February 2016

Department for Communities and Local Government

Evaluation of the Help to Buy Equity Loan

Scheme

Authors: Stephen Finlay, Ipsos MORI, in partnership with

Peter Williams, Christine Whitehead and the London School

of Economics

© Crown copyright, 2016

Copyright in the typographical arrangement rests with the Crown.

You may re-use this information (not including logos) free of charge in any format or medium, under the

terms of the Open Government Licence. To view this licence,

http://www.nationalarchives.gov.uk/doc/open-

government-licence/version/3/ or write to the Information Policy Team, The National Archives, Kew, London

TW9 4DU, or email: psi@nationalarchives.gsi.gov.uk.

This document/publication is also available on our website at www.gov.uk/dclg

If you have any enquiries regarding this document/publication, complete the form at

http://forms.communities.gov.uk/

or write to us at:

Department for Communities and Local Government

Fry Building

2 Marsham Street

London

SW1P 4DF

Telephone: 030 3444 0000

For all our latest news and updates follow us on Twitter: https://twitter.com/CommunitiesUK

February 2016

ISBN: 978-1-4098-4761-8

3

Contents

Chapter 1: Executive summary 6

1.1 Introduction 6

1.2 Assessing additionality of Help to Buy Equity Loan 6

1.3 Provider and consumer perspectives of Help to Buy Equity Loan 7

Chapter 2: Introduction 10

2.1 Policy background 10

2.2 Research objectives 11

2.3 Research methods 11

2.4 Acknowledgements 12

Chapter 3: The market – a secondary data analysis 13

3.1 Introduction 13

3.2 Help to Buy within the wider market context 14

3.3 Help to Buy Equity Loan Statistics – Take-up, property profile, users, and loan

information 29

3.4 Sub National Analysis 35

3.5 Conclusion 40

Chapter 4: Supply-side perspectives 41

4.1 Developer perspectives 41

4.2 Lender perspectives 48

4.3 Help to Buy Equity Loan Agent perspective 58

4.4 Wider stakeholder perspective 63

Chapter 5: Demand-side perspectives 68

4

5.1 Introduction 68

5.2 Who is using Help to Buy Equity Loan? 69

5.3 Has Help to Buy Equity Loan encouraged home ownership? 72

5.4 Has Help to Buy Equity Loan impacted on ‘housing careers’? 79

5.5 Perceptions of the Help to Buy Equity Loan process 88

5.6 Conclusions 94

Chapter 6: Assessing additionality 96

6.1 Defining additionality 96

6.2 Demand-side additionality 97

6.3 Developer and lender perspectives on additionality 102

6.4 Bringing the evidence together 108

6.5 A longer term view 110

6.6 Conclusion 114

Chapter 7: Conclusions 116

7.1 The study 116

Appendix 1 122

A1 Technical details 122

A1.1 Telephone interview survey 122

A1.2 Developer and lender interviews 126

A2 Research materials 128

A2.1 Lender, Developers, Agents questions 128

A2.2 Household telephone interview survey questionnaire 133

6

Chapter 1: Executive summary

1.1 Introduction

In April 2013, Help to Buy Equity Loan was introduced with the intention of providing

a stimulus to the housebuilding market by increasing the supply of housing through

the building of more new homes. This report presents the findings from a programme

of research to consider two key objectives:

• to make a robust assessment of the ‘additionality’ of the Help to Buy Equity

Loan scheme, defined as identifying the increase in the production of housing

services (either through a greater number of new homes built or through a

production of bigger homes) as a result of the policy, over and above what

would have been produced in its absence; and

• to provide evidence of the experiences and implementation of the scheme

from the perspective of both providers and consumers.

1.2 Assessing additionality of Help to Buy Equity Loan

There are inherent challenges in making an assessment of additionality, the

introduction of the policy in April 2013 means it is not possible to establish any

meaningful counterfactual and disentangling the effects of the policy from other

related policy initiatives add further complication. Furthermore, the assessment of

additionality has to be considered in the context of the overall cycle of the scheme as

well as changes in the wider economy and housing market. Thus, a best estimate of

additionality is produced through the triangulation of various data sources.

Using primary and secondary data the research derived a central estimate that

investment in Help to Buy Equity Loan up to January 2015, is estimated to have

generated 43% additional new homes built as a result of the Help to Buy Equity

Loan policy, over and above what would have been built in the absence of the policy.

This estimate of additonality suggests that for every 100 households that purchased

with Help to Buy Equity Loan assistance, 43 lead to new dwellings being built that

would not otherwise have been built.This is equivalent to contributing 14% to total

new build output since the introduction of the policy to June 2015.

This central estimate of additionality is based on the following evidence:

• Analysis of Land Registry Price Paid Data on New Build Transactions and

Help to Buy Transaction Data from the Department for Communities and

Local Government, indicates that a third (33%) of all new build transactions,

once the policy was fully in place, have been supported by Help to Buy Equity

Loan;

7

• Analysis of a representative sample of consumers who have bought with the

assistance of Help to Buy Equity Loan shows that 43% would not have been

able to afford the same or similar property in the new build or existing markets

without the scheme’s assistance;

• In interviews, all developers agreed that supply was demand-led so that sales

led to starts on at least a one-to-one basis – that is if a Help to Buy Equity

Loan sale is additional, there will be an additional new build unit. Therefore

43% is the central estimate of additionality; and

• Applying the central estimate of additionality (43%) to the contribution made

by Help to Buy Equity Loan sales to new build transactions (33%) allows us to

estimate the direct impact on supply as equivalent to contributing 14% to total

new build output.

Developers, based on their own assessment of customer affordability, suggested

that up to 50% of all Help to Buy Equity Loan sales could have been added to their

sales and therefore to their new starts – this would imply that 16.5% of total new

build output was directly related to the scheme.

The analysis has provided a clear indication of the additionality triggered by the Help

to Buy Equity Loan scheme. The scheme has made consumer demand more

effective which in turn has fed through into an increase in housing supply backed by

an expanded and more supportive mortgage market. On this definition, 43% of Help

to Buy Equity Loan sales are estimated to be additional, equivalent to contributing to

14% of total new build output up to June 2015.

Allowing for wider market additonality effects, including market confidence, as well

as cash flow and capacity, suggests that the policy could have contributed as much

as 45% to total new build output initially (2013/14). This partly reflects the fact that

developers thought that sales would have declined in 2013 in the absence of this

support. Thereafter, the impacts of these wider market additonality effects are

expected to be lower - suggesting the proportion of total new build output could fall

back to a maximum of 25% from 2015.

This broader total could potentially increase as lender confidence is maintained,

mortgage availability for new build sales grows and cash flow and other financial

constraints are reduced. However the scale of the impact on output decisions into

the future depends on many other factors around the economy and financial markets

as well as the continuation of the scheme.

1.3 Provider and consumer perspectives of Help to Buy

Equity Loan

Developers are largely positive about the scheme although views and experiences

differed, particularly depending on their size. Larger developers tended to recognise

the scheme’s important role in facilitating increased building programmes and output

levels, especially when measured against projected declines pre-implementation.

8

Smaller developers were generally positive but the impact on their sales was more

unpredictable.

In the main, developers have seen improved confidence in the market and see Help

to Buy Equity Loan making a strong contribution to the profile and awareness of the

new build market. They estimate that between 40-50% of Help to Buy Equity Loan

sales would not have happened without the assistance. Increased sales in turn have

eased cash flow and enabled developers to buy more land (although high land prices

remain a considerable barrier to increasing output levels) and many indicate the

scheme’s positive impact on their balance sheets as it replaced previous shared

equity schemes.

Developer views of their experience of the Help to Buy Equity Loan process were

also largely positive. The simple eligibility criteria made it more appealing to potential

purchasers and this together with a strong national image had raised the profile of,

and subsequent interest in, the new build market. Many also recognised the valuable

role the scheme had played in strengthening relations between developers and

lenders.

Most developers felt Help to Buy Equity Loan would continue to play a valuable role

in helping access to the market, particularly among first-time buyers, with most

having little concern were the maximum price limit to be reduced.

