2023 PropTech

Year in Review

February 2024

2

01

EXECUTIVE SUMMARY

2

02

KEY SUBSECTOR MARKET TRENDS

13

03

PROPTECH MARKET SUMMARY

31

04

PUBLIC MARKETS

35

05

HOULIHAN LOKEY OVERVIEW

38

06

APPENDIX

48

$4,226

$4,833

$6,964

$6,119

$14,507

$9,407

$4,211

$250

$475

$2,060

$1,345

$4,305

$2,901

$510

$4,477

$5,308

$9,024

$7,464

$18,812

$12,308

$4,721

2017 2018 2019 2020 2021 2022 2023

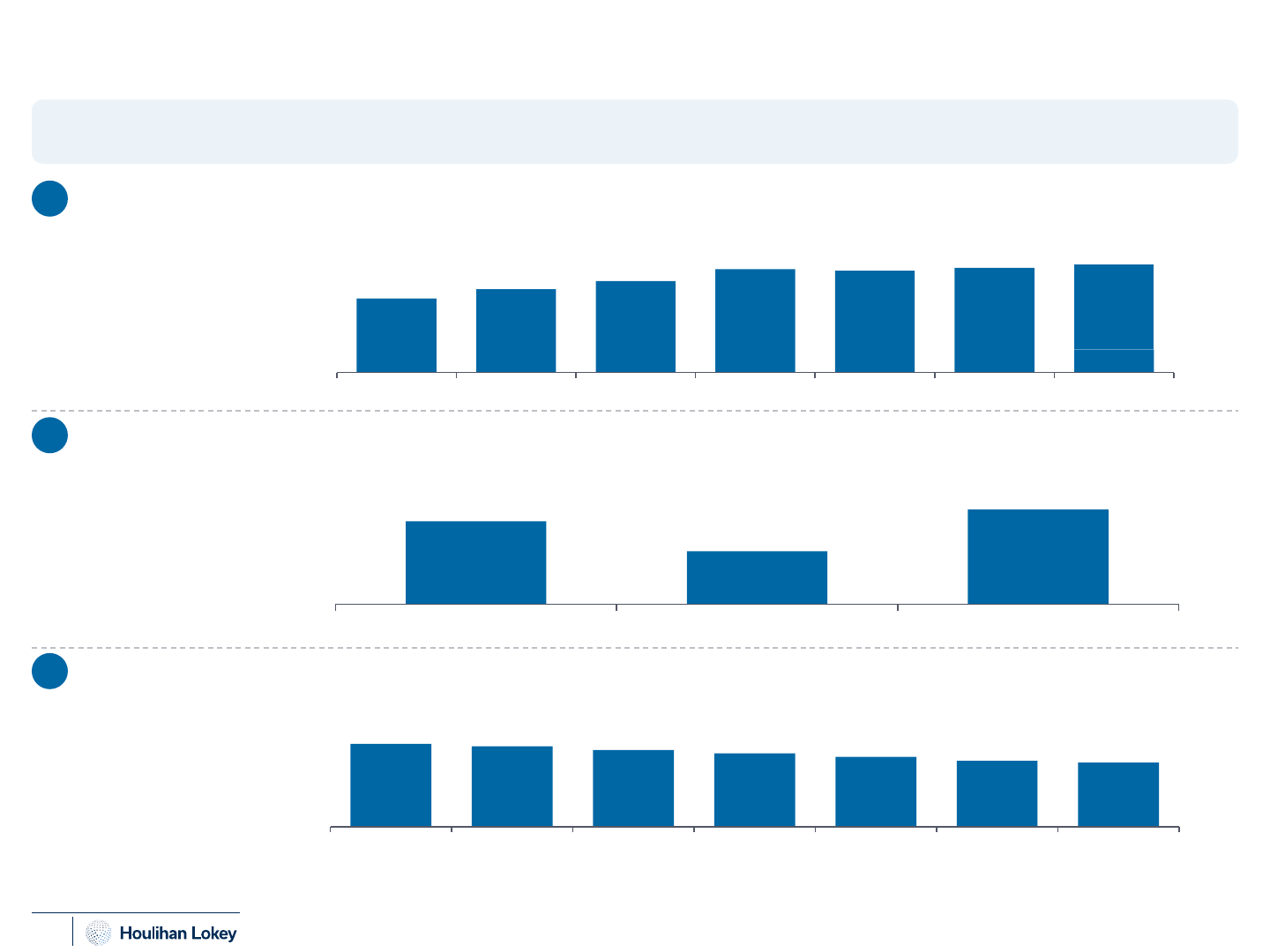

PropTech 2023—A Challenging Year With Optimism Ahead

3

• Against the backdrop of macroeconomic uncertainty, increasing interest rates, and a tightening residential real estate market, 2023 saw more

than $4.7 billion in growth equity and debt investments into U.S. PropTech companies.

– PropTech remains a very diverse market

. Some end markets have been more affected by the macro environment (e.g., mortgage, office), but

there is still a large opportunity driven by increasing technology adoption among real estate investors and property managers looking

to streamline operations and increase efficiency.

• ~50 capital raises were north of $20 million in 2023 as scale leaders continue to emerge across all categories of PropTech.

– Multiple $50+ million capital raises in construction tech, multi-family, and CRE technology (Avenue One, Kasa Living, Mighty Buildings)

highlight the TAM opportunity and attractiveness of certain end markets.

– Throughout the year, investors increasingly prioritized growth, profitability, and revenue stability.

While PropTech experienced a significant market pullback in 2023, the market opportunity remains large and attractive for

category leaders.

U.S. PropTech Private Growth Capital Investment—Trailing Seven Years

Sources: PitchBook, CB Insights, company filings, company websites, press releases.

Debt Raise ValueEquity Raise Value

Average U.S. PropTech Growth Investment/Year (2017–2023)

$8,873

Seven-Year

Average

(62%) YoY

($M)

Alignment of Multiple Factors Drove 2023 Headwinds

4

U.S. Office Vacancy Increasing as Return to Office Stalls

Landmark NAR Class-Action Decision Threatens Agent Commissions, Creating Uncertainty for Residential Sector

Inflation Down From 2022 High but Remains Above FOMC Longer-Run Target Rate

An aggressive rate tightening cycle, increased office vacancy rate, and the ongoing NAR lawsuit all negatively impacted the

2023 PropTech market.

U.S. Office Vacancy Rate

(3)

Kastle Back to Work Barometer

(4)

(1) Bureau of Labor Statistics.

(2) Federal Reserve.

(3) Cushman & Wakefield, “U.S. Office MarketBeat Q3 2023.”

(4) Kastle Systems Back to Work Barometer. Reflects swipes of Kastle

access controls from the top 10 cities, averaged weekly.

(5) Redfin, 10/31/2023.

(6) National Association of Realtors (NAR), 9/6/2023.

16%

17%

17%

17%

17%

17%

17%

18%

18%

19%

19%

23%

29%

33%

36%

35%

43%

44%

45%

48%

49%

48%

Q1-21 Q3-21 Q1-22 Q3-22 Q1-23 Q3-23

YoY inflation

declined to 3.4% in

Dec-23, down from

the high of 9.1% in

Jun-22.

(1)

U.S. office utilization

has stagnated at

~50% of workdays as

companies settle into

hybrid work plans.

(4)

Traditional brokers will undoubtedly now train their agents to welcome

conversations about fees…it’s also possible that buyers will become the ones

who decide how much to pay a buyer’s agent…many buyers will still hire a

buyer’s agent, but at a fee they negotiate.

– Glenn Kelman | CEO, Redfin

(5)

The U.S. model of independent, local broker marketplaces is widely considered

the best value and most efficient model in the world, with no hidden or extra

costs and with more complete, verified information compared to other countries,

We look forward to arguing our case in court.

– Mantill Williams | VP PR & Communication Strategy, NAR

(6)

While NAR plans to appeal the decision, the potential decoupling of buyer and seller commissions could put downward pressure on commission rates.

1

2

3

One-Year CPI Change

(1)

FOMC Longer Run Target Rate

(2)

2.0%

3.4%

0.0%

5.0%

10.0%

Dec-18 Oct-19 Aug-20 Jun-21 Apr-22 Feb-23 Dec-23

PropTech Is Not Alone: Challenging Conditions Impacted Private Markets Broadly

in 2023

5

• Software M&A volumes were impacted by the market uncertainty in 2023, with U.S. software M&A deal volume down ~33% YoY, a significant

decline when compared to U.S. PropTech M&A deal volume only being down ~5% YoY.

– Continued “flight-to-quality” in M&A and growth investing; investors are willing to pay more for companies with market-leading KPIs.

• Challenging market conditions heavily impacted growth capital investing in 2023, with U.S. software growth equity investment declining

~33% YoY to ~$67 billion, versus a ~62% YoY decline for U.S. PropTech.

Broad private market tech slowdown as macroeconomic and geopolitical headwinds persist.

U.S. Annual Software Growth Capital Deal Value

(2)

Software growth capital also declined in 2023 compared to the previous

two years.

1,628

1,492

1,401

2,263

1,760

1,188

2018 2019 2020 2021 2022 2023

2023 was a slow year for software M&A activity, especially when viewed

against 2021 and 2022.

U.S. Annual Software M&A Deal Volume

(1)

$54.0

$55.3

$70.4

$164.9

$99.5

$66.7

2018 2019 2020 2021 2022 2023

Sources: S&P Capital IQ as of 12/31/2023, PitchBook.

