1

Bloomberg Goldman

Sachs Global Clean

Energy Index

November 2023

Bloomberg Goldman Sachs Clean Energy Index Methodology November 2023

2

Table of Contents

Introduction 3

Section 1: Index Overview 3

Section 2: Bloomberg Thematic Research 3

Bloomberg New Energy Finance (BloombergNEF) 3

Section 3: Index Eligibility Process 3

Parent Index 3

Sector Eligibility 3

Liquidity Eligibility 3

Section 4: Index Selection Process 5

Section 5: Index Weighting 6

Section 6: Index Maintenance 6

Index Rebalance and Reconstitution 6

Deletion Policy 7

Addition Policy 7

Replacement Policy 7

Corporate Actions 7

Risks 7

Limitations of the Index 7

Section 7: Benchmark Oversight and Governance 8

Benchmark Governance, Audit and Review Structure 8

Index and Data Reviews 8

Expert Judgement 9

Data Providers and Data Extrapolation 9

Conflicts of Interest 9

Restatement Policy 9

Appendix A: Environmental Social & Governance (ESG) Disclosures 11

Disclaimer 16

Bloomberg Goldman Sachs Clean Energy Index Methodology November 2023

3

Introduction

The Bloomberg Goldman Sachs Global Clean Energy Index aims to represent the performance of a set of companies that are

expected to derive significant revenues from products and services that contribute to production of energy from renewable

sources . Bloomberg Goldman Sachs Global Clean Energy Index is a modified float-adjusted market capitalization weighted index

designed by identifying companies using a combination of analyst research and curated data acquired from Bloomberg New

Energy Finance and Sustainalytics.

Section 1: Index Overview

Name

Bloomberg Goldman Sachs Global Clean Energy Index

Ticker

BGSCE (Price Return)

BGSCET (Total Return)

BGSCEN (Net Total Return)

Currency

USD

Inception Date

10/27/2021

Weighting Modified Market Capitalization

Publication

Weekdays (except January 1

st

)

Section 2: Bloomberg Thematic Research

Bloomberg New Energy Finance (BloombergNEF)

BloombergNEF (“BNEF”) is a strategic research provider covering global commodity markets and the disruptive technologies

driving the transition to a low-carbon economy. BloombergNEF’s expert coverage assesses pathways for the power, transport,

industry, buildings and agriculture sectors to adapt to the energy transition.

Bloomberg Index Services Limited (“BISL”) utilizes the BNEF Clean Energy Exposure Rating (“CEER”) to determine index eligibility.

The CEER provides an estimate of a company’s value attributable to clean energy activity. Please refer to the BNEF Clean Energy

Exposure Ratings methodology through the link below for additional details.

BNEF Clean Energy Exposure Rating Methodology

Section 3: Index Eligibility Process

Parent Index

In order to be eligible for the Bloomberg Goldman Sachs Global Clean Energy Index, a security must be a member of the

Bloomberg Global Equity Index. Please refer to the Bloomberg Global Equity Index methodology through the link below for

additional details.

Bloomberg Global Equity Indices Methodology

Sector Eligibility

A security must be classified to any of the relevant Bloomberg New Energy Finance (BNEF) sectors within the CEER. Please refer to

the BNEF Clean Energy Exposure Ratings methodology through the link below for additional details.

BNEF Clean Energy Exposure Rating Methodology

Liquidity Eligibility

A security must have a minimum 90-day average value traded of $5 million.

Bloomberg Goldman Sachs Clean Energy Index Methodology November 2023

4

Exclusions

There are two core exclusionary criteria: companies with low thematic relevance scores, sourced by BNEF and companies excluded

by Sustainalytics ESG factors.

Thematic Exclusion

BNEF analysts estimate the proportion of an organization's value that is attributable to its activities across clean energy. They take

into account reported segment revenues, along with other available metrics such as segmented EBITDA. Estimates are based on

quarterly reviews by sector specialists.

The exposures are grouped in four categories. A security must have an exposure level of A1, A2 or A3 in order to be eligible for the

Index. Additionally, the security must have coverage by BNEF, securities without coverage, zero exposure or exposure score of A4

are ineligible for the index.

For further details refer to the BNEF methodology in the link below:

BNEF Clean Energy Exposure Rating Methodology

Sustainalytics Exclusions

Bloomberg Goldman Sachs Global Clean Energy Index excludes securities based on the ESG factors sourced from Sustainalytics

listed below. This is not intended to be an exhaustive definition, please see Appendix A for additional detail. A security is excluded

if it fails the inclusion criteria for any of the ESG factors listed below or if it has no coverage across all of the ESG factors listed

below.

Categories

Criteria

Extreme Event Controversies

Companies involved in ESG-

related controversial incidents.

These incidents are assessed

through a framework that

considers the severity of

incidents and corporation’s

accountability and whether they

form part of a pattern of

corporate misconduct.

Researched companies considered to be the “worst of the worst” in the peer

group or sector

• Impact and risk are severe and irreversible.

• The case is highly exceptional in the peer group.

• Impact of the misconduct is on a broad range of stakeholders over a long

duration, and imposes a clear cost on society.

• There are serious ongoing risks posed to the company.

