REPORTING TO STATE TAX AUTHORITIES OF FEDERAL TAX EXAMINATION

ADJUSTMENTS AND THEIR EFFECT ON STATE TAX LIABILITY

ISSUE

State and local reporting of federal income tax changes can impose a significant compliance burden

on multijurisdictional companies, their tax representatives, and the tax administrators in the states

in which they have nexus. There is no consistent method for reporting to state tax authorities

federal tax examination adjustments and their effect on state tax liability. The states have not

adopted a uniform notification period for reporting federal adjustments.

IMPORTANCE TO CPAs

CPAs interact with the state and local tax authorities on behalf of their clients. CPAs assist clients

with federal, state, and local tax compliance and planning, including reporting federal audit

changes to states. For example, CPAs analyze and address the potential impact of federal audit

adjustments, including state reporting requirements (i.e., filing amended returns), the impact of

audit adjustments across various states (i.e., calculation of state taxable income), and the potential

impact with tiered partnership structures as well. Failure to timely notify the state of the federal

adjustments can result in lost refund opportunities, tolling of the statute of limitations, and the

imposition of penalties and interest.

It is best to develop sound tax and administrative processes and policies, including the rules for

reporting federal audit changes to the states. The goal is to have fair, reasonable, and administrable

state audit and reporting rules that minimize the complexities and burdens for taxpayers, CPAs,

and the state tax authorities. CPAs are interested in working with the state tax authorities and state

legislatures as each state develops and modifies its audit rules and considers revising its rules

applicable to reporting federal audit changes. This issue is especially relevant due to the likelihood

that states will consider changes related to the reporting of federal audit adjustments to

accommodate the new federal partnership audit regime.

AICPA POSITION

The AICPA encourages state CPA societies to work with policymakers for fair, reasonable, and

administrable rules that minimize the complexities and burdens to taxpayers and state tax

authorities alike.

2

The AICPA supports the positions in the Tax Executives Institute (TEI) and Council On State

Taxation (COST) policy statements.

1

As COST states, fair and efficient state procedures for

reporting federal tax changes should include:

1. A clear definition of what constitutes a “final determination” that triggers a reporting

requirement;

2. A minimum period of at least 180 days (or six months) to report such changes to the state;

3. To prevent the imposition of interest, the ability to make advanced payments before there

is a “final determination” that triggers the filing responsibility for an amended return or

report; and

4. Limiting the issues open for adjustment to those items that are altered as a result of the

federal change (after the normal statute of limitations has expired).

The AICPA also joins TEI in supporting states’ adoption of uniform procedures to report federal

income tax changes. The burden of complying with the many different state rules to report the

same information in different formats to different states is inefficient and costly for all parties.

The AICPA recommends states adopt the following guidelines and procedures to provide

taxpayers with certainty and consistency:

1. States should allow taxpayers 180 days to report federal income tax changes to state tax

authorities (and to report state changes to municipal tax authorities).

2. This 180‐day period should commence upon the later of:

a. The taxpayer’s execution of federal Form 870, or its equivalent, agreeing to the final and

complete disposition of all deficiencies or overassessments. If the agreement is subject to

final approval by the IRS (or Joint Committee on Taxation or U.S. Department of Justice,

as appropriate), the state should deem the agreement final when the taxpayer receives a

copy of the agreement executed by the government. If the Form 870 does not resolve all

issues raised during the examination, the state should consider the Form 870 a “partial

Form 870” that does not trigger the 180‐day period.

b. The expiration of the statutory time period to petition the U.S. Tax Court for a

redetermination of the Notice of Deficiency.

c. The execution of a signed closing agreement between the taxpayer and the IRS pursuant to

section 7121 of the Internal Revenue Code (IRC)

2

, which results in a final determination

1

TEI issued a State and Local Tax Policy Statement on Reporting Federal Income Tax Changes, adopted November

17, 2015. COST adopted a position paper on state reporting requirements of federal tax changes.

2

All references herein to “section” or “§” are to the Internal Revenue Code of 1986 (Code), as amended, or the

Treasury Regulations promulgated thereunder.

3

of all items in a completed federal audit. (States should not trigger the 180‐day period for

closing agreements resolving only specific issues in an ongoing federal audit.)

d. A final, nonappealable decision of the U.S. Tax Court, U.S. District Court, U.S. Court of

Appeals, or U.S. Federal Claims; a decision of the Supreme Court of the United States; or

those courts’ approval of a stipulation disposing of the case.

e. Filing an amended federal income tax return that changes state taxable income or state tax

attributes.

3. States should adopt or accept a uniform form or forms similar to the form used for federal amended

tax returns (i.e., Form 1040X, Amended U.S. Individual Income Tax Return, Form 1120X,

Amended U.S. Corporation Income Tax Return, etc.) to report federal income tax changes to a

State Department of Revenue. A sample model return for reporting such changes is attached in

Appendix A. The model form would need state-specific components because state income tax

systems are different. However, having a common starting point for taxpayers to begin their

reporting of federal adjustments to the states would help ease the compliance burden that exists

due to the lack of any common standards among the states.

4. To help reduce the ambiguities in various state statutes and to alleviate the burden of evaluating

the various state requirements for reporting federal changes, the AICPA suggests that the states

also consider the following recommendations:

a. States should provide an automatic extension of the statute of limitations for a minimum one-

year period for assessments and filing refund claims, commencing on the date the federal

change is reported. States should base the date the federal change is reported on the postmark

date of the report of changes submitted to the state. States should limit the extension of the

statute of limitations to those changes arising directly from the federal adjustment.

b. As it relates to changes in tax liability, states should consider implementing a standard

minimum threshold before the filing of an amended return is required. This threshold would

eliminate the administrative burden and expense of filing an amended return for both the

taxpayer and the state in situations where the state adjustment is minimal.

c. In addition to considering a standard minimum threshold, where the only change to the federal

return relates to an increase or reduction in net operating loss (NOL), states should only require

the filing of an amended return in the tax year(s) in which there is a tax effect. Florida is an

example of a state that currently addresses this issue (Rule 12C-1.023 F.A.C.).

3

d. Further related to changes in tax liability, states should allow taxpayers the right to offset state

tax liability changes resulting from federal audit adjustments against other adjustments to state

3

See Florida Rule 12C-1.023 F.A.C. available at https://www.flrules.org/gateway/ruleno.asp?id=12C-1.023, items (3)

and (4) regarding when amended return filings are required if there is only a change to an NOL.

4

items unrelated to the federal audit (e.g., correcting the calculation of a state credit claimed or

where applicable, state NOL for the same year or years covered by the federal audit

necessitating the amended state filing).

e. States should allow taxpayers to file the simplified forms via a paper return without regard to

the means required for originally filed returns (i.e., states should not require mandatory

electronic filing for amended returns). The most efficient and accurate preparation of required

amended returns as a result of the issuance of an RAR is often accomplished by filing a paper

return or report with workpapers attached.

5. As an overarching recommendation, the AICPA supports and suggests that states adopt the draft

updated proposed Model Uniform (RAR) Statute for Reporting Adjustments to Federal Taxable

Income that was submitted by the multi-organization task force to the MTC at its December 14,

2016 meeting (See Appendix B).

BACKGROUND

An Internal Revenue Service (IRS) audit is often a lengthy and expensive process for the taxpayer

involved. After the IRS audit concludes and adjustments to the taxpayer’s federal return are agreed

to or determined, the taxpayer faces challenges in communicating these changes to the various

states.

As illustrated in the attached Appendix C, of those states requiring that taxpayers report federal

adjustments to the state, sixteen do not specify the form that the report should take, twelve require

the taxpayer to file an amended state return, and several others suggest (but do not require) using

an amended return as the reporting mechanism. Thus, for a taxpayer doing business in multiple

states, a single change to the taxpayer’s Federal return can require filing many different types of

amended state tax returns or forms with different state tax departments. Even if states used the

same form in all jurisdictions requiring a written notice, the taxpayer must comply with many

different due dates. Time periods for reporting the adjustments to the states range from thirty days

to two years. One state has no specific deadline but requires that the taxpayer report “immediately”

after the federal change.

Generally, the states have statutes providing that when a federal change is reported to the state tax

authorities, the state is automatically granted additional time to make adjustments to the taxpayer’s

state return. The time period used by these states varies from ninety days to five years. In some

states, the report of a federal change may not extend the time for a refund claim, even though it

extends the time for a state assessment, producing an inequitable result. The disparity among the

states in extending the statute of limitations for purposes of the federal change or a general

extension of time for assessment of all tax return items further compounds the problem.

