DEPARTMENT OF HEALTH AND HUMAN SERVICES

Centers for Medicare & Medicaid Services

42 CFR Parts 401, 405, 410, 411, 414, 423, 424, 425, 427, 428, and 491

[CMS-1807-P]

RIN 0938-AV33

Medicare and Medicaid Programs; CY 2025 Payment Policies under the Physician Fee

Schedule and Other Changes to Part B Payment and Coverage Policies; Medicare Shared

Savings Program Requirements; Medicare Prescription Drug Inflation Rebate Program;

and Medicare Overpayments

AGENCY: Centers for Medicare & Medicaid Services (CMS), Health and Human Services

(HHS).

ACTION: Proposed rule.

SUMMARY: This major proposed rule addresses: changes to the physician fee schedule (PFS);

other changes to Medicare Part B payment policies to ensure that payment systems are updated

to reflect changes in medical practice, relative value of services, and changes in the statute;

codification of, and proposing policies for, the Medicare Prescription Drug Inflation Rebate

Program under the Inflation Reduction Act of 2022; updates to the Medicare Diabetes Prevention

Program expanded model; payment for dental services inextricably linked to specific covered

medical services; updates to drugs and biological products paid under Part B including

immunosuppressive drugs and clotting factors; Medicare Shared Savings Program requirements;

updates to the Quality Payment Program; Medicare coverage of opioid use disorder services

furnished by opioid treatment programs; updates to policies for Rural Health Clinics and

Federally Qualified Health Centers; electronic prescribing for controlled substances for a

covered Part D drug under a prescription drug plan or a Medicare Advantage Prescription Drug

(MA-PD) plan under the Substance Use-Disorder Prevention that Promotes Opioid Recovery and

Treatment for Patients and Communities Act (SUPPORT Act); update to the Ambulance Fee

This document is scheduled to be published in the

Federal Register on 07/31/2024 and available online at

https://federalregister.gov/d/2024-14828, and on https://govinfo.gov

Schedule regulations; codification of the Inflation Reduction Act and Consolidated

Appropriations Act, 2023 provisions; updates to Clinical Laboratory Fee Schedule regulations;

updates to the diabetes payment structure and PHE flexibilities; expansion of colorectal cancer

screening and Hepatitis B vaccine coverage and payment; establishing payment for drugs

covered as additional preventive services; Medicare Parts A and B Overpayment Provisions of

the Affordable Care Act.

DATES: To be assured consideration, comments must be received at one of the addresses

provided below, no later than 5 p.m. on September 9, 2024.

ADDRESSES: In commenting, please refer to file code CMS-1807-P.

Comments, including mass comment submissions, must be submitted in one of the

following three ways (please choose only one of the ways listed):

1. Electronically. You may submit electronic comments on this regulation to

https://www.regulations.gov. Follow the “Submit a comment” instructions.

2. By regular mail. You may mail written comments to the following address ONLY:

Centers for Medicare & Medicaid Services,

Department of Health and Human Services,

Attention: CMS-1807-P,

P.O. Box 8016,

Baltimore, MD 21244-8016.

Please allow sufficient time for mailed comments to be received before the close of the comment

period.

3. By express or overnight mail. You may send written comments to the following

address ONLY:

Centers for Medicare & Medicaid Services,

Department of Health and Human Services,

Attention: CMS-1807-P,

Mail Stop C4-26-05,

7500 Security Boulevard,

Baltimore, MD 21244-1850.

FOR FURTHER INFORMATION CONTACT:

[email protected], for any issues not identified below. Please

indicate the specific issue in the subject line of the email.

Michael Soracoe, (410) 786-6312, Morgan Kitzmiller, (410) 786-1623, or

[email protected], for issues related to practice expense, work

RVUs, conversion factor, and PFS specialty-specific impacts.

Kris Corwin, (410) 786-8864, or [email protected], for

issues related to strategies for updates to practice expense data collection and methodology.

Hannah Ahn, (814) 769-0143, or [email protected], for

issues related to potentially misvalued services under the PFS.

Kris Corwin, (410) 786-8864, Patrick Sartini, (410) 786-9252, Mikayla Murphy, (667)

414-0093, or [email protected], for issues related to direct

supervision using two-way audio/video communication technology, telehealth, and other

services involving communications technology.

Tamika Brock, (312) 886-7904, or [email protected], for

issues related to teaching physician billing for services involving residents in teaching settings.

Sarah Leipnik, (410) 786-3933, Mikayla Murphy, (667) 414-0093, Regina Walker-Wren,

(410) 786-9160, or [email protected], for issues related to payment

for caregiver training services and addressing health-related social needs(community health

integration, principal illness navigation, and social determinants of health risk assessment).

Erick Carrera, (410) 786-8949, or [email protected], for

issues related to office/outpatient evaluation and management visit inherent complexity add-one.

Sarah Irie, (410) 786-1348, Emily Parris (667) 414-0418, or

[email protected], for issues related to payment for advanced

primary care management service.

Sarah Leipnik, (410) 786-3933, or [email protected], for

issues related to global surgery payment accuracy.

Pamela West, (410) 786-2302, for issues related to supervision of outpatient therapy

services in private practices, certification of therapy plans of care, and KX modifier threshold.

Lindsey Baldwin, (410) 786-1694, Regina Walker-Wren, (410) 786-9160, Erick Carrera,

(410) 786-8949, Mikayla Murphy, (667) 414-0093, or

[email protected], for issues related to advancing access to

behavioral health services.

Laura Ashbaugh, (410) 786-1113, and Erick Carrera, (410) 786-8949, Zehra Hussain,

(214) 767-4463, or [email protected], for issues related to dental

services inextricably linked to specific covered medical services.

Zehra Hussain, (214) 767-4463, or [email protected], for

issues related to payment of skin substitutes.

Laura Kennedy, (410) 786-3377, Adam Brooks, (202) 205-0671, Rachel Radzyner, (410)

786-8215, Rebecca Ray, (667) 414-0879, and Jae Ryu, (667) 414-0765 for issues related to

Drugs and Biological Products Paid Under Medicare Part B.

[email protected], for issues related to complex drug

administration.

Glenn McGuirk, (410) 786-5723, or [email protected] for issues related to

Clinical Laboratory Fee Schedule.

Lisa Parker, (410) 786-4949, or [email protected], for issues related to FQHC

payments.

Heidi Oumarou, (410) 786-7942, for issues related to the FQHC market basket.

Michele Franklin, (410) 786-9226, or [email protected], for issues related to RHC

payments.

Kianna Banks (410) 786-3498 and Cara Meyer (667) 290-9856, for issues related to

RHCs and FQHCs and Conditions for Certification or Coverage.

Colleen Barbero (667) 290-8794, for issues related to Medicare Diabetes Prevention

Program.

Ariana Pitcher, (667) 290- 8840, or [email protected], for issues related to

Medicare coverage of opioid use disorder treatment services furnished by opioid treatment

programs.

Sabrina Ahmed, (410) 786-7499, or [email protected], for issues

related to the Medicare Shared Savings Program (Shared Savings Program) Quality performance

standard and quality reporting requirements.

Janae James, (410) 786-0801, or [email protected], for issues related

to Shared Savings Program beneficiary assignment and benchmarking methodology.

Richard (Chase) Kendall, (410) 786-1000, or [email protected], for

issues related to reopening ACO payment determinations, and mitigating the impact of

significant, anomalous, and highly suspect billing activity on Shared Savings Program financial

calculations.

Lucy Bertocci, (410) 786-3776, or [email protected], for issues

related to Shared Savings Program prepaid shared savings, advance investment payments,

beneficiary notice and eligibility requirements.

Rachel Radzyner, (410) 786-8215, for issues related to payment for preventative services,

including preventive vaccine administration and drugs covered as additional preventive services.

Elisabeth Daniel, (667) 290-8793, for issues related to the Medicare Prescription Drug

Inflation Rebate Program.

Genevieve Kehoe, [email protected], or 1-844-711-2664 (Option

4) for issues related to the Request for Information: Building upon the MIPS Value Pathways

(MVPs) Framework to Improve Ambulatory Specialty Care.

Kimberly Long, (410) 786-5702, for issues related to expanding colorectal cancer

screening.

Rachel Katonak, (410) 786-8564, for issues related to expanding Hepatitis B vaccine

coverage.

Mei Zhang, (410) 786-7837, for issues related to requirement for electronic prescribing

for controlled substances for a covered Part D drug under a prescription drug plan or an MA-PD

plan (section 2003 of the SUPPORT Act).

Katie Parker, (410) 786-0537, for issues related to Parts A and B overpayment provisions

of the Affordable Care Act.

Amy Gruber, (410) 786-1542, for issues related to low titer O+ whole blood transfusion

therapy during ground ambulance transport.

Renee O’Neill, (410) 786-8821, or Sophia Sugumar, (410) 786-1648, for inquiries related

to Merit-based Incentive Payment System (MIPS) track of the Quality Payment Program.

Danielle Drayer, (516) 965-6630, for inquiries related to Alternative Payment Models

(APMs).

SUPPLEMENTARY INFORMATION:

Addenda Available Only Through the Internet on the CMS Website: The PFS Addenda

along with other supporting documents and tables referenced in this proposed rule are available

on the CMS website at https://www.cms.gov/Medicare/Medicare-Fee-for-Service-

Payment/PhysicianFeeSched/index.html. Click on the link on the left side of the screen titled,

“PFS Federal Regulations Notices” for a chronological list of PFS Federal Register and other

related documents. For the CY 2025 PFS proposed rule, refer to item CMS-1807-P. Readers

with questions related to accessing any of the Addenda or other supporting documents referenced

in this proposed rule and posted on the CMS website identified above should contact

CPT (Current Procedural Terminology) Copyright Notice: Throughout this proposed

rule, we use CPT codes and descriptions to refer to a variety of services. We note that CPT

codes and descriptions are copyright 2020 American Medical Association. All Rights Reserved.

CPT is a registered trademark of the American Medical Association (AMA). Applicable Federal

Acquisition Regulations (FAR) and Defense Federal Acquisition Regulations (DFAR) apply.

I. Executive Summary

A. Purpose

This major annual rule proposes to revise payment policies under the Medicare PFS and

makes other policy changes, including proposals to implement certain provisions of the Further

Continuing Appropriations and Other Extensions Act of 2024 (Pub. L. 118-22, November 16,

2023), Consolidated Appropriations Act, 2023 (Pub. L. 117-328, September 29, 2022), Inflation

Reduction Act of 2022 (IRA) (Pub. L. 117-169, August 16, 2022), Consolidated Appropriations

Act, 2022 (Pub. L. 117-103, March 15, 2022), Consolidated Appropriations Act, 2021 (CAA,

2021) (Pub. L. 116-260, December 27, 2020), Bipartisan Budget Act of 2018 (BBA of 2018)

(Pub. L. 115-123, February 9, 2018) and the Substance Use-Disorder Prevention that Promotes

Opioid Recovery and Treatment for Patients and Communities Act (SUPPORT Act) (Pub. L.

115-271, October 24, 2018), related to Medicare Part B payment. In addition, this major

proposed rule includes proposals regarding other Medicare payment policies described in

sections III. and IV.

This rulemaking also proposes to codify policies previously established in guidance for

the Medicare Prescription Drug Inflation Rebate Program at new parts 427 and 428, including

clarifications to certain existing policies, consistent with sections 1847A(i) and 1860D-14B of

the Act. This rulemaking also proposes new policies for the Medicare Prescription Drug Inflation

Rebate Program, including removal of units of drugs subject to discarded drug refunds from the

Part B rebate amounts, exclusion of units for which a manufacturer provides a discount under the

340B Program from the Part D inflation rebate amount starting on January 1, 2026, the process

for reconciliation of a Part B or Part D rebate amount to incorporate certain revised information,

and procedures for imposing civil money penalties on manufacturers that do not pay Part B or

Part D inflation rebate amounts within a specified period of time.

This rulemaking proposes to update the Rural Health Clinic (RHC) and Federally

Qualified Health Clinic (FQHC) Conditions for Certification and Conditions for Coverage

(CfCs), respectively, by clarifying the requirements and intent of the program regarding the

provision of services. We also aim to ensure RHCs are provided flexibility in the services they

offer, including specialty and laboratory services.

This rulemaking also proposes to further advance Medicare’s overall value-based care

strategy of growth, alignment, and equity through the Medicare Shared Savings Program (Shared

Savings Program) and the Quality Payment Program. The structure of the programs enables us to

develop a set of tools for measuring and encouraging improvements in care, which may support a

shift to clinician payment over time into Advanced Alternative Payment Models (APMs) and

accountable care arrangements which reduce care fragmentation and unnecessary costs for

patients and the health system.

This rulemaking also proposes changes to Medicare regulations regarding requirements

for reporting and returning Parts A and B overpayments.

B. Summary of the Major Provisions

Please note, some sections of this proposed rule contain a request for information (RFI).

In accordance with the implementing regulations of the Paperwork Reduction Act of 1995

(PRA), specifically 5 CFR 1320.3(h)(4), these general solicitations are exempt from the PRA.

Facts or opinions submitted in response to general solicitations of comments from the public,

published in the Federal Register or other publications, regardless of the form or format thereof,

provided that no person is required to supply specific information pertaining to the commenter,

other than that necessary for self-identification, as a condition of the agency's full consideration,

are not generally considered information collections and therefore not subject to the PRA.

Respondents are encouraged to provide complete but concise responses. These RFIs are issued

solely for information and planning purposes; they do not constitute a Request for Proposal

(RFP), applications, proposal abstracts, or quotations. These RFIs do not commit the U.S.

Government to contract for any supplies or services or make a grant award. Further, CMS is not

seeking proposals through these RFIs and will not accept unsolicited proposals. Responders are

advised that the U.S. Government will not pay for any information or administrative costs

incurred in response to these RFIs; all costs associated with responding to these RFIs will be

solely at the interested party’s expense. Not responding to these RFIs does not preclude

participation in any future procurement, if conducted. It is the responsibility of the potential

responders to monitor these RFI announcements for additional information pertaining to these

requests. Please note that CMS will not respond to questions about the policy issues raised in

these RFIs. CMS may or may not choose to contact individual responders. Such communications

would only serve to further clarify written responses. Contractor support personnel may be used

to review RFI responses. Responses to this notice are not offers and cannot be accepted by the

U.S. Government to form a binding contract or issue a grant. Information obtained as a result of

these RFIs may be used by the U.S. Government for program planning on a non-attribution basis.

Respondents should not include any information that might be considered proprietary or

confidential. These RFIs should not be construed as a commitment or authorization to incur cost

for which reimbursement would be required or sought. All submissions become U.S.

Government property and will not be returned. CMS may publicly post the comments received,

or a summary thereof.

Section 1848 of the Social Security Act (the Act) requires us to establish payments under

the PFS, based on national uniform relative value units (RVUs) that account for the relative

resources used in furnishing a service. The statute requires that RVUs be established for three

categories of resources: work, practice expense (PE), and malpractice (MP) expense. In

addition, the statute requires that each year we establish, by regulation, the payment amounts for

physicians’ services paid under the PFS, including geographic adjustments to reflect the

variations in the costs of furnishing services in different geographic areas.

In this major proposed rule, we are proposing to establish RVUs for CY 2025 for the PFS

to ensure that our payment systems are updated to reflect changes in medical practice and the

relative value of services, as well as changes in the statute. This proposed rule also includes

discussions and provisions regarding several other Medicare Part B payment policies, Medicare

and Medicaid provider and supplier enrollment policies, and other policies regarding programs

administered by CMS.

