CLEAN ENERGY

IMPACT REPORT

CO

2

TABLE OF CONTENTS

Introduction .................................................... 1

Investing in Clean Energy ............................... 4

Financing Clean Energy .................................. 7

I. New Energy Deployment ........................ 8

II. Refinancings .......................................... 10

III. Clean Tech Ecosystem ...........................12

Looking Forward ............................................14

Methodology .................................................15

This document has been prepared by the Environmental Markets Group at Goldman Sachs and is not a product of the research department of Goldman

Sachs. This document should not be used as a basis for trading in the securities or loans of the companies named herein or for any other investment

decision. This document does not constitute an offer to sell the securities or loans of the companies named herein or a solicitation of proxies or votes

and should not be construed as consisting of investment advice.

1

1

The target was expanded in November 2015 as part of our updated Environmental Policy Framework. Learn More.

2012

2016

2025

BY 2021

SET INITIAL TARGET

$40 BN

ACHIEVED 2012 TARGET

AHEAD OF SCHEDULE

BY 2025

EXPANDED TARGET

1

$150 BN

Goldman Sachs has a long-standing commitment

to harnessing innovative market solutions to address

critical environmental challenges, in particular

climate change. Since energy accounts for the

vast majority of greenhouse gas emissions,

clean energy is key to addressing climate change.

It also brings benefits of energy diversification

and security, technology innovation and green

jobs, as well as sustainable economic growth

and health improvements.

Clean energy is at an inflection point as rapid cost

declines have facilitated significant growth of the

industry. However, the clean energy sector, and

renewable energy generation in particular, is capital

intensive, with high upfront costs and payback

materializing over subsequent years. As such,

the ability to mobilize capital and facilitate efficient

financing is particularly important.

Clean energy companies often look to the capital

markets to meet their capital needs, but due to a

variety of barriers there is still insufficient capital

available relative to the global need.

In 2012, Goldman Sachs established a target to finance and invest

$40 billion in clean energy globally over the following decade. Just

over four years later, we achieved this initial goal. In November 2015,

we increased our existing target to $150 billion by 2025, expanding our

ambitions and underscoring our commitment to mobilizing capital to

scale up clean energy and foster sustainable economic development.

Introduction

As a leading financial institution, we play an

important role in mobilizing capital, facilitating

innovative financing mechanisms and helping to

address market barriers to scale up clean energy

and aid in the transition to a low carbon economy.

In 2012, when there was significant volatility in the

capital markets for clean energy, we set our original

goal for deploying $40 billion in capital to reinforce

our long-term commitment to and conviction in

the sector.

In May 2016, we reached and exceeded our initial

goal with the completion of over $41 billion in

financings and investments. With this capital,

we have helped clients establish themselves as

major clean energy producers around the world.

For example, we have invested in clean energy

developers, including the largest offshore wind

developer globally and one of the largest Indian

independent renewable developers. We have also

made a number of investments to help expand

access to clean energy for underserved markets.

Introduction

2

Introduction

This report highlights the impact of the companies

that we have helped finance and the investments

that we have made since 2012. As of this

report’s publication, there is no consensus on

the methodology for measuring impact across

the different types of capital deployed. We have

defined a methodology based on publicly available

information, where available, and assumptions

commonly used by the industry. Please see

our methodology on page 15 for further detail.