(1) Total deal volume reflects count of M&A/buyout transactions of U.S. headquartered software target companies.

(2) Total deal value is represented in billions and inclusive of both equity and debt raises. Includes all VC stages and growth/expansion investments of U.S. headquartered software target companies.

($B)

(33%) YoY

(33%) YoY

Drivers of Optimism in PropTech for 2024

6

Federal Funds Rate Implied by Futures Market for Next 12 Months

(4)

Strong 2023 Public Market Performance Provides Healthy Valuation Environment for M&A Activity

Investors Expecting Rate Cuts in 2024

Investors Face Increased Pressure to Deploy Capital as Global PE Dry Powder Reaches Record Levels

Substantial private equity dry powder, stronger public company performance, and expectations for future interest rate cuts

offer optimism for a stronger 2024.

Source: S&P Capital IQ as of 12/31/2023.

(1) PitchBook (12/4/23), “Q3 2023 Global Private Market Fundraising Report.” Dry powder as of 3/31/2023.

(2) Includes companies in the PropTech Index shown on page 36; latest available cash balance as of 12/31/2023.

(3) PropTech Index includes all companies shown on page 36 and is weighted on a market-capitalization basis.

(4) CME FedWatch Tool, represents expected value based on mid-point of fed fund rate range as of 2/2/2024.

38%

24%

43%

PropTech Index

(3)

S&P 500 NASDAQ

($B)

$1,063

$1,194

$1,310

$1,484

$1,460

$1,501

$1,546

2017 2018 2019 2020 2021 2022 2023

(1)

Dry powder accumulating

within PE Universe, but

fund dynamics create

increased pressure for

capital deployment in

2024.

Public strategic

PropTech companies

have $73 billion in cash

on their balance sheets

and are well positioned to

drive consolidation.

(2)

Investors anticipate rate

cuts in 2024, increasing

incentive for investors

and acquirers to deploy

dry powder/ cash

reserves.

1

2

3

5.3%

5.2%

4.9%

4.7%

4.5%

4.2%

4.1%

Mar-24 May-24 Jun-24 Jul-24 Sep-24 Nov-24 Dec-24

+24%

2023

PropTech Financing Market—1H vs. 2H 2023

7

2023 Monthly PropTech Growth Investment vs. S&P 500 Index

Sources: PitchBook, CB Insights, S&P Capital IQ as of 12/31/2023, company filings, company websites, press releases.

($M)

Equity and Debt Raise Value

S&P 500 Index

PropTech investment activity slowed throughout 2023 as many investors exercised caution and many companies focused on

extending runway from prior funding rounds by cutting costs.

1H 2023 PropTech Equity and Debt Investment: ~$2.8B 2H 2023 PropTech Equity and Debt Investment: ~$1.9B

• Following several years of record investment activity, 2023 saw a fundamental shift in the growth capital fundraising market, both for PropTech

and tech more broadly, as investors increasingly focused on responsible growth, revenue visibility, and profitability.

$228

$511

$519

$515

$692

$306

$202

$297

$425

$544

$271

$210

Jan-23 Feb-23 Mar-23 Apr-23 May-23 Jun-23 Jul-23 Aug-23 Sep-23 Oct-23 Nov-23 Dec-23

On Average, Smaller Investment Sizes With More Meaningful Slowdown in Larger

Growth Rounds

Commercial/Multi-Family Increased Its Share of PropTech Equity Investment by Category

Sources: PitchBook, CB Insights, company filings, company websites, press releases.

Average U.S. PropTech Investment Deal Size ($M) Count of $20M+ U.S. PropTech Investments

(48%)

YoY

8

Average investment size stabilized in 2H 2023 but remained below 2022 levels, reflecting a continued focus on funding

capital-efficient businesses.

Residential

52%

Construction

13%

CRE/Multi-Family

35%

Residential

40%

Construction

23%

CRE/Multi-Family

37%

2021 2022 2023

• Investors continue to shift capital away from residential in favor of commercial and multi-family, highlighted by rounds raised by market

leaders—including MaintainX, HALIO, and Verkada—in 2H 2023.

Commercial/multi-family

has grown into the category

leader for PropTech in 2023.

The residential vertical

garnered the majority of

PropTech investment in the

near-zero-rate environment.

(45%)

YoY

32

30

74

90

87

44

28

23

1H-20 2H-20 1H-21 2H-21 1H-22 2H-22 1H-23 2H-23

$37.9

$20.9

$41.5

$48.9

$36.3

$30.5

$19.5

$16.8

1H-20 2H-20 1H-21 2H-21 1H-22 2H-22 1H-23 2H-23

Residential

33%

Construction

28%

CRE/Multi-Family

39%

PropTech M&A Market Remained Active With Continued Consolidation Despite

Market Pressure

9

Sources: PitchBook, CB Insights, company filings, company websites, press releases.

(1) Deal values represent enterprise values.

(2) Includes $400 million cash consideration and up to $100 million potential earnout over three years.

Strategic acquirers drove ~90% of overall activity in PropTech M&A.

• Expanding number of large strategics and PE-backed platforms (e.g., Zillow, GreenStreet, etc.) will continue to drive M&A activity in 2024.

U.S. PropTech M&A Transactions—Trailing Six Years Significant 2023 M&A Transactions

(1)

• The market continued to show a “flight to quality” in 2023, shifting toward enterprise-oriented solutions with a demonstrated track record of

profitability. Going forward, we expect that:

– The market will increasingly value businesses that have used capital efficiently to build a strong profitability and growth profile.

– Financial sponsors will face increasing pressure to deploy dry powder, but the focus will remain on reserving premium multiples for top-quality

assets with differentiated growth, retention, and cash flow metrics.

– The PropTech market will continue to rebound as investors adjust to higher interest rates and the overall technology landscape continues to

see returns in the public market.

$500M

(2)

/

$700M

/

UndisclosedUndisclosed

/ //

Undisclosed

104 104

103

162

99

94

2018 2019 2020 2021 2022 2023

Strong PropTech Public Market Performance Fueled by Broader Tech Rebound

10

PropTech stocks outperformed in 2023, with high-quality, “profitable growth” companies continuing to trade at premium

valuations.

2023 Public Market Performance

PropTech Index

(1)

S&P 500 NASDAQ

38%

24%

43%

• Houlihan Lokey’s PropTech Index outperformed the S&P 500 in

the 2023, with multiple constituents seeing 100%+ share price

increases.

2024E EV/Revenue vs. “Rule of 40” Components

(3)(4)

CY24E EBITDA Margin

<25% 25%+

CY24E

Revenue

Growth

<15% 2.0x 8.3x

15%+ 4.6x 13.3x

Top 10 2023 PropTech Performers

(2)(3)

286% 143% 113%116%

Source: S&P Capital IQ as of 12/31/2023.

(1) PropTech Index includes all companies shown on page 36 and is weighted on a market-capitalization basis.

(2) Individual companies’ performances are based on stock price performance as of 12/31/2023.

(3) Includes all companies shown on page 36, excluding negative Rule of 40 companies.

(4) Reflects metrics based on CY24E revenue, EBITDA, and revenue growth.

• Investors are increasingly valuing companies that balance revenue

growth and profitability and no longer rewarding “growth at all

costs.”

Public Market Performance Driven by Combination of Growth

and Profitability

2024E EV/Revenue vs. “Rule of 40”

(3)(4)

R² = 0.67

0.0x

10.0x

20.0x

0.0% 20.0% 40.0% 60.0% 80.0%

107%

94% 82% 77%80% 76%

Leading Global PropTech Coverage Team

U.S. PropTech Team

Chris Gough

Managing Director

+1 415.273.3696

Chris.Gough@HL.com

Rip Furniss

Senior Vice President

+1 646.259.7483

Pat Hagerty

Vice President

+1 646.259.7528

Tombstones included herein represent transactions closed from 2019 forward.

*Selected transactions were executed by Houlihan Lokey professionals while at other firms acquired by Houlihan Lokey or by professionals from a Houlihan Lokey joint venture company.

has been acquired by

Sellside Advisor*

has been acquired by

a portfolio company of

Sellside Advisor*

has been acquired by

Sellside Advisor*

has received an investment from

Financing Advisor*

has been acquired by

Sellside Advisor*

has received a majority investment

from

Sellside Advisor*

has been acquired by

Sellside Advisor

has been acquired by

Sellside Advisor*

has been acquired by

Sellside Advisor

has received a strategic growth

investment from

Sellside Advisor

a portfolio company of

has been acquired by

Sellside Advisor

has been acquired by

Sellside Advisor

a portfolio company of

has been acquired by

Sellside Advisor*

has been acquired by

MLS Technology Holdings, LLC

Sellside Advisor*

has been acquired by

Sellside Advisor*

has received a strategic investment

from

Sellside Advisor*

has acquired

Buyside Advisor*

has received a majority

recapitalization from

Sellside Advisor*

Leader in PropTech Advisory

has been acquired by

Sellside Advisor

has received funding from

Financial Advisor*

has acquired

a portfolio company of

Buyside Advisor

11

has acquired

Buyside Advisor

a portfolio company of

has agreed to be acquired by

Sellside Advisor

Transaction Pending

a portfolio company of

has been acquired by

Sellside

Advisor

Sascha Pfeiffer

Managing Director

+44 (0) 69 204 34 6415

Sascha.Pfeiffer@HL.com

Dominic Orsini

Managing Director

+44 (0) 161 240 6447

Mark Fisher

Managing Director

+44 (0) 20 7907 4203

Kevin Walsh

Managing Director

+1 415.273.3664

Global Coverage

Raymond Fröjd

Managing Director

+46 (0) 70 747 25 17

Global Team Built to Advise the Converging Software, FinTech, and Financial

Services Markets

12

Houlihan Lokey Software Leadership Team

Financial Services FinTech

Jeff Levine

Global Head of

Financial Services

Mike McMahon

Managing Director

Asset Management

David Villa

Managing Director

Specialty Finance

Brent Ferrin

Managing Director

Specialty Finance

James Page

Managing Director

Mortgage

Juan Guzman

Managing Director

Insurance

Arik Rashkes

Managing Director

Insurance

Craig Tessimond

Managing Director

Insurance

Gagan Sawhney

Managing Director

Capital Markets

Jennifer Fuller

Managing Director

Mortgage

Mark Fisher

Managing Director

Tim Shortland

Managing Director

Chris Pedone

Managing Director

Paul Tracey

Managing Director

Christian Kent

Managing Director

Kartik Sudeep

Managing Director

Alec Ellison

Global Head of

FinTech

Tobias Schultheiss

Managing Director

Todd Carter

Chairman of Global Tech

Jason Hill

Co-Head of U.S.

