Wine Australia

WINE CHANNEL PURCHASE BEHAVIOUR OF AUSTRALIAN WINE CONSUMERS

MAIN REPORT

Project Management

1

Contents

Background and objectives 3

Subscription service/wine club –

Winery owned deep dive

35

Key findings 4

Subscription service/wine club –

Independent deep dive and

comparison with winery owned

41

Demographics 6 Winery website deep dive 48

Frequency and spend

characteristics

7

Online retailer deep dive and

comparison with winery wine club

53

Wine purchasing channels 12 Barriers to buying online 59

Changes in wine purchasing

behaviour

17 Methodology 63

Cellar door deep-dive 27

2

Project Management

1

2

3

4

5

6

7

8

9

10

11

12

13

Background and objectives

3

Project Management

The outcome of this research is to provide

practical suggestions for wine producers to

consider when developing retail channel

strategies.

Specifically, it will explore the different

purchasing channels with a particular focus on

buying wine:

• in person from a cellar door / winery during a

visit

• through subscription services with a winery or

an independent retailer, and

• online through a winery website or other

online alcohol retailer websites.

For each of the channels in focus, it is important

to understand the following:

• previous channel purchasing

• how often are consumers using the channel to

purchase wine

• how much wine they are purchasing through

the channel

• how much they are spending through the

channel

• what their motivations are for using the channel

• frustrations they have with using the channel,

and

• suggestions as to what could be helpful to them

to use the channel more.

Since COVID-19, there has been considerable change to the way that consumers purchase wine, and it is uncertain as to

what extent the impact has been made on changing consumer behaviour in the long term.

Key findings

4

Project Management

Nearly all channels experienced a decrease in frequency of use in 2020 given the

extensive disruption that COVID-19 had on people’s ability to purchase wine (p 18).

Some respondents noted that they weren’t drinking as much or had budget constraints

(p 24-25). Others noted that they had shifted to online channels (p 56) because of

COVID-19. The transition to online for many is expected to continue going forward (p 18).

1

2

The most commonly used channels to purchase wine in Australia in 2019 was in person at

the bottle shop / drive through, followed by in person at the cellar door and thirdly through

online retailers. Only in 2020 did online retailers become the second most popular channel;

however, this is expected to move back into third place once cellar doors reopen and

travel returns (p 13).

There is an opportunity for wineries to increase direct to consumer purchases by focusing

on exclusivity. This was evident at the cellar door with a third believing that it would

encourage them to purchase (p 32), especially when some are doing price comparisons

whilst there (p 33). This was also a point of difference to be explored between winery

owned wine clubs compared to other clubs (p 47), and winery websites compared to

online retailers (p 57).

3

Key findings continued

5

Project Management

When compared to online retailer websites, a higher proportion indicated that assistance

with using the winery website would improve their ability to purchase wine (p 57). Where

possible, wineries should review their websites to improve the customer journey. This would

include from first landing on the site, finding the information they need and the ease in

making a purchase. This is especially important, with one-third of respondents giving up if

they run into difficulties whilst buying online (p 61).

4

5

Most respondents are happy to pay a tasting fee whilst at the cellar door as long as it is

considered to offer value for money, and they are provided with a positive experience (p

31, 33).

Staying connected with a winery is important to some as they chose to join wine clubs or

buy direct from the winery website to support local businesses. Interestingly, subscriptions

services such as Naked Wines also deliver on this desire (p 45, 46). That connection is also

important at the cellar door (p 33).

6

Around a half did not buy wine at all online since 2019. This is despite three quarters being

confident in using the internet to make purchases, with the majority buying other items

online. Whilst there are many that will not change their minds to using this channel to

purchase wine, there are some issues that could be addressed. Some of these include;

concerns about damages through delivery or not knowing which website to buy from

(p 62).

7

Demographics of respondents

6

Project Management

53.7%

46.1%

0.2%

34%

25%

20%

8%

9%

1%

3%

n=1,007 – Australian wine drinkers who purchase wine

Age groups

Household income before tax

Highest level of education

Gender

Reside

Frequency and

spend

CHARACTERISTICS

7

Regularity of wine consumption by age and location

8

Project Management

Two-thirds (67%) of respondents consume wine regularly during the week.

There are no significant differences in the frequency of consumption between states or territories. By age, 21% of people surveyed aged over 55

report drinking wine less than once per month, higher than the 15% on average reportedly drinking it this often.

S4. How often do you consume wine?

Base: Wine-drinking Australians n=1007 (18-34 n=280, 35-54 n=372, 55+ n=355; NSW and ACT n=342, Victoria n=253, Queensland

n=202, South Australia n=80, Western Australia n=90, Northern Territory n=10*, Tasmania n=30

14

12

12

17

15

13

14

16

10 10

7

30

33

29

29

29

31

35

26

24

40

27

23

22

28

19

25

24

17

19

32

20

30

17

21

17

14

16

19

17

18

21

20

13

15

12

13

21

15

13

18

21

12

10

23

TOTAL 18-34 35-54 55+ NSW & ACT VIC QLD SA WA NT* TAS

Most days/every day 2-5 times a week About once a week 1-3 times a month Less than once per month

%

Significance two tailed test of difference by segment

[ / significantly less/more than the total sample]

*Caution: small base

Typical spend on wine by age and location

9

Project Management

A1. How much do you typically spend on wine every month?

Base: Wine-drinking Australians n=1007 (18-34 n=280, 35-54 n=372, 55+ n=355; NSW and ACT n=342, Victoria n=253, Queensland

n=202, South Australia n=80, Western Australia n=90, Northern Territory n=10*, Tasmania n=30

When it comes to typical monthly spending on wine, Australians aged over 55 appear to not only have a higher tendency to spend

the least on wine each month (11% compared to 8%), but there is also a higher tendency to spend $100 or more compared to the

average (12% compared to 9%). Additionally, significantly fewer people over 55 are in the mid-range of spending, with 14%

spending $20–$29.99 per month compared to 19%. Again, no significant differences are found when comparing regional wine

expenditure.

8

5

6

11

9

7

7

8

4

10

17

15

16

14

15

11

17

17

19

18

17

14

16

12

13

15

13

14

9

18

10

0

19

25

21

14

20

20

19

18

17

20

27

18

18

19

19

18

16

19

19

21

30

20

17

14

19

17

18

18

15

18

13

20

17

9

6

9

12

10

9

7

11

9

10

3

TOTAL 18-34 35-54 55+ NSW & ACT VIC QLD SA WA NT* TAS

<$10 $10 to $14.99 $15 to $19.99 $20 to $29.99 $30 to $49.99 $50 to $99.99 $100 or more

%

Significance two tailed test of difference by segment

[ / significantly less/more than the total sample]

14

13

15

13

12

12

18

26

8

30

22

23

28

35

36

37

26

26

23

22

17

28

17

24

25

33

27

17

15

23

14

22

14

12

13

26

15

28

21

16

14

13

7

3

14

TOTAL Under $20,000 $20,000 -

$49,999

$50,000 -

$79,999

$80,000 –

$99,999

$100,000 -

$149,000

$150,000 -

$199,000

$200,000+ Prefer not to

say

Most days / every day 2-5 times a week About once a week 1-3 times month Less than once per month

Regularity of wine consumption by household income

10

Project Management

Compared to the average, respondents earning $200,000 or more were more likely to be regular wine consumers during the week (overall 85%

compared to 67% overall). This was similar to those with a household income before taxes between $150,000–$199,000 (81%). Those earning less

than $50,000 have a tendency to drink wine less regularly.

S4. How often do you consume wine?

Base: Wine-drinking Australians n=1007 (Household income before taxes - Under $20,000 n=54, $20,000-$49,999 n=189, $50,000-

$79,999 n=234, $80,000-$99,999 n= 125, $100,000 - $149,000 n=201, $150,000-$199,000 n=99, $200,000+ n=39, Prefer not to say n=66)

%

8

20

13

8

7

5

2

3

5

15

30

22

12

15

14

4

5

15

14

15

14

14

14

12

9

5

24

19

9

17

26

20

19

17

8

24

18

24

18

15

18

19

25

18

17

17

0

10

16

20

22

26

31

9

9

2

6

10

6

8

16

31

6

TOTAL Under $20,000 $20,000 -

$49,999

$50,000 -

$79,999

$80,000 –

$99,999

$100,000 -

$149,000

$150,000 -

$199,000

$200,000+ Prefer not to

say

<$10 $10 to $14.99 $15 to $19.99 $20 to $29.99 $30 to $49.99 $50 to $99.99 $100 or more

Typical spend on wine by household income

11

Project Management

Not surprisingly, those in the higher household income bracket i.e. $150,000 plus are spending more on wine each month – typically $50–$99.99

(26% compared to 17%) but even more so for $100 or more (31% compared to 9%). Those in the lower household income brackets are more

likely to spend under $15 each month while those in the middle-income brackets are more likely to spend $20–$29.99. It is important to take into

consideration that the overall proportion of respondents with a household income over $150,000 represented 14% of the total sample.

A1. How much do you typically spend on wine every month?

Base: Wine-drinking Australians n=1007 (Household income before taxes - Under $20,000 n=54, $20,000-$49,999 n=189, $50,000-

$79,999 n=234, $80,000-$99,999 n= 125, $100,000 - $149,000 n=201, $150,000-$199,000 n=99, $200,000+ n=39, Prefer not to say n=66)

%

Wine purchasing

channels

12

Channel mix for purchasing wine

13

Project Management

A2. Which of the following channels did you purchase wine from in 2019?

A2. Which of the following channels did you purchase wine from in 2020?

B3. Over the next 12 months, how often do you plan on using the following channels?

Base: Wine-drinking Australians n=1007

• The most commonly-used channel of wine

purchasing was in-store; 96% of wine-

drinking Australians surveyed purchased

wine on at least one occasion at a local

bottle shop, drive-through or similar store

in 2019. A small decline was experienced

in 2020 to 94%, which is expected not to

change in the future.

• Bottle shops are popular because people

like to see the wine, its easy and

convenient. The 2 percentage point drop

in 2020 was mostly due to concerns about

COVID-19 and restrictions.

• 2020 saw a reduction in wine purchasing

across most channels except for online

retailers e.g. Dan Murphy’s.

%

19

18

18

20

27

40

49

96

17

17

16

20

23

40

39

94

17

17

18

20

26

43

47

94

Winery

telemarketing

Winery email

Winery wine club

Non winery wine

club

Winery online

Online retailers

Cellar door

Bottle shop

Future

2020

2019

Channel mix for purchasing wine in 2019

14

Project Management

A2. Which of the following channels did you purchase wine from in 2019? Mean calculated based on the following - Never (0), 1-2 times (2), 3-5 times (4), 6-8

times (7), >8 times (8). Base: Wine-drinking Australians n=1007

% Never 1-2 times 3-5 times 6-8 times

more than

8 times

At least

once

Mean

In person – local bottle shop, drive-

through etc

4 24 21 14 37

96

5.3

In person –

from a cellar door / winery during a visit

51 31 9 4 5

49

1.6

Online -

through an online retailer (including bottle shop

websites) that isn’t a winery (e.g. Dan Murphy’s)

60 20 11 5 5

40

1.5

Online –

through a cellar door / winery’s own website

(through the online shopping cart)

73 16 7 2 2

27

0.9

Subscription service / wine club with an independent

company e.g. The Wine Society, Qantas wine club or

Naked Wines

80 11 7 2 1

20

0.7

Mailing list –

when a winery calls you directly

81 11 5 2 1

19

0.6

Mailing list –

through an email sent from the winery

82 11 4 2 1

18

0.6

Subscription service or wine club –

with a cellar door/winery

82 10 5 1 1

18

0.6

In addition to being the most commonly-used method of purchasing wine in 2019, in-person shopping was undertaken on the most

occasions by Australian wine drinkers surveyed; 37% purchased wine in-store from a bottle shop or drive-through more than 8 times in

2019. Other channels were undertaken less often, and on fewer occasions. Cellar door visits were the second-most common way to

purchase wine, though 31% reported only doing so once in the year.

Channel mix for purchasing wine in 2020

15

Project Management

A2. Which of the following channels did you purchase wine from in 2020? Mean calculated based on the following - Never (0), 1-2 times (2), 3-5 times (4), 6-8

times (7), >8 times (8). Base: Wine-drinking Australians n=1007

In 2020, in-person wine purchases from local bottle shops and drive-throughs remained the top channel, undertaken by 94% of wine-

drinking Australians surveyed, an average number of 5 times. For the second-most common channel, 2020 saw online wine retailers

overtaking cellar door / winery purchases, both in terms of the average number of times wine was purchased, and the number of

Australians that purchased there, resulting in an increase in the mean from 1.6 to1.7 times. The change in popularity was due to a decrease

in in-person winery and cellar door purchases, down from 49% to 39%, with an average number of purchases of 1.6 to 1.3, likely influenced

by lockdowns and travel restrictions. Online winery websites also saw a decrease, from 27% purchasing at least once in 2019, to 23% in 2020.

% Never 1-2 times 3-5 times 6-8 times

more than

8 times

At least

once

Mean

In person – local bottle shop, drive-

through etc

6 27 21 13 33

94 5.0

Online -

through an online retailer (including bottle shop

websites) that isn’t a winery (e.g. Dan Murphy’s)

60 16 13 4 7 40 1.7

In person –

from a cellar door / winery during a visit

61 25 8 3 3 39 1.3

Online –

through a cellar door / winery’s own website

(through the online shopping cart)

77 12 6 3 3 23 0.9

Subscription service / wine club with an independent

company e.g. The Wine Society, Qantas wine club or

Naked Wines

80 11 5 2 1 20 0.7

Mailing list –

when a winery calls you directly

83 8 5 2 1 17 0.6

Mailing list –

through an email sent from the winery

83 10 4 2 1 17 0.6

Subscription service or wine club –

with a cellar door/winery

84 8 5 2 1 16 0.6

Channel mix for purchasing wine going forward

16

Project Management

B3. Over the next 12 months, how often do you plan on using the following channels? Mean calculated based on the following - Never (0), 1-2 times (2), 3-5

times (4), 6-8 times (7), >8 times (8). Base: Wine-drinking Australians n=1007

Over the next 12 months, in-person wine purchases from local bottle shops and drive-throughs will continue to be the top channel, 94% of

wine-drinking Australians surveyed, an average number of 5 times. What’s changing though is with lockdown restrictions ending,

respondents anticipate returning to cellar doors and making purchases (up from 39% in 2020 to 47%). More also anticipate using online

retailers more often (up from 40% in 2020 to 43%).

% Never 1-2 times 3-5 times 6-8 times

more than

8 times

At least

once

Mean

In person – local bottle shop, drive-

through etc

6 25 24 14 32

94 5.0

Online -

through an online retailer (including bottle shop

websites) that isn’t a winery (e.g. Dan Murphy’s)

57 18 13 5 8 43 1.8

In person –

from a cellar door / winery during a visit

53 31 10 3 3 47 1.5

Online –

through a cellar door / winery’s own website

(through the online shopping cart)

74 14 7 3 2 26 0.9

Subscription service / wine club with an independent

company e.g. The Wine Society, Qantas wine club or

Naked Wines

80 11 6 2 2 20 0.7

Mailing list –

when a winery calls you directly

83 9 5 2 1 17 0.6

Mailing list –

through an email sent from the winery

83 10 4 2 1 17 0.6

Subscription service or wine club –

with a cellar door/winery

82 10 5 2 1 18 0.6

Changes in

WINE PURCHASING BEHAVIOUR

17

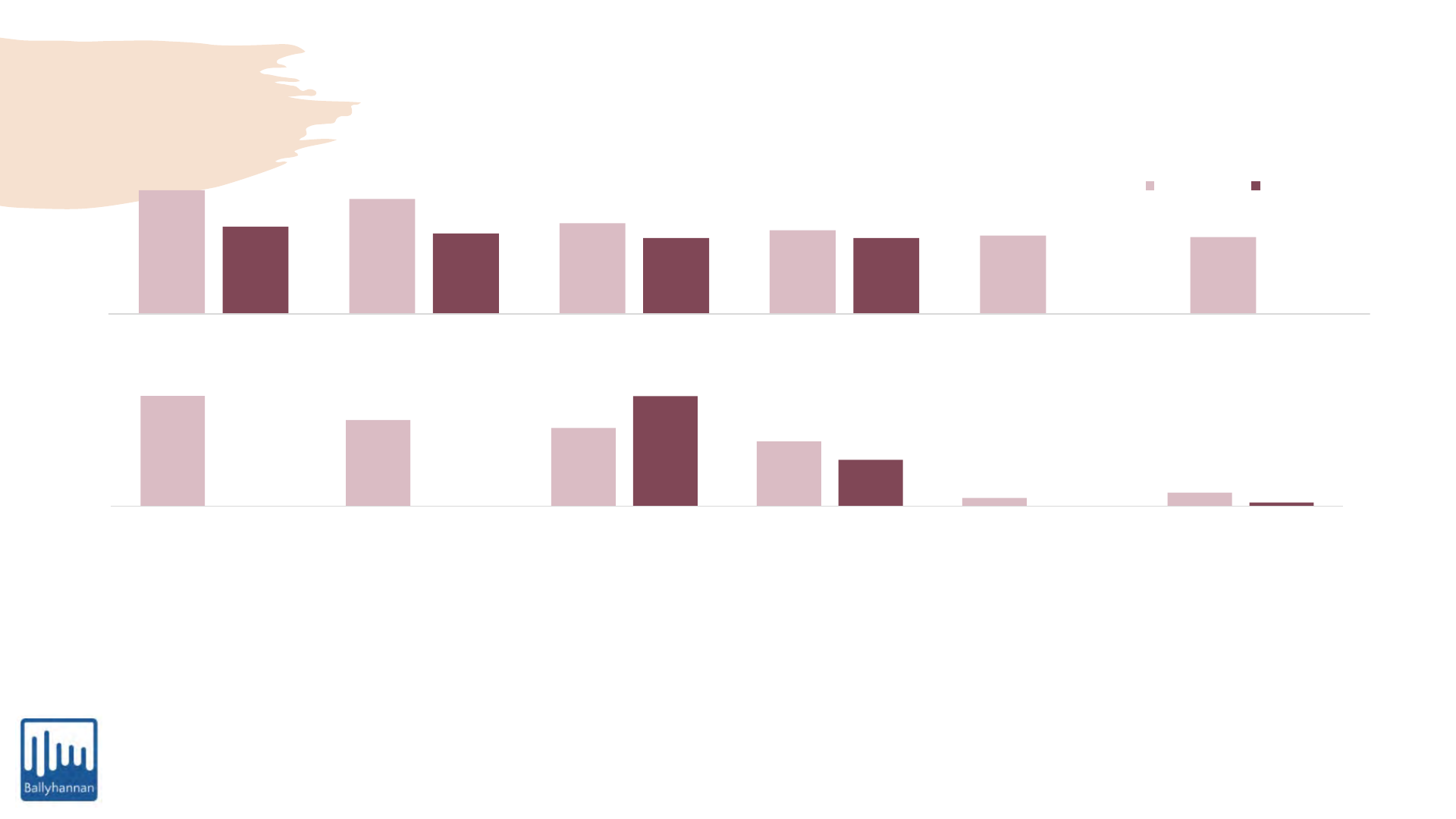

Change in purchase behaviour for the channels

18

Project Management

A2. Which of the following channels did you purchase wine from in 2019? A3. Which of the following channels did you purchase wine from in 2020? B3. Over the next 12

months, how often do you plan on using the following channels?

Base: Australian wine drinkers that purchased wine in each of the channels n=1,007

Cellar doors as a wine purchasing channel were greatly impacted in 2020 as a result of COVID-19 restrictions with the

percentage of those that used the channel much lower than in 2019. But going forward respondents were keen to return.

It is interesting to note that nearly all channels experienced a decrease in frequency of use in 2020, with many noting that

they weren’t drinking as much. While the proportion of respondents who purchased through a winery website declined in

2020, the proportion of those using online retailers was steady. Both are expected to grow further over the next 12

months.

-12

-10

-8

-6

-4

-2

0

2

4

6

8

10

Bottle shop Cellar door Direct call Direct mail Winery owned

wine

club/subscription

service

Other

subscription

service

Winery website Online retailer

Change from 2019 to 2020 Change from 2020 to next 12 months

Percentage point change in channels used

(%)

9

9

9

10

10

13

10

13

9

19

19

29

32

30

33

32

32

28

18

18

22

23

21

22

20

21

21

19

19

18

14

16

16

16

19

18

16

16

12

10

10

7

8

9

13

19

19

10

11

12

9

14

5

11

Total Bottle shop Cellar door Direct call Direct mail Winery owned

wine

club/subscription

service

Other subscription

service

Winery website Online retailer

18-24

25-34

35-44

45-54

55-64

65 and over

Users of each channel by age bracket in 2019

19

Project Management

A2. Which of the following channels did you purchase wine from in 2019?

Base: Australian wine drinkers that purchased wine in each of the channels 1-2 times, 3-5 times, 6-8 times, >8 times

Younger respondents were more likely to purchase wine through non-brick and mortar

channels compared to the average. Those aged between 25–34 years and 35–44 years had a

greater tendency to purchase wine online in 2019. In 2020, a higher proportion of 25–34 years

were purchasing wine when wineries called them directly or sent an email, but this is not

expected to continue going forward.

%

33

34

35

41

42

45

41

38

37

25

25

26

19

22

23

24

26

26

20

20

15

14

13

13

13

14

18

9

9

10

9

8

6

7

7

7

8

8

9

10

9

8

8

9

5

3

3

3

4

4

3

3

4

4

Total Bottle shop Cellar door Direct call Direct mail Winery owned

wine

club/subscription

service

Other subscription

service

Winery website Online retailer

NSW

VIC

QLD

WA

SA

TAS

ACT

NT

Users of each channel by state

20

Project Management

A2. Which of the following channels did you purchase wine from in 2019?

Base: Australian wine drinkers that purchased wine in each of the channels 1-2 times, 3-5 times, 6-8 times, >8 times

Those residing in NSW are more likely than the average to purchase wine through non-bricks

and mortar channels in 2019. This increased in 2020, however only purchasing online is

expected to be used more going forward. Victorians expect to be using all channels more

than they were back in 2019.

%

8

7

5

8

8

4

5

5

8

20

20

15

16

14

18

15

19

16

25

25

20

18

18

20

18

17

20

35

35

43

38

40

37

42

43

42

11

12

15

19

19

19

18

15

13

0.8

0.7

1.0

1.1

0.5

1.1

0.5

0.7

0.7

Total

Bottle shop

Cellar door

Direct call

Direct mail

Winery

owned wine

club/subscrip

tion service

Other

subscription

service

Winery

website

Online

retailer

Primary school

Some secondary school

Completed secondary school

No formal schooling

Trade or technical qualification

University diploma or degree

Postgraduate

Prefer not to say

Level of education for users of each channel

21

Project Management

A2. Which of the following channels did you purchase wine from in 2019?

Base: Australian wine drinkers that purchased wine in each of the channels 1-2 times, 3-5 times, 6-8 times, >8 times

Respondents with a university education are strongly represented across all wine purchasing

channels but are more likely to purchase wine at the cellar door, online and from subscription

services.

%

Reasons for using channel more

22

Project Management

B4. What are the reasons for you using [channel] more to purchase wine?

In person – local bottle shop,

drive-through etc.

• Convenient, live near a shop

• Easy to buy

• Like to browse

In person – from a cellar door /

winery during a visit.

• Hoping to travel again, restrictions permitting

• Because people like going to wineries

• Convenient and easy for those living near wine regions

• Like the choice, variety and high quality

Mailing list – when a winery calls

you directly.

• Because of lockdown/restrictions

• Convenient

• Good deals

Mailing list – through an email

sent from the winery.

• Because of lockdown/restrictions

• Easy to use and access

• Convenient

• Trusted supplier

• Good variety and cheaper prices

Reasons for using channel more, continued

23

Project Management

B4. What are the reasons for you using [channel] more to purchase wine?

Subscription service or wine club –

with a cellar door/winery.

• Because of lockdown/restrictions

• Convenience

• Wines are good value and can get discounts, rewards and special deals

• Like trying new wines

• Deliver direct to residence and good service attitude

Subscription service/wine club

with an independent company

e.g. The Wine Society, Qantas

wine club or Naked Wines.

• Allows access to wines not at bottle shops

• Good deals, choices and service

• Convenient and easy

• Good pricing and cheap freight

• Contactless

• Use reward points

Online – through a cellar door /

winery’s own website (through the

online shopping cart).

• Because of lockdown/restrictions

• Convenience

• Contactless

• Easy to use / access

• Wanted to buy wine after visiting the winery

• Can take my time / compare prices

• Support local business

• New releases / new flavours / good wines

• Promotion / offers

Online - through an online retailer

(including bottle shop websites)

that isn’t a winery (e.g. Dan

Murphy’s).

• Because of lockdown/restrictions

• Convenience

• Contactless

• Easy to use / access

• Like the discounts and special offers

• Good selection at reasonable prices

• Free delivery

Reasons for not using channel or using less

24

Project Management

B5. What are the reasons for you using [channel] less to purchase wine?

B6. What are the reasons for not purchasing wine through [channel]?

In person – local bottle shop,

drive-through etc.

• Risk associated with COVID-19

• Restrictions / lockdowns

• Drinking less

• Moved to online

• Less spare money to buy wine

In person – from a cellar door /

winery during a visit.

• Unknown when restrictions are easing

• Not planning to visit/not convenient

• Have had a bad experience in the past

• Drinking less

• Prefer using other channels

• Wineries are expensive

Mailing list – when a winery calls

you directly.

• Cheaper at bottle shops, can’t afford it at the time they call

• Don’t like being on mailing lists

• Don’t like pushy sales people

• Wines on offer aren’t attractive, small variety offered

• Unknown about how the wine tastes

• Paying for shipping can be expensive and delivery can be slow

• Prefer other channels better, not interested in using this channel

Mailing list – through an email

sent from the winery.

• Do not deal with wineries

• Prefer other channels i.e. buying in person

• Don’t send emails of the wines I like

• Ignore when too many emails are sent

• Winery closed down during COVID-19 lockdown

• Afraid of scams

Reasons for not using channel or using less, continued

25

Project Management

B5. What are the reasons for you using [channel] less to purchase wine?

B6. What are the reasons for not purchasing wine through [channel]?

Subscription service or wine club –

with a cellar door/winery.

• Expensive / can’t afford / not considered value for money

• Delivery concerns / too slow / damaged

• Drinking less / rationalising purchases / budget limitations

• Don’t want to use this channel, prefer using other channels

• Don’t always want the scheduled wine / or be locked in

• Potential to buy too much wine

• Too many emails / feel harassed

Subscription service/wine club with

an independent company e.g. The

Wine Society, Qantas wine club or

Naked Wines.

• Not preferred channel / never considered using

• Concerned about quality of wine

• Want to save money

• Want to drink less / concerned will buying too much / don’t drink enough to subscribe

• Too expensive / can’t afford

• Don’t want to commit

• Concerned about long delivery wait times

Online – through a cellar door /

winery’s own website (through the

online shopping cart).

• Prefer other channels

• Like to buy in person / get advice / try first

• Expensive / budget constraints

• Don’t need to

• Buying less wine

• Delivery concerns / too slow / expensive

• Not convenient

Online - through an online retailer

(including bottle shop websites) that

isn’t a winery (e.g. Dan Murphy’s).

• Don’t like paying delivery fees

• Like to buy in person / get advice / try first

• Don’t always have wine of choice

• Drinking less during COVID-19

• Bad experience with wine purchased as it did not taste nice

Channel deep dive

26

Purchasing wine

in-person

CELLAR DOOR

27

Average quantity purchased at the cellar door

28

Project Management

You indicated that you have purchased wine, in person – from a cellar door / winery during a visit. The following questions are

focused on this channel. [S/R]

CB1. On average, how many bottles do you purchase per transaction through this channel?

Base: Wine-drinking Australians that bought wine at a winery / cellar door in 2019-2020 n=317 (18-34 n=127, 35-54 n=113, 55+ n=77)

13

36

17

9

5

12

4

3

18

36

18

9

6

9

1

3

11

34

20

10

6

9

7

4

6

39

12

6

4

22

6

4

1 bottle 2 bottles 3 bottles 4 bottles 5 bottles 6 bottles 7-12 bottles More than 12

bottles

TOTAL 18-34 35-54 55+

%

Mean

2.93

Mean

3.40

Mean

3.74

Mean

3.29

Significance two tailed test of difference by segment

[ / significantly less/more than the total sample]

Overall, half of respondents purchased 2 to 3 bottles whilst at a cellar door. While this was the

same for those aged 55 and above, this segment were significantly more likely to purchase 6

bottles compared to the total. Only a small percentage buy more than a dozen bottles.

4

19

25

26

14

9

3

4

17

24

29

13

9

4

3

16

24

27

18

10

4

5

26

29

19

10

9

1

>$10 $10 - $14.99 $15 - $19.99 $20 - $24.99 $25 - $29.99 $30 - $49.99 $50 or more

TOTAL 18-34 35-54 55+

Typical spend at the cellar door

29

Project Management

You indicated that you have purchased wine, in person – from a cellar door / winery during a visit. The following questions are

focused on this channel. [S/R]

CB2. What is the average price you pay per bottle when you are at the cellar door?

Base: Wine-drinking Australians that bought wine at a winery / cellar door in 2019-2020 n=317 (18-34 n=127, 35-54 n=113, 55+ n=77)

%

The split between paying less than $20 versus $20 or more is relatively even (48/52).

Those aged 55 and above however typically will spend less than $20 a bottle (60/40)

while those aged 35–54 will spend more (42/58).

Overall, the two most common price brackets are $15–$19.99 and $20–$24.99

Reasons for buying wine at the cellar door

30

Project Management

You indicated that you have purchased wine, in person – from a cellar door / winery during a visit. The following questions are

focused on this channel. [M/R]

CB3. What are your reasons for buying from the cellar door?

Base: Wine-drinking Australians that bought wine at a winery / cellar door in 2019-2020 n=317

%

The appeal of visiting wineries and making a purchase is directly associated with the social interaction

through talking with staff and getting recommendations (28%), and tasting the wine at the cellar

door(39%). Respondents also appreciated providing support to businesses and buying directly from the

winery (32%).

However, respondents are less likely to use this channel when it comes to getting discounts or price

transparency.

39

32

28

26

25

24

I like to try before I buy I like buying directly from

the winery

I like to get

recommendations from

the winery staff

Special offers Convenience Better value for money

23

23

17

14

14

3

Wines I want not available

elsewhere

Better range Price transparency Discounts on volume I trust this channel more

than others

Don’t know / unsure

Feelings towards tasting fees at the cellar door

31

Project Management

You indicated that you have purchased wine, in person – from a cellar door / winery during a visit. The following questions are

focused on this channel. [M/R]

CB5. How do you feel about paying a tasting fee at the cellar door?

Base: Wine-drinking Australians that bought wine at a winery / cellar door in 2019-2020 n=317 (18-34 n=127, 35-54 n=113, 55+ n=77)

%

The majority of respondents that purchased wine at a cellar door are happy to pay for a tasting

fee, but only of it is a reasonable price and/or offers value for money.

Of the quarter (27%) that are not willing to pay a tasting fee, this was mostly driven by those aged

55 and above.

42

39

27

14

5

50

41

22

17

2

38

40

23

16

8

32

35

42

8

6

I am happy to pay a tasting

fee if it’s a reasonable

amount e.g., less than $10

per person

I am happy to pay a tasting

fee only if it is redeemable

e.g. I get value for money or

the amount is deducted

from a purchase

I am not willing to pay a

tasting fee

I like to book and pay for a

seated tasting

Don't know/Other

TOTAL 18-34 35-54 55+

Areas for improvement

32

Project Management

You indicated that you have purchased wine, in person – from a cellar door / winery during a visit. The following questions are

focused on this channel. [M/R]

CB6. What could be put in place to improve this channel for purchasing wine?

Base: Wine-drinking Australians that bought wine at a winery / cellar door in 2019-2020 n=317

%

To improve wine purchasing from cellar doors, 49% of respondents surveyed feel that the wine on

sale could be more competitively priced. Additionally, 33% feel selling wines exclusive to the cellar

door and having a better experience would improve wine purchasing at wineries and cellar doors.

This is interesting when compared to the motivations for using the channel as it was less likely used to

get discounts and only around a quarter used it to buy wine exclusive to the cellar door.

49

33

33

32

22

10

1

Wine is more

competitively priced

Winery provides a

better cellar door

experience

Wine is exclusive to

the cellar door

Bigger range Improved service

Don’t know / unsure

Other

A look at the cellar door experience

33

Project Management

Base: In-depth interviews of Australian wine drinkers that have visited a cellar door/winery in the last 6 months, n=20

Visiting

When planning to visit, respondents local to an area would generally go with friends and

/ or family after conducting Google searches on the day to see what was open. The

decisions of which wineries to go to was generally decided by consensus of the group

based on if they have a restaurant/cafe, offer activities, the brand, accessibility of

location (i.e. easy access along main routes) and opening times. When in location, some

respondents said recommendations from other wineries were important, as this may

drive them off their planned route. When respondents were not local to the area, they

may go to tourism offices for recommendations.

Most respondents were happy to pay a tasting fee if the price was reasonable, offered

value for money, received a price reduction off purchased wine, or they were provided

something in return. Notably, demographics were a contributing factor with lower

income earners requesting discounts and/or gifts; whilst higher income earners wanted

an experience, older vintages or exclusive wines only sold at the cellar door.

Tasting

fees

Some respondents conducted price comparisons to see if they could purchase cheaper

from a retailer.

Price

checks

A look at the cellar door experience, continued

34

Project Management

Base: In-depth interviews of Australian wine drinkers that have visited a cellar door/winery in the last 6 months, n=20

Experie

nces

The majority of respondents said that a large proportion of their decision to purchase/not

purchase at the cellar door was based on the staff. Positive interactions included staff

having knowledge about the wine, conversations between staff/consumers and being

personable. This would see consumers purchase >2 bottles based on the experience.

However negative experiences; no knowledge of wine, not being looked after and/or

forgotten about, may see no purchases or 1-2 bottles only to support the time of the staff

and not the cellar door.

Reliable delivery was a concern as it is generally believed that cellar doors delivery is nor

reliable and takes too long.

Exclus

ivity

Several consumers were looking for special packaging, special releases, older vintage,

or wines that they could not get at a retailer.

Delivery

Subscription

service/wine club

WINERY OWNED

35

Average quantity delivered through winery service

36

Project Management

You indicated that you have purchased wine through a subscription service or wine club- with a cellar door/winery. The following

questions are focused on this channel. [S/R]

CE2. On average, how many bottles are provided in a club pack or in your delivery?

Base: Wine-drinking Australians that bought wine through a subscription service with a winery / cellar door in 2019-2020 n=119 (18-

34 n=49, 35-54 n=48, 55+ n=22*)

%

The number of bottles delivered to those that had purchased wine through a wine club or winery

subscription service varied with 4 bottles, half a dozen and 7–12 bottles in a delivery being the most

common amounts. Fewer were receiving more than a dozen.

3

8

10

22

13

18

21

5

1 2 3 4 5 6 7-12 More than 12

*Small sample, only total shown.

Annual spend per delivery through winery subscription

service/wine club

37

Project Management

You indicated that you have purchased wine through a subscription service or wine club- with a cellar door/winery. The following

questions are focused on this channel. [S/R]

CE3. How much is your annual spend per delivery with the wine club each year?

Base: Wine-drinking Australians that bought wine through a subscription service with a winery / cellar door in 2019-2020 n=119

%

Around a quarter (23%) tend to spend between $200–$249 a year on their winery subscription service/wine

club. Almost half (48%) of this is made up of 18–34 years and 70% have a household income before taxes of

$80,000 or more. For the 18% spending $300 or more they were mostly from NSW/VIC, aged between 35–54

years and earning $80,000 plus a year.

*Small sample, only total shown.

10

14

18

23

14

18

2

Under $100 $100 - $149 $150 - $199 $200 -$249 $250 - $299 $300 or more

Don’t know / unsure

Reasons for buying wine through winery subscription service

38

Project Management

You indicated that you have purchased wine through a subscription service or wine club- with a cellar door/winery. The following

questions are focused on this channel. M/R]

CE4. What are your reasons for using this channel?

Base: Wine-drinking Australians that bought wine through a subscription service with a winery / cellar door in 2019-2020 n=119

%

Special offers, convenience and value for money are the key motivations for purchasing wine through this

channel.

*Small sample, only total shown.

35

32

29

28 28

26

Special offers Convenience Better value for money Better range Price transparency I like buying directly from

the winery

26 26

18 18

11

1

Wines I want not available

elsewhere

Discounts on volume I like to try before I buy I like to get

recommendations from

the winery staff

I trust this channel more

than others

Other

Reason for joining and level of customisation

39

Project Management

You indicated that you have purchased wine through a subscription service or wine club- with a cellar door/winery. The following

questions are focused on this channel.

CE6. Do you prefer being able to choose your own wines or have them chosen for you? CE7, What are the main reasons for joining

a winery’s wine club?

Base: Wine-drinking Australians that bought wine through a subscription service with a winery / cellar door in 2019-2020 n=119

%

For those that use wine clubs, being able to

provide flexibility in the order is important with

more than half (55%) wanting the ability to

choose their own wines while another 39% want

the option to customise when they want to vary

from the set pack.

*Small sample, only total shown.

15

28

39

55

I like to choose my own wines

I like to have set packs but be

able to customise them if I want

to

I like to have wines chosen for me

– set packs

I have no preference either way

Preference for customisation

n=119 (%)

Reasons for joining winery subscription service

n=119 (%)

Most users of this channel joined because they

wanted to stay connected with the winery and

support local businesses.

A good portion also joined whilst at the cellar

door because they were asked or so they could

get a discount.

37

37

39

40

Signed up to get an initial discount

at the cellar door

Want to support local businesses

Was asked to join whilst at the

cellar door for a tasting

Want to stay in touch with the

winery and see their latest offers

Areas for improvement for winery subscriptions

40

Project Management

You indicated that you have purchased wine through a subscription service or wine club- with a cellar door/winery. The following

questions are focused on this channel. [S/R]

CE8. What could be put in place to improve this channel for purchasing wine?

Base: Wine-drinking Australians that bought wine through a subscription service with a winery / cellar door in 2019–2020 n=119

%

Free delivery was the main suggestion for improvement for almost half of respondents. Improving value for

money through better deals and extras/treats were also popular options for over a third of those using this

channel.

*Small sample, only total shown.

46

35

34 34

33

28

27

23

4

2

Free delivery More deals Easier ordering

process

Extras/treats

included in

delivery

Bigger range Faster delivery

timings

More reliable

delivery timings

More

information to

help me

choose which

wine to buy

Don’t know /

unsure

Other

Subscription

service/wine club

WINERY OWNED WINE CLUBS

COMPARED TO INDEPENDENT

WINE CLUBS

41

Wine club/subscription services being used

42

Project Management

You indicated that you have purchased wine through a subscription service / wine club with an independent company that isn’t a

winery. The following questions are focused on this channel. [M/R] CF5. Which wine club do you have a subscription with?

Base: Wine-drinking Australians that bought wine through an independent subscription service in 2019-2020 n=157 (18-34 n=53, 35-

54 n=65, 55+ n=39)

%

Naked Wines, CellarMasters and the Qantas Wine Club are three of the most commonly used subscription services.

Naked Wines and Qantas Club are more popular with those aged between 18–34 years while Cellar Masters is more

popular for those aged 55+.

Other subscription services were with Virgin Wines, Wine Selectors and Good Pair Days.

38

35

31

26

11 11

11

5

42

34

40

28

21

4

11

4

40

32

29

32

9

5

14

3

31

41

21

13

3

33

5

10

Naked Wines CellarMasters Qantas wine club The Wine Society Love and Other

Drinks

Other Vinomofo

Don’t know /

unsure

TOTAL 18-34 35-54 55+

Average quantity delivered through wine clubs

43

Project Management

CE2 & CF2. On average, how many bottles are provided in a club pack or in your delivery?

Base: Wine-drinking Australians that bought wine through an independent subscription service n=157 and through a winery owned

club or subscription service n = 119

%

Compared to those using winery subscription services/wine clubs, respondents using independent

subscriptions are receiving more bottles in each delivery.

3

8

10

22

13

18

21

5

4

10

13

15

9

13

27

9

1 2 3 4 5 6 7-12 More than 12

Winery club

Other club

Annual spend per delivery through wine clubs

44

Project Management

CE3 & CF3. How much is your annual spend per delivery with the wine club/subscription service each year?

Base: Wine-drinking Australians that bought wine through an independent subscription service n=157 and through a winery owned

club or subscription service n = 119

%

Compared to those using winery subscription services/wine clubs, respondents using independent

subscriptions are spending around $50 less a year on their subscription with 27% spending $150–$199 and 18%

spending $250–$299.

10

14

18

23

14

18

2

10

16

27

11

18

12

6

Under $100 $100 - $149 $150 - $199 $200 -$249 $250 - $299 $300 or more Not sure

Winery club

Other club

Reasons for buying wine through wine clubs

45

Project Management

CE4 & CF4. What are your reasons for using this channel?

Base: Wine-drinking Australians that bought wine through an independent subscription service n=157 and through a winery owned

club or subscription service n = 119

%

Compared to those using winery subscription services/wine clubs, a higher proportion of respondents using

independent subscriptions find this channel convenient and offers better value for money and range. Given the

nature of the service, wines are not exclusive like they are to a winery. Other reasons for buying wine through this

channel included supporting small independent wineries through subscriptions like Naked Wines.

45

42

33

31

29

28

32

29

28 28

Convenience Better value for money Better range Price transparency I like having the hassle

removed from selecting

wines

I like being offered

exclusive deals

Other club Winery club

26

20

18

15

2

3

26

11

1

I like getting personalised

and knowledgeable

advice on wines to select

Provide curated offers Wines I want not

available elsewhere

I trust this channel more

than others

Don't know Other

Reason for joining and level of customisation

46

Project Management

CE6 & CF7. Do you prefer being able to choose your own wines or have them chosen for you?

CF9, What made you choose this service – e.g. instead of a winery’s own wine club?

Base: Wine-drinking Australians that bought wine through an independent subscription service n=157 and through a winery owned club or

subscription service n = 119

Responses were very similar for both types

of subscriptions services when it comes to

being able to choose own wines or taking

set packs

Preference for customisation (%) Reasons for using independent subscription service over winery owned

# Recommended

# Advertising/marketing

# Good deals, discounts, specials

# Used coupons/discount code/voucher

# Better price

# Better service/experience

# Prefer the range, variety to choose from

# Support several businesses

#Better value and quality

# Easy/convenient/I just like it

# I know what I’m getting

# Use rewards points

# Delivery faster / convenient times

15

28

39

55

15

25

42

52

I have no preference

either way

I like to have wines chosen

for me – set packs

I like to have set packs but

be able to customise them

if I want to

I like to choose my own

wines

Other club

Winery club

Many chose this channel for varied reasons. Some of these

were because they were able to use reward points, had

access to a bigger range of wines, and they were able

support several independent wineries.

Areas for improvement for independent subscription

services

47

Project Management

CE8 & CF10. What could be put in place to improve this channel for purchasing wine?

Base: Wine-drinking Australians that bought wine through an independent subscription service n=157 and through a winery owned

club or subscription service n = 119

%

For 52% of respondents that have purchased wine from an independent wine club or subscription service in 2019 and

2020, free delivery would improve the service the most. Following this, more deals appeal to 39%.

38% would like to see extras and treats included in delivery, compared with 34% when it came to wine subscriptions direct

from wineries, showing a point of difference in expectation from the channel of wine purchasing. A bigger range is also

desired by 34% from an independent wine subscription.

46

35

34

33

34

28

27

23

4

2

52

39

38

34

28

24

19

17

4

3

Free delivery More deals Extras/treats

included in

delivery

Bigger range Easier

ordering

process

Faster

delivery

timings

More reliable

delivery

timings

More

information to

help me

choose which

wine to buy

Don’t know /

unsure

Other

Winery club Other club

Online

WINERY WEBSITE SHOPPING CART

48

Average quantity purchased through winery website

49

Project Management

You indicated that you have purchased wine online – through a cellar door / winery’s own website. The following questions are

focused on this channel. [S/R]

CG1. On average, how many bottles do you purchase per transaction through this channel?

Base: Wine-drinking Australians that bought online on a winery web shop in 2019-2020 n=196 (18-34 n=90, 35-54 n=82, 55+ n=24*)

%

Significance two tailed test of difference by segment

[ / significantly less/more than the total sample]

There is a relatively even mix between respondents using this channel to buy in smaller quantities (i.e. 2 to 4

bottles) as well as half a dozen and up to a dozen. Those aged 55 and above were significantly more likely to

buy more than a dozen bottles at a time. Those aged 35–64 years on average purchase 4.65 bottles, 1 bottle

more than those aged 18–34 years.

8

16

18

16

8

13

15

6

10

23

20

19

9

13

3

2

6

11

16

17

10

16

18

6

4

8

17

4

46

17

1 2 3 4 5 6 7-12 More than 12

Total 18-34 35-54 55+

Mean

3.58

Mean

4.65

Sample size

too small

Mean

4.28

Average price spent per bottle through winery website

50

Project Management

You indicated that you have purchased wine online – through a cellar door / winery’s own website. The following questions are

focused on this channel. [S/R]

CG2. What is the average price you pay per bottle through the winery’s online shopping cart?

Base: Wine-drinking Australians that bought online on a winery web store in 2019–2020 n=196 (18-34 n=90, 35-54 n=82, 55+ n=24*)

%

Almost a half (45%) tended to spend between $20–$30 per bottle through the winery shopping cart. Half(51%) of

this was made up of 18–34 years and 69% have a household income before taxes of $80,000 or more. Those aged

55 years plus are more likely to purchase cheaper bottles of wine (i.e. less than $20) online compared to the total.

5

12

19

23

22

9 9

2

14

18

28

22

7

9

21

13

29

17 17

4

0

<$10 $10 - $14.99 $15 - $19.99 $20 - $24.99 $25 - $29.99 $30 - $49.99 $50 or more

TOTAL 18-34 35-54 55+

Reasons for buying wine through winery website

51

Project Management

You indicated that you have purchased wine online – through a cellar door / winery’s own website. The following questions are

focused on this channel. [M/R]

CG3. What are your reasons for using this channel?

Base: Wine-drinking Australians that bought online on a winery web store in 2019–2020 n=196

%

While a third use the channel because it is convenient another 30% started buying directly from the winery on

their website because of the disruptions caused by COVID-19.

35

30

28

26

24

23

22

Convenience I started using this

because of COVID-19

restrictions

Special offers Better value for money Offer free delivery Easy ordering process Wines I want not

available elsewhere

20

19 19

17

16 16

2

Discounts on volume Better range I like buying directly

with the winery

Good reviews that

help me make a

decision on what to

buy

Price transparency I trust this channel

more than others

Don’t know / unsure

Areas for improvement for purchasing through winery

website

52

Project Management

You indicated that you have purchased wine online – through a cellar door / winery’s own website. The following questions are

focused on this channel. [M/R]

CG5. What could be put in place to improve this channel for purchasing wine?

Base: Wine-drinking Australians that bought online on a winery web store in 2019–2020 n=196

%

Free delivery, more deals and receiving extras/treats were all considered ways to improve this channel. Wineries could

also provide the content on their sites with more information to help customers make a decision on which wine to buy

and potentially review the consumer purchase journey with 14% feeling that they need assistance with using the website.

47

39

31

28

25

23

22

21

14

3

1

Free delivery More deals Extras/treats

included in

delivery

Faster

delivery

timings

More reliable

delivery

timings

Easier

ordering

process

More

information

to help me

choose

which wine

to buy

Bigger range Assistance

with using

the website

Don’t know /

unsure

Other

Online

ONLINE RETAILERS COMPARED TO

WINERY WEBSITES

53

Average quantity purchased online

54

Project Management

CG1 & CH1. On average, how many bottles do you purchase per transaction through this channel?

Base: Wine-drinking Australians that bought wine through online retailers in 2019-2020 n=340 and through winery website n=196

%

When respondents purchase wine online through an online retailer that isn’t a winery, 38% buy half a dozen to a

dozen wines, and another 20% purchase more than a dozen bottles at once. The average quantity of bottles

ordered by wine drinkers surveyed is 9.6, 5 more bottles than through the winery website.

8

16

18

16

8

13

15

6

6

11

13

7

5

13

25

20

1 2 3 4 5 6 7-12 >12

Winery website

Online retailer site

Average price spent per bottle online

55

Project Management

CG2. What is the average price you pay per bottle through the winery’s online shopping cart?

CH2. What is the average price you pay per bottle through an online retailer website?

Base: Wine-drinking Australians that bought wine through online retailers in 2019-2020 n=340 and through winery website n=196

%

Compared to a winery website, respondents tend to spend less per bottle through an online retailer.

5

12

19

23

22

9 9

11

25

27

15

12

4

6

<$10 $10 - $14.99 $15 - $19.99 $20 - $24.99 $25 - $29.99 $30 - $49.99 $50 or more

Winery website

Online retailer site

Reasons for buying wine online

56

Project Management

CG3 & CH3. What are your reasons for using this channel?

Base: Wine-drinking Australians that bought wine through online retailers in 2019-2020 n=340 and through winery website n=196

%

Compared to winery websites, respondents buying wine online from retailers, rated nearly all of the reasons

for using the channel higher, especially on convenience, special offers and better value for money. There

was also a higher proportion that use this channel to get discounts on volume which could be contributing to

the lower average spend per bottle.

35

28

26

23

30

24

19

54

41

36

34

32

28

26

Convenience Special offers Better value for

money

Easy ordering

process

I started using this

because of COVID-

19 restrictions

Offer free delivery Better range

Winery website

Online retailer

20

16

17 17

22

1

2

25

22

17

14

12

2

1

Discount on volume Price transparency Good reviews that

help me make a

decision on what to

buy

I trust this channel

more than others

Wines I want not

available

elsewhere

Other

Don’t know /

unsure

Areas for improvement for purchasing online

57

Project Management

CG5 & CH5. What could be put in place to improve this channel more?

Base: Wine-drinking Australians that bought wine through online retailers in 2019-2020 n=340 and through winery website n=196

%

Areas for improvement through online retailer websites were very similar to winery websites with free delivery, more deals

and including extras/treats in deliveries.

Respondents however feel that online retailers have faster and more reliable delivery timings along with easier ordering

process, resulting in a smaller proportion wanting assistance with using the website.

47

39

31

21

28

22

25

23

14

3

1

51

37

33

23

22

21

18

15

9

7

2

Free delivery More deals Extras/treats

included in

delivery

Bigger

range

Faster

delivery

timings

More

information

to help me

choose

which wine

to buy

More

reliable

delivery

timings

Easier

ordering

process

Assistance

with using

the website

Don’t know

/ unsure

Other

Winery website Online retailer

Buying wine online an in-depth look

58

Project Management

Base: In-depth interviews of Australian wine drinkers that have purchased wine online over the last 3-6 months n=20

Key highlights:

• Dan Murphy’s and BWS were the most commonly used sites

• Other sites were wine.qantas.com, winedirect.com.au, Cellar Masters (recently joined with Dan Murphy’s), Liquorland, and Naked

Wines

• Some use auction sites for bidding and direct purchase such as Grey’s online, eBay and Amazon

• Numerous sources were used to find the sites including emails, sign ups, friends and social media

• Major retailers were used as they were the cheapest, fastest and would provide delivery

• Time for delivery was not a factor and all were happy for if they wanted to buy 1 or 2, then they could go to the shop to pick up.

• Location of bottle shop was a factor in purchasing online due to ‘click and collect’ feature which would influence their purchase

decision. Majority used this service.

• Searches on sites were split by varietal/vintage and discounts.

• Apart from those familiar with the wine industry, all said they found that they purchased more when going online. This was to get the

discount or bundle with free delivery.

• All agreed that it was very easy to find the wine they were after.

• Price matching on other webpages occurred.

• Majority indicated that the online experience couldn’t be improved, but some mentioned more discounts, more emails on special

releases etc.

• One elderly regular user purchased wine after abandoning the online shopping cart when Qantas Wine called within 10 minutes to

ask why they did not go through with the purchase. The caller established a rapport by discussing what they liked to buy, offering a

better price, free wine and free delivery.

Winery websites specifically:

• Only 1–2 said they would buy from winery website. All others said they wouldn’t because of price, delivery fees, and how long it

would take to arrive.

• Those that knew what wine they were after and couldn’t find online would go to the winery, however this was only a small proportion

Barriers to buying online

59

Exploring the barriers to buying wine online – lack of

confidence or other reasons

60

Project Management

D1. How confident are you in general using the internet to make online purchases?

D2. Since you indicated that you haven’t purchased wine online and don’t intend to, have you bought other products/services online before?

D3. You indicated that you have used the internet to make purchases online. Is there a reason why you have not purchased wine online?

D5. You indicated that you haven’t purchased anything online before. What are the main reasons behind that?

Whilst several barriers were identified for not using online channels for wine

purchases made by those that had used these channels at some point since

2019, 47% indicated that they had not bought wine online at all.

For those that did not buy wine online, more than two thirds (70%) still felt

confident making purchases online. With such a high level of overall

confidence, it is not surprising that 86% have used the internet to buy other

products online.

The reasons provided for not buying wine include:

• Quicker and easier to buy in person, prefer to buy in person

• Just don’t want to

• Buying online is perceived to be expensive

• Some don’t feel they drink enough and don’t want to be locked into

receiving a specified amount of bottles, especially to get free delivery

• Many don’t trust delivery, most are concerned about damaged bottles

• Lack of wine knowledge

• Getting information on where to purchase

• Couldn’t get the wine wanted

Of the 12% that have not purchased anything it is mostly because they do not

trust providing personal details and credit card details and prefer to see the

product and go to the store.

Confidence in online purchases

(%)

44

41

32

29

11

12

7

9

4

7

2

2

Total n=1007 Did not use any online

channel n=475

Very confident, I

use it all the time

Somewhat

confident

Neutral

Not really

confident

Not at all

confident

DK/NA

On average, around a third of respondents are buying wine

through an online channel. And this is significantly lower than

buying in person at a bottle shop at 96% with many

preferring this channel given its convenience and liking the

ability to see the bottles and browse when making a

selection.

Reasons why people don’t buy wine online

Issues with buying online in general

61

Project Management

D6. If you have difficulty purchasing something online, what are you most likely to do?

Base: Wine-drinking Australians not confident with purchasing wine online that have bought other products online n=220

36

33

23

8

Give up

Contact the organisation

Ask family/ friends for help

Other

Likely outcome if difficulties occur purchasing online

n=220 (%)

Another potential barrier to explore is when customers

do not experience a seamless user experience whilst

buying online.

Over a third (36%) of respondents indicated that they

would give up on purchasing online if they found it

difficult to buy online.

More than half (56%) however would reach out for help

by either contacting the organisation or asking friends

or family.

Other reasons included trying again later or going to a

different website.

Reasons that could convert consumers to buy wine online

62

Project Management

D4. What would help you to consider buying wine online in the future? N=389

Almost half (42%) of the respondents suggested that they would never consider buying wine online

But some would consider if…

• Their circumstances changed, for example if bottle shops were closed because of lockdowns

• Special deals, promotions, or larger incentives were offered

• Better prices were offered, in particular cheaper prices and free shipping

• Same day shipping and reliable delivery times were provided

• More choices were available i.e. items they would like to purchase, based on personal preference

• Exclusive wines were provided online that they could not get from a retailer

• A more flexible return policy on breakages or spoilages was provided

• Quality and satisfaction guarantees were provided.

• Smaller samples could be provided to allow the consumer to taste before purchasing

• Delivery concerns were addressed including secure packaging, transparent parcel tracking system, and ability to

choose timing of delivery

• Websites were advertised directing consumers where to go to buy wine online as there is a lot of competition in the

market which is overwhelming.

• They were purchasing for the purpose of gift giving or for a special occasion.

• They already know what their favourite wine is or if they know the brand and the taste (having tried before)

• Different payment options are available

• They have the ability to compare prices.

Methodology

63

Data handling

64

Project Management

Statistical significance – 5% at 95 per cent level of confidence

All tests for statistical significance have been undertaken at the 95 per cent level of confidence, and unless otherwise noted, any notation of a ‘difference’ between

subgroups means that the difference discussed is significant at the 95 per cent level of confidence. When reporting significant differences in segments, (+x%; x%)

represents the difference in % above total sample, and % of total sample respectively.

A green circle or blue square around a value denotes that the result is significantly lower or greater (respectively) than that of the total sample for that question. E.g.

Charts have been shown by segments to demonstrate where significant differences lie. Where the sample sizes are small, charts may not be shown.

Treatment of means

Where responses are scale variables, for example 1 to 5 where 1 is disagree strongly and 5 is agree strongly, the mean is also calculated with the removal of don’t know.

Rounding of figures – may result in anomalies of +/- 1%

All results have been rounded to the nearest whole percentage figure and anomalies of about +/- 1% may occur in charts i.e. total percentages for each bar add to

99%, or 100% or 101% due to rounding error.

Net figures are also rounded – which may also result in anomalies

Net results are also rounded after summing the separate proportions rather than simply summing two rounded figures (e.g. ‘% total agree’). For this reason, anomalies of

about 1% sometimes occur between net results and rounded results shown in charts. For example, a proportion of 33.3% ‘agree’ rounds to 33%, and a proportion of 12.4%

‘strongly agree’ rounds to 12%. However, when combined to derive the total agree (i.e. agree plus strongly agree), 33.3% plus 12.4% equals 45.7%, which would be

rounded to 46%. In this case, the results would be shown in a chart as 33% agree and 12% strongly agree, but the proportion reported as ‘total agree’ would be 46%.

Method

Data collection was conducted using both qualitative and quantitative surveys

Phase 1

Quantitative surveys conducted in August 2021 n = 1007

A quota was determined to ensure coverage was consistent with the proportion of regular Australian wine drinkers consistent with Wine Intelligence Australia

market landscape report.

For the five channels where there was a ‘deep dive’, to reduce respondent burden, programming was applied to the survey to ensure that responses were

reasonably spread and minimum sample targets reached.

Phase 2

In depth interviews with respondents recruited through the quantitative survey were conducted in October 2021 n = 20. Interviews on average went for around

30 minutes and were recorded.

Phase 3

In depth interviews with wineries to identify successes and best practice identified over the last 2 years. Interviews were conducted in October/ November 2021

n = 8. Results of these interviews are provided separate to this report.

65

Project Management