CONTENTS

Corporate Information 2

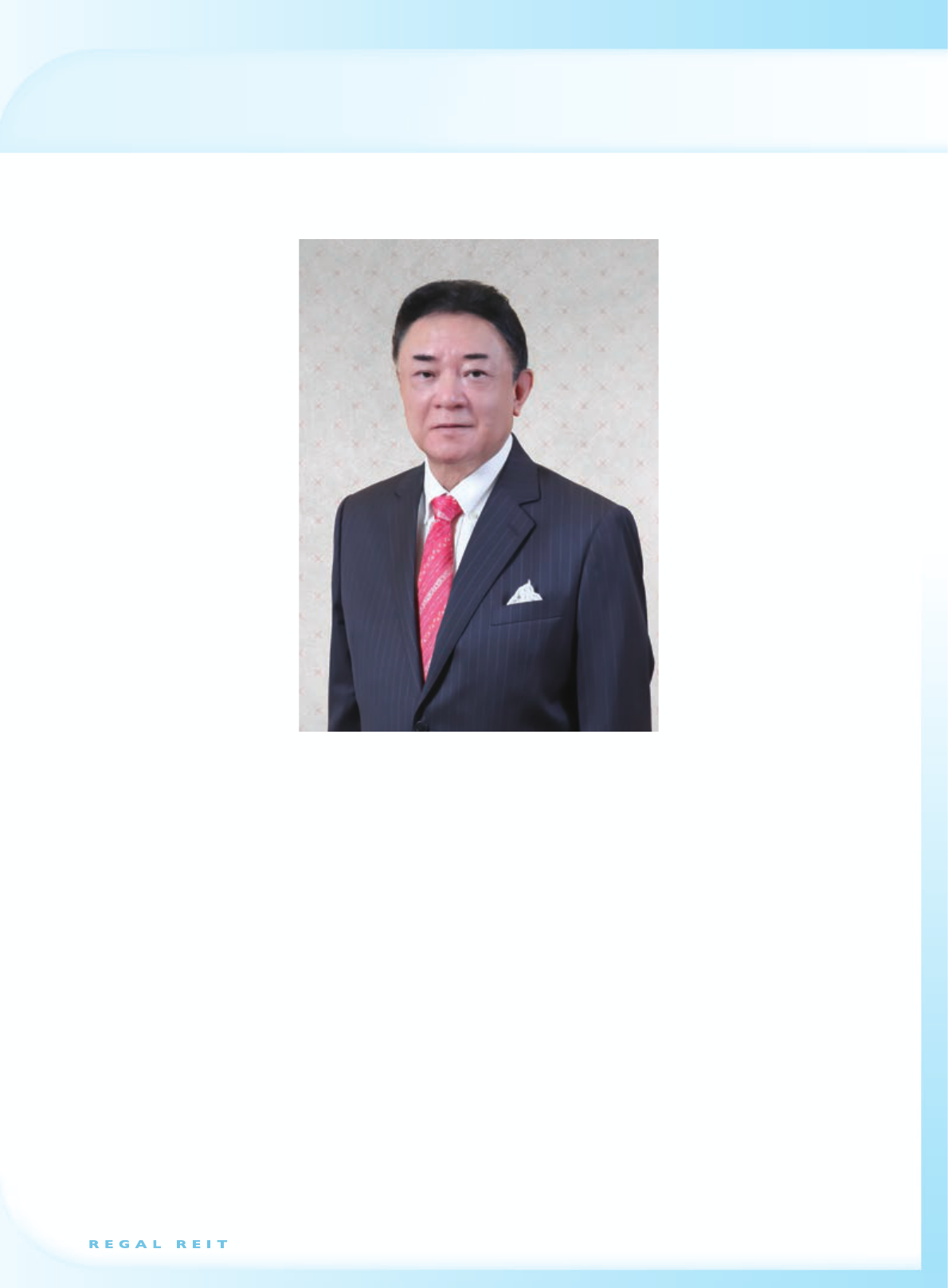

Chairman

’

s Statement 3

Property Portfolio 7

Report of the REIT Manager 17

Director and Executive Officer Profiles 39

Corporate Governance Report 43

Connected Party Transactions 59

Disclosure of Interests 66

Audited Financial Statements 68

Consolidated Statement of Profit or Loss 68

Consolidated Statement of Comprehensive Income 69

Consolidated Statement of Financial Position 70

Consolidated Statement of Changes in Net Assets 72

Attributable To Unitholders

Distribution Statement 73

Consolidated Statement of Cash Flows 74

Notes to Consolidated Financial Statements 76

Independent Auditor

’

s Report 119

Performance Table 124

Trustee

’

s Report 125

Valuation Report 126

Summary of Property Portfolio 186

Summary Financial Information 188

Annual Report 2023

2

CORPORATE INFORMATION

MANAGER OF REGAL REIT

Regal Portfolio Management Limited (the

“

REIT Manager

”

)

Unit No. 2001, 20th Floor,

68 Yee Wo Street,

Causeway Bay,

Hong Kong.

Tel: 2805-6336

Fax: 2577-8686

Email: [email protected]

BOARD OF DIRECTORS OF THE REIT MANAGER

Non-executive Directors

Lo Yuk Sui (Chairman)

Lo Po Man (Vice Chairman)

Jimmy Lo Chun To

Kenneth Ng Kwai Kai

Executive Directors

Johnny Chen Sing Hung

Simon Lam Man Lim

Independent Non-executive Directors

John William Crawford, JP

Bowen Joseph Leung Po Wing, GBS, JP

Kai Ole Ringenson

Abraham Shek Lai Him, GBS, JP

AUDIT COMMITTEE OF THE REIT MANAGER

John William Crawford, JP (Chairman)

Bowen Joseph Leung Po Wing, GBS, JP

Kai Ole Ringenson

Abraham Shek Lai Him, GBS, JP

Kenneth Ng Kwai Kai

DISCLOSURE COMMITTEE OF THE REIT MANAGER

John William Crawford, JP (Chairman)

Johnny Chen Sing Hung

Simon Lam Man Lim

Kenneth Ng Kwai Kai

Kai Ole Ringenson

NOMINATION COMMITTEE OF THE REIT MANAGER

Lo Yuk Sui (Chairman)

John William Crawford, JP

Bowen Joseph Leung Po Wing, GBS, JP

Kai Ole Ringenson

Abraham Shek Lai Him, GBS, JP

Kenneth Ng Kwai Kai

RESPONSIBLE OFFICERS OF THE REIT MANAGER

Johnny Chen Sing Hung

Simon Lam Man Lim

Peony Choi Ka Ka

SECRETARY OF THE REIT MANAGER

Peony Choi Ka Ka

TRUSTEE OF REGAL REIT

DB Trustees (Hong Kong) Limited (the

“

Trustee

”

)

AUDITOR

Ernst & Young

Registered Public Interest Entity Auditor

PRINCIPAL VALUER

Colliers International (Hong Kong) Limited

PRINCIPAL BANKERS

Bank of Communications (Hong Kong) Limited

The Bank of East Asia, Limited

Cathay United Bank Company, Limited, Hong Kong Branch

China Construction Bank (Asia) Corporation Limited

Chong Hing Bank Limited

Hang Seng Bank Limited

Hua Xia Bank Co., Limited Hong Kong Branch

Industrial and Commercial Bank of China (Asia) Limited

Oversea-Chinese Banking Corporation Limited,

Hong Kong Branch

United Overseas Bank Limited

LEGAL ADVISER

Baker & McKenzie

UNIT REGISTRAR

Computershare Hong Kong Investor Services Limited

Shops 1712-1716, 17th Floor,

Hopewell Centre,

183 Queen

’

s Road East,

Wan Chai,

Hong Kong.

WEBSITE

www.RegalREIT.com

Annual Report 2023

3

CHAIRMAN

’

S STATEMENT

Dear Unitholders,

I have pleasure to present, on behalf of the Board of Directors of Regal Portfolio Management Limited as the REIT

Manager, the 2023 Annual Report of Regal Real Estate Investment Trust.

FINANCIAL RESULTS

For the year ended 31st December, 2023, Regal REIT recorded a consolidated profit before distributions to Unitholders of

HK$265.7 million, as compared to a profit of HK$929.9 million for the 2022 financial year. The profit recorded for the

year under review was principally attributable to the gain of HK$366.9 million arising from the increase in the fair value

of Regal REIT

’

s investment property portfolio, as compared to its appraised value as at 31st December, 2022, while for the

2022 financial year, a fair value gain of HK$754.7 million was recorded. However, if the effects of these fair value changes

are excluded, Regal REIT would report a core operating loss of HK$101.2 million for the year under review, as compared to

a core operating profit of HK$175.2 million for the preceding year. The core operating loss incurred was mainly due to the

substantial increase in financial expenses, which amounted to HK$611.2 million (2022 - HK$281.8 million), as the Hong

Kong Interbank Offered Rates (HIBOR), on which the borrowing costs of Regal REIT

’

s bank loans were based, had risen

rapidly in the second half of 2023.

Annual Report 2023

4

Consequently, Regal REIT recorded an adjusted loss of HK$127.6 million for 2023 (2022 - total distributable income of

HK$204.8 million), which precludes any distribution for the year. Therefore, same as with the interim period, the Board of

Directors of the REIT Manager has decided not to declare any final distribution for the year ended 31st December, 2023

(2022 - final distribution of HK$0.010 per Unit and total distributions for the year of HK$0.061 per Unit).