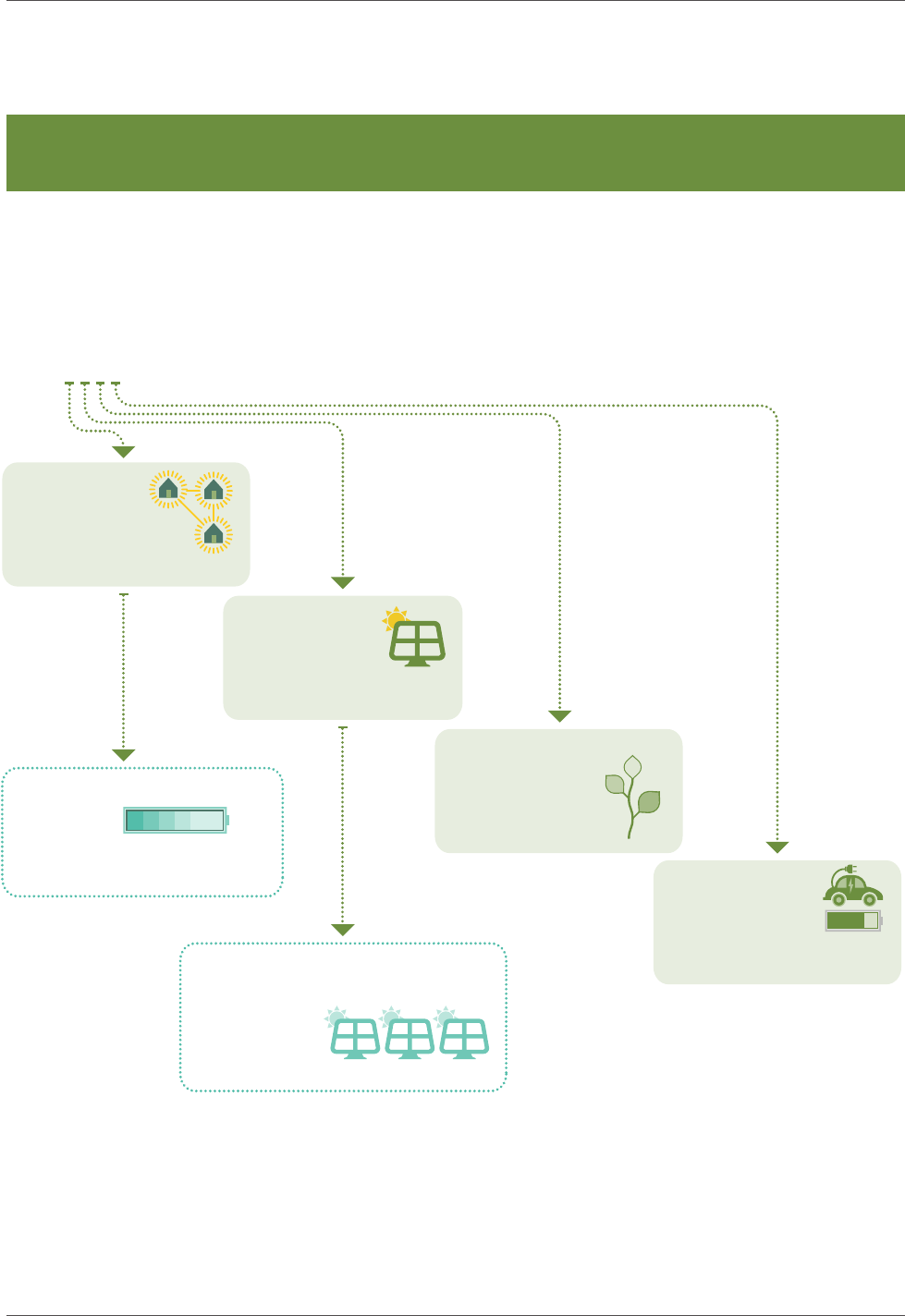

We break down our capital deployed as investments

and financings according to the following:

Investing in Clean Energy: Our investments

include capital deployed through our principal

investing activities, middle market investing

teams and our impact investing platform, across

both equity and debt transactions. These include

investments in new management teams and in

established companies that need capital, as well

as in projects and structured transactions. In

addition to capital, we bring deep expertise, long-

standing relationships and strategic insight to our

investments.

Financing Clean Energy: Financings are

transactions where we play an intermediary role

connecting clients seeking capital with investors

looking to deploy capital. We provide a diverse

range of financing solutions to meet a variety of

needs, and have further segmented the capital

deployed into three categories for purposes of

considering the impact:

I. New Energy Deployment: Financing clean

energy developers to help them construct and

bring new projects to commercial operations.

II. Refinancings: Refinancings of clean energy

projects, which free up balance sheet capital

for further deployment.

III. Clean Tech Ecosystem: Financings for

companies developing advanced clean

technologies primarily in sectors outside

of renewable electricity generation.

