Contents

Executive Summary............................................................................................................................ 3

Overview ............................................................................................................................................ 4

General IC3 Filing Information.......................................................................................................... 4

Complaint Characteristics................................................................................................................... 6

Perpetrator Characteristics.................................................................................................................. 8

Complainant Characteristics............................................................................................................... 10

Complainant-Perpetrator Dynamics ................................................................................................... 13

Additional Information About IC3 Referrals.................................................................................…..14

Results of IC3 Referrals ................................................................................................................…..15

Conclusion.....................................................................................................................................…..16

Appendix I: Explanation of Complaint Categories........................................................................…..18

Appendix II: Best Practices to Prevent Internet Fraud ..................................................................…..19

Appendix III: Complainant/Perpetrator Statistics, by State...........................................................…..23

2

The Internet Crime Complaint Center

2005 Internet Fraud Crime Report:

January 1, 2005-December 31, 2005

Executive Summary

In December 2003, the Internet Fraud Complaint Center (IFCC) was renamed the Internet Crime Complaint Center

(IC3) to better reflect the broad character of such criminal matters having a cyber (Internet) nexus. The 2005 Internet

Crime Report is the fifth annual compilation of information on complaints received and referred by the IC3 to law

enforcement or regulatory agencies for appropriate action. From January 1, 2005 – December 31, 2005, the IC3

website received 231,493 complaint submissions. This is an 11.6% increase over 2004 when 207,449 complaints

were received. These filings were composed of fraudulent and non-fraudulent complaints primarily related to the

Internet.

In 2005, IC3 processed more than 228,400 complaints that could lead to Internet crime investigations by law

enforcement and regulatory agencies nationwide. These complaints were composed of many different fraud types

such as auction fraud, non-delivery, and credit/debit card fraud, as well as non-fraudulent complaints, such as

computer intrusions, spam/unsolicited e-mail, and child pornography. All of these complaints are accessible to

federal, state, and local law enforcement to support active investigations, trend analysis, and public outreach and

awareness efforts.

From the submissions, IC3 referred 97,076 complaints of crime to federal, state, and local law enforcement agencies

around the country for further consideration. The vast majority of cases were fraudulent in nature and involved a

financial loss on the part of the complainant. The total dollar loss from all referred cases of fraud was $183.12

million with a median dollar loss of $424.00 per complaint. This is up from $68 million in total reported losses in

2004. Other significant findings related to an analysis of referrals include:

• Internet auction fraud was by far the most reported offense, comprising 62.7% of referred complaints. Non-

delivered merchandise and/or payment accounted for 15.7% of complaints. Credit/debit card fraud made up

6.8% of complaints. Check fraud, investment fraud, computer fraud, and confidence fraud round out the top

seven categories of complaints referred to law enforcement during the year.

• Of those individuals who reported a dollar loss, the highest median losses were found among Nigerian letter

fraud ($5,000), check fraud ($3,800), and other confidence fraud ($2,025) complainants.

• Among perpetrators, nearly 75.4% were male and half resided in one of the following states: California, New

York, Florida, Texas, Illinois, Pennsylvania and Ohio. The majority of reported perpetrators were from the

United States. However, a significant number of perpetrators where also located in Nigeria, United Kingdom,

Canada, Italy, and China.

• Among complainants, 64.0% were male, nearly half were between the ages of 30 and 50 (average age 40.2) and

one-third resided in one of the four most populated states: California, Florida, Texas, and New York. While

most were from the United States, IC3 received a number of complaints from Canada, Australia, Great Britain,

Germany, and Japan.

• Males lost more money than females (ratio of $1.86 dollars lost per male to every $1.00 dollar lost per female).

This may be a function of both online purchasing differences by gender and the type of fraudulent schemes by

which the individuals were victimized.

• Electronic mail (E-mail) and web pages were the two primary mechanisms by which the fraudulent contact took

place. In all, 73.2% of complainants reported that they had e-mail contact with the perpetrator and 16.5% had

contact through a web page.

• Recent high activity scams seen by IC3 include Super Bowl Tickets scams, phishing attempts associated with

spoofed sites, re-shipping, eBay account takeovers, natural disaster fraud, and international lottery scams.

3

Overview

The Internet Crime Complaint Center (IC3), which began operation on May 8, 2000, as the Internet Fraud

Complaint Center was established as a partnership between the National White Collar Crime Center (NW3C) and

the Federal Bureau of Investigation (FBI) to serve as a vehicle to receive, develop, and refer criminal complaints

regarding the rapidly expanding arena of cyber crime. IC3 was intended and continues to emphasize serving the

broader law enforcement community, including federal, state and local agencies, which employ key participants in

the growing number of Cyber Crime Task Forces. Since its inception, IC3 has received complaints across a wide

variety of cyber crime matters, including online fraud (in its many forms), intellectual property rights (IPR) matters,

computer intrusions (hacking), economic espionage (theft of trade secrets), child pornography, international money

laundering, identity theft, and a growing list of additional criminal matters.

IC3's mission is to serve as a vehicle to receive, develop, and refer criminal complaints regarding the rapidly

expanding arena of cyber crime. IC3 gives the victims of cyber crime a convenient and easy-to-use reporting

mechanism that alerts authorities of suspected criminal or civil violations. For law enforcement and regulatory

agencies at the federal, state, and local level, IC3 provides a central referral mechanism for complaints involving

Internet related crimes. Significant and supplemental to partnering with law enforcement and regulatory agencies, it

will remain a priority objective of IC3 to establish effective alliances with industry. Such alliances will enable IC3 to

leverage both intelligence and subject matter expert resources, pivotal in identifying and crafting an aggressive,

proactive approach to combating cyber crime. In 2005 the IC3 has seen an increase in several additional crimes that

are exclusively related to the Internet. Phishing, spoofing, and spam complaints have increased over the past year.

Overall, the “IC3 2005 Internet Crime Report” is the fifth annual compilation of information on complaints received

and referred by IC3 to law enforcement or regulatory agencies for appropriate action. The results provide an

examination of key characteristics of 1) complaints, 2) perpetrators, 3) complainants, 4) interaction between

perpetrators and complainants, and 5) success stories involving complaints referred by IC3. The results in this

report are intended to enhance our general knowledge about the scope and prevalence of Internet fraud in the United

States. This report does not represent all victims of Internet fraud, or fraud in general, because it is derived solely

from the people who filed a report with IC3.

General IC3 Filing Information

Internet crime complaints are primarily submitted to IC3 online at www.ic3.gov or www.ic3.gov. Complainants

without Internet access can submit information via telephone. After a complaint is filed with IC3, the information is

reviewed, categorized, and referred to the appropriate enforcement or regulatory agency.

