Prepared by:

Property Tax Division

Utah State Tax Commission

August 1, 2022

Property Tax Division

2021

Annual Statistical

REPORT

UTAH PROPERTY TAX

2021 ANNUAL STATISTICAL REPORT

For

Locally Assessed Real Property

Locally Assessed Personal Property

for tax year 2021

Centrally Assessed Property

Motor Vehicle

Prepared By:

PROPERTY TAX DIVISION

UTAH STATE TAX COMMISSION

210 NORTH 1950 WEST

SALT LAKE CITY, UT 84134

(801) 297-3600

www.propertytax.utah.gov

August 1, 2022

This report provides assessment and property tax collection data

ITEM

2

3

Tax Relief 4

6

7

8

9

10

11

12

13

14

15

16

17

18

29

20

21

22-23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

Table 13 - Property Tax Revenue Paid as Tax Increment by County

46

47

48

TABLE OF CONTENTS

PAGE NUMBER

OVERVIEW

Property Value

Property Taxes

COUNTY SPECIFIC TAXABLE VALUE

Table 2 - Summary Totals Property Taxes Charged All Property in Utah

Table 1 - Total Taxable Value of All Property in Utah

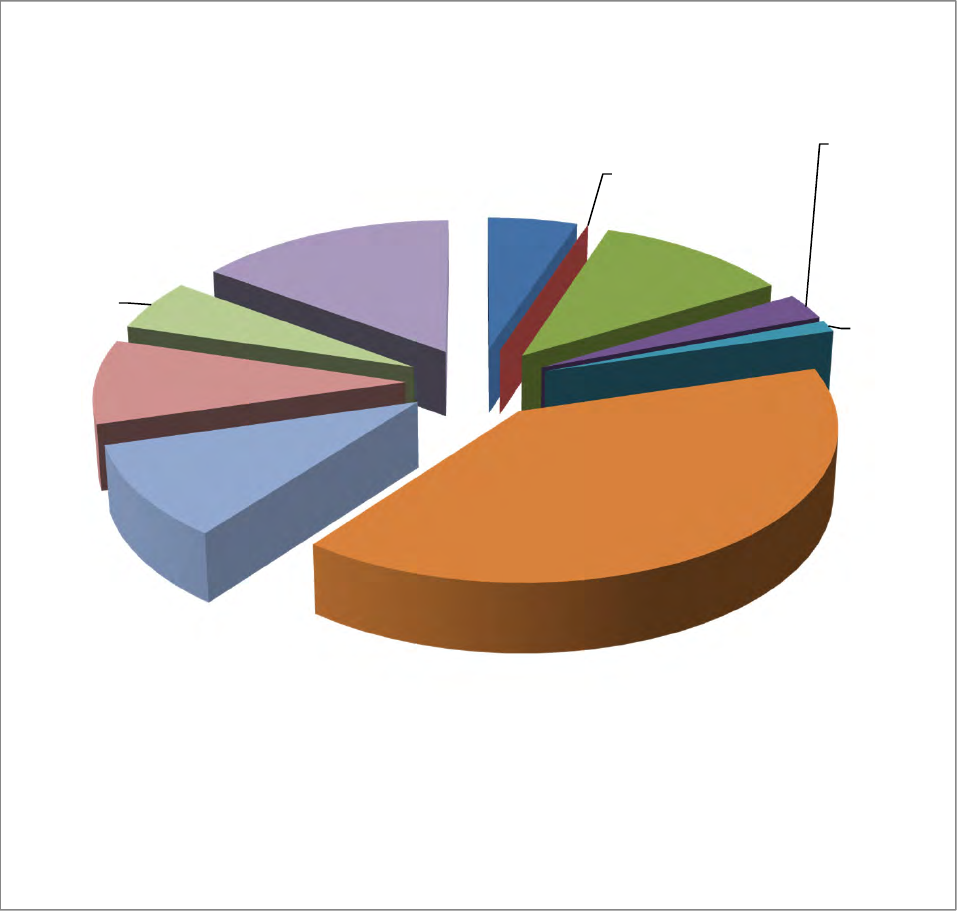

Figure 1 - Taxable Value for All Utah Property by Type

Table 1A & 1B Combined - Taxable Value of Real Property - Land & Buildings

Figure 2 - Taxable Value for Locally Assessed Real Property

Figure 3 - Locally Assessed Taxable Value Ranked by County

Figure 4 - Taxable Value Primary & Other Residential Property by County

Table1C - Personal Property Taxable Value Summary

Table 1D - Summary of Taxable Values for Centrally Assessed Property

Table 1E - Utility Taxable Value

Figure 5 - Taxable Value for Centrally Assessed Utilities

Table 1F - Natural Resource Taxable Value

Figure 6 - Taxable Value for Centrally Assessed Natural Resources

Figure 7 - Centrally Assessed Taxable Values Ranked by County

Table 2E - Taxes Charged Centrally Assessed Natural Resources

Figure 11 - Taxes Charged for Centrally Assessed Natural Resources

Figure 12 - Taxes Charged Local & Centrally Assessed

Table 3 - Property Tax Per Capita & Property Tax as a Percent of Per Capita Income

MISCELLANEOUS PROPERTY TAX INFORMATION

Table 2F - Property Taxes Charged by Entity and County

Figure 13 - Taxes Charged Primary & Other Residential by County

Table 15 - Motor Vehicle Fees Collected

Table 10 - Utah Assessment/Sales Ratio Performance Measures

Table 11 - Report of Tax Relief Granted for 2021

Table 4 - Utah Weighted Average Tax Rates for 2021

Table 5 - Historical Weighted Average Tax Rates by County

Figure 14 - Weighted Average Tax Rates Ranked by County

Table 6 - Estimated Average House Values, Property Taxes and Tax Distributions

Figure 15 - Estimated Average Residential Property Tax Ranked by County

Table 8 - Utah's 25 Largest Centrally Assessed Companies for 2021

Table 14 - Property Tax Increment as a Percentage of Property Taxes Collected

Table 12 - Real Property Parcel Counts

Figure 17 - Statewide Tax Relief - Number of People

Figure 16 - Taxable Value for Utah's 25 Largest Centrally Assessed Companies for 2021

Table 9 - Largest Centrally Assessed Companies for each of Utah's

Table 7 - Utah Average Value, Rate and Tax for 2021

Figure 10 - Taxes Charged for Centrally Assessed Utilities

COUNTY SPECIFIC TAXES CHARGED

Figure 11 - Taxes Charged for Centrally Assessed Natural Resources

Table 2D - Taxes Charged Centrally Assessed Utilties

Figure 9 - Taxes Charged for Locally Assessed Real Property

Table 2A - 2C - Taxes Charged Local Assessed

Figure 8 - Taxes Charged for All Utah Property by Type

Page 1

FMV Taxable Value

Primary Residential 100% 55%

A

ll Other Locally

Assessed Real 100% 100%

Personal Property

(except Manufactured

Homes as Prim. Res,) 100% 100%

Personal Property

(Manufactured Homes

as Prim. Res,) 100% 55%

Centrally Assessed

Property 100% 100%

M

otor

V

e

hi

c

l

e

A

ge

Based and Value

Based Fee-in-Lieu

4

--

FAA (Farmland

Assessment Act) 100%

Varies based on

production value

OVERVIEW

Property Value

With the exception of state-assessed properties, county assessors value all taxable real property and

personal property which are collectively referred to as locally assessed property. The Property Tax Division

of the State Tax Commission values utilities, mines and railroads, which are collectively referred to as

centrally assessed property.

1

Fair market value means the amount at which property would change hands between a willing buyer and a willing seller, neither being

under any compulsion to buy or sell and both having reasonable knowledge of the relevant facts.

2

See Utah Code Annotated Section 59-2-103.

3

See Utah Code Annotated Section 59-2-501 through 516.

4

Age based fees are not based on market value. Numbers in this report are converted to an estimated market value. This value per

Administrative Rule R884-24P-60(M) is calculated by dividing aged based revenues by 0.015.

All taxable property in Utah is valued at 100 percent of its fair market value, based upon its location and

status as of January 1st of each year.

Fair market value less any exemptions equals taxable value

1

. Taxable value is the value against which the

tax rate is applied to compute taxes charged.

Currently, primary residential properties receive a 45% exemption

2

. Primary residential property is any

dwelling used as a person's primary residence, including condominiums, apartments and rental property, and

includes up to one acre of land. The taxable value of all other properties, except some agricultural land

3

, is

assessed at 100% of fair market value.

Utah motor vehicles are charged a fee-in-lieu of property taxes which is identified throughout this report as

"fee-in-lieu."

This report addresses taxable value. The relationship of taxable value to fair market value is illustrated in the

table below.

Page 2

Property Taxes

Class of Property Taxable Value % Market Value %

Primary Residential 202,922,129,406 53.55% 368,949,326,193 67.70%

Commercial 79,863,422,245 21.08% 79,863,422,245 14.66%

Other Real* 47,981,885,621 12.66% 47,981,885,621 8.80%

Personal 20,947,479,612 5.53% 20,947,479,612 3.84%

Natural Resources 9,062,078,070 2.39% 9,062,078,070 1.66%

Utilities 18,136,854,817 4.79% 18,136,854,817 3.33%

Statewide w/o Motor

Vehicle 378,913,849,771 100% 544,941,046,558 100%

Motor Vehicles 14,751,411,006 3.75% 14,751,411,006 2.64%

Statewide with

Motor Vehicle 393,665,260,777 559,692,457,564

Class of Property Taxes Charged %

A

ctual % Effective %

Primary Residential 2,305,170,483 54.37% 1.14% 0.62%

Commercial 909,173,282 21.44% 1.14% 1.14%

Other Real* 453,970,944 10.71% 0.95% 0.95%

Personal 249,349,706 5.88% 1.19% 1.19%

Natural Resources 112,437,576 2.65% 1.24% 1.24%

Utilities 209,457,797 4.94% 1.15% 1.15%

Statewide w/o Motor

Vehicle 4,239,559,788 100% 1.12% 0.78%

Motor Vehicles 221,271,164 5.22% 1.50% 1.50%

Statewide with

Motor Vehicle 4,460,830,952 1.13%

1 Utah Code Annotated 59-2-901 through 926

The following figure summarizes the distribution of property tax revenue in 2019.

Tax rates are expressed as a percentage of taxable value. Rates are set under a process

known as "Truth in Taxation"

1

, which requires public notice and hearings in the event a taxing

entity plans to increase its property tax revenues above the previous year's revenue, exclusive

of revenue from new growth.

The following table summarizes statewide taxable value and statewide market value by class

of property.

Value

The following table summarizes taxes charged and average tax rates by class of property.

Effective tax rates are a percentage of fair market value.

Taxes Charged Tax Rates

*Other Real includes Agricultural Land assessed under the Farmland Assessment Act (FAA), and is included in the FAA Taxable Value.

0% 10% 20% 30% 40% 50% 60%

SpecialDistricts

Cities&Towns

County

Schools

12%

13%

18%

57%

Page 3

Tax Relief

Relief Type # of Recipients % Of Total

Active Duty Armed

Forces 141 0.36%

Veterans 24,436 61.88%

Blind 694 1.76%

Home Owner

Credit* 9,515 24.10%

Indigent Abatemen

t

4,703 11.91%

Statewide 39,489 100.00%

1,377,413

214,955,065,420

517,921

441,088

45,858

94.15%

Tax relief is administered by county governments. About 25% percent of tax relief is state funded through

the "Circuit Breaker" Program. County government funds tax relief to the Active duty, veterans with a

disability, blind and indigent. Also, a portion of the Circuit Breaker Program is funded by county

government.

The following table summarizes the number of recipients in each property tax relief category.

Tax Relief

Miscellaneous Statistics

Number of locally assessed taxable real property parcels

*Homeowners credit is the State reimbursed portion of the Circuit Breaker. Previous year reports included the Renters Credit portion.

Information is from Table 10.

