Form 508 (Rev.7/2023)

1

Georgia Department of Human Services

FOOD STAMP (SNAP)/MEDICAID/TANF Renewal Form

If you need help reading or completing this document or need help communicating with us, ask us or

call (877) 423-4746. Our services, including interpreters, are free. If you are deaf, hard-of-hearing, deaf-

blind or have difficulty speaking, you can call us at the number above by dialing 711 (Georgia Relay).

If you are reapplying for Food Stamps (SNAP) or renewing your TANF or Medicaid benefits, you can file this

renewal/application form with only your name, address, and signature. However, it will help us to process your

application, recertification/renewal more quickly if you complete the entire form and provide verification of

information, if it is requested. You may use this form to file a joint renewal/application for the Food Stamp (SNAP)

/Medicaid and/or TANF program

or for the Food Stamp (SNAP) Program only. Your Food Stamp (SNAP) renewal will not be

terminated solely on the basis that your

renewal/application for another program has been denied/terminated. We will make

a separate eligibility determination

for your Food Stamp (SNAP) renewal.

Please PRINT the name and address of the person who is reapplying for benefits in the space below:

Client Name:

Date of Birth:

Social Security Number:

(Optional for Non-Applicants*)

Are you homeless? Yes ____ No ____

*See Citizenship Immigration Status &

Social Security Numbers below.

Street Address:

Mailing Address:

Main Phone Number:

Other Contact Number:

Electronic Communication:

Email: Yes ___ or No ___ (optional)

Texting: Yes ___ or No ___ (optional)

Email Address: (optional)

What is your Preferred Language?

If an interview is required,

will you

need an

interpreter?

Yes

or No

Americans with Disabilities Act: Request for Reasonable Modification & Communication Assistance (if applicable):

Do you have a disability that will require a Reasonable Modification or Communication Assistance? Yes No

(If yes, please describe the reasonable modification or Communication Assistance that you are requesting):

Sign Language interpreter____; TTY____; Large Print___; Electronic communication (email)___; Braille___;

Video Relay____; Cued Speech Interpreter____; Oral Interpreter____; Tactile Interpreter____; Telephone call reminder of

program deadlines____; Telephonic signature (if applicable)____; Face-to-face interview (home visit)____;

Other:________________

Do you need this Reasonable Modification or Communication Assistance one-time or ongoing ? If

possible,

briefly explain when and how long you need this modification or assistance?

For Office Use only: Date Received Client ID #

Date Initiated

Programs

Initiated: TANF Food Stamps (SNAP) Medicaid

Form 508 (Rev.7/2023)

2

I declare under penalty of perjury to the best of my knowledge and belief that the person(s) for whom I am applying for

benefits is/are U.S. citizen(s) or are noncitizen(s) lawfully present in the United States. I further certify that all of the

information provided on this application is true and correct to the best of my knowledge. I understand and agree that

DHS-

DFCS, DCH and authorized Federal Agencies may verify the information I give on this application. Information

may be

obtained from past or present employers. I understand that my information will be used to track wage

information and my

participation in work activities.

I will report any change in my situation according to Food Stamp (SNAP) and/or TANF program requirements. I will also

report If anyone in my household receives lottery or gambling winnings, gross amount of $4250 or more (before taxes or

other

amounts are withheld). I will report these winnings within 10 days from the end of the month in which my household

receives the winnings. I understand if any information is incorrect, my benefits may be reduced or denied, and I may be

subject to criminal

prosecution or disqualified from DHS-DFCS programs for knowingly providing incorrect information. I

understand that I can be

prosecuted if I provide false information or hide information. I understand that if I fail to tell DHS-

DFCS about some of my expenses during my application or renewal process and/or fail to verify them, DHS-DFCS will not

budget that expense in calculating the amount of my Food Stamp (SNAP) benefits.

The Georgia Department of Human Services (“DHS”) collects Personally Identifiable Information (PII), such as names,

addresses, telephone numbers, email addresses, and dates of birth, etc., during your application for benefits. By submitting

any personal information to us, you agree that we may collect, use, and disclose any such personal information in

accordance with DHS policies, procedures, and as permitted or required by law and/or regulations.

Signature:

Date

Witness Signature if signed by ‘X’

Date

Express Lane Eligibility:

Express Lane Eligibility (ELE) is an automatic process to enroll or renew eligible children under the age of 19 who are

receiving Supplemental Nutrition Assistance Program (SNAP) or Temporary Assistance for Needy Families (TANF) into the

Medical Assistance program. If your children are eligible for SNAP or TANF, the Division of Family and Children Services

(DFCS) will use the household size, residency, and income information from SNAP or TANF, but DFCS will verify

citizenship or immigration status using Medical Assistance rules to make an ELE determination to enroll or renew the

children in Medicaid or PeachCare for Kids®. If your children are eligible for PeachCare for Kids®, they may be subject to a

premium. DFCS will send you a determination notice, let you make any changes and allow you to opt out at any time.

Do you agree to allow DFCS to use your information from SNAP or TANF to make an ELE determination to enroll or renew

your children in Medicaid or PeachCare for Kids®?

☐Yes ☐No

Form 508 (Rev.7/2023)

3

Authorized Representative:

Complete this section only if you want a person or an organization to fill out your application/renewal, complete your

interview for Food Stamps (SNAP) or TANF, and/or use your Food Stamp (SNAP) EBT card to buy food when you

cannot go to the store. Please check for each program type who you want to designate as an authorized

representative. Please check which duties you want the person or organization to have. If you are applying for

Medicaid, you can choose more than one person to apply for Medical Assistance on your behalf.

Authorized Representative 1 Program Types: Food Stamps (SNAP) ❑ TANF ❑ Medical Assistance ❑

Authorized Representative 1 Duties: Sign application on applicant’s behalf ❑ Complete and submit renewal form ❑

Receive copies of notices and other communication ❑ Act on behalf of applicant in all other matters ❑

Receive a TANF benefit card (EPPIC) ❑

Person Name 1: _________________________________________

Organization Name 1 (if applicable): _________________________ Phone: _____________________________

Address: _______________________________________________ Apt: ____________________________

City: ___________________________________________________ State: ________ Zip: ________________

Electronic Communication: Email: Yes ___ No ___ (optional) Texting: Yes ___ No ___ (optional)

Email Address (optional) ___________________________________

Preferred Language: ______________________________________ Is an interpreter needed? Yes ___or No ___

Authorized Representative 2 Program Types: Food Stamps (SNAP) ❑ TANF ❑ Medical Assistance ❑

Authorized Representative 2 Duties: Sign application on applicant’s behalf ❑ Complete and submit renewal form ❑

Receive copies of notices and other communication ❑ Act on behalf of applicant in all other matters ❑

Receive a TANF benefit card (EPPIC) ❑

Person Name 2: _________________________________________

Organization Name 2 (if applicable): _________________________ Phone: _____________________________

Address: _______________________________________________ Apt: ____________________________

City: ___________________________________________________ State: ________ Zip: ________________

Electronic Communication: Email: Yes ___ No ___ (optional) Texting: Yes ___ No ___ (optional)

Email Address (optional) ___________________________________

Preferred Language: ______________________________________ Is an interpreter needed? Yes ___or No ___

Americans with Disabilities Act: Request for Reasonable Modification & Communication Assistance

for

Authorized Representatives (if applicable):

Does the authorized representative have a disability that will require a Reasonable Modification or Communication

Assistance? Yes No

(If yes, please describe the reasonable modification or Communication Assistance that

you are requesting):

Sign Language interpreter____; TTY____; Large Print____; Electronic communication (email)____; Braille ;

Video Relay____; Cued Speech Interpreter ; Oral Interpreter____; Tactile Interpreter____; Telephone call reminder

of program deadlines____; Telephonic signature (if applicable)____; Face-to-face interview (home visit)____;

Other:

Does the authorized representative need this Reasonable Modification or Communication Assistance

one-time

or ongoing____? If possible, briefly explain when and how long you need this modification or

assistance?