From January 1, 2005 – December 31, 2005, there were 231,493 complaints filed online with IC3. This is an 11.6%

increase over 2004 when 207,449 complaints were received. The number of complaints filed for the first three

quarters remained steady with a significant increase in the fourth quarter. The fourth quarter had a record number of

69,625 complaints filed. Additionally, complaint submissions have increased annually (see Chart 1 and 2). The

number of complaints filed per month, last year, averaged 19,291. Dollar loss of referred complaints was at an all

time high in 2005, $183.12 million, compared to previous years (see Chart 4).

The number of referred complaints has seen a slight drop in the number of complaints referred in 2005 due,

primarily, to a change in how zero dollar loss complaints are handled and the rise in complaints associated with

federal investigations stemming from fraud surrounding natural disasters such as Hurricane Katrina, Hurricane Rita,

and the tsunami disaster of southeast Asia as well as the FBI Virus Spam operation (see Chart 3). These, 131,331

complaints that were not directly referred to law enforcement are accessible to law enforcement, used in trend

analysis, and also help provide a basis for future outreach events and educational awareness programs. Typically,

these complaints do not represent dollar loss but provide a picture of the types of scams that are emerging via the

Internet. These complaints in large part are comprised of fraud involving reshipping, counterfeit checks, phishing,

etc.

During 2005, there were 228,407 complaints processed on behalf of the complainants. This total includes various

crime types, such as auction fraud, non-delivery, and credit/debit card fraud, as well as non-fraudulent complaints,

such as computer intrusions, spam, and child pornography.

4

Chart 1

Yearly Comparison of Complaints Received Via the IC3 Website

0

50000

100000

150000

200000

250000

2000 2001 2002 2003 2004 2005

Chart 2

Monthly Comparison of Complaints Received Via theIC3 Website

0

5000

10000

15000

20000

25000

30000

Jan Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec

2000

2001

2002

2003

2004

2005

5

Chart 3

0

20000

40000

60000

80000

100000

120000

2001 2002 2003 2004 2005

Yearly Comparision of Referrals

Chart 4

$17.80

$54.00

$125.60

$68.14

$183.12

$0.00

$50.00

$100.00

$150.00

$200.00

2001 2002 2003 2004 2005

Yearly Dollar Loss of Referred Complaints (in millions)

The results contained in this report were based on information that was provided to IC3 through the complaint forms

submitted online at www.ic3.gov or www.ifccfbi.gov by complainants however, the data represent a sub-sample

comprised of those complaints that have been referred to law enforcement. While IC3’s primary mission is to serve

as a vehicle to receive, develop, and refer criminal complaints regarding cyber crime, those complaints involving

more traditional methods of contact (e.g., telephone and mail) were also referred. Using information provided by the

complainant, it is estimated that just over 91.5% of all complaints were related to the Internet or online service.

Criminal complaints were referred to law enforcement and/or regulatory agencies based on the residence of the

subject(s) and victims(s). In 2005, there were 12 Memorandums of Understanding (MOUs) from non-NW3C

member agencies added to the Pyramid database system and an additional 12 NW3C member agencies added to the

database.

6

Complaint Characteristics

During 2005, Internet auction fraud was by far the most reported offense, comprising 62.7% of referred fraud

complaints. This represents an 11.9% decrease from the 2004 levels of auction fraud reported to IC3. In addition,

during 2005, the non-delivery of merchandise and/or payment represented 15.7% of complaints (down 0.1% from

2004), and credit and debit card fraud made up an additional 6.8% of complaints which is up 25.9% from 2004

levels. Check fraud, investment fraud, and computer fraud complaints represented 5.4% of all remaining

complaints. Other confidence fraud, identity theft, financial institutions fraud, and child pornography complaints

together represented less than 2.5% of all complaints.

0.4%

0.5%

0.7%

0.9%

1.4%

1.5%

2.6%

6.8%

15.7%

62.7%

Child Pornography

Financial Institutions Fraud

Identity Theft

Confidence Fraud

Computer Fraud

Investment Fraud

Check Fraud

Credit/debit Card Fraud

Non-delivery

Auction Fraud

Chart 3

Top 10 IC3 Complaint Categories

Chart 5

Statistics contained within the complaint category must be viewed as a snapshot which may produce a misleading

picture due to the perception of consumers and how they characterize their particular victimization within a broad

range of complaint categories. It is also important to realize IC3 has actively sought support from many key Internet

E-Commerce stake holders and as part of these efforts many of these companies, such as eBay, have provided their

customers links to the IC3 website. As a direct result, an increase in referrals depicted as auction fraud has emerged.

Through its relationships with enforcement and regulatory agencies, IC3 continues to refer specific fraud types to

the appropriate agencies. Complaints received by IC3 included confidence fraud, investment fraud, business fraud,

and other unspecified frauds. Identity theft complaints are referred to the Federal Trade Commission (FTC) as well

as being addressed by other agencies. Compared to 2004, there were slightly higher reporting levels of all complaint

7

types, except for auction fraud and non-delivery, in 2005. For a more detailed explanation of complaint categories

used by IC3, refer to Appendix 1 at the end of this report.

A key area of interest regarding Internet fraud is the average monetary loss incurred by complainants contacting

IC3. Such information is valuable because it provides a foundation for estimating average Internet fraud losses in the

general population. To present information on average losses, two forms of averages are offered: the mean and the

median. The mean represents a form of averaging familiar to the general public: the total dollar amount divided by

the total number of complaints. Because the mean can be sensitive to a small number of extremely high or extremely

low loss complaints, the median is also provided. The median represents the 50

th

percentile, or midpoint, of all loss

amounts for all referred complaints. The median is less susceptible to extreme cases, whether high or low cost.

Of the 97,076 fraudulent referrals processed by IC3 during 2005, 83,151 involved a victim who reported a monetary

loss. Other complainants who did not file a loss may have reported the incident prior to victimization (e.g., received

a fraudulent business investment offer online or in the mail), or may have already recovered money from the

incident prior to filing (e.g., zero liability in the case of credit/debit card fraud).

The total dollar loss from all referred cases of fraud in 2005 was $183.12 million. That loss was significantly greater

than 2004 which reported a total loss of $68.14 million; however, this was a direct result of a number of cases in

2005 that reported losses in the millions of dollars. Of those complaints with a reported monetary loss, the mean

dollar loss was $2,202.23 and the median was $424.00. Twenty four percent (23.6%) of these complaints involved

losses of less than $100, and (43.0%) reported a loss between $100 and $1,000. In other words, two-thirds of these

cases involved a monetary loss of less than $1,000. A third of the complainants reported high dollar losses, with

25.6% indicating a loss between $1,000 and $5,000 and only 7.8% indicating a loss greater than $5,000. The highest

dollar loss per incident was reported by Nigerian Letter Fraud (median loss of $5,000). Check fraud victims, with a

median loss of $3,800 and confidence fraud (median loss of $2,025) were other high dollar loss categories. The

lowest dollar loss was associated with computer fraud (median loss of $216.56) and auction fraud (median loss of

$385) offenses.