Among lenders, although the new build lending market is dominated by a small

number of large providers, the introduction of Help to Buy Equity Loan had helped

make it more financially viable to enter the new build lending market. In turn this is

seen to have built capacity and encouraged lenders back to higher loan to value

lending, a trend consistent with wider evidence showing uplifts in the number and

value of new mortgage loans (although still remain below pre-crisis levels) and

higher loan to value mortgage products since early 2013. Lenders were however

less clear on the extent to which it had resulted in increased levels of output although

most recognised that if the scheme had not existed, the new build market would

have evolved more slowly.

Experience of the process for lenders was again largely positive with perceived

concerns principally focussed on consumer understanding of the scheme,

particularly around mortgage portability and paying off the equity loan element,

although there appears to be little evidence of this from the consumers interviewed

(see below).

Among Help to Buy agents, the less restrictive criteria associated with Help to Buy

Equity Loan, compared to previous schemes, was seen to be more attractive to

developers, creating greater momentum and enabling the scheme to assist more

buyers. It was felt that the process was handled as efficiently as possible, in large

part reflecting that agents were only paid on completion. Agents also recognised how

the scheme had strengthened their relationship with developers.

The survey of consumers, based on those who have successfully purchased using

Help to Buy Equity Loan, presents a largely positive picture in terms of experiences

and impacts. A lack of consumer understanding of finances is not apparent. A

9

majority (58%) of those surveyed say they had a great deal of understanding about

the financial commitment when they bought while an overwhelming majority continue

to remain confident in their ability to pay mortgage repayment and the equity loan

elements. Stated levels of satisfaction with the overall experience are also high, with

70% saying they were very satisfied.

The survey showed that the scheme has helped improve access to the homeowner

market, and assisted moves within that market. Key findings include:

• Median income levels of first-time buyers using the scheme (who make up the

majority of the sample) are in line with national estimates

1

, while median

deposits are below national estimates

2

and a majority (64%) say they did not

use additional sources of finance to help with their deposit;

• A majority (82%) say they would not have been able to buy the same property

without assistance, while most agreed the scheme had helped them buy

property that was bigger (61%) or in a better area (60%);

• A majority (61%) say they started to look for property to buy sooner than they

otherwise would have; and

• A significant minority (36%) say they feel unable to move up the property

ladder now, a sentiment that is strongest among those at the lower end of the

market (in flats and smaller sized property).

Overall, the scheme has met its objectives in terms of increased housing supply. It

has done this via a stimulus to demand which has fed through into an expansion of

supply and with little evidence of a serious and destabilising impact on house prices

– Help to Buy Equity Loan has typically supported 2% to 3% of total residential

property transactions in England on a monthly basis. The scheme helped restore

market confidence as shown by consumers, developers and lenders and as

expressed in re-invigorated regional and local housing markets.

1

See https://www.cml.org.uk/industry-data/ Note this will also include those who have purchased using Help to

Buy Equity Loan

2

See

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/445547/Chapter_3_Owner_occupi

ers.pdf

10

Chapter 2: Introduction

2.1 Policy background

With the slow recovery of both housebuilding and the mortgage market the Help to

Buy Equity Loan scheme was announced in the March 2013 Budget as part of a

broader range of measures which aimed to increase the supply of low-deposit

mortgages for credit-worthy households. These measures also included the Help to

Buy: mortgage guarantee scheme. The policy initiatives aimed to offset some of the

negative impact of the dearth of higher loan to value (above 70/75%) lending which

had significantly decreased since the downturn, and had particularly impacted on

first-time buyers.

As well as addressing deposit and affordability issues the Help to Buy Equity Loan

scheme also intended to provide a stimulus to the housebuilding industry and the

housing market by encouraging developers to build more new homes.

The Help to Buy Equity Loan scheme is funded to a value of £9.7 billion until 2020

and is expected to cover up to 194,000 new home buyers. The specific scheme only

applies in England and is administered by the Homes and Communities Agency who

work with local Help to Buy Agents. By the end of June 2015 more than 55,000

properties had been bought with the help of this scheme

3

.

The Help to Buy Equity Loan scheme was introduced on April 1

st

2013 and was open

to all those who wanted to buy a new build home. The scheme grants an equity loan

worth up to 20 per cent of the value of the new build home. The buyer has to provide

a cash deposit of at least five per cent and a main mortgage lender a loan of up to 75

per cent. There are only a few restrictions around eligibility for the scheme - it applies

only to property worth up to a value of £600k and the property must be the primary

residence.

The equity loan is fully repayable when the owner sells their home or at the end of

their mortgage, whichever comes first. The equity loan has a planned term of 25

years and is always longer than the main mortgage. A minimum of 10% of the total

property value can be part repaid at any time after the first year of the loan. If the

property has increased in value since purchase then the owner will pay back a

greater sum than borrowed to cover the equity loan; conversely if the property

decreases in value the owner will pay back a lesser amount. This means that the

government shares in any capital gain or loss.

3

Supplied by Department for Communities and Local Government (via the Home and Communities Agency who

have responsibility for administering the scheme)

11

If, after five years, the equity loan has not been repaid an annual charge of 1.75% of

the market value of the property is applied. This fee increases annually by retail price

index plus one per cent, if this is positive. The aim of this charge is to encourage

borrowers to pay off the equity loan.

2.2 Research objectives

In March 2015, Ipsos MORI, in partnership with Peter Williams, Christine Whitehead

and the London School of Economics, were commissioned by the Department of

Communities and Local Government to undertake an evaluation of the Help to Buy

Equity Loan Scheme.

The primary objective of this study is to provide a comprehensive evidence base to

make a robust assessment of the ‘additionality’ of the Help to Buy Equity Loan

scheme – defined as identifying the increase in the production of housing services

(either through a greater number of new homes built or through a production of

bigger homes) as a result of the policy, over and above what would have been built

in the absence of the policy.

The second objective is to provide evidence on the perceived experiences,

implementation and reach of the scheme, from the point of view of consumers and

those organisations involved in the delivery of the policy (termed providers in this

report).

2.3 Research methods

In seeking to address the core objectives we have been mindful of the challenges

posed by separating out effects, given the number of relevant interventions in both

the housing and finance markets during this period as well as the difficulty of

understanding what might have happened without the scheme due to the lack of an

appropriate counterfactual.

With these issues in mind the research team developed a programme of research

using a range of primary and secondary research methods in order to triangulate

results and meet the research objectives. These include:

• Analysis of existing secondary data sources – drawing on a range of

secondary data sets (including general housing market statistics, mortgage

market statistics, housebuilding data and a number of other private sources)

to seek to identify any changes in new build housing market conditions pre-

and post-implementation;

• Qualitative in-depth interviews – covering developers, lenders, agents and

wider stakeholder groups (such as Homes and Communities Agency, Council

of Mortgage Lenders, Home Builders Federation) a total of 43 interviews have

been conducted to capture evidence of actual change in terms of numbers of

12

homes, relevant mortgage products and additional movement in the housing

market as well as any shifts in sentiment in the industries; and

• Quantitative telephone survey – conducted by Ipsos MORI with a

representative sample of 501 households who had purchased a property with

the assistance of Help to Buy Equity Loan

4

. The survey was designed to

capture ‘demand-side’ perspectives, in particular to assess the numbers who

in the absence of the policy would not have been able to purchase. The

survey also captures evidence on the experience of the Help to Buy Equity

Loan process from the ‘consumer’ perspective.

Further technical details on these elements of the research programme are provided

in Appendix 1 and 2 to this report and include details of all research materials used

for the primary data collection elements.

2.4 Acknowledgements

We would like to thank all the organisations and individuals who participated in the

in-depth interviews and the survey, without whose valuable input the research would

not have been possible. We would also like to thank Suzanne Cooper, Diana

Kasparova and Stephanie Kvam at the Department, as well as other members of the

Project Board and Steering Group and particularly Professor Michael Ball, University

of Reading, for his external academic peer reviewer contributions.

