The NAIC’s Capital Markets Bureau monitors developments in the capital markets globally and analyzes their

potential impact on the investment portfolios of U.S. insurance companies. Please see the Capital Markets Bureau

website at INDEX.

Collateralized Loan Obligation (CLO) Combo Notes Primer

Analyst: Jennifer Johnson

Executive Summary

Brief Background on CLOs

Collateralized loan obligations (CLOs) are structured finance securities collateralized predominantly by a

pool of below investment grade, first lien, senior secured, syndicated bank loans, with smaller

allocations to other types of investments such as middle market loans and second lien loans. CLO debt

issued to investors consists of several tranches, or layers, with different payment priorities and, in turn,

• Collateralized Loan Obligation (CLO) Combo Notes (Combo Notes) are a repackaging of all or

a portion of CLOs’ debt and equity tranches, often into a special purpose vehicle (SPV). CLOs

are structured finance securities collateralized primarily by leveraged bank loans.

• CLO Combo Notes are typically structured as principal-only and may or may not have a

stated coupon; proceeds received from the underlying CLO tranches (i.e. principal and

interest) are used to pay down the principal balance of the combo note.

• Risks associated with investing in combo notes include refinancing risk and ramp-up risk.

Refinancing risk occurs when interest rates are low, and the underlying CLO tranches are

prepaid in full as they are refinanced; ramp-up risk occurs if the CLO manager for the

underlying CLO tranches is unable to fully fund the underlying leverage bank loan portfolio

during the CLO’s ramp-up period, resulting in amortization (paying down) of the CLO

tranches.

• Investing in CLO Combo Notes allows the investor to invest in lower-rated CLO debt with

high-yield returns, while achieving a nominally investment grade rating.

2

differing credit quality and credit ratings. The senior-most tranche of a CLO is the most protected, in

terms of credit enhancement, and, therefore, has the highest credit quality and the lowest coupon.

CLOs evolved out of collateralized bond obligations (CBOs), which are structured finance securities

collateralized predominantly by high-yield bonds, first brought to market in the late 1980s. New

issuance of CBOs has been insignificant as they proved to be volatile during the telecom/tech recession

of the early 2000s. However, CLOs performed well during the recent financial crisis, so as a result, they

were deemed “survivors.”

Underlying CLO Collateral

The credit risk of a CLO is dependent on the underlying assets within the portfolio. For “traditional”

CLOs, the collateral pool primarily consists of below investment grade, first lien, senior secured broadly

syndicated bank loans (usually at least 90% of the total portfolio), and it may include a predetermined

allowable portion of other asset types such as second lien bank loans (which are highly leveraged) and

unsecured debt, as well as middle market loans. Some CLOs consist predominantly of middle market

loans as the underlying collateral.

The average rating of the collateral is typically about single-B, and the leveraged bank loans are typically

floating rate, based on the London Interbank Offered Rate (LIBOR). A CLO collateral manager is

responsible for investment management decisions for the CLO’s underlying portfolio. As such, they must

have the appropriate infrastructure in place to properly manage the transaction. This includes not only

having seasoned portfolio managers and credit analysts as part of the team, but also experienced

operations professionals and appropriate data management systems in place.

Capital Structure

The CLO capital structure is comprised of CLO tranches, which include several layers of debt plus an

“equity” tranche that serves as a first-loss position. CLO tranches range from senior to subordinated; the

more subordinated the tranche, the lower the credit quality, and the more required credit enhancement

(i.e., the ratio of the principal value of the collateral to the principal value of the CLO debt). As such,

senior tranches are rated higher (investment grade) than subordinated tranches (below investment

grade) by the nationally recognized statistical rating organizations (NRSROs), such as Standard & Poor’s

(S&P) and Moody’s Investors Service. The “equity” tranche is typically unrated. Principal and interest on

the CLO debt and returns to equity holders are paid in accordance with “waterfall” instructions that are

included in legal documents, such as the trust indenture.

