Arbitech, LLC

64 Fairbanks, Irvine, CA 92618

Date: September 12, 2023 Brandon Seedorf, Chief Operating Officer

Application Facts: Company Profile

Industry Transportation, Warehousing & Utilities

NAICS

423430

Type of App

New

Location

Clark County

RDA

LVGEA, Mitch Keenan

Tax Abatement Requirements: Statutory

Company Application Meeting Requirements

Job Creation 50 54 Yes

Average Wage $29.28 $38.61 Yes

Equipment Capex (SU & MBT)

Equipment Capex (PP)

Additional Requirements:

65% 74%

Yes

51% 80%

Yes

Current Pending

Will comply

Total Tax Liability (without tax abatements)

Direct (company)

Total

$741,489 $8,730,026

Tax Abatements Contract Terms

Estimated Tax Abatement

Sales Tax Abmt. 2% for 2 years

$67,187

Modified Business Tax Abmt. 50% for 4 years

$76,567

Personal Property Tax Abmt. 50% for 10 years

$22,034

Total Estimated Tax Abatement over 10 yrs. $165,788

Net New Tax Revenues Direct

Indirect Taxes after Abatements

Local Taxes

Property $541,464 $3,751,460

$4,292,924

Sales $35,063 $2,088,190

$2,123,253

Lodging

$0

$116,812

$116,812

State Taxes

Property $29,615 $218,279

$247,894

Sales $29,615 $699,398

$729,013

Modified Business $401,773 $615,040

$1,016,813

Lodging $0 $37,529

$37,529

Total Estimated New Tax Revenue over 10 yrs.

$1,037,530 $7,526,708

$8,564,238

Economic Impact over 10 yrs. Economic

Construction Total

Total Jobs Supported 193 8 201

Total Payroll Supported $112,408,838 $545,934 $112,954,772

Total Economic Value $369,427,698 $1,573,212 $371,000,910

IMPORTANT TERMS & INFORMATION

Tax Abatements are reduction or discount of tax liability and companies do not receive any form of payment.

Total Estimated Tax Abatement is a tax reduction estimate. This estimated amount will be discounted from total tax liability.

Estimated New Tax Revenue is amount of tax revenues local and state government will collect after the abatement was given to

applying company.

Economic Impact is economic effect or benefits that this company and it's operations will have on the community and state economy

measured by total number of jobs, payroll and created output.

Health Insurance

Arbitech, LLC (Arbitech) is considering establishing a 50,275 sq. ft. headquarter,

distribution, and fulfilment facility in Henderson. Founded in 2000, Arbitech has

become the world’s leading independent distributor of data center products. Over

two decades, Arbitech has developed a network of supply sources that enable its

customers to choose from a comprehensive catalog of the latest technology

products as well as constrained and End Of Life (EOL) items that aren’t always

available through conventional distribution options, yet are vital to continuing

operations for many organizations. The company's distribution center stocks and

ships servers, storage, and networking products on a daily basis. From its

configuration room, the company offers complete server, blade, storage, and

networking configuration, performed by Arbitech’s certified engineers.

Arbitech has enjoyed solid growth since inception, and attributes much of its

success to the local community and the family environment that has been a

corner-stone of the business. Throughout the year, Arbitech participates in and

donates to a variety of organizations including American Red Cross, Boys & Girls

Club, and Make a Wish (amongst others). The company also considered

Pennsylvania, South Carolina, and Kentucky as potential locations for the

project. Source: Arbitech, LLC

Revenues generated outside NV

Business License

$1,053,915$1,000,000 Yes

July 10, 2023

Mr. Tom Burns

Executive Director

Nevada Governor’s Office of Economic Development

555 E. Washington Avenue, Suite 5400

Las Vegas, Nevada 89101

Dear Mr. Burns,

Arbitech, LLC is applying to the State of Nevada for the Sales & Use Tax Abatement,

the Modified Business Tax Abatement, and Personal Property Tax Abatement. We

request that Arbitech, LLC be placed on the September 12, 2023, GOED Board

meeting agenda.

