159

Journal of International Studies , Vol. 18,2022, pp: 159-189

How to cite this article:

Ikhsan, M. F., Aziz, N. A., & Mahyudin, E. (2022). Case study on the implementation

of Goods and Services Tax (GST) in Malaysia and Singapore. Journal of International

Studies, 18, 159-189. https://doi.org/10.32890/jis2022.18.6

CASE STUDY ON THE IMPLEMENTATION OF GOODS

AND SERVICES TAX (GST) IN MALAYSIA

AND SINGAPORE

1

OK.Mohammad Fajar Ikhsan,

2

Norsyuhada Azwin Aziz &

3

Emil Mahyudin

1

Asian Institute of International Affairs & Diplomacy – AIIAD,

Universiti Utara Malaysia

2

Malaysia Building Society Berhad, Malaysia

3

Department of International Relations, Universitas Padjajaran

(UNPAD), Indonesia

1

Corresponding author: [email protected], [email protected]

Received: 10/5/2022 Revised: 15/6/2022 Accepted: 28/6/2022 Published: 17/10/2022

ABSTRACT

Goods and Services Tax or GST is one of the most controversial taxes,

causing dissatisfaction among the people. The distribution of justice

and the implementation and effectiveness of GST policies tend to be

the most frequently debated issues. The objective of this study is to

examine the implementation, impacts, effectiveness, and challenges

of GST policy in Southeast Asian countries, particularly Malaysia and

Singapore. By employing a critical analysis perspective such as from

Marxism’s lens of view, it is expected that this article will provide

a new perspective in analysing GST policy implementation in the

region. A descriptive qualitative analysis approach was used in this

study, emphasising the content analysis method and the data obtained

https://e-journal.uum.edu.my/index.php/jis

JOURNAL OF

INTERNATIONAL STUDIES

160

Journal of International Studies , Vol. 18, 2022, pp: 159-189

from ofcial sources and literature studies. The study found that

GST contributed to Singapore and Malaysia’s economy and revenue.

Nevertheless, the GST impact affected the citizens of Singapore and

Malaysia, especially the lower-income earners. The study argued

that there is a dilemma in the GST tax policy implementation. It can

be assumed through the ndings that the GST policy did not meet

the conscience of the Marxist perspective as it is regressive. Thus,

in several parts of GST implementation, it has both advantages

to the country’s production and productivity. On the other hand, it

disadvantages society, particularly the lower- and middle-class groups.

Keywords: GST, tax policy, marxism, wealth, Malaysia, Singapore.

INTRODUCTION

In this modern day, it is believed that tax can contribute to the countries’

economic growth. Taxation is one of the oldest elds of knowledge,

back to the days of Egyptian pharaohs, Greece, and Rome. Later in

the 11

th

century, Great Britain introduced and operated the modern

tax system during the Roman Empire. Taxes can be described as

unintended taxes, which can be explained as a form of efforts made

by the government (state) in the space of local, regional, and national

authorities to fund government operations and policies collected

compulsorily from individuals or companies (Kagan, 2022). In the

perspective of economics, taxes are imposed on every individual or

corporation involved in business activities as well as in economic

transactions, which include producers and consumers (Kagan, 2019a).

One of the taxes implemented by various countries is consumption tax,

which is the Goods and Services Tax (GST). GST is a value-added tax

levied on most goods and services sold for municipal consumption

(Kagan, 2019b).

GST is an indirect federal sales tax implemented on every transaction

of goods and services. In trading or business activities, the government

includes GST in the cost of the product, which is also charged to

consumers (buyers). The government will collect the amount and

accumulated GST earned in business activities. From historical

records, France was among the rst countries to implement GST in

1954. To date, it can be estimated that at least 160 countries are using

this tax system afliated in other forms, such as the United Kingdom,

Canada, Australia, Brazil, Singapore, South Korea, Italy, Nigeria,

India, and Vietnam (Kagan, 2020a).

161

Journal of International Studies , Vol. 18,2022, pp: 159-189

In addition, by emphasising case studies in the Southeast Asia region,

this article highlights the case studies in Malaysia and Singapore

by assuming that both countries implement the imposition of goods

and services tax using the GST policy. Meanwhile, other Southeast

Asia countries tend to use Value-Added Tax (VAT) policy as the

terminology in their tax policies. Although the characteristics of

GST and VAT are generally the same, the only difference between

these taxes comes from the specic rules that each country applies

to the tax itself, such as tax rates, goods exempted from taxes, and

registration requirements. For example, Cambodia, Indonesia, Laos,

the Philippines, Thailand, and Vietnam prefer to apply a VAT policy.

At the same time, Myanmar imposes the Commercial Tax Policy. For

this reason, this study is important to observe how the two countries,

Malaysia and Singapore, which use the same tax policy, namely GST,

implement the policy and how GST affects the economic, social, and

political structures.

THEORETICAL CONCEPTS: MARXISM VIEWS AND

PREFERENCES ON TAX

Marx himself acknowledged the primacy of tax as a burden on the

poor (Ireland, 2019). Besides, in the Neue Rheinische Zeitung

newspaper, Marx published the No Tax Payments in November 1848;

whereby he wrote, “From today, therefore, taxes are abolished! It is

high treason to pay taxes. Refusal to pay taxes is the primary duty

of the citizen!” The passage described here explains that Marx was

not interested in taxation. In his book, Capital, vol. I, 1867, as the

national debt received its funding in government revenue, which was

needed to cover annual interest payments, the new taxation system

was the required complement to the national loan system. The loans

allowed the government to meet extraordinary expenses without the

taxpayers necessarily noticing. As a result, they required higher taxes.

On the other hand, the rise in taxes triggered by the accumulated debts

incurred one after the other also caused the government to resort to

new loans for exceptional expenses. However, he had his own policies

regarding the tax. Marx and Engels preferred progressive tax over

regressive tax (Ireland, 2019).

Progressive tax could be described as a tax that enforces a decreased

tax charge on low-earnings earners as compared to people with

better income, primarily based totally on the taxpayers’ capacity to

162

Journal of International Studies , Vol. 18, 2022, pp: 159-189

pay (Kagan, 2021). This means that progressive tax is the one that

imposes a higher tax rate for those with higher income. Marx and

Engels supported this type of tax. The tax makes sense as it can

assist those who can least afford to pay them. These schemes leave

additional money in the hands of low-salary employees who are likely

to spend all their earnings to enhance the economy. However, it is

believed that every progress and commercialisation in a large number

of industries will only benet the core class (Ikhsan et al., 2020) and

tends to burden the lower-class society.

As Marx’s greatest contribution was the concept of class struggle

that is the catalyst for the working class (proletariat) or the working

class to defend their rights and freedoms from continuing to be the

victim of the capitalist (bourgeois), the progressive tax is relevant to

him. It is because ‘richer, higher tax’ will be imposed on those with

high income. However, progressive tax also becomes a discrimination

against the high-income earners. Marx and Engels advocated this

progressive tax in the Communist Manifesto. In addition, they both

supported direct tax rather than indirect text. In this context, the

progressive tax is categorised as a direct tax, while the regressive tax

is considered an indirect tax (Kagan, 2021).

On top of that, fairness is one of the important elements that a state

should apply. Fairness, also known as equity, means that everybody

will pay a reasonable share of the taxes (Oklahoma Policy Institute,

2020). In this context, the fairness of tax has been fought by Marx,

and that is the reason for him to support the progressive tax. Marx and

Engels addressed the issue of income inequality and tax inequality.

Although they stated that income inequality is unavoidable in

capitalism, tax inequality can still be reduced (Ireland, 2019).

Another criterion is adequacy. Adequacy means taxes should offer

sufcient revenue to meet the basic needs of society. It can be analysed

that the tax structure adequacy test can be declared to be successful if

it generates sufcient revenue to meet public demand and services. If

revenue growth is adequate each year to nance service cost growth,

and if there are adequate business activities of the sort to be taxed,

rates can be kept reasonably low.

Additionally, transparency is the most important characteristic in

implementing tax policy. Transparency refers to taxpayers and leaders

who can easily obtain tax system information and how tax money

163

Journal of International Studies , Vol. 18,2022, pp: 159-189

is used. For example, in a clear tax system, which is taxable, how

much they pay and what they do with the money will be recognised.

