Annual Report

2018-2019 and 2019-2020

Insurance Development and Regulatory Authority

i

Table of Content

SL No

Particulars Page Number

01

Key Takeaways of Bangladesh Insurance 1

02

Chairman, Members and Other Officers 3

03 The World Economy and Insurance 7

04 Position of Bangladesh in the World insurance Market

7

05 Insurance Penetration and Density in Bangladesh 9

06 An Overview of Bangladesh Insurance Industry 11

07

Activities of Insurance Development and Regulatory Authority

13

08 Prime Minister Sheikh Hasina and Insurance Sector

13

09 National Insurance Policy, 2014 13

10 Authority Meeting 13

11 Registration of Insurance Company

14

12 Insurance Surveyors

14

13 Agent License fees 15

14 Approval of Life Insurance Product 15

15 Approval of Non-Life Insurance Products

16

16 Coordinating Meeting 16

17 Promulgating Rules and Regulation 16

18 Inspection 16

19 Imposing Penalty 17

20 Remarkable steps taken by IDRA 17

21 Significant steps taken for the non-life insurance sector 18

22 Significant steps taken for the life insurance sector 19

23 Innovation Team 19

24 Bangladesh Insurance Sector Development Project 19

25 Arranging Insurance Fair 19

26 Digital World Fare 20

27 Participation in Development Fairs held at all District and Upazila

level

20

28 Enhancing Trust Among the Common People 20

29 Actions against Anti-money Laundering 20

30 Implementation of National Integrity Strategy (NIS) 21

31 Introducing the Bengali Language in all aspects 21

32 Membership of AFI and IAIS 21

33 Formulation of Third Capital Market Development Program

outline

21

34 Digitalization in Insurance Sector 21

35 Workshop/ Seminar 22

36 Meeting Regarding Settlement of Insurance Claim 22

37 Financial Stability Report 22

38 Collecting Financial Information from the insurer 22

39 Insurance for Expatriate Workers 23

40 Various Ongoing Development Tasks 23

41 Appointment of Chief Executive Officer 23

42

Approval of Branch Opening 23

ii

SL No

Particulars Page Number

43

Income and Expenditure of IDRA 23

44

Life Insurance

2

7

45

Premium

2

7

46

The Sector

-

wise premium income

2

8

47

First Year and Renewal Premium Income

2

9

48

Market Share in Life Insurance Business

30

49

Top ten insurers in terms of premium income

3

2

50

Total Number of Policy in Life insurance Business

3

3

51

Newly Issued Policies

3

4

52

Lapsed Policy

3

5

53

Life Fund

3

5

54

Top ten insurers in terms

of Life Fund

3

8

55

Life Insurers’

Assets

3

9

56

The mix of the assets

40

57

Investment

4

2

58

Investment portfolios

4

3

59

Top Ten insurers in terms of investment

4

5

60

Investment Return

4

6

61

Management Expenses

4

7

62

Claim Settlement

4

9

63

Number

of Settled Insurance Claims

5

2

64

Policy holder Liability and Actuarial Surplus

5

3

65

Paid

-

Up Capital

5

4

66

Life insurers’ Agent

5

4

67

Branches of Life Insurers

5

5

68

Staff

5

5

69

Tax and VAT

5

5

70

Non

-

Life Insurance

5

6

71

Premium

5

6

72

Sub cla

ss wise gross premium income

5

7

73

Gross premium and Net Premium of SBC

5

9

74

Market Share

60

75

Number of Policy

6

1

76

Management Expenses and Management Expenses Ratio

6

3

77

Combined Ratio

6

5

78

Assets

6

5

79

Investment

6

8

80

Investment Income

7

1

81

Claim Settlement

7

1

82

Number of Claims

7

5

83

Branch

7

6

84

Agent

7

7

85

Staff

7

7

86

Paid

-

Up Capital

7

8

87

Stamp Duty

7

8

88

Tax and VAT

7

9

89

Annexure

80

iii

Vision

To bring general public under the coverage of insurance step by step by tackling the economic

risk of life, health and assets therby ensuring social and economic security as one the human

rights.

Mission

To bring hundred percent risk of life and assets of the country under insurance coverage.

iv

Insurance Company Full Name Annual Report Purpose Company

Labels

1 Alpha Islami Life Insurance Ltd Alpha

2 Astha Life Insurance Astha

3 Baira Life Insurance company Ltd Baira

4 Best Life Insurance Ltd Best

5 Chartered Life Insurance company Ltd Chartered

6 Delta Life Insurance company Ltd Delta

7 Diamond Life Insurance company Ltd Diamond

8 Fareast Islami Life Insurance company Ltd Fareast

9 Golden Life Insurance Ltd Golden

10 Guardian Life Insurance Ltd Guardian

11 Homeland Life Insurance company Ltd Homeland

12 Jamuna Life Insurance company Ltd Jamuna

13 Jiban Bima Corporation JBC

14 Life insurance Corporation of Bangladesh Ltd LIC

15 Meghna Life Insurance company Ltd Meghna

16 Mercantile Islami Life Insurance company Ltd Mercantile

17 MetLife (American Life Insurance Company) MetLife

18 National Life Insurance company Ltd National

19 Bengal Islami Life Insurance company Ltd Bengal Islami

20 Padma Islami Life Insurance Ltd Padma

21 Popular Life Insurance company Ltd Popular

22 Pragati Life Insurance Ltd Pragati

23 Prime Islami Life Insurance Ltd Prime

24 Progressive Life Insurance company Ltd Progressive

25 Protective Islami Life Insurance company Ltd Protective

26 Rupali Life Insurance company Ltd Rupali

27 Sandhani Life Insurance company Ltd Sandhani

28 Sonali Life Insurance company Ltd Sonali

29 Sunflower Life Insurance company Ltd Sunflower

30 Sunlife Life Insurance company Ltd Sunlife

31 Swadesh Life Insurance company Ltd Swadesh

32 Trust Islami Life Insurance Ltd Trust

33 Zenith islami Life Insurance Ltd Zenith

34 Akij Takaful Life Insurance Company Ltd Akij Takaful

35 NRB Islamic Life Insurance Company Ltd NRB Islamic

v

Abbreviations for Non-Life Insurance Companies

SL Insurance Company Full Name Annual Report Purpose Company

Labels

1 Agrani insurance Company ltd Agrani

2 Asia Insurance Ltd Asia

3 Asia Pacific General Insurance Company Ltd Asia Pacific

4 Bangladesh Co-operative Insurance Ltd BD Co-operative

5 Bangladesh General Insurance Company Ltd BD General

6 Bangladesh National Insurance Company Ltd BD National

7 Central Insurance Company Ltd Central

8 City General Insurance Company Ltd City General

9 Continental Insurance Ltd Continental

10 Crystal Insurance Company Ltd Crystal

11 Desh General Insurance Company ltd Desh General

12 Dhaka Insurance Ltd Dhaka

13 Eastern Insurance Company Ltd Eastern

14 Eastland Insurance Company Ltd Eastland

15 Express Insurance Ltd Express

16 Federal Insurance Company Ltd Federal

17 Global Insurance Ltd Global

18 Green Delta Insurance Company Ltd Green Delta

19 Islami Commercial Insurance Company Ltd Islami Commercial

20 Islami Insurance Bangladesh Ltd Islami Insurance BD

21 Janata Insurance Company Ltd Janata

22 Karnaphuli Insurance Company Ltd Karnaphuli

23 Meghna Insurance Company Ltd Meghna

24 Mercantile Insurance Company Ltd Mercantile

25 Nitol Insurance Company Ltd Nitol

26 Northern Islami Insurance Ltd Northern Islami

27 Paramount Insurance Company Ltd Paramount

28 Peoples Insurance Company Ltd Peoples

29 Phoenix Insurance Company Ltd Phonix

vi

30 Pioneer Insurance Company Ltd Pioneer

31 Pragati Insurance Ltd Pragati

32 Prime Insurance Company Ltd Prime

33 Provati Insurance Company Ltd Provati

34 Purubi General Insurance Company Ltd Purubi

35 Reliance Insurance Ltd Reliance

36 Republic Insurance Company Ltd Republic

37 Rupali Insurance Company Ltd Rupali

38 Shadharan Bima Corporation SBC

39 Sena Kalyan Insurance Company Ltd Sena Kalyan

40 Sikder Insurance Company Ltd Sikder

41 Sonar Bangla Insurance Ltd Sonar Bangla

42 South Asia Insurance Company Ltd South Asia

43 Standard Insurance Ltd Standard

44 Takaful Islami Insurance Ltd Takaful Islami

45 Union Insurance Company Ltd Union

46 United Insurance Company Ltd United

List of Abbreviations and Accronyms

Gross Domestic Product GDP

Fixed Deposit Account FDR

Insurance Development and Regulatory Authority IDRA

Alliance for Financial Inclusion AFI

International Association of Insurance Supervisors IAIS

Tax Deduct at Source TDS

VAT Deduct at Source VDS

Know your Customer KYC

Central Rating Committee CRC

Central Eastern Europe CEE

vii

Table and Annexure

SL Subject

Page No

Chart 1 Growth of Gross Premium Income Adjusted with Inflation

8

Chart 2 Region Wise Life and Non-Life Premium Income -2019

8

Chart 3 Insurance Density and Penetration in Selected Countries 2019

9

Chart 4

Gross Domestic Product (GDP), Premium Income & Penetration in

Bangladesh (2015-19)

