Functional & System Requirement Specifications

Integrated e-Filing and CPC 2.0 Project

Integration– Banks

Confidentiality Agreement

“This document contains proprietary information exclusively vests with ITD. This document may not, in whole or in part,

be copied, photocopied, stored, saved, reproduced, replicated, disseminated, translated, transmitted or reduced to in any

medium (whether electronic, mechanical, machine-readable and/or any other tangible or intangible form of any nature),

by the intended recipient/s or user/s without the express consent, in writing, from the Authorized Representative of ITD

Management.”

All the Intellectual Property Rights (i.e. copyrights) as may be available under the applicable laws, pertaining to ITD’s

confidential information, shall exclusively vest with ITD only, and any breach thereof shall be subject to indemnification.

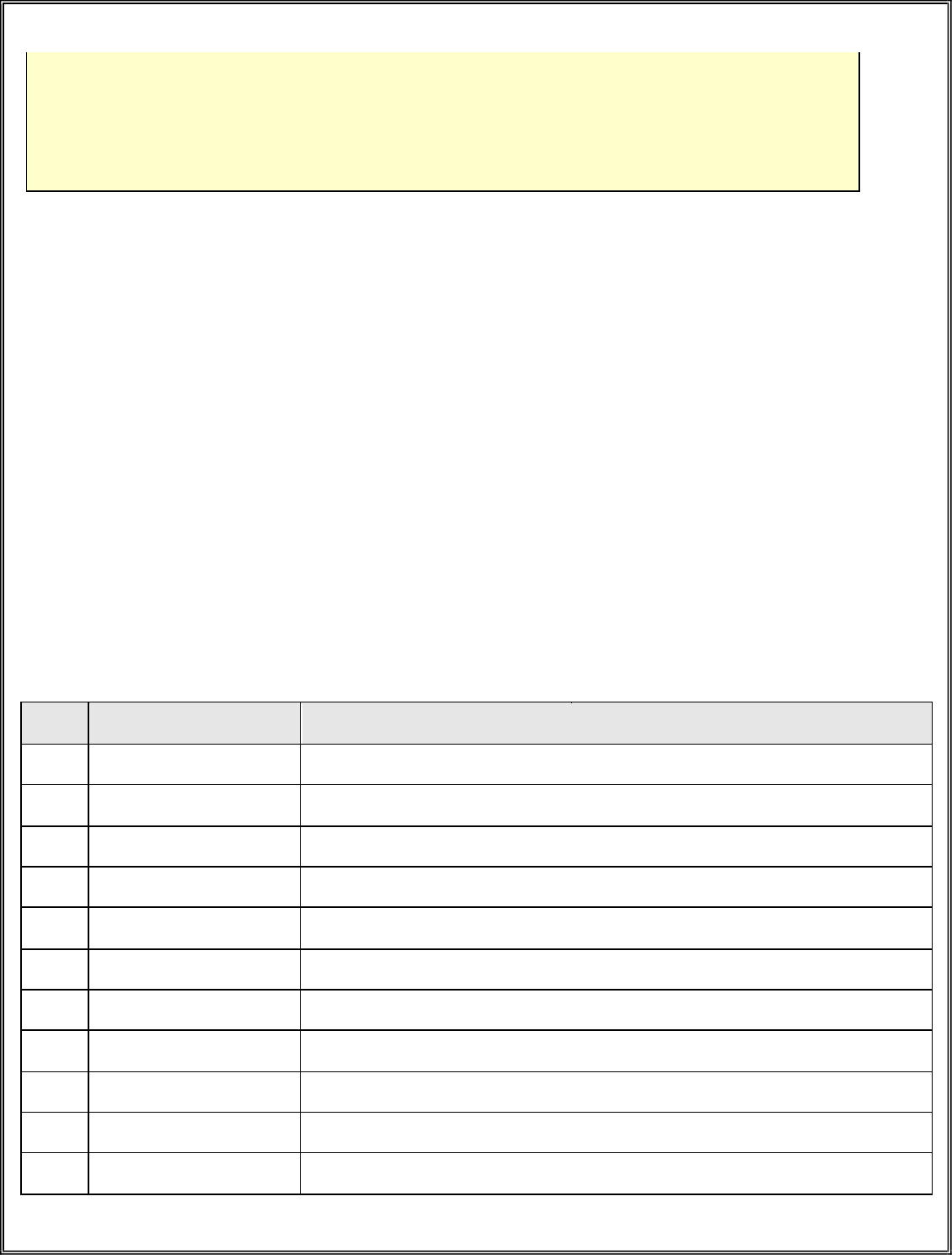

Definition/ Acronyms/ Abbreviation:

Sl.

Acronym/ Abbreviation/Definitions

Description / Full Form

1

HTTP

Hypertext Transfer Protocol

2

PAN

Permanent Account Number

3

XML

Extensible Markup Language

4

EVC

Electronic Verification Code

5

ATM

Auto Teller Machine

1 Brief about Efiling2.0

Integrated e-Filing and CPC envisions to redefine income tax filing and processing in India to provide a best-in-class

experience to all taxpayers.

The objectives of the proposed integrated Efiling and CPC 2.0 project are – 1.

To partner with government to reform tax processing in the country

2. To provide a differentiated experience to taxpayer

3. To enhance departmental efficiency and effectiveness

The above is planned to be achieved by –

1. Providing ease in filing returns using wizard based forms and generating pre-filled returns for the taxpayers.

2. Actively promoting e-verification of returns and establish complete (100%) paperless environment.

3. Reducing processing time of returns on year-on-year (YoY) basis and achieve real time processing of returns and

credit of refunds.

4. Educating and empowering the taxpayer by pro-actively engaging with taxpayer through digital media

5. Pro-actively communicating and engaging with taxpayer and enhancing transparency

6. Reducing errors, grievances, rectifications on a YoY basis and achieve “first-time-right” outcome

7. Facilitating taxpayer and consistently reducing the outstanding demand