HOTEL MARKET AND BUSINESS REVIEW

After a strong initial rebound from the depths of the COVID pandemic, the pace of recovery in the global economy in 2023

has overall moderated. Economic activity was still falling short of pre-pandemic projections, especially in the emerging

market and developing economies. Aggregate economic growth in advanced economies was resilient for most of last year,

slowing less than previously expected, which largely reflected the recovering status in the United States where consumer

spending has remained fairly robust.

In spite of some domestic challenges and external pressures, China was able to accomplish the major targets set for 2023.

Growth in its Gross Domestic Product (GDP) for the year picked up by 5.2%, which was in line with the official growth

target and exceeded the 3% growth attained in 2022. In Hong Kong, the overall economic conditions have been very

challenging under the high interest rates environment. The city recorded a 3.2% growth in its GDP in 2023, which was 0.8

percentage point below the low end of the Government

’

s growth forecast in August 2023.

Following the removal of all travel restrictions early last year, Hong Kong received a total of about 34 million visitors in

2023. Though this reflected an increase of 55 times year-on-year due to the low comparative base, it only represented

about 55% of the aggregate visitor arrivals in the pre-COVID times. Visitors from China remained the most important

market segment in the local tourism sector.

According to a hotel survey published by the Hong Kong Tourism Board, the average hotel occupancy rate for all the

surveyed hotels in different categories in Hong Kong in 2023 was 82.0%, an increase of 16.0 percentage points from

2022, while the industry-wide average room rate improved by 30.7%, with the average Revenue per Available Room

(RevPAR) having an overall increase of 62.3% year-on-year.

Being one of the major hotel owners in Hong Kong, Regal REIT presently owns a portfolio of nine operating hotels,

comprising five hotels under the full-service

“

Regal

”

brand (the

“

Initial Hotels

”

) and four hotels under the select-service

“

iclub

”

brand, together commanding a total room count of over 4,900 guestrooms and suites.

Apart from the iclub Wan Chai Hotel which is owned and self-operated by Regal REIT, all the five Initial Hotels and the

three other iclub Hotels are leased to a wholly-owned subsidiary of Regal Hotels International Holdings Limited (

“

RHIHL

”

),

the immediate listed holding company of Regal REIT, for hotel operations.

As mentioned in my Chairman

’

s Statement in the 2023 Interim Report of Regal REIT, due to the different operating modes

and revenue structures of the three Initial Hotels (namely, the Regal Airport Hotel, Regal Kowloon Hotel and Regal Oriental

Hotel) and the two iclub Hotels (namely, iclub Fortress Hill Hotel and iclub To Kwa Wan Hotel) when they were operating

under various government hotel quarantine schemes in 2022, the aggregate net operating income of these five hotels for

2023 was as a whole still below the level attained in 2022, despite the continuing improvements that have been achieved

in their operating performance since the lifting of travel restrictions early last year. However, for those hotels that have

all along been operating normal hotel business (namely, the Regal Hongkong Hotel, Regal Riverside Hotel, iclub Sheung

Wan Hotel and iclub Wan Chai Hotel), their business operations in 2023 have strongly rebounded, recording significant

increases in their aggregate net property income (

“

NPI

”

) of about 200.0% over the level attained in 2022.

Annual Report 2023

5

In accordance with the terms of the 2023 market rental packages, the Initial Hotels generated aggregate base rent of

HK$480.0 million. The market rental reviews for the Initial Hotels for 2024 were completed in September 2023 and their

aggregate annual base rent for 2024 was determined to be HK$544.0 million, which is approximately 13.3%, or HK$64.0

million, above the aggregate base rent for 2023. Variable rent will continue to be based on 50% sharing of the excess of

the aggregate NPI of the Initial Hotels over their aggregate base rent.

The other three iclub Hotels (namely, the iclub Sheung Wan Hotel, the iclub Fortress Hill Hotel and the iclub To Kwa Wan

Hotel) leased to the RHIHL lessee generated rental receipts of HK$98.0 million for 2023, which included aggregate variable

rent of HK$6.0 million earned by the iclub Sheung Wan Hotel and iclub Fortress Hill Hotel.

Based on the market rental reviews determined by the independent professional property valuer under the terms of the

leases, the aggregate base rent for these three iclub Hotels for 2024 was fixed at HK$118.0 million, which is approximately

28.3%, or HK$26.0 million, above the aggregate base rent in 2023, with variable rent similarly to be based on 50%

sharing of the excess of the NPI over the base rent of each individual hotel.

The iclub Wan Chai Hotel was the first iclub hotel in Hong Kong and has been self-operated by Regal REIT since 2011. The

NPI (including the lease rentals from the non-hotel portions) of this property has increased by 88.6% as compared to 2022.

At the extraordinary general meeting (the

“

EGM

”

) held on 31st January, 2024, the independent Unitholders approved,

among others, the extensions and amendments of the existing lease agreements and lease guarantees for the iclub Sheung

Wan Hotel and iclub Fortress Hill Hotel for another ten years to 31st December, 2034, with the market rental packages

for the extended terms continuing to be determined annually by a jointly appointed independent professional property

valuer. At the same EGM, the independent Unitholders also approved the extensions and amendments of the existing hotel

management agreements for these two hotels, which will also run through to 31st December, 2034.

Regal REIT concluded the refinancing exercises for the iclub Sheung Wan Hotel, iclub Fortress Hill Hotel and iclub To Kwa

Wan Hotel in the second half of 2023, with the tenure of the refinancing loans staggered from 2 years to 5 years. Further

information on the hotel properties owned by Regal REIT, including their detailed lease terms and their 2023 operating

data, is contained in the Report of the REIT Manager in the 2023 Annual Report.

BUSINESS OUTLOOK

According to a recent research from the World Bank Group, global growth is expected to slow to 2.4% in 2024, the third

consecutive year of deceleration, reflecting the lagged and ongoing effects of tight monetary policies to rein in inflation,

restrictive credit conditions, and weak global trade and investment.

Despite the progress to date, there is still considerable distance before Hong Kong

’

s economy can recover fully to the

pre-pandemic level. Ongoing headwinds and challenges, including slackened global demand, increasing geoeconomic

fragmentation and tightened monetary conditions, would continue to adversely impact on the pace and extent of its

economic recovery.

In the 2023 Policy Address, tourism was stated to be one of the major driving forces of the Hong Kong economy and

the Government is taking positive steps to enhance the attractions of Hong Kong as a major tourist city. Under the

coordination of the Government, there will be over 80 mega events to be hosted in Hong Kong in just the first half of this

year. These events can drive the businesses of multiple sectors, including tourism, hotels, catering and retail, and bring

significant economic benefits to Hong Kong. In addition, effective from 6th March, 2024, the Individual Visit Scheme

was further expanded to a total of 51 Mainland China cities by adding Xi

’

an and Qingdao. Together with the potential

resumption of

“

multiple-entry

”

endorsements for Shenzhen residents, these should give an extra boost to the business of

the local tourist and hotel industries.

Annual Report 2023

6

On the financial front, the hike cycle of the United States interest rates should already be at its peak. It is now widely

expected that its interest rates may start to ease in mid-2024, although this is set against the backdrop that the inflation

will stabilise further. By the nature of its business and financial structure, the financial performance of Regal REIT is highly

sensitive to fluctuations in interest rates. Although the interest rates in Hong Kong have slowly receded from their high

levels that prevailed in late 2023, Regal REIT has entered into several interest rate swap transactions in early February 2024

to swap the interest expenses on parts of its outstanding bank loans from floating rates to fixed rates. It is anticipated this

could reduce the financial expenses of Regal REIT in the near term, while at the same time hedge against any unexpected

reversionary upward movements in the interest rates.

The REIT Manager is optimistic that the tourist and hotel markets in Hong Kong will continue to recover. The REIT Manager

is also optimistic that when the interest rates in Hong Kong gradually settle to more normal levels, Regal REIT will be able

to resume distributions to Unitholders.

Finally, I would also like to express my appreciation and gratitude to my other fellow Directors, all the staff members as

well as all the Unitholders for their continued support during the past year.

Lo Yuk Sui

Chairman

Regal Portfolio Management Limited

(as the REIT Manager of Regal REIT)

Hong Kong, 27th March, 2024

Annual Report 2023

7

NEW TERRITORIES

Hong Kong

Convention &

Exhibition Centre

HONG KONG

Hong Kong

International Airport

LANTAU ISLAND

AsiaWorld-Expo

HONG KONG ISLAND

KOWLOON PENINSULA

Hong Kong

Disneyland

Room Count

Opening Year

Approx. Covered

Floor Area (sq. m.)

Ballroom

Meeting Room

Business Centre

Gross Floor Area (sq. m.)

Restaurant

Bar / Lounge

Swimming Pool

Spa

Club Lounge

Regal Airport Hotel

Regal Hongkong Hotel

Regal Kowloon Hotel

Regal Oriental Hotel

Regal Riverside Hotel

iclub Wan Chai Hotel

iclub Sheung Wan Hotel

iclub Fortress Hill Hotel

iclub To Kwa Wan Hotel

Key to Hotel Facility Icons

1 6

7

8

9

2

3

4

5

PROPERTY PORTFOLIO

Location of the Hotel Properties in Hong Kong

5

4

9

8

3

2

1

6

7

Annual Report 2023

8

9 Cheong Tat Road,

Hong Kong International Airport,

Chek Lap Kok, Hong Kong.

