pillsburylaw.com

Pillsbury Winthrop Shaw Pittman LLP

Second Edition

March 2017

World Aircraft

Repossession Index

Pillsbury Winthrop Shaw Pittman LLP

ATTORNEY ADVERTISING: Results depend on a number of factors unique to each matter.

Prior results do not guarantee a similar outcome.

Pillsbury Winthrop Shaw Pittman LLP, 1540 Broadway, New York, NY 10036, +1.888.387.5714.

© 2017 Pillsbury Winthrop Shaw Pittman LLP. All rights reserved.

pillsburylaw.com

Abu Dhabi

•

Austin

•

Beijing

•

Dubai

•

Hong Kong

•

Houston

•

London

•

Los Angeles

•

Miami

•

Nashville

•

New York

•

Northern Virginia

•

Palm Beach

Sacramento

•

San Diego

•

San Diego North County

•

San Francisco

•

Shanghai

•

Silicon Valley

•

Tokyo

•

Washington, DC

Pillsbury Winthrop Shaw Pittman LLP

World Aircraft

Repossession Index

SECOND EDITION

covering 72 jurisdictions worldwide

March 2017

Executive Editor

MARK N. LESSARD

Partner | mark.lessard@pillsburylaw.com

Executive Editor

PAUL P. JEBELY

Partner | paul.jebely@pillsburylaw.com

Executive Editor

JONATHAN C. GOLDSTEIN

Partner | jonathan.goldstein@pillsburylaw.com

General Editor

JASON. P. GREENBERG

Special Counsel | jason.greenberg@pillsburylaw.com

Co-Editor

SARAH HUMPLEBY

Counsel | sarah.humpleby@pillsburylaw.com

Co-Editor

SHARON NOURANI

Associate | sharon.nourani@pillsburylaw.com

© 2017 Pillsbury Winthrop Shaw Pittman LLP

pillsburylaw.com

© 2017 Pillsbury Winthrop Shaw Pittman LLP

pillsburylaw.com

Worldwide Aircraft Repossession Index

2

Disclaimers

Please read the following disclaimers, which apply to all material contained in this publication, before using it. The material

in this publication is provided subject to the following disclaimers.

(1) The material contained in each “One-Page Summary” and the “Local Counsel Explanatory Notes” section of this publication

has not been provided by Pillsbury Winthrop Shaw Pittman LLP (“Pillsbury”) unless otherwise stated. Instead, it has been

provided by the law firm(s) and the person(s) / contributor(s) indicated in such summary or notes.

(2) This publication is issued to inform Pillsbury clients and other interested parties of the current legal climate in certain

countries and jurisdictions that may be of interest to them in relation to aircraft, and no other use of this publication or the

material contained in this publication is permitted. The material contained herein does not constitute the legal opinion,

business advice or other advice of Pillsbury, any other law firm or any person(s) or contributor(s) identified in this publication.

The material contained in this publication is not, and should not be regarded as, a substitute for legal or business advice.

(3) NO READER MAY RELY ON THIS PUBLICATION OR THE MATERIAL CONTAINED HEREIN AS ANY FORM OF

LEGAL, BUSINESS OR OTHER ADVICE OR OPINION. EACH OF THE EXECUTIVE EDITORS, THE GENERAL EDITOR,

EACH OF THE CO-EDITORS, PILLSBURY, EACH OF THE CONTRIBUTING AUTHOR(S) AND EACH OF THEIR

RESPECTIVE LAW FIRMS, AND EACH OTHER CONTRIBUTOR TO THIS PUBLICATION EXPRESSLY DISCLAIMS

ALL LIABILITY TO ANY PERSON WITH RESPECT TO ANYTHING DONE OR OMITTED TO BE DONE, AND WITH

RESPECT TO THE CONSEQUENCES OF ANYTHING DONE OR OMITTED TO BE DONE, WHOLLY OR PARTLY IN

RELIANCE UPON THE WHOLE OR ANY PART OF THE MATERIAL CONTAINED IN THIS PUBLICATION.

(4) THE MATERIAL PROVIDED IN THIS PUBLICATION IS GENERAL AND MAY NOT APPLY IN A SPECIFIC

SITUATION. Subject to the foregoing, material provided in this publication provides a general estimate and preliminary

indication only as to the current legal climate in relation to repossessing, deregistering and exporting aircraft from the

country and jurisdiction(s) indicated, based on information received from local counsel in such country and/or jurisdiction

as of the date indicated. The actual likelihood of success for any specific set of circumstances will depend on the particular

facts and parties involved. READERS MUST OBTAIN ACTUAL AND UP-TO-DATE LEGAL AND OTHER PROFESSIONAL

ADVICE IN THE RELEVANT JURISDICTION(S) WITH RESPECT TO ANY SPECIFIC SITUATION THAT MAY RELATE

TO MATERIAL PROVIDED IN THIS PUBLICATION.

(5) THE MATERIAL PROVIDED IN THIS PUBLICATION DOES NOT REPRESENT AN EXHAUSTIVE ANALYSIS of all

legal issues in the country and/or jurisdiction(s) indicated relevant to financing, leasing, repossessing, registering, deregistering

and/or exporting aircraft in or from such country and/or jurisdiction. There are relevant issues not addressed herein and

further legal, business and other professional advice in the relevant country and/or jurisdiction(s) should be sought.

ATTORNEY ADVERTISING. Results depend on a number of factors unique to each matter. Prior results do not guarantee a similar outcome.

© 2017 Pillsbury Winthrop Shaw Pittman LLP

pillsburylaw.com

Worldwide Aircraft Repossession Index

3

Contents

Disclaimers....................................... 2

Preface ........................................... 5

About the Editors ................................. 6

The Pillsbury Asset Finance Team .................. 8

About Pillsbury .................................. 10

Methodology and Interpretation of Results..........11

Summary of Scores................................17

Aruba . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

One-page Summary

Australia ........................................20

One-page Summary

Austria ...........................................21

One-page Summary

Azerbaijan ...................................... 22

One-page Summary

Belgium......................................... 23

One-page Summary

Bermuda ........................................24

One-page Summary

Brazil ...........................................25

One-page Summary

Bulgaria.........................................26

One-page Summary

Canada.......................................... 27

ARTICLE

Catch Me If You Can: Prelude To An Aircraft Repo....28

Cayman Islands ..................................31

One-page Summary

China ...........................................32

One-page Summary

Costa Rica....................................... 33

One-page Summary

Czech Republic..................................34

One-page Summary

Denmark........................................35

One-page Summary

Dominican Republic .............................36

One-page Summary

Egypt ........................................... 37

One-page Summary

El Salvador......................................38

One-page Summary

Estonia .........................................39

One-page Summary

Fiji..............................................40

One-page Summary

Finland ......................................... 41

One-page Summary

ARTICLE

Mortgagee Duties: PK Airfinance Sarl

v Alpstream AG...................................42

France ..........................................44

One-page Summary

French Polynesia . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

One-page Summary

Germany ........................................46

One-page Summary

Guatemala ......................................47

One-page Summary

Guernsey........................................48

One-page Summary

Hong Kong ......................................49

One-page Summary

Hungary ........................................50

One-page Summary

India.............................................51

One-page Summary

Indonesia .......................................52

One-page Summary

Ireland.......................................... 53

One-page Summary

ARTICLE

Aviation Finance Unchained: The Potential

Application of Blockchain Technology ...............54

Israel ...........................................56

One-page Summary

Italy ............................................ 57

One-page Summary

Japan ...........................................58

One-page Summary

Jersey...........................................59

One-page Summary

© 2017 Pillsbury Winthrop Shaw Pittman LLP

pillsburylaw.com

Worldwide Aircraft Repossession Index

4

CONTENTS

Jordan ..........................................60

One-page Summary

Kenya ........................................... 61

One-page Summary

Korea ...........................................62

One-page Summary

Latvia...........................................63

One-page Summary

Lebanon ........................................64

One-page Summary

Lithuania .......................................65

One-page Summary

Macau ..........................................66

One-page Summary

Malaysia ........................................ 67

One-page Summary

Mauritius .......................................68

One-page Summary

Mexico..........................................69

One-page Summary

Mozambique . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 70

One-page Summary

Myanmar ........................................71

One-page Summary

Namibia......................................... 72

One-page Summary

Netherlands..................................... 73

One-page Summary

New Caledonia .................................. 74

One-page Summary

New Zealand . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 75

One-page Summary

Nigeria.......................................... 76

One-page Summary

ARTICLE

Applicability of U.S. Risk Retention Rules

to Structured Aircraft Portfolio Transactions ........ 77

Norway .........................................82

One-page Summary

Oman ...........................................83

One-page Summary

Pakistan ........................................84

One-page Summary

Papua New Guinea ..............................85

One-page Summary

Peru ............................................86

One-page Summary

Poland .......................................... 87

One-page Summary

Portugal ........................................88

One-page Summary

Romania ........................................89

One-page Summary

Russia ..........................................90

One-page Summary

Rwanda ......................................... 91

One-page Summary

Slovenia.........................................92

One-page Summary

South Africa ....................................93

One-page Summary

Sri Lanka........................................94

One-page Summary

Switzerland . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 95

One-page Summary

Taiwan (Republic of China) ......................96

One-page Summary

Turkey.......................................... 97

One-page Summary

Ukraine .........................................98

One-page Summary

United Arab Emirates ...........................99

One-page Summary

United Kingdom................................100

One-page Summary

United States....................................101

One-page Summary

Vietnam........................................102

One-page Summary

ARTICLE

All Hat and No Chattel: Does Aircraft Lease

Chattel Paper Still Matter After Cape Town? .......103

Local Counsel Explanatory Notes................. 107

World Map ......................................118

About the Contributors ..........................120

Third Party Data Notes ..........................148

Appendix: 30-Minute (Check-Box)

Jurisdictional Questionnaire ..................... 149

© 2017 Pillsbury Winthrop Shaw Pittman LLP

pillsburylaw.com

Worldwide Aircraft Repossession Index

5

Preface

World Aircraft Repossession Index

Second Edition

Pillsbury Winthrop Shaw Pittman LLP is pleased to publish this Second Edition of the World Aircraft

Repossession Index.