Besides, a clean tax system will be able to discover who pays the tax

and who prots from tax exemptions, deductions, and credits.

THE IMPLEMENTATION OF GST IN MALAYSIA AND

POLICY ON CONSUMPTION TAX

GST is proposed to replace the consumption tax, Sales and Service

Tax (SST). The advent of GST in Malaysia is an effort to reform

the tax system to enhance the performance and effectiveness of the

existing tax system. The announcement of the GST implementation

in Malaysia was made during the Budget 2005 presentation, stating

that GST would come into effect on January 1, 2007, to replace the

existing consumption tax, SST. However, the government has delayed

the enforcement of the GST to allow traders to prepare the computing

system and provide appropriate exposure and training to the affected

staff. On 16

th

December 2009, the GST Bill was tabled in Parliament

for the First Reading. The Bill was supposed to be tabled for Second

Reading and beyond but has been postponed considering the views

of various groups and societies. This issue involves various people,

especially the citizen (Sanusi et al., 2015).

Therefore, the Prime Minister during the time, Datuk Seri Najib

Tun Razak, took several attempts to revise the GST system before

formally announcing GST implementation. Then, on the Budget

2014 held in Parliament on 25

th

October 2013, the Prime Minister

announced the GST implementation from 1

st

April 2015, with a rate of

6 percent. However, GST in Malaysia only lasted for three years. The

government abolished GST on 1

st

September 2018, due to the shifting

of administration or government in Malaysia. The new government

implemented SST again in the country (Dezan Shira & Associates,

2018).

Before GST was introduced in Malaysia, the initial consumption tax

system or policy applied in Malaysia was SST. SST was implemented

in Malaysia in 1970 and comprised two distinct tax laws on various

goods and services, the Sales Tax Act 1972 and the Service Tax Act

1975. Sales and service taxes are single-stage taxes that are only

charged at one point in the supply chain. In this aspect, the Sales

Tax is only levied on certain goods that have been prescribed at the

164

Journal of International Studies , Vol. 18, 2022, pp: 159-189

manufacturer’s stage. At the same time, the Services Tax is imposed

on the customer, except for duty-free areas. Sales Tax and Service Tax

are charged at 10 percent and 6 percent, respectively, before being

replaced by GST in 2015 (Goh & Aminuddin, 2015).

Due to the transparency issue of SST, the Malaysian government

introduced the GST system. If SST is single-stage taxation, GST is

the opposite. GST is multistage taxation, whereby the tax is levied

from the supplier to the customer. In this context, GST is divided

into three types: Standard-rated Supplies, Zero-rated Supplies, and

Exempt Supplies. These types of GST are different from each other.

For the Standard-rated Supplies, it is only charged for any supply of

taxable goods and services businesses in Malaysia (Dezan Shira &

Associates, 2016). In this type, the consumers must pay the tax at 6

percent. In contrast, the registered business in each stage, except for

the consumer, can claim their input tax from the government, meaning

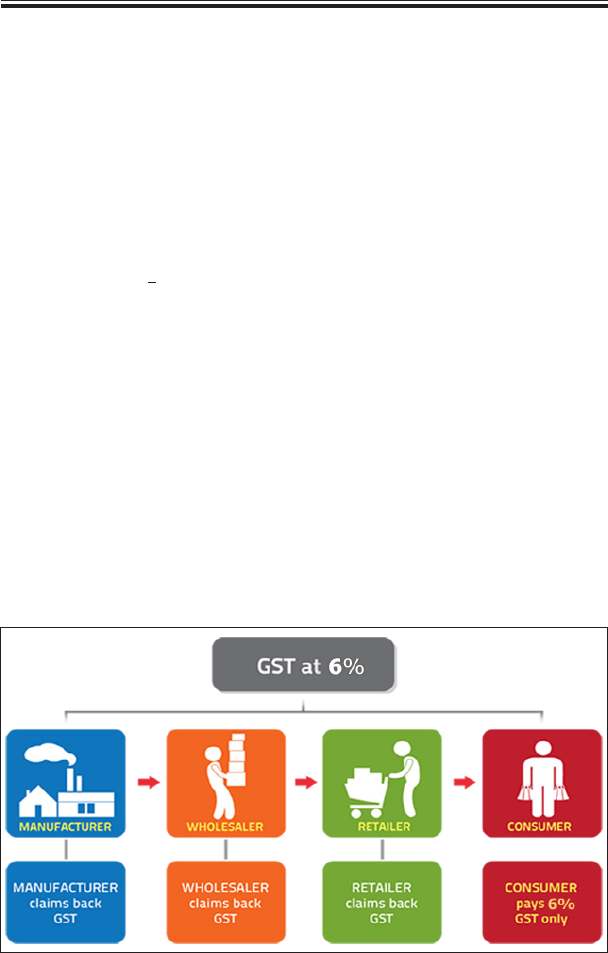

that the consumer must bear the entire tax. The Figure 1 shows the

Standard-rated Supplies in Malaysia and their computation.

Figure 1

The Standard-rated Supplies charges

Source: Royal Malaysian Customs Department (2020)

4

held in Parliament on 25

th

October 2013, the Prime Minister announced the GST implementation from

1

st

April 2015, with a rate of 6 percent. However, GST in Malaysia only lasted for three years. The

government abolished GST on 1

st

September 2018, due to the shifting of administration or government

in Malaysia. The new government implemented SST again in the country (Dezan Shira & Associates,

2018).

Before GST was introduced in Malaysia, the initial consumption tax system or policy applied in

Malaysia was SST. SST was implemented in Malaysia in 1970 and comprised two distinct tax laws on

various goods and services, the Sales Tax Act 1972 and the Service Tax Act 1975. Sales and service

taxes are single-stage taxes that are only charged at one point in the supply chain. In this aspect, the

Sales Tax is only levied on certain goods that have been prescribed at the manufacturer’s stage. At the

same time, the Services Tax is imposed on the customer, except for duty-free areas. Sales Tax and

Service Tax are charged at 10 percent and 6 percent, respectively, before being replaced by GST in

2015 (Goh & Aminuddin, 2015).

Due to the transparency issue of SST, the Malaysian government introduced the GST system. If SST is

single-stage taxation, GST is the opposite. GST is multistage taxation, whereby the tax is levied from

the supplier to the customer. In this context, GST is divided into three types: Standard-rated Supplies,

Zero-rated Supplies, and Exempt Supplies. These types of GST are different from each other. For the

Standard-rated Supplies, it is only charged for any supply of taxable goods and services businesses in

Malaysia (Dezan Shira & Associates, 2016). In this type, the consumers must pay the tax at 6 percent.

In contrast, the registered business in each stage, except for the consumer, can claim their input tax from

the government, meaning that the consumer must bear the entire tax. The Figure 1 shows the Standard-

rated Supplies in Malaysia and their computation.

Figure 1

The Standard-rated Supplies charges

Source: Royal Malaysian Customs Department (2020)

165

Journal of International Studies , Vol. 18,2022, pp: 159-189

Table 1

The Computation of GST for Standard-rated Supplies

Level of

supply

Sales price

(including GST at 6%)

Payment to Government

Raw material

supplier

Sales price = RM50.00

GST = RM3.00

Total sales price = RM53.00

GST collection = RM3.00

Less: GST paid = RM0.00

GST payable = RM3.00

Manufacturer

Sales price = RM100.00

GST = RM6.00

Total sales price = RM106.00

GST collection = RM6.00

Less: GST paid = RM3.00

GST payable = RM3.00

Wholesaler

Sales price = RM125.00

GST = RM7.50

Total sales price = RM132.50

GST collection = RM7.50

Less: GST paid = RM6.00

GST payable = RM1.50

Retailer

Sales price = RM156.00

GST = RM9.36

Total sales price = RM165.36

GST collection = RM9.36

Less: GST paid = RM7.50

GST payable = RM1.86

Source: Royal Malaysian Customs Department (2020)

The next type is the Zero-rated Supplies. In this category, goods and

services are charged with 0 percent GST. It means that GST will not

be levied on consumers. However, business entities can still reclaim

their input tax. Examples of products in this class are basic foods such

as sh and meat, cooking oil and the rst 200 units of electricity per

month.

