DHS-2 Rev. 09-16

Instructions Page

1

of 4

RHODE ISLAND DEPARTMENT OF HUMAN SERVICES

APPLICATION FOR ASSISTANCE (DHS-2)

Getting Help with this Application

You can ask for help in completing this form. You can ask for the form and notices to be translated. If you have

a disability or condition that makes it hard for you to understand or answer questions on this application, we can

help. Please let us know by speaking with a DHS representative or calling the DHS Call Center at

1-855-MYRIDHS (1-855-697-4347).

Who Should Complete the Application?

This document should be filled out by you or an adult member of your household, or a relative, friend or authorized

representative who knows the financial situation of all household members.

Answering the Questions

If you answer all the questions on the assistance application, we can determine if you are eligible for ALL

programs. Instruction pages 3 and 4 provide a description of each program that you can apply for using this

application. Small boxes with the program acronyms/initials will appear next to each of the questions on the

application. These boxes with the acronyms/initials tell you which questions you must answer for each program.

For example, if you are applying for child care assistance, answer those questions that have CCAP next to them.

If you are applying for SNAP only, although we encourage you to fill out as much of the application as possible,

we will accept your application if it is submitted with just a name, address and signature.

Each question is followed by a section of boxes used for filling in the required information. Respond to each

question by indicating either YES or NO with a check mark in the box next to the question. IF the answer is YES

supply the requested information by writing in the space available beneath the question. You must provide the

information asked for EVERY household member. If the question does not apply to you or anyone in your

household, then the answer is NO. Leave the box blank and move on to the next question.

Securing your Application Date

The first page of this application can be detached and submitted with your signature to DHS to establish a start

date and begin your application. You will need to complete and submit the rest of the application in order to

receive benefits/coverage.

If you need more space to answer questions

Turn to page 27 if you run out of space where there are boxes to write in additional information. Indicate

in one of the boxes which

question you are referring with its number. You may also attach separate sheets

of paper, if necessary.

Your Rights and Responsibilities/Signature Page

Read pages 28-32

. These pages contain important information about your Rights and Responsibilities. All

applicants are required to sign application page 32 before submitting the application. If you submit the first

page only to secure your application date, you must sign application page 1 and then submit the rest of the

application with a signature on application page 32.

Appointing an Authorized Representative

If you would like to appoint an authorized representative to act on behalf of the household in applying for

program benefits or using the benefits you may do so on application page 2.

Electronic Benefit Transfer (EBT) Card

RIW cash assistance and SNAP benefits are issued through the Electronic Benefit Transfer (EBT) process. You

can get your benefits by using your EBT card. You will receive more information about this process from your

local office.

Application Mailing Address: RI Department of Human Services, P.O. Box 8709, Cranston, RI 02920-8787

General Instructions for Completing this Application

DHS-2 Rev. 09-16

Instructions Page

2

of 4

EXAMPLES OF DOCUMENTS YOU MAY NEED TO PROVIDE FOR YOUR INTERVIEW

OR TO SUBMIT FOR BENEFIT APPROVAL

Note: The same document may be used to verify more than one category, for example, a driver’s license can verify identity and address. If you

are applying for Medicaid, we will verify your information with data sources as much as possible.

1. To verify your identity, age/date of birth, citizenship and/or immigration status (All Programs)

Driver’s License

School or work Idenficaon

Immigraon and Naturalizaon Documents (e.g., Green Card)

Hospital birth records

Birth Cerficates

U.S. Passport

Any other documentaon requested for cizenship, immigraon

status, or age may be used for verificaon of identy

2. To verify your Rhode Island residence (All Programs except ACC, unless questionable)

Rent or mortgage receipts showing address

Lease agreement of leer from landlord

Library card showing address

Mail received with your home address (ulity bills, bank statements)

Voter’s registraon card

3. To verify your income (All Programs)

Check stubs (showing the last 30 days of income)

Proof of alimony received

Employer statement showing income before taxes, hourly work schedule

and the number of hours worked for the past four weeks (if you get paid in

cash or you do not have your check stubs)

Proof of receipt of unemployment insurance benefits, temporary

disability benefits (TDI), Veteran’s Administraon (VA) benefits.

Previous tax returns

Social Security, Supplemental Security Income, or Veteran’s Benefits

award leer

Proof of self-employment income (includes rental income and freelance

work): provide tax returns or self-employment ledger

Other rerement or disability benefit award leers

Child Support court order

4. To verify your resources (RIW, GPA, EAD, LTSS, MPP, SSP, KB, CCAP if over $9,500)

Documentaon of ownership of a trust

Vehicle registration including car, boat, truck, motorcycle, camper

Proof of rental properes

Proof of ownership of other income producing property

Trust documents, property

Proof of ownership of a burial plot (if you own more than one)

Stock and/or bonds

Bank accounts, savings accounts, credit union statements, CD’s

Proof of ownership of real property other than your home.

5. To verify your dependent care expenses (RIW, SNAP)

Proof of expenses related to child care or caring for incapacitated adult living in the home: receipts showing your out-of-pocket expenses

6. To verify your shelter costs (SNAP, RIW, LTSS)

Rent, lease or mortgage documents

Proof of property insurance

Statement from landlord

Receipts or statement from ulity company

Property taxes statement

Statement from person who shares shelter costs

Statement from U.S. Department of Housing and Urban Development (HUD)

7. To verify your child support expenses (SNAP, ACC)

Child support that you pay: income summary if child support is deducted from wages or income

Copy of court order

8. To verify your medical expenses not covered by insurance (SNAP, EAD)

Summary of provided services such as doctor or hospital visits

Prescription pill bottles showing cost on label or printout

Receipts showing unreimbursed medical expenses

Invoices or receipts for medical equipment (including the rental cost)

Health insurance policy showing premium amount

9. To verify relationships among household members (RIW, CCAP, ACC)

Adoption papers or records

Marriage license/tribal marriage certificates

Hospital or public health records of birth or parentage

Divorce/custody papers

Child support paternity records

Guardianship papers or records

10. To verify your disability or blindness (RIW, SNAP, CCAP, GPA, EAD, LTSS)

Proof of receipt of Rerement, Survivors, and Disability Insurance (RSDI) or Supplemental Security Income (SSI); copy of the award leer or similar

documentaon from the Social Security Administraon and/or current finding of eligibility for RSDI or SSI based on blindness

Copy of medical examinaon report on file at the Office of Rehabilitaon Services (ORS), Services for the Blind and Visually Impaired

Statement from a medical professional

DHS-2 Rev. 09-16

Instructions Page

3

of 4

ABOUT THE PROGRAMS

A

gain, the letter boxes next to each program below are used through this application to identify questions you need to answer to be

considered for specific programs. Answer only those questions for the programs you want to apply for. For example, if you want to

apply for all programs, answer all the questions. If you are applying for only RIW and ACC, you must answer a question with a RIW or

ACC box above it, and can leave the other questions blank.

RIW RI Works (RIW) Cash Assistance: The RIW Program gives cash assistance for a limited number of months to families in need of

support, as well as those who are unable to work, or in training or looking for a job. Applicants for RIW must be responsible for the support and

care of a child under age 18, or between ages 18 and 19 if enrolled full-time in and expected to complete secondary school prior to their 19th

birthday. A pregnant woman with no other children can qualify for assistance if she is in her third trimester of pregnancy. RIW requires

an interview with an eligibility worker and a meeting with a Social Caseworker to complete an employment plan.

SNAP Supplemental Nutrition Assistance Program (SNAP): SNAP, formerly known as food stamps, helps low income households buy

the food needed to stay healthy. Your income minus certain allowable expenses will determine if you are eligible for SNAP benefits. You will

need to participate in an interview over the telephone or in the office before you can be granted SNAP benefits.

CCAP Child Care Assistance Program (CCAP): Child Care Assistance is available to families with earnings up to 180% of the federal

poverty level and is only available to cover hours of employment or short-term training. Families may be required to pay a co-payment based on

their family size, income level and number of children. Families that participate in RIW automatically meet the income requirements for CCAP.

Prior to enrollment, RIW applicants or participants who are not employed must discuss child care options with a Social Worker as part of the

assessment process and the development of the employment plan. For families not participating in the RIW Program, eligibility for CCAP is

based on working at least 20 hours per week at or above Rhode Island's minimum wage.

GPA General Public Assistance (GPA) Program: GPA is available for adults ages 18-64 who have very limited income and resources

and have a chronic or disabling illness or condition that keeps them from working. Adults who have a current pending application for

Supplemental Security Income (SSI) may be determined eligible for GPA benefits. A determination for ACC Medicaid health care coverage must

be completed prior to a determination of eligibility based on a disabling condition. GPA applicants can apply for ACC Medicaid healthcare

coverage by completing the ACC questions on this application, or by applying online at www.healthyrhode.ri.gov.

SUPPLEMENTAL NUTRITION ASSISTANCE PROGRAM

(SNAP)

You may file your application immediately as long as we have your name, address and the signature of a responsible

household member or your

authorized representative on this application. If you are determined eligible, benefits will be

calculated from the date we receive this form in our

office. We are required to verify information you provide and take

action on your application within thirty (30) days of the filing date unless you are

entitled to expedited service. To

determine whether or not you are eligible, you must be interviewed. The application filing date for pre-release

applicants is

the date of release from the institution.

You will be sent a written request for any verification missing from your application. Your application will be denied if the

missing verification is not received within ten (10) days of the written request.

FINANCIAL ASSISTANCE (RIW) (GPA) (CCAP) (SSP)

If you are applying for RIW GPA, CCAP or SSP and are

determined eligible for benefits, those benefits will be

determined from

the date the signed application is

received.

MEDICAID (LTSS) (EAD)

Retroactive Medicaid coverage for certain health expenses may be provided to applicants eligible through the LTSS and EAD pathways for up

to three (3) months prior to the date we receive a signed

application, provided all factors of eligibility are

met for each month. There is no

retroactive coverage available for ACC Medicaid beneficiaries.

Applicants may qualify for Medicaid through more than one eligibility pathway. If you are uncertain which pathway best suits the needs of

the applicants in your household, contact 1-855-MYRIDHS (1-855-697-4347).