This edition of the World Aircraft Repossession Index covers 72 popular jurisdictions worldwide in which

aircraft are registered and operate. Utilizing seven primary criteria and a proprietary scoring methodology,

you will find a one-page summary for each jurisdiction which summarizes the expert analysis provided by

reputable local counsel and certain key data obtained from other third-party sources.

The attorneys in Pillsbury’s Asset Finance practice are well aware of the challenges of leasing and financing

aircraft in countries around the globe. When considering doing business in any jurisdiction, it is always

advisable to learn about the local issues that may have an impact on your investment. Prudent lessors and

financiers of aircraft will want to know in advance what challenges they might encounter in the event they

need to repossess, deregister and export an aircraft while it is registered or located in a foreign jurisdiction.

Analyzing jurisdictional questionnaires from legal counsel is often an important part of gathering this

knowledge. However, processing the narrative responses contained in traditional jurisdictional question-

naires and comparing such responses across various jurisdictions can be a time consuming and costly

endeavor. This publication aims to help change that.

Pillsbury has developed a “check-box” jurisdictional questionnaire (the form of which can be found in the

Appendix to this publication), which forms the foundation of our proprietary scoring system. Utilizing

this innovative framework, the World Aircraft Repossession Index presents a one-page summary for each

jurisdiction, which provides a helpful overview and focuses on the most common issues encountered in the

context of aircraft repossession, deregistration and export. Our objective scoring methodology then allows

us to rank each jurisdiction on a consistent basis across all of these common issues, as well as provide an

overall ranking for each jurisdiction.

Based on the data provided by local counsel and certain third-party data providers, the World Aircraft

Repossession Index numerically scores the legal environment for repossessing aircraft in each participating

jurisdiction. The results of our analysis are also represented in a chart and world map, indicating the compar-

ative ranking that has been assigned to each jurisdiction covered by the World Aircraft Repossession Index.

Please read the disclaimer on page 2 before using any of the information contained in this publication.

We gratefully acknowledge and would like to thank all of the contributors in each jurisdiction, as well as

each of our third-party data providers for dedicating their time, free of charge, to make this publication

possible. Special thanks to Ms. Crystal Siu, a prized Asset Finance paralegal based in Pillsbury’s Hong Kong

oce, whose eorts in support of this publication were above and beyond the call of duty. We would also

like to give due recognition to Mr. Dominic Pearson, formerly of Pillsbury, who created the World Aircraft

Repossession Index and served as the general editor of the first edition of this publication. Many thanks

to you all!

JASON P. GREENBERG

Special Counsel | Pillsbury Winthrop Shaw Pittman LLP

T 213.488.7344 | F 213.629.1033

jason.greenberg@pillsburylaw.com

Los Angeles, March 2017

© 2017 Pillsbury Winthrop Shaw Pittman LLP

pillsburylaw.com

Worldwide Aircraft Repossession Index

6

About the Editors

Mark N. Lessard, Partner and Global Head, Finance

Mark Lessard is a partner in Pillsbury’s New York oce and is the Global Head of the firm’s

Finance practice, primarily representing clients who are active in the Aviation, Aerospace and

Transportation sectors. Mr. Lessard represents lenders, lessors, investors, operators, underwriters,

liquidity providers, manufacturers, rating agencies and trustees in connection with all forms

of transportation asset-backed financings, including term loans and revolving credit facilities,

operating leases, leveraged and tax leases, as well as private placements and other capital markets

oerings, such as portfolio securitizations, EETCs and debt repackagings. Mr. Lessard has particular

experience in cross-border transactions, having placed, financed or repossessed aviation assets in

dozens of jurisdictions around the world. He is an active member of the Executive Committee of

the Legal Advisory Panel to the Aviation Working Group, which has been at the forefront of the

adoption and implementation of the Cape Town Convention on International Interests in Mobile

Equipment. Mr. Lessard is a Member of the Legal Advisory Panel to Aviation Working Group (2012-

present), and is recognized in the following publications: Chambers USA, Aviation Finance—National

(2009-2016); Legal 500 US, Asset Finance and Leasing (2010, 2013-2016); International Who’s Who

of Aviation Lawyers (2010-2013); Who’s Who Legal, Aviation—New York (2010, 2012, 2014-2016);

and Guide to the World’s Leading Aviation Lawyers, Euromoney/Legal Media Group (2013).

Paul P. Jebely, Partner and Co-Leader, Asset Finance

Paul Jebely is the managing partner of Pillsbury’s Hong Kong oce and a co-leader of the firm’s

Asset Finance practice. He is recognized as a leading aviation lawyer, advising a range of clients on

billions of dollars of commercial and business aircraft finance transactions. Mr. Jebely has been

repeatedly recognized by legal directories such as Chambers, Legal 500 and Who’s Who as a “very

highly rated” leading individual in aviation finance and singled out in Chambers as “extremely

competent,” “commercially aware,” “responsive,” “courteous,” “technically skilled,” “capable,”

“attentive” and “driven.” He has been quoted by the Financial Times, Wall Street Journal, Bloomberg,

the China Business Network and various industry publications on the basis of his experience in

the aviation markets in Asia and Africa in particular. Among other recognition, he was the 2015

recipient of the “Outstanding Contribution to African Aviation Development” award—the only

lawyer to receive the award since its inception in 1999, and was recognized by Asian Legal Business

in October 2016 among “Asia 40 Under 40” top “brightest legal minds in the region.”

Mr. Jebely is admitted to practice law in England, New York and Ontario. He is experienced in

negotiating and executing international commercial and business aircraft and engine financing,

leasing and trading transactions, and in advising in various enforcement and repossession situa-

tions. He has advised clients that represent the full range of industry participants in transactions

concerning all classes of commercial and business aircraft. He is currently the Chairman of the

Community of Hong Kong Aviation Professionals, and a member of the Board of Governors of the

Asian Business Aviation Association.

Mark N. Lessard

+1.212.858.1564

mark.lessard@pillsburylaw.com

Paul P. Jebely

+852.3959.7503

paul.jebely@pillsburylaw.com

© 2017 Pillsbury Winthrop Shaw Pittman LLP

pillsburylaw.com

Worldwide Aircraft Repossession Index

7

ABOUT THE EDITORS

Jonathan C. Goldstein, Partner, Asset Finance

Jonathan Goldstein is a partner in Pillsbury’s Asset Finance practice and is located in the

New York oce. He is recognized as a leading lawyer and rising star servicing the aviation

and rail industries. Mr. Goldstein represents sponsors, lenders, hedge funds, commercial

banks and leasing companies in connection with a broad spectrum of international financial

and corporate transactions. He advises clients on public oerings and private placement of

securities (equipment notes and portfolio securitizations), acquisitions, leveraged leasing,

secured and unsecured lending, structured financings, syndicated credit facilities, pre-delivery

payment financing and warehouse facilities. Mr. Goldstein’s practice also addresses simple

and complex bank loans, mergers and acquisitions, leveraged financings, joint ventures, sale/

resale transactions and bankruptcy workouts.

Legal 500 notes that “Mr. Goldstein has a very good reputation in aviation finance.” He has been

involved with numerous transactions that have won awards, including Overall Deal of the Year,

North American Deal of the Year and Most Innovative Deal of the Year from AirFinance Journal.

Jason P. Greenberg, Special Counsel, Asset Finance

Jason Greenberg is a special counsel in Pillsbury’s Asset Finance practice and is located in

the Los Angeles oce. His practice focuses on equipment finance and leasing, and specializes

in cross-border secured lending and commercial aircraft transactions. Mr. Greenberg has

significant experience representing lenders, borrowers, lessors, lessees, purchasers, sellers

and rating agencies, and managing transactions in jurisdictions throughout the world. Prior

to joining Pillsbury, Mr. Greenberg worked at two global top-10 commercial aircraft lessors

and in the aviation finance practice of a major international law firm.

Sarah Humpleby, Counsel, Asset Finance

Sarah Humpleby is a counsel in Pillsbury’s Asset Finance practice and is based in the London

oce. She has a broad range of asset finance experience in aircraft, rolling stock, shipping and

other equipment leasing as well as a background in general banking and finance. Ms. Humpleby

acts for clients across the aviation industry including major operating lessors, financiers and

airlines, and for operating lessors of rolling stock and has previously spent time on secondment

with Barclays. Ms. Humpleby was named as a rising star in aviation in the Airfinance Journal’s

Guide to Aviation Lawyers 2013 and in the Euromoney Rising Stars Expert Guide 2016.

Sharon Nourani, Associate, Asset Finance

Sharon Nourani is an associate in Pillsbury’s Asset Finance practice and is based in the Hong

Kong oce. She advises key clients on a broad range of cross-border, high-value aircraft finance

transactions, including finance and operating leases, sale and leasebacks, pre-delivery payment

financings and secured loan transactions.

