Guide to

Employment, Labour and Equality Law

Starting Employment

Day ve statement

Within ve days of starting work, all

employees must get a written statement of

the following core terms of employment:

1. the full names of the employer and

the employee

2. the address of the employer

3. the expected duration of the contract,

in the case of a temporary contract, or

the end date if the contract is a xed-

term contract

4. the rate or method of calculation of

the employee’s pay

5. the number of hours the employer

reasonably expects the employee to

work per normal working day and per

normal working week

This is as well as the full written statement

of terms of employment which must be

given within two months of starting the

job.

National Minimum Wages

Pay/Wages

Under the new Employment Miscellaneous

Provisions Act 2019 wage rates for

employees under 18 and those over 18

have been simplied and will be solely

based on age. Trainee rates of pay have

been abolished.

Sectoral Employment Order

A Sectoral Employment Order (SEO) setting

legally binding rates of pay and terms and

conditions for the Electrical Contracting

sector came into effect on the 1 September

2019.

Working Hours

Zero Hours

The Organisation of Working Time Act

1997 (OWTA) is amended to prohibit zero

hour contracts except in the following

circumstances:

• where the work is of a casual nature

• where the work is done in emergency

circumstances

• where short-term relief work is used

to cover routine absences for the

employer

Minimum payment in certain

circumstances

A new minimum payment will apply when

an employee on a zero hours contract, is

called in to work and does not receive the

expected hours of work.

The minimum payment is calculated as

three times the national minimum hourly

rate of pay or three times the minimum

hourly rate of pay set out in an Employment

Regulation Order (if one exists for that

sector and for as long as it remains in

force).

The already existing method of payment

(at least 25% of the contract hours or 15

hours) continues to apply overall.

Banded Hours provisions

• Employees whose contract of

employment or statement of terms

of employment does not reect the

reality of the hours they habitually

work are entitled to request to be

placed in a band of hours that better

reects the hours they have worked

over a 12-month reference period.

Updates to Guide to Employment, Labour and Equality Law

Since we published our Guide to Employment, Labour and Equality Law in September 2018

there have been changes under employment law. Below your will nd the latest changes.

• If you are an employee, you must be

working for your employer for at least

a year before making this request

Annual leave and certied sick leave

From the rst day in a job employees are

building up holiday entitlements even

if they are on certied sick leave and

whether they are part-time or full time. If

an employee is on certied sick leave at

the end of the leave year the annual leave

they have earned and have not been able

to take is carried over and available to take

for the next 15 months.

Family friendly leave

Maternity leave and premature birth

Mothers of premature babies born over

two weeks before their due date are

entitled to extend their maternity leave by

the difference between the birth date and

the date maternity leave was due to start.

Ordinarily maternity leave commences no

later than two weeks before the due date.

Paternity leave

Paternity leave of two weeks is available

to a relevant parent within 26 weeks

of the birth of their child. A paternity

benet payment is available for qualifying

relevant parents from the Department of

Employment and Social protection.

Parental leave

The maximum period of parental leave

increased from 18 to 22 weeks from 1

September 2019, and increases again to

26 weeks from 1 September 2020. The

age of the child for which parental leave is

available has increased from 8 to 12 years.

For a child with a disability the parental

leave age threshold remains unchanged

and is available up to the age of 16.

Visit our website workplacerelations.ie

for more detailed information or call our

information service on

0818

80 80 90.