Specifically, this proposed rule addresses:

● Background (section II.A.)

● Determination of PE RVUs (section II.B.)

● Potentially Misvalued Services Under the PFS (section II.C.)

● Payment for Medicare Telehealth Services Under Section 1834(m) of the Act (section

II.D.)

● Valuation of Specific Codes (section II.E.)

● Evaluation and Management (E/M) Visits (section II.F.)

● Enhanced Care Management (section II.G.)

● Supervision of Outpatient Therapy Services in Private Practices, Certification of

Therapy Plans of Care with a Physician or NPP Order, and KX Modifier Thresholds (section

II.H.)

● Advancing Access to Behavioral Health Services (section II.I.)

● Proposals on Medicare Parts A and B Payment for Dental Services Inextricably Linked

to Specific Covered Services (section II.J.)

● Payment for Skin Substitutes (section II.K.)

● Drugs and Biological Products Paid Under Medicare Part B (section III.A.)

● Rural Health Clinics (RHCs) and Federally Qualified Health Centers (FQHCs)

(section III.B.)

● Rural Health Clinic (RHC) and Federally Qualified Health Center (FQHC) Conditions

for Certification and Conditions for Coverage (CfCs) (section III.C.)

● Clinical Laboratory Fee Schedule: Revised Data Reporting Period and Phase-in of

Payment Reductions (section III.D.)

● Medicare Diabetes Prevention Program (MDPP) (section III.E.)

● Modifications Related to Medicare Coverage for Opioid Use Disorder (OUD)

Treatment Services Furnished by Opioid Treatment Programs (OTPs ) (section III.F.)

● Medicare Shared Savings Program (section III.G.)

● Medicare Part B Payment for Preventive Services (§§ 410.10, 410.57, 410.64,

410.152) (section III.H.)

● Medicare Prescription Drug Inflation Rebate Program (section III.I.)

● Request for Information: Building upon the MIPS Value Pathways (MVPs)

Framework to Improve Ambulatory Specialty Care (section III.J.)

● Expand Colorectal Cancer Screening (section III.K.)

● Requirements for Electronic Prescribing for Controlled Substances for a Covered

Part D Drug under a Prescription Drug Plan or an MA-PD Plan (section III.L.)

● Expand Hepatitis B Vaccine Coverage (section III.M.)

● Low Titer O+ Whole Blood Transfusion Therapy During Ground Ambulance

Transport (section III.N.)

● Medicare Parts A and B Overpayment Provisions of the Affordable Care Act

(section III.O.)

● Updates to the Quality Payment Program (section IV.)

● Collection of Information Requirements (section V.)

● Response to Comments (section VI.)

● Regulatory Impact Analysis (section VII.)

C. Summary of Costs and Benefits

We have determined that this proposed rule is economically significant. We estimate the

CY 2025 PFS conversion factor to be 32.3562 which reflects a 0.05 percent positive budget

neutrality adjustment required under section 1848(c)(2)(B)(ii)(II) of the Act, the 0.00 percent

update adjustment factor specified under section 1848(d)(19) of the Act, and the removal of the

temporary 2.93 percent payment increase for services furnished from March 9, 2024, through

December 31, 2024, as provided in the CAA, 2024. For a detailed discussion of the economic

impacts, see section VII., Regulatory Impact Analysis, of this proposed rule.

II. Provisions of the Proposed Rule for the PFS

A. Background

In accordance with section 1848 of the Social Security Act (the Act), CMS has paid for

physicians’ services under the Medicare physician fee schedule (PFS) since January 1, 1992.

The PFS relies on national relative values that are established for work, practice expense (PE),

and malpractice (MP), which are adjusted for geographic cost variations. These values are

multiplied by a conversion factor (CF) to convert the relative value units (RVUs) into payment

rates. The concepts and methodology underlying the PFS were enacted as part of the Omnibus

Budget Reconciliation Act of 1989 (OBRA ’89) (Pub. L. 101-239, December 19, 1989), and the

Omnibus Budget Reconciliation Act of 1990 (OBRA ’90) (Pub. L. 101-508, November 5, 1990).

The final rule published in the November 25, 1991 Federal Register (56 FR 59502) set forth the

first fee schedule used for Medicare payment for physicians’ services.

We note that throughout this proposed rule, unless otherwise noted, the term

“practitioner” is used to describe both physicians and nonphysician practitioners (NPPs) who are

permitted to bill Medicare under the PFS for the services they furnish to Medicare beneficiaries.

B. Determination of PE RVUs

1. Overview

Practice expense (PE) is the portion of the resources used in furnishing a service that

reflects the general categories of physician and practitioner expenses, such as office rent and

personnel wages, but excluding malpractice (MP) expenses, as specified in section 1848(c)(1)(B)

of the Act. As required by section 1848(c)(2)(C)(ii) of the Act, we use a resource-based system

for determining PE RVUs for each physicians’ service. We develop PE RVUs by considering

the direct and indirect practice resources involved in furnishing each service. Direct expense

categories include clinical labor, medical supplies, and medical equipment. Indirect expenses

include administrative labor, office expense, and all other expenses. The sections that follow

provide more detailed information about the methodology for translating the resources involved

in furnishing each service into service specific PE RVUs. We refer readers to the CY 2010

Physician Fee Schedule (PFS) final rule with comment period (74 FR 61743 through 61748) for

a more detailed explanation of the PE methodology.

2. Practice Expense Methodology

a. Direct Practice Expense

We determine the direct PE for a specific service by adding the costs of the direct

resources (that is, the clinical staff, medical supplies, and medical equipment) typically involved

with furnishing that service. The costs of the resources are calculated using the refined direct PE

inputs assigned to each CPT code in our PE database, which are generally based on our review of

recommendations received from the American Medical Association (AMA) Relative Value Scale

Update Committee (RUC) and those provided in response to public comment periods. For a

detailed explanation of the direct PE methodology, including examples, we refer readers to the 5-

year review of work RVUs under the PFS and proposed changes to the PE methodology in the

CY 2007 PFS proposed rule (71 FR 37242) and the CY 2007 PFS final rule with comment

period (71 FR 69629).

b. Indirect Practice Expense per Hour Data

We use survey data on indirect PEs incurred per hour worked to develop the indirect

portion of the PE RVUs. Prior to CY 2010, we primarily used the PE/HR by specialty obtained

from the AMA’s Socioeconomic Monitoring System (SMS). The AMA administered a new

survey in CY 2007 and CY 2008, the Physician Practice Information Survey (PPIS). The PPIS is

a multispecialty, nationally representative, PE survey of physicians and NPPs paid under the PFS

using a survey instrument and methods highly consistent with those used for the SMS and the

supplemental surveys. The PPIS gathered information from 3,656 respondents across 51

physician specialty and health care professional groups. We believe the PPIS is the most

comprehensive source of PE survey information available. We used the PPIS data to update the

PE/HR data for the CY 2010 PFS for almost all of the Medicare-recognized specialties that

participated in the survey.

When we began using the PPIS data in CY 2010, we did not change the PE RVU

methodology or how the PE/HR data are used. We only updated the PE/HR data based on the

new survey. Furthermore, as we explained in the CY 2010 PFS final rule with comment period

(74 FR 61751), because of the magnitude of payment reductions for some specialties resulting

from the use of the PPIS data, we transitioned its use over a 4-year period from the previous PE

RVUs to the PE RVUs developed using the new PPIS data. As provided in the CY 2010 PFS

final rule with comment period (74 FR 61751), the transition to the PPIS data was complete for

CY 2013. Therefore, PE RVUs from CY 2013 forward are developed based entirely on the PPIS

data, except as noted in this section.

Section 1848(c)(2)(H)(i) of the Act requires us to use the medical oncology supplemental

survey data submitted in 2003 for oncology drug administration services. Therefore, the PE/HR

for medical oncology, hematology, and hematology/oncology reflects the continued use of these

supplemental survey data.

Supplemental survey data on independent labs from the College of American

Pathologists were implemented for payments beginning in CY 2005. Supplemental survey data

from the National Coalition of Quality Diagnostic Imaging Services (NCQDIS), representing

independent diagnostic testing facilities (IDTFs), were blended with supplementary survey data

from the American College of Radiology (ACR) and implemented for payments beginning in

CY 2007. Neither IDTFs nor independent labs participated in the PPIS. Therefore, we continue

to use the PE/HR that was developed from their supplemental survey data.

Consistent with our past practice, the previous indirect PE/HR values from the

supplemental surveys for these specialties were updated to CY 2006 using the Medicare

Economic Index (MEI) to put them on a comparable basis with the PPIS data.

We also do not use the PPIS data for reproductive endocrinology and spine surgery since

these specialties are not separately recognized by Medicare, nor do we have a method to blend

the PPIS data with Medicare-recognized specialty data.

Previously, we established PE/HR values for various specialties without SMS or

supplemental survey data by crosswalking them to other similar specialties to estimate a proxy

PE/HR. For specialties that were part of the PPIS for which we previously used a crosswalked

PE/HR, we instead used the PPIS based PE/HR. We use crosswalks for specialties that did not

participate in the PPIS. These crosswalks have been generally established through notice and

comment rulemaking and are available in the file titled “CY 2025 PFS proposed rule PE/HR” on

the CMS website under downloads for the CY 2025 PFS proposed rule at

https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/PhysicianFeeSched/PFS-

Federal-Regulation-Notices.html.

For CY 2025, we have incorporated the available utilization data for two new specialties,

Marriage and Family Therapist (MFT) and Mental Health Counselor (MHC), which we

recognized effective January 1, 2024, in accordance with section 4121 of the CAA, 2023. We

are proposing to use proxy PE/HR values for these new specialties, as there are no PPIS data for

these specialties, by crosswalking the PE/HR as follows from specialties that furnish similar

services in the Medicare claims data:

● Marriage and Family Therapist (MFT) from Licensed Clinical Social Workers; and

● Mental Health Counselor (MHC) from Licensed Clinical Social Workers

These updates are reflected in the “CY 2025 PFS proposed rule PE/HR” file available on

the CMS website under the supporting data files for the CY 2025 PFS proposed rule at

https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/PhysicianFeeSched/PFS-

Federal-Regulation-Notices.html.

c. Allocation of PE to Services

To establish PE RVUs for specific services, it is necessary to establish the direct and

indirect PE associated with each service.

(1) Direct Costs

The relative relationship between the direct cost portions of the PE RVUs for any two

services is determined by the relative relationship between the sum of the direct cost resources

(that is, the clinical staff, medical supplies, and medical equipment) typically involved with

furnishing each of the services. The costs of these resources are calculated from the refined

direct PE inputs in our PE database. For example, if one service has a direct cost sum of $400

from our PE database and another service has a direct cost sum of $200, the direct portion of the

PE RVUs of the first service would be twice as much as the direct portion of the PE RVUs for

the second service.

(2) Indirect Costs

We allocate the indirect costs at the code level based on the direct costs specifically

associated with a code and the greater of either the clinical labor costs or the work RVUs. We

also incorporate the survey data described earlier in the PE/HR discussion. The general

approach to developing the indirect portion of the PE RVUs is as follows:

● For a given service, we use the direct portion of the PE RVUs calculated as previously

described and the average percentage that direct costs represent of total costs (based on survey

data) across the specialties that furnish the service to determine an initial indirect allocator. That

is, the initial indirect allocator is calculated so that the direct costs equal the average percentage

of direct costs of those specialties furnishing the service. For example, if the direct portion of the

PE RVUs for a given service is 2.00 and direct costs, on average, represent 25 percent of total

costs for the specialties that furnish the service, the initial indirect allocator would be calculated

so that it equals 75 percent of the total PE RVUs. Thus, in this example, the initial indirect

allocator would equal 6.00, resulting in a total PE RVU of 8.00 (2.00 is 25 percent of 8.00 and

6.00 is 75 percent of 8.00).

● Next, we add the greater of the work RVUs or clinical labor portion of the direct

portion of the PE RVUs to this initial indirect allocator. In our example, if this service had a

work RVU of 4.00 and the clinical labor portion of the direct PE RVU was 1.50, we would add

4.00 (since the 4.00 work RVUs are greater than the 1.50 clinical labor portion) to the initial

indirect allocator of 6.00 to get an indirect allocator of 10.00. In the absence of any further use

of the survey data, the relative relationship between the indirect cost portions of the PE RVUs for

any two services would be determined by the relative relationship between these indirect cost

allocators. For example, if one service had an indirect cost allocator of 10.00 and another service

had an indirect cost allocator of 5.00, the indirect portion of the PE RVUs of the first service

would be twice as great as the indirect portion of the PE RVUs for the second service.

● Then, we incorporate the specialty specific indirect PE/HR data into the calculation.

In our example, if, based on the survey data, the average indirect cost of the specialties

furnishing the first service with an allocator of 10.00 was half of the average indirect cost of the

specialties furnishing the second service with an indirect allocator of 5.00, the indirect portion of

the PE RVUs of the first service would be equal to that of the second service.

(3) Facility and Nonfacility Costs

For procedures that can be furnished in a physician’s office, as well as in a facility

setting, where Medicare makes a separate payment to the facility for its costs in furnishing a

service, we establish two PE RVUs: facility and nonfacility. The methodology for calculating

PE RVUs is the same for both the facility and nonfacility RVUs but is applied independently to

yield two separate PE RVUs. In calculating the PE RVUs for services furnished in a facility, we

do not include resources that would generally not be provided by physicians when furnishing the

service. For this reason, the facility PE RVUs are generally lower than the nonfacility PE RVUs.

(4) Services with Technical Components and Professional Components

Diagnostic services are generally comprised of two components: a professional

component (PC); and a technical component (TC). The PC and TC may be furnished

independently or by different healthcare providers, or they may be furnished together as a global

service. When services have separately billable PC and TC components, the payment for the

global service equals the sum of the payment for the TC and PC. To achieve this, we use a

weighted average of the ratio of indirect to direct costs across all the specialties that furnish the

global service, TCs, and PCs; that is, we apply the same weighted average indirect percentage

factor to allocate indirect expenses to the global service, PCs, and TCs for a service. (The direct

PE RVUs for the TC and PC sum to the global.)

(5) PE RVU Methodology

For a more detailed description of the PE RVU methodology, we direct readers to the CY

2010 PFS final rule with comment period (74 FR 61745 through 61746). We also direct readers

to the file titled “Calculation of PE RVUs under Methodology for Selected Codes” which is

available on our website under downloads for the CY 2025 PFS proposed rule at

https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/PhysicianFeeSched/PFS-

Federal-Regulation-Notices.html. This file contains a table that illustrates the calculation of PE

RVUs as described in this proposed rule for individual codes.

(a) Setup File

First, we create a setup file for the PE methodology. The setup file contains the direct

cost inputs, the utilization for each procedure code at the specialty and facility/nonfacility place

of service level, and the specialty specific PE/HR data calculated from the surveys.

(b) Calculate the Direct Cost PE RVUs

Sum the costs of each direct input.

Step 1: Sum the direct costs of the inputs for each service.

Step 2: Calculate the aggregate pool of direct PE costs for the current year. We set the

aggregate pool of PE costs equal to the product of the ratio of the current aggregate PE RVUs to

current aggregate work RVUs and the projected aggregate work RVUs.