• The company is directly responsible for the misconduct.

• The level of involvement is exceptional among peers in numerous

respects.

• Cases are recurring and have not been addressed adequately or at all.

• The company fails to demonstrate the ability to remediate the issue.

• The company has refused to address the issue and/or has tried to conceal

the wrongdoing and/or its involvement.

Controversial Weapons

Researched companies that have any involvement in the core weapon

system or components and services of the core weapon system, including

Exposure Level

Description

A1 Main Drive (50-100%)

50-100% of the organization’s value is estimated to derive from clean

energy

A2 Considerable (25-49%)

25-49% of the organization’s value is estimated to derive from clean energy

A3 Moderate (10-24%)

10-24% of the organization’s value is estimated to derive from clean energy

A4 Minor (<10%)

Less than 10% of the organization’s value is estimated to derive from clean

energy

Bloomberg Goldman Sachs Clean Energy Index Methodology November 2023

5

Companies involved in a core

weapon system or components

and services of a core weapon

system that are either tailor-

made and essential or non-

tailor made and non-essential

for the lethal use of the weapon

significant ownership, tailor-made, and non-tailor made, are excluded from

the Index.

UNGC Violation

Companies that benchmark

administrators find in violation

of the United Nations Global

Compact (UNGC) principles

Researched companies who have breached a principle of the UN Global

Compact

Civilian Firearms

Companies that manufacture

and sell assault weapons to

civilian customers, manufacture

and sell small arms to civilian

customers, manufacture and

sell small arms to military and

law enforcement, or

manufacture and sell key

components of small arms.

Companies involved in the

retail and/or distribution of

assault weapons or small arms.

Researched companies classified as generating 5% of revenue in the

manufacture and sale of assault and non-assault weapons to civilian

customers.

Researched companies classified as deriving 5% or more of its revenue from

the distribution and retail sale of assault and non-assault weapons.

Researched companies classified as generating 5% of revenue from the

manufacture and sale of key components of assault and non-assault

weapons.

Thermal Coal Extraction:

Companies that extract thermal

coal.

Researched companies classified as generating 5% of revenue in the

extraction of thermal coal.

Tobacco

Companies that manufacture

tobacco products, supply

tobacco-related products and

services, or derive revenue from

the distribution and/or retail

sale of tobacco products.

Researched companies classified as generating 5% of revenue in the

production of tobacco or tobacco-related products and services.

Researched companies classified as deriving 10% or more of its revenue from

the distribution and retail sale of tobacco products.

Arctic Oil and Gas Exploration

Companies involved in Arctic

Oil and Gas Exploration.

Researched companies classified as generating 5% of revenue from Arctic

Oil and Gas Exploration.

Oil Sands

Companies that use Oil Sands

to produce fuels such as

gasoline and diesel.

Researched companies classified as generating 5% of revenue in the product

involvement with Oil Sands.

Researched companies classified as deriving 10% or more of its revenue from

the distribution and retail sale of Oil Sands.

Thermal Coal Power

Generation

Companies that generate

electricity from thermal coal, or

have generating capacity for

thermal coal.

Researched companies classified as generating above 50% of revenue from

Thermal Coal Power Generation. Severity Score of 4 or higher.

Section 4: Index Selection Process

All securities that satisfy the Index Eligibility Process are considered for inclusion in the Index.

Bloomberg Goldman Sachs Clean Energy Index Methodology November 2023

6

Changes in the methodology may be made periodically to ensure representativeness, accuracy and integrity.

Section 5: Index Weighting

The index securities are modified market capitalization weighted. The float market cap weights are constrained based on their

clean energy exposures. 60% of index weight is assigned to issuers classified as A1 Main driver (50-100% of value) exposures, with

top 8 issuers by weight in this category capped at 5% and rest of the issuers in this category capped at 4% . 30% of index weight is

assigned to securities classified as A2 Considerable (25-49%) exposures, with security weights in this category capped at 2.5%. The

remaining 10% of the index weight is assigned to issuers classified as A3 Moderate (10-24%) exposures, with issuer weights in this

category capped at 1%. If there are multiple securities per issuer, then the issuer weight is redistributed proportionally to all of the

securities within the issuer based on the free float market capitalization of each security. A minimum cap of 0.02% is applied to all

the issuers in the index. Any excess weight from capping is then redistributed proportionally to the remaining uncapped issuers.

If, after the Index Selection Process is applied, the number of issuers in the Index is less than or equal to 20, then the Index issuers

are equal weighted. If the number of issuers in the Index is greater than 20 and less than 32, then the bottom-tier cap (2.5%) is

relaxed and the weight equally redistributed among all the remaining uncapped issuers such that the bottom-tier cap is still less

than the top-tier cap (5%) and the weights sum to 1. If it is not possible to redistribute the weights such that the bottom-tier cap is

still less than the top-tier cap, then the Index issuers are equal weighted.

Section 6: Index Maintenance

To ensure that the Index accurately reflects the aggregate performance of its constituent members, the Index must be rebalanced

and reconstituted periodically and maintained on a daily basis for corporate actions, corporate events, any restatements, data

integrity and changes to the methodology. The Index rebalance and reconstitution is performed to update the eligibility, selection,

and weighting process for index inclusion.