Follow us on Twitter @WRC_ie

Published September 2019

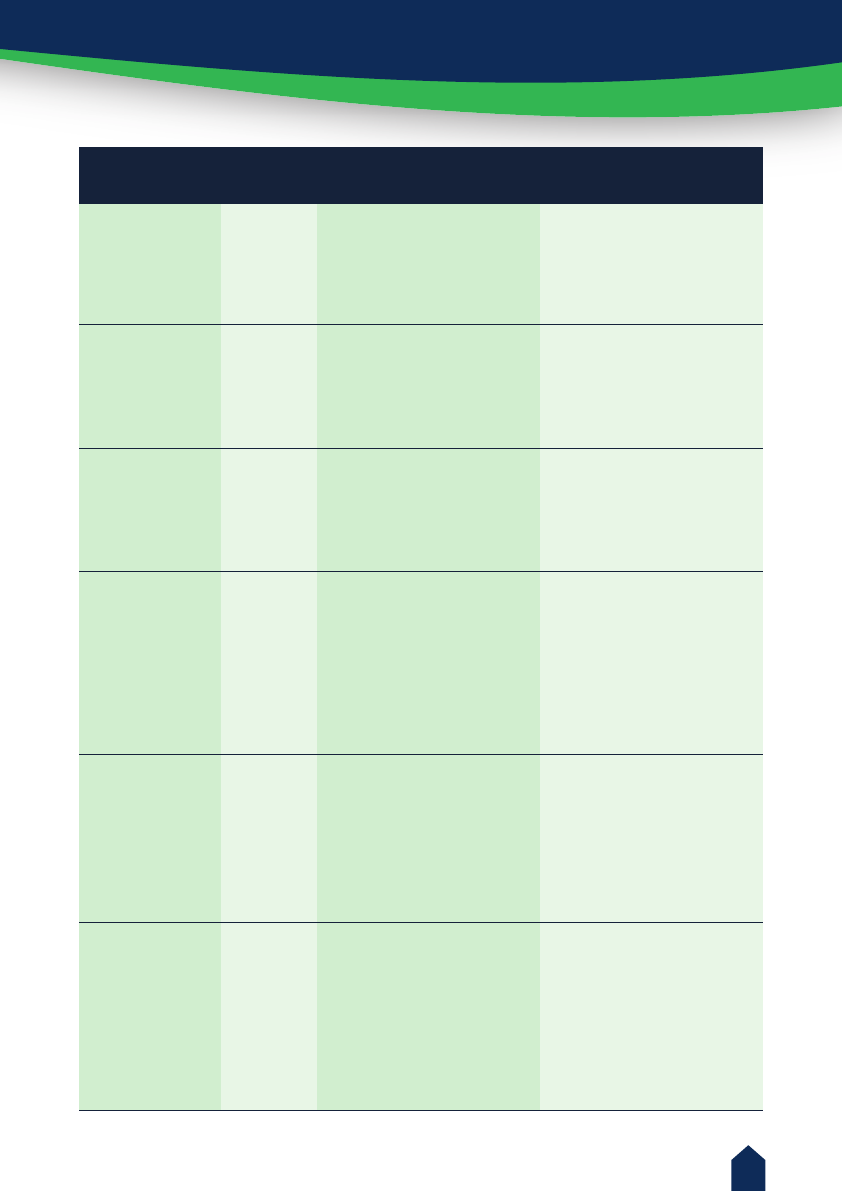

Band

A

B

C

D

E

F

G

H

From

3 hours

6 hours

11 hours

16 hours

21 hours

26 hours

31 hours

36 hours and over

To

6 hours

11 hours

16 hours

21 hours

26 hours

31 hours

36 hours

The bands of hours are as follows:

3

1.