Tel: (852) 2286 8888

Fax: (852) 2286 8686

Email: [email protected]

Website: airport.regalhotel.com

• The only hotel connected directly to the airport passenger terminals

• Close to the Hong Kong-Zhuhai-Macao Bridge

• State-of-the-art meeting and conference venues of approximately 3,300 sq. m.

with a built-in giant high-definition LED wall (9m x 4m) and 3D Projection Mapping

Technology

• Easy access to AsiaWorld-Expo, Hong Kong Disneyland and The Big Buddha

• MASTERCHEF Recommendation Restaurant – Rouge (2020-2023)

• Gold Benchmarking Certificate by EarthCheck (2018-2023)

• Trusted Cleanliness Badge by TrustYou (2020-2021)

• Anti-epidemic Hygiene Measures Certification by Hong Kong Quality Assurance Agency

(2020)

• Certificate of Excellence by TripAdvisor (2016-2020)

• World

’

s Best Airport Hotel by Business Traveller UK Magazine for 13 years (2008-2019)

• Best Airport Hotel Asia Pacific by Travel Weekly Asia for 3 consecutive years (2017-

2019 and 2023)

• Travel Hall of Fame Award by TTG Asia Media Pte Ltd for 5 years (2015-2018 and

2023)

• Best Airport Hotel in Asia-Pacific by Business Traveller Asia-Pacific Magazine for 17

consecutive years (2001-2017)

• Best Airport Hotel in Asia-Pacific by TTG Asia Media Pte Ltd for 10 consecutive years

(2005-2014)

• World

’

s Best Airport Hotel and Best Airport Hotel Asia in the Skytrax Awards for 4

consecutive years (2011-2014)

1,171 1,050 sq. m.

1999 27

83,400 sq. m. 1

71,988 sq. m. 2

5 1

1 1

Café Aficionado Presidential Suite Regal Ballroom

REGAL AIRPORT HOTEL

Annual Report 2023

9

Executive Club Lounge

88 Yee Wo Street,

Causeway Bay, Hong Kong.

Tel: (852) 2890 6633

Fax: (852) 2881 0777

Email: [email protected]

Website: hongkong.regalhotel.com

• Located in the heart of Causeway Bay, one of the popular shopping and

commercial districts in Hong Kong

• Within walking distance from Victoria Park, Hong Kong Stadium - home to the

annual spectacular Rugby Sevens Tournament and Happy Valley Racecourse

where exciting horse races are staged regularly

• Convenient location to the Hong Kong Convention and Exhibition Centre

• Regal Ballroom and The Forum (meeting and conference centre) provide a full

range of facilities catering to the needs of business travellers, meeting and

exhibition delegates

• Executive Club Floor features a collection of 81 tastefully appointed guestrooms

and suites with a private lounge

• HACCP Certification by SGS Hong Kong (2022-2025)

• Caring Company 10 Years+ Award by The Hong Kong Council of Social Service

(2018-2024)

• Gold Benchmarking Certificate by EarthCheck (2018-2023)

• MASTERCHEF Recommendation Restaurant – Regal Palace (2020-2023)

• Travellers

’

Choice Award by TripAdvisor (2020-2023)

• Quality Restaurant Certification (15 years+) by Hong Kong Tourism Board –

Regal Palace (2023)

• Top Producing Hotel by Trip.com (2022)

• Trusted Cleanliness Badge by TrustYou (2020-2022)

• Best Business Hotel by Ctrip (2019)

• Certificate of Excellence by TripAdvisor (2019)

481 239 sq. m.

1993 14

32,000 sq. m. 1

25,090 sq. m. 1

3 1

1

Executive Suite

Regal Palace

REGAL HONGKONG HOTEL

Annual Report 2023

10

71 Mody Road, Tsimshatsui,

Kowloon, Hong Kong.

Tel: (852) 2722 1818

Fax: (852) 2369 6950

Email: [email protected]

Website: kowloon.regalhotel.com

• Conveniently located in Tsim Sha Tsui East, a commercial and tourist district

• Within walking distance from the Tsim Sha Tsui (

“

TST

”

), East TST and Hung Hom MTR

stations, 10-minute drive to the Hong Kong West Kowloon Station - the terminus

of High Speed Rail (Hong Kong Section) with easy access to other cities of Mainland

China

• Close to TST

’

s waterfront with promenade, major shopping centres and entertainment

areas

• Nearby popular tourist attractions including K11 Musea, Hong Kong Science Museum,

Hong Kong Space Museum, Hong Kong Museum of Art, Hong Kong Cultural Centre,

Clock Tower and the Star Ferry, etc.

• HACCP Certification by SGS Hong Kong (2022-2025)

• Caring Company Award by The Hong Kong Council of Social Service (2018-2024)

• Gold Benchmarking Certificate by EarthCheck (2020-2023)

• Anti-epidemic Hygiene Measures Certification by Hong Kong Quality Assurance Agency

(2020-2023)

• Travellers

’

Choice Award by TripAdvisor (2021-2023)

• MASTERCHEF Recommendation Restaurant - Regal Court (2019-2023) & Mezzo (2021-

2023)

• Trusted Cleanliness Badge by TrustYou (2020-2021)

• Loved by Guests Award by Hotels.com (2020)

• Certificate of Excellence by TripAdvisor (2016-2017 and 2019)

600 1

1982 353 sq. m.

43,500 sq. m. 12

31,746 sq. m. 1

3 1

Regal Court Luxembourg Room Royal Suite

REGAL KOWLOON HOTEL

Annual Report 2023

11

Suite

30-38 Sa Po Road, Kowloon City,

Kowloon, Hong Kong.

Tel: (852) 2718 0333

Fax: (852) 2718 4111

Email: [email protected]

Website: oriental.regalhotel.com

• The only full-service hotel located in the heart of Hong Kong

’

s heritage district,

Kowloon City, neighboring the Kai Tak Development Area including the world-

class Kai Tak Cruise Terminal

• Vicinity to historic landmarks such as Wong Tai Sin Temple and Chi Lin Nunnery

• 5-minute walking distance to Sung Wong Toi MTR station of the Tuen Ma Line,

with easy inter-change to Mong Kok and other business and shopping districts

• Spacious and quiet rooms set up with 1 King, 2 Queen or up to 4 single beds

are offered to cater for different needs. Facilities include private lounge and

gymnasium in a compact and cozy environment

• Gold Benchmarking Certificate by EarthCheck (2018-2023)

• Halal Certificate by The lncorporated Trustees of The Islamic Community Fund

of Hong Kong (2013-2022)

• Trusted Cleanliness Badge by TrustYou (2021)

• Indoor Air Quality Certificate – Excellent Class by Environmental Protection

Department (2014-2019)

• Caring Company 5 Years+ Award by The Hong Kong Council of Social Service

(2014-2019)

• Carbon Reduction Certificate by the Environmental Campaign Committee

(2016-2019)

•

”

Good Employer Charter

”

Certificate by Labour Department (2018-2019)

• 10-year QTS Merchant Recognition for The China Coast Pub + Restaurant by

Hong Kong Tourism Board (2019)

494 1

1982 345 sq. m.

27,300 sq. m. 7

22,601 sq. m.

4

The China Coast Pub+Restaurant

Communal Lounge

REGAL ORIENTAL HOTEL

Annual Report 2023

12

34-36 Tai Chung Kiu Road, Shatin,

New Territories, Hong Kong.

Tel: (852) 2649 7878

Fax: (852) 2637 4748

Email: [email protected]

Website: riverside.regalhotel.com

• The largest hotel in Shatin overlooking the Shing Mun River

• Easy access to Hong Kong Island, Kowloon and the mainland border

• Within walking proximity to Shatin New Town Plaza, a mega shopping complex

featuring over 400 shops and restaurants

• Close to Sha Tin Racecourse, Hong Kong Science & Technology Parks, The Chinese

University of Hong Kong and the Ten Thousand Buddhas Monastery

• Executive Club Lounge provides comprehensive facilities that bring a truly comfortable

and convenient stay

• Gold Benchmarking Certificate by EarthCheck (2018-2023)

• MASTERCHEF Recommendation Restaurant – Dragon Inn (2020-2023)

• MASTERCHEF Recommendation Restaurant – Vi (2021-2023)

• Popular Hotel of the Year by Meituan Hotel Award (2022-2023)

• Hala Certificate by The Incorporated Trustees of The Islamic Community Fund of Hong

Kong (2023)

• MASTERCHEF Recommendation Restaurant – Regal Terrace (2023)

• U Favourite Food Awards – My Favourite Buffet Restaurant – L

’

Eau (2023)

• 15-year QTS Quality Merchant Recognition by Hong Kong Tourism Board – L

’

Eau and

Avanti Pizzeria (2023)

• Outstanding QTS Merchant Silver Award by Hong Kong Tourism Board – L

’

Eau (2022)

• Anti-epidemic Hygiene Measures Certification by Hong Kong Quality Assurance Agency

(2020-2022)

• Trusted Cleanliness Badge by TrustYou (2020-2021)

• MameAwards – Mame

’

s Best Choice of Postpartum Hotel (2021)

• Squarefoot Serviced Apartment Awards 2020 – Best Serviced Apartment Provider

(2020)

• Certificate of Appreciation by Christian Action

’

s Signature Employer Program

(2018-2020)

• Trip.com Best Selling Hotel Awards (2020)

• Certificate of Appreciation in Hong Kong No Air-Con Night from Green Sense

(2012-2020)

1,147 549 sq. m.