Of particular concern are the differences among the states in determining what constitutes a

“federal change.” For example, one state requires a report when an IRS audit is started. In other

states, the signing of a federal Form 870 or similar form agreeing to Federal adjustments triggers

the reporting requirement. Under the laws of many states, it is not clear what period is used in

5

determining a federal change for purposes of tolling the period for reporting the change to the state.

For instance, states could use the issuance of the Revenue Agent’s Report (RAR), the completion

of the administrative appeals process, the expiration of the time for challenging a Notice of

Deficiency in the U.S. Tax Court, or the completion of the judicial appeals process as the event

that triggers required state filings.

A single change to a taxpayer’s federal tax return can trigger different reporting requirements and

deadlines among the states. Because states may extend the statute of limitations on assessments

for up to five years after the reported adjustment, states could subject taxpayers to several years of

uncertainty before the taxpayer’s state tax liability is finally settled. Also, since the taxes paid to

any one state can potentially impact the calculation of taxable income or credits in other states, the

ultimate effect of a single federal change may result in many state and Federal tax adjustments

covering a number of years. Uniform state laws for reporting federal changes would help mitigate

the uncertainty and administrative complexity of the current system for the benefit of taxpayers

and the states.

RECENT STATE ACTIVITY

In June 1995, the AICPA issued a Report of Corporate State Tax Administrative Uniformity.

4

In

2003, the Multistate Tax Commission (MTC) worked with the AICPA on this issue and developed

a Model RAR Statute that was adopted on August 1, 2003.

5

COST adopted a position paper on state reporting requirements of federal tax changes. On

February 6, 2017, COST discussed the need for updated RAR rules and an updated RAR Model

Statute in a recent paper, New Federal Partnership Audit Procedures – Issues to Consider and

When to Act, submitted and presented to the California Sacramento Delegation Project.

TEI also issued a State and Local Tax Policy Statement on Reporting Federal Income Tax Changes,

adopted November 17, 2015.

On December 14, 2016, the MTC Uniformity Committee considered the issue of uniformity of

state RAR rules and updating its proposed Model RAR Statute. At that meeting, members of a

joint multi-organization task force on state partnership audits, including the AICPA State

Partnership Audits Task Force, American Bar Association State and Local Tax Committee (ABA

SALT Committee), COST, and TEI, encouraged the MTC Uniformity Committee to pursue

updating the RAR rules and their Model RAR Statute. The MTC Uniformity Committee decided

at that meeting to further discuss updating the RAR rules and Model RAR Statute at its next

meeting in March 2017. The AICPA and the multi-organization task force plan to continue

discussions with the MTC on the partnership audits and RAR issue in 2017. (See Appendix B for

further details on the draft updated proposed Model RAR Statute.)

4

Available at http://www.aicpa.org/Advocacy/Tax/DownloadableDocuments/Final-June-1995-Purple-Book.pdf.

5

See the MTC Model Uniform Statute for Reporting Federal Tax Adjustments with Accompanying Model

Regulation, Adopted August 1, 2003.

6

See a chart of the current state rules in Appendix C regarding deadlines for reporting a federal

change or adjustment by a corporation and any required attachments. The chart is posted on the

MTC website for the current MTC project that the MTC has undertaken with respect to the state

implications of the new federal partnership audit provisions. Given that greater state uniformity

is a prime goal of this MTC project, it is important at this time to modify and make consistent the

rules for reporting federal audit changes to the states. Over the next year, many states are likely

to consider changing their partnership audit rules, and in this process, are likely to consider changes

to all of their audit reporting rules. The AICPA also has developed a position paper on state

conformity to the federal partnership audit rules.

AICPA STAFF CONTACTS

James Cox, Senior Manager – State Legislation, 202/434-9261, james.cox@aicpa-

cima.com

Julia Morriss, Coordinator – State Regulatory and Legislative Affairs, 202/434-9202,

Eileen Sherr, Senior Manager – Tax Policy & Advocacy, 202/434-9256,

7

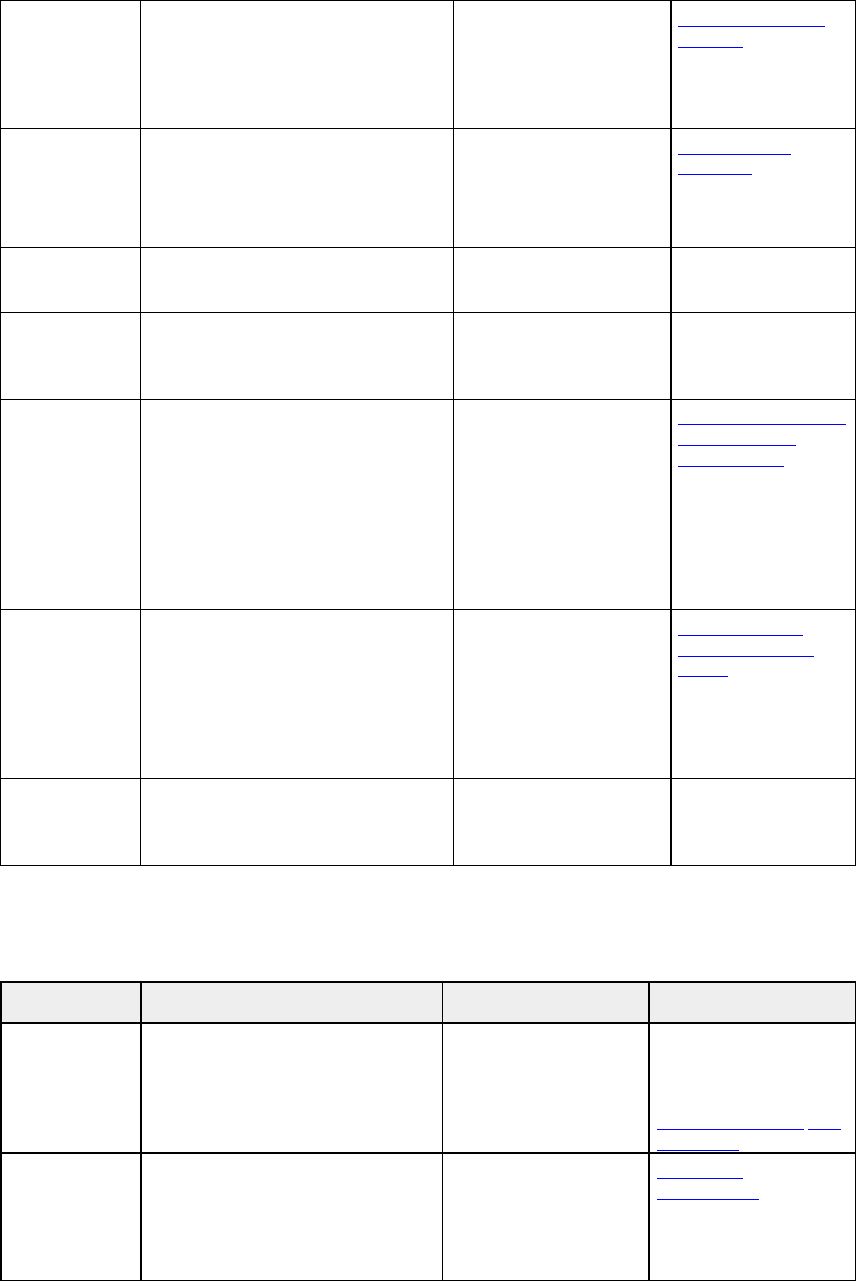

Appendix A – Sample Federal RAR Reporting Form

Taxpayer name

Taxpayer address

Federal ID number

Type of return being amended:

1120

1120S 1040

1041

1060

990

Other _______________________________

For calendar year ________ or fiscal year ended ______________________________

The federal RAR covers this entity/person only

federal consolidated group

both spouses filing a joint tax return

other _______________________________

This form includes this entity/person only

all entities in the federal consolidated group

other combination of entities

both spouses filing a joint return

other _______________________________

Column A

As originally

reported or

adjusted

Column B

Net change

Column C

Corrected

amount

TAX COMPUTATION

1

Tax on net income (see Schedule A,

line 7)

2

Other taxes [if any]

3

Total tax before credits (line1+2) [or

greater of line 1 or 2]

4

Credits

5

Total tax after credits (line 3-4)

PAYMENTS

6

Overpayment from prior year

7

Estimated tax payments

8

8

Paid with extension

9

Tax paid with original return

10

Taxes paid after filing of original return

11

Total payments (total of lines 6 through

10)

12

Overpayment on original return (or as

last adjusted)

13

Net payments to date (line 11-12)

REFUND OR TAX DUE

14

Refund (If line 5<13, line 5-13)

15

Tax due (If line 5>13, line 13-5)

16

Interest

17

Balance (line 15+16)

Certification/declaration (I certify/declare that this form and any attachments are correct and

complete to the best of my knowledge.)