Index Rebalance and Reconstitution

The Index is reconstituted and rebalanced quarterly in March, June, September, and December.

Selection Date

The Index Eligibility Process is applied using data as of the last Wednesday in January, April, July, and October.

Index Share Determination Date

Float Shares are determined using Shares Outstanding and Free Float as of the last Wednesday in January, April, July, and

October. Index Weighting is determined using prices as of 3 weeks prior to the Index Effective Date.

Index Announcement Date

An Index reconstitution and rebalance announcement date shall be the last Wednesday in February, May, August, and November.

Index Effective Date

The Index reconstitutions and rebalances go effective after the close of trading on the 2nd Wednesday in March, June, September,

and December, respectively.

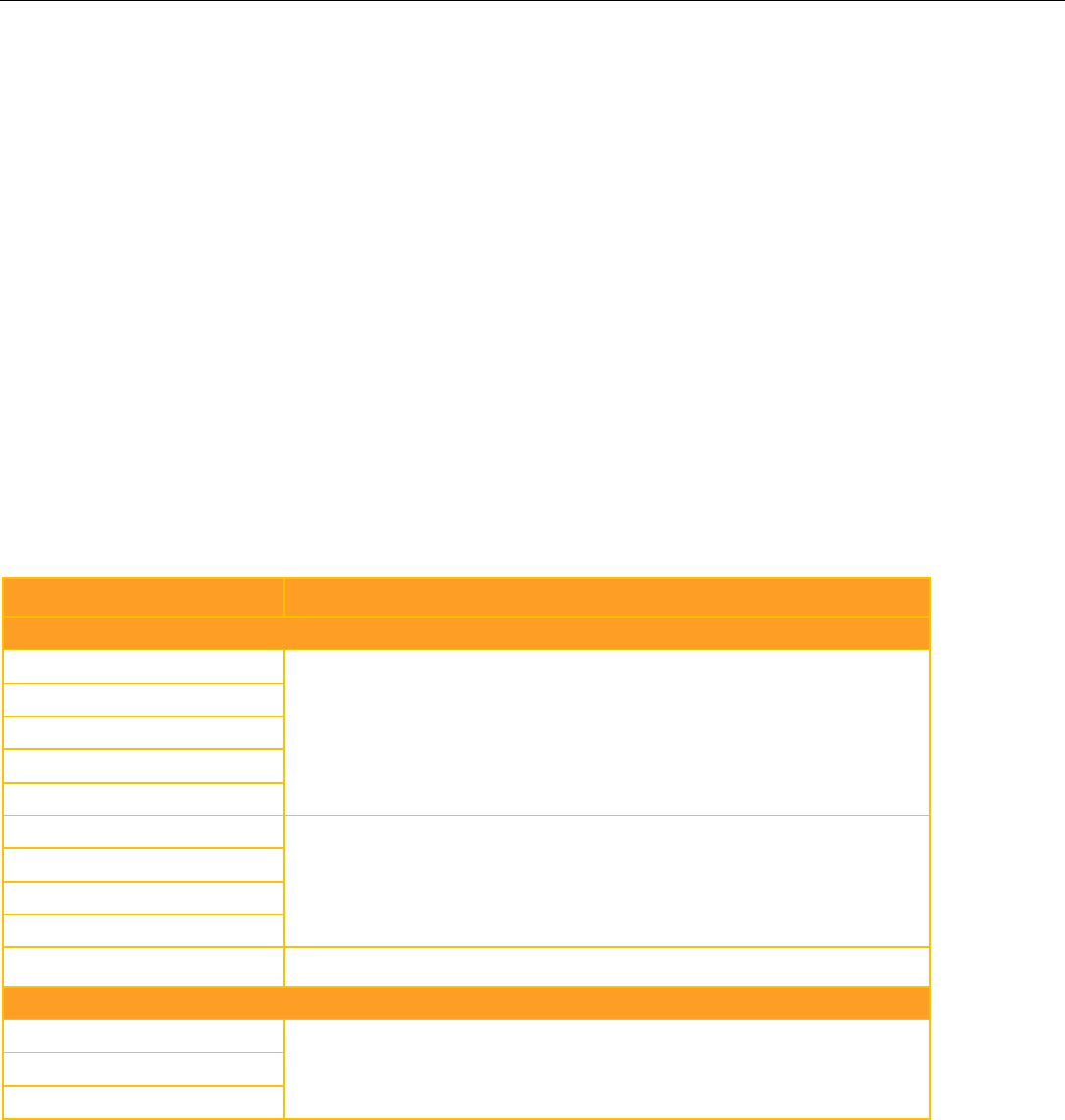

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Selection Date (Eligibility)

Last

Wednesday

X

X X X

Selection Date (Weighting)

3 Weeks Prior

to Effective

Date

X X X X

Announcement Date

Last

Wednesday

X X X X

Effective Date

2nd

Wednesday

X X X X

Bloomberg Goldman Sachs Clean Energy Index Methodology November 2023

7

Deletion Policy

Index securities are not deleted outside of the quarterly reconstitution unless a security has a fundamental alteration, such as a

merger, acquisition, delisting, or other major corporate event, that would make it ineligible for inclusion in the Index.