1986 9

69,100 sq. m. 1

59,668 sq. m. 1

8 1

2 1

Deluxe Suite OM Spa Riverside Ballroom

REGAL RIVERSIDE HOTEL

Annual Report 2023

13

iPlus Premier

211 Johnston Road,

Wan Chai, Hong Kong.

Tel: (852) 3963 6000

Fax: (852) 3963 6022

Email: [email protected]

Website: wanchai.iclub-hotels.com

• 99 chic and trendy guestrooms and suites with interactive services and

innovative facilities

• Convenient location within walking distance to Wan Chai MTR station and

Hong Kong Convention and Exhibition Centre

• Centrally located on Hong Kong Island - 2 MTR stations from Central and 1

MTR station from Causeway Bay

• Flexible room configuration accommodates up to 4 guests, ideal for families and

travelling groups

• Rooms on high floors feature fascinating view of exciting city vistas

• Daily complimentary morning refreshments and coffee & tea throughout the day

in the multi-functional indoor iLounge

• New kitchen equipment for long stay guests

• Newly equipped entertainment corner with board games

• 24-hour self-service laundry and drying facilities

• 24-hour complimentary use of computers in iEngage

• 24-hour complimentary use of fitness facilities in Sweat Zone

• A completely smoke-free hotel

• Gold Benchmarking Certificate by EarthCheck (2024)

• Gold Circle Award by Agoda (2023)

• Travellers

’

Choice Award by TripAdvisor (2020-2021)

• Trusted Cleanliness Badge by TrustYou (2020)

• Customer Review Award by Agoda (2020)

• Anti-epidemic Hygiene Measures Certification by Hong Kong Quality Assurance

Agency (2020)

• Certificate of Excellence by TripAdvisor (2019)

• Guest Rated Award

“

Good

”

by Expedia.com (2018)

99

2009

5,530 sq. m.

5,326 sq. m.

1

1

iSuite Premier

iLounge

iclub WAN CHAI HOTEL

Annual Report 2023

14

iPlus Premier

138 Bonham Strand,

Sheung Wan, Hong Kong.

Tel: (852) 3963 6100

Fax: (852) 3963 6122

Email: [email protected]

Website: sheungwan.iclub-hotels.com

• A contemporary select-service hotel with 248 chic and trendy guestrooms and suites

• Convenient location with 3-minute walking distance to Sheung Wan MTR station,

7-minute walking distance to Hong Kong Macau Ferry Terminal and walking distance

to Hollywood Road and SoHo area

• Flexible room configuration accommodates up to 6 guests in a room, ideal for families

and travelling groups

• Daily complimentary morning refreshments and coffee & tea throughout the day in

iLounge

• 24-hour self-service laundry and drying facilities

• 24-hour complimentary use of computers in iEngage

• 24-hour complimentary use of fitness facilities in Sweat Zone

• A completely smoke-free hotel

• Gold Benchmarking Certificate by EarthCheck (2024)

• Popular Hotel of the Year by MeiTuan Hotel (2023)

• Gold Circle Award by Agoda (2023)

• Traveller Review Awards by Booking.com (2020-2022)

• Loved by Guests Award by Hotels.com (2020-2021)

• Travellers

’

Choice Award by TripAdvisor (2020-2021)

• Trusted Cleanliness Badge by TrustYou (2021)

• Anti-epidemic Hygiene Measures Certification by Hong Kong Quality Assurance Agency

(2020)

• Certificate of Excellence by TripAdvisor (2019)

• Guest Rated Award

“

Excellent

”

by Expedia.com (2018)

• Best Serviced Apartment Award by GoHome.com.hk (2017-2018)

• Guest Review Awards by Booking.com (2015-2018)

248

2014

9,600 sq. m.

7,197 sq. m.

1

1

iBusiness

Lobby

iclub SHEUNG WAN HOTEL

Annual Report 2023

15

Connecting Room

18 Merlin Street,

North Point, Hong Kong.

Tel: (852) 3963 6300

Fax: (852) 3963 6322

Email: [email protected]

Website: fortresshill.iclub-hotels.com

• A contemporary select-service hotel with 338 chic and trendy guestrooms

• Convenient location within walking distance to Fortress Hill or Tin Hau MTR stations

• 2 MTR stations away from the Hong Kong Convention & Exhibition Centre and

commercial hub in Eastern District (Tai Koo Place)

• Easy access to East Coast Park and Victoria Park, the biggest park on Hong Kong

Island

• The only pet-friendly hotel in Fortress Hill providing designated floor and pets

playground

• Newly equipped family iSuite with microwave

• New kitchen equipment for long stay guests

• Relaxed outdoor garden with exclusive clubhouse-like experiences

• Newly equipped entertainment corner with board games

• Connecting rooms for travelling group

• Rooms on higher floors feature fascinating harbour view and Hong Kong skyline

• Daily complimentary morning refreshments and coffee & tea throughout the day in

iLounge

• 24-hour self-service laundry and drying facilities

• 24-hour complimentary use of computers in iEngage

• 24-hour complimentary use of fitness facilities in Sweat Zone

• A completely smoke-free hotel

• Gold Benchmarking Certificate by EarthCheck (2024)

• Popular Hotel of The Year by MeiTuan Hotel (2023)

• Best Performance by Trip.com Group (2023)

• Trusted Cleanliness Badge by TrustYou (2020)

• Travellers

’

Choice Award by TripAdvisor (2020)

• Anti-epidemic Hygiene Measures Certification by Hong Kong Quality Assurance Agency

(2020)

• Certificate of Excellence by TripAdvisor (2019)

• Carbon Reduction Certificate by Hong Kong Green Organisation Certification (2018)

338

2014

9,400 sq. m.

6,849 sq. m.

1

1

Carpark

iLounge

iclub FORTRESS HILL HOTEL

Annual Report 2023

16

iBusiness Premier

iSelect Premier

Hotel Lobby

8 Ha Heung Road,

To Kwa Wan, Hong Kong.

Tel: (852) 3963 6600

Fax: (852) 3963 6622

Email: [email protected]

Website: tokwawan.iclub-hotels.com

• A contemporary select-service hotel opened in 2017 with 340 chic and trendy

guestrooms

• Close to To Kwa Wan MTR station of the Tuen Ma Line

• 3-minute walking distance to the airport bus station

• Flexible room configuration accommodates up to 6 guests in a room, ideal for families

and travelling group

• Rooms on higher floors feature fascinating harbour view and Hong Kong skyline

• Daily complimentary morning refreshments

• 24-hour self-service laundry and drying facilities

• 24-hour complimentary use of computers in iEngage

• 24-hour complimentary use of fitness facilities in Sweat Zone

• A completely smoke-free hotel

• Silver Benchmarking Certificate by EarthCheck (2024)

• Outstanding Partner Award by MeiTuan Hotel (2023)

• Travellers

’

Choice Award by TripAdvisor (2020-2021)

• Anti-epidemic Hygiene Measures Certification by Hong Kong Quality Assurance Agency

(2020)

• Trusted Cleanliness Badge by TrustYou (2020)

• City Hotel of the Year 2018 by GHM (Guangdong, Hong Kong, Macao) Hotel General

Managers Society (2018)

• Indoor Air Quality Certificate – Good Class by Environmental Protection Department

(2017-2018)

340

2017

9,490 sq. m.

6,298 sq. m.

1

1

iclub TO KWA WAN HOTEL

Annual Report 2023

17

REPORT OF THE REIT MANAGER

The Directors of the REIT Manager herein present their report together with the audited consolidated financial statements

of Regal Real Estate Investment Trust (

“

Regal REIT

”

) and its subsidiaries (collectively, the

“

Group

”

) for the year ended 31st

December, 2023.

LONG-TERM OBJECTIVES AND VISION OF REGAL REIT

The primary objectives of Regal REIT and the REIT Manager are to provide long-term stable, growing distributions and

capital growth for the unitholders of Regal REIT (the

“

Unitholders

”

) through active ownership of hotels and strategic

investment in hotels, serviced apartments and/or commercial properties (including office and retail properties).

The vision of Regal REIT and the REIT Manager is to build up the existing portfolio of hotel properties in Hong Kong and to

be a pre-eminent owner of quality international hotels and other properties with a primary focus in Hong Kong as well as

to reinforce Regal REIT

’

s status as a growing attractive option for investors.

ORGANISATION AND STRUCTURE OF REGAL REIT

Regal REIT was constituted by a trust deed dated 11th December, 2006 (as amended and restated by a first amending

and restating deed dated 23rd March, 2021 and a second amending and restating deed dated 31st January, 2024) (the

“

Trust Deed

”

) entered into between the REIT Manager and the Trustee of Regal REIT. Regal REIT is a collective investment

scheme established in the form of a unit trust under Hong Kong laws and its units (the

“

Units

”

) have been listed on the

main board of The Stock Exchange of Hong Kong Limited (the

“

HK Stock Exchange

”

) since 30th March, 2007 (the

“

Listing

Date

”

).

