2

Appendix 2

Insurance Transactions and Positions,

and Pension Schemes

APPENDIX

Insurance Transactions and Positions

Introduction

A2.1 Over the lifetime of insurance contracts, insur-

ance companies produce services to their policyholders

for which they do not charge explicitly. ese services

include nancial protection against risk and nancial

intermediation services that arise when funds collected

from policyholders and held as technical reserves are

invested. ese services are an undi erentiated com-

ponent of premiums, and need to be derived from

amounts accruing to the insurers and amounts accru-

ing to the policyholders. ese amounts are re ected in

various accounts of the balance of payments depend-

ing on the type of the activity—that is, the primary

income account, secondary income account, nancial

account, and, in some cases, the capital account. Ser-

vice fees explicitly charged by insurance companies

(e.g., for agents’ commissions, salvage, claims adjust-

ment, actuarial services) are recorded in the goods and

services account as auxiliary insurance services. Com-

pilers wishing to improve insurance data rst need to

understand the current situation regarding crossborder

insurance transactions in order to assess their relative

importance. e compiler should get acquainted with

the situation and gain an understanding by means of

interviewing domestic insurance companies, or, in case

of resident policyholders and bene ciaries, of assessing

the relevance regarding transactions with insurance

companies abroad.

A2.2 Two types of insurance schemes are distin-

guished in the international standards—social insur-

ance and other insurance. Social insurance schemes

di er from other insurance in that they are o en

linked to public insurance programs that provide pro-

tection against various social risks (e.g., loss of income

due to sickness, old age, or unemployment), and in

which participation is o en compulsory. Other insur-

ance includes freight insurance on goods imports and

exports, life insurance, other types of direct insurance

(i.e., nonlife insurance), and reinsurance. Here, the

policies are taken out by an institutional unit on its

initiative and for its own bene t, independent of any

social insurance scheme. e Insurance Transactions

and Positions part of the appendix deals with estimat-

ing other insurance services.

A2.3 Within other insurance, nonlife insurance and

reinsurance are treated similarly, which is a change to

previous international standards. However, there are

di erences between life and nonlife policies leading to

di erent types of entries in the international accounts.

For life insurance, the prebene ts period generally

extends throughout the entire life of the contract and

there is little or no uncertainty about the payment. e

payments made over the years are regarded as a nan-

cial investment (or saving), which will be returned to

the policyholder in later years. us the recording of

premiums and bene ts is made in the nancial account.

A2.4 e balance of payments compiler is con-

fronted with di erent situations regarding the avail-

ability of data on cross border insurance activities. e

data for estimating exports of insurance services will

be best obtained by surveying resident insurance com-

panies. e data collected through this survey should

cover data on the nonresident policyholders’ share in

net premiums, claims, and reserves. is will enable

the conceptual adjustments necessary for the record-

ing of these operations in the balance of payments and

international investment position (IIP) statistics.

A2.5 e same will not be possible for the imports

of insurance services with the provider of the insurance

services being nonresident to the compiler’s economy.

us estimates have to be either based on ratios avail-

able from the domestic insurance sector, information

derived from an international transactions report-

332 Balance of Payments and International Investment Position Compilation Guide

ing system (ITRS), partner economy data, or from

a survey that can be used to collect premiums paid

and claims recovered from the domestic policyholder.

Imports of reinsurance services could be covered by

the same survey of domestic insurance companies

discussed in the foregoing paragraph. Model form 12

in Appendix 8 is designed for collecting data on insur-

ance services and other related transactions.

Overview of Insurance Accounting:

Nonlife Insurance

A2.6 In nonlife insurance, policyholders make reg-

ular premium payments to an insurance company. In

return, the company guarantees nancial protection

against the occurrence of events, such as accidents,

sickness, and re. “Term-life insurance” (as opposed

to “life insurance”) is also treated as nonlife insurance

in external accounts, because it only provides a stated

bene t upon the death of the policy holder, provided

that the death occurs within a speci c time period.

However, the policy does not provide any returns be-

yond the stated bene t, unlike life insurance policies,

which have a savings component that can be used for

wealth accumulation.

A2.7 e chief function of nonlife insurers lies in

the proper redistribution of premiums earned and

other income to individuals of homogeneous groups

that have incurred losses. A special form of nancial

intermediation is also involved, in which funds at the

disposal of the insurance unit, called (nonlife) insur-

ance technical reserves, are invested in nancial and

other assets to generate income. Nonlife insurance

technical reserves cover unearned premiums, reserves

for unexpired risks, and claims outstanding at the end

of the reporting period. For the purpose of nancial

reporting, these funds and the corresponding invest-

ment income, called premium supplements, are assets

of the policyholders and liabilities of the insurance

companies.

Premiums

Written, unearned, and earned premiums

A2.8 An insurance premium represents the price

the insurance company charges for the policy and the

service it renders to the policyholder. e concept of

unearned premiums is important to the insurance

business, as it deals with the recognition of revenue

for the time period in which the policy is in force.

In the jargon of an insurance company, at the time a

policy is rst written, the total of the premium may be

unearned, as premiums are o en fully prepaid at the

inception of the policy. Direct written premiums are

the amounts charged to and actually paid over the life

of a contract by the policyholders for insurance cov-

erage. Each day therea er, the premium amount ac-

crues to the insurance unit until the end of the policy.

At the end of the reporting period, the insurance unit

assesses the premium reserves representing the unex-

pired terms of the policy. e earned premium plus

the unearned premium for a policy equals the written

premium. e recognition of premiums earned versus

premiums received and estimates of claims incurred

but not yet reported or resolved can be seen as the ap-

plication of usual accrual accounting principles.

1

ere are multiple reinsurance types and, hence, methods for

ceding business to a reinsurer.

x% of the risk

Written premiums

Earned

premiums

Unearned

premiums

(100-x) %

of the risk

Reporting period

Net written premiums and reinsurance

premiums

A2.9 In most of the cases the direct written premi-

ums constitute the basis for the compiler to determine

the amounts of premiums related to direct business

and to derive earned premiums at the end of the pe-

riod. However, an intermediate step may be neces-

sary in case the premium amounts in the accounts of

insurers are already further adjusted for reinsurance

premiums. Insurance companies purchase reinsurance

to protect themselves against the risks of losses above

certain thresholds. If a risk is reinsured, the insurance

company will cede to a reinsurer (i.e., another insur-

ance company) a part of the premiums in proportion

to the risk assumed. e other part is used by the in-

surance company to nance the risk that remains.

1

333 Insurance Transactions and Positions, and Pension Schemes

A2.10 On the other hand, insurance companies

themselves may act as a reinsurer and accept indirect

business from another insurance company in form of

assumed premiums. us gross written premiums in

insurers’ accounts could include both written premi-

ums charged to policyholders (also called direct writ-

ten premiums)

2

and assumed reinsurance premiums

from insurance companies. Net written premiums

then constitute gross written premiums minus ceded

reinsurance premiums.

3

Claims

Insurance claims

4

incurred and paid

A2.11 At the time the policy becomes e ective,

the policyholder has transferred the uncertain loss

of assets to the insurance company in form of poten-

tial claims in exchange for the premium paid. Claims

incurred refer to the expected nancial obligations

that cover the insured risks as provided by the policy.

Claims may be known or unknown by the company,

reported or unreported. Paid claims occur when ac-

tual payments of cash have been made to claimants for

insured events of the current or previous periods. To

properly match the income earned (premiums) of the

insurance company with the expenses incurred in the

relevant period, provisions are made in the insurers’

accounts as of the accounting date for claims incurred

that will be settled a er the current accounting period.

Claim associated expenses (also called claim/loss ad-

justment expenses, incurred to investigate and settle

losses) are generally considered part of the claim cost

for an insurance company.

A2.12 In insurance accounting, claims incurred for

the accounting period are calculated as follows:

Claims/losses paid during the accounting period for

nonlife insurance contracts

Minus Loss reserves outstanding (at the beginning of

the accounting period)

Plus Loss reserves outstanding (at the end of the

accounting period)

Equals Claims incurred

A2.13 Loss reserves are the unpaid part of claims

incurred as of the accounting date, as explained ahead

in Insurance technical reserves and expected income

attributable to policyholders.