Technology

John Lambros

Co-Head of U.S.

Technology

John.Lambros@HL.com

Chris Gough

Managing Director

Shane Kaiser

Managing Director

SKaise[email protected]

Vikram Pandit

Managing Director

VPandit@HL.com

Sascha Pfeiffer

Head of European

Technology

Sascha.Pfeiffer@HL.com

Phil Adams

Global Head of Tech

Phil.Adams@HL.com

Kevin Walsh

Managing Director

Joshua Wepman

Managing Director

James Craven

Managing Director

James.C[email protected]

Raymond Frojd

Managing Director

Raymond.Frojd@HL.com

Dominic Orsini

Managing Director

Dominic.Orsini@HL.com

Adrian Reed

Managing Director

Additional Senior Officers With End-Market and Business-Model Expertise

13

01

EXECUTIVE SUMMARY

02

KEY SUBSECTOR MARKET TRENDS

03

PROPTECH MARKET SUMMARY

04

PUBLIC MARKETS

05

HOULIHAN LOKEY OVERVIEW

06

APPENDIX

2

13

31

35

38

48

Macroeconomic Trends Affecting the Real Estate Market

14

Continued Strength in the Labor Market; Unemployment Rate Near 20-Year Low

Mortgage Rates Have Begun to Decline; Projected to Keep Declining With News of Inflation Calming

Inflation Down From 2022 High but Remains Above Fed Target Rate

Cooling inflation, strong labor market, and declining mortgage rates suggest investors see path to a successful “soft landing”

in 2024.

Mortgage rates declined

for nine consecutive

weeks to end 2023 and

are forecasted to

decline to 6.1% by Q4

2024.

(5)

6.6%

5.0%

6.0%

7.0%

8.0%

Jan-23 Mar-23 May-23 Jul-23 Aug-23 Oct-23 Dec-23

(1) Reuters.

(2) Bureau of Labor Statistics.

(3) Federal Reserve.

(4) Freddie Mac.

(5) National Associate of Realtors (NAR). Reflects 30-year fixed rate

mortgage forecast for Q4 2024 as of 1/26/24.

30-Year Fixed Rate Mortgage Avg. as of 12/28/2023

(4)

While Fed is “within

striking distance” of

2% target, officials

expect to approach rate

cuts “methodically and

carefully.”

(1)

3.7%

157.2

120.0

145.0

170.0

0.0%

10.0%

20.0%

Dec-05 Dec-07 Dec-09 Dec-11 Dec-13 Dec-15 Dec-17 Dec-19 Dec-21 Dec-23

U.S. Unemployment Rate (%) Total U.S. Nonfarm Employment (M)

Labor market showing

continued resilience as

employment metrics

improve despite tight

monetary policy.

(4) (4)

+3% YoY

1

2

3

One-Year CPI Change

(2)

2.0%

3.4%

0.0%

5.0%

10.0%

Jan-21 Jun-21 Nov-21 Apr-22 Sep-22 Feb-23 Jul-23 Dec-23

FOMC Longer Run Target Rate

(3)

5.3M

5.1

4.9

5.3

5.5

5.5

5.3 5.3

5.6

6.1

5.1

4.1

4.3

4.6

4.2

'13A '14A '15A '16A '17A '18A '19A '20A '21A '22A '23A '24E '24E '24E

6.6%

5.0%

6.0%

7.0%

8.0%

Jan-23 Mar-23 May-23 Jul-23 Aug-23 Oct-23 Dec-23

Interest rates

reach 23 year high

of 7.8% in last

week of Oct-23

Key Subsegment Trends: Residential Real Estate

15

(1) Freddie Mac.

(2) Mortgage Bankers Association (MBA).

(3) National Association of Realtors (NAR).

(4) Fannie Mae.

Forecasts for 2024 expect an average of 6% YoY growth in existing

home sales.

MBA Forecast as of

1/19/2024

NAR Forecast as of

1/26/2024

Existing home sales saw continuous QoQ declines in 2023 but are

expected to return to positive growth in 2024.

Existing Home Sales (SAAR, M) and QoQ Growth

(2)

30-Year Fixed Rate Mortgage Avg. as of 12/28/2023

(1)

Existing Home Sales (M)

(2)(3)(4)

Average Historical Annual Transactions/Year (2013A–2023A)

1

Mortgage Rates Have Begun to Fall From the 2023

High With the Decline Expected to Continue

3

Residential Transactions Fell Throughout 2023,

Expected to Rebound in 2024

4

Existing Home Sales Expected to Rise in 2024 but

Remain Below Historical Average

Fannie Mae Forecast

as of 1/10/2024

2

The Level of Refinancing for Mortgage Origination

Expected to Increase in 2024

Total 1-to-4 Family Home Mortgage Originations ($B)

(2)

Difficult market conditions significantly impacted the residential real estate and mortgage markets in 2023, but home sales are

expected to rise in 2024 as mortgage rates are expected to continue to decline in line with rate cuts.

MBA Forecast as of

1/19/2024

4.3

4.3

4.0

3.9

4.0

4.2

4.4

4.6

3%

(2%)

(5%)

(4%)

4%

5%

5%

4%

Q1-23 Q2-23 Q3-23 Q4-23 Q1-24E Q2-24E Q3-24E Q4-24E

$267

$371

$363

$324

$304

$389

$432

$411

$66

$92

$81

$75

$86

$110

$135

$140

Q1-23 Q2-23 Q3-23 Q4-23 Q1-24E Q2-24E Q3-24E Q4-24E

Purchase Mortgage Originations Refinance Mortgage Originations

‘24E

Key Subsegment Trends: Residential Real Estate (cont.)

16

(1) Freddie Mac.

(2) CBRE Research, CBRE Econometric Advisors, Freddie Mac, U.S. Census Bureau, Realtor.com®, FHFA, Q3 2023.

New Home Purchase Cost Remains Substantially More Expensive Than Apartment Rents

Monthly Payment for a New Purchase vs. Monthly Rent

(2)

Housing Inventory in Existing Homes (M)

(1)

and Median Sales Price for Existing Homes ($K)

(1)

1

Home Prices Remain Elevated Despite Higher Rates as Inventory Remains Tight

Significant and Expanding Gap Between Rental and Home Purchase Cost

+52%

Higher monthly payment for

newly purchased home vs.

renting.

(2)

+79%

Increase in monthly payment

for a new home purchase since

Q3 2020.

(2)

+39%

Increase in median sales price

for existing home since

December 2019.

(1)

(28%)

Decrease in housing inventory

since December 2019.

(1)

2

$1,500

$2,000

$2,500

$3,000

$3,500

Q3-17 Q3-18 Q3-19 Q3-20 Q3-21 Q3-22 Q3-23

Monthly Payment for a New Purchase Monthly Rent

$383K

0.0

0.5

1.0

1.5

2.0

$0

$150

$300

$450

Dec-19 Jun-20 Dec-20 Jun-21 Dec-21 Jun-22 Dec-22 Jun-23 Dec-23

Existing Homes

Inventory (M)

Existing Homes

Median Sale Price ($K)

Housing Inventory in Homes for Sale (M)

Housing Inventory: Median Listing Price in US ($K)

Tight inventory conditions in residential market kept home prices elevated and pushed cost of ownership vs. renting gap

higher.

Key Subsegment Trends: Residential Real Estate Tech

17

Sources: PitchBook, CB Insights, company filings, company websites, press releases.

Residential Real Estate (RRE) Tech Highlights Top 10 U.S. RRE Tech Equity Rounds of 2023

Date Company

Selected

Investor(s)

Equity

Invested

Equity

Funding to

Date

Latest

Reported

Valuation

3/6 $150 $574 $1,092

4/24 $100 $236 $700

2/7 $100 $176 $400

7/1 $38 $134 $410

10/11 $30 $37 $88

1/12 $29 $35 $200

8/25 $25 $25 $433

12/7 $22 $25 NA

1/31 $20 $23 NA

8/3 $19 $53 $209

($M)

Home Sustainability

• IOT/smart home solutions focused on

optimizing energy and water consumption,

monitoring air quality, and reducing carbon

footprint continue to attract interest from

sustainability-conscious investors.

