Collateralized Loan Obligations – Stress Testing U.S. Insurers’

Year-End 2018 Exposure

Authors

Azar Abramov, Jean-Baptiste Carelus, Jennifer Johnson, Eric Kolchinsky, Hankook Lee, and Elizabeth

Muroski

Email: CapitalMark[email protected]

Executive Summary

• Collateralized Loan Obligations (CLOs) are structured finance securities collateralized

predominantly by a pool of below investment grade leveraged bank loans. CLOs are a growing

asset class for U.S. insurers and the focus of regulatory concern.

• The NAIC completed a series of stress tests of insurer owned CLOs. The Stress Thesis for the

NAIC’s stress testing U.S. insurer CLO exposure is that the consequences of less stringent

underwriting on the underlying bank loan collateral will result in substantially lower recovery

rates during the next recession.

• Results showed that:

o Losses on “normal” CLO tranches—those with regular promises of principal and

interest—only reached BBB-rated tranches, even under the worst-case scenario.

o For “atypical” CLO tranches—those that have unusual payment promises, such as equity

tranches and Combo Notes—losses reached AA-rated securities.

• U.S. insurer investments in CLOs as a whole do not appear to be a significant risk.

2

About CLOs

CLOs are structured finance securities collateralized predominantly by a pool of below investment

grade, first lien, senior secured, syndicated bank loans, with smaller allocations to other types of

investments, such as middle market loans and second lien loans. CLO debt issued to investors consists of

several tranches, or layers, with different/sequential payment priorities and, in turn, differing credit

quality and credit ratings. The senior-most tranche is the most protected and, therefore, has the highest

credit quality (and highest rating) and generally the lowest coupon. CLOs have structural features that

serve as protection for the debt investors, such as overcollateralization (O/C)—i.e., assets to liabilities

ratio, O/C—and interest coverage tests.

Most CLO portfolios are actively managed by an investment management firm (the CLO manager), which

can buy and sell bank loans and other permissible asset types for the underlying portfolio, during a pre-

defined reinvestment period (typically the first four to five years post-inception, or “closing,” of the

transaction). Due in part to sound structural features, a low default rate environment for bank loans and

prudent investment management, CLOs were considered “survivors” of the financial crisis, and CLOs

outstanding have been steadily increasing in recent years (See Chart 1).

Chart 1: Historical CLOs Outstanding in the U.S. ($bil), 2010–2018

Source: SIFMA

While they are historically a very small portion of total U.S. insurer cash and invested assets, CLOs offer

an attractive yield alternative to traditional bond investments. U.S. insurer exposure to CLOs at year-end

2018 was about $130 billion.

1

Bank Loan Collateral

The credit risk of a CLO is dependent on the underlying assets within the portfolio. For “traditional”

CLOs, the collateral pool primarily consists of below investment grade, first lien, senior secured, broadly

1

This is an update from our Special Report “U.S. Insurers' Exposure to Collateralized Loan Obligations (CLOs) as of

Year-End 2018” published June 2019. We have added another $8.6 billion of CLO-related investments—primarily

CLO Combo Notes.

3

syndicated bank loans (usually at least 90% of the total portfolio); and it may include a pre-determined

allowable portion of other asset types, such as second lien bank loans (which are highly leveraged) and

unsecured debt, as well as middle market loans. Some CLOs consist predominantly of middle market

loans as the underlying collateral.

The average rating of the underlying collateral is typically about single-B, and the leveraged bank loans

are typically floating rate, based on London Inter-bank Offered Rate (LIBOR). In addition, there is also an

allowance for leveraged bank loans that are “covenant-lite” (cov-lite)—that is, those that do not have as

many restrictions relative to the borrower’s debt-service ability as typical bank loans.

Cov-lite loans with “loose” or no financial maintenance covenants have been on the rise in recent years,

peaking at $742 billion outstanding in 2017 (double the amount in 2016), according to FitchRatings

research. By the end of 2018, cov-lite represented about 80% of all leveraged loans according to S&P

Global Market Intelligence’s Leveraged Data & Commentary unit, and there were about $922 billion in

cov-lite loans as of January 2019.