Signature of corporate officer if corporation (including title and date)

Signature of paid preparer (including title, PTIN, state tax preparer ID number, and date)

Firm’s name, address, telephone number

Make check payable to [insert payee]

Mail to [insert address]

SCHEDULE A – APPORTIONMENT COMPUTATION

Column A

As

originally

reported or

adjusted

Column B

Net change

Column C

Corrected

amount

1

Net apportionable income

2

Apportionment factor

3

State net apportioned income

(line 1 x 2)

4

Income specifically allocated to the

state

5

Other additions or subtractions

6

Income subject to tax (line 3+4+5)

7

Tax on net income

9

SCHEDULE B – OTHER TAXES [AS NEEDED]

Column A

As originally

reported or

adjusted

Column B

Net change

Column C

Corrected

amount

1

Other taxes [e.g., net-worth based taxes

that are included in the computation]

2

Apportionment factor

3

Apportioned tax

SCHEDULE C – OTHER COMPUTATIONS [AS NEEDED]

Column A

As originally

reported or

adjusted

Column B

Net change

Column C

Corrected

amount

SCHEDULE D -- EXPLANATION OF CHANGES

Show any computation in detail. Attach additional schedules if necessary.

Schedule/

Line #

Explanation

Federal RAR Reporting Form

Instructions

When to use this form

Use this form to report changes to income [franchise] states that are required as a result of an IRS

agent’s RAR (Revenue Agent’s Report).

When to file

The taxpayer must file this form within 180 days of the final determination by the IRS.

10

Attachments

The taxpayer must attach a copy of the federal final determination to this form.

Taxpayer information section

Enter the taxpayer name, address, federal ID number, type of return that is amended, and the

income years covered by this form in the spaces provided.

Check the appropriate box for type of return included in the federal RAR.

Check the appropriate box for the entities/persons included in this return.

Refer to the instructions for the state corporate income tax return and related schedules and forms

for the year you are amending for more information relating to the computation of apportionable

net income, apportionment methodology, taxable net income computation, tax credits, or other

state specific items. For additional information, please contact [taxpayer services and assistance

telephone number].

Signature

Either the president, vice-president, treasurer, assistant treasurer, chief accounting officer, or any

other duly authorized officer (if a corporation) must sign this form.

Anyone paid to prepare the form must sign. The practitioner must enter the practitioner’s federal

PTIN, state tax preparer number (if applicable), name, address, and telephone number in the spaces

provided.

Specific instructions

Lines 1-8, Column A Enter the amounts as shown on your original return or as adjusted by any

prior audit or amended return

Lines 1-8, Column B Enter the amount(s) of any change(s) and explain the change(s) on Schedule

D -- Explanation of Changes. The amounts entered in Column B should be

the net increase or net decrease for each line that has been changed.

Lines 1-8, Column C Add the increase reported in Column B to the amount in Column A; or

subtract the decrease reported in Column B from the amount in Column A.

Enter the results here. If Column B has no entries, enter the amount from

Column A in Column C.

Line 2 Other taxes [if any – enter state specific instructions here].

Line 9 Enter the amount of tax paid with the original return.

11

Line 10 Enter the amount of any tax paid after the filing of the original return.

Line 12 Enter the amount of any overpayment reported on the original return or as

last adjusted.

Line 16 Enter the amount of interest due. Interest is computed on the underpayment

of tax from the statutory due date to the date of payment. (Refer to “Interest

Rates” section of instructions.) Do not include the penalty with your

remittance. If a penalty is due, the [Department of Revenue] will calculate

the amount of penalty due and issue a bill to the corporation.

Schedule A – Apportionment Computation

Lines 1-7, Column A Enter the amounts as shown on your original return or as last adjusted.

Lines 1-7, Column B Enter the amount(s) of any change(s) and explain the change(s) on Schedule

D – Explanation of Changes. The amounts entered in Column B are the net

increase or net decrease for each line that has been changed.

Lines 1-7, Column C Add the increase reported in Column B to the amount in Column A; or

subtract the decrease reported in Column B from the amount in Column A.

Enter the results in Column C. If Column B has no entries, enter the amount

from Column A in Column C.

Line 1 The term “net apportionable income” includes all income that is

apportionable to the state as reported on [insert state specific instructions

for determining net apportionable income. This is adjusted to reflect state

terminology such as “business income.”].

Line 2 [Insert state specific instructions for apportionment factors, if any].

Line 4 The term “income specifically allocated to the state” includes income that

is not apportioned, but which is 100% taxable in the state. [Include state

specific instructions for allocated income. This term is adjusted to reflect

state terminology such as “nonbusiness income.”]

Line 5 [Insert state specific instructions. This may include net operating losses or

other post-apportionment addition or subtraction modifications.]

Line 7 Multiply taxable income by the appropriate tax rates. (See schedule below.)

Enter amount on this line and on Line 1 of the main part of this form.

Schedule B – Other Taxes [as needed]

Lines 1-3, Column A Enter the amounts as shown on your original return or as last adjusted.

12

Lines 1-3, Column B Enter the amount(s) of any change(s) and explain the change(s) on Schedule

D – Explanation of Changes. The amounts entered in Column B are the net

increase or net decrease for each line that has been changed.

Lines 1-3, Column C Add the increase reported in Column B to the amount in Column A; or

subtract the decrease reported in Column B from the amount in Column A.

Enter the results in Column C. If Column B has no entries, enter the amount

from Column A in Column C.

Schedule C [as needed]

[Insert state specific instructions here.]

Schedule D – Explanation of Changes

Explain in detail the nature of the adjustments and attach appropriate supporting forms and

schedules.

Tax Rates [Insert applicable state rates and information in the table below.]

Tax Years

Beginning on

or after

But before

Rate

Income Base

Other Base

[as needed]

Minimum

[as needed]

Interest

Interest rates on tax underpayments:

Period

Interest Rate

14

Appendix B

Joint Request from COST, TEI, the ABA SALT Committee, and the AICPAto Update the

MTC’s Model Uniform Statute for Reporting Adjustments to Federal Taxable Income

and

Draft Updated Proposed Model Uniform Statute for Reporting Adjustments to Federal

Taxable Income

Mr. Wood Miller

Chair, Uniformity Committee

Ms. Holly Coon

Vice-Chair, Uniformity Committee

Multistate Tax Commission Multistate Tax Commission

Via E-Mail

Submitted 12/12/16 to the MTC Uniformity Committee for Initial Consideration at its 12/14/2016

Meeting (with minor edits)

Re: Joint Request from COST, TEI, the ABA SALT Committee, and the AICPA to Update

the MTC’s Model Uniform Statute for Reporting Adjustments to Federal Taxable Income

Dear Mr. Miller and Ms. Coon:

On behalf of the Council On State Taxation (COST), Tax Executives Institute (TEI), the State and

Local Tax Committee of the American Bar Association’s Section of Taxation (ABA), and the

American Institute of Certified Public Accountants (AICPA) (the “Working Group”) **, we

submit a draft Model Uniform Statute for Reporting Adjustments to Federal Taxable Income for

discussion purposes.

Earlier this year (in 2016), the Working Group came together to consider the effects that changes

to the federal partnership audit procedures, enacted in November 2015 as part of the Bipartisan

Budget Act of 2015 (H.R. 1314), will have on state and local taxation. During our group’s

discussions, it became clear that state and local taxing jurisdictions will be required to substantially

amend their statutes for reporting federal audit adjustments when addressing the new federal

partnership audit rules.

Although the Multistate Tax Commission (MTC) adopted a model statute for reporting federal

audit adjustments in 2003, states and localities have not adopted that model widely, and state and

local reporting of federal income tax adjustment statutes continue to vary significantly. For

example, state and local reporting statutes do not provide a uniform time period, use consistent

triggers, or provide taxpayers with a streamlined method for reporting federal audit adjustments.