DHS-2 Rev. 09-16

Instructions Page

4

of 4

SSP RI SSI State Supplemental Payment Program (SSP): The State of Rhode Island supplements the Federal Supplemental Security

Income (SSI) benefit rate for eligible persons. Authorization of the monthly SSP for current SSI recipients will be completed automatically when

they apply at SSA. Applicants for SSP who have been denied through SSA for excess income will need to meet the income, resource, age

and/or disability standards (age 65 or older, disabled or blind) established for Medicaid for low-income persons who are aged or living with a

disability. If an applicant is eligible based on income and is claiming a disability which has not been reviewed or determined by the SSA, the

SSP Unit will send a referral to the Medicaid Review Team (MART) for a disability determination.

ACC Affordable Care Coverage -- Medicaid and Private Health Insurance with Financial Help (ACC): Medicaid is available for

parents/caretakers with income up to 136% of the Federal Poverty Level (FPL), children with income up to 261% of the FPL, pregnant women

with income up to 253% of the FPL and adults age 19 to 64 with income up to 133% of the FPL who are otherwise ineligible for Medicaid and not

eligible for or enrolled in Medicare through this eligibility pathway. Adults who are awaiting a determination of disability by a government

agency, have resources above the limits for EAD eligibility, and/or do not meet the criteria for disability determination may apply for Medicaid

affordable care coverage through this pathway. Families and individuals not eligible for Medicaid with income below 400% of the FPL may be

eligible for a tax credit from the federal government to help pay the costs of coverage through a private a health plan. You can also apply for

coverage online at

www.healthyrhode.ri.gov or over the phone by calling the HSRI Contact Center at 1-855-840-4774.

LTSS Medicaid Long Term Services and Supports (LTSS): LTSS are available for individuals who meet the necessary level of need

and financial requirements, and for individuals with disabilities. You must meet both the financial and clinical “level of care” requirements to

qualify fo

r LTSS. For people who qualify, Medicaid LTSS may be provided in a health institution like a nursing home, at home, or in certain

pre-approved community settings including some assisted living residences. The range of long-term services Medicaid covers includes, but

is not limited to, homemaker/certified nursing assistant (CNA) services, environmental modifications, case management, self-directed care,

respite, minor home modifications and shared living/RIte at Home. The range of services and the choice of service settings depends on an

individual’s care needs.

EAD Medicaid: Health Coverage for Low-Income Elders and Persons with Disabilities and Working Adults with

Disabilities/Sherlock Plan (EAD): To qualify for Medicaid for low-income elders and persons with disabilities, an individual or member of a

couple must be age 65 years or older or living with a disability. Persons who are blind also qualify for coverage in this category. Income must be

at or below 100% of the FPL, and resources cannot exceed $4,000 for a single person and $6,000 for a couple. In addition, a person under age

65 must be determined to have a disability by the Medicaid Review Team (MART) that prevents gainful activity, including work, for a minimum of

one year. Some applicants who have income and/or resources above these amounts may qualify for Medicaid through the medically needy

pathway if they have high medical expenses each month. You will be given more information about this pathway if you do not meet the EAD

income and resource standards. People who receive Supplemental Security Income (SSI) based on age or disability are automatically eligible for

Medicaid and do not need to complete this application. People who receive Social Security Disability Insurance (SSDI) must apply, but do not

have to undergo a disability review by the MART.

Medicaid for Working People with Disabilities Program/Sherlock Plan: People eligible under this category are entitled to the full

scope of Medicaid benefits, home and community-based services, and services needed to gain and/or maintain employment. To be found

eligible for this program, a person must be at least eighteen (18) years of age, meet the Medicaid requirements for eligibility based on a disability,

have proof of active, paid employment, have income at or below 250% of the FPL and meet special resource standards.

MPP Medicare Premium Payment Program (MPP): Eligibility for the MPP is based on income and helps adults over age 65 and adults

with disabilities pay all or some of the costs of Medicare Part A and Part B premiums, deductibles and co-payments. Medicare Part A is hospital

insurance coverage and Medicare Part B is for physician services, durable medical equipment and outpatient services. People with income up to

135% of the FPL are eligible to participate in MPP.

KB Katie Beckett (KB): Katie Beckett provides Medicaid/health insurance coverage to children under age 19 who are living at home but

have complex health needs that typically require the care provided in a health facility like a hospital or nursing home. To determine Katie Beckett

eligibility, only the income and resources of the child who needs coverage are considered. A child may qualify for the same services available

through this pathway if family income is within the limits for coverage for the ACC groups. Call 1-855-MYRIDHS (1-855-697-4347) if you need more

information about which pathway is best for you.

DHS-2 Rev. 09-16

Application Page

1

of 32

RHODE ISLAND DEPARTMENT OF HUMAN SERVICES

APPLICATION FOR ASSISTANCE (DHS-2)

Do you need: Help filling out this application? Free language help?

Preferred language: _______________________________ Preferred language read:_________________________________

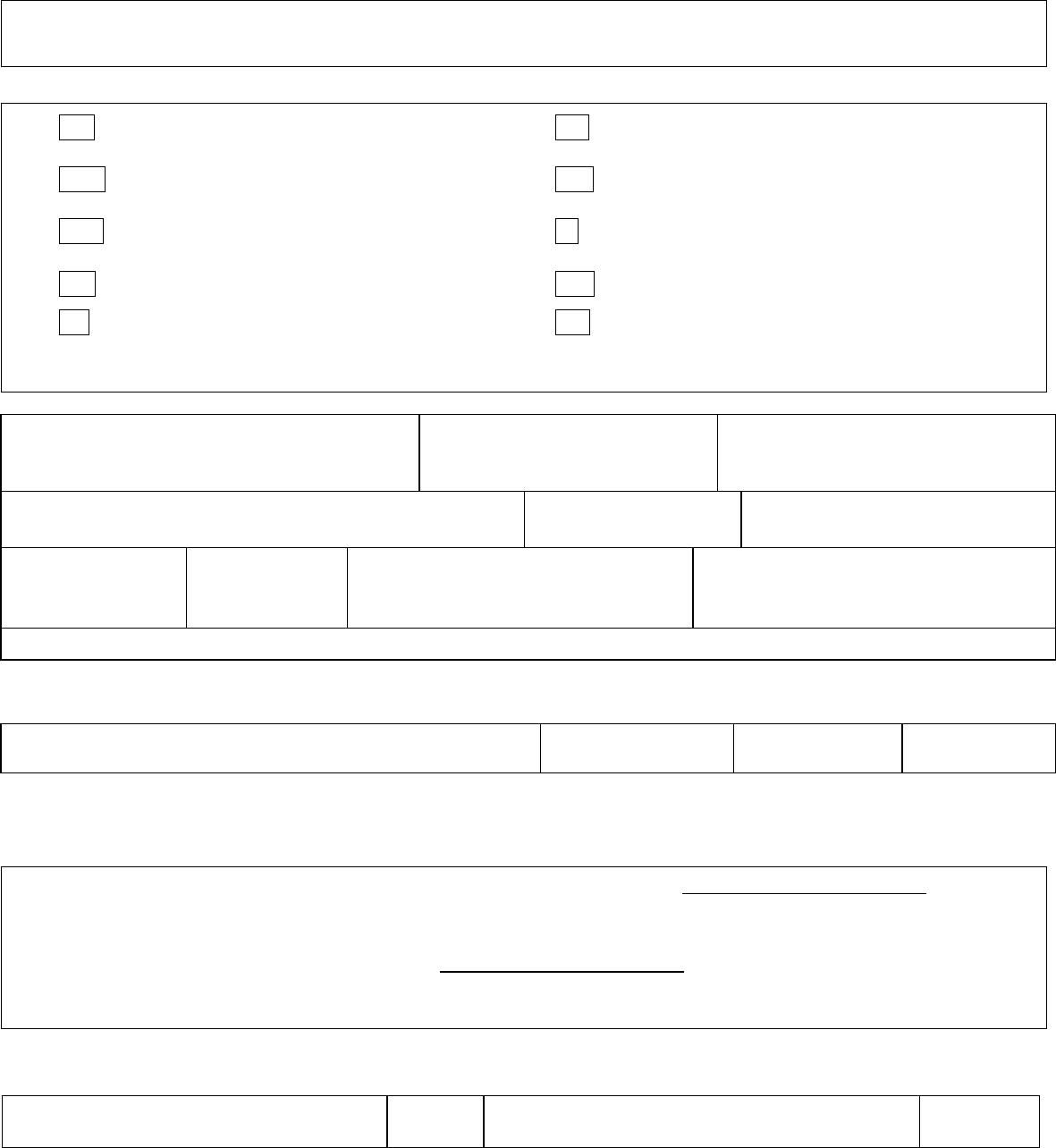

I want to apply for:

RIW

CASH ASSISTANCE (RHODE ISLAND WORKS- RIW)

ACC

MEDICAID/PRIVATE HEALTH INSURANCE WITH FINANCIAL

HELP (ACC)

SNAP

SUPPLEMENTAL NUTRITION ASSISTANCE PROGRAM

(SNAP)

LTSS

MEDICAD: LONG-TERM SERVICES AND SUPPORTS (LTSS)

CCAP

CHILD CARE ASSISTANCE PROGRAM (CCAP)

KB

KATIE BECKETT: HEALTH COVERAGE FOR CHILDREN WITH

SEVERE DISABILITIES (KB)

GPA

GENERAL PUBLIC ASSISTANCE (GPA)

MPP

MEDICARE PREMIUM PAYMENT PROGRAM (MPP)

SSP

RI SSI STATE SUPPLEMENTAL PAYMENT PROGRAM

(SSP)

EAD

MEDICAID HEALTH COVERAGE FOR AGE 65 AND OVER,

BLIND OR DISABLED OR

PERSONS WITH DISABILITIES

AND WORKING ADULTS WITH DISABILITIES/SHERLOCK

PLAN

(EAD)

First Name, Middle Initial, Last Name Suffix

E-Mail Address

Telephone Number

( )

Cell Home Work

Street Address

Apartment/Unit Number:

City/Town

State

Zip Code

Alternate Telephone Number:

( )

Cell

Home

Work

Are you homeless? YES NO

Best time to contact you: morning afternoon evening night weekend anytime

If your mailing address is different, please fill it in below. If not, please leave blank.

Street or PO Box Address

City

State

Zip Code

FOR SNAP APPLICANTS ONLY: Answer the questions below to see if you can get SNAP benefits faster (within 7 days). If your income, cash

and money in the bank add up to less than your monthly

housing expense; or your monthly income is less than $150 and your money in the

bank and liquid resources are less than $100; or you are a migrant or seasonal farm worker, you may be eligible for expedited service.