Taxable value of locally assessed non-commercial real property

parcels

Average home sale price (Metropolitan counties)

1

Average home sale price (Non-metropolitan counties)

2

Per capita income

3

Five year statewide average collection rate

4

1Metropolitan counties include Davis, Salt Lake, Utah, Washington and Weber

2

Non-Metropolitan counties all other excluding Davis, Salt Lake, Utah, Washington and Weber

3

Average per capita personal income for 2020 forecast: U.S. Department of Commerence, Bureau of Economic Analysis

4

Percent of taxes charged that are collected. Fee-in-lieu revenues are not included in the calculation of the collection rate

Page 4

COUNTY

SPECIFIC

TAXABLE

VALUE

COUNTY

TOTAL LOCALLY

ASSESSED REAL

PROPERTY

1

% OF

VALUE

TOTAL LOCALLY

ASSESSED

PERSONAL

PROPERTY

1

% OF

VALUE

TOTAL

CENTRALLY

ASSESSED

2

% OF

VALUE

TOTAL OF LOCAL &

CENTRAL

ASSESSMENT

BEAVER 606,920,702 32.53% 541,145,841 29.01% 717,472,216 38.46% 1,865,538,759

BOX ELDER 4,178,999,346 67.40% 732,495,303 11.81% 1,288,774,468 20.79% 6,200,269,117

CACHE 10,002,578,040 89.53% 717,101,933 6.42% 452,729,116 4.05% 11,172,409,089

CARBON 1,231,645,436 63.41% 82,980,971 4.27% 627,805,099 32.32% 1,942,431,506

DAGGETT 197,983,841 57.16% 3,529,500 1.02% 144,841,287 41.82% 346,354,628

DAVIS 28,537,145,050 88.87% 2,707,978,911 8.43% 866,641,781 2.70% 32,111,765,742

DUCHESNE 1,420,864,225 54.80% 89,529,107 3.45% 1,082,249,364 41.74% 2,592,642,696

EMERY 365,141,178 16.22% 133,905,925 5.95% 1,752,032,961 77.83% 2,251,080,064

GARFIELD 659,377,168 87.02% 17,576,983 2.32% 80,739,653 10.66% 757,693,804

GRAND 1,798,107,485 76.54% 63,068,182 2.68% 488,032,700 20.77% 2,349,208,367

IRON 4,444,198,025 72.32% 1,023,887,187 16.66% 677,509,059 11.02% 6,145,594,271

JUAB 836,163,314 57.35% 58,870,190 4.04% 562,868,824 38.61% 1,457,902,328

KANE 1,674,609,239 93.23% 54,461,386 3.03% 67,209,997 3.74% 1,796,280,622

MILLARD 846,986,199 33.18% 229,274,166 8.98% 1,476,670,124 57.84% 2,552,930,489

MORGAN 1,243,163,242 79.95% 54,635,543 3.51% 257,131,935 16.54% 1,554,930,720

PIUTE 132,129,955 83.23% 863,536 0.54% 25,762,417 16.23% 158,755,908

RICH 1,243,773,341 84.44% 88,515,000 6.01% 140,697,502 9.55% 1,472,985,843

SALT LAKE 125,791,280,109 88.23% 8,521,693,578 5.98% 8,251,968,719 5.79% 142,564,942,406

SAN JUAN 536,839,753 56.94% 83,096,296 8.81% 322,928,052 34.25% 942,864,101

SANPETE 1,732,312,655 90.76% 50,087,911 2.62% 126,188,532 6.61% 1,908,589,098

SEVIER 1,463,632,654 75.17% 115,121,943 5.91% 368,424,853 18.92% 1,947,179,450

SUMMIT 25,490,347,584 96.74% 307,513,088 1.17% 552,621,502 2.10% 26,350,482,174

TOOELE 4,920,067,007 80.09% 295,493,847 4.81% 927,362,068 15.10% 6,142,922,922

UINTAH 1,874,463,047 47.28% 111,732,233 2.82% 1,978,339,827 49.90% 3,964,535,107

UTAH 54,931,764,352 91.84% 2,644,958,061 4.42% 2,237,314,748 3.74% 59,814,037,161

WASATCH 8,204,697,142 97.24% 89,154,648 1.06% 143,453,006 1.70% 8,437,304,796

WASHINGTON 23,828,037,902 94.93% 614,207,834 2.45% 657,415,800 2.62% 25,099,661,536

WAYNE 416,963,984 93.01% 12,065,825 2.69% 19,266,809 4.30% 448,296,618

WEBER 22,157,245,297 90.20% 1,502,534,684 6.12% 904,480,468 3.68% 24,564,260,449

STATEWIDE 330,767,437,272

87.29%

20,947,479,612

5.53%

27,198,932,887

7.18%

378,913,849,771

2

The sum of all centrally assessed property (Table 1D).

TABLE 1

TOTAL TAXABLE VALUE OF ALL PROPERTY IN UTAH FOR 2021

Numbers based upon year-end data from the TC-233b Reports received from each county.

Page 6

TAXABLE VALUE FOR ALL UTAH PROPERTY BY TYPE FOR 2021

FIGURE 1

RealProperty

(330.76)

87.29%

PersonalProperty

(20.94)

5.53%

Utilities(18.13)

4.79%

NaturalResources

(9.06)

2.39%

ValueinBillionsof Dollars

Page 7

FAA

PRIMARY NON-PRIMARY COMMERCIAL LAND & VACANT LAND TOTAL REAL

COUNTY RESIDENTIAL RESIDENTIAL & INDUSTRIAL BUILDINGS NON FAA PROPERTY

BEAVER 231,225,122 96,367,997 98,445,666 110,330,473 70,551,444 606,920,702

BOX ELDER 2,826,605,458 58,552,086 984,051,273 138,173,013 171,617,516 4,178,999,346

CACHE 6,837,388,775 398,029,090 2,166,416,710 124,486,940 476,256,525 10,002,578,040

CARBON 665,223,484 149,513,510 348,547,444 7,549,631 60,811,367 1,231,645,436

DAGGETT 34,622,792 122,002,245 18,303,604 3,170,656 19,884,544 197,983,841

DAVIS 22,319,786,205 290,738,916 5,274,334,844 18,973,327 633,311,758 28,537,145,050

DUCHESNE 641,470,535 253,213,085 201,453,900 40,084,030 284,642,675 1,420,864,225

EMERY 232,885,586 30,613,366 67,635,511 12,023,012 21,983,703 365,141,178

GARFIELD 153,291,295 237,440,412 151,712,543 17,470,798 99,462,120 659,377,168

GRAND 555,112,748 406,699,161 719,902,349 7,855,072 108,538,155 1,798,107,485

IRON 2,471,250,365 731,910,135 758,915,570 98,624,965 383,496,990 4,444,198,025

JUAB 540,555,922 71,373,312 193,107,839 23,337,128 7,789,113 836,163,314

KANE 360,434,088 826,901,215 258,785,317 4,393,461 224,095,158 1,674,609,239

MILLARD 404,814,887 50,127,677 205,237,347 129,996,834 56,809,454 846,986,199

MORGAN 950,068,960 82,204,897 106,317,125 24,909,564 79,662,696 1,243,163,242

PIUTE 48,685,030 43,077,970 10,227,795 18,948,385 11,190,775 132,129,955

RICH 101,242,928 875,753,093 77,202,054 14,139,728 175,435,538 1,243,773,341

SALT LAKE 80,546,118,319 2,605,755,000 42,569,687,450 69,577,740 141,600 125,791,280,109

SAN JUAN 284,690,000 59,651,730 96,187,112 13,277,374 83,033,537 536,839,753

SANPETE 1,034,214,915 340,997,806 126,798,121 59,248,488 171,053,325 1,732,312,655

SEVIER 854,209,011 155,923,341 325,789,828 31,844,423 95,866,051 1,463,632,654

SUMMIT 7,326,030,649 15,774,174,366 2,190,270,066 68,385,120 131,487,383 25,490,347,584

TOOELE 3,651,563,280 160,965,624 912,750,814 33,151,769 161,635,520 4,920,067,007

UINTAH 1,135,014,193 51,328,145 512,528,621 46,695,128 128,896,960 1,874,463,047

UTAH 37,195,680,879 577,664,760 12,575,776,703 149,862,434 4,432,779,576 54,931,764,352

WASATCH 3,139,569,306 4,068,570,098 412,563,130 42,968,398 541,026,210 8,204,697,142

WASHINGTON 12,684,375,686 5,763,134,460 3,622,545,018 23,814,262 1,734,168,476 23,828,037,902

WAYNE 116,362,068 145,970,329 66,895,850 15,154,656 72,581,081 416,963,984

WEBER

15

,

579

,

636

,

920

1

,

520

,

295

,

781

4

,

811

,

032

,

641

100

,

236

,

385

146

,

043

,

570

22,157,245,297

STATEWIDE 202,922,129,406 35,948,949,607 79,863,422,245 1,448,683,194 10,584,252,820 330,767,437,272

TABLE 1A

(Prior to 2019, Table 1A and 1B were separate tables, they are now combined into this single table.)

TAXABLE VALUE OF REAL PROPERTY FOR 2021

1

Numbers based upon year-end data from the TC-233B Reports received from each county.

LAND & BUILDINGS

1

Page 8

FIGURE 2

TAXABLE VALUE FOR 2021

LOCALLY ASSESSED REAL PROPERTY

PrimaryResidential

(202.92)

61.35%

Non‐Primary

Residential

(35.94)

10.87%

Commercial&

Industrial(79.86)

24.14%

FAA/NonFAA

(12.03)

3.64%

Value in Billions of Dollars

Page 9

FIGURE 3

LOCALLY ASSESSED REAL TAXABLE VALUE RANKED BY

COUNTY FOR 2021

1

1

Numbers based upon year-end data from the TC-233B Reports received from each county.