Insurance technical reserves and expected

income attributable to policyholders

Insurance technical reserves

A2.14 An insurance company must apply sound

methods to estimate potential claim liabilities on its

balance sheet to cover all expected and unexpected

claims and expenses, as there is always a delay between

the times the insured events occur and the times the

claims are reported and settled. e insurance com-

pany has incurred a potential liability at the time the

policy becomes e ective. Until the insured incident

occurs, the potential liability is re ected in unearned

premiums and the other components of insurance

technical reserves.

A2.15 Unearned premiums are established as a lia-

bility becauseinsurance companies receive premiums

in advance of some or all of the policy period that is

covered by the policy. Following the accrual princi-

ple, these premiums cannot be recognized as revenue

until they are earned. Also, insurance companies may

need to refund these premiums to policyholders if the

policy is cancelled before its stated ending date.

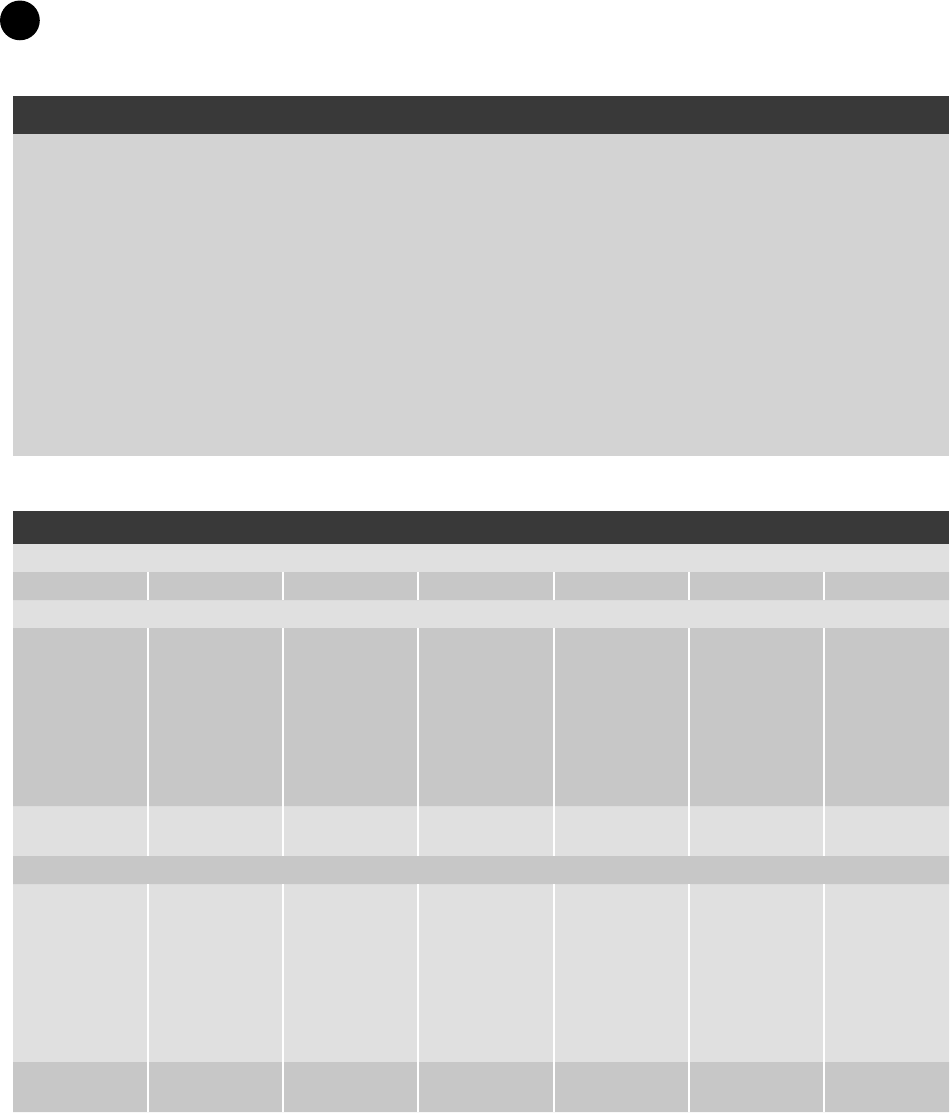

A2.16 e nonlife insurance technical reserves

set aside on the balance sheet (see Example A2.2

ahead) for future commitments that arise out of in-

surance contracts (including any related adminis-

tration expenses, taxes, etc.) consist of mainly two

components:

a . Unearned premium reserves are that part of pre-

miums written that apply to the unexpired part

of the policy period. ese reserves are to be

carried forward to the following accounting pe-

riod. e insurance policy period for which the

premium is paid in advance and during which

the insurance company bears the risk does (usu-

ally) not correspond with the reporting period.

If an insurance company expects its unearned

premium reserves to be insu cient to cover

estimated claims and expenses in the following

accounting period from contracts concluded by

2

Direct written premiums are the premiums received from poli-

cies issued directly by the primary insurance company to its

policyholders.

3

e di erent meaning of “net” in the context of the BPM6 should

be noted: “Net” as applied to premiums implies that the service

charge for the insurance services has been deducted from actual

premiums to record the premiums in the secondary income

account, whereas here net written premiums are net of ceded

reinsurance premiums. See the BPM6 , paragraph 12.42.

4

Claims incurred are also called losses incurred in insurance

accounting.

334 Balance of Payments and International Investment Position Compilation Guide

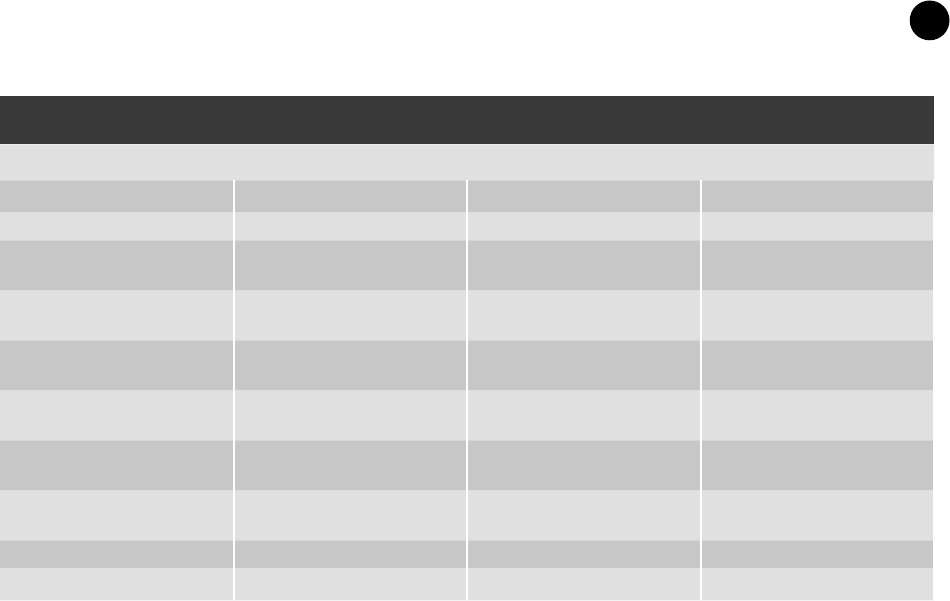

Example A2.1. Illustration of insurance company profi t and loss account

In million U.S. dollars 2012 2011

INCOME

Gross premium written 5,488.9 5,255.7

Reinsurance premium ceded –288.7 –272.0

Net premium written 5,200.2 4,983.7

Premium assumed 300.0 250.0

Net changes in unearned premium

reserves

–35.6 –24.6

Net earned premium 5,164.6 4,959.1

Interest and dividend income 793.8 704.4

Gains and losses on investments (net) 130.2 291.4

Income on investment property 194.4 186.4

Other income 89.1 89.4

Total operating income 6,672.1 6,480.7

EXPENSES

Claims incurred including claims

handling costs (nonlife)