How much money do members of your household have in cash or money in the bank? $

What is the total amount of income from any source (including unearned income such as Child Support, SSI, TDI, Unemployment, or

SSDI, RSDI, etc.) you expect your household to receive this month? $_________________

What is your current monthly rent/mortgage payment? $ Utilities? $

________________

Do you pay to heat or cool your home? Yes No

Is anyone in your household a migrant or seasonal farm worker? Yes No

Under penalty of perjury, I attest that all of the information contained in this application is true. I understand that I am

breaking the

law if I give wrong information and can be punished under federal law, state law or both.

Signature of Applicant or Recipient

Date

Signature of Authorized Representative

Date

You may tear off this sheet and submit JUST the front and backside of this page with your Name, Address and Signature to allow us to

date stamp and start this application. To determine ongoing benefit eligibility, you must sign and complete the remainder of this

application and may bring or mail or fax the application to the DHS office.

DHS-2 Rev. 09-16

Application Page

2

of 32

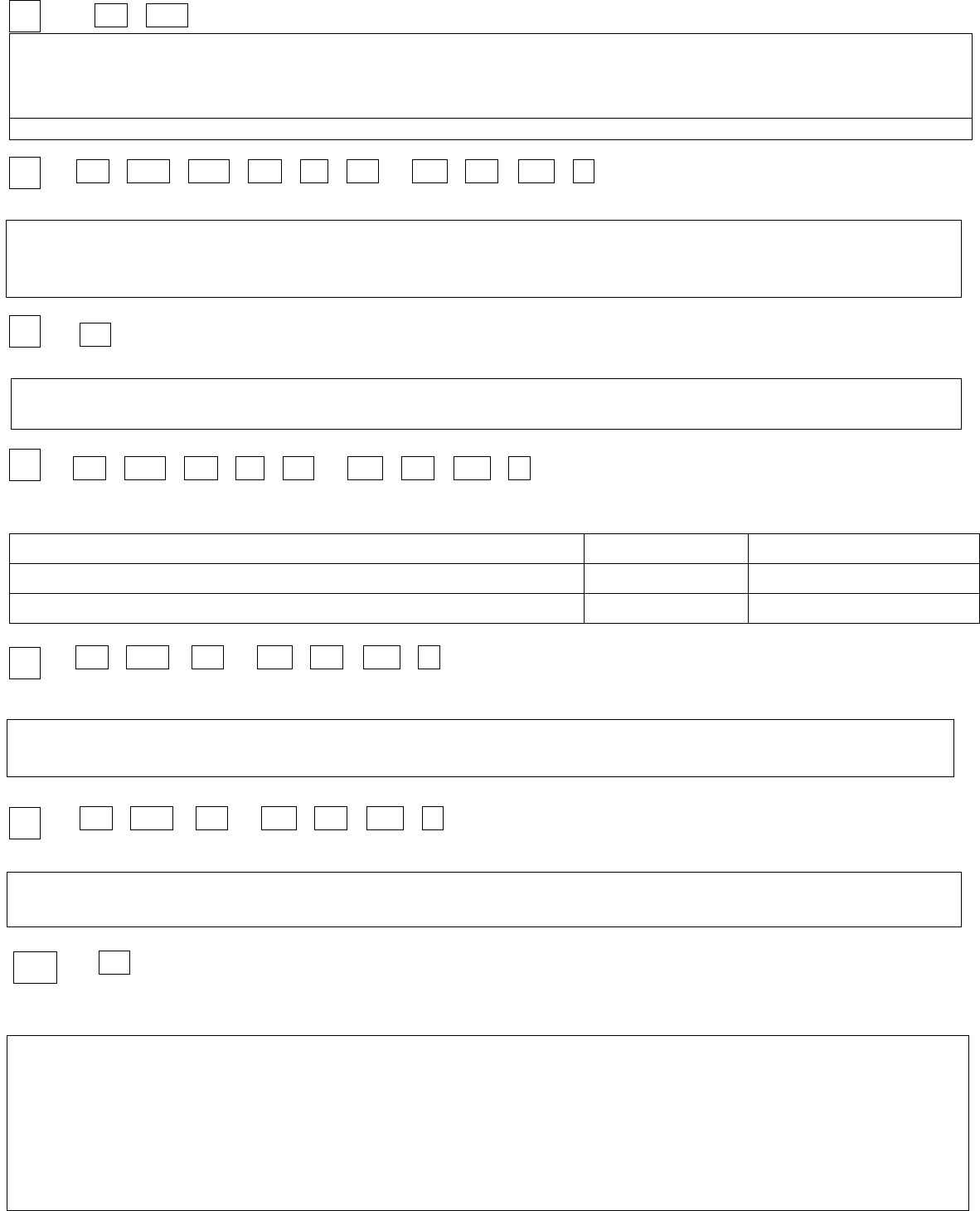

If you would like someone to apply on your behalf, authorize someone to use your benefits, and/or receive important notices or bills for health

insurance, answer the questions below. Selecting an Authorized Representative is optional. You and your Authorized Representative will both

have access to your electronic account. If you want to name an Authorized Representative, check “Yes” below and enter his or her details. Your

authorized representative must be 18 or older and can be a friend, relative, or anyone else you choose.

Do you want this person to:

Apply for benefits on your behalf? Use your benefits? (SNAP & RIW Cash benefits only) Receive Notices?

HOUS

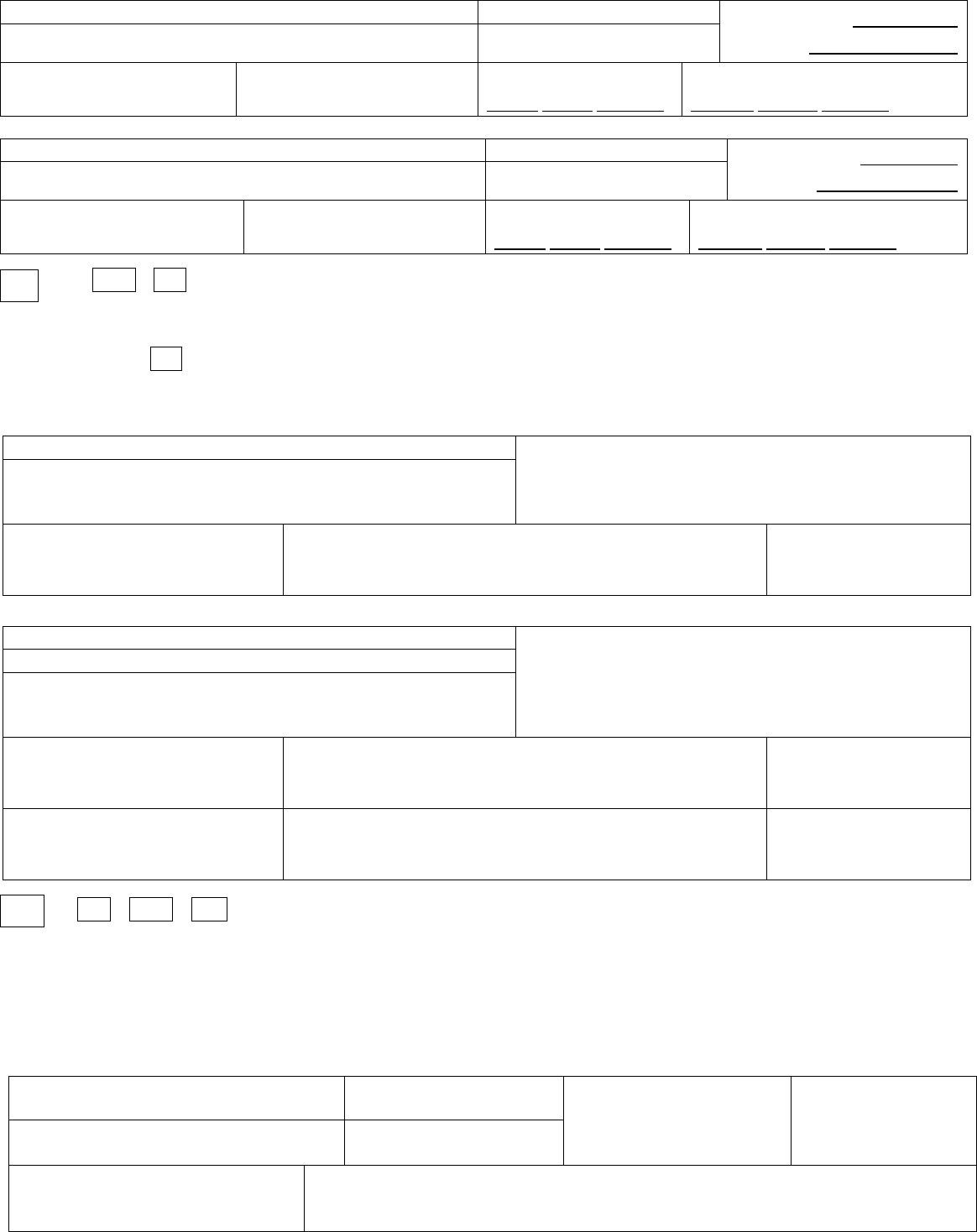

EHOLD COMPOSITION: Please list the members of your household below.

• SNAP Applicants: list yourself and everyone who lives in your home now, even if they do not want assistance.

• Health Coverage/ACC Applicants: include yourself, other family members, and anyone who is included on your federal tax return, if you file one.

Only include your unmarried partner (boyfriend or girlfriend) if you live together AND have a child together. Do not include your roommate. You can

complete an application for other people in your family even if you don’t need coverage or are not eligible for coverage.

Household members choosing not to seek benefits are not required to answer questions about Social Security Numbers or Citizenship information.

Name

(First, Last, Middle Initial, Suffix)

D.O.B.

(mm/dd/yyyy)

Gender

M: Male

F: Female

Social Security

Number

(

Required only if applying for

benefits)

Is this person’s name different

on his/her Social Security Card?

If yes, write the name on the card

below

U.S. Citizen?

(Required only if

applying for

benefits)

Yes No

Yes

No

Yes No

Yes No

Yes No

Yes No

Yes No

If there are more people in your household, please list them on page 27 marked, “for applicant/recipient use only”.

If you are applying for SNAP benefits, how would you like to be interviewed?