CLO Stress Methodology

Because of recent regulatory interest in leveraged bank loans and CLOs—due in part to the loosened

underwriting standards on the underlying leveraged bank loans (such as the increase in cov-lite, along

with a lack of subordination and weaker earnings-before-interest-tax-deprecation-and-amortization

(EBITDA) multiples with leveraged bank loans)—the NAIC Structured Securities Group (SSG), along with

the Capital Markets Bureau (CMB) performed a series of stress tests on U.S. insurer holdings of CLOs as

of year-end 2018. Three scenarios were formed, each with increasing conservatism. Note that a

probability of occurrence was not assigned to any of the stress test scenarios—these scenarios are not

meant to value the securities. The goal was to measure the potential impact of CLO distress on

insurance company balance sheets.

The NAIC endeavored to model all tranches of broadly syndicated CLOs held by U.S. insurers at year-end

2018. Excluded were CLOs securitized by middle market loans and commercial real estate; collateralized

debt obligations (CDOs) collateralized by asset-backed securities (ABS) and trust preferred securities

(TruPs); and collateralized bond obligations (CBOs) and resecuritizations. It is, however, the NAIC’s

intention to stress test middle market CLOs at a later date.

Stress Thesis

Our Stress Thesis is that the consequences of less stringent underwriting on the underlying bank loan

collateral will result in substantially lower recovery rates during the next recession. Specifically, the

stress tests aim to show how CLOs would fare if bank loan recoveries deteriorated from historical norms

as compared to unsecured debt recoveries. In addition, the recovery stress scenario was run under both

a historical and a moderately stressful default environment.

4

Stress Tests Methodology

The following summarizes the NAIC’s stress tests methodology. A full report on the CLO stress tests

methodology may be found on the NAIC’s CMB webpage via the link: CLO Stress Tests Methodology.

Default Rates:

Base default rate data was obtained from Moody’s Annual Default Study published in 2019 (Moody’s

Study).

2

The stress tests used 10-year cohort data for all cohorts with at least 10 years (1970–2009), and

an issuer-weighted average term structure of default rates was calculated for each broad rating category

(e.g., Baa, Ba, etc.). In addition, a weighted average standard deviation (σ) was also calculated for each

tenor.

Two default scenarios were used in the stress tests: “Historical” and “Historical + 1σ.” Rating category

default rates were scaled by historical ratios to produce rating-specific default vectors as shown in Table

1 and Table 2.

Table 1: “Historical” Default Vectors

Table 2: “Historical + 1σ” Default Vectors

2

Moody’s, Corporates – Global Annual Default Study: Defaults Will Rise Modestly in 2019 Amid Higher Volatility,

Excel Supplement, 2019.