Addition Policy

Index securities are not added outside of the quarterly reconstitution.

Replacement Policy

Index securities are not replaced outside of the quarterly reconstitution.

Corporate Actions

Refer to Bloomberg Global Equity Indices Non Market Cap Corporate Action Methodology for the treatment of corporate actions.

Risks

The following is a summary of certain risks associated with the Indices but is not meant to be an exhaustive list of all risks associated

with the Indices. Although the Indices are designed to be representative of the markets they are measuring, they may not be

representative of every use case. There is also inherent, though transparent, judgment in their construction, as outlined in this

methodology. The Indices are designed for general applicability and not to address the individual circumstances and needs of

users. BISL does not advise about the usefulness of the Indices to a particular circumstance; users are therefore encouraged to seek

their own counsel for such matters. This methodology is subject to change, which may impact its usefulness to users. Although

efforts will be made to alert users of any change, every individual user may not be aware of them. Such changes may also

significantly impact the usefulness of the Indices. BISL may also decide to cease publication of an Index. BISL maintains internal

policies regarding user transitions, but no guarantee is given that an adequate alternative is available generally or for a particular

use case. Markets for stocks, as with all markets, can be volatile. As the Indices are designed to measure this market, its Indices

could be materially impacted by market movements, thus significantly affecting the use or usefulness of the Index for some or all

users. Also, certain equity markets are less liquid than others — even the most liquid markets may suffer periods of illiquidity.

Illiquidity can have an impact on the quality or amount of data available to BISL for calculation and may cause the Indices to

produce unpredictable results.

Limitations of the Index

Though the Indices are designed to be representative of the markets they measure or otherwise align with their stated objective,

they may not be representative in every case or achieve their stated objective in all instances. They are designed and calculated

strictly to follow the rules of this Methodology, and any Index Level or other output is limited in its usefulness to such design and

calculation.

Markets can be volatile, including those market interests that the Index measures or upon which the Index is dependent to achieve

its stated objective. For example, illiquidity can have an impact on the quality or amount of data available to the administrator for

calculation and may cause the Index to produce unpredictable or unanticipated results.

In addition, market trends and changes to market structure may render the objective of the Indices unachievable or to become

impractical to replicate by investors.

In particular, the indices measure global equity markets. As with all equity investing, the indices are exposed to market risk. The

value of equities fluctuates with the changes in economic forecasts, interest rate policies established by central banks and

perceived geo-political risk. The indices do not take into account the cost of replication and as a result a tracking portfolio's returns

will underperform the index with all else equal. As the indices are designed to measure those markets, its indices could be

materially impacted by market movements, thus significantly impacting the use or usefulness of the fixings for some or all users.

In addition, certain Sub-Indices may be designed to measure smaller subsets of the indices such as specific styles, size, and sector.

Some of these Sub-Indices have very few qualifying constituents and may have none for a period of time. During such period, the

Sub-Indices will continue to be published at its last value, effectively reporting a 0% return, until new constituents qualify. If no

constituents are expected to qualify (due to changes in market structure and other factors), the Sub-Indices may be discontinued. In

such an event, this discontinuation will be announced to index users.

Bloomberg Goldman Sachs Clean Energy Index Methodology November 2023

8

BISL relies on external data providers for the provision of ESG data used in the selection, weighting and calculation of the

benchmarks. This includes climate models, estimations and sourcing of underlying ESG data used to calculate such scores. BISL

places reliance on such external data providers with respect to their ESG data, oversight over the quality of that data, and the

maintenance of that data’s underlying methodology to ensure its representativeness. BISL does not have control over, or detailed

insight into, the reliability of the raw data sourced external providers and their respective calculation models. External provider ESG

data methodologies may furthermore be subject to change. ESG data may not cover the entire universe of eligible constituents for

a particular Index. The measurement of the benchmark may become unreliable should the ESG data become unavailable or

inaccurate.

Section 7: Benchmark Oversight and Governance

Benchmark Governance, Audit and Review Structure

BISL uses three primary committees to provide overall governance and oversight of its benchmark administration activities:

● The Product, Risk & Operations Committee (“PROC”) is responsible for the first line of control over the creation, design,

production and dissemination of benchmark indices, strategy indices and fixings administered by the BISL.

● The oversight function is provided by Bloomberg’s Benchmark Oversight Committee (“BOC”). The BOC is independent of the

PROC and is responsible for the review and challenge of the BISL Board of Directors and the PROC regarding relevant aspects of

the provision of Benchmarks by BISL, as set out in the UK BMR.

● The Risk Committee (“RiskCo”) advises the Board, the PROC and the BOC on the Company’s overall risk appetite, tolerance and

strategy and oversees the Company’s risk exposure and risk strategy

Index and Data Reviews

The Index Administrator will periodically review the Indices (both the rules of construction and data inputs) on a periodic basis, not

less frequently than annually, to determine whether they continue to reasonably measure the intended underlying market interest,

the economic reality, or otherwise align with their stated objective. More frequent reviews may be done in response to extreme

market events and/or material changes to the applicable underlying market interests.