9

Chart 5 Population and Density of Insurance

10

Chart 6 Premium Income & Growth Rate of the Insurance Industry

11

Chart 7 Registration and Renual of Registration Fees Received by IDRA (2011-19)

14

Chart 8 Surveyor Registration License and Renewal Fees (2009-2017)

14

Chart 9 Agent License Fees and Renewal Fees (2011-19)

15

Chart 10 Inspection by IDRA in the various insurance companies during

2011-2019

17

Chart 11 Statement of Fine imposed by IDRA (2010-11 to 2019-20)

17

Chart 12 Income and Expenditure Statement of IDRA (2010-2011 to 2019-2020)

24

Chart 13 Gross Premium category-wise in Life Insurance Business

27

Chart 14

Premium income, Re-insurance, Net Premium Income and Retention rate

(2015-2019)

28

Chart 15

First Year and Renewal Premium with Group and Health Insurance

(2015-2019)

29

Chart 16

First Year and Renewal Premium without Group and Health Insurance

(2015-2019)

29

Chart 17 Market share of all the Life Insurers in the years 2016 to 2019

31

Chart 18 Top Ten insurers in terms of Premium Income

33

Chart 19 Number of Policy in Life Insurance Business

33

Chart 20 Life Fund and Growth Rate (2015-2019)

36

Chart 21 Life Fund of all the life Insurers from 2018 to 2019

37

Chart 22

Top ten Insurers in 2018 and 2019 in terms of Life Fund

39

Chart 23 Asset of Life Insurence in 2018 and 2019

40

Chart 24 Life insurer’s investment and Return on Investment from 2015 to 2019 41

Chart 25 Class wise Investment of Life Insurence (2018 -

2019)

41

Chart 26

Actual Management expenses, allowable limits, and excess

management expenses (2015 to 2019)

48

Chart 27 Class Wise Life Insurers Claim Settlement from 2015 to 2019

49

Chart 28 Settlement of Insurance Claim (2015-2019)

50

Chart 29 Class Wise Number of Initimated Claims from 2015 to 2019

52

Chart 30 Number of Claims Settled and Percentage of Claim Settlement

53

Chart 31 Net Policy holder Liability and Actuarial Surplus

53

Chart 32 Paid-

Up Capital in Life Insurance Business

54

viii

SL Subject

Page No

Chart 33

Number of Financial Associate (Agent) and Employer of Agent in Life

Insurance Business

54

Chart 34 Branches in Life Insurance Business from 2015 to 2019

55

Chart 35 Number of Staff in Life Insurance Business

55

Chart 36 Tax and VAT collection by Life Insurer from 2015 to 2019

56

Chart 37

Amount of Gross Premium and Growth Rate in Non-

Life Insurance Business

56

Chart 38 Direct Gross Premium Earned by SBC (2015-

2019)

57

Chart 39 Gross Premium Income of SBC including Reinsurance Business

59

Chart 40

Reinsurance Premium paid by SBC

59

Chart 41

Non-Life Insurers’ Gross Premium Income, Market Share and Growth

Rate

61

Chart 42 Segment-Wise Number of Policies (2015 to 2019)

62

Chart 43

Actual Management Expenses, Allowable Management Expenses, and

Excess Management Expenses from 2015 to 2019

63

Chart 44 Ratio of Management Expenses in Non-Life Insurance (2015-2019) 64

Chart 45

Premium, Management Expenses, Commission and Combined Ratio (%)

65

Chart 46

Concentration of Assets as at 31st December 2018 and -2019–Non Life

Insurance Business 66

Chart 47 Investment at the end of 2018 and 2019 in Non-Life Ins

urance sectors

69

Chart 48 Investment and Return on Investment (2015 to 2019)

71

Chart 49 Class wise Claim Ratios and Total Claim Ratios (2015-2019) 72

Chart 50 Class Wise Amount of Claim in Non-Life Insurance s

ector

73

Chart 51

Class Wise Gross Claim Settlement Amount in Non-Life sector (2015-

2019)

73

Chart 52 Class-Wise Claim Settlement Rates (%) from 2015 to 2019 74

Chart 53 Number of Claims in Non-Life Insurance Sector (2015-2019) 75

Chart 54

Number of Claim Settlement and Percentage of claim Settlement (2015-

2019)

76

Chart 55 Number of Staff in Non-Life Insurance Business 78

Chart 56 Amount of Paid Up Capital in Non-Life Insurance Business (2015-2019) 78

Chart 57 Stamp Duty Paid by Non-Life Insurers (2015-2019)

78

Chart 58 Tax and VAT paid by Non-life insurers (2015-2019)

79

Annexure

Annexure 01

List of Licensed Life Insurers and Listed with Stock exchanges 80

Annexure 02 List of Licensed Non-Life Insurers and Listed with Stock exchanges 81

Annexure 03 Life Insurance policies approved by IDRA 82

Annexure 04 Non-Life Insurance Products are approved by IDRA 90

Annexure 05 List of Acts, Rules & Regulations relating to Insurance of Bangladesh 91

Annexure 06

International training attained by IDRA staff from June 2017 to December 2019

93

Annexure 07 Gross Premium collection by the Non-Life insurers 96

Annexure 08 Asset Position of Non-Life insurers (2015-2019)

98

ix

List of Graph

SL Subject Page No

Graph 1 Insurance Penetration from 2015 to 2019 10

Graph 2 Insurance Density (Per Capita Gross premium) from 2015 to 2019 10

Graph 3 Premium Income & Growth Rate of the Insurance Industry 11

Graph 4 Total Asset and Asset Growth Rate of Insurance Industry in Bangladesh 12

Graph 5 Total Investment and Investment Growth Rate of Insurance Industry in

Bangladesh

12

Graph 6 Premium Growth Rate of Life Insurance (2015 to 2019) 28

Graph 7 Number of Inforce Policies from 2015 to 2019 34

Graph 8 Total Issued Policies in Life Insurance Sector (2015-2019) 34

Graph 9 Number of Lapsed Policies of Life Insurer from 2015 to 2019 35

Graph 10 Balance of Life Fund from 2015 to 2019 36

Graph 11 Growth of the Life Fund from 2015 to 2019 37

Graph 12 Top ten Insurers in 2018 and 2019 in terms of Life Fund 38

Graph 13 Life Insurers Assets’ Amount and Growth Rate from 2015 to 2019 40

Graph 14 Life Insurer’s Asset in Various Fields in 2018 41

Graph 15 Amount of Asset of Top Ten Insurers 42

Graph 16 Percentage of Investment in 2018 44

Graph 17 Percentage of Investment in 2019 44

Graph 18 Top Ten Insurers in terms of Investment in 2018 45

Graph 19 Top Ten Insueres in terms of Investment 46

Graph 20 Class-Wise Life Insurer’s Investment Return (2018-2019) 47

Graph 21 Excess Management Expenses in Life Sector from 2015 to 2019 48

Graph 22 Percentage of Management Expenses over Premium Income (2015 to 2019) 49

Graph 23 Proportion of Claim Settlement of Different Sections (2015 to 2019) 50

Graph 24 Percentage of Claim Settlement 51

Graph 25 Claim Amount, Claim Settle and Percentage of Claim Settlement from 2015

to 2019

51

Graph 26 Growth Rate of Non-Life Insurers’ Premium Income (2015-2019) 57

Graph 27 Class wise Business Growth of Non-Life Sector (2015 to 2019) 58

Graph 28 Sahre of various Segment in Total Non-Life Insurance Business (2015 to

2019)

58

Graph 29 Business Segment wise Retention Ragte in Precent from 2015 to 2019 59

Graph 30 Top ten Insurers in Non-Life Insurance Market from 2016 to 2019 60

x

SL Subject Page No

Graph 31 Non-life Insurers’ Portfolio Wise Policy Growth Rate in Percent (2015 to

2019)

62

Graph 32 Policy Portfolio wise Market Share in Non-Life Industry (2015-2019) 63

Graph 33 Changes of Management Expenses and Excess Management Expenses

(2015 to 2019)

64

Graph 34 Ratio of Management Expenses in Non-Life Sector (from 2015- 2019) 64

Graph 35 Asset in various classes from 2016 to 2019 67

Graph 36 Amount of Total Assets in Non-Life Insurance and Growth Rates (2015 to

2019)