Chart 6

Percentage of Referrals by Monetary Loss

23.6%

43.0%

25.6%

4.8%

0.3%

2.7%

$.01 to $99.99

$100 to $999.99

$1,000 to $4,999.99

$5,000 to $9,999.99

$10,000 to $99,999.99

$100,000 and over

8

Table 1: Amount Lost by Selected Fraud Type for Individuals Reporting Monetary Loss

Complaint Type % of Reported Total

Dollar Loss

Of those who reported a loss the

Average (median) $ Loss per

Complaint

Nigerian Letter Fraud 2.7 $5,000.00

Check Fraud 7.1 $3,800.00

Confidence Fraud 2.3 $2,025.00

Investment Fraud 6.2 $2,000.00

Non-delivery (mdse and

payment)

14.6 $410.00

Auction Fraud 41.0 $385.00

Credit/debit Card Fraud 4.4 $240.00

Perpetrator Characteristics

Equally important to presenting the prevalence and monetary impact of Internet fraud is providing insight into the

demographics of fraud perpetrators. In those cases with a reported location, over 75% of the perpetrators were male

and over half resided in one of the following states: California, New York, Florida, Texas, Illinois, Pennsylvania and

Ohio (see Map 1). These locations are among the most populous in the country. Controlling for population, Nevada,

New York, District of Columbia, Florida, Washington and California have the highest per capita rate of perpetrators

in the United States. Perpetrators also have been identified as residing in Nigeria, United Kingdom, Canada, Italy,

and China (see Map 2). Inter-state and international boundaries are irrelevant to Internet criminals. Jurisdictional

issues can enhance their criminal efforts by impeding investigations with multiple victims, multiple states/counties,

and varying dollar losses.

The vast majority of perpetrators were in contact with the complainant through either e-mail or via the web. (Refer

to Appendix III at the end of this report for more information about perpetrator statistics by state.) These statistics

highlight the anonymous nature of the Internet. The gender of the perpetrator was reported only 46.7% of the time,

and the state of residence for domestic perpetrators was reported only 52.0% of the time.

Chart 7

9

Gender of Peretrators

75.4%

24.6%

Male

Female

Gender of Per

p

etrators

Table 2: Perpetrators per 100,000 people (based on 2005 Census figures)

1 Nevada 26.50

2 New York 19.98

3 District of Columbia 19.80

4 Florida 18.54

5 Washington 16.92

6 California 16.52

7 Arizona 16.26

8 Illinois 14.76

9 Oregon 13.70

10 Delaware 13.63

Map 1 - Top Ten States by Count: Individual Perpetrators (Number is Rank)

Top Ten States - Perpetrator

1. California – 15.2%

2. New York – 9.8%

3. Florida – 8.4%

4. Texas – 6.9%

5. Illinois – 4.8%

6. Pennsylvania – 3.6%

7. Ohio – 3.6%

8. Georgia – 3.0%

9. New Jersey – 3.0%

10. Michigan – 3.0%

10

9

10

4

2

7

3

5

8

6

1

Map 2 - Top Ten Countries by Count: Perpetrators (Number is Rank)

Top Ten Countries - Perpetrator

1. United States – 71.2%

2. Nigeria – 7.9%

3. United Kingdom – 4.2%

4. Canada – 2.5%

5. Italy – 1.7%

6. China – 1.1%

7. South Africa – 1.0%

8. Greece – 0.8%

9. Romania – 0.7%

10. Russia– 0.7%

4

10

3

8

9

5

1

6

2

7

Complainant Characteristics

The following graphs offer a detailed description of the individuals who filed an Internet fraud complaint through

IC3. The complainant’s average age was 40.2 years and the majority of complainants were male, between 30 and 50

years of age, and a resident of one of the four most populated states: California, New York, Florida and Texas. The

District of Columbia, Alaska, and Colorado, while having a relatively small number of complaints (ranked 48

th

, 45

th

and 21

st

respectively), had among the highest per capita rate of complainants in the United States (see Table 3).

While most complainants were from the United States, IC3 has also received a number of filings from Nigeria,

Canada, and United Kingdom (see Map 4).

Chart 8

Gender of Complainants

Male

64.0%

Female

36.0%

Female

Male

11

Table 3: Complainants per 100,000 people (based on 2005Census figures)

1 Alaska 158.66

2 District of Columbia 107.90

3 Colorado 93.33

4 South Carolina 80.16

5 Nevada 77.77

6 Washington 77.01

7 Oregon 75.99

8 Arizona 73.66

9 Utah 72.12

10 Maryland 70.01

Chart 9

Age Demographic of Complainants

17.9%

22.8%

24.7%

23.5%

2.8%

8.4%

under 20

20-29

30-39

40-49

50-59

60 and over

Table 4 compares differences between the dollar loss per incident and the various complainant demographics. Males

reported greater dollar losses than females (ratio of $1.86 dollars to every $1.00 dollar). Individuals between the

ages of 50-59 reported higher losses than other age groups.

12

Table 4: Amount Lost per Referred Complaint by Selected Complainant Demographics

Complainant Demographics Average (median) $ Loss per Typical Complaint

Male

Female

$552.99

$297.91

Under 20

20-29

30-39

40-49

50-59

60 and older

$401.00

$468.00

$450.00

$436.50

$569.97

$543.00

Map 3 - Top Ten States by Count: Individual Complainants (Number Rank)

4

3

10

5

1

9

7

6

2

8

Top Ten States - Complainant

1. California – 13.6%

2. Florida – 7.1%

3. Texas – 6.6%

4. New York – 5.6%

5. Pennsylvania – 3.9%

6. Illinois – 3.7%

7. Ohio – 3.6%

8. New Jersey – 3.1%

9. Michigan – 3.0%

10. Virginia – 2.9%

13

Map 4 - Top Ten Countries by Count: Individual Complainants

Top Ten Countries - Complainant

1. United States – 92.50%

2. Canada – 2.37%

3. Australia – .77%

4. United Kingdom – .47%

5. Germany – .25%

6. Netherlands – .22%

7. France – .20%

8. India – .18%

9. Singapore – .15%

10. Italy – .13%

4

5

6

7

10

2

1

8

9

3

Complainant-Perpetrator Dynamics

One of the components of fraud committed via the Internet that makes investigation and prosecution difficult is that

the offender and victim may be located anywhere in the world. This is a unique characteristic not found with other

types of “traditional” crime. This jurisdictional issue often requires the cooperation of multiple agencies to resolve a

given case. Table 5 highlights this truly “borderless” phenomenon. Even in California, where most of the reported

fraud cases originated, only 27.34% of all cases involved both a complainant and perpetrator residing in the same

state. Other states have an even smaller percentage of complainant-perpetrator similarities in residence. These

patterns not only indicate “hot spots” of perpetrators (California for example) that target potential victims from

around the world, but also indicate that complainants and perpetrators may not have had a relationship prior to the

incident.