54.93

28.54

25.49

23.83

22.16

10.00

8.20

4.92

4.44

4.18

1.87

1.80

1.73

1.67

1.46

1.42

1.24

1.24

1.23

0.85

0.84

0.66

0.61

0.54

0.42

0.37

0.20

0.13

0 20406080100

SALTLAKE

UTAH

DAVIS

SUMMIT

WASHINGTON

WEBER

CACHE

WASATCH

TOOELE

IRON

BOXELDER

UINTAH

GRAND

SANPETE

KANE

SEVIER

DUCHESNE

RICH

MORGAN

CARBON

MILLARD

JUAB

GARFIELD

BEAVER

SANJUAN

WAYNE

EMERY

DAGGETT

PIUTE

Taxable Value in Billions of Dollars

Page 10

FIGURE 4

TAXABLE VALUE COMPARISON OF

BY COUNTY FOR 2021

PRIMARY & SECONDARY RESIDENTIAL PROPERTY

0% 20% 40% 60% 80% 100%

WEBER

WAYNE

WASHINGTON

WASATCH

UTAH

UINTAH

TOOELE

SUMMIT

SEVIER

SANPETE

SANJUAN

SALTLAKE

RICH

PIUTE

MORGAN

MILLARD

KANE

JUAB

IRON

GRAND

GARFIELD

EMERY

DUCHESNE

DAVIS

DAGGETT

CARBON

CACHE

BOXELDER

BEAVER

Primary Non‐Primary

Page 11

MANUFACTURED MANUFACTURED TOTAL

HOMES HOMES BUSINESS PERSONAL

COUNTY PRIMARY USE NON PRIMARY PERSONAL

1

SCME

3

PROPERTY

2

BEAVER 344,710 186,345 540,614,786 0 541,145,841

BOX ELDER 2,413,557 0 730,081,746 0 732,495,303

CACHE 13,467,556 0 703,634,377 0 717,101,933

CARBON 3,222,573 1,764,614 77,536,050 457,734 82,980,971

DAGGETT 211,125 714,625 2,603,750 0 3,529,500

DAVIS 49,492,597 439,852 2,658,046,462 0 2,707,978,911

DUCHESNE 1,455,566 1,780,568 86,292,973 0 89,529,107

EMERY 2,049,256 296,616 131,560,053 0 133,905,925

GARFIELD 178,575 120,000 17,278,408 0 17,576,983

GRAND 4,064,023 31,405 58,972,754 0 63,068,182

IRON 0 0 1,023,887,187 0 1,023,887,187

JUAB 0 0 58,870,190 0 58,870,190

KANE 275,689 15,508 54,170,189 0 54,461,386

MILLARD 0 0 229,274,166 0 229,274,166

MORGAN 723,837 5,000 53,906,706 0 54,635,543

PIUTE 48,504 84,606 730,426 0 863,536

RICH 159,450 88,355,550 0 0 88,515,000

SALT LAKE 49,333,742 10,983,594 8,458,257,949 3,118,293 8,521,693,578

SAN JUAN 557,225 649,220 81,889,851 0 83,096,296

SANPETE 548,098 46,984 49,492,829 0 50,087,911

SEVIER 617,148 204,966 114,299,829 0 115,121,943

SUMMIT 0 0 307,513,088 0 307,513,088

TOOELE 6,435,601 0 289,058,246 0 295,493,847

UINTAH 2,421,812 146,535 109,163,886 0 111,732,233

UTAH 17,185,061 0 2,621,887,490 5,885,510 2,644,958,061

WASATCH 1,858,605 1,339,541 85,956,502 0 89,154,648

WASHINGTON 9,037,756 3,008,203 602,161,875 0 614,207,834

WAYNE 80,560 3,000 11,982,265 0 12,065,825

WEBER 60,628,351 0 1,441,906,333 0 1,502,534,684

STATEWIDE 226,810,977 110,176,732 20,601,030,366 9,461,537 20,947,479,612

3

Semiconductor Manufacturing equipment is microchips and integrated circuits. SCME that is categorized as personal property assessed by the

county assessor is assessed and charged property tax but the value is not included in the certified tax rate calculation per legislation.

TABLE 1C

SUMMARY OF PERSONAL PROPERTY TAXABLE VALUE FOR 2021

1

The sum of all other personal property.

2

The sum of manufactured homes, machinery and fixtures and other personal property.

Page 12

TOTAL TOTAL

TOTAL NATURAL CENTRALLY

COUNTY UTILITIES

1

RESOURCES

2

ASSESSED

3

BEAVER 618,524,816 98,947,400 717,472,216

BOX ELDER 1,023,900,449 264,874,019 1,288,774,468

CACHE 404,448,129 48,280,987 452,729,116

CARBON 327,728,748 300,076,351 627,805,099

DAGGETT 133,563,620 11,277,667 144,841,287

DAVIS 805,653,318 60,988,463 866,641,781

DUCHESNE 200,345,879 881,903,485 1,082,249,364

EMERY 1,665,453,234 86,579,727 1,752,032,961

GARFIELD 66,873,998 13,865,655 80,739,653

GRAND 370,635,508 117,397,192 488,032,700

IRON 530,428,263 147,080,796 677,509,059

JUAB 481,979,992 80,888,832 562,868,824

KANE 50,818,395 16,391,602 67,209,997

MILLARD 1,088,683,068 387,987,056 1,476,670,124

MORGAN 232,505,423 24,626,512 257,131,935

PIUTE 22,541,756 3,220,661 25,762,417

RICH 140,086,644 610,858 140,697,502

SALT LAKE 4,642,243,265 3,609,725,454 8,251,968,719

SAN JUAN 172,983,472 149,944,580 322,928,052

SANPETE 75,640,202 50,548,330 126,188,532

SEVIER 158,924,412 209,500,441 368,424,853

SUMMIT 478,716,809 73,904,693 552,621,502

TOOELE 586,886,788 340,475,280 927,362,068

UINTAH 459,491,855 1,518,847,972 1,978,339,827

UTAH 1,983,473,762 253,840,986 2,237,314,748

WASATCH 102,883,837 40,569,169 143,453,006

WASHINGTON 617,438,946 39,976,854 657,415,800

WAYNE 16,742,725 2,524,084 19,266,809

WEBER 677,257,504 227,222,964 904,480,468

STATEWIDE 18,136,854,817 9,062,078,070 27,198,932,887

Numbers based upon year-end data from the TC-233B Reports received from each county.

1

These values are detailed in Table 1E.

2

These values are detailed in Table 1F.

3

Sum of "Utilities" and "Natural Resources" columns.

TABLE 1D

SUMMARY OF TAXABLE VALUES FOR CENTRALLY ASSESSED

PROPERTY BY THE UTAH STATE TAX COMMISSION

FOR CALENDAR YEAR 2021

Page 13

GROUND ELECTRIC ELECTRIC ELECTRIC GAS GAS LIQUID TELE- TOTAL

COUNTY AIR CARRIER ACCESS RAILROAD GENERATION RURAL UTILITY UTILITY PIPELINE PIPELINE COMM. UTILITIES

2

BEAVER 74,393 0 42,735,110 279,779,045 0 180,416,507 3,841,450 68,986,236 25,319,088 17,372,987 618,524,816

BOX ELDER 29,017 0 217,459,066 97,494,711 1,256,308 219,373,077 37,337,503 348,518,881 34,407,499 68,024,387 1,023,900,449

CACHE 607,555 0 63,722,855 0 0 114,888,060 95,225,929 73,430,582 0 56,573,148 404,448,129

CARBON 14,806 0 124,243,767 0 0 80,568,933 13,260,229 83,859,926 0 25,781,087 327,728,748

DAGGETT 0 0 0 0 2,422,617 640,119 211,883 110,139,910 15,414,835 4,734,256 133,563,620

DAVIS 98,912 443,513 114,863,402 0 0 244,383,807 191,397,860 20,578,625 102,583,198 131,304,001 805,653,318

DUCHESNE 1,606 0 28,204 0 35,812,804 22,228,613 14,515,964 45,370,414 15,650,722 66,737,552 200,345,879

EMERY 0 0 61,421,801 0 0 1,576,424,471 3,347,409 4,200,860 0 20,058,693 1,665,453,234

GARFIELD 3,023 0 0 0 23,717,615 8,770,597 3,745,070 0 0 30,637,693 66,873,998

GRAND 782,996 0 109,019,173 0 0 39,155,428 6,388,875 21,630,730 169,531,127 24,127,179 370,635,508

IRON 4,637,698 0 107,601,664 0 14,350,572 173,278,283 34,001,780 58,623,007 80,262,376 57,672,883 530,428,263

JUAB 7,249 0 88,474,564 0 192,402 304,810,103 1,236,771 42,560,253 26,093,279 18,605,371 481,979,992

KANE 40,016 0 0 0 26,004,033 3,298,168 0 0 0 21,476,178 50,818,395

MILLARD 5,678 0 94,645,422 129,820,595 2,407,463 656,314,888 6,801,286 100,453,404 61,123,103 37,111,229 1,088,683,068

MORGAN 2,839 0 41,531,665 0 0 24,353,853 5,302,195 37,586,324 112,669,907 11,058,640 232,505,423

PIUTE 0 0 0 0 945,618 16,076,332 3,193,666 0 0 2,326,140 22,541,756

RICH 0 0 0 0 0 29,753,700 477,235 76,187,196 25,782,686 7,885,827 140,086,644

SALT LAKE 859,781,592 0 304,214,076 0 0 1,355,579,514 715,704,368 79,172,469 20,943,377 1,306,847,869 4,642,243,265

SAN JUAN 498,075 0 0 0 3,764,356 65,556,162 2,000,072 22,435,775 62,447,707 16,281,325 172,983,472

SANPETE 20,912 0 0 0 0 32,587,644 15,538,847 4,598,530 0 22,894,269 75,640,202

SEVIER 8,085 0 0 0 1,869,715 122,484,165 11,411,664 7,291 0 23,143,492 158,924,412

SUMMIT 28,953 0 67,845,293 0 1,356,365 151,623,659 41,432,999 78,860,984 64,426,302 73,142,254 478,716,809

TOOELE 56,679 0 204,700,548 0 2,045,616 226,912,898 47,379,054 44,311 44,483,617 61,264,065 586,886,788

UINTAH 1,811,299 0 0 0 14,892,645 139,378,836 16,032,195 143,480,423 84,601,357 59,295,100 459,491,855

UTAH 20,006,096 0 240,096,471 0 0 994,238,059 314,282,491 130,052,335 0 284,798,310 1,983,473,762

WASATCH 1,493,066 0 8,347,791 0 1,136,100 43,711,349 22,326,197 261,596 1,750,963 23,856,775 102,883,837

WASHINGTON 41,530,444 0 10,000 0 80,240,745 170,008,086 102,681,271 83,698,226 37,672,693 101,597,481 617,438,946

WAYNE 0 0 0 0 7,531,454 6,477 0 0 0 9,204,794 16,742,725

WEBER 3,439,076 2,966,834 159,376,742 0 0 246,846,247 127,203,124 242 6,941,054 130,484,185 677,257,504

STATEWIDE 934,980,065 3,410,347 2,050,337,614 507,094,351 219,946,428 7,243,668,035 1,836,277,387 1,634,738,530 992,104,890 2,714,297,170 18,136,854,817

2

These "Total Utilities" numbers are included in Table 1D.

TABLE 1E

UTILITY TAXABLE VALUES FOR PROPERTY ASSESSED BY THE

STATE TAX COMMISSION FOR CALENDAR YEAR 2021

1

1

Numbers based upon year-end data from the TC-233B Reports received from each county.

Page 14

FIGURE 5

TAXABLE VALUE FOR 2021

CENTRALLY ASSESSED UTILITIES

AirCarrier,

(.93)

5.16%

GroundAccess

(.03)

.02%

Railroad,

(2.0)

11.30%

ElectricGeneration

(.50)

2.80%

ElectricRural

(.21)

1.21%

ElectricUtility

(7.24)

39.94%

GasUtlility

(1.83)

10.12%

GasPipeline

(1.63)

9.01%

LiquidPipeline

(.99)

5.47%

Telecommunications

(2.74)

14.97%

Value in Millions of Dollars

Page 15

TOTAL

COAL O & G O & G O & G METAL LAND NON-METAL SAND & NATURAL

COUNTY COAL LOAD-OUT GATHERING PRODUCTION DISPOSAL MINING ONLY MINING GRAVEL URANIUM RESOURCE

2

.