Introduction 5

2. Workplace Relations

Ofces and Services

5

Department of Business, Enterprise

and Innovation 5

The Workplace Relations Commission 6

The Labour Court 6

Employment Appeals Tribunal 7

Low Pay Commission 7

Health and Safety Authority 8

Mechanisms for Setting Terms and

Conditions 9

Adjudication Services 10

Mediation Services

(Employment Rights Issues) 11

Inspection and Enforcement Services 12

Mediation (Internal Workplace Issues) 12

Conciliation Services 13

Advisory Services 13

Important Contacts 14

3. Commencing Employment 17

Contract of Employment 17

Employment Permits 17

Terms of Employment (Terms of

Employment (Information) Acts) 18

Complaints 19

Additional Information 20

4. Working Hours 21

Organisation of Working Time

Act 1997 21

Maximum Weekly Working Time 21

Rest 22

Night Workers 23

Maximum night working time 23

Denitions,exemptionsandother

features of the Working Time Act 23

Holidays 24

Public Holidays 25

Sunday Premium 25

Zero Hours 26

Records 26

Complaints 26

Additional Information 27

5. Part-Time Employees

29

General 29

Who is Covered By The Act? 29

Objective grounds 30

Part-Time Employee 30

Full-Time Employee 30

Comparable Employee 30

Agency Worker 31

Complaints 31

Additional Information 31

6. Fixed-Term Workers 33

General 33

Who is Covered by the Act? 34

Objective grounds 34

Fixed-Term Employee 34

Permanent Employee 34

Comparable Permanent Employee 34

Objective Conditions 35

Objective Grounds Justifying

a Renewal 35

IndeniteFixed-TermContracts 35

Employeesonxed-termcontracts 36

Vacancies and training opportunities 36

Table of Contents

4

Informationaboutxed-termworking 36

Complaints 36

Additional Information 36

7. Employment of Children

and Young Persons

37

General 37

Children over age 14 38

Young People 38

Additional Information 38

8. Carer’s Leave 39

General 39

Who is covered by the Act? 39

Entitlement to Carer’s Leave 39

Meaning of ‘Full-time care

and attention’ 40

Manner in which Carer’s Leave

may be taken 40

Intervals between periods of

Carer’s Leave 40

Protection of Employment Rights 41

Protection against Penalisation

including Dismissal 41

NoticationofIntentiontotake

Carer’s Leave 41

Exceptional or Emergency

Circumstances 42

ConrmationofCarer’sLeave 42

Complaints 42

Additional Information 42

9. Pay/Wages 43

General 43

Minimum Rates of Pay 43

Who is covered? 43

Minimum Hourly Rates of Pay 44

Determining the average hourly

rate of pay 44

Working Hours 44

Reckonable and Non-Reckonable Pay 44

Training / Study Criteria 44

Records 45

Overtime 46

Methods of Payment 46

Statement of Wages 46

Deductions 46

Sick Pay and Sick Leave 47

Complaints 47

Additional Information 48

10. Termination of Employment 49

Minimum Notice 49

Redundancy 50

Collective Redundancies 51

Insolvency 52

Dismissal 53

Complaints 56

Additional Information 56

11. Equality 57

Employment Equality 57

Collective Agreements 57

Occupational Pensions 57

Equal Status 58

Complaints 58

12. Other Relevant Provisions 59

Transfer of Undertakings 59

Rights of Posted Workers and of

non-national workers in Ireland 60

Domestic Workers 61

Worker Participation 62

Employment Agencies 63

Safety, Health and Welfare at Work 63

Complaints 65

Additional Information 65

Appendix I-

Adjudication Redress Provisions 67

5

This booklet provides information on

employment rights and equality legislation

applying in Ireland. It should be noted that

this legislation applies to all workers working

in Ireland including posted EU workers and

all other non-national workers working in

Ireland under a contract of employment (See

page 60-61 for more detail regarding posted

EU workers and other non-national workers).

Department of Business,

Enterprise and Innovation

The Department’s overall mission is to

encourage the creation of high quality and

sustainable full employment by championing

enterprise across government, supporting

a competitive enterprise base, promoting

a low tax environment to incentivise work

and enterprise and promoting fair and

competitive markets.

The Department ensures through work

at national and international levels that

workplaces are safe, employment rights

are appropriate and respected, harmonious

industrial relations are promoted and any

disputes or contraventions are handled

efciently and effectively; that skills needs

are identied and met through alignment

of education and training provision and,

as required, through targeted and efcient

economic migration.

The Department strives to make all markets

work more efciently through smart

regulation which, among other matters,

encourages high standards of compliance,

and quality employment without unnecessary

regulatory costs.

The Department’s responsibilities in regard

to industrial relations lie in the formulation of

policy, support and oversight of the industrial

relations institutions, the administration of

industrial relations and trade union law and

the monitoring of developments in industrial

disputes. In addition the Department is

involved in the promotion of employee

participation in the workplace.

In addition, the Department of Business,

Enterprise and Innovation is responsible for

the promotion, administration and review of

avarietyofmeasures inthe eld oflabour

legislation and employment rights.

1 Introduction

2 Workplace Relations Ofces and Services

Workplace Relations Commission -

Guide to Employment, Labour and Equality Law

6

The Department also administers the

Employment Permits system which facilitates

enterprises to access talent from overseas

that is in short supply in the State. The suite

of supporting regulations ensures that the

system remains attuned to the changing

labour market and enterprise environment.

The Workplace Relations

Commission

The Workplace Relations Commission

(WRC) has responsibility for

4 promoting the improvement of

workplace relations, and maintenance

of good workplace relations,

4 promoting and encouraging

compliance with relevant enactments,

4 providing guidance in relation to

compliance with codes of practice

approved under Section 20 of the

Workplace Relations Act 2015,

4 conducting reviews of, and monitoring

developments as respects, workplace

relations,

4 conducting or commissioning research

into matters pertaining to workplace

relations,

4 providing advice, information and the

ndingsofresearchconductedbythe

Commission to joint labour committees

and joint industrial councils,

4 advising and apprising the Minister

in relation to the application of, and

compliance with, relevant enactments,

and

4 providing information to members of

the public in relation to employment

enactments.

The Commission’s core services include the

inspection of employment rights compliance,

the provision of information, the processing

of employment agency and protection of

young persons (employment) licences and

the provision of mediation, conciliation,

facilitation and advisory services.

The Commission has a board consisting

of a chairperson and 8 ordinary members

appointed by the Minister for Business,

Enterprise and Innovation.

The Labour Court

The Labour Court, established under the

Industrial Relations Act 1946, provides a

comprehensive service for the resolution

of disputes about industrial relations

and has sole appellate jurisdiction in all

disputes arising under employment rights

enactments. The Court’s functions can be

divided between those relating to industrial

relations matters and those relating to

the determination of appeals in matters of

employment rights. Additionally, the Court

has a number of functions in relation to

Joint Labour Committees and the making

of Employment Regulation Orders as well

as registering Joint Industrial Councils and

Employment Agreements.