Step 3: Calculate the aggregate pool of direct PE costs for use in ratesetting. This is the

product of the aggregate direct costs for all services from Step 1 and the utilization data for that

service.

Step 4: Using the results of Step 2 and Step 3, use the CF to calculate a direct PE scaling

adjustment to ensure that the aggregate pool of direct PE costs calculated in Step 3 does not vary

from the aggregate pool of direct PE costs for the current year. Apply the scaling adjustment to

the direct costs for each service (as calculated in Step 1).

Step 5: Convert the results of Step 4 to an RVU scale for each service. To do this, divide

the results of Step 4 by the CF. Note that the actual value of the CF used in this calculation does

not influence the final direct cost PE RVUs as long as the same CF is used in Step 4 and Step 5.

Different CFs would result in different direct PE scaling adjustments, but this has no effect on

the final direct cost PE RVUs since changes in the CFs and the associated direct scaling

adjustments offset one another.

(c) Create the Indirect Cost PE RVUs

Create indirect allocators.

Step 6: Based on the survey data, calculate direct and indirect PE percentages for each

physician specialty.

Step 7: Calculate direct and indirect PE percentages at the service level by taking a

weighted average of the results of Step 6 for the specialties that furnish the service. Note that for

services with TCs and PCs, the direct and indirect percentages for a given service do not vary by

the PC, TC, and global service.

We generally use an average of the three most recent years of available Medicare claims

data to determine the specialty mix assigned to each code. Codes with low Medicare service

volume require special attention since billing or enrollment irregularities for a given year can

result in significant changes in specialty mix assignment. We finalized a policy in the CY 2018

PFS final rule (82 FR 52982 through 59283) to use the most recent year of claims data to

determine which codes are low volume for the coming year (those that have fewer than 100

allowed services in the Medicare claims data). For codes that fall into this category, instead of

assigning a specialty mix based on the specialties of the practitioners reporting the services in the

claims data, we use the expected specialty that we identify on a list developed based on medical

review and input from expert interested parties. We display this list of expected specialty

assignments as part of the annual set of data files we make available as part of notice and

comment rulemaking and consider recommendations from the RUC and other interested parties

on changes to this list annually. Services for which the specialty is automatically assigned based

on previously finalized policies under our established methodology (for example, “always

therapy” services) are unaffected by the list of expected specialty assignments. We also finalized

in the CY 2018 PFS final rule (82 FR 52982 through 52983) a policy to apply these service-level

overrides for both PE and MP, rather than one or the other category.

Step 8: Calculate the service level allocators for the indirect PEs based on the

percentages calculated in Step 7. The indirect PEs are allocated based on the three components:

the direct PE RVUs; the clinical labor PE RVUs; and the work RVUs.

For most services the indirect allocator is: indirect PE percentage * (direct PE

RVUs/direct percentage) + work RVUs.

There are two situations where this formula is modified:

● If the service is a global service (that is, a service with global, professional, and

technical components), then the indirect PE allocator is: indirect percentage (direct PE

RVUs/direct percentage) + clinical labor PE RVUs + work RVUs.

● If the clinical labor PE RVUs exceed the work RVUs (and the service is not a global

service), then the indirect allocator is: indirect PE percentage (direct PE RVUs/direct percentage)

+ clinical labor PE RVUs.

(Note: For global services, the indirect PE allocator is based on both the work RVUs and

the clinical labor PE RVUs. We do this to recognize that, for the PC service, indirect PEs would

be allocated using the work RVUs, and for the TC service, indirect PEs would be allocated using

the direct PE RVUs and the clinical labor PE RVUs. This also allows the global component

RVUs to equal the sum of the PC and TC RVUs.)

For presentation purposes, in the examples in the download file titled “Calculation of PE

RVUs under Methodology for Selected Codes”, the formulas were divided into two parts for

each service.

● The first part does not vary by service and is the indirect percentage (direct PE

RVUs/direct percentage).

● The second part is either the work RVU, clinical labor PE RVU, or both depending on

whether the service is a global service and whether the clinical PE RVUs exceed the work RVUs

(as described earlier in this step).

Apply a scaling adjustment to the indirect allocators.

Step 9: Calculate the current aggregate pool of indirect PE RVUs by multiplying the

result of step 8 by the average indirect PE percentage from the survey data.

Step 10: Calculate an aggregate pool of indirect PE RVUs for all PFS services by adding

the product of the indirect PE allocators for a service from Step 8 and the utilization data for that

service.

Step 11: Using the results of Step 9 and Step 10, calculate an indirect PE adjustment so

that the aggregate indirect allocation does not exceed the available aggregate indirect PE RVUs

and apply it to indirect allocators calculated in Step 8.

Calculate the indirect practice cost index.

Step 12: Using the results of Step 11, calculate aggregate pools of specialty specific

adjusted indirect PE allocators for all PFS services for a specialty by adding the product of the

adjusted indirect PE allocator for each service and the utilization data for that service.

Step 13: Using the specialty specific indirect PE/HR data, calculate specialty specific

aggregate pools of indirect PE for all PFS services for that specialty by adding the product of the

indirect PE/HR for the specialty, the work time for the service, and the specialty’s utilization for

the service across all services furnished by the specialty.

Step 14: Using the results of Step 12 and Step 13, calculate the specialty specific indirect

PE scaling factors.

Step 15: Using the results of Step 14, calculate an indirect practice cost index at the

specialty level by dividing each specialty specific indirect scaling factor by the average indirect

scaling factor for the entire PFS.

Step 16: Calculate the indirect practice cost index at the service level to ensure the

capture of all indirect costs. Calculate a weighted average of the practice cost index values for

the specialties that furnish the service. (Note: For services with TCs and PCs, we calculate the

indirect practice cost index across the global service, PCs, and TCs. Under this method, the

indirect practice cost index for a given service (for example, echocardiogram) does not vary by

the PC, TC, and global service.)

Step 17: Apply the service level indirect practice cost index calculated in Step 16 to the

service level adjusted indirect allocators calculated in Step 11 to get the indirect PE RVUs.

(d) Calculate the Final PE RVUs

Step 18: Add the direct PE RVUs from Step 5 to the indirect PE RVUs from Step 17 and

apply the final PE budget neutrality (BN) adjustment. The final PE BN adjustment is calculated

by comparing the sum of steps 5 and 17 to the aggregate work RVUs scaled by the ratio of

current aggregate PE and work RVUs. This adjustment ensures that all PE RVUs in the PFS

account for the fact that certain specialties are excluded from the calculation of PE RVUs but

included in maintaining overall PFS BN. (See “Specialties excluded from ratesetting

calculation” later in this proposed rule.)

Step 19: Apply the phase-in of significant RVU reductions and its associated adjustment.

Section 1848(c)(7) of the Act specifies that for services that are not new or revised codes, if the

total RVUs for a service for a year would otherwise be decreased by an estimated 20 percent or

more as compared to the total RVUs for the previous year, the applicable adjustments in work,

PE, and MP RVUs shall be phased in over a 2-year period. In implementing the phase-in, we

consider a 19 percent reduction as the maximum 1-year reduction for any service not described

by a new or revised code. This approach limits the year one reduction for the service to the

maximum allowed amount (that is, 19 percent), and then phases in the remainder of the

reduction. To comply with section 1848(c)(7) of the Act, we adjust the PE RVUs to ensure that

the total RVUs for all services that are not new or revised codes decrease by no more than 19

percent, and then apply a relativity adjustment to ensure that the total pool of aggregate PE

RVUs remains relative to the pool of work and MP RVUs. For a more detailed description of

the methodology for the phase-in of significant RVU changes, we refer readers to the CY 2016

PFS final rule with comment period (80 FR 70927 through 70931).

(e) Setup File Information

● Specialties excluded from ratesetting calculation: To calculate the PE and MP RVUs,

we exclude certain specialties, such as NPPs paid at a percentage of the PFS and low volume

specialties, from the calculation. These specialties are included to calculate the BN adjustment.

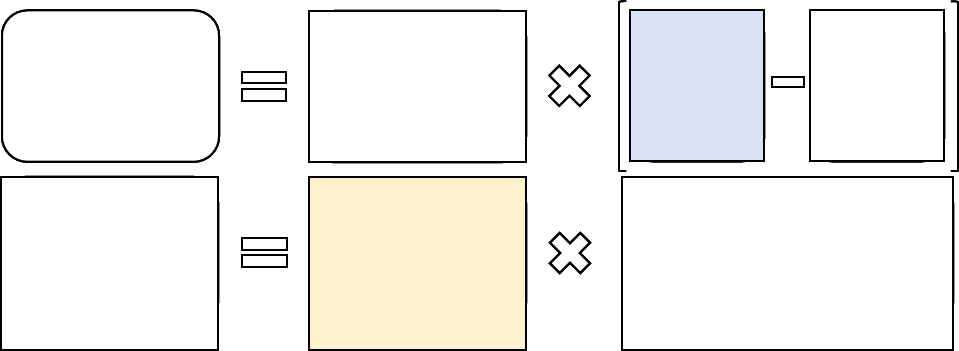

They are displayed in Table 1.