Regal REIT is regulated by the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong) (the

“

SFO

”

), the

Code on Real Estate Investment Trusts (the

“

REIT Code

”

) and the Rules Governing the Listing of Securities on The Stock

Exchange of Hong Kong Limited (the

“

Listing Rules

”

), as if they were applicable to Regal REIT.

As at 31st December, 2023, the property portfolio of Regal REIT was comprised of (a) Regal Airport Hotel, Regal Hongkong

Hotel, Regal Kowloon Hotel, Regal Oriental Hotel and Regal Riverside Hotel (collectively, the

“

Initial Hotels

”

); and (b) iclub

Wan Chai Hotel, iclub Sheung Wan Hotel, iclub Fortress Hill Hotel and iclub To Kwa Wan Hotel (collectively, the

“

iclub

Hotels

”

).

The REIT Manager and the Trustee

The REIT Manager is licensed by the Securities and Futures Commission in Hong Kong (the

“

SFC

”

) to undertake the

regulated activity of asset management. The REIT Manager does not manage the five Initial Hotels or the four iclub Hotels

directly.

The Trustee is DB Trustees (Hong Kong) Limited, a wholly-owned subsidiary of Deutsche Bank AG. The Trustee is qualified

to act as a trustee for collective investment schemes authorised under the SFO. In this role, the Trustee holds the assets

of Regal REIT in trust for the benefit of the Unitholders as a whole and oversees the activities of the REIT Manager for

compliance with the Trust Deed and all regulatory requirements.

Annual Report 2023

18

The RHIHL Lessee and the Hotel Manager

The Initial Hotels are leased to Favour Link International Limited (the

“

RHIHL Lessee

”

), a wholly-owned subsidiary of Regal

Hotels International Holdings Limited (

“

RHIHL

”

, together with its relevant subsidiaries, collectively, the

“

RHIHL Group

”

),

with lease terms expiring on 27th December, 2028 (for Regal Airport Hotel) and 31st December, 2030 (for each of Regal

Hongkong Hotel, Regal Kowloon Hotel, Regal Oriental Hotel and Regal Riverside Hotel) under the relevant lease agreements

and supplemental lease agreements (together, the

“

Initial Hotels Lease Agreements

”

). The market rental packages for each

of the Initial Hotels will be determined annually by a jointly appointed independent professional property valuer.

Regal Hotels International Limited, a wholly-owned subsidiary of RHIHL, was appointed as the hotel manager (the

“

Hotel

Manager

”

) under long-term hotel management agreements to operate the Initial Hotels (the

“

Initial Hotels Management

Agreements

”

) for a term of twenty years from 16th March, 2007. On 20th December, 2019, Regal REIT entered into a

hotel management agreement with the Hotel Manager for the operation of the hotel portion of iclub Wan Chai Hotel for

a term of ten years from 1st January, 2021 to 31st December, 2030 (the

“

Wan Chai Hotel Management Agreement

”

) and

the iclub Wan Chai Hotel is self-operated and not leased out by Regal REIT.

The iclub Sheung Wan Hotel is leased to the RHIHL Lessee with the lease term expiring on 31st December, 2024 under

a lease agreement (the

“

SW Lease Agreement

”

). The Hotel Manager was appointed as the hotel manager of the iclub

Sheung Wan Hotel under a 10-year hotel management agreement (the

“

SW Hotel Management Agreement

”

) commencing

on 10th February, 2014. On 11th January, 2024, Regal REIT and the RHIHL Lessee entered into supplemental deeds

amending (a) the SW Lease Agreement to extend the lease term of ten years from 1st January, 2025 to 31st December,

2034; and (b) the SW Hotel Management Agreement to extend its term from the expiry date of its current term (i.e., 9th

February, 2024) to 31st December, 2034 with the inclusion of a new non-fault based early termination provision exercisable

only by the lessor, respectively. The market rental packages for the extended lease term of the iclub Sheung Wan Hotel will

continue to be determined annually by a jointly appointed independent professional property valuer. Such extended terms

for the SW Lease Agreement and the SW Hotel Management Agreement were approved by the independent Unitholders at

the extraordinary general meeting of Regal REIT held on 31st January, 2024.

The iclub Fortress Hill Hotel is leased to the RHIHL Lessee with the lease term expiring on 31st December, 2024 under a

lease agreement (the

“

FH Lease Agreement

”

). The Hotel Manager was also appointed as the hotel manager of the iclub

Fortress Hill Hotel under a 10-year hotel management agreement (the

“

FH Hotel Management Agreement

”

) commencing

on 28th July, 2014. On 11th January, 2024, Regal REIT and the RHIHL Lessee entered into supplemental deeds amending (a)

the FH Lease Agreement to extend the lease term of ten years from 1st January, 2025 to 31st December, 2034; and (b) the

FH Hotel Management Agreement to extend its term from the expiry date of its current term (i.e., 27th July, 2024) to 31st

December, 2034 with the inclusion of a new non-fault based early termination provision exercisable only by the lessor,

respectively. The market rental packages for the extended lease term of the iclub Fortress Hill Hotel will continue to be

determined annually by a jointly appointed independent professional property valuer. Such extended terms for the FH Lease

Agreement and the FH Hotel Management Agreement were approved by the independent Unitholders at the extraordinary

general meeting of Regal REIT held on 31st January, 2024.

On 4th September, 2017, Regal REIT acquired the iclub To Kwa Wan Hotel and leased it to the RHIHL Lessee for hotel

operations for a term of five years commencing on 4th September, 2017 under a lease agreement (the

“

TKW Lease

Agreement

”

), which is extendable at the option of Regal REIT for a further term to 31st December, 2027. On 29th

December, 2021, Regal REIT exercised its options to extend the lease term of the iclub To Kwa Wan Hotel for a further

term, commencing from 4th September, 2022 and expiring on 31st December, 2027 (both days inclusive). On 8th June,

2022, Regal REIT and the RHIHL Lessee entered into the supplemental deed amending the TKW Lease Agreement to

formally effect the extension of the abovementioned lease term. The Hotel Manager was appointed as the hotel manager

of the iclub To Kwa Wan Hotel under a 10-year hotel management agreement (the

“

TKW Hotel Management Agreement

”

)

commencing on 4th September, 2017.

Annual Report 2023

19

HOTEL PORTFOLIO

The portfolio of nine hotel properties of Regal REIT are strategically located in different districts in Hong Kong, enabling

hotel guests to have easy and convenient access to the mass transit network and other public transportation networks.

The Regal REIT

’

s hotel portfolio is comprised of two hotel types, namely, full-service hotels, which offer a wide range of

services including food and beverage outlets and other facilities, and select-service hotels, which offer contemporary design

and are equipped with tech-savvy facilities.

Hotel Types District Location No. of Rooms Operations Mode

Full-service hotels:

Regal Airport Hotel Chek Lap Kok 1,171 Under Lease

Regal Hongkong Hotel Causeway Bay 481 Under Lease

Regal Kowloon Hotel Tsim Sha Tsui 600 Under Lease

Regal Oriental Hotel Kowloon City 494 Under Lease

Regal Riverside Hotel Shatin 1,147 Under Lease

3,893

Select-service hotels:

iclub Wan Chai Hotel Wan Chai 99 Self-operated

iclub Sheung Wan Hotel Sheung Wan 248 Under Lease

iclub Fortress Hill Hotel Fortress Hill 338 Under Lease

iclub To Kwa Wan Hotel To Kwa Wan 340 Under Lease

1,025

Total 4,918

RENTAL AND REVENUE STRUCTURE

Initial Hotels – Rental Revenue Derived from Hotel Operations

Rental revenues, represented by base rent and variable rent in respect of the Initial Hotels, are derived from hotel

operations, that is, from the hotel businesses leased to the RHIHL Group and managed by the Hotel Manager.

Specifically, total hotel revenue consists of the following:

Room revenue, which is primarily driven by hotel room occupancy rates and achieved average room rates;

Food and beverage revenue (

“

F&B Revenue

”

), which is primarily driven by banquet business, local patron and hotel

room guests

’

usage of bars and restaurants; and

Other income, which consists of ancillary hotel revenue and other items, which is mainly driven by hotel room

occupancy rates which, in turn, affect telephone, internet and business centre usage, spa and health centres, parking

and dry cleaning/laundry services.

Hotel operating costs and expenses consist of direct costs and expenses attributable to the respective operating

departments, e.g. rooms department, food and beverage department, etc. as well as costs and expenses attributable to

overhead departments such as the administration department, the sales and marketing department and the repairs and

maintenance department.

Annual Report 2023

20

Most categories of variable expenses, such as certain labour costs in housekeeping and utility costs, fluctuate with changes

in the levels of room occupancies. The cost of goods sold in the hotel business, such as food products and beverages,

fluctuate with guest frequency of dining in restaurants, bars and banquets.

The following performance indicators are commonly adopted in the hotel industry:

Room occupancy rates;

Average room rates; and

RevPAR, room revenue divided by rooms available, or a product of the occupancy rates and the average room rates

(RevPAR does not include F&B Revenue or other income, i.e. only room revenue).