166

Journal of International Studies , Vol. 18, 2022, pp: 159-189

Figure 2

The Zero-rated Supplies Charges

Source: Royal Malaysian Customs Department (2020)

Lastly, the Exempt Supplies is where GST is not charged on the supply.

It means that tax will not be imposed on consumers. In addition, the

business sectors, particularly the nal parties in the supply-chain

system (before the consumer), are not justied in claiming their input

tax credit even though they may be subject to GST at the time of

input purchase. For example, this category includes private health

care, private education, and certain nancial services (Dezan Shira

& Associates, 2016). For better understanding, Figure 3 shows the

Exempt Supplies in GST.

The benet of GST in Malaysia makes business costs lower. It is

because they can reclaim or recover their input from the government.

Besides, GST is more transparent than SST because no hidden tax

is imposed, which means the consumer knows the number of goods

and services subject to tax. In addition, GST can increase trade

competitiveness because no GST is levied on exported goods and

services (Dezan Shira & Associates, 2016). However, GST did not

last long as SST 2.0 was re-introduced after the new government took

over the administration, with the Services Tax at 6 percent and the

Sales Tax at 5 percent to 10 percent.

6

Source: Royal Malaysian Customs Department (2020)

Lastly, the Exempt Supplies is where GST is not charged on the supply. It means that tax will not be

imposed on consumers. In addition, the business sectors, particularly the final parties in the supply-

chain system (before the consumer), are not justified in claiming their input tax credit even though they

may be subject to GST at the time of input purchase. For example, this category includes private health

care, private education, and certain financial services (Dezan Shira & Associates, 2016). For better

understanding, Figure 3 shows the Exempt Supplies in GST.

Figure 3

The Exempt Supplies Charges

167

Journal of International Studies , Vol. 18,2022, pp: 159-189

Figure 3

The Exempt Supplies Charges

Source: Royal Malaysian Customs Department (2020)

THE IMPLEMENTATION OF GST IN SINGAPORE

The Singapore government imposed GST on its people after it had

achieved the status of advanced country with a per capita income of

over USD15,000. In 1989, Singapore’s per capita income (based on

purchasing power parity [PPP]) was USD16,356; in 1994 (when GST

came into effect), it was USD24,853; and in 2012, it was USD60,79.

By referring to the “Report of the Economic Committee on the

Singapore Economy: New Directions”, the concept of implementing

GST came into the picture. The report published in 1986 explored

the reasons for the prevailing recession, suggested policy changes,

and analysed the key strategies for pursued growth and promotion of

different economic sectors (Ministry of Trade and Industry Republic

of Singapore, 1986).

In April 1994, GST was rst introduced in Singapore to reduce

the burden of higher income taxes by implementing an indirect

tax on economic consumption at a 3 percent rate. GST encourages

Singaporeans to save money. It has become an important part of the

country’s economy as it constitutes 15 percent of the government’s

6

Source: Royal Malaysian Customs Department (2020)

Lastly, the Exempt Supplies is where GST is not charged on the supply. It means that tax will not be

imposed on consumers. In addition, the business sectors, particularly the final parties in the supply-

chain system (before the consumer), are not justified in claiming their input tax credit even though they

may be subject to GST at the time of input purchase. For example, this category includes private health

care, private education, and certain financial services (Dezan Shira & Associates, 2016). For better

understanding, Figure 3 shows the Exempt Supplies in GST.

Figure 3

The Exempt Supplies Charges

168

Journal of International Studies , Vol. 18, 2022, pp: 159-189

total revenues, almost the same amount received from income taxes.

The current GST rate in Singapore is at 7 percent and may rise to

9 percent from 2021 to 2025. GST in Singapore experienced two

reforms, the 1994 Reform and the 2003/2004 Reform. In 1994, as

stated earlier, the tax was 3 percent, and the corporate and personal

income taxes were cut. Then, in the 2003/2004 Reform, the GST rate

rose to 4 percent in 2003 and 5 percent in 2004. As with the 1994

law, the 2003/2004 law was also put on the market as a bundle of tax

reform initiatives.

In this phase, the goal of GST is not to increase the tax collection

but rather to educate and enable its citizens to adapt to the new tax.

Simultaneously in 1994, the government of Singapore also established

a Committee against Proteering (CAP) to examine all complaints and

feedback on proteering and raising arbitrary prices by traders using

government-imposed GST as an excuse (refer to Table 2 regarding

the percentage of GST in Singapore, and Table 3 on the elaboration of

categories on what will be taxed and exempted).

Table 2

GST Percentage Rate in Singapore

Year GST percentage (%)

1 April 1994 to 31 December 2002 3

1 January 2003 to 31 December 2003 4

1 January 2004 to 30 June 2007 5

1 July 2007 until now 7

Source: Inland Revenue Authority of Singapore (IRAS) (2020a)

Table 3

Taxable and Non-taxable Goods and Services

Taxable Supplies Taxable Supplies

Standard-

Rated Supplies

(7% GST)

Zero-Rated

Supplies

(0% GST)

Exempt

Supplies

(GST is not

applicable)

Out-of-

Scope

Supplies

(GST is not

applicable)

(continued)

169

Journal of International Studies , Vol. 18,2022, pp: 159-189

Taxable Supplies Taxable Supplies

Goods Most local sales

fall under this

category.

E.g., sale of

a TV set in a

Singaporean

retail shop

Export of goods.

E.g., sale of

a laptop to

an overseas

customer where

the laptop is

shipped to an

overseas address

Sale and

rental of

unfurnished

residential

property;

Importation

and local

supply of

investment

precious

metals

Sale where

goods are

delivered

from

overseas to

another place

overseas;

Private

transactions

Services Most local

provisions of

services fall

under this

category.

E.g., provision

of spa services

to a customer in

Singapore

Services that

are classied

as international

services.

E.g., air ticket

from Singapore

to Thailand

(international

transportation

service)

Financial

services.

E.g., issue

of a debt

security

Digital

payment

tokens (from

1 January

2020)

E.g.,

exchange of

Bitcoin for

at currency

Source: IRAS (2020b)

THE IMPACTS OF GST IMPLEMENTATION IN MALAYSIA

Politics

The impact of GST implementation on politics in Malaysia has

an interesting story. Malaysia once applied SST, then to be more

transparent, SST was replaced by GST. In this situation, good

governance should play a role. Governance may be described as the

government’s ability to make, implement laws, and provide goods

and services to the public regardless of any constitution or chamber

they hold (Fukuyama, 2013). Therefore, governance will shape the

country’s tax system. It means that the government needs to change

the perspective of the public and taxpayers about the benets they will

gain from implementing the GST, which means that the government

must tackle the people to believe in GST.

170

Journal of International Studies , Vol. 18, 2022, pp: 159-189

However, not all people agree with the implementation of GST. The

consequences of GST implementation in Malaysia’s politics happened

when the government transitioned, leading to the abolishment of GST.

Suppose we refer to an Economist, Ahmad Zubaidi. In that case, it can

be assumed that the opposition party used the GST issue as a political

instrument to gain people’s support by selling stories that if GST

is implemented later, the price of goods will rise, and ination will

increase. Therefore, it will cause the people to become poor (www.

bharian.com.my, accessed, 20 Aug 2020). In addition, it was argued

that Pakatan Harapan tended to use the GST issues as an attractive

political instrument to convince voters to vote for Pakatan Harapan in

the 14

th

Malaysian General Election. Pakatan Harapan also saw that

the issue of GST was among the important discourses in Malaysian

society.

As a result, Pakatan Harapan won the election, and the long-standing

government in Malaysia, Barisan Nasional, lost their majority vote.

It can be observed as one of the reasons for their loss in Malaysia’s

General Election. Francis Hutchinson once mentioned that GST is one

of the features that had signicantly changed the order and landscape

of the country’s political economy, especially in the run-up to general

elections or voting. In contrast, others are just a continuation of

the fragmentation of Malay-based political parties (Yong, 2018). It

is because the people started questioning the transparency of GST

as they felt burdened by the tax. After Pakatan Harapan took over

the government, they implemented SST. Therefore, the tax applied

in the country greatly impacted the people that affected the political

situation.