In addition to material changes, BISL may from time to time terminate one or more Indices (“Discontinued Indices”), whether due to

changes in market structure, a lack of requisite data, insufficient usage, or for other regulatory or practical concerns. The process for

terminating such Discontinued Indices is as follows:

The PROC will review proposed terminations, taking into account the reasons for termination, the impact on users (if any), the

availability of alternative products and other such factors. If termination is approved, users will be provided as much prior notice as

is reasonable under the circumstances, typically 90 days. In the event there is little or no known usage identified, the Discontinued

Indices may be terminated with less (or no) notice, as applicable. In the event the Discontinued Indices are licensed for use as the

basis of an ETF or other widely-available financial product or is otherwise determined by BISL to be an important benchmark

without reasonable substitutes, the notice period may be extended, as warranted. Any advance notice period is subject to BISL

being reasonably able to continue administering and calculating such benchmark during such period (for example, BISL has access

to requisite data on commercially reasonable terms, is not subject to any litigation or other claims, has adequate internal resources

and capabilities, etc.). Terminations and associated user engagement decisions made by the PROC are subject to review by BISL's

oversight function, the BOC.

Criteria for data inputs include reliable delivery and active underlying markets.

Whether an applicable market is active depends on

whether there are sufficient numbers of transactions (or other indications of price, such as indicative quotes) in the applicable

constituents (or similar underlying constituent elements) that a price (or other value, as applicable) may be supplied for such

constituent(s).

Other than as set forth in this Methodology, there are no minimum liquidity requirement for Index constituents and/or minimum

requirements or standards for the quantity or quality of the input data. The review will be conducted by product managers of the

Indices in connection with the periodic rebalancing of the Indices or as otherwise appropriate.

Any resulting change to the Methodology deemed to be material (discussed below) will be subject to the review of the PROC

Bloomberg Goldman Sachs Clean Energy Index Methodology November 2023

9

under the oversight of the BOC, each of which committees shall be provided all relevant information and materials it requests

relating to the change. Details regarding the PROC and BOC are described above.

Material changes will be reflected and tracked in updated versions of this Methodology.

Material changes related to the Indices will be made available in advance to affected stakeholders whose input will be solicited.

The stakeholder engagement will set forth the rationale for any proposed changes as well as the timeframe and process for

responses. The Index Administrator will endeavor to provide at least two weeks for review prior to any material change going into

effect. In the event of exigent market circumstances, this period may be shorter. Subject to requests for confidentiality, stakeholder

feedback and the Index Administrator's responses will be made accessible upon request.

In determining whether a change to an Index is material, the following factors shall be taken into account:

The economic and financial impact of the change;

Whether the change affects the original purpose of the Index; and/or

Whether the change is consistent with the overall objective of the Index and the underlying market interest it seeks to

measure.

Expert Judgement

The Indices are rules-based, and their construction is designed to consistently produce values without the exercise of expert

judgment or discretion. Nevertheless, BISL may use expert judgment or discretion with regards to the following:

• Index restatements

• Extraordinary circumstances during a market emergency

• Data interruptions, issues, and closures

• Significant acquisitions involving a non-Index company

When expert judgment or discretion is required, BISL undertakes to be consistent in its application, with recourse to written

procedures outlined in the methodology of the Indices and internal procedures manuals. In certain circumstances exercises of

expert judgment or discretion are reviewed by senior members of BISL management and Bloomberg Compliance teams, and are

reported to the PROC, BISL’s governance committee, which operates under the supervision of BISL’s oversight function, the BOC.

BISL also maintains and enforces a code of ethics to prevent conflicts of interest from inappropriately influencing index

construction, production, and distribution, including the use of expert judgment or discretion.

Data Providers and Data Extrapolation

The Indices are rules-based, and their construction is designed to consistently produce Index Levels without the exercise of

discretion. The Indices are produced without the interpolation or extrapolation of input data.

In addition, the Index Administrator seeks to avoid contributions of input data that may be subject to the discretion of the

source of such data and instead seeks to use input data that is readily available and/or distributed for a number of non-index or

benchmark creation purposes. Accordingly, the Indices require no 'contributors' to produce and no codes of conduct with any

such sources are required.

Conflicts of Interest

The Index confers on BISL discretion in making certain determinations, calculations and corrections from time to time. In making

those determinations, calculations and corrections, the Index Administrator has no obligation to take the needs of any Product

Investor or any other party into consideration. BISL is committed to avoiding and, where necessary, managing actual or potential

conflicts of interest in the BISL decision-making process and has established a Conflicts of Interest Policy to minimize or resolve

actual or potential conflicts of interest. BISL does not create, trade or market Products.

Restatement Policy

BISL strives to provide accurate calculation of its indices. However, to the extent a material error in index values is uncovered

following publication and dissemination, a public notification will be made alerting of such error and the expected date of a revised

publication, if warranted.

An error to an equity Index in excess of 3 basis point over one day will automatically be reviewed for restatement. If the Index in

Bloomberg Goldman Sachs Clean Energy Index Methodology November 2023

10

error is a Primary Index (listed below) and has occurred in the last 2 business days, a restatement will be made for all impacted

indices. Errors occurring beyond the last 2 business days will be evaluated on a case-by-case basis.

Real-time indices are not considered for restatement, all real-time dissemination is considered indicative.