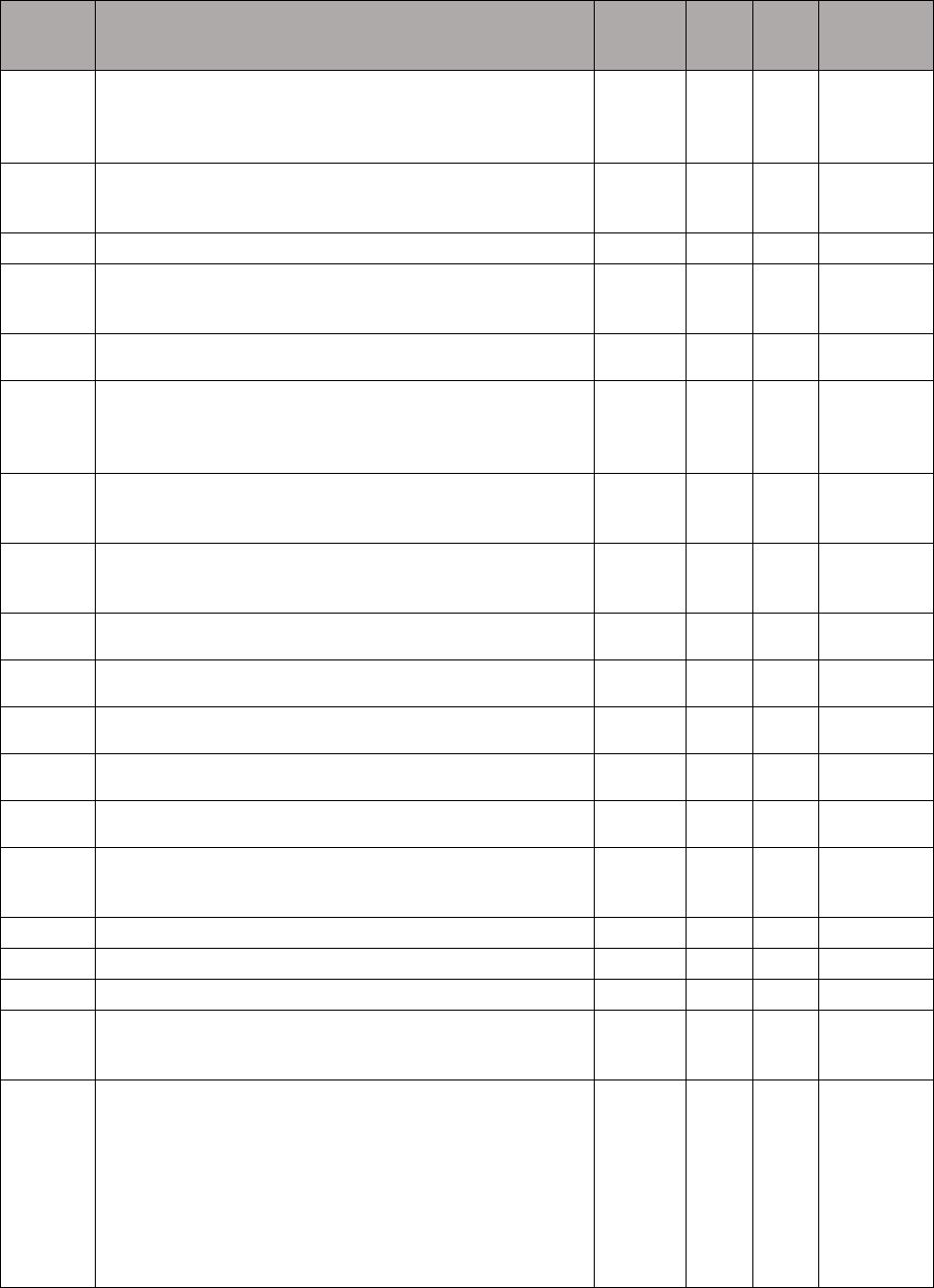

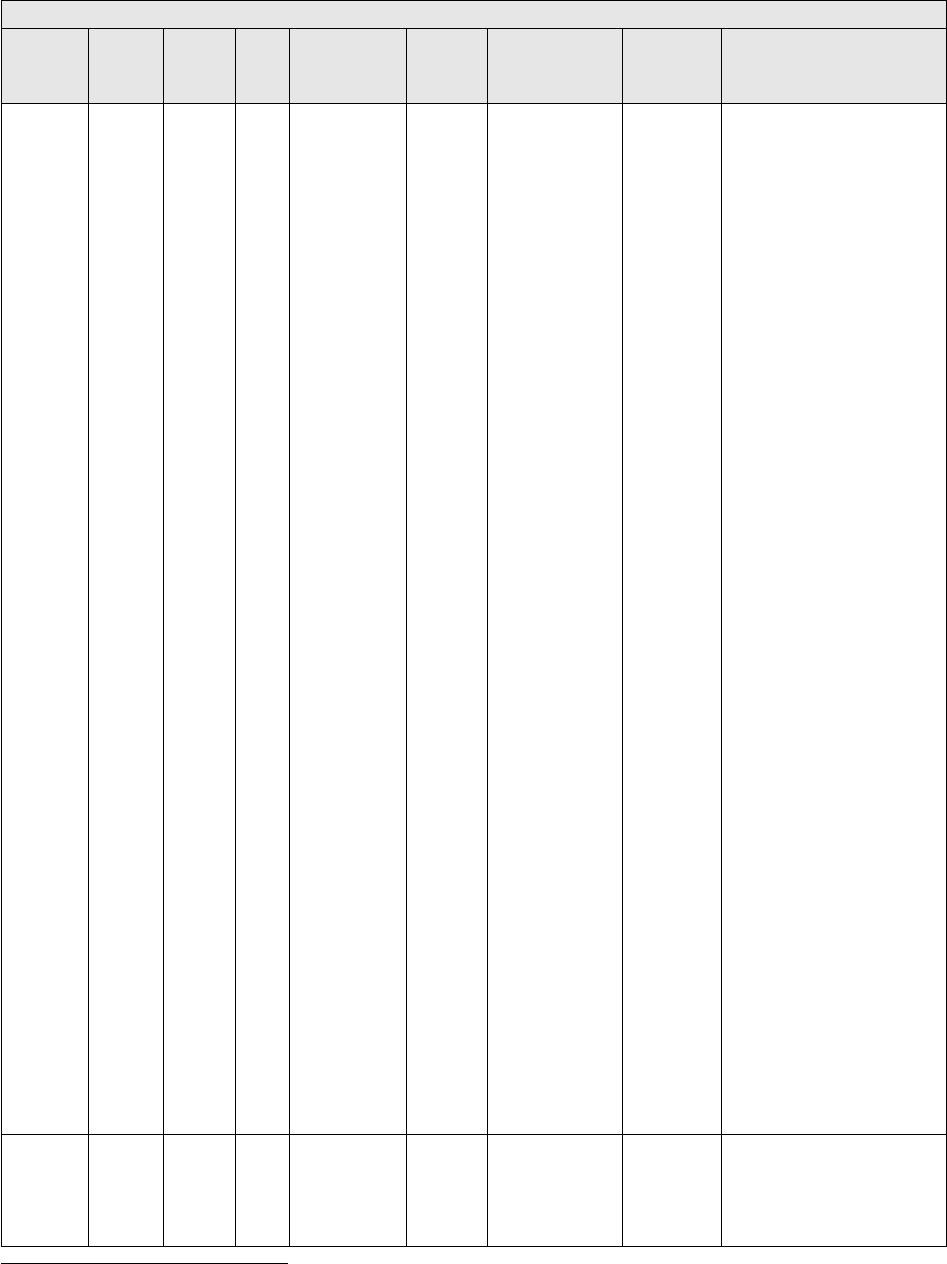

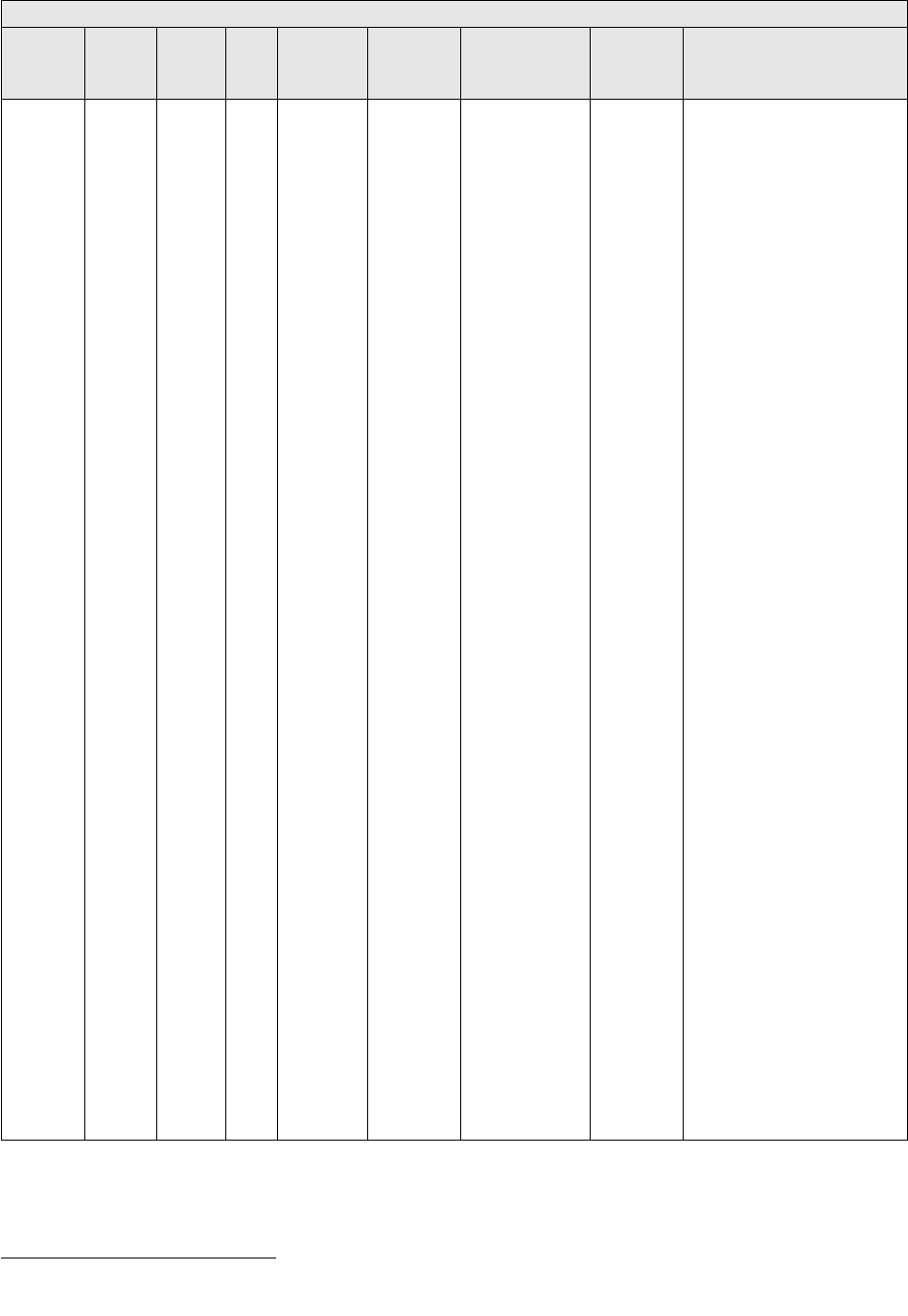

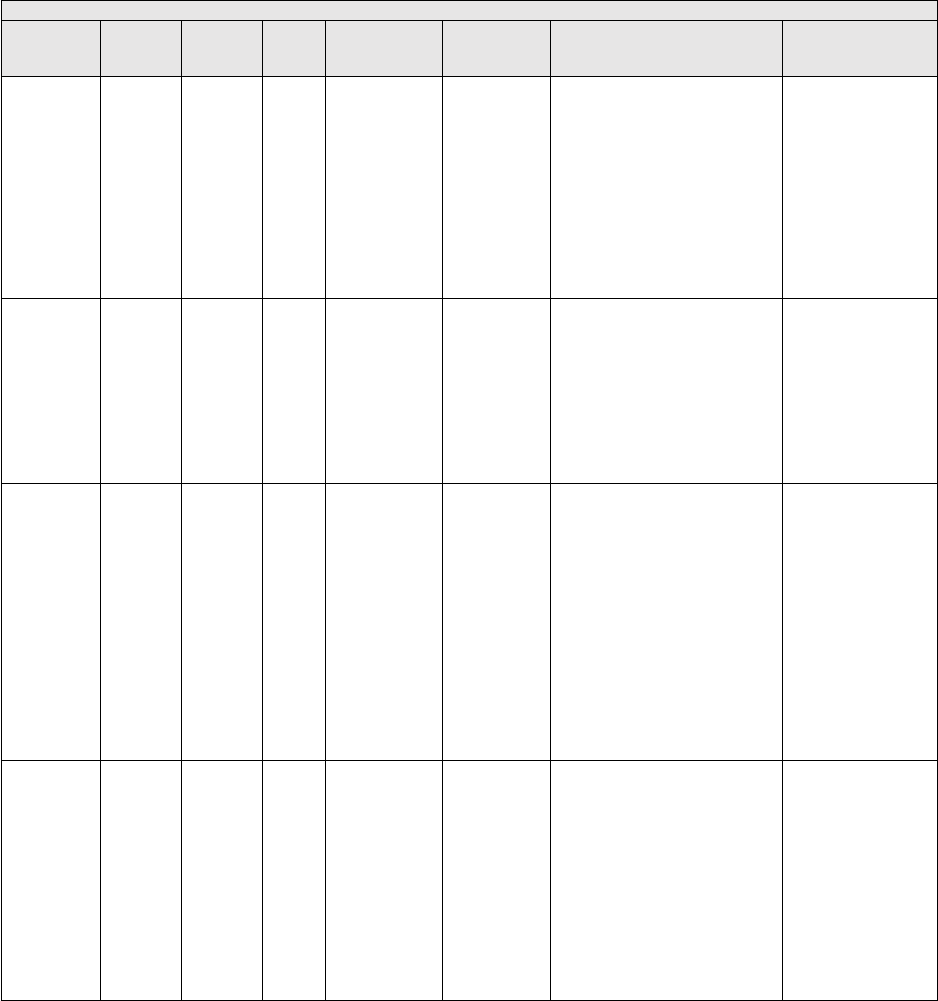

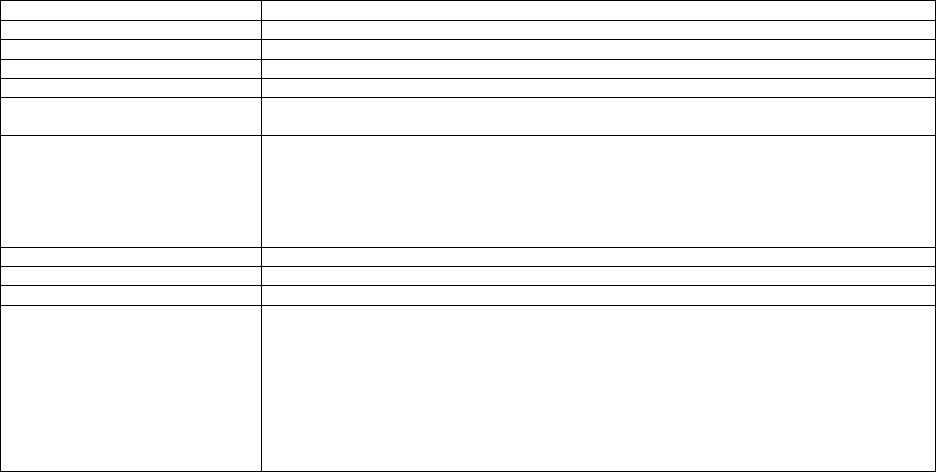

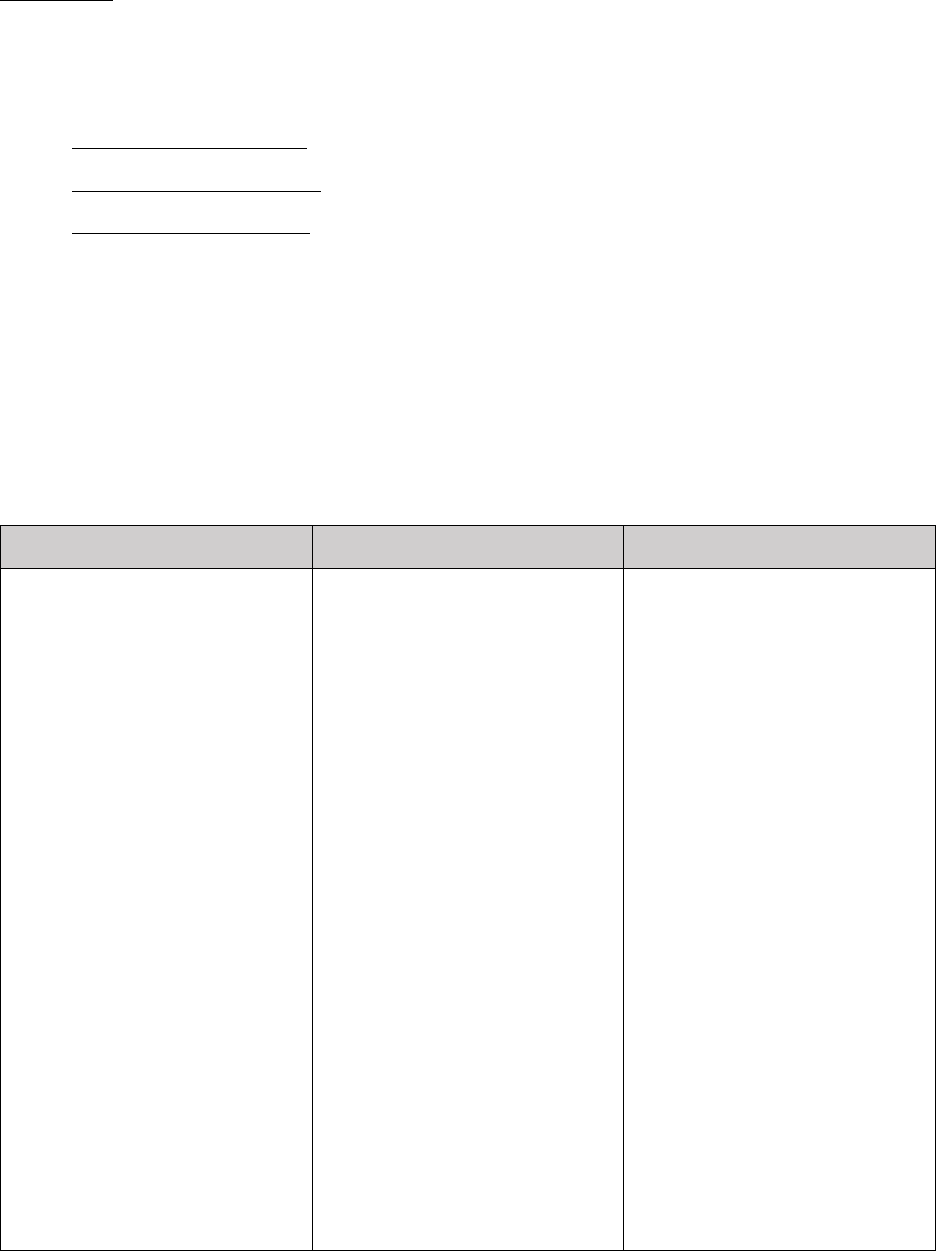

TABLE 1: Specialties Excluded from Ratesetting Calculation

Specialty

Code

Specialty Description

49

Ambulatory surgical center

50

Nurse practitioner

51

Medical supply company with certified orthotist

52

Medical supply company with certified prosthetist

53

Medical supply company with certified prosthetist-orthotist

54

Medical supply company not included in 51, 52, or 53.

55

Individual certified orthotist

56

Individual certified prosthetist

57

Individual certified prosthetist-orthotist

58

Medical supply company with registered pharmacist

59

Ambulance service supplier, e.g., private ambulance companies, funeral homes, etc.

60

Public health or welfare agencies

61

Voluntary health or charitable agencies

73

Mass immunization roster biller

74

Radiation therapy centers

87

All other suppliers (e.g., drug and department stores)

88

Unknown supplier/provider specialty

89

Certified clinical nurse specialist

96

Optician

97

Physician assistant

A0

Hospital

A1

SNF

A2

Intermediate care nursing facility

A3

Nursing facility, other

A4

HHA

A5

Pharmacy

A6

Medical supply company with respiratory therapist

A7

Department store

A8

Grocery store

B1

Supplier of oxygen and/or oxygen related equipment (eff. 10/2/2007)

B2

Pedorthic personnel

B3

Medical supply company with pedorthic personnel

B4

Rehabilitation Agency

B5

Ocularist

C1

Centralized Flu

C2

Indirect Payment Procedure

C5

Dentistry

● Crosswalk certain low volume physician specialties: Crosswalk the utilization of

certain specialties with relatively low PFS utilization to the associated specialties.

● Physical therapy utilization: Crosswalk the utilization associated with all physical

therapy services to the specialty of physical therapy.

● Identify professional and technical services not identified under the usual TC and 26

modifiers: Flag the services that are PC and TC services but do not use TC and 26 modifiers (for

example, electrocardiograms). This flag associates the PC and TC with the associated global

code for use in creating the indirect PE RVUs. For example, the professional service, CPT code

93010 (Electrocardiogram, routine ECG with at least 12 leads; interpretation and report only), is

associated with the global service, CPT code 93000 (Electrocardiogram, routine ECG with at

least 12 leads; with interpretation and report).