BEAVER 0000071,939,706 2,000,273 24,994,512 12,909 0 98,947,400

BOX ELDER 0000007,669,313 51,490,850 205,713,856 0 264,874,019

CACHE 0000001,496,806 12,175,258 34,608,923 0 48,280,987

CARBON 109,796,658 11,918,795 11,544,614 149,756,711 0 0 4,751,049 12,038,302 270,222 0 300,076,351

DAGGETT 0 0 0 10,475,517 0 0 11,704 790,446 0 0 11,277,667

DAVIS 0000009,666,164 0 51,322,299 0 60,988,463

DUCHESNE 0 0 149,262,623 536,914,404 190,430,091 0 204,285 315,663 4,776,419 0 881,903,485

EMERY 47,546,642 8,893,310 68,821 23,673,438 0 0 2,165,475 1,451,813 2,780,228 0 86,579,727

GARFIELD 0 0 0 4,248,826 0 1,407,285 338,401 0 1,278,873 6,592,270 13,865,655

GRAND 0 0 2,827,558 17,242,403 1,837,980 19,360 261,859 95,171,644 36,388 0 117,397,192

IRON 00000134,960,600 1,858,883 48,746 10,212,567 0 147,080,796

JUAB 1,447,904 0 0 23,821 0 10,318,101 1,033,513 43,992,276 24,073,217 0 80,888,832

KANE 9,496,896 00000563,051 274,259 6,057,396 0 16,391,602

MILLARD 0000036,125,233 112,793 349,752,989 1,996,041 0 387,987,056

MORGAN 0000003,612,118 13,985,453 7,028,941 0 24,626,512

PIUTE 000001,332,199 1,226,747 661,715 0 0 3,220,661

RICH 000000267,293 0 343,565 0 610,858

SALT LAKE 0 0 0 970,923 0 3,287,630,990 34,819,188 4,953,961 281,350,392 0 3,609,725,454

SAN JUAN 0 0 4,621,122 90,204,386 290,208 19,086,004 350,985 865,425 7,867,107 26,659,343 149,944,580

SANPETE 0 0 0 7,937,591 0 0 229,742 35,190,595 7,190,402 0 50,548,330

SEVIER 100,335,518 0 0 72,238,243 0 0 319,171 33,554,427 3,053,082 0 209,500,441

SUMMIT 0 0 213,908 32,086,881 0 0 3,486,689 34,754,556 3,362,659 0 73,904,693

TOOELE 00000181,611,211 3,881,113 125,984,036 28,998,920 0 340,475,280

UINTAH 0 0 423,835,002 832,823,502 7,509,282 0 1,526,051 242,370,099 10,784,036 0 1,518,847,972

UTAH 0 0 0 31,406 0 3,025,195 28,452,787 628,751 221,702,847 0 253,840,986

WASATCH 00000010,296,147 421,758 29,851,264 0 40,569,169

WASHINGTON 0000063,666,473 47,378 36,262,997 0 39,976,854

WAYNE 00000403,876 301,661 0 1,818,547 0 2,524,084

WEBER 000000937,162 221,275,151 5,010,651 0 227,222,964

STATEWIDE 268,623,618 20,812,105 592,373,648 1,778,628,052 200,067,561 3,747,859,766 125,506,896 1,307,190,063 987,764,748 33,251,613 9,062,078,070

2

These "Total Natural Resource" numbers are included in Table 1D.

TABLE 1F

NATURAL RESOURCE TAXABLE VALUES FOR PROPERTY ASSESSED

BY THE STATE TAX COMMISSION FOR 2021

1

1

Numbers based upon year-end data from the TC-233B Reports received from each county.

Page 16

FIGURE 6

TAXABLE VALUE FOR 2021 CENTRALLY ASSESSED NATURAL RESOURCES

CoalMines

(2.6)

2.96%

CoalLoad‐Out

(.020)

0.23%

OIL&GASGathering

(.59)

6.54%

OIL&GASProduction,

(1.77)

19.63%

OIL&GASDisposal

(.20)

2.21%

MetaliferousMining,

(3.74)

41.36%

LandOnly

(.12)

1.38%

Non‐MetalMining(1.30)

14.42%

Sand&Gravel

(.98)

10.90%

Uranium

(.033)

.37%

Value in Billions of Dollars

Page 17

FIGURE 7

CENTRALLY ASSESSED TAXABLE VALUES RANKED

BY COUNTY FOR 2021

8,251,968,719

2,237,314,748

1,978,339,827

1,752,032,961

1,476,670,124

1,288,774,468

1,082,249,364

927,362,068

904,480,468

866,641,781

717,472,216

677,509,059

657,415,800

627,805,099

562,868,824

552,621,502

488,032,700

452,729,116

368,424,853

322,928,052

257,131,935

144,841,287

143,453,006

140,697,502

126,188,532

80,739,653

67,209,997

25,762,417

19,266,809

0 2,000,000,000 4,000,000,000 6,000,000,000 8,000,000,000 10,000,000,000

SALTLAKE

UTAH

UINTAH

EMERY

MILLARD

BOXELDER

DUCHESNE

TOOELE

WEBER

DAVIS

BEAVER

IRON

WASHINGTON

CARBON

JUAB

SUMMIT

GRAND

CACHE

SEVIER

SANJUAN

MORGAN

DAGGETT

WASATCH

RICH

SANPETE

GARFIELD

KANE

PIUTE

WAYNE

Page 18

TAXES

CHARGED

INFORMATION

TOTAL REAL

PROPERTY

TOTAL PERSONAL

PROPERTY

TOTAL LOCALLY

ASSESSED TOTAL UTILITIES

TOTAL NATURAL

RESOURCES

TOTAL CENTRAL

ASSESSED

TOTAL LOCAL &

CENTRAL ASSESSED

COUNTY

BEAVER 5,445,410 5,100,576 10,545,986 5,692,353 923,576 6,615,929 17,161,914

BOX ELDER 44,827,368 7,871,706 52,699,074 10,151,734 2,740,692 12,892,427 65,591,500

CACHE 101,010,703 7,896,833 108,907,536 3,838,453 439,433 4,277,886 113,185,422

CARBON 18,736,984 1,376,204 20,113,188 4,967,794 4,399,548 9,367,341 29,480,530

DAGGETT 1,900,177 35,899 1,936,075 1,179,371 99,195 1,278,566 3,214,641

DAVIS 344,815,892 33,287,808 378,103,700 9,770,995 719,859 10,490,854 388,594,554

DUCHESNE 20,405,398 1,271,595 21,676,993 2,844,819 12,033,731 14,878,550 36,555,543

EMERY 5,830,120 1,486,851 7,316,971 25,320,682 1,181,475 26,502,157 33,819,128

GARFIELD 5,759,184 155,211 5,914,394 576,564 108,493 685,058 6,599,452

GRAND 19,617,996 706,125 20,324,121 3,838,024 1,205,200 5,043,223 25,367,344

IRON 40,515,724 10,244,175 50,759,899 4,671,783 1,318,553 5,990,336 56,750,235

JUAB 9,978,350 709,808 10,688,158 5,425,874 897,428 6,323,302 17,011,460

KANE 15,926,237 531,076 16,457,312 487,053 166,591 653,644 17,110,957

MILLARD 10,082,776 2,523,442 12,606,218 12,270,841 4,217,620 16,488,461 29,094,680

MORGAN 16,027,395 696,411 16,723,806 2,873,592 308,621 3,182,213 19,906,020

PIUTE 1,264,866 7,899 1,272,764 200,763 26,927 227,690 1,500,454

RICH 7,135,917 579,566 7,715,482 845,948 3,427 849,375 8,564,857

SALT LAKE 1,531,320,460 108,309,421 1,639,629,881 56,168,243 46,875,489 103,043,732 1,742,673,612

SAN JUAN 7,376,162 1,102,245 8,478,407 2,314,020 1,921,530 4,235,549 12,713,956

SANPETE 21,019,655 692,158 21,711,814 901,875 647,683 1,549,558 23,261,372

SEVIER 18,334,118 1,461,001 19,795,119 1,847,741 2,339,105 4,186,846 23,981,965

SUMMIT 191,968,760 2,433,513 194,402,273 3,996,328 688,378 4,684,706 199,086,979

TOOELE 67,990,870 4,165,830 72,156,700 7,579,519 4,400,053 11,979,572 84,136,271

UINTAH 24,250,163 1,410,137 25,660,299 5,765,880 18,907,614 24,673,494 50,333,793

UTAH 565,418,334 28,003,797 593,422,131 21,640,896 2,630,525 24,271,421 617,693,552

WASATCH 100,956,603 1,136,880 102,093,483 1,248,725 518,963 1,767,688 103,861,170

WASHINGTON 210,791,033 5,793,657 216,584,690 5,142,683 359,142 5,501,824 222,086,514

WAYNE 2,728,416 78,639 2,807,055 110,332 16,346 126,679 2,933,734

WEBER 256,879,637 20,281,246 277,160,884 7,784,913 2,342,380 10,127,293 287,288,176

STATEWIDE 3,668,314,709 249,349,706 3,917,664,415 209,457,797 112,437,576 321,895,373 4,239,559,788

TABLE 2

SUMMARY TOTAL PROPERTY TAXES CHARGED AGAINST EACH CLASS OF PROPERTY FOR 2021

Taxes charged calculated by multiplying the 233b year-end post BOE values by the 2020 approved tax rates by taxing area.

Includes revenue distributed or charged against value in an RDA

Page 20

RealProperty

(3,668.31)

86.53%

PersonalProperty

(249.34)

5.88%

Utilities

(209.45)

4.94%

NaturalResources

(112.43)

2.65%

TaxesinMillionsofDollars

PRIMARY NON PRIMARY COMMERCIAL NON FAA & FAA LAND & TOTAL REAL

COUNTY RESIDENTIAL RESIDENTIAL INDUSTRIAL UNIMPROVED BUILDINGS PROPERTY

BEAVER 2,084,065 825,890 908,850 605,235 1,021,370 5,445,410

BOX ELDER 30,603,860 618,020 10,463,188 1,780,454 1,361,847 44,827,368

CACHE 69,038,497 3,830,152 22,228,016 4,716,175 1,197,862 101,010,703

CARBON 10,113,907 2,222,462 5,370,582 917,599 112,435 18,736,984

DAGGETT 333,128 1,176,077 173,017 188,913 29,042 1,900,177

DAVIS 269,344,088 3,491,359 64,172,121 7,583,800 224,524 344,815,892

DUCHESNE 9,365,493 3,531,116 3,021,591 3,933,328 553,870 20,405,398

EMERY 3,749,981 462,657 1,123,895 328,512 165,075 5,830,120

GARFIELD 1,397,806 2,067,416 1,309,056 840,061 144,845 5,759,184

GRAND 6,068,376 4,461,199 7,804,946 1,200,838 82,635 19,617,996

IRON 22,380,610 6,864,382 6,963,992 3,447,723 859,017 40,515,724

JUAB 6,503,948 843,529 2,276,553 90,838 263,482 9,978,350

KANE 3,659,909 7,599,545 2,524,848 2,101,160 40,775 15,926,237

MILLARD 4,899,964 579,610 2,468,060 663,995 1,471,148 10,082,776

MORGAN 12,281,856 1,023,345 1,383,007 1,032,492 306,695 16,027,395

PIUTE 480,536 405,247 100,584 105,657 172,840 1,264,866

RICH 595,328 5,008,673 452,465 996,813 82,637 7,135,917

SALT LAKE 988,424,892 32,513,158 509,527,308 1,766 853,335 1,531,320,460

SAN JUAN 3,996,248 781,267 1,342,736 1,083,621 172,290 7,376,162

SANPETE 13,096,461 3,681,474 1,676,649 1,884,946 680,126 21,019,655

SEVIER 10,713,703 1,843,723 4,260,532 1,156,474 359,686 18,334,118

SUMMIT 55,183,628 118,772,176 16,558,784 933,470 520,702 191,968,760

TOOELE 50,802,053 2,168,760 12,465,245 2,123,231 431,580 67,990,870

UINTAH 14,594,262 653,152 6,746,810 1,656,581 599,358 24,250,163

UTAH 383,873,755 5,992,779 127,694,223 46,173,567 1,684,009 565,418,334

WASATCH 39,025,895 49,595,250 5,201,957 6,619,209 514,291 100,956,603

WASHINGTON 112,127,091 51,078,453 32,011,587 15,368,922 204,980 210,791,033

WAYNE 764,991 953,380 439,137 472,377 98,532 2,728,416

WEBER 179,666,152 16,168,154 58,503,544 1,508,139 1,033,650 256,879,637

STATEWIDE 2,305,170,483 329,212,403 909,173,282 109,515,898 15,242,643 3,668,314,709

1

Numbers based upon year-end data from the TC233b Reports received from each county.