Table 5: Perpetrators from Same State as Complainant (Other top three locations in parentheses)

State % 1 2 3

1. California

2. Florida

3. Arizona

4. Texas

5. New York

6. Nevada

7. Washington

8 District of Columbia

9. Georgia

10. Indiana

27.3%

19.4%

19.4%

17.8%

17.1%

16.8%

15.4%

13.9%

13.2%

13.0%

1. New York (9.3%)

2. California (12.1%)

3. California (14.3%)

4. California (13.0%)

5. California (12.5%)

6. California (14.3%)

7. California (15.1%)

8. California (16.7%)

9. California (12.4%)

10. California (12.0%)

1. Florida (7.6%)

2. New York (8.8%)

3. New York (7.9%)

4. New York (9.1%)

5. Florida (7.9%)

6. New York (8.1%)

7. New York (9.3%)

8. New York (13.9%)

9. Florida (8.6%)

10. New York (9.0%)

1. Texas (6.0%)

2. Texas (6.3%)

3. Florida (7.0%)

4. Florida (7.9%)

5. Texas (6.6%)

6. Florida (8.1%)

7. Texas (6.6%)

8. Texas (6.9%)

9. New York (8.1%)

10. Florida (8.4%)

14

Another factor that impedes the investigation and prosecution of Internet crime is the anonymity afforded by the

Internet. Chart 7 illustrates how complainants and perpetrators in the cases reported rarely interacted face-to-face.

The majority of perpetrators were in contact with the complainant through e-mail (73.2%) or a webpage (16.5%). A

mere 4.5% had phone contact with the complainant and 2.0% had corresponded through the physical mail.

Interaction through chat rooms (1.8%) and in-person meetings (0.8%) was rarely reported. The anonymous nature

of an e-mail address or website allows perpetrators to solicit a large number of victims with a keystroke.

Chart 10

73.2%

16.5%

4.5%

2.0%

1.8%

0.9%

0.8%

0.3%

E Mail

Web Page

Phone

Physical Mail

Chat Room

Printed Material

In Person

Fax

Contact Method

Additional Information About IC3 Referrals

Although IC3 is dedicated to specifically addressing complaints about Internet crime, it also receives complaints

about other crimes. These include violent crimes, robberies, burglaries, threats, and many other violations of law.

The people submitting these types of complaints are generally directed to make immediate contact with their local

law enforcement agency in order to secure a timely and effective response to their particular needs. If warranted, the

IC3 personnel may make contact with local law enforcement authorities on behalf of the complainant. IC3 also

receives a substantial number of computer-related offenses that are not fraudulent in nature.

For those complaints that are computer-related but not considered Internet fraud, IC3 routinely refers these to

agencies and organizations that handle those particular violations. For example, if IC3 receives an allegation of the

distribution of child pornography via the Internet, the complaint information is immediately forwarded to the

National Center for Missing and Exploited Children (http://www.ncmec.org/). Spam complaints and cases of

identity theft are forwarded to the Federal Trade Commission and referred to other government agencies with

jurisdiction.

15

Results of IC3 Referrals

IC3 routinely receives updates on the disposition of referrals from agencies receiving complaints. These include

documented arrests and restitution, as well as updates related to ongoing investigations, pending cases, and arrest

warrants. However, IC3 can only gather this data from the agencies that voluntarily return enforcement results, and

it has no authority to require agencies to submit or return status forms.

IC3 has assisted law enforcement with many successful case resolutions. Some of the cases include the following:

• According to an Economic Crimes Task Force in Los Angeles, California, Chad Arndt was arrested in

September of 2004 on charges of grand theft. Arndt allegedly created a fake website mimicking a valid

escrow service and then bid on several computers listed on the eBay auction site. Arndt lured sellers to the

fake site and sent false emails confirming payment. Several sellers then sent the merchandise believing that

payment had been secured. The IC3 started receiving complaints about Arndt when the sellers attempted to

collect their money and found that the site was no longer available. Arndt is charged with seven counts of

grand theft.

• The Internet Crime Complaint Center (IC3) has learned that Gilbert Vartanian, the subject of multiple high-

dollar crime complaints, has been indicted by a federal grand jury in Sacramento, California Vartanian is

accused of using eBay to offer tickets to major sporting events including NFL and NBA games as well as

boxing, auto racing events and Rolex watches. The indictment alleges that between January and June of

2004, Vartanian created numerous eBay accounts to commit this fraud and even bid on his own auctions in

order to leave positive feedback and enhance his credibility. After placing the highest bid, auction winners

were directed to send a check or money order to various post office boxes Vartanian was using, but he

never sent their merchandise. Vartanian failed to respond to some customers entirely and others received

an empty envelope or envelope containing only a slip of paper. Vartanian, who was arrested in January of

2005 on 12 counts of mail fraud, has pled not guilty. He has been released on $50,000 bond and was

ordered not to engage in any online auctions while awaiting trail. If convicted he faces up to 20 years in

prison and $250,000 in fines. The arrest and indictment are the result of an extensive investigation by the

United States Postal Inspection Service.

• A federal jury returned a guilty verdict in the case of a former Wichita, Kansas man accused of 12 counts of

wire fraud. James A. Bird faces a maximum penalty of 20 years in prison and a $250,000 fine on each

count. Bird, the former president and CEO of a web design firm called FX Solutions, used eBay to sell

expensive items which buyers paid for but never received. Among the items offered by Bird were three

Patek Phillipe collectors watches valued at $8,500, $16,336.99 and $16,600. According to evidence

presented at trial, Bird was never in possession of these watches. Bird also listed 25 sets of golf clubs at

$650 a set. Buyers paid by personal or cashiers check and never received the goods they ordered.

Complaints received by the Internet Crime Complaint Center (IC3) about Bird were referred to several

Kansas law enforcement agencies. The investigation into his scheme was ultimately conducted by the

Federal Bureau of Investigation and the case was prosecuted by the United States Attorney’s Office.