● Payment modifiers: Payment modifiers are accounted for in creating the file consistent

with the current payment policy as implemented in claims processing. For example, services

billed with the assistant at surgery modifier are paid 16 percent of the PFS amount for that

service; therefore, the utilization file is modified to only account for 16 percent of any service

that contains the assistant at surgery modifier. Similarly, for those services to which volume

adjustments are made to account for the payment modifiers, time adjustments are applied as well.

For time adjustments to surgical services, the intraoperative portion in the work time file is used;

where it is not present, the intraoperative percentage from the payment files used by contractors

to process Medicare claims is used instead. Where neither is available, we use the payment

adjustment ratio to adjust the time accordingly. Table 2 details the manner in which the

modifiers are applied.

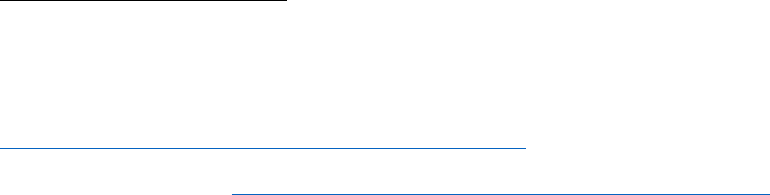

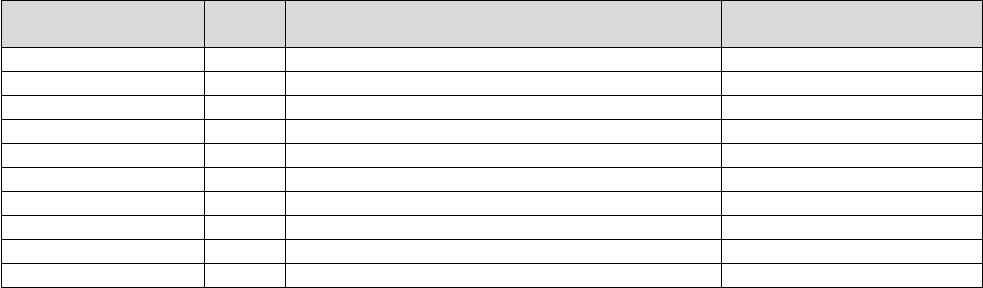

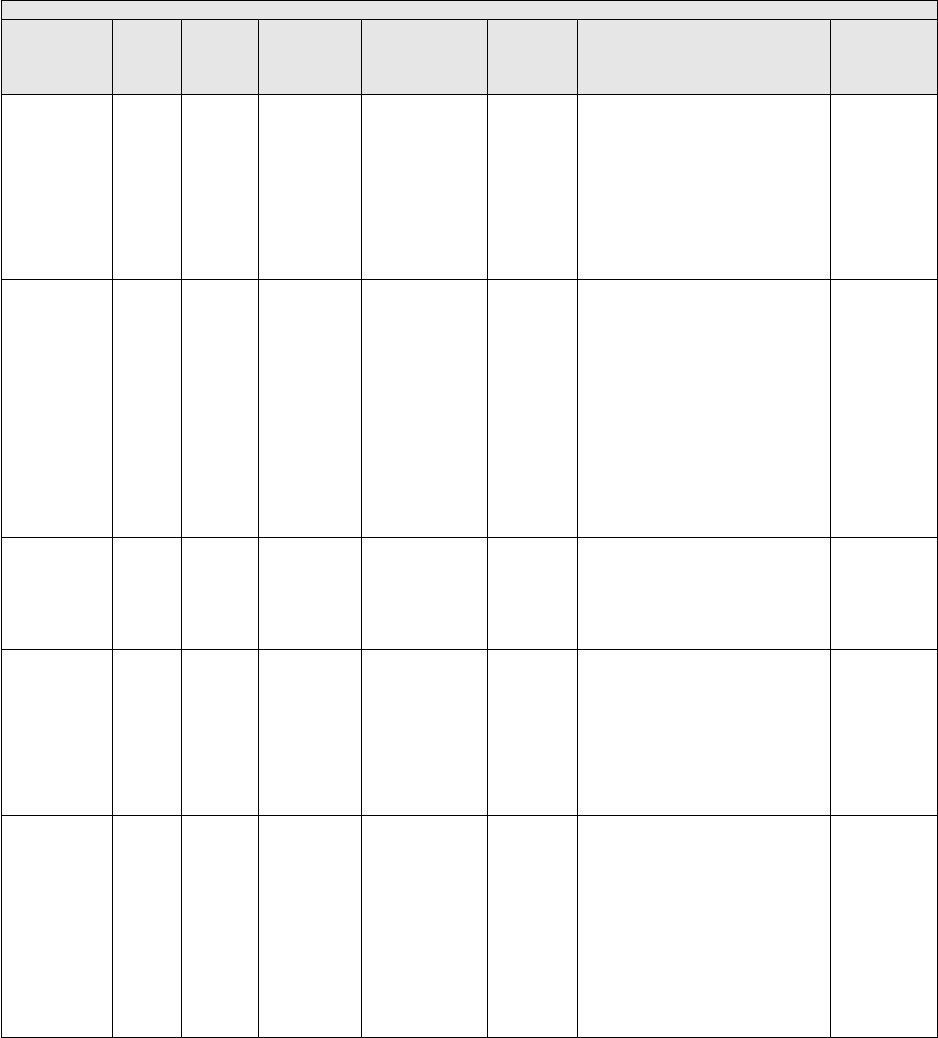

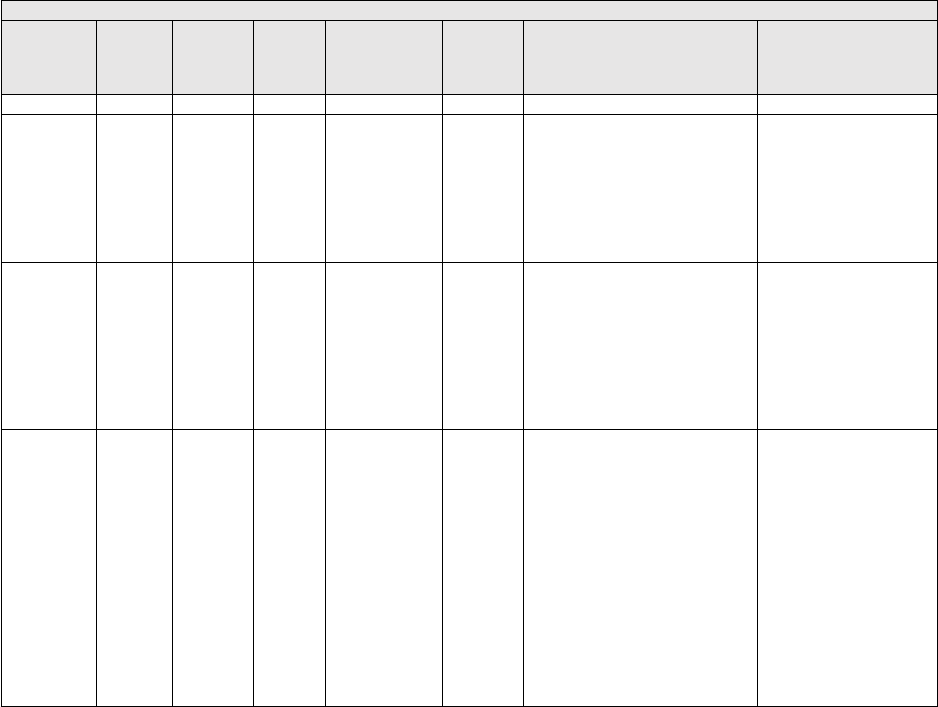

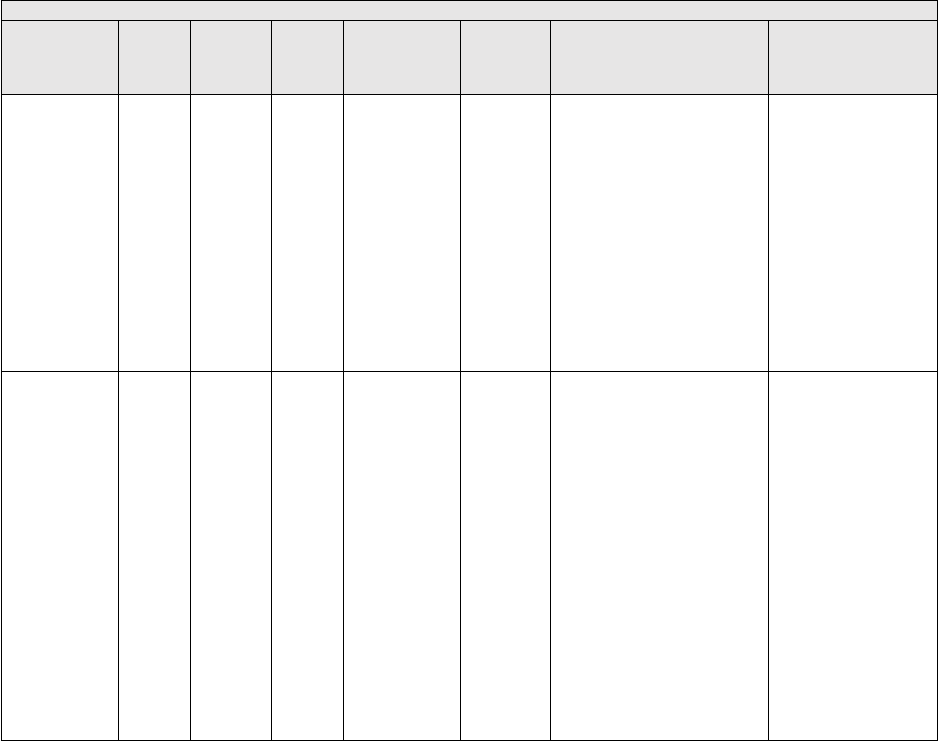

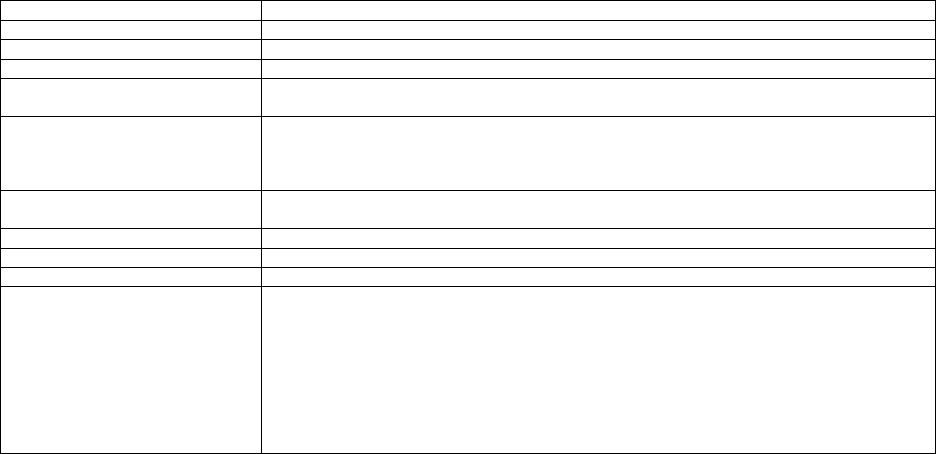

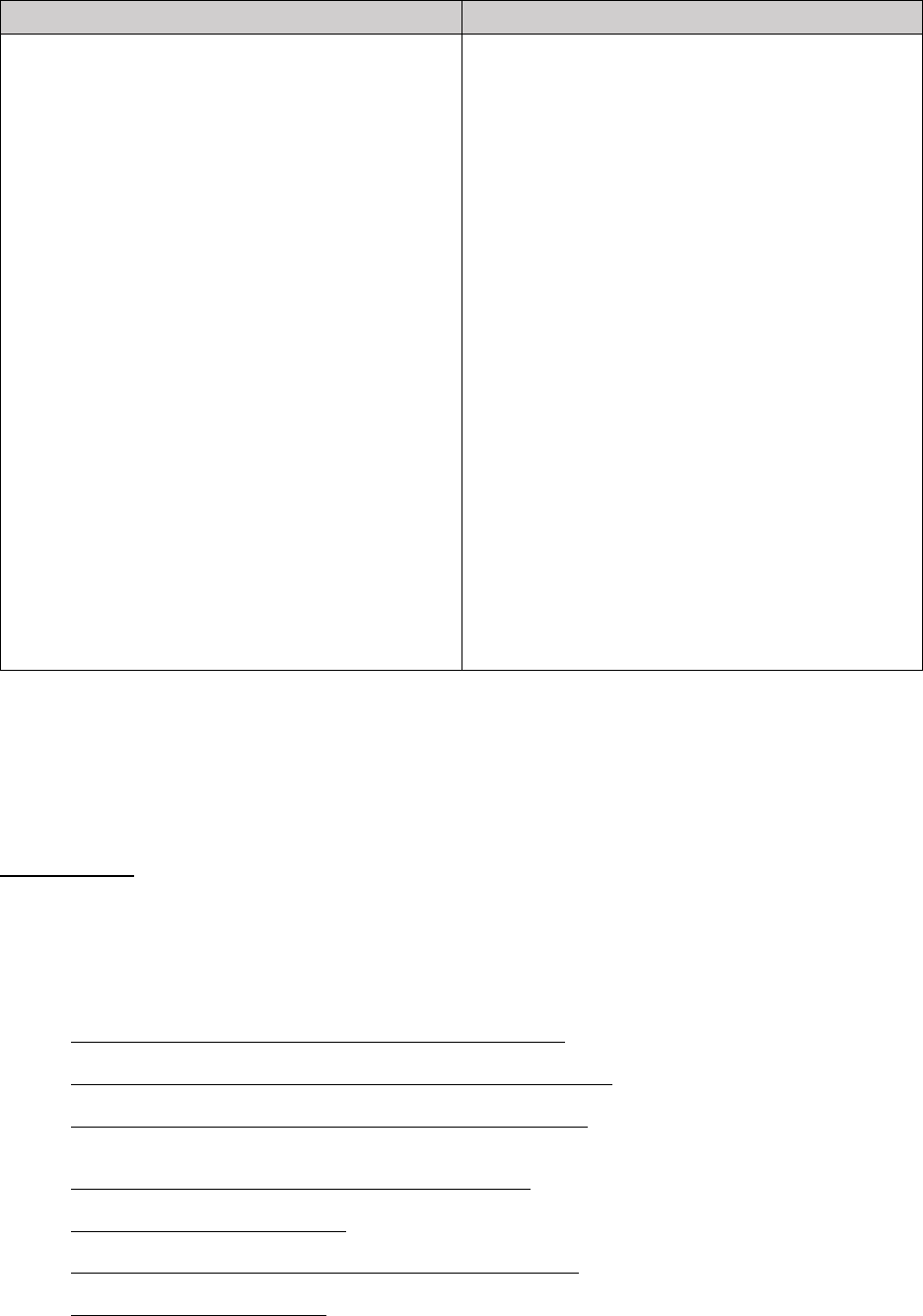

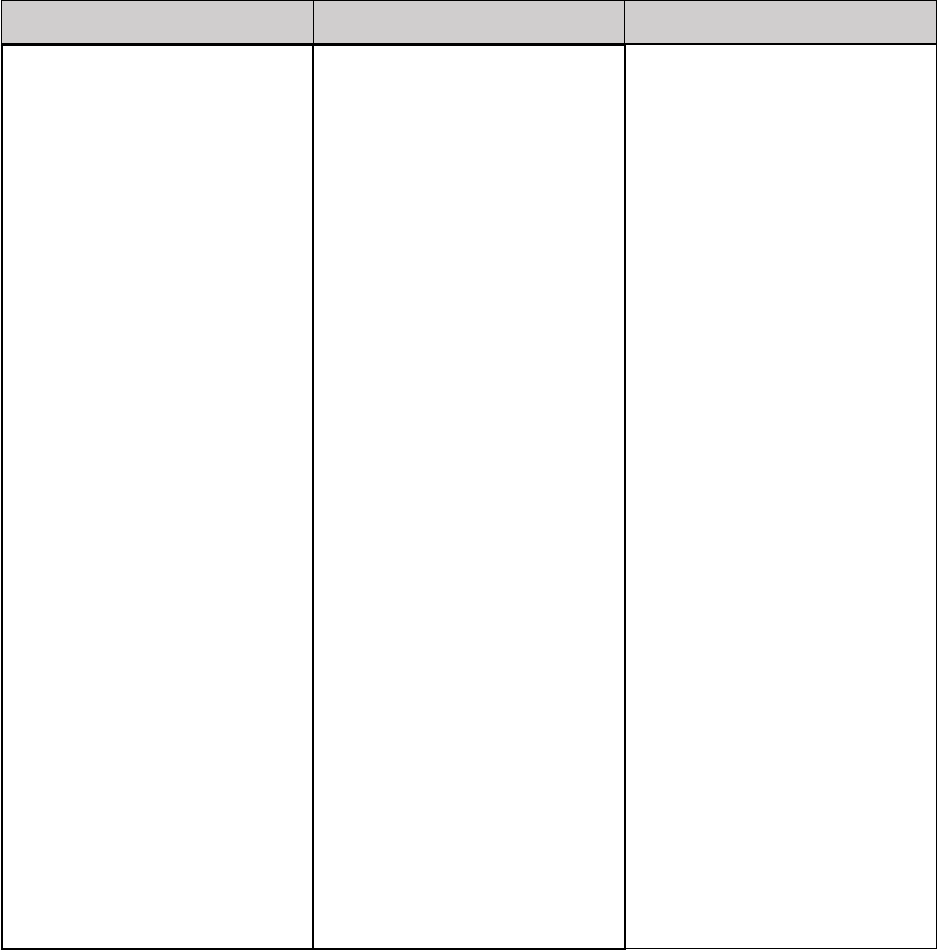

TABLE 2: Application of Payment Modifiers to Utilization Files

Modifier

Description

Volume Adjustment

Time Adjustment

80,81,82

Assistant at Surgery

16%

Intraoperative portion

AS

Assistant at Surgery –

Physician Assistant

14% (85% * 16%)

Intraoperative portion

50 or

LT and RT

Bilateral Surgery

150%

150% of work time

51

Multiple Procedure

50%

Intraoperative portion

52

Reduced Services

50%

50%

53

Discontinued Procedure

50%

50%

54

Intraoperative Care only

Preoperative + Intraoperative

Percentages on the payment files used

by Medicare contractors to process

Medicare claims

Preoperative + Intraoperative

portion

55

Postoperative Care only

Postoperative Percentage on the

payment files used by Medicare

contractors to process Medicare claims

Postoperative portion

62

Co-surgeons

62.5%

50%

66

Team Surgeons

33%

33%

CO, CQ

Physical and Occupational

Therapy Assistant Services

88%

88%

We also adjust volume and time that correspond to other payment rules, including special

multiple procedure endoscopy rules and multiple procedure payment reductions (MPPRs). We

note that section 1848(c)(2)(B)(v) of the Act exempts certain reduced payments for multiple

imaging procedures and multiple therapy services from the BN calculation under section

1848(c)(2)(B)(ii)(II) of the Act. These MPPRs are not included in the development of the

RVUs.

Beginning in CY 2022, section 1834(v)(1) of the Act required that we apply a 15 percent

payment reduction for outpatient occupational therapy services and outpatient physical therapy

services that are provided, in whole or in part, by a physical therapist assistant (PTA) or

occupational therapy assistant (OTA). Section 1834(v)(2)(A) of the Act required CMS to

establish modifiers to identify these services, which we did in the CY 2019 PFS final rule (83 FR

59654 through 59661), creating the CQ and CO payment modifiers for services provided in

whole or in part by PTAs and OTAs, respectively. These payment modifiers are required to be

used on claims for services with dates of service beginning January 1, 2020, as specified in the

CY 2020 PFS final rule (84 FR 62702 through 62708). We applied the 15 percent payment

reduction to therapy services provided by PTAs (using the CQ modifier) or OTAs (using the CO

modifier), as required by statute. Under sections 1834(k) and 1848 of the Act, payment is made

for outpatient therapy services at 80 percent of the lesser of the actual charge or applicable fee

schedule amount (the allowed charge). The remaining 20 percent is the beneficiary copayment.

For therapy services to which the new discount applies, payment will be made at 85 percent of

the 80 percent of allowed charges. Therefore, the volume discount factor for therapy services to

which the CQ and CO modifiers apply is: (0.20 + (0.80* 0.85), which equals 88 percent.

We note that for CY 2025, we are proposing mandatory use of the 54 and 55 modifiers

when practitioners furnishing global surgery procedures share in patient care and intend only to

furnish preoperative/intraoperative or postoperative portions of the total global procedure. If

finalized, this proposal will likely increase the number of claims subject to the adjustment

described in the discussion above. We discuss this proposal in section II.G. of this proposed

rule.

For anesthesia services, we do not apply adjustments to volume since we use the average