Prior to joining Pillsbury, Ms. Nourani worked in Hong Kong in the aviation finance practice

of an international law firm.

Jonathan C. Goldstein

+1.212.858.1888

jonathan.goldstein@pillsburylaw.com

Jason P. Greenberg

+1.213.488.7344

jason.greenberg@pillsburylaw.com

Sarah Humpleby

+44.20.7847.9544

sarah.humpleby@pillsburylaw.com

Sharon Nourani

+852.3959.7506

sharon.nourani@pillsburylaw.com

© 2017 Pillsbury Winthrop Shaw Pittman LLP

pillsburylaw.com

Worldwide Aircraft Repossession Index

8

The Pillsbury Asset Finance Team

Mark N. Lessard | Partner &

Global Head of Finance

+1.212.858.1564

mark.lessard@pillsburylaw.com

Paul Jebely | Partner &

Co-leader of Asset Finance

+852.3959.7503

paul.jebely@pillsburylaw.com

Graham Tyler | Partner &

Co-leader of Asset Finance

+44.20.7847.9562

graham.tyler@pillsburylaw.com

Charlotta Otterbeck | Partner &

Leader of Asset Finance for the Americas

+1.212.858.1409

charlotta.otterbeck@pillsburylaw.com

Debra Erni | Partner

+44.20.7847.9595

debra.erni@pillsburylaw.com

Vanessa C. Gage | Partner

+1.415.983.1040

vanessa.gage@pillsburylaw.com

Jonathan C. Goldstein | Partner

+1.212.858.1888

jonathan.goldstein@pillsburylaw.com

Daniel M. Richards | Partner

+1.212.858.1324

daniel.richards@pillsburylaw.com

Jason P. Greenberg | Special Counsel

+1.213.488.7344

jason.greenberg@pillsburylaw.com

Adam Beavill | Counsel

+44.20.7847.9586

adam.beavill@pillsburylaw.com

Michael C. Berens | Counsel

+1.212.858.1135

michael.berens@pillsburylaw.com

Richard J. Evans | Counsel

+1.213.488.7192

richard.evans@pillsburylaw.com

Sarah Humpleby | Counsel

+44.20.7847.9544

sarah.humpleby@pillsburylaw.com

Melissa B. Jones-Prus | Counsel

+1.212.858.1646

melissa.jonesprus@pillsburylaw.com

Maria J. Cho | Senior Associate

+1.212.858.1452

maria.cho@pillsburylaw.com

Rakhi Savjani | Senior Associate

+44.20.7847.9578

rakhi.savjani@pillsburylaw.com

© 2017 Pillsbury Winthrop Shaw Pittman LLP

pillsburylaw.com

Worldwide Aircraft Repossession Index

9

THE PILLSBURY ASSET FINANCE TEAM

Andrés Berry | Associate

+1.212.858.1238

andres.berry@pillsburylaw.com

William DeCotiis | Associate

+1.212.858.1239

william.decotiis@pillsburylaw.com

Luca Denora | Associate

+852.3959.7504

luca.denora@pillsburylaw.com

David Flickinger | Associate

+1.212.858.1041

david.ickinger@pillsburylaw.com

John A. Hunt | Associate

+1.212.858.1095

john.hunt@pillsburylaw.com

Chris Knight | Associate

+44.20.7847.9640

chris.knight@pillsburylaw.com

E Way Liow | Associate

+852.3959.7505

eway.liow@pillsburylaw.com

Sharon Nourani | Associate

+852.3959.7506

sharon.nourani@pillsburylaw.com

Maureen J. Reed | Associate

+1.212.858.1257

maureen.reed@pillsburylaw.com

Andrew Taggart | Associate

+1.415.983.1108

andrew.taggart@pillsburylaw.com

Ella Bouet | Senior Law Clerk

+1.415.983.7223

ella.bouet@pillsburylaw.com

Golda Calonge | Senior Law Clerk

+1.212.858.1229

golda.calonge@pillsburylaw.com

Issac M. Lee | Senior Law Clerk

+1.212.858.1253

issac.lee@pillsburylaw.com

Bernadette E. Ryan | Senior Legal Analyst

+1.213.488.7139

bernadette.ryan@pillsburylaw.com

Luke Drake | Paralegal

+44.20.7847.9587

luke.drake@pillsburylaw.com

Anny Espinal | Paralegal

+1.212.858.1069

anny.espinal@pillsburylaw.com

Kanika Juyal | Paralegal

+44.20.7847.9533

kanika.juyal@pillsburylaw.com

Crystal Siu | Paralegal

+852.3959.7509

crystal.siu@pillsburylaw.com

© 2017 Pillsbury Winthrop Shaw Pittman LLP

pillsburylaw.com

Worldwide Aircraft Repossession Index

10

About Pillsbury

Pillsbury’s Asset Finance practice is a leader in the field of structuring, negotiating and

closing transactions for transportation assets, with particular emphasis on aircraft and other

aviation equipment. For more than 60 years we have been representing some of the most

active international participants in the financing of transportation assets, including major

banks, leasing companies, airlines, investors, traders and manufacturers.

Powered by a team of highly rated lawyers in the U.S., Europe

and Asia, Pillsbury’s Asset Finance practice has, in the last

5 years alone, helped a diverse range of market participants

keep more than 1,500 commerical aircraft flying, reflecting

an aggregate asset value of more than $75 billion. We have

had important roles in all of the U.S., and many foreign,

airline bankruptcies and restructurings and work closely

with lawyers in our restructuring group on these matters.

Our team also has significant experience with railroad rolling

stock, locomotives, ships, containers and fleets of land-based

vehicles, as well as other capital assets financed with similar

techniques, such as floating drilling rigs, satellites, telecom-

munications and manufacturing equipment. In recent years

we have successfully negotiated and documented Ex-Im

Bank-supported financings for equipment valued at more

than $4 billion. We have also dealt with other export credit

agencies and government-supported programs, such as

Japan Eximbank, ECGD, COFACE and HERMES.

Pillsbury’s Asset Finance practice includes attorneys in our

New York, London, Hong Kong, Los Angeles, San Francisco

and Washington D.C. oces who are supported by leading

practitioners in related fields such as taxation, aviation

regulatory, restructuring, capital markets, mergers and acqui-

sitions, international trade and licensing, corporate aviation,

insurance, accident investigations and litigation. Our team

has extensive experience with cross-border financings of

transportation assets located and operated throughout the

world and often handles large scale transactions involving

multiple jurisdictions. Our oces and network of local law

firms stand ready to assist our clients any place, any time.

This broad-based, integrated approach allows us to oer a

full range of legal services to all industry participants.

Our Asset Finance attorneys are well-known in the industry

for their cutting edge contributions whether completing

novel transactions, publishing articles on new financing

techniques, sitting on standard-setting committees or

speaking at some of the many conferences, seminars,

workshops and other events organized for the asset

finance community. These contributions are consistently

recognized by industry observers, including the prestigious

Chambers publication, which has named us one of the

leading aviation finance firms in the world. We have also

recently received awards and accolades for our legal work

from Jane’s Transport Finance, AirFinance Journal, Global

Trade Review and Trade Finance.

© 2017 Pillsbury Winthrop Shaw Pittman LLP

pillsburylaw.com

Worldwide Aircraft Repossession Index

11

Methodology and Interpretation of Results

It is critical to note that there exist many avenues for mitigating the risks that result in the

designation of a particular country as being “HIGHER RISK”, including registering an aircraft

in an alternate jurisdiction. Creating an index of this sort poses two big challenges. Firstly, in

order to allow quantitative based scoring, the jurisdictional questionnaire must be crafted in a

way that allows the questions to be eciently and comfortably answered by local counsel in a

closed-ended fashion without qualification; that is, by selecting an answer from a pre-defined

set of responses (such as “Yes” or “No”). Secondly, having boxed-in those answers so as to

allow for scoring, careful consideration must be given to how the jurisdiction may be scored

in a meaningful and useful manner. The first of these challenges has been accomplished by the

creation of what we have called the 30-Minute (Check-Box) Jurisdictional Questionnaire.

The second of these challenges has been accomplished by generating a simple but eective

weighted scoring mechanism. You should read this section to understand better what the results

contained in the one-page summaries mean, and how to interpret them.