For Medicaid only:

Do you expect to file a federal income tax return NEXT YEAR? (You can still apply for health insurance even if

you

don’t file a federal income tax return.)

❑ Yes ❑ No

If yes, please answer questions a, b, and c. If No, please answer question c.

a.

Will you file jointly with a spouse? ❑ Yes ❑ No If yes, name of spouse:

b.

Will you claim any dependents on your tax return? ❑ Yes ❑ No

If yes, list name(s) of dependents:

c.

Will anyone be claimed as a tax dependent on someone else’s return? ❑ Yes ❑ No

If yes, list the name of the tax filer and the tax dependents:

How is the tax dependent related to the tax filer? _________________________________________________

Form 508 (Rev.7/2023)

4

COMMUNITY OUTREACH SERVICES:

For more information about other DHS services, please visit our website at www.dfcs.georgia.gov or call (877) 423-4746.

Please answer all questions and provide proof of all income and any expenses as requested.

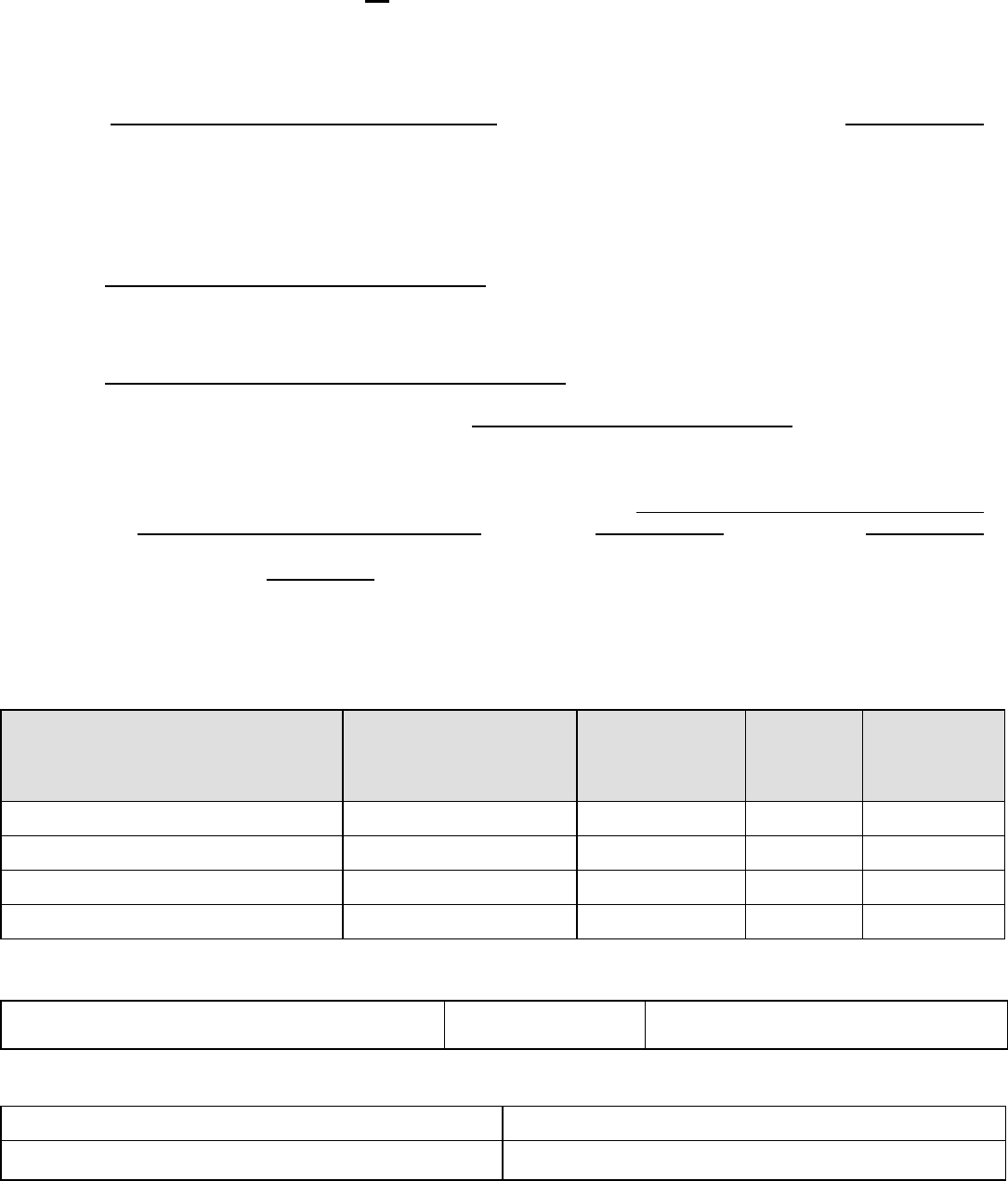

CITIZENSHIP IMMIGRATION STATUS AND SOCIAL SECURITY NUMBERS:

Please fill out the chart below about the applicant and all household members. The following federal laws and

regulations: The Food and Nutrition Act of 2008, 7 U.S.C. § 2011-2036, 7. C.F.R. § 273.2, 45 C.F.R.

§ 205.52, 42 C.F.R. § 435.910, and 42 C.F.R. § 435.920, authorize DFCS to request you and your household members

Social Security number(s). Anyone who is living in your household and is not applying for benefits may be treated as a non-

applicant. Non-applicants do not have to give us information about their Social Security number, citizenship, or immigration

status and are not eligible for benefits. Other household members may still be able to receive benefits if they are otherwise

eligible. If you want us to decide whether any household members are

eligible for benefits, you will still need to tell us about

their citizenship or immigration status and give us their Social Security number (SSN). You will still need to tell us about their

income and resources to determine the eligibility and

benefit level of the household. We will not report any non-applicant

household members to the United States Citizenship and Immigration Services (USCIS) Systematic Alien Verification for

Entitlements (SAVE) system if they do not give us their citizenship or immigration status. However, if immigration status

information has been submitted on your application, this information may be subject to verification through the SAVE system

and may affect the

household’s eligibility and benefit level. We will match your information with other Federal, state, and local

agencies to verify your income and eligibility. This information may also be given to law enforcement officials to use to catch

people who are running from the law. If your household has a Food Stamp (SNAP) claim, the information on this application,

including SSN, may be given to Federal and State agencies and private claims collection agencies for them to use in

collecting

the claim. We will not deny benefits to applicant household members because other household members fail to provide their

SSN, citizenship, or immigration status. If you are applying for emergency medical services only, you do not have to provide your

SSN or information about your immigration status.

First Name

M I

Last Name

Ethnicity

Hispanic

or

Latino?

(Optional)

Race

(Optional)

Sex

M/F

Date Of

Birth

Format

(mm/dd/yy)

Relationship

To You

Social Security

Number

(Optional for Non-

Applicants )

Are you a U.S

citizen, U.S.

National, qualified

immigrant or in a

satisfactory

immigration

status?

(Applicants only)

(Y/N)

Does

the

mother

of this

child live

in the

home?

(Y/N)

Does

the

father of

this child

live in

the

home?

(Y/N)

Do you

want

Medicaid?

(Y/N)

Y/N

SELF

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Y/N

Race Codes (Choose all that apply):

AI – American Indian or Alaska Native AS – Asian BL – Black or African American

HP – Native Hawaiian or Other Pacific Islander WH – White

By providing Race/Ethnicity information, you will assist us in administering our programs in a non-discriminatory manner. Your

household is not required to give us this information, and it will not affect your eligibility or benefit level. However, if you do not provide

this information, visual identification of race and ethnicity will be made during the first face-to-face interview.