Initial Hotels – Rental Structure and Market Rental Packages

Pursuant to the Initial Hotels Lease Agreements, for the years 2011 to 2028 (for Regal Airport Hotel) and 2030 (for the

other four Initial Hotels), respectively, the rental packages in respect of the Initial Hotels are determined on a yearly basis

by a jointly appointed independent professional property valuer. The determinations comprise the amount of market

rents (inclusive of the amount of base rent (the

“

Base Rent

”

) for each Initial Hotel, the variable rent (the

“

Variable Rent

”

)

sharing percentage and the RHIHL Lessee

’

s contributions to the furniture, fixtures and equipment (the

“

FF&E

”

) reserve

calculated as a percentage of total hotel revenue) to be applied for each of the Initial Hotels for the relevant respective

years from 2011 to 2028 (for Regal Airport Hotel) and 2030 (for the other four Initial Hotels), respectively, together with

the amount of the security deposit required (collectively, the

“

IH Market Rental Package

”

).

IH Market Rental Package for 2023

According to the IH Market Rental Package for 2023, the aggregate Base Rent for the Initial Hotels was determined at

HK$480.0 million, to be payable by cash by the RHIHL Lessee on a monthly basis. Regal REIT would be entitled to receive

Variable Rent based on 50% sharing of any excess of the aggregate NPI over the aggregate Base Rent. No FF&E reserve is

required to be contributed by the RHIHL Lessee and the obligation for such contribution rests with the Lessors. The RHIHL

Lessee has provided third party guarantees as security deposits for an aggregate amount of HK$120.0 million, which is

equivalent to three months

’

Base Rent.

IH Market Rental Package for 2024

An independent professional property valuer, Ms. Stella Ho, was jointly appointed by the lessors and the RHIHL Lessee in

June 2023 to conduct rent reviews for the Initial Hotels for 2024. According to the determination of the IH Market Rental

Package for 2024, the aggregate amount payable by the RHIHL Lessee as Base Rent was determined to be HK$544.0

million, with Variable Rent continuing to be based on sharing 50% of the excess of the aggregate NPI from the operations

of the Initial Hotels over the aggregate Base Rent thereof in 2024. No FF&E reserve is required to be contributed by the

RHIHL Lessee and the obligation for such contribution rests with the lessors.

The RHIHL Lessee has provided third party guarantees as security deposits, effective on 1st January, 2024, for an aggregate

amount of HK$136.0 million, which is equivalent to three months

‘

aggregate Base Rent of the Initial Hotels for 2024,

issued by a licensed bank in Hong Kong. Details of the IH Market Rental Package for 2024 can be referred to in an

announcement published by the REIT Manager on 12th September, 2023.

Annual Report 2023

21

iclub Wan Chai Hotel – Revenue Structure

Hotel Portion

The hotel portion of iclub Wan Chai Hotel, which is under an owner-operate mode, is managed by the Hotel Manager

under the Wan Chai Hotel Management Agreement. Gross hotel revenue and the associated operating costs and expenses

are accounted for directly by Regal REIT.

Non-hotel Portions

iclub Wan Chai Hotel – non-hotel portions, comprised of a portion of the ground floor and the 27th to 29th floors of the

premises, are let out for generating monthly rental income.

iclub Sheung Wan Hotel – Rental Structure and Market Rental Package

Pursuant to the SW Lease Agreement and its supplemental deed, the RHIHL Lessee is obligated to pay rentals in respect

of the iclub Sheung Wan Hotel to Regal REIT for the period from 10th February, 2014 to 31st December, 2034, with fixed

rentals for the first three years of the lease term.

After the lapse of the three initial lease years, market rental reviews by a jointly appointed independent professional

property valuer take place annually for each of the remaining periods of the lease term to determine the market rental

components (comprising the Base Rent, Variable Rent and lessee

’

s contribution to the FF&E reserve) together with the

amount of the security deposit required (collectively, the

“

SW Market Rental Package

”

).

SW Market Rental Package for 2023

According to the determination of SW Market Rental Package for 2023, the Base Rent payable by the RHIHL Lessee was

HK$32.0 million, with Variable Rent to be based on 50% of the excess of the NPI over the Base Rent. No FF&E reserve is

required to be contributed by the RHIHL Lessee and the obligation for such contribution rests with the lessor. The RHIHL

Lessee has provided a third party guarantee as a security deposit for an amount of HK$8.1 million, which is equivalent to

three months

’

Base Rent together with rates and Government rent of the iclub Sheung Wan Hotel for 2023.

SW Market Rental Package for 2024

The same independent professional property valuer, Ms. Stella Ho, was jointly appointed in June 2023 to determine the

SW Market Rental Package for 2024. According to the determination of the SW Market Rental Package for 2024, the Base

Rent to be payable by the RHIHL Lessee is HK$42.0 million, with Variable Rent to be based on 50% of the excess of the

NPI over the Base Rent. No FF&E reserve is required to be contributed by the RHIHL Lessee and the obligation for such

contribution rests with the lessor. The RHIHL Lessee is required to provide a third party guarantee as a security deposit,

effective on 1st January, 2024, for an amount of HK$10.6 million, which is equivalent to three months

’

Base Rent together

with rates and Government rent of the iclub Sheung Wan Hotel for 2024. Details of the SW Market Rental Package for

2024 can be referred to in an announcement published by the REIT Manager on 12th September, 2023.

Annual Report 2023

22

iclub Fortress Hill Hotel – Rental Structure and Market Rental Package

Pursuant to the FH Lease Agreement and its supplemental deed, the RHIHL Lessee is obligated to pay rentals in respect of

the iclub Fortress Hill Hotel to Regal REIT for the period from 28th July, 2014 to 31st December, 2034, with fixed rentals

for the first three years of the lease term.

After the lapse of the three initial lease years, market rental reviews by a jointly appointed independent professional

property valuer take place annually for each of the remaining periods of the lease term to determine the market rental

components (comprising the Base Rent, Variable Rent and lessee

’

s contribution to the FF&E reserve) together with the

amount of the security deposit required (collectively, the

“

FH Market Rental Package

“

).

FH Market Rental Package for 2023

According to the determination of FH Market Rental Package for 2023, the Base Rent payable by the RHIHL Lessee was

HK$30.0 million, with Variable Rent to be based on 50% of the excess of the NPI over the Base Rent and no FF&E reserve

is required to be contributed by the RHIHL Lessee and the obligation for such contribution rests with the lessor. The RHIHL

Lessee has provided a third party guarantee as a security deposit for an amount of HK$7.8 million, which is equivalent to

three months

’

Base Rent together with rates and Government rent of the iclub Fortress Hill Hotel for 2023.

FH Market Rental Package for 2024

Concurrent with the appointment as independent professional property valuer for the SW Market Rental Package 2024,

Ms. Stella Ho was also appointed in June 2023 to determine the FH Market Rental Package for 2024. According to the

determination of the FH Market Rental Package for 2024, the Base Rent to be payable by the RHIHL Lessee is HK$40.0

million, with Variable Rent to be based on 50% of the excess of the NPI over the Base Rent. No FF&E reserve is required

to be contributed by the RHIHL Lessee and the obligation for such contribution rests with the lessor. The RHIHL Lessee is

required to provide a third party guarantee as a security deposit, effective on 1st January, 2024, for an amount of HK$10.3

million, which is equivalent to three months

’

Base Rent together with rates and Government rent of the iclub Fortress Hill

Hotel for 2024. Details of the FH Market Rental Package for 2024 can be referred to in an announcement published by the

REIT Manager on 12th September, 2023.

iclub To Kwa Wan Hotel – Rental Structure

Pursuant to the TKW Lease Agreement and its supplemental deed, the RHIHL Lessee is obligated to pay rentals in respect

of the iclub To Kwa Wan Hotel to Regal REIT for the period from 4th September, 2017 to 31st December, 2027, with fixed

rentals for the first five years of the lease term.

After the lapse of the five initial lease years, market rental reviews by a jointly appointed independent professional property

valuer take place annually for each of the remaining periods of the lease term to determine the market rental components

(comprising the Base Rent, Variable Rent and the lessee

’

s contribution to the FF&E reserve) together with the amount of

security deposit required (collectively, the

“

TKW Market Rental Package

”

).

Annual Report 2023

23

TKW Market Rental Package for 2022/23

The same independent professional property valuer, Ms. Stella Ho, was jointly appointed in March 2022 to conduct the

first rent review for the iclub To Kwa Wan Hotel for the period from 4th September, 2022 to 31st December, 2023 (the

“

TKW 2022/23 Lease Year

”

). According to the determination of the TKW Market Rental Package for the TKW 2022/23

Lease Year, the pro-rated Base Rent payable by the RHIHL Lessee for the first period of the TKW 2022/23 Lease Year (from

4th September, 2022 to 31st December, 2022) is HK$8.775 million, while the Base Rent for the second period of the

TKW 2022/23 Lease Year (from 1st January, 2023 to 31st December, 2023) is HK$30.0 million, with Variable Rent to be

based on 50% of the excess of the NPI over the Base Rent and no FF&E reserve is required to be contributed by the RHIHL

Lessee and the obligation for such contribution rests with the lessor for the whole period of the TKW 2022/23 Lease Year.

The RHIHL Lessee has provided a third party guarantee as a security deposit for an amount of HK$7.0 million (for the first

period of the TKW 2022/23 Lease Year) and HK$7.8 million (for the second period of the TKW 2022/23 Lease Year).

