Vaping products in Canada

A market scan of industry product, labelling and

packaging promotional practices

DAVID HAMMOND, KATHERINE EAST, DANIELLE WIGGERS, & SYED MAHAMAD

DECEMBER 15, 2020

FUNDING

THIS STUDY WAS PERFORMED FOR HEALTH CANADA UNDER CONTRACT

NO. 4500409939.

SUGGESTED CITATION

HAMMOND D, EAST K, WIGGERS D, MAHAMAD S. VAPING PRODUCTS

IN CANADA: A MARKET SCAN OF INDUSTRY PRODUCT, LABELLING AND

PACKAGING PROMOTIONAL PRACTICES. DECEMBER 2020.

CONTACT

DAVID HAMMOND PHD

PROFESSOR

SCHOOL OF PUBLIC HEALTH & HEALTH SYSTEMS

UNIVERSITY OF WATERLOO

DHAMMOND@UWATERLOO.CA

519 888 4567 EXT. 46462

2

Executive summary

The e-cigarette market has rapidly evolved in Canada, with changes to the types of products and

retail settings, particularly after the implementation of the Tobacco and Vaping Products Act (TVPA).

The primary objective of the current project was to document industry practices in relation to vaping

products with a focus on two primary areas:

• Information and promotional elements displayed on vaping products, packaging, and labels (e.g.,

brand name, logo, descriptors, images, colour, design elements, font styles);

• Other attributes of products and packages (e.g., shape, size).

A scan of online vaping retailers was conducted between January and September 2020 to identify

vaping devices and e-liquids available for sale in Canada. First, online searches were conducted to

identify products from a list of 25 popular e-cigarette brands. Second, additional products were

identified through two national online retailers, as well as an additional online vape shop in each of

five provinces: British Columbia, Alberta, Ontario, Quebec, and Nova Scotia. The online scans

identified a total of 560 vaping devices, consisting of 3,204 varieties, in addition to 1,778 e-liquids.

Images of all products were documented, coded, and analyzed to identify package design attributes.

In addition, a telephone scan was conducted with 81 ‘brick and mortar’ vape shops and gas &

convenience stores across five provinces to compare the profile of products identified in the online

scan with products available in stores across the country. Finally, the exterior packaging for a subset

of 12 popular vaping products was examined to illustrate design themes of packaging as it would be

presented to consumers in retail settings.

VAPING DEVICES

The findings from the retail scan depict an incredibly diverse market in Canada with respect to the

types of vaping products available and the information communicated through packaging. The scan

identified hundreds of different vaping devices available for sale across 43 unique device brands,

with more than 3,000 device varieties after accounting for different colours and visual designs.

Virtually all brands offered the same model of vaping devices in a wide variety of colours and

designs.

Vaping products are available in a wide variety of shapes and sizes, including refillable ‘open-tank’

systems such as box-mods and pen-style devices, pod-based devices that use replaceable

3

cartridges, and disposable products. The size and shape of devices varied considerably within each

of these categories, although to a lesser extent for pen-style devices.

The retail scan also identified a range of device ‘skins’ and other accessories offered by e-cigarette

manufacturers and third parties that can be used to enhance and personalize product packaging.

E-LIQUID PRODUCTS

As was the case with vaping devices, a wide range of e-liquid products was identified, including

with respect to flavours and nicotine levels. E-liquid packaging exhibited a wide range of colours,

with no one dominant colour.

E-liquids were considerably more likely than vaping devices to feature nature-related design

themes and lifestyle references. For example, approximately 10% of e-liquids featured either a real

or fictional person, character or animal. In addition, approximately 60% of packages featured

references to food or drinks, with fruit, confectionary/dessert, and soft drinks the most common

references.

Nicotine labelling and health warning practices were inconsistent on e-liquids: approximately two-

thirds of packages displayed a visible health warning based on the product images online. A

nicotine concentration statement was visible on 84% of packages and an indication that the

product contains nicotine was visible on 71% of packages.

EXTERIOR PACKAGING

The current project examined a limited number of ‘exterior’ packages for vaping devices —the

packaging in retail stores in which vaping devices and e-liquids are contained, including ‘starter

kits’. However, even the small sub-sample of popular brands examined illustrated sophisticated

packaging designs, including various methods of opening. Health warnings and nicotine labelling

were inconsistent, both in terms of whether this information was displayed on the principal display

area of packages, as well as the content of these message.

SUMMARY

Overall, the current project demonstrates the incredible diversity in product packaging and design

of vaping products on the Canadian market.

4

Table of contents

EXECUTIVE SUMMARY 2

METHODS 5

OBJECTIVES 5

OVERVIEW 5

ONLINE RETAIL SCAN 5

PROTOCOL USED TO IDENTIFY VAPING PRODUCTS 5

DATA EXTRACTION AND CODING 7

TELEPHONE RETAIL SCAN OF ‘BRICK AND MORTAR’ STORES 10

RESULTS 11

ONLINE RETAIL SCAN – VAPING DEVICES 11

VAPING DEVICES – BRANDS 11

VAPING DEVICES – TYPES & SHAPES 11

BOX MOD VAPING DEVICES 13

VAPING DEVICES – COLOURS 14

VAPING DEVICES – DESIGN THEMES 16

ONLINE RETAIL SCAN - E-LIQUIDS 21

E-LIQUIDS – FLAVOURS 21

E-LIQUIDS – NICOTINE PROFILE 22

E-LIQUIDS – NICOTINE LABELLING AND HEALTH WARNINGS 22

E-LIQUIDS – PACKAGE COLOURS 24

E-LIQUIDS – PACKAGE DESIGN THEMES 25

TELEPHONE RETAIL SCAN 31

BRAND AVAILABILITY 31

PACKAGING EXTENSIONS & CUSTOMIZATIONS 32

EXTERIOR PACKAGING OF VAPING DEVICES 33

VAPING DEVICES 33

STARTER KITS 34

E-LIQUIDS 34

DISCUSSION 47

OVERVIEW OF FINDINGS FOR VAPING DEVICES 47

COLOURS AND DESIGN THEMES 47

PACKAGING ACCESSORIES AND PERSONALIZATION 47

TYPE AND SHAPE 47

OVERVIEW OF FINDINGS FOR E-LIQUIDS 48

COLOURS AND DESIGN THEMES 48

NICOTINE LABELLING AND HEALTH WARNINGS 48

OVERVIEW OF FINDINGS FOR EXTERIOR PACKAGING 49

LIMITATIONS 49

APPENDIX 51

APPENDIX A – TELEPHONE RETAIL SCAN 51

APPENDIX B – VAPING DEVICE BRANDS: ONLINE RETAIL SCAN 52

APPENDIX C – E-LIQUID BRANDS: ONLINE RETAIL SCAN 53

5

Methods

Objectives

The objective of the current project was to document industry practices in regard to vaping

products

1

, with a focus on two primary areas:

• Information and promotional elements displayed on vaping products, packaging, and labels (e.g.,

brand name, logo, descriptors, images, colour, design elements, font styles);

• Other attributes of products and packages (e.g., shape, size).

Overview

A scan of online vaping retailers was conducted between January and September 2020 to identify

vaping devices and e-liquids available for sale online in Canada. First, online searches were conducted

to identify products from a list of 25 popular e-cigarette brands. Second, additional products were

identified through two national online retailers, as well as an additional online vape shop in each of

five provinces: British Columbia, Alberta, Ontario, Quebec, and Nova Scotia. The online scans

identified a total of 560 vaping devices, consisting of 3,204 varieties, in addition to 1,748 e-liquids.

Images of all products were documented, coded, and analyzed to identify package design attributes.

In addition, a telephone scan was conducted with 81 ‘brick and mortar’ vape shops, and gas and

convenience stores, across the five provinces to compare the profile of products identified in the

online scan with products available in stores across the country.

Online retail scan

PROTOCOL USED TO IDENTIFY VAPING PRODUCTS

Vaping products in Canada were identified through a comprehensive scan of online retailers. The

online retailer scan was conducted in three steps, as described below, to ensure a broad and

diverse set of vaping products were identified to adequately characterize the Canadian market.