• Slowdown in residential RE software

consolidation in 2023 as the market grappled

with declines in existing home sales, driven by

a challenging macroeconomic environment.

Activity Slowdown

• Residential real estate technology players

saw a wave of M&A activity in 2023 as the

sector continues to consolidate.

Significant RRE M&A

Key Players

Key Players

Key Transactions

/

/

/

/

1,008

850

900

950

1,000

1,050

Dec-22 Feb-23 Apr-23 Jun-23 Aug-23 Oct-23 Dec-23

278

280

327

377

LTM Q3-20 LTM Q3-21 LTM Q3-22 LTM Q3-23

Key Subsegment Trends: Multi-Family

18

1

Multi-Family Construction Levels Hit Record in July

U.S. Multi-Family Housing Units Under Construction (in Thousands)

(1)

Multi-family units under construction remained near an all-time

high in December 2023.

(1)

1.02M

Record multi-family housing

units under construction in July

2023.

(1)

+7.3%

Increase in multi-family housing

units under construction YoY in

December 2023.

(1)

+7% YoY

2

Multi-Family Completions Levels Continues Strength

U.S. Multi-Family Housing Units Completed (in Thousands)

(2)

Multi-family completions have experienced sustained growth in the

past four years.

115K

Multi-family completions in Q3

2023.

(2)

+15%

Increase in multi-family

completion YoY in LTM Q3

2023, the highest on record.

(2)

36% Increase

(1) U.S. Census Bureau.

(2) CBRE Research.

Multi-family construction and completion continues to bring new inventory online.

Key Subsegment Trends: Multi-Family (cont.)

19

2

3

Multi-Family Rent Growth Normalizes as Inflation

Subsides

4

Multi-Family Net Absorption Growth Signals Optimism

Multi-Family Rental Vacancy Rates Normalizes at 20-

Year Average

Multi-Family Vacancy Rate

(3)

20-Year Average Multi-Family Vacancy Rate

5.0%

1

Multi-Family Debt Maturity “Wall”

Multi-Family Loans Maturing: 2020 – 1H 2022 Originations ($B)

(1)(2)

$246 billion of multi-family loans originated in lower-rate

environment from 2020 to 1H 2022 will mature in the next three years.

(1)(2)

Vacancy rates have trended up over the past few quarters but have

normalized near the long-run average of 5%.

(3)

Multi-Family YoY Rent Growth

(2)

Multi-Family Net Absorption (Units in Ks)

(3)

(1) Newmark 2023 U.S. Multifamily Capital Markets Report.

(2) Globest.

(3) CBRE Research, CBRE Econometric Advisors.

$87

$96

$63

2023E 2024E 2025E

Stabilizing rents and vacancy rate normalization demonstrates a return to normal while upcoming debt maturities may put

pressure on multi-family owners and investors.

5.1%

0%

2%

4%

6%

Q3-18 Q3-19 Q3-20 Q3-21 Q3-22 Q3-23

Net absorption totaled 82K units in Q3 2023, a significant

improvement from the negative figure in 2022.

(3)

Multi-family rent growth rates are down significantly from the

record 15.2% YoY increase in Q1 2022.

(3)

0.7%

(10%)

0%

10%

20%

Q3-18 Q3-19 Q3-20 Q3-21 Q3-22 Q3-23

97

(38)

(53)

(11)

2

79

82

(75)

25

125

Q1-22 Q2-22 Q3-22 Q4-22 Q1-23 Q2-23 Q3-23

Key Subsegment Trends: Multi-Family Tech

20

Multi-Family Tech Highlights Top 10 U.S. Multi-Family Tech Equity Rounds of 2023

Date Company

Selected

Investor(s)

Equity

Invested

Equity

Funding to

Date

Latest

Reported

Valuation

10/31 $70 $120 $270

12/12 $48 $200+ NA

6/7 $35 $67 $285

10/30 $32 $99 NA

1/6 $22 $37 $100

1/26 $15 $22 NA

5/24

BCT Venture

Capital

$13 $33 NA

3/16 $12 $18 NA

10/17 $10 $10 NA

11/29 $9 $9 NA

($M)

AI Tenant Acquisition and Payments Modernization

• The implementation of AI across tenant

acquisition, especially within the virtual

leasing market, has driven substantial

efficiency gains as consumer demand for

multi-family rises.

• Vertical-focused multi-family payment

platforms gaining momentum as landlords

and tenants adopt modernized rent

processing solutions.

• Multi-family property owners/operators

continue to utilize manual “point-solutions”;

daily processes such as leasing, rental

payment processing, and back-office

competencies are at an inflection point, ripe

for digitization.

Highly Fragmented Market for Consolidation

Key Players

Key Players

Sources: PitchBook, CB Insights, company filings, company websites, press releases.

Multi-Family Technology Landscape

Multi-Family Software Platforms

Portal Listing Platforms

Tenant-Focused

Front-End

Communications

Marketing/Resident Onboarding

Touring/Visualization

CRM

Consumer Listing

Tenant Experience Moving

Tenant

Application/

Screening

Tenant

Credit/

Financial

Parking

Tenant

Rewards

Insurance/SDR/

Lease Guarantee

Flex Stay/

Community

Living

Indicates an Operating Subsidiary

21

To view full market map, please contact:

, [email protected], or Pat.Hage[email protected]

Multi-Family Technology Landscape (cont.)

Multi-Family Software Platforms

Lease Admin.

Management/Operations

HOA/Condo Management

PMS

Maintenance/Operations Energy/Utilities Management

Back Office

Data, Analytics, and LMS Payments-Related

Building Connectivity/

Smart Apartments

Access Management

Indicates an Operating Subsidiary

22

To view full market map, please contact:

, [email protected], or Pat.Hage[email protected]

Key Subsegment Trends: Commercial Real Estate

23

(1) Cushman & Wakefield, “U.S. Office MarketBeat Q4 2023.”

(2) New York City represents “New York – Midtown South” office market.

(3) Kastle Systems, Back to Work Barometer.

(4) Trepp, “The Year-End 2023: CRE at a Crossroads.”

1

2

Net Absorption Reached a Multi-Year Low in 2023,

Vacancy Rate Climbing

U.S. Office Market Net Absorption (S.F. in M) and Vacancy Rate (%)

(1)

U.S. net absorption rates remained meaningfully negative, as vacancy

rates continued to increase throughout 2023.

(1)

3

U.S. Office Utilization Increasing, but Still Below Pre-

Pandemic Levels as Employers Accept Hybrid Reality

Kastle’s Back-to-Work Barometer Average for Top 10 U.S. Cities Throughout

the year

(3)

The CRE market remains mixed across geographies as concerns linger about the market’s vacancy rates and long-term return-

to-office trends.

YoY Change in Office Rent Asking Price per Square Foot in Q4 2023

(1)(2)

Changes in Office Rent Rates Highlight Divergence

Across Markets

4

U.S. Near-Term CRE Debt ($B)

(4)

~$1.1 Trillion “Maturity Wall” Approaching for

Commercial Real Estate Debt

$544

$533

2024 2025

With nearly $1.1 trillion of

the outstanding U.S.

commercial real estate

debt maturing before the

end of 2025, borrowers are

under pressure as liquidity

problems persist. Refinancing

risk will remain a key

challenge through 2025.

(4)

98.9%

30.0%

41.6%

47.9%

Feb-20 2021 2022 2023

5.0%

7.4%

2.2%

(5.5%)

Boston Miami NYC - Midtown San Francisco

(2.4)

(12.1)

(12.5)

(22.8)

(20.8)

(14.7)

(19.2)

17.0%

17.2%

17.7%

18.2%

18.7%

19.2%

19.7%

Q2-22 Q3-22 Q4-22 Q1-23 Q2-23 Q3-23 Q4-23

Net Absorption Vacancy Rate

Commercial Real Estate Tech Landscape

24

Building Operations

IWMS

Tenant Experience Visitor Management

Access Management

Operations and Facility Management

IoT/Smart Buildings

Flex Space Management Parking Management

CRE Software Platforms

Energy Management

Indicates an Operating Subsidiary

To view full market map, please contact:

Sales and Leasing

CRM, Marketing,

and Workflow

Listing Services

Financing Platforms

Portfolio Management Data and Analytics

Funding Marketplaces

Investor ManagementDeal Management

Valuation and AppraisalLease Management

Key Subsegment Trends: Commercial Real Estate Tech

25

Commercial Real Estate (CRE) Tech Highlights Top 10 U.S. CRE Tech Equity Rounds of 2023

Date Company

Selected

Investor(s)

Equity

Invested

Equity

Funding to

Date

Latest

Reported

Valuation

2/13 $133 $239 $474

5/17 $100 $142 NA

10/9 $100 $445 $3,300

5/31 $93 $173 $433

5/17 $93 $116 NA

11/16 $70 $357 $693

6/22 $58 $93 $450

12/6 $50 $104 $1,000

10/18 $50 $150 $560

5/3 $50

(1)

$426 $1,000

($M)

ESG/Regulatory Drivers

• Technology solutions that reduce the climate

impact for CRE owners continue to draw

investment as the industry faces increasing

pressure from regulators to reduce climate

impact.

• CRE owners and tenants have continued to

utilize technology to encourage in-person

attendance while acknowledging that a

hybrid work environment is the “new normal.”

Hybrid Reality

Key Players

Key Players

Sources: PitchBook, CB Insights, company filings, company websites, press releases.

(1) Extension to Series E, bringing total round funding to $250 million.