Form 508 (Rev.7/2023)

5

If you or other household applicants are a Naturalized Citizen, or a qualified alien/immigrant complete the following

chart:

(please add additional pages as needed)

NAME

First

Middle Initial Last

Immigration document

type

Alien/Certificate/Document ID

number

Have you lived

in the U.S. since

1996?

(Y/N)

Date

Naturalized/Date

of Entry or

Admission into

U.S.

(if applicable)

Format

(mm/dd/yy)

Are you, or your

spouse or parent

a veteran or an

active-duty

member of the

U.S. military?

(Y/N)

For Medicaid only:

Was anyone in your household in Foster Care at age 18? ☐ Yes ☐ No

If you have tax dependents that do not live in the home with you, please list below.

Name: _______________________ Social Security Number __________________ Sex: M F (please circle one)

Date of Birth: __________________ Citizenship: ___________________________________________________

Relationship to you: __________________________ (please add additional pages as needed)

Tell Us More about the Applicant and All Household Members

We need more information about the applicant and all household members in order to decide who is eligible for

benefits.

Please answer only the questions about the benefits you want to receive on the page below.

1. Has anyone received any benefits in another county or state? (For Food Stamps (SNAP) and TANF only)

❑ Yes ❑ No

If yes:

Who:

Where:

When:

2.

Has anyone been convicted of giving false information about where they live and who they are to get multiple FS

benefits in more than one area after 8/22/1996? (For Food Stamps (SNAP) only) ❑ Yes ❑ No

If yes:

Who:

Where:

When:

3.

Did anyone in your household voluntarily quit a job or voluntarily reduce his/her work hours below 30 hours per

week within 30 days of the date of application? (For Food Stamps (SNAP) and TANF only) ❑ Yes ❑ No

If yes, who quit?

Why

did he/she quit?

4.

Is anyone pregnant? (This question does not apply to Food Stamps (SNAP) applicants) ❑ Yes ❑ No

If yes, Name of pregnant woman: ______________________

What is the estimated due date? ____________; and how many babies expected? ________

If no, did anyone in the household deliver or was a pregnancy terminated within the last 12 months? ❑ Yes ❑ No

If yes, Name of pregnant woman: ______________________

What was the delivery/termination date? _________; and how many babies were delivered/expected? _____

*For TANF applicants only please provide the following:

Unborn baby’s father’s name: ____________________ Father’s address:__________________________________

Form 508 (Rev.7/2023)

6

5.

For Medicaid applicants, does anyone have any unpaid medical bills for the last 3 months? ❑ Yes ❑ No

If yes, please send the unpaid bills if you have a Medicaid case.

6.

Is anyone disqualified from the Food Stamp (SNAP) or TANF Program? (For Food Stamps (SNAP) and TANF

only) ❑ Yes ❑ No

If yes:

Who:

Where:

7.

Is anyone fleeing to avoid prosecution or jail for a felony? (For Food Stamps (SNAP) and TANF only) ❑ Yes ❑ No

If yes, who: ____________________________________________

8.

Is anyone violating conditions of probation or parole? (For Food Stamps (SNAP) and TANF only) ❑ Yes ❑ No

If yes, who: ____________________________________________

9.

Does anyone have a felony conviction because of behavior related to the possession, use or distribution of a

controlled drug substance (i.e., drug felon) after 8/22/1996 (For Food Stamps (SNAP) and TANF only) or a violent

felony (For TANF only)? ❑ Yes ❑ No

If yes:

Who:

When: _________________________________________

a.

Are you in compliance with the terms of probation related to any sentence received as a result of a drug felony

conviction? (For Food Stamps (SNAP) only) ❑ Yes ❑ No

b.

Are you in compliance with the terms of parole related to any sentence received as a result of a drug felony

conviction? (For Food Stamps (SNAP) only) ❑ Yes ❑ No

c.

Have you successfully completed all the terms of probation or parole related to any drug related conviction?

(For Food Stamps (SNAP) only) ❑ Yes ❑ No

10.

Have you or any household member been convicted of trading Food Stamp (SNAP) benefits for drugs after

8/22/1996? (For Food Stamps (SNAP) only) ❑ Yes ❑ No

If yes:

Who:

When: ___________________________________________

11.

Have you or any household member been convicted of buying or selling Food Stamp (SNAP) benefits over $500

after 8/22/1996? (For Food Stamps (SNAP) only) ❑ Yes ❑ No

If yes:

Who:

When:

12.

Have you or any household member been convicted of trading Food Stamp (SNAP) benefits for guns, ammunition,

or explosives after 8/22/1996? (For Food Stamps (SNAP) only) ❑ Yes ❑ No

If yes:

Who:

When:

13.

Have you or any member of your household been convicted as an adult of aggravated sexual abuse, murder,

sexual exploitation, and other abuse of children, a Federal or State offense involving sexual assault, or an

offense under State law determined by the Attorney General to be substantially similar to such an offense, after

2/7/2014? (For Food Stamps (SNAP) only) ❑ Yes ❑ No

If yes:

Who:

When:

a.

Are you in compliance with the terms of probation related to any sentence received as a result of a felony

conviction? (For Food Stamps (SNAP) only) ❑ Yes ❑ No

Form 508 (Rev.7/2023)

7

b.

Are you in compliance with the terms of parole related to any sentence received as a result of a felony

conviction? (For Food Stamps (SNAP) only) ❑ Yes ❑ No

c.

Have you successfully completed all the terms of probation or parole related to any felony related

conviction? (For Food Stamps (SNAP) only) ❑ Yes ❑ No

14.

Have you or any household member received lottery or gambling winnings? ❑ Yes ❑ No

If yes:

Who:

When: ______________

Amount Received:

15.

Has anyone used TANF funds or the EPPIC Card at the following establishments, liquor stores, casinos, poker

rooms, adult entertainment business, bail bonds, night clubs, salons/taverns, bingo halls, racetracks,

gun/ammunition stores, cruise ships, psychic readers, smoking shops, tattoo/piercing shops, and spa/massage

salons? (For TANF only) ❑ Yes ❑ No

If yes:

Who:

When: ___________________________________________

16.

Is anyone who is applying for benefits, currently receiving alimony? ❑ Yes ❑ No

If yes:

Who:

Monthly Amount Received

: ___________________

Date alimony agreement finalized or last modified:

For Food Stamps (SNAP) and TANF only:

STUDENTS IN HIGHER EDUCATION: Is anyone in your household enrolled at least half-time in a college,

university, vocational or technical school? ❑ Yes ❑ No If yes, who:

School Name: Grade/Status: Graduation date:

Is

the student employed? ❑ Yes ❑ No Enrolled in work study? ❑ Yes ❑ No

If yes, hours worked per week (Please complete the employment section below as well.)

For Food Stamps (SNAP) only:

Does anyone age 60 or older or disabled have medical expenses? ❑ Yes ❑ No

Did your medical expenses such as Medicare premiums, prescription drug cost, or hospital bills change?

❑Yes ❑ No

If yes, list expenses on chart below. Attach bills, prescription drugs for most recent month(s).

Household Member Billed

Type of Expense

(Doctor, Hospital,

Prescription)

Amount

Owed

Date of Bill

Will

Insurance

Pay?

Yes/No

Does anyone 60 years of age or older or disabled have medical expenses for transportation? ❑Yes ❑ No

If yes, please provide the information below. If you are receiving Medicaid, provide proof:

Purpose of the trip (doctor or hospital visit;

pharmacy pick- up)

Total miles

driven:

Cost of taxi, bus, parking, or lodging:

Does someone else pay any of these medical expenses for you? ❑Yes ❑ No

If yes, please provide information below:

Which expense is paid?