Key Impact Highlights

f The $41 billion in capital we have harnessed

through investments and financings has helped

89 companies and projects scale up clean

energy technologies and renewables across

29 countries.

f Through our investments and financings in new

energy deployment, we have helped facilitate

31 gigawatts (GW) of new renewable

generation, which can power the equivalent

of 5.5 million U.S. homes with clean energy.

The aggregate new generation includes 4.5

gigawatts from investments and nearly 27

gigawatts from the companies we have financed.

f We have helped clients refinance almost

15 gigawatts of solar and wind, freeing

up balance sheets for new development.

f In addition, we have helped companies

finance and deploy advanced clean energy

technologies ranging from electric vehicles

and smart grids to solar components and

advanced bio-products.

f Collectively, the clean energy technologies

supported by our financings and investments

will avoid 74 million metric tons of greenhouse

gases in 2016, equivalent to the carbon

sequestered by 70 million acres of forests or

taking 16 million cars off the road. Taking into

consideration the electricity produced throughout

the life of these assets, which averages more

than 20 years, the impact will be multiple folds

greater than this annual number.

f In aggregate, the companies we have invested

in and helped finance employed more than

129,000 people in green jobs and generated

total revenues of over $34 billion in fiscal year

2015. The revenue these companies produce

and the jobs they create catalyze the broader

growth of the clean energy industry across the

value chain and drive an even greater indirect

economic impact.

3

OF NEW ENERGY

CATALYZED

4.5 GW

OF NEW ENERGY

FINANCED

27GW

OF OPERATING ASSETS

REFINANCED

15 GW

IN 89 COMPANIES AND

PROJECTS SINCE 2012

DEPLOYED

$41BN

INVESTMENT

FINANCING

EQUIVALENT

TO THE CARBON

SEQUESTERED BY

CAPITAL INVESTED

$2.5 BN

IN NEW ENERGY

DEPLOYMENT

$11BN

IN REFINANCINGS

$15 BN

FOR CLEAN TECH

ECOSYSTEM

$13 BN

FINANCED

TECHNOLOGIES

EMPLOYED

129 THOUSAND

PEOPLE GLOBALLY

IN FISCAL YEAR 2015

METRIC TONS OF

GREENHOUSE GASES IN 2016

AVOIDING

74 MILLION

CO

2

REVENUES

IN FISCAL YEAR 2015

GENERATED

$34 BILLION

$

OR

70MILLION ACRES OF FOREST

16MILLION CARS OFF THE ROAD

Goldman Sachs Clean Energy Impact

Summary

See our methodology for assessing impact

Introduction

4

Investing in Clean Energy

Investing in Clean Energy

Through our investment activities, we are involved in the growth of companies across the clean energy

ecosystem. We have a long history of investing in new management teams and companies that need capital,

as well as directly in projects and structured transactions. In addition, we have a long-standing commitment

to impact investing in communities across the United States, which includes providing capital that enables

access to clean energy and efficiency solutions in underserved markets.

Across the vast majority of our investments, we work alongside our clients to bring both capital and strategic

insight to high-quality companies with strong management teams. We provide support for our portfolio

companies’ long-term goals and efforts to build value. Though the total capital invested includes all our

investments, we have only included the impact from investments where we played a key role. Impact metrics

for passive minority investments have been excluded.

f Since 2012, we have invested more than $2.5

billion in capital across 35 companies and

projects. These investments span nine countries

across the Americas, Europe and Asia.

f This capital has led to 4.5 gigawatts of new

renewable capacity since our investment. Wind

accounts for 3.1 gigawatts of new development.

Solar accounts for 740 megawatts, and 630

megawatts have been in other clean energy

technologies including advanced biomass and

sustainable hydropower, reflecting the relative

maturation of these technologies during our

investment period.

f This new renewable energy capacity will

generate enough clean energy to power one

million U.S. homes. In developing countries

such as India, where we have helped build one

of the nation’s largest independent renewable

energy developers, deployment of wind and

solar provides significant economic and social co-

benefits given 360 million people still lack access

to grid-connected energy and reliable electricity

remains a significant challenge.