4

Drawn from a sample frame supplied by the Department (via the Home and Communities Agency who have

responsibility for administering the scheme) at January 2015 comprising 44,471 records. Results are

representative in terms of first-time buyer status, broad region, property size and time since completion.

13

Chapter 3: The market – a secondary data

analysis

3.1 Introduction

A number of secondary datasets have been explored in relation to this project, both

within official and industry statistics. There are a limited number of relevant datasets

which can be expected to provide significant value added because the scheme has

only been running for just over two years - so most actual Help to Buy Equity Loan

activity must inherently come out of the pipeline already in place prior to its

introduction.

Furthermore while it is possible to describe what is happening, it is not possible to

identify causation. To the extent that the data can be interpreted it is likely mainly to

indicate what might be happening in the market now and in the future – e.g. through

increased sales activity and growing confidence as activity rates rise – rather than

provide any direct measure of additional output simply because of the short period of

elapsed time since its introduction. In this context it is important to note, as

discussed further in Chapter 4, that Help to Buy Equity Loan is seen as a very

different product from immediately preceding products.

Additionally, there have been a number of difficulties in securing relevant data

including whether Help to Buy Equity Loan activity was identified in each relevant

dataset as well as a reluctance on the part of a number of private sector providers to

make data available – partly because of the costs and time involved in extracting the

relevant datasets.

The secondary data sets explored include Help to Buy Equity Loan statistics, more

general housing market statistics, mortgage market statistics, housebuilding data

including the Home Builders Federation New Housing Pipeline Data report produced

in conjunction with Glenigan, the National House Building Council annual New Home

Statistics Review 2014 plus a number of other private sources. The latest available

aggregated data on Help to Buy Equity Loan purchases are also presented, based

on unpublished management information held by the Homes and Communities

Agency covering transactions up to 30 June 2015, of which headline official statistics

are published by the Department

5

.

The project specification set out the expectation that analysis of such datasets would

help establish changes in new build housing market conditions - pre- and post-

implementation and through the duration of the scheme which we can then

5

https://www.gov.uk/government/collections/help-to-buy-equity-loan-and-newbuy-statistics

14

triangulate with the analysis with the primary data. We note above that any such

analysis can at best be indicative.

In the analysis that follows we begin by analysing wider general housing market

trends and identifying trends before and after the introduction of Help to Buy Equity

Loan. We then present more detailed equity loan statistics in order to establish the

main attributes of Help to Buy Equity Loan sales and then move on to look at data at

local authority level.

3.2 Help to Buy within the wider market context

An understanding of the role of Help to Buy Equity Loan must start from the post-

global financial crisis recession and the up-turn of private house building from its low

points in 2008/9 to 2010/11 (depending upon whether measured by starts or

completions). Help to Buy Equity Loan was introduced in April 2013 as a

replacement for both government and industry sponsored shared equity products. By

that time there was already evidence of expansion in housing starts - although the

improvement was fairly hesitant and from a very low base (65,000 in 2009).

In this section we begin by looking at planning permissions, before moving on to

starts, completions and transactions data. We then consider house prices, the

mortgage market and consumer confidence. Our focus throughout is on the possible

impact of Help to Buy Equity Loan.

Planning Permissions in England and in the North, Midlands and South

Figure 3.1 shows changes in the number of private housing units securing detailed

planning approval between January 2011 and February 2015. The red shaded

portion indicates when Help to Buy has been in place. There is an upward trajectory.

15

Figure 3.1: Number of residential units securing detailed planning approval,

England, January 2011-February 2015

Source: Glenigan, 2015

Planning permissions in the North, Midlands and South (excluding London) have

seen some growth in the number of private housing units being approved since mid-

2012 (Figure 3.2). Planning approvals increased by 58% in the Midlands in 2013, the

year Help to Buy Equity Loan was introduced, compared to a year earlier (Glenigan

and HBF, 2015). Over the same period, permissions increased by about 20% in the

North and South. In London, planning permissions increased considerably between

2012 and mid-2014, but then fell sharply in 2014 Quarter 3 (Figure 3.3).

Figure 3.2: Residential units securing detailed planning approval, North,

Midlands and South (excluding London), 2009-2014

Source: Glenigan and Home Builders Federation, 2015

16

Figure 3.3: Residential units securing detailed planning approval, London,

2009-2014

Source: Glenigan and Home Builders Federation, 2015

Starts and Completions

There is no means of comparing Help to Buy Equity Loan starts with the wider

market as these are not identified until sale. We can, however, look at trends in the

numbers of starts over time identifying any changes since Quarter 2 2013 when Help

to Buy Equity Loan was introduced.

Private developers in England started 99,000 homes in 2013 and 112,000 in 2014.

These were strong improvements from the low of 65,000 starts in 2009, but starts

have still not yet returned to pre-crisis levels - there were 159,900 private starts in

2007 (Table 3.1). Completions have followed a somewhat similar pattern (Figure

3.4).

Growth in starts is less well established in London, although the first two quarters of

2015 show strong improvement. In market terms this might seem surprising given

that the greatest economic improvement has been centred on London and the South

East.

17

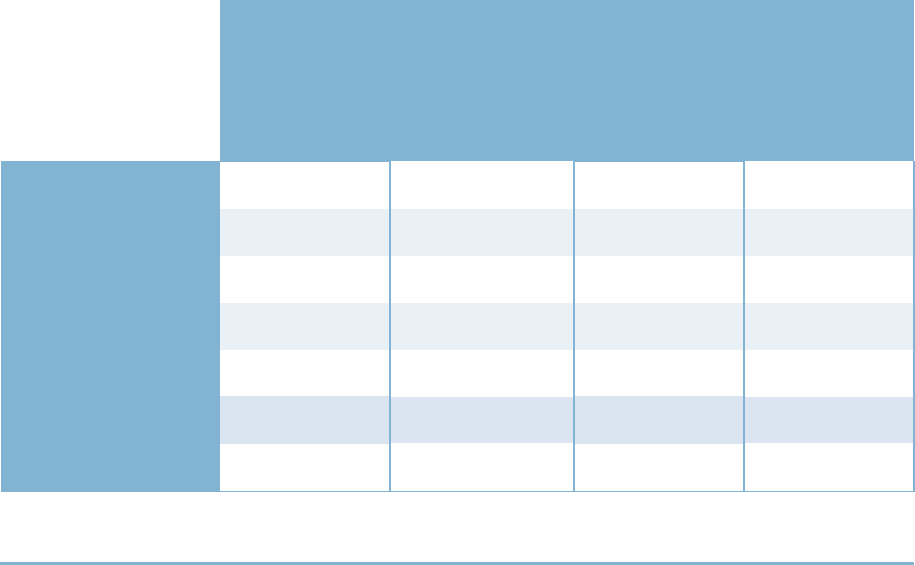

Table 3.1: Private Enterprise Starts and Completions, 2007-2014

2007

2008 2009 2010 2011 2012 2013 2014

2015

(Q1 &

Q2)

London

starts

16,060

10,660

8,830

10,170

14,200

11,220

13,040

12,850

10,430

London

completions

15,230

13,190

14,340

8,870

10,580

12,310

11,460

12,020

6,680

Rest of

England

starts

143,840

71,710

56,170

74,690

73,590

69,040

85,780

97,060

52,560

Rest of

England

completions

138,990

107,910

83,280

74,410

75,310

76,440

75,550

80,730

46,320

England

starts

159,900

82,370

65,000

84,860

87,790

80,260

98,820

109,910

62,990

England

completions

154,220

121,100

97,620

83,280

85,890

88,750

87,010

92,750

53,000

Source: Department for Communities and Local Government 2015a, Live Table 253a (released 20 August

2015 and updated from 19 November 2015 release)

Figure 3.4: Private enterprise starts and completions, England, by quarter, Q1

2007- Q2 2015

Source: Department for Communities and Local Government 2015a, Live Table 253a (released 20

August 2015 and updated from 19 November 2015 release)

Note: Quarterly seasonally unadjusted figures used for direct comparison

18

As will be discussed later in section 3.3, Help to Buy Equity Loan transactions have

been concentrated in lower priced Homes and Communities Agency Operating

Areas, with only 24% of transactions occurring in the South East, East and London

(See Table 3.17). The stronger growth of starts outside London also suggests that

Help to Buy Equity Loan works better in lower priced areas but that in those areas it

has also helped stabilise and improve the market in a way that has not occurred in

the capital. Table 3.2 below gives England figures for quarterly private enterprise

starts, completions and Help to Buy Equity Loan transactions where applicable.