The Court consists of 13 full-time members

– a Chairman, 4 Deputy Chairmen and

8 ordinary members representative of

employers (4) and workers (4). The Chairman

and Deputy Chairmen are appointed by

the Minister for Business, Enterprise and

Innovation;the4Employers’Membersofthe

Court are nominated by IBEC (Irish Business

and Employers Confederation) and the 4

Workers’ Members of the Court are nominated

by ICTU (Irish Congress of Trade Unions) and

then appointed by the Minister. The Labour

Court also has a legal adviser (the Registrar).

7

For the purposes of hearing cases, the Court

operates in Divisions – a Division consists

of a Chairman, an Employers’ Member and a

Workers’ Member. Certain issues may require

a meeting of the full Court.

The Industrial Relations Acts 1946 – 2015

assign various functions to the Court. These

functions are mainly concerned with the

investigation of trade disputes and the

issuing of recommendations on how the

dispute should be resolved. The Labour Court

is not a court of law. Effectively, for most

purposes, the Labour Court acts as a court of

last resort i.e. the services of the Court are

availed of when the other options for the

resolution of industrial relations disputes

have been explored and exhausted.

The Labour Court also acts as a court

of appeal in relation to the decisions

of Workplace Relations Commission

AdjudicationOfcersandcompliancenotices

issued by Commission inspectors. The

Workplace Relations Act 2015 provides that

the Court has sole appellate jurisdiction in

all disputes arising under employment right

enactments.

Employment Appeals Tribunal

The Employment Appeals Tribunal (EAT) is

an independent body bound to act judicially,

and was set up to provide a fair, inexpensive

and informal means for individuals to seek

remedies for alleged infringements of their

statutory rights.

The Tribunal deals with rst instance

employment rights complaints which were

presented before 1st October, 2015 (legacy

complaints) under the following legislation

4 Redundancy Payments Acts, 1967 to

2014

4 Minimum Notice and Terms of

Employment Acts, 1973 to 2005

4 Unfair Dismissals Acts, 1977 to 2015

Appeals of Rights Commissioner

recommendations made before 1st October,

2015 (legacy appeals) under Terms of

Employment, Payment of Wages, Unfair

Dismissal, Redundancy (Consultation and

Information), Maternity Protection, Adoptive

Leave, Carer’s Leave, Parental Leave, Protection

of Young Person’s (Employment), Consumer

Protection (penalisation), Competition

(penalisation), Chemicals (penalisation) and

Transfer of Undertakings legislation are dealt

with by the Employment Appeals Tribunal.

Note that in accordance with the Workplace

Relations Act 2015 all complaints and

disputes under employment, equality and

equal status legislation which were presented

after 30th September, 2015 will be dealt with

by the Workplace Relations Commission.

The EAT will remain in place to deal

with legacy complaints and appeals on

completion of which it will be dissolved.

Updates in this regard are available on

www.workplacerelations.ie.

Low Pay Commission

The remit of the Low Pay Commission (LPC) is to

recommend levels for the minimum wage rates

that will help as many low-paid workers as

possiblewithoutanysignicantadverseimpact

on employment or the economy. The advice the

LPC offers the Government to achieve this is

based on the best available evidence.

8

The Commission comprises 8 members

and an independent Chairperson. There

are members who have an understanding

of the interests of employers, particularly

small to medium-sized employers and

those operating in traditionally low

pay sectors, and who possess a good

knowledge and understanding of the

particular issues faced by Irish businesses,

particularly in relation to labour costs and

competitiveness. There are members who

have an understanding of the interests of

employees, particularly the impact of living

on the minimum wage and the sectors

where low pay and minimum wage workers

are concentrated. There are also academics

with particular knowledge or expertise

in relation to economics, labour market

economics, statistics, and employment law,

as well as proven competence in analysing

and evaluating economic research and

statisticalanalysis.Thetermofofceofa

member of the Commission is three years

from the date of his or her appointment.

A person may not be a member of the

Commission for more than two consecutive

termsofofcebutisotherwiseeligiblefor

re-appointment.

The National Minimum Wage (Low Pay

Commission) Act 2015 requires the

Commission in making a recommendation to

the Minister on the National Minimum Wage

(NMW) to have regard to a number of factors

since the most recent making of a National

Minimum Wage Order.

The remit, and the legislation, also require

that the Commission give consideration to

a range of issues in coming to a decision

on a recommendation to the Minister

for an appropriate rate for the minimum

wage. Some of the issues are, essentially,

matters of fact, while others necessitate an

element of assessment and appraisal, and

considered judgement.