–1,610.9 –1,465.8

Claims and benefi ts paid (life) –2,369.8 –2,226.3

Change in actuarial reserve –591.1 –738.0

Reinsurers’ share of benefi ts and claims 205.9 160.8

Policyholder dividends and bonuses –173.4 –166.7

Insurance benefi ts and claims (net) –4,539.3 –4,436.0

Acquisition costs –692.4 –647.4

Operating and administrative expenses –534.2 –509.8

Interest payable –44.6 –41.8

Other expenses –51.7 –29.3

Total operating expenses –5,862.2 –5,664.3

Profi t or loss from operating activities 809.9 816.4

Finance costs –7.2 –6.0

Share of profi t or loss of associates 2.8 1.8

Profi t or loss before taxes 805.5 812.2

Income taxes –103.5 –138.4

Profi t or loss for the period 702.0 673.8

the end of the accounting period, it may create

so-called unexpired risk provisions. Some in-

surance companies also separately disclose pro-

visions to meet costs of discounts to be granted

to certain policyholders.

b . Estimated loss reserves and reserves for claims in-

curred but not reported are provisions set aside

to meet the estimated costs of settling claims

that have occurred up to the end of the account-

ing period from policies currently in force and

policies written in the past, a er the deduction

of amounts already paid. is amount includes

funds for unpaid claims, claims adjustment and

handling expenses known but not yet settled,

and estimates for claims incurred but not yet

noti ed (so called incurred but not reported)

by the balance sheet date. Insurance companies

may also set aside funds for preventing cash- ow

depletion for signi cant unforeseen events or

catastrophes, when many policyholders may be

a ected at about the same time. ese kinds of

reserves should, however, be taken into account

only if there has been an event that triggered the

increase of liabilities vis-à-vis the policyholders.

335 Insurance Transactions and Positions, and Pension Schemes

Example A2.2. Excerpt from an insurance company balance sheet

Insurance company X: Insurance liabilities at year end

In million U.S. dollars Life General Total

Participating contracts 12,383.7 – 12,383.7

Unit-linked nonparticipating

contracts

9,998.4 – 9,998.4

Other nonparticipating

contracts

9,359.1 – 9,359.1

Outstanding claims

provisions

– 1,111.8 1,111.8

Provisions for claims

handling expenses

– 78.4 78.4

Provisions for claims incurred

but not reported

– 480.6 480.6

Provisions for unearned

premiums

– 396.4 396.4

Provisions for unexpired risks – 3.0 3.0

Total 31,741.2 2,070.3 33,811.5

Otherwise these amounts are seen as internal re-

serves set aside for saving purposes and should

not be included in nonlife technical reserves of

the balance of payments and IIP.

Expected income (attributable to

policyholders)

A2.17 Insurance companies generally distinguish

two sources of income, from investing shareholder

(equity) capital and from investing policyholders’

funds (also referred to as holdings of own assets and

technical reserves, respectively). e investment of

policyholders’ funds is a distinct feature of insurance

companies and made possible because of the time span

between the collection of premiums and the eventual

loss settlements.

Using the Insurance Companies’

Accounting Data to Derive Balance

of Payments and IIP Components

A2.18 Box A2.1 summarizes the BPM6 methodol-

ogy as described in Annex 6c of the BPM6 regarding

the balance of payments data on nonlife insurance. Al-

though the terms used to describe transactions of the

insurance sector in the BPM6 and the 2008 SNA are

based on and in strong accordance with the accounting

terminology that insurance companies use to set up

their accounts (as explained in Employment-Related

Pension Schemes and Social Security Schemes of this

appendix), the compiler may need to make certain ad-

justments before data can be used to derive relevant

balance of payments entries according to the BPM6 .

ese adjustments are necessary, for instance, to de-

termine and di erentiate the amounts of premiums

related to direct business with policyholders, and the

amounts related to reinsurance (both ceded and as-

sumed), as further explained ahead.

A2.19 e paragraphs ahead aim at identifying

the terms and the necessary adjustments needed to

compile balance of payments data. All entries relate to

nonresident policyholders.

Secondary income account:

Net premiums earned

A2.20 Net premium earned equals premiums earned

plus premium supplement minus service charge. For the

compilation of balance of payments purposes according

to the BPM6 , there is no netting between direct insur-

ance and reinsurance. erefore, the compiler should

distinguish between the amounts related to direct busi-

ness, and the amounts related to reinsurance (both

ceded and assumed). is means that direct written pre-

miums received from policyholders should not be net-

ted for any premiums ceded to reinsurers, and should

exclude premiums assumed from other insurance com-

panies. e rationale is that the direct insurance com-

pany is fully liable vis-à-vis the policyholder, regardless

336 Balance of Payments and International Investment Position Compilation Guide

Box A2.1 BPM6 Entries in the Balance of Payments Related to Nonlife Insurance Transactions

Services account

The insurance service charge is derived implicitly with the following formula (see BPM6, Appendix 6c):

Insurance services = gross premiums earned

plus premium supplements (investment income attributable to policyholders in insurance)

minus claims due/incurred (adjusted for claims volatility, if needed)

Primary income account

Investment income attributable to policyholders in insurance (equal to premium supplements)

Secondary income account

Net premiums earned = gross premiums earned

plus premium supplements

minus insurance services

Claims payable/due

Financial account

Changes in nonlife insurance technical reserves (e.g., for policyholders’ funds invested)

Currency and deposits (for actual premiums written and claims paid)

of whether part of the risks are reinsured (see 2008 SNA ,

paragraph 17.57).

A2.21 e written premiums from direct business

are used to determine the earned premiums from the

insurers’ accounts of the reporting period.

5

From the

business with nonresident policyholders:

Written premiums (for direct business only)

Plus Unearned premium reserve (at the beginning

of the reporting period)

Minus Unearned premium reserve (at the end of the

reporting period)

Equals Premiums earned (from direct business)

A2.22 e adjusted written premiums and derived

earned premiums constitute the rst two components

for the compilation of the insurance accounts accord-

ing to international standards. Written premiums

correspond to premiums received in the BPM6 , and

are recorded in other investment—for example, as an

increase in the insurance companies’ deposits abroad.

A2.23 In Example A2.1 (Illustration of insurance

company pro t and loss account), to determine the

earned premiums, the compiler would have to use the

gross premiums written (not taking into account the

reinsurance premiums ceded) excluding premiums

assumed, and the net change in unearned premium

reserves, and inquire about the share of nonresident

5

e results are measured on an accounting period basis, which

could be the calendar or scal year, as opposed to the policy period.

policyholders. Bene ts are payments to life insurance

policyholders and would need to be separated from

nonlife claims paid.

Secondary income account: Claims payable/due

A2.24 Claims incurred in insurance accounts

correspond to claims payable in the BPM6 , and are

recorded in the secondary income account of the bal-

ance of payments (see BPM6 , paragraph 12.44), while

claims paid are recorded in other investment—for

example, as a decrease in the insurance companies’

deposits abroad. e calculation for claims incurred is

set out in paragraph A2.12.

A2.25 For insurance companies to accurately esti-

mate future loss payments, especially for claims un-

known, predictions are in general based on historical

data of settlement and reporting patterns of homog-

enous groups of policyholders, and actuarial meth-

ods that take account of uncertainties to determine

the amount of reserves. Certain lines of business with

expected individual large risks involved, with high

frequency of losses, or with cumulative risks (such as

natural disasters) are likely to be hedged by insurance

companies through customized reinsurance.

A2.26 In case of a signi cant unforeseeable event

during the accounting period, the derived insurance

services rendered by the insurance company to the pol-

icyholders should not turn into a negative gure—that

is, neither the volume nor the price of insurance ser-

vices should be a ected by the volatility of claims. e

337 Insurance Transactions and Positions, and Pension Schemes

2008 SNA therefore recommends the use of adjusted

claims incurred when measuring the output of insur-

ance companies. e adjustment would be negative in

periods when large values of claims are incurred, thus

increasing the value of the service by reducing the dif-

ference between actual claims in a particular period

and a normally expected level of claims.