67

Graph 37 Top ten Non-Life Insures’ Based on Assets 68

Graph 38 Share of Investmet in Different Sectors (2018 to 2019)

69

Graph 39 Amount of Investment and Growth of Investment in Non-Life Sector (2015-

2019)

70

Graph 40 Top Ten Insurers Share of Investment from 2017 to 2019 70

Graph 41 Ratio of Assets and Investment in Non-Life Sector (2015-2019) 71

Graph 42 Sub-class basis Claim Settlement Ratio in Non-Life Sector from 2015 to 2019

72

Graph 43 Class-wise Amount of Claims (2015 to 2019) 74

Graph 44 Segment wise Non-Life Insurer’s Total Claim (2015 to 2019) 75

Graph 45 Number of Branches of Non-Life Insurers (2015-2019) 76

Graph 46 Number of Agents in Non-Life Insurance from 2015 to 2019 77

1

Key Takeaways of Bangladesh Insurance

Total Number of Insurers: 79

Total Number of Life Insurers: 32 Private insurers and 1 State-owned Insurer

Total Non-Life Insurers: 45 Private, 1 State-owned insurer

Total Number of surveyors: 137

Total number of insured population: 13 million at the end of 2019

Current scenario of the insurance industry

Serial

Number

Important Indicators 2017 2018 2019

1

Gross premium (Life) BDT Crore 8198.46 8989.07 9599.63

2

Gross Premium (Non-life) BDT Crore 2981.43 3393.94 3789.78

3

Number of life policies 10951920

10716832

9741335

4

Number of non-life policies 2418630 2936818 3114063

5

Total Assets (life ) BDT Crore 37052.36 38687.51 41174.62

6

Total Assets (Non-life) BDT Crore 11124.29 11293.23 12074.70

7

Total Investment (Life) BDT Crore 29934.39 31080.24 33831.42

8

Total Investment (Non-life) BDT Crore 5854.93 5984.55 6324.67

9

Amount of Claim (Life) BDT Crore 6803.41 7332.86 7264.92

10

Amount of Claim (Non-life) BDT Crore 2713.54 3133.04 2563.66

11

Percentage (%) of claim settlement (Life) 81.59 88.88 89.55

12

Percentage (%) of claim settlement (Non-Life)

35.75 40.87 52.07

13

Number of Agents (Life) 381839 358604 395651

14

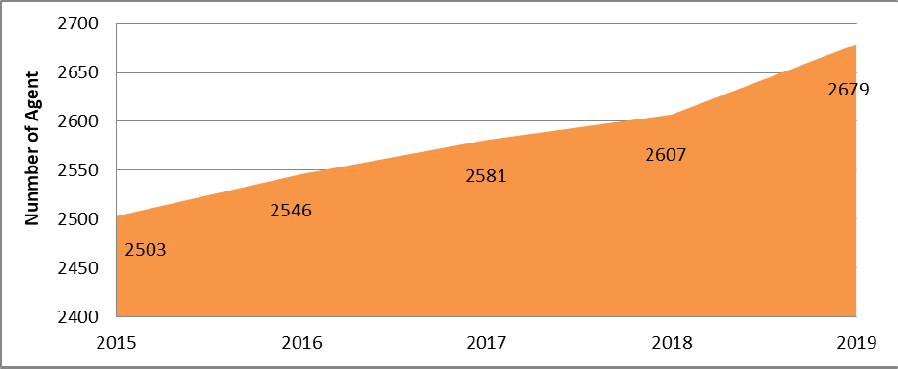

Number of Agents (Non-Life) 2581 2607 2679

15

Number of Branches (Life) 6647 6349 6146

16

Number of Branches (Non-Life) 1352 1367 1378

17

Number of staff (Life) 22530 23654 20453

18

Number of Staff (Non-Life) 16998 16786 17209

2

3

Chairman of IDRA

SL

Name Designation From To

1

M.Shefaque Ahmed, Actuary Chairman 27-Jan-2011

26-Jan-2014

2

Md. Fazlul Karim Chairman (in-charge) 29-Jan-2014

3-Mar-2014

3

Md. Quddus Khan Chairman (in-charge) 4-Mar-2014 8-Apr-2014

4

M. Shefaque Ahmed, Actuary Chairman 9-Apr-2014 8-Apr-2017

5

Gokul Chand Das

Chairman (Current Charge)

9-Apr-2017 22-Aug-2017

6

Md. Shafiqur Rahman Patwari Chairman 23-Aug-2017

25-Aug-2020

7

Dr. M. Mosharraf Hossain, FCA

Chairman (in-charge) 26-Aug-2020

26-Sep-2020

8

Dr. M. Mosharraf Hossain, FCA

Chairman 27-Sep-2020

14-Jun-2022

9

Mohammad Jainul Bari Chairman 16-Jun-2022

-

Members of IDRA

SL

Name Designation From To

Administration Wing

1

Md. Nurul Islam Molla Member 30-Mar-2011 11-Dec-2013

2

Md. Quddus Khan Member 27-Feb-2014 26-Feb-2017

3

Gokul Chand Das Member 1-Mar-2017 29-Feb-2020

4

Moinul Islam Member 15-Sep-2020

Life Wing

1

Dr. Md. Ziaul Haque Mamun Member 30-Jan-2011 31-Dec-2011

2

Sayed Ahmed Khan Member 29-Apr-2012 28-Apr-2013

3

Sultan-ul-Abedine Molla Member 4-Mar-2014 3-Mar-2017

4

Dr. M. Mosharraf Hossain, FCA Member 4-Apr-2018 25-Aug-2020

5

Quamrul Hasan Member 26-Jun-2022 -

Non-Life Wing

1

Naba Gopal Bonik Member 30-Jan-2011 29-Jan-2014

2

Zuber Ahmed khan Member 4-Mar-2014 3-Mar-2017

3

Md. Nazrul Islam Member 27-Jun-2022 -

Law Wing

1

Md. Fazlul Karim Member 4-Apr-2011 3-Apr-2014

2

Md. Murshid Alam Member 14-Sep-2014 13-Sep-2017

3

Borhan Uddin Ahmed Member 2-Oct-2017 11-May-2020

4

Md. Dalil Uddin Member 10-Jun-2020

4

Executive Directors

SL Name Designation From To

1 Dr. Md. Sk. Rezaul Islam Executive Director

(Additional Secretary)

4-Dec-2017 16-Aug-2020

2 Kazi Monower Hossain Executive Director

(Joint Secretary)

16-Jul-2017 22-Oct-2019

3 Khalil Ahmed Executive Director

(Joint Secretary)

4-Jun-2017 28-Jan-2020

4 Md. Husnul Mahmud Khan Executive Director

(Joint Secretary)

30-May-2017 4-Jul-2017

5 Ashraf Hossain Executive Director

(Joint Secretary)

24-Oct-2019 20-Dec-2020

6 Md. Sarwar Alam Executive Director

(Joint Secretary)

26-Jul-2020 13-Jan-2021

7

Md. Hiruzzaman,

NDC

Executive Director

(Joint Secretary)

17-Jan-2020 4-Mar-2021

8 SM Sakil Akther Executive Director

(Joint Secretary)

27-Sep-2020 20-Dec-2022

9 Md. Harun-Or-Rashid Executive Director

(Joint Secretary)

25-Feb-2021 -

10 Dr. Nazneen Kawshar Chowdhury Executive Director

(Joint Secretary)

12-May-2022

-

11 Mohammad Khalid Hossain Executive Director

(Joint Secretary)

13-Dec-2022

-

Directors

SL Name Designation From To

1 Md. Siddiqur Rahman Director

(Joint Secretary)

22-May-2019

10-Jun-2020

2 Dr. Md. Bashirul Alam Director

(Joint Secretary)

10-Aug-2017 24-Mar-2019

3 Farooq Ahmed Director

(Joint Secretary)

12-Aug-2017 22-May-2019

4 Md. Shah Alam Director

(Deputy Secretary)

2-Jul-2017

5 Abul Kasem Mohammad Fazlul Haque

Director

(Deputy Secretary)

11-Jul-2017 15-Oct-2020

6 Kamrul Hoque Maruf Director

(Deputy Secretary)

11-Jun-2017 9-Jul-2020

7 S. M. Tarique Director

(Deputy Secretary)

11-Jun-2017 13-Jul-2017

8 MD. Ariful Islam Director

(Deputy Secretary)

18-Sep-2019 17-May-2021

9 Md. Abdus Salam Soner Director

(Deputy Secretary)

3-Nov-2019 25-Apr-2022

10 Md. Jahangir Alam Director

(Deputy Secretary)

15-Jul-2020

11 Nazia Shirin Director

(Deputy Secretary)

16-Jul-2020 16-Jun-2022

5

12 Mohammad Shofiuddin Director

(Deputy Secretary)

13-Jul-2021 17-Jun-2022

13 Md. Abdul Mozid Director

(Deputy Secretary)