TABLE 2A

PROPERTY TAXES CHARGED AGAINST EACH CLASS

OF REAL PROPERTY FOR 2021

1

Page 22

MANUFACTURED

HOMES

MANUFACTURED

HOMES BUSINESS TOTAL

PRIMARY NON PERSONAL PERSONAL

COUNTY RESIDENTIAL PRIMARY PROPERTY SCME

3

PROPERTY

BEAVER 3,055 1,756 5,095,765 0 5,100,576

BOX ELDER 27,540 0 7,844,166 0 7,871,706

CACHE 153,842 0 7,742,992 0 7,896,833

CARBON 53,330 28,279 1,286,953 7,641 1,376,204

DAGGETT 2,155 6,966 26,778 0 35,899

DAVIS 623,637 5,533 32,658,638 0 33,287,808

DUCHESNE 20,767 25,858 1,224,970 0 1,271,595

EMERY 28,294 3,265 1,455,292 0 1,486,851

GARFIELD 1,639 1,081 152,491 0 155,211

GRAND 45,743 352 660,030 0 706,125

IRON** 0 0 10,244,175 0 10,244,175

JUAB** 0 0 709,808 0 709,808

KANE** 2,915 144 528,018 0 531,076

MILLARD** 0 0 2,523,442 0 2,523,442

MORGAN 10,111 62 686,237 0 696,411

PIUTE 420 723 6,756 0 7,899

RICH 1,167 578,399 0 0 579,566

SALT LAKE 675,237 139,025 107,457,468 37,690 108,309,421

SAN JUAN 8,223 8,913 1,085,109 0 1,102,245

SANPETE 7,234 589 684,335 0 692,158

SEVIER 9,114 2,786 1,449,101 0 1,461,001

SUMMIT 0 0 2,433,513 0 2,433,513

TOOELE 93,109 0 4,072,721 0 4,165,830

UINTAH 30,227 1,798 1,378,111 0 1,410,137

UTAH 188,012 0 27,759,320 56,465 28,003,797

WASATCH 23,551 16,276 1,097,053 0 1,136,880

WASHINGTON 89,068 27,746 5,676,843 0 5,793,657

WAYNE 543 19 78,077 0 78,639

WEBER 752,285 0 19,528,962 0 20,281,246

STATEWIDE 2,851,218 849,569 245,547,122 101,796 249,349,706

**New Computer system in counties unable to break out manufactured, primary and non primary from personal property.

TABLE 2C

PROPERTY TAXES CHARGED AGAINST EACH CLASS

OF PERSONAL PROPERTY FOR 2021

1

1

Numbers based upon year-end data from the TC233b Reports received from each county.

3

Semiconductor Manufacturing equipment is microchips and integrated circuits. SCME that is categorized as personal property assessed by the

county assessor is assessed and charged property tax but the value is not included in the certified tax rate calculation per legislation.

Page 23

LOCALLY ASSESSED REAL PROPERTY

TAXES CHARGED FOR 2020

FIGURE 9

PrimaryResidential

(2,305.17)

62.84%

Non‐Primary

Residential

(329.21)

8.97%

Commercial&

Industrial

(909.17)

24.78%

FAA/NonFaa

(124.75)

3.40%

Taxes in Millions of Dollars

Page 24

GROUND ELECTRIC ELECTRIC ELECTRIC GAS GAS LIQUID TELE- TOTAL

COUNTY AIR CARRIER ACCESS RAILROAD GENERATION RURAL UTILITY UTILITY PIPELINE PIPELINE COMM. UTILITIES

2

BEAVER 680 0 412,184 2,520,215 0 1,667,888 35,053 664,146 236,556 155,631 5,692,353

BOX ELDER 316 0 2,141,629 933,804 12,033 2,256,406 398,544 3,365,166 337,400 706,436 10,151,734

CACHE 6,400 0 596,082 0 0 1,081,306 940,352 647,663 0 566,650 3,838,453

CARBON 224 0 1,910,147 0 0 1,225,429 201,759 1,239,797 0 390,437 4,967,794

DAGGETT 0 0 0 0 22,369 5,630 1,864 968,681 135,573 45,254 1,179,371

DAVIS 1,181 5,231 1,436,189 0 0 2,978,949 2,313,169 231,406 1,207,563 1,597,306 9,770,995

DUCHESNE 26 0 378 0 509,038 299,821 223,995 608,986 216,767 985,808 2,844,819

EMERY 0 0 860,499 0 0 24,041,285 54,277 57,667 0 306,955 25,320,682

GARFIELD 24 0 0 0 198,121 73,108 31,228 0 0 274,082 576,564

GRAND 8,042 0 1,123,281 0 0 415,386 69,329 223,601 1,744,629 253,757 3,838,024

IRON 42,634 0 941,454 0 121,578 1,516,255 306,007 516,291 705,786 521,779 4,671,783

JUAB 88 0 988,534 0 2,014 3,444,250 13,801 475,143 287,352 214,692 5,425,874

KANE 411 0 0 0 246,218 29,671 0 0 0 210,754 487,053

MILLARD 72 0 1,085,568 1,404,842 26,034 7,474,007 81,154 1,087,461 666,539 445,165 12,270,841

MORGAN 39 0 518,097 0 0 301,471 68,083 460,715 1,384,991 140,196 2,873,592

PIUTE 0 0 0 0 7,905 140,595 29,511 0 0 22,751 200,763

RICH 0 0 0 0 0 174,613 2,997 464,504 158,538 45,297 845,948

SALT LAKE 10,004,519 0 3,624,278 0 0 16,559,768 8,928,158 962,028 271,307 15,818,186 56,168,243

SAN JUAN 6,507 0 0 0 53,006 921,156 27,507 286,249 797,055 222,538 2,314,020

SANPETE 301 0 0 0 0 373,938 192,564 46,841 0 288,231 901,875

SEVIER 105 0 0 0 21,041 1,400,689 141,996 81 0 283,829 1,847,741

SUMMIT 215 0 551,148 0 9,230 1,157,289 310,854 612,263 795,623 559,706 3,996,328

TOOELE 772 0 2,592,132 0 24,875 2,944,696 642,080 616 569,427 804,922 7,579,519

UINTAH 22,771 0 0 0 187,443 1,741,063 206,089 1,789,810 1,059,667 759,037 5,765,880

UTAH 205,692 0 2,663,334 0 0 11,127,705 3,230,699 1,461,920 0 2,951,547 21,640,896

WASATCH 18,841 0 107,283 0 13,294 514,919 275,995 3,329 20,488 294,576 1,248,725

WASHINGTON 360,383 0 77 0 692,653 1,380,541 890,983 640,879 288,460 888,708 5,142,683

WAYNE 0 0 0 0 49,620 43 0 0 0 60,669 110,332

WEBER 42,357 32,812 1,777,139 0 0 2,770,930 1,491,565 3 75,382 1,594,726 7,784,913

STATEWIDE 10,722,601 38,043 23,329,432 4,858,861 2,196,471 88,018,806 21,109,612 16,815,244 10,959,104 31,409,624 209,457,797

TABLE 2D

PROPERTY TAXES CHARGED AGAINST EACH CLASS

OF UTILITIES PROPERTY FOR 2021

1

1

Numbers based upon year-end data from the TC233b Reports received from each county.

Page 25

CENTRALLY ASSESSED UTILITIES

FIGURE 10

TAXES CHARGED FOR 2021

Taxes in Millions of Dollars

AirCarrier

(10.72)

5.12%

GroundAccess

(.038)

.00%

Railroad

(23.32)

11.14%

ElectricGeneration

(4.85)

2.32%

ElectricRural

(2.19)

1.05%

ElectricUtility

(88.01)

42.02%

GasUtlility

(21.10)

10.08%

Gas

Pipeline

(16.81)

8.03%

LiquidPipeline

(10.95)

5.23%

Telecommunications

(31.40)

15.00%

Page 26

TOTAL

COAL O & G O & G O & G METAL LAND NON-METAL SAND & NATURAL

COUNTY COAL LOAD-OUT GATHERING PRODUCTION DISPOSAL MINING ONLY MINING GRAVEL URANIUM RESOURCE

2

BEAVER 0 0 0 0 0 672,133 17,812 233,524 107 0 923,576

BOX ELDER 0 0 0 0 0 0 80,295 493,220 2,167,177 0 2,740,692

CACHE 0 0 0 0 0 0 13,798 106,229 319,406 0 439,433

CARBON 1,594,948 181,392 167,651 2,205,577 0 0 71,126 174,820 4,033 0 4,399,548

DAGGETT 0 0 0 92,132 0 0 111 6,952 0 0 99,195

DAVIS 0 0 0 0 0 0 113,862 0 605,997 0 719,859

DUCHESNE 0 0 2,060,888 7,346,437 2,554,661 0 2,751 4,428 64,566 0 12,033,731

EMERY 639,170 136,020 925 318,528 0 0 29,133 19,517 38,183 0 1,181,475

GARFIELD 0 0 0 33,291 0 10,930 2,638 0 10,432 51,202 108,493

GRAND 0 0 29,028 177,011 18,869 199 2,688 977,032 374 0 1,205,200

IRON 0 0 0 0 0 1,207,353 16,901 413 93,885 0 1,318,553

JUAB 16,157 0 0 270 0 108,122 11,369 490,089 271,421 0 897,428

KANE 84,893 0 0 0 0 0 5,062 2,452 74,185 0 166,591

MILLARD 0 0 0 0 0 412,586 1,220 3,782,229 21,585 0 4,217,620

MORGAN 0 0 0 0 0 0 46,951 170,888 90,782 0 308,621

PIUTE 0 0 0 0 0 11,137 10,258 5,532 0 0 26,927

RICH 0 0 0 0 0 0 1,501 0 1,925 0 3,427

SALT LAKE 0 0 0 11,300 0 43,068,785 428,549 68,697 3,298,158 0 46,875,489

SAN JUAN 0 0 58,970 1,151,137 3,703 243,556 4,508 11,044 101,119 347,492 1,921,530

SANPETE 0 0 0 101,729 0 0 2,714 453,149 90,091 0 647,683

SEVIER 1,117,039 0 0 803,145 0 0 3,549 381,428 33,944 0 2,339,105

SUMMIT 0 0 2,203 394,734 0 0 26,040 238,033 27,368 0 688,378

TOOELE 0 0 0 0 0 2,380,991 49,891 1,587,448 381,724 0 4,400,053

UINTAH 0 0 5,256,349 10,396,409 93,063 0 19,150 3,005,061 137,583 0 18,907,614

UTAH 0 0 0 372 0 34,485 298,605 6,411 2,290,652 0 2,630,525

WASATCH 0 0 0 0 0 0 124,497 4,935 389,531 0 518,963

WASHINGTON 0 0 0 0 0 0 32,177 440 326,525 0 359,142

WAYNE 0 0 0 0 0 2,652 1,948 0 11,746 0 16,346

WEBER 0 0 0 0 0 0 10,160 2,280,905 51,315 0 2,342,380

STATEWIDE 3,452,207 317,412 7,576,014 23,032,071 2,670,296 48,152,930 1,429,265 14,504,874 10,903,815 398,694 112,437,576

TABLE 2E

PROPERTY TAXES CHARGED AGAINST EACH CLASS

1

Numbers based upon year-end data from the TC233b Reports received from each county.