1

The term ‘vaping products’ is used to refer to both nicotine and non-nicotine vaping products, often called ‘e-cigarettes’. THC-containing vaping

products as well as ‘heated tobacco products’, such as IQOS, were not included in the retail scan.

6

IDENTIFICATION OF LEADING VAPING BRANDS

A list of 25 leading vaping brands was identified using brand data reported by 16-19-year-old e-

cigarette users surveyed in August-September 2019 as part from the 2019 ITC Youth Tobacco and

Vaping Survey.

2

Collectively, the 25 brands represented more than 90% of brand market share

reported by young people who vape in the ITC survey.

2

•

JUUL

•

Blu

•

Smok

•

Aspire

•

Eleaf

•

Smoke NV

•

Kanger Tech

•

Joyetech

•

V2

•

STLTH

•

VooPoo

•

Suorin

•

Uwell

•

Vaporesso

•

Geek Vape

•

Innokin

•

Snowwolf

•

Tesla

•

Lost Vape

•

Mi-Pod

•

FreeMax

•

JustFog

•

iJoy

•

MYLE

•

Vype/Vuse

Information on all available devices and e-liquids for the 25 brands was identified by searching

three online sources, in the following order: 1) Canadian website of manufacturer; 2) non-Canadian

website of manufacturer (only if Canadian website of manufacturer not available); or 3) online

retailers (Vape Vine and Ace Vaper). Each of the 25 leading brands, except one (V2 / Vapour2) were

confirmed to be available for sale in Canada. Data on all varieties of vaping devices and e-liquids for

the 25 brands were collected between January and February 2020.

NATIONAL ONLINE RETAILERS

Additional vaping devices and e-liquids were identified through two large national online retailers—

Vape Vine (www.vapevine.ca) and Ace Vaper (www.acepvaper.ca). The two retailers were selected

by entering the search terms “Vape” and “Canada” into a Google search. The top ten links to online

retailers were identified. Brief searches were conducted for each of the ten online retailers to

identify the two with the greatest coverage of the leading 25 brands (see above). Vape Vine and

Ace Vaper were selected based on this criterion. Data on all vaping devices and e-liquids were

collected from the two retailers between January and May 2020.

PROVINCIAL ONLINE VAPE SHOPS

Vape shops were identified in each of five provinces: British Columbia, Alberta, Ontario, Quebec,

and Nova Scotia. Vape shops were identified through a Google search and one vape shop was

randomly selected from each of the five provinces. Vape shops were only eligible if product

2

Hammond D, Reid JL, Rynard VL, Burkhalter R. ITC Youth Tobacco and Vaping Survey: Technical Report – Wave 3 (2019). University of Waterloo;

Updated May 2020. Available at: http://davidhammond.ca/wp-content/uploads/2020/05/2019_P01P3_W3_Technical-Report_updated202005.pdf

7

information was posted online. Data collection from the provincial retail shops was conducted

between May and September 2020.

DATA EXTRACTION AND CODING

Once a unique product was identified, a ‘screenshot’ was taken to capture all relevant and available

product information, including images. For example, if a particular brand had two device models,

and each model was offered in five colours (varieties), 10 different screenshots would be collected.

A data extraction protocol was developed by the research team based on existing literature and a

preliminary review of product images. Data extraction and coding were conducted by Research

Assistants for each of the product attributes described below.

VAPING DEVICE ATTRIBUTES

DEVICE BRAND – Device ‘brand’ refers to the device manufacturer identified on the product (e.g.,

JUUL, Vype/Vuse, Smok). Data were also collected on device ‘model’ and ‘variety’. Device ‘model’

refers to a specific device configuration or style (e.g., Vype/Vuse ePen vs. Vype/Vuse ePod 3).

Device ‘variety’ refers to a specific colour/design (e.g., blue, red). As noted above, each variety was

considered to be an individual product in the analysis.

DEVICE TYPE & SHAPE – Vaping devices were categorized into five primary types: 1) disposable

products consist of both the device and e-liquid, and cannot be reused or refilled; 2) pod devices

use replaceable cartridges or ‘pods’ of e-liquid; 3) box mod devices have ‘open’ tanks that can be

refilled with bottles of e-liquid, and typically offer greater customization of wattage, power, and

other settings; 4) pen-style tank systems, which are similar to box mod but with a distinctive ‘pen-

like’ shape; and 5) cigalike devices, which mimic the appearance of combusted cigarettes, and

could be either disposable or refillable.

POD

3

BOX MOD

PEN

CIGALIKE

3

Image source: www.ruthlessvapor.com [Accessed 10 Feb 2020]

8

DEVICE COLOUR— Up to three primary colours were identified for each product based on product

images.

DEVICE DESIGN THEMES— A coding protocol was developed to identify 21 specific design themes,

organized into four general categories, shown below. A

Design themes

•

Simple/minimal

•

Bubble letter font

•

Nature

•

Metallic/shiny

•

Technology

•

Geometric/swirly

Lifestyle themes

•

Lifestyle references

•

Religion or mythology

•

Person, character, or

animal

Food and drink themes

•

Candy/dessert

•

Cannabis

•

Fruit

•

Soft drink

•

Energy drink

•

Caffeine

•

Spice/herb

•

Other food

•

Other drink

Other themes

•

Health benefits

•

Reference to probiotics,

colouring agents, amino

acids, essential fatty acids,

glucuronolactone, taurine,

vitamins, mineral nutrients

•

Reference to tobacco

More detailed coding instructions were provided for the following themes:

Lifestyle advertising - evokes a way of life including fashion, glamour, recreation, sport, excitement,

vitality, risk, daring (e.g., picture of a casino chip, sport activity, beach scenes, fashion images;

including text, e.g., chill, gamble).

Person, character, or animal - Image of a person, character or animal, whether real or fictional.

Food/drink - imagery or indication of a food/drink flavour –indicate all flavours that are shown (e.g.,

if apple pie, fruit and desert; if pecan pie, desert and other; including text).

Soft drink - (a sugary non-alcoholic drink that is usually but not always carbonated, e.g., cola, pop,

lemonade, sugary fruit drinks).

Energy drink - a drink containing a stimulant [usually caffeine] that may or may not be carbonated;

typically marketed as energizers/alertness enhancers, NOT brewed drinks (tea/coffee).

Health benefits - health benefit claims, including claims related to capacity to restore energy and

alertness; including text).

9

Probiotics - Imagery or indication of probiotics, colouring agents, amino acids, essential fatty acids,

glucuronolactone, taurine, vitamins, mineral nutrients (including text).

Tobacco - Imagery or indication of tobacco/tobacco or comparison with tobacco/smoking.

E-LIQUID PACKAGING ATTRIBUTES

E-LIQUID FLAVOUR— The flavour of e-liquids was recorded verbatim from the description listed

online, and subsequently coded into 11 categories:

•

Fruit

•

Candy, chocolate, desserts

•

Non-alcoholic drink

•

Alcoholic beverage

•

Tobacco

•

Menthol/mint

•

Coffee

•

Spice

•

Unflavoured

•

Tobacco & menthol

•

Other flavour

NICOTINE PROFILE— Based on information available online or the product label, the type of e-

liquid was coded as ‘salt-based’, ‘freebase’, or ‘hybrid’. The nicotine concentration was also

recorded, either in mg/ml or in percentage. All values were converted into percentages for the

report, where 1.0mg/ml = 0.1%.

NICOTINE LABELLING AND HEALTH WARNINGS— Among e-liquids for which the principal display of

the package was visible in the online image, the presence of nicotine content and concentration

visible on the display, and the presence of health warnings visible on the display, were recorded

(yes vs. no/undiscernible).

E-LIQUID PACKAGING DESIGN THEMES— The same coding protocol as vaping devices was used to

identify 21 specific design themes, organized into four general categories for e-liquid packaging

(see above).

RELIABILITY OF CODING PROTOCOL

To establish the reliability of the coding protocol, three Research Assistants coded the device and

e-liquid packaging colours, nicotine labelling and health warnings, and design themes for a subset

of images for 300 vaping device varieties and 160 e-liquids (~10% of all images). The Research

Assistants reached agreement on 95.4% of codes and met to resolve any coding discrepancies for

the remaining products.