A2.27 ere are three di erent accounting meth-

ods to help estimate the expected level of claims (see

BPM6 , paragraph A6c.22): (1) the expectations ap-

proach is based on expected claims using smoothed

past gures of gross claims incurred or ratios of gross

claims over premiums, applied to current premiums;

it replicates the ex-ante model of insurance companies

when pricing the premiums based on expectations of

loss; (2) the accounting approach uses ex-post data

of observed claims incurred and is based on changes

in insurance companies’ equalization reserves and

changes in own funds; and (3) the sum of costs plus

“normal” pro t approach measures output by tak-

ing the sum of costs plus an estimate of normal pro t

based on smoothed past actual pro ts.

A2.28 According to international standards, ex-

ceptionally high claims following a natural disaster

or catastrophe are recorded as secondary income or

a capital transfer provided by the insurance company

to the policyholders. e rationale for treating certain

claims as capital transfers is that these claims do not

a ect the level of disposable income of the claimants.

e net worth of policyholders will thus show the ef-

fects of the destruction of assets and an o setting in-

crease in nancial assets from the capital transfers (see

2008 SNA , paragraph 17.40, and BPM6 , paragraph

13.24). e entries in the secondary income account

recognize the intermediation e ect of direct insurance

by transferring a pool of relatively small premiums

from many policyholders to a small number of large

claims from some of these policyholders.

Primary income account: Premium supplements

A2.29 When a policy is written, insurance compa-

nies receive cash, which is at their disposal to invest until

claims are later reported and settled. Distinguishing be-

tween technical reserves and own assets is relevant for

deriving the insurance services according to the BPM6.

A2.30 In international standards, the income

earned from the investment of insurance techni-

cal reserves are called premium supplements (see

BPM6 , paragraph 11.83) and are imputed as primary

income receivable by policyholders, as the technical

reserves are assets of the policyholders. is income

is retained by the insurance companies in practice.

e same amount is then shown within the equation

as payable to the insurance company by the poli-

cyholder as premium supplements in the services

account.

A2.31 In Example A2.1, the income retained from

investing policyholders’ funds is called policyholder

dividends (and bonuses). Bonuses are amounts in

life insurance policies that are explicitly attributed to

policyholders each year. e compiler would need to

inquire about the estimated (prorated) share of in-

come payable to nonresident policyholders for nonlife

business.

Financial account: Insurance technical reserves

A2.32 Reserves are increased or reduced when

premiums are earned and claims are paid from out-

standing loss reserves. In the accounting system of the

company, the payment is matched to the loss reserve

and a corresponding entry is made to reduce the re-

serve for the payment made to the policyholder. At

the end of the accounting period, insurance technical

reserves can decrease in net terms when claims paid

out of reserves exceed amounts added to respective

reserves.

A2.33 ese reserves for unearned premiums and

against outstanding insurance claims are recorded in

the other investment category of the nancial account

under Insurance, pension, and standardized guarantee

schemes (see BPM6 , paragraphs 5.64, and 7.63–7.64).

e split of these reserves between liabilities to resi-

dents and nonresidents may have to be undertaken

according to a suitable indicator such as premiums

earned or written.

A2.34 For the recording of insurance technical re-

serves in the IIP, ows that result from exposure to the

e ect of exchange rates will have to be taken into ac-

count (see Chapter 9 for more details on other changes

in nancial positions).

Goods and services account:

Deriving insurance services

A2.35 All components are now available to the

compiler to derive the insurance service charge ac-

cording to the BPM6 , paragraph 10.111.

338 Balance of Payments and International Investment Position Compilation Guide

A2.36 e implicit insurance service the insurance

company renders is a measurement of the output of

the insurance industry. e service provided to resi-

dents and nonresidents is derived by determining the

output of the insurance in a way that mimics the ac-

counting practices based on premiums earned and

losses incurred pertaining to the accounting period:

Gross premiums earned (from direct business)

Plus Net income from investments attributable to

policyholders (premium supplements)

Minus Estimated claims incurred (adjusted for claim

volatility, if necessary)

Equals Insurance service charge

Data sources

Conducting a survey of domestic

insurance companies

A2.37 e compiler can obtain most comprehen-

sive data for exports of insurance services from sur-

veying resident insurance companies. To enable an

appropriate coverage of the domestic insurance sector,

a survey frame should be available, including a list of

insurance companies, which may be provided by the

authority issuing the licenses for insurance business.

Insurance agents and brokers are usually required to

register with insurance authorities; therefore, a list of

these businesses should be readily available from of-

cial sources (see also Box A2.2).

A2.38 rough surveying domestic insurance

companies, the compiler is able to request information

on a conceptually correct basis as explained in previ-

ous paragraphs—that is, premiums earned and claims

due—as well as insurance technical reserves and the

income earned on those reserves.

A2.39 Resident insurance companies should report

details of premiums and claims in respect of business

obtained from abroad and in respect of international

reinsurance ows. In addition, these companies may

be asked to report details of premiums and claims in

respect of insurance written by them on imports.

A2.40 Supervisory institutions may be a source for

qualitative aggregate information. Although balance

sheets and pro t and loss account information from

those institutions may have the caveat of long timeli-

ness, they may be combined with information avail-

able from shorter-term external sector statistics (e.g.,

from the ITRS) or administrative data, for estimating

an interim (moving) measure for the distinction be-

tween national and international business.

A2.41 Insurance terms may di er due to di erent

accounting practices that are being applied in world-

wide insurance accounting.

6

A2.42 A model form for insurance survey is pre-

sented in Appendix 8.

Box A2.2 Insurance Sales Agents and Brokers

Insurance sales agents or brokers commonly sell one or

more types of insurance, such as property and casualty,

life, health, disability, and long-term care. They either

work exclusively for one insurance company based on

a contractual agreement, or work independently and

represent several companies at the same time. As fa-

cilitators, agents help match insurance policies for their

clients with the company, and help policyholders settle

their insurance claims. Insurance agents and brokers are

usually required to register with insurance authorities;

therefore, a list of these businesses should be readily

available from offi cial sources. An exploratory survey

could be undertaken to identify agents and brokers

placing insurance abroad.

The agent’s commission is generally a percentage of

each premium. If the insurance company that is sur-

veyed collects premiums directly from its policyholders,

the premiums balance receivable would include the full

amount of premiums due from policyholders. If agents

act as intermediary between insurance company and

policyholder, there are generally two possibilities. If the

insurance company uses an agent but charges directly

the policyholders for premiums due, the commissions

payable to the agent will not reduce the amount that

is received and recorded for premiums. If the agent

collects premiums on behalf of the insurance company,

the premium shown in the insurance accounts would

normally be recorded net of commissions. The compiler

should be aware of the possibility that premiums could

be collected by agents but not yet transferred to the

insurance company (uncollected premium balances), or

that commissions have been deducted (premiums gener-

ally should be recorded gross of agent commissions, and

commissions for agent services should be separately re-

corded). Insurance companies keep periodic statements

of the sums due and owed to an agent, sometimes

referred to as agents’ balances.

6

A joint International Accounting Standards Board and Finan-

cial Accounting Standards Board project on the accounting of

insurance contracts currently focuses on the recognition and

measurement of insurance contracts, and the presentation of in-

come and expenses arising from those contracts; see http://www.

ifrs.org/Current+Projects/IASB+Projects/Insurance+Contracts/

About+Insurance.htm .

339 Insurance Transactions and Positions, and Pension Schemes

in life insurance corporations and pension funds re-

serves, which re ect the present value of the insurance

corporation’s estimated (actuarial value of) liabilities

for future claims by life insurance policyholders.

A2.45 e assets account in the sectoral balance

sheet is used to record the amount of nancial corpo-

rations’ prepayments of premiums to insurance cor-

porations. It also includes prepayments that insurance

corporations have made to other insurance corpora-

tions (i.e., to reinsurance companies abroad). In gen-

eral, the asset category is relatively minor compared

to the liability account. Prepayment of insurance

premiums is the only category of insurance technical

reserves for which there are both asset and liability ac-

counts in the sectoral balance sheet. Report 4SR of the

monetary statistics is the report form used to compile

the data on all resident insurance corporations and

pension funds.