Primary Indices:

Bloomberg US Large Cap Equity Index (B500T)

Bloomberg Developed Markets Large & Mid Cap Index (DMTR)

Bloomberg Emerging Markets Large & Mid Cap Index (EMTR)

If the error affects a non-Primary Index the following factors will be reviewed to determine whether to restate. Not all conditions

need to be present to warrant a restatement, and certain factors may be more determinative than others depending on the

circumstances of the given error.

The relative importance of the data field impacted by the error;

When the error occurred and when it was discovered;

The number of indices and sub-indices affected;

Whether the impacted indices are linked to tradable products;

The magnitude of the error;

The burden of restatement on client re-processing relative to the impact of the error;

The impact of the restatement on analytical tools.

Best efforts will be made to address errors in non-Primary indices as outlined in the table below:

Event

Action (If discovered within 2 business days)

Missed Corporate Action

Spin-off

Restate indices and reissue file

Regular Cash Dividend

Special Cash Dividend

Stock Split

Stock Dividend, Bonus

Mergers & Acquisition

Update made the next business day; no restatement and no reissuance of

files

Delisting

Reclassification

Change in Listing

IPO incorrectly added

Update made at next rebalance

Rebalance

Incorrect Add

Unless the error is discovered during pro-forma period, update will be made

at next rebalance

Incorrect Removal

Share changes

Bloomberg Goldman Sachs Clean Energy Index Methodology November 2023

11

Appendix A: Environmental Social & Governance (ESG) Disclosures

In order to be eligible for the Index, securities must be included in the Sustainalytics researched coverage for the all the ESG factors listed below.

EXPLANATION OF HOW ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG) FACTORS

ARE REFLECTED IN THE KEY ELEMENTS OF THE BENCHMARK METHODOLOGY

1

. Name of the benchmark administrator. Bloomberg Index Services Limited (“BISL”)

2

. Type of benchmark. Equity

3

. Name of the benchmark or family benchmarks.

Bloomberg Goldman Sachs Global Clean Energy Index

4

. Does the benchmark methodology for the benchmark or

family

of benchmarks take into account ESG factors?

Yes

5. Where the response to Item 4 is positive, please list below, for each family of benchmarks, those ESG factors that are taken

into account in the benchmark methodology, taking into account the ESG factors listed in Annex II to Delegated Regulation (EU)

2020/1816.

Please explain how those ESG factors are used for the selection, weighting or exclusion of underlying assets.

The ESG factors shall be disclosed at an aggregated weighted average value at the level of the family of benchmarks.

a) List of environmental

factors considered:

Thermal Coal Extraction

Exclusion

Researched companies classified as

generating 5% of revenue in the extraction of

thermal coal.

Thermal Coal Power Generation Exclusion Researched companies classified as

generating above 50% of revenue from

Thermal Coal Power Generation. Severity

Score of 4 or higher.

Arctic Oil and Gas Exploration

Exclusion

Researched companies classified as

generating 5% of revenue from Arctic Oil and

Gas Exploration.

Oil Sands

Exclusion

Researched companies classified as

generating 5% of revenue in the product

involvement with Oil Sands.

Researched companies classified as deriving

10% or more of its revenue from the

distribution and retail sale of Oil Sands.

Degree of exposure of the

portfolio to the sectors listed in

Sections A to H and Section L of

Annex I to Regulation (EC) No

1893/2006 of the European

Parliament and of the Council.

N/A

The Index does not take apply this ESG factor

in the methodology

Greenhouse gas (GHG) intensity

of the benchmark.

N/A

The Index does not take apply this ESG factor

in the methodology

Percentage of GHG emissions

reported versus estimated.

N/A

The Index does not take apply this ESG factor

in the methodology

Exposure of the benchmark

portfolio to companies the

activities of which fall under

Divisions 05 to 09, 19 and 20

of Annex I to Regulation (EC) No

1893/2006.

N/A The Index does not take apply this ESG factor

in the methodology

Bloomberg Goldman Sachs Clean Energy Index Methodology November 2023

12

Exposure of the benchmark

portfolio to activities included in

the environmental goods and

services sector, as defined in

Article 2, point (5) of Regulation

(EU) No 691/2011 of the European

Parliament and of the Council

N/A

The Index does not take apply this ESG factor

in the methodology

b) List of social factors

considered:

Civilian Firearms

Exclusion

Researched companies that have any

involvement in the manufacturing and selling

of small arms or assault weapons or key

components of small arms to civilian

customers and/or military and law

enforcement are excluded from the Index.

In addition, researched companies that have

5% or more revenue from the retail and/or

distribution of small arms or assault weapons

are excluded from the Index.

Controversial Weapons

Exclusion

Researched companies that have any

involvement in the core weapon system or

components and services of the core weapon

system, including significant ownership,

tailor-made, and non-tailor made, are

excluded from the Index.

Extreme Event Controversies

Exclusion

Researched companies involved in ESG-

related controversial incidents. These

incidents are assessed through a framework

that considers the severity of incidents and

corporation’s accountability and whether

they form part of a pattern of corporate

misconduct. Companies considered to be

the “worst of the worst” in the peer group or

sector:

• Impact and risk are severe and irreversible.