Telephone Interview (OR)

In-Office Interview

(Note: an in-office interview is required for RIW cash assistance. Your SNAP and RIW interview can be combined.)

Telephone#: Day__________________________________________ Evening:_________________________________________

We may need to contact you regarding the status of your application and/or to request additional

information. What is your preferred

method of contact?

Email Paper Mail

Note: If you are applying for SNAP and you select “email”, you will continue to receive notices in the mail at this time

.

I live in a (check one):

Elderly/Disabled Housing

Homeless: lobby, street, car

Own Home/Trailer

Shelter/Halfway House

Rent home/apt/trailer

Living in another’s home/apartment

Drug/Alcohol rehab center

No permanent address

Nursing Home/Facility:

Name of Facility:

Residential care/Assisted Living:

Name of Facility:

Other (describe):

Is anyone in the household applying for dental coverage? Yes No If yes, please write their names below:

1._______________________________________________________ 4.__________________________________________________

2._______________________________________________________ 5.__________________________________________________

3._______________________________________________________ 6.__________________________________________________

Authorized Representative’s Name

Mailing Address

Primary Phone Number ( )

Cell Work Other

Secondary Phone Number ( )

Cell Work Other

Email Address

Preferred method of contact

Email Phone Paper Mail

Preferred time of contact?

Morning Afternoon Evening Anytime

Preferred Language Spoken

English Español Português

Preferred Written Language

English Español Português

Company/Organization Name and ID (if applicable)

D

HS-2 Rev. 09-16

Application Page

3

of 32

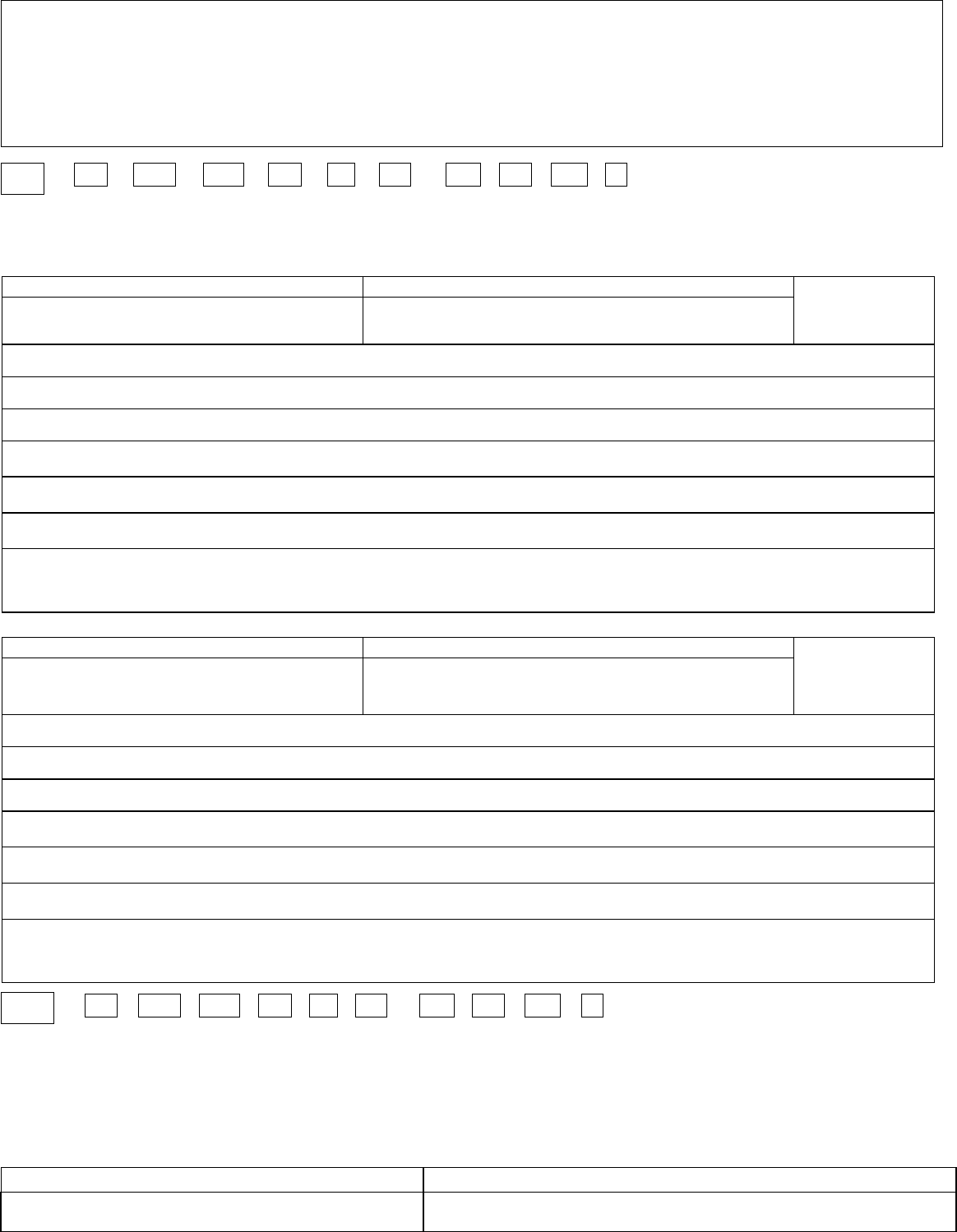

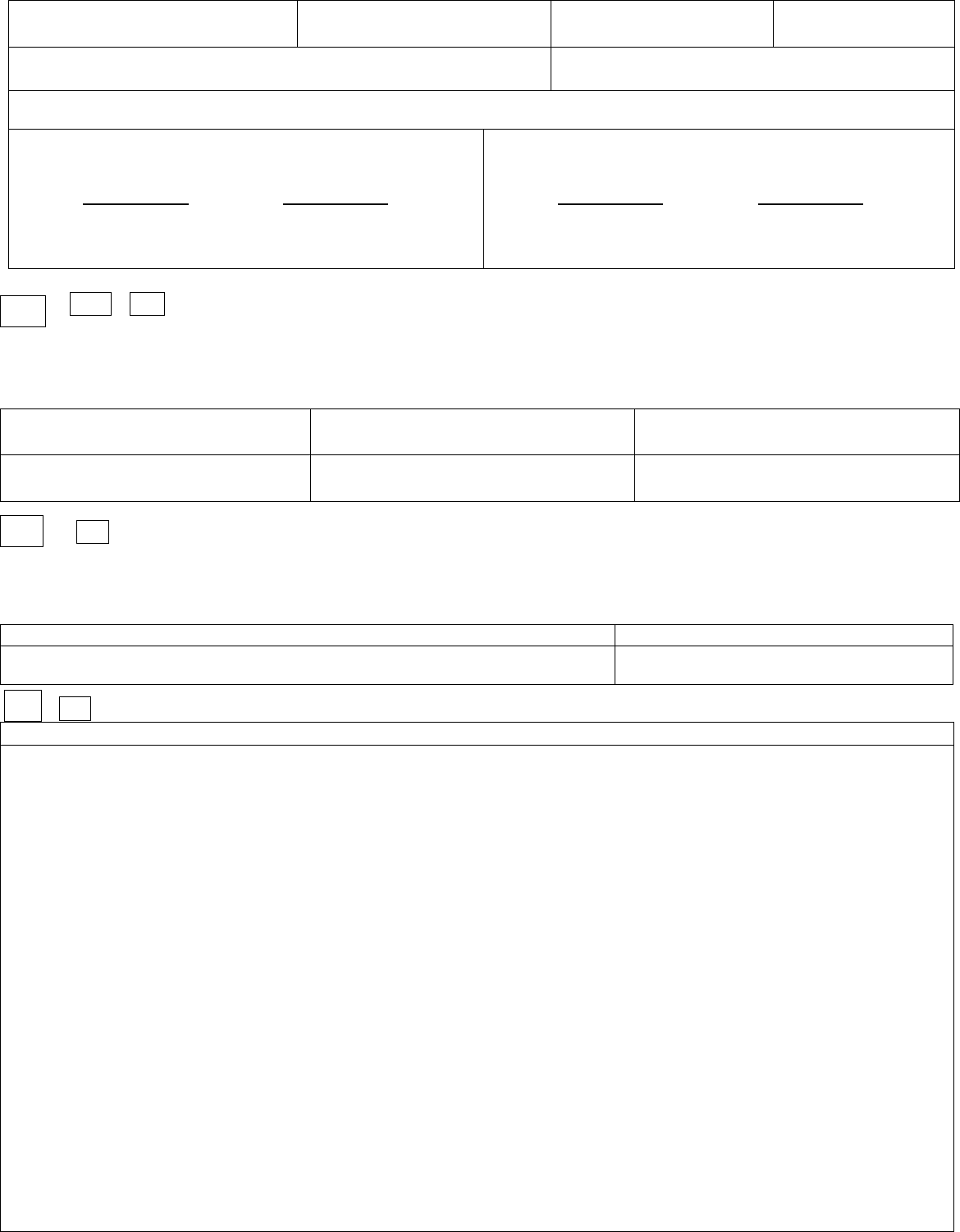

1

Please fill out some additional information below about each member of your household.

**Race/Ethnicity Information: We ask you to provide this information so we can make sure that all people are able to get the benefits

they need and we are not discriminating against anyone. You do not have to provide this information. If you choose not to provide

this information, it will not affect your eligibility for benefits. You may select more than one category under “race”.

Name

Relationship

to Primary

Applicant

Lives with Primary Applicant?

Yes or No

If no, enter address

Ethnicity

Enter a

number

(see below)

Race

Enter a

number

(see below)

Marital Status

Applying for

Benefits?

Self

Yes

No, Address:

Yes No

Yes

No, Address:

Yes No

Yes No, Address:

Yes No

Yes No, Address:

Yes No

Yes No, Address:

Yes No

Yes No, Address:

Yes No

Yes No, Address:

Yes No

Ethnicity: 1-Hispanic 2-Non-Hispanic 3-Mexican 4-Puerto Rican 5-Cuban 6-Other Hispanic

Race: 1-White 2-Black or African American 3- American Indian or Alaskan Native 4-Asian 5-Asian Indian 6-Chinese 7-Filipino 8-Japanese

9-Korean 10-Vietnamese 11-Other Asian 12-Guamanian 13-Chamorro 14-Samoan 15-Native Hawaiian 16-Other Pacific Islander

17-Other

2

Is any applicant getting benefits/receiving assistance in another state? YES NO

If, YES, Who?________________________________________________________ Which State?_____________________________

3

Before now, has any applicant ever applied for, or received any type of assistance payments, benefits or SNAP/Food Stamp benefits in

Rhode Island or in another state?