A2.46 MFS do not contain income statements (see

MFSM-CG). Data on the investment income from in-

surance reserve assets could be estimated by applying

an appropriate return rate calculated as a speci ed

percentage of the amount of the outstanding balances.

Nonlife insurance services—Deriving insurance

services payable from incomplete information

A2.47 e compiler may not always be able to

compile a comprehensive set of accounts in order to

approximate insurances services exports in a given

reporting period, especially for shorter time periods

(e.g., quarterly data). erefore, in conjunction with

the national accounts compiler, the insurances services

provided to the rest of the world could be estimated

from the total estimated output

8

of the insurance sec-

tor and the average ratio of total premiums earned

from abroad to total premiums earned (see Example

A2.4). Premiums are a better indicator than claims for

determining the share of insurance services attribut-

able to the rest of the world. e reason is that claims

are contingent on events incurred to trigger payments,

and there may be periods without claims or with

irregularly large claims. From the ITRS, there may be

data available on a cash basis of premiums received

from abroad, and claims paid.

Example A2.3 Excerpt from the sectoral

balance sheet for the fi nancial corporations

subsector (liability side)

Insurance technical reserves

Net equity of households in life insurance reserves

Residents

Nonresidents

Net equity of households in pension funds

Residents

Nonresidents

Prepayment of premiums and reserves against

outstanding claims

Insurance technical reserves for life and nonlife

insurance policies derived from standardized

reporting forms (SRFs) in monetary and

fi nancial statistics (MFS)

A2.43 e MFS can be a data source for compiling

insurance technical reserves. In MFS, insurance tech-

nical reserves receive separate treatment and appear as

liabilities in the accounts of insurance corporations and

pension funds in the other nancial corporations’ sub-

sector (see Example A2.3).

7

In many economies such

reserves constitute a signi cant contribution to the

total liabilities of the nancial corporations’ sector. e

separate identi cation therefore supports the analysis

of activities of this particular subsector, which is re-

ected in their specialized treatment in national nan-

cial reporting and international statistical standards.

A2.44 Technical reserves have three components.

e rst component is the liabilities account for obli-

gations for prepaid insurance premiums received from

all resident and nonresident policyholders. Included

are prepayments for both life insurance and nonlife

insurance policies, as well as premium prepayments

for reinsurance (see Monetary and Financial Statistics

Manual and Compilation Guide (MFSM-CG)). e

second component of insurance technical reserves

comprises changes in reserves for claims outstanding,

which insurance companies hold in order to cover the

amounts for (valid) claims that are not yet settled or

claims that may be disputed. e third component

covers the obligation from net equity of households

7

Other nancial corporations are part of other sectors in the

BPM6 classi cation of institutional sectors (see BPM6 , Table 4.2).

8

See 2008 SNA , paragraph 6.185, on the calculation of output for

the insurance industry (total premiums earned plus premium

supplements less adjusted claims incurred).

340 Balance of Payments and International Investment Position Compilation Guide

Import of insurance services with and

without an insurance company resident

in the reporting economy

A2.48 Insurance services receivable (imported)

are much more di cult to capture, as the compiler

is not able to request information directly from in-

surance corporations. Data from an ITRS will be

on a cash basis and capture premiums paid and

claims received. An appropriate ratio derived from

the domestic insurance industry can be applied to

premiums paid. If this ratio cannot be obtained, the

compiler should estimate the ratio by using the long-

term relationship between premiums and claims.

e ITRS provides information on economies to

which premiums are paid and from where claims

are received. e compiler could contact the balance

of payments compilers in those economies to obtain

appropriate ratios for their services estimates.

Overview of insurance accounting:

Reinsurance

A2.49 Reinsurance is the primary vehicle used by

insurance companies to diversify, mitigate, and man-

age their risk. Reinsurance is the acceptance by the re-

insurance company of all or part of the risk of loss of

the primary insurance company (also called the ced-

ing company). ere are di erent types of reinsurers—

those whose basic business is reinsurance, and those

that conduct reinsurance business in addition to their

primary business. Reinsurance companies either use

direct negotiation channels, or contact primary insur-

ance companies through brokers or intermediaries to

whom they pay commissions as a percentage of the

reinsurance premium.

A2.50 ere are two principal forms of reinsur-

ance, pro rata and excess of loss reinsurance, which

increase the primary insurance company’s capacity

to accept larger exposures than normal. In a pro rata

reinsurance contract, the reinsurers and reinsured

company share a proportional part of the premiums

Example A2.4 Estimation of insurance

services provided to nonresidents

Estimated domestic insurance output

in period x (could also be based on

period x–1) 50

Total premiums written 200

of which premiums received/ written

from abroad 70

Estimated insurance service

provided to nonresidents 17.5 = 50*70/200

Example A2.5 Deriving transactions related to nonlife insurance

This example presents how to calculate/estimate balance of payments entries related to nonlife insurance. It is assumed

that the balance of payment compilers received the following information on nonlife insurance from resident insurance

companies:

Total premiums received from abroad 170

Total claims paid to abroad 160

Net increase in technical reserves due to prepayments 30

Net increase in technical reserves due to claims not yet paid until end of year 20

Adjustment for volatility for claims payable during the year –50

Total investment income earned from investment of assets 40

of which ratio of attributable to nonresident policyholders 30 %

Based on the foregoing information:

(1) The following calculation should be executed:

Gross premiums receivable from abroad = Total premiums received from abroad—Net increase in technical reserves

due to prepayments = 170 – 30 = 140

Claims payable to abroad = Total claims paid to abroad + Net increase in technical reserves due to claims not yet paid =

160 + 20 = 180

Expected long-term level of claims = Claims payable + Adjustment for volatility in claims payable = 180 + (–50) = 130

Premium supplements (investment attributable to policyholders) (debits) = Ratio of attributable to nonresident

policyholders*Total investment income = 30%*40 = 12

341 Insurance Transactions and Positions, and Pension Schemes

Example A2.5 Deriving transactions related to nonlife insurance

(2) The following balance of payments transactions should be derived:

Current Account:

Goods and services—Insurance services (credits)

Gross premiums receivable from abroad + premium supplements—expected long-term level of claims = 140 + 12 – 130 = 22

Primary income – Other investment—Investment income attributable to policyholders in insurance (nonlife

insurance—premium supplements) (debits) = 12

Secondary income—Other current transfers—Net nonlife insurance premiums (credits)

Gross premiums receivable + premium supplements—insurance services = 140 + 12 – 22 = 130

Secondary income—Other current transfers—Nonlife insurance claims (debits)

Claims payable to abroad = 180

Financial Account:

Other investment—Insurance, pension, and standardized guarantee schemes—Nonlife insurance technical reserves

(increase in liabilities to policyholders)

Net increases in technical reserves due to prepayments of premiums + net increase in technical reserves due claims not

yet paid (incurred claims not yet paid) = 30 + 20 = 50

Other investment—Currency and deposits (increase in assets)

Premiums received from abroad—claims paid to abroad = 170 – 160 = 10

Recording of transactions for nonlife insurance in the balance of payments statistics (economy of insurance companies)

Year Credit Debit

Current account

Services

Insurance and pension services 22

Primary income

Other investment

Investment income attributable to

policyholders in insurance, pension schemes, and

standardized guarantee schemes 12

Secondary income

Financial corporations, nonfi nancial corporations,

households, and NPISHs

Other current transfers

Net nonlife insurance premiums

1

Nonlife insurance claims

1

130

180

Net acquisition of fi nancial assets Net incurrence of liabilities

Financial account

Other investment

Deposit-taking corporations, except the central bank

Currency and deposits

Insurance, pension, and standardized guarantee

schemes

Nonlife insurance technical reserves

1

+10

+50

1

Supplementary item

(concluded )

and losses of the primary insurance company’s pro

rata reinsured business. In an excess of loss contract,

the primary insurance company pays the amount of

each claim up to a limit determined in advance, and

the reinsurer pays the amount of the claim above

that limit either per risk, per occurrence, or if rein-

sured losses incurred in aggregate exceed an agreed

amount. A reinsurer can cede all or part of the rein-

surance it has previously assumed to another reinsur-

ance company. is transaction is called retrocession.