Who pays the expense?

To whom does this person pay the bills?

Address:

Form 508 (Rev.7/2023)

8

For Medicaid only:

OTHER HEALTH COVERAGE

Is anyone enrolled in health insurance now from the following?

□

Georgia Department of Human Services Medicaid PeachCare for Kids®

Medicare

□

VA Healthcare Programs TRICARE (Don’t check if you have direct care or Line of Duty)

□

Employer Insurance: Name of Insurance_ Policy Number

□

Other: Name of Insurance Policy Number

Do you have any health insurance other than Medicaid? ❑Yes ❑ No

If yes, send us a copy of your insurance card.

RESOURCES:

(Not needed for MAGI Medicaid): Does any person in your household have any of the following resources?

❑ Yes ❑ No (If yes provide the information below. If you are receiving Aged, Blind or Disabled Medicaid

(other than Medicare Savings Plans such as QMB, SLMB or QI-1 only) provide proof.

Resource Type

Owner

Account/Policy #

(Do not complete

If your

account/policy # is

the same as your

SSN)

Value

Name of Bank, Insurance

Company etc.

Cash

Checking/Savings

Credit Union

Annuities

Stocks or Bonds

Safe Deposit Box

Retirement Account

(For non-MAGI

Medicaid/TANF only)

Vehicles

(For non-MAGI

Medicaid/TANF only)

CD’s/Annuities

(For non-MAGI

Medicaid/TANF only)

Pre-Paid Funeral

Plans

(For non-MAGI

Medicaid/TANF only)

Cemetery Plots

(For non-MAGI

Medicaid/TANF only)

Trust Funds

(For non-MAGI

Medicaid/TANF only)

Non-Home Place

Property

(For non-MAGI

Medicaid/TANF only)

Home Place Property

(For non-MAGI

Medicaid/TANF only)

Life Insurance

(For non-MAGI

Medicaid/TANF only)

Other

For Aged, Blind or Disabled Medicaid only:

Have you, your spouse or someone you are applying for sold, traded, or given away a resource in the last 60

months. ❑Yes ❑ No

If yes, what? When?

For Food Stamps (SNAP), TANF, and Medicaid:

EMPLOYMENT: Does anyone in your household work? ❑ Yes ❑ No

If yes, list information of the

employed person’s pay from employment such as wages, bonus, and tips, and

attach proof of ALL gross

income received in the last 4 weeks.

Form 508 (Rev.7/2023)

9

PERSON WORKING

EMPLOYER

PAY

PER

HOUR

HOURS

PER

WEEK

HOW

OFTEN

PAID

DATE(S)

PAID

BONUS

PAY

TIPS

Is anyone currently on strike? ❑ Yes ❑ No

For Medicaid only:

PRE-TAX EXPENSES:

Health Insurance $_________ How often?_____________ Vision Insurance $_________ How often?_____________

Dental Insurance $_________ How often?_____________ Other Deduction Type $_________ How often?________

Other Deduction Type $_________ How often?__________ Other Deduction Type $_________ How often?_______

Other Deduction Type $_________ How often?___________

More? Please attach on a separate sheet of paper.

Pre-Tax expenses are deductions taken out of your income before taxes are applied. Not all

deductions are pre-tax.

TAX RETURN DEDUCTIONS:

Check all that apply and give the amount and how often you pay it.

NOTE: You shouldn’t include a cost that you already considered in your answer to self-employment.

Alimony Paid $_________ How often?____________ Student Loan Interest $_________ How often?_____________

Other Deduction Type $_________ How often?________ Other Deduction Type $_________ How often?_________

For Food Stamps (SNAP), TANF, and Medicaid:

Has anyone stopped working? ❑Yes ❑ No If yes, complete the following and provide proof:

What job stopped?

Name of Household Member who stopped working:

Place of employment:

Date Pay Stopped:

Date of Final Check:

Amount of final Pay (gross):

Has anyone started working? ❑Yes ❑ No If yes, complete the following and provide proof:

Name of person who started working:

Date Started:

Phone Number:

Name of employer/business:

Rate of Pay:

$

Date first check received/will

be received:

How often paid (please check one):

□

Weekly Bi-weekly Twice a month Monthly Other

SELF-EMPLOYMENT:

Is anyone self-employed: ❑Yes ❑ No (If yes, who?)

Please provide proof of self-employment income through tax files, business records, receipts, bills, or

statements from customers of an established business.

Is this business incorporated? ❑Yes ❑ No

Does this person have any self-employment expenses? ❑Yes ❑ No

If yes, what type of expenses does this person have?

Form 508 (Rev.7/2023)

10

For Medicaid and TANF only: provide proof for self-employment expenses.

UNEARNED INCOME:

Does anyone in your household receive money from Contributions, Social Security, SSI, VA, Child

Support,

Unemployment, Retirement, or any other income? ❑Yes ❑ No

If yes, complete the information below and provide proof of all income received in the last 4 weeks or the

most recent award letter.

Name

Source

Amount

How Often?

For MAGI Medicaid: Income from Child support, veteran’s payment, Supplemental Security Income (SSI),

or Workman’s Compensation Benefits will not be counted.

DEPENDENT CARE COSTS:

Do you pay for the care of a dependent child or a disabled adult household member? ❑Yes ❑ No

If yes, complete the questions below.

Person who requires care:

Person who pays for care:

Provider’s Name:

How much provider

is paid:

How often

paid:

Provider’s Phone #:

Reason for Care:

Do you pay transportation expenses for a dependent child or disabled adult household member? ❑Yes ❑ No

Are these expenses included in the dependent care expenses? ❑Yes ❑ No

If no, please answer this question: Total miles driven weekly:

Form 508 (Rev.7/2023)

11

SHELTER COSTS:

Did you or any household member start paying shelter costs or did your shelter costs change? ❑Yes ❑No

If yes, complete the chart below.

Expense

Amount

How Often?

Who paid?

Rent/Mortgage

Property Taxes

Property Insurance

Electricity

Gas

Fuel oil/Wood/

Kerosene

Well/Septic

Tank/Water/Sewage

Garbage

Telephone

Other

What is the home’s primary heating or cooling source? (electricity, gas, air conditioner)

Does someone else pay any of these household bills for you? ❑Yes ❑No If yes, complete the chart below:

Who pays the bill?

What bills are paid?

What amount is paid?

To whom does this person pay the bills?

Have you received energy assistance in the last 12 months? ❑Yes ❑No

If yes, amount received $

Do you share monthly household expenses with anyone in the home? ❑Yes ❑No

If yes, who?

Comments/Documentation

Paid to whom Amount paid $ per

Landlord Name Landlord Address

CHILD SUPPORT PAYMENT:

Do you or someone in your household pay child support to someone living outside of the home? ❑Yes ❑No

If yes, complete the chart below:

Who is obligated to pay?

How much is the obligated amount?

For whom is the child support paid?

How much is the actual amount paid?

To whom is the child support paid?

How often is the child support paid?

For Food Stamps (SNAP) only, please provide proof of amount paid in the past 3 months and the

legal obligation to pay.

This section is FOR TANF RECIPIENTS ONLY – You must complete the following: Shot Records:

Is there any child under age 7, who is not yet enrolled in school? (Pre-K is not considered “school.”)

❑Yes ❑No

If yes, send Form 3231- Child Care Immunization form for each child under age 7.

Form 508 (Rev.7/2023)

12

School Requirements:

Are all children (6-18 yrs. old) attending school? ❑Yes ❑No

If yes, name(s) of child(ren)

Name

of school(s)

Grade(s)

Is there any child 16 years of age or older who is not in school? ❑Yes ❑No

If yes, name of child/children?