10

EXTERIOR PACKAGING

Most vaping devices and many e-liquids are sold with ‘exterior’ packaging, which may display

additional promotional or product information. Examples of exterior packaging are shown for a

subset of popular vaping products, which were purchased for an unrelated project.

Telephone retail scan of ‘brick and mortar’ stores

The original data collection plan consisted of in-store visits to local ‘brick and mortar’ retail outlets

in each of five Canadian cities, one per each of the five provinces assessed in the online scan:

Vancouver (British Colombia), Edmonton (Alberta), Toronto (Ontario), Montreal (Quebec), and

Halifax (Nova Scotia). However, this was not possible due to the COVID-19 pandemic. Therefore,

the in-store visits were replaced by telephone retail scans.

The primary purpose of the telephone scan was to assess the extent to which vaping products

identified through online searches incorporated brands sold in smaller vape shops, as well as gas

and convenience stores, both of which represent an important component of the retail network for

vaping products in Canada.

4

A list of ‘vape shops’ and gas/convenience stores was compiled in each city using online Google

searches of business directories. A total of 10 vape shops and 10 convenience/gas stations were

randomly selected in each of the five cities. A research assistant used a standardized telephone

protocol to collect information on brand availability, flavours, and nicotine levels (See Appendix A).

This information was compared with the brand data collected in the online surveys to assess

comparability. Telephone retail scans were conducted between June and August 2020.

4

Nugent R (on behalf of Health Canada). The vaping market in Canada, 2019. Canadian Public Health Association Tobacco and Vaping Control Forum;

Sept 23 2020.

11

Results

ONLINE RETAIL SCAN – VAPING DEVICES

VAPING DEVICES – BRANDS

A total of 43 unique device brands were identified in the online retail scan, consisting of 560

devices. After accounting for different colours and variants, a total of 3,204 varieties were

identified. Device brands with the greatest number of varieties included Smok (538), Aspire (538),

Eleaf (299), VooPoo (213), and Joyetech (236). The full list of brands and number of varieties in

each is displayed in Appendix B.

VAPING DEVICES – TYPES & SHAPES

Overall, approximately half of all devices were box mod systems (50.7%), one quarter were pod

devices (25.3%), and one-fifth were pen devices (22.1%). Substantially fewer devices identified

were cigalikes (1.1%) or disposables (0.5%). The general shape and size of vaping devices largely

corresponded to the device type, as described below.

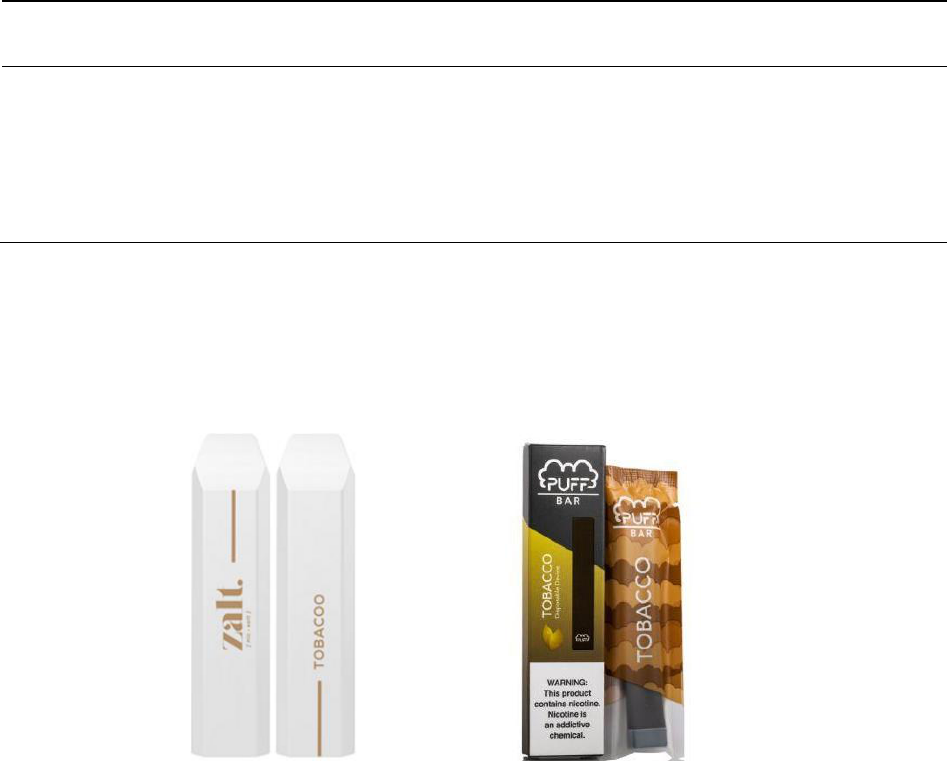

DISPOSABLE VAPING DEVICES

Figure 1 illustrates the shape and size of vaping devices for all three disposable brands identified in

the online retail scan. While the shapes differ to some extent across brands, all disposable devices

had a relatively small, rectangular profile that would easily fit within a hand.

Figure 1. Shapes of disposable vaping devices.

STIG

PUFF BAR

ZALT

12

PEN-STYLE VAPING DEVICES

By definition, vape pens have an oblong, linear shape. The shape of vape pens is less variable than

other vaping devices, with some variation in the style of mouthpiece, size of the e-liquid ‘window’,

and customizable features and display (Figure 2).

Figure 2. Examples of shapes for pen-style vaping devices.

INNOKIN JEM

KANGER EVOD

SMOK STICK M17

POD-STYLE VAPING DEVICES

Pod-based devices are available in a wide array of size and shapes, ranging from the sleek

rectangular device popularized by JUUL, to shapes more reminiscent of box mod systems (Figure

3). In most cases, the pod or cartridge is contained in the mouthpiece, which can be replaced for

new e-liquid.

Figure 3. Examples of shapes for pod-style vaping devices

JUUL C3

VYPE/VUSE EPOD

VAPORESSO TARGET PM80

13

Figure 3. Examples of shapes for pod-style vaping devices cont.

SMOK NOVO 2

SUORIN DROP

ASPIRE BREEZE 2

BOX MOD VAPING DEVICES

Box mod tank vaping devices are typically the largest devices, although the size can vary depending

upon the brand and variety (Figure 4). Many boxes-style devices can be modified in ways that alter

the shape of the mouthpiece and other attributes.

Figure 4. Examples of shapes for box mod style vaping devices

SMOK MORPH BOX

ASPIRE MIX

IJOY DIAMOND MINI

SMOK FETCH MINI

ELEAF ISTICK PICO SQUEEZE

ASPIRE SKY STAR REVO

14

VAPING DEVICES – COLOURS

Most vaping devices were available in different colours (Table 1). As one example, the SMOK Nord

Pod devices were available in 38 different colour varieties, some of which are shown below (Figure

5). In regard to vaping devices, colour varieties generally do not signify differences in device model

or performance features; rather, they simply reflect differences in the design.

Table 1. Dominant colours displayed on vaping device (n=567)

Dominant Colour 1

Dominant Colour 2

Dominant Colour 3

Black

50.4% (1594)

16.3% (515)

18.3% (578)

Silver

11.8% (372)

22.8% (720)

7.0% (222)

Blue

7.4% (233)

5.7% (179)

10.1% (318)

Red

6.5% (207)

6.4% (201)

7.9% (250)

Multicolour/rainbow

4.8% (151)

0.7% (23)

2.6% (81)

Green

3.4% (109)

3.3% (105)

4.9% (154)

Grey

3.1% (99)

6.0% (190)

4.2% (132)

Gold

2.7% (86)

4.2% (134)

2.5% (80)

White

2.7% (84)

22.1% (699)

5.5% (175)

Purple/violet

2.0% (63)

2.6% (83)

2.9% (91)

Orange

1.5% (46)

1.8% (56)

2.2% (70)

Pink

1.2% (39)

2.2% (70)

2.4% (75)

Brown

1.2% (38)

0.9% (28)

1.2% (39)

Yellow

0.7% (23)

2.1% (67)

2.7% (85)

None

0.2% (5)

2.9% (93)

25.8% (815)

Other

0.5% (16)

0% (1)

0% (0)

15

Figure 5. Illustration of colour varieties within a brand model of pen-style vaping devices

SMOK NORD POD SYSTEM

SMOK MAG 225W

IJOY CAPTAIN

16

VAPING DEVICES – DESIGN THEMES

DESIGN THEMES

Table 2 summarizes the graphic design elements of the vaping devices. Most devices displayed

simple or minimalistic designs, while approximately one third also displayed imagery that conveyed

technology themes or had geometric designs. A smaller number of devices displayed references to

nature or used ‘bubble letter’ font. Many devices exhibited a shiny metallic or reflective finish.