1 2 3 4 5 6 7 8 9 10

Ba1 0.6% 1.8% 3.1% 4.4% 5.8% 7.2% 8.2% 9.0% 9.8% 10.7%

Ba2

1.0% 2.4% 3.9% 5.4% 6.8% 8.0% 9.1% 10.4% 11.8% 13.4%

Ba3

1.8% 4.8% 8.0% 11.6% 14.6% 17.5% 20.0% 22.4% 24.7% 26.7%

B1

2.7% 6.7% 10.9% 14.7% 18.5% 21.9% 25.3% 28.2% 30.8% 32.9%

B2

4.0% 9.8% 15.1% 19.7% 23.4% 26.8% 29.7% 32.1% 34.3% 36.4%

B3

6.5% 13.6% 20.2% 25.7% 30.4% 34.4% 37.9% 40.9% 43.5% 45.5%

Caa

12.8% 23.1% 30.9% 37.1% 41.7% 45.4% 48.2% 51.0% 53.6% 55.8%

Ca-C

49.8% 61.5% 67.6% 70.8% 71.5% 71.5% 72.5% 73.4% 73.4% 73.4%

1 2 3 4 5 6 7 8 9 10

Ba1 1.1% 3.4% 5.4% 7.4% 9.5% 11.3% 12.5% 13.3% 14.1% 15.0%

Ba2

1.9% 4.5% 6.8% 9.0% 11.2% 12.6% 13.9% 15.4% 17.1% 18.7%

Ba3

3.5% 9.0% 14.0% 19.4% 23.8% 27.5% 30.6% 33.4% 35.6% 37.4%

B1

4.7% 10.7% 16.4% 21.1% 25.3% 28.8% 32.1% 35.2% 38.3% 40.9%

B2

7.1% 15.6% 22.7% 28.3% 32.0% 35.2% 37.7% 40.0% 42.7% 45.3%

B3

11.5% 21.7% 30.4% 36.8% 41.5% 45.2% 48.1% 51.1% 54.1% 56.5%

Caa

20.1% 32.7% 41.7% 47.3% 51.3% 53.7% 55.7% 58.2% 60.2% 62.5%

Ca-C

77.9% 87.3% 91.0% 91.0% 91.0% 91.0% 91.0% 91.0% 91.0% 91.0%

5

Certain Ca-C default rates (as highlighted in yellow in Table 1 and Table 2) were adjusted to ensure that

marginal defaults rates remained non-negative.

Recovery Rates:

Recovery rate data was obtained from Exhibit 7 of the Moody’s Study, which provides historical recovery

rates for nine categories of corporate debt recoveries, ranging from first lien bank loans down to junior

subordinated bonds. A portion of the defaulted amount of underlying bank loan collateral was modeled

to recover at a set of recovery rate assumptions. The NAIC Stress Thesis expects the underlying bank

loans to perform similar to unsecured debt in the next market downturn; other asset types in the

portfolio were assumed to perform similar to their next worse category—the “stepdown” scenario.

The third-party software used by the NAIC provided inputs for three primary debt categories: senior

secured bank loan, second lien bank loan, and senior unsecured bond. We also added an “other”

category for any debt not covered by the three aforementioned categories. (see Table 3).

Table 3: Mapping Recovery Rates

Since the bulk of CLO collateral are classified as senior secured loans, the assumed recovery rate was

reduced from 64% to 40% in the Stepdown scenario.

Stress Test Scenarios:

Three scenarios were run: A, B and C as shown in Table 4:

Table 4: Scenarios of Stress Testing

What Was Not Modeled

Correlations were not explicitly modeled, as each CLO has a unique underlying portfolio, which can be

diversified across a number of issuers and industries, and advanced correlation analysis is beyond the

scope of this project.

Collateral Label

Historical Priority

Position

Stepdown Priority

Position

Notes

Senior Secured Loan

1st Lien Bank Loan

Sr. Unsecured Bank

Loan

Consistent with our

Stress Thesis

Second Lien Loan

2nd Lien Bank Loan

Sr. Subordinated Bond

Lowest recovery avail.

Senior Unsecured

Bond

Sr. Unsecured Bond

Subordinated Bond

Consistent with the

Stress Thesis

Other

Jr. Subordinated Bond

Sr. Subordinated Bond

Lowest recovery avail.

Scenario Default Rate Recovery Rate

A Historical Historical

B Historical Stepdown

C Historical + 1σ Stepdown

6

CLO managers were also not factored into the stress testing, given the difficulty of this task. There are

limited purchases and sales permitted after the reinvestment period; and while CLO managers intend to

improve the credit quality of the portfolio, sometimes they do not. Historical performance is indicative,

but no guarantee of future returns and given the dominant position of CLOs in the leveraged bank loan

market, CLO manager trading decisions may be a ‘zero-sum game’ for the CLO market in general.

Stress Test Results

At the deal level, over 900 unique transactions (and over 7,600 tranches) were analyzed using a third-

party vendor waterfall model, totaling about $527 billion par value (85% of total U.S. CLOs outstanding

at year-end 2018). The portfolios were run as of June 30, 2019, with results as shown in Table 5. In

Scenario A, which used a base default rate and historical recovery rate, the mean expected portfolio loss

was the lowest at 9.7%, compared to Scenario C, where a stressed default rate and “stepdown” recovery

rate generated an expected portfolio loss that was more than double, or 19.11%.

Table 5: Underlying Portfolio Losses by Scenario

Industry Results

Our analysis of the U.S. insurance industry’s total CLO exposure resulted in five categories for the purposes

of this report, as shown in Table 6.

Table 6: CLO Categories

Mapped and Modeled

We were able to model $96.9 billion of insurance company CLO exposure, which was separated into two

categories: Normal and Atypical. There were $95.9 billion of Normal tranches, which pay regular promises

7

of principal and interest, and $1 billion of Atypical tranches. Atypical tranches have unusual payment

promises, and they consist of mostly equity and Combo Note tranches.