Arbitech, LLC will create 54 new positions in the first 24 months of operations, with

an average hourly wage of $38.61. Arbitech, LLC will make an overall capital

investment of $2,053,915.

Arbitech, LLC meets and exceeds the statutory requirements for tax abatements.

This application has the full support of the Las Vegas Global Economic Alliance.

Sincerely,

Mitch Keenan

AVP Economic Development

Las Vegas Global Economic Alliance

1

ARBITECH

coo

2

HENDERSON-

3

Company is an / a: (check one)

Incentive Application

New location in Nevada

Expansion of a Nevada company

Other:

Yes No

Headquarters Service Provider

Technology Distribution / Fulfillment

Back Office Operations Manufacturing

Research & Development / Intellectual Property Other:

Arbitech, LLC

July 7, 2023

Section 2 - Corporate Information

PROPOSED / ACTUAL NEVADA FACILITY ADDRESS

1191 Center Point Drive

PERCENTAGE OF REVENUE GENERATED BY THE NEW JOBS

CONTAINED IN THIS APPLICATION FROM OUTSIDE NEVADA

EXPECTED DATE OF NEW / EXPANDED OPERATIONS (MONTH / YEAR)

Type of Facility:

TELEPHONE NUMBER

Section 4 - Nevada Facility

INDUSTRY TYPE

COUNTY

ZIP

NAICS CODE / SIC

949-936-2367

Brandon Seedorf

brandon.seedorf@arbitech.com

COO

Jun-2024

80%

Has your company ever applied and been approved for incentives available by the Governor's Office of Economic Development?

Note: Criteria is different depending on whether the business is in a county where the population is 100,000 or more or a city where the population is 60,000 or more

“urban” area), or if the business is in a county where the population is less than 100,000 or a city where the population is less than 60,000 (i.e., “rural” area).

E-MAIL ADDRESS

PREFERRED PHONE NUMBER

310-864-0664

If Yes, list the program awarded, date of approval, and status of the accounts (attach separate sheet if necessary):

COMPANY NAME (Legal name under which business will be transacted in Nevada)

CORPORATE ADDRESS

MAILING ADDRESS TO RECEIVE DOCUMENTS (If different from above)

WEBSITE

COMPANY CONTACT TITLE

www.arbitech.com

COMPANY CONTACT NAME

WHAT OTHER STATES / REGIONS / CITIES ARE BEING CONSIDERED FOR YOUR COMPANY'S RELOCATION / EXPANSION / STARTUP?

Pennsylvania, South Carolina, Kentucky

CITY / TOWN

Henderson

Clark County

89074

Reseller of computer hardware

CITY / TOWN

Irvine

STATE / PROVINCE

CA

92618

FEDERAL TAX ID #

330907636

Arbitech, LLC

64 Fairbanks

ZIP

CITY / TOWN

STATE / PROVINCE

ZIP

Please check two of the boxes below; the company must meet at least two of the three program requirements:

businesses. In cases of expanding businesses, the capital investment must equal at least 20% of the value of the tangible property owned by the

New businesses locating in urban areas require fifty (50) or more permanent, full-time employees on its payroll by the eighth calendar quarter following

A capital investment of $1,000,000 in eligible equipment in urban areas or $250,000 in eligible equipment in rural areas are required. This criteria is

quarter in which the abatement becomes effective. In rural areas, the requirement is ten (10) or more. For an expansion, the business must increase the

employees on its payroll by 10% more than its existing employees prior to expansion, or by 25 (urban) or 6 (rural) employees, whichever is

business.

423430

greater.

In both urban and rural areas, the average hourly wage that will be paid by the business to its new employees is at least 100% of the average

statewide hourly wage.