1

1

The Climate Group, The Business Case for Off-Grid Energy in India. Learn more.

f Collectively, the 4.5 gigawatts of renewable

energy will avoid 6.7 million metric tons of

greenhouse gases in 2016, equivalent to the

carbon sequestered by 6.3 million acres of forest

or taking 1.4 million cars off the road. Accounting

for the lifetime energy generation of the assets,

the impact will be multiple times greater.

f The companies that we invested in directly

employ more than 3,000 people globally

as of the first quarter of 2016.

5

Investing in Clean Energy

OF NEW ENERGY

CATALYZED

4.5GW

IN 35 COMPANIES AND

PROJECTS SINCE 2012

INVESTED

$2.5BN

METRIC TONS OF

GREENHOUSE GASES IN 2016

AVOIDING

6.7MILLION

CO

2

OF WIND

3.1GW

OF OTHER CLEAN

TECHNOLOGIES

0.6 GW

OF SOLAR

0.7GW

EQUIVALENT

TO THE CARBON

SEQUESTERED BY

OR

6.3MILLION ACRES OF FOREST

1.4

MILLION CARS OFF THE ROAD

Goldman Sachs Clean Energy Impact

Investments

See our methodology for assessing impact

6

Among our $2.5 billion in investments, there are a number of strategic investments where we are

an equity investor with board positions in clean energy developers. We have facilitated strong growth

and enabled the companies to focus on building renewable energy projects at scale. In addition, we have

invested directly into renewable energy projects across the range of capital structures, including equity

and tax equity, as well as debt. We have also invested in mid-sized companies, where our capital helps

scale up operations and increase market penetration. Finally, through our impact investment platform,

we have invested in underserved communities to provide more equitable and affordable access to clean

energy. The following are highlights of select investments:

Clean Energy Developers Project-Level Investments

One of the largest

independent renewable

developers in India with

1 GW of installed capacity

TRES MESAS

WIND FARM

150 MW wind farm

in Mexico

Largest offshore wind

developer globally with

1.7 GW of new wind

capacity in the past

two years

SOUTH PLAINS

WIND FARM

200 MW wind farm

in Texas

Renewable development

platform in Japan helping

to transition to a clean

energy mix post-Fukushima

U.S. DISTRIBUTED

SOLAR

165 MW of distributed

solar across the U.S.

Mid-Sized Growth Investments Clean Energy Access

Distributed solar developer

focused on commercial

and industrial projects

in China

Solar and energy efficiency

for low-to-moderate income

(LMI) families in Louisiana,

New York and Connecticut

Distributed and utility solar

developer focused on

projects across Singapore

and southeast Asia

Distributed solar for a

portfolio of single-family

homes in Salt Lake City,

predominantly leased

to LMI families

Minnesota-based

manufacturer of solar

modules designed

for commercial and

industrial projects

Largest public housing

Energy Performance

Contract to improve

energy efficiency for

10,000 residents

Investing in Clean Energy

7

Financing Clean Energy

Financing Clean Energy

We have long-term relationships with our clients as an advisor and financier. Through our Investment

Banking activity, we work with our clients to help raise capital across their full growth cycle, connecting

capital providers to companies that need capital to grow. From private placements, initial public offerings

(IPOs) and follow-ons to hybrid instruments including convertible bonds, we look for efficient and effective

ways to help our clients meet their capital needs.

We consider the impact of our financing activities across the following three categories:

I. New Energy Deployment

II. Refinancings

III. Clean Tech Ecosystem

f Since 2012, we have financed almost $39 billion

through 119 transactions in the clean energy

sector. These transactions include $17 billion of

equity financings, $10 billion of convertible and

hybrid instruments, and $12 billion of debt

financings. As the companies and the sector

have matured, we have been able to harness

more diverse financing tools to expand the investor

base and facilitate greater cost of capital efficiency.

THROUGH 119 TRANSACTIONS

SINCE 2012

FINANCED

$39BN

EQUITY

$17BN

DEBT

$12 BN

CONVERTIBLE

AND HYBRID

$10 BN

8

Financing Clean Energy

I. New Energy Deployment

Solar and wind energy are adding more new generation to the grid each year than conventional energy

sources, with costs having decreased by 80% and 20%, respectively, over the past several years.

1

f Since 2012, we have raised $11 billion for

14 clean energy developers and projects.