Please provide a copy of current check stubs if this child is employed or a statement from the provider if

engaged in any other work-related activity.

Domestic Violence:

Are you or anyone in your household a victim of Domestic Violence, Sexual Harassment, Sexual Assault, or

Stalking? ❑Yes ❑ No

If yes, please let us know the name of victim

After assessment, if your household qualifies, we can waive certain program requirements, such as,

participation in work activities or referral to the Division of Child Support Services.

Auto Expense:

Are you the parent or a relative of the child (or children) and are you included in the TANF AU with the child

(or with the children)? ❑Yes ❑No

If yes, answer the following questions:

Do you or any other adult AU member own or is purchasing an automobile? ❑Yes ❑No

If yes, who? (Name of owner)

Year, Make and Model of the vehicle:

Please list automobile note payments, Insurance, Maintenance, and other related expenses:

Do you have any other recurring expenses (for example credit card bills) that you are paying? ❑Yes ❑No

If yes, please list:

Form 508 (Rev.7/2023)

13

RIGHTS AND RESPONSIBILITIES FOR ALL PROGRAMS

YOU HAVE THE RIGHT TO:

•

request assistance filling out this form and free language assistance services (interpreters, translated

materials,

or direct in-language services) if you have trouble reading, writing, speaking, or understanding the

English language.

•

request auxiliary aids and services and reasonable modifications if you or someone in your household has a

disability.

HEARING NOTICE: In all programs you have the right to request a fair hearing in writing or in person. You may ask for a

hearing by calling 1-877-423-4746 or you may ask for a hearing before a state hearings officer if you do not agree with this

decision. You may be represented at the hearing by a lawyer, relative, friend or anyone you choose. If you want a hearing,

you must ask for the hearing in writing or by contacting the agency within:

o 90 days from the date of this notice for Food Stamps (SNAP)

o 30 days from the date of this notice for Medicaid and TANF

YOU ARE RESPONSIBLE FOR:

• giving your worker correct information and providing proof of statements needed to receive benefits. When you sign

this form, you are giving your worker permission to get information from your employer, bank, neighbor, or others

so we can make sure you are receiving the correct amount of benefits.

• telling the truth at all times. If you or someone who is applying for you provides incorrect information, you may be

committing a crime, and you may go to jail.

• providing proof that you or anyone in your household applying for benefits is a U.S. citizen or eligible immigrant.

• cooperating with state and federal personnel who work for Fraud Prevention or the Office of Investigative Services

and who are doing special case reviews. If you do not cooperate and we cannot determine that you are still

eligible

for Food Stamps (SNAP), your case may be denied or closed.

• (for Food Stamps (SNAP)) cooperating with Quality Control reviewers when they call or come to your home to

interview you about the information you have given your case manager. If you do not cooperate with them, your

case may be denied or closed.

• (for Food Stamps (SNAP) and TANF) repaying benefits you should not have received.

• (for Medicaid) cooperating with Medicaid Eligibility Quality Control or Program Integrity when they call or come to

your

home to interview you about the information you have given your case manager.

• (for Medicaid) members who are in a Nursing Home, Intermediate Care Facility, Community-Based Service, or

are enrolled in and receive services through a waiver program, cooperating with Estate Recovery.

If you receive Food Stamps (SNAP), you must report when your total monthly gross income goes over the income limit for

your

household size. If you are a working adult with no children, you must report when your work hours are less than 20

hours a

week or 80 hours per month. You must report these changes no later than the 10th day from the end of the

month in which the

change occurred.

You must also report when your household receives substantial lottery and gambling winnings. This is a cash prize won

in a

single game. If you or a household member receives lottery or gambling winnings, gross amount of $4250 or more

(before

taxes or other amounts are withheld), you must report these winnings within 10 days from the end of the month

in which the

household received the winnings.

If you receive TANF or Medicaid, you must report all changes in your situation within 10 days of the change occurring.

I understand that any lump sum or “windfall” payment that any person in my Medicaid case receives must be budgeted,

along

with any other income that we might have, to determine eligibility.

In the Medicaid Program, you have a right to:

• Receive Medicaid even if you have other health insurance.

• Choose your Medicaid doctor or provider.

• Have your Medicaid application approved or denied within 10, 45, or 60 days from the date you apply, depending

on the type of Medicaid.

Form 508 (Rev.7/2023)

14

As a condition of my Medicaid eligibility:

• I agree to assign to the State all rights to medical support and to payment for medical care from any third party

(hospital and medical benefits).

• I agree to cooperate with the State in identifying and providing information to assist the State in pursuing any third

party who may be liable to pay for care and services. I understand that I must report any payments received for

medical care within ten days. (If you are completing this form on behalf of another individual and do not have the

power to execute an assignment for that individual, the individual will need to execute an assignment of the rights

described above as a condition of his/her eligibility for Medicaid).

• I agree to give the State the right to require an absent parent to provide medical insurance, if available. I

understand I must get medical support from the absent parent if it is available and must cooperate with the Division

of Child Support Services in obtaining this support. If I do not cooperate, I understand I may lose my Medicaid

benefits and only my children will receive benefits unless good cause is established.

FOOD STAMP (SNAP) PROGRAM PENALTY WARNINGS: You may lose your benefits or be subject to criminal

prosecution for knowingly providing false information.

• Do not give false information or hide information to get benefits that your household should not get.

• Do not use Food Stamps (SNAP) or EBT cards that are not yours and do not let someone else use yours.

• Do not use Food Stamp (SNAP) benefits to buy nonfood items such as alcohol or cigarettes or to pay on credit

cards.

• Do not trade or sell Food Stamps (SNAP) or EBT cards for illegal items, such as firearms, ammunition, or

controlled substance (illegal drugs).

Anyone in your household who breaks any of these rules on purpose can be barred from the Food Stamp (SNAP)

Program

from one year to permanently, fined up to $250,000, imprisoned for 20 years or both. She/he may be

subject to prosecution under other applicable Federal and State laws and may also be barred from the Food

Stamp (SNAP)

program for an additional 18 months if court ordered.

Anyone in your household who intentionally breaks the rules may not get Food Stamps (SNAP) for one year for

the first offense, two years for the second offense, and permanently for the third offense.

If a court of law finds you or any household member guilty of using or receiving benefits in a transaction involving

the

sale of a controlled substance, you or that household member will not be eligible for benefits for two years

for the first offense and permanently for the second offense.

If a court of law finds you or any household member guilty of having used or received benefits in a transaction

involving the sale of firearms, ammunition, or explosives, you or that household member will be permanently

ineligible to participate in the Food Stamp (SNAP) Program upon the first offense of this violation.

If a court of law finds you or any household member guilty of having trafficked benefits for an aggregate amount

of $500 or more, you or that household member will be permanently ineligible to participate in the Food Stamp

(SNAP) Program

upon the first offense of this violation.

If you or any household member is found to have given a fraudulent statement or representation with respect to

identity (who they are) or place of residence (where they live) in order to receive multiple Food Stamp (SNAP)

benefits, you or

that household member will be ineligible to participate in the Food Stamp (SNAP) Program for a

period of 10 years.

I understand that if I give false information or withhold information, I may be prosecuted for fraud.

TANF PROGRAM PENALTY WARNINGS: In the TANF Program, an intentional action by providing false or misleading

information to establish or maintain an AU’s eligibility, increase benefits, prevent a decrease in benefits, withholding

information to avoid a negative action or using the cash assistance at prohibited places is considered an Intentional

Program Violation.