Please check all that the company is applying for on this application:

Recycling Real Property Tax Abatement

Modified Business Tax Abatement

Personal Property Tax Abatement

Section 1 - Type of Incentives

Company Name:

Date of Application:

Sales & Use Tax Abatement

Wholesaler and Value-added reseller of computer hardware

DESCRIPTION OF COMPANY'S NEVADA OPERATIONS

Section 3 - Program Requirements

4

5 (A)

Equipment List

5 (B)

Employment Schedule

5 (C)

Evaluation of Health Plan, with supporting documents to show the employer paid portion of plan meets the minimum of 65%.

5 (D)

Company Information Form

When to break ground, if building (month, year)?

Estimated completion date, if building (month, year):

How much space (sq. ft.)?

How much space (sq. ft.)?

Do you plan on making building tenant improvements?

When to make improvements (month, year)?

Section 5 - Complete Forms (see additional tabs at the bottom of this sheet for each form listed below)

If No, skip to Part 3. If Yes * , continue below:

Dec, 2023

Part 1. Are you currently leasing space in Nevada?

If No, skip to Part 2. If Yes, continue below:

How much space (sq. ft.)?

Due to expansion, will you lease additional space?

Do you plan on making building tenant improvements?

How much expanded space (sq. ft.)?

Annual lease cost of expanded space:

If No, skip to Part 2. If Yes *

, continue below:

Expanding at the current facility or a new facility?

Part 2. Are you currently/planning on

Annual lease cost at current space:

50,275

What year(s)?

Annual lease cost of space:

What year(s)?

2023

Expansions - Plans Over the Next 10 Years

New Operations / Start Up - Plans Over the Next Ten Years

leasing space in Nevada?

Yes

If No, skip to Part 3. If Yes, continue below:

How much space (sq. ft.)?

What year(s)?

Section 6 - Real Estate & Construction (Fill in either New Operations/Startup or Expansion, not both.)

Yes

Part 2. Are you currently operating at an

If No, skip to Part 3. If Yes * , continue below:

Do you plan on making building improvements?

Purchase date, if buying (month, year):

Purchase date, if buying (month, year):

When to break ground, if building (month, year)?

Arbitech will be investing into Tenant Improvements and is estimating construction costs to be $1,000,000.- The amount of constructions jobs will depend on the

scope of the project. Arbitech will keep the state abreast as the project progresses.

Estimated completion date, if building (month, year):

How much space (sq. ft.)?

owner occupied building in Nevada?

BRIEF DESCRIPTION OF CONSTRUCTION PROJECT AND ITS PROJECTED IMPACT ON THE LOCAL ECONOMY (Attach a separate sheet if necessary):

*

Please complete Section 7 - Capital Investment for New Operations / Startup.

*

Please complete Section 7 - Capital Investment for Expansions below.

If Yes * , continue below:

buying an owner occupied facility in Nevada?

No

If No, skip to Part 3. If Yes, continue below:

Part 3. Do you plan on building or buying a

If No, skip to Part 3. If Yes * , continue below:

When to make improvements (month, year)?

If Yes * , continue below:

How much space (sq. ft.)?

If No, skip to Part 3. If Yes *

, continue below:

Due to expansion,

will you be making building improvements?

Current assessed value of real property?

When to make improvements (month, year)?

new facility in Nevada?

Part 3. Are you currently/planning on

building a build-to-suit facility in Nevada?

No

Check the applicable box when form has been completed.

If No, skip to Part 2. If Yes, continue below:

Part 1. Are you currently/planning on

When to make improvements (month, year)?

$555,036.00

5

Overtime Merit increases Tuition assistance

Bonus

PTO / Sick / Vacation COLA adjustments Retirement Plan / Profit Sharing / 401(k)

Other:

No

Medical

Vision

Dental

Qualified after (check one):

Upon employment

Three months after hire date

Six months after hire date Other:

Health Insurance Costs:

Percentage of health insurance premium by (min 65%):

Plan Type:

UHC Harmony HMO and SignatureValue HMO

Employer Contribution (annual premium per employee):

Company: 74%

Employee Contribution (annual premium per employee)

Employee: 26%

Total Annual Premium:

How much capital investment is planned? (Breakout below):

$1,000,000

17,945.58$

Building Costs (if building / making improvements):

Total number of employees after expansion:

OTHER COMPENSATION (Check all that apply):

BRIEF DESCRIPTION OF ADDITIONAL COMPENSATION PROGRAMS AND ELIGIBILITY REQUIREMENTS (Attach a separate sheet if necessary):

[SIGNATURE PAGE FOLLOWS]

Expansions

Building Purchase (if buying): Building Purchase (if buying):

end of the first eighth quarter of new operations?:

Other:

Equipment Cost:

Total:

Land:

$1,053,915

Section 7 - Capital Investment (Fill in either New Operations/Startup or Expansion, not both.)

New Operations / Start Up

$2,053,915

Expansions

Current assessed value of personal property in NV:

How much capital investment is planned? (Breakout below):

Equipment Cost:

Total:

How many full-time equivalent (FTE*) employees will be created by the

Section 8 - Employment (Fill in either New Operations/Startup or Expansion, not both.)

How many full-time equivalent (FTE*) employees will be created by the

Land:

Building Costs (if building / making improvements):

Is the equipment purchase for replacement

of existing equipment?

How many FTE employees prior to expansion?:

4,665.85$

Average hourly wage of these new employees:

$38.61

Is health insurance for employees and is an option for dependents offered?: Yes (attach health plan and quote or invoice)

*

FTE represents a permanent employee who works an average of 30 hours per week or more, is eligible for health care coverage, and whose position is a "primary job" as set

forth in NAC 360.474.

(Must attach the most recent assessment from the County Assessor's Office.)

13,279.73$

Package includes (check all that apply):

Section 9 - Employee Health Insurance Benefit Program

Average hourly wage of these existing employees:

54

New Operations / Start Up

Average hourly wage of these new employees:

end of the first eighth quarter of expanded operations?:

6

7

Site Selection Factors

Company Name: County:

Section 1 - Site Selection Ratings

Availability of qualified workforce:

5

Transportation infrastructure:

4

Labor costs:

4

Transportation costs:

4

Real estate availability:

3

State and local tax structure:

5

Real estate costs:

3

State and local incentives:

5

Utility infrastructure:

3

Business permitting & regulatory structure:

3

Utility costs:

3

Access to higher education resources:

4

Arbitech, LLC

Clark

Directions: Please rate the select factors by importance to the company's business (1 = very low; 5 = very high). Attach this form to the Incentives

Application.

The economic development incentives offered by the State of Nevada have been an integral factor in our decision making process to locate our operation here in the state. Arbitech

was examining mulitple locations throughout the western states and ultimately, after much due diligence and economic feasibility analysis, Nevada was chosen for its overall incentive

package and pro-business climate.