These financings include IPOs and convertible

bonds for U.S.-based solar and wind developers,

as well as financings to support the deployment

of wind and solar projects in China, the world’s

largest renewable energy market. In addition to

corporate-level financings, we have completed

project-level financings, including those for

solar in the United Kingdom and sustainable

hydropower in Vietnam.

f Since our involvement, our clients have

collectively deployed 27 gigawatts of new

clean energy, including 15 gigawatts of solar,

12 gigawatts of wind and 200 megawatts of

other clean energy technologies including

sustainable hydropower.

f The 27 gigawatts of new renewable

assets can power more than 4.5 million

U.S. homes.

f These renewable assets will avoid 42 million

metric tons of greenhouse gases in 2016,

equivalent to the carbon sequestered by 40

million acres of forest or taking 9 million cars

off the road. The emission benefits will be

multiple folds greater when accounting for the

lifetime energy generation of these assets.

f These companies generated more than

$17 billion in total revenues in fiscal year 2015.

From the year immediately prior to our initial

financing through fiscal year 2015, they grew

revenue by more than 25%.

U.S. HOMES

4.5 MM

OF ENERGY IS ENOUGH

TO POWER

OR THE EQUIVALENT OF ALL OF

NEW YORK CITY AND WESTCHESTER COUNTY

DID YOU KNOW?

27GW

1

REN21, Renewables 2016 Global Status Report. Learn more.

f During this period, these companies nearly

doubled the number of people they employ,

directly creating 20,000 new green jobs,

and employing 43,000 people globally

as of fiscal year 2015.

PEOPLE GLOBALLY

IN FISCAL YEAR 2015

EMPLOYED

43THOUSAND

REVENUES

IN FISCAL YEAR 2015

GENERATED

$17BILLION

$

9

Goldman Sachs Clean Energy Impact

I. Financing New Energy Deployment

See our methodology for assessing impact

Financing Clean Energy

OF NEW ENERGY

FINANCED

27GW

OF WIND

12 GW

OF OTHER CLEAN

TECHNOLOGIES

0.2 GW

OF SOLAR

15 GW

FOR 14 COMPANIES AND

PROJECTS SINCE 2012

RAISED

$11BN

METRIC TONS OF

GREENHOUSE GASES IN 2016

AVOIDING

42 MILLION

CO

2

EQUIVALENT

TO THE CARBON

SEQUESTERED BY

OR

40MILLION ACRES OF FOREST

9MILLION CARS OFF THE ROAD

10

II. Refinancings

Renewable energy projects often benefit from long-term power purchase agreements with creditworthy

buyers and have visible cash flows once operational. As long-dated cash-yielding assets, clean energy

matches well with financing structures that can tap into the large liquid capital markets. We have led

innovative transactions that have helped companies leverage the capital markets to efficiently refinance

and free up their balance sheets.

f Since 2012, we have raised nearly $15 billion

through refinancings for 22 companies

and projects. These transactions include

securitizations and yield-vehicles that enable

developers to take clean energy assets from

their balance sheet, aggregate and refinance

them through the public capital markets, which

brings benefits of diversification and liquidity.

For investors, these transactions provide a

liquid instrument through which they can gain

exposure to the long-term yield of clean energy

assets. We have also provided warehousing

facilities and led green project bonds to

refinance operating renewable assets.

f Collectively, these transactions have facilitated

the refinancing of nearly 15 gigawatts of

clean energy projects globally, helping to

enhance cost of capital efficiency and expand

the investor base.

f If this capital were redeployed to the same

amount of new renewable projects, it would

equate to avoiding 20 million tons annually

of greenhouse gases, equivalent to the carbon

sequestered by 19 million acres of forest or

taking 4 million cars off the road.

f The companies we have helped refinance

generated $3 billion in total revenues

in fiscal year 2015.

Select Transactions

JAPAN MEGA

SOLAR BOND TRUST

In September 2013, we underwrote the first rated solar securitization globally via the

Japan Mega Solar Bond Trust. This structure has enabled developers to raise capital

against the operating cash flows of renewable projects that are under construction and

newly constructed, while providing investors with direct exposure to higher yielding clean

infrastructure assets. In doing so, it has brought together developers and institutional

investors and opened up a new investor base through capital market financings.