You may be referred to the Office of Inspector General to determine your penalty based on the severity of the offense if

you:

• do not report changes on time or do not tell the truth or use the cash assistance funds or TANF DEBIT card to

withdraw cash or perform transactions at casinos, liquor stores, adult-oriented entertainment facilities “strip clubs”,

poker rooms, bail bonds, night clubs/salons/taverns, bingo halls, race tracks, gaming establishments,

gun/ammunition

stores, cruise ships, psychic readers, smoking shops, tattoo/piercing shops, and spa/massage

salons is strictly

prohibited, give false information about where you live so you can receive benefits in more than

one state and

convicted of a drug-related charge or a serious violent felony, on or after 1/1/97.

Form 508 (Rev.7/2023)

15

Anyone in your household who breaks these rules on purpose can be barred from the TANF program from six months to

permanently.

For MEDICAID, committing fraud or abuse is against the law. You may be referred to the Medicaid and PeachCare for

Kids® Program Integrity Unit. Violators may be limited to using one provider, terminated from the program, or asked to

reimburse the

Department of Community Health for medical services provided.

Fraud is a dishonest act done on purpose. Abuse is an act that does not follow good practices.

Examples of participant fraud and abuse are:

• Letting someone else use your Medicaid, PeachCare for Kids

®

or CMO health insurance card

• Getting prescriptions with the intent of abusing or selling drugs

• Using forged documents to get services

• Misusing or abusing equipment that is provided by Medicaid or PeachCare for Kids

®

• Providing incorrect information or allowing others to do so in order to obtain Medicaid or PeachCare for Kids

®

eligibility

• Failure to report changes which occur in income, living arrangements, or resources

To report suspected Medicaid fraud on recipients or providers, call the Georgia Department of Community Health-Office of

Inspector General at (local) (404) 463-7590 or (toll free) (800) 533-0686; by email at oiganonymous@dch.ga.gov; by mail at

Department of Community Health, OIG PI Section, 2 Martin Luther King Jr. Drive SE, 19

th

Floor, East Tower, Atlanta GA

30334; or visit https://dch.georgia.gov/report-medicaidpeachcare-kids-fraud.

VOTER REGISTRATION INFORMATION

If you are not registered to vote where you live now, would you like to apply to register to vote here today?

Yes

No

I do not want to answer the Voter Registration question

Applying to register or declining to register to vote will not affect the amount of assistance that you will be

provided by

this agency.

If you would like help in filling out the voter registration application form, we will help you. The decision whether to

seek or accept help is yours. You may fill out the application form in private.

If you believe that someone has interfered with your right to register or to decline to register to vote, your

right to

privacy in deciding whether to register or in applying to register to vote, or your right to choose your

own political

party or other political preference, you may file a complaint with the Secretary of State at

2 Martin Luther King Jr. Drive, Ste. 802, West Tower, Atlanta, GA 30334 or by calling (404) 656-2871.

IF YOU DO NOT CHECK EITHER BOX, YOU WILL BE CONSIDERED TO HAVE DECIDED NOT TO

REGISTER TO

VOTE AT THIS TIME.

A copy of the Georgia Voter Registration application is included with DFCS applications, renewals, and

change of address forms. You can also request a Voter Registration application from your caseworker. If

you

complete a Voter Registration application, submit it to the Georgia Secretary of State’s Office

following the

instructions provided on the Voter Registration application.

Form 508 (Rev.7/2023)

16

IF YOU ARE RENEWING YOUR MEDICAID AND FOOD STAMPS (SNAP) OR TANF, YOU MUST SIGN AND DATE

IN THE BOX THAT BEST FITS YOUR SITUATION.

PLEASE RETURN THIS FORM PRIOR TO THE CERTIFICATION END DATE TO BEGIN THE RENEWAL PROCESS.

I will report any change in my situation according to Food Stamp (SNAP) and/or TANF program requirements. I will also report If

anyone in my household receives lottery or gambling winnings, gross amount of $4250 or more (before taxes or other amounts

are

withheld). I will report these winnings within 10 days from the end of the month in which my household receives the

winnings. I understand if any information is incorrect, my benefits may be reduced or denied, and I may be subject to criminal

prosecution or disqualified from DHS-DFCS programs for knowingly providing incorrect information. I understand that I can be

prosecuted if I provide false information or hide information. I understand that if I fail to tell DHS-DFCS about some of my

expenses during my application or renewal process and/or fail to verify them, DHS-DFCS will not budget that expense in

calculating the amount of my SNAP benefits.

The Georgia Department of Human Services (“DHS”) collects Personally Identifiable Information (PII), such as names,

addresses, telephone numbers, email addresses, and dates of birth, etc., during your application for benefits. By submitting

any personal information to us, you agree that we may collect, use, and disclose any such personal information in accordance

with DHS policies, procedures, and as permitted or required by law and/or regulations.

______________________________________ __________

(Signature)

(Date)

For Medicaid only – sign here when the Applicant/Member/Legal Guardian is completing:

If I am applying for/renewing Medicaid for myself, I declare under penalty of perjury that I am a U.S. Citizen, U.S. National and/or

qualified immigrant present in the United States. If I am a parent or legal guardian, I declare that the applicant(s) is a U.S. Citizen,

U.S. National and/or qualified immigrant in the United States. I further certify that all of the information provided on this application is

true and correct to the best of my knowledge.

(Signature)

(Date)

For Medicaid only – sign here when a Person Other Than Applicant/Member/Parent/Legal Guardian is

completing:

I certify to the best of my knowledge and belief that the person(s) for whom I am applying for/renewing Medicaid is/are U.S. citizen(s),

U.S. National(s) and/or qualified immigrant or are lawfully present in the United States. I further certify that all of the information provided

on this application is true and correct to the best of my knowledge.

(Signature)

(Date)

Phone where you can be reached _______________________________________________

If the Applicant/Member/Parent/Legal Guardian wants this person as the personal representative, she or he must

check here and sign below Yes No

(Applicant/Member/Parent/Legal Guardian)

(Date)

For Food Stamps (SNAP) and/or TANF – when the Applicant/Recipient/Legal Guardian is completing: I declare

under penalty of

perjury to the best of my knowledge and belief that the person(s) for whom I am applying for benefits is/are

U.S. citizen(s) or are

noncitizen(s) lawfully present in the United States. I further certify that all of the information provided on

this application is true and correct to the best of my knowledge. I understand and agree that DHS-DFCS, DCH and authorized

Federal Agencies may verify the information I give on this application. Information may be obtained from past or present

employers. I understand that my information

will be used to track wage information and my participation in work activities.

Form 508 (Rev.7/2023)

17

(Keep these documents for your information)

This chart explains some of the terms used on this form.

Applicant

An individual who applies to receive public assistance or benefits.

Assistance Unit (AU)

An assistance unit includes eligible individuals who live together, including a pregnant individual and an

unborn child, and receive public assistance/benefits.

Caretaker

A parent, pregnant individual, relative or legal guardian who applies for and receives TANF with children in

his or her care, including an unborn child.

Client ID

A unique number assigned to an individual receiving public assistance/benefits.

Disqualified

The action taken to remove an individual from a Food Stamp (SNAP) or TANF case because they did

not tell the truth and received benefits that they should not have received.

Domestic Violence

Domestic violence can include being hit, kicked, beaten, raped, choked, threatened, controlled, or kept

from getting what you need to live (such as food, medicine, or a home) by a spouse,

boyfriend/girlfriend,, partner, or “ex”.

Electronic Benefit

Transfer (EBT)

The system used in Georgia to pay benefits to individuals who are eligible for Food Stamps (SNAP).

Individuals receiving assistance are issued an EBT debit card, which is used to access their Food

Stamp (SNAP) accounts.

Electronic

Communications

You have the option to choose how you would like to receive notifications about your information. If

you choose to receive email or text notifications, you will receive a message notifying you that you

have a notice in My Notices located in GA Gateway Customer Portal.