7.5

8

8.5

9

9.5

10

Mar-21 Nov-21 Jul-22 Mar-23 Nov-23

Key Subsegment Trends: Construction

26

(1) U.S. Census Bureau.

(2) Dodge Construction Network.

(3) Associated Builders and Contractors.

(4) CNN, “What Biden’s Infrastructure Law Has Done so Far.”

(5) Construction Dive, “IIJA Brings New Funds, Challenges to NYC Infrastructure Overhaul.”

1

Nonresidential Construction Spend Hits Record

Levels in 2023

2

Construction Starts Remain Slightly Below 2022 Highs,

Nonbuilding Starts Driven by IIJA Funding

U.S. Seasonally Adjusted Annual Rate of Nonresidential Construction Spend ($B)

(1)

Since the pandemic there has been a large increase in commercial

construction spend, growing 18% YoY.

(1)

Construction starts have slightly weakened as high interest rates and

tight credit have restrained activity.

3

Despite Recent Dip, Commercial Backlogs Remain

Strong as Labor Supply Does Not Meet Demand

4

The IIJA Has Introduced a High Level of Funding for

Infrastructure Projects

Commercial and Institutional Construction Backlog Indicator

(3)

Commercial construction project demand/pipeline at record levels, despite labor shortage and office market uncertainty.

+18% YoY

+4% Since Oct-21

(4%)

Decrease in total construction starts

YoY as of YTD November 2023.

(2)

+19%

Increase in nonbuilding construction

starts YoY as of YTD November 2023.

(2)

(7%)

Decrease in nonresidential construction

starts YoY as of YTD November 2023.

(2)

(14%)

Decrease in residential construction

starts YoY as of YTD November 2023.

(2)

As the spending ramps up into 2025, construction companies will

see a large investment from the U.S. government to start on new

infrastructure projects with:

$550B

Earmarked for new federal

infrastructure projects over a five-year

period.

(4)

~50%

Increase in Federal Transit

Administration and Federal Highway

Administration funding post-IIJA.

(5)

$800

$900

$1,000

$1,100

$1,200

Aug-22 Nov-22 Feb-23 May-23 Aug-23 Nov-23

Key Subsegment Trends: Construction (cont.)

27

(1) National Association of Realtors (NAR) and Freddie Mac.

(2) U.S. Census Bureau.

(3) S&P Capital IQ as of 12/31/2023.

1

The Share of New Single-Family Homes for Sale Has Risen as Homebuilding Has Increased and Existing Homeowners Are

Less Likely to Sell as Mortgage Rates Remain High

2

Undersupply of Single-Family Homes Likely to Persist

as Residential Construction Starts Remain Depressed

When Compared to Pre-2008

3

Positive Sentiment Drives a Market Recovery for

Homebuilding Stocks

Single-Family Homes Construction Starts (in Thousands)

(2)

+59%

S&P Homebuilders Select Industry Index

(3)

U.S. New Single-Family Homes Share of Single-Family Homes for Sale

(1)

Many buyers are opting for new construction homes as builders have been providing attractive concessions, including mortgage rate buydowns

to attract bidders and offload inventory.

+8% Since Dec-20 Year-End

Despite headwinds in the residential real estate market, homebuilder activity has remained strong throughout 2023.

$6,000

$8,000

$10,000

Jan-23 Mar-23 Jun-23 Sep-23 Dec-23

0

500

1,000

1,500

2,000

2001 2003 2005 2007 2009 2011 2013 2015 2017 2019 2021 2023

33.6%

10%

20%

30%

40%

Dec-19 Jun-20 Dec-20 Jun-21 Dec-21 Jun-22 Dec-22 Jun-23 Dec-23

Key Subsegment Trends: Construction Tech

28

Construction Tech Highlights Top 10 U.S. Construction Tech Equity Rounds of 2023

Date Company

Selected

Investor(s)

Equity

Invested

Equity

Funding to

Date

Latest

Reported

Valuation

9/22 $440

(1)

$735 $3,750

2/6 $55 $114 $185

9/12 $52 $150 $342

5/18 $50 $111 $300

6/6 $42 $48 $162

10/30 $41 $41 $121

1/17 $40 $40 $90

11/17 $37 $56 $78

10/18 $24 $44 $117

11/9 $14 $22 NA

($M)

Technology Is Needed to Fill Labor Gaps

• Construction hiring and job openings

continue to outpace labor supply, driving the

need for greater technology adoption within

construction.

• The industrial construction market continues

to benefit from the Infrastructure Investment

and Jobs Act as spending ramps up into 2025,

driving investment and M&A for tech

companies focused on the space.

Industrial Strength

• The construction tech landscape is highly

fragmented and has begun to see

consolidation across multiple subsectors

from both public and sponsor-backed

companies.

Significant Construction Tech M&A

Key Players

Key Players

Key Transactions

Sources: PitchBook, CB Insights, company filings, company websites, press releases.

(1) Includes the Series E extension.

/

/

/

/

/

Construction Technology Landscape

29

Indicates an Operating Subsidiary

Pre-Construction

CAD/BIM

Estimates/Takeoffs

Bid Management

Field Service Management

Operations Management

Compliance

CRM/Marketing Automation

Document Management

Collaboration

Project Management Software

Site Management/Reporting

Planning/Scheduling

Safety/Inspection

Sales Enablement

Proposals/Quotes

Workforce Management

To view full market map, please contact:

, [email protected], or Pat.Hage[email protected]

Construction Technology Landscape (cont.)

30

Indicates an Operating Subsidiary

Procurement/Marketplaces

Robotics

Build Materials

Heavy Equipment

Remodeling

Asset Management

Communication

Materials/Inventory Management

Supply Chain Management

Logistics

Data/Analytics

Payments/Lending

Financial Management Software

Insurtech

ERP/Accounting

CMMS

Fleet Management

Equipment Management

Prefab/Modular

To view full market map, please contact:

, [email protected], or Pat.Hage[email protected]

31

01

EXECUTIVE SUMMARY

02

KEY SUBSECTOR MARKET TRENDS

03

PROPTECH MARKET SUMMARY

04

PUBLIC MARKETS

05

HOULIHAN LOKEY OVERVIEW

06

APPENDIX

2

13

31

35

38

48

Top PropTech Investors in 2023 by Number of Investments

32

Selected 2023 Investments

Multiple, large funds with a dedicated PropTech sector thesis.

Source: PitchBook.

Note: Portfolio companies not necessarily new entrants as of 2023.

Strategic Growth Investors Selected Investments (2022 and 2023)

Asset Owners/Managers

Insurance/Title

Brokerage

Other Strategics

Continued Activity From Strategic Investors

33

Investment arms of real estate, insurance, and brokerage incumbents are increasingly participating in growth rounds for

PropTech companies alongside private equity and venture capital firms or as stand-alone investors.

(2023)

(2023)

Source: PitchBook.

Note: Portfolio companies shown are 2022 investments unless annotated as 2023.

/

(2023)

(2023)

(2023)(2023) (2023)

(2023)

(2023)

(2023) (2023) (2023) (2023)(2023)

(2023) (2023) (2023) (2023) (2023) (2023)

(2023) (2023) (2023)

(2023)

(2023)

(2023)(2023) (2023) (2023) (2023) (2023)