In addition, jurisdictions vary widely as to whether adjustments must be reported when each

15

federal change becomes final or when all federal changes for the tax year become final; as to

whether assessments and refunds are limited to effects arising directly from the federal changes;

and, as to whether a report of federal changes will be considered a claim for refund. These

variations make the reporting of federal audit changes to states cumbersome and often impractical

within the prescribed reporting periods, leading to non-compliance.

Our Working Group has participated in each of the MTC’s Partnership Work Group conference

calls and met with MTC officials to address how state and local taxing jurisdictions should

incorporate the changes to the federal partnership audit rules. We believe that the need to revise

state and local federal audit reporting statutes to incorporate the new federal partnership rules

provides a unique opportunity for the states to replace their current reporting of federal income tax

adjustments statutes with a uniform reporting statute. We request that the MTC Uniformity

Committee expand the scope of the Partnership Work Group to update the MTC’s Model Uniform

Statute for Reporting Adjustments to Federal Taxable Income to ensure that the MTC’s model

statute is workable for both taxpayers and states and localities. Our Working Group has

collaborated to incorporate several changes designed to meet this objective, and we respectfully

submit it to the MTC for discussion purposes.

The attached draft model statute retains the 180 day reporting period but proposes the following

changes to the current MTC model statute:

• Creates a separate section for definitions, some of which are state-specific, such as the reference

to the “Internal Revenue Code” as being in effect on a certain date rather than as in effect from

time to time;

• Revises the definition of “final determination” to result in a more comprehensive solution and to

incorporate concepts from the Internal Revenue Code and underlying regulations;

• Contemplates the MTC’s adoption of a model streamlined form to report federal audit

adjustments, in lieu of requiring taxpayers to file amended state returns for each year under audit;

• Clarifies that the filing of the report of federal audit changes will also constitute a claim for

refund, regardless of whether an amended state return is filed;

• Clarifies that any subsequent state assessment or refund must arise directly from the federal

changes, unless the state’s normal statute of limitations remains open;

• Adds an optional de mininis exception whereby taxpayers may notify the state of adjustments to

taxable income resulting in an assessment or refund of less than $250 in tax without requiring a

report of those changes (while providing states the option to request such a report);

• Adds a statute of limitations to address instances where the taxpayer failed to file a report of

federal changes;

• Adds an estimated tax provision that allows taxpayers to pay estimated state taxes and toll interest

prior to filing a report of federal adjustments in anticipation of a potential state tax liability and to

16

obtain a refund of any differential if the payments proved to be greater than the final state tax

liability; and

• Clarifies that the effective date of these statutory changes are prospective, and logically, based

on the date of the final determination.

The Working Group believes that the proposed changes are important for fair and efficient state

tax administration and that the adoption of these provisions would significantly benefit both

taxpayers as well as state and local taxing jurisdictions. We therefore encourage the MTC to

evaluate the Working Group’s proposed changes to the MTC’s model while awaiting technical

corrections to the federal partnership audit rule statutes and issuance of Treasury regulations. This

will enable the MTC to move forward quickly once the federal partnership audit rules become

effective.

In addition to the attached model statute, we have included the following for your review and

consideration:

• A proposed model report of federal audit changes developed by TEI’s State and Local Tax

Committee, which is similar to the report the South Carolina DOR circulated in its November 14,

2016 request for public comments;

• A copy of COST’s policy statement on reporting requirements for federal audit changes;

• A copy of TEI’s policy statement on reporting requirements for federal audit changes;

• Recent Bloomberg BNA survey of the states, illustrating the tremendous lack of uniformity of

current state reporting of federal income tax adjustment statutes.

We thank you for your time and consideration. Please let us know if you have any questions or

concerns.

***

Respectfully submitted,

Nikki Dobay Pilar Mata

West Coast Counsel Tax Counsel

Council On State Taxation Tax Executives Institute

cc: Ms. Helen Hecht/Mr. Bruce Fort cc: COST Board of Directors cc: Messrs. Bruce Ely and

William Thistle cc: Mr. Jonathan Horn/Ms. Eileen Sherr

** The attached Model Uniform Statute for Reporting Adjustments to Federal Taxable Income is

for discussion purposes only and has not yet been officially endorsed by COST, TEI, the ABA, or

AICPA. Any organization may propose changes of its own during the approval process, which is

now under way. In addition, (in February 2017), the AICPA has updated its 1995 policy statement.

17

Draft Updated Proposed Model Uniform Statute

for Reporting Adjustments to Federal Taxable Income

Draft Submitted to the MTC Uniformity Committee for Initial Consideration at its 12/14/2016 Meeting

*

SECTION A. Definitions

The following definitions shall apply for the purposes of [this subdivision of the State Code]:

(1) “Final determination” shall mean and be deemed to occur when the last of any of the following

events has occurred with respect to a taxpayer’s federal taxable year, except for entities filing unitary

or other types of combined or consolidated returns with the [State Agency], “final determination” shall

be based upon the occurrence of the last of such events for all members of the group:

(a) The taxpayer: (i) has final adjustments to its federal taxable income resulting from an examination

by the IRS pursuant to Section 7601 of the IRC, including any requisite review by the Joint Committee

on Taxation pursuant to Section 6405 of the IRC; and (ii) has not filed a petition for redetermination

with the United States Tax Court pursuant to Sections 6213 or 6226 of the IRC or a claim for refund

with a district court or the United States Court of Federal Claims pursuant to Sections 6226 or 7422 of

the IRC, and the time for the taxpayer to timely file such a petition for redetermination or such a claim

for refund has lapsed under the applicable statute;

(b) The taxpayer and the IRS have executed the forms necessary for the relevant tax period so as to

establish finality under Section 7121(b) the IRC;

(c) The time for the IRS to make an assessment for the relevant tax period has expired pursuant to

Section 6501 of the IRC; or

(d) A judgment from a United States court, or any other court of original jurisdiction to which the

United States has submitted to personal jurisdiction regarding a taxpayer’s tax issues, has become final

under Section 2412(d)(2)(G) of Title 28 of the United States Code.

(2) “Report of federal adjustments” shall mean (1) an amended [State] tax return, (2) the Multistate

Tax Commission’s model report of federal adjustments**, or (3) any other method authorized by the

[State Agency]. The report of federal adjustments shall contain information reasonably necessary to

provide the [State Agency] with an understanding of the adjustments to the taxpayer’s federal taxable

income and their impact on the taxpayer’s [State] tax liability. The report of federal adjustments shall

serve as the taxpayer’s means to report additional [State] tax due, report a claim for refund or credit of

[State] tax, and make other adjustments (including net operating losses) as a result of the taxpayer’s

federal taxable income.

18

1/4156121.1

(3) “Taxpayer” shall mean [insert State definition].

(4) “[State] tax” shall mean the [applicable State (or local) tax levied at XXX of the State Code].

(5) “IRC” shall mean the Internal Revenue Code of 1986, as codified at 26 United States Code (U.S.C.)

Section 1, et seq., [insert state’s current practice to incorporate IRC]

(6) “IRS” shall mean the Internal Revenue Service of the U.S. Department of the Treasury.

SECTION B. Reporting of IRS Adjustments to Federal Taxable Income

A taxpayer shall notify the [State Agency] of adjustments by the IRS to its federal taxable income as

follows:

(1) Except as provided in subsection (2), a taxpayer whose federal taxable income has been adjusted

shall file a report of federal adjustments with the [State Agency] within one hundred eighty (180) days

following the date of the final determination.

(2) In the event the adjustments to the taxpayer’s federal taxable income result in a [State] tax liability

of less than $250 (excluding penalties and interest) or a refund of less than $250 (excluding interest),

the taxpayer may, in lieu of filing a report of federal adjustments, notify the [State Agency] in writing

or on a form prescribed by the [State Agency] that the federal adjustments are de minimis. The taxpayer

shall provide the [State Agency] with such notice within one hundred eighty (180) days following the

date of the final determination. The taxpayer’s notice shall contain information reasonably necessary

to provide the [State Agency] with an understanding of the federal changes and their impact on the

taxpayer’s [State] tax liability.

(a) In the event the taxpayer provides the [State Agency] with notice that the adjustments are de minimis

pursuant to Section B(2), the [State Agency] may request, in writing, that the taxpayer file a report of

federal adjustments pursuant to Section B(1). The [State Agency] shall issue that request to the

taxpayer within the later of: (i) one hundred eighty (180) days following the date on which the taxpayer

provided such notice, or (ii) the expiration of the limitations period specified in [citation to State statute

setting forth normal limitations period].