allowed charge when simulating RVUs; therefore, the RVUs as calculated already reflect the

payments as adjusted by modifiers, and no volume adjustments are necessary. However, a time

adjustment of 33 percent is made only for medical direction of two to four cases since that is the

only situation where a single practitioner is involved with multiple beneficiaries concurrently, so

that counting each service without regard to the overlap with other services would overstate the

amount of time spent by the practitioner furnishing these services.

● Work RVUs: The setup file contains the work RVUs from this proposed rule.

(6) Equipment Cost per Minute

The equipment cost per minute is calculated as:

(1/ (minutes per year * usage)) * price * ((interest rate/(1 (1/((1 + interest rate)^ life of

equipment)))) + maintenance)

Where:

minutes per year = maximum minutes per year if usage were continuous (that is,

usage=1); generally, 150,000 minutes.

usage = variable, see discussion below in this proposed rule.

price = price of the particular piece of equipment.

life of equipment = useful life of the particular piece of equipment.

maintenance = factor for maintenance; 0.05.

interest rate = variable, see discussion below in this proposed rule.

Usage: We currently use an equipment utilization rate assumption of 50 percent for most

equipment, with the exception of expensive diagnostic imaging equipment, for which we use a

90 percent assumption as required by section 1848(b)(4)(C) of the Act.

Useful Life: In the CY 2005 PFS final rule we stated that we updated the useful life for

equipment items primarily based on the AHA’s “Estimated Useful Lives of Depreciable Hospital

Assets” guidelines (69 FR 66246). The most recent edition of these guidelines was published in

2018. This reference material provides an estimated useful life for hundreds of different types of

equipment, the vast majority of which fall in the range of 5 to 10 years, and none of which are

lower than two years in duration. We believe that the updated editions of this reference material

remain the most accurate source for estimating the useful life of depreciable medical equipment.

In the CY 2021 PFS final rule, we finalized a proposal to treat equipment life durations of

less than 1 year as having a duration of 1 year for the purpose of our equipment price per minute

formula. In the rare cases where items are replaced every few months, we noted that we believe

it is more accurate to treat these items as disposable supplies with a fractional supply quantity as

opposed to equipment items with very short equipment life durations. For a more detailed

discussion of the methodology associated with very short equipment life durations, we refer

readers to the CY 2021 PFS final rule (85 FR 84482 through 84483).

● Maintenance: We finalized the 5 percent factor for annual maintenance in the CY

1998 PFS final rule with comment period (62 FR 33164). As we previously stated in the CY

2016 PFS final rule with comment period (80 FR 70897), we do not believe the annual

maintenance factor for all equipment is precisely 5 percent, and we concur that the current rate

likely understates the true cost of maintaining some equipment. We also noted that we believe it

likely overstates the maintenance costs for other equipment. When we solicited comments

regarding data sources containing equipment maintenance rates, commenters could not identify

an auditable, robust data source that CMS could use on a wide scale. We noted that we did not

believe voluntary submissions regarding the maintenance costs of individual equipment items

would be an appropriate methodology for determining costs. As a result, in the absence of

publicly available datasets regarding equipment maintenance costs or another systematic data

collection methodology for determining a different maintenance factor, we did not propose a

variable maintenance factor for equipment cost per minute pricing as we did not believe that we

have sufficient information at present. We noted that we would continue to investigate potential

avenues for determining equipment maintenance costs across a broad range of equipment items.

● Interest Rate: In the CY 2013 PFS final rule with comment period (77 FR 68902), we

updated the interest rates used in developing an equipment cost per minute calculation (see 77

FR 68902 for a thorough discussion of this issue). The interest rate was based on the Small

Business Administration (SBA) maximum interest rates for different categories of loan size

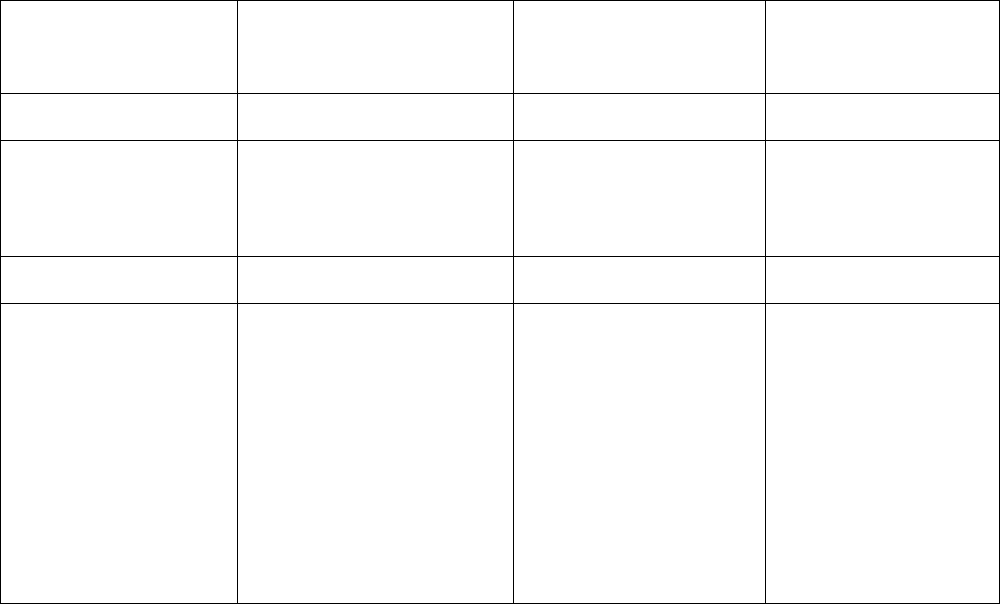

(equipment cost) and maturity (useful life). The Interest rates are listed in Table 3.

