfully administering the HHF program. It will leverage this experience and

knowledge to stand up the MAA Pilot Program. AHFA will monitor throughout the pilot program

period to determine if any program design modifications are needed. The MAA Pilot Program,

applying program requirements established for the statewide MAA program, will serve Alabama

loans currently serviced by AHFA, totaling 26,441 loans.

CounselorDirect, as described in previous sections, is the system of record for the pilot program.

As the pilot program continues, we will use best practices to shape the upcoming programs and

remaining system development. Using CounselorDirect to administer the pilot program allows the

program administration team to become experts at the system and fine tune policies and

procedures leading to significant efficiencies for the larger program launch.

28

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN

Administrative &

Program Budget

Total Program Allocation

$ 125,695,705

Administrative Budget Proposal

Percent

Amount

Salaries and benefits 5.08% $ 6,380,000

Professional services 6.58% $ 8,275,000

Information Technology & Communications 0.88% $ 1,100,000

Advertising 0.99% $ 1,250,000

Buildings, leases & equipment 0.44% $ 550,000

General and administrative 1.03% $ 1,299,000

Total Admin Budget 15.00% $ 18,854,000

Program Design Elements

Counseling or Educational Services 2.50% $ 3,142,393

Legal Services 2.50% $ 3,142,393

Total Counseling or Legal Services 5.00% $ 6,284,786

Program Design Budget

Targeting - 100% AMI (less than or equal to) 60.00% $ 75,417,423

Remaining Program Design Budget 20.00% $ 25,139,497

Total Program Design Budget 80.00% $ 100,556,920

6

29

ALABAMA HOMEOWNER ASSISTANCE FUND PLAN