Table 3.2: Private enterprise starts and completions and Help to Buy Equity

Loan transactions, England, 2007-2015

Year & Quarter

Private

Enterprise starts

Private

Enterprise

completions

Help to Buy

Equity Loan

transactions

Q1

43,040

38,450

--

Q2

41,470

38,940

--

Q3

40,440

34,620

--

2007

Q4

34,950

42,210

--

Q1

29,290

31,410

--

Q2

25,400

32,750

--

Q3

15,670

27,230

--

2008

Q4

12,010

29,720

--

Q1

12,490

24,100

--

Q2

15,360

25,590

--

Q3

20,160

22,210

--

2009

Q4

16,990

25,720

--

Q1

21,260

19,520

--

Q2

24,930

22,400

--

Q3

22,400

20,210

--

2010

Q4

16,270

21,150

--

Q1

21,120

19,430

--

Q2

23,390

23,120

--

Q3

23,660

19,650

--

2011

Q4

19,620

23,690

--

Q1

20,630

22,670

--

Q2

19,820

23,160

--

Q3

22,230

19,670

--

2012

Q4

17,580

23,250

--

Q1

22,350

18,480

--

Q2

26,420

23,780

2,103

Q3

28,370

20,610

3,945

2013

Q4

21,680

24,140

7,976

Q1

30,370

21,110

5,582

Q2

29,610

24,670

8,777

Q3

29,150

21,640

5,847

2014

Q4

20,780

25,330

8,181

Q1

32,760

24,470

4,924

2015

Q2

30,230

28,530

9,067

Sources: Starts and Completions data, Department for Communities and Local Government,

2015e, Live Table 213; Help to Buy data, Department for Communities and Local Government

2015c, data published 09 September 2015 (updated from 19 November 2015 release)

19

Similarly, Figure 3.5 shows National House-Building Council private sector new build

registrations by quarter, with the red shaded area representing when Help to Buy

Equity Loan is in operation. There is some evidence of strengthening.

Figure 3.5: Private sector new build registrations, 2006-2014

Source: National House-Building Council, 2015

Help to Buy Equity Loan and market transactions

Help to Buy Equity Loan activity can best be compared with wider market

transactions. There have been 56,402 Help to Buy Equity Loan transactions in the

two years between April 2013 and June 2015 and Help to Buy Equity Loan has

typically supported 2 to 3% of total residential property transactions in England on a

monthly basis. The peak month was June 2014, when Help to Buy Equity Loan

accounted for 6% of total housing transactions (Table 3.3). Around a third of all new

build transactions once the policy was fully in place have been supported by Help to

Buy Equity Loan.

20

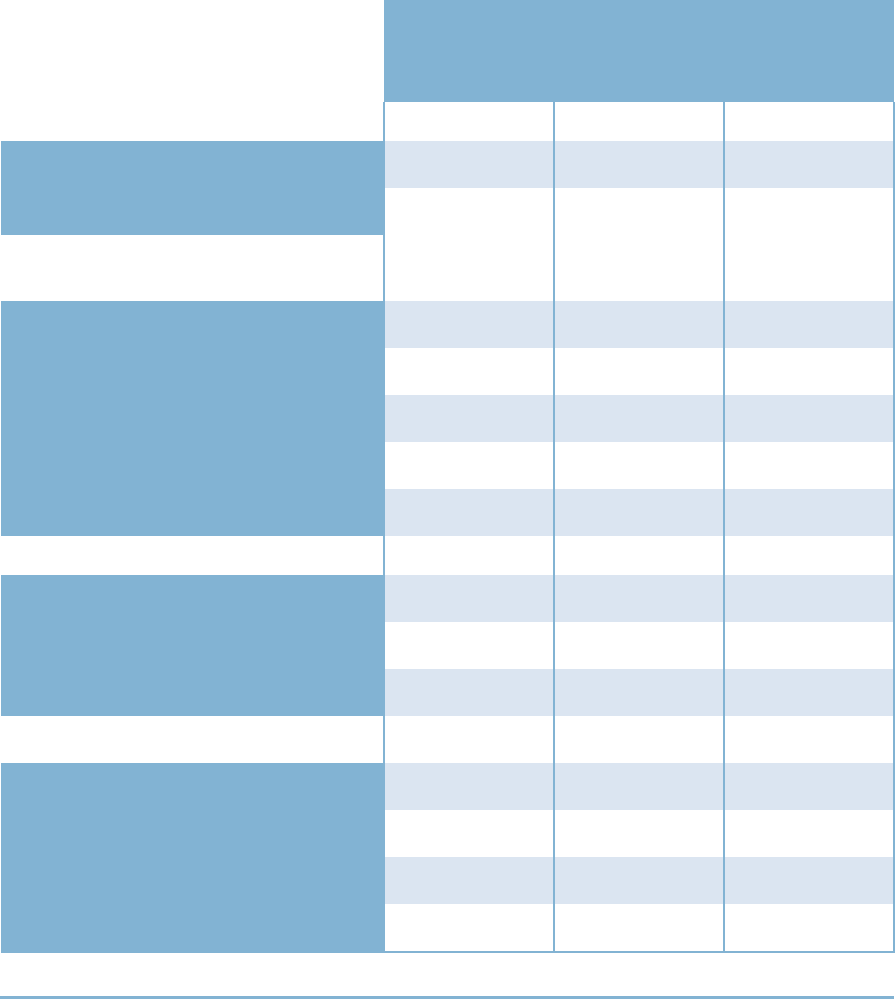

Table 3.3: Help to Buy Equity Loan transactions and total transactions over

time, April 2013 – June 2015

Month

Help to Buy

Equity Loan

transactions

in England

Transactions

in England

Help to Buy

Equity Loan

as percent of

total

transactions

New Build

Transactions

Help to Buy

Equity Loan

as percent

of New Build

transactions

2013

Apr

8

48,769

0%

4,835

0%

May

318

63,349

1%

6,028

5%

Jun

1,777

63,011

3%

10,314

17%

Jul

775

70,450

1%

4,818

16%

Aug

1,376

75,995

2%

6,190

22%

Sep

1,794

66,568

3%

6,709

27%

Oct

1,744

73,179

2%

6,348

27%

Nov

2,346

78,935

3%

7,310

32%

Dec

3,886

75,864

5%

10,557

37%

2014

Jan

1,175

62,435

2%

4,318

27%

Feb

1,628

62,207

3%

5,239

31%

Mar

2,779

64,284

4%

7,196

39%

Apr

1,870

67,024

3%

6,166

30%

May

2,369

73,799

3%

7,112

33%

Jun

4,538

77,112

6%

11,791

38%

Jul

1,651

80,680

2%

6,100

27%

Aug

1,958

83,876

2%

6,492

30%

Sep

2,238

75,266

3%

7,101

32%

Oct

2,211

82,259

3%

7,156

31%

Nov

2,226

69,580

3%

6,647

33%

Dec

3,744

74,015

5%

10,407

36%

2015

Jan

1,111

53,914

2%

4,029

28%

Feb

1,328

54,853

2%

4,727

28%

Mar

2,485

61,134

4%

7,291

34%

Apr

1,773

57,232

3%

5,614

32%

May

2,549

64,250

4%

5,593

46%

June

4,745

67,028

7%

5,845

81%*

Sources: Transactions in England, Land Registry, 2015; New Build Transaction Data, Land Registry Price

Paid Data, various years (accessed 17 October 2015); Help to Buy Transaction Data, Department for

Communities and Local Government, 2015c, data published 09 September 2015

* Figure likely to be amended in future revisions to published data

Figure 3.6 compares the trend in new build transactions and the trend in Help to Buy

Equity Loan transactions. It clearly shows the seasonality of both, with spikes

occurring around June and December (relating to developer reporting requirements),

and it shows that after October 2013, Help to Buy Equity Loan transactions usually

made up just under a third of all new build transactions in England. Figure 3.7 shows

the trend in all property transactions in England over the period since the scheme

was introduced (red line and left axis) compared to the trend in Help to Buy Equity

Loan transactions over time (blue line and right axis).