TKW Market Rental Package for 2024

The same independent professional property valuer, Ms. Stella Ho, was jointly appointed in June 2023 to determine the

TKW Market Rental Package for 2024. According to the determination of the TKW Market Rental Package for 2024, the

Base Rent to be payable by the RHIHL Lessee is HK$36.0 million, with Variable Rent to be based on 50% of the excess of

the NPI over the Base Rent. No FF&E reserve is required to be contributed by the RHIHL Lessee and the obligation for such

contribution rests with the lessor. The RHIHL Lessee is required to provide a third party guarantee as a security deposit,

effective on 1st January, 2024, for an amount of HK$9.3 million, which is equivalent to three months

’

Base Rent together

with rates and Government rent of the iclub To Kwa Wan Hotel for 2024. Details of the TKW Market Rental Package for

2024 can be referred to in an announcement published by the REIT Manager on 12th September, 2023.

Furniture, Fixtures & Equipment Reserve

Regal REIT is obligated under the respective Initial Hotels Lease Agreements, the Wan Chai Hotel Management Agreement,

the SW Lease Agreement and its supplemental deed, the FH Lease Agreement and its supplemental deed and the TKW

Lease Agreement and its supplemental deed to maintain a reserve to fund expenditures for replacements of FF&E in the

respective hotels during the year.

During the year, Regal REIT contributed amounts equal to 2% of the total hotel revenue (i.e. the total of room revenue,

food and beverage revenue and/or other income of the hotel properties) for each month and, as a result, HK$28.1 million

was contributed to the FF&E reserve with corresponding expenditures of HK$32.4 million being recorded for the purposes

intended.

Capital Addition Projects

As an ongoing initiative, Regal REIT invests in capital addition projects for continuous upgrade on the quality and

standards of the rooms and facilities for its hotel properties. Regal REIT undertakes, in addition to the FF&E reserve, the

funding of capital addition projects with the objective of improving portfolio competitiveness and product offerings to

enhance income generating capabilities, profitability of the hotel property portfolio and enable special utilisations. Other

enhancement projects may also be conducted to comply with updated licensing requirements or to conform to legislation

enactments and standards from time to time.

Annual Report 2023

24

REVIEW OF OPERATIONS AND FINANCIAL RESULTS

The results of the Group for the year ended 31st December, 2023 are set out in the consolidated financial statements.

Review of the Economic Environment in 2023

According to research issued by the International Monetary Fund (IMF) in late 2023, the pace of recovery has moderated,

after a strong initial rebound from the depths of the COVID-19 pandemic. Several forces are holding back the recovery.

Some reflect the long-term consequences of the pandemic, war in Ukraine, and increasing geoeconomic fragmentation.

Others are more cyclical, including the effects of monetary policy tightening necessary to reduce inflation, withdrawal of

fiscal support amid high debt, and extreme weather events

1

.

Despite signs of economic resilience in earlier 2023 and progress in reducing headline inflation, economic activity is still

generally falling short of pre-pandemic projections. The strongest recovery among major economies has been in the United

States, where GDP in 2023 is estimated to exceed its pre-pandemic path. The euro area has recovered, though less strongly

and below pre-pandemic projections, reflecting greater exposure to the war in Ukraine and the associated adverse terms-

of-trade shock, as well as a spike in imported energy prices

1

.

GDP growth in China reached 5.2%

2

in 2023 and growth momentum is fading following a COVID-19 reopening surge in

early 2023. Real estate investment and housing prices continue to decline, putting pressure on local governments

’

revenues

from land sales and threatening already fragile public finances

1

.

For 2023 as a whole, Hong Kong

’

s GDP increased by 3.2%

3

in real terms over 2022, following a contraction of 3.7% in

2022. Exports of services staged a strong rebound, benefitting from the revival of visitor arrivals after the resumption of

normal travel with the Mainland and the rest of the world. Private consumption expenditure turned to a notable increase

after the removal of anti-epidemic measures, supported by rising household incomes and the Government

’

s various

initiatives. Overall investment expenditure reverted to growth in tandem with the economic recovery. Yet, total exports of

goods fell further amid the challenging external environment

4

.

According to statistics published by the Census and Statistics Department of the Hong Kong Government, the seasonally

adjusted unemployment rate of Hong Kong stood at 2.9% in October - December 2023, same as that in September -

November 2023. This is 0.6 percentage point lower than the same period last year. The unemployment rates of the various

sectors stayed low in October - December 2023. Compared with the preceding three-month period, the unemployment

rates of most sectors either declined or stayed unchanged. The underemployment rate also remained unchanged at 1.0%

in the two periods. Movements in the underemployment rate in different industry sectors varied, but the magnitudes were

generally not large

5

.

1

Source: Publications, International Monetary Fund,

“

World Economic Outlook – Navigating Global Divergences

”

, 10th October,

2023.

2

Source: Press Release, National Bureau of Statistics of China,

“

National Economy Witnessed Momentum of Recovery with Solid

Progress in High-quality Development in 2023

”

, 17th January, 2024.

3

Source: Budget Speech, The 2024-25 Budget,

“

Economic Situation in 2023

”

, 28th February, 2024.

4

Source: Press Release, Census & Statistics Department,

“

Advance estimates on Gross Domestic Product for fourth quarter and

whole year of 2023

”

, 31st January, 2024.

5

Source: Press Release, Census and Statistics Department,

“

Unemployment and underemployment statistics for October – December

2023

”

, 18th January, 2024.

Annual Report 2023

25

Visitor Arrivals in Hong Kong, 2023 versus 2022

6

Visitors to Hong Kong by

Geographical Regions

2023

(Percentage

of total

visitors)

2023

(No. of

visitors)

2022

(No. of

visitors)

Variance

(No. of

visitors)

Variance

(%)

Mainland China 78.71% 26,760,453 375,130 26,385,323 7,033.6%

South & Southeast Asia 7.12% 2,420,644 78,491 2,342,153 2,984.0%

North Asia 2.20% 749,388 15,664 733,724 4,684.1%

Taiwan 2.31% 783,778 24,249 759,529 3,132.2%

Europe, Africa & the Middle East 2.54% 864,031 44,542 819,489 1,839.8%

The Americas 2.66% 904,205 41,735 862,470 2,066.5%

Australia, New Zealand & South Pacific 0.86% 293,145 14,528 278,617 1,917.8%

Macau SAR/Not identified 3.60% 1,224,016 10,225 1,213,791 11,870.8%

Totals 100% 33,999,660 604,564 33,395,096 5,523.8%

Overnight visitors included in above 50.5% 17,159,320 567,785 16,591,535 2,922.2%

Following the removal of all travel restrictions early last year, Hong Kong received a total of about 34 million visitors in

2023. Due to the low comparative base, this reflected an increase of 55 times year-on-year, but, as a matter of fact, it only

represented about 55% of the aggregate visitor arrivals in the pre-COVID times. Visitors from China continued to account

for the largest share in the local tourism sector. As per the Hong Kong Tourism Board (HKTB), the trend for overnight-

visitors percentage improved and stood at 50% in the fourth quarter, with an average stay of about 3.6 nights

7

.

Mainland China visitors increased and recorded a growth rate of 70 times, with arrivals aggregating approximately 26.8

million, representing 78.7% of the total visitor arrivals to Hong Kong in 2023.

Arrivals from short-haul markets comprising other Asian regions (including North Asia, South & Southeast Asia, Taiwan and

Macau) were reported as 5.2 million and accounted for 15.2% of total arrivals, representing a growth rate of 39 times as

compared to 2022.

For the long-haul markets, a growth rate of nearly 20 times was recorded, with total arrivals of approximately 2.1 million.

Visitors from the Americas also displayed an increase with a growth rate of 21 times and represented 2.7% of the total

number of visitors. Overall, visitor arrivals from the European, Africa and the Middle East markets recorded an aggregate

growth of 18 times, with the visitor number reaching 0.9 million and accounting for 2.5% of total arrivals.

Similar to other international gateway cities, in-bound visitor numbers drive the core lodging demand for the local hotel

industry. Overnight visitors aggregated approximately 17.2 million, representing 50.5% of total arrivals and showing an

increase of 29 times year-on-year.

6

Source: Research, Hong Kong Tourism Board,

“

Visitor Arrival Statistics – Dec 2023

”

, January 2024;

“

Visitor Arrival Statistics – Dec

2022

”

, January 2023; the REIT Manager.

7

Source: News, The Standard,

“

Hong Kong welcomes 34 million tourists in 2023 with mainland being largest market

”

, 13th

January, 2024.

Annual Report 2023

26

Review of Hotel Room Supply in Hong Kong in 2023 and Forecast for 2024

In 2023, the hotel room supply in Hong Kong reported growth of 1.0% over 2022. This represented an annual increase

of 904 units from 89,205 to 90,109 rooms. During the year under review, 2 new hotel properties were opened and the

number rose from 319 to 321, posting year-on-year growth of 0.6%. A continuing increase in the new room supply by

616 units in 2024 with 2 new hotels is anticipated. By the end of 2024, it is projected that the hotel room supply will

reach 90,725 with an increase of about 0.7% over the preceding year

8

.

Industry Performance

Room Occupancy Rates, Average Room Rates and RevPAR (Revenue per available room) of the different category of hotels

are summarized below.