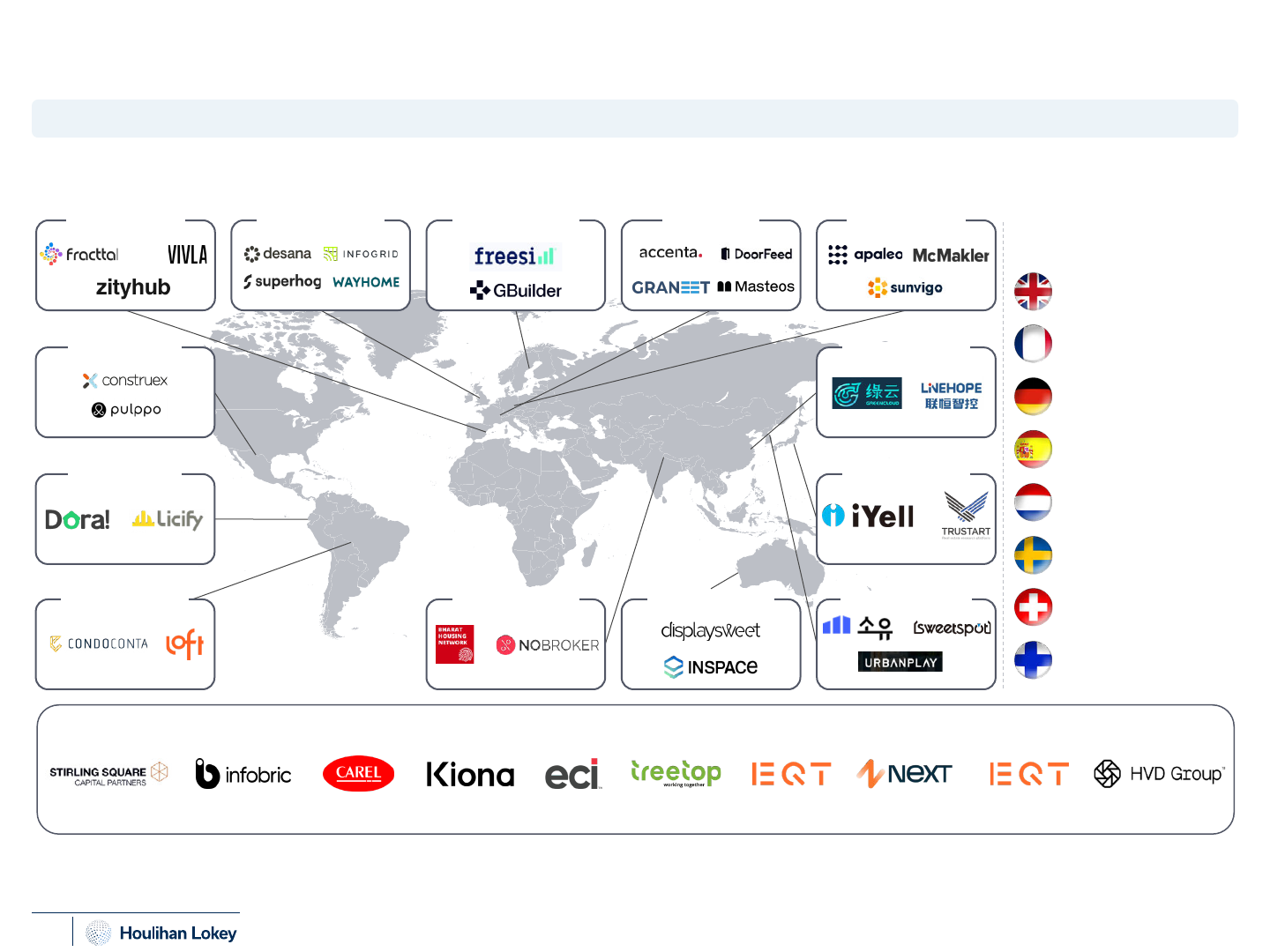

Globalization of the PropTech Market

34

Global PropTech market poised to surpass $32 billion by 2030.

(1)

International PropTech Innovation Gaining Momentum

SIGNIFICANT M&A OUTSIDE OF THE U.S. IN 2023

Brazil

Source: PitchBook, CrunchBase.

Note: All companies shown completed capital raises in 2023.

(1) Zion Market Research.

(2) Ascendix, “What Is PropTech and How It Changed the Real Estate Industry,” 2023.

(3) PitchBook, all transactions with a European-based target in construction technology and real estate

technology (January 2020 to December 2023).

Spain

U.K.

Germany

China

Japan

Australia

Colombia

Mexico

France

Nordics

/ /// /

South Korea

# of PropTech

Companies

(2)

% of M&A

Activity

(3)

805 20%

547 27%

342 12%

304 8%

277 9%

143 9%

140 3%

105 4%

India

European PropTech

M&A Activity Summary

35

01

EXECUTIVE SUMMARY

02

KEY SUBSECTOR MARKET TRENDS

03

PROPTECH MARKET SUMMARY

04

PUBLIC MARKETS

05

HOULIHAN LOKEY OVERVIEW

06

APPENDIX

2

13

31

35

38

48

PropTech Public Company Performance

36

Source: S&P Capital IQ as of 12/31/2023.

2023 Share Price Performance

35%19% 32%58%32% 39%29%93% 31%

2023 Share Price Performance

Public PropTech Ecosystem

32%

31%

35%

58%

32%

29%

19%

39%

93%

(40%)

0%

40%

80%

120%

160%

Jan-23 Feb-23 Mar-23 Apr-23 May-23 Jun-23 Jul-23 Aug-23 Sep-23 Oct-23 Nov-23 Dec-23

Real Estate Media/Portals RE Data/RE Software Residential Brokerage

Commercial Brokerage Traditional Mortgage/Title Credit/Mortgage Marketing

Real Estate Sharing Economy/Travel Broader Data Construction Technology

Broader Data

Commercial

Brokerage

Credit/Mortgage

Marketing

RE Sharing

Economy/Travel

RE Media/

Portals

Mortgage/Title

Residential

Brokerage

Construction

Technology

RE Data/

RE Software

PropTech Public Company Valuation

37

Source: S&P Capital IQ as of 12/31/2023.

Note: Multiples represent mean value of sector group.

2024E Revenue/2024E EBITDA Multiple

9.9x/19.6x1.2x/13.8x 1.9x/13.3x3.1x/11.3x7.0x/20.9x 4.1x/13.7x5.2x/19.5x1.1x/16.3x 8.6x/19.0x

Enterprise Value/2024E Revenue

Enterprise Value/2024E EBITDA

Public PropTech Ecosystem

9.9x

8.6x

7.0x

5.2x

4.1x

3.1x

1.9x

1.2x

1.1x

Broader

Data

Construction

Technology

RE Media

Portals

RE Data/RE

Software

Mortgage/

Title

RE Sharing/

Travel

Credit/

Mortgage

Marketing

Commercial

Brokerage

Residential

Brokerage

20.9x

19.6x

19.5x

19.0x

16.3x

13.8x

13.7x

13.3x

11.3x

RE Media

Portals

Broader

Data

RE Data/RE

Software

Construction

Technology

Residential

Brokerage

Commercial

Brokerage

Mortgage/

Title

Credit/

Mortgage

Marketing

RE Sharing/

Travel

Broader Data

Commercial

Brokerage

Credit/Mortgage

Marketing

RE Sharing

Economy/Travel

RE Media/

Portals

Mortgage/Title

Residential

Brokerage

Construction

Technology

RE Data/

RE Software

38

01

EXECUTIVE SUMMARY

02

KEY SUBSECTOR MARKET TRENDS

03

PROPTECH MARKET SUMMARY

04

PUBLIC MARKETS

05

HOULIHAN LOKEY OVERVIEW

06

APPENDIX

2

13

31

35

38

48

Houlihan Lokey Advises Next One Technology on Its Sale to EQT

39

Houlihan Lokey acted as the exclusive

financial advisor to Next One Technology

(Next) on its sale to EQT.

• On December 20, 2023, Next announced it

had been acquired by EQT.

• Next, headquartered in Linköping, Sweden,

with operations across the Nordics and the

United Kingdom, provides a leading cloud-

based construction technology project

management platform tailored for

construction, maintenance, and contractor

businesses.

2,500+

Customers

130+

FTEs

has received a strategic

growth investment

Undisclosed

Next and HVD Group have an exciting and complementary fit. Not only from a

product perspective, but also in terms of the culture and people, having followed

Mikael and his team over the recent years. We are also confident that a combined

offering will continue to drive our already high customer satisfaction, as we

together with HVD Group will be able to offer an even more comprehensive

product to our end users.

—Johan Jarskog, CEO, Next

Investing in HVD Group and Next creates a strong Northern European platform

with leading tech and product capabilities. We have followed the space for several

years and are excited to back what is in our mind the most attractive platforms in

one of the largest verticals globally. We are extremely impressed by the respective

teams led by Mikael and Johan, and we look forward to bringing EQT Private

Equity's software experience to support the organizations.

—Ali Farahani, Partner, EQT

• Next helps customers to achieve long-term sustainable profitability through

instant visibility on project financial performance, increasing productivity,

slashing administrative time, and ensuring compliance.

• The platform allows SME customers to get more organized and gain a

better business overview, and it also enables smarter and faster

administration, leading to significant improvements in terms of productivity,

control, quality, and profitability.

Transaction Overview Selected Transaction Commentary

Next Platform

Company Highlights

(1)

Sources: Company websites, press releases.

(1) As of 1/3/2023.

Geographical Footprint

Three Offices

One Office

One Office

Headquarter (Linköping) Offices

Project Management

Planning

Procurement

Deviation Handling

Document Management

Financial Management

Project Budget

Payment Plan

Invoice Handling

Project Forecast

Site Execution

Inspections

Journal

Checklists

Staff Register

SEK 200M+

Revenue

The picture can't be displayed.

Houlihan Lokey Advises Treetop on Its Sale to ECI

40

Houlihan Lokey acted as the exclusive

financial advisor to Nedvest, the sole

shareholder of Treetop, on Treetop’s sale to

ECI.

• On December 18, 2023, Treetop, a portfolio

company of Nedvest, announced it had been

acquired by ECI.

• Treetop offers a wide range of enterprise

resource planning software and business

applications that cater to SMBs in the

residential construction and crafts sector in

the Netherlands.

has received a strategic

growth investment

Undisclosed

As this industry continues to evolve and modernize, ECI remains steadfast in its

mission to empower and elevate its customers with investments in innovation, a

top-notch R&D team and global support for customer growth. As Treetop and ECI

join forces, we look forward to continuing the customer-centric approach that has

defined Treetop’s success.

—Geert-Jan den Besten, CEO, Treetop

Treetop empowers business owners through modern technology and automation

that addresses the unique business challenges of the Dutch residential

construction industry. ECI’s heritage as a leader in residential construction

industry software and Treetop’s many decades of experience and deep, loyal

customer base in the Netherlands make a great combination.

—Trevor Gruenewald, CEO, ECI Software Solutions

• Treetop’s connected software platform enables construction companies to

seamlessly manage business processes and deliver meaningful digital

transformation.

• In 2024, Treetop plans to launch a new cloud-native ERP software solution

for smaller construction companies, delivering substantial value.

Transaction Overview Selected Transaction Commentary

Company Highlights

(1)

All-in-one ERP software

built specifically for

SMB construction

companies.

ERP software platform for

middle-market

construction companies.

2D/3D building design

software for

constructors.

a portfolio company of

has been acquired by

Sellside Advisor

Construction managed

services provider.

Customer and quality

processes software.

Construction software

for the self-employed.