21

Figure 3.6: Help to Buy Equity Loan and new build residential property

transactions in England, April 2013-June 2015

Source: New Build Transactions, Land Registry Price Paid Data, various years (accessed 17 October

2015); Help to Buy Transactions, Department for Communities and Local Government, 2015c, data

published 09 September 2015

Figure 3.7: Help to Buy Equity Loan and total residential property transactions

in England, April 2013-June 2015

Source: Total Transactions, Land Registry, 2015; Help to Buy Transactions, Department for

Communities and Local Government, 2015c, data published 09 September 2015

22

House prices

Average property prices in England have been steadily rising since January 2010.

Figure 3.8 juxtaposes average price trends for all property in England against the

average property price of Help to Buy Equity Loan purchases. This shows both the

difference in price and the similarity in market trajectory.

Figure 3.8: Average property price in England and average Help to Buy Equity

Loan property price, 2010-2015

Source: Average property price data, Office for National Statistics, 2015a, HPI Reference Table 2

(data published 13 October 2015); Help to Buy Equity Loan Average Property Price Data, Homes and

Communities Agency, 2015

The price of new build property has been a source of some debate over a number of

years although this has subsided since the downturn. However it has resurfaced

around Help to Buy Equity Loan with some but not all lenders raising the issue. It is a

difficult area to research given it is about comparing the price of new build with

existing homes and thus there is a question of equivalence. However, based on

market data collected by Esurv (2015) (not reproduced here) the evidence suggests

that new flats, semi-detached and terraced properties are more likely to command

what are in effect a quite varied price premium than new detached properties across

the country. New build price premia are particularly significant in the North of

England and in the Midlands.

23

Table 3.4 shows average prices of new build properties in London and England

compared with average Help to Buy Equity Loan prices in 2013, 2014 and 2015.

Table 3.4: Average price of New Build Property and Help to Buy Equity Loan

property, London and England, 2010-2015 Q1 (£)

Year

Quarter

England,

simple

average new

dwelling

house price

(£)

England,

Help to Buy

Equity

Loan

average

purchase

price (£)

London,

simple

average new

dwelling

house price

(£)

London,

Help to Buy

Equity

Loan

average

purchase

price (£)

2010

Q1

211,000

234,000

Q2

218,000

264,000

Q3

218,000

272,000

Q4

222,000

253,000

2011

Q1

214,000

257,000

Q2

225,000

295,000

Q3

235,000

301,000

Q4

241,000

349,000

2012

Q1

232,000

327,000

Q2

235,000

335,000

Q3

237,000

313,000

Q4

237,000

328,000

2013

Q1

234,000

357,000

Q2

250,000

186,093

384,000

263,561

Q3

250,000

198,870

341,000

273,594

Q4

250,000

208,714

365,000

296,766

2014

Q1

274,000

211,789

423,000

286,078

Q2

294,000

218,070

511,000

331,472

Q3

294,000

217,270

441,000

313,334

Q4

280,000

219,671

467,000

342,484

2015

Q1

274,000

220,086

477,000

325,671

Q2

294,000

231,224

527,000

351,126

Source: Simple average new dwelling prices, Office for National Statistics, 2015b House Price

Index Reference Table 11; Help to Buy average prices, Homes and Communities Agency, 2015,

unpublished management data

There has also been extensive and divergent media discussion around the issue of

whether Help to Buy Equity Loan has boosted house prices

6

. As we argue it almost

certainly helped to stabilise prices. However the evidence that it led to a house price

boom is weak as a simple comparison between the number of Help to Buy Equity

Loans and total transactions (see Table 3.3 above) and the total number of mortgage

loans would indicate.

6

For example, see http://www.bbc.co.uk/news/uk-24061897

24

Further, as evidenced later in this chapter, the ten local authority areas with the

highest Help to Buy Equity Loan activity saw median house prices between 2013

and 2014 increase by 6.5% on average. This compares to an increase of 10.5% in

median house prices between 2013 and 2014 across England as a whole

7

.

A recent report from Shelter (2015) as well as other commentary (eg, Savills, 2014a

and b) have also noted that the impacts of the scheme vary by region and locality but

that it was clear Help to Buy Equity Loan was not driving the market in ways some of

the more negative commentaries had suggested. The Financial Policy Committee

recently reached the same conclusion with respect to the Help to Buy mortgage

guarantee scheme (Financial Policy Committee, 2015).

The mortgage market

Turning to the mortgage market, Figure 3.9 shows the number of new loans for

house purchase in England since 2007. It clearly reflects the effects of the global

financial crisis, with loan volumes dropping dramatically after mid-2007. Since the

low point in early 2009 loan volumes have been on an upward trend, although they

are still almost a third below the pre-crisis peak. Figure 3.10, which presents data on

the value of new mortgage loans, tells a similar story. Both indicate that there was an

uplift in early 2013.

Figure 3.9: Number of new loans for house purchase, England, 2007-2015

Source: Council for Mortgage Lenders Economics, 2015

7

Office for National Statistics, 2015a, HPI Reference Table 2 (data published 13 October 2015)

25

Figure 3.10: Value of new loans for house purchase (£m), England, 2007-2015

Source: Council for Mortgage Lenders Economics, 2015

High loan to value loans became much less available after the crisis, but in the last

few years lenders have increased the number of such products on offer. Figure 3.11

shows that since 2012, the number of loan products with maximum loan to values of

90% has more than doubled, and the numbers of maximum 80% and 85% loan

products have also increased.

In this context while it is important to recognise that the vast majority of Help to Buy

Equity Loan transactions involve traditional mortgages of around 75%, the

programme was also about restoring confidence in the market (commented on

further in Chapter 4.2). The recovery of the higher loan to value product market is

part of that story. Further it should be noted that not all offers were available for new

build properties and this was particularly the case at higher loan to values.

26

Figure 3.11: Number of new mortgage products by loan to value band by

month 2012-2015

Source: Moneyfacts

Consumer confidence

Data on market confidence (Halifax housing market confidence as measured by

Ipsos MORI) show some general improvement between 2011 and 2015, with more

people believing that it is a fairly good time to buy or sell property (Tables 3.5 and

3.6; Figures 3.12 and 3.13). Since 2013, however, the proportion of people thinking it

is a ‘very good time to buy’ has decreased by over 3% with a corresponding increase

in those reporting it is either a ‘fairly bad time’ or that they are unsure.

Table 3.5: Results, survey question: ‘Thinking about the next 12 months, do

you think it would be a good time or a bad time for people in general to buy a

property?’ (per cent)

2011

2012 2013 2014 2015

Very good time to buy

11.3%

13.2%

9.7%

6.7%

6.4%

Fairly good time to buy

40.3%

40.4%

48.4%

46.6%

49.2%

Fairly bad time to buy

23.7%

21.9%

23.0%

27.1%

25.0%

Very bad time to buy

10.7%

10.0%

7.0%

6.6%

4.6%

Don't know

14.0%

14.6%

11.7%

12.7%

15.0%

Source: Ipsos MORI, Various years; author’s calculation

27

Figure 3.12: Results, survey question: ‘Thinking about the next 12 months, do

you think it would be a good time or a bad time for people in general to buy a

property?