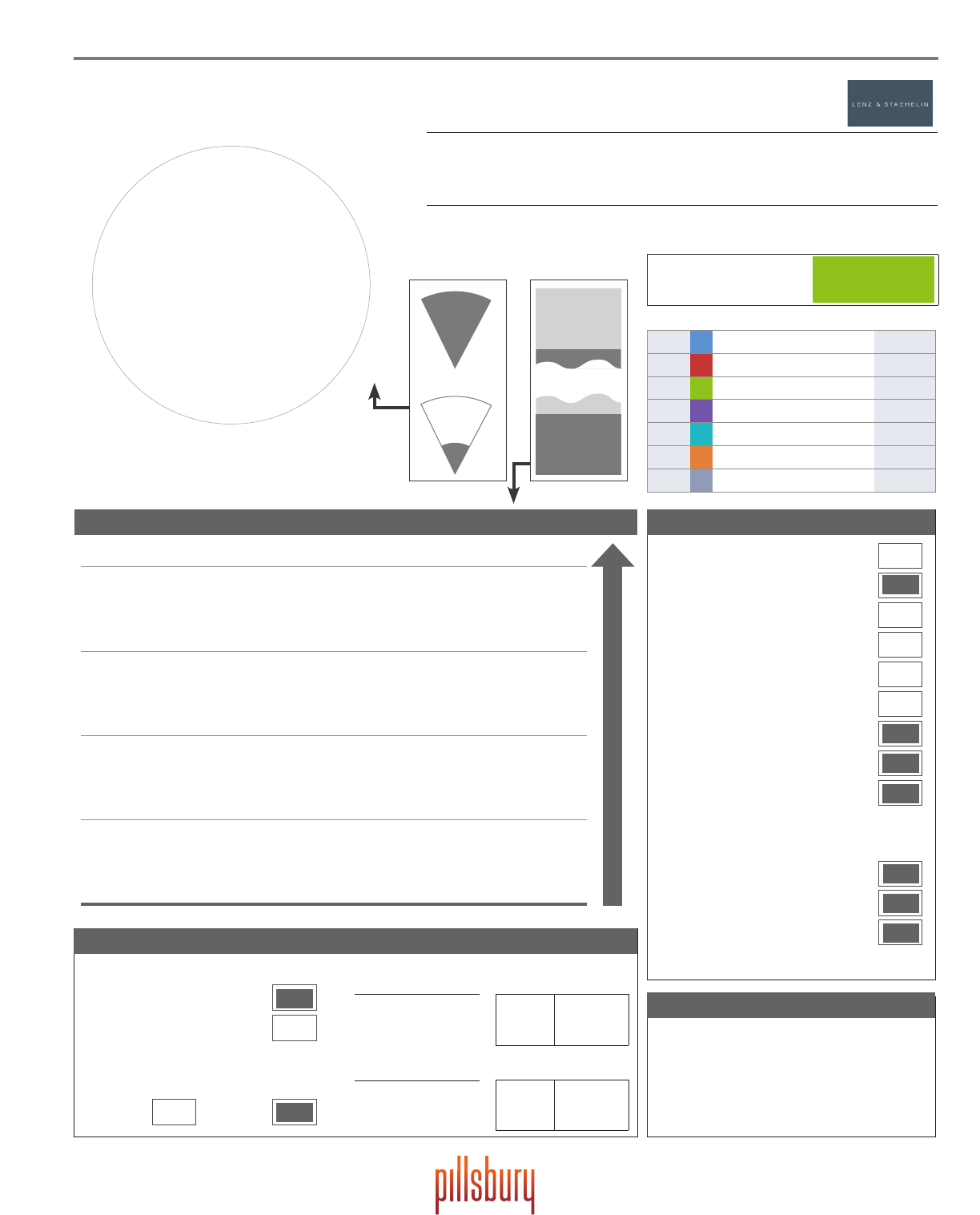

The Pillsbury World Aircraft Repossession Index measures

the legal environment for aircraft repossessions in each

country or jurisdiction using seven factors (repossession,

insolvency, deregistration, export, judgments and arbitral

awards, preferential liens and political stability). Each

factor is assigned a weighting in accordance with its relative

importance, with each factor’s score and its weighting

being used to calculate the overall score for the country or

jurisdiction. Each factor’s score is determined according

to several sub-factors comprising either: (a) the questions

asked in the jurisdictional questionnaire, or (b) certain other

information about the jurisdiction collected from external

sources. A summary of each of the seven factors and their

component sub-factors is presented in the Table on the next

page and described in detail in the commentary below. The

baseline assumptions for this analysis are that the aircraft is

registered in the relevant jurisdiction, operated by an airline

based in such jurisdiction and located in such jurisdiction

at the time of repossession.

Overall Score and Recoverability Category. The overall

score for each jurisdiction is expressed near the top of the

page of each one-page summary. A score of 0% represents

the poorest possible score and the lowest rating in terms of

asset recoverability. In contrast, a score of 100% represents

the best possible score and the highest rating in terms of

asset recoverability. Additionally, each jurisdiction has been

assigned a broader asset recoverability rating or category

as follows: those jurisdictions whose overall score was

75% or higher have been assigned a “LOWER RISK” asset

recoverability rating; those jurisdictions whose overall score

was 50% or higher, but less than 75%, have been assigned a

“MODERATE” asset recoverability rating; and finally those

jurisdictions whose overall score was less than 50% have

been assigned a “HIGHER RISK” asset recoverability rating.

World Map. On pages 118 and 119 we have summarized the

overall scores and asset recoverability ratings of each juris-

diction in the form of a world map. The green, yellow and red

colorings represent jurisdictions whose asset recoverability

ratings are “LOWER”, “MODERATE” and “HIGHER” risk

respectively, with the finer gradient of the color indicating

whether the jurisdiction sits at the top, middle of bottom of

the range for that category.

30-Minute (Check-Box) Jurisdictional Questionnaire.

For each country or jurisdiction covered in this index, a

reputable local counsel completed a 30-Minute (Check-

Box) Jurisdictional Questionnaire. A copy of the pro-forma

jurisdictional questionnaire is provided in the Appendix

on page 149. The completed questionnaires provided the

majority of the information used to score the jurisdictions.

However, the Political Stability factor was determined using

information collected from other third-party sources.

Aircraft Registration. In the 30-Minute (Check-Box)

Jurisdictional Questionnaire, we asked local counsel to

answer questions relating to the registration of the aircraft

on the country’s aircraft register. While this information is

not scored (as it is the characteristics of deregistration of the

aircraft, not registration, that is most relevant), it serves two

purposes which we hope will be of use to readers.

Firstly, it is informative in respect of whose name the

aircraft may be registered in that jurisdiction and whether

© 2017 Pillsbury Winthrop Shaw Pittman LLP

pillsburylaw.com

Worldwide Aircraft Repossession Index

12

METHODOLOGY AND INTERPRETATION OF RESULTS

the interests of the owner and mortgagee may also be noted,

either on the aircraft register, the certificate of registration or

on some other public register. It is also informative in respect

of the existence of any delegation arrangements with other

countries, such as 83bis delegation agreements pursuant

to Article 83bis of the Chicago Convention, such that an

aircraft operating and habitually based in that country may

be registered in another country.

Secondly, because delegation arrangements allow operating

lessors and financiers to mitigate against the adverse eects

of the local aircraft registration (and deregistration) rules by

allowing an aircraft to be registered in another country, this

has allowed us to blend the deregistration score of such other

country with the scores of each of the remaining factors for

the country in which the aircraft is habitually based. This

blended score thus more accurately reflects the total aircraft

repossession risk, and is presented in the one-page summary.

Repossession by Owner-Lessor or by Mortgagee?

We have designed the questions in the 30-Minute

(Check-Box) Jurisdictional Questionnaire in a manner

that contemplates both repossession of an aircraft from a

defaulting lessee under an aircraft lease, as well as repos

-

session by a “mortgagee” from a defaulting owner-debtor.

The phrase “mortgagee” when used in this publication and

in the jurisdictional questionnaire means a person who has

a first priority security interest in the aircraft, and includes a

person in the equivalent position to a mortgagee under appli-

cable local law, such as a “pledgee”, or a “chargee” holding an

“international interest” in the airframe and aircraft engines

pursuant to the Cape Town Convention.

Factor 1: Repossession (weighting: 22.5%). This factor

evaluates the owner-lessor or mortgagee’s theoretical ability

to repossess the aircraft in a cost eective and timely manner.

This factor comprises the following sub-factors:

Self-help remedies. Credit was given if the local jurisdiction

allows the owner-lessor or mortgagee to exercise so-called

self-help remedies. “Self-help” means that the laws of the

local jurisdiction permit the owner-lessor or mortgagee, as

applicable, to repossess the aircraft from an uncooperative

lessee (or debtor) without the need to obtain a court order,

provided that it does so peaceably, without using force or

the threat of force.

Requirement for a deposit, bond or other security in judicial

proceedings. Credit was given if the courts of the jurisdiction

do not typically require the owner-lessor or mortgagee, as a

condition to obtaining a judicial order for repossession of the

aircraft, to deposit a bond or other guarantee with the court.

Repossession taxes and fees. Credit was given if there are no

significant fees or taxes payable in order for the owner-lessor

or mortgagee to obtain a judicial order for repossession

of the aircraft. An example of such a tax might include a

Table: Summary of Factors and Sub-Factors

WEIGHTING FACTORS SUB-FACTORS

22.5%

Repossession

(1) Self-help remedies; (2) Requirement for a deposit, bond or other security in judicial proceedings; (3) Repossession

taxes and fees; (4) Speed of repossession; (5) Legal cost of repossession; (6) ASU Cape Town Discount or Qualifying

OECD Status

12.5%

Insolvency

(1) Sophistication of insolvency laws; (2) Insolvency moratorium; (3) Overreaching of the lessee’s insolvency estate.

10.0%

Deregistration

(1) Third party deregistration rights; (2) Historical precedent of refusing to deregister; (3) Convenience of deregistration

10.0%

Export

(1) Third party export rights; (2) Export licenses and permits; (3) Export fees and taxes

7.5%

Judgments and

Arbitral Awards

(1) Enforceability of judgments; (2) Enforceability of arbitral awards

7.5%

Preferential Liens

(1) Onerous and unusual preferential liens: non-possessory liens; (2) Onerous and unusual preferential liens: eet-wide

liens; (3) Onerous and unusual preferential liens: liens in favor of a lessee or debtor; (4) Government requisition and

conscation.