3

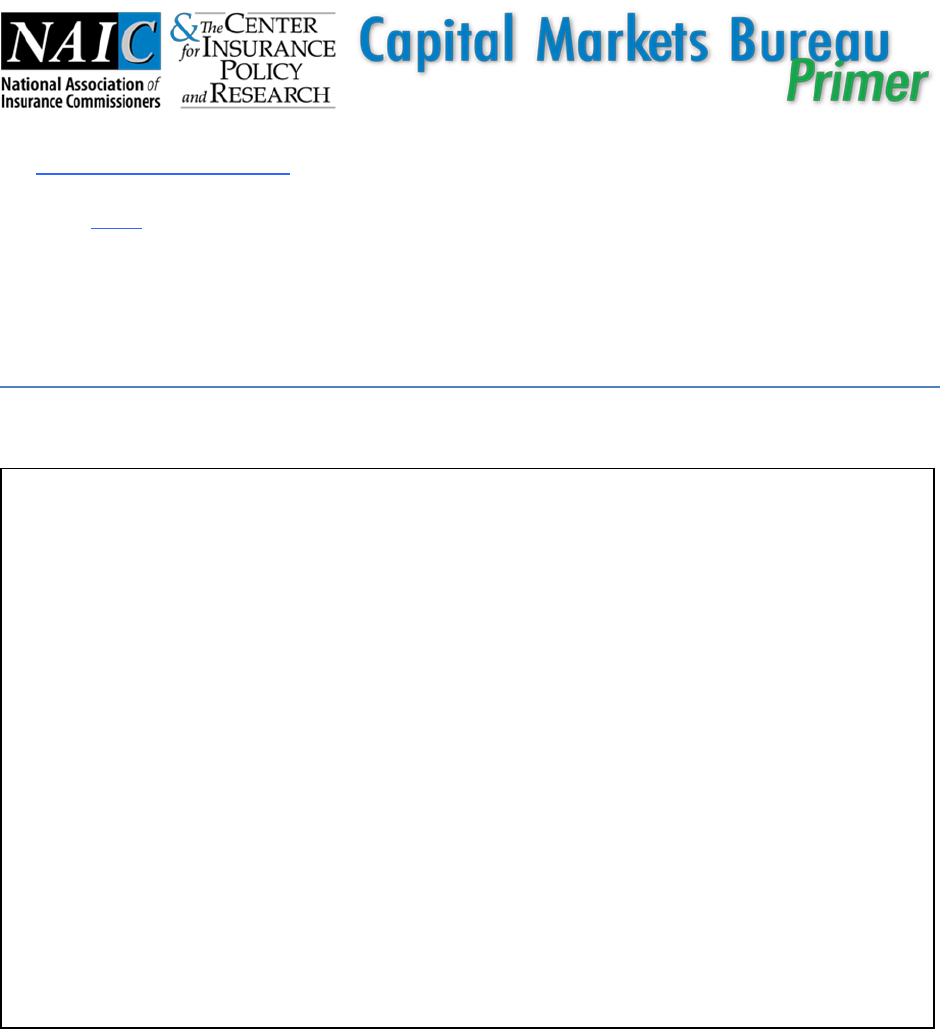

An example of a CLO structure is shown in Figure 1.

Figure 1:

Additional information on CLOs may be found in the NAIC Capital Markets Bureau’s primer on CLOs,

dated August 2018.

What are CLO Combo Notes?

CLO Combo Notes (Combo Notes) are a repackaging of all or a portion of, several tranches from the

same CLO, and in some cases, the CLO tranches are combined with a U.S. government bond (such as a

Treasury strip) for principal protection (that is, when additional credit enhancement is needed). Combo

Notes may be formed with just one or two tranches of a given CLO or several tranches of CLO, including

the debt tranches and equity tranche (subordinated notes).