Source: Ipsos MORI, Various years; author’s calculations

Table 3.6: Results, survey question: ‘Thinking about the next 12 months, do

you think it would be a good time or a bad time for people in general to sell a

property?’ (per cent)

2011

2012

2013

2014

2015

Very good time to sell

1.0%

1.6%

3.8%

8.9%

6.6%

Fairly good time to sell

10.7%

14.4%

32.4%

45.9%

49.8%

Fairly bad time to sell

43.3%

45.4%

38.3%

27.3%

24.0%

Very bad time to sell

29.0%

23.1%

12.5%

5.5%

3.6%

Don't know

15.0%

15.2%

12.4%

12.7%

16.0%

Source: Ipsos MORI, Various years; author’s calculations

28

Figure 3.13: Results, survey question: ‘Thinking about the next 12 months, do

you think it would be a good time or a bad time for people in general to sell a

property?

Source: Ipsos MORI, Various years; author’s calculations

Conclusions on market context data

These market context data show that Help to Buy Equity Loan was introduced when

some signs of an improvement in housing market activity as measured by these

different statistics were already in place. Since then that improvement has generally

strengthened - although there are notable differences between Homes and

Community Agency Operating Areas where Help to Buy Equity Loan covers a larger

proportion of new build sales as opposed to in the South where Help to Buy Equity

Loan provides less support to making new homes affordable.

It is not possible to say what might have happened without the new policy, although

the secondary data on starts suggest that the initial improvement in the

housebuilding market prior to the scheme was not robust. Equally we cannot say

how much of the upturn and its strength can be explained by the policy. The

interviews and other primary data discussed in the next two chapters would generally

support the view that it has had a positive effect and we develop this assessment

into an overall view of additionality in Chapter 6.

29

3.3 Help to Buy Equity Loan Statistics – Take-up,

property profile, users, and loan information

Analysis of Help to Buy Equity Loan purchaser data indicates that as of end-June

2015, the Help to Buy Equity Loan programme had been responsible for over £2bn

of equity loans, supporting the purchase of over £12bn worth of property (Table 3.7).

Table 3.7: Help to Buy Equity Loan figures (as of 30 June 2015)

Transactions

Value of Equity

Loans (£m) at

completion

Total value of

properties sold

(£m)

Cumulative value after two

years (March 2013-June

2015)

56,402

£2,424.81 £12,184.53

Source: Department for Communities and Local Government, 2015c

The dwellings purchased using Help to Buy Equity Loan have generally been family-

sized properties. Nearly half of all properties purchased under the programme have

three bedrooms (Table 3.8). Smaller properties - those with one and two bedrooms -

account for about a quarter of homes purchased so far under the programme. The

proportion of smaller homes bought with Help to Buy Equity Loan has fallen over the

seven quarters for which data are available, from 33% in the second quarter of 2013

to 24% in the first quarter of 2015.

Table 3.8: Property size by number of bedrooms (as of 30 June 2015)

Number

of bed-

rooms

Q2 2013 (%)

Q3 2013 (%)

Q4 2013 (%)

Q1 2014 (%)

Q2 2014 (%)

Q3 2014 (%)

Q4 2014 (%)

Q1 2015 (%)

Q2 2015 (%)

% of all

trans-

actions

(as of

30

June

2015)

% of all

trans-

actions

in

London

(as of 30

June

2015)

1

6%

5%

5%

4%

3%

4%

3%

3%

3%

4%

24%

2

27%

26%

25%

24%

23%

23%

21%

19%

21%

23%

47%

3

47%

45%

46%

44%

45%

46%

49%

49%

47%

47%

22%

4

20%

22%

22%

25%

25%

25%

25%

27%

27%

25%

6%

5+

1%

1%

2%

2%

2%

2%

2%

2%

2%

2%

0%

Source: Source: Homes and Communities Agency, 2015 unpublished management data

30

This picture generally reflects the geographical pattern of transactions (Table 3.9).

The distribution in London is quite different to the national picture, with over 70% of

Help to Buy Equity Loan properties having only one or two bedrooms. There are a

variety of factors that may account for this observed difference, including a generally

younger age profile across London and a greater proportion of property that are

flats

8

.

Table 3.9: Property size distribution by Homes and Communities Agency

Operating Area (as of 30 June 2015)

HCA Operating Area

1-bed

2-beds

3-beds

4-beds

5+beds

London

24%

47%

22%

6%

0%

East and South East

5%

28%

42%

23%

2%

South and South West

4%

26%

44%

24%

2%

Midlands

2%

19%

47%

29%

3%

North West

2%

15%

55%

27%

2%

North East, Yorkshire

and the Humber

1%

17%

56%

24%

2%

Source: Homes and Communities Agency, 2015 unpublished management data

Help to Buy Equity Loan has mainly supported the purchase of houses (Table 3.10).

As of June 2015, some 16% of all Help to Buy Equity Loan transactions were for flats

and 84% for houses, split fairly equally among detached, semi-detached and

terraced houses.

Table 3.10: Property type (as of June 2015)

Type of property

Percentage of all transactions (as of

30 June 2015)

Flats

16%

Houses

Detached

27%

Semi-Detached

29%

Terraced

28%

Source: Department for Communities and Local Government, 2015c

8

Almost half (49%) of the stock in the London area are flats compared with 16% of homes outside of London –

see English Housing Survey Profile of English Housing 2013.

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/445370/EHS_Profile_of_English_h

ousing_2013.pdf

31

Most Help to Buy Equity Loan users have been first-time buyers. In England as a

whole some 82% of recipients were first-time buyers, while in London the proportion

was higher, at 95% (Table 3.11).

Table 3.11: Proportion and number of Help to Buy Equity Loan recipients who

are first-time buyers (as of 30 June 2015)

Location

First-

time

buyer

Not first-time

buyer

Total number

of

transactions

London

95%

5%

3,128

Rest of the Country

82%

18%

53,274

England

82%

18%

56,402

Source: Homes and Communities Agency, 2015, unpublished management data

Data on household income show that about half of Help to Buy Equity Loan

borrowers had household incomes below £40,000. Some 64% of borrowers had

household incomes between £20,000 and £50,000 (Figure 3.14). A small proportion

had either lower household incomes (below £20,000) or higher ones (over £100,000)

- about 3% in each case.

Figure 3.14: Help to Buy Equity Loan transactions by household income band

as of 30 June 2015

Source: Department for Communities and Local Government, 2015c

For the programme to date, the mean applicant household income in the country as

a whole was £47,200 (Table 3.12). Incomes were highest in London (average

£64,900) and lowest in the Homes and Community Agency Operating Areas of the

North East, Yorkshire and the Humber (average £39,000).

32

Table 3.12: Average Help to Buy Equity Loan applicant household income by

Homes and Communities Agency Operating Area (as of 30 June 2015)

HCA Operating Area

Mean household income

London

£64,901

East and South East

£54,448

South and South West

£49,454

Midlands

£44,825

North West

£41,412

North East, Yorkshire and the Humber

£39,006

Overall

£47,189

Source: Homes and Communities Agency, 2015, unpublished management data

The average price of a property purchased under the Help to Buy Equity Loan

programme to date has been £216,000. The regional distribution of property prices

reflected that of incomes: the highest prices were in London (average over

£300,000) while the lowest were in the Homes and Community Agency Operating

Areas of the North East, Yorkshire and the Humber (average £165,000) (Table 3.13).

Table 3.13: Average purchase prices, deposits, mortgages and loan values of

Help to Buy Equity Loan transactions by Homes and Communities Agency

Operating Area (as of 30 June 2015)

HCA Operating Area

Average

Purchase

Price

Average

Mortgage

Average

Equity

Loan

Average

Deposit

London

£314,210

£223,897

£62,270

£28,043

East and South East

£258,182

£184,043

£51,383

£22,756

South and South West

£238,709

£169,417

£47,532

£21,760

Midlands

£200,741

£144,427

£39,938

£16,375

North West

£177,722

£128,252

£35,418

£14,052

North East, Yorkshire

and The Humber

£164,939

£119,517

£32,852

£12,570

OVERALL

£216,030

£154,726

£42,992

£18,312

Source: Homes and Communities Agency, 2015, unpublished management data

About three-quarters of properties bought under the programme cost between

£100,000 and £250,000, with only a small percentage costing less than £100,000 or

more than £450,000 (Table 3.14). In the first two years of Help to Buy Equity Loan

the proportion of higher-value properties increased probably reflecting observed

behaviour across the market commented on earlier in this chapter. In 2013 some

11% of purchased properties cost more than £300,000, but by 2014 this percentage

had grown to 16%.