Economy

GST’s impact can be seen through the economic spectrum. One of the

effects is on the Small and medium-sized enterprises (SMEs). SMEs

are outlined into two categories; manufacturing: sales turnover not

surpassing RM50 million or full-time employees not surpassing 200

staff; and services and other sectors: sales turnover not surpassing

RM20 million or full-time employees not exceeding 75 workers

(Central Bank of Malaysia, 2017). SMEs have made a remarkable

contribution to a nation’s economic prosperity (Filzah, 2009).

SMEs in Malaysia are subject to income tax, either as an individual

(unincorporated) or corporate (incorporated) taxpayer, depending on

the establishment of the business (Pope, 2008).

171

Journal of International Studies , Vol. 18,2022, pp: 159-189

One of the impacts of GST on SMEs is boosting exports’ protability.

Exports are important in maintaining economic progress in every

country. From the SME perspective, GST uses the zero-rated export.

Zero-rated exports mean that exporters can claim the input tax credit

for all input tax incurred in the production of the exported supplies.

It will enhance export competitiveness and create new market

prospects for Malaysian SMEs. Besides, to support local producers

and exporters, The Approved Trader Scheme (ATS) was implemented

specically to solve the cash ow issue that importers always face;

most of them have re-exported their inventories.

Furthermore, GST has contributed to increasing the economic growth

in Malaysia. As Anil from Hernancres Tax Consultancy (year) stated,

GST was spent on driving the Start-up Project, which is part of the

12 National Key Economic Areas (NKEAs) that contributed to the

economic growth of Malaysia as measured by the Gross National

Income Index. It is because the government’s priority is maximising

income (Ikhsan et al., 2017). For example, it has contributed to building

infrastructure such as the Mass Rapid Transit (MRT) project, boosting

the oil and gas companies, and promoting the digital economy’s

growth by utilising the Industrial Revolution 4.0 mechanism and the

halal industry. The country’s gross domestic product (GDP) grew 5.8

percent from a year earlier after rising to 5.6 percent in the rst quarter

(Bernama, 2017).

Besides, according to the Economic Report 2017–2018, collections

of GST appeared to grow yearly. As indicated, in 2015, the GST

collection amounted to RM27 billion, in 2016 to RM41.2 billion and

in 2017 to RM44 billion. It showed that GST signicantly increased

by broadening and expanding the tax base and increasing transparency

and compliance. Based on this reason, the introduction of GST

revealed that it is a scal step intended to increase the performance

of the Malaysian tax scheme. Therefore, ination slightly happens in

Malaysia as the price of goods increases. At the same time, Malaysia

is also focusing on handling the COVID-19 pandemic. As mentioned

by the then Malaysian Prime Minister, Tan Sri Muhyiddin Yassin

declared the interest of Malaysians as the nation’s priority with

capacity and resources dedicated to ghting the COVID-19 pandemic

(Shukri, 2021).

172

Journal of International Studies , Vol. 18, 2022, pp: 159-189

Society

From a societal perspective, GST implementation received many

reactions from society in Malaysia and Singapore. One of the impacts

on society is the price-level increase as the prices of goods and services

will increase when GST is charged. In the case of Malaysia, people

tend to have a negative view of GST (Narayanan, 2014). People

assume that GST could lead to price increases (Palil & Ibrahim,

2011), which is believed could lead to reducing the purchasing power

of consumers.

As a consumption tax, it is likely to be regressive; that is, it will

extract a large percentage of income from the low-income class

through taxes as compared to the higher-income class. It shows that

the middle class will be affected most by this tax. However, the people

in Malaysia benetted from GST. Because of the tax system, Datuk

Seri Najib’s government at the time provided the citizens with BR1M

(Bantuan Rakyat 1Malaysia). BR1M was one of the economic relief

policies initiated by the government to economise society. As Datuk

Seri Najib said, the BR1M being passed to the target population was

from the subsidy rationalisation and revenue and services tax (GST).

However, as claimed by the opposition parties, BR1M is a political

orchestration to raise votes from the people.

THE EFFECTIVENESS OF GST

IMPLEMENTATION IN MALAYSIA

Even though GST only lasted for about three years in Malaysia, this tax

has helped the nation’s economy and transparency. It is because GST

was introduced in Malaysia to overcome the transparency problem

while the country applied SST. SST was not stated in the consumption

record. In contrast, GST is stated in the consumption receipt when the

consumer buys goods or uses services. That is why most analysts in

Malaysia agree that GST can recover the economic revenue. In 2017,

the GST collection was more than RM40 billion. This huge amount

then returned to the people through adopting the various projects by

upgrading infrastructure and improving public transport systems in

developing the country. Figure 4 shows the GST revised estimate in

2017 and the GST budget estimate in 2018.

173

Journal of International Studies , Vol. 18,2022, pp: 159-189

Figure 4

The Contribution of GST in 2017

Source

2017

Revised

Estimate

2018

Budget Estimate

Change

(RM million) (RM million) (%) (RM million) (%)

Export Duty 1,222 1,400 2.2 178 14.6

Import Duty 3,008 3,022 4.7 14 0.5

Excise Duties 11,806 12,334 19.4 528 4.5

GST 41,500 43,800 68.6 2,300 5.5

Others 2,959 3,300 5.2 341 11.5

TOTAL 60,495 63,856 100.0 3,361 5.6

Source: Ministry of Finance Malaysia (2017)

According to analysts, the collection of GST has many benets for

the people. The government used it for programmes such as KR1M

(Kedai Rakyat 1Malaysia), which offers affordable goods to reduce

the cost of living. In addition, during the announcement of GST

implementation in the 2014 Budget, the government announced the

‘offset measures’ such as reducing individual income tax between

(1%–3%), reducing corporate income tax from 25 percent to 24 percent

and SME tax deduction from 20 percent to 19 percent. BR1M for

households earning RM3,000 a month were also raised from RM500

to RM650, while households earning RM3,000-4,000 a month were

initially given BR1M of RM450 for the rst time. Subsequently, in

Budget 2015, the BR1M amount was raised to RM950 and RM750,

respectively. For single individuals earning RM2,000 and below,

BR1M was increased to RM350. It mitigated the impact of price

increases (Omar, 2018).

THE CHALLENGES OF GST IMPLEMENTATION

IN MALAYSIA

The challenges of GST in Malaysia come from various factors;

one of the challenges is from the citizens themselves, particularly

their acceptance and perception of the tax system. In this context,

the implementation of GST became an issue when people started

174

Journal of International Studies , Vol. 18, 2022, pp: 159-189

questioning its advantages as the people felt that it caused an increase

in living costs and ination. Therefore, even though GST is not the

main reason for the problem, it also contributes to the ination and

living costs problem.

In addition, the lack of information and awareness about GST among

citizens in Malaysia is challenging, making them form negative

thoughts about GST. The introduction of GST on 1

st

April 2015 has,

until now, given rise to objections from different groups, including

those from the middle- and low-income levels. It also became

resistant in the business context. As indicated, the imposition of GST

in Malaysia has impacted the retail sector. Some service-oriented

sectors are also facing short-term downturns as consumers become

cautious about spending (shopping) (Urif, 2016), negatively impacting

business activities.

Besides, as stated by Joel Liew, the Chief Technology Ofcer at

Feradigm company, most SMEs are not fully ready for GST based on

his interactions with those involved in the SME industry. He said that

even though they all attended GST courses or lectures and understood

the tax system in principle, laws, and what they need to do, it was

difcult to implement when it comes to enforcing it towards their own

business. Besides, most SMEs are using the manual way to keep their

accounting records, which means when GST is adopted, they need to

upgrade to the accounting software. Furthermore, GST has become a

challenge to Malaysians because of the rate levied on the tax. The 6

percent tax rate is quite high to be implemented as a starting point for

GST.

Another challenge of GST in Malaysia is that it confuses the people.

In this context, confusion regarding the mobile prepaid cards once

happened. Although GST replaced SST for mobile prepaid reload by

6 percent, there were still many complaints about it during the rst

day of implementation due to the higher prices of mobile reload. As

mentioned by the Communications and Multimedia minister at that

time, Ahmad Shabery Cheek said that GST for prepaid mobile top-up

would be charged based on the customer’s usage, wherein customers

who paid RM10 for prepaid top-up would get the value of mobile

service worth RM10 (Gomez, 2015).