30.0%

Political Stability

(1) OECD membership; (2) Sovereign credit rating; (3) World Justice Project – Rule of Law Index (2016); (4) Heritage

Foundation – Freedom Index (2016); (5) World Economic Forum – Global Competitiveness Report 2015-2016

© 2017 Pillsbury Winthrop Shaw Pittman LLP

pillsburylaw.com

Worldwide Aircraft Repossession Index

13

METHODOLOGY AND INTERPRETATION OF RESULTS

stamp tax payable as a condition to admitting documents

in evidence for the purposes of repossession proceedings

(where self-help remedies are not available). We left it

to local counsel to determine, using their professional

judgement, whether they thought any such fees were signif-

icant; however, we indicated that “significant” fees or taxes

would include any fees or taxes assessed on a percentage

basis against the value of the aircraft or the sum secured by

a mortgage, etc., but might exclude nominal fees or nominal

taxes amounting to less than US$1,000 or its equivalent in

the local currency of the jurisdiction.

Speed of repossession. We asked local counsel to estimate,

on the balance of probabilities, how quickly a court order

may be obtained for repossession of an aircraft, following

commencement of judicial proceedings, given a choice

of four bands: (a) less than or equal to 60 days, (b) more

than 60 days but less than or equal to 180 days, (c) more

than 180 days but less than or equal to one year, or (d) more

than one year. Greater credit was given to the faster bands.

In estimating the speed with which such order could be

obtained, we asked local counsel to ignore any self-help

remedies that may be available as an alternative means of

repossession. We also asked local counsel to assume that:

1.

the mortgagee or the owner-lessor is ultimately

successful;

2.

the proceedings are contested by the lessee (or an insol-

vency practitioner or bankruptcy trustee on its behalf ),

but are otherwise not contested by any competing

creditor;

3.

where judicial proceedings are instigated by the

mortgagee, it has the cooperation of the owner-lessor,

4.

there is already either an English or New York judgment

or an arbitration award ordering repossession (and that

local counsel should select the answer that represents

the quickest of either litigating afresh on the merits or

enforcing such judgment or award);

5.

the lessee is insolvent at the time the proceedings are

instituted; and

6.

the proceedings may either be for a preliminary (i.e.

interim) or a final order, whichever can be obtained the

quickest in the local jurisdiction.

Legal cost of repossession. We also asked local counsel to

estimate, on the balance of probabilities, the legal costs

of obtaining a court order for repossession of an aircraft,

following commencement of judicial proceedings, given a

choice of four bands: (a) less than or equal to US$50,000, (b)

more than US$50,000 but less than or equal to US$250,000,

(c) more than US$250,000 but less than or equal to

US$1,000,000, or (d) more than US$1,000,000. Greater credit

was given to the less costly bands. We asked local counsel to

make an equivalent set of assumptions as they made when

answering the speed of repossession question. In addition,

we also indicated to local counsel that their estimate

should be inclusive of all court and lawyer fees incurred by

the owner-lessor or mortgagee, but should disregard any

amounts that represent any potential recovery of those costs.

ASU Cape Town Discount or Qualifying OECD Status. Bonus

credit was given if either or both of the following apply: (1)

as of May 30, 2016, the country qualifies for the OECD’s

Aircraft Sector Understanding Cape Town Discount (http://

www.oecd.org/tad/xcred/ctc.htm); and/or (2) as of June 24,

2016 the country is an OECD “high-income” or “zero-rated”

country, with an investment grade sovereign credit rating,

according to Standard & Poor’s (or where a Standard & Poor’s

rating is not available, according to Moody’s, if available).

Factor 2: Insolvency (weighting: 12.5%). This factor

evaluates the friendliness of the jurisdiction’s insolvency

laws from a creditor’s perspective. This factor comprises

the following sub-factors:

Sophistication of insolvency laws. Credit was given where

local counsel was of the opinion that the jurisdiction’s insol-

vency laws were moderately or well developed. We asked

local counsel to restrict their analysis to insolvency law as

it relates to the rights of a mortgagee (as a creditor) and an

owner-lessor (as a creditor/owner) and to take into account

the frequency, volume and history of case law, any pertinent

legal commentary on the subject, and the sophistication of

the applicable statutes.

Insolvency moratorium. We asked local counsel to indicate,

under the mandatorily applicable laws of the local juris-

diction, the period during which a moratorium may be

imposed in the event of a lessee or debtor insolvency /

bankruptcy which adversely aects the rights of the owner-

lessor or mortgagee to repossess an aircraft on termination

of the leasing of the aircraft or enforcement of the mortgage.

A choice of four bands was given: (a) less than or equal to 60

days, (b) more than 60 days but less than or equal to 180 days,

(c) more than 180 days but less than or equal to one year, or

(d) more than one year or variable. We asked local counsel

to assume that the lessee or debtor entity is subject to the

mandatorily applicable insolvency / bankruptcy laws of the

local jurisdiction. In circumstances where, under the law of

the local jurisdiction, more than one answer is applicable

because the moratorium period may vary depending on

other factors (e.g. whether or not the Cape Town Convention

applies or some other criteria are met), local counsel was

asked to select the most favorable (i.e. the shortest) such

© 2017 Pillsbury Winthrop Shaw Pittman LLP

pillsburylaw.com

Worldwide Aircraft Repossession Index

14

METHODOLOGY AND INTERPRETATION OF RESULTS

time period, and to indicate that the answer applied only to

limited circumstances. Greater credit was given for a shorter

moratorium period, and additional credit was given where

a shorter moratorium period applied in all circumstances,

rather than only in limited circumstances.

Overreaching of the lessee’s insolvency estate. Credit was given

where the mandatorily applicable insolvency laws of the

local jurisdiction did not deem the aircraft to be the lessee’s

property and part of its bankruptcy or insolvency estate

(notwithstanding the owner-lessor’s status as legal owner),

in circumstances where the lessee is put into administration,

liquidation or similar bankruptcy or insolvency process. In

answering this question, we asked local counsel to assume

that the lessee is subject to the mandatorily applicable

insolvency / bankruptcy laws of the local jurisdiction, and

that the lease is a true operating lease (and not a finance or

capital lease).

Factor 3: Deregistration (weighting: 10%). This factor

evaluates the ease with which an owner-lessor or a mortgagee

may deregister an aircraft registered on the country’s aircraft

register. This factor comprises the following sub-factors:

Third party deregistration rights. Credit was given if the

laws of the local jurisdiction and/or the local practice of the

aircraft register or aviation authority will honor a unilateral

request by the owner-lessor or mortgagee to deregister the

aircraft from the aircraft register, without the cooperation

of the lessee. Such a request could be honored either: (a)

pursuant to the exercise of a deregistration power of attorney

or an “irrevocable deregistration and export authorization”

(“IDERA”) pursuant to the Cape Town Convention granted

in favor of the owner-lessor or mortgagee (as applicable), or

(b) pursuant to such person’s status as an owner-lessor or

mortgagee of the aircraft, even without any such power or

IDERA. In answering these questions, we also asked local

counsel to assume that:

1.

the owner-lessor or mortgagee has repossessed the

aircraft, or is seeking simultaneous repossession of the

aircraft;

2.

the leasing has terminated or that the mortgage has

become enforceable, as applicable;

3.

where any such deregistration request is made by an

owner-lessor, it is with the consent of the mortgagee

(if any); and

4.

“cooperation of the lessee” includes a requirement

that the original of the certificate of registration be

surrendered.

Historical precedent of refusing to deregister. In the event that

laws of the local jurisdiction and/or the local practice of the

aircraft register or aviation authority entitle an owner-lessor

or mortgagee to deregister an aircraft, credit was deducted if

local counsel was aware of any instances where the aircraft

register or aviation authority had refused to honor a request

by the owner-lessor and/or the mortgagee (as applicable) to

deregister the aircraft, despite being otherwise entitled to do

so. “Despite being otherwise entitled to do so” means that the

owner-lessor or mortgagee, in submitting the deregistration

request, has complied with the local law and the paperwork

required for deregistration is otherwise in order.

Convenience of deregistration. Credit was given if, with

respect to deregistration of an aircraft, the aircraft register

or aviation authority does not require the application

forms necessary for registration, any necessary consents,

authorizations or supporting documents to be notarized

and/or authenticated before it will accept and process the

deregistration of an aircraft. “Authenticated” includes any

requirement that a document be apostilled, consularized,

legalized or translated.

Factor 4: Export (weighting: 10%). This factor evaluates

the ease with which an owner-lessor or a mortgagee may

export an aircraft habitually based in the country. This factor

comprises the following sub-factors:

Third party export rights. Credit was given if the laws of the

local jurisdiction allow an owner-lessor (with the consent of

the mortgagee, if any) or a mortgagee to unilaterally export

the aircraft from the country without the cooperation of the

lessee (and the owner-lessor, in the case of the mortgagee).

We asked local counsel to assume that:

1.

the owner-lessor or mortgagee has repossessed and

deregistered the aircraft, or is seeking simultaneous

repossession and deregistration of the aircraft;

2.

the leasing has terminated or the mortgage has become

enforceable, as applicable;

3. the owner-lessor or mortgagee has an export power of

attorney granted in its favor; and

4.

the lessee or owner-debtor is insolvent and uncoop-

erative at the time the owner-lessor or mortgagee is

seeking to export the aircraft from the country.

Export licenses and permits. Credit was given if an owner-

lessor or mortgagee may export the aircraft from the country

without requiring an export license or permit. We asked local

counsel to disregard any restrictions relating to the export

of goods to countries subject to sanctions or with respect

to classified or military equipment installed on the aircraft.