The particular issues the Commission is

obliged to have regard to in considering its

recommendation are —

(a) changes in earnings during the

relevant period,

(b) changes in currency exchange rates

during the relevant period,

(c) changes in income distribution

during the relevant period,

(d) whether during the relevant

period—

(i) unemployment has been

increasing or decreasing,

(ii) employment has been

increasing or decreasing, and

(iii) productivity has been increasing

or decreasing,

both generally and in the sectors

most affected by the making of an

order,

(e) international comparisons,

particularly with Great Britain and

Northern Ireland,

(f) the need for job creation, and

(g) the likely effect that any proposed

order will have on —

(i) levels of employment and

unemployment,

(ii) the cost of living, and

(iii) national competitiveness.

Health and Safety Authority

The Health and Safety Authority is the national

statutory body with responsibility for ensuring

that all workers (employed and self-employed)

and those affected by work activity are protected

from work related injury and ill-health. This is

done by enforcing occupational health and

safety law, promoting accident prevention,

and providing information and advice across

all sectors, including retail, healthcare,

manufacturing,shing, entertainment,mining,

9

construction, agriculture and food services.

The Authority was initially established under

the Safety, Health and Welfare at Work Act

(1989), since replaced by the Safety, Health

and Welfare at Work Act 2005, and it operates

under the aegis of the Department of Business,

Enterprise and Innovation.

The Authority’s primary functions include:

4 Monitoring and enforcing compliance

with occupational health and safety

legislation.

4 Providing information and expert

advice to employers, employees and

the self-employed.

4 Promoting workplace safety, health,

welfare, education and training.

4 Publishing research on workplace

hazards and risks.

4 Acting as Lead National Competent

Authority for a number of chemicals

regulations including REACH

(Registration, Evaluation, Authorisation

and Restriction of Chemicals)

Regulation and the Seveso III Directive.

4 Acting as Market Surveillance Authority

for ensuring the safety of certain

products used in workplaces and

consumer applications.

4 Proposing new regulations and codes

of practice to the Minister.

Mechanisms for Setting Terms

and Conditions

JOINT LABOUR COMMITTEES

Joint Labour Committees (JLCs) are bodies

established under the Industrial Relations

Actstoprovidemachineryforxingstatutory

minimum rates of pay and conditions of

employment for particular employees in

particular sectors. They may be set up by

the Labour Court on the application of (i)

the Minister for Business Enterprise and

Innovation or (ii) a trade union or (iii) any

organisation claiming to be representative

of the workers or the employers involved. A

JLC is made up of equal numbers of employer

and worker representatives appointed by the

Labour Court and a chairman and substitute

chairman appointed by the Minister for

Business Enterprise and Innovation. JLCs

operate in areas where collective bargaining is

not well established and wages tend to be low.

The function of a JLC is to draw up proposals

forxingminimumratesofpayandconditions

of employment for the workers affected.

When proposals submitted by a JLC are

adopted by the Labour Court, the Minister for

Business Enterprise and Innovation may give

statutory effect to the proposals through the

making of an Employment Regulation Order.

Employers are then obliged to pay wage rates

and provide conditions of employment not

less favourable than those prescribed.

Any breaches of an Employment Regulation

Order may be referred to the WRC for

appropriate action.

An employer of workers to whom an

Employment Regulation Order applies must

keep records of wages, payments etc., and

must retain these records for three years.

The employer must also post up a prescribed

notice in the place of employment setting

out particulars of the statutory rates of pay

and conditions of employment.

A list of JLCs is available at

www.workplacerelations.ie .

10

REGISTERED EMPLOYMENT

AGREEMENTS

An Employment Agreement is an agreement

relating to the remuneration or the

conditions of employment of workers of any

class, type or group made between a trade

union or trade unions of workers and one or

more than one employer or a trade union of

employers, that is binding only on the parties

to the Agreement in respect of the workers of

that class, type or group.

Any party to an Employment Agreement

may apply to the Labour Court to register the

Agreement. The Labour Court shall register

such agreements in the Register of Employment

Agreements – they then become Registered

Employment Agreements - if it is satised

that they comply with rules set down in the

Industrial Relations (Amendment) Act 2015. The

effect of registration is to make the provisions

of the Registered Agreement legally binding

on the parties to the Agreement only. Any

contraventions of a Registered Employment

Agreement may be referred to the WRC for

appropriate action.