9-Jan-2023 -

14 Subir Chowdhury Director 10-Jan-2023 -

Deputy Director

SL Name Designation From To

1 Md. Solaiman Deputy Director 10-Jan-2023

-

Department wise staff

Administration Wing

SL

Name Designation Joining Date

1 Kazi Abdul Zahid Assistent Director 1-Sep-2001*

2

Md. Shamsul Alam Khan Assistent Director 2-May-2012

3 Tania Afrin Assistent Director 7-May-2012

4 Md. Ikhtiar Hasan Khan Assistent Director 14-May-2014

5 Tahmina Akter Officer 1-Aug-2011

6

Shamir Chandra Sarker Officer 3-Jan-2012

7 Hamed Bin Hasan Officer 2-May-2012

8 Amit Majumder Officer 2-May-2012

9

Md. Shuhel Rana Officer 2-May-2012

10 Mirza Abu Yosuf Officer 30-Dec-2015

11 Shusmoy Mondal Officer 23-Aug-2012

12 Amdadul Haque Program Operator 2-May-2012

13 Sufia Akther Program Operator 2-May-2012

14 Asraf Ali Computer Operator 20-Jun-2022

15 Alauddin Ahmed

Data Entry/ Control Operator

2-May-2012

16 Md. Masum Shahriar Data Entry/ Control Operator 15-Jun-2022

Life Wing

SL

Name Designation Joining Date

1 Md. Abu Mahmud Assistent Director 26-Aug-2012

2 Tanjid-Ul-Islam Officer 2-May-2012

3 Ruksana Asad Banna Officer 2-May-2012

4 Md. Asiqur Rahman Ujjal

Computer Operator 6-Jun-2022

5 Ashiful Haque Data Entry/ Control Operator 15-Jun-2012

6 Taslima Akter Data Entry/ Control Operator 27-Jun-2012

6

Non-Life Wing

SL

Name Designation Joining Date

1 Md Murshedul Muslim Assistent Director 2-May-1994*

2 Md. Delowar Hussain Bhuyan

Assistent Director 1-Nov-2001*

3 Kazi Sadia Arabi Officer 3-Jan-2012

4 Ala Uddin Officer 2-May-2012

5 Farjana Khaled Officer 22-Aug-2012

6 Syed Shariful Haque Officer 22-May-2014

7 Md. Shafiqul Islam Officer 24-Feb-2003*

8 Quazi Shabnam Ferdousi Officer 25-Jan-2015

9 Samia Ara Chowdhury Program Operator 2-May-2012

10 Bishwajit Roy Computer Operator 6-Jun-2022

11 Omar Bin Khalil Data Entry/ Control Operator 15-Jun-2021

12 Mst. Papiya Sultana Data Entry/ Control Operator 15-Jun-2021

Law Wing

SL

Name Designation Joining Date

1 Md. Rashidul Ahsan Habib Assistent Director 4-Sep-2011

2 Rumana Zaman Assistent Director 9-Nov-2014

3 Fahamida Sharwar Officer 3-Jan-2012

4 Md. Shamsul Alam Officer 2-May-2012

5 Md. Mostofa Al Mamun Data Entry/ Control Operator 3-Jan-2012

6 Md. Biplab Hosin Data Entry/ Control Operator 15-Jun-2021

*Appointment by the CRC

7

The world economy and insurance

The World economy

In 2018 total size of the global GDP was 86.201 trillion US dollars which was $81.182 trillion

in 2017. The same year, advanced economies especially the USA, Germany, Canada, United

Kingdom and Japan posted approximately 1.8% growth which is lower than the 2.3% growth

of 2017. The emerging-market comprising of India, China, Brazil, and Russia on the other

hand registered 4.5% growth in 2018 which contributed the most in the uptick of global

growth. Alongside in 2018, global trade of goods and services increased by 3.6% compared to

2017.

According to the Swiss Re, global direct premiums in 2018 outstriped 5 trillion dollar mark for

the first time reaching $5,193 billion which accounted for 6% of global GDP. The growth rate

of 2018 was positive in both nominal and real terms but less attractive than that of 2017. The

low growth rate in 2018 compared to 2017 is attributed to low growth in the life sector. Total

life insurance premium income was 2,820 billion in 2018 and the life sector accelerated only

by 0.2%. China is the largest life insurance market in the world. Low growth in China was the

major cause of decreasing life premium growth as well as growth of overall global premiums.

Non-life sector witnessed an upsurge of 3% total premium income reaching 2,373 billion. This

growth was contributed by a 7.1% premium acceleration in the Emerging market and a 6.4%

growth in the Asia Pacific region. In 2018, 54.30% of the total premium income was generated

from life portfolios whereas the rest was produced by non-life insurers.

World insurance market showed remarkable growth in 2019 reaching a $6 trillion premium

mark. Out of 6,292.60 billion dollar direct premiums 46.34% were generated from the life

sector and the rest 53.66% from the non-life sector. In 2019 total premium income in the life

and non-life sectors were 2,916.27 billion and 3,376.33 billion dollars respectively. The

emerging market witnessed a 6.6% growth in 2019 whereas the advanced market managed to

grow by 2.1%. In 2019 overall premium growth declined to 2.2%.

Position of Bangladesh in the World Insurance Market

In 2019 real premium growth rate of Bangladesh was 3.1%. In contrast, the real global

premium growth was 2.9% (Chart 1). In total global premium income, the life-sector

contributed 46.30% and the non-life sector contributed the rest. In Bangladesh however,

overall premium income is dominated by the life sector. In 2019, 70% of total premium

income came from the life sector and 30% came from the non-life sector.

The Swiss Re report shows that Bangladesh ranked 55th out of 88 countries in 2019 in terms

of life insurance business. When the global premium growth was 2.2% in 2019 Bangladesh

achieved a 1.3% real growth in life insurance premium.

8

Chart 1

Growth of Gross Premium Income Adjusted with Inflation -2019 (in percentage)

Region/Country Life Non-life Life and Non-lfie

Advanced Market

1.3 2.7 2.1

Emerging Market

5.6 7.7 6.6

Asia

2.6 7.6 4.4

India

7.3 5.7 6.9

Bangladesh

1.3 7.4 3.1

World

2.2 3.5 2.9

Source: Swiss Re, Sigma no 4/2020

In 2019 growth rate of the non-life sector was 7.4%. At the same time, the global growth rate

of the non-life sector was 3.5% (Chart-1). In the world market, Bangladesh placed 86th in the

non-life sector. Whereas in the life sector Bangladesh placed 68 out of 88 countries according

to Swiss re-report.

Chart 2

Region Wise Life and Non-Life Premium Income -2019 Billion Dollar

Region/Country Life Non-Life Life and Non-Life

Advanced Market

2298.7

(44.80)

2832.22

(55.20)

5130.92

(100.00)

Emerging Market

617.57

(53.16)

544.11

(46.84)

1161.68

(100.00)

Advanced Asia-Pacific

645.16

(69.00)

289.20

(31.00)

934.36

(100.00)

Emerging Asia-Pacific

469.03

(57.80)

342.02

(42.20)

811.05

(100.00)

India

79.67

(74.90)

26.64

(25.10)

106.31

(100.00)

Bangladesh

1.03

(70.00)

0.44

(30.00)

1.47

(100.00)

World

2916.27

(46.30)

3376.33

(53.70)

6292.60

(100.00)

Source: Swiss Re sigma 4/2020, Note: Percentage shows in bracket

Various reasons are responsible for low rate of penetration and insurance density. In

Bangladesh, the insurance market lacks diversified products. Agriculture insurance, universal

health insurance, catastrophic insurance, and insurance for passengers are absent which

contracted the supply side, what is more, the demand for insurance is very low compared to

other products in the financial system as image crisis is also a responsible factor. Out of 167

million population, only 13 million have an insurance policy of different kinds. Besides that,

lack of proper reviewing systems of the products, absence of innovative culture in designing

products, and limited scope of distribution channel including digital platform are other causes

that hinder the insurance sector to move forward in the right direction.

9

Insurance Penetration and Density in Bangladesh

Insurance penetration and Insurance Density are the key indicators widely used to understand

the country’s overall development of insurance sector. Insurance penetration indicates the

percentage of total premium income over GDP and Insurance Density shows per capita

premium expenditure. Insurance penetration was 0.55% in 2017 which increased a bit and

reached 0.57% in 2018 and in subsequent year’s density fell to an all-time low of 0.49%.

Insurance density was $8 in the year 2017 which increased by $1 in 2018 and remained the

same in 2019 (source: swiss re, sigma report) (Chart-3). Density and Penetration rate,

calculated based on the data collected from insurers, have shown in chart 4 and 5 in Figures 1

and 2.