Examples are shown in Figure 6.

Table 2. Design themes displayed on vaping devices, overall and by leading brand.

All devices

(n=3,182)

JUUL

(n=4)

Smok

(n=538)

Vype/Vuse

(n=31)

Stlth

(n=5)

Aspire

(n=186)

Simple/minimal

1

2888 (90.8%)

4 (100.0%)

536 (99.6%)

28 (93.3%)

5 (100.0%)

170 (91.4%)

Bubble letter font

2

3 (0.1%)

0 (0.0%)

0 (0.0%)

1 (3.2%)

0 (0.0%)

0 (0.0%)

Nature

3

63 (2.0%)

0 (0.0%)

19 (3.5%)

1 (3.2%)

0 (0.0%)

7 (3.8%)

Metallic/shiny

2266 (71.2%)

4 (100.0%)

442 (82.2%)

11 (35.5%)

0 (0.0%)

89 (47.8%)

Technology

4

929 (29.2%)

0 (0.0%)

179 (33.3%)

0 (0.0%)

0 (0.0%)

52 (28.0%)

Geometric/swirly

933 (29.3%)

0 (0.0%)

264 (49.1%)

17 (54.8%)

0 (0.0%)

49 (26.3%)

Specific instructions for coding:

1

Simple/minimal design (NOT busy or cluttered);

2

Bubble letter font (rounded edges);

3

Nature/outdoors/earthy/camo (e.g., image of leaves);

4

Technology/gadget/futuristic.

17

Figure 6. Examples of design themes on vaping devices

Bubble letter font

Nature

FREEMAX - TWISTER 80W

IJO Y - SOLO ELF

V YPE/VUSE - EPOD

AS PIRE – COBBLE AIO

S MO K – STICK V8

Metallic/ shiny

Technology

S MO K – G320

INNO KIN - ENDURA

T18II MINI

ELEAF - IJUST 3 PRO

V USE EPOD

S MO K - G-PRIV BABY

LUXE EDITION

KA NGER TECH - VOLA

Geometric/ swirly

S MO K - FETCH MINI

AS PIRE - MULUS

V YPE/VUSE - EPOD

V O OPOO - DRAG NANO POD

18

LIFESTYLE THEMES

Table 3 shows lifestyle-related references on devices. Very few devices were coded as having

explicit lifestyle references, although a considerable number displayed images of people (either

real, fictional or symbolic), as well as animals. Examples are shown in Figure 7.

Table 1. Lifestyle references displayed on vaping devices, overall and by leading brand.

All devices

(n=3,182)

JUUL

(n=4)

Smok

(n=538)

Vype/Vuse

(n=31)

Stlth

(n=5)

Aspire

(n=186)

Lifestyle references

5 (0.2%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Religion or mythology

4 (0.1%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Person, character, animal

137 (4.3%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

4 (2.2%)

Figure 7. Examples of lifestyle reference on vaping devices

UWELL - BLOCKS

VAPORESSO - SWAG

SMOK - S-PRIV

VAPORESSO - TAROT

NANO

VAPORESSO - SWAG

19

FOOD AND DRINK THEMES

Table 4 summarizes the number of vaping devices with references to food or drinks. Relatively few

devices featured food or drink imagery or text, with the exception of disposable products which

accounted for all references to food or drinks directly on devices. Examples are shown in Figure 8.

Table 4. Food and drink references displayed on vaping devices, overall and by leading brand.

All devices

(n=3,182)

JUUL

(n=4)

Smok

(n=538)

Vype/Vuse

(n=31)

Stlth

(n=5)

Aspire

(n=186)

Any

15 (0.5%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Fruit

10 (0.3%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Soft drink

3 (0.1%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Caffeine

1 (0.1%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Spice/herb

1 (0.1%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Other food

1 (0.1%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Confectionary/dessert

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Cannabis

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Energy drink

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Other drink

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Figure 8. Examples of food or drink references displayed on vaping devices

ZALT - PRE-FILLED

DIS POSABLE

PUF F BAR DISPOSABLES

V GOD - STIG

20

OTHER THEMES

As Table 5 indicates, few vaping devices featured overt health-related references. References to

tobacco reflect references to tobacco flavours of disposable products printed directly on the device.

Examples are shown in Figure 9.

Table 2. Other themes displayed on vaping devices, overall and by leading brand.

Figure 9. Examples of tobacco reference on vaping devices

ZALT - PRE-FILLED DISPOSABLE

PUFF BAR DISPOSABLES - DEVICE

All devices

(n=3,182)

JUUL

(n=4)

Smok

(n=538)

Vype/Vuse

(n=31)

Stlth

(n=5)

Aspire

(n=186)

Implies health benefits

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Reference to probiotics

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Reference to tobacco

3 (0.1%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

21

ONLINE RETAIL SCAN - E-LIQUIDS

A total of 1,748 e-liquid products were identified and analyzed. A full list of brands and varieties is

listed in Appendix C.

E-LIQUIDS – FLAVOURS

Table 6 shows the categories of flavours corresponding to the e-liquid flavour names. Fruit flavours

accounted for almost half of products, followed by candy, chocolate and desserts. Non-alcoholic

beverages were also popular, followed by more traditional cigarette flavours including tobacco and

menthol/mint. Less than 1% of products did not display a reference to an identifiable flavour on the

packaging or other information available online.

Table 6. Summary of e-liquid flavours, overall and by leading brand.

5

All e-liquids

(n=1,748)

JUUL

(n=12)

Smok

(n=3)

Vype/Vuse

(n=48)

Stlth

(n=10)

Fruit

43.6% (763)

33.3% (4)

0.0% (0)

60.4% (29)

70.0% (7)

Candy, chocolate, desserts

27.6% (482)

8.3% (1)

100% (3)

0.0% (0)

0.0% (0)

Non-alcoholic drink

12.5% (219)

0.0% (0)

0.0% (0)

0.0% (0)

0.0% (0)

Tobacco

7.6% (133)

25.0% (3)

0.0% (0)

14.6% (7)

10.0% (1)

Menthol/mint

4.1% (72)

16.7% (2)

0.0% (0)

12.5% (6)

10.0% (1)

Coffee

1.4% (25)

0.0% (0)

0.0% (0)

0.0% (0)

0.0% (0)

Alcoholic beverage

0.8% (14)

0.0% (0)

0.0% (0)

0.0% (0)

0.0% (0)

Spice

0.6% (10)

8.3% (1)

0.0% (0)

8.3% (4)

0.0% (0)

Unflavoured

0.4% (7)

0.0% (0)

0.0% (0)

0.0% (0)

10.0% (1)

Tobacco & menthol

0.3% (6)

0.0% (0)

0.0% (0)

0.0% (0)

0.0% (0)

Other flavour

1.0% (17)

8.3% (1)

0.0% (0)

4.2% (2)

0.0% (0)

5

Note that no e-liquids were identified under the Aspire brand.

22

E-LIQUIDS – NICOTINE PROFILE

Overall, 53.1% (n=929) of e-liquids were labelled or otherwise indicated online as ‘freebase’ or

‘regular’, while 46.7% (816) were salt-based, and 0.2% (n=3) were ‘hybrid’. Among the 1,748 e-

liquids, there were a total of 4,798 different nicotine concentrations available; in other words, each

e-liquid was offered in an average of two or three different nicotine concentrations. As Table 7

indicates, average nicotine concentration was 2%, although the ‘top 5’ brands all had higher

nicotine concentrations. Salt-based e-liquids averaged 3.6% nicotine concentration, while freebase

e-liquids averaged 0.9%.