In July 2013, we were a joint book runner for the IPO of NRG Yield, the first U.S. YieldCo.

NRG Yield acquired clean energy assets from its parent company NRG Energy, freeing

up its balance sheet, while providing investors with a liquid investment that provides

the benefits of both yield and growth. Subsequent financings included a follow-on equity

financing and debt financing to fund the acquisition of the Alta Wind Facility, a one-

gigawatt wind farm in the western U.S. and at the time the largest operating wind farm

in the country.

In December 2014, we acted as joint lead book runner on a $204 million, 20-year issuance

for Energía Eólica, a Peruvian wind farm operator of ContourGlobal. This was the first

green project bond issued in Latin America, demonstrating that green bonds can be viable

financing vehicles for issuers to raise project-specific debt in emerging markets. This

transaction won the Bond of the Year award from Environmental Finance in 2015.

Financing Clean Energy

11

Goldman Sachs Clean Energy Impact

II. Refinancings

See our methodology for assessing impact

Financing Clean Energy

OF OPERATING ASSETS

REFINANCED

15GW

OF WIND

7.4 GW

OF OTHER CLEAN

TECHNOLOGIES

3.9 GW

OF SOLAR

3.5 GW

TO FREE UP BALANCE SHEET

FOR 22 COMPANIES AND PROJECTS SINCE 2012

RAISED

$15BN

METRIC TONS OF

GREENHOUSE GASES IN 2016

AVOIDING

20MILLION

CO

2

EQUIVALENT

TO THE CARBON

SEQUESTERED BY

OR

19MILLION ACRES OF FOREST

4 MILLION CARS OFF THE ROAD

12

III. Clean Tech Ecosystem

We have also helped raise capital to facilitate the development of advanced clean technologies across the low

carbon economy. These technologies are integral to the low carbon ecosystem as they enable smarter, more

efficient consumption, cleaner transportation and greener products, and facilitate the increased uptake of

clean energy across the value chain.

f Since 2012, we have helped raise nearly

$13 billion across 38 transactions for

18 companies and projects, including:

i. Electric Vehicles (EVs) and Battery

Storage: We have led a number of financings

to facilitate greater deployment of EVs and

the scale-up of battery storage, which both

powers EVs and can provide energy services

to the grid. For example, our financing is

facilitating the construction of the world’s

largest battery factory.

ii. Solar Components: The scale-up

of manufacturing the components necessary

to construct and operate solar energy

systems has helped rapidly reduce overall

costs. The companies that we have financed

have collectively manufactured the equivalent

of 27 gigawatts of solar modules since our

initial financings.

iii. Advanced Bio-Products: We have financed

companies that produce advanced bio-

based products, including drop-in biofuels,

pelletized biomass and bio-based chemical

feedstocks. The impact of advanced bio-

based products varies based on lifecycle

emissions, and we focus our impact analysis

on products that are produced sustainably.

iv. Grid Technologies: The smart grid

companies we have worked with have

collectively deployed nearly 84 million

networked devices, also known as

“endpoints,” which enable optimized

monitoring, delivery and consumption.

These companies leverage data analytics

and the “Internet of Things” to engage

customers and drive greater efficiencies.

For example, one client has been able

to reduce electricity consumption by

3.2 terrawatt-hours (TW-hours) in 2015,

which is equivalent to the electricity

produced by 2.3 gigawatts of distributed

solar projects.

f The technologies deployed by a subset of these

companies will avoid more than 5 million

metric tons of greenhouse gases in 2016,

equivalent to the carbon sequestered by 5 million

acres of forest or taking 1 million cars off the road.

f In fiscal year 2015, these companies generated

total revenues of more than $10 billion and

employed 81,000 people globally, of which

17,000 new jobs have been added since our

initial financings.