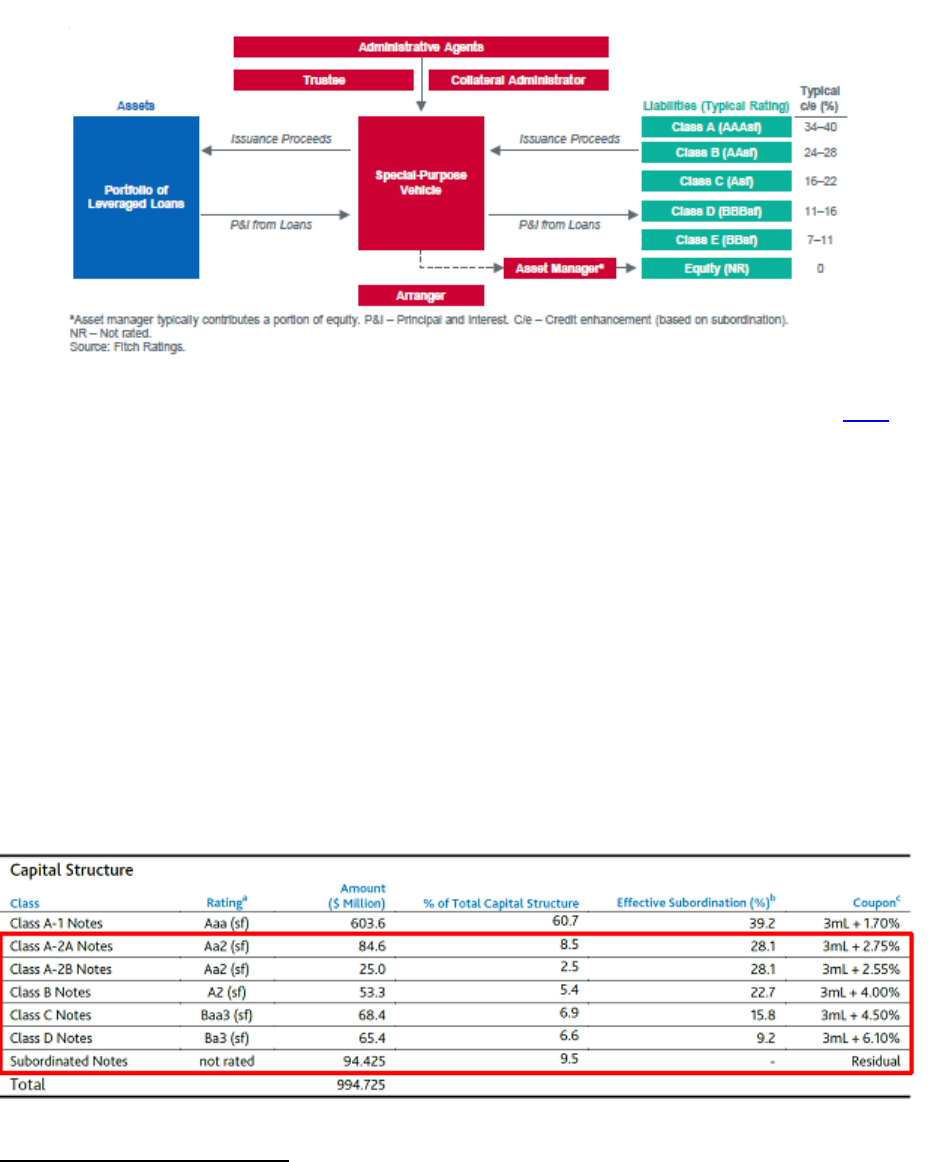

As shown in the example below (Table 1), the highlighted tranches (all except for the Class A-1 Notes)

were placed into a combo note issued by a newly formed SPV.

1

Table 1: CLO Capital Structure

1

Moody’s Investors Service, New Issuer Report: 5180-2 (Combination Note) Ltd., December 2015.