Treetop Platform

Sources: Company websites, press releases.

(1) As of 1/8/2024.

120+ FTEs

6 Unique Brands

3,000+ Customers

Houlihan Lokey Advises TruArc Partners on Its Acquisition of Watchtower Security

41

Houlihan Lokey acted as the exclusive buyside

financial advisor to TruArc on its acquisition

of Watchtower Security.

• On December 1, 2023, TruArc Partners

announced it had acquired Watchtower

Security.

• Watchtower Security, headquartered in St.

Louis, provides state-of-the-art managed

video surveillance and analytics solutions to

property managers and owners in the multi-

family housing market.

• Watchtower’s integrated end-to-end solution

offering protects properties through best-in-

class software, hardware, and ancillary

services, including 24/7 system monitoring.

has received a strategic

growth investment

Undisclosed

Transaction Overview Selected Transaction Commentary

Watchtower Platform

Company Mission

Sources: Company websites, press releases.

has acquired

Buyside Advisor

TruArc is thrilled to welcome Watchtower into our portfolio. Asset

protection continues to be an active investment theme that we have

great conviction in. We believe that Watchtower’s recurring business

model and commitment to innovation and customer satisfaction align

seamlessly with our investment framework.

—Brandon Kiss, Partner, TruArc Partners

We aim to be the national leader in providing video surveillance services

to the multi-family housing industry and intend to achieve it by

developing a staff that is passionate about providing premium service and

technology while adapting to emerging client needs.

Differentiated video surveillance platform exclusive to multi-family.

Watchtower’s full-service approach allows property managers 24/7

property insights while delivering substantial cost savings.

System Monitoring

Forensic Video

Review

All-Access

Surveillance Portal

Property Protection

Software

Houlihan Lokey Advises Stirling Square on Its Acquisition of Infobric

42

Houlihan Lokey acted as the exclusive

financial advisor to Stirling Square Capital

Partners on its acquisition of Infobric from

Summa Equity.

• On June 21, 2023, Stirling Square Capital

Partners announced it had acquired Infobric

from Summa Equity.

• Infobric, headquartered in Sweden with

operations across the Nordics and the United

Kingdom, provides end-to-end construction

software products supporting the

digitalization of the construction industry.

10,000+

Customers

300,000+

Individual Users

Equipment and AssetsWorkforce

has received a strategic

growth investment

Undisclosed

We are proud to welcome Stirling Square as our new investor as they bring sector

expertise, local market knowledge as well as pan-European expertise which will be

critical as we continue to expand internationally. Importantly, they also share

Infobric’s values as growth-oriented, long-term entrepreneurial investors who share

our commitment to sustainability.

—Dan Friberg, President and CEO, Infobric

We are delighted to invest in Infobric alongside its ambitious management team

who have built a software leader in the build phase of the construction value

chain. We look forward to bringing our experience in the contech sector to

support the business to accelerate its impressive growth trajectory, including

enabling further international growth and expanding the software offering.

—Patrick Severson, Partner, Stirling Square

• Infobric enables its customers to manage site safety, machinery and

equipment, contracts, and workers and provides efficient sharing of

resources and workforce optimization.

• Since being acquired by Summa in 2018, Infobric has pursued impressive

geographical growth and expanded its offering, while making several

acquisitions across the sector. Infobric is now the market leader in Sweden,

Norway, and the U.K.

(Announced

3/16/2023)

(Announced

3/17/2023)

Transaction Overview Selected Transaction Commentary

Infobric Platform

Company Highlights

(1)

Recent Bolt-On Acquisitions

Rich Data Insights Reduces Time and

Administration Effort

Data Sharing

Between Sites

Mobile Workforce

Management

Site Workforce

Management

Contractor

Management

Fleet and Asset

Management

(Announced

1/5/2023)

(Announced

3/30/2023)

Sources: Company websites, press releases.

(1) As of 6/21/2023.

has acquired

a portfolio company of

Buyside Advisor

Transaction Overview

Houlihan Lokey Advises BoomTown on Its Sale to Inside Real Estate

43

Houlihan Lokey acted as the exclusive

financial advisor to BoomTown on its

sale to Inside Real Estate.

• On January 20, 2023, BoomTown

announced that it had been acquired by

Inside Real Estate.

• BoomTown is the leading end-to-end

residential real estate technology

platform for high-producing agent-

teams and brokers, enabling a seamless

workflow from lead to close.

• The transaction will create an industry

leading provider of residential real

estate software and services, across

product and customer segments.

No. 1

User-Rated Real Estate

CRM

40%

Real Trends Top 250

Teams Served

350+

Employees

~100k

Real Estate Professionals

Served

Fully Integrated

Predictive CRM

Cloud-based intelligent CRM automates lead capture

and engagement to drive leads to conversion.

Lead and workflow management tools allow agents to

identify, target, and convert their highest probability

buyers/sellers.

Comprehensive

Transaction

Management and

Back-Office

Platform

Integrated transaction management platform creates

seamless lead-to-close solution.

Full suite of capabilities including commission

au

tomation, accounting, agent management, and

reporting/analytics tools.

Premier Front-

Office Solution for

Agents, Teams,

and Brokers

Category-leading custom IDX-integrated websites

specifically designed for residential RE brokers and

teams.

Data-driven digital marketing with dynamic campaign

management enables high-ROI lead generation.

Joining Joe and the talented Inside Real Estate team enables us to continue on

our combined mission to serve the real estate industry with world class

technology and services. With a clear vision for the future, we look forward to

accelerating the pace of innovation to fuel our clients’ growth and success.

”

Grier Allen,

Co-Founder and CEO,

BoomTown

I’m thrilled to welcome BoomTown to the Inside Real Estate family! Our

companies share a common DNA that is focused on driving real results for every

client, every day. Together, we will deliver an unmatched experience for every

user from single agents, to top performing teams and mega teams, to robust

national enterprise brands.

Joe Skousen,

CEO,

Inside Real Estate

“

”

“

Sources: Company websites, press releases.

BoomTown Highlights

Selected Transaction Commentary

has been acquired by

Sellside Advisor

Houlihan Lokey Advises BoomTown on Its Sale to Inside Real Estate (cont.)

44

Sources: Company websites, press releases.

Combine to Create a Category Leader in RRE Technology

2018

2020 20232019

2021 2022

First Complete

and Modern Back-

Office Suite

No. 1 Front-Office

Experience

BoomTown and Inside Real Estate

combine to create a category leader

in residential real estate technology.

Brokermint transaction positions

BoomTown as an industry-leading

end-to-end platform.

AmpStats transaction strengthens

Inside Real Estate’s recruiting

features.

BoomTown acquisition of

RealContact as precursor to Success

Assurance concierge solution.

MyAgentFinder acquisition launches

BoomTown Marketplace.

dashCMA acquisition amplifies Inside

Real Estate’s pricing capabilities.

Leading

Marketplace and

Tech Partner

Ecosystem

Industry-Leading

Home Ownership

Solutions

Lovell Minnick Partners investment

supports Inside Real Estate’s long-

term strategy.

2019

Genstar Capital provides additional

capital to Inside Real Estate to

accelerate growth.

2021

The Growth of a Category-Leading Platform

• The combined technology will deliver an enhanced and elevated front-office experience that supports every type of user—from single

agents, to top-performing teams and mega teams, to top brokerages and enterprise brands in growing their businesses.

• Together, the company’s combined portfolio of back-of

fice solutions, including CORE Back Office, Brokermint, and Inside Real Estate’s

recently acquired AmpStats, will provide the foundation for the industry’s most innovative, modern, and complete back-office solution.

• Inside Real Estate’s marketplace of leading add-on

services and solutions, including the Propertyboost listing promotion and lead

generation tool, will continue to expand and be paired with a new Preferred Partner program, unlocking additional value and

differentiation for customers through a vetted, network of premium, tightly integrated partner solutions.

• Inside Real Estate will continue to invest heavily in the first integrated lifetime homeownership platform, CORE Home. The techn

ology,

paired with smart affiliated services solutions and branded for Inside Real Estate’s customers, will place brokers and agents at the heart

of the consumer relationship.

A Global Leader in Technology Advisory

Note: Ranking based on data provided by Refinitiv. Excludes accounting firms and brokers.

(1) As of December 2023; excludes corporate MDs.

(2) As of January 31, 2024.

(3) LTM ended December 31, 2023.

Expertise in High-Growth Technology

Sectors

Significant experience and expertise across

vertical and horizontal business management

software, HCM, property tech, tech-enabled

services, UCaaS, industrial tech, data and

analytics, FinTech, adtech, and cyber.

Global Tech Coverage and

Knowledge

Our global footprint with offices in key

M&A markets in the Americas, Asia, and

Europe gives us integrated coverage,

while our local roots mean that we have

a strong understanding of the markets

we cover.

15 technology offices globally

150+ technology-focused financial

professionals

40+ technology-focused Managing

Directors

Broad and Deep Investor Coverage

29

senior officers dedicated to the

sponsor community the America’s and

Europe.

Coverage of

1,000+ private equity

firms,

250+ credit funds, and 70+

family offices.

Catalog and deal experience on financial

sponsor preferences and behaviors.

Houlihan Lokey’s Capital Markets Group

comprises more than 90 dedicated

professionals across 11 offices in five

countries that raised approximately

$26

billion

in capital during over the past

two years.