(b) In the event the [State Agency] requests a report of federal adjustments within the time prescribed

in Section B(2)(a), the taxpayer shall have one hundred eighty (180) days from the date the [State

Agency’s] request is postmarked in which to file a report of federal adjustments.

(c) [[Option 1]] If the [State Agency] does not request that the taxpayer file a report of federal

adjustment within the time prescribed in Section B(2)(a), the taxpayer’s notice that the adjustments are

de minimis will be deemed accepted by the [State Agency]. [Option 2] If the [State Agency] does not

request that the taxpayer file a report of

19

1/4156121.1

federal adjustments within the time prescribed in Section B(2)(a), the taxpayer’s notice that the

adjustments are de minimis will be deemed accepted and the [State Agency] may assess and bill the

taxpayer the fixed sum of $250 if the taxpayer reported that it would have owed the State a de minimis

[State] tax liability.

(d) Absent fraud, the taxpayer shall not be subject to additional assessment nor allowed to file a claim

for refund or credit of [State] taxes pursuant to [citation to State statute setting forth claim for refund

requirements] based on adjustments to the taxpayer’s federal taxable income unless the statute of

limitations for issuing assessments of [State] tax, interest, and penalties has not expired.

SECTION C. Assessments of Additional [State] Tax, Interest, and Penalties Arising from

Adjustments to Federal Taxable Income.

The [State Agency] shall be required to issue any assessment of additional [State] tax, interest, and

penalties arising directly from IRS adjustments to a taxpayer’s federal taxable income as follows:

(1) If the taxpayer files a report of federal adjustments within the period specified in Section B, the

[State Agency] may assess any additional [State] tax, interest, and penalties arising directly from the

adjustments to the taxpayer’s federal taxable income and issue a notice of assessment to the taxpayer

within the later of:

(a) The expiration of the limitations period specified in [citation to State statute setting forth normal

limitations period]; or

(b) The expiration of the one (1) year period following the date of filing of the report of federal

adjustments.

(2) If the taxpayer fails to file the report of federal adjustments within the period specified in Section

B, the [State Agency] may assess any additional [State] tax, interest, and penalties arising directly from

the adjustments to federal taxable income and issue a notice of assessment to the taxpayer within the

later of:

(a) The expiration of the limitations period specified in [citation to State statute setting forth normal

limitations period];

(b) The expiration of the one (1) year period following the date of filing of the report of federal

adjustments;

(c) The expiration of the one (1) year period following the date on which the Internal Revenue Service,

another state, or an organization representing and/or conducting audits for the states’ tax agencies,

notifies the [State Agency], in writing or by electronic means, that a final determination has been made

with respect to the taxpayer’s federal taxable income for a specified tax year; or

(d) Absent fraud, the expiration of the six (6) year period following the date of the final determination.

20

1/4156121.1

SECTION D. Estimated [State] Tax Payments During Federal Audit.

A taxpayer may make estimated payments to the [State Agency] of the [State] tax that it determines

may ultimately be owed to [State] as a result of a pending IRS audit, prior to a final determination for

a tax year, without filing a report of federal adjustments with the [State Agency]. The estimated [State]

tax payments shall be credited against any tax liability ultimately found to be due to [State] (“final tax

liability”) and limit the accrual of further statutory interest on that amount. If the estimated [State] tax

payments exceed the final [State] tax liability and statutory interest ultimately determined to be due on

that amount, or the IRS ultimately does not make any adjustments to the taxpayer’s federal taxable

income, the taxpayer shall be entitled to a refund or credit for the excess, provided the taxpayer files a

report of federal adjustments or claim for refund or credit of [State] tax pursuant to [citation to State

statute setting forth claim for refund requirements] within one (1) year following the final

determination date.

SECTION E. Claims for Refund or Credits of [State] Tax Arising from Federal Adjustments.

A taxpayer may file a claim for refund or credit of [State] tax arising directly from federal adjustments

based on the later date of: (1) [citation to State statute setting forth claim for refund requirements],

including any extensions; or (2) one (1) year from the due date of report of federal adjustments

prescribed in Section B, including any extensions pursuant to Section F.

SECTION F. Scope of Adjustments and Extensions of Time.

(1) Unless otherwise agreed to by the taxpayer and the [State Agency], any adjustments by the [State

Agency] or by the taxpayer made after the expiration of the [State’s normal statute of limitations for

assessment and refund] shall be limited to changes to the taxpayer’s [State] tax liability arising directly

from adjustments to the taxpayer’s federal taxable income for that tax year.

(2) The time periods provided for in [this subdivision of the State Code] may be extended, in writing,

by agreement between the taxpayer and the [State Agency]. Any extension granted for filing the report

of federal adjustments shall extend the last day prescribed by law for assessing any additional [State]

tax arising directly from the adjustments to federal taxable income and the period for filing a claim for

refund or credit of [State] taxes pursuant to [citation to State statute setting forth claim for refund

requirements] arising directly from adjustments to the taxpayer’s federal taxable income.

SECTION G. Effective Date

The amendments to this [section/chapter] apply to final determinations made on and after X [date].

*Prepared by a working group consisting of representatives of the Council On State Taxation (COST),

Tax Executives Institute (TEI), the ABA Section of Taxation’s SALT Committee, and the AICPA. As of

this date, this draft has not been officially endorsed by these organizations.

**See attached cover letter to the Uniformity Committee explaining the background of this model

report.

21

Appendix C

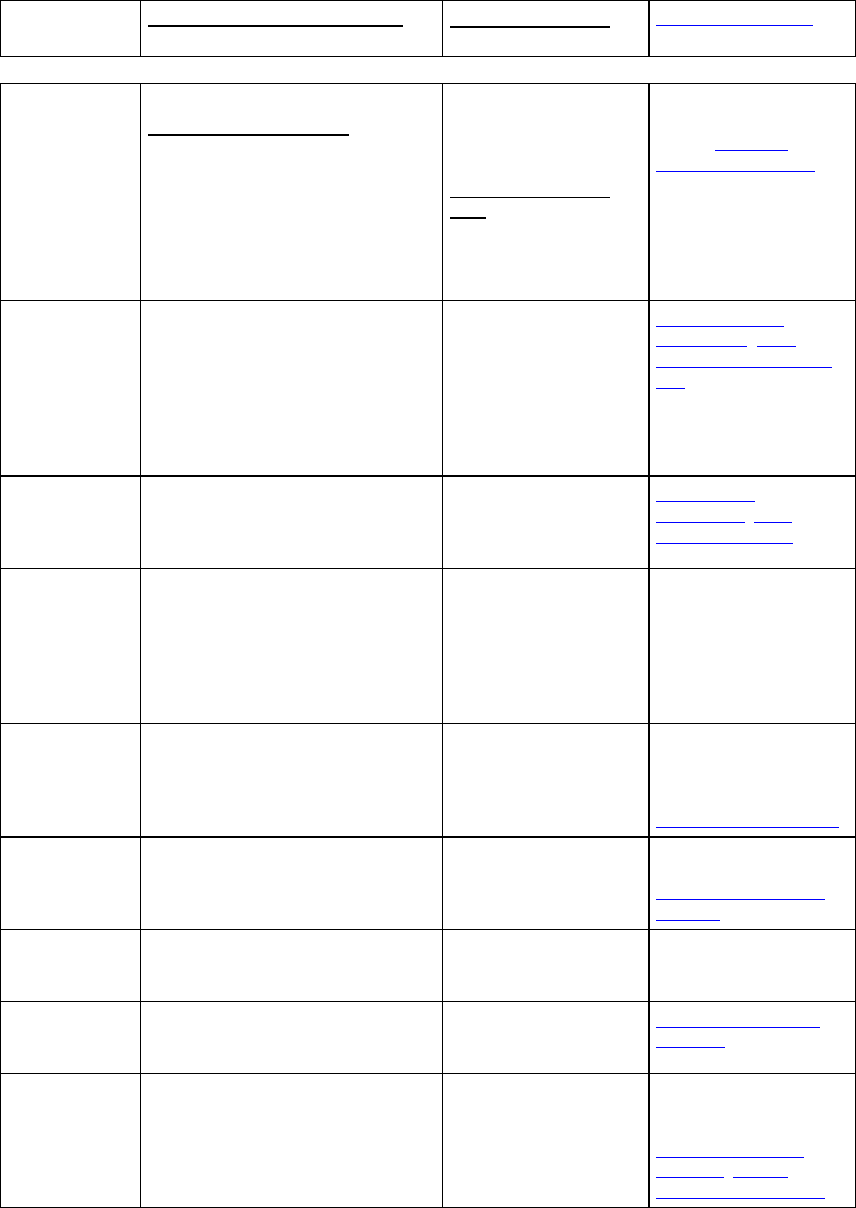

State RAR Rules – (Posted on MTC website) State Tax Smart Charts

Business Income Tax > Amended or Audited Returns > Amended Returns > Deadline for

Reporting Federal Changes > C Corporations

The following chart indicates the deadline for reporting a federal change or adjustment by a C Corporation, as well as, any

attachments that the corporation must file. The information in this chart is as of August 8, 2016.