342 Balance of Payments and International Investment Position Compilation Guide

A2.51 International standards measure transac-

tions of reinsurance companies in a way similar to

transactions of direct nonlife insurance companies

(see Overview of insurance accounting: Nonlife in-

surance). However, there are some peculiar payments

in reinsurance. e primary insurance company re-

mits to the reinsurer the net premium a er deducting

the so-called agreed upon ceding commission. is

commission is paid by the reinsurer to reimburse the

ceding company for its acquisition expenses and other

costs incurred to place the business with the reinsurer.

A2.52 Another commission o en found in reinsur-

ance agreements provides for pro t sharing. e re-

insurer and the ceding company generally agree to a

predetermined percentage of the pro t realized by the

reinsurer on the contracts ceded by the primary insur-

ance companies and the cedants’ share of such pro ts,

called pro t commission.

A2.53 As is the case for the primary insurance

company, the premiums for the reinsurer are gener-

ally not fully earned when received, so provisions are

made for the unearned part of the written premiums.

Earned premiums are calculated by the sum of premi-

ums written plus the unearned premium reserve at the

beginning of the reporting period, less the unearned

premium reserve at the end of the reporting period.

e amount of the unearned premium reserve less the

ceding commission is the amount the reinsurer would

have to pay back, in case the contract was canceled.

A2.54 Reinsurers are also required to establish re-

serves for claims outstanding and for expenses associ-

ated with settling and adjusting these claims. Claims

or losses incurred are calculated as claims incurred

and paid during the current period, plus claims in-

curred during the current period that are unpaid at

the end of the period.

A2.55 e management of the reserves may di er

from those of primary insurance companies due to

the longer duration of contracts and the magnitude of

losses. Conceptually, the income reinsurers earn from

investing the reserves is treated similar to that of pri-

mary insurers, as investment income payable to the

primary insurance company and returned as premium

supplement. A primary insurance company thus pays

investment income to its policyholders based on the

whole of the premiums earned, and receives invest-

ment income from the reinsurer corresponding to the

amount of the premiums it has ceded to the reinsurer.

A2.56 e value of output of the reinsurer can be

expressed with the following formula:

Gross premiums earned less commission payable

Plus Net income from investments (premium sup-

plements)

Minus Claims due (adjusted for claim volatility, if nec-

essary) and profit commission payable

Equals (Re-) insurance services

A2.57 International accounting standards prohibit

the o setting of reinsurance assets against related li-

abilities and require transactions between the direct

insurer and its clients on the one hand and the holder

of a policy and reinsurer on the other to be recorded

as entirely separate sets of transactions. In insur-

ance companies’ accounts of ceding companies net

premiums written (received) generally refer to gross

premiums written (including direct and reinsurance

assumed) less the premiums ceded proportionally to

reinsurers. Indirect business accepted from another

insurance company is included in gross premiums

written as reinsurance assumed.

A2.58 As with direct insurance, in exceptional

cases, some part of reinsurance claims may be re-

corded as capital transfers rather than as current

transfers. All other entries in the international ac-

counts are derived and recorded similarly to nonlife

insurances (see Example A2.6).

A2.59 Services receivable from reinsurance compa-

nies abroad

9

can be best captured through surveying

the domestic recipient insurance company, as de-

scribed in paragraphs A2.37–A2.42.

9

Reinsurance is o en placed with reinsurance companies abroad

and therefore is o en cross border.

Example A2.6 Estimation of insurance

services in indirect insurance

Premiums residents pay to

nonresident insurance companies 80

Claims received from nonresident

insurance companies 50

Average long-term ratio between

insurance service charge and

premiums paid 15 %

Estimated insurance services 12 (= 80*15%)

Net premiums 68 (= 80–12)

Claims received 50

343 Insurance Transactions and Positions, and Pension Schemes

Overview of insurance accounting:

Life insurance

A2.60 ere are three distinguishing features for

life insurance contracts: the relationship between pre-

miums and claims/bene ts over time, the length of

time for which the contract is written, and the certainty

that a claim/bene t will occur. Practically, the insur-

ance company determines the relationship between

premium and bene t by combining the saving ele-

ment of a single policy with actuarial calculations of an

insured population.

A2.61 Actuarial calculations are based on valuation

assumptions with regard to mortality, disablement,

and morbidity, taking into account the premiums to be

received in the future, the investment earnings poten-

tial, and all the future liabilities under the conditions of

each current insurance contract. A policyholder who

cancels the policy before the agreed expiration date is

generally entitled to partial bene ts from the insurer.

Bene ts are thus always paid to the policyholder or to

his or her bene ciary. For these reasons, part of the

premiums paid by the policyholders may be regarded

as savings and part of the bene ts received by the ben-

e ciaries as withdrawals from savings. e recording,

therefore, of premiums and payments of bene ts takes

place in the nancial account rather than in the sec-

ondary income account (see BPM6 , paragraph 5.65).

A2.62 e actuarial reserves represent the present

value of the future cash ows payable at the end of the in-

surance policy, rather than claims in the current period.

Actuarial reserves accrue to particular policyholders de-

pending on amounts guaranteed in their policies. us

the total liability of the insurer is the sum of the actuarial

reserves for every individual policy (see Example A2.1).

A2.63 Premium supplements are more signi cant

for life insurance than for nonlife insurance (see 2008

SNA , paragraphs 6.193 and 6.197). Part of the total in-

come earned on the reserves for policyholders—that

is, the income allocated to actuarial reserves—is al-

located to the (individual) policyholder and added to

the insurance technical reserves.

A2.64 Changes in life insurance actuarial reserves

are derived as follows:

Gross premiums earned

Plus Part of premium supplements allocated to actu-

arial reserves

Minus Benefits due

Equals Changes in life insurance actuarial reserves

A2.65 Policyholders with life insurance policies

may be eligible for additional bonuses in each year

distributed to the policyholders by means of increas-

ing the future insurance bene ts in addition to a

minimum guaranteed amount. Generally, life insur-

ance products mentioning “with pro t policy” or

“participating policy” means the policy and thereby

the policyholder is eligible to receive these bonuses.

ey are included in investment income attributable

to life insurance policyholders and recorded as pre-

mium supplements in the income account (see BPM6 ,

paragraph 11.81).

A2.66 e value of output of life insurance can be

expressed with the following formula:

Gross premiums earned

Plus Bonuses (premium supplements)

Minus Benefits due

Minus Net increases in life insurance actuarial reserves

Equals Life insurance services

10

A2.67 Similar to nonlife insurance, reserves for un-

earned premiums and against outstanding insurance

claims are recorded in the other investment category

of the nancial account under Insurance, pension and

standardized guarantee schemes ; but in addition there

are the actuarial reserves for life insurance and with-

pro t insurance that represent amounts set aside for

payments of bene ts in future:

11

Unearned premiums in accounting period

Plus Increase in reserves for benefits outstanding

Plus Changes in life insurance reserves (actuarial

reserves and reserves for with-profit insurance)

A2.68 Box A2.3 summarizes the BPM6 metho-

dology as described in Annex 6c of the BPM6 manual,

regarding the balance of payments data on life insurance.

10

Alternatively, the service can be calculated as follows: total

investment income earned on the life insurance technical reserves

less the part of this investment income actually allocated to the

policyholders and added to the insurance reserves (see 2008 SNA,

paragraph 6.199).

11

In the commercial accounts of insurance corporations, some of

them may be described as provisions for bonuses (and rebates).

ese comprise amounts intended for policyholders but not yet cred-

ited to policyholders, because these are o en used by the insurer for

smoothing bene ts over time (see also 2008 SNA , paragraph 13.77).