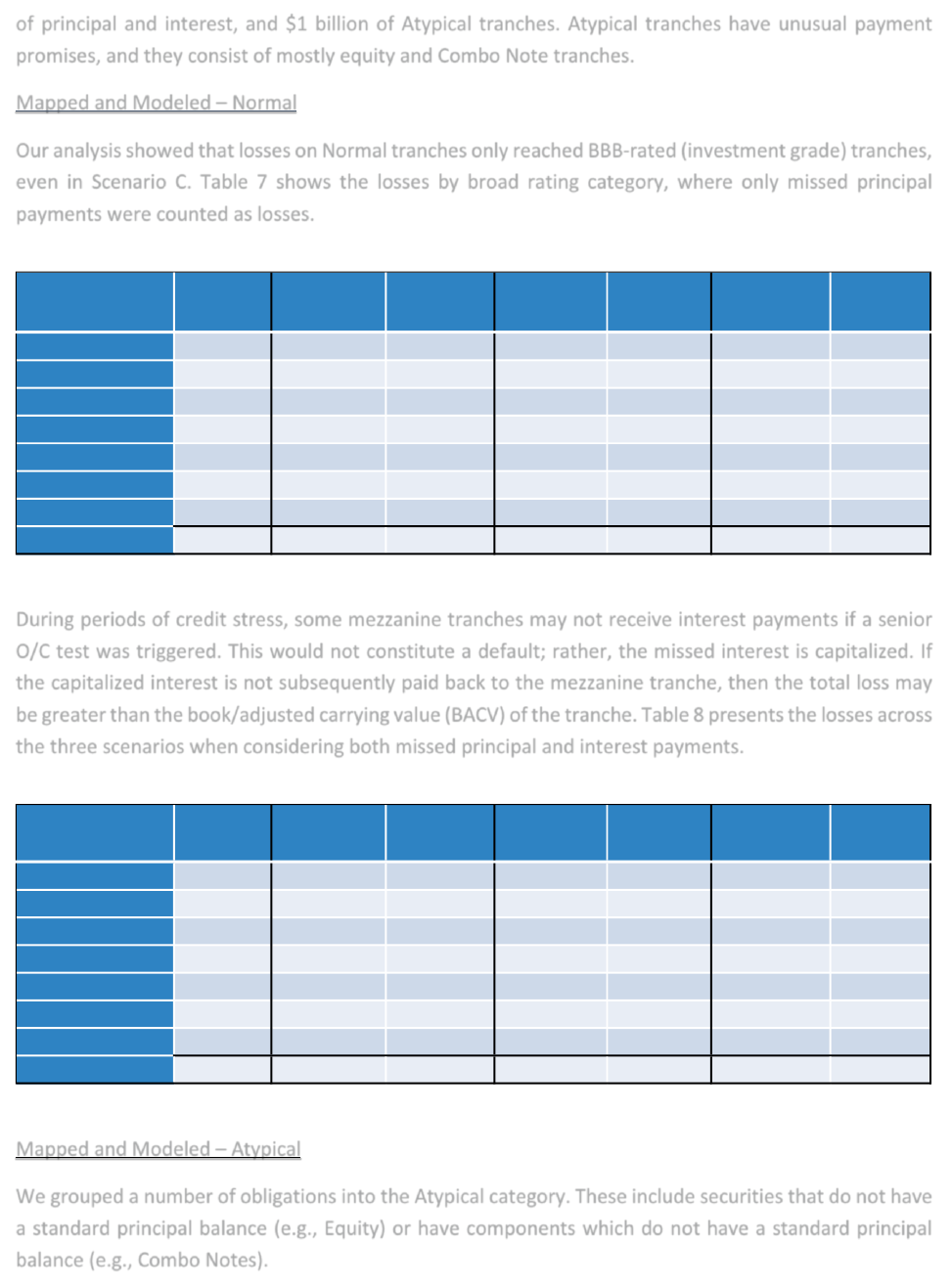

Mapped and Modeled – Normal

Our analysis showed that losses on Normal tranches only reached BBB-rated (investment grade) tranches,

even in Scenario C. Table 7 shows the losses by broad rating category, where only missed principal

payments were counted as losses.