E-LIQUIDS – NICOTINE LABELLING AND HEALTH WARNINGS

Among e-liquids for which the principal display area of the package was visible in the online image

(n=1551), an indication that the product contains nicotine was visible on 71.2% of packages

(n=1105), and the nicotine concentration was visible on 83.8% (n=1286) of packages.

8

In addition,

53.2% of packages (n=485) indicated that the product was a ‘nicotine salt’ based e-liquid. Health

warnings were visible on 63.5% of packages, as shown by online retailers.

6

Table 7a. Nicotine profile of e-liquids, overall and by leading brand.

Nicotine (%)

All e-liquids

(n=4,798)

JUUL

(n =25)

Smok

(n=3)

Vype/Vuse

(n=122)

Stlth

(n=30)

All e-liquids

Mean (SD)

2.0 (1.7)

3.7 (1.3)

5.0 (0.0)

2.7 (1.3)

3.7 (1.3)

0% (No nicotine)

15.5% (743)

0% (0)

0% (0)

4.9% (6)

0% (0)

0.1-1.0%

36.2% (1735)

0% (0)

0% (0)

9% (11)

0% (0)

1.1-2.0%

18.4% (883)

24.0% (6)

0% (0)

37.7% (46)

33.3% (10)

2.1-3.0%

6.2% (299)

28.0% (7)

0% (0)

30.3% (37)

0% (0)

3.1-4.0%

9.1% (438)

0% (0)

0% (0)

0% (0)

33.3% (10)

4.1-5.0%

13.4% (643)

48.0% (12)

100% (3)

18.0% (22)

33.3% (10)

5.1-6.0%

1.1% (51)

0% (0)

0% (0)

0% (0)

0% (0)

6.1-7.0%

0.1% (6)

0% (0)

0% (0)

0% (0)

0% (0)

6

Note: it is possible that this information was visible elsewhere on the package. In most cases, online retailers only displayed the ‘front’ of e-liquid

packages; therefore, warnings may have been displayed on areas of the e-liquid packages that was not visible in the online image. This limitation is

discussed in greater length in the Discussion section.

23

Table 7b. Nicotine profile of e-liquids by salt and free base form, overall and by leading brand.

Nicotine (%)

All e-liquids

(n=4,798)

JUUL

(n =25)

Smok

(n=3)

Vype/Vuse

(n=122)

Stlth

(n=30)

‘Salt-base’ e-liquids

Mean (SD)

3.6 (1.3)

3.7 (1.3)

5.0 (0.0)

3.1 (1.1)

3.7 (1.3)

0% (No nicotine)

0.1% (2)

0% (0)

0% (0)

0% (0)

0% (0)

0.1-1.0%

3.4% (69)

0% (0)

0% (0)

0% (0)

0% (0)

1.1-2.0%

25.4% (513)

24.0% (6)

0% (0)

37.9% (36)

33.3% (10)

2.1-3.0%

14.8% (299)

28.0% (7)

0% (0)

39.0% (37)

0% (0)

3.1-4.0%

21.7% (438)

0% (0)

0% (0)

0% (0)

33.3% (10)

4.1-5.0%

31.8% (643)

48.0% (12)

100% (3)

23.2% (22)

33.3% (10)

5.1-6.0%

2.5% (51)

0% (0)

0% (0)

0% (0)

0% (0)

6.1-7.0%

0.3% (6)

0% (0)

0% (0)

0% (0)

0% (0)

‘Freebase’ e-liquids

Mean (SD)

0.9 (0.6)

-

-

1.1 (0.8)

-

0% (No nicotine)

26.8% (741)

0 (0)

0 (0)

22.2% (6)

0 (0)

0.1-1.0%

60% (1660)

0 (0)

0 (0)

40.7% (11)

0 (0)

1.1-2.0%

13.3% (367)

0 (0)

0 (0)

37.0% (10)

0 (0)

2.1-3.0%

0 (0)

0 (0)

0 (0)

0 (0)

0 (0)

3.1-4.0%

0 (0)

0 (0)

0 (0)

0 (0)

0 (0)

4.1-5.0%

0 (0)

0 (0)

0 (0)

0 (0)

0 (0)

5.1-6.0%

0 (0)

0 (0)

0 (0)

0 (0)

0 (0)

6.1-7.0%

0 (0)

0 (0)

0 (0)

0 (0)

0 (0)

24

E-LIQUIDS – PACKAGE COLOURS

Table 8 shows the dominant colours used on e-liquid packaging. As was the case for vaping devices,

e-liquids featured a wide range of colours, with no one dominant theme.

Table 8. Dominant packaging colours on e-liquid packaging, overall and by leading brand (n=1,747)

Colour

Dominant Colour 1

Dominant Colour 2

Dominant Colour 3

Red

14.8% (238)

8.7% (139)

3.5% (56)

Blue

14.3% (229)

12.5% (200)

5.0% (81)

Black

11.5% (185)

7.9% (127)

23.5% (378)

Green

9.9% (159)

8.4% (135)

7.1% (114)

White

8.9% (143)

27.9% (449)

29.4% (472)

Pink

8.7% (140)

5.2% (83)

3.1% (49)

Yellow

8.1% (130)

8.9% (143)

5.6% (90)

Orange

7.7% (124)

6.0% (96)

2.6% (42)

Brown

6.1% (98)

2.1% (33)

2.2% (35)

Purple/violet

5.3% (85)

3.4% (54)

1.6% (26)

Gold

2.6% (41)

2.7% (44)

1.3% (21)

Silver

0.9% (14)

2.4% (38)

1.6% (25)

Grey

0.8% (13)

3.0% (48)

1.6% (25)

Other

0.4% (7)

0.7% (11)

0.3% (5)

None

0.1% (1)

0.4% (7)

11.7% (188)

25

E-LIQUIDS – PACKAGE DESIGN THEMES

DESIGN THEMES

As Table 9 indicates, almost half of e-liquid packaging was considered to be of simple/minimal

design. All Stlth, and almost all JUUL, e-liquid packaging was considered simple/minimal, and no

Smok or Vype/Vuse e-liquids were considered simple/minimal. One tenth of e-liquid packages were

considered to have bubble letter font, feature geometric shapes and display references to nature.

Less than 5% of packages were metallic/shiny in appearance, while very few had references to

technology. Examples are shown in Figure 10.

Table 9. Design themes on e-liquid packaging, overall and by leading brand.

All e-liquids

(n=1,778)

JUUL

(n=12)

Smok

(n=3)

Vype/Vuse

(n=48)

Stlth

(n=10)

Simple/minimal

1

805 (46.1%)

11 (91.7%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Geometric/swirly

222 (12.7%)

0 (0.0%)

3 (100.0%)

11 (22.9%)

0 (0.0%)

Nature

2

160 (9.2%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Bubble letter font

3

158 (9.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Metallic/ shiny

61 (3.5%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Technology

4

7 (0.4%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Specific instructions for coding:

1

Simple/minimal design (NOT busy or cluttered);

2

Nature/outdoors/earthy/camo (e.g.,

image of leaves);

3

Bubble letter font (rounded edges);

4

Technology/gadget/futuristic.

Figure 10. Examples of design themes on e-liquid packaging

Bubble letter font

V A PERGATE

MO NSTER VAPE LABS

LO ADED

26

Figure 10. Examples of design themes on e-liquid packaging cont.

Nature

RIPE VAPES

M.E.O

CHARLIE’S CHALK DUST

Metallic/ shiny

V2

MET4

SILVERBACK JUICE CO.

Technology

Geometric/ swirly

DECODED

DSV SELECT

VYPE/VUSE

27

LIFESTYLE THEMES

As shown in Table 10, approximately 3% of e-liquid packages included lifestyle references. Few

packages featured religious or mythical references; however, almost 10% featured a person,

character or animal on packaging. Examples are shown in Figure 11.

Table 10. Lifestyle-related references on e-liquid packaging, overall and by leading brand.