344 Balance of Payments and International Investment Position Compilation Guide

Box A2.3 BPM6 Entries in the Balance of Payments Related to Life Insurance Transactions

Services account

The insurance service charge is derived implicitly with the following formula (see BPM6 , Appendix 6c):

Insurance services = gross premiums earned

plus bonuses (investment income attributable to life insurance policyholders)

minus benefi ts due/incurred

minus net increases ( plus net decreases) in life insurance actuarial reserves

Primary income account

Investment income attributable to policyholders in insurance (equal to premium supplements)

Financial account

Changes in life insurance reserves

Currency and deposits (for actual premiums written and benefi ts paid)

Example A2.7 Excerpt from an insurance company profi t and loss accounts

Insurance company X: Gross premiums by life insurance business line and region (in million U.S. dollars)

Economy A Economy B Economy C Economy D Other Total

2012

Individual

insurance

545.4 123.0 81.8 72.5 133.0 955.7

Group

insurance

1,586.4 78.8 36.0 40.4 – 1,741.6

Unit-linked life

insurance

74.9 96.1 – 14.1 4.6 189.7

Reinsurance ––––6.96.9

Gross premiums

life insurance

2,206.7 297.9 117.8 127.0 144.5 2,893.9

2011

Individual

insurance

577.1 118.6 137.4 65.3 133.5 1,031.9

Group

insurance

1,555.3 28.6 20.4 34.6 – 1,638.9

Unit-linked life

insurance

84.6 64.1 – 8.4 – 157.1

Reinsurance ––––4.54.5

Gross premiums

life insurance

2,217.0 211.3 157.8 108.3 138.0 2,832.4

A2.69 Insurance companies o er di erent types

of life insurance products. Insurance companies may

o er group insurance contracts concluded for com-

panies’ employees, or insurance contracts for indi-

viduals (see Example A2.7). Group insurance has the

distinctive feature that the premium is determined by

the group of people eligible to purchase insurances

as a whole for reasons such as working for a particu-

lar employer, rather than related to cover a speci c

(high-) risk factor. Claims, however, are due individu-

ally. With regard to the type of investment, so-called

unit-linked life insurance policies are fund-linked

products where policyholders can determine the type

of investment by choosing a particular fund and thus

carrying the investment risk. A life insurance bene-

t may be paid as a lump sum or as an annuity. e

345 Insurance Transactions and Positions, and Pension Schemes

claim may be xed or may vary to re ect the income

earned from the investment of premiums during the

period for which the policy operates (with-pro t poli-

cies). e unit-linked policy is a special kind of with-

pro t policies, because the claim varies according to

the value of the chosen fund. Accruing pro ts may

be paid out in part to the policyholder in the form

of dividends. Other policies o er a guaranteed return

not dependent on the company’s underlying invest-

ment performance.

Insurance on imports

A2.70 e point of uniform valuation is the free-

on-board (f.o.b.) statistical value of exports at the cus-

toms frontier of the exporting economy (see BPM6 ,

paragraph 10.30). Imports are normally valued at

cost, insurance, freight (c.i.f.), at the domestic custom

frontier by customs. To convert imports of goods to

the f.o.b. valuation, the value of freight and insurance

premiums incurred from the frontier of the export-

ing economy to the border of the importing economy

should be deducted ( BPM6 , paragraph 10.34), and

included in balance of payments transport and insur-

ance transactions in case a nonresident transporter or

insurer is involved.

A2.71 Insurance premiums are o en estimated by

the compiler together with freight services on imports by

sampling importers and agents of foreign transport oper-

ators, or extracting data from customs import documen-

tation.

12

In order to avoid overstating insurance services,

a ratio can be used to estimate services from the reported

insurance premiums recorded in the secondary income

account. e ratio may be derived from the domestic

nonlife insurance industry and applied to premiums paid.

A2.72 It is o en the case that freight insurance costs

are based on single events (the shipment of a good)

and are of short-term nature. ey may be determined

by the insurance company based on the value of the

speci c good being shipped (e.g., replacement cost

value, or invoice value), and the category of good that

is being shipped (e.g., fragile goods, hazardous mate-

rials). In those cases, advance payments for insurance

coverage can be recorded as current expense by the

policyholder and as current revenue by the insurance

company, rather than spreading the payments over

time. e claims are recorded when paid in the second-

ary income account. In cases where traders take out

insurance policies to cover their freight on a lump-sum

and long-term basis, insurance on imports is treated

the same way as other nonlife insurance policies.

12

See in Chapter 11 more details on c.i.f.-f.o.b. conversion of

good’s value.

Box A2.4 Implementation of the BPM6: Insurance, Pension Schemes, and Standardized Guarantee

Schemes in the Case of Austria

Background

This example covers the implementation of insurances, pension schemes, and standardized guarantee schemes in accor-

dance with the BPM6 in the case of Austria. Since the calculation of insurance transactions under the BPM6 has become

more sophisticated compared to the BPM5 (see BPM6 , Appendix 6C), the Oesterreichische Nationalbank (OeNB) adapted

the collection and compilation of insurance data for the balance of payments and IIP statistics. Prior to the implementation

of this new data collection system, the OeNB used less detailed administrative data from the Financial Market Authority

(FMA) for insurance exports and mirror data from other economies of the European Union (EU) for imports. For the com-

pilation of the insurance data, information from the national accounts was used—for example, the ratio of the long-term

relationship between net premiums and claims. Life/nonlife insurances position information was compiled from fl ows only;

there were no data on claims, and the database differed between balance of payments statistics and national accounts. For

the coverage of reinsurance, primarily highly aggregated balance sheet data were available and the cross border / domes-

tic distinction was based on the assumption that active reinsurance is predominantly a domestic business in Austria.

New data collection

In 2015, the EU will introduce the new Solvency II regulation for insurances to enhance consumer protection. The new

regulation allows the FMA to collect more detailed data. The new quarterly reports include data on cross border premi-

ums and claims on a gross basis for direct insurance and reinsurance (best estimates) on an accrual and cash basis, broken

down by insurance division and by economy, including domestic business in Austria. The new annual report includes cross

346 Balance of Payments and International Investment Position Compilation Guide

border premiums and claims for reinsurance on an accrual and cash basis, broken down by economy. Additionally, the

annual report includes fi nancial assets and liabilities from reinsurance by economy, and insurance technical reserves for

index linked and other life insurance. These data were used by the OeNB to adapt the compilation of insurance and pen-

sion schemes data to the BPM6 requirements.

New data compilation

Some adjustments were necessary to compile insurance, pension schemes, and standardized guarantee schemes for bal-

ance of payments and IIP statistics. Therefore, the OeNB implemented several calculations and derivations, which are

described ahead, to meet all needs for the compilation.

In order to receive more accurate results, the OeNB decided to adjust the general formula for the calculation of the insur-

ance service charge for all types of insurances asdescribed in the BPM6 . The adjustment—which is referred to in the BPM6

as the volatility of claims adjustments—was necessary as high claims could have led to a negative value for the service

charge. Therefore, the OeNB used the long-term spread ratio for the calculation:

The next step was the recording of net premiums and claims.Thenet premiumswere calculated as described in the BPM6 :

Net premiums = gross premiums earned

plus premium supplement

minus service charge

For nonlife insurances, net premiums and claims were recorded in the secondary income, on different sides: if the insur-

ance taker was a nonresident, premiums were recorded as credits and claims as debits, and vice versa if the insurance

taker was a resident.

For life insurances, the net premiums and claims were recorded as a transaction in other investment insurance technical

reserves,which covers net premiums increase (assets or liabilities) and claims decrease (assets or liabilities). The following

adjustments needed to be done for the compilation:

Transactions (+):

Financial transaction (increase) in insurance technical reserves by economy = gross premiums (accrual basis) for index

linked and other life insurance exports and imports by economy

plus premium supplements (income)

minus service charge

Transactions (–):

Claims (accrual basis) vs. insurance companies per economy = fi nancial transaction (decrease) in insurance technical

reserves

Annual position reports on technical reserves were distinguished between index linked and other life insurances. How-

ever, there was no geographical breakdown. Therefore the geographical information received for the premiums was used

to derive a geographical breakdown of the positions. The differences between the annual positions and the sum of the

quarterly transactions were recorded as other valuation adjustments, which were evenly distributed over the year.