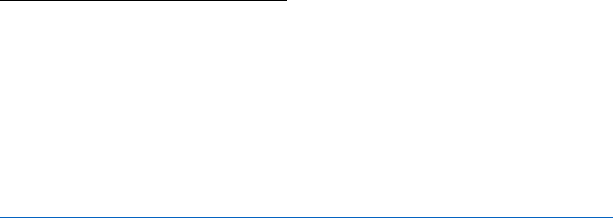

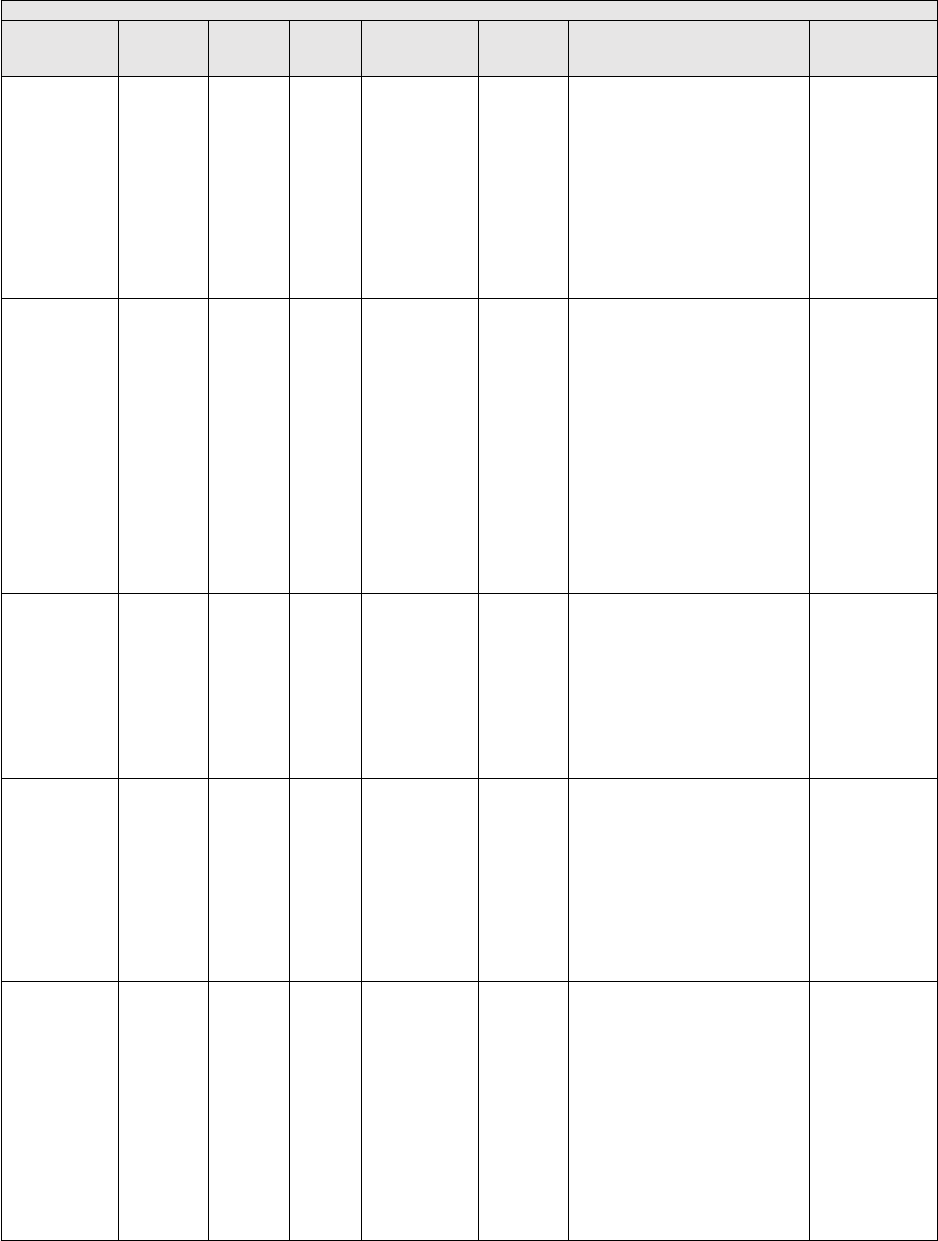

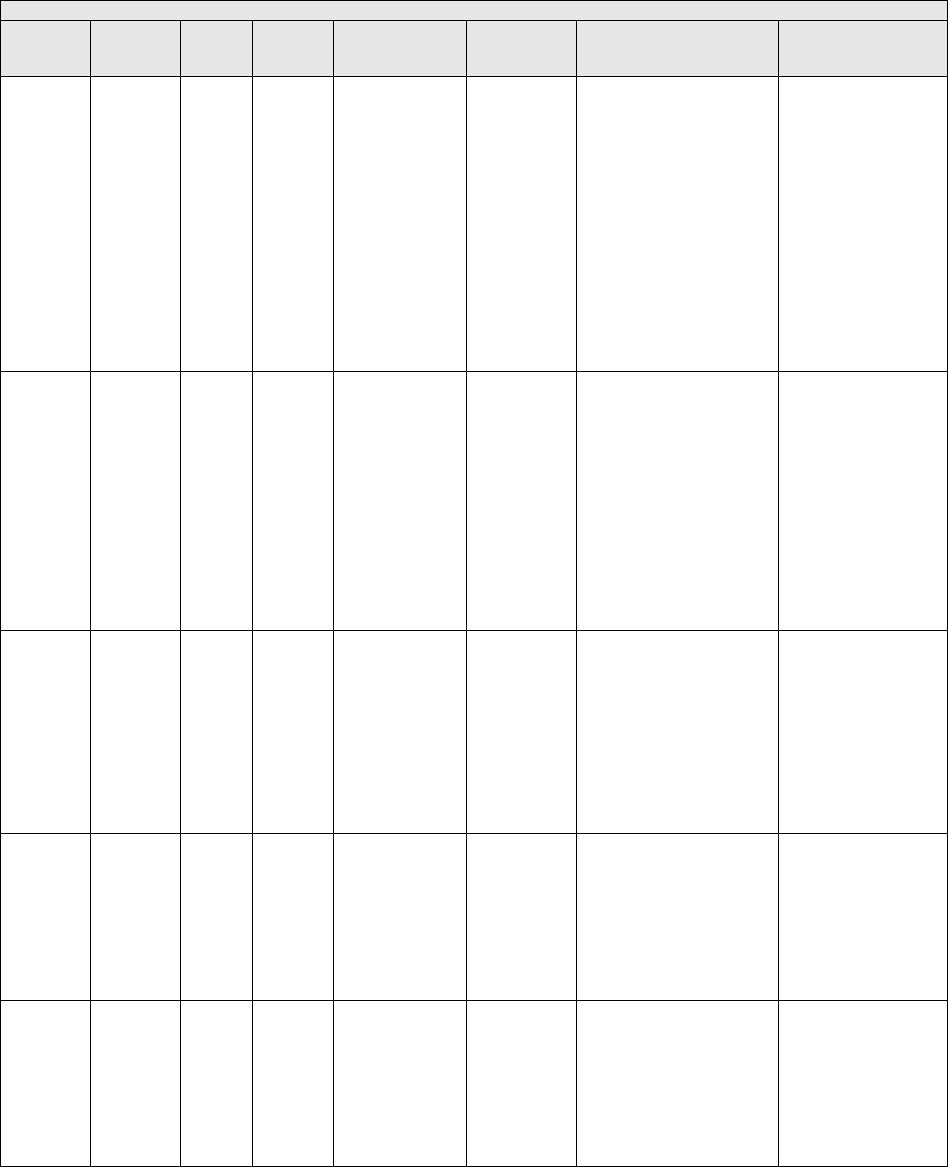

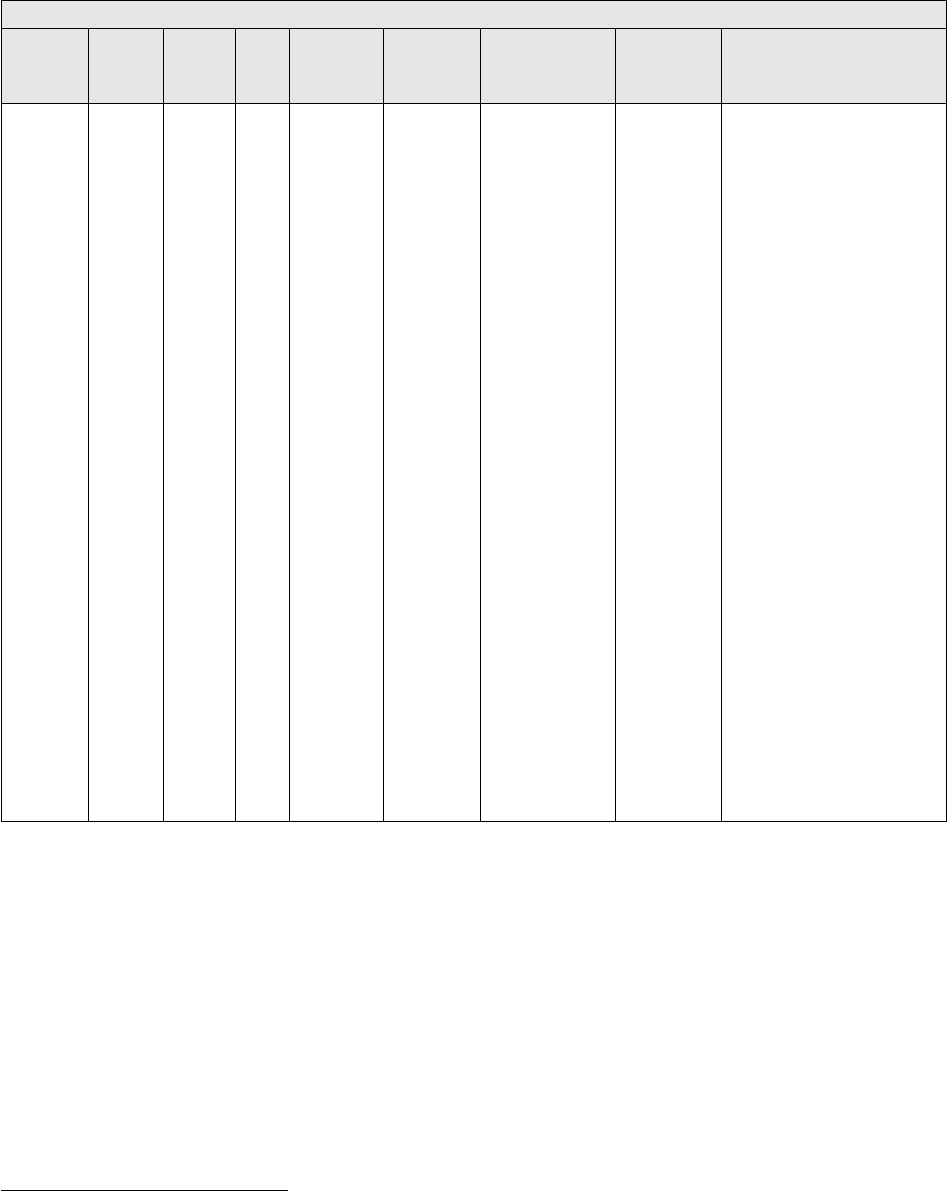

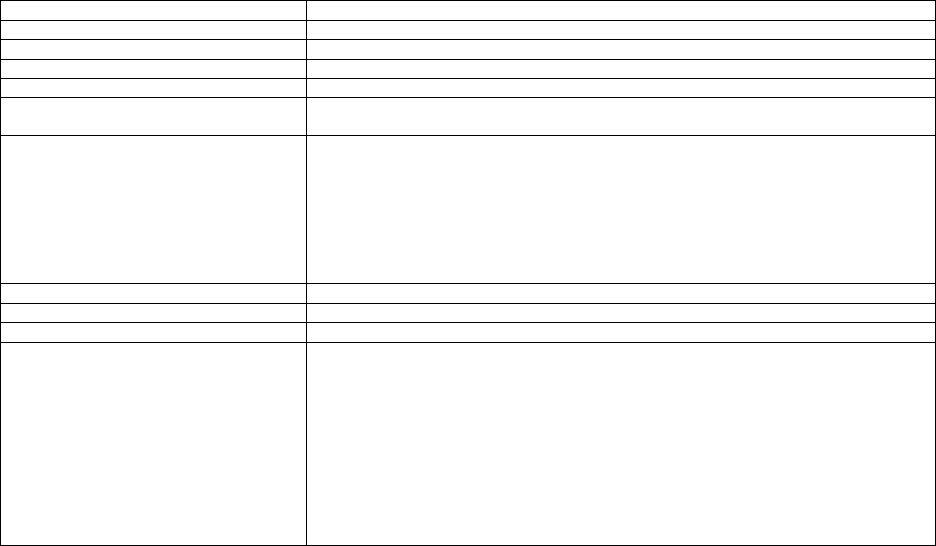

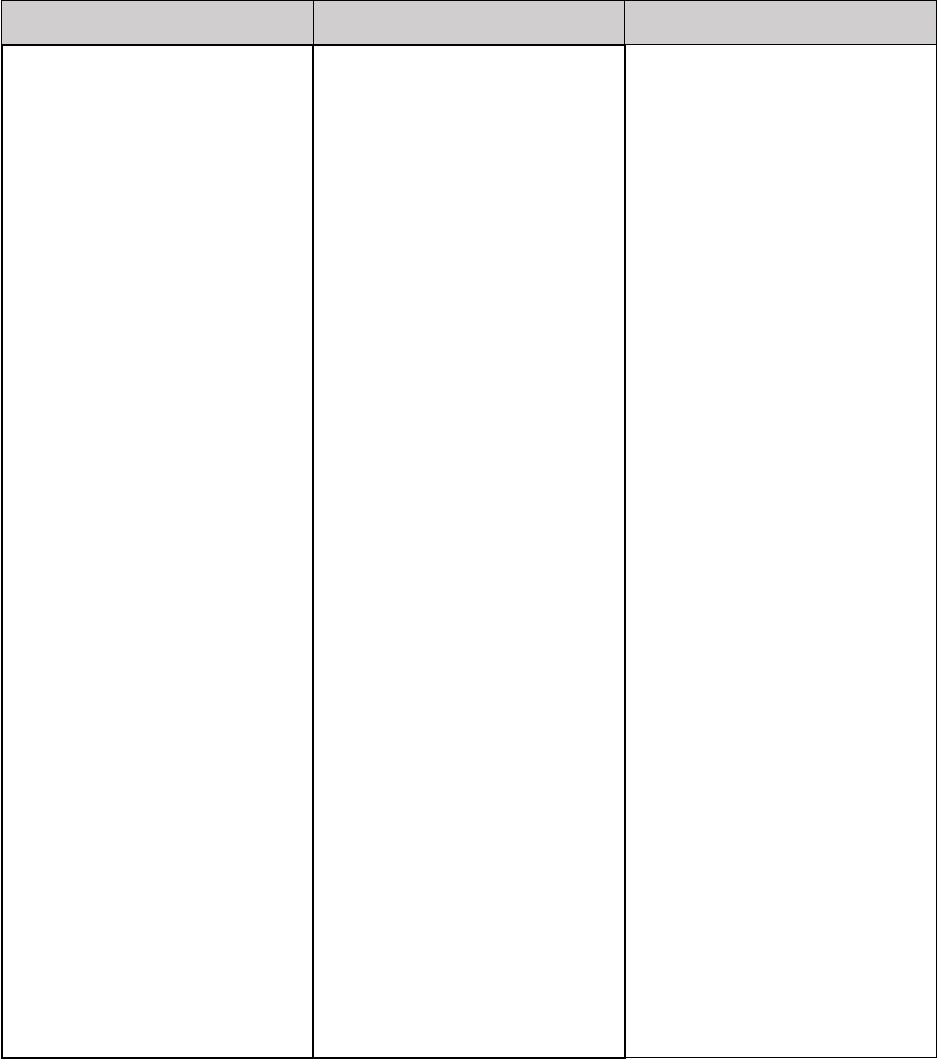

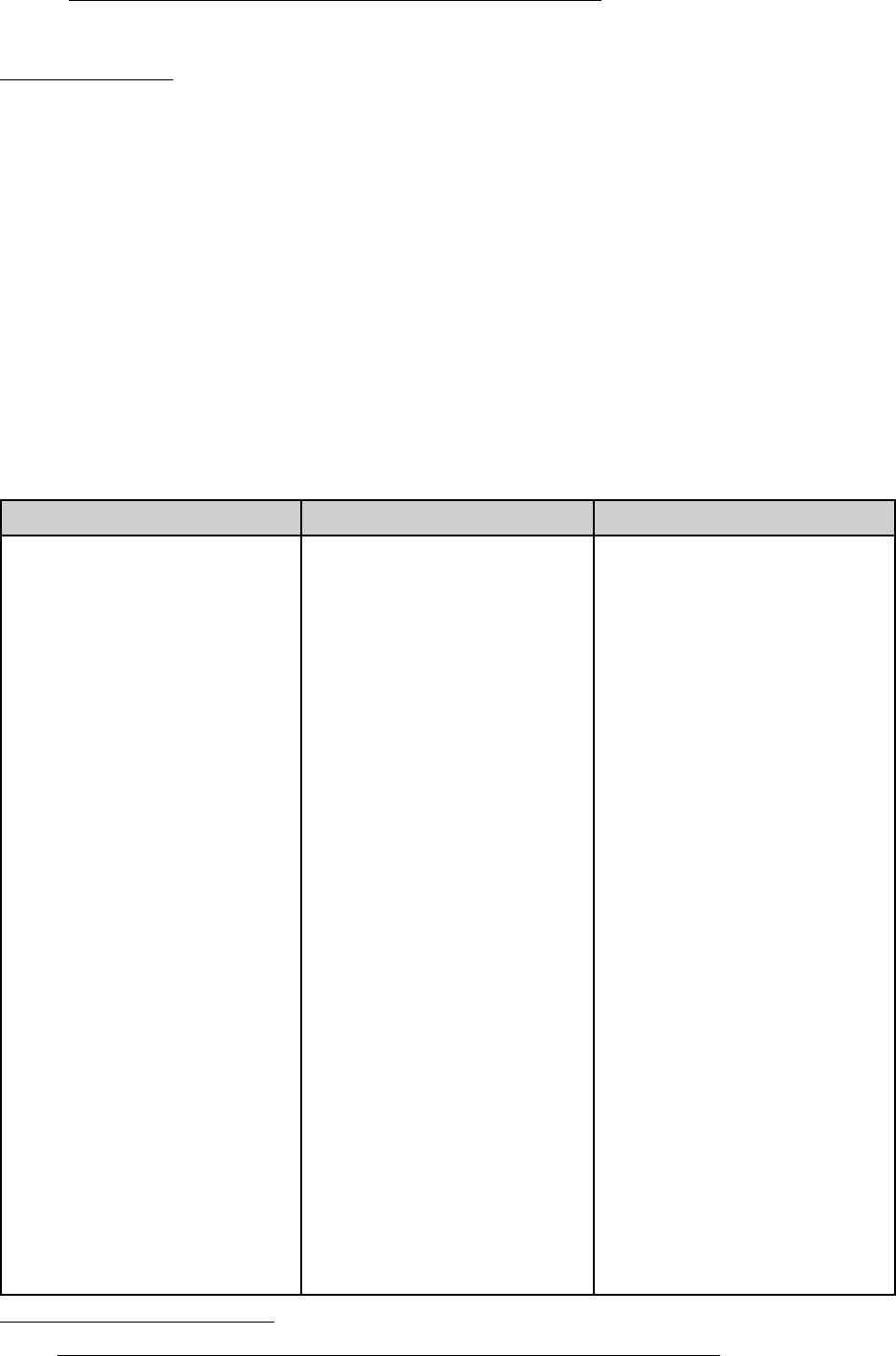

TABLE 3: SBA Maximum Interest Rates

Price

Useful Life

Interest Rate

<$25K

<7 Years

7.50%

$25K to $50K

<7 Years

6.50%

>$50K

<7 Years

5.50%

<$25K

7+ Years

8.00%

$25K to $50K

7+ Years

7.00%

>$50K

7+ Years

6.00%

We are not proposing any changes to the equipment interest rates for CY 2025.