In conclusion, the challenges of GST in Malaysia come from the

people. It is because they are not all ready or can accept a new tax to be

175

Journal of International Studies , Vol. 18,2022, pp: 159-189

implemented in the country. Most of them stated that GST would only

give them disadvantages as the price level, living cost, and ination

increase. Even though GST is more transparent than SST, whether it

triggers the prices of goods and services to increase to the extent that

they are burdened will be considered an insignicant effort.

THE IMPACTS OF GST IMPLEMENTATION

IN SINGAPORE

Politics

As for Singapore, the effect of GST on the political sector did not create

many issues. It is because GST implementation in Singapore was a

success in the early years. Singapore’s successful implementation of

GST is attributed in no small part to the government’s unwavering

commitment to introducing the tax and, subsequently, to increasing

the tax rate. In addition, a unique political environment where the

governing political party is overwhelmingly dominant and enjoys

strong credibility among the electorate, is relatively insulated from

pressures exerted by vested interest groups, and is virtually certain of

being in the government in the foreseeable future undoubtedly aided

the tax reform process (Poh, 2005).

However, Singapore’s politics may be a bit problematic when

the ruling party of Singapore, the People’s Action Party, planned

to increase GST from 7 percent to 9 percent starting from 2021

to 2025 to support rising expenditure on health care, security, and

infrastructure. However, in response to this statement, the opposition

party, Singapore’s Workers’ Party, stated that they did not support or

were against the government’s plans to increase the GST rate. One of

the opposition party members asserted that the government should

nd other resources to support the expenditure, but not by increasing

the GST rate. The matter of the GST hike might trigger the political

environment in Singapore.

Therefore, the Deputy of Prime Minister, Heng Swee Keat, stated, “I

hope that when elections come around, the WP won’t use the GST

to distract people from longer-term issues that we face.” (Iwamoto,

2018). Nevertheless, as the Covid-19 pandemic occurred, Heng

expressed that the plan to increase the GST rate will not be scrapped

and will need to be done by 2025. Therefore, GST rates also play

176

Journal of International Studies , Vol. 18, 2022, pp: 159-189

a crucial role in maintaining the powers in politics. In addition, the

government transition makes it worse because each government

wants to implement different tax policies in the country.

Economy

According to the Asia Pacic Indirect Tax Leader, Koh Soo How, in

2017, the Inland Revenue Authority of Singapore collected S$11.1

billion in GST. In addition, he also stated that GST contributed the

most to the county’s revenue compared to other taxes implemented

in Singapore (Tan, 2018). Then, in 2018, Singapore’s GST revenue

was only $11.29 billion. However, the revenue in 2019 went down to

$11.18; this year, it is expected to collect $11.27 billion. The gure

below shows the overall budget balance of Singapore.

Figure 5

Overall Budget Balance

Source: Singapore budget (2020)

Furthermore, due to the global pandemic of COVID-19, Singapore

was affected, especially in the economic sector. Therefore, the plan

to increase the tax rate of GST would not take effect in 2021. As said

by the Deputy of Prime Minister, who is also the Finance Minister,

Heng Swee Keat, in his Budget speech, “In other words, the GST

rate will remain at 7 percent in 2021” (Lim, 2020). The objective of

increasing the GST rate was to boost the government’s revenue due to

13

Figure 5

Overall Budget Balance

Source: Singapore budget (2020)

Furthermore, due to the global pandemic of COVID-19, Singapore was affected, especially in the

economic sector. Therefore, the plan to increase the tax rate of GST would not take effect in 2021. As

said by the Deputy of Prime Minister, who is also the Finance Minister, Heng Swee Keat, in his Budget

speech, “In other words, the GST rate will remain at 7 percent in 2021” (Lim, 2020). The objective of

increasing the GST rate was to boost the government’s revenue due to the expected increase in recurrent

expenditure, particularly in health care, given that the country is grappling with an ageing population.

Society

In Singapore, the GST hike also affected its citizens. Starting from January 2020, digital services would

be taxed under GST, particularly imported digital services. The possible digital streaming services that

are affected are Spotify and Netflix. However, this tax is not yet named. In addition, the amendment

allows the government to collect GST on overseas services starting in 2020, particularly by imposing

an overseas vendor registration regime on business-to-consumer services, such as through the

applications, e-market listing fees, software, and video streaming, and online subscription fees (Ng,

2018).

As explained by Ong Teng Koon, a member of Marsiling-Yew Tee GRC, the digital tax will become a

disadvantage to the lower-income communities because they lack digital exposure. He added that some

digital services could also serve as more accessible replacements for physical facilities, for example,

online learning and education, including online entertainment. However, knowing this digital tax might

burden the lower-income groups, the Singapore government has prepared the GST Voucher Scheme to

177

Journal of International Studies , Vol. 18,2022, pp: 159-189

the expected increase in recurrent expenditure, particularly in health

care, given that the country is grappling with an ageing population.

Society

In Singapore, the GST hike also affected its citizens. Starting from

January 2020, digital services would be taxed under GST, particularly

imported digital services. The possible digital streaming services

that are affected are Spotify and Netix. However, this tax is not yet

named. In addition, the amendment allows the government to collect

GST on overseas services starting in 2020, particularly by imposing

an overseas vendor registration regime on business-to-consumer

services, such as through the applications, e-market listing fees,

software, and video streaming, and online subscription fees (Ng,

2018).

As explained by Ong Teng Koon, a member of Marsiling-Yew Tee

GRC, the digital tax will become a disadvantage to the lower-income

communities because they lack digital exposure. He added that some

digital services could also serve as more accessible replacements

for physical facilities, for example, online learning and education,

including online entertainment. However, knowing this digital tax

might burden the lower-income groups, the Singapore government

has prepared the GST Voucher Scheme to help the households reduce

their GST burden. In this issue, the subsidies of Internet access to the

affected groups will also be considered (Ng, 2018).

THE EFFECTIVENESS OF GST IMPLEMENTATION

IN SINGAPORE

The effectiveness of GST or VAT in Singapore can be measured

through its impact on the economy. Besides, GST in Singapore is

also effective on society. For example, the Singapore government

has implemented an offsetting plan to ease the burden on people. The

offset package includes raising tax rates and reducing taxes on low-

income Singaporeans, raising property taxes, reducing rent, utility

charges, and maintenance charges on public housing, and increasing

subsidies for government, education, and health services. In addition,

after the implementation of GST in 1994, 70 percent of individuals

who, before the implementation of GST, had to pay taxes were no

178

Journal of International Studies , Vol. 18, 2022, pp: 159-189

longer obliged to pay taxes. Then, when the GST tax rate was raised

from 5 percent to 7 percent effective from 1

st

July 2007, it was found

that the lower 20 percent of Singapore households paid an additional

GST of $370 per annum but received an offset package of $910 per

annum plus a permanent benet payment of $1,000 a year.

In 2010, the Singapore government revealed that 84.2 percent of GST

was contributed by foreigners living and working in Singapore and the

top 40 percent of Singapore households. On the other hand, the lower

20 percent of Singapore households contributed only 4 percent of the

GST collected. However, the government believes it has prepared and

contributed the GST collection back to its people.

Furthermore, the GST policy in Singapore helps the government

to lower individual and corporate income taxes. Before the GST

implementation, the individual and corporate income taxes were 30

percent. After the GST implementation, the tax rate for corporate

was decreased to 17 percent and the individual income tax rate to

22 percent until the present day. The Singapore authorities have

brought numerous measures to lessen the aggressive impact of the tax

implementation since it was introduced more than two decades ago.

Among the redistributions achieved are increased subsidies to offset

the GST payable to education and the introduction of automatic

unemployment benets and wage hikes for the working and low-

income groups. In conclusion, GST in Singapore is highly effective

due to the government’s yearly percentage increase rate. GST’s

effectiveness in Singapore includes society and the economic

sector. However, the effectiveness might be crucial to every country

implementing the tax policy. The challenges of GST implementation

are also essential in shaping a better GST form.