Financing Clean Energy

PEOPLE GLOBALLY

IN FISCAL YEAR 2015

EMPLOYED

81THOUSAND

REVENUES

IN FISCAL YEAR 2015

GENERATED

$10BILLION

$

13

GRID

TECHNOLOGIES

$0.4BN

ELECTRIC VEHICLES

AND BATTERY STORAGE

$6.9BN

FOR 18 COMPANIES AND PROJECTS ACROSS

THE CLEAN TECH ECOSYSTEM SINCE 2012

RAISED

$13BN

ADVANCED

BIO-PRODUCTS

$3.7BN

SOLAR

COMPONENTS

$1.8BN

IN ENERGY SAVINGS IN 2015

3.2 TW-HOURS

ONE COMPANY DROVE

EQUIVALENT

OF SOLAR MODULES

27GW

MANUFACTURED

Goldman Sachs Clean Energy Impact

III. Financing the Clean Tech Ecosystem

See our methodology for assessing impact

Financing Clean Energy

14

our global electricity needs by 2020. Some of these

companies across sectors are also directly investing

in clean energy projects as well as issuing green

bonds that align their capital-raising with their

green activities.

More broadly, clean technologies are rapidly

disrupting a number of industries. LED lighting

has reached 28% market share as of 2015 and is

expected to reach 69% by 2020 from only 1% in

2010, one of the most rapid technology shifts that

is underway.

1

Automotive companies are facilitating

a future of mobility that is based on advanced

clean vehicles, investing in connectivity and

shared models that meet the mobility needs

of consumers in the most optimal and sustainable

way. Chemical companies are developing new

processes based on renewable resources.

Looking forward, there are clear signs of an

accelerating transition to a smarter, more efficient

low carbon economy. We remain firmly committed

to facilitating this transition and doing our part

as a leading financial institution.

Looking Forward

Looking Forward

The global energy requirements of the future are extensive, and clean energy will be a major and growing

part of that future. Our role in bringing greater capital access and efficiency to the clean energy market

remains important. Last year, as part of our revised Environmental Policy Framework, we expanded our

existing target from $40 billion to $150 billion in capital deployment for the clean energy sector by 2025.

In the past several years, the clean energy industry

has scaled up faster than market expectations.

We have reached a critical inflection point in the

deployment of clean energy technologies, with

lower costs and significant co-benefits accelerating

global uptake.

This uptake of clean energy has expanded beyond

traditional energy producers. In 2012, our clients

focused on this sector were largely solar and wind

developers and a handful of companies developing

cutting-edge clean technologies. As we look at 2016

and the years ahead, the ecosystem has and will

continue to become more expansive, cutting across

industries and providing a large global

market opportunity.

Already, an increasing number of corporates,

including large technology companies and retailers,

are procuring clean energy for their operations,

acting as credit-worthy long-term off-takers and

often targeting 100% of their power needs from

renewables. We at Goldman Sachs are among these

companies, and have a 100% renewable goal for

Goldman Sachs Expanded Clean Energy Target

$0

$30

$60

$90

$120

$150

2012

$2 BN

2013

$13 BN

2014

$26BN

2025

$150BN

2015

$38BN

MAY 2016

$41 BN

1

Goldman Sachs Global Investment Research, The Low Carbon Economy. Learn more.

15

Methodology

Methodology

We have defined a methodology to assess the impact of our financing and investing activity. In doing so,

we reviewed existing methodologies and consulted with industry experts. Given the absence of a common

methodology, lack of consistent public disclosure, geographic differences and the unavailability of certain

impact metrics, there are limitations to the scope and consistency of this impact report. However, we have

strived to be transparent in our approach and our descriptions of impact. Minor differences in aggregate

numbers may occur due to rounding.

Impact Analysis for Investing

For our investing activity, we take the approach

of only assessing the impact of companies where

we have a seat on the board of directors or a

similar role. In these cases, we are working

directly with management teams to bring capital

and insight to help these companies grow, and

therefore consider the full impact of the company.

For projects, we consider the full impact of the

project given the direct connection of the capital

invested to the development of the project.

We assess the impact of our investments from

the date of our initial investment through the

first quarter of 2016. We include the growth

in megawatts deployed following our investment and

exclude any megawatts already deployed prior to our

involvement. Employees and revenues are included

solely for corporate-level investments and are as

of the first quarter of 2016 and fiscal year 2015,

respectively.

Data is sourced from the companies we have

invested in, as well as from public company filings

and press releases where available.