Chart 3

Insurance Density and Penetration Rate in Selected Countries 2019

Country GDP

Rank

Premium

Rank

Premium

(In USA

Million)

Market

Share(%)

Penetration (%)

Density

(USdollar)

Growth(%)

USA 1 1 2460123 39.1 11.43 7495 3.9

India 6 11 106307 1.69 3.76 78 9.2

Malayasia 36 33 17150 0.27 4.72 536 3.3

Philipine 37 46 3195 0.1 1.72 57 3.7

Banglades

h

43 69 1475 0.02 0.49 9 7.6

Srilanka 65 75 1090 0.02 1.25 51 -2.4

Vietnam 40 45 7368 0.12 2.24 76 21.4

Source: Swiss re, sigma no 4/2020

Chart 4

Gross Domestic Product (GDP), Premium Income & Penetration Rate in Bangladesh (2015-2019)

Year

GDP(Current price in

crore taka)

Gross premium income

core taka

Penetration in percent

Life Non-Life Life Non-

Life

Life and

Non-Life

2015

1515802.30 7316.09 2643.01 0.48

0.17 0.66

2016

1732863.90 7588.45 2772.88 0.44

0.16 0.60

2017

1975815.20 8198.46 2981.43 0.41

0.15 0.57

2018

2250479.30 8989.07 3393.94 0.40

0.15 0.55

2019

2542482.60 9599.63 3789.78 0.38

0.15 0.53

Source: GDP-world Bankm Premium-IDRA

10

Graph 1

Insurance Penetration form 2015 to 2019

Chart 5

Population and Density from 2015 to 2019

Year Population

(Core)

Insrance Density in taka Density in

the USA dollar

Life Non-Life aggregate

2015

16.12 453.85 163.96 617.81 7.95

2016

16.30 465.69 170.17 635.85 8.12

2017

16.47 497.87 181.06 678.93 8.58

2018

16.46 546.12 206.19 752.31 8.97

2019

16.75 573.20 226.29 799.49 9.47

Source: Population-Bangladesh Bureau of Statistics and Premium Income-IDRA

Graph 2

Insurance Density (Per-capita gross premium) from 2015 to 2019

11

An Overview of Bangladesh Insurance Industry

Despite having various challenges overall insurance premium income was expanded. Without

considering the inflationary impact the growth rates were 10.76% and 8.13% in the years 2018

and 2019 respectively, the growth rate was 7.90% in 2017. In the year 2018 and 2019 gross

premium income were BDT 12383.01 crore and BDT 13389.41 crore respectively and in 2017

the premium income was BDT 11,179.89 crore.

Chart 6

Premium Income and Growth Rates (2015-2019) (crore taka)

Year Gross Premium (Crore taka) Growth in precent

Life Non-life Lfie and Non-Life Life Non-Life Life and Nonlife

2015

7316.09 2643.01 9959.10 3.39 8.07 4.59

2016

7588.45 2772.88 10361.33 3.72 4.91 4.04

2017

8198.46 2981.43 11179.89 8.04 7.52 7.90

2018

8989.07 3393.94 12383.01 9.64 13.84 10.76

2019

9599.63 3789.78 13389.41 6.79 11.66 8.13

Source: Premium Income collected from all the insurers.

Graph 3

Premium Income and Growth in the Insurance Industry (2015-2019)

IDRA put tremendous effort in the year 2017 to 2019 to settle insurance claims publicly. In

response to that effort, some of the insurers settled insurance claims in festive mode as a result

premium income accelerated in the life insurance sector. High officials of IDRA attended in

these formalities to motivate insurers and insured both. In the year 2017, the growth of the life

and the non-life insurers’ premium income outstrips the expected growth rates which were

8.04% and 13.84% respectively. In 2018 growth rates were also very high in both the life and

non-life sector. The life sector sealed 6.79% growth and the non-life sector managed to

achieve an 11.66% growth in 2019. (Chart-6 and Graph-3).

12

Lion portion of total premium income comes from the life sector and most of the insurance

policies are long-term in nature, therefore the size of life sectors’ assets is bigger than that of

non-life sector. At the end of 2018, the size of life insurers’ assets was BDT 38,688 crore

which augmented by 6.43%, and reached BDT 41,175 crores at the end of 2019. On the other

hand, the size of total assets in the non-life insurance sector was BDT 11,293 crore at the end

of 2018 which increased by 6.92% and extended to BDT 12075 crore at the end of 2019. The

sum of total assets of the entire industry was grown by 3.75% in 2018 which accelerated

further by 6.54% in 2019 (Graph 4).

Graph 4

Total Asset and Growth Rates of Insurance Industry in Bangladesh (2015-2019)

Source: data collected from different insurers.

Graph 5

Total Investment and Growth Rates of Insurance Industry in Bangladesh (2015-2019)

Source: data collected from different insurers.

13

There was up-and-down in the investment landscape as claim settlement and management

expense reduce the investment, conversely investment income and premium income accelerate

the investable amount. In 2017 industry’s aggregate investment grew up by 8.20% which took

a nosedive and fell to 3.56% in 2018 and again raise to 8.34% in the year 2019. In terms of

monetary value total assets accounted for BDT 35,789 crores at the end of 2017 which

accelerated in the subsequent two years and reached BDT 40,156 crore at the end of 2019.

75.41% of the total assets of the industry were invested in different avenues as prescribed by

investment regulation.

Activities of Insurance Development and Regulatory Authority in 2018 and 2019

Prime Minister Sheikh Hasina and Insurance Sector

In the tenure of Prime Minister Sheikh Hasina government, the Insurance act 2010 came into

effect demolishing the old insurance act 1938. She formed IDRA on 18th March 2010

enacting the Insurance Development and Regulatory (IDRA) Act-2010. Insurance

development and regulatory authority was formed with 4 members and Chairman according to

IDRA act 2010. With the joining of the Chairman and two members, IDRA started its function

on 27th January 2011. At present existing workforce comprises of Chairman, four members,

three executive directors, two directors, and 72 staff of different grades.

Sheikh Hasina is the longest-serving prime minister in our country. People call her

‘Deshratna’, ‘Jananetry’ because of her overarching contribution to the development of

Bangladesh. She is also the architect of digital Bangladesh. The insurance sector was

neglected for a long time but the Awami government made a tremendous and visible effort for

the development of the insurance sector when she became prime minister for the second time.

His thoughtful direction and timely measures played an enormous role in the development of

the insurance sector.

The insurance sector is playing important role in the economy as a result of timely initiatives

of the prime minister. Owing to her direction, IDRA has been trying to introduce a new

product in health insurance, introduced new products for expatriate workers, and enhanced

awareness about insurance among mass people. Today Bangladesh insurance industry is well

capable of covering multibillion-dollar projects and some of these are Bangabandhu Satellite,

Padma Bridge, Bangabandhu Tunnel, Ruppur Atomic Energy Plant.

National Insurance Policy, 2014

The government published National Insurance Policy in 2014 through a gazette to accelerate

the progress and development of the insurance sector. National Insurance Policy-2014 has 50

guidelines out of which 12 have been implemented and the IDRA has taken various initiatives

to implement the rest of the guidelines.

Authority Meeting

From inception to the end of 2019 total 126 authority meetings took place under the section 13

of the insurance Development and Regulatory Authority Act 2010. There were 1,173 policy

decisions were taken in these meetings and 98 percent of total decisions were implemented to

the end of 2019.

14

Registration of Insurance Company

32 life insurers and 45 non-life licensed insurers were in the operation of the insurance

business at the end of 2019. IDRA issued a license during 2019 to Asta life to conduct a life

insurance business. From 2013 to 2018 14 life insurers and 2 non-life insurers’ licenses were

issued. Detailed information relating to the registered insurers, their paid-up capital and part of

capital collected from the capital market through market listing has shown in annexure-1 and

annexure -2. IDRA analyzes the audited income statement before renewing the license. Chart-

7 shows the Fiscal year to Fiscal year basis registration income. Registration income in FY

2018-2019 and FY 2019-2020 were taka 105.67 and taka 114.53 million respectively.

Chart 7

Registration and Renewal of Registration Fees Received by IDRA (2011-19) (Million Taka)

FY Life Non-Life Total Fees

2010-2011

0 0.42 0.42

2011-2012

192.91 52.28 245.19

2012-2013

247.46 77.82 325.28

2013-2014

218.77 68.24 287.01

2014-2015

219.23 5.50 294.73

2015-2016

234.15 78.08 312.23

2016-2017

242.26 86.60 328.86

2017-2018

230.23 110.26 340.49 (Unaudited)

2018-2019

78.24 27.43 105.67(Unaudited)

2019-2020

84.45 30.08 114.53(Unaudited)

Insurance Surveyors

At the end of 2019 total number of 137 surveyors were in operation out of which 94 operate in

Dhaka, 39 in Chittagong, 3 in Khulna, and 1 in Rajshahi. Insurance surveyor is providing

their services in 7 exclusive domains these are Fire, Motor, Marine-Cargo, Aviation,

Engineering, and Miscellaneous. Their functions have been framed by the Regulation which

was promulgated in 2018. IDRA received BDT 0.53 million in FY 2019-2020 from 137 active

surveyors (Chart-8).