Jurisdiction

C Corporations

Comment

Citation

Alabama

No deadline specified.

Attach RAR or any other

itemized explanation of

federal changes furnished

by the IRS.

Ala. Admin. Code r.

810-3-40-.01(4)

Alaska

File amended return within 60 days after

final determination of federal adjustment.

Attach all documents

related to the change,

including RAR.

We recommend you

reference cited authority for

more information.

Alaska Stat.

§43.20.030(d), Form

6000 Instructions,

Corporation Net

Income Tax Return

Arizona

Within 90 days after final

determination of federal adjustment,

either:

• file amended return, or

• file copy of final federal

determination, concede accuracy or state

errors, and request recomputation of tax

by department.

Provide sufficient

information for the

department to recompute

Arizona taxable income

based on the RAR changes.

Ariz. Rev. Stat.

§43327, Form 120

Instructions,

Corporation Income

Tax Return

Arkansas

File amended return within 180 days

after receipt of notice and demand for

payment from IRS.

Attach copy of federal

amended return or IRS audit

report.

Prior to Oct. 1, 2015,

amended return had to be

filed within 90 days after

receipt of notice and

demand for payment from

IRS.

We recommend you

reference cited authority for

more information.

Ark. Code. Ann. §26-

18-306(b)(1), Form

AR1100CT

Instructions, C

Corporation Income

Tax Return

California

File amended return or send a letter with

copies of the federal changes within 6

months after final determination of

federal change or filing amended federal

return.

Attach copy of the final

federal determination and

all underlying data and

schedules that explain or

support the federal

adjustments.

Cal. Rev. & Tax

Code §18622, Form

100X Instructions,

Amended

Corporation

Franchise or Income

Tax Return

Colorado

File amended return within 30 days after

final determination of federal change or

filing amended federal return.

Do not attach RAR to

amended return.RAR

showing federal return

changes and state account

number will be accepted for

multistate

Colo. Rev. Stat. §3922-

601(6), Form 112

Instructions, C-

Corporation Income

Tax Return

22

corporations in lieu of an

amended return.

Connecticut

File amended return within 90 days after

final determination of federal change or

filing federal amended return.

Attach IRS notification of

changes or federal Form

1120X.

Conn. Gen. Stat.

§12-226, Form

CT1120X Instructions,

Amended

Corporation

Business Tax

Return

Delaware

File amended return within 90 days after

final determination of federal adjustment

or filing amended federal return.

Attach copy of federal

amended return.

Del. Code Ann. tit.

30, §514, Form 1100

Instructions,

Corporate Income

Tax Return

District of

Columbia

File amended return within 90 days after

final determination of federal change or

filing amended federal return.

Provide detailed statement

explaining the adjustments.

D.C. Code Ann.

§474301(f), Form D-20

Instructions,

Corporation

Franchise Tax

Return

Florida

File amended return within 60 days after

final determination of federal adjustment

or assessment, payment, or collection of

tax, whichever occurs first.

Attach copy of amended

federal return or other

adjustment (such as an

RAR).

Fla. Stat. ch. 220.23,

Rule 12C-1.023

Georgia

File amended return within 180 days

after final determination of federal

adjustment.

Attach copy of federal Form

1120X or federal audit

adjustments.

Ga. Code Ann. §487-

82(e)(1), Form 600

Instructions,

Corporation Tax

Return

Hawaii

File amended return within 90 days after

final determination of federal change or

filing amended federal return.

Attach copy of the

document issued by the

federal government

changing the federal taxable

income of the corporation.

Haw. Rev. Stat.

§235-101(b), Form

N-30 Instructions,

Corporation Income

Tax Return

Idaho

File amended return within 60 days after

final determination of federal adjustment.

Attach copies of all RARs

and any other documents

and schedules required to

clarify the adjustments to

taxable income.

Idaho Code §63-

3069(1), IDAPA

35.01.01.890, Form

41 Instructions,

Corporation Income

Tax Return

23

Illinois

File amended return within 120 days

after federal changes are agreed to or

finally determined (two years and 120

days if claiming a refund resulting from

the change).

Attach copy of federal

finalization or proof of

acceptance from IRS along

with copy of amended

federal form plus any other

related forms, schedules, or

attachments, if applicable.

Examples of federal

finalization include copy of:

• federal refund check;

• signed and dated audit

35 ILCS 5/506(b),

Form IL-1120-X

Instructions,

Amended

Corporation Income

and Replacement

Tax Return

report from the IRS,

including copies of

preliminary, revised,

corrected, and superseding

reports, if applicable; and/or

• federal transcript

verifying federal taxable

income.

Indiana

File amended return within 180 days

after the federal modification is made

(120 days for modifications made before

2011).

Attach copy of amended

federal return, RAR, audit

report, and/or applicable

federal waivers.

Ind. Code §6-3-4-6,

Ind. Admin. Code tit.

45, r. 3.1-1-94, Form

IT-20X Instructions,

Amended Corporate

Adjusted Gross

Income Tax Return

Iowa

File amended return within 60 days of

final disposition of federal audit.

Include amended federal

return and copy of federal

RAR, if applicable. Copy of

federal RAR and

notification of final federal

adjustments provided by

taxpayer will be acceptable

in lieu of an amended

return.

Iowa Admin. Code r.

701 52.3(422), Iowa

Code §421.27(2),

Form IA 1120X

Instructions,

Amended

Corporation Income

Tax Return

Kansas

File amended return within 180 days

after the federal adjustment is paid,

agreed to, or becomes final, whichever is

earlier.

Attach copy of amended

federal return, RAR, or

adjustment letter with full

explanation of changes

made.

Kan. Stat. Ann.

§793230(f), Form K-

120

Instructions,

Corporate Income

Tax Return

Kentucky

Department must be notified within 30

days of initiation of federal audit. File

amended return within 30 days after

conclusion of audit.

Submit copy of final federal

determination with

amended return.

Ky. Rev. Stat. Ann.

§141.210(4), Form

720 Instructions,

Corporation Income

Tax and LLET

Return

24

Louisiana

File amended return within 180 days of

the final determination of the federal

adjustments.

Attach detailed explanation

of changes and copy of

federal amended return, if

applicable.

La. Rev. Stat. Ann.

§47:287.614(C),

Form CIFT-620

Instructions,

Corporation Income

and Franchise Tax

Return

Maine

File amended return within 180 days

after final determination of the federal

change or correction or the filing of the

federal amended return.

Tax years before July 1, 2011: File

amended return within 90 days after

final determination of the federal

change or correction or the filing of the

federal amended return.

Attach copy of federal

amended return or RAR.

For returns reflecting

federal net operating losses,

attach copy of federal Form

1139.

Me. Rev. Stat. Ann. tit.

36, §5227-A(2),

Form 1120-ME

Instructions,

Corporate Income

Tax Return

Maryland

File amended return within 90 days after

final determination of federal

Attach copy of federal

amended return or final

Md. Code Ann.

§13409, Form 500

adjustment.

IRS adjustment report.

Instructions,

Corporation Income

Tax Return

Massachusetts

File amended return within three months

after final determination of federal

adjustment.

Attach copy of federal

amended return or RAR.

Mass. Gen. Laws ch.

62C, §30, Mass.

Regs. Code tit. 830,

§62C.30.1(3), Form

CA-6 Instructions,

Application for

Abatement/Amended

Return

Michigan

File amended return within 120 days after

final determination of federal adjustment.

Attach copy of federal

amended return or signed

and dated IRS audit

document.

Mich. Comp. Laws

§206.687(2), Mich.

Comp. Laws

§208.1507(2), Mich.