• Glenn Hall of Fairmont, WV has been arrested and charged in an Internet scam. After receiving multiple

complaints from the Internet Crime Complaint Center (IC3) the Fairmont Police Department started an

investigation into Hall’s activities. Hall’s company, “Miracle Associates”, had a website which offered

pocket bikes, which are small motorcycle-like vehicles, for sale. Hall allegedly collected money from

victims in several states and failed to deliver the merchandise. Hall has been charged with one felony count

of false pretenses. The maximum penalty upon conviction is up to ten years imprisonment and a fine of up

to $2,500. The investigation is ongoing and Sgt. Moran of the department expects total losses will be in the

thousands of dollars.

• The Internet Crime Complaint Center (IC3) has learned through the Sacramento Hi-Tech Crimes Task

Force, that Sabika Nazli Shahid was arrested and charged with one felony count of obtaining money and

property under false pretenses. The investigation was initiated after dozens of complaints that Wholesale

Depot, a business that sells tires and wheels in Modesto CA, took money from customers but never

delivered the goods. According to Stanislaus County Sheriff’s detectives, Shahid, an employee of

16

Wholesale Depot, admitted that she received money orders from customers and received a commission for

it. Authorities also interviewed employees at Tire and Wheel Outlet in Stockton, CA. Both businesses are

owned by members of the same family. In addition to filing with the IC3, fifty customers filed complaints

with the nonprofit MidCal Better Business Bureau. Complaints were also received by the Sacramento Hi-

Tech Crimes Task Force at their Turlock office. The monetary loss to customers totals more than $77,000.

Naeem Asghar, the owner of Wholesale Depot has asked for copies of all the complaints and claims he will

make restitution. The company had sent out refund checks to several victims in the days preceding the

arrest. The investigation is ongoing.

Conclusion

The IC3 report has outlined many of the current trends and patterns in Internet crime. The data indicates that fraud

reports are increasing, with 231,493 complaints, in 2005, up from 207,449 complaints in 2004 and 124,515 in 2003.

This total includes many different fraud types and non-fraudulent complaints. Yet, research indicates that only one

in seven incidents of fraud ever make their way to the attention of enforcement or regulatory agencies

1

. The total

dollar loss from all referred cases of fraud was $183.12 million down from $68.14 million in 2004.

Internet auction fraud was again the most reported offense followed by non-delivered merchandise/payment, and

credit/debit card fraud. Among those individuals who reported a dollar loss from the fraud, the highest median dollar

losses were found among Nigerian Letter fraud victims ($5,000), check fraud victims ($3,800), and confidence fraud

victims ($2,025). Male complainants reported greater losses than female complainants, which may be a function of

both online purchasing differences by gender and the type of fraud. Comparing data from the 2004 and the 2005

reports, e-mail and webpages were the two primary mechanisms by which the fraudulent contact took place. In all,

almost three-fourths of all complainants reported they had e-mail contact with the perpetrator.

Although this report can provide a snapshot of the prevalence and impact of Internet fraud, care must be taken to

avoid drawing conclusions about the “typical” victim or perpetrator of these types of crimes. Anyone who utilizes

the Internet is susceptible, and IC3 has received complaints from both males and females ranging in age from ten to

one hundred years old. Complainants can be found in all fifty states, in dozens of countries worldwide, and have

been affected by everything from work-at-home schemes to identity theft. Although the ability to predict

victimization is limited, particularly without the knowledge of other related risk factors (e.g., the amount of Internet

usage or experience), many organizations agree that education and awareness are major tools to protect individuals.

Despite the best proactive efforts, some individuals may find themselves the victims of computer-related criminal

activity even when following the best prevention strategies (see Appendix II).

Over the past year, the IC3 has begun to update/change its method of gathering data regarding complaints, in

recognition of the constantly changing nature of cyber crime, and to more accurately reflect meaningful trends.

With this in mind, changes to the IC3 website and complaint form have been implemented, with those changes

taking effect as of January, 2006. Along with these changes the IC3 and its partners have launched a public website,

www.lookstoogoodtobetrue.com , which will educate consumers to various consumer alerts, tips and fraud trends.

In reviewing statistics contained in this report, it is recognized that consumers may characterize crime problems with

an easier “broad” character, which may be misleading. For instance, a consumer that gets lured to an auction site

which appears to be eBay, may later find that they were victimized through a cyber scheme. The scheme may in

fact have involved SPAM, unsolicited e-mail inviting them to a site, and a “spoofed” website which only imitated

the true legitimate site. The aforementioned crime problem could be characterized as SPAM, phishing, possible

identity theft, credit card fraud or auction fraud. In such scenarios, many complainants have depicted schemes such

as auction fraud even though that label may be incomplete or misleading.

It is also important to note that the IC3 has actively sought support from many key Internet E-Commerce stake

holders over the past several years. With these efforts, companies like eBay have adopted a very pro-active posture

in teaming with the IC3 to identify and respond to cyber crime schemes. As part of these efforts, eBay and other

1

National White Collar Crime Center, The National Public Survey on White Collar Crime, August 2005.

17

companies have provided guidance and/or links for their customers to the IC3 website. This activity has no doubt

also contributed to an increase in referrals regarding schemes depicted as “auction fraud”.

Whether a bogus investment offer, a dishonest auction seller, or a host of other Internet crimes, the IC3 is in the

position to offer assistance. Through the online complaint and referral process, victims of Internet crime are

provided with an easy way to alert authorities, at many different jurisdictional levels, of a suspected criminal or civil

violation.

18

Appendix I

Explanation of Complaint Categories

Although the transition to IC3 better reflects the processing of Internet crime complaints, the fraud complaint

categories were still used during 2005 to categorize complaint information. IC3 Internet Fraud Analysts determined

a fraud type for each Internet fraud complaint received and sorted complaints into one of nine fraud categories.

• Financial Institution Fraud - Knowing misrepresentation of the truth or concealment of a material fact by a

person to induce a business, organization, or other entity that manages money, credit, or capital to perform a

fraudulent activity.

2

Credit/debit card fraud is an example that ranks among the most commonly reported

offenses to IC3. Identity theft also falls into this category; cases classified under this heading tend to be those

where the perpetrator possesses the complainant’s true name identification (in the form of a social security card,

driver’s license, or birth certificate), but there has not been a credit or debit card fraud committed.

• Gaming Fraud - To risk something of value, especially money, for a chance to win a prize when there is a

misrepresentation of the odds or events.

3

Sports tampering and claiming false bets are two examples of gaming

fraud.

• Communications Fraud - A fraudulent act or process in which information is exchanged using different forms of

media. Thefts of wireless, satellite, or landline services are examples of communications fraud.