4

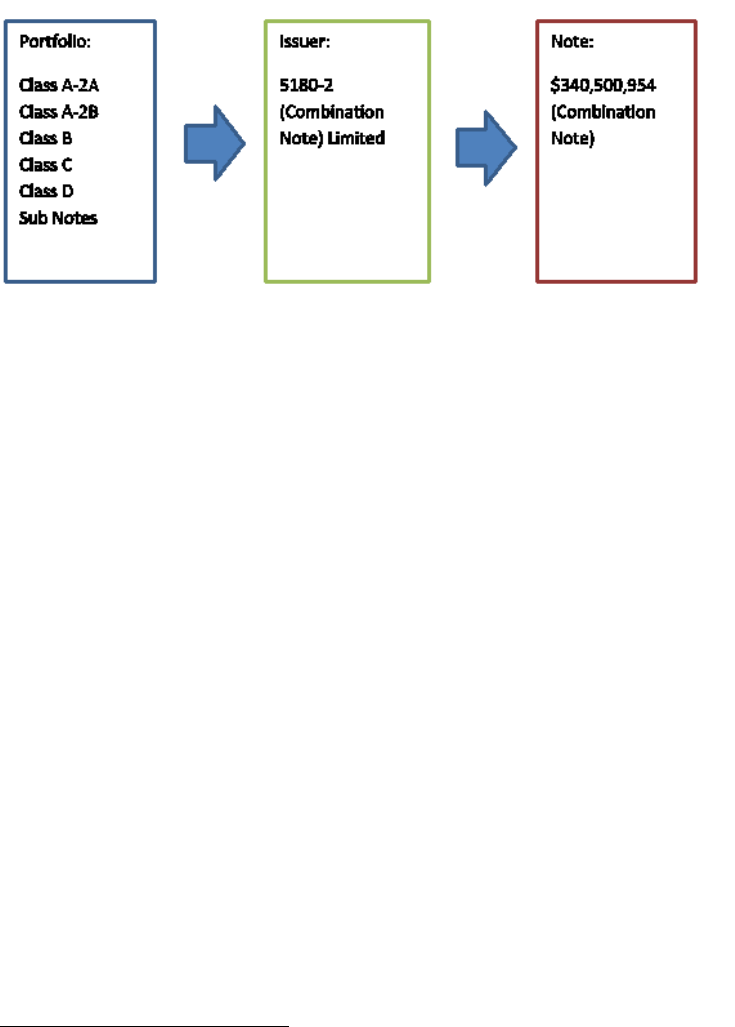

Figure 2 shows the resulting combo note that was created with the aforementioned, highlighted

tranches as “collateral.” Note that a portion of the Class A-2A Notes and Subordinated Notes were

included in the combo note.

Fig. 2: Combo Note Structure

Source: Moody’s Investors Service: 5180-2 (Combination Note) Ltd.

In terms of structure, Combo Notes may be formed with any mix of a CLO’s tranches. “The most

common form [of Combo Notes] transforms bonds paying both principal and interest into principal-only

notes.”

2

Usually, a portion of the tranches with credit ratings of “A” or lower, as well as the equity

tranche, are included in the combo note,

3

and it is structured as principal-only, with no stated coupon.

(However, Combo Notes may be structured with a stated coupon.) Combo Notes are structured to meet

an investor’s specific coupon and ratings target.

The notional value of the Combo Notes is typically equal to the aggregate of its components, but it could

be higher or lower depending on how proceeds received on the underlying tranches are allocated.

4

For

instance, if the stated interest on the Combo Notes is lower than the stated interest on the underlying

tranches, the difference, or excess spread, will be used to pay down principal on the Combo Notes,

thereby causing them to have a lower notional value than the combined aggregate principal value of the

underlying CLO tranches.

Principal payments and interest earned on the underlying CLO tranches are used to amortize the

principal balance of the combo note (thereby creating credit enhancement, where the CLO principal and

interest proceeds are used to pay down the principal balance of the combo note), and combo

noteholders receive a return similar to that of a CLO equity tranche.

2

FitchRatings, CLOs and Corporate CDOs Rating Criteria, July 2019.

3

Morningstar Credit Ratings, LLC, Proposed CLO Ratings Methodology, August 2017.

4

S&P Global, Guidance|Criteria|Structured Finance|CDOs: Global Methodology and Assumptions For CLOs and

Corporate CDOs, June 2019.

5

Combo Note Credit Ratings

NRSROs have established criteria related to assessing the credit quality and assigning credit ratings to

CLO Combo Notes. The rating on Combo Notes is computed differently from CLO tranches. While similar

economic and portfolio stresses may be completed upon assessing the credit quality of Combo Notes,

they typically lack a regular principal balance or required interest payments, so instead, the ratings are

based on ultimate payment of a notionally defined balance. The difference in the two approaches can

be large.