YES NO

If, YES, Who?________________________________________________________ Which State?_________________________________

Under what name?____________________________________________________ When?_______________________

What type(s) of benefits were received?______________________________________________________________________________

RIW

SNAP

CCAP

GPA

SSP

ACC

LTSS

EAD

MPP

KB

RIW

SNAP

CCAP

GPA

SSP

ACC

LTSS

EAD

MPP

KB

SNAP

DHS-2 Rev. 09-16

Application Page

4

of 32

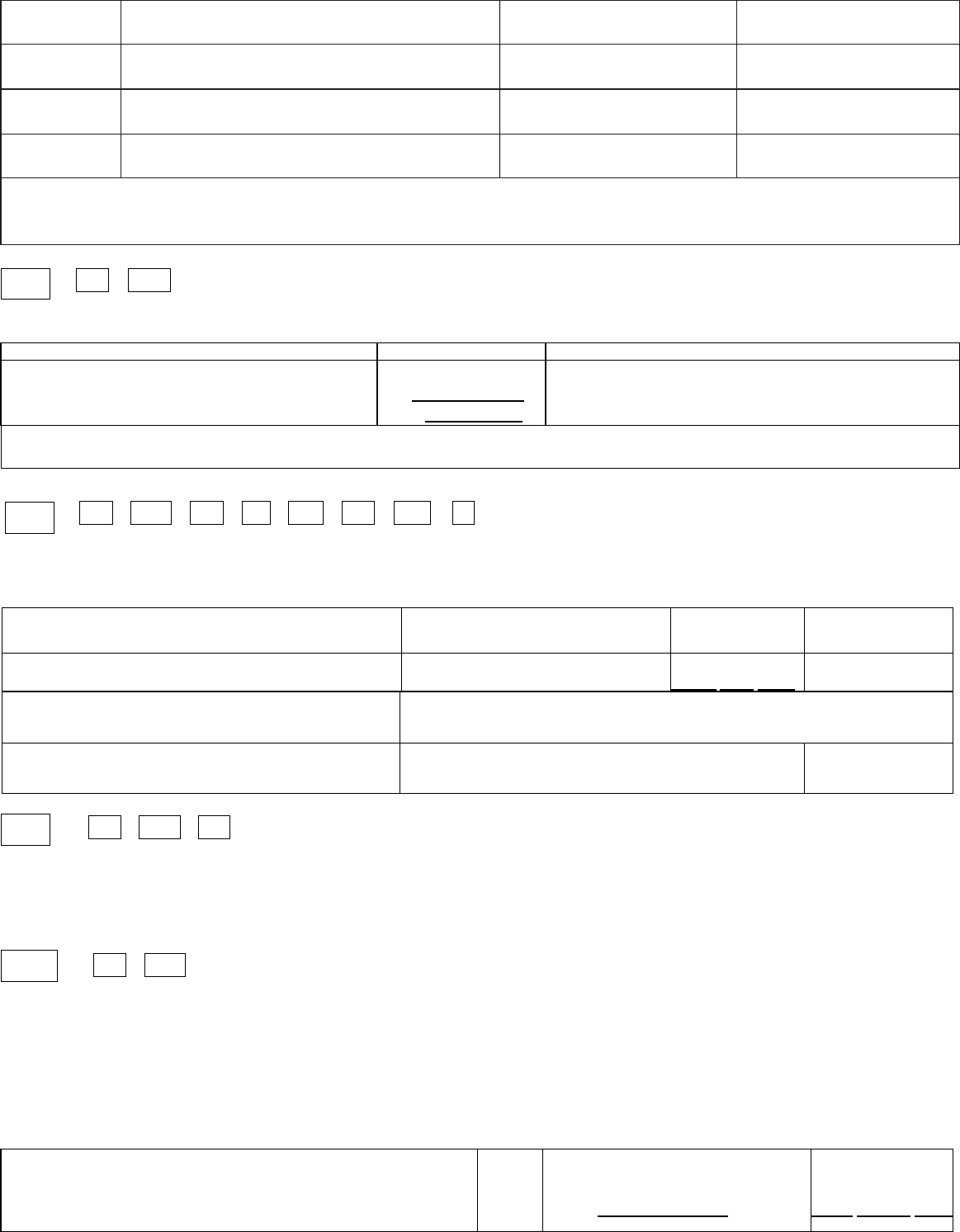

4

The Rhode Island Department of Human Services (DHS) uses an automatic phone system to make “appointment reminder calls” to

remind you of a scheduled phone or office interview appointment. The reminders are for SNAP and Rhode Island Works

certification and recertification appointments. Two days before your scheduled appointment, you will automatically be contacted

at the number you write on this application, unless you choose to opt out below.

Check here if you would not like to receive information about next steps in the application process from an automated telephone system:

5

Is any applicant imprisoned (detained or jailed)? YES NO

If, YES, Who?_________________________________________________________ Which facility?_______________________________

Date of imprisonment:___________________________________ Date of release_________________________________

6

Was any applicant in the care and custody of the RI Department of Children, Youth and Families on his/her 18

th

birthday? YES NO

If, YES, Who?____________________________________________________________________________________________________

7

Is any applicant pregnant? Yes No

If Yes, please fill in the boxes below for each person who is pregnant.

Last Name First Name Middle Initial

Pregnancy Due Date

Number of Babies Expected

8

Is any applicant a honorably discharged veteran or active duty member of the military? Yes No

If, YES, Who?_______________________________________________________________________________________________

9

Is any applicant a military veteran, a dependent of a veteran, or a survivor of a veteran? Yes No

If, YES, Who?______________________________________________________ Check one: veteran child spouse

10

Is any applicant an American Indian or Alaskan Native? YES NO

If yes, you may be eligible for Rhode Island Medicaid protections and for special benefits. Fill in the information below.

Is any applicant a member of a Federally Recognized Tribe? Yes No If yes, who?________________________________________

Tribe Name:_________________________________________________________ Tribe State:__________________________________

Has this person ever received services from the Indian Health Service, Tribal Program or Urban Indian Health Program? Yes No

Is this person eligible to get services from the Indian Health Service, Tribal Health Program, or Urban Indian Health Programs through a

referral from one of these programs? Yes No

RIW

SNAP

RIW

SNAP

CCAP

GPA

SSP

ACC

LTSS

EAD

MPP

KB

ACC

RIW

CCAP

GPA

SSP

ACC

LTSS

EAD

MPP

KB

RIW

SNAP

ACC

LTSS

EAD

MPP

KB

RIW

SNAP

ACC

LTSS

EAD

MPP

KB

ACC

DHS-2 Rev. 09-16

Application Page

5

of 32

11

If you are applying for SNAP, you will need to select a head of household. A head of household is typically an adult parent of the

children in the home or a person who is working and providing financial support for the household. If there is no parent or working

individual, you can select any adult to be the head of household. Please select a head of household below.

Last Name First Name Middle Initial

12

Is there anyone who lives with you who purchases and prepares

food separately?

YES NO

If yes, list the people who purchase and prepare food separately.

Last Name First Name Middle Initial

Last Name First Name Middle Initial

13

A

re you or anyone in your household not a U.S. citizen? YES NO

If yes, fill in the information in the boxes below for each individual who is

requesting benefits and is not a U.S. citizen.

If you are applying for Child Care or Katie Beckett, answer this question for the child only.

**If you are a non-citizen applying for benefits, the information you provide below will be subject to verification by the United States Citizenship and

Immigration Services (USCIS- formerly known as INS) through submission of information from this application to USCIS. Submitted information

received from USCIS may affect your household’s eligibility and level of benefits. Household members choosing not to seek benefits are not

required to provide citizenship/immigration information. Household members who are seeking benefits must supply information about citizenship

or immigration status. The amount of benefits will depend on the number of people requesting benefits, but eligible household members who

apply will be able to get benefits even though some people in the household are not seeking benefits. Household members who are not seeking

benefits will be required to provide their financial information if it is needed to determine eligibility and benefit amount for persons who are

applying.

*Non-Ci

tizen Status: 1- Lawful Permanent Resident (LPR/Green Card) 2-Asylee 3-Refugee 4- Cuban/Haitian Entrant 5-Paroled into the U.S.

6-Conditional Entrant 7-Battered Spouse/Child/Parent 8-Victim of Trafficking 9-Granted Withholding of Deportation/Removal 10-Work Visa

11-Student Visa 12-Temporary Protected Status 13-Lawful Temporary Resident 14-Other (please describe)

Person 1

Last Name

First Name

Middle Initial

*Non-Citizen Status (enter a number from above):

Please provide information on your documentation below:

Alien Registration #____________________________ Naturalization Certificate #____________________________

Permanent Resident Card (Green Card, I-551): Employment Authorization Card (I-766):

Alien #________________________________ Alien #_____________________________________________

Card #________________________________ Arrival/Departure Record (I-94, I-94A) issued by USCIS:

Machine Readable Immigrant Visa (with temporary I-551 language) SEVIS ID________________________________

Visa #________________Country of Issuance_______________ Student and Exchange Visitor Information System (SEVIS) ID:

Alien #__________________________________ ________________________________________

Refugee Travel Document (I-571)#________________________ Certificate of Eligibility for Nonimmigrant (F-

1) Student Status

Foreign Passport Number______________________________ (I-20): SEVIS ID____________________________________

Reentry Permit (I-327)#:________________________________ Country of Issuance:_________________________________

SNAP

SNAP

RIW SNAP CCAP GPA SSP ACC LTSS EAD MPP KB

DHS-2 Rev. 09-16

Application Page

6

of 32

Certificate of Eligibility for Exchange Visitor (J-1) Status (DS2019) Temporary I-551 Stamp (on passport or I-94, I-94A)

SEVIS ID________________________________________________ Country of Issuance: _______________________________

Country of Issuance_______________________________________ Alien Number:________________________

Other documents or status types:

Document Description__________________________________ Alien #____________________SEVIS ID_________________________

If your name is different on your immigration document, please provide the name on the document:

Document Expiration Date:______/_____/__________ Date of Entry into U.S.: ______/_____/__________

Country of Origin:_____________________________ Lived in the U.S. before 08/22/1996?