• The case is highly exceptional in the peer

group.

• Impact of the misconduct is on a broad

range of stakeholders over a long duration,

and imposes a clear cost on society.

• There are serious ongoing risks posed to

the company.

• The company is directly responsible for the

misconduct.

• The level of involvement is exceptional

among peers in numerous respects.

• Cases are recurring and have not been

addressed adequately or at all.

• The company fails to demonstrate the

ability to remediate the issue.

•

The company has refused to address the

issue and/or has tried to conceal the

wrongdoing and/or its involvement.

UNGC Violation

Exclusion

Researched companies who have breached a

principle of the UN Global Compact

Bloomberg Goldman Sachs Clean Energy Index Methodology November 2023

13

Tobacco

Exclusion

Researched companies classified as

generating 5% of revenue in the production

of tobacco or tobacco-related products and

services.

Researched companies classified as deriving

10% or more of its revenue from the

distribution and retail sale of tobacco

products.

Exposure of the benchmark

portfolio to companies without

due diligence policies on issues

addressed by the fundamental

International Labor Organisation

Conventions 1 to 8.

N/A

The Index does not take apply this ESG factor

in the methodology

Weighted average gender pay

gap.

N/A

The Index does not take apply this ESG factor

in the methodology

Weighted average ratio of female

to male board members.

N/A The Index does not take apply this ESG factor

in the methodology

Weighted average ratio of

accidents, injuries, fatalities.

N/A

The Index does not take apply this ESG factor

in the methodology

Numbers of convictions and

amount of fines for violations of

anti-corruption and anti-bribery

laws.

N/A

The Index does not take apply this ESG factor

in the methodology

c) List of governance

factors considered:

Weighted average percentage of

board members who are

independent

N/A

The Index does not take apply this ESG factor

in the methodology

Weighted average percentage of

female board members

N/A

The Index does not take apply this ESG factor

in the methodology

6. Where the response to Item 4 is positive, please list below, for each benchmark, those ESG factors that are taken into account

in the benchmark methodology, taking into account the ESG factors listed in Annex II to Delegated Regulation (EU) 2020/1816,

depending on the relevant underlying asset concerned.

Please explain how those ESG factors are used for the selection, weighting or exclusion of underlying assets.

The ESG factors shall not be disclosed for each constituent of the benchmark, but shall be disclosed at an aggregated weighted

average value of the benchmark.

Alternatively, all of this information may be provided in the form of a hyperlink to a website of the benchmark administrator

included in this explanation. The information on the website shall be easily available and accessible. Benchmark administrators

shall ensure that information published on their website remains available for five years

a) List of environmental factors considered:

As above

b) List of social factors considered:

As above

c) List of governance factors considered:

As above

7. Data and standards used.

a) Data input.

(i)

Describe whether the data are reported, modelled or,

sourced internally or externally.

(ii)

Where the data are reported, modelled or sourced

externally, please name the third party data provider.

All ESG data for the benchmarks is sourced externally from

Sustainalytics.

Please refer to the link below for additional details:

https://www.sustainalytics.com/investor-solutions/esg-

research/esg-screening/esg-criteria

Bloomberg Goldman Sachs Clean Energy Index Methodology November 2023

14

b) Verification and quality of data

Describe how data are verified and how the quality of those

data is ensured.

The Indices use the following external data providers, all of

which have robust governance and processes in place to

validate the quality and reliability of the data.

Sustainalytics:

• Universe Management

○ Centralized universe definitions and processes for

rebalancing;

○ Quarterly rebalances of Sustainalytics’ standard

coverage and compliance universes;

○ Clear, transparent and consistent approach to the

allocation of research versus coverage entities.

• Company Research

○ Continuous improvement and maintenance of quality

and research standards;

○ Feedback that is received from Companies in

Sustainalytics’ Coverage Universe and that are a part of

Sustainalytics ESG Risk Ratings and controversy

research is taken into consideration, and whenever

relevant included;

○ Quality reviews of ESG assessments before publication;

○ Reviewing controversy ratings by the Events Oversight

Committee – focus on controversy level changes to and

from level 4 and 5.

• Data and deliverable management

○ Quality and reliability of Sustainalytics Covered

Company and identifier data through automated

quality assurance;

○ Quality and reliability of Sustainalytics proprietary (i.e.

research) data through automated quality assurance,

prior to publication;

○ Quality and reliability of standard deliverables through

end-of-gate quality assurance process.

○ Quality and reliability of custom client deliverables

through end-of-gate quality assurance processes

(automated and manual);

○ Monitoring and investigating ESG score fluctuations

and their root causes using automated tools.

• Update cycle

○ Sustainalytics aims for annual updates of management

indicators for the Covered Companies’;

○ Continuous updates are made as incidents occur and

feed into updates of event indicators, which is not

disclosure driven;

○ Annual updates to the rating framework (selection of

material ESG issues, weighting of indicators).

c) Reference standards

Describe the international standards used in the benchmark

methodology.

UNGC Violations: The United Nations Global Compact

(UNGC) Principles, the Organisation for Economic

Cooperation and Development (OECD) Guidelines for

Multinational Enterprises, the UN Guiding Principles on

Business and Human Rights (UNGPs), and their underlying

Bloomberg Goldman Sachs Clean Energy Index Methodology November 2023

15

conventions.