THE CHALLENGES OF GST IMPLEMENTATION

IN SINGAPORE

The current challenges of GST in Singapore are concerning the

government’s planned hike rate. As planned, the GST rate will be

increased by next year, but due to the coronavirus outbreak, the

government then announced and changed the GST hike plan from

2021 to 2025. In this context, the citizens will feel the challenge,

179

Journal of International Studies , Vol. 18,2022, pp: 159-189

especially the lower-income group. As stated in the previous part, the

opposed party of the government also disagreed with the GST hike

planned by the government. However, the Singapore government

has played a vital role in ensuring that the GST increase rate will not

burden their citizens.

Even though the price of products and services can increase, the

government has provided or supported the Singaporeans through

subsidies for education, health, housing, and other alternative aid.

Besides, the GST Voucher Scheme initiated by the government

in Budget 2012 to assist lower-income Singaporeans will be

strengthened once the GST rate is raised. In addition, the Assurance

Package for GST announced in Budget 2020 is one of the Singapore

government initiatives to help people with the increasing GST. Under

this package, each adult in Singapore can acquire a payout of $700

to $1,600 over ve years, and lower-income households can receive

more. Furthermore, those living in one- to three-room Housing and

Development Board (HBD) ats can receive offsets similar to ten

years’ value of extra GST expenses.

However, as aforementioned, these GST hikes are planned to become

a challenge due to the coronavirus outbreak and people’s acceptance,

even though subsidies will be provided when GST increases. Besides,

as stated by Kor and Seow (2019), Singapore’s implementation of

the GST reverse charge has a signicant effect on companies in

Singapore, as it will require them to self-account GST to the Inland

Revenue Authority of Singapore (IRAS) on imported services as if

they were the service providers supplying services to themselves.

From this perspective, the challenges of GST will affect businesses.

One of the challenges for the GST reverse charge is its invisibility.

Unlike the GST paid by local providers, the GST for imported

commodities is unseeable to the accounting ofcer who processes the

invoice. Invoices issued from overseas service providers will check

the same before and after 1

st

January 2020 as foreign service providers

do not charge Singapore GST.

However, after 1

st

January 2020, accounting personnel were required

to self-account for the GST output duty on foreign services. The

necessity to self-account GST on foreign services may go past the

accounting department. For example, payment for the Board of

180

Journal of International Studies , Vol. 18, 2022, pp: 159-189

Directors’ fees overseas is subjected to a reverse charge; therefore, the

payment may be handled by the human resource ofcer rather than

the accounting ofcer (Kor & Seow, 2019). In sum, the challenges

of GST in Singapore include the hike planned rate and the reverse

charge of GST levied on imported goods. In addition, the coronavirus

outbreak challenged the government to implement the raised GST rate

as the economy in Singapore is quite unstable. The following section

discusses the differences in GST implementation between Malaysia

and Singapore to answer the objectives of this current study.

HOW DOES MARXISM EXPLAIN THE GST

IMPLEMENTATION IN MALAYSIA AND SINGAPORE?

The GST implementation in Malaysia and Singapore has both positive

and negative sides. As Marx considered the progressive tax, GST or

consumption tax is not a proposed tax by Marxist as it is a regressive

tax, even though Malaysia also applied progressive tax like income

tax. As the GST discourse is concerned, the regressive tax affected

the lower-income groups more than the high-income earners. In this

context, the fairness or so-called fair distribution of wealth come as

one of the indicators to identify whether the tax is good or not. As

Marx stated, progressive tax, like income tax, is fairer than regressive

tax. Therefore, the question is whether the GST system is reasonable

to be implemented.

The Royal Malaysian Customs Department (RMCD) (2020) stated

that GST is a fairness and equity tax. In GST, taxes are equally imposed

among all the companies involved, whether in the manufacturing,

wholesale distribution, retailing, or service industries. Therefore,

GST is known as multistage taxation because all sectors will be taxed.

In addition, fairness can be identied through the consumption price,

as Malaysians, whether of high or lower income, will pay the same

tax rates for goods and services. It means that Malaysia’s GST is quite

fair to all consumers. Whether rich or poor, they still have to pay 6

percent when purchasing goods.

Nevertheless, the lower-income group is still affected by GST due

to their high sensitivity to the consumption of basic goods (Kadir,

2017). Therefore, this means that Marx is right about the regressive

tax burdening the lower-income or poor people. Lim Guan Eng, the

181

Journal of International Studies , Vol. 18,2022, pp: 159-189

Finance Minister during the Pakatan Harapan administration, stated

that GST hit the poor community as previously they never had to pay

taxes. However, when GST was applied, they had to pay for stuff

they purchased (Rashvinjeet, 2018). It becomes one reason for Marx’s

argument towards progressive tax. It is because progressive tax, such

as income tax, is only levied on the high-income group. In Malaysia,

income tax is levied on households that achieve an income above

RM3,000. From this progressive tax, the government will distribute

the wealth to the lower-income and build the infrastructure, as Marx

mentioned as fairness.

However, Marx’s view about the wealth distribution on regressive

tax remains debatable. It is because the Malaysian government takes

initiatives to redistribute GST collection to reduce the citizens’ burden.

It can be seen that the Malaysian government try to make a win-win

situation between the GST and the citizens. People must pay GST

whenever they buy or use the goods and services. However, in return,

the government help back their people with the initiative such as the

BR1M through the GST collection. As stated by Datuk Seri Najib, the

main purpose of BR1M is a method of redistribution of income from

the 60% of the richest group to the 40 percent of the lowest income

group and as an economic driver, especially in rural or small towns

(Mardhiah, 2018). This initiative is truly meaningful, especially to

the lower-income earners and the poor. The government also built

KR1M to decrease the affected people by GST, as KR1M offered

goods at a lower price. Besides, the Zero-rated Supplies and Exempt

Supplies adopted in Malaysia help the poor as the basic and essential

stuff at zero-rated while the public amenities are exempted. In the

context of wealth distribution, Marx also preferred inheritance tax.

An inheritance tax is a tax payable by a person who inherits money or

property from a deceased person.

As observed, GST in Singapore remains until today, even though the

rate might increase in 2021. The effectiveness of GST in Singapore

is quite the same as in Malaysia. The difference is that GST in

Singapore remains, but it has been abolished in Malaysia. Marx stated

that regressive tax burdened the people, and it must be admitted that

the fact is true. However, the Singapore government know how to

reduce the burden on the lower-income household. In this perspective,

to combat the GST burden, the Singapore government has provided

the GST Voucher Scheme that the government introduced in Budget

182

Journal of International Studies , Vol. 18, 2022, pp: 159-189

2012 to help the lower-income group. This voucher will be enhanced

when the GST rate is raised. Besides, the Assurance Package for GST

announced in Budget 2020 is also one of the Singapore government’s

efforts to help their people with the increasing GST. Under this

package, every adult Singaporean will receive a cash payout of $700

to $1,600 over ve years. Lower-income households will receive

more than that. Those living in one- to 3-room HDB ats will receive

offsets equivalent to about ten years’ worth of additional GST

expenses. In addition, GST has contributed to Singapore’s revenue as

it became the second tax, after corporate tax, that contributed to the

nation’s revenue. It shows that wealth and income redistribution are

also through the collection of GST.

In addition, as the Singapore government planned to increase the GST

rate by 2021, the economists estimated that the 2 percent increase in

the GST rate could boost Singapore’s headline ination rate by 1.0–

1.5 percentage points and core ination, the measure closely watched

by policymakers even more (Lam, 2018). Based on the Marxist

preference of tax, Singapore has also adopted the progressive income

tax and inheritance tax. Without a doubt, these taxes contribute to

national revenue. However, this study only focused on regressive tax,

whereby GST was highlighted in this article.

CONCLUSION

This paper concluded that the tax system inuences every state’s

political, economic, and social condition. Tax is crucial in every

country, as it is one of the fundamental tools to shape and increase

the economy. For example, GST has contributed to Singapore and

Malaysia’s economy and revenue. Nevertheless, the GST impact

affected the citizens of Singapore and Malaysia, especially the lower-

income earners. It is because of its features, which is a regressive tax.

This study also showed that not all can accept the GST tax policy. As

for theoretical implication, it can be observed that by Marx and the

Marxism theory, the regressive tax itself does not meet the criteria

of the Marxist as it is a regressive tax. GST has both pros and cons.