Yes No

If this individual has applied for or received permanent residence status, please provide the USCIS/INS Status Date/Permanent Residence

Date:

______/_____/__________

Does this individual have a Sponsor?

Yes

No If yes, what is the type of sponsor?

Individual

Agency/Organization

Is the sponsor a member of the household? Yes No If yes, name of household member:___________________________________

If the sponsor is a person/organization outside of the household, please provide the following information:

Organization Name:___________________________________________ Sponsor Name:_______________________________________

Address:____________________________________________________ Primary Phone Number:________________________________

Secondary Phone Number:_____________________________________ Email Address:_______________________________________

Person 2

Last Name

First Name

Middle Initial

*Non-Citizen Status (enter a number from above):

Please provide information on your documentation below:

Alien Registration #____________________________ Naturalization Certificate #____________________________

Permanent Resident Card (Green Card, I-551): Employment Authorization Card (I-766):

Alien #________________________________ Alien #_____________________________________________

Card #________________________________ Arrival/Departure Record (I-94, I-94A) issued by USCIS:

Machine Readable Immigrant Visa (with temporary I-551 language) SEVIS ID________________________________

Visa #________________Country of Issuance_______________ Student and Exchange Visitor Information System (SEVIS) ID:

Alien #__________________________________ ________________________________________

Refugee Travel Document (I-571)#________________________ Certificate of Eligibility for Nonimmigrant (F-

1) Student Status

Foreign Passport Number______________________________ (I-20): SEVIS ID____________________________________

Reentry Permit (I-327)#:________________________________ Country of Issuance:_________________________________

Certificate of Eligibility for Exchange Visitor (J-1) Status (DS2019) Temporary I-551 Stamp (on passport or I-94, I-94A)

SEVIS ID________________________________________________ Country of Issuance: _______________________________

Country of Issuance_______________________________________ Alien Number:________________________

Other documents or status types:

Document Description__________________________________ Alien #____________________SEVIS ID_________________________

If your name is different on your immigration document, please provide the name on the document:

Document Expiration Date:______/_____/__________ Date of Entry into U.S.: ______/_____/__________

Country of Origin:_____________________________ Lived in the U.S. before 08/22/1996?

Yes No

If this individual has applied for or received permanent residence status, please provide the USCIS/INS Status Date/Permanent Residence

Date:

______/_____/__________

DHS-2 Rev. 09-16

Application Page

7

of 32

Does this individual have a Sponsor?

Yes

No If yes, what is the type of sponsor?

Individual

Agency/Organization

Is the sponsor a member of the household? Yes No If yes, name of household member:___________________________________

If the sponsor is a person/organization outside of the household, please provide the following information:

Organization Name:___________________________________________ Sponsor Name:_______________________________________

Address:____________________________________________________ Primary Phone Number:________________________________

Secondary Phone Number:_____________________________________ Email Address:_______________________________________

14

Are you or anyone in the household living with a mental, emotional or physical disability or illness, or blind? YES NO

If yes, complete the boxes below for each person.

Person 1:

Last Name First Name Middle Initial

Medical problem (describe)

Caused by an

accident?

Yes No

Has this person applied for SSI or Social Security Benefits (SSDI)?

Yes

No If yes, date applied:______/______/__________

Has the Social Security Administration made an official decision that this person is living with a disability or blind? Yes No

Is this person receiving services for with the RI Office of Rehabilitation Services or Services for

the Blind? Yes No

If this person is a parent who is not working, does this person’s disability make

him/her unable to care for the child(ren)?

Yes

No

Is this disability expected to last at least 12 months and will it prevent this person from working or going to school?

Yes

No

Does this person need help with activities of daily living such as bathing, dressing, getting into bed, daily chores, etc.?

Yes

No

Does this person need long-term care services at home or in a community or health facility setting like a nursing home to help with the

condition?

Yes No

Person 2:

Last Name First Name Middle Initial

Medical problem (describe)

Caused by an

accident?

Yes No

Has this person applied for SSI or Social Security Benefits (SSDI)? Yes No If yes, date applied:______/______/__________

Has the Social Security Administration made an official decision that this person is living with a disability or blind? Yes No

Is this person active with the Office of Rehabilitation Services or Services for

the Blind? Yes No

If this person is a parent who is not working, does this person’s disability make

him/her unable to care for the child(ren)?

Yes

No

Is this disability expected to last at least 12 months and will it prevent this person from working or going to school? Yes No

Does this person need help with activities of daily living such as bathing, dressing, getting into bed, daily chores, etc.? Yes No

Does this person need long-term care services at home or in a community or health facility setting like a nursing home to help with the

condition?

Yes No

15

Do you or anyone in the household expect income from a job this month? YES NO

Note: If you are self-employed, you will be asked to provide that information in the next question.

EXAMPLES: Salaries/Wages, Commissions, National Guard, Army Reserve, Work Study, Job Training, Sheltered Workshop, U.S. Military,

Jury Duty, Foreign Earned Income

If yes, complete the boxes below for each person who is employed and each job.

Person 1/Job 1:

Last Name First Name Middle Initial

Employer Name, Address and/or Employer Identification Number, if available

RIW SNAP CCAP GPA SSP ACC LTSS EAD MPP KB

RIW

SNAP

CCAP

GPA

SSP

ACC

LTSS

EAD

MPP

KB

DHS-2 Rev. 09-16

Application Page

8

of 32

Date Job Began/Will Begin

Type of Work

Day of Week Paid

How Often Paid:

Hourly

Weekly

Every two weeks

Twice a month

Monthly

Yearly

Other

Average hours worked each week____________________

List below the gross amount paid on each pay day over the last 30 days.

Pay Day

Date Paid

Pay period end date

Hours worked per pay

period

Gross wages before

taxes

Tips/Commissions

1

st

/

/

/

/

$

$

2

nd

/

/

/

/

$

$

3

rd

/

/

/

/

$

$

4

th

/

/

/

/

$

$

Did you receive earned income tax credit in your paycheck?

Yes

No

Is this job part of a work study program?

Yes

No

Is this an On the Job training program?

Yes

No

Will this income be received in the following month?

Yes

No

List the number of hours and amount you expect to be paid for next month:

Number of Hours: Expected Gross Earnings:$ Tips/Commissions: $

Does this person have work related expenses required

by the employer or due to being blind or disabled?

Yes

No

If yes, expense type:

Expense amount:

$

Did this person receive unemployment compensation in

the last 12 months? Yes No

If yes, dates received:

From to

Did this person refuse a job or training program

offer in the last 30 days?

Yes No

If this person’s income is not the same from month to month, how much do you think this person will make next year? $

Person 2/Job 2:

Last Name First Name Middle Initial

Employer Name, Address and/or Employer Identification Number, if available

Date Job Began/Will Begin

Type of Work

Day of Week Paid

How Often Paid:

Hourly

Weekly

Every two weeks

Twice a month

Monthly

Yearly

Other

Average hours worked each week____________________

List below the gross amount paid on each pay day over the last 30 days.

Pay Day

Date Paid

Pay period end date

Hours worked per pay

period

Gross wages before

taxes

Tips/Commissions

1

st

/

/

/

/

$

$

2

nd

/

/

/

/

$

$

3

rd

/

/

/

/

$

$

4

th

/

/

/

/

$

$

Did you receive earned income tax credit in your paycheck?

Yes

No

Is this job part of a work study program? Yes No

Is this an On the Job training program?

Yes

No

Will this income be received in the following month?

Yes

No

List the number of hours and amount you expect to be paid for next month:

Number of Hours: Expected Gross Earnings:$ Tips/Commissions: $

Does this person have work related expenses required

by the employer or due to being blind or disabled?

Yes

No

If yes, expense type:

Expense amount:

$

Did this person receive unemployment compensation in

the last 12 months? Yes No

If yes, dates received:

From to

Did this person refuse a job or training program

offer in the last 30 days?

Yes No

If this person’s income is not the same from month to month, how much do you think this person will make next year? $

DHS-2 Rev. 09-16

Application Page

9

of 32

Person 3/Job 3:

Last Name First Name Middle Initial

Employer Name, Address and/or Employer Identification Number, if available

Date Job Began/Will Begin

Type of Work

Day of Week Paid

How Often Paid:

Hourly

Weekly

Every two weeks

Twice a month

Monthly

Yearly

Other

Average hours worked each week____________________

List below the gross amount paid on each pay day over the last 30 days.

Pay Day

Date Paid

Pay period end date

Hours worked per pay

period

Gross wages before

taxes

Tips/Commissions

1

st

/

/

/

/

$

$

2

nd

/

/

/

/

$

$

3

rd

/

/

/

/

$

$

4

th

/

/

/

/

$

$

Did you receive earned income tax credit in your paycheck?

Yes

No

Is this job part of a work study program? Yes No

Is this an On the Job training program?

Yes

No

Will this income be received in the following month?

Yes

No

List the number of hours and amount you expect to be paid for next month:

Number of Hours: Expected Gross Earnings:$ Tips/Commissions: $

Does this person have work related expenses required

by the employer or due to being blind or disabled?

Yes

No

If yes, expense type:

Expense amount:

$

Did this person receive unemployment compensation in

the last 12 months? Yes No

If yes, dates received:

From

to

Did this person refuse a job or training program

offer in the last 30 days?

Yes No

If this person’s income is not the same from month to month, how much do you think this person will make next year? $

16

Do you, your spouse, or anyone in the household receive income from self-employment? YES NO

EXAMPLES: Home Business, On

line Sales (ex. EBay, Craigslist), Farming, Fishing, Babysitting/Child Care, Door-to-door Sales, Home Sales,

House Cleaning

If yes, complete the boxes below about each person. Attach documentation of expenses.

Person 1/Job 1:

Last Name First Name Middle Initial

Gross Income/How Often

$

per

Average number of

hours worked per week

Type of Business

Name of Business

Will this income be received in

the following

months?

YES NO

Total Monthly Business Related

Expenses:

$_______________________

How much net income (income minus expenses) will you get from this

self

-employment this month?