Positions (annually including breakdown indexed linked and other)—recorded in the IIP:

Share by economy = premiums earned per economy

divided by total premiums

Box A2.4 Implementation of the BPM6: Insurance, Pension Schemes, and Standardized Guarantee

Schemes in the Case of Austria (continued)

BPM6 approach OeNB approach

Insurance services = gross premiums earned Insurance services = gross premiums earned

Plus premium supplements multiplied by long-term “spread” between premiums and

claims (“ratio”)

Minus claims due/incurred Plus premium supplements

347 Insurance Transactions and Positions, and Pension Schemes

Position in insurance service technical reserves per economy = total position in insurance technical reserves

multiplied by share per economy

Other valuation adjustments = difference between opening position, transactions, and closing position

Financial assets and liabilities from reinsurance:

For fi nancial assets and liabilities from reinsurance the transactions by economy were derived from new quarterly

(estimates by insurance companies) and annual balance sheet data (revisions were evenly distributed over quarters).

The positions by economy were reported annually together with the revised annual fl ows. Quarterly (intra-annual) posi-

tions were estimated based on provisional quarterly transactions by economy. The annual difference between opening

position, transaction, and closing position were recorded as other valuation adjustments and evenly distributed over the

quarters.

Investment income attributable to policy holders (= premium supplements):

The premium supplements were recorded in the primary income receivable by policyholders. The same amount was

also shown as payable to the insurance company by the policyholder as premium supplements in the secondary income

account.

Debits (liabilities vis-à-vis nonresident insurance takers):

Income ratio for rest of the world by economy = position in insurance technical reserves vis-à-vis rest of the world by

economy

divided by total position in insurance technical reserves

Income from insurance technical reserves per economy = income ratio by economy

multiplied by income from fi nancial assets held by insurance sector

(from direct and other investment according to balance of pay-

ments, from portfolio investment total)

Plausibility check = total income

divided by position in insurance technical reserves vis-à-vis rest of the world

Credits (assets vis-à-vis nonresident insurance companies):

The average rate from debits/liabilities was applied on the position of technical reserves. The rate was still based on

cumulated fl ows and mirror data, however, including benefi ts.

Pension schemes and standardized guarantees:

The principal logic of the BPM6 for pension schemes and standardized guarantees is similar to life insurance claims and

liabilities.

Service charge = gross contributions

plus supplements

minus benefi ts payable

plus/minus adjustments

Active reinsurance = insurer premiums paid

minus premiums earned

if + = increase in liabilities

if − = decrease in liabilities

Passive reinsurance = insurance taker claims incurred

minus claims paid

if + = increase in liabilities

if − = decrease in liabilities

premiums paid

minus premiums earned

if + = increase in assets

if − = decrease in assets

claims incurred

minus claims paid

if + = increase in assets

if − = decrease in assets

Box A2.4 Implementation of the BPM6: Insurance, Pension Schemes, and Standardized Guarantee

Schemes in the Case of Austria (continued)

348 Balance of Payments and International Investment Position Compilation Guide

The market valuation of positions depends on the nature of the pension scheme. The defi ned contribution schemes (func-

tion like mutual funds) are assets of the “fund”; the defi ned benefi t schemes, which were based on “promised” benefi ts,

both funded and unfunded, are equal to the present value of the “promised” benefi ts.

Standardized guarantees are recorded as equal to the present value of expected calls under outstanding guarantees, net

of any recoveries the guarantor expects to receive from the default parties.

Position-taking with Austrian insurance companies and Austrian pension funds resulted in the conclusion that cross border

pension entitlements and cross border provisions of standardized guarantees are not existing or rather insignifi cant. There

were no immediate actions taken for balance of payments compilation in these areas for the changeover to the BPM6 . A

new stock-taking exercise will be carried out within the next years.

Diffi culties encountered

• Insurance companies are not able to deliver data for technical reserves positions by economy. Because these data

are necessary for the compilation of balance of payments and IIP statistics, the OeNB decided to estimate the

distribution by economy.

• The differentiation between accrual and cash data can be diffi cult.

• Concerning data delivery, the OeNB relies on the supervisory data as well as the infrastructure and resources of

the supervisory authority. This additional link between the insurance and pension fund companies and the OeNB

can add complexity and make communication more challenging. In addition, the OeNB depends to a large extent

on the developments in supervision regarding quality and details available.

Tables A2.2–A2.4 in the annex to this appendix show the collection and compilation of the insurance transactions in detail.

Box A2.4 Implementation of the BPM6: Insurance, Pension Schemes, and Standardized Guarantee

Schemes in the Case of Austria (concluded)

Employment-Related Pension Schemes

and Social Security Schemes

Introduction

A2.73 e availability, coverage, and mechanisms

of pension systems bene tting individuals vary widely

from economy to economy. In the 2008 SNA the dis-

tinction of so-called social insurance schemes is made

between social security and employment-related

schemes, based on the provider of these social insur-

ance pensions. e part provided by general govern-

ment is called social security if it meets certain criteria,

and the part by employers is called employment-

related schemes other than social security (see 2008

SNA , paragraph 17.118).

A2.74 e estimation of pension services in the

international accounts may be important in econo-

mies with high percentages of border workers, guest

workers, and international organizations that hire sta

from the host economy.

A2.75 ere are two forms of employment-related

pension schemes, the de ned bene t scheme and the

de ned contribution scheme . Both schemes are nanced

by contributions normally shared between the em-

ployer and the employee, which accumulate in special

funds, and from which bene ts are paid and surplus

funds are invested to earn further income. e di er-

ence between these schemes lies in the determination

of the bene ts payable to an employee on retirement,

which in turn is determined by who is bearing the

risk of the scheme to provide an adequate income in

retirement.

A2.76 Conceptually, these two schemes trigger

transactions in accounts similar to the ones in in-

surance accounting (see Insurance Transactions

and Positions); namely, the derivation of an output

of the pension fund is recorded in the services ac-

count, the net contributions made to the pension

fund are recorded in the secondary income ac-

count, the change in pension entitlements due to

transactions is recorded in the nancial account

as well as an adjustment item in the secondary in-

come account, and the investment income earned

on existing entitlements is recorded in the primary

income account. However, the di erent features

with regard to the bene ts payable upon retirement

result in di erences in the accounting concepts of

these pension schemes and, consequently, in how

349 Insurance Transactions and Positions, and Pension Schemes

the compiler will design the reporting forms to

obtain the relevant information. is is further ex-

plained ahead.

A2.77 In general, the data for exports of cross bor-

der pension services are best captured by obtaining

information from resident pension funds. is enables

the compiler to undertake conceptual adjustments

that are necessary for the recording of these operations

in the balance of payments statistics.

A2.78 e same comprehensive approach will not

be feasible for obtaining imports of pension services

because the pension funds are nonresident of the

compiler’s economy. us when estimating pension

services the compiler should take into account data

on compensation of employees derived from the ITRS

and ratios available from domestic pension funds, or

from a combination of estimates and assumptions,

such as estimates of the portion of the population re-

ceiving pension services combined with estimates of

rates of pension compensation.

A2.79 Some social insurance is provided by the

government under a social security scheme. Account-

ing for social security funds is less complex, because

there are no funds invested on behalf of the bene cia-

ries, and instead, current workers’ contributions are

used by the government entity operating the scheme

to pay out current bene ts (the system is also known

as “pay-as-you-go”).

A2.80 In the absence of detailed international stan-

dards for accounting for cross border positions and

transactions of de ned bene t and de ned contribu-

tion pension funds, the compilation guidance con-

tained in the following paragraphs is one acceptable

way of accounting for these pension plans in balance

of payments statistics.

Defi ned benefi t scheme

Overview of defi ned benefi t accounting

A2.81 In a de ned bene t scheme the amount of

pension bene ts accrues usually according to a func-

tion of one or more factors, such as age and length of

service within the company, and will take into account

the nal salary, or the average of the last few years of