© 2017 Pillsbury Winthrop Shaw Pittman LLP

pillsburylaw.com

Worldwide Aircraft Repossession Index

15

METHODOLOGY AND INTERPRETATION OF RESULTS

Export taxes and fees. Credit was given if there are no signif-

icant fees or taxes payable in order for the owner-lessor or

mortgagee to export the aircraft from the country. We left

it to local counsel to determine, using their professional

judgement, whether they thought any such fees were signif-

icant; however, we indicated that “significant” fees or taxes

would include any fees or taxes assessed on a percentage

basis against the value of the aircraft or the sum secured by

a mortgage, etc., but might exclude nominal fees or nominal

taxes amounting to less than US$1,000 or its equivalent in

the local currency of the jurisdiction.

Factor 5: Judgments and Arbitral Awards (weighting:

7.5%). This factor evaluates the ease with which an owner-

lessor or a mortgagee may enforce a judgment or arbitral

award in the jurisdiction without having to re-litigate the

case on its merits. This factor comprises the following

sub-factors:

Enforceability of judgments. Credit was given if the courts

of the jurisdiction will recognize and enforce either: (a)

a judgment rendered by a New York state or U.S. federal

court sitting in New York, or (b) a judgment rendered by

an English court, without the case being re-examined

on its merits. “Enforcement” means the enforcement of

money awards only (and not injunctive or any other type of

non-monetary relief). We also indicated to local counsel that

“without the case being re-examined on its merits” meant

that enforcement would only be subject to the satisfaction

of one or more of the following threshold conditions (and

would not be subject to any other additional conditions):

1.

the court rendering the judgment must have had

jurisdiction over the defendant and has obtained such

jurisdiction in a way that is compatible with the laws of

the local jurisdiction;

2.

the judgment of the rendering court must have been

final and conclusive and not subject to appeal;

3.

the judgment must have been given on the merits of the

case (and, for example, must not have been obtained by

way of “judgment in default”);

4. the judgment must not have been obtained by fraud;

5.

the judgment must not be incompatible with the public

policy of the local jurisdiction;

6.

the judgment must not contradict another judgment

rendered by a court in the local jurisdiction; and/or

7.

in the case of a judgment rendered by an English court, if

the country is a sister EU member state, any of the condi-

tions or exceptions permitted by the “recast” Brussels

Regulation (Council Regulation (EU) 1215/2012).

Additionally, we made clear that a requirement for

reciprocity of recognition/enforcement by a New York or

English court (as applicable) is NOT a permitted threshold

condition, unless it can be said with reasonable certainty

that on a general basis (rather than on a case by case basis)

such reciprocity requirement will be satisfied with respect

to any such New York or English court judgment (because,

for example, a reciprocal enforcement treaty exists).

Enforceability of arbitral awards. Credit was given if the

country has adopted the 1958 Convention on the Recognition

and Enforcement of Foreign Arbitral Awards (the New York

Convention) and the courts of the the local jurisdiction

recognize and enforce a decision of an arbitrator. We asked

local counsel to assume that a court in the local jurisdiction

would be entitled to refuse enforcement of the arbitral award

based on one of the exceptions and carve-outs enumerated

in the New York Convention.

Factor 6: Preferential Liens (weighting: 7.5%). This factor

evaluates the status of any onerous or unusual non-con-

sensual preferential liens and requisition risks which could

be imposed by the laws of the local jurisdiction and which

may adversely aect an owner-lessor’s or mortgagee’s rights

to the aircraft. “Preferential lien” means a lien that would

take priority over the owner-lessor’s ownership and/or

a mortgagee’s secured creditor rights in the aircraft, and

“non-consensual” means that it arises by operation of law and

not by agreement between a person with rights in the aircraft

and the lien-holder. This factor comprises the following

sub-factors:

Onerous and unusual preferential liens: non-possessory liens.

Credit was given if the laws of the local jurisdiction do not

provide for any non-consensual preferential non-possessory

liens over aircraft that could arise in favor of a repairer /

mechanic or a landlord / hangar-keeper.

Onerous and unusual preferential liens: fleet-wide liens. Credit

was given if the laws of the local jurisdiction do not provide

for any fleet-wide non-consensual preferential liens or

equivalent rights or rights of detention over aircraft that

could arise in favor of third parties not requiring any form of

registration. A “fleet-wide” lien means a lien that has arisen

as a result of unpaid amounts attributable to a particular

aircraft in an operator’s fleet, but has attached or is capable

of attaching to any other aircraft in that operator’s fleet (i.e.

any other aircraft operated by that operator), regardless of

the fact that the owners of such aircraft may be dierent.

Onerous and unusual preferential liens: liens in favor of a lessee

or debtor. Credit was given if the laws of the local jurisdiction

© 2017 Pillsbury Winthrop Shaw Pittman LLP

pillsburylaw.com

Worldwide Aircraft Repossession Index

16

METHODOLOGY AND INTERPRETATION OF RESULTS

do not provide for any non-consensual preferential liens or

equivalent rights or rights of detention over aircraft that

could arise in favor of a lessee or debtor (i.e. not a third party)

not requiring any form of registration. An example of such

lien might include a non-consensual preferential lien over

the aircraft arising by operation of law in favor of a lessee

in circumstances where the lessee has a valid counterclaim

against the owner-lessor.

Government requisition and confiscation. Credit was given if

the laws of the local jurisdiction do not allow the government

to requisition or confiscate an aircraft without needing to pay

the owner reasonable compensation. We asked local counsel

to disregard government requisition or confiscation of the

aircraft in circumstances where there has been a violation of

any drug-tracking laws or other criminal oenses.

Factor 7: Political Stability (weighting: 30%). This factor

evaluates, predominantly, the adherence by the jurisdiction

to the rule of law, by reference to a number of rule of law

indices and other approximate measures, and should be

helpful in determining the ease with which the theoretical

legal rights available to an owner-lessor or mortgagee may

be enforced in practice. This factor comprises the following

sub-factors:

OECD Membership. Credit was given if the country is an

OECD “high-income” or “zero-rated” country according to

the OECD’s “country risk” classification system (see further,

http://www.oecd.org/tad/xcred/crc.htm).

Sovereign credit rating. Credit was given to countries with

an investment grade sovereign credit rating, according to

Standard & Poor’s (or where a Standard & Poor’s rating is

not available, according to Moody’s, if available).

World Justice Project – Rule of Law Index (2016). Greater credit

was given to countries with higher scores on the following

measures: “Absence of Corruption”, “Open Government”,

“Regulatory Enforcement” and “Civil Justice” (see further,

http://worldjusticeproject.org/rule-of-law-index).

Heritage Foundation – Index of Economic Freedom (2016).

Greater credit was given to countries with higher scores on

the following measures: “Property rights” and “Freedom

from corruption” (see further, http://www.heritage.org/

index/).

World Economic Forum – Global Competitiveness Report

2015-2016. Greater credit was given to countries with

higher scores on the following measures: “Property rights”,

“Irregular payments and bribes”, “Judicial independence”,

“Favoritism in decisions of government ocials”, “Eciency

of legal framework in settling disputes”, “Eciency of legal

framework in challenging regulations” and “Transparency

of government policymaking” (see further, http://reports.

weforum.org/global-competitiveness-report-2015-2016/).

In the event that there is no data on the country in either

one or two of the rule of law indices, each such index is

ignored for scoring purposes without any negative eect

on that country’s aggregate score for this factor. In the rare

event that there is no data on the country in all three of the

indices, then the Political Stability factor is ignored in its

entirety and a note is made on the one-page summary for

that country (and in the Summary of Scores table on pages

17 and 18) indicating that no such data is available.

© 2017 Pillsbury Winthrop Shaw Pittman LLP

pillsburylaw.com

Worldwide Aircraft Repossession Index

17

Summary of Scores

Summarized in the table below are the overall scores for each country included in this

publication, together with a breakdown of the scores for each factor. The table has been

sorted in descending order of overall score, with the highest scoring country at the top and

the lowest scoring country at the bottom.