• Utility Fraud - When an individual or company misrepresents or knowingly intends to harm by defrauding a

government regulated entity that performs an essential public service, such as the supply of water or electrical

services.

4

• Insurance Fraud - A misrepresentation by the provider or the insured in the indemnity against loss. Insurance

fraud includes the “padding” or inflating of actual claims, misrepresenting facts on an insurance application,

submitting claims for injuries or damage that never occurred, and “staging” accidents.

5

• Government Fraud - A knowing misrepresentation of the truth, or concealment of a material fact to induce the

government to act to its own detriment.

6

Examples of government fraud include tax evasion, welfare fraud, and

counterfeit currency.

• Investment Fraud - Deceptive practices involving the use of capital to create more money, either through

income-producing vehicles or through more risk-oriented ventures designed to result in capital gains.

7

Ponzi/Pyramid schemes and market manipulation are two types of investment fraud.

• Business Fraud - When a corporation or business knowingly misrepresents the truth or conceals a material fact.

8

Examples of business fraud include bankruptcy fraud and copyright infringement.

• Confidence Fraud - The reliance on another’s discretion and/or a breach in a relationship of trust resulting in

financial loss. A knowing misrepresentation of the truth or concealment of a material fact to induce another to

act to his or her detriment.

9

Auction fraud and non-delivery of payment or merchandise are both types of

confidence fraud and are the most reported offenses to IC3. The Nigerian Letter Scam is another offense

classified under confidence fraud.

2

Black’s Law Dictionary, Seventh Ed., 1999.

3

Ibid.

4

Ibid.

5

Fraud Examiners Manual, Third Ed., Volume 1, 1998.

6

Black’s Law Dictionary, Seventh Ed., 1999. The Merriam Webster Dictionary, Home and Office Ed., 1995.

7

Barron’s Dictionary of Finance and Investment Terms, Fifth Ed., 1998.

8

Black’s Law Dictionary, Seventh Ed., 1999.

9

Ibid.

19

Appendix II

Best Practices to Prevent Internet Crime

Internet Auction Fraud

Prevention tips:

• Understand as much as possible about how Internet auctions work, what your obligations are as a buyer, and

what the seller’s obligations are before

you bid.

• Find out what actions the website takes if a problem occurs and consider insuring the transaction and shipment.

• Learn as much as possible about the seller, especially if the only information you have is an e-mail address. If it

is a business, check the Better Business Bureau where the seller/business is located.

• Examine the feedback on the seller, and use common sense. If the seller has a history of negative feedback then

do not deal with that particular seller.

• Determine what method of payment the seller is asking for and where he/she is asking to send payment. Use

caution when the mailing address is a post office box number.

• Be aware of the difference in laws governing auctions between the U.S. and other countries. If a problem occurs

with the auction transaction that has the seller in one country and a buyer in another, it might result in a dubious

outcome leaving you empty handed.

• Be sure to ask the seller about when delivery can be expected and warranty/exchange information for

merchandise that you might want to return.

• To avoid unexpected costs, find out if shipping and delivery are included in the auction price or are additional.

• Finally, avoid giving out your social security number or driver’s license number to the seller, as the sellers have

no need for this information.

Steps to take if victimized:

1. File a complaint with the online auction company. In order to be considered for eBay’s Fraud Protection

Program, you should submit an online Fraud Complaint at http://crs.ebay.com/aw-cgi/ebayisapi.dll?crsstartpage

30 days after the listing end-date.

2. File a complaint with the Internet Crime Complaint Center (http://www.ic3.gov).

3. Contact law enforcement officials at the local and state level (your local and state police departments).

4. Also contact law enforcement officials in the perpetrator's town & state.

5. File a complaint with the shipper USPS (http://www.usps.com/websites/depart/inspect).

6. File a complaint with the National Fraud Information Center (http://www.fraud.org/info/contactnfic.htm).

7. File a complaint with the Better Business Bureau (http://www.bbb.org).

Non-Delivery of Merchandise

Prevention tips:

• Make sure you are purchasing merchandise from a reputable source. As with auction fraud, check the reputation

of the seller whenever possible, including the Better Business Bureau.

• Try to obtain a physical address rather than merely a post office box and a phone number. Also call the seller to

see if the number is correct and working.

• Send them e-mail to see if they have an active e-mail address. Be cautious of sellers who use free e-mail

services where a credit card wasn’t required to open the account.

• Investigate other websites regarding this person/company.

• Do not judge a person/company by their fancy website; thoroughly check the person/company out.

• Be cautious when responding to special offers (especially through unsolicited e-mail).

• Be cautious when dealing with individuals/companies from outside your own country. Remember the laws of

different countries might pose issues if a problem arises with your transaction.

• Inquire about returns and warranties on all items.

• The safest way to purchase items via the Internet is by credit card because you can often dispute the charges if

something is wrong. Also, consider utilizing an escrow or alternate payment service, after conducting thorough

research on the escrow service.

• Make sure the website is secure when you electronically send your credit card numbers.

20

Credit Card Fraud

Prevention tips:

• Don’t give out your credit card number(s) online unless the website is both secure and reputable. Sometimes a

tiny icon of a padlock appears to symbolize a higher level of security to transmit data. This icon is not a

guarantee of a secure site, but may provide you some assurance.

• Before using a site, check out the security software it uses to make sure that your information will be protected.

• Make sure you are purchasing merchandise from a reputable/legitimate source. Once again investigate the

person or company before purchasing any products.

• Try to obtain a physical address rather than merely a post office box and a phone number, call the seller to see if

the number is correct and working.

• Send them e-mail to see if they have an active e-mail address and be wary of sellers who use free e-mail

services where a credit card wasn’t required to open the account.

• Do not purchase from sellers who won’t provide you with this type of information.

• Check with the Better Business Bureau to see if there have been any complaints against the seller before.

• Check out other websites regarding this person/company.

• Be cautious when responding to special offers (especially through unsolicited e-mail).

• Be cautious when dealing with individuals/companies from outside your own country.

• If you are going to purchase an item via the Internet, use a credit card since you can often dispute the charges if

something does go wrong.

• Make sure the transaction is secure when you electronically send your credit card numbers.

• You should also keep a list of all your credit cards and account information along with the card issuer’s contact

information. If anything looks suspicious or you lose your credit card(s) contact the card issuer immediately.

Prevention tips for Businesses:

• Do not accept orders unless complete information is provided (including full address and phone number).

Require address verification for all of your credit card orders. Require anyone who uses a different shipping

address than their billing address to send a fax with their signature and credit card number authorizing the

transaction.