Our Target

Our target is focused exclusively on the clean

technology and renewable energy sector, and

on commercial transactions. It includes financing

and investments for clean technologies including

solar, wind, sustainable hydropower, biomass,

geothermal, electric vehicles, energy storage,

energy efficiency, advanced materials, advanced

bio-products, LED lighting, and grid technologies,

including smart grid and renewable energy

transmission, among others.

For financings, we include the total amount of capital

raised for a company when we are a bookrunner on a

transaction, and our pro rata allocation of a financing

when we are a co-manager. For bank loans and

certain other private debt transactions, we include

the full lending amount of capital in cases where

we played an integral role in structuring the loan and

developing the syndicate. Otherwise, we include our

pro rata commitment to the facility.

For investments, we include the direct amount of

capital we invested in the companies and projects.

We separately track strategic advisory transactions

(mergers and acquisitions), green bond proceeds

directed towards uses other than clean energy,

environmentally-related grants, and our internal

renewable energy and green operational

investments, but do not include these as

part of this target.

For the purposes of this report, we include

transactions from the beginning of 2012 through

May 2016, when we achieved our initial target.

16

Impact Analysis for Financing

For corporate-level financings, we assess the

impact of the companies that we have served, as

we have long-term relationships with our corporate

clients and often help them raise capital throughout

their growth cycle, across multiple transactions.

More specifically, we consider the full impact of

these companies from our first financing since

2012 through the first quarter of 2016. For project-

level financings that entail new development, we

consider the full impact of these projects. However,

employees and revenues are excluded for project-

level financings.

For New Energy Deployment, we include the growth

in megawatts deployed from a baseline of the

quarter prior to our first financing through the first

quarter of 2016. Revenues are included in the fiscal

year prior to our financing and the 2015 fiscal year to

calculate growth. Similarly, employee numbers are

included as of the fiscal year prior to our financing

and the 2015 fiscal year.

For Refinancings, we include the total megawatts

that had been refinanced as of the first quarter

of 2016 to illustrate the potential balance sheet

capacity that could be redeployed for additional

new development. We include the total revenues

from companies as of the 2015 fiscal year. For

YieldCo-related financings, employee metrics

are excluded.

For companies across the broader Clean Tech

Ecosystem, we highlight the impacts of specific

companies and transactions given the difficulty

of aggregation across a variety of technologies

with disparate nature of disclosure and complexities

in calculating direct impacts. Revenues and

employees are included in the fiscal year prior

to our financing and 2015 fiscal year.

Data is sourced from public filings and press

releases.

Calculating Emissions

We assess the emissions impact from the

megawatt-hours produced by the operating projects

which have been deployed since our initial financing

or investment. We use the actual capacity factor

of projects, where available. When not available,

we rely on assumptions to calculate megawatt-

hours. For projects in the U.S., we use 2015 annual

average capacity factors from the United States

Energy Information Administration. For other

countries, we use governmental and other credible

sources, or apply a known capacity factor from

other companies’ data from the same country.

In order to assess the greenhouse gases avoided,

we utilize the emissions from electricity generation

in each country. In the U.S., we use the latest annual

non-baseload carbon dioxide output emission rate,

as disclosed by the United States Environmental

Protection Agency (EPA) in their eGRID analysis,

which is based on 2012 data. For other countries,

as non-baseload data is not available, we use

system average data on CO

2

emissions per

megawatt-hour from the International Energy

Agency’s CO

2

Emissions from Fuel Combustion

Highlights 2013 Edition, which is based on 2011

data. Equivalencies for forests and cars are based

on U.S. numbers from the EPA’s Greenhouse Gas

Equivalencies Calculator.

For the Clean Tech Ecosystem, we assess the

emissions impact where applicable. With respect

to electric vehicles, we calculate the emissions from

an EV traveling an average vehicle’s miles per year,

utilizing California’s non-baseload emission rate to

calculate the emissions from electricity required to

charge the vehicle, and compare it to the emissions

of an average passenger vehicle per the EPA. For

advanced bio-products, we adjust the emissions

benefits to account for the lifecycle emissions from

processing the products. For solar components,

we do not assess emissions given that the solar

components, once manufactured, are used by

various developers and could result in duplication

with New Energy Deployment impact metrics. For

smart grid technologies, we rely on direct public

disclosure of emissions impact given the complexity

in direct calculations.

Methodology

17