3. Adjusting RVUs To Match the PE Share of the Medicare Economic Index (MEI)

In the past, we have stated that we believe that the MEI is the best measure available of

the relative weights of the three components in payments under the PFS—work, practice expense

(PE), and malpractice (MP). Accordingly, we believe that to ensure that the PFS payments

reflect the relative resources in each of these PFS components as required by section 1848(c)(3)

of the Act, the RVUs used in developing rates should reflect the same weights in each

component as the cost share weights in the Medicare Economic Index (MEI). In the past, we

have proposed (and subsequently finalized) to accomplish this by holding the work RVUs

constant and adjusting the PE RVUs, MP RVUs, and CF to produce the appropriate balance in

RVUs among the three PFS components and payment rates for individual services, that is, that

the total RVUs on the PFS are proportioned to approximately 51 percent work RVUs, 45 percent

PE RVUs, and 4 percent MP RVUs. As the MEI cost shares are updated, we would typically

propose to modify steps 3 and 10 to adjust the aggregate pools of PE costs (direct PE in step 3

and indirect PE in step 10) in proportion to the change in the PE share in the rebased and revised

MEI cost share weights, and to recalibrate the relativity adjustment that we apply in step 18 as

described in the CY 2023 PFS final rule (87 FR 69414 and 69415) and CY 2014 PFS final rule

(78 FR 74236 and 74237). The most recent recalibration was done for the CY 2014 RVUs.

In the CY 2014 PFS proposed rule (78 FR 43287 through 43288) and final rule (78 FR

74236 through 74237), we detailed the steps necessary to accomplish this result (see steps 3, 10,

and 18). The CY 2014 proposed and final adjustments were consistent with our longstanding

practice to make adjustments to match the RVUs for the PFS components with the MEI cost

share weights for the components, including the adjustments described in the CY 1999 PFS final

rule (63 FR 58829), CY 2004 PFS final rule (68 FR 63246 and 63247), and CY 2011 PFS final

rule (75 FR 73275).

In the CY 2023 PFS final rule (87 FR 69688 through 69711), we finalized to rebase and

revise the MEI to reflect more current market conditions faced by physicians in furnishing

physicians' services (referred to as the “2017-based MEI”). We also finalized a delay of the

adjustments to the PE pools in steps 3 and 10 and the recalibration of the relativity adjustment in

step 18 until the public had an opportunity to comment on the rebased and revised MEI (87 FR

69414 through 69416). Because we finalized significant methodological and data source

changes to the MEI in the CY 2023 PFS final rule and significant time has elapsed since the last

rebasing and revision of the MEI in CY 2014, we believed that delaying the implementation of

the finalized CY 2023 rebased and revised MEI was consistent with our efforts to balance

payment stability and predictability with incorporating new data through more routine updates.

We refer readers to the discussion of our comment solicitation in the CY 2023 PFS final rule (87

FR 69429 through 69432), where we reviewed our ongoing efforts to update data inputs for PE

to aid stability, transparency, efficiency, and data adequacy. We also solicited comment in the

CY 2023 PFS proposed rule on when and how to best incorporate the CY 2023 rebased and

revised MEI into PFS ratesetting, and whether it would be appropriate to consider a transition to

full implementation for potential future rulemaking. We presented the impacts of implementing

the rebased and revised MEI in PFS ratesetting through a 4-year transition and through full

immediate implementation, that is, with no transition period in the CY 2023 PFS proposed rule.

We also solicited comment on other implementation strategies for potential future rulemaking in

the CY 2023 PFS proposed rule. In the CY 2023 PFS final rule, we discussed that many

commenters supported our proposed delayed implementation, and many commenters expressed

concerns with the redistributive impacts of the implementation of the rebased and revised MEI in

PFS ratesetting. Many commenters also noted the AMA’s intent to collect practice cost data

from physician practices, which could be used to derive cost share weights for the MEI and RVU

shares.

In light of the AMA’s current data collection efforts and because the methodological and

data source changes to the MEI finalized in the CY 2023 PFS final rule would have significant

impacts on PFS payments, similar to our discussion of this topic in the CY 2024 PFS rulemaking

cycle (88 FR 78829 through 78831), we continue to believe that delaying the implementation of

the finalized 2017-based MEI cost share weights for the RVUs is consistent with our efforts to

balance payment stability and predictability with incorporating new data through more routine

updates. For these reasons, we did not propose to incorporate the 2017-based MEI in PFS

ratesetting for CY 2024. As we noted in the CY 2024 PFS final rule, many commenters on the

CY 2024 PFS proposed rule supported our continued delayed implementation of the 2017-based

MEI in PFS ratesetting (88 FR 78830). Most of these commenters urged us to pause

consideration of other sources for the MEI until the AMA’s efforts to collect practice cost data

from physician practices have concluded, although a few commenters recommended that we

implement the MEI for PFS ratesetting as soon as possible. We agree with the commenters that

it would be prudent, and avoid potential duplication of effort, to wait to consider other data

sources for the MEI while the AMA’s data collection activities are ongoing. As we discussed in

the CY 2024 PFS final rule, we continue to monitor the data available related to physician

services' input expenses, but we are not proposing to update the data underlying the MEI cost

weights at this time. Given our previously described policy goal to balance PFS payment

stability and predictability with incorporating new data through more routine updates to the MEI,

we are not proposing to incorporate the 2017-based MEI in PFS ratesetting for CY 2025. We

invite comments on this approach as well as any information on the timing of the AMA’s

practice cost data collection efforts and other sources of data we could consider for updating the

MEI.

4. Changes to Direct PE Inputs for Specific Services

This section focuses on specific PE inputs. The direct PE inputs are included in the CY

2025 direct PE input public use files, which are available on the CMS website under downloads

for the CY 2025 PFS proposed rule at https://www.cms.gov/Medicare/Medicare-Fee-for-Service-

Payment/PhysicianFeeSched/PFS-Federal-Regulation-Notices.html.

a. Standardization of Clinical Labor Tasks

As we noted in the CY 2015 PFS final rule with comment period (79 FR 67640 through

67641), we continue to make improvements to the direct PE input database to provide the

number of clinical labor minutes assigned for each task for every code in the database instead of

only including the number of clinical labor minutes for the preservice, service, and post service

periods for each code. In addition to increasing the transparency of the information used to set

PE RVUs, this level of detail would allow us to compare clinical labor times for activities

associated with services across the PFS, which we believe is important to maintaining the

relativity of the direct PE inputs. This information would facilitate the identification of the usual

numbers of minutes for clinical labor tasks and the identification of exceptions to the usual

values. It would also allow for greater transparency and consistency in the assignment of

equipment minutes based on clinical labor times. Finally, we believe that the detailed

information can be useful in maintaining standard times for particular clinical labor tasks that can

be applied consistently to many codes as they are valued over several years, similar in principle

to physician preservice time packages. We believe that setting and maintaining such standards

would provide greater consistency among codes that share the same clinical labor tasks and

could improve the relativity of values among codes. For example, as medical practice and

technologies change over time, standards could be updated simultaneously for all codes with the

applicable clinical labor tasks instead of waiting for individual codes to be reviewed.

In the CY 2016 PFS final rule with comment period (80 FR 70901), we solicited

comments on the appropriate standard minutes for the clinical labor tasks associated with

services that use digital technology. After consideration of comments received, we finalized

standard times for clinical labor tasks associated with digital imaging at 2 minutes for

“Availability of prior images confirmed”, 2 minutes for “Patient clinical information and

questionnaire reviewed by technologist, order from physician confirmed and exam protocoled by

radiologist”, 2 minutes for “Review examination with interpreting MD”, and 1 minute for “Exam

documents scanned into PACS” and “Exam completed in RIS system to generate billing process

and to populate images into Radiologist work queue.” In the CY 2017 PFS final rule (81 FR

80184 through 80186), we finalized a policy to establish a range of appropriate standard minutes

for the clinical labor activity, “Technologist QCs images in PACS, checking for all images,

reformats, and dose page.” These standard minutes will be applied to new and revised codes that

make use of this clinical labor activity when they are reviewed by us for valuation. We finalized

a policy to establish 2 minutes as the standard for the simple case, 3 minutes as the standard for

the intermediate case, 4 minutes as the standard for the complex case, and 5 minutes as the

standard for the highly complex case. These values were based upon a review of the existing

minutes assigned for this clinical labor activity; we determined that 2 minutes is the duration for

most services and a small number of codes with more complex forms of digital imaging have

higher values. We also finalized standard times for a series of clinical labor tasks associated

with pathology services in the CY 2016 PFS final rule with comment period (80 FR 70902). We

do not believe these activities would be dependent on number of blocks or batch size, and we

believe that the finalized standard values accurately reflect the typical time it takes to perform

these clinical labor tasks.

In reviewing the RUC-recommended direct PE inputs for CY 2019, we noticed that the 3

minutes of clinical labor time traditionally assigned to the “Prepare room, equipment and

supplies” (CA013) clinical labor activity were split into 2 minutes for the “Prepare room,

equipment and supplies” activity and 1 minute for the “Confirm order, protocol exam” (CA014)

activity. We proposed to maintain the 3 minutes of clinical labor time for the “Prepare room,

equipment and supplies” activity and remove the clinical labor time for the “Confirm order,

protocol exam” activity wherever we observed this pattern in the RUC-recommended direct PE

inputs. Commenters explained in response that when the new version of the PE worksheet

introduced the activity codes for clinical labor, there was a need to translate old clinical labor

tasks into the new activity codes, and that a prior clinical labor task was split into two of the new

clinical labor activity codes: CA007 (Review patient clinical extant information and

questionnaire) in the preservice period, and CA014 (Confirm order, protocol exam) in the

service period. Commenters stated that the same clinical labor from the old PE worksheet was

now divided into the CA007 and CA014 activity codes, with a standard of 1 minute for each

activity. We agreed with commenters that we would finalize the RUC-recommended 2 minutes

of clinical labor time for the CA007 activity code and 1 minute for the CA014 activity code in

situations where this was the case. However, when reviewing the clinical labor for the reviewed

codes affected by this issue, we found that several of the codes did not include this old clinical

labor task, and we also noted that several of the reviewed codes that contained the CA014

clinical labor activity code did not contain any clinical labor for the CA007 activity. In these

situations, we believe that the three total minutes of clinical staff time would be more accurately

described by the CA013 “Prepare room, equipment and supplies” activity code, and we finalized

these clinical labor refinements. We direct readers to the discussion in the CY 2019 PFS final

rule (83 FR 59463 through 59464) for additional details.

Following the publication of the CY 2020 PFS proposed rule, one commenter expressed

concern with the published list of common refinements to equipment time. The commenter

stated that these refinements were the formulaic result of applying refinements to the clinical

labor time and did not constitute separate refinements; the commenter requested that CMS no

longer include these refinements in the table published each year. In the CY 2020 PFS final rule,

we agreed with the commenter that these equipment time refinements did not reflect errors in the

equipment recommendations or policy discrepancies with the RUC’s equipment time

recommendations. However, we believed it was important to publish the specific equipment

times that we were proposing (or finalizing in the case of the final rule) when they differed from

the recommended values due to the effect these changes can have on the direct costs associated

with equipment time. Therefore, we finalized the separation of the equipment time refinements

associated with changes in clinical labor into a separate table of refinements. We direct readers

to the discussion in the CY 2020 PFS final rule (84 FR 62584) for additional details.

Historically, the RUC has submitted a “PE worksheet” that details the recommended

direct PE inputs for our use in developing PE RVUs. The format of the PE worksheet has varied

over time, and among the medical specialties developing the recommendations. These variations

have made it difficult for the RUC’s development and our review of code values for individual

codes. Beginning with its recommendations for CY 2019, the RUC mandated the use of a new

PE worksheet for its recommendation development process that standardizes the clinical labor

tasks and assigns them a clinical labor activity code. We believe the RUC’s use of the new PE

worksheet in developing and submitting recommendations helps us simplify and standardize the

hundreds of clinical labor tasks currently listed in our direct PE database. As in previous

calendar years, to facilitate rulemaking for CY 2025, we are continuing to display two versions

of the Labor Task Detail public use file: one version with the old listing of clinical labor tasks

and one with the same tasks crosswalked to the new listing of clinical labor activity codes.

These lists are available on the CMS website under downloads for the CY 2025 PFS proposed

rule at https://www.cms.gov/Medicare/Medicare-Fee-for-Service-

Payment/PhysicianFeeSched/PFS-Federal-Regulation-Notices.html.

b. Updates to Prices for Existing Direct PE Inputs

In the CY 2011 PFS final rule with comment period (75 FR 73205), we finalized a

process to act on public requests to update equipment and supply price and equipment useful life

inputs through annual rulemaking, beginning with the CY 2012 PFS proposed rule. Beginning in

CY 2019 and continuing through CY 2022, we conducted a market-based supply and equipment

pricing update using information developed by our contractor, StrategyGen, which updated

pricing recommendations for approximately 1300 supplies and 750 equipment items currently

used as direct PE inputs. Given the potentially significant changes in payment that would occur,

in the CY 2019 PFS final rule, we finalized a policy to phase in our use of the new direct PE

input pricing over a 4-year period using a 25/75 percent (CY 2019), 50/50 percent (CY 2020),

75/25 percent (CY 2021), and 100/0 percent (CY 2022) split between new and old pricing. We

believed that implementing the proposed updated prices with a 4-year phase-in would improve

payment accuracy while maintaining stability and allowing interested parties to address potential

concerns about changes in payment for particular items. This 4-year transition period to update

supply and equipment pricing concluded in CY 2022; for a more detailed discussion, we refer

readers to the CY 2019 PFS final rule with comment period (83 FR 59473 through 59480).

For CY 2025, we are proposing to update the price of 17 supplies and one equipment

item in response to the public submission of invoices following the publication of the CY 2024

PFS final rule. The 18 supply and equipment items with proposed updated prices are listed in the

valuation of specific codes section of the preamble under Table 16, CY 2025 Invoices Received

for Existing Direct PE Inputs.

An interested party submitted 30 invoices to update pricing for the human amniotic

membrane allograft mounted on a non-absorbable self-retaining ring (SD248) supply. We

previously updated the price of this supply in the CY 2024 final rule (88 FR 78901) based on

averaging together the price of the Prokera Slim, Prokera Classic, and Prokera Plus devices. The

interested party submitted new invoices for all three of these devices which averaged to a new