However, it is still relevant to be applied in the country. Based on

the orthodox and heterodox liberal conception, the tax policy could

contribute to the national revenue, where every transaction should be

charged.

183

Journal of International Studies , Vol. 18,2022, pp: 159-189

In contrast, most critical theorists have raised their concern about how

the tax policy could be distributed equally to the people, especially in

lower-income societies. As for practical implications, the government

needs to ensure that welfare distribution can reach all levels of the

lower class of society, including the working class and precariat groups.

Undoubtedly, nobody enjoys paying taxes, but one must know that

taxes are essential for funding public goods and services. Moreover,

some believe the taxes also contribute to the country’s production.

Further studies are needed to put other perspectives in analysing the

effectiveness of GST policies, particularly involving working-class,

middle, and lower-class societies as their focus of study and require

other theoretical lenses of view.

ACKNOWLEDGMENT

This research received no specic grant from any funding agency.

REFERENCES

Ahmaz Zubaidi (2014, September 10). GST bukan faktor harga barang

naik. Berita Harian. https://www.bharian.com.my/taxonomy/

term/61/2014/09/5345/gst-bukan-faktor-harga-barang-naik

Amadeo, K. (2020). Fiscal policy types, objectives, and tools. The

Balance. https://www.thebalance.com/what-is-scal-policy-

types-objectives-and-tools-3305844

Aziz, M. A. (2017, October 26). Pengurusan skal berhemat terus

dikekal. Berita Harian Online. https://www.bharian.com.

my/rencana/muka10/2017/10/341997/pengurusan-fiskal-

berhemat-terus-dikekal

Bakar, A. S. A. (2018). Impak cukai barangan dan perkhidmatan

(GST) ke atas indeks harga pengguna (IHP): Analisis intervansi

[Paper presentation]. 5th Annual ECoFI Symposium 2018,

EDC Hotels & Resorts, Sintok, Kedah, Malaysia.

Bedi, R. S. (2018, August 12). GST impacted the poor, says Guan Eng.

The Star. https://www.thestar.com.my/news/nation/2018/08/12/

gst-impacted-the-poor-says-guan-eng

Bernama. (2017, October 24). GST bantu tingkatkan ekonomi negara.

Astro Awani. http://www.astroawani.com/berita-malaysia/gst-

bantu-tingkatkan-ekonomi-negar a-158812

184

Journal of International Studies , Vol. 18, 2022, pp: 159-189

Bernama. (2018, April 30). GST jimat bilion ringgit ketirisan SST.

MyMetro. https://www.hmetro.com.my/mutakhir/2018/04/335342/

gst-jimat-bilion-ringgit-ketirisan-sst

Candela, L. (2019). Introduction to scal policy. Course Hero. https://

www.coursehero.com/study-guides/boundless-economics/

introduction-to-scal-policy/

Chen, J. (2020). Ination. https://www.investopedia.com/terms/i/

ination.asp

Department of Statistics Malaysia. (2019, July 15). Current population

estimates, Malaysia, 2018-2019. https://www.dosm.gov.my/

v1/index.php?r=column/pdfPrev&id=aWJZRkJ4UEdKcUZpT

2tVT090Snpydz09

Dezan Shira & Associates. (2016). An introduction to Malaysian GST.

M. Clarke (Ed.), ASEAN Brieng. https://www.aseanbrieng.

com/news/an-introduction-to-malaysian-gst/

Dezan Shira & Associates. (2018). Malaysia to re-introduce sales and

services tax from September 1. ASEAN Brieng. https://www.

aseanbrieng.com/news/malaysia-to-re-introduce-sales-and-

services-tax-from-sept-1/

Expat.com. (2018). The tax system in Malaysia. Expat.com. https://

www.expat.com/en/guide/asia/malaysia/11917-taxes-in-

malaysia.html

Goh, M. P., & Aminuddin, A. S. (2015). Taxing times ahead? https://

www.inhousecommunity.com/article/taxing-times-ahead/

Gomez, J. (2015, May 19). Too many exemptions led to Malaysia’s

GST confusion, say tax experts. The Edge Markets. https://

www.theedgemarkets.com/article/too-many-exemptions-led-

malaysias-gst-confusion-say-tax-experts

Government of Singapore. (2019). Budget 2020 Revenue and

Expenditure.https://www.singaporebudget.gov.sg/budget_

2020/revenue-expenditure

Guide Me Singapore (2020). Singapore tax system and tax rates.

In-House Community. https://www.guidemesingapore.com/

business-guides/taxation-and-accounting/introduction-to-

taxation/singapore-tax-system-and-tax-rates

Hassan, A. A. G., Saari. M. Y., Utit, C., Hassan, A., & Harun, M.

(2016). Estimating the impact of GST implementation on cost

of production and cost of living in Malaysia. Jurnal Ekonomi

Malaysia, 50(2), 15–30. http://dx.doi.org/10.17576/JEM-2016-

5002-02

185

Journal of International Studies , Vol. 18,2022, pp: 159-189

Hillier, B. (2015). Why the GST is unfair (and why the working class

should pay no tax). Red Flag. https://redag.org.au/article/

why-gst-unfair-and-why-working-class-should-pay-no-tax

https://www.businesstoday.in/moneytoday/expert-view/a-

welldesigned-gst-can-boost-gdp-growth-by-2percent/

story/8474.html

https://www.nst.com.my/business/2018/05/364702/gst-had-minimal-

impact-ination-economists

Hussin, R. (2019, October 24). Inasi: Dua faktor berlakunya

peningkatan harga di dalam ekonomi. Majalah Labur.

https://www.majalahlabur.com/kewangan/inasi-dua-faktor-

berlakunya-peningk atan-harga-di-dalam-ekonomi

Ibrahim, M. I. (2018, August 25). Wang BR1M bukan hasil curi -

Najib. Berita Harian Online. https://www.bharian.com.my/

berita/nasional/2018/08/465884/wang-br1m-bukan-hasil-curi-

najib

Ikhsan, M. F., Ghani, A. B. A., & Subhan, I. (2017). The relevancy

of the ‘guanxi’ and ‘xinyong’ concepts in Chinese business

capitalisation in Indonesia. Journal of International Studies,

13, 97–116. Universiti Utara Malaysia, UUM Press.

Ikhsan, O. M. F., Islam, R., Khamis, K. A., & Sunjay, A. (2020).

Impact of digital economic liberalization and capitalization in

the era of industrial revolution 4.0: Case study in Indonesia.

Problems and Perspectives in Management, 18(2), 290.

Inland Revenue Authority of Singapore (IRAS). (2020a). Current GST

rates. Inland Revenue Authority of Singapore. https://www.

iras.gov.sg/irashome/gst/gst-registered-businesses/learning-

the-basics/how-to-implement-gst/current-gst-rates/

Inland Revenue Authority of Singapore (IRAS). (2020b). Goods and

services tax (GST): What it is and how it works. Inland Revenue

Authority of Singapore. https://www.iras.gov.sg/taxes/goods-

services-tax-(gst)/basics-of-gst/goods-and-services-tax-(gst)-

what-it-is-and-how-it-works

Ireland, D. (2019). What Marxist tax policies actually look like?

Historical Materialism, 27(2), 188–221.

Iwamoto, K. (2018, March 1). Opposition and activists up in arms

over Singapore’s plan to hike GST. Nikkei Asian Review.

https://asia.nikkei.com/Politics/Opposition-and-activists-up-

in-arms-over-Singapore-s-plan-to-hike-GST

Jenkins, G. P., & Rup Khadka. (1998). Value added tax policy and

implementation in Singapore. International VAT Monitor, 9(2),

35–47.