SECTORAL EMPLOYMENT ORDERS

On foot of a request, from a trade union of

workers, a trade union or an organisation

of employers, or a trade union of workers

jointly with a trade union or an organisation

of employers, the Labour Court can carry out

an examination of the remuneration, sick pay

or pension scheme of workers in a particular

economic sector. The Labour Court, having

considered the applicable economic factors,

may make a recommendation to the Minister,

who shall, if he/she is satised that the

Labour Court, in making its recommendation

has complied with the provisions of the

Industrial Relations (Amendment) Act

2015, accept the recommendation and by

Ministerial Order conrm the terms of the

recommendation. Such Order applies to

every worker of the class, type or group

in the economic sector to which it is

expressed to apply, and his or her employer.

The 2015 Act provides for exemptions in

specic circumstances from the obligation

to pay remuneration set down in Sectoral

Employment Orders. Any contraventions of

Sectoral Employment Orders may be referred

to the WRC for appropriate action.

JOINT INDUSTRIAL COUNCILS

Joint Industrial Councils (JICs) are voluntary

negotiating bodies for particular industries

or parts of industries that are representative

of employers and trade unions. A Council,

provided that it fulls certain conditions,

may register with the Labour Court as a

Joint Industrial Council under the Industrial

Relations Acts. The rules of such Councils

must provide for the referral of disputes to

the Council for consideration before resort

is had to industrial action. A registered JIC

may request the Labour Court to appoint a

chairperson and secretary to the Council.

Adjudication Services

Adjudication Ofcers of the Workplace

Relations Commission (WRC) are statutorily

independent in their decision making duties

as they relate to adjudicating on complaints

referred to them by the WRC Director General.

The Adjudication Ofcer’s role is to hold a

hearing where both parties are given an

opportunity to be heard by the Adjudication

Ofcer and to present any evidence

relevant to the complaint. Hearings of the

Workplace Relations Commission are held

in private. However, complaints may, in

certain instances, be disposed of by means

of written procedure (i.e. without hearing).

TheAdjudicationOfcerwillnotattemptto

mediate or conciliate the case. Parties may

11

be accompanied and represented at hearings

byatradeunionofcial,anofcialofabody

that, in the opinion of the Adjudication

Ofcer,representstheinterestsofemployers,

a practicing barrister or practicing solicitor or

anyotherperson,iftheAdjudicationOfcer

so permits.

The Adjudication Ofcer will then decide

the matter and give a written decision in

relation to the complaint. The decision,

which will be communicated to both parties

and published, will

(a)

declare whether the complainant’s

complaint was or was not well founded,

(b) require the employer to comply with

the relevant provision(s),

(c) require the employer to make such

redress as is just and equitable in the

circumstances.

A party to a complaint may appeal to

the Labour Court from a decision of an

AdjudicationOfcer.

The redress that may be granted by an

Adjudication Ofcer in the case of the

different areas of employment and equality

legislation is set out an Appendix I.

Mediation Services (Employment

Rights Issues)

In line with Section 39 of the Workplace

Relations Act 2015, the Workplace Relations

Commission (WRC) may be in a position to

offer a mediation service in certain cases

to facilitate the resolution of complaints/

disputes where possible at an early stage and

without recourse to adjudication. The ability

of the WRC to offer mediation will depend on

a number of factors including the availability

of resources. Complaints/disputes may only

be referred for mediation with the agreement

of both parties to the complaint/dispute.

Mediation seeks to arrive at a solution

through an agreement between the parties,

rather than through an investigation or

hearing or formal decision. The Mediation

Ofcer empowers the parties to negotiate

their own agreement on a clear and informed

basis, should each party wish to do so. The

process is voluntary and either party may

terminate it at any stage.

Mediation can take the form of telephone

conferences with the parties, face-to-face

mediation conferences/meetings or such

other means as the Mediation Ofcer

considers appropriate.

All communications by a Mediation Ofcer

with the parties and all records and notes

held for the purposes of resolving any matter

arecondential andcannotbedisclosedin

any subsequent hearing or investigation

process or in proceedings before a court

(other than proceedings in respect of a

contravention of the terms of a resolution

agreed during the mediation conference).

Where a complaint/dispute is resolved,

whether by mediation or otherwise, the

Mediation Ofcer will record in writing the

terms of the resolution, the parties will be

asked to sign that record and the record of

resolution will be given to the Director General

of the Workplace Relations Commission. A

copy will also be given to each party.

The terms of a resolution are binding on the

parties and if either party contravenes these

terms, the contravention will be actionable in

any court of competent jurisdiction.

12

The terms of a resolution may not be

disclosedbyaMediationOfcerorbyeither

party in any proceedings before a court

(other than proceedings in respect of the

contravention of the terms of the resolution).