In the example above, the average rating of the portfolio using Moody’s Weighted Average Rating

Factor (WARF) methodology is between B1–B2.

5

Nevertheless, the rating assigned to the Combo Note

was Baa. The higher rating was achieved by directing all the interest and principal on the underlying

portfolio to pay down the principal balance of the Combo Note. In some cases, a nominal interest rate

(e.g., 1%) is paid. Since most Combo Notes are bilateral transactions, these mechanisms are determined

by the investor.

Furthermore, most rating agency methodologies assume that a loss or default occurs when interest is

not paid. Hence, setting interest at zero or at a very low rate increases the rating assigned under these

methodologies without having any effect on the overall credit risk of the underlying portfolio. The

interest rates paid by Combo Notes are typically far below market, however. For example, the Ba3

tranche above pays LIBOR + 6.10%, and the Baa3 tranche pays LIBOR + 4.5%. The Combo Note is

similarly rated Baa and yet pays no interest and receives no assessment for this risk.

As such, the rating on the CLO combo note could be higher than that of some of the underlying

tranches.

What Investors Get from Investing in Combo Notes

By combining several CLO debt and equity tranches into one SPV, a combo note issuer can create an

investment grade credit quality security that, in turn, allows an investor to invest (indirectly) in lower-

rated CLO debt that provides high-yield returns. Due in part to a benign credit environment in recent

years, CLO debt and equity tranches have benefited from consistent performance of the underlying bank

loan collateral. And investing in a combo note provides indirect access to investing in CLO equity for

those institutional investors not otherwise able to do so directly.

What Are the Risks?

Similar to CLOs, Combo Notes may be exposed to credit risk—that is, the risk that the underlying

portfolio will not be able to generate enough cash flows to pay the combo noteholder its principal owed

when due. In addition, combo noteholders are subject prepayment risk, or refinancing risk when

interest rates decrease, and the/an underlying CLO tranche(s) are refinanced. When this occurs, the

combo noteholder may choose not to invest in the newly refinanced notes and would then receive an

5

The WARF methodology assumes that the “equity” rating factor is equivalent to Ca, or 10000.

6

immediate paydown on its principal balance. Note that refinancing a CLO tranche is usually only

permitted after its “non-call” period, or after the first two years of the CLO’s closing date. Also, if an

event of default on a CLO were to be triggered that accelerates early redemption of the CLO debt, there

could be a shortfall in available funds for the combo noteholders. If a combo note is prepaid in full prior

to maturity, most often the combo note is either exchanged back into the underlying CLO tranche(s), or

a new structure is created with a residual class of notes.

Lastly, a combo note can be structured such that the holder could end up with full equity

ownership/control or a majority ownership of the subordinated portion of a CLO’s capital structure. This

is a concern of some CLO managers, who are responsible for the portfolio management and credit

selection (bank loans) for the underlying CLOs.

Regulatory Arbitrage

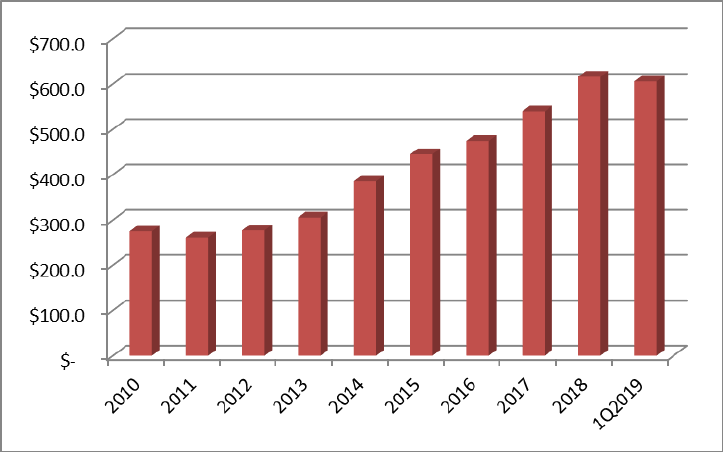

While the volume of Combo Notes is not necessarily tracked, as most of the market is privately placed,

they have made a notable comeback since the financial crisis as the CLO market has grown (see