Comp. Laws

§208.75(2), Form

4567 Instructions,

MBT Annual Return,

Form 4891

Instructions,

Corporate Income

Tax Annual Return,

Form 4892

Instructions,

Corporate Income

Tax Amended

Return

25

Minnesota

File amended return, or mail letter to

Department of Revenue detailing how

the federal determination is incorrect or

does not change the Minnesota tax,

within 180 days after final determination

of federal change or filing of federal

amended return.

Attach copy of federal

amended return or IRS audit

report.

Minn. Stat.

§289A.38(7), Form

M4 Instructions,

Corporation

Franchise Tax

Return

Mississippi

File amended return within 30 days after

agreeing to the federal change.

Attach copy of federal

amended return or RAR. If

the taxpayer files

consolidated for federal

purposes, a proforma

amended federal return

should be filed as well as

the amended consolidated

federal return.

Miss. Code. Ann.

§27-7-51(4), Corporate

Income and Franchise

Tax

FAQs

Missouri

File amended return within 90 days after

final determination of federal change or

filing amended federal return.

Attach copy of federal

amended return, RAR,

closing agreement, and/or

applicable court decision.

If federal return was not

amended, explain why the

state return is being

amended.

Mo. Rev. Stat.

§143.601, Mo. Code.

Regs. Ann. tit. 12,

§10-2.105, Form

MO-1120

Instructions,

Corporation Income

Tax/Franchise Tax

Return

Montana

File amended return within 90 days after

notice of federal change or filing

Attach the applicable forms

and statements

Mont. Code Ann.

§15-31-506, Mont.

amended federal return.

explaining all adjustments

in detail.

Admin. R. 42.23.303,

Form CIT, Corporate

Income Tax Return

Nebraska

File amended return within 60 days after

a correction or change to the federal

return.

Attach copy of federal

amended return, IRS report,

or other document that

substantiates the

adjustments claimed.

Neb. Rev. Stat.

§772775, Reg. 24-046,

Form 1120N

Instructions,

Corporation Income

Tax Return

Nevada

N/A, because state does not tax general

business corporation income.

New

Hampshire

File amended return within 6 months

after final determination of federal

adjustment.

Attach copy of federal

amended return or IRS

adjustment report.

N.H. Rev. Stat. Ann.

§77A:10, N.H. Rev.

Stat. Ann §77-E:9,

Report of Change

General Instructions

26

New Jersey

File amended return within 90 days after

final determination of federal change or

filing amended federal return.

N.J. Stat. Ann.

§54:10A-13, Form

CBT-100

Instructions,

Corporation

Business Tax

Return

New Mexico

Tax years before July 1, 2013: File

amended return within 90 days after

final determination of federal

adjustment.

Tax years after July 1, 2013: File

amended return within 180 days after

final determination of federal

adjustment.

Attach copy of federal

amended return or RAR.

N.M. Stat. Ann. §7-

113, Form CIT-1

Instructions,

Corporate Income and

Franchise Tax

Return

New York

File amended return within 90 days after

final determination of federal change

(120 days for taxpayers making a

combined report) or filing amended

federal return.

Attach copy of federal

Form 4549, Income Tax

Examination Changes. If

the corporation filed as part

of a consolidated group for

federal tax purposes but on

a separate basis for state tax

purposes, submit a

statement indicating the

changes that would have

been made if the

corporation had filed on a

separate basis for state tax

purposes.

N.Y. Tax Law,

§211(3), N.Y. Comp.

Code R. & Regs. tit.

21, §6-1.3, N.Y.

Comp. Code R. &

Regs. tit. 21, §6-1.4,

Form CT-3, General

Business

Corporation

Franchise Tax

Return

North Carolina

File amended return within 6 months of

notification of correction or final federal

determination.

Include a complete

explanation of reasons for

filing an amended return,

including specific schedule

and line number references,

on

Schedule J of the return.

N.C. Gen. Stat.

§105-130.20, Form

CD-405 Instructions,

Corporation Tax

Return

27

North Dakota

File amended return within 90 days after

final determination of federal change or

filing amended federal return.

Attach copy of federal

amended return, Form

1139, or RAR. If

corporation is included in a

consolidated federal return,

attach copy of amended pro

forma separate company

federal return, pages 1-4 of

amended consolidated

federal return, and schedule

of gross income and

deductions by company that

supports the amended

consolidated taxable

income.

N.D. Cent. Code §57-

38-34.4, N.D.

Admin. Code §81-

03-01.1-09, Form

40X Instructions,

Amended

Corporation Income

Tax Return

Ohio

Commercial Activity Tax (CAT): No

deadline specified.

Corporate Franchise Tax: File

amended return within 1 year after

earliest of:

• final determination of federal

adjustment;

• payment of additional tax as a

result of federal adjustment; or

• receipt of refund as a result of

federal adjustment.

Commercial Activity Tax

(CAT):

Attach copy of federal

amended return or RAR if

refund requested.

Corporate Franchise Tax:

Attach copy of federal

amended return or RAR.

Ohio Rev. Code

Ann. §5733.031(C),

Form FT 1120

Instructions,

Corporation

Franchise Tax

Report, Unofficial

Department

Guidance

Oklahoma

File amended return within 1 year after

final determination of federal change.

Attach copy of federal

Form 1120X or 1139 and

proof of disposition by IRS

or copy of RAR, when

applicable.

Okla. Stat. tit. 68,

§2375, Okla. Admin.

Code §710:50-38(a),

Form 512

Instructions,

Corporation Income

Tax Return

Oregon

File amended return within 90 days after

federal change or filing amended federal

return.

Attach copy of federal

amended return or RAR.

Or. Rev. Stat.

§314.380(2), OAR

150-314.380(2)-(B),

Form 20 Instructions,

Corporation Excise

Tax Return, Form

20-I Instructions,

Corporation Income

Tax Return

Pennsylvania

File amended return within six months

after receipt of final federal change or

correction or filing amended federal

return.

Attach copy of federal

amended return, statement

of reasons for filing the

amended return, and

supporting forms or

schedules.

We recommend you

reference cited authority for

more information.

72 P.S. §7406(a),

Form CT-1 PA,

Corporation Tax

Booklet, Form RCT-

128C Instructions,

Report of Change in

Corporate Net

Income Tax

28

Rhode Island

File amended return within 60 days after

receipt of final determination of

Attach copy of federal

amended return or RAR.

R.I. Gen. Laws §4411-

19, Form RI-

federal change.

1120X Instructions,

Amended Business

Corporation Tax

Return

South Carolina

File amended return within 180 days

after final determination of federal

adjustment.

Attach copy of federal

amended return or RAR.

S.C. Code Ann. §1254-

85(D)(2), Form

SC 1120

Instructions,

Corporation Income

Tax Return,

Corporate Income

Tax FAQs

South Dakota

N/A, because state does not tax general

business corporation income.

Tennessee

No deadline specified.

Mail letter of explanation

(Franchise and Excise

Tax Federal Income

Revision Form preferred)

and supporting

documentation (such as

copies of federal amended

return, signed RAR, and/or

refund check) to

Department of Revenue. A

taxpayer that files a

consolidated federal return

should enclose a schedule

detailing the changes that

apply to the entity for

which the revisions are

being reported or a

consolidated schedule

reflecting all adjustments

by entity.

Important Notice,

Unofficial

Department

Guidance

Texas

File amended return within 120 days

after final determination of federal

adjustment or filing amended federal

return.

Attach cover letter of

explanation, with enclosures

necessary to support the

amendment.

Tex. Tax Code Ann.

§171.212, 34 Tex.

Admin. Code

§3.584(f)

Utah

File amended return within 90 days after

final determination of federal change or

filing amended federal return.

Attach copy of federal

amended return, IRS audit

or adjustment report, or

other explanation of

changes.

Utah Code Ann. §59-

7-519, Form TC-20

Instructions,

Corporation

Franchise or Income

Tax Return

29

Vermont

File amended return within 60 days after

notice of federal change or filing federal

amended return.

Attach copy of IRS report.

Vt. Stat. Ann. tit 32,

§5866(a), Form CO-

411 Instructions,

Corporation Income

Tax Return

Virginia

File amended return within 1 year after

final determination of federal change or

filing federal amended return.

Attach copy of federal

amended return, RAR,

adjustment letter, or other

form/statement showing the

nature of

Va. Code. Ann.

§58.1-311, Form 500

Instructions,

Corporation Income

Tax Return

any federal change and date

it became final.

Washington

N/A, because state does not tax general

business corporation income.