Where a complaint/dispute is not resolved,

theMediationOfcerwillnotifytheparties

to the complaint or dispute and the Director

General of the WRC in writing of that fact. The

Director General will then refer the complaint

or dispute concerned for adjudication by an

AdjudicationOfcer.

Inspection and Enforcement

Services

Inspectors of the Workplace Relations

Commission are authorised to carry out

inspections, examinations or investigations

for the purposes of monitoring and enforcing

compliance with employment legislation. The

identity of the complainant will not be divulged

to the employer unless the complainant has

given his/her consent to do so.

Where an Inspector determines that

a contravention of specied areas of

employment law (including the non-payment

of certain monies due to an employee under

employment law) has taken place, and the

employer concerned fails or refuses to rectify

the non-compliance the Inspector may issue

a Compliance Notice setting out the steps

the employer must take to effect compliance.

If the employer does not appeal and fails or

refuses to rectify or set out in writing how

he or she proposes to rectify the matters set

out in the notice, the Workplace Relations

Commission may initiate prosecution

proceedings against the employer.

In respect of a specied range of acts of

non-compliance on the part of employers,

anInspectorwillserveaxedchargenotice.

If the person on whom the notice is served

pays the charge the matter does not proceed

to Court. However, if the person fails or

refuses to pay the charge the matter can be

progressed to the District Court where the

defendant can defend their position in the

normal way.

WRC inspectors are also appointed by the

Minister for Business, Enterprise and Innovation

asauthorisedofcersforthepurposesofthe

Employment Permit Acts 2003 to 2014.

Mediation (Internal Workplace

Issues)

Mediation is a voluntary, condential

process that allows two or more disputing

partiestoresolvetheirconictinamutually

agreeable way with the help of a neutral

third party, a mediator.

The Workplace Mediation Service, which

is provided by ofcers of the Workplace

Relations Commission’s (WRC) Conciliation

and Advisory Services, provides a prompt,

condential and effective remedy

to workplace conicts, disputes and

disagreements. Workplace mediation is

particularly suited to disputes involving

individuals or small groups of workers.

Examples of such disputes would be:

4Interpersonaldifferences,conicts,

difcultiesinworkingtogether

4 Breakdown in a working relationship

4 Issues arising from a grievance and

disciplinary procedure (particularly

before a matter becomes a disciplinary

issue)

4 Industrial Relations issues which have

not been the subject of a referral to

aWRCAdjudicationOfcer(trade

dispute), the WRC’s Conciliation Service

or the Labour Court.

13

The Workplace Mediation Service is focused

on assisting parties to deal effectively with

issues that arise in the workplace. The

provision of this service is subject to the

availability of resources within the Workplace

Relations Commission.

Conciliation Services

The purpose and mission of the Workplace

Relations Commission’s conciliation

service is to provide an impartial, fast and

effective conciliation service operating to a

uniformly high standard in both the public

and private sectors.

Conciliation is a voluntary process in which the

parties to a dispute agree to avail of a neutral

and impartial third party to assist them in

resolving their industrial relations differences.

The Workplace Relations Commission

provides a conciliation service by making

availableIndustrialRelationsOfcersofthe

Commission to chair ‘conciliation conferences’.

Theseofcersare sometimesreferredtoas

‘IROs’oras‘ConciliationOfcers’.Conciliation

conferences are basically an extension of

the process of direct negotiations, with an

independent chairperson present to steer the

discussions and explore possible avenues of

settlement in a non-prejudicial fashion.

Participation in the conciliation process

is voluntary, and so too are the outcomes.

Solutions are reached only by consensus,

whether by negotiation and agreements

facilitated between the parties themselves,

or by the parties agreeing to settlement

termsproposedbytheConciliationOfcer.

The Industrial Relations Ofcer treats as

condentialallinformationreceivedduring

the course of conciliation.

The conciliation process is informal and non-

legalistic in its practice. The parties are free

to represent themselves or be represented by

trade unions or by employer organisations. The

Commission does not believe that the nature

of the process requires legal representation of

either party at conciliation meetings.

All requests for assistance and inquires

may be referred in writing and should be

directed to the Director of Conciliation,

Workplace Relations Commission, Workplace

Mediation and Early Resolution Services and

or by contacting the Workplace Relations

Commission’s Conciliation Services or by

using the online Conciliation Referral Form

on www.workplacerelations.ie.

Advisory Services

The Workplace Relations Commission’s

Advisory Service promotes good practice

in the workplace by assisting and advising

organisations in all aspects of industrial

relations in the workplace. It engages

with employers, employees and their

representatives to help them to develop

effective industrial relations practices,

procedures and structures. Such assistance

could include reviewing or developing

effective workplace procedures in areas such

as grievance, discipline, communications and

consultation.