Key Facts and Figures

2,000+

CLIENTS SERVED

ANNUALLY

312

MANAGING

DIRECTORS

(1)

~2,000

TOTAL FINANCIAL

PROFESSIONALS

36

LOCATIONS

WORLDWIDE

$1.8B

REVENUE

(3)

$8.3B

MARKET

CAPITALIZATION

(2)

Partner-Led Approach

Providing unbiased, insightful advice in the best interest of our clients, Houlihan Lokey will have significant senior resources dedicated to

guiding clients.

45

2023 M&A Advisory Rankings

All Global Technology Transactions

Deals

Advisor

89

Houlihan Lokey1

76

Rothschild & Co2

68

JP Morgan3

63

Goldman Sachs & Co4

59

Morgan Stanley5

Source: LSEG (formerly Refinitiv).

Excludes accounting firms and brokers.

36

LOCATIONS

WORLDWIDE

150+

TECHNOLOGY

FINANCIAL

PROFESSIONALS

40+

TECH MANAGING

DIRECTORS

89

TECHNOLOGY

DEALS IN CY23

No. 1

GLOBAL TECH

M&A ADVISOR*

Local Technology Team

Americas

Atlanta

Baltimore

Boston

Charlotte

Chicago

Dallas

Houston

Los Angeles

Miami

Minneapolis

New York

San Francisco

São Paulo

Washington, D.C.

Asia-Pacific

Beijing

Fukuoka

Gurugram

Hong Kong SAR

Mumbai

Shanghai

Singapore

Sydney

Tokyo

Europe and Middle East

Amsterdam

Antwerp

Dubai

Frankfurt

London

Madrid

Manchester

Milan

Munich

Paris

Stockholm

Tel Aviv

Zurich

*Source: LSEG (formerly Refinitiv). Excludes accounting firms and brokers.

Our Tech M&A Team Is No. 1 Globally With Unrivaled Reach

46

Houlihan Lokey’s Subsector Research

47

Click on the images below to access Houlihan Lokey’s recent sector-specific reports.

Commercial Real Estate Technology Multi-Family Technology Construction Technology

Travel & Hospitality Technology Field and Frontline Operations

48

01

EXECUTIVE SUMMARY

02

KEY SUBSECTOR MARKET TRENDS

03

PROPTECH MARKET SUMMARY

04

PUBLIC MARKETS

05

HOULIHAN LOKEY OVERVIEW

06

APPENDIX

2

13

31

35

38

48

EquipmentShare Raises $150 Million in Series E Extension Round

49

Series E Extension

Led by

$150M Equity Raised

Transaction Overview EquipmentShare Overview

• On September 13, EquipmentShare

announced its $150 million Series E

extension funding round led by BDT &

MSD Partners.

• EquipmentShare is a leading equipment

and digital solutions provider serving the

construction industry.

• By empowering contractors, builders, and

equipment owners with its proprietary

technology, T3, EquipmentShare aims to

drive productivity, efficiency, and

collaboration across the construction

sector.

Platform Overview

Sources: PitchBook, company website, press releases.

Selected Deal Commentary

Headquarters Columbia, MO

Founded 2015

Description

Developer of a fleet management platform intended to serve

contractors and original equipment manufacturers. The company’s

platform offers services that include insurance verification,

background checks, payment processing, and an easy interface for

lending and renting contracting equipment, enabling construction

contractors to make informed decisions about their equipment and

fleet through automated data collection.

Select Current

Investors

Through a combination of deep,

hands-on industry knowledge

and cutting-edge technology

systems, EquipmentShare is

helping to make the rental

equipment market and broader

construction space more

productive, efficient and safe.

–Henry Yeagley,

Partner, BDT & MSD Partners

T3 Technology Platform: The OS for Construction

This round of funding not only

attracts fresh capital from both

new and existing investors, but it

also showcases our ability to

stand tall in a challenging

macroeconomic landscape,

positioning us for even greater

success in the future.

–Jabbok Schlacks,

Co-Founder and CEO,

EquipmentShare

Inventory

Management

Cost Capture

CRM

Work Orders

Analytics

Time Tracking

Fleet

Management

E-Logs/

Reporting

Limble Raises $58 Million in Series B Round

50

Series B

Led by

$58M Equity Raised

Transaction Overview Limble Overview

• On June 22, Limble announced its $58

million Series B funding round led by

Goldman Sachs Growth Equity.

• Limble provides a leading CMMS

software that streamlines everyday

maintenance workflows and drastically

lowers stress from unexpected

breakdowns.

• In 2022 alone, maintenance teams used

Limble to save hundreds of millions of

dollars in downtime, parts spend, and

labor while doing the unseen work of

keeping our world safe and functional.

Platform Overview

Sources: PitchBook, company website, press releases.

Selected Deal Commentary

Headquarters Lehi, UT

Founded 2015

Description

Developer of computerized maintenance management software

designed to track, manage, schedule, and report maintenance

activities. The company’s platform has a variety of features such as

asset management, work order, preventive maintenance, predictive

maintenance, inventory, and vendor management, enabling

professionals to increase efficiency and reduce costs.

Select Current

Investors

Limble has disrupted this market

with an intuitive, user-friendly,

and modern CMMS that

streamlines even the largest

operations, and fast

implementation means customers

see ROI within weeks. The

product has proven its value with

thousands of customers

worldwide.

–Brendon Hardin,

Vice President,

Goldman Sachs

The success of Limble can truly

be credited to a deep

understanding of the specific

challenges that face maintenance

and facility managers, and the

design of a powerful yet

streamlined system to solve

those problems. We set out to

empower the maintenance

professionals.

–Bryan Christiansen,

Founder and CEO,

Limble

Work Order Management Spare Parts Inventory

Preventive Maintenance

Predictive Maintenance

Asset Management

Reports and Dashboard

$135M

Customers saved in

downtime costs in 2022.

$68M

Customers saved in parts

spend in 2022.

$442M

Customers saved in reduced

labor costs in 2022.

HqO Raises $50 Million in Series D Round

51

Series D

Led by

$50M Equity Raised

Transaction Overview HqO Overview

• On October 18, HqO announced its $50

million Series D funding round led by

Koch Real Estate Investments.

• HqO leverages real estate experience

insights from 1.7+ million people and

8,000+ workplaces to inform its tenant

experience platform.

• Through its Real Estate Experience (REX)

platform, a powerful and dynamic suite of

applications and services, HqO has

powered over 400 million square feet at

more than 700 properties across 32

countries.

Platform Overview

Sources: PitchBook, company website, press releases.

Selected Deal Commentary

Headquarters Boston, MA

Founded 2015

Description

Developer of a professional tenant experience platform designed to

connect people to places, experiences, and each other. The

company’s platform offers a tool for startup companies to search

for products or services and get connected with professionals who

can provide advice, references, and introductions, enabling users to

communicate with their closest business contacts and connect with

new partners.

Select Current

Investors

By developing cutting-edge

technology and tools that

prioritize user sentiment, HqO is

not only adapting to the rapidly

changing real estate industry, but

driving its progression. With

HqO’s vision and our investment,

we are confident that together we

are building a more

transformative ecosystem.

–Justin Wilson,

Managing Director,

Koch Real Estate

HqO is here to reimagine the

status quo and lead the charge

toward a more connected,

efficient, and user-centric real

estate experience. We’re

doubling down on our

commitment to connect real

estate to the people and help

create spaces that truly serve the

evolving needs of those who use

them.

–Chase Garbarino,

Co-Founder and CEO,

HqO

Experience Manager

HqO REX Platform

Intelligence

Marketplace

Asset-agnostic, cross-property tenant

experience management system

Standard for measuring and assessing

end-user experience within a property

Directory of services and amenity

partners

Funnel Leasing Raises $32 Million in Series B-2 Round

52

Series B-2

Led by

$32M Equity Raised

Transaction Overview Funnel Leasing Overview

• On October 30, Funnel Leasing

announced its $32 million Series B-2

funding round led by RET Ventures.

• Funnel provides renter management

software (RMS) built on a foundation of

modern, renter-centric technology.

• The financing expands Funnel’s sales and

marketing teams significantly.

• The round further recognizes the

completion of Funnel’s front office suite

including CRM, virtual leasing agent,

online leasing, onboarding, and a resident

portal.

Platform Overview

Sources: PitchBook, company website, press releases.

Selected Deal Commentary

Headquarters Odessa, FL

Founded 2010

Description

Developer of a cloud-based real estate marketing software

designed to manage inventory and optimize the renter experience

from prospect to close. The company’s software offers complete

marketing and leasing management services, enabling residential

professionals to manage inventory, track leads and deals, advertise

listings, and access performance analytics.

Select Current

Investors

Our conversations with our

strategic investors point to the

need for a streamlined,

centralized operating model that

leverages automation to reduce

costs for multifamily operators

while improving the customer

experience. Only Funnel’s renter-

centric architecture empowers

operators to make these needed

changes.

–John Helm,

Founder and Partner,

RET Ventures

The future of multifamily

leverages enterprise-grade

technology, automations and

shared services to provide

renters and residents the best

experience at every step of their

journey—from inquiry to move-

in to renewals—all while making

teams’ roles more engaging.

–Tyler Christiansen,

CEO, Funnel

86%

Initial inquiries handled

by automation.

90%

Increase in tours

scheduled.

85%

Increase in lead-to-lease

conversion.

Renter-

Centric

CRM

Reporting

Online

Leasing +

Renewals

Resident

Onboarding

+ Portal

ILS

Syndication

AI Agent:

Email, SMS,

Chat, and

Voice

Contact

Center