Table 7: Principal Losses on Normal Tranches ($mil.)

During periods of credit stress, some mezzanine tranches may not receive interest payments if a senior

O/C test was triggered. This would not constitute a default; rather, the missed interest is capitalized. If

the capitalized interest is not subsequently paid back to the mezzanine tranche, then the total loss may

be greater than the book/adjusted carrying value (BACV) of the tranche. Table 8 presents the losses across

the three scenarios when considering both missed principal and interest payments.

Table 8: Principal and Interest Losses on Normal Tranches ($ mil.)

Mapped and Modeled – Atypical

We grouped a number of obligations into the Atypical category. These include securities that do not have

a standard principal balance (e.g., Equity) or have components which do not have a standard principal

balance (e.g., Combo Notes).

Lowest Rating

Mapped

Exposure

Scenario A

Loss

Loss %

Scenario B

Loss

Loss %

Scenario C

Loss

Loss %

AAA 43,729 - 0.0% - 0.0% - 0.0%

AA 22,701 - 0.0% - 0.0% - 0.0%

A 15,204 - 0.0% - 0.0% - 0.0%

BBB 11,525 - 0.0% - 0.0% 1,942 16.9%

BB 2,465 7 0.3% 1,126 45.7% 2,344 95.1%

B 174 74 42.5% 169 97.0% 171 98.6%

CCC 11 10 89.1% 11 100.0% 11 100.0%

Total 95,808 91 0.1% 1,305 1.4% 4,469 4.7%

Lowest Rating

Mapped

Exposure

Scenario A

Loss

Loss %

Scenario B

Loss

Loss %

Scenario C

Loss

Loss %

AAA 43,768 - 0.0% - 0.0% - 0.0%

AA 22,684 - 0.0% - 0.0% - 0.0%

A 15,202 - 0.0% - 0.0% - 0.0%

BBB 11,525 - 0.0% - 0.0% 3,040 26.4%

BB 2,487 12 0.5% 1,612 64.8% 3,584 144.1%

B 174 132 75.9% 265 152.6% 275 158.0%

CCC 11 11 101.8% 13 116.3% 13 118.6%

Total 95,852 155 0.2% 1,890 2.0% 6,912 7.2%

8

Equity tranches have a notional balance and are not entitled to receive principal payments. In stressed

environments, O/C tests cut off cash payments to equity holders. As a result, it is not possible to calculate

a principal loss on these tranches. Combo Notes are a combination of equity tranches and other tranches

within a capital structure, typically rated to a return of principal only. Combo Notes do have a principal

balance, and all cash flows from the underlying securities are directed to their repayment.

Combo Notes losses to principal averaged 28% in Scenario A and increased to 30% in Scenario C. This

performance was mostly driven by the equity tranche component, whose payments were stopped (due

to the O/C test trigger). We found that the risk on rated Combo Notes is not comparable with similarly

rated Normal tranches. Among the modeled Combo Notes, losses reached AA-rated tranches.

Atypical tranches are particularly concerning, as they are susceptible to high losses in stress scenarios;

however, they are concentrated in only a few companies.

Ready to Map

“Ready to Map” tranches include those where the reported Committee on Uniform Securities

Identification Procedures (CUSIP) number could be mapped to a tranche that has since been paid in full.

The mismatch is due to a timing issue—that is, running the stress test model as of June 30, 2019, with CLO

exposure reported by U.S. insurers as of Dec. 31, 2018. The total amount of CLO exposure affected by this

phenomenon is $6 billion. This issue will rectify itself when we perform the stress tests with year-end 2019

reported data.

Almost $5 billion of this total was rated single-A or higher at year-end 2018; results for Ready to Map

tranches are expected to be similar to the aforementioned Mapped and Modeled tranches. We do not

believe that this sector presents a qualitatively different risk from the modeled securities.

Out of Scope

Tranches that were deemed “Out of Scope” for this project totaled $12.2 billion, as shown in Table 9.

Table 9: Out of Scope Categories

Middle market CLOs are backed by loans to small and medium sized companies. These loans have less

publicly available information and may have materially different performance. For example, middle

9

market loans have less liquidity, which may have a negative impact on recovery rates. Nevertheless, we

are seeking a data source which will allow us to analyze these CLOs.