33

Table 3.14: Price distribution (as of 30 June 2015)

Percent of transactions by year

Total to 30 June

2015

Price Band

2013

2014

2015 (to

30 June

2015)

Number %

£50,000-£99,999

4%

3%

2%

1,514

3%

£100,000-£149,999

24%

20%

17%

11,436

20%

£150,000-£199,999

32%

30%

29%

17,149

30%

£200,000-£249,999

21%

21%

20%

11,685

21%

£250,000-£299,999

9%

12%

14%

6,651

12%

£300,000-£349,999

5%

6%

7%

3,243

6%

£350,000-£399,999

3%

4%

4%

2,049

4%

£400,000-£449,999

1%

2%

2%

1,123

2%

£450,000-£499,999

1%

2%

2%

868

2%

£500,000-£549,999

0%

1%

1%

306

1%

£550,000-£600,000

1%

1%

1%

378

1%

Total transactions

14,024

28,387

13,991

56,402

Source: Homes and Communities Agency, 2015, unpublished management data

In more than two years of operation, a total of 838 developers have made Help to

Buy Equity Loan transactions. Of those, the top ten accounted for 70% of

transactions (Table 3.15). The most active developers each accounted for around

15% of transactions.

34

Table 3.15: Top ten Help to Buy Equity Loan developers, percent of

transactions over time and Homes and Communities Agency Operating Area

(HCA OA) where most active (as of 30 June 2015)

2013

2014

2015

%of all

trans-

actions

to 30

Jan 15

HCA

OA

where

most

active

Developer

Q2

Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

1

27%

14%

15%

12%

21%

10%

16%

13%

20%

16%

Mids

2

18%

10%

18%

9%

18%

11%

21%

11%

19%

16%

Mids

3

12%

13%

13%

13%

12%

14%

13%

14%

13%

13%

Mids

4

3%

10%

6%

9%

6%

8%

4%

8%

4%

6%

Mids

5

4%

4%

3%

5%

3%

5%

3%

5%

4%

4%

NW

6

6%

4%

5%

3%

4%

3%

5%

2%

3%

4%

S & SW

7

3%

4%

2%

5%

2%

4%

3%

6%

2%

3%

NE,Y&H

8

5%

3%

2%

4%

3%

2%

2%

3%

3%

3%

S & SW

9

5%

2%

3%

2%

4%

2%

2%

2%

3%

3%

S & SW

10

1%

3%

3%

2%

2%

3%

2%

2%

2%

2%

E & SE

Source: Homes and Communities Agency, 2015, unpublished management data

Table A3.1 in the Appendix 3 shows the house builders with more than 20 active

sites as of May 2015. All of the top ten Help to Buy Equity Loan developers except

for Galliford are on this list.

Some 18 lenders have made loans under the programme, but most were

responsible for only a small number of transactions. The top four lenders who are

also among the top mortgage lenders in the general market together accounted for

over 80% of Help to Buy transactions since the start of the programme (Table 3.16).

A major lender’s share of loans has fallen since the onset of the programme and in

2015 Quarter 2 was just 23% (down from 85% in the first quarter of Help to Buy).

Two other major lenders have grown their Help to Buy Equity Loan business strongly

in the last three quarters.

35

Table 3.16: Top 7 Help to Buy lenders, percentage of transactions by quarter

(as of 30 June 2015)

2013

2014

2015

% of all

trans-

actions

to 30

June

2015

Number

of

loans

to 30

June

2015

Lender

Q2

Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

1

85%

60%

48%

40%

41%

36%

28%

19%

23%

38%

21,279

2

4%

24%

36%

40%

36%

30%

26%

39%

44%

34%

19,121

3

7%

12%

11%

11%

10%

11%

12%

10%

10%

11%

6,087

4

0%

0%

3%

4%

6%

11%

15%

16%

10%

8%

4,600

5

4%

2%

2%

3%

3%

5%

7%

6%

3%

4%

2,281

6

0%

0%

0%

0%

2%

3%

5%

5%

4%

2%

1,291

7

0%

0%

0%

0%

1%

3%

4%

4%

3%

2%

1,032

Source: Homes and Communities Agency, 2015, unpublished management data

3.4 Sub National Analysis

The ‘East and South East’ Homes and Communities Agency Operating Area

accounts for the largest number of transactions under the programme, with more

than three times as many as London, the region with the fewest (Table 3.17). In the

Operating Areas of the Midlands and the North of England, where 56% of all Help to

Buy Equity Loan transactions occurred, transactions completed with a Help to Buy

Equity Loan represented between 3-4% of all transactions in those areas. This is in

contrast to London and the East and South East, where Help to Buy Equity Loan

only accounted for 1-2% of all transactions. The Operating Area where Help to Buy

Equity Loan transactions represented the largest proportion of total transactions was

the South and South West.

36

Table 3.17: Help to Buy Equity Loan transactions by Homes and Communities

Agency Operating Area (as of 30 June 2015)

HCA Operating Area

Number of

Transactions

Proportion of

all Help to Buy

Equity Loan

Transactions

Proportion of

all

Transactions

in Area*

London

3,128

6%

1%

East and South East

10,398

18%

2%

South and South West

11,168

20%

5%

Midlands

14,817

26%

4%

North West

7,106

13%

3%

North East, Yorkshire and the

Humber

9,785

17%

4%

Overall

56,402

100%

3%

Source: Homes and Communities Agency, 2015, unpublished management data, Total Transaction

Data, Land Registry 2015

*Land Registry transaction data has been summed to estimate transactions by Homes and

Communities Agency Operating Areas; these numbers should be seen as indicative only

The ten local-authority areas with the highest level of Help to Buy Equity Loan

activity, in terms of the number of transactions, are shown in Table 3.18. Many of

these areas are very large, so the actual number of transactions in relation to

population size is quite small. Table 3.19 shows high activity areas in terms of

number of transactions per thousand inhabitants. Most of these high activity areas

are fairly widely spread across the southern half of the country, although not in

London or the South East. The concentrations in these local authorities reflect the

current pattern of residential development and the availability of Help to Buy Equity

Loan-appropriate stock. The areas are small, so the number of housing starts per

quarter is also small.

37

Table 3.18: Ten local authorities with highest Help to Buy Equity Loan activity

by numbers of transactions based on mid-2014 population figures (as of 30

June 2015)

Highest-lowest by number of transactions

Local authority

Help to Buy Equity Loan

transactions as of 30

June 2015

Transactions per

thousand population

Wiltshire

990

2.05

Leeds

911

1.19

Central Bedfordshire

893

3.32

Peterborough

740

3.89

County Durham

726

1.40

Milton Keynes

724

2.79

Birmingham

706

0.64

Bedford

690

4.21

Aylesbury Vale

660

3.58

Manchester

603

1.16

Source: Help to Buy Equity Loan Transaction Data, Homes and Communities Agency, 2015,

unpublished management data; Population Figures, Office for National Statistics, 20

15c, data

published 25 June 2015

Table 3.19: Ten local authorities with highest Help to Buy Equity Loan activity

by numbers of transactions per thousand people based on mid-2014

population figures (as of 30 June 2015)

Highest-lowest by transactions per thousand

Local authority

Transactions per

thousand population

Help to Buy Equity

Loan transactions as of

30 June 2015

Corby

4.25

278

Bedford

4.21

690

Peterborough

3.89

740

Aylesbury Vale

3.58

660

Chorley

3.58

399

South Norfolk

3.56

460

Gloucester

3.52

442

Hinckley and Bosworth

3.41

367

Telford and Wrekin

3.37

571

Dartford

3.35

342

Source: Help to Buy Equity Loan Transaction Data, Homes and Communities Agency, 2015,

unpublished management data; Population Figures, Office for National Statistics, 20

15c, data

published, 25 June 2015

38

In Figure 3.15, the number of starts has been summed by quarter in these high

activity areas to show the trend over time. Since the introduction of Help to Buy

Equity Loan, there has been an upward trend in starts generally in these high activity

areas, albeit with significant dips around Quarter 4 of both 2013 and 2014, reflecting

seasonal patterns.