Controversial Weapons: International treaties and conventions

used to define Controversial Weapons include Non-

proliferation Treaty (1968), Biological and Toxin Weapons

Convention (1972), Chemical Weapons Convention (1997),

Anti-Personnel Mine Ban Convention (1999), Convention on

Cluster Munitions (2008), United Nations Convention on

Certain Conventional Weapons (1980), and Convention on the

Physical Protection of Nuclear Material (1980)

Date on which information has been last updated and

reason for the update:

September 2023, (Update of reference standards)

Bloomberg Goldman Sachs Clean Energy Index Methodology November 2023

Disclaimer

BLOOMBERG is a trademark or service mark of Bloomberg Finance L.P. GOLDMAN SACHS is a trademark and service mark of Goldman Sachs &

Co. LLC. Bloomberg Finance L.P. and its affiliates (collectively, “Bloomberg”) and Goldman Sachs & Co. LLC are not affiliated with each other.

Bloomberg’s association with Goldman Sachs is to act as the administrator and calculation agent of the Bloomberg Goldman Sachs Global Clean

Energy (the “Index”), which is the property of Goldman Sachs. Neither party guarantees the timeliness, accurateness, or completeness of any data

or information relating to the Index. Neither party makes any warranty, express or implied, as to the Index, any data or values relating thereto or any

financial product or instrument linked to, using as a component thereof or based on the Index (“Products”) or results to be obtained therefrom, and

each party expressly disclaims all warranties of merchantability and fitness for a particular purpose with respect thereto. To the maximum extent

allowed by law, Bloomberg, Goldman Sachs, their respective licensors, and the respective employees, contractors, agents, suppliers, and vendors

of each of Bloomberg, Goldman Sachs and their respective licensors shall have no liability or responsibility whatsoever for any injury or damages—

whether direct, indirect, consequential, incidental, punitive, or otherwise—arising in connection with the Index, any data or values relating thereto or

any Products—whether arising from their negligence or otherwise.

The BloombergNEF ("BNEF"), service/information is derived from selected public sources. Bloomberg Finance L.P. and its affiliates, in providing the

service/information, believe that the information it uses comes from reliable sources, but do not guarantee the accuracy or completeness of this

information, which is subject to change without notice, and nothing in this document shall be construed as such a guarantee. The statements in this

service/document reflect the current judgment of the authors of the relevant articles or features, and do not necessarily reflect the opinion of

Bloomberg Finance L.P., Bloomberg L.P. or any of their affiliates (“Bloomberg”). Bloomberg disclaims any liability arising from use of this document,

its contents and/or this service. Nothing herein shall constitute or be construed as an offering of financial instruments or as investment advice or

recommendations by Bloomberg of an investment or other strategy (e.g., whether or not to “buy”, “sell”, or “hold” an investment). The information

available through this service is not based on consideration of a subscriber’s individual circumstances and should not be considered as information

sufficient upon which to base an investment decision. You should determine on your own whether you agree with the content. This service should

not be construed as tax or accounting advice or as a service designed to facilitate any subscriber’s compliance with its tax, accounting or other legal

obligations. Employees involved in this service may hold positions in the companies mentioned in the services/information.

This document constitutes the provision of factual information, rather than financial product advice. Nothing in the Indices shall constitute or be

construed as an offering of financial instruments or as investment advice or investment recommendations (i.e., recommendations as to whether or

not to “buy”, “sell”, “hold”, or to enter or not to enter into any other transaction involving any specific interest or interests) by Bloomberg or a

recommendation as to an investment or other strategy by Bloomberg. Data and other information available via the Indices should not be

considered as information sufficient upon which to base an investment decision. All information provided by the Indices is impersonal and not

tailored to the needs of any person, entity or group of persons. Bloomberg does not express an opinion on the future or expected value of any

security or other interest and do not explicitly or implicitly recommend or suggest an investment strategy of any kind. Customers should consider

obtaining independent advice before making any financial decisions. © 2023 Bloomberg. All rights reserved. This document and its contents may

not be forwarded or redistributed without the prior consent of Bloomberg.

The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”)

except (i) in Argentina, Australia and certain jurisdictions in the Pacific islands, Bermuda, China, India, Japan, Korea and New Zealand, where

Bloomberg L.P. and its subsidiaries distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office,

where a subsidiary of BFLP distributes these products.

Bloomberg Goldman Sachs Clean Energy Index Methodology November 2023

17

Take the next step.

For additional information,

email

indexhelp@bloomberg.net

or press the <HELP> key twice

on

the Bloomberg Terminal*

bloomberg.com/indices

Beijing

+86 10 6649 7500

Hong Kong

+852 2977 6000

New York

+1 212 318 2000

Singapore

+65 6212 1000

Dubai

+971 4 364 1000

London

+44 20 7330 7500

San Francisco

+1 415 912 2960

Sydney

+61 2 9777 8600

Frankfurt

+49 69 9204 1210

Mumbai

+91 22 6120 3600

São Paulo

+55 11 2395 9000

Tokyo

+81 3 4565 8900