Page 27

FIGURE 11

TAXES CHARGED FOR 2021

CENTRALLY ASSESSED NATURAL RESOURCES

CoalMines

(3.45)

3.07%

CoalLoad‐Out

(.31)

.28%

O&GGathering

(7.57)

6.74%

O&GProduction

(23.03)

20.48%

O&GDisposal

(.26)

2.37%

MetaliferousMining

(48.15)

42.83%

LandOnly

(1.42)

1.27%

Non‐MetalMining

(14.50)

12.90%

Sand&Gravel

(10.90)

9.70%

Uranium

(.39)

.35%

Taxes in Millions of Dollars

Page 28

FIGURE 12

TAXES CHARGED LOCAL AND CENTRALLY ASSESSED FOR 2021

Note: Motor Vehicle Fee-In-Lieu Excluded

1,742,673,612

617,693,552

388,594,554

287,288,176

222,086,514

199,086,979

113,185,422

103,861,170

84,136,271

65,591,500

56,750,235

50,333,793

36,555,543

33,819,128

29,480,530

29,094,680

25,367,344

23,981,965

23,261,372

19,906,020

17,161,914

17,110,957

17,011,460

12,713,956

8,564,857

6,599,452

3,214,641

2,933,734

1,500,454

0 300,000,000600,000,000900,000,0001,200,000,0001,500,000,0001,800,000,0002,100,000,000

SALTLAKE

UTAH

DAVIS

WEBER

WASHINGTON

SUMMIT

CACHE

WASATCH

TOOELE

BOXELDER

IRON

UINTAH

DUCHESNE

EMERY

CARBON

MILLARD

GRAND

SEVIER

SANPETE

MORGAN

BEAVER

KANE

JUAB

SANJUAN

RICH

GARFIELD

DAGGETT

WAYNE

PIUTE

Page 29

FIGURE 13

TAXES CHARGED PRIMARY AND OTHER RESIDENTIAL PROPERTY

BY COUNTY FOR 2021

0% 20% 40% 60% 80% 100%

WEBER

WAYNE

WASHINGTON

WASATCH

UTAH

UINTAH

TOOELE

SUMMIT

SEVIER

SANPETE

SANJUAN

SALTLAKE

RICH

PIUTE

MORGAN

MILLARD

KANE

JUAB

IRON

GRAND

GARFIELD

EMERY

DUCHESNE

DAVIS

DAGGETT

CARBON

CACHE

BOXELDER

BEAVER

Primary Other

Page 30

GENERAL

COUNTY % SCHOOLS %

CITIES &

TOWNS %

SPECIAL

DISTRICTS %

TOTAL

TAXES

CHARGED

2

BEAVER

3,508,865

20%

11,386,322

66%

234,489

1%

2,032,238

12% 17,161,914

BOX ELDER

11,523,785

18%

42,518,930

65%

7,149,660

11%

4,399,125

7% 65,591,500

CACHE

20,312,373

18%

79,041,476

70%

12,871,167

11%

960,407

1% 113,185,423

CARBON

7,070,455

24%

16,425,879

56%

2,100,076

7%

3,884,120

13% 29,480,530

DAGGETT

1,369,233

43%

1,679,684

52%

94,726

3%

70,998

2% 3,214,641

DAVIS

52,281,078

13%

244,843,862

63%

43,556,857

11%

47,912,757

12% 388,594,554

DUCHESNE

8,894,186

24%

23,741,781

65%

1,310,233

4%

2,609,343

7% 36,555,543

EMERY

10,803,657

32%

18,187,498

54%

663,391

2%

4,164,581

12% 33,819,127

GARFIELD

1,095,641

17%

4,791,863

73%

424,670

6%

287,278

4% 6,599,452

GRAND

6,631,958

26%

17,117,830

67%

138,632

1%

1,478,923

6% 25,367,343

IRON

8,909,028

16%

31,866,613

56%

8,687,822

15%

7,286,772

13% 56,750,235

JUAB

3,689,064

22%

11,096,812

65%

602,833

4%

1,622,751

10%

17,011,460

KANE

6,314,367

37%

8,772,494

51%

1,036,413

6%

987,683

6% 17,110,957

MILLARD

9,336,878

32%

17,415,652

60%

665,345

2%

1,676,805

6% 29,094,680

MORGAN

4,167,479

21%

14,639,424

74%

483,073

2%

616,042

3% 19,906,018

PIUTE

523,311

35%

775,446

52%

173,114

12%

28,582

2% 1,500,453

RICH

1,685,831

20%

5,987,540

70%

250,317

3%

641,170

7% 8,564,858

SALT LAKE

285,058,650

16%

880,063,061

51%

307,384,924

18%

270,166,977

16% 1,742,673,612

SAN JUAN

3,255,067

26%

7,141,957

56%

591,064

5%

1,725,868

14% 12,713,956

SANPETE

5,685,294

24%

14,657,808

63%

1,622,843

7%

1,295,426

6% 23,261,371

SEVIER

7,801,461

33%

13,918,657

58%

2,261,848

9%

0

0% 23,981,966

SUMMIT

21,811,837

11%

113,920,832

57%

23,002,140

12%

40,352,168

20% 199,086,977

TOOELE

11,317,546

13%

57,184,409

68%

8,748,961

10%

6,885,355

8%

84,136,271

UINTAH

14,407,506

29%

29,814,409

59%

793,532

2%

5,318,346

11% 50,333,793

UTAH

60,848,844

10%

436,485,138

71%

86,753,885

14%

33,605,685

5% 617,693,552

WASATCH

17,782,215

17%

69,598,622

67%

4,919,960

5%

11,560,373

11% 103,861,170

WASHINGTON

125,377,943

56%

74,938,415

34%

12,269,095

6%

9,501,060

4% 222,086,514

WAYNE

850,610

29%

2,033,829

69%

38,524

1%

10,772

0% 2,933,735

WEBER

62,631,438

22%

152,219,487

53%

32,976,248

11%

39,461,004

14% 287,288,176

STATE WIDE 774,945,600

18%

2,402,265,729

57%

561,805,841

13%

500,542,611

12%

4,239,559,781

TABLE 2F

PROPERTY TAXES CHARGED BY ENTITY AND COUNTY FOR 2021

1

2

Total taxes charged, (excluding uniform fee of 1.5 percent for fee-in-lieu and aged-based vehicles), are the same as appear in Table 2, column 8 of this

report. Differences may be in rounding.

1

Percentages derived from tax rate certification records

Page 31

MISCELLANEOUS

PROPERTY TAX

INFORMATION

2020 2020 POPULATION 2020 PER CAPITA 2020 LOCALLY 2020 PER CAPITA PER CAPITA

PERSONAL INCOME ESTIMATE PERSONAL INCOME

ASSESSED PROPERTY

TAXES PROPERTY TAXES PROPERTY TAX AS % OF

COUNTY (THOUSANDS OF $)

1

(PERSONS)

2

(in $)

3

(in $)

4

(in $)

5

PER CAPITA INCOME

6

BEAVER 274,367 6,710 40,889 8,392,608 1,251 3.06%

BOX ELDER 2,276,646 56,046 40,621 50,052,647 893 2.20%

CACHE 5,363,946 128,289 41,811 104,167,529 812 1.94%

CARBON 832,424 20,463 40,679 17,343,287 848 2.08%

DAGGETT 45,365 950 47,753 1,927,194 2,029 4.25%

DAVIS 17,213,443 355,481 48,423 349,404,026 983 2.03%

DUCHESNE 755,042 19,938 37,869 21,454,379 1,076 2.84%

EMERY 352,194 10,012 35,177 5,524,557 552 1.57%

GARFIELD 201,536 5,051 39,900 5,722,544 1,133 2.84%

GRAND 577,398 9,754 59,196 17,382,111 1,782 3.01%

IRON 1,883,899 54,839 34,353 52,127,853 951 2.77%

JUAB 469,900 12,017 39,103 9,344,044 778 1.99%

KANE 327,282 7,886 41,502 15,774,885 2,000 4.82%

MILLARD 505,581 13,188 38,336 10,407,000 789 2.06%

MORGAN 678,545 12,124 55,967 14,468,125 1,193 2.13%

PIUTE 65,326 1,479 44,169 1,280,188 866 1.96%

RICH 101,419 2,483 40,845 7,081,567 2,852 6.98%

SALT LAKE 64,351,937 1,160,437 55,446 1,567,775,251 1,351 2.44%

SAN JUAN 429,754 15,308 28,074 7,465,767 488 1.74%

SANPETE 946,478 30,939 30,592 21,066,129 681 2.23%

SEVIER 812,000 21,620 37,558 16,467,291 762 2.03%

SUMMIT 6,377,651 42,145 151,326 177,974,554 4,223 2.79%

TOOELE 2,778,055 72,259 38,446 65,879,551 912 2.37%

UINTAH 1,152,102 35,734 32,241 27,308,541 764 2.37%

UTAH 27,354,876 636,235 42,995 520,890,996 819 1.90%

WASATCH 2,031,291 34,091 59,584 78,838,745 2,313 3.88%

WASHINGTON 7,259,617 177,556 40,886 194,195,822 1,094 2.68%

WAYNE 115,018 2,711 42,426 2,662,123 982 2.31%

WEBER 11,373,189 260,213 43,707 257,288,734 989 2.26%

STATEWIDE

156,906,281 3,205,958 45,858

3,629,668,048 1,132 2.47%

TABLE 3

PROPERTY TAX PER CAPITA AND PROPERTY TAX

AS A PERCENT OF PER CAPITA INCOME FOR THE YEAR 2020

(WHEN 2021 DATA IS AVAILABLE, THIS TABLE WILL BE UPDATED)

5

Per Capita Property Taxes is the Locally Assessed Property Taxes divided by the Population Estimate

6

Property Taxes as % of Personal Income Per Capita is Per Capita Property Taxes divided by Per Capita Personal Income

Income and population from US Department of Commerce/Bureau of Economic Analysis/Interactive Data/Regional Economic Data/GDP & Personal Income

1

Personal Income is income from all sources received by persons living within the county

4

"Locally Assessed" includes "Total Locally Assessed" and "Fee-in-Lieu Motor Vehicles." per TC-233b Reports and 2014 tax rates for each taxing area

2

Population estimate is the Census Bureau's midyear population estimate

3

Per Capita Personal Income is the countywide personal income divided by countywide population estimate