All e=liquids

(n=1,778)

JUUL

(n=12)

Smok

(n=3)

Vype/Vuse

(n=48)

Stlth

(n=10)

Lifestyle references

49 (2.8%)

0 (0.0%)

1 (10%)

0 (0.0%)

0 (0.0%)

Person, character, animal

170 (9.7%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Religion or mythology

10 (0.6%)

0 (0.0%)

0 (0.0%)

3 (6.3%)

0 (0.0%)

Figure 11. Examples of lifestyle references on e-liquid packaging

Lifestyle advertising

VAPETASIA

NASTY JUICE

DINNER LADY

MUSKOKA REFINED

LIQUID EFX

AIR FACTORY

28

FOOD AND DRINK THEMES

A majority of e-liquids featured references to food or drinks on packaging, as shown in Table 11.

Examples are shown in Figure 12.

Table 11. Food and drink references on e-liquid packaging, overall and by leading brand.

All e=liquids

(n=1,778)

JUUL

(n=12)

Smok

(n=3)

Vype/Vuse

(n=48)

Stlth

(n=10)

Any

1050 (60.1%)

7 (58.3%)

3 (100.0%)

11 (22.9%)

7 (70.0%)

Fruit

836 (47.8%)

3 (25.0%)

3 (100.0%)

7 (14.6%)

7 (70.0%)

Confectionary/dessert

181 (10.4%)

1 (8.3%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Soft drink

124 (7.1%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Spice/herb

85 (4.9%)

3 (25.0%)

0 (0.0%)

3 (6.3%)

0 (0.0%)

Other food

56 (3.2%)

0 (0.0%)

0 (0.0%)

1 (2.1%)

0 (0.0%)

Other drink

36 (2.1%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Caffeine

26 (1.5%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Energy drink

1 (0.1%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Cannabis

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

29

Figure 12. Examples of food and drink references on e-liquid packaging

Confectionary/ dessert

SEA PODS COTTON CANDY

GÖST

MR. FOG

Fruit

KAPOW

VAPERGATE

FRUITBAE

Beverages

ZIP LABS

BARISTA VAPE CO.

ZIIP LAB ZPODS

30

OTHER THEMES

Very few e-liquid packets had themes relating to health benefits, tobacco, religion, or lifestyle

(Table 12). This was largely consistent across brands, except a quarter of JUUL e-liquid packets

were found to have imagery or indication of tobacco, or comparison with tobacco smoking

(Table 12). Examples are shown in Figure 13.

Table 12. Other references on e-liquid packaging, overall and by leading brand.

Figure 13. Examples of tobacco references on e-liquid packaging

Reference to tobacco

MAD HATTER

NAKED

MYLE

All

e=liquids

(n=1,778)

JUUL

(n=12)

Smok

(n=3)

Vype/Vuse

(n=48)

Stlth

(n=10)

Implies health benefits

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Reference to probiotics

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

0 (0.0%)

Reference to tobacco

60 (3.4%)

3 (25.0%)

0 (0.0%)

3 (6.3%)

1 (10.0%)

31

TELEPHONE RETAIL SCAN

Ten vape shops and 10 convenience stores were called in each of the five provinces. Responses

were received from 81 stores, including 46 vape shops and 35 convenience stores.

Table 13. Number of completed telephone retail scans, by province.

Vape shops

Convenience

stores

British Columbia

10

9

Alberta

9

7

Ontario

10

8

Quebec

8

5

Nova Scotia

9

6

BRAND AVAILABILITY

A total of 55 brands were reported in vape shops and convenience stores. In total, 27 (49.1%) of

brands identified in the telephone scan were previously identified and included in the online scan.

Table 14 - Vaping Device Brands identified in the telephone scan and frequency (n=81 stores).

Eleaf (81)

Epod (81)

Juul (43)

Smok (37)

Vuse (33)

Aspire (29)

Geekvape (26)

Voopoo (26)

Uwell (22)

Stlth (18)

Vaporesso (16)

Innokin (14)

Lost (12)

Joytech (11)

Kangertech (6)

Logic (6)

Yocan (5)

Aegis (4)

Blu (4)

Freemax (4)

Suorin (4)

Caliburn (3)

Ijoy (3)

Justfog (3)

Nitecore (2)

Relx (2)

Smoktech (2)

Snowwolf (2)

Stig (2)

Allo (1)

Alure (1)

Asmodus (1)

Berrydrop (1)

Bmv (1)

Davinci (1)

Drag (1)

Efest (1)

Eve (1)

Hellvape (1)

Horizon (1)

Horizontech (1)

Metalmoose (1)

Mile (1)

Nautilus (1)

Obs (1)

Phix (1)

Rui (1)

Sense (1)

Shadow (1)

Sigelei (1)

Vandy (1)

Vapefly (1)

Viva (1)

Wasp (1)

Nord (1)

32

PACKAGING EXTENSIONS & CUSTOMIZATIONS

The retail scan identified a range of device ‘skins’ and other accessories that can be used to

enhance product packaging. A variety of third-party retailers offer skins for popular brands; in the

current study, skins were only included if they were being offered for sale in conjunction with a

vaping device. For example, Vuse/Vype offers a line of skins that consumers can order with their

vaping device and e-liquids, as well as engraving for both pre-set designs and personalized

lettering—see Figure 14.

Figure 14. Personalized accessories: vaping device ‘skins’ and engraving

Vuse skins

7

Vuse pouch

8

VUSE LIMITED EDITION DESIGN

9

VUSE PERSONAL ENGRAVING

10

7

Vuse Canada. Imperial Tobacco Canada Lt. Available at: https://www.vuse.com/ca/en/buy-online/vype-epod-skins/ [Accessed 20 Nov 2020]

8

Vuse Canada. Imperial Tobacco Canada Lt. Available at: https://www.vuse.com/ca/en/buy-online/the-pouch [Accessed 20 Nov 2020]

9

Vuse Canada. Imperial Tobacco Canada Lt. Available at: https://www.vuse.com/ca/en/vype-epod-starter-kit/#step-7 [Accessed 20 Nov 2020]

10

Vuse Canada. Imperial Tobacco Canada Lt. Available at: https://www.vuse.com/ca/en/buy-online/engravable [Accessed 20 Nov 2020]

33

The current study provides only a limited glimpse into ‘special’ or ‘limited edition’ packaging. This

practice has been used by major brands and typically involves a novel colour or design on the

exterior of vaping devices, as illustrated in Figure 15.

Figure 15. Limited edition packaging for JUUL

11

JUUL LIMITED EDITION ‘RUBY’ DEVICE

JUUL LIMITED EDITION ‘AQUA’ DEVICE

EXTERIOR PACKAGING OF VAPING DEVICES

A subset of devices, starter kits, and e-liquids are shown for 12 popular brands to examine the

exterior packaging of vaping devices – see Figures 16 to 27 on the following pages.

VAPING DEVICES

For exterior packaging that only contained devices and no e-liquids, all packages displayed an

image and name of the device on the ‘front’ principal display area. Packaging for vaping devices

featured multiple colours and other graphic design or aspects of brand imagery. In addition,

exterior packaging of devices often included several ‘layers’ of packaging and different types of

‘openings’, including packages that slide open from the top or side, or ‘book’ openings.

A health warning was displayed on the ‘front’ principal display area for only one vaping device

package (Vuse) and not for the other five vaping device brands (Voopoo, Aspire, Joytech, iStick,

or Kanger Tech). Warnings were displayed on the ‘back’ of packages for these five brands,

11

JUUL Canada. Available at: https://www.juul.ca/en-CA/shop/devices/ruby-device-kit [Accessed 20 Nov 2020].

34

typically in small font and the message content was inconsistent across brands. A wide range of

product information was also included on the back panel of packages, including product

specifications.

STARTER KITS

The exterior packaging for starter kits was similar to packaging for vaping devices with respect to

the level of brand imagery and design; however, a greater amount of product information was

displayed on the principal display area. This information conveyed details about both the

product and the e-liquids included in the starter kit, including nicotine level and flavour. All

starter kits included a prominent warning on the front display panel of packages, with additional

product information on the back panel. Starter kits also include ‘sub-packaging’ for the device

and e-liquids, which contained additional brand imagery and product information.

E-LIQUIDS

Packaging of the pod-based e-liquids included branded information, colours, design features, as

well as detail on flavours, nicotine level and the number of flavour pods. At least one of the

liquids appeared to feature labelling consistent with the July 2020 federal labelling requirements,

including a list of ingredients on the back of packages.