For Email Communication, you must provide us with your email address and accept the terms and

conditions for paperless notices located in GA Gateway Customer Portal after you create an account.

Please visit the GA Gateway Customer Portal Website at www.gateway.ga.gov to update your

notification settings.

For Texting Communication, you must provide us with your phone number. Standard message and

data rates may apply. This may vary by carriers, please check with your provider.

EPPICard debit

MasterCard

The State of Georgia has implemented a convenient “electronic” payment option for the TANF

recipients called the EPPICard debit MasterCard. Under this payment option, money is deposited in the

recipient’s account on the first calendar day of the month. If the first falls on a weekend or holiday,

benefits are made available on the last business day of the prior month. The recipient has immediate

access to his or her funds because the funds are electronically loaded to the debit MasterCard.

Grantee Relative

A parent, pregnant individual, relative or legal guardian who applies for and receives TANF in his or her

name on behalf of the children, including an unborn child.

Gross Income

A person’s total income before taking taxes or other deductions into account.

Homeless Individual

An individual who lacks a fixed and regular nighttime residence or an individual whose primary nighttime

residence is:

• a supervised shelter designed to provide temporary accommodations (such as a welfare hotel or

congregate shelter);

• a halfway house or similar institution that provides temporary residence for individuals intended to be

institutionalized;

• a temporary accommodation for not more than 90 days in the residence of another individual; or a

place not designed for, or ordinarily used, as a regular sleeping accommodation for human beings (a

hallway, a bus station, a lobby, or similar places).

Household Members

Individuals who live in your home. For Food Stamps (SNAP), individuals who live together and purchase

and prepare their meals together.

Income

Payments such as wages, salaries, commissions, bonuses, worker’s compensation, disability, pension,

retirement benefits, interest, child support or any other form of money received.

Middle Class Tax

Relief Act of 2012

This Act prohibits the use of cash assistance funds or TANF Debit Cards to withdraw cash or perform

transactions at casinos, liquor stores, adult-oriented entertainment facilities, poker rooms, bail bonds,

night clubs/salons/taverns, bingo halls, racetracks, gaming establishments, gun/ammunition stores,

cruise ships, psychic readers, smoking shops, tattoo/piercing shops, and spa/massage salons. The use

of cash assistance funds or the TANF Debit Card at these businesses will constitute an intentional

program violation (fraud) on the part of the recipient.

Form 508 (Rev.7/2023)

18

Non-applicant

An individual who does NOT apply for or receive public assistance/benefits. Non-applicants are not

required to provide a social security number, citizenship, or immigration status.

Payee

A payee is an individual who accepts responsibility for receiving cash assistance and spending the funds

on behalf of the AU. A payee may or may not be an AU member.

Pre-Tax Expenses

Pre-Tax expenses are deductions taken out of your income before taxes are applied. Not all deductions

are pre-tax. Most common pre-tax deductions are health insurance, dental insurance, vision insurance,

etc. http://www.irs.gov

Qualified

Alien/Immigrant

A qualified alien/immigrant is a person who is legally residing in the U.S. who falls within one of the

following categories:

• a person lawfully admitted for permanent residence (LPR) under the Immigration and

Nationality Act (INA);

• Amerasian immigrant under section 584 of the Foreign Operations, Export Financing and

Related Program Appropriations Act of 1988;

• A person who is granted asylum under section 208 of the INA;

• Refugees, admitted under section 207 of the INA;

• A person paroled as a refugee or asylee under section 212 (d)(5) of the INA;

• A person whose deportation is being withheld under section 243(h) of the INA as in effect prior

to April 1, 1997, or section 241(b)(3) of the INA, as amended;

• A person who is granted conditional entry under section 203(a)(7) of the INA as in effect prior

to April 1, 1980;

• Cuban or Haitian immigrants as defined in section 501(e) of the Refugee Education Assistance

Act of 1980;

• Victims of human trafficking under section 107(b)(1) of the Trafficking Victims Protection Act of

2000;

• Battered immigrants who meet the conditions set forth in section 431 (c) of the Personal

Responsibility and Work Opportunity Reconciliation Act of 1996, as amended;

• Afghan or Iraqi immigrants granted special immigrant status under section 101(a)(27) of the

INA (subject to specified conditions);

• American Indians born in Canada living in the U.S. under section 289 of the INA or non-

citizens of federally-recognized Indian tribe under Section 4(e) of the Indian Self-Determination

and Education Assistance Act and;

• Hmong or Highland Laotian tribal members that rendered assistance to U.S. personnel by

taking part in military or rescue operation during Vietnam Era (8/05/1964 – 5/07/1975).

For Medical Assistance applicants only, Compact of Free Association (COFA) are citizens of the

Federated States of Micronesia, the Republic of the Marshall Islands and the Republic of Palau. COFA

migrants do not have to meet the 5-year bar.

Resources

Cash, property, or assets such as bank accounts, vehicles, stocks, bonds, and life insurance.

Sexual Assault

Nonconsensual sexual act proscribed by Federal, Tribal, or State law, including when the victim lacks

capacity to consent.

Sexual Harassment

Hostile, intimidating, or oppressive behavior based on sex that creates an offensive work environment.

Stalking

The act or crime of willfully and repeatedly following or harassing another person in circumstances that

would cause a reasonable person to fear injury or death especially because of express or implied

threats.

Taxable Income

Payments such as wages, salaries, commissions, bonuses, disability, pension, retirement benefits,

interest, or any other form of money received.

Tax Dependent

An individual who expects to be claimed on a tax filer's tax return. http://www.irs.gov

Tax Filer

An individual who expects to file a tax return. http://www.irs.gov

Tax Return

Deductions

Tax return deductions are the allowable IRS deductions found on your tax return form 1040, starting with

line 23 to line 35. They include: Educator expenses; Form 2106; Health Savings Form 8889; Moving

Expenses Form 3909; Penalty/Early Withdrawal of Savings; Alimony Paid; IRA Deduction; Student

Loan Interest; Tuition and Fees Form 8917; Domestic Production Activities Form 8903.

http://www.irs.gov

Form 508 (Rev.7/2023)

19

Trafficking in the

Food Stamp (SNAP)

Program

Trafficking SNAP benefits means:

(1) Buying, selling, stealing, or otherwise exchanging SNAP benefits issued and accessed via EBT

cards, card numbers and PIN numbers or by manual voucher and signature, for CASH or consideration

other than eligible food, either directly, indirectly, in complicity or collusion with others, or acting alone;

(2) The exchange of firearms, ammunition, explosives, or controlled substances; (3) Purchasing a

product with SNAP benefits that has a container requiring a return deposit with the intent of obtaining

cash by discarding the product and returning the container for the deposit amount, intentionally

discarding the product, and intentionally returning the container for the deposit amount; (4) Purchasing

a product with SNAP benefits with the intent of obtaining cash or consideration other than eligible food

by reselling the product, and subsequently intentionally reselling the product purchased with SNAP

benefits in exchange for cash or consideration other than eligible food; (5) Intentionally purchasing

products originally purchased with SNAP benefits in exchange for cash or consideration other than

eligible food. (6) Attempting to buy, sell, steal, or otherwise affect an exchange of SNAP benefits issued

and accessed via Electronic Benefit Transfer (EBT) cards, card numbers and personal identification

numbers (PINs), or by manual voucher and signatures, for cash or consideration other than eligible

food, either directly, indirectly, in complicity or collusion with others, or acting alone.

Form 508 (Rev.7/2023)

20

Notice of ADA/Section 504 Rights

Help for People with Disabilities

The Georgia Department of Human Services and the Georgia Department of Community Health (“the Departments”) are

required by federal law* to provide persons with disabilities an equal opportunity to participate in and qualify for the

Departments’ programs, services, or activities. This includes programs such as SNAP, TANF and Medical Assistance.