Weighting: (22.5%) (12.5%) (10.0%) (10%) (7.5%) (7.5%) (30.0%)

Country Repo. Insolvency Dereg. Export Judg. / Arb. Pref. Liens Pol. Stab. TOTAL

Aruba 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% No Data 100.0%

Australia 100.0% 90.0% 100.0% 100.0% 100.0% 75.0% 99.2% 96.6%

Canada 96.4% 90.0% 100.0% 100.0% 100.0% 75.0% 100.0% 96.1%

United States 96.4% 90.0% 100.0% 100.0% 100.0% 100.0% 93.7% 96.0%

Netherlands 82.1% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 96.0%

New Zealand 100.0% 90.0% 100.0% 100.0% 100.0% 75.0% 94.4% 95.2%

Denmark 92.9% 90.0% 80.0% 100.0% 100.0% 75.0% 99.2% 93.0%

Bermuda 95.0% 60.0% 100.0% 100.0% 100.0% 100.0% No Data 91.3%

Cayman Islands 95.0% 90.0% 100.0% 100.0% 100.0% 50.0% No Data 91.3%

United Kingdom 89.3% 60.0% 100.0% 100.0% 100.0% 75.0% 94.4% 89.0%

Germany 71.4% 100.0% 60.0% 75.0% 100.0% 100.0% 100.0% 87.1%

Guernsey 90.0% 90.0% 80.0% 100.0% 100.0% 50.0% No Data 86.8%

Ireland 85.7% 80.0% 100.0% 100.0% 100.0% 50.0% 85.7% 86.3%

Finland 78.6% 90.0% 60.0% 75.0% 100.0% 100.0% 94.4% 85.8%

Jersey 95.0% 60.0% 80.0% 100.0% 100.0% 75.0% No Data 85.7%

Austria 71.4% 80.0% 100.0% 50.0% 100.0% 100.0% 93.7% 84.2%

Norway 85.7% 80.0% 40.0% 75.0% 100.0% 25.0% 100.0% 80.2%

France 85.7% 60.0% 20.0% 75.0% 100.0% 100.0% 93.7% 79.4%

Switzerland 71.4% 80.0% 20.0% 75.0% 100.0% 75.0% 100.0% 78.7%

Czech Republic 82.1% 90.0% 40.0% 75.0% 100.0% 50.0% 82.9% 77.4%

Hong Kong 67.9% 60.0% 100.0% 100.0% 33.3% 50.0% 88.9% 75.7%

Taiwan (Republic of China) 71.4% 80.0% 0.0% 100.0% 66.7% 100.0% 89.8% 75.5%

Portugal 53.6% 90.0% 80.0% 75.0% 100.0% 75.0% 69.8% 72.9%

Estonia 67.9% 60.0% 60.0% 0.0% 100.0% 100.0% 93.7% 71.9%

French Polynesia 80.0% 60.0% 20.0% 75.0% 100.0% 100.0% No Data 71.4%

New Caledonia 80.0% 60.0% 20.0% 75.0% 100.0% 100.0% No Data 71.4%

Costa Rica 57.1% 60.0% 80.0% 100.0% 100.0% 100.0% 56.3% 70.3%

Israel 57.1% 70.0% 40.0% 50.0% 100.0% 100.0% 81.6% 70.1%

Japan 42.8% 60.0% 20.0% 75.0% 100.0% 100.0% 94.0% 69.9%

Lithuania 75.0% 60.0% 0.0% 100.0% 100.0% 75.0% 74.0% 69.7%

Belgium 67.9% 70.0% 20.0% 50.0% 100.0% 25.0% 94.4% 68.7%

Poland 50.0% 60.0% 40.0% 75.0% 100.0% 100.0% 75.4% 67.9%

© 2017 Pillsbury Winthrop Shaw Pittman LLP

pillsburylaw.com

Worldwide Aircraft Repossession Index

18

SUMMARY OF SCORES

Weighting: (22.5%) (12.5%) (10.0%) (10%) (7.5%) (7.5%) (30.0%)