• Be especially careful with orders that come from free e-mail services -- there is a much higher incidence of

fraud from these services. Many businesses won’t even accept orders that come through these free e-mail

accounts anymore. Sending an e-mail requesting additional information before you process the order asking for:

a non-free e-mail address, the name and phone number of the bank that issued the credit card, the exact name on

credit card, and the exact billing address.

• Be wary of orders that are larger than your typical order amount and orders with next day delivery.

• Pay extra attention to international orders. Validate the order before you ship your product to a different

country.

• If you are suspicious, pick up the phone and call the customer to confirm the order.

• Consider using software or services to fight credit card fraud online.

• If defrauded by a credit card thief, you should contact your bank and the authorities.

Investment Fraud

Prevention tips:

• Do not invest in anything based upon appearances. Just because an individual or company has a flashy website

doesn’t mean it is legitimate. Web sites can be created in just a few days. After a short period of taking money,

a site can vanish without a trace.

• Do not invest in anything you are not absolutely sure about. Do your homework on the investment to ensure

that it is legitimate.

• Thoroughly investigate the individual or company to ensure that they are legitimate.

• Check out other websites regarding this person/company.

• Be cautious when responding to special investment offers (especially through unsolicited e-mail) by fast talking

telemarketers. Know whom you are dealing with!

• Inquire about all the terms and conditions dealing with the investors and the investment.

• Rule of Thumb: If it sounds too good to be true, it probably is.

21

Nigerian Letter Scam/419 Scam

Prevention tips:

• Be skeptical of individuals representing themselves as Nigerian or other foreign government officials asking for

your help in placing large sums of money in overseas bank accounts.

• Do not believe the promise of large sums of money for your cooperation.

• Do not give out any personal information regarding your savings, checking, credit, or other financial accounts.

• If you are solicited, do not respond and quickly notify the appropriate authorities.

Business Fraud

Prevention tips:

• Purchase merchandise from reputable dealers or establishments.

• Try to obtain a physical address rather than merely a post office box and a phone number, and call the seller to

see if the number is correct and working.

• Send them e-mail to see if they have an active e-mail address and be wary of those that utilize free e-mail

services where a credit card wasn’t required to open the account.

• Do not purchase from sellers who won't provide you with this type of information.

• Purchase merchandise directly from the individual/company that holds the trademark, copyright, or patent. Be

aware of counterfeit and look-alike items.

• Beware when responding to e-mail that may not have been sent by a reputable company. Always investigate

before purchasing any products.

Identity Theft

Prevention tips:

• Check your credit reports once a year from all three of the credit reporting agencies (Experian, Transunion, and

Equifax)

• Guard your Social Security number. When possible, don’t carry your Social Security card with you.

• Don’t put your Social Security Number or driver’s license number on your checks.

• Guard your personal information. You should never give your Social Security number to anyone unless they

have a good reason for needing it.

• Carefully destroy papers you discard, especially those with sensitive or identifying information.

• Be suspicious of telephone solicitors. Never provide information unless you have initiated the call.

• Delete any suspicious e-mail requests without replying.

Steps to take if victimized:

1. Contact the fraud departments of each of the three major credit bureaus and report that your identity has been

stolen.

2. Get a “fraud alert” placed on your file so that no new credit will be granted without your approval.

3. Contact the security departments of the appropriate creditors and/or financial institutions for any accounts that

may have been fraudulently accessed. Close these accounts. Create new passwords on any new accounts that

you open

4. File a report with your local police and/or the police where the identity theft took place.

5. Retain a copy of the report because it may be needed by the bank, credit card company, or other businesses to

prove your innocence.

Cyberstalking

Prevention tips (from W.H.O.A – Working to Halt Online Abuse at www.haltabuse.org):

• Use a gender-neutral user name/e-mail address.

• Use a free e-mail account such as Hotmail (www.hotmail.com) or YAHOO! (www.yahoo.com) for

newsgroups/mailing lists, chat rooms, Instant messages (IMs), e-mails from strangers, message boards, filling

out forms and other online activities.

• Don’t give your primary e-mail address to anyone you do not know or trust.

• Instruct children to never give out their real name, age, address, or phone number over the Internet without your

permission.

22

• Don’t provide your credit card number or other information as proof of age to access or subscribe to a website

you’re not familiar with.

• Lurk on newsgroups, mailing lists and chat rooms before “speaking” or posting messages.

• When you do participate online, be careful – only type what you would say to someone’s face.

• Don’t be so trusting online – don’t reveal personal things about yourself until you really and truly know the

other person.

• Your first instinct may be to defend yourself – Don’t – this is how most online harassment situations begin.

• If it looks to good to be true – it is.

23

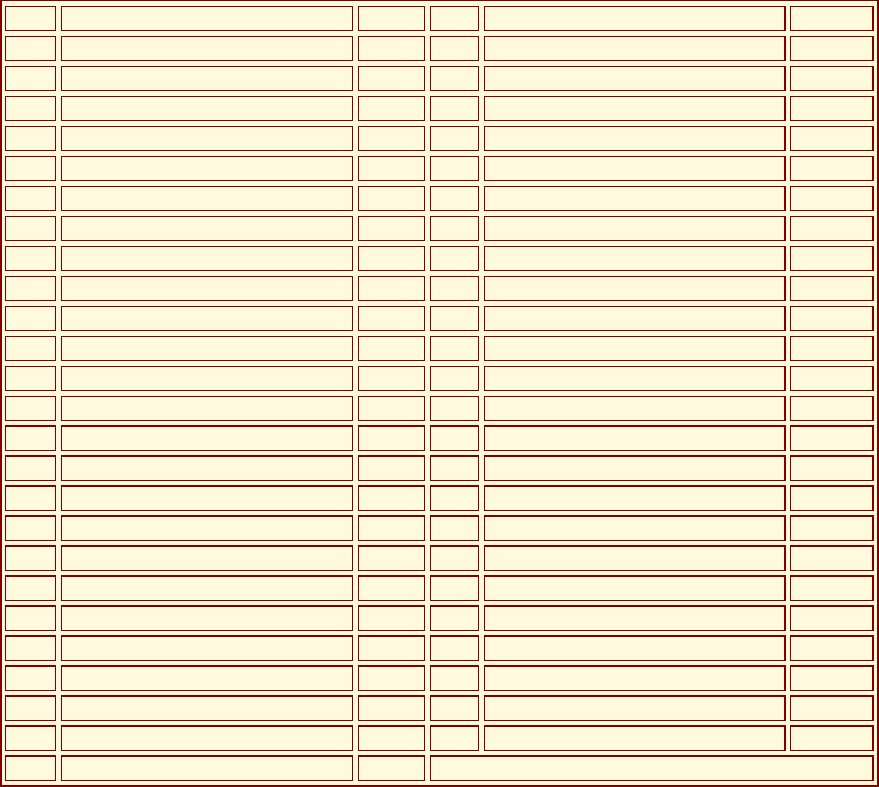

Appendix III

Complainant/Perpetrator Statistics, by State

Complainants By State

Represents % of total individual complainants within the United States where state is known