Examples of exterior packaging are provided on the following pages.

35

FIGURE 16

VOOPOO VAPING DEVICE

36

FIGURE 17

ASPIRE BREEZE 2

VAPING DEVICE

37

FIGURE 18

ISTICK PICO 25

VAPING DEVICE

38

FIGURE 19

KANGER TECH TOP EVOD

VAPING DEVICE

39

FIGURE 20

SMOKE NOVO 2

VAPING DEVICE

40

FIGURE 21

VUSE EPOD VAPING DEVICE

41

FIGURE 22

JOYTECH EGO VAPING DEVICE

42

FIGURE 23

MY BLUE INTENSE STARTER KIT

43

FIGURE 24

STLTH STARTER KIT

44

FIGURE 25

JUUL STARTER KIT

45

FIGURE 26

VYPE EPEN 3 – STARTER KIT & E-LIQUID

46

FIGURE 27

VUSE EPOD – E-LIQUID

47

Discussion

OVERVIEW OF FINDINGS FOR VAPING DEVICES

The findings from the current retail scan depict an incredibly diverse market in Canada with respect

to the types of vaping products available and the information communicated through packaging.

The scan identified hundreds of different vaping devices available for sale across 43 unique device

brands, with more than 3,000 device varieties after accounting for different colours and visual

designs. Several of the leading brands in Canada had dozens of different colour varieties for the

same device model.

COLOURS AND DESIGN THEMES

In general, colour differentiation and graphic imagery (e.g., geometric/swirly designs) were far

more prominent on vaping devices compared to specific references to lifestyle or other themes.

This reflects the fact that the design of most devices is based on colours and abstract imagery, and

displays relatively little text. The notable exception was disposable products, for which the package

must communicate both the brand attributes of the device, as well as the attributes of the

particular flavour of e-liquid contained within a disposable device. In this sense, disposable

products represent a hybrid of sorts between the types of designs common to devices and the

designs common to e-liquids.

PACKAGING ACCESSORIES AND PERSONALIZATION

The retail scan identified a range of device ‘skins’ and other accessories, which are sold by third

parties and vaping device manufacturers. For example, when purchasing Vype/Vuse online from

the manufacturer, consumers are offered the opportunity to select engraving designs for their

device, which feature a wide variety of ‘pre-set’ designs and personalized text. In general,

packaging accessories offer consumers opportunities to enhance and personalize vaping products

beyond the designs already available.

TYPE AND SHAPE

Analyzing the shape and size of devices presents considerable challenges given the wide array of

devices and the extent to which many devices can be customized to change components. This is

particularly true for box-mods, which accounted for half of all devices identified in the scan, and to

some extent for pen-style devices. Together, these open-tank systems accounted for three

quarters of all devices identified. These systems offer greater flexibility in terms of device

48

configuration and customization, as well as the types of e-liquids that can be used, which may have

considerable appeal among more frequent users and price sensitive consumers. Pod-based devices

accounted for approximately one quarter of devices and include several of the market share

leaders in Canada, including JUUL and Vype/Vuse. The variety of other pod-based brands suggest

that pod systems have become firmly established in Canada, and now extend well beyond JUUL.

The scan identified very few ‘cigalike’ and disposable devices.

OVERVIEW OF FINDINGS FOR E-LIQUIDS

COLOURS AND DESIGN THEMES

Data were also collected for more than 1,700 e-liquids. As was the case with vaping devices, e-

liquid packaging exhibited a wide range of colours, with no single dominant colour. E-liquids were

considerably more likely than vaping devices to feature nature-related themes, playful font styles

such as bubble fonts, as well as lifestyle references. For example, approximately 10% of e-liquid

packages featured a real or fictional person, character or animal. In addition, approximately 60% of

e-liquid packages featured references to food or drinks, with fruit, confectionary/dessert, and soft

drinks being the most common references.

E-liquid packages (particularly pod packages) are likely to have much lower social visibility than

vaping devices. Other than the mouthpiece, flavoured pod packaging is not externally visible after

they are inserted into the pod device, whereas e-liquid bottles for tank systems are disposed after

use and are rarely visible in public. Therefore, the packaging for most e-liquids may have its

greatest impact at the point-of-sale, or indirectly through promotions in which they are featured.

NICOTINE LABELLING AND HEALTH WARNINGS

Nicotine labelling and health warning practices were inconsistent on e-liquids: approximately two-

thirds of packages displayed a visible health warning based on the product images online. Although

these products may have displayed warnings on other parts of the packaging not visible in the

online image, the warnings were often obscure even when they were visible on the ‘front’ of

packages. Nicotine was also inconsistently visibly labelled. Among e-liquids for which the principal

display area of the package was visible in the online image, a nicotine concentration statement was

visible on 84% of packages and an indication that the product contains nicotine was visible on 71%

of packages. In addition, no health warnings on the potential health harms of vaping were observed

directly on vaping devices based on the images shown online, although this was not required under

federal regulations at the time of this study.

49

OVERVIEW OF FINDINGS FOR EXTERIOR PACKAGING

The current project examined a limited number of ‘exterior’ packages for vaping devices. However,

even the small sub-sample of popular brands illustrate the sophisticated packaging, including

various methods of opening. At the time of the scan, which was mostly conducted prior to

mandatory health warnings implemented in July 2020, health warning practices were inconsistent

on exterior packaging. Warning messages were typically included in very small text on the back of

packages. None of the packaging for vaping devices only displayed warnings on the ‘front’ principal

display area. Labelling of nicotine for starter kits was also inconsistent. For example, there was no

indication of nicotine on the front of JUUL starter kits.

LIMITATIONS

The current scan did not include all vaping products and e-liquids available on the Canadian

market. The telephone retail scan of brick-and-mortar stores conducted in five provinces identified

additional vaping product brands, approximately half of which were included in the online retail

scan. However, the profile of vaping products and brands identified in the retail scan closely align

with national estimates of sales data on attributes such as flavour profile, nicotine concentration,

and market-share leaders.

12

Indeed, based on national survey data from the ITC Youth Tobacco and

Vaping surveys, the brands captured in the scan account for more than 90% of market share

among 16-to-19-year-olds, and approximately 80% of brand market share reported by adult vapers

in the ITC Adult surveys.

13

The current scan was primarily limited to images of products as shown online. This presents two

limitations. First, the entire device or e-liquid container could not be viewed if the images online

displayed only one profile or angle. Second, virtually all devices and many e-liquids are sold in an

exterior package, which may include additional promotional or product information. The current

report examined exterior packaging only for a small subset of products. Although this subset of

products account for a substantial share of the vaping sales in Canada, we are unable to draw

conclusions about important elements of exterior packaging for the entire market, such as the

display and content of health warning messages.

12

1) Euromonitor Passport. Smokeless Tobacco, E-Vapour Products and Heated Tobacco in Canada. Euromonitor International; July 2019. 2) Nugent

R (on behalf of Health Canada). The vaping market in Canada, 2019. Canadian Public Health Association Tobacco and Vaping Control Forum; Sept

23 2020.

13

1) Hammond D, Reid JL, East K. Youth vaping, tobacco use and the evolving nicotine market in Canada: patterns of use and policy implications.

Canadian Public Health Association – Tobacco and Vaping Control Forum; 2020 Sept 23; Ottawa, ON. 2) Fong GT, et al. The ITC 4-Country Smoking

& Vaping Survey: Preliminary findings from the ITC Canada 2020 Surveys. November, 2020.

50

The coding of design themes requires subjective evaluations of images and design. This was

mitigated by developing a comprehensive list of design themes and the development of a coding

protocol. There was also very high inter-rater reliability in preliminary testing.

The current scan was conducted shortly before—and in some cases during—the implementation of

provincial and federal regulations that impacted the availability and packaging of vaping products in

Canada. In particular, new federal labelling regulations were implemented in July 2020, including

requirements for new health warnings and ingredient labelling. Nova Scotia had also begun to

implement restrictions of e-liquid flavours during data collection. However, this report aimed to

provide a snapshot of vaping product packaging in Canada, and we did not explore differences in

devices and e-liquids by province.