186

Journal of International Studies , Vol. 18, 2022, pp: 159-189

Kadir, J. M. A. (2017). Impact of goods and services tax on the

Malaysian economy (Doctoral dissertation). University of

Malaya, Malaysia). http://studentsrepo.um.edu.my/7962/9/

juliana.pdf

Kagan, J. (2019a). Goods and services tax. Investopedia. https://

www.investopedia.com/terms/g/gst.asp

Kagan, J. (2019b). Income tax terms guide: Taxes. Investopedia.

https://www.investopedia.com/terms/t/taxes.asp

Kagan, J. (2020). Progressive Tax. Investopedia. https://www.

investopedia.com/terms/p/progressivetax.asp

Kagan, J. (2021). Regressive tax. Investopedia. https://www.

investopedia.com/terms/r/regressivetax.asp

Kagan, J. (2022). Taxation. Investopedia. https://www.investopedia.

com/terms/t/taxation.asp

Kelkar, V. (2009, December 1). A well-designed GST can boost GDP

growth by 2%. Business Today.

Khoo, S. (2015, March 30). Challenges of GST: Cost management

and competitiveness. The Star. https://www.thestar.com.

my/tech/tech-news/2015/03/30/challenges-of-gst-cost-

management-and-competitiveness/

Lam, L. (2018, February 19). Singapore Budget 2018: GST to be raised

from 7% to 9% sometime between 2021 and 2025. The Straits

Times. https://www.straitstimes.com/singapore/singapore-

budget-2018-gst-to-be-raised-from-7-to-9-sometime-between-

2021-and-2025

Lee, P. M., & Zulkeli, N. N. (2021). US-China relations: Trade War

and the Quest for Global Hegemony. Journal of International

Studies, 17, 131–155. https://doi/org/10.32890/jis2021.17.6

Li, X. (2018, October 16). Why the GST became Malaysia’s public

enemy number one. The Diplomat. https://thediplomat.

com/2018/10/why-the-gst-became-malaysias-public-enemy-

number-one/

Lim, J. (2020, February 18). Budget 2020: GST hike will not take

effect in 2021, but will still be raised by 2025. Today Online.

https://www.todayonline.com/singapore/budget-2020-gst-

hike-9-will-not-take-ef fect-2021-will-still-be-raised-2025

Macrotrends. (2020). Malaysia ination rate 1960-2020. Macrotrends.

https://www.macrotrends.net/countries/MYS/malaysia/

ination-rate-cpi

Mardhiah, A. (2018, September 5). Merapatkan jurang perbezaan

antara kaya dan miskin merupakan tujuan utama pemberian

BR1M- Najib. Sarawak Voice. https://sarawakvoice.

187

Journal of International Studies , Vol. 18,2022, pp: 159-189

com/2018/09/05/merapatkan-jurang-perbezaan-antara-kaya-

dan-miskin-merupakan-tujuan-utama-pemberian-br1m-

najib/

Ministry of Communications and Multimedia. Department of

Information Services Malaysia. (2013). Cukai barang dan

perkhidmatan: Apa yang perlu anda tahu. https://docs.jpa.gov.

my/docs/ipbook/GST_2014/les/buku_gst_20122013.pdf

Ministry of Finance Malaysia. (2017). Estimates of federal government

revenue 2018. https://parlimen.gov.my/ipms/eps/2017-10-27/

CMD.27.2017%20-%20ANGGA R A N % 2 0 H A S I L % 2 0 .

Cover%20Page..pdf

Ministry of Finance Singapore. (2008). ST: Key points omitted in

article on ination. Ministry of Finance Singapore. https://

www.mof.gov.sg/news-publications/forum-replies/ST-Key-

points-omitted-in-article-on-ination

Ministry of Finance Singapore. (2019). Goods and services tax.

Ministry of Finance Singapore. https://www.mof.gov.sg/

policies/taxes/goods-and-services-tax

Ministry of Trade and Industry Republic of Singapore. (1986). The

Singapore economy: New directions. https://eservice.nlb.

gov.sg/data2/BookSG/publish/d/d08447b5-ce22-4de2-9d6c-

89cd9cb95074/web/html5/index.html?opf=tablet/BOOKSG.

xml&launchlogo=tablet/BOOKSG_BrandingLogo_.

png&pn=65

Mok, E. (2019). What is VAT and how does it work in Singapore?

Paul Wan & Co. https://pwco.com.sg/guides/gst-registered-

company/vat/

Muzainah, M., Tayib, M. R., & Yusof, N. (2005). Malaysian indirect

tax administration system: An analysis of efciency and

taxpayers’ perceptions. International Journal of Management

Studies, 12(2), 19–40. http://e-journal.uum.edu.my/index.php/

ijms/article/view/9208/1897

Ng, J. S. (2018, November 20). Bill passed to tax overseas services like

Netix from 2020. The Straits Times. https://www.straitstimes.

com/politics/bill-passed-to-tax-overseas-services-like-netix-

from-2020

Oklahoma Policy Institute. (2020). Characteristics of an effective tax

system. Oklahoma Policy Institute.

Omar, A. W. (2018). GST untuk kemajuan, tingkat pembangunan

negara. Berita Harian Online. https://www.bharian.com.my/

rencana/surat-pembaca/2018/05/422555/gst-untuk-kemajuan-

tingkat-pembangunan-negara

188

Journal of International Studies , Vol. 18, 2022, pp: 159-189

Poh, E. H. (2005). The Singapore GST: A possible model for Hong

Kong? Asia-Pacic Journal of Taxation, 8(4), 133–160.

Rasid, A. H. (2018, May 2). GST had minimal impact on ination:

Economists. New Straits Times.

Royal Malaysian Customs Department. (2020). How does GST work.

Royal Malaysian Customs Department. http://www.customs.

gov.my/en/cp/Pages/cp_hdw.aspx

Sanusi, S., Omar, N., & Mohd Sanusi, Z. (2015). Good and services

tax (GST) governance in the Malaysian new tax environment.

Procedia Economics and Finance, 31, 373–379. https://core.

ac.uk/download/pdf/82527915.pdf

Shukri, S. (2021). The Rohingya refugee crisis in Southeast Asia:

ASEAN’s role and way forward. Journal of International

Studies, 17, 239–263. https://doi.org/10.32890/jis2021.17.10

Sim, K. H. (2019, November 26). GST increase: Here’s how much

the government will collect – And how much more will you

be paying. Dollars and Sense. https://dollarsandsense.sg/gst-

to-increase-to-9-heres-how-much-more-the-government-will-

collect-and-how-much-more-will-you-be-paying/

Statista. (2020). Singapore: Ination rate from 1984 to 2021. Statista.

https://www.statista.com/statistics/379423/inflation-rate-in-

singapore/

Tan, W. (2018, January 23). How much additional revenue can S’pore

get from raising GST and other taxes? Today Online. https://

www.todayonline.com/singapore/where-spores-additional-tax-

revenue-could-come-experts

Tham, Y. C. (2020, Jun 6). Parliament: Planned increase in GST will

need to be done by 2025, says DPM Heng Swee Keat. The

Straits Times. https://www.straitstimes.com/politics/planned-

increase-in-gst-will-need-to-be-done-by-2025-heng

The Business Times. (2019, February 28). Government yet to decide

on exact timing of GST increase to 9%: Heng Swee Keat.

The Business Times. https://www.businesstimes.com.sg/

government-economy/government-yet-to-decide-on-exact-

timing-of-gst-increase-to-9-heng-swee-keat

The Tribune. (2017, July 5). Marxists express concern over new tax

regime. The Tribune. https://www.tribuneindia.com/news/

archive/ludhiana/marxists-express-concern-over-new-tax-

regime-431999

Urif, H. B. (2016). Employees’ attitudes toward goods and services

tax (GST) in Open University Malaysia (OUM). Imperial

Journal of Interdisciplinary Research, 2(9), 92–99.

189

Journal of International Studies , Vol. 18,2022, pp: 159-189

Wolff, J. (2017). Karl Marx. In The Stanford Encyclopedia of

Philosophy (Winter 2017 Edition). https://stanford.library.

sydney.edu.au/archives/win2017/entries/marx/

Yong, C. (2018, April 20). Analyst: GST has altered Malaysian

politics. The Straits Times. https://www.straitstimes.com/

singapore/analyst-gst-has-altered-malaysian-politics.

YYC Advisors. (2020). An overview of GST Malaysia. YYC Advisors.

https://www.yycadvisors.com/overview-of-gst-malaysia.html

Zakaria, N. S. (2017). Review on the goods and services tax in

Malaysia. Journal of Business Innovation, 2(2), 99–106. http://

kuim.edu.my/journal/index.php/JBI/article/view/408