1

California 13.6

27

Alabama 1.1

2

Florida 7.1

28

Nevada 1.1

3

Texas 6.6

29

Oklahoma 1.1

4

New York 5.6

30

Utah 1.0

5

Pennsylvania 3.9

31

Louisiana 1.0

6

Illinois 3.7

32

Kansas .9

7

Ohio 3.6

33

Iowa .9

8

New Jersey 3.1

34

Arkansas .7

9

Michigan 3.0

35

Alaska .6

10

Virginia 2.9

36

New Mexico .5

11

Washington 2.8

37

Mississippi .5

12

Georgia 2.7

38

Idaho .5

13

North Carolina 2.6

39

West Virginia .5

14

Arizona 2.6

40

New Hampshire .5

15

Colorado 2.5

41

Maine .5

16

Maryland 2.3

42

Hawaii .5

17

Indiana 2.1

43

Nebraska .5

18

South Carolina 2.0

44

District of Columbia .4

19

Massachusetts 2.0

45

Rhode Island .3

20

Missouri 1.9

46

Montana .3

21

Wisconsin 1.7

47

Delaware .3

22

Tennessee 1.7

48

Vermont .2

23

Minnesota 1.7

49

Wyoming .2

24

Oregon 1.6

50

South Dakota .2

25

Connecticut 1.3

51

North Dakota .2

26

Kentucky 1.1

(Please note that percentages contained in the table above may not add up to 100%. The table above only represents

statistics from 50 states and the District of Columbia. The table above does not represent statistics from other U.S.

territories or Canada.)

24

Perpetrators By State

Represents % of total individual perpetrators within the United States (where state is known)

1

California 15.2

27

Oklahoma 1.0

2

New York 9.8

28

South Carolina .9

3

Florida 8.4

29

Connecticut .9

4

Texas 6.9

30

Louisiana .8

5

Illinois 4.8

31

Kansas .7

6

Pennsylvania 3.6

32

Utah .7

7

Ohio 3.6

33

Arkansas .6

8

Georgia 3.0

34

Iowa .6

9

New Jersey 3.0

35

West Virginia .5

10

Michigan 3.0

36

Mississippi .5

11

Washington 2.7

37

Maine .5

12

Arizona 2.5

38

Hawaii .4

13

North Carolina 2.3

39

Nebraska .4

14

Virginia 1.9

40

New Hampshire .4

15

Indiana 1.9

41

Rhode Island .4

16

Maryland 1.8

42

New Mexico .3

17

Tennessee 1.7

43

Idaho .3

18

Nevada 1.6

44

Delaware .3

19

Missouri 1.6

45

District of Columbia .3

20

Massachusetts 1.6

46

Montana .3

21

Colorado 1.5

47

Vermont .2

22

Wisconsin 1.3

48

Alaska .2

23

Oregon 1.3

49

South Dakota .1

24

Minnesota 1.2

50

Wyoming .1

25

Kentucky 1.2

51

North Dakota .1

26

Alabama 1.1

(Please note that percentages contained in the table above may not add up to 100%. The table above only represents

statistics from 50 states and the District of Columbia. The table above does not represent statistics from other U.S.

territories or Canada.)

25

Complainants per 100,000 people (based on 2005 Census figures)

1

Alaska 158.66

27

Wisconsin 53.52

2

District of Columbia 107.90

28

Pennsylvania 53.12

3

Colorado 93.33

29

Massachusetts 52.99

4

South Carolina 80.16

30

Oklahoma 52.48

5

Nevada 77.77

31

Delaware 52.28

6

Washington 77.01

32

Montana 52.16

7

Oregon 75.99

33

North Carolina 51.62

8

Arizona 73.66

34

Michigan 51.01

9

Utah 72.12

35

Georgia 50.96

10

Maryland 70.01

36

Rhode Island 50.64

11

Florida 68.87

37

New York 50.27

12

Virginia 66.46

38

Texas 49.87

13

Hawaii 64.54

39

Illinois 49.41

14

California 64.47

40

Iowa 49.15

15

Wyoming 64.21

41

Tennessee 48.58

16

New Hampshire 64.20

42

New Mexico 47.60

17

Maine 63.26

43

Kentucky 46.75

18

Connecticut 61.73

44

West Virginia 46.34

19

New Jersey 60.67

45

Nebraska 46.11

20

Idaho 58.99

46

North Dakota 43.82

21

Indiana 58.48

47

Alabama 43.11

22

Kansas 57.13

48

Arkansas 42.71

23

Missouri 55.13

49

South Dakota 40.34

24

Minnesota 55.08

50

Louisiana 39.15

25

Vermont 55.05

51

Mississippi 30.75

26

Ohio 53.63

26

Perpetrators per 100,000 people (based on 2005 Census figures)

1

Nevada 26.50

27

Kentucky 10.90

2

New York 19.98

28

Wyoming 10.80

3

District of Columbia 19.80

29

Utah 10.73

4

Florida 18.54

30

New Hampshire 10.69

5

Washington 16.92

31

Montana 10.58

6

California 16.52

32

Alaska 10.55

7

Arizona 16.26

33

West Virginia 10.40

8

Illinois 14.76

34

Connecticut 10.28

9

Oregon 13.70

35

Kansas 10.27

10

Delaware 13.63

36

North Carolina 10.26

11

New Jersey 13.56

37

Virginia 10.04

12

Maine 13.32

38

Massachusetts 9.88

13

Georgia 13.14

39

Wisconsin 9.46

14

Rhode Island 13.01

40

Alabama 9.39

15

Colorado 12.97

41

Idaho 9.31

16

Maryland 12.36

42

Minnesota 9.23

17

Vermont 12.20

43

Arkansas 8.85

18

Ohio 12.17

44

South Carolina 8.60

19

Texas 11.80

45

Nebraska 8.47

20

Indiana 11.78

46

Iowa 8.06

21

Hawaii 11.76

47

North Dakota 7.85

22

Michigan 11.50

48

South Dakota 7.22

23

Pennsylvania 11.28

49

New Mexico 7.00

24

Tennessee 11.22

50

Louisiana 6.94

25

Oklahoma 11.11

51

Mississippi 6.09

26

Missouri 10.90

27