Page 33

NUMBER OF RANGE OF RATES

A

VERAGE

COUNTY TAX AREAS MIN MAX TAX RATES

BEAVER 16 0.008317 0.010656 0.009166

BOX ELDER 69 0.009539 0.012379 0.010430

CACHE 53 0.008725 0.011197 0.009831

CARBON 20 0.014123 0.019431 0.015178

DAGGETT 8 0.008795 0.010356 0.009518

DAVIS 125 0.009539 0.013429 0.011917

DUCHESNE 29 0.013411 0.015904 0.014427

EMERY 25 0.013047 0.017312 0.015572

GARFIELD 28 0.007767 0.010454 0.008491

GRAND 9 0.010266 0.012670 0.010794

IRON 31 0.007717 0.009925 0.008918

JUAB 15 0.010466 0.012951 0.011641

KANE 19 0.008939 0.012919 0.009942

MILLARD 20 0.010814 0.013903 0.011690

MORGAN 7 0.012219 0.01369 0.013083

PIUTE 5 0.008360 0.010383 0.009704

RICH 17 0.005171 0.006785 0.005820

SALT LAKE 373 0.009572 0.016122 0.012498

SAN JUAN 9 0.012449 0.015330 0.013521

SANPETE 22 0.010052 0.014804 0.012196

SEVIER 15 0.011118 0.014588 0.012326

SUMMIT 64 0.013751 0.005830 0.008168

TOOELE 43 0.011651 0.015087 0.013356

UINTAH 22 0.011830 0.015106 0.012942

UTAH 142 0.008923 0.025654 0.010709

WASATCH 33 0.011701 0.013858 0.012479

WASHINGTON 55 0.007657 0.010297 0.009021

WAYNE 7 0.006459 0.007042 0.006662

WEBER 274 0.008921 0.014217 0.010997

STATEWIDE 1555 0.011069

TABLE 4

UTAH AVERAGE TAX RATE BY COUNTY FOR 2021

Page 34

COUNTY 2014 2015 2016 2017 2018 2019 2020 2021

BEAVER 0.009488 0.009354 0.009248 0.008866 0.009005 0.009175 0.009275 0.009166

BOX ELDER 0.012819 0.012729 0.012581 0.012393 0.011196 0.011247 0.010750 0.010430

CACHE 0.012066 0.012738 0.012291 0.012040 0.011596 0.011090 0.010532 0.009831

CARBON 0.011986 0.012197 0.013686 0.014089 0.014239 0.014586 0.016605 0.015178

DAGGETT 0.009340 0.010540 0.010122 0.010071 0.010124 0.010449 0.010453 0.009518

DAVIS 0.013687 0.013861 0.012951 0.012686 0.012455 0.012370 0.012117 0.011917

DUCHESNE 0.012011 0.012241 0.013443 0.013653 0.014367 0.014037 0.014037 0.014427

EMERY 0.012380 0.012642 0.01347 0.013619 0.012950 0.013161 0.013012 0.015572

GARFIELD 0.008900 0.008957 0.007939 0.008173 0.008781 0.008753 0.008642 0.008491

GRAND 0.010179 0.010532 0.01061 0.010733 0.010417 0.010526 0.011135 0.010794

IRON 0.012552 0.012706 0.011897 0.010890 0.010999 0.010636 0.009991 0.008918

JUAB 0.013232 0.013149 0.013055 0.013070 0.013414 0.013189 0.011894 0.011641

KANE 0.010938 0.010959 0.011472 0.011179 0.010899 0.010865 0.010258 0.009942

MILLARD 0.010605 0.010861 0.011426 0.011728 0.011230 0.011517 0.011601 0.011690

MORGAN 0.011371 0.011263 0.011516 0.011224 0.012207 0.013076 0.013378 0.013083

PIUTE 0.011380 0.011329 0.011784 0.011103 0.010800 0.010365 0.009913 0.009704

RICH 0.007525 0.007622 0.007562 0.007668 0.007041 0.006760 0.006514 0.005820

SALT LAKE 0.015224 0.015114 0.013884 0.013663 0.013595 0.013582 0.013264 0.012498

SAN JUAN 0.013435 0.013836 0.013772 0.013055 0.013555 0.013425 0.013393 0.013521

SANPETE 0.013443 0.013542 0.013532 0.014340 0.014153 0.013595 0.013091 0.012196

SEVIER 0.011327 0.011634 0.014452 0.014219 0.013653 0.012416 0.013087 0.012326

SUMMIT 0.009189 0.008692 0.009249 0.008603 0.009206 0.008812 0.008691 0.008168

TOOELE 0.014066 0.014127 0.013766 0.013570 0.014997 0.014073 0.013881 0.013356

UINTAH 0.010268 0.010625 0.011611 0.012488 0.012718 0.012734 0.012594 0.012942

UTAH 0.011882 0.011789 0.011735 0.011193 0.010868 0.010421 0.010794 0.010709

WASATCH 0.011732 0.011542 0.012167 0.011965 0.011941 0.011876 0.012757 0.012479

WASHINGTON 0.011689 0.011705 0.011331 0.010609 0.010289 0.009641 0.009466 0.009021

WAYNE 0.005420 0.007480 0.006712 0.006656 0.006820 0.006712 0.006654 0.006662

WEBER 0.015203 0.013962 0.013856 0.013635 0.013194 0.012586 0.011953 0.010997

STATE WIDE

AVERAGE 0.011494 0.011646 0.011763 0.011627 0.011611 0.011437 0.011370 0.011069

HISTORICAL AVERAGE TAX RATES BY COUNTY

TABLE 5

Page 35

FIGURE 14

AVERAGE TAX RATES EXCLUDING MOTOR VEHICLES

RANKED BY COUNTY FOR 2021

0.015572

0.015178

0.014427

0.013521

0.013356

0.013083

0.012942

0.012498

0.012479

0.012326

0.012196

0.011917

0.011690

0.011641

0.010997

0.010794

0.010709

0.010430

0.009942

0.009831

0.009704

0.009518

0.009166

0.009021

0.008918

0.008491

0.008168

0.006662

0.005820

EMERY

CARBON

DUCHESNE

SANJUAN

TOOELE

MORGAN

UINTAH

SALTLAKE

WASATCH

SEVIER

SANPETE

DAVIS

MILLARD

JUAB

WEBER

GRAND

UTAH

BOXELDER

KANE

CACHE

PIUTE

DAGGETT

BEAVER

WASHINGTON

IRON

GARFIELD

SUMMIT

WAYNE

RICH

Page 36

2021 AVERAGE 2021 PRIMARY

ESTIMATED RESIDENTIAL

RESIDENTIAL EFFECTIVE PROPERTY SCHOOL CITIES & SPECIAL

COUNTY

SALES PRICE

1

TAX RATE

2

TAX COUNTY DISTRICTS TOWNS DISTRICTS

BEAVER

$233,598

0.004957 1,158 237 768 16 137

BOX ELDER

$380,034

0.005955 2,263 398 1,467 247 152

CACHE

$404,364

0.005553 2,246 403 1,568 255 19

CARBON

$211,426

0.008362 1,768 424 985 126 233

DAGGETT

$291,536

0.005292 1,543 657 806 45 34

DAVIS

$495,409

0.006637 3,288 442 2,072 369 405

DUCHESNE

$248,085

0.008030 1,992 485 1,294 71 142

EMERY

$133,066

0.008856 1,178 376 634 23 145

GARFIELD

$269,340

0.005015 1,351 224 981 87 59

GRAND

$497,557

0.006012 2,992 782 2,019 16 174

IRON

$356,461

0.004981 1,776 279 997 272 228

JUAB

$401,595

0.006618 2,658 576 1,734 94 254

KANE

$383,924

0.005585 2,144 791 1,099 130 124

MILLARD

$231,842

0.006657 1,543 495 924 35 89

MORGAN

$610,983

0.007110 4,344 909 3,195 105 134

PIUTE

$216,176

0.005429 1,174 409 606 135 22

RICH

$538,903

0.003234 1,743 343 1,218 51 130

SALT LAKE

$578,367

0.006749 3,904 639 1,971 689 605

SAN JUAN

$210,664

0.007720 1,626 416 914 76 221

SANPETE

$290,664

0.006965 2,024 495 1,276 141 113

SEVIER

$292,232

0.006898 2,016 656 1,170 190 0

SUMMIT

$2,142,860

0.004143 8,878 973 5,080 1,026 1,799

TOOELE

$435,936

0.007652 3,336 449 2,267 347 273

UINTAH

$242,535

0.007072 1,715 491 1,016 27 181

UTAH

$506,006

0.005676 2,872 283 2,030 403 156

WASATCH

$1,193,505

0.006837 8,160 1,397 5,468 387 908

WASHINGTON

$584,027

0.004862 2,839 1,603 958 157 121

WAYNE

$368,827

0.003616 1,334 387 925 18 5

WEBER

$425,795

0.006343 2,701 589 1,431 310 371

STATEWIDE

3

$454,335

0.006248 2,640 573 1,616 202 250

2

Effective tax rate equals the total residential taxes charged divided by the total residential market values.

3

Each county receives equal weight (unweighted average).

TABLE 6

2021 ESTIMATED AVERAGE HOUSE VALUES, PROPERTY TAXES

AND TAX DOLLAR DISTRIBUTIONS BY COUNTY

1

Property Tax Division Database "Ratio Link"

DOLLAR DISTRIBUTION OF PROPERTY TAX

Page 37

FIGURE 15

ESTIMATED AVERAGE RESIDENTIAL PROPERTY TAX

RANKED BY COUNTY FOR 2021

8,878

8,160

4,344

3,904

3,336

3,288

2,992

2,872

2,839

2,701

2,658

2,263

2,246

2,144

2,024

2,016

1,992

1,776

1,768

1,743

1,715

1,626

1,543

1,543

1,351

1,334

1,178

1,174

1,158

0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 10,000

SUMMIT

WASATCH

MORGAN

SALTLAKE

TOOELE

DAVIS

GRAND

UTAH

WASHINGTON

WEBER

JUAB

BOXELDER

CACHE

KANE

SANPETE

SEVIER

DUCHESNE

IRON

CARBON

RICH

UINTAH

SANJUAN

MILLARD

DAGGETT

GARFIELD

WAYNE

EMERY

PIUTE

BEAVER

Tax Based on the Average Residential Sales Price

Page 38

COUNTY

A

VERAGE

ESTIMATED

RESIDENTIAL

SALES PRICE

1

RESIDENTIAL

EXEMPTION

A

VERAGE

ESTIMATED

TAXABLE

VALUE

A

VERAGE TAX

RATE

A

VERAGE

ESTIMATED

TAX

BEAVE

R

$233,598

0.45 128,479 0.00916619 1,178

BOX ELDER

$380,034

0.45 209,019 0.01043016 2,180

CACHE

$404,364

0.45 222,400 0.00983053 2,186

CARBON

$211,426

0.45 116,284 0.01517750 1,765

DAGGETT

$291,536

0.45 160,345 0.00951775 1,526

DAVIS

$495,409

0.45 272,475 0.01191676 3,247

DUCHESNE

$248,085

0.45 136,447 0.01442659 1,968

EMER

Y

$133,066

0.45 73,186 0.01557188 1,140

GARFIELD

$269,340

0.45 148,137 0.00849111 1,258

GRAND

$497,557

0.45 273,656 0.01079411 2,954

IRON

$356,461

0.45 196,054 0.00891765 1,748

JUAB

$401,595

0.45 220,877 0.01164133 2,571

KANE

$383,924

0.45 211,158 0.00994168 2,099

MILLARD

$231,842

0.45 127,513 0.01169020 1,491

MORGAN

$610,983

0.45 336,041 0.01308286 4,396

PIUTE

$216,176

0.45 118,897 0.00970400 1,154

RICH

$538,903

0.45 296,397 0.00582000 1,725

SALT LAKE

$578,367

0.45 318,102 0.01249785 3,976

SAN JUAN

$210,664

0.45 115,865 0.01352089 1,567

SANPETE

$290,644

0.45 159,854 0.01219605 1,950

SEVIE

R

$292,232

0.45 160,728 0.01232600 1,981

SUMMIT

$2,142,860

0.45 1,178,573 0.00816825 9,627

TOOELE

$435,936

0.45 239,765 0.01335593 3,202

UINTAH

$242,535

0.45 133,394 0.01294218 1,726

UTAH

$506,006

0.45 278,303 0.01070927 2,980

WASATCH

$1,193,505

0.45 656,428 0.01247906 8,192

WASHINGTON

$584,027

0.45 321,215 0.00902075 2,898

WAYNE

$368,827

0.45 202,855 0.00666200 1,351

WEBER

$425,795

0.45 234,187 0.01099650 2,575

STATEWIDE

AVERAGE 454,334 249,884 0.01106879 2,642

1

Property Tax Division Database "Ratio Link"

TABLE 7

UTAH AVERAGE HOUSE VALUE & TAX BY COUNTY FOR 2021

Page 39

COMPANY NAME NAICS CODE

2

ECONOMIC ACTIVITY

PACIFICORP 221122 ELECTRIC UTILITY

KENNECOTT UTAH COPPER LLC 212221 METALLIFEROUS MINING

UNION PACIFIC RAILROAD COMPANY 482111 RAILROAD

QUESTAR GAS 221210 GAS UTILITY

VERIZON COMMUNICATIONS INC 443142 TELECOMMUNICATIONS

LUMEN TECHNOLOGIES INC 517919 TELECOMMUNICATIONS

INTERMOUNTAIN POWER AGENCY 221122 ELECTRIC UTILITY

KERN RIVER GAS TRANS CP 486210 GAS PIPELINE

STAKER & PARSON COMPANIES INC 212399 SAND & GRAVEL

AT&T INC 517312 TELECOMMUNICATIONS

RUBY PIPELINE LLC 486210 GAS PIPELINE

MOUNTAINWEST PIPELINE LLC 486210 GAS PIPELINE

DELTA AIR LINES INC 481111 AIR CARRIER

GRAYMONT WESTERN US IN 212311 NON-METALLIFEROUS MINING

MID AMERICA PIPELINE CO 237110 LIQUID PIPELINE

UINTA WAX OPERATING LLC 211120 OIL & GAS PRODUCTION

FIRST WIND ENERGY - MILFORD UTAH 221115 ELECTRIC GENERATION

T MOBILE US INC 517312 TELECOMMUNICATIONS

UNEV PIPELINE LLC 486210 LIQUID PIPELINE

COMPASS MINERALS OGDEN INC 212393 NON-METALLIFEROUS MINING

SKYWEST INC 481111 AIR CARRIER

EP ENERGY E&P COMPANY 211120 OIL & GAS PRODUCTION

GENEVA ROCK PRODUCTS INC 237310 SAND & GRAVEL

DESERET GENERATION/TRANS COOP 221118 ELECTRIC UTILITY

SLC PIPELINE LLC 237120 LIQUID PIPELINE

2

NAICS Code: Six Digit Standard Industrial Classification.