8. Ensuring real time data exchange with all stakeholders and achieve total seamless integration

9. Continuously promoting tax compliance in the country resulting into reduction of tax delinquency

2 Scope

The scope of this document is to provide the technical and operational details to integrate Efiling2.0 with the banks. It will

also include the test strategy.

3 Need for Change

As per the ITD requirement, Efiling to be integrated with the banks to provide all Efiling related services to the registered

users having valid bank account with the RBI approved banks in India without the need of specific service wise integration.

The existing validation framework was designed only or enabling e-verification. This functionality to be enhanced to use

the same for pre-validation of account with right account status captured so as to leverage for issuance of refund through

ECS.

The existing framework, does not permit bank from providing mobile number linked to the bank account other than of

Indian mobile issued from India. On account of which Non-resident Indians having Indian bank account are unable to

validate their account as well as use it for verification purpose.

Banks share their IFSC with smaller banks including cooperative banks which are integrated with them for availing

RTGS/NEFT. However they are unable to validate the account details of such integrated bank account holders.

4 Integration Details

The Efiling2.0 system will integrate with Banks to make use of the below list of e-Filing services provided through their

respective bank.

• e-Filing login through Net Banking

Registered Efiling user can login to Efiling through net banking login seamlessly if the PAN is linked with the

bank account

• Pre-validate bank account details

Registered Efiling user can pre-validate their bank account details. Pre-validated bank account details can be

used for e-Verification of Returns, forms, Password reset and Refund processing.

• Generate EVC through ATM

Registered Efiling user can generate EVC through their bank ATM to e-Verify the Return/other forms.

5 Integration Approach

Integration approach for Inbound and Outbound calls to Efiling System are updated as below.

5.1 Inbound Redirect

This section talks about Inbound redirect requests with SSO.

5.1.1 e-Filing Login through Net banking

The purpose of this section is to define the technical and process flow details for login to e-Filing portal via Net Banking.