Need Information

Tranches in this category totaled about $15.1 billion and included those for which we do not have a CLO

model available from our vendor, a Combo Note where the underlying CLO is modeled but terms and

conditions of the transaction are unknown, or the filer identified the investment as a CLO but did not

identify the relevant tranche.

A brief review of these securities showed that more than half were Atypical, primarily Combo Notes.

Analysis

Of the losses on the Mapped and Modeled, Normal are relatively small compared to the total capital and

surplus of the U.S. insurance industry. Furthermore, they are concentrated within a small number of

companies.

Starting with all U.S. insurers with any CLO exposure as of year-end 2018, we divided the Principal Loss

(compare with Table 7) by each company’s 2018 total capital and surplus for each scenario. These results

were bucketed by U.S. insurer asset size, and the median, average and maximum was calculated. These

results are presented in Table 10.

Table 10: Ratio of Principal Loss to Total Capital and Surplus

It is worth noting that the median loss ratios for all three scenarios is zero. Furthermore, it is clear that

average losses in Scenario B and C are driven primarily by their respective outliers.

We also observed a concentration of Atypical securities in a small number of insurers. To demonstrate

this, we combined the Mapped and Modeled; i.e., Atypical with likely Atypical tranches from Ready to

Map and Need Information. Again, starting with the set of U.S. insurers with any CLO exposure, we

calculated a ratio of Atypical tranches and likely Atypical tranches to total capital and surplus (See Table

11). Please note that these are not losses, but exposures only.

Asset Size Med. A Med. B Med. C Avg. A Avg. B Avg. C Max. A Max. B Max. C

> $50B - - - - - 2% - 6% 26%

$10B to $50B - - - - - 2% 1% 9% 28%

$5B to $10B - - - - - - 1% 3% 5%

$2.5B to $5B - - - - 1% 2% - 14% 52%

$1B to $2.5B - - - - 2% 4% 37% 96% 157%

$500mm to $1B - - - - - 2% 1% 6% 44%

$250mm to $500 mm - - - - - - - 4% 17%

< $250mm - - - - - - - 3% 7%

10

Table 11: Ratio of Atypical Exposure to Total Capital and Surplus

Once again, the median exposure to Atypical tranches (out of all companies with CLO exposure) is zero,

while averages are skewed by a small number of companies.

Conclusion

The Stress Thesis for the NAIC’s modeling of U.S. insurer CLO investments states that lower recovery rates

are expected on the underlying bank loan portfolios in the next recession due to less stringent

underwriting terms. As the NAIC SSG and CMB performed stress testing on U.S. insurer CLO investments—

the majority of which are high credit quality based on credit ratings—results showed that Normal

tranches that rated A and higher did not experience any losses under the three different scenarios

tested. In the most stressful scenario, losses only reached BBB-rated notes for Normal tranches.

Since U.S. insurer exposure to CLOs is relatively small, at less than 2% of total cash and invested assets as

of year-end 2018 and the vast bulk of these investments are rated single A or above, we do not believe

that the CLO asset class currently presents a risk to the industry as a whole.

Nevertheless, our analysis also showed that a few insurers have concentrated investments in Combo

Notes and low rated tranches. Even though they tend to perform well during stable market conditions,

Combo Notes experience significant losses when the environment is stressed. Given the complexity and

volatility of CLO investments in general, however, their exposure as a percent of total capital and surplus

is worth identifying, particularly for insurers with large exposures as a percentage of their total asset size.

The NAIC will continue to monitor U.S. insurer investments in CLOs and report as deemed appropriate.

Asset Size Median Average Max

> $50B - - 26%

$10B to $50B - 6% 282%

$5B to $10B - 1% 26%

$2.5B to $5B - 1% 22%

$1B to $2.5B - - 25%

$500mm to $1B - - 10%

$250mm to $500mm - 2% 68%

< $250mm - 1% 8%

11

Useful Links:

NAIC Capital Markets Special Report – U.S. Insurance Industry Exposure to Collateralized Loan

Obligations as of Year-End 2018, June 2018

NAIC Capital Markets Primer – Leveraged Bank Loans, November 2018

NAIC Capital Markets Primer—Collateralized Loan Obligations, July 2018

NAIC Capital Markets Primer – Combo Notes, October 2019