TABLE 8

UTAH'S 25 LARGEST CENTRALLY ASSESSED COMPANIES

FOR 2021 RANKED FROM LARGEST TO SMALLEST

1

1

Source: Utah State Tax Commission, Property Tax Division. Ranking determined assessed

Page 40

FIGURE 16

TAXABLE VALUE FOR UTAH'S 25 LARGEST

CENTRALLY ASSESSED COMPANIES FOR 2021

0123456

SLCPIPEPLINELLC

DESERETGENERATION/TRANSCOOP

GENEVAROCKPRODUCTSINC

EPENERGYE&PCOMPANYLP

SKYWESTINC

COMPASSMINERALSOGDENINC

UNEVPIPELINELLC

TMOBILEUSINC

FIRSTWINDENERGYMILFORDUTAH

UINTAWAXOPERATINGLLC

MIDAMERICAPIPELINECO

GRAYMONTWESTERNUSINC

DELTAAIRLINESINC

MOUNTAINWESTPIPELINELLC

RUBYPIPELINELLC

AT&TINC

STAKER&PARSONCOMPANIESINC

KERNRIV

ERGASTRANSMISSIONCO

INTERMOUNTAINPOWERAGENCY

LUMENTECHNOLOGIESINC

VERIZONCOMMUNICATIONSINC

QUESTARGAS

UNIONPACIFICRAILROADCOMPANY

KENNECOTTUTAHCOPPERLLC

PACIFICORP

Taxable Value in Billions of Dollars

Page 41

COUNTY NAME COMPANY NAME

BEAVER

FIRSTWIND ENERGY

BOX ELDER

RUBY RIVER PIPELINE

CACHE

PACIFICORP

CARBON

UNION PACIFIC RAILROAD

DAGGETT

MOUNTAINWEST PIPELINE

DAVIS

PACIFICORP

DUCHESNE

EP ENERGY E&G COMPANY

EMERY

PACIFICORP

GARFIELD

GARKANE ENERGY COOPERATIVE

GRAND

MID AMERICA PIPELINE

IRON

PACIFICORP

JUAB

PACIFICORP

KANE

GARKANE ENERGY COOPERATIVE

MILLARD

INTERMOUNTAIN POWER AGENCY

MORGAN

SLC PIPELINE

PIUTE

PACIFICORP

RICH

RUBY RIVER PIPELINE

SALT LAKE

KENNECOTT UTAH COOPER

SAN JUAN

ELK OPERATING SERVICES

SANPETE

REDMOND MINERALS INC

SEVIER

PACIFICORP

SUMMIT

PACIFICORP

TOOELE

PACIFICORP

UINTAH

UINTA WAX OPERATING

UTAH

PACIFICORP

WASATCH

PACIFICORP

WASHINGTON

PACIFICORP

WAYNE

GARKANE ENERGY COOPERATIVE

WEBER

PACIFICORP

TABLE 9

THE LARGEST CENTRALLY ASSESSED COMPANIES

FOR EACH OF UTAH'S COUNTIES

FOR THE 2021 ASSESSMENT YEAR

Page 42

COUNT COUNT COUNT COUNT COUNT

BEAVER 0 52 0 53 13 118

BOX ELDER 3 490 19 237 219 968

CACHE 1 605 10 235 5 856

CARBON 0 216 9 363 149 737

DAGGETT 0 15 0 2 3 20

DAVIS 42 4,582 94 835 65 5,618

DUCHESNE

3 118 11 182 49 363

EMERY 0 57 2 92 1 152

GARFIELD 0 51 5 56 29 141

GRAND 0 71 3 141 102 317

IRON 1 589 16 637 254 1,497

JUAB 1 80 1 56 4 142

KANE 0 104 3 144 49 300

MILLARD 0 77 2 83 63 225

MORGAN 4 198 2 17 17 238

PIUTE 0 22 1 43 17 83

RICH 0 16 2 12 0 30

SALT LAKE 26 7,724 253 2,241 790 11,034

SAN JUAN 0 64 0 128 37 229

SANPETE 0 217 7 198 315 737

SEVIER 0 206 2 255 364 827

SUMMIT 3 194 11 108 86 402

TOOELE 8 778 10 305 331 1,432

UINTAH 0 188 13 240 196 637

UTAH 23 2,088 52 729 276 3,168

WASATCH 0 163 9 189 184 545

WASHINGTON

2 1,935 59 977 822 3,795

WAYNE 0 19 0 36 9 64

WEBER 24 3,517 98 921 254 4,814

TOTAL 141 24,436 694 9,515 4,703 39,489

1

Funded by County

2

Funded by State General Fund

TOTAL TAX

RELIEF

VETERANS WITH

DISABILITY

1

BLIND

1

HOMEOWNERS

CREDIT

2

ACTIVE DUTY

ARMED FORCES

1

COUNT

INDIGENT

ABATEMENT

1

TABLE 10

REPORT OF TAX RELIEF GRANTED FOR 2021

Page 43

FIGURE 17

2021 STATEWIDE TAX RELIEF RECIPIENTS

ActiveDuty

141

.36%

Veterans

24,436

61.88%

Blind

694

1.76%

HomeownersCredit

9,515

24.10%

Indigent

4703

11.91%

Number of People

Page 44

TOTAL

RESIDENTIAL RESIDENTIAL TOTAL

COUNTY RESIDENTIAL NON PRIMARY TOTAL COMMERCIAL & FAA

V

ACANT OTHER COUNT

PRIMARY USE USE RESIDENTIAL COMMERCIAL LAND

BEAVER 2,127 341 2,468 299 2,767 2,108 2,825 450 8,150

BOX ELDER 16,872 337 17,209 1,249 18,458 9,503 10,352 12,613 50,926

CACHE 32,604 1,128 33,732 2,281 36,013 7,611 4,664 0 48,288

CARBON 7,479 1,067 8,546 623 9,169 1,706 2,302 2,996 16,173

DAGGETT 280 728 1,008 77 1,085 343 1,401 379 3,208

DAVIS 96,485 591 97,076 4,499 101,575 1,427 4,973 6,387 114,362

DUCHESNE 4,925 1,532 6,457 535 6,992 5,007 17,605 2,730 32,334

EMERY 3,251 295 3,546 271 3,817 2,025 2,873 5,912 14,627

GARFIELD 1,572 1,839 3,411 207 3,618 1,994 4,157 387 10,156

GRAND 3,130 1,347 4,477 758 5,235 345 1,141 446 7,167

IRON 17,771 3,238 21,009 1,858 22,867 4,051 19,948 2,113 48,979

JUAB 3,605 52 3,657 273 3,930 3,642 2,347 2,157 12,076

KANE 2,858 3,258 6,116 343 6,459 1,764 7,786 503 16,512

MILLARD 4,491 484 4,975 417 5,392 6,186 4,587 45 16,210

MORGAN 3,593 87 3,680 123 3,803 2,167 824 935 7,729

PIUTE 548 392 940 83 1,023 939 753 312 3,027

RICH 700 2,705 3,405 327 3,732 2,304 3,838 589 10,463

SALT LAKE 307,377 1,875 309,252 25,067 334,319 1,325 40,099 2,004 377,747

SAN JUAN 2,780 197 2,977 382 3,359 2,999 3,147 0 9,505

SANPETE 7,793 2,364 10,157 599 10,756 9,199 8,604 1,970 30,529

SEVIER 7,412 1,596 9,008 664 9,672 4,503 3,094 1,454 18,723

SUMMIT 14,748 15,309 30,057 1,820 31,877 3,709 5,352 1,401 42,339

TOOELE 21,067 2,217 23,284 1,016 24,300 2,523 950 1,874 29,647

UINTAH 10,782 1,122 11,904 1,030 12,934 3,606 3,349 285 20,174

UTAH 158,727 1,904 160,631 12,869 173,500 7,230 21,935 0 202,665

WASATCH 11,495 4,524 16,019 776 16,795 2,372 7,861 726 27,754

WASHINGTON 57,295 17,457 74,752 3,226 77,978 2,835 12,960 3,460 97,233

WAYNE 741 567 1,308 132 1,440 1,034 1,169 255 3,898

WEBER 73,839 2,075 75,914 7,306 83,220 2,676 10,023 893 96,812

STATEWIDE 876,347 70,628 946,975 69,110 1,016,085 97,133 210,919 53,276 1,377,413

TABLE 11

2021 REAL PROPERTY PARCEL COUNTS

Page 45

2016

2017 2018 2019 2020 2021

BEAVER

102,108

2,138,508 2,014,054 1,995,650 2,018,092 3,170,504

BOX ELDER

5,737,398

5,393,563 2,045,959 4,923,809 4,672,441 5,204,470

CACHE

3,875,636

3,224,916 2,868,757 3,177,348 2,932,765 3,090,272

CARBON

182,169

135,339 124,248 122,114 27,114 27,025

DAGGETT

0

000

DAVIS

12,618,059

11,851,997 14,517,461 16,166,178 13,178,222 13,368,447

DUCHESNE

0

00

EMERY

0

00

GARFIELD

0

00

GRAND

0

00

IRON

944,905

5,405,318 5,391,927 5,621,060 5,490,346 6,425,661

JUAB

0

00

KANE

0

00

MILLARD

0

00

MORGAN

119,814

123,665 145,892 172,235 271,822 35,018

PIUTE

0

00

RICH

92,194

92,545 94,223 100,828 99,193 2,627

SALT LAKE

91,034,199

90,926,825 97,371,093 119,028,102 134,818,268 139,176,243

SAN JUAN

0

000

SANPETE

111,362

119,504 124,240 4,311 0

SEVIER

51,172

50,675 52,952 57,484 60,023 562,888

SUMMIT

3,590,613

3,976,604 4,032,986 5,194,855 4,994,809 5,374,200

TOOELE

5,742,663

2,752,574 2,998,190 2,976,768 3,013,267 3,289,636

UINTAH

158,974

164,222 5,019 147,290 137,336 125,562

UTAH

24,637,927

25,708,897 25,968,704 31,804,236 29,135,558 30,137,214

WASATCH

000

0 7,603 152,360

WASHINGTON

2,293,586 2,736,202 3,137,510

2,974,961 2,950,789 3,125,201

WAYNE

000

0

WEBER

17,683,824 16,244,195 15,468,363

16,468,328 9,710,026 10,712,651

TOTAL

168,976,603 171,045,549 176,361,578 210,935,557 213,517,674 223,979,978

Property taxes generated by taxing entity tax rates may be paid to a Redevelopment Agencies through statutory authority,

resolutions and interlocal agreements. This report is a summary by county of property tax dollars paid to these agencies.

If you would like this report by taxing entity, please contact the Property Tax Division at 801-297-3600.

TABLE 12

PROPERTY TAX REVENUE PAID AS TAX INCREMENT BY COUNTY

Page 46

TABLE 13

PROPERTY TAX INCREMENT AS A PERCENTAGE OF PROPERTY

TAXES COLLECTED

2021 Property Taxes

Collected

2021 Property Tax

Increment Paid Percentage

BEAVER

15,852,496

3,170,504

20.00%

BOX ELDER

62,477,414

5,204,470

8.33%

CACHE

110,140,235

3,090,272

2.81%

CARBON

24,937,097

27,025

0.11%

DAGGETT

3,092,953 0.00%

DAVIS

367,334,377

13,368,447

3.64%

DUCHESNE

34,483,868 0.00%

EMERY

32,441,865 0.00%

GARFIELD

6,169,812 0.00%

GRAND

24,706,256 0.00%

IRON

51,944,767

6,425,661