Chart 8

Surveyor License Registration and Renewal fees (2011 to 2019)

Year BDT Million Taka

2010-2011

0.20

2011-2012

0.59

2012-2013

0.54

2013-2014

0.56

2014-2015

0.54

2015-2016

০.৫৪ 0.54

2016-2017

0.52

2017-2018

0.55 (Unaudited)

2018-2019

0.59 (Unaudited)

2019-2020

0.53(Unaudited)

15

Agent License fees

IDRA issues agent license for the insurer based on the application received from the insurer. A

total number of 4,48,696 agents license to the 33 life insurers and 2478 agents license to the

45 non-life insurer were issued by IDRA in FY 2019-2020 and earned a total taka 5.96 million

(chart-09).

Chart 9

Agent License Fees and Renewal Fees (2011-19) (Million Taka)

Years Agent Fees (Life) Agent Fees (Non-Life) Total Agent Fees

2010-2011

4.31 0.25 4.56

2011-2012

19.67 1.98 21.65

2012-2013

11.03 2.26 13.26

2013-2014

17.89 0.45 18.43

2014-2015

23.16 .44 23.60

2015-2016

10.13 0.52 10.65

2016-2017

8.544 0.41 8.95

2017-2018

7.16 0.36 7.52 (Unaudited)

2018-2019

8.12

.৪৮

8.60 (Unaudited)

2019-2020

5.61 0.34 5.95 (Unaudited)

According to subsection 1 of section 58 of the insurance act 2010, No person shall pay or

contract to pay any remuneration or reward whether by way of commission or in any other

name for soliciting or procuring insurance business in Bangladesh to any person except an

insurance agent or an employer of agents or broker.

Agents receive a commission in return for procuring insurance business. Paying excess

commission to the agent is disastrous for the insurers as it augments the management

expenses. IDRA has taken various initiatives to reduce the commission and to retain

management expenses within the level prescribed by the act.

Approval of Life Insurance Product

IDRA approved different types of life insurance products from inception to the end of 2019

under section 16 of the insurance act 2010. Approved products are in different areas for

example various types of microinsurance, deposit insurance, Pension insurance, Accidental

Life Insurance as a rider (ADAB) and Permanent Total Disability Insurance (PDAB) and

Health Insurance, Children Protection Insurance, Hajj Bima, Denmohor Bima, Education

Expense Insurance Plan, Mortgage Assurance Plan, Family Protection Plan and SME Loan

Protection Plan (Annexure-3).

Besides that, to bring the expatriate workers, particularly those who are working in the Middle

East, under insurance coverage insurance benefit has been provided by the Ministry of

Expatriate and Welfare and Jiban Bima Corporation. IDRA launched a flagship education

insurance program through its own finance as a pilot basis with a formal brand name which is

Bangabandhu Education Insurance. Another insurance program namely Bangabandhu Surakha

Bima was framed and designed by IDRA. Surakha Bima is being marketed by Shadharan

Bima Corporation.

16

Approval of Non-Life Insurance Products

Central Rating Committee (CRC) was formed on 6 may of 1990 under section 3bbb of the

insurance act 1938 to determine the rate of the product, and set terms and conditions relating

to the products of non-life insurers. Subsequently, after replacing the insurance act 1938 by

2010, CRC acted on these activities and recommend and place these products before the

authority of the IDRA for the final approval under section 17 of the insurance act and section

15 of the IDRA act 2010. Based on the recommendation authority approves various new

products, premium rates along with terms and conditions. Based on the recommendation of

CRC authority has approved a revised tariff rate in recent times for non-life insurers and

published it in the website of IDRA that had revised in the year 2000 last time. At the end of

year 2019 CRC conducted total 168 meeting. Basing on their recommendation IDRA

approved various products. A detailed list is attached in Annexure-4.

Coordinating Meeting

IDRA collects key information from insurers and present before all Chief Executive Officers

in the form of PowerPoint. This platform has been designed to glean various opinions of the

different participants which ultimately help IDRA in framing various directives.

Promulgating Rules and Regulation

Since the inception of IDRA to date, 9 Rules and 15 Regulation have been published as gazate

under the Insurance Act 2010 and Insurance Development and Regulatory Act 2010

(Annexure-5). Besides, the Corporation act, of 2019 was passed by the government in 2019.

Other rules and regulations are in a different stage of implementation.

Inspection

IDRA conducted hundreds of onsite inspections from 2011 to 2020, see details in chart 53.

The main objective of the onsite inspection is to inspect whether insurers operate insurance

business within the purview of the insurance act or not. Besides that, in some cases,

inspections are dedicated to finding out whether or not insurers underwrite policies without

receiving any premium or receiving less premium or paying any excess commission in the

case of procuring insurance business. Another important objective of onsite monitoring is to

find out any non-compliance with regards to rules, regulations, or circulars of IDRA

applicable for the insurers. In recent times anti-money laundering obtains high importance

around the globe including in Bangladesh. In our country, we have anti-money laundering

laws. Bangladesh Financial Intelligence Unit (BFIU) is the custodian of the anti-money

laundering act. BFIU also inspects to find out breaches of anti-money laundering law. IDRA

resolves the observation of the inspection report through a hearing where insurers are given

equal opportunity to defend themselves.

17

Chart 10

Inspection by IDRA in the various Insurance Companies during 2011 - 2019

Year Number of Inspection

2011

7

2012

143

2013

20

2014

16

2015

90

2016

24

2017

0

2018

26

2019

30

Imposing Penalty

IDRA sends inspection team to different carriers on regular basis to ensure discipline in the

industry. IDRA framed an inspection manual and uploaded it to the website. If any

indiscipline finds in the inspection report IDRA calls the insurer for a hearing and asks them to

provide a showcase before the authority. If any allegation is proven in the hearing then IDRA

fines the respective insurer under the insurance act 2010 and provides befitting direction and

advice for the future. From 2011 to 2019 IDRA conducted a total number of 340 inspections

and imposed a fine of taka 197.46 million (Chart-11).

Chart 11

Statement Fines Imposed by IDRA (2010-2011 to 2019-2020) (Million Taka)

FY Life Non-Life Total

2010-2011

0.10 1.57 1.67

2011-2012

9.48 13.87 23.53

2012-2013

2.88 8.65 11.53

2013-2014

3.73 4.05 7.78

2014-2015

3.36 11.08 14.44

2015-2016

4.03 45.25 49.28

2016-2017

3.63 33.99 37.62

2017-2018

2.42 19.37 21.79 (Unaudited)

2018-2019

0 16.05 16.5 (Unaudited)

2019-2020

8.1 5.6 13.5 (Unaudited)

Remarkable steps has taken by IDRA

•

IDRA mandated to make sure the policyholder's phone number in the policy form of

KYC for future communication. It enabled insurers to disseminate information

regularly in the event of any development.

•

IDRA directed all the insurers to set up hotline numbers helping policyholders to

provide policy-related information, take claim-related complaints and resolve the

complaints on a fast track basis.

18

•

Due to the initiative of the Neuro Development Trustee Board under the Ministry of

Social Welfare IDRA designed a special insurance policy for the Neuro Development

Disabled people.

•

IDRA issued a circular with the directives that no agent license will be issued without

proper training.

•

To enhance a positive image among the masses and to enhance insurance literacy, a

large-scale promotional initiatives have been taken. As a part of the promotional

activities, various workshops, and meetings have arranged with stakeholders.

•

IDRA developed a dynamic website and uploading a wide range of information to

facilitate the stakeholders. IDRA updates the website regularly with recent information

so that stakeholders get informed about the recent development. Moreover, the

claimant could complain through this website filling a form.

•

Insurers were directed to inform IDRA in case of receiving any complaint from

stakeholders, policyholders, or shareholders within two working days.

•

IDRA directed all insurers to submit meeting minutes of the Audit Committee, Claim

committee and Board meeting minutes to the authority.

•

Insurers were directed to accord prior approval submitting all relevant information in

case of procuring or selling land, building, flat, and other fixed assets.

•

In a drive to accelerate the fast approval process, IDRA made a checklist of

information to attach with the application so that total file processing time reduces.

•

Insurers were ask to conduct all the transactions above the limit of taka 10,000 through

the banking channel.

•

IDRA prepared a citizen charter which was uploaded to the website.

•

IDRA always persuade insurers to innovate new product taking into account market

demand.

•

IDRA conducts special audits by chartered accountant firms regularly of the annual

accounts of the insurers. The terms of reference set by IDRA to conduct the special

audit.

•

IDRA arranges coordinating meetings with the Managing Directors and Chief

Executive officer every three months intervals to discuss the next course of action and

to give direction to the insurers.

Significant steps taken for the non-life insurance sector

•

The direction was given to stop tariff rate violations.

•

The direction was given to stop accrued business.

•

Imposing restrictions the sales of insurance business to the director's own business

firm.