The banks have to initiate the process to apply to integrate for e-Filing portal access. This will include submission of the

eFiling registration form with bank details and sharing digital signature certificate. Bank requesting for Efiling portal access

through net banking facility will be setup in e-Filing database.

5.1.1.1 Process Flow – Functional

1 User logs into the Net-Banking of the PAN linked bank account.

2 User clicks on the 'Login to e-Filing' link.

3 The user must confirm to be redirected to the e-Filing portal.

4 Once the user clicks on 'Continue', a new browser tab / window will be open and the user will be redirected to

the e-Filing portal.

5 The bank site redirects the user request with PAN and other required details in encrypted and authenticated

format to e-Filing portal.

6 e-Filing portal will authenticate the details on success the user will be logged on e-Filing portal.

5.1.1.2 Process Flow – Technical

User logs into the PAN and Bank account linked Net Banking account of their respective bank

• Clicks on the 'Login to e-Filing' link. This link is to be provided in a prominent place so that user need not to search

for the same post login to Net Banking.

• The user must confirm to be redirected to the e-Filing portal only if the bank account is linked with the PAN. (In

case user has multiple bank accounts, can select any one of the account numbers to be sent to e-Filing)

• Once the user clicks on 'Continue', a new browser tab / window will be open, and the user will be redirected to

the e-Filing portal.

• The bank site redirects the user request with PAN and other required details to e-Filing portal (html form submit).

Form to be submitted to SSO URL using POST method with 2 hidden fields ‘data’ and ‘signature’

• During redirection from bank, data and signature (optional encryption field) will be passed and will reach e-Filing

portal through the tax-payer's browser. These details will be digitally signed by the bank.

• Value of ‘data’ field must contain the bank’s user id, pan, request timestamp, account number, IFSC, account type,

mobile number, account name, account status, email id (same order) delimited by "^".

• On receipt of the digitally signed input from bank (through the tax-payer's browser) at e-Filing portal, e-Filing will

authenticate the bank using bank's user-id, bank public digital certificate. After successful authentication, a session

will be created for the taxpayer.

• In case data is encrypted by the banks, then the data payload will be decrypted with ITD private key, and the

decrypted data will be used for validation

• Request End Point

URL

UAT - https://eportalut.incometax.gov.in/iecuat/netbanking/login Prod -

https://eportal.incometax.gov.in/iec/netbanking/login

Method

POST

Service Type

URL Redirection from Bank portal - Incoming

Configuration at E-Filing Website

• On receipt of the digitally signed input from bank (through the tax-payer's browser) at e-Filing portal, e-Filing will

authenticate the bank, using the bank's user id, digital signature and using certificate.

• After successful authentication, a session will be created for the taxpayer. User will have the access to the features

as defined by e-Filing portal for the role.

• Once the request reaches e-Filing portal the data and signature will be validated.

• Banks must provide the Referrer URL for the request.

• The Referrer URL will be mapped against the respective UserID provided to all banks by e-Filing portal.

• All the URLs should be HTTPS. SSL used by the 3rd Party website should be certified by external certification

authority.

• POST request must have a valid https-based referral URL of the Bank

• e-Filing portal will validate the form details, authenticate the user ID, signature and referrer URL details. If

successful, the user will be logged on e-Filing portal. e-Filing will also store the bank account details coming in the

request as a pre-validated bank account details for the PAN.

• All the incoming bank details would be audited.

• As it is browser redirection – after initiating session with Efiling2.0 portal, session established at Efiling2.0 will not

have any dependency with the bank portal session.

• On clicking 'Logout' at the e-Filing portal, the session created for the user on e-Filing portal will be terminated.

Hidden form fields

Paramete

r Name

Description

Field Specification

Sample Value

Data

Value of ‘data’ field must contain the

bank’s user id, pan, request

timestamp, account number, IFSC,

account type, mobile number,

account name (same order)

delimited by "^".