West Virginia

File amended return within 90 days after

final determination of federal change or

filing federal amended return.

Attach copy of RAR

detailing adjustments.

W. Va. Code §11-2420,

W. Va. Code St.

R. §110-24-20, Form

WV/CNF-120, West

Virginia Combined

Corporation Net

Income/Business

Franchise Tax

Return

Wisconsin

Mail report to department and/or file

amended return within 90 days after final

determination of federal change or filing

amended federal return.

Send copy of federal

amended return and/or final

federal audit report.

Wis. Stat. §71.76,

Wis. Admin. Code

§2.105, Form 4

Instructions,

Corporation

Franchise and

Income Tax Return

Wyoming

N/A, because state does not tax general

business corporation income.

Business Income Tax > Amended or Audited Returns > Amended Returns > Deadline for Reporting

Federal Changes > S Corporations

The following chart indicates the deadline for reporting a federal change or adjustment by an S Corporation, as well as, any

attachments that the S corporation must file. The information in this chart is as of August 8, 2016.

Jurisdiction

S Corporations

Comment

Citation

Alabama

No deadline specified.

Attach RAR or any other

itemized explanation of

federal changes furnished

by the IRS.

Ala. Admin. Code r. 810-

3-40-.01(4)

Alaska

File amended return within 60 days

after final determination of federal

adjustment.

Attach all documents

related to the change,

including RAR.

Alaska Stat.

§43.20.030(d), Form

6000 Instructions,

Corporation Net Income

Tax Return

30

Arizona

Within 90 days after final

determination of federal

adjustment, either: • file

amended return, or

• file copy of final federal

determination, concede accuracy or

state errors, and request recomputation

of tax by department.

Provide sufficient

information for the

department to recompute

Arizona taxable income

based on the RAR

changes.

Ariz. Rev. Stat. §43327,

Form 120S

Instructions, S

Corporation Income

Tax Return

Arkansas

File amended return within 90 days

after receipt of notice and demand for

payment from IRS.

Ark. Code. Ann. §26-

18-306(b)(1), Form

AR1100S Instructions,

Effective Oct. 1, 2015, file amended

return within 180 days after receipt of

notice and demand for payment from

IRS.

S Corporation Income Tax

Return

California

File amended return or send a letter

with copies of the federal changes

within 6 months after final

determination of federal change or

filing amended federal return.

Attach copy of the final

federal determination and

all underlying data and

schedules that explain or

support the federal

adjustments.

Cal. Rev. & Tax Code

§18622, Form 100X

Instructions, Amended

Corporation Franchise or

Income Tax Return

Colorado

File amended return within 30 days

after final determination of federal

change or filing amended federal return.

Include statement of

reasons for difference.

Colo. Rev. Stat. §3922-

601(6)

Connecticut

File amended return within 90 days

after final determination of federal

change or filing federal amended return.

Conn. Gen. Stat. §12727,

Form CT1065/CT-1120SI

Instructions, Composite

Income Tax Return

Delaware

File amended return within 90 days

after final determination of federal

change or filing amended federal return.

Attach copy of federal

amended return.

Del. Code Ann. tit. 30,

§514, Form 1100S

Instructions, S

Corporation

Reconciliation And

Shareholders

Information Return

District of

Columbia

File amended return within 90 days

after final determination of federal

change or filing amended federal return.

Provide detailed statement

explaining the

adjustments.

D.C. Code Ann.

§474301(f), Form D-20

Instructions,

Corporation Franchise

Tax Return

31

Florida

File amended return within 60 days

after final determination of federal

adjustment or assessment, payment, or

collection of tax, whichever occurs first.

Attach copy of amended

federal return or other

adjustment (such as an

RAR).

Fla. Stat. ch.

220.23(2)(a), Rule

12C1.023

Georgia

File amended return within 180 days

after final determination of any federal

change or correction.

Attach copy of federal

Form 1120S or federal

audit adjustments.

Ga. Code Ann. §48-

782(e)(1), Form 600S

Instructions, S

Corporation Income

Tax Return

Hawaii

File amended return within 90 days

after federal change or filing amended

federal return.

Attach copy of the

document issued by the

federal government

changing the federal

taxable income of the

corporation.

Haw. Rev. Stat.

§235101(b)

Idaho

File amended return within 60 days

after final determination of federal

change.

Attach copies of all RARs

and any other documents

and schedules required to

clarify the adjustments to

taxable income.

Idaho Code §63-

3069(1), IDAPA

35.01.01.890, Form 41S

Instructions, S

Corporation Income

Tax Return

Illinois

File amended return within 120 days

after federal changes are agreed to or

finally determined (two years and 120

days if claiming a refund resulting from

the change).

Attach copy of federal

finalization or proof of

acceptance from the IRS

along with copy of

amended federal form, if

applicable. Examples of

federal finalization include

copy of:

• audit report from

the

IRS; and/or

• federal record of

account verifying ordinary

business income.

35 ILCS 5/506(b), Form

IL-1120-ST-X

Instructions, Amended

Small Business

Corporation

Replacement Tax Return

Indiana

File amended return within 180 days

after the federal modification is made

(120 days for modifications made

before 2011).

Attach copy of amended

federal return, RAR, audit

report, and/or applicable

federal waivers.

Ind. Code §6-3-4-6, Ind.

Admin. Code tit. 45, r.

3.1-1-94, Form IT-20S

Instructions, S

Corporation Income

Tax Return, Unofficial

Department Guidance

32

Iowa

File amended return within 60 days of

final disposition of federal audit.

Include amended federal

return and copy of federal

RAR, if applicable. Copy

of federal RAR and

notification of final

federal adjustments

provided by taxpayer will

be acceptable in lieu of an

amended return.

Iowa Admin. Code r.

701 52.3(422), Iowa

Code §421.27(2)

Kansas

File amended return within 180 days

after payment or final determination of

federal adjustment.

Attach copy of amended

federal return, RAR, or

adjustment letter with full

explanation of changes

made.

Kan. Stat. Ann.

§793230(f), Form K-120S

Instructions,

Partnership or S

Corporation Return

Kentucky

Department must be notified within 30

days of initiation of federal audit. File

amended return within 30 days after

conclusion of audit.

Submit copy of final

federal determination with

amended return.

Ky. Rev. Stat. Ann.

§141.210(4), Form

720S Instructions, S

Corporation Income

Tax and LLET Return

Louisiana

File amended return within 180 days of

the final determination of the federal

adjustments.

Attach detailed

explanation of changes

and copy of federal

amended return, if

applicable.

La. Rev. Stat. Ann.

§47:287.614(C), Form

CIFT-620 Instructions,

Corporation Income and

Franchise Tax

Return

Maine

N/A, because no return filing

requirement for tax years after 2011.

Tax years before 2012:

File amended return within:

• 180 days after federal change or

Attach copy of federal

amended return, if

applicable, and

explanation of reason for

the change or correction.

Me. Rev. Stat. Ann. tit.

36, §5245(1), Tax Alert,

Vol. 22, No. 3, Form

1065ME/1120S-ME,

Information Return for

Partnerships & S

Corporations

federal amended return is filed effective

on or after July 1, 2011; or

• 90 days after federal change or

federal amended return is filed effective

before July 1, 2011.

Maryland

File amended return within 90 days

after final determination of federal

adjustment.

Attach copy of federal

amended return or final

IRS adjustment report.

Md. Regs. Code tit. 03,

§03.04.02.11(A), Form

510 Instructions,

Passthrough Entity Income

Tax Return

33

Massachusetts

File amended return within 3 months

after final determination of federal

adjustment.

Attach copy of federal

amended return or RAR.

Mass. Gen. Laws ch.

62C, §30, Mass. Regs.

Code tit. 830,

§62C.30.1(3), Form

CA-6 Instructions,

Application for

Abatement/Amended

Return

Michigan

File amended return within 120 days

after final determination of federal

adjustment.

Attach copy of federal

amended return or signed

and dated IRS audit

document.

We recommend you

reference cited authority

for more information.

Mich. Comp. Laws

§206.687(2), Mich.

Comp. Laws

§208.1507(2), Mich.

Comp. Laws

§208.75(2), Form 4567

Instructions, MBT

Annual Return

Minnesota

File amended return, or mail letter to

Department of Revenue detailing how

the federal determination is incorrect or

does not change the Minnesota tax,

within 180 days after final

determination of federal change or

filing of federal amended return.

Attach copy of federal