•

In line with insurance act necessary directives were made so that one director cannot

hold other financial institutions’ directorship simultaneously. Directors will not be able

to work as directors at other financial institutions simultaneously.

•

Revising the surveyor’s levy and others expenses.

•

Directed non-life insurers to submit reinsurance-related information.

•

The direction was given to non-life insurers to submit a quarterly business statement to

IDRA.

•

IDRA eliminates the practices of a percentage-based salary structure for the regular

office staff instead of agents.

19

Significant steps taken for the life insurance sector

•

In a drive to reduce the lapse ratio of a life insurer, a circular was issued with necessary

instructions.

•

A revised commission schedule was issued.

•

Board and management authorities of vulnerable insurers who incurred excess

management expenses over the allowable limit were called several times to show cause

before the authority.

•

IDRA restructured the organogram of commission-based manpower.

•

In an attempt to continuous monitoring of life insurers’, investment portfolio, life

insurers were directed to submit investment returns quarterly.

•

The insurer has been submitting a closing business statement since 2012.

•

To increase the number of actuarial staff and to sensitize the insurer about the actuarial

issues life insurers were asked to set up actuarial departments irrespective of their size

and date of inception.

Innovation Team

An innovation team, comprised of three members, led by a Director, has been working since

2017. The innovation team is mainly focusing on introducing innovative ideas to accelerate

the business growth, ease of doing business, grievance redress system, and reduce the non-

compliance. This very team was trained several times by the expert of `Access to

Information’, a dedicated team of Prime Minister Office, on ease of doing business and

innovation concept. To introduce innovative ideas this innovation team is working

relentlessly. Some ideas earned the attention of the authority, these ideas are (1) affixing

sticker in the car with the insurer's hotline number so that anyone can trace the car where it has

been insured (2) receiving complaints from policyholders about an insurance claim.

Policyholders who are living in a remote corner of the country can also have easy and fast

access to this system.

Bangladesh Insurance Sector Development Project

Government-approved BDT 632 crore worth Bangladesh Insurance Sector Development

Project, where government contribution is BDT 118.50 crore and world Bank loan is BDT

513.50 crore, which was launched finally in 2018 now it is functional. Insurance Development

and Regulatory Authority, Shadharan Bima Corporation, Jiban Bima Corporation, and

Bangladesh Insurance Academy are the direct beneficiaries of this project. The main purposes

of this project are to enhance the technical capacity of the beneficiary organization and

introduce an automation system in IDRA to monitor insurers. Once, all insurers will come

under an automated system it shall enable IDRA to solve various problems which may reduce

the grievance of policyholders and increase the revenue of the government.

Arranging Insurance Fair

Bima Mela is a kind of insurance awareness event that has been taking place in the divisional

city since 2016. It is a joint production of IDRA, BIA, and BIF. The first Bima Mela was held

in Dhaka in 2016, the second one in Sylhet in 2017, the third one in Chittagong in 2018, and

20

the last one in Khulna in 2019. Major objectives of Bima Mela are creating awareness of the

masses in festive mode, settle insurance claims, promoting the different products of the

insurers, and sharing ideas and values directly with the participant.

Digital World Fare

Bangladesh Government organized Digital World Fare to show off the digital advancement of

the different sectors in which IDRA participated under the banner of the Financial Institution

Division. IDRA received a prize for active participation and showcasing its digital services to

the participant.

Participation in Development Fairs held at all District and Upazila level

It was a magnificent effort of the government to display the different achievements to the

people across the country. This fair was held in every district across the country. IDRA

handed over the responsibility to different insurance companies to ensure the presence of the

insurance sector in every district. The motive is not commercial rather showing the sectorial

development among the gathering. IDRA was able to exhibit success and offering of insurance

among the masses successfully.

Enhancing trust among the common people

Trust in insurance has reached a crucial stage and this has been declining. Because of the

inability of paying the claim in time and the proper way a kind of distrust grows among

common people and the trend is worsening every year which results in the insurance sector

falling behind other sectors including banks and the gap has been widening. IDRA as supreme

authority and custodian of this sector has addressed this problem properly and taken the

following steps to come out from this crisis:

1. IDRA set up five member’s special committee led by a member to resolve all

complaints that are being received by IDRA on a daily basis.

2. IDRA instructed insurers to upload product-related short video clips and the list of

unsettling insurance claims on their website.

Due to the constant and unrelenting effort of IDRA claim settlement rate increased a bit. In

2018 total intimated claim amount was taka 10465.90 crores out of which 88.88% of total

claims were settled by all life insurers. In the non-life sector, this rate was 40.87%. In 2019

total claim settlement rates were 89.55% and 52.07% in the life and non-life sectors

respectively.

Actions against Anti-money Laundering

IDRA and Bangladesh Financial Intelligence Unit (BFIU) are working together to combat

money trafficking and terrorist financing. IDRA is providing various directions to the insurers

in combating money trafficking and terrorist financing regularly. Dedicated summit held in

Coxs-Bazar in the last three consecutive years with Chief Anti Money Laundering Officer

(CAMELCO). CAMELCO plays a vital role in creating a culture within the organization

combating money laundering threats. Becasuse of the demand of the National Insurance

21

Policy-2014 IDRA has formed Financial Intelligence Cell. BFIU designed a new kind of

Know Your Customer (KYC) form keeping in mind the money laundering threats for the

insurer. IDRA has been observing very carefully the implementation of such instruction while

issuing an insurance policy. FIC is working with BFIU very closely.

Implementation of National Integrity Strategy (NIS)

Integrity in all aspects is very crucial for long-term sustainability and sound corporate

governance. Considering the importance of NIS, IDRA has a committee to implement NIS in

the insurance sector. When the first time the concept of the National Integrity Strategy was

developed IDRA called all the CEOs and MDs in a meeting and shared the true values of the

NIS. According to the decision that came from this meeting a committee was formed, this very

committee submits reports in regular intervals relating to NIS to the authority. Taking the

government directions as standard, IDRA evaluates the level of implementation and takes

required steps in case of any deviation.

Introducing the Bengali Language in all aspects

Insurance Development and Regulatory Authority made it effective to use the Bengali

Language in official purpose as the court order in response to the writ petition number

1996/2014 which was mostly inspired by clause three of the constitution of Bangladesh and

the Bengali Language Circulation Act-1987. Besides that, authority is using the Bengali

language as the medium of communication in all domestic purposes except a few cases. For

the sake of policyholders’ better understanding, all the insurers were directed to prepare

proposal form and policy documents in Bengali and English may be used along with Bangla.

Membership of AFI and IAIS

IDRA is a member of the Alliance for Financial Inclusion (AFI) and the International

Association of Insurance Supervisors (IAIS). Being a member of these two international

organizations IDRA gets a scope of receiving international experience on contemporary

issues.

Formulation of Third Capital Market Development Program outline

In formulating the Third capital market development program Asian Development Bank

appointed The Aris Group and The Capital Group. IDRA met with them several times.

Decisions of the meeting reflected in various rules and regulations for what they were

appointed.

Digitalization in Insurance Sector

Information asymmetry at the customer end is a major problem in the insurance sector.

Policyholder wants to know various information for example: Whether the premium income

deposited properly? When to deposit the next premium? What they should do if the deposit

slip lost for some unexpected reasons and many more. When they do not have such

information dissatisfaction and fear grow among them which results in some policyholders do

not continue the policy in a logic to prevent more losses. Those who continue the policy

22

remain in uncertainty. Taking all these facts into consideration IDRA inducted a project

namely Unified Messaging Platform in 2019. State of the art technology-based platform

collects 27 types of information of the policyholders including name of the customer, phone

number of the customer, details of the premium deposits, duration of the policy. Using these

information policyholders are getting SMS upon deposit of premium, sending premium

reminder message, SMS for accrued premium and electronic premium receipt.

Workshop/ Seminar

IDRA arranged various workshops, seminars, and training programs in 2018 and 2019 to

enhance the training of its staff or to share the knowledge with the insurers. IDRA arranged

different workshop programs on agent license regulation, Bancassurance, Insurance awareness

program, increasing efficiency of the insurer in the underwriting process, innovation, ease of

doing business, UMP, Using technology to regulate the insurer, etc. Besides that various in-

house short training programs are also arranged by IDRA for the capacity building of its staff.

Apart from that, Bangladesh Insurance Association arranged an international program titled

‘International Micro Insurance Summit’ with participation from home and abroad. IDRA staff,

CEO, and different level of staff of the insurers are among the participant in these seminars,

workshops, and training programs.

Meeting Regarding Settlement of Insurance Claim

IDRA generally sends all the complaints of the claimant to the insurer with proper direction.