Check one:

$_______________________________

Profit Loss

If caring for children in your home, number of children cared for:

Number of weeks worked:

Person 2/Job 2:

Last Name First Name Middle Initial

Gross Income/How Often

$

per

Average number of

hours worked per week

RIW

SNAP

CCAP

GPA

SSP

ACC

LTSS

EAD

MPP

KB

DHS-2 Rev. 09-16

Application Page

10

of 32

Type of Business

Name of Business

Will this income be received in

the following

months?

YES

NO

Total Monthly Business Related

Expenses:

$_______________________

How much net income (income minus expenses) will

you get from this self

-employment this month? Check one:

$_______________________________

Profit Loss

If caring for children in your home, number of children cared for:

Number of weeks worked:

17

Do you, or your spouse, or anyone in the household receive or expect to

receive, income other than from a job or self-employment, such as

the types below? (This includes money given to you by a friend or relative

.) YES NO

If yes, complete the boxes below for each person.

If you are applying for ACC only, do not report Supplemental Security Income (SSI), Veterans Disability Benefits, child support, gifts, proceeds

from loans (such as student loans, home equity loans, or bank loans) or scholarships for classes. Provide more information about your dividend

payments, interest payments, capital gains or losses, or income from partnership corporations not included in your self-employment income.

For all other programs, list the portion of student loans, scholarships, awards or fellowship grants used for living expenses.

Person 1:

Last Name First Name

Middle Initial

Amount/How Often

$___________per_____________

Date Income Received

_______/_______/__________

Claim Number (if applicable)

Type of Income

Will this income be received in the

following months?

YES

NO

Do you have any expenses

withheld from or related to this

income? YES NO

If yes, please describe the expense(s):

Amount of expense(s):

_______________________________

Person 2:

Last Name First Name

Middle Initial

Amount/How Often

$___________per_____________

Date Income Received

_______/_______/__________

Claim Number (if applicable)

Type of Income

Will this income be received in the

following months?

YES NO

Do you have any expenses

withheld from or related to this

income? YES NO

If yes, please describe the expense(s):

Amount of expense(s):

_______________________________

Person 3:

Last Name First Name

Middle Initial

Amount/How Often

$___________per_____________

Date Income Received

_______/_______/__________

Claim Number (if applicable)

Type of Income

Will this income be received in the

following months?

YES

NO

RIW

SNAP

CCAP

GPA

SSP

ACC

LTSS

EAD

MPP

KB

EXAMPLES:

Adoption Subsidy

Court Award

401(k)

Gifts, Prizes, Inheritance, Lottery

Railroad Retirement

Royalties

Unemployment Compensation

Cash Support

Alien Sponsorship

In-kind Shelter

Retirement Pensions

VA Aid and Attendance

Alimony

Income Tax Refund

Social Security (RSDI)

VA Compensation

Annuities

Other in-kind

Section 8 Utility Payment

VA Basic Benefits

Net Capital Gains/Investment

Income

Gambling winnings

Royalty Income

Interest Income

Income from Partnership Corporations

Child Support

Insurance and Lawsuit Claim

SSI, SSDI

VA Improved Pension

Dividends, Interest

Strike Benefits

Workers’ Compensation

IRA Distributions

Earned Income Tax Credit Refund

Military Allotment

TDI

Promissory Note

Foster Care

Out of State Assistance

Trust Funds

Student Income (Loans, Grants, Scholarships)

DHS-2 Rev. 09-16

Application Page

11

of 32

Do you have any expenses

withheld from or related to this

income? YES NO

If yes, please describe the expense(s):

Amount of expense(s):

_______________________________

Pe

rson 4:

Last Name First Name

Middle Initial

Amount/How Often

$___________per_____________

Date Income Received

_______/_______/__________

Claim Number (if applicable)

Type of Income

Will this income be received in the

following months?

YES

NO

Do you have any expenses

withheld from or related to this

income? YES NO

If yes, please describe the expense(s):

Amount of expense(s):

_______________________________

If anyone in the household expects income within the next 12 months, fill in the box below for that person.

Last Name

First Name

Middle Initial

Type of income Expected

Expected Date income will be

received

/

/

18

Please report any additional allowable tax deductions not previously reported on this application.

The purpose of a tax reduction is to reduce your taxable income. If you pay any of the expenses listed below, that means your income is lower and

it may lower the cost of your health insurance. If you have previously reported expenses in questions 15 - 17, you do not have to report them

again here.

Examples of allowable deductions:

Health Savings Account (HSA) Contributions Interest Paid on Student Loans IRA/401K Deductions

Self-Employment Retirement Plans and Self-Employment Health Insurance Educator Expenses Domestic Product Activities

Penalties Paid for Early Withdrawal from Savings Tuition and School Fees Business expenses of

Moving Costs Related to a job change performing artists, reservists, and fee-basis

government officials

Alimony Paid

Who?_______________________________

How much?__________________________

How Often?__________________________

Student Loan Interest

Who?_______________________________

How much?__________________________

How Often?__________________________

Tuition and School Fees

Who?_______________________________

How much?__________________________

How Often?__________________________

Other_____________________________

Who?_______________________________

How much?__________________________

How Often?__________________________

Other____________________________

Who?_______________________________

How much?__________________________

How Often?__________________________

Other_____________________________

Who?_______________________________

How much?__________________________

How Often?__________________________

19

Please complete the boxes below for every household member even if the tax payer or tax dependent is not in your home.

Name

Does this person

plan to file a federal

income tax return

next year?

Will this person file

jointly with a

spouse/partner?

(If married, you have to file

jointly to qualify for a tax

credit)

Does this person

have any tax

dependents?

(A dependent can be

claimed by only one tax

filer. For joint filers, you

need to list dependents for

the tax filer who will

sign the tax form.)

Is this person

claimed as a tax

dependent on

someone else’s tax

return?

How is this

person related to

the tax filer?

YES NO

YES NO

If yes, name of spouse

or partner:

YES NO

If yes, name of tax

dependents:

YES NO

If yes, name of the tax

filer:

ACC

ACC

DHS-2 Rev. 09-16

Application Page

12

of 32

YES NO

YES NO

If yes, name of spouse

or partner:

YES NO

If yes, name of tax

dependents:

YES NO

If yes, name of the tax

filer:

YES NO

YES NO

If yes, name of spouse

or partner:

YES NO

If yes, name of tax

dependents:

YES NO

If yes, name of the tax

filer:

YES NO

YES NO

If yes, name of spouse

or partner:

YES NO

If yes, name of tax

dependents:

YES NO

If yes, name of the tax

filer:

20

Is anyone in the household enrolled in or does anyone in the household have access to health coverage now? YES NO

If yes, complete the boxes below for each person/type of insurance.

*Examples of Insurance Types: Tricare, Veteran’s Health Insurance, Peace Corps, Medicare, Employer Insurance, Private Insurance, Cobra,

Dental Insurance, Retiree Plan, Other

Name

Insurance Company

Name

Insurance Policy # or

Medicare Claim #

*Insurance Type

(see examples above)

Currently

Enrolled?

____________________

Monthly

Premium:____________

_________________________

Check one: Individual

Family

YES NO

If no, plans to enroll?

YES NO

Start Date:

____________________

Monthly

Premium:____________

_________________________

Check one: Individual

Family

YES NO

If no, plans to enroll?

YES NO

Start Date:

____________________

Monthly

Premium:____________

_________________________

Check one: Individual

Family

YES NO

If no, plans to enroll?

YES NO

Start Date:

____________________

Monthly

Premium:____________

_________________________

Check one: Individual Family

YES NO If no,

plans to enroll?

YES NO

Start Date:

____________________

Monthly

Premium:____________

_________________________

Check one: Individual

Family

YES NO

If no, plans to enroll?

YES NO

Start Date:

____________________

Monthly

Premium:____________

_________________________

Check one: Individual

Family

YES NO

If no, plans to enroll?

YES NO

Start Date:

Please fill in the information below if there are any upcoming changes to any of the employer insurance listed above.

Name of person with employer coverage:______________________________________________

Employer plans to drop plan on (MM/DD/YYYY):____________________ Will become eligible on (MM/DD/YYYY):___________________

Name of person with employer coverage:______________________________________________

Employer plans to drop plan on (MM/DD/YYYY):_____________________Will become eligible on (MM/DD/YYYY):___________________

ACC

LTSS

EAD

MPP

DHS-2 Rev. 09-16

Application Page

13

of 32

Fill in the information below for all family members applying for health coverage.

Name: Last covered by health insurance:

Within the last year:______/_____/______

1-3 years ago

More than 3 years ago Never Other/Uninsured

Name: Last covered by health insurance: Within the last year:______/_____/______ 1-3 years ago

More than 3 years ago Never Other/Uninsured

21

Please fill in the boxes below about the educational background of each member of your household.

Person 1:

Name

Highest Grade Completed

High School Graduation Date

(if graduated):_____/_____/______

Received GED?

Yes

No

In School Now?

Yes No

If in school, name of school:

Attending:

Full Time

Half Time

Less than Half Time

Type: K-12 GED Vocational College/University Trade School Other Expected Graduation Date: ______/______/________

Participating in a work study program?

Yes

No

Participating in a training program?

Yes

No

If yes, name of training program:

Person 2:

Name

Highest Grade Completed

High School Graduation Date

(if graduated):_____/_____/______

Received GED?

Yes

No

In School Now?

Yes No

If in school, name of school:

Attending:

Full Time

Half Time

Less than Half Time

Type: K-12 GED Vocational College/University Trade School Other Expected Graduation Date: ______/______/________

Participating in a work study program?

Yes

No

Participating in a training program?

Yes

No

If yes, name of training program:

Person 3:

Name

Highest Grade Completed

High School Graduation Date

(if graduated):_____/_____/______

Received GED?

Yes

No

In School Now?

Yes No

If in school, name of school:

Attending:

Full Time

Half Time

Less than Half Time

Type: K-12 GED Vocational College/University Trade School Other Expected Graduation Date: ______/______/________

Participating in a work study program?

Yes

No

Participating in a training program?

Yes

No

If yes, name of training program:

Person 4:

Name

Highest Grade Completed

High School Graduation Date

(if graduated):_____/_____/______

Received GED?

Yes

No

In School Now?

Yes No

If in school, name of school:

Attending:

Full Time

Half Time

Less than Half Time

Type: K-12 GED Vocational College/University Trade School Other Expected Graduation Date: ______/______/________

Participating in a work study program?

Yes

No

Participating in a training program?