Figure 3.15: Private enterprise starts and completions in ten local authorities

with highest Help to Buy Equity Loan activity by number of transactions per

thousand people, 2010-2014

Source: author’s calculations based on Help to Buy Equity Loan Transaction Data, Homes and

Communities Agency, 2015, unpublished management data; Population Figures, Office for National

Statistics, 2015c, data published 25 June 2015; Starts and Completions data, Department for

Communities and Local Government Live Table 253a, data published 20 August 2015

A table summarising information on active developments in these high activity local

authorities is included in Appendix 3. In general, these local authorities have

ambitious growth targets and plans which encourage substantial house building over

the next 15 to 20 years. The active sites are mostly being developed by the major

developers, and Help to Buy Equity Loan is being widely advertised on most of them.

Perhaps surprisingly, the individual sites themselves are not very large, usually less

than 150 units and many below 100. Often, however, these smaller sites are being

brought forward as phases within larger schemes, including major urban extensions.

Table 3.20 shows trends in median house price in these ten high activity local

authorities. Between 2013 and 2014, prices rose on average by 6.5% in these

authorities compared with an average price rise of 10.5% over the same period

nationally.

39

Table 3.20: Price trends in ten local authorities with highest Help to Buy Equity

Loan activity by number of transactions per thousand people, 2010-2014

2010

2011

2012

2013

2014

Corby

124,995

119,950

119,850

130,000

132,250

Bedford

183,000

179,000

185,000

187,500

205,000

Peterborough

132,998

130,000

132,000

140,000

150,000

Aylesbury Vale

230,000

230,000

227,500

237,500

250,000

Chorley

150,000

145,475

150,000

147,750

154,000

South Norfolk

184,000

175,000

176,998

182,000

195,000

Gloucester

147,000

140,000

142,000

148,000

158,000

Hinckley and Bosworth

152,000

149,000

145,000

150,000

165,000

Telford and Wrekin

139,995

135,250

139,950

142,495

145,000

Dartford

187,000

185,000

196,625

200,000

220,000

Average across local

authorities

163,099

158,868

161,492

166,525

177,425

Per cent change each

year

6.50%

-2.59%

1.65%

3.12%

6.55%

Source: Office for National Statistics, 2015d, data published 24 June 2015

The Help to Buy Equity Loan data analysis shows clearly how and where Help to

Buy Equity Loan has impacted. It has supported the purchase of over 50,000 new

homes with a total value of over £12bn. The vast majority of sales (82%) have been

to first-time buyers. Most have been family sized homes with nearly 50% of Help to

Buy Equity Loan purchases being three bedroom property. There is some evidence

to suggest the proportion of family homes purchased under the scheme is growing.

The picture with respect to property sizes suggests that Help to Buy Equity Loan

may have allowed some first-time buyers to miss out the first step of a smaller home.

However in London in particular the emphasis is on smaller units.

Most households buying under Help to Buy Equity Loan had identified household

incomes below £50,000 and the average property price was £212,000 some £55,000

below the Office for National Statistics average of £267,000. Three quarters of

homes were priced between £100,000 and £250,000 and 87% below £300,000.

Some 838 developers have made transactions under the scheme along with 18

lenders. In both cases a small number of large firms dominate delivery. In the case

of lenders there has been some expansion of the market with reliance on the largest

mortgage lender falling from 85% of loans in Quarter 2 2013 to 17% in Quarter 1

2015.

40

3.5 Conclusion

Help to Buy Equity Loan has become a small but significant element of total

transactions, albeit with considerable spatial variations. There is evidence to suggest

it has boosted total output – starts in 2013 were a long way up on 2012 and in 2014

they were higher than 2013 (starts are chosen as our preferred measure of output

over completions which clearly lag).

The extent of the expansion in output varies greatly across the country with the

largest growth in the Northern and Southern Homes and Communities Agency

Operating Areas (representing between 3-5% of total transactions) where the biggest

falls were also seen after 2008 and the least in the London and East and South East

Operating Areas, (representing between 1-2% of total transactions) where output

levels were less affected. This tends to suggest that Help to Buy Equity Loan take-up

has been greatest in generally lower price and demand areas.

The evidence on local authority areas shows how significant Help to Buy Equity Loan

has been in specific local authorities, which were often identified growth areas.

Data on new mortgage loans by both number and volume show an upturn in 2013 as

do data on the number of loan products with higher loan to value ratios. Although

most are not for new build homes this rise has supported an increase in first-time

buyers as measured by both the number and value of new loans. Housing market

confidence in general also showed a slight increase, although confidence that it is a

‘very good’ time to buy has waned.

This secondary data analysis can provide some indications of how the Help to Buy

Equity Loan policy might evolve as the market changes through to 2020 and beyond.

We return to this issue in Chapter 6.

41

Chapter 4: Supply-side perspectives

4.1 Developer perspectives

We interviewed some fifteen senior executives from fourteen larger developers (in

one case we interviewed two people in order to obtain specific information about the

London market as well as the national picture) over the period from April to June

2015. These included the six largest developers in terms of the number of

transactions (in themselves covering almost 60% of transactions) and six of the

largest seven in terms of the number of active sites. The interviewees included both

national and regional developers across England - with the majority covering large

parts of the country but including some who specialised in two or three regions. As a

result we obtained information on developer experience in all regions as well as on

the national picture.

During May and June we also interviewed five senior executives from smaller

builders who were operating in one or sometimes two regions. One had not done

any Help to Buy Equity Loan sales - although they were closely involved in

discussions with the Homes and Communities Agency; one had done one sale; the

other three had greater experience of Help to Buy Equity Loan transactions.

Interviews covered four main topic areas: the firm’s involvement in Help to Buy

Equity Loan; the impact of the scheme on the firm’s own decisions; their

understanding of the impact of the scheme on the market; and how they saw the

future. While the responses all reflected the individual circumstances of the firms

involved – especially in terms of their experience since the crisis and the extent of

restructuring that this had generated – and somewhat different attitudes to the

specifics of the scheme, the overall picture was generally similar across the larger

developers. The involvement and attitudes of smaller builders obviously differed from

that of the larger developers with some of these differences reflecting the different

views of the trade bodies covered in section 4.4.

Involvement in Help to Buy Equity Loan

All the larger developers had been involved in Help to Buy Equity Loan from its

inception (or within a couple of months) and many had been directly involved in

discussions on the design and objectives of the policy. They had also been involved

in earlier government schemes of similar nature and involvement flowed from this

existing position. They had all remained in the scheme and expected to do so until it

finished – and to be part of any future policy initiative of a similar type.

All had transactions levels of a scale which made it a core element in their sales

strategies. All marketed the scheme using the logo on their web and their local sales

drives. They did not directly incentivise their local sales personnel to use the scheme

but all were well versed in the details. All had panels of solicitors and Independent

42

Financial Advisors who were highly experienced in processing applications. One of

the things that they most liked about Help to Buy Equity Loan was that there was a

strong national image into which they could tap in their own marketing strategies.

They almost all took part in road shows and other local and regional activities and

were in direct contact with relevant agents on a regular basis. In other words Help to

Buy Equity Loan was a core part of their activity; the processes mainly worked well

and they had senior executives who specialised in this element of their decision

making. (In most cases we were able to talk directly with this specialist).

Among the smaller builders registration tended to be later. This, in part, was driven

by their perception that the Homes and Communities Agency dealt first with FirstBuy

conversions and thus the major suppliers, and in part because they were coming

new to the scheme and took time fully to clarify whether it was appropriate to join.

They had not been involved in earlier schemes, seeing them as too restrictive and

complex for their needs.

All five were positive about registration for Help to Buy Equity Loan and thought that

it was potentially worthwhile for their own activities. They did not wait until they had a

specific transaction or scheme available before registering.