What is more, considering the severity IDRA sometime calls for the insurer's management

authority for hearing. Following this process, IDRA resolved 43,746 number of application of

different life insurers in 2019. In the same way, the total number of complaints was 38 against

non-life insurers out of which 28 were mitigated following due process. A dedicated and

independent committee was formed headed by a retired justice of the Supreme Court including

one representative (member) from IDRA as per the requirement of section 73 of the insurance

act of 2010 and Dispute Mitigation Regulation-2012. From 2015 to 2019 DRC resolved 29

complaints out of 32 complaints in 112 meeting.

Financial Stability Report

IDRA collects financial data from the insurer to prepare financial stability report which

includes premium income, assets, investment, and the amount of fixed deposit. This report

sends periodically to the Bangladesh Bank.

Collecting Financial Information from the insurer

Analyzing the various indicators is one of the core tasks of IDRA for which IDRA relies on

the data of the insurer. IDRA collected various kinds of information from 2009 to 2019 which

includes assets, insurer class-wise premium income, comprehensive income, various ratios

such as retention ratios, claim ratio, combine ratio, management expenses, the yield on

investment, and life fund.

23

Insurance for Expatriate Workers

Every year nearly 1 million workers go abroad with work visas, particularly in the Middle

East. They have to work in very adverse working environment and face risks of exploitation,

discrimination, abuse, and insufficient services to protect their right. Some of them die as a

result of working in a risky job and some of them undergoes mental trauma as the condition

are opposite to that of home conditions. Such dire conditions of workers earned the attention

of the Prime Minister. Because of her order Ministry of Expatriate came forward with a plan

to introduce insurance for expatriate workers. IDRA along with MOEA formulated an

Insurance Policy for Expatriate Workers under which two separate insurance plans were also

designed by the professional actuary. Out of two insurance products first one offers taka

200,000 insurance coverage against the premium of taka 990 and the second one is a little

higher in terms of benefit and premium which offers 500,000 taka insurance benefits against

premium of BDT 2475. In case of death, policyholders will receive the full amount of sum

assured value whereas, in the event of minor injury or major organ lose such as eye, hand, legs

insured will receive partial compensation according to severity.

Various Ongoing Development Tasks

In light of the different instructions of Honorable Prime Minister Sheikh Hasina and Finance

Minister IDRA has undertaken various tasks that are under process. These important tasks are

Agriculture insurance for Haor areas, Insurance for Neuro Disabled persons, Insurance for

athletes, Surokhaa Bima for personal safety, Insurance for Railway Passengers, Mandatory

Insurance for Building, scholarships Program for Actuarial students, Listing insurer in the

capital market, initiating Bancassurance distribution channel. If these initiatives can be

fulfilled insurance sector can foster its growth.

Appointment of Chief Executive Officer

According to section 80 of the insurance act 2010 and the regulation of CEO appointment and

removal IDRA gives necessary approval upon analyzing the application of the insurers. In

2019 IDRA approves 11 and 7 CEO for the life and non-life sectors respectively.

Approval of Branch Opening

It is required to have outlets across the country to sell insurance products. The Agency system

is still the lifeline for the insurer and the branch act as a nodal point for the agents. Insurers

apply for the approval of branch license to IDRA following section 14 of the insurance act

2010 and the two regulations namely Regulations of Branch set up, 2012 and Regulation of

Branch set up fees. Till 2019 101 branches for life insurers and 365 branches for non-life

insurers were approved by IDRA.

Income and Expenditure of IDRA

Section 16 of the IDRA act 2010 clearly says the IDRA’s sources of income. The sources of

income are as follows:

24

1. Grants made by any local authority or any other person or organization;

2. Loans received by the authority;

3. Sum of money received from insurers as fees for registration and renewal thereof;

4. Sum of money received as fine which is imposed by the authority on insurers;

5. A specified part of the income of the insurance companies, as determined in a

prescribed manner;

6. Fees received from the appointment of brokers, insurance surveyors ,and insurance

agents;

7. Grants received from any foreign government, organization, or international

organization with the prior approval of the government

8. Sum of money received from the sale of properties belonging to the authority;

9. Sum of money receipt from any other sources; and

10. Income from investment sector.

Insurance Development and Regulatory Authority started its function with a taka 80 lac

(8 million) government contribution. IDRA earns in the form of various license fees, penalties,

and interest on deposits. On the other hand, staff salary, office rent, electricity bill, stationery,

hospitality expenses are the most common elements of expenditure. IDRA deposited taka 128

core from its income to the government exchequer. Last 10 years income and expenditure are

summarized that shown in chart 12.

Chart 12

Income and Expenditure of IDRA from 2010-2011 to 2019-2020 (BDT Crore)

Fiscal

Year

Expenditure Amount Expenditure Amount

2010

-

11

Government Grants

80,00,000

Expenditure

33,57,143

Income from fees

71,57,054

Income over

expenditure

1,17,99,911

Total

1,5

1,57,054

Total

1,51,57,054

2011

-

12

Income from fees and

others

29,17,84,379

Expenditure

2,34,38,464

Interest from fixed

deposit and Bank interest

1,67,16,896

Others income

36,650

Income over

expenditure

28,50,99,461

Total

30,85,37,925

Total

30,85

,37,925

2012

-

13

Income from fees and

others

35,27,33,026

Expenditure

3,86,28,078

Interest from fixed

deposit and Bank interest

4,87,00,099

Others income

2,78,917

Income over

expenditure

36,30,83,964

Total

40,17,12,042

Total

40,17,12,042

25

Fiscal

Year

Expenditure Amount Expenditure Amount

2013

-

14

Income from fees and

others

31,94,44,060

Expenditure

7,66,35,967

Interest from fixed

deposit and Bank interest

6,81,01,293

Others income

98,086

Income over

expenditure

31,10,07,471

Total

38,76,43,439

Total

38,76,43,439

2014

-

15

Income from fees an

d

others

33,71,27,855

Expenditure

9,90,97,067

Interest from fixed

deposit and Bank interest

7,38,33,833

Others income

7,37,346

Income over

expenditure

31,26,01,967

Total

41,16,99,034

Total

41,16,99,034

2015-16

Income from fees and

others

37,58,

56,328

Expenditure

7,96,25,644

Interest from fixed

deposit and Bank interest

7,88,70,056

Others income

3,64,621

Income over

expenditure

37,54,65,361

Total

Income from fees and

others

Income tax

(9,38,66,340)

Income over

expenditure

28,15,99,0

21

Interest from fixed

deposit and Bank interest

45,50,91,005

Total

45,50,91,005

2016

-

17

Income from fees and

others

37,77,39,538

Expenditure

8,97,98,335

Interest from fixed

deposit and Bank interest

6,31,99,937

Others income

23,85,228

Income ove

r

expenditure

35,35,26,368

Total

Income from fees and

others

Income tax

(8,83,81,592)

Income over

expenditure

26,51,44,776

Interest from fixed

deposit and Bank interest

44,33,24,703

Total

44,33,24,703

2017-18

(Unaudited)

Income from fees and

others

37,29,39,266

Expenditure

12,91,14,475

Interest from fixed

deposit and Bank interest

3,76,00,000

Others income

29,35,199

Income over

expenditure

28,43,59,989

Total

Income from fees and

others

Income tax

(7,10,89,997)

Inco

me over

expenditure

21,32,69,992

26

Fiscal

Year

Expenditure Amount Expenditure Amount

Interest from fixed

deposit and Bank interest

41,34,74,465

Total

41,34,74,465

2018

-

19

(Unaudited)

Income from fees and

others

13,03,23,477

Expenditure

11, 41,97,913

Interest from the fixed

deposit and Bank interest

5,55,68,333

Others income

Income from fees and

others

23,38,736

Income over

expenditure

7,40,32,633

Income tax

(1,85,08,158.25)

Income over

expenditure

5,55,24,474.75

Interest from fixed

deposit and Bank interest

18,82,30,546

Total

18,82

,30,546

2019-20

(Unaudited)

Income from fees and

others

13,21,44,421 Expenditure 9,43,97,646

Interest from the fixed

deposit and Bank interest

7,06,88,299

Others income

Income from fees and

others

21,03,740 Income over

expenditure

11,05,38,814

Income tax (2,76,34,703.50)

Income over

expenditure

8,29,04,110.50

Total 20,49,36,460 Total 20,49,36,460

27

Life Insurance

Premium

The life insurance sector uplifted the entire industry again in 2018 like before by undertaking

BDT 8,989.06 crores of premium income compared to 8,198.46 crores of 2017. The growth

pace was 10 years highest and achieved a 9.46% growth rate. This tremendous growth success

came into effect due to strong economic progress and the extraordinary effort of life insurers.

Premium income of 2019 was a bit slower than the preceding year. Despite that, the total

premium income was grown by 6.79% and reached BDT 9,599 crore helping to touch a new

milestone to cross over BDT 9,000 crore bar for the first time. If the overall economic

condition remains stable and insurers continue their all-out effort then the premium may rise in

coming years. However, the claim settlement rate is one of the determiners that swing the

growth rate in both ways.

Disposable income has been raising parallel with raising GDP and per capita income in every