Alphanumeric,

Mandatory

B700000001^AAAPC4405A^2021-08-05-

18.28.41.116^0111222333444^SBIN0004337

^SB^91-8698346793^Joshi

Dhawan^00^joshidhawan28@gmail.com

Signature

It is value of Digital Signature

Certificate registered with e-Filing in

PKCS7 format with base 64 encoding

Alphanumeric,

Mandatory

encryptio

n

Optional field indicating if the data

field is encrypted or not. Considered

false if not passed.

In case, this value is true, then the

data field should be encrypted with

the ITD public key.

String, Optional

true

Field mapping details of “data” field

S.NO.

Field Name

Data Type, Field Specifications

Description

Sample Value

1

User ID

Character (10)

Alphanumeric, Mandatory

Unique ID to be provided by e-

Filing.

B700000001

2

PAN

Character (10)

Alphanumeric, Mandatory

PAN (Linked to Net Banking) of

the user.

This should be the PAN of an

individual taxpayer

AAAPC4405A

3

Timestamp

Character, Mandatory

YYYY -MM-DD-hh24.mi.ss.ffffff

2021-08-05-18.28.41.116

4

Bank Account

Number

Character, Mandatory

Bank Account Number

0111222333444

5

IFS Code

Character (10), Mandatory

IFS Code of the account.

SBIN0004337

6

Account Type

Character, Mandatory

Type of Account

Check annexure for details

SB

7

Mobile Number

Alphanumeric, Optional If

passed, country code and

mobile number separated with

‘-

‘

Else pass as “null”

Account Holder Mobile Number

linked to the account

91-8698346793

8

Account Name

Alphanumeric

Account Holder Name as per

bank records

Joshi Dhawan

9

Account Status

Number

Status of Account

Check annexure for details

00

10

Email Id

Alphanumeric, Optional

If not passed, pass as “null”

Account holder email id linked to

the account

joshidhawan28@gmail.com

Sample form to be invoked as depicted in below table

<form name="LoginToEFiling" method="post" action=https://eportalut.incometax.gov.in/iecuat/netbanking/login

>

<input type="hidden" name="data"

value="B700000001^AAAPC4405A^2021-08-05-18.28.41.116^0111222333444^SBIN0004337^SB^91-8698346793^Joshi

Dhawan^00^joshidhawan28@gmail.com"/>

<input type="hidden" name="signature" value="Signature of data field using DSC"/>

</form>

5.1.1.3 Onboarding Process

Banks need to share Digital signature in .cer format, referral URL (URL from where Efiling portal will be called) and

contact details with ITD.

The Bank Id will be shared with the banks that will be mapped against each bank In case of UAT, IP whitelisting

needs to be done at the bank end and the Efiling end.

In case banks choses to encrypt the data payload, the ITD public key will be shared with the banks to be used for

encryption.

5.2 Outbound - API

This section talks about Outbound requests from IEC System to relevant Bank API.

5.2.1 Pre-Validate Bank Account Details

Banks will expose the web service for e-Filing to validate bank account details. This facility is required for e-Filing to

prevalidate the taxpayer bank account details. Web service to be developed by banks and exposed to e-Filing as per the

below specifications.

• Efiling will invoke the web-service with the request parameters as mentioned in the Request payload below.

• The web service request is signed with Efiling private key and encrypted with banks public key.

• Banks should decrypt the request using bank’s private key and verify the signature using Efiling public key. Then

does the below validations to return the response.

o Validates request parameters - bank account no, pan, mobile no, email id, name and IFSC code.

o Returns the response containing the flags with Y for matched value and N for Non matched value

as mentioned in the Response parameters table below. Request End Point

URL

https://<bank specific URL>/VerifyTaxpayerDetails

Content-Type

application/xml

Method

post

Service Type

SOAP Webservice - Outgoing

Request Header

Parameter Name

Description

Field Specification

Sample Value

NA

NA

NA

NA

Request Payload

Parameter Name

Description

Field Specification

Sample Value

uniqueRequestId

Valid unique Request ID. First 10

letters of uniqueRequestID should

be the User ID of the requester and

followed by a hyphen (-) and unique

random number(max length

allowed:40)