51

Appendix

Appendix A – Telephone retail scan

PHONE SCAN – CONVENIENCE STORES

1. Do you sell e-cigarettes? (yes/no)

2. What brands do you carry? (enter each brand they carry)

a. If they say they carry many brands but aren’t specific, ask ‘Do you carry JUUL or Vype?’

(Enter these brands if they say yes)

3. What is the highest nicotine level you carry? (enter % or mg/ml)

a. If they don’t know, ask ‘Do you have anything over 2% (or 20mg/ml)?

4. Do you sell any that come in fruit flavours? (yes/no)

5. Do you sell any that come in menthol? (yes/no)

PHONE SCAN – VAPE SHOPS

1. What brands of e-cigarettes do you carry? (enter each brand they carry)

a. If they say they carry many brands but aren’t specific, ask ‘Do you carry JUUL or Vype?’

(Enter these brands if they say yes)

2. What is the highest nicotine level you carry? (enter % or mg/ml)

a. If they don’t know, ask ‘Do you have anything over 2% (or 20mg/ml)?’

3. Do you sell any that come in fruit flavours? (yes/no)

4. Do you sell any that come in menthol? (yes/no)

Note: If store staff say they don't know or if they refuse to answer any question, record this in

the excel file in the Notes column (‘DK’ for don’t know, ‘R’ for refuse to answer)

52

Appendix B – Vaping Device Brands: Online retail scan

Table B1 - List of all vaping device brands identified in the online scan and number of varieties

Smok (538)

Aspire (538)

iJoy (351)

Eleaf (299)

Joyetech (236)

VooPoo (213)

Vaporesso (201)

Innokin (161)

Snowwolf (136)

Tesla (135)

Kanger Tech (128)

Geek Vape (124)

Lost Vape (88)

Uwell (78)

Suorin (49)

V2 (45)

Mi-Pod (34)

Vype/Vuse (31)

JustFog (23)

FreeMax (22)

WISMEC (19)

Zalt (16)

OVNS (13)

Puff Bar Disposables (9)

Vapmor (8)

HorizonTech (6)

VGOD (6)

STLTH (5)

MYLE (5)

Smoant (5)

Orchid (5)

BO Vaping (4)

Sigelei (4)

Limitless (4)

Artery Vapour (4)

JUUL (4)

Pioneer4You (3)

Khree (3)

EONSMOKE (3)

Blu (2)

Smoking Vapor (2)

VandyVape (2)

Hcigar (1)

53

Appendix C – E-liquid Brands: Online retail scan

Table C1 - List of all E-liquid Brands identified in the online scan and number of varieties

V2 (62)

Twelve Monkeys Vapor (51)

Vype/Vuse (48)

NAKED 100 (41)

Lemon Drop (39)

Ziip Lab Zpods (38)

Koil Killaz Quebec (36)

Twist E-Liquid (31)

Drip More (29)

Fruitbae (28)

Vital (28)

Chill (27)

Monster Vape Labs (25)

Nasty Juice (25)

Keep It 100 (24)

PurEliquid (23)

Dinner Lady (22)

Illusions (22)

Air Factory (21)

Element (21)

EONSMOKE (20)

AllDay Vapor (19)

Vapetasia (18)

Sovereign Juice Co. (18)

Archer E-liquid (18)

Kapow (18)

Mad Hatter (17)

The Milkman (16)

SpringTime (16)

Berry Drop (16)

Saltbae50 (15)

7 Daze MFG (15)

Ultimate 100 (15)

SEA Pods (14)

Juice Head (14)

Dvine (14)

Myst (14)

Pachamama (13)

GÖST (13)

Plus Pods (13)

LOADED (12)

Just (12)

Suavae (12)

JUUL (12)

Fresh Farms E-liquid (11)

Rope Cut (11)

PGVG Labs. (11)

Phillip Rocke (11)

True Northern Quebec (11)

Ruthless Vapor (11)

MYLE (10)

STLTH (10)

Harleys Original (10)

Five Pawns (10)

Blackwood (10)

Flavour Crafters (10)

SKWEZED (9)

Premium Labs (9)

Drip Social (9)

Kilo (9)

TDK The Drip Kings (9)

One Hit Wonder (9)

JūST Quebec (9)

Twist Tea (9)

Mr. Fog (8)

Marco Polo (8)

Silverback Juice Co. (8)

Humble Juice Co. (8)

Food Fighter (8)

PODZ (8)

Salt Nix (8)

Liberty Reserve (8)

The Front (8)

Hundred (8)

Propaganda (7)

Beard Vape Co. (7)

Velvet Cookie (7)

Zalt (7)

Immorality (7)

Muskoka Refined (7)

Exotix (7)

Sovereign Juice Co (7)

Blu (6)

Mi-Pod (6)

54

4X PODS (6)

Decoded (6)

Met4 (6)

Ripe Vapes (6)

M.E.O (6)

PuR (6)

Ultra Max (6)

Cassadaga (6)

Tumbleweed Quebec (6)

Lab Salts (6)

ORO (6)

Patchy Drips (6)

Sucker Punch (6)

Cali Pods (5)

FRYD (5)

Northern Nectar Quebec (5)

Charlies Chalk Dust Quebec (5)

Fruit by the Ounce (5)

Crave (5)

Brew House (5)

Burst (5)

IVG (5)

The Juice Punk Inc (5)

Splashy (5)

Softie Salts (5)

Ultra (5)

Aqua (5)

Simply Nic (5)

Kanger Tech (4)

Vapergate (4)

Solace (4)

RYPE Vapors (4)

Holy Cannoli (4)

BLTS (4)

Windsor Vapes (4)

Flawless (4)

80V (4)

Skol (4)

Crumbz Drops (4)

Mind Blown Vape (4)

DISC Quebec (4)

Petersons (4)

Bottom of the bowl (4)

Classic (4)

Noms (4)

Rhype (4)

Drip Flavors (4)

Crazy Juice (4)

Fizzy (4)

Ultimate Berries (4)

VIA (3)

Hope (3)

California Grown (3)

SMOK (3)

Canada E-Clouds (3)

Sir Prestons (3)

Definitive (3)

Jazzy Boba (3)

Liquid EFX (3)

Cloudfire Quebec (3)

Beaver Sauce Quebec (3)

Salt Box (3)

3 Baccos (3)

3 Titans (3)

Cola Man (3)

Cosmic Fog (3)

KVNDI (3)

SMAX (3)

Vape Breakfast Classics (3)

Vape Time (3)

Peak (3)

Japellos (3)

Don Cristo (3)

Salt Worx (3)

The Salty One (3)

Vape Evasion (2)

Banana Butt Quebec (2)

Coastal Clouds Quebec (2)

Cloud Remedy (2)

Marina Vape (2)

Brewell Vapory (2)

Coffee Time (2)

Fresh Pressed (2)

Glas Vapor (2)

KOI (2)

Lees (2)

Salt Cellar (2)

TobacNo7 (2)

Daves Finest (2)

French Pressed (2)

Sour Master (2)

Sub Ohm Invasion SOI (2)

Taffy Splash (2)

Theory Labs (2)

Vape Pink (2)

Yogi (2)

POP Vapors (1)

Bablito Industries (1)

Wiquid (1)

Barista Vape Co. (1)

55

Barista Brew Co. (1)

Saucy (1)

Off the Record (1)

Suicide Bunny (1)

Bazooka Quebec (1)

Saub-ohm Sauz Quebec (1)

E-Fizz Quebec (1)

Beantown Vapor (1)

Buhl (1)

Choco Cow (1)

Clarity (1)

DSV Select (1)

Exicision (1)

Graham Slam (1)

HM Vapes (1)

Joy (1)

SVRF (1)

The Standard Vape (1)

U Turn (1)

Cool Pods (1)

Moonshiner (1)

Indulge (1)

COP (1)

El Vaporo (1)

Famous Fair (1)

Icy Fresh (1)

Lost Art (1)

Milkshake Liquids (1)

OG Bear (1)

Pastry Boy (1)

Ross Sauce (1)

The Mamasan (1)

Toronto Juice Co. (1)

USA Vape Labs (1)

Zenith (1)