Hong Kong Hotel Market Performance (2023 versus 2022)

9

Room Occupancy Rates Average Room Rates RevPAR

2023 2022 2023 2022 2023 2022

Category % % HK$ HK$ HK$ HK$

High Tariff A 76 56 2,347 1,707 1,784 956

High Tariff B 84 72 1,098 824 922 593

Medium Tariff 84 66 730 664 613 438

All Hotels 82 66 1,392 1,065 1,141 703

According to the hotel performance survey published by the HKTB, the average hotel occupancy rate for all the surveyed

hotels in different categories in Hong Kong in 2023 was 82.0%, an increase of 16.0 percentage points over 2022. While

the industry-wide average room rate improved by 30.7%, with the average Revenue per Available Room (RevPAR) of

HK$1,141, resulting in an overall increase by 62.3% or an increase of HK$438 on a year-on-year basis.

Performance Highlights of Regal REIT

Being one of the major hotel owners in Hong Kong, Regal REIT presently owns a portfolio of nine operating hotels

strategically located in different districts in Hong Kong, comprising five hotels under the full-service

“

Regal

”

brand (the

“

Initial Hotels

”

) and four hotels under the select-service

“

iclub

”

brand, commanding an aggregate of 4,918 guestrooms

and suites.

The financial performance of Regal REIT with regard to operating results and net asset value relies on the underlying

performance of the respective hotel businesses operated by the RHIHL Lessee and the self-operated iclub Wan Chai Hotel,

all under the management of the Hotel Manager.

While 2023 was seen as the first year after the pandemic, with the hotels shifting from the quarantine mode in 2022 and

returning to the normal hotel operating mode and, therefore, the operating statistics of the hotels owned by Regal REIT for

2023 as highlighted below may bear less reference to that for 2022 owing to the change in the business mode.

8

Source: Research, Hong Kong Tourism Board,

“

Hotel Supply Situation – as at Dec 2023

”

, March 2024; the REIT Manager.

9

Source: Research, Hong Kong Tourism Board,

“

Hotel Room Occupancy Report – Dec 2023

”

, January 2024; the REIT Manager.

Annual Report 2023

27

For year 2023 as a whole, the five Initial Hotels operated with satisfactory results, especially for those hotels in the city

area. During the year, the Initial Hotels generated aggregate total hotel revenue of HK$1,185.3 million, or an increase of

11.2% year-on-year, despite the fact that three of them operated as quarantine hotels in 2022 with higher occupancy

rates, average room rates and RevPAR under the quarantine hotel operations mode. As they shifted from the quarantine

hotel operations back to the normal hotel operations, the Initial Hotels recorded a combined average occupancy rate of

69.4% in 2023 as compared to 62.3% in the prior year.

Likewise, the other four iclub Hotels recorded satisfactory results, with individual occupancy rates all surpassing 80%, and

in particular, iclub Sheung Wan Hotel recorded a year-round occupancy rate of 90.5%.

Further details on the Individual hotel performance data and statistics for 2023 are further elaborated on the following

sections and in the valuation report section of the respective hotel property in pages 126 to 185.

Performance of the Initial Hotels

Total hotel revenue, gross operating profit (

“

GOP

”

), NPI and statistics for the combined Initial Hotels for FY2023 versus

FY2022 are set out below.

FY2023 FY2022 Variance Variance

HK$

’

million HK$

’

million HK$

’

million %

Operating Results

Room revenue 862.0 775.8 86.2 11.1%

Food and beverage revenue 305.2 235.7 69.5 29.5%

Other income 18.1 54.8 (36.7) (67.0%)

Total hotel revenue 1,185.3 1,066.3 119.0 11.2%

Operating expenses (795.1) (673.8) (121.3) (18.0%)

Gross operating profit 390.2 392.5 (2.3) (0.6%)

Other expenses (44.6) (42.9) (1.7) (4.0%)

Net rental income 37.2 40.6 (3.4) (8.4%)

Net property income 382.8 390.2 (7.4) (1.9%)

Statistics

Average room rate HK$874.20 HK$875.97 (HK$1.77) (0.2%)

Occupancy rate 69.4% 62.3% 7.1% 11.4%

RevPAR HK$606.61 HK$545.99 HK$60.62 11.1%

Total available room nights 1,420,945 1,420,945

— —

Occupied room nights 986,001 885,672 100,329 11.3%

Annual Report 2023

28

During the year under review, total hotel revenue of the Initial Hotels recorded a combined result of HK$1,185.3 million

(2022 - HK$1,066.3 million), representing an increase of HK$119.0 million or 11.2% year-on-year. GOP and NPI were

HK$390.2 million and HK$382.8 million, respectively, reflecting satisfactory results upon resumption of normal hotel

operations.

The combined average occupancy rate of the Initial Hotels in 2023 was 69.4%, as compared to 62.3% in the prior year.

While the combined average room rate remained steady and their combined average RevPAR has risen by 11.1% to

HK$606.61 year-on-year.

Base Rent

According to the IH Market Rental Package for 2023, Regal REIT received Base Rent in the form of cash for each Initial

Hotel on a monthly basis. During the year under review, Regal REIT received aggregate Base Rent of HK$480.0 million,

representing a monthly Base Rent of HK$40.0 million.

Variable Rent

Regal REIT is entitled to receive Variable Rent through the sharing of the excess aggregate NPI from the Initial Hotels

’

operations over the annual Base Rent. For the year under review, the aggregate NPI from hotel operations of the Initial

Hotels amounted to HK$382.8 million, which was below the aggregate Base Rent of HK$480.0 million. Therefore, no

Variable Rent was earned for the year.

Performance of iclub Wan Chai Hotel

The hotel portion of the iclub Wan Chai Hotel recorded an average room rate of HK$902.96 in 2023, compared to

HK$562.25 in 2022. With the year-round occupancy rate of 94.3% in 2023 (2022 - 92.6%), the RevPAR achieved for

2023 was HK$851.06 as compared to HK$520.87 for the previous year. Meanwhile, the non-hotel portions of the iclub

Wan Chai Hotel, comprised the portion of the ground floor and other areas on the 27th to 29th floors of the premises,

continued to be leased to tenants throughout the year.

Hotel portion

For the year ended 31st December, 2023, the hotel portion contributed gross hotel revenue of HK$31.3 million and

incurred operating costs and expenses of HK$14.9 million.

Non-hotel portions

For the year ended 31st December, 2023, rental income of HK$5.8 million was generated from the leasing of the non-

hotel portions.

Annual Report 2023

29

Performance of iclub Sheung Wan Hotel

For 2023, the iclub Sheung Wan Hotel achieved an overall occupancy rate of 90.5%, as compared to 86.6% in 2022. Its

average room rate of HK$823.49 (2022 - HK$510.52) increased by 61.3%, resulting in a year-on-year growth of 68.7% in

its average RevPAR.

Base Rent

According to the SW Market Rental Package for 2023, Regal REIT received Base Rent in the form of cash on a monthly

basis. During the year, Regal REIT received HK$32.0 million.

Variable Rent

Regal REIT is entitled to receive Variable Rent through the sharing of the excess NPI from the iclub Sheung Wan Hotel

’

s

operations over the Base Rent. For the year under review, as the NPI from hotel operations was HK$39.3 million, which

exceeded the Base Rent of HK$32.0 million, Variable Rent of HK$3.6 million was earned.

Performance of iclub Fortress Hill Hotel

For 2023, the iclub Fortress Hill Hotel achieved an overall occupancy rate of 84.7%, as compared to 72.6% in 2022. Its

average room rate of HK$609.55 (2022 - HK$969.31) decreased by 37.1%, resulting in a year-on-year contraction of

26.6% in its average RevPAR.

Base Rent

According to the FH Market Rental Package for 2023, Regal REIT received Base Rent in the form of cash on a monthly

basis. During the year, Regal REIT received HK$30.0 million.

Variable Rent

Regal REIT is entitled to receive Variable Rent through the sharing of the excess NPI from the iclub Fortress Hill Hotel

’

s

operations over the Base Rent. For the year under review, as the NPI from hotel operations was HK$34.7 million, which

exceeded the Base Rent of HK$30.0 million, Variable Rent of HK$2.4 million was earned.

Performance of iclub To Kwa Wan Hotel

For 2023, the iclub To Kwa Wan Hotel achieved an overall average occupancy rate of 80.8%, as compared to 70.0%

in 2022. Its average room rate of HK$579.32 (2022 - HK$1,003.43) decreased by 42.3%, resulting in a year-on-year

contraction of 33.4% in its average RevPAR, owing to the fact that it operated as a quarantine hotel in 2022.

Base Rent

According to the TKW Market Rental Package for the second period of the TKW 2022/23 Lease Year (from 1st January,

2023 to 31st December, 2023), Regal REIT received Base Rent in the form of cash on a monthly basis. During the year,

Regal REIT received HK$30.0 million.

Variable Rent

Regal REIT is entitled to receive Variable Rent through the sharing of the excess NPI from the iclub To Kwa Wan Hotel

’

s

operations over the Base Rent. For the year under review, as the NPI from hotel operations was HK$29.3 million, which fell

short of the Base Rent of HK$30.0 million, no Variable Rent was earned.

Annual Report 2023

30

Net Rental and Hotel Income

The aggregate net rental and hotel income for Regal REIT for the year ended 31st December, 2023 (as compared to the

prior year) is set out below.

2023 2022

HK$

’

million % HK$

’

million %

Initial Hotels

Base Rent 480.0 77.7 475.0 77.1

Variable Rent

— — — —

Other income 2.6 0.4 2.3 0.3

iclub Sheung Wan Hotel