Appendix). Combo Notes have become popular investments among U.S. insurers due to “favorable”

capital treatment and attractive risk-adjusted returns. That is, the investment grade rating on the

Combo Note determines statutory capital held for the investment even though the underlying

components of the Combo Note include below investment grade CLO tranches—particularly, high-risk

CLO equity. The Combo Note can receive a lower capital charge because of its investment grade rating

than it would have if the insurer had invested directly in the underlying CLO tranches; this is known as

regulatory arbitrage.

Institutional investors (i.e., financial institutions and insurance companies) have been seeking out

investments in Combo Notes for access to bank loans, as well as for the aforementioned regulatory

treatment. The appetite for Combo Notes is primarily driven by challenging arbitrage opportunities in

the current financial environment as interest rates remain relatively low.

7

Appendix:

Historical CLOs Outstanding in the U.S. ($bil), 2010–1Q2019

Source: Securities Industry and Financial Markets Association (SIFMA)

8

Key Terminology

Amortization Period

Once the reinvestment period has ended, the CLO manager pays down the debt (tranches, or CLO

liabilities) following the priority of payments included in the legal documents, using bank loan

prepayments or proceeds from the sale of underlying assets.

Closing Date

Date the underlying portfolio is fully ramped, and coverage and quality tests begin to take effect.

Collateralized Bond Obligation (CBO)

Structured finance security collateralized predominantly by bonds, particularly high-yield corporate

bonds, investment grade corporate bonds, or emerging market sovereign and/or corporate bonds.

Collateralized Debt Obligation (CDO)

Structured finance security collateralized by trust preferred securities (TrUPS), asset-backed securities

(ABS), residential mortgage-backed securities (RMBS), commercial real estate/commercial mortgage-

backed securities (CRE/CMBS), or other CDOs or CLOs.

Collateralized Loan Obligation (CLO)

Structured finance security collateralized predominantly by broadly syndicated, leveraged bank loans.

Combination Note

Structured as a principal-only note, it is backed by cash flows from several tranches of a CLO, typically

with ratings of A or lower, along with and equity tranche. Principal and interest payments on the

underlying CLO tranches pay down the outstanding principal balance of the combo note.

Credit Enhancement

Also referred to as “overcollateralization,” it is the ratio of the aggregate principal value of pooled assets

to the outstanding debt (notes) that comprises the capital structure.

Credit Risk

Possibility that a payment obligation will be missed, resulting in a loss; possibility of loss if a borrower

defaults on making a loan payment.

Effective Date

Date on which the ramp-up period ends.

9

Leveraged Bank Loans

Loans by a group of lenders to companies that are typically rated below investment grade. The loans are

typically secured with a lien on the company’s assets and are generally senior to the company’s other

debt.

NAIC Designation

Alphanumeric symbols used by the NAIC Securities Valuation Office (SVO) to denote a category of credit

quality, ranging on a scale of one (highest credit quality) through six (lowest credit quality).

Non-Call Period

First two years of the transaction’s life where the bond holders receive a yield spread specified at closing

and the bonds cannot be called.

Prepayment Risk

The risk that a borrower will repay a loan before its maturity, depriving the lender of future interest

payments.

Ramp-Up Period

Following the closing date, the months following (usually anywhere from one to four months) during

which the CLO manager purchases the remaining collateral for the bank loan portfolio.

Refinance Risk

The risk that the rated tranches (of the combo note) are paid off in full prior to maturity.

Risk-Based Capital Charge (Capital Charge)

Minimum amount of capital for a reporting entity to support its overall business operations in

consideration of its size and risk profile; companies with large amounts of risk are required to hold

higher amounts of capital and, thus, receive a higher capital charge.

Special Purpose Vehicle (or SPV)

Trusts whose operations are limited to the acquisition and financing of specific assets into the pool that

collateralizes the structured securities (in this case, CLOs); an SPV is the actual issuer of the CLO

tranches.

Tranche

Class of debt within a securitization’s capital structure.