The Departments provide reasonable modifications when the modifications are necessary to avoid discrimination based

on disability. For example, we may change policies, practices, or procedures to

provide equal access. To ensure

equally effective communication, we provide persons with disabilities or their companions with disabilities communication

assistance, such as sign language interpreters. Our help is free. The Departments are not required to make any

modification that would result in a fundamental alteration in the nature of a service, program, or activity or in undue

financial and administrative burdens.

How to Request a Reasonable Modification or Communication Assistance

Please contact your caseworker if you have a disability and need a reasonable modification, communication assistance, or

extra help. For instance, call if you need an aid or service for effective communication, like a sign language interpreter.

You may contact your caseworker or call DFCS at

(877) 423-4746 or the DCH Katie Beckett (KB) Team at 678-248-7449

to make your request. You may also make your request

using the DFCS ADA Reasonable Modification Request Form,

which is available at your local DFCS office or online at https://dfcs.georgia.gov/adasection-504-and-civil-rights, or you

may obtain the DCH ADA Reasonable Modification Request Form at the KB office, online at

https://medicaid.georgia.gov/programs/all-programs/tefrakatie-beckett, or you may email your modification request to

DCH.ADAassistance@dch.ga.gov.

How to File a Complaint

You have the right to make a complaint if the Departments have discriminated against you because of

your disability.

For example, you may file a discrimination complaint if you have asked for a reasonable modification or sign language

interpreter that has been denied or not acted on within a reasonable time. You can make a complaint orally or in writing

by contacting your case worker, your local DFCS office, or the DFCS Civil Rights, ADA/Section 504 Coordinator at 47

Trinity Avenue SW, Atlanta, GA 30334, (877) 423-4746. For DCH, contact the KB Team ADA/Section 504 Coordinator at

2211 Beaver Ruin Road, Suite 150, Norcross, GA 30071 or P.O. Box 172, Norcross, GA 30091, (678) 248-7449. The

DCH email is: dch.adarequests@dch.ga.gov.

You can ask your case worker for a copy of the DFCS civil rights complaint form. The complaint form is also available at

https://dfcs.georgia.gov/adasection-504-and-civil-rights. If you need help making a discrimination complaint, you may

contact the DFCS staff listed above. Individuals who are deaf or hard of hearing or who may have speech disabilities

may call 711 for an operator to connect with us. The email for DCH Civil Rights complaints is:

dch.civilrights@dch.ga.gov. The link for the DCH Civil Rights process and complaint form is located at:

https://dch.georgia.gov/adasection-504-and-civil-rights.

You may also file a discrimination complaint with the appropriate federal agency. Contact information for the U.S.

Department of Agriculture (USDA) and U.S. Department of Health and Human Services (HHS) is within the

“Nondiscrimination Statement” included within.

*Section 504 of the Rehabilitation Act of 1973; Americans with Disabilities Act of 1990; and the Americans with

Disabilities Act Amendments Act of 2008 ensure persons with disabilities are free from unlawful discrimination.

Under the Department of Community Health (DCH) policy, the Medical Assistance programs cannot deny you

eligibility

or benefits based on your race, age, sex, disability, national origin, or religion.

Form 508 (Rev.7/2023)

21

Do Not Send Applications to the USDA or HHS

Nondiscrimination Statement

In accordance with federal civil rights laws and U.S. Department of Agriculture (USDA) civil rights regulations and policies,

the USDA, its agencies, offices, and employees, and institutions participating in or administering USDA programs are

prohibited from discriminating based on race, color, national origin, sex (including gender identity and sexual orientation),

religious creed, disability, age, political beliefs, or reprisal or retaliation for prior civil rights activity in any program or

activity conducted or funded by USDA. Programs that receive federal financial assistance from the U.S. Department of

Health and Human Services (HHS), such as Temporary Assistance for Needy Families (TANF), and programs HHS

directly operates are also prohibited from discrimination under federal civil rights laws and HHS regulations.

Persons with disabilities who require alternative means of communication for program information (e.g., Braille, large print,

audiotape, American Sign Language), should contact the agency (state or local) where they applied for benefits.

Individuals who are deaf, hard of hearing or who have speech disabilities may contact USDA through the Federal Relay

Service at (800) 877-8339. Additionally, program information may be made available in languages other than English.

CIVIL RIGHTS COMPLAINTS INVOLVING USDA PROGRAMS

USDA provides federal financial assistance for many food security and hunger reduction programs such as the

Supplemental Nutrition Assistance Program (SNAP), the Food Distribution Program on Indian Reservations (FDPIR) and

others. To file a program complaint of discrimination, complete the Program Discrimination Complaint Form, (AD-3027)

found online at https://www.usda.gov/sites/default/files/documents/ad-3027.pdf, and at any USDA office or write a letter

addressed to USDA and provide in the letter all of the information requested in the form. To request a copy of the

complaint form, call (866) 632-9992. Submit your completed form or letter to USDA by:

1. Mail: Food and Nutrition Service, USDA

1320 Braddock Place, Room 334, Alexandria, VA 22314; or

2. fax: (833) 256-1665 or (202) 690-7442; or

3. phone: (833) 620-1071; or

4. email: FNSCIVILRIGHTSCOMPLAINT[email protected].

For any other information regarding SNAP issues, persons should either contact the USDA SNAP hotline number at (800)

221-5689, which is also in Spanish, or call the state information/hotline numbers (click the link for a listing of hotline

numbers by state); found online at: SNAP hotline.

CIVIL RIGHTS COMPLAINTS INVOLVING HHS PROGRAMS

HHS provides federal financial assistance for many programs to enhance health and well-being, including TANF, Head

Start, the Low Income Home Energy Assistance Program (LIHEAP), and others. If you believe that you have been

discriminated against because of your race, color, national origin, disability, age, sex (including pregnancy, sexual

orientation, and gender identity), or religion in programs or activities that HHS directly operates or to which HHS provides

federal financial assistance, you may file a complaint with the Office for Civil Rights (OCR) for yourself or for someone

else.

To file a complaint of discrimination for yourself or someone else regarding a program receiving federal financial

assistance through HHS, complete the form online through OCR’s Complaint Portal at https://ocrportal.hhs.gov/ocr/. You

may also contact OCR via mail at: Centralized Case Management Operations, U.S. Department of Health and Human

Services, 200 Independence Avenue, S.W., Room 509F HHH Bldg., Washington, D.C. 20201; fax: (202) 619-3818; or

email: OCRmail@hhs.gov. For faster processing, we encourage you to use the OCR online portal to file complaints rather

than filing via mail. Persons who need assistance with filing a civil rights complaint can email OCR

at [email protected] or call OCR toll-free at 1-800-368-1019, TDD 1-800-537-7697. For persons who are deaf, hard of

hearing, or have speech difficulties, please dial 7-1-1 to access telecommunications relay services. We also provide

alternative formats (such as Braille and large print), auxiliary aids and language assistance services free of charge for

filing a complaint.

This institution is an equal opportunity provider.

Under the Department of Human Services (DHS), you may also file other discrimination complaints by contacting your

local DFCS office, or the DFCS Civil Rights, ADA/Section 504 Coordinator at Georgia Department of Human Services,

Office of General Counsel, 47 Trinity Avenue SW, Atlanta, GA 30334, (877) 423-4746. For complaints alleging

discrimination based on limited English proficiency, contact the DHS Limited English Proficiency and Sensory Impairment

Program at Georgia Department of Human Services, Office of General Counsel, 47 Trinity Avenue SW, Atlanta, GA

30334, (877) 423-4746.

Do Not Send Applications to the USDA or HHS