Country Repo. Insolvency Dereg. Export Judg. / Arb. Pref. Liens Pol. Stab. TOTAL

Korea 57.1% 60.0% 0.0% 75.0% 100.0% 100.0% 82.9% 67.7%

Italy 75.0% 90.0% 0.0% 100.0% 100.0% 75.0% 54.4% 67.6%

Hungary 75.0% 70.0% 40.0% 100.0% 100.0% 50.0% 54.0% 67.1%

Slovenia 67.9% 60.0% 0.0% 75.0% 100.0% 75.0% 75.0% 65.9%

South Africa 50.0% 100.0% 80.0% 25.0% 100.0% 100.0% 55.2% 65.8%

Mauritius 46.4% 60.0% 100.0% 50.0% 100.0% 75.0% 64.8% 65.5%

Kenya 67.9% 90.0% 100.0% 100.0% 100.0% 75.0% 18.5% 65.2%

Turkey 75.0% 90.0% 80.0% 100.0% 100.0% 50.0% 24.6% 64.8%

China 57.1% 90.0% 100.0% 75.0% 33.3% 50.0% 44.4% 61.2%

Macau 32.1% 80.0% 40.0% 75.0% 100.0% 100.0% 55.0% 60.2%

Nigeria 75.0% 90.0% 100.0% 75.0% 100.0% 50.0% 9.7% 59.8%

Rwanda 67.9% 60.0% 20.0% 100.0% 100.0% 100.0% 32.1% 59.4%

Latvia 75.0% 20.0% 0.0% 50.0% 100.0% 75.0% 68.4% 58.0%

Indonesia 71.4% 80.0% 80.0% 75.0% 33.3% 50.0% 27.2% 56.0%

Pakistan 67.9% 20.0% 100.0% 100.0% 100.0% 100.0% 8.5% 55.3%

Mozambique 46.4% 90.0% 80.0% 75.0% 100.0% 75.0% 7.1% 52.5%

Oman 57.1% 20.0% 80.0% 75.0% 33.3% 75.0% 40.8% 51.2%

United Arab Emirates 21.4% 20.0% 80.0% 50.0% 33.3% 75.0% 75.0% 50.9%

Namibia 46.4% 90.0% 0.0% 75.0% 66.7% 75.0% 35.2% 50.4%

Brazil 32.1% 100.0% 80.0% 25.0% 100.0% 50.0% 26.4% 49.4%

Papua New Guinea 57.1% 90.0% 80.0% 75.0% 66.7% 50.0% 0.0% 48.4%

Sri Lanka 57.1% 40.0% 80.0% 25.0% 100.0% 50.0% 27.8% 47.9%

Malaysia 64.3% 20.0% 0.0% 100.0% 33.3% 0.0% 61.1% 47.8%

India 53.6% 60.0% 40.0% 25.0% 100.0% 25.0% 41.1% 47.8%

Mexico 50.0% 90.0% 0.0% 0.0% 100.0% 100.0% 30.2% 46.5%

Fiji 78.6% 50.0% 0.0% 100.0% 100.0% 50.0% 0.0% 45.2%

Vietnam 57.1% 50.0% 80.0% 50.0% 33.3% 75.0% 15.9% 45.0%

Ukraine 71.4% 50.0% 40.0% 25.0% 100.0% 50.0% 9.5% 42.9%

Romania 39.3% 60.0% 0.0% 25.0% 100.0% 50.0% 38.9% 41.8%

El Salvador 50.0% 20.0% 40.0% 75.0% 100.0% 50.0% 16.3% 41.4%

Azerbaijan 60.7% 20.0% 0.0% 100.0% 100.0% 25.0% 18.4% 41.0%

Peru 35.7% 60.0% 20.0% 25.0% 100.0% 75.0% 22.4% 39.9%

Jordan 21.4% 50.0% 80.0% 0.0% 33.3% 25.0% 52.0% 39.0%

Russia 21.4% 100.0% 20.0% 25.0% 33.3% 100.0% 15.5% 36.5%

Myanmar 42.9% 0.0% 100.0% 50.0% 33.3% 75.0% 7.4% 35.0%

Dominican Republic 21.4% 20.0% 40.0% 75.0% 100.0% 50.0% 14.9% 34.5%

Bulgaria 7.1% 20.0% 20.0% 75.0% 100.0% 75.0% 22.2% 33.4%

Guatemala 21.4% 50.0% 0.0% 75.0% 100.0% 50.0% 10.9% 33.1%

Lebanon 21.4% 20.0% 0.0% 25.0% 100.0% 100.0% 8.9% 27.5%

Egypt 7.1% 0.0% 80.0% 50.0% 33.3% 25.0% 15.7% 23.7%

© 2017 Pillsbury Winthrop Shaw Pittman LLP

pillsburylaw.com

Worldwide Aircraft Repossession Index

19

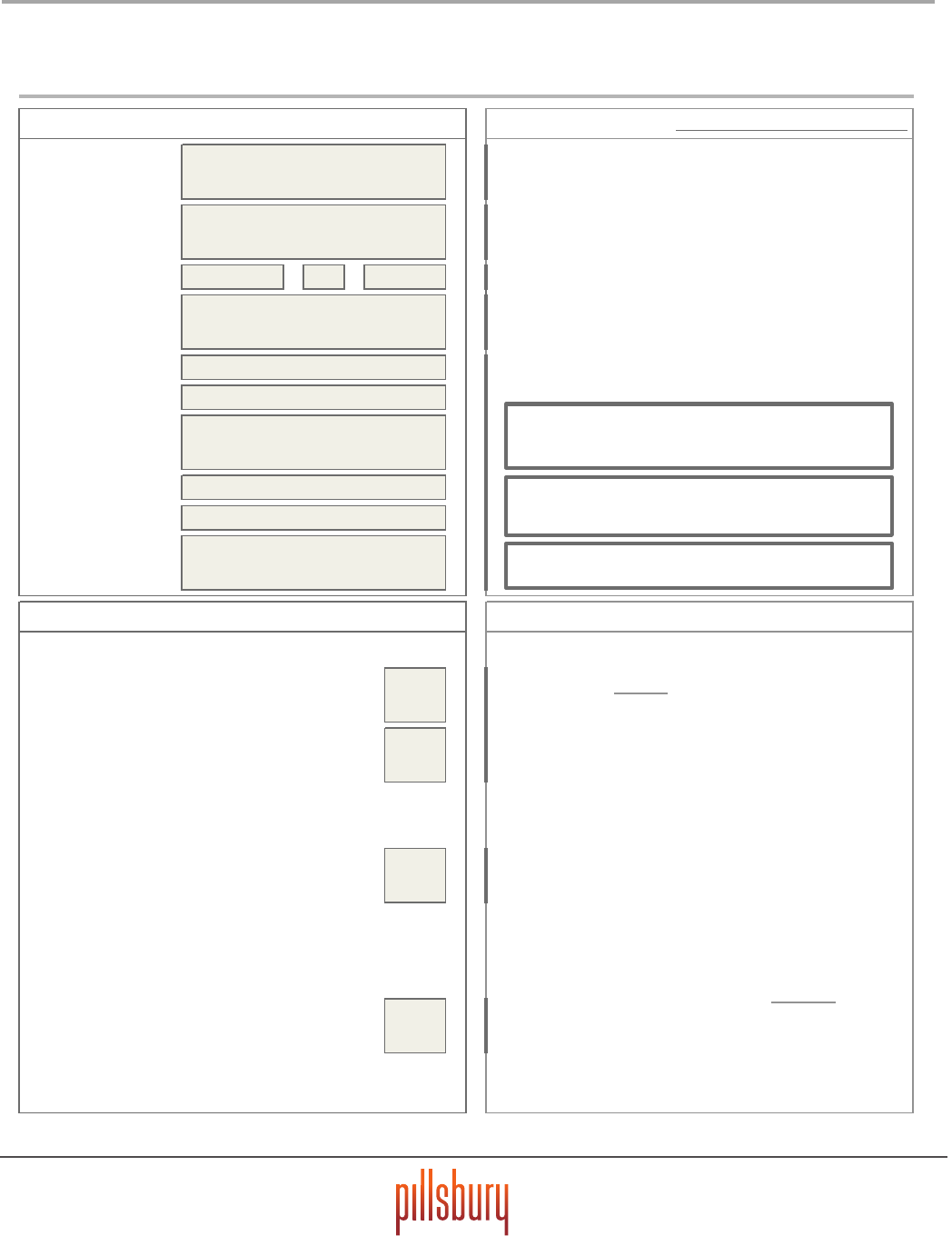

Aircra Registration

Key Facts

†

More Results

Time & Cost Indicators

R

E

P

O

S

S

E

S

S

I

O

N

I

N

S

O

L

V

E

N

C

Y

D

E

R

E

G

I

S

T

R

A

T

I

O

N

E

X

P

O

R

T

J

U

D

G

./

A

R

B

.

P

R

E

F

.

L

I

E

N

S

P

O

L

I

T

I

C

A

L

S

T

A

B

I

L

I

T

Y

Aruba (*)

Jurisdiction(s): Aruba

ONE-PAGE SUMMARIES

Up to Date: September 2016

COMPLETED BY:

Gomez & Bikker

CONTACT:

LINCOLN D. GOMEZ, Managing Partner, lincoln@gobiklaw.com

B. PATRICK HONNEBIER, Of Counsel, b.honnebier@gobiklaw.com

Overall Score Category

100%

LOWER

(**) Overall Score disregards Political

Stability (insucient data)

Weighting Score:

22.5%

Repossession

100%

12.5%

Insolvency

100%

10.0%

Deregistration

100%

10.0%

Export

100%

7.5%

Judgments/Arb.

100%

7.5%

Preferential Liens

100%

30.0%

Political Stability

No data

++

++

$

50,000 60 days 60 days

$

250,000 180 days 180 days

$

1,000,000 1 year 1 year/

variable

Insolvency

Moratorium

Period (time)

Speed of

Repossession

(time)

Legal Cost of

Repossession

($)

CHEAPER/FASTER

Sovereign credit rating (S&P):

OECD high-income/zero-rated

country:

Cape Town Contracting State:

Eligible for ASU Cape Town Discount:

Self-help (Lessor-owners):

Self-help (Mortgagees):

Moderately or well-developed

insolvency laws:

Absence of significant taxes or similar

fees payable on export:

Absence of fleetwide liens:

a New York court judgment:

an English court judgment:

an arbitral award:

BBB+

NO

YES

NO

YES

YES

YES

YES

YES

YES

YES

YES

Possible principal registrants:

Owner (if not also the operator):

Operator (if not also the owner):

Additional interests that may be noted, either on the

aircraft register, some other pulbic register, or on the

certificate of registration:

Owner: Mortgagee:

Please send any requests for more detailed

results or the full set of responses to the

Jurisdictional Questionnaire to:

repoindex@pillsburylaw.com

Before using the information on this page, please

read the GENERAL DISCLAIMER on page 2.

Alternative Country

of Registration #1:

N/A

Alternative Country

of Registration #2:

N/A

Blended

Score:

Blended

Category:

N/A N/A

Blended

Score:

Blended

Category:

N/A N/A

YES

YES

YES YES

Poorer

score

Better

score

Estimated

potential

cost/speed

Estimated

does not

exceed range

(**)

(*) Local counsel has provided additional notes for this country.

All such notes are set out on page 107 et. seq.

†

Additional information regarding third party data

is set out on page 148.

Local court will enforce, without reexamination

of case on merits…

© 2017 Pillsbury Winthrop Shaw Pittman LLP

pillsburylaw.com

Worldwide Aircraft Repossession Index

20

Aircra Registration

Key Facts

†

More Results

Time & Cost Indicators

R

E

P

O

S

S

E

S

S

I

O

N

I

N

S

O

L

V

E

N

C

Y

D

E

R

E

G

I

S

T

R

A

T

I

O

N

E

X

P

O

R

T

J

U

D

G

./

A

R

B

.

P

R

E

F

.

L

I

E

N

S

P

O

L

I

T

I

C

A

L

S

T

A

B

I

L

I

T

Y

Australia (*)

Jurisdiction(s): C’th of Australia, New South Wales & Others

ONE-PAGE SUMMARIES

Up to Date: August 2016

COMPLETED BY:

King & Wood Mallesons

CONTACT:

JOHN CANNING, Partner, john.[email protected]

TEJASWI NIMMAGADDA, Counsel,

Overall Score Category

97%

LOWER

Weighting Score:

22.5%

Repossession

100%

12.5%

Insolvency

90%

10.0%

Deregistration

100%

10.0%

Export

100%

7.5%

Judgments/Arb.

100%

7.5%

Preferential Liens

75%

30.0%

Political Stability

99%

++

++

$

50,000 60 days 60 days

$

250,000 180 days 180 days

$

1,000,000 1 year 1 year/

variable

Insolvency

Moratorium

Period (time)

Speed of

Repossession

(time)

Legal Cost of

Repossession

($)

CHEAPER/FASTER

Sovereign credit rating (S&P):

OECD high-income/zero-rated

country:

Cape Town Contracting State:

Eligible for ASU Cape Town Discount:

Self-help (Lessor-owners):

Self-help (Mortgagees):

Moderately or well-developed

insolvency laws:

Absence of significant taxes or similar

fees payable on export:

Absence of fleetwide liens:

a New York court judgment:

an English court judgment:

an arbitral award:

AAA

YES

YES

YES

YES

YES

YES

YES

YES

YES

YES

YES

Possible principal registrants:

Owner (if not also the operator):

Operator (if not also the owner):

Additional interests that may be noted, either on the

aircraft register, some other pulbic register, or on the

certificate of registration:

Owner: Mortgagee:

Please send any requests for more detailed

results or the full set of responses to the

Jurisdictional Questionnaire to:

repoindex@pillsburylaw.com

Before using the information on this page, please

read the GENERAL DISCLAIMER on page 2.

Alternative Country

of Registration #1:

New Zealand

Alternative Country

of Registration #2:

United States

Blended

Score:

Blended

Category:

97%

LOWER

Blended

Score:

Blended

Category:

97%

LOWER

YES

NO

NO

YES

Poorer

score

Better

score

Estimated

potential

cost/speed

Estimated

does not

exceed range

(*) Local counsel has provided additional notes for this country.

All such notes are set out on page 107 et. seq.

†

Additional information regarding third party data

is set out on page 148.

Local court will enforce, without reexamination

of case on merits…

© 2017 Pillsbury Winthrop Shaw Pittman LLP

pillsburylaw.com

Worldwide Aircraft Repossession Index

21

Aircra Registration

Key Facts

†

More Results

Time & Cost Indicators

R

E

P

O

S

S

E

S

S

I

O

N

I

N

S

O

L

V

E

N

C

Y

D

E

R

E

G

I

S

T

R

A

T

I

O

N

E

X

P

O

R

T

J

U

D

G

./

A

R

B

.

P

R

E

F

.

L

I

E

N

S

P

O

L

I

T

I

C

A

L

S

T

A

B

I

L

I

T

Y

Austria

Jurisdiction(s): Austrian Federal Law, European Law

ONE-PAGE SUMMARIES

Up to Date: August 2016

COMPLETED BY:

BINDER GRÖSSWANG

Rechtsanwälte GmbH

CONTACT:

EMANUEL WELTEN, Partner, welten@bindergroesswang.at

ROBERT WIPPEL, Attorney, wippel@bindergroesswang.at

Overall Score Category

84%

LOWER

Weighting Score:

22.5%

Repossession

71%

12.5%

Insolvency

80%

10.0%

Deregistration

100%

10.0%

Export

50%

7.5%

Judgments/Arb.

100%

7.5%

Preferential Liens

100%

30.0%

Political Stability

94%

++

++

$

50,000 60 days 60 days

$

250,000 180 days 180 days

$

1,000,000 1 year 1 year/

variable

Insolvency

Moratorium

Period (time)

Speed of

Repossession

(time)

Legal Cost of

Repossession

($)

Sovereign credit rating (S&P):

OECD high-income/zero-rated

country:

Cape Town Contracting State:

Eligible for ASU Cape Town Discount:

Self-help (Lessor-owners):

Self-help (Mortgagees):

Moderately or well-developed

insolvency laws:

Absence of significant taxes or similar