It facilitates joint management–staff forums

to work through issues of mutual concern;

for example workplace change or difcult

industrial relations issues.

It provides good practice training workshops

on a variety of aspects of the employment

relationship including the operation of

workplace procedures and, through a

facilitative process, can assist organisations

to implement them. In addition, the Advisory

14

Service commissions and publishes research

on current industrial relations themes. The

Advisory Service also facilitates a procedure

to help management and employee

representatives to resolve disputes in

situations where negotiating arrangements

are not in place and where collective

bargaining fails to take place.

Members of the Advisory Service team are

independent, impartial and experienced

in industrial relations practice and theory.

In discussion with the parties concerned, a

designated member of the Advisory team

willtailorassistancetottherequirements

ofindividualorganisationsorrms,whether

largeorsmall.Thisassistanceiscondential

to the parties and is provided free of charge.

Requests for the assistance of the Advisory

Service may be made by contacting the

Workplace Relations Commission.

Body/Ofce

Department of

Business, Enterprise and

Innovation

Workplace Relations

Commission

Overall policy and

strategy in relation to

employment rights

Regulation of the

Labour Market and

employment permits

Information Provision

Complaints/Dispute

receipt and registration

Adjudication Services

Inspection &

Enforcement Services

Mediation Services

Protection of Young

Persons (Employment)

and Employment

Agency licensing.

info@dbei.gov.ie

employmentpermits

@dbei.gov.ie

See contact us page on

www.workplacerelations.ie

See contact us page on

www.workplacerelations.ie

See contact us page on

www.workplacerelations.ie

See contact us page on

www.workplacerelations.ie

See contact us page on

www.workplacerelations.ie

See contact us page on

www.workplacerelations.ie

01-6312121

Lo-call

0818

201616

or 01-4175333

Lo-call

0818

-808090 or

059 9188990

0818

-808090

01-6313380

Lo-call

0818

220100

or 059 9178800

Lo-call

0818

220227

or 01-6136700

059-9178800

Role Email Telephone

Important Contacts

15

Body/Ofce

Low Pay Commission

Employment Appeals

Tribunal

Labour Court

Irish Human Rights

and Equality

Commission

Conciliation &

Facilitation Services

Workplace Mediation

Service

Advisory Services

Advises the Government

in relation to levels for

national minimum pay

Adjudication on

complaints referred

to the EAT before 1st

October, 2015

Appeals against

adjudication decisions

and compliance notices

and the investigation

of industrial relations

disputes

Protection and

promotion of equality

See contact us page on

www.workplacerelations.ie

See contact us page on

www.workplacerelations.ie

advisory

@workplacerelations.ie

secretarylpc@djei.ie

EAT@djei.ie

info@labourcourt.ie

publicinfo@ihrec.ie

Lo-call

0818

220227

or 01-6136700

Lo-call

0818

220227

or

01-6136700

01-6136700

01-6313055

Lo-call

0818

220222

or

01-6313006

Lo-call

0818

220228

or 01-6136666

Lo-call

0818

245545

Role Email Telephone

16

17

Contract of Employment

Anyone who works for an employer for a

regular wage or salary has automatically a

contract of employment whether written or

not. The Terms of Employment (Information)

Acts 1994 to 2014 dene a contract of

employment as a contract of service or

apprenticeship or any contract under which

workers are supplied by employment

agencies. Contracts may be expressed (oral

or in writing) or implied, Many of the terms

of a contract of employment may emerge

from the common law, statutes or collective

agreements made through trade unions or

may be derived from the custom or practice

in a particular industry.

The Terms of Employment (Information)

Acts 1994 to 2014 provide that an employer

must provide an employee with a written

statement of certain particulars of the terms

of employment. These Acts are outlined

further in this Section.

The Protection of Employees (Fixed-Term

Work) Act 2003 provides that where an

employer proposes to renew a xed-term

contract, the xed-term employee shall be

informed in writing by the employer of the

objective grounds justifying the renewal of

the xed-term contract and the failure to

offeracontractofindeniteduration,atthe

latest by the date of the renewal. This Act is

outlined further in Section 6 of the Guide.

Employers are required by section 14(1) of the

Unfair Dismissals Acts 1977 to 2007 to give

a notice in writing to each employee setting

out the procedure which the employer will

observe before, and for the purpose of,

dismissing the employee. This must be given

not later than 28 days after entering into a

contract of employment. There is a separate

section in this Guide on dismissals - see

Section 10 - Termination of Employment.

The Payment of Wages Act 1991, gives every

employee the right to a written statement

every pay day with every deduction itemised.

This entitlement is described at Section 9 of

the Guide.

Employment Permits