Yes

No

If yes, name of training program:

RIW SNAP CCAP ACC

DHS-2 Rev. 09-16

Application Page

14

of 32

22

Ar

e you, your spouse, or anyone in the household in a group living arrangement such as the types listed below? YES NO

Shelter for Homeless Drug Treatment Center Hospital Group Home

Alcohol Treatment Center Domestic Violence Shelter Assisted Living Facility

Dormitory

If yes, complete the boxes below.

Last Name First Name Middle Initial

Name of Facility

Type of Facility

Number of meals

provided per day?

23

Are you or any member of your household hiding or running from the law to avoid prosecution, being taken into custody, or

going to jail, for a felony crime or attempted felony crime, or violating a condition or parole or probation? YES NO

If yes, complete the boxes below for each household member.

Last Name First Name Middle Initial

Date of Finding

State

24

If you are applying for child care assistance, please tell us about your schedule regarding your need for child care. Fill in the table

below with the reason you need child care and enter the time for child care on each day.

Person 1:

Parent’s Name:

Child’s Name:

Day

Need Reason (check the appropriate boxes)

Start Time

End Time

Monday

Work High School/GED Completion

Special Needs due to Health Condition

Tuesday

Work High School/GED Completion

Special Needs due to Health Condition

Wednesday

Work High School/GED Completion

Special Needs due to Health Condition

Thursday

Work High School/GED Completion

Special Needs due to Health Condition

Friday

Work High School/GED Completion

Special Needs due to Health Condition

Saturday

Work High School/GED Completion

Special Needs due to Health Condition

Sunday

Work High School/GED Completion

Special Needs due to Health Condition

If your schedule varies, please explain how (you may send additional documentation to verify).

Person 2:

Parent’s Name:

Child’s Name:

Day

Need Reason (check the appropriate boxes)

Start Time

End Time

Monday

Work High School/GED Completion

Special Needs due to Health Condition

Tuesday

Work

High School/GED Completion

Special Needs due to Health Condition

Wednesday

Work

High School/GED Completion

Special Needs due to Health Condition

RIW

SNAP

LTSS

SNAP

CCAP

D

HS-2 Rev. 09-16

Application Page

1

5 of 32

Thursday

Work High School/GED Completion

Special Needs due to Health Condition

Friday

Work High School/GED Completion

Special Needs due to Health Condition

Saturday

Work High School/GED Completion

Special Needs due to Health Condition

Sunday

Work High School/GED Completion

Special Needs due to Health Condition

If your schedule varies, please explain how (you may send additional documentation to verify).

25

Do you, your spouse or anyone in the household pay for room and/or board? YES NO

If yes, complete the box below for the household member who pays for room and/or board.

Last Name

First Name

Middle Initial

Amount Paid/How Often

What does the room/board cover?

$

per

Room only Board (1-2 meals) Board (3 meals)

Who is the room/board payment paid to?

26

Does anyone in your household, including you, have a legal claim or lawsuit for illnesses or injuries resulting from a car or workplace

accident or other matter in which you may receive money? YES NO

If yes, complete the boxes below for each person.

Last Name First Name Middle Initial

Type of Claim (describe)

Date of Incident

Workers’

Compensation

?

/

/

Yes No

Person (or company)

responsible/Address

Insurance Company Name/ Address

Attorney Name

Attorney Address

Claim Number

27a

Are there children in the household who have a parent (natural or adoptive) living outside the home or deceased? YES NO

If applying for ACC, answering this question is optional. If YES, I know I’ll be asked to cooperate with the Office of Child Support Services that

collects medical support from a non-custodial parent. If I think that cooperating to collect medical support will harm me or my children, I can tell the

agency and I may not have to cooperate.

27b

If you answered yes to question #27a and are applying for RIW and/or CCAP, please fill in the boxes below for each parent living

outside the home (non-cus

todial parent) or deceased.

State law assumes a child born during the time a couple is married or within 10 months of a final decree of divorce to be their child. List the present or former

spouse as the non-custodial parent of the child(ren) born during that time. If divorce decree or court order excludes your spouse or former spouse as

father of any of the child(ren) listed in the application, you need to list the biological parent of the child(ren) and provide copies of the decree or order with this

application.

Pa

rent 1:

Non-custodial/Deceased Parent’s Last Name First Name MI

Gender

M F

Non-custodial/Deceased Parent’s SSN

/

/

Birth Date

/ /

RIW

SNAP

RIW

CCAP

GPA

SSP

LTSS

EAD

MPP

KB

RIW

CCAP

ACC

RIW

CCAP

DHS-2 Rev. 09-16

Application Page

16

of 32

Non-custodial Parent’s Address

Non-custodial Parent’s Telephone Number

Employer Name

Employer Address

Is this parent disabled and/or

a veteran? Yes No

Was the child born during the marriage or within

300 days after the marriage ended due to death

or divorce? Yes No

If yes, date married

/

/

Are the parents of the child(ren)

currently married to each other?

Yes No

If no, date divorced / /

Non-custodial Parent’s Marital Status

Never Married Divorced Widowed

Married Separated Unknown

Non-custodial Parent’s

Race: Ethnicity: Hair Color: Height: Weight: Birth City: Birth State:

Has the non-custodial parent ever been in jail?

Yes No

If yes, incarceration begin date:

________/_________/_________

Incarceration end date:

________/_________/_________

Is a parent of the child(ren) deceased?

Yes No

If yes, deceased parent’s date of death:

________/_________/_________

Child(ren) of this non-custodial parent living in the applicant’s

household.

Child’s Last Name First Middle Initial

State of Birth

Is child support, health coverage or paternity court ordered?

(If yes, check off type of coverage and list date.)

1.

Yes

No

Support

Health

Cov

Paternity

Date / /

Date

/ /

Date

/ /

2.

Yes

No

Support

Health

Cov

Paternity

Date / /

Date

/ /

Date

/ /

3.

Yes

No

Support

Health

Cov

Paternity

Date / /

Date

/ /

Date

/ /

We ask information about the non-custodial parent so that we can seek child support from him/her. If you fear that you or your child will be

harmed

by the non-custodial parent if you help us in this process, you may be excused from cooperating. We will refer you to a Domestic

Violence

Advocate who can discuss this with you and help with safety planning. Check this box if you fear harm to either you or your child

if

you

help us collect child support:

Parent 2:

Non-custodial/Deceased Parent’s Last Name First Name MI

Gender

M

F

Non-custodial/Deceased Parent’s SSN

/

/

Birth Date

/ /

Non-custodial Parent’s Address

Non-custodial Parent’s Telephone Number

Employer Name

Employer Address

Is this parent disabled and/or

a veteran? Yes No

Was the child born during the marriage or within

300 days after the marriage ended due to death

or divorce? Yes No

If yes, date married

/

/

Are the parents of the child(ren)

currently married to each other?

Yes No

If no, date divorced / /

Non-custodial Parent’s Marital Status

Never Married Divorced Widowed

Married Separated Unknown

Non-custodial Parent’s

Race: Ethnicity: Hair Color: Height: Weight: Birth City: Birth State:

Has the non-custodial parent ever been in jail?

Yes No

If yes, incarceration begin date:

________/_________/_________

Incarceration end date:

________/_________/_________

DHS-2 Rev. 09-16

Application Page

17

of 32

Is a parent of the child(ren) deceased?

Yes No

If yes, deceased parent’s date of death:

________/_________/_________

Child(ren) of this non-custodial parent living in the applicant’s

household.

Child’s Last Name First Middle Initial

State of Birth

Is child support, health coverage or paternity court ordered?

(If yes, check off type of coverage and list date.)

1.

Yes

No

Support

Health

Cov

Paternity

Date / /

Date

/ /

Date

/ /

2.

Yes

No

Support

Health

Cov

Paternity

Date / /

Date

/ /

Date / /

3.

Yes

No

Support

Health

Cov

Paternity

Date / /

Date

/ /

Date

/ /

We ask information about the non-custodial parent so that we can seek child support from him/her. If you fear that you or your child will be

harmed

by the non-custodial parent if you help us in this process, you may be excused from cooperating. We will refer you to a Domestic

Violence

Advocate who can discuss this with you and help with safety planning. Check this box if you fear harm to either you or your child

if

you

help us collect child support:

Pa

rent 3:

Non-custodial/Deceased Parent’s Last Name First Name MI

Gender

M F

Non-custodial/Deceased Parent’s SSN

/

/

Birth Date

/ /

Non-custodial Parent’s Address

Non-custodial Parent’s Telephone Number

Employer Name

Employer Address

Is this parent disabled and/or

a veteran? Yes No

Was the child born during the marriage or within

300 days after the marriage ended due to death

or divorce? Yes No

If yes, date married

/

/

Are the parents of the child(ren)

currently married to each other?

Yes No

If no, date divorced / /

Non-custodial Parent’s Marital Status

Never Married Divorced Widowed

Married Separated Unknown

Non-custodial Parent’s

Race: Ethnicity: Hair Color: Height: Weight: Birth City: Birth State:

Has the non-custodial parent ever been in jail?

Yes No

If yes, incarceration begin date:

________/_________/_________

Incarceration end date:

________/_________/_________

Is a parent of the child(ren) deceased?

Yes No

If yes, deceased parent’s date of death:

________/_________/_________

Child(ren) of this non-custodial parent living in the applicant’s

household.

Child’s Last Name First Middle Initial

State of Birth

Is child support, health coverage or paternity court ordered?

(If yes, check off type of coverage and list date.)

1.

Yes

No

Support

Health

Cov

Paternity

Date / /

Date

/ /

Date

/ /

2.

Yes

No

Support

Health

Cov

Paternity

Date / /

Date

/ /

Date / /

3.

Yes

No

Support

Health

Cov

Paternity

Date / /

Date

/ /

Date

/ /

DHS-2 Rev. 07-16 Application Page

17

of 30

DHS-2 Rev. 09-16

Application Page

18

of 32

We ask information about the non-custodial parent so that we can seek child support from him/her. If you fear that you or your child will be

harmed

by the non-custodial parent if you help us in this process, you may be excused from cooperating. We will refer you to a Domestic

Violence

Advocate who can discuss this with you and help with safety planning. Check this box if you fear harm to either you or your child

if

you

help us collect child support:

Person 4:

Non-custodial/Deceased Parent’s Last Name First Name MI

Gender

M F

Non-custodial/Deceased Parent’s SSN

/

/