Mandatory

ABCD000000-123456

PAN

PAN of the taxpayer

Mandatory

PAN of the taxpayer

Name

Name of the taxpayer

Mandatory

6238941526895213

BankAccountNumber

Bank Account Number of the

taxpayer

Mandatory

SBIN0003286

IFSC

IFSC

MobileNumber

Mobile Number of the taxpayer as

registered with bank

Mandatory

1234567890

(

Size and format validation is not

required)

EmailId

Email Id of the taxpayer as registered

with bank

Optional

abc@gmail.com

Sample payload is depicted in below table.

<soapenv:Envelope xmlns:soapenv="http://schemas.xmlsoap.org/soap/envelope

/"

xmlns:dit="http://iec.incometax.gov.in/ditsecws" xmlns:req="http://iec.incometax.gov.in/ditsecws/request"> <soapenv:Header/>

<soapenv:Body>

<dit:verifyTaxpayerDetails>

<dit:DitRequest uniqueRequestId="XXXXXXXXXX-XXXX">

<req:PAN>XXXXXXXXX</req:PAN>

<req:NameXXXXXXXXX</req:Name>

<req:BankAccountNumber>XXXXXXXXX</req:BankAccountNumber>

<req:IFSC>XXXXXXXXX</req:IFSC>

<req:MobileNumber>XXXXXXXXX</req:MobileNumber>

<req:EmailId >XXXXXXXXX</req:EmailId >

</dit:DitRequest>

</dit:verifyTaxpayerDetails>

</soapenv:Body> </soapenv:Envelope>

Response Payload

Parameter Name

Description

Field Specification

Sample Value

nameBankAccnt

Name as per Bank Account Number

Mandatory

1

panBankAccntLinka

geFlag

PAN – Bank account/IFSC linkage Success –

Y PAN – Bank account/IFSC linkage Failure -

N

Mandatory

Y/N

mobileVerFlag

Mobile number verification successful – Y

Mobile number verification failure - N

Mandatory

Y/N

emailVerFalg

Email Id verification successful – Y

Email Id verification failure - N

Mandatory

Y/N

accountType

Type of Account as per Annexure 1

Mandatory

CA

accountStatus

Account Status as per Annexure 1

Mandatory

00

Sample payload is depicted in below table.

<soapenv:Envelope xmlns:soapenv="http://schemas.xmlsoap.org/soap/envelope/"

xmlns:dit="http://iec.incometax.gov.in/ditsecws" xmlns:req="http://iec.incometax.gov.in/ditsecws/request">

</ soapenv:Header>

<soap:Body>

<ns2:verifyTaxpayerDetailsResponse xmlns="http://iec.incometax.gov.in/ditsecws/request"

xmlns:ns2="http://incometaxindiaefiling.gov.in/ditsecws" xmlns:ns3="http://iec.incometax.gov.in/ditsecws/response">

<ns2:DitResponse uniqueRequestId="XXXXXXXXXX-XXXX">

<ns3:nameBankAccnt>XXXXXXXXXXXX</ns3:nameBankAccnt>

<ns3:panBankAccntLinkageFlag>X</ns3:panBankAccntLinkageFlag>

<ns3:mobileVerFlag>X</ns3:mobileVerFlag>

<ns3:emailVerFalg>X</ns3:emailVerFalg>

<ns3:accountType>XX</ns3:accountType>

<ns3:accountStatus>XX</ns3:accountStatus>

</ns2:DitResponse>

</ns2:verifyTaxpayerDetailsResponse>

</soap:Body> </soap:Envelope>

Error Messages from service

S. No Scenario

Error Code

Description

1

Unique Request ID is duplicate

EF-WS-SEC-ERR-10004

Duplicate Request. Please submit

the request with valid request ID

2

any exception occurs

EF-WS-COM-ERR-10001

Service Unavailable.

Please try again later

3

Signature is not valid

EF-WS-BVB-ERR-10002

Invalid DSC. Please use the DSC

registered with Bank DSC.

4

PAN field is empty

EF-WS-BVB-ERR-10003

Please provide the PAN

5

PAN is not in correct format

EF-WS-BVB-ERR-10004

Invalid PAN. Please retry.

6

Unique Request ID field is empty

EF-WS-BVB-ERR-10005

Please provide the

Unique Request ID.

7

Unique Request ID is not in correct

format

EF-WS-BVB-ERR-10006

Invalid Unique Request ID. Please

retry.

8

Name as per PAN is empty

EF-WS-BVB-ERR-10007

Please provide the Name.

9

Name is not in correct format.

EF-WS-BVB-ERR-10008

No special characters are allowed

in Name. Please retry.

10

Bank Account Number field is

empty

EF-WS-BVB-ERR-10009

Please provide the Bank Account

Number

11

Bank Account Number is not in

correct format. It should not

allow special characters

EF-WS-BVB-ERR-

100010

Invalid Bank Account Number.

Please retry.

12

IFSC field is empty

EF-WS-BVB-ERR-

100011

Please provide the IFSC.

13

IFSC is not in correct format

EF-WS-BVB-ERR-

100012

Invalid IFSC Please retry.

14

Mobile Number field is empty

EF-WS-BVB-ERR-

100013

Please provide the Mobile

Number.

16

Email Id field is empty

It should allow empty field.

17

Email Id is not in correct format

EF-WS-BVB-ERR-

100016

Invalid E-mail Id. Please retry.

18

Bank Account Number does not

exist

EF-WS-BVB-ERR-

100017

Bank Account Number Not Found

19

Bank account is in dormant state.

Account status will be

54

Bank account is in dormant state.

Please try with a different bank

account number.

20

Bank Account has been closed

Account status will be

01

Bank Account has been closed.

Please try with a different bank

account number.

21

Invalid Bank Account number

Account status will be

02

Invalid Bank Account Number

22

Bank account number and IFSC

code combination should be

linked with PAN

If not, pan account

linkage flag should be

'N'

If yes, pan account linkage flag

should be 'Y

23

PAN details not found with bank

EF-WS-BVB-ERR-

100020

PAN of primary/secondary holder

is missing

5.3 Inbound API

Banks should register in Efiling2.0 portal as per the Registration process of the Efiling2.0. Efiling admin user will validate

the Bank registration details and approves the registration.

Once admin approves the registration, Efiling portal shares the userId and the login link of Efiling portal through e-mail.

Bank needs to login to Efiling portal and they need to reset the password during first login.

Certain key values needed for accessing the Efiling APIs are available in Profile sections of the Bank user Login.

- clientid

- client-secret

- username

- password

5.3.1 Generate EVC through ATM

All Banks will get Registered in IEC2.0 by sharing the necessary details. Banks will get the following details by IEC2.0 team.

• userid

• password

• clientid(added in IEC2.0)

• clientSecret(added in IEC2.0)

Efiling2.0 will expose the webservice for Bank ATMs to generate EVC.

• Efiling validates whether the pan is registered or not, if registered, generates EVC and sends to the mobile and

email id registered in Efiling for that particular pan and the web service response to the bank contains success

message. The EVC generated is valid for 72 hrs.

Request End Point

URL

UAT-https://uatservices.incometax.gov.in/iec-uat/uat/BankAtmGenEvcService/getBankAtmGenEvcDetails

Prod -

https://services.incometax.gov.in/iec/api/BankAtmGenEvcService/getBankAtmGenEvcDetails

Content-Type

application/xml

Method

POST

Service Type

Incoming

Request Soap Header

Signing: The header of the Simple Object Access Protocol (SOAP) request must contain ClientId, ClientSecret, Username

Token and Timestamp. Username Token provides a standard way of representing a username (User ID registered in eFiling)

and password pair with WS-Security. The request must be digitally signed using the private key of the user (user must

have registered a valid DSC with e-Filing). Signature includes key info element that contains X.509 certificate details. To

validate the signature details, the following elements must be signed in the SOAP:

• Timestamp

• UsernameToken

• Body

Encryption: After signing, the request (UsernameToken and Body) must be encrypted using the e-Filing's public key

Parameter Name

Description

Field Specification

Sample Value

clientId

Efiling Team will provide the client id

from API Gateway as a pre-requisite.

Mandatory

l7xx73b2ac90ce2f4f0d899e3

bfb5b04fa84

clientSecret

Efiling Team will provide the client

secret from API Gateway as a pre-

requisite.

Mandatory

3edda3a406604bfe8a046

4003e6ac41d

UserNameToken

User ID and password must be in clear

text.

Alphabets

Mandatory

EXA00001

TimeStamp

OASIS standards with Expiry time of

180 seconds.

Alphabets

Mandatory

2020-12-12-

23.45.45.000112

Signature

Signature (OASIS standards) of

UserNameToken, TimeStamp and

Body.

Alphabets

Mandatory

Request Soap Body (in Plain XML)

Parameter Name

Description

Field

Specification

Sample Value

uniqueRequestId

Valid unique Request ID. First 10 letters of

uniqueRequestID should be the User ID(user Id

provided during registration) of the requester

and followed by a hyphen (-) and unique random

number

Mandatory

ABCD000000-123456

Pan

PAN of the user

Mandatory

APXPR1234L

atmId

Unique ID of the ATM.

Mandatory

Refer in

below

payload

atmCardNo

Masked ATM card number of the user.

Mandatory

Refer in

below

payload

bankAccNum

Bank Account Number of the Account linked to

PAN

Mandatory

Refer in

below

payload

ifsCode

IFS Code of the account.

Mandatory

Refer in

below

payload

atmAccessTime

ATM access time in format YYYY-MM-

DDhh24.mi.ss.SSSSSS

Mandatory

Refer in

below

payload

accountNa

me

Name of Account Holder

Mandatory

Refer in

below

payload

accountTy

pe

Type of Account as per Annexure 1

Mandatory

Refer in

below

payload

mobileNu

mber

Mobile number of the account holder registered

with bank

Mandatory

Refer in

below

payload

emailId

Email Id of the account holder registered with

bank

Mandatory

Refer in

below

payload

accountSt

atus

Status of account as per Annexure 1

Mandatory

Refer in

below

payload

Sample payload content (in Plain text):

<soapenv:Envelope >

<soapenv:Header>

<!-- Soap Headers should have the parameters mentioned in Request Soap header table above -- >

</soapenv:Header>

<soapenv:Body>

<dit:getBankAtmGenEvcDetails>

<dit:DitRequest uniqueRequestId="XXXXXXXXXXXX">

<req:pan>XXXXXXXXXX</req:pan>

<req:atmId>XXXXXXXXX000000</req:atmId>

<req:atmCardNo>12xxxxxxxxxx3456</req:atmCardNo>

<req:bankAccNum>0000000000000</req:bankAccNum>

<req:ifsCode>BANK0123456</req:ifsCode>

<req:atmAccessTime>2015-12-31-10.25.28.123456</req:atmAccessTime>

<req:accountName>ABCDEFGH</req:accountName>

<req:accountType>XX</req:accountType>

<req:mobileNumber>XXXXXXXXXX</req:mobileNumber>

<req:emailId>abc@mail.com</req:emailId>

<req:accountStatus>XX</req:accountStatus>

</dit:DitRequest>

</dit:getBankAtmGenEvcDetails>

</soapenv:Body>

</soapenv:Envelope>

Response Payload

Parameter Name

Description

Field Specification

Sample Value

result

Successful response

EVC has been

generated

successfully

Refer in

below

payload

ErrorCode

Error response

Error code as per the

table below

Refer in

below

payload

ErrorDesc

Error response

Error description for

the code as per table

below

Refer in

below

payload

Error Codes and Description

Scenario

Error Code

Error Description

If Unique Request ID is

duplicate.

EF-WS-SEC-ERR-10004

Duplicate Request. Please submit the

request with valid request ID.

If any exception occurs

EF-WS-COM-ERR-10001

Service Unavailable. Please try again later

If Signature is not valid

EF-WS-SEC-ERR-10003

Invalid DSC. Please use the DSC registered

with e-Filing

If PAN is not registered in

eFiling

EF-WS-PQS-ERR-10001

PAN is not registered in e-Filing

If username and password are

invalid

EF-WS-SEC-ERR-10001

Invalid user id / password

If Username and

UniqueRequestId (first 10

characters) does not match.

EF-WS-SEC-ERR-10006

Logged In UserID should match with

UserID in uniqueRequestID

Sample response payload is depicted in below table.

Positive Response:

<soap:Envelope xmlns:soap="http://schemas.xmlsoap.org/soap/envelope/">

<soap:Body>

<ns2:getBankAtmGenEvcDetailsResponse

xmlns="http://iec.incometax.gov.in/ditsecws/request"

xmlns:ns2="http://iec.incometax.gov.in/ditsecws"

xmlns:ns3="http://iec.incometax.gov.in/ditsecws/response">

<ns2:DitResponse>

<ns3:result>EVC has been generated successfully</ns3:result>

</ns2:DitResponse>

</ns2:getBankAtmGenEvcDetailsResponse>

</soap:Body>

</soap:Envelope>

Negative Response:

<soap:Envelope xmlns:soap="http://schemas.xmlsoap.org/soap/envelope/">

<soap:Body>

<ns2:getBankAtmGenEvcDetailsResponse

xmlns="http://iec.incometax.gov.in/ditsecws/request"

xmlns:ns2="http://iec.incometax.gov.in/ditsecws"

xmlns:ns3="http://iec.incometax.gov.in/ditsecws/response">

<ns2:DitResponse>

<ns3:ErrorCode>EF-WS-PQS-ERR-10001</ns3:ErrorCode>

<ns3:ErrorDesc>PAN is not registered in e-Filing</ns3:ErrorDesc>

</ns2:DitResponse>

</ns2:getBankAtmGenEvcDetailsResponse>

</soap:Body>

</soap:Envelope>

5.4 Test Strategy

UAT environment access will be provided to Banks for Integration testing over https with the above-mentioned APIs with

the provided details.

5.5 Security Conditions

All requests to Efiling2.0 should be over https requests with TLS enabled for both Incoming and outgoing requests. Also

signing and encryption of payloads enables banks to share payloads more securely.

Efiling system will also provide the below utility to ensure that the data shared between Bank and IEC2.0 system is

transferred with encoding. Banks may use this for the secure transfer of payloads.

5.6 Frequency of Data Exchange

The frequency of the data exchange will be real-time, event based. Whenever the user clicks on any link or action on the

Efiling portal or bank website, respective API of the Efiling or Bank gets invoked and synchronous response is received.

6 Annexure - 1

6.1 Account Types

Sl. No

Account Type

Description

1.

SB

Saving Bank Account

2.

CA

Current Account

3.

CC

Cash Credit Account

4.

OD

Over Draft Account

5.

TD

Term Deposit Account

6.

LN

Loan Account

7.

SG

State Government Account

8.

CG

Central Government Account

9.

NR

Non Resident External (NRE)

10.

NO

Non Resident Ordinary (NRO)

11.

PP

Public Provident Fund Account

12.

OT

Other Account Types

6.2 Account Status

Account Status

Account Description

Account Validity Flag

00

Account Valid

V

01

Account Closed

I

02

No Such Account

I

51

KYS Doc Pending

V

52

Account Holder Turning Major

V

53

A/C Inoperative

V

54

Dormant Account

V

55

Account in zero balance and no transactions has been

happened

V

60

Account Holder Expired

V

62

Account Under Litigation

V

65

Account Holder Name Invalid

V

68

Account in Blocked Status

V

69

Customer Insolvent

V