8

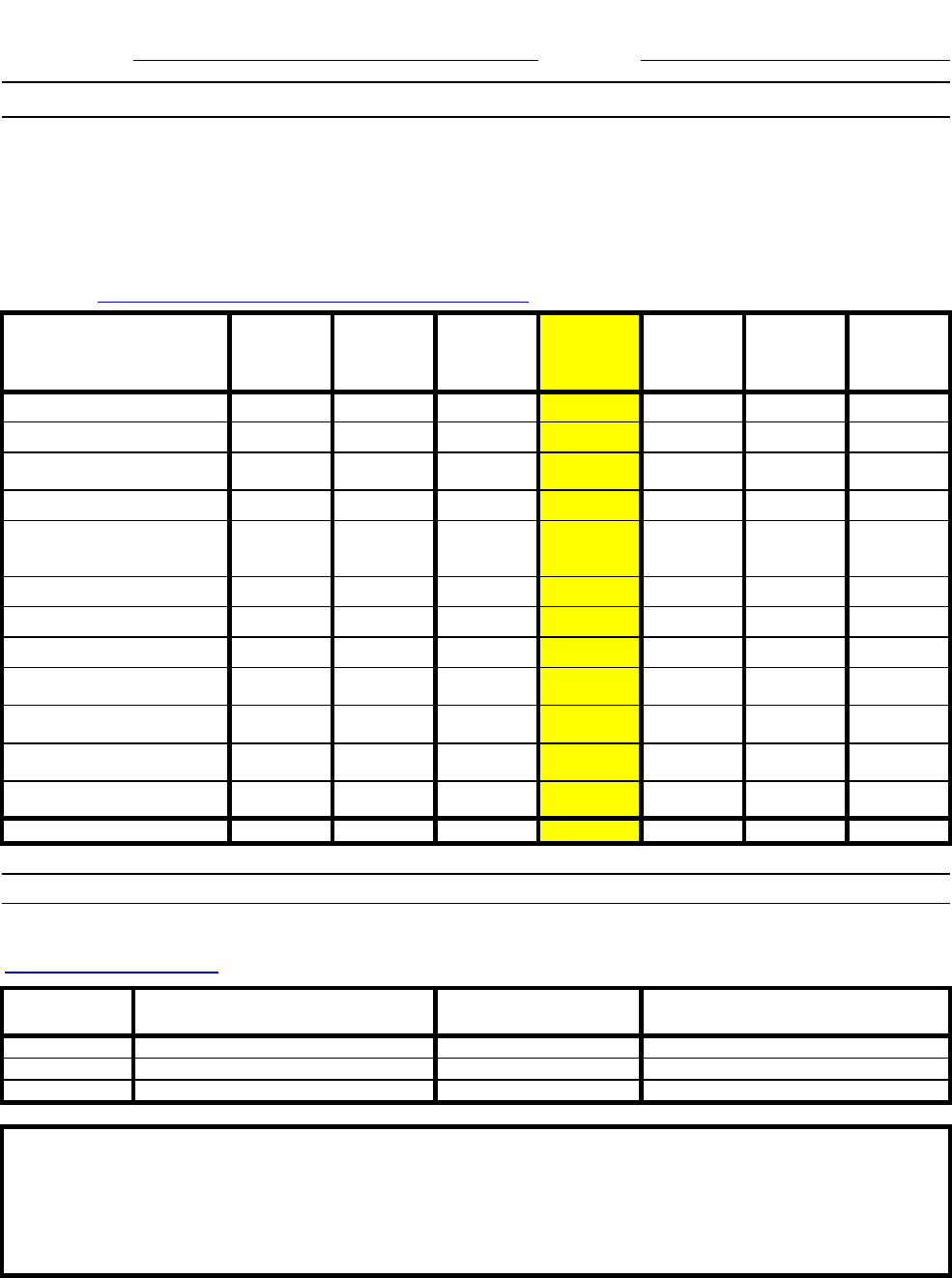

5(A) Capital Equipment List

Company Name:

Arbitech

County:

( b) (c) (d)

# of Units Price per Unit Total Cost

4 $60,000.00 $240,000.00

10 $400.00 $4,000.00

1 $280,000.00 $280,000.00

20 $2,500.00 $50,000.00

36 $1,000.00 $36,000.00

35 $950.00 $33,250.00

35 $350.00 $12,250.00

50 $2,650.00 $132,500.00

50 $450.00 $22,500.00

105 $250.00 $26,250.00

25 $1,650.00 $41,250.00

6 $13,000.00 $78,000.00

6 $1,500.00 $9,000.00

40 $700.00 $28,000.00

35 $350.00 $12,250.00

50 $50.00 $2,500.00

2 $3,500.00 $7,000.00

2 $3,000.00 $6,000.00

165 $201.00 $33,165.00

$1,053,915.00

Yes No

Equipment Name/Description

42U server racks

Shipping stations (rollers, scales)

server rack shelving

Shipping packaging machines

Portable stage racking

Conference room A/V equipment

Is any of this equipment* to be acquired under an operating lease?

*Certain lease hold equipment does not qualify for tax abatements

Clark

Monitors

(a)

8 port switches

Keyboard/mice

Directions: Please provide an estimated list of the equipment [columns (a) through (c)] which the company intends to purchase over the two-year

allowable period. For example, if the effective date of new / expanded operations begins April 1, 2023, the two-year period would be until March

31, 2025. Add an additional page if needed. For guidelines on classifying equipment, visit:

tax.nv.gov/LocalGovt/PolicyPub/ArchiveFiles/Personal_Property_Manuals. Attach this form to the Incentives Application.

Forklifts

TOTAL EQUIPMENT COST

Conference room table/chairs

Section 1 - Capital Equipment List

Pallet jacks

Racking- Full warehouse

48 port switches for configuration center and data center

Warehouse/config work benches

Office Desks

Office chairs

Computers

Docking stations

6

Company Name: County:

(b) ( c ) (d) (e) (f) (g) (h)

Position SOC

Code

Number of

Positions

Company

Average Hourly

Wage

Region

Average Hourly

Wage*

Average

Weekly Hours

Annual Wage

per Position

Total Annual

Wages

11-1011 4 $96.15 $101.11 40 $199,992.00 $799,968.00

11-1021 2 $43.26 $60.02 40 $89,980.80 $179,961.60

53-7062 25 $19.00 $18.17 40 $39,520.00 $988,000.00

11-2022 1 $96.15 $57.05 40 $199,992.00 $199,992.00

41-4011 7 $48.07 $42.42 40 $99,985.60 $699,899.20

41-9031 1 $64.90 $53.35 40 $134,992.00 $134,992.00

11-3061 1 $96.15 $43.72 40 $199,992.00 $199,992.00

13-1028 3 $43.26 $31.50 40 $89,980.80 $269,942.40

11-3071 2 $35.82 $41.44 40 $74,505.60 $149,011.20

11-3021 1 $48.07 $61.89 40 $99,985.60 $99,985.60

17-2061 5 $40.86 $50.19 40 $84,988.80 $424,944.00

43-6011 2 $45.68 $29.52 40 $95,014.40 $190,028.80

54 $38.61 $36.65 $4,336,716.80

(a)

Year

3-Year

4-Year

5-Year

*

Column (e) determines if wage is commensurate to current wage ranges in the region the company plans to locate/is located. For these

purposes the mean average hourly wage for the location has been used.

U = Unknown / data set for region is not currently available.

Source: Lighcast

TM

county wages based on the Bureau of Labor Statistics Occupational Employment and Wage Statistics program

and county-level administrative wage data.

Sales Representatives, Wholesale

and Manufacturing, Technical and

Scientific Products

Computer Hardware Engineers

Executive Secretaries and Executive

Administrative Assistants

Sales Engineers

Purchasing Managers

Buyers and Purchasing Agents

Transportation, Storage, and

Distribution Managers

Computer and Information Systems

Managers

$655,200.00

10

$31.50

5(B) Employment Schedule

Arbitech, LLC

Clark

Section 1 - Full-Time Equivalent (FTE) Employees

Directions: Please provide an estimated list of full time employees [columns (a) through (d)] that will be hired and employed by the company by the end of the first

eighth quarter of new / expanded operations. For example, if the effective date of new / expanded operations is April 1, 2023, the date would fall in Q2, 2025. The

end of the first eighth quarter would be the last day of Q2, 2025 (i.e., June 30, 2025). Attach this form to the Incentives Application. A qualified employee must be

employed at the site of a qualified project, scheduled to work an average minimum of 30 per week, if offered coverage under a plan of health insurance provided by

his or her employer, is eligible for health care coverage, and whose position of a “primary job” as set forth in NAC 360.474.

(b)

Number of New FTE(s)

(c)

Average Hourly Wage

(a)

New Hire Position Title/Description

Chief Executives

Sales Managers

General and Operations Managers

Laborers and Freight, Stock, and

Material Movers, Hand

Directions: Please estimate full-time job growth in Section 2, complete columns (b) and (c). These estimates are used for state economic impact and net tax

revenue analysis that this agency is required to report. The company will not be required to reach these estimated levels of employment. Please enter the

estimated new full time employees

on a year by year basis (not cumulative)

Please use the Bureau of Labor Statistics Standard Occupational Classification System (SOC) link to populate

section (b): https://www.bls.gov/soc/2018/major_groups.htm#11-0000

TOTAL

Section 2 - Employment Projections

(d)

Payroll

10

$31.50

10

$31.50

$655,200.00

$655,200.00

10

5(C) Evaluation of Health Plans Offered by Companies

Company Name:

Arbitech, LLC

County:

Total Number of Full-Time Employees: 54

Average Hourly Wage per Employee $38.61

Average Annual Wage per Employee (implied) $80,308.80

COST OF HELATH INSURANCE

Annual Health Insurance Premium Cost: $17,945.58

Percentage of Premium Covered by:

Company 74%

Employee 26%

HEALTH INSURANCE PLANS:

Base Health Insurance Plan*:

Deductible - per employee -$

Coinsurance N/A

Out-of-Pocket Maximum per employee 2,500$

Additional Health Insurance Plan*:

Deductible - per employee 1,000$ In Network

Coinsurance 30% / 50% in/out of network

Out-of-Pocket Maximum per employee 5,000$ in network

Additional Health Insurance Plan*:

Deductible - per employee 250$ in network

Coinsurance 20% / 50% in/out of network

Out-of-Pocket Maximum per employee 3,500$ in network

*Note: Please list only "In Network" for deducatble and out of the pocket amounts .

[following requirements outlined in the Affordable Care Act and US Code, including 42 USC Section 18022]

Covered employee's premium not to exceed 9.5% of annual wage 7.9%

ME

C

Annual Out-of-Pocket Maximum not to exceed $9,450 (2024)

$2,500

ME

C

Minimum essential health benefits covered (Company offers PPO):

(A) Ambulatory patient services

(B) Emergency services

(C) Hospitalization

(D) Maternity and newborn care

(E) Mental health/substance use disorder/behavioral health treatment

(F) Prescription drugs

(G) Rehabilitative and habilitative services and devices

(H) Laboratory services

(I) Preventive and wellness services and chronic disease management

(J) Pediatric services, including oral and vision care

No Annual Limits on Essential Health Benefits

Name of person authorized for signature Signature

7/10/2023

Title Date

Generalized Criteria for Essential Health Benefits (EHB)

COO

Clark

UHC Harmony HMO and SignatureValue HMO

Copay $20/$40

PCP/Specialist

11

5(D) Company Information

Company Name:

Arbitech, LLC

County:

Glenn Harrick

Jamie Carwana

Are there any subsidiary or affiliate companies sharing tax liability with the applicant company?

No Yes

If Yes, continue below:

Name Title

Clark

Section 1 - Company Interest List

Directions: Please provide a detailed list of owners and/or members of the company. The Governor’s Office of Economic Development

strives to maintain the highest standards of integrity, and it is vital that the public be confident of our commitment. Accordingly, any

conflict or appearance of a conflict must be avoided. To maintain our integrity and credibility, the applicant is required to provide a

detailed list of owners, members, equity holders and Board members of the company.

(a)

( b)

Jimmy Whalen

CEO

David Walker

CFO

Doug Kari

CLO

Brandon Seedorf

COO

Tj Currens

Senior Account Executive

Jeremy Bailey

Director of Sales

Tom Larsen

President

Jared Kvidera

Senior Account Executive

Kevin Whalen

Senior Account Executive

Stuart Jefferies

Executive Director Sourcing

Greg Flanders

VP of Purchasing

Josh Jackson

Director of E-Commerce

Brian Collins

Senior Account Executive

Senior Account Executive

Controller

Please include any additional details below:

Section 2 - Company Affiliates and/or Subsidiaries

Directions: In order to include affiliates/subsidiaries, under the exemption letter, they must to be added to the Contract. Per standard

practice GOED requires a corporate schematic to understand the exact relationships between the companies. Please populate the

below table to show the exact relationships between the companies and include:

1. The names as they would read on the tax exemption letter.

2. Which entity(ies) will do the hiring?

3. Which entity(ies) will be purchasing the equipment?

Name of Subsidiary or Affiliate Entity, Role and Legal Control Relationship

12

13

WELCOME TO ARBITECH

YOUR PREMIER INDEPENDENT DISTRIBUTOR

14

Our Story

• Founded in 2000 in Laguna Beach, CA

• 150 Employees

o 10 Person Sourcing Team

o 25 Sales and Support reps

o 7 Certified Engineers

• 55,000 sq ft Warehouse

• $20M+ in physical inventory

• 100% channel-focuse

d distributor

• 2022 Revenue of $230M

We Del

iver Results!

15

Executive Leadership

Jimmy Whalen – CEO,

President

David Walker - CFO

Doug Kari - CLO

Stuart Jeffries – Exec

Dir of Sourcing

Jamie Carwana – Sr.

Controller

Jason McCarty – Director

of IT

Bill Cox – Director of Sales

16

Customer Service

Customer Service

• Every salesperson has an ISR rep to help manage client relationships

• We offer a single point of contact, making the customer experience

b

e

tt

e

r

• O

ur goal is to provide the best buying experience

• We are much more efficient than bigger distributors

• Quotes are turned around in hours, not days

• We are problem solvers, with outside the box thinking

• IT Consultants that are vendor agnostic

E

ach ac

count is assigned a dedicated, experienced account team

that is committed to assisting with quotes, answering technology

questions, and offering alternative solutions at competitive

prices. By providing quality products, quickly and efficiently, and

at low, hassle-free prices, Arbitech enables you to win more

business.

17

Stage and Configuration Center

• Config, Flash & Test 60+ servers/day

• Asset tagging

• Custom Imaging

• Software/firmware updates

• Pre-Co

nfigure switches

• Rack

up equipment for deployment or development

• IT Services (customer sends us the gear)

Capabilities

Engineering Services

• Pre/Post Sales engineering support

• Reverse logistics for older assets

• Certified engineers on all major OEM

platforms

18

Customer Success Stories

CDW

• Arbitech was founded on the broker sales of Compaq memory and HDDs in 2000

• This business evolved into full server configurations, networking, storage and other high run rate IT products

• The “Arbitrage Technology” model was born

Synnex

• Not only one of our largest vendors, but also one of our largest clients

• Arbitech acts as a strategic source for select product lines, as well as discontinued, end of life, used/refurb products

Amazon Marketplace

• Our largest active customer

• 2022 Revenue – over $30M

• Pr

imary products : IT networking, headsets, docking stations, document scanners, printers, barcode scanners, consumer electronics

ProSys

• Helped them source constrained HP toner for one of their largest clients, State Farm

• Our procurement team was able find stock overseas, utilizing strategic partnerships

MGM Hotel

• Initial relationship formed with proof-of-concept to virtualize Honeywell NVR servers.

• Mandalay Bay shooting – FBI required replication of 50+ servers in 72 hours.

• Arbitech delivered in 48 hours, cementing our relationship with MGM.

• Velasea formed with authorized OEM partnerships – Lenovo, Nvidia, DELL, NetApp, HPE, Durabook, Evolv, etc.

HID Global

• Matt Williams (former Velasea customer, current Amazon team) requested help sourcing constrained NXP components.

• Upon confirming pricing/availability, Matt introduced us to HID and we were onboarded as a vendor immediately.

• Since we fulfilled 9 separate orders with revenues exceeding $2.4M

Zenitel

• Our main contact at HID referred an industry friend to Velasea to help with constrained components, ironically more NXP chips.

• Upon confirming pricing/availability we were onboarded as a vendor immediately, selling directly to Fideltroniks plant in Poland.

• First order of $725k

19

Our Catalog of Products

20