User Guide

ZAKATY

Version 2 | March 2024

2

This Guide clarifies how to use Zakaty, which allow individuals to voluntarily calculate and pay Zakat in a

reliable manner to deliver it to those who are eligible who are registered in the Social Insurance.

3

1. About Zakaty

2. How to create a new account?

3. How to log in?

4. What are the services provided by “Zakaty”?

5. How to calculate the Nisab

6. What about the Zakat spending?

7. Alerts and Notifications

8. Inquiry or Complain

9. Contact us

04

05

09

11

19

21

22

23

25

Contents

4

About Zakaty

A national platform created by Zakat, Tax, and Customs Authority (ZATCA) to create a balanced

and integrated zakat environment, allowing individuals to pay easily through calculating

and paying the Zakat via e-payment channels to deliver it to those who are illegible who are

registered in the Ministry of Ministry of Human Resources and Social Development represented

by Social Insurance and Empowerment Agency.

Zakaty Services

• Payment of Zakat amount directly

• Zakat long calculator that calculates various Zakat items (e.g., gold, silver, salary, trade

offers, stocks, Sukuk, debts, investment funds, properties) Check out Zakat Items

• Zakat short calculator that calculates money zakat only.

• Updating the quorum of Zakat (Nisab) daily.

• Payments record with zakat amounts.

• Various payment channels (Sadad, Mada, Visa/ Mastercard, Apple Pay)

• Alerts for scheduling and reminding of Zakat payment dates

• Price of gold and silver

• Price of securities

• Price of investment funds

• Saudi Stock Market

• Sukuk Market

5

How can you create a new account?

Via Website

• Click “Login”, then “New Registration” and fill the required data.

• Log in directly if you have a previous user name by adding the user name or e-mail and

password.

• Add verification code of 4 numbers after receiving it via your phone number.

For clarification:

You can use Zakat Payment and Calculation Service

without creating a new account.

xxxxxxxxxxxx

xxxxxxxxxxxx

xxxxxxxxxxxx

6

Via the App

• Click “Login”, then “New Registration” and fill the required data.

• Log in directly if you have a previous user name by adding the user name or e-mail and

password.

• Add verification code of 4 numbers after receiving it via your phone number.

7

Via the National Single Sign-On Service (NAFATH)

• Click on "Login" and then "Log in by NAFATH".

• Enter the verification code sent in a SMS message to your Phone Number.

xxxxxxxxxxxx

xxxxxxxxxxxx

8

xxxxxxxxxxxx

9

How to log in?

Via the National Single Sign-On Service (NAFATH)

• Enter the ZAKATY website via https://zakaty.gov.sa/

• Click on Log in through NAFATH and enter your ID number

• Enter the verification code sent in a SMS message to your Phone Number.

Via Application

• After entering into Zakaty App, click “Login” and fill login data.Add verification code of 4

numbers after receiving it via your phone number.

xxxxxxxxxxxx

10

Via the National Single Sign-On Service (NAFATH)

• Enter the ZAKATY website via https://zakaty.gov.sa/

• Click on Log in through NAFATH and enter your ID number

• Enter the verification code sent in a SMS message to your Phone Number.

xxxxxxxxxxxx

xxxxxxxxxxxx

11

What are the services provided by “Zakaty”?

Zakaty is characterized by a group of services easing the Zakat payer to calculate and pay zakat

and know the Nisab.

Via Website

Through the (Nisab today) service, you can know the Nisab. It is the amount, if a Muslim owns it

and year has passed, he has to be pay Zakat. It shall be updated according to the prices of gold

and silver on daily basis.

Pay your Zakat

Through this service, you can pay the Zakat amount to be collected directly through available

e-channels.

The Nisab is updated often to reflect changes in the price of gold and silver globally, and it may

be shared on social media.

12

How to pay via Website

Payment can be made via available e-channels

• Select the proper payment channel

• Add a phone number

• Accept the instructions and conditions

• Click “Send Activation Code”

• Enter the sent verification code

13

Payment Channels

• Upon selecting Sadad, Sadad invoice will be issued. If the due payment is not made within

the specified date, the invoice will be void.

• Payment via Sadad is made through the ATM or Bank Website through selecting the invoiced

code of ZATCA and entering the Sadad number to complete the payment.

• Upon selecting Mada or Visa/ Mastercard, the invoice details will appear to the user to

complete the card data.

xxxxxxxxxxxxxxxxxxx

xxxxx

xxxxxxxxxxxxxxxxxxx

xxx

14

How to Pay via Application

Payment details

Payment can be made via available e-channels

• Select the proper payment channel

• Add a phone number

• Agree on instructions and conditions

• Enter the sent verification code

• Click “Pay”

• Upon selecting Sadad, Sadad invoice will be issued. If the due payment is not made within

the specified date, the invoice will be void.

• Payment via Sadad is made through the ATM or Bank Website through selecting the invoiced

code of ZATCA and entering the Sadad number to complete the payment.

15

You can pay by visiting ZATCA’s Services Halls

Edit mobile number

xxxxxxxxxxxxx

xxxxxxxxxxxxx

xxxxxxxxxxxxx xxxxxxxxxxxxx

xxxxxxxxx

xxxxxxxxx

16

My Payment Record

A record view all zakat payments previously made and scheduled.

For clarification: You have to log in to use this service.

xxxxxxxxxxxxx

xxxxxxxxxxxxx

17

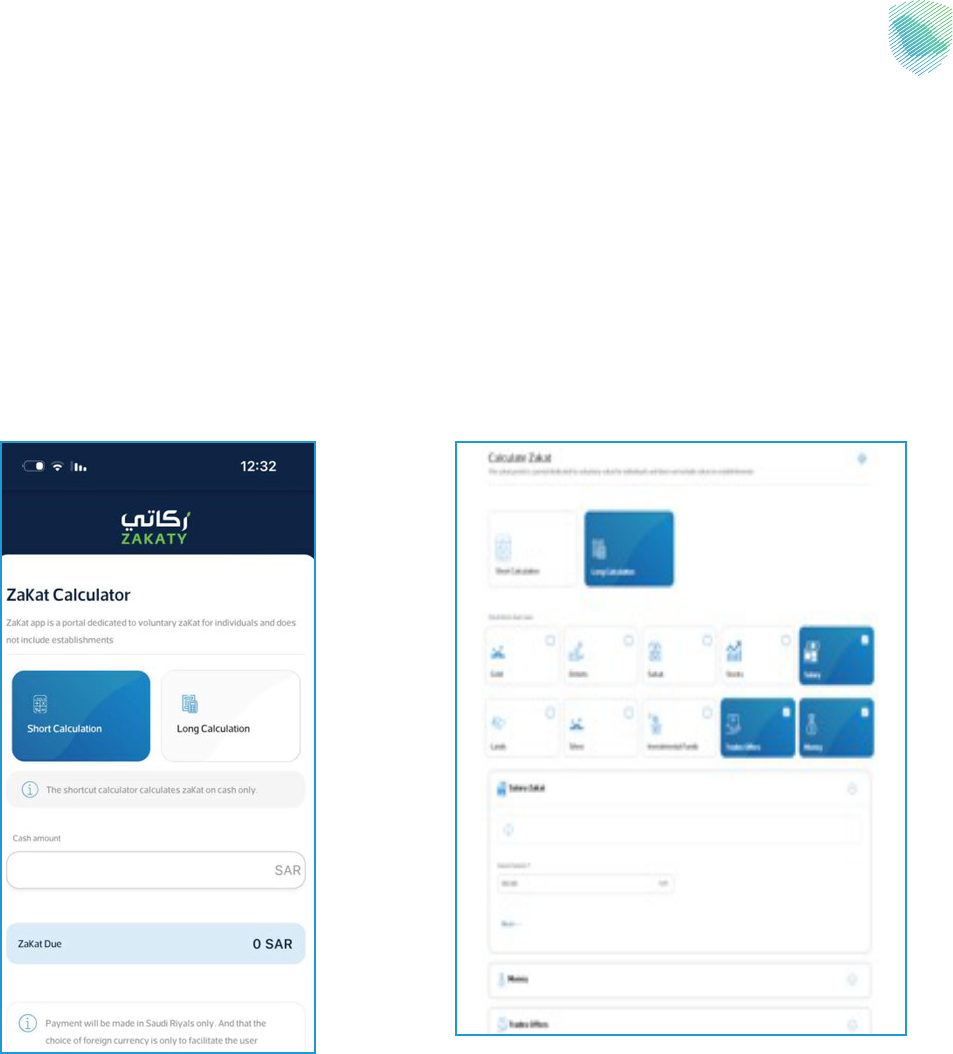

Zakat Calculator

Zakaty is characterized by two calculators; short and long calculation.

Short Calculator

Calculates money zakat only. Enter the cash amount and zakat amount will be automatically

calculated. Method of calculating zakat by the short calculator: All amounts owned by the Zakat

payer ÷ 40. If the money reaches Nisab, the amount to be paid by the zakat payer will appear. If

not, a notification clarifying that zakat base is less than the Nisab will appear.

For example:

Money 9000 ÷ 40 = 225

WebsiteApplication

18

Long Calculator

Calculates various zakat items through entering into the calculator and selecting the zakat item

required.

You can select more than one item, and click on “Next”. The items will be added to the table and

calculated in the “Zakat Base”.

WebsiteApplication

19

How to calculate the Nisab?

Method of Gold Zakat Calculation: Net Gold = (number of grams × karat ÷ 24) × gold price at the

day of zakat payment ÷ 40, knowing that gold Nisab is 85 g. If the gold reaches the quorum,

zakat becomes due, and the amount due will appear. If the gold does not reach the quorum, a

notification clarifying that zakat base is less than 85 g.

Method of Silver Zakat Calculation: Number of grams × silver price at the day of zakat payment

÷ 40, knowing that silver Nisab is 595 g. If the silver reaches the Nisab, zakat becomes due, and

the amount due will appear. If the silver does not reach the Nisab, a notification clarifying that

zakat base is less than 595 g.

Method of Money Zakat Calculation: All amounts owned by the Zakat payer ÷ 40. If the money

reaches Nisab, the amount to be paid by the zakat payer will appear. If not, a notification clarifying

that zakat base is less than the Nisab will appear.

Method of Salary Zakat Calculation: All salaries remaining at the account within one year ÷

40. If the salaries reach Nisab, the amount to be paid by the zakat payer will appear. If not, a

notification clarifying that zakat base is less than the Nisab will appear.

Method of Trade Offers Zakat Calculation: All goods value at the date of zakat payment ÷ 40. If

the goods reach Nisab, the amount to be paid by the zakat payer will appear. If not, a notification

clarifying that zakat base is less than the Nisab will appear.

Method of Stock Zakat Calculation: Number of stocks × total market value of stock less the

book value ÷ 40. If the stocks reach Nisab, the amount to be paid by the zakat payer will appear.

If not, a notification clarifying that zakat base is less than the Nisab will appear.

20

Method of Debts Zakat Calculation: Number of debts instruments owned by the zakat payer ×

its market value at the date of zakat payment ÷ 40. If the debts reach Nisab, the amount to be

paid by the zakat payer will appear. If not, a notification clarifying that zakat base is less than the

Nisab will appear.

Method of Sukuk Zakat Calculation: Debts value ÷ 40. If the debts reach Nisab, the amount to

be paid by the zakat payer will appear. If not, a notification clarifying that zakat base is less than

the Nisab will appear.

Method of Investment Funds Zakat Calculation: Number of fund units owned by the zakat payer

× its price at the date of zakat payment ÷ 40. If the units amount reaches Nisab, the amount to

be paid by the zakat payer will appear. If not, a notification clarifying that zakat base is less than

the Nisab will appear.

Method of Properties Zakat Calculation: Number of the property × property market value ÷

40. If the properties reach Nisab, the amount to be paid by the zakat payer will appear. If not, a

notification clarifying that zakat base is less than the Nisab will appear.

21

What about the Zakat spending?

Zakat spending in Zakaty is limited in the Social Insurance. Zakat payer can select the region and

case of the beneficiary.

Via Website

You can select the region and case of the beneficiary. If not, the allocation will be made

automatically.

• Select the Beneficiary Region.

• Select the Beneficiary Case.

Via Application

22

Alerts and Notifications

For clarification: You have to log in to use this service.

Via Website

Alerts

Through this service, you can add an alert to remind you of zakat payment date.

• Select “Clock” icon from Home Page

• Select method of alert: E-mail - Phone - Internal Notification

• Add a new alert

Notifications

• Select “Alarm” icon from Home Page

• When selecting alert through an internal notification, you will receive your own notifications.

Via Application

xxxxxxxxxxxxx

23

Inquiry or Complain

From “Contact us” list, you will find the suggestions and inquiries.

24

ZAKATY Q&A

Q: Can I pay Zakat from outside the Kingdom as a scholarship student?

A: Yes, payment services are possible using international phone lines.

Q: Is the gold price updated on a daily basis?

A: It is updated accurately and on a daily basis by connecting the ZAKATY Platform to the gold

price website.

Q: Can Zakat be calculated on foreign stock?

A: Yes, the Zakat calculator includes a foreign stock option as well as various stock options.

Q: Can I pay with a Visa card?

A: Yes, you can make payments with a Visa card and alternative methods.

Q: How can Saudi stocks be reliably calculated?

A: Based on connecting ZAKATY to the Saudi Exchange platform (Tadawul).

Q: Is it possible to calculate Zakat on many items?

A: Yes, you can input more than one Zakat item into the calculator to get the total Zakat base and

the amount of Zakat due.

Q: Does ZATCA collect a certain amount of Zakat payments?

A: No, all Zakat payments are sent toward beneficiaries of social security and empowerment by

the Ministry of Human Resources and Social Development.

25

Contact us

You can contact us via 19993

Email: [email protected]

Twitter: @SaudiZAKATY

IOSAndroid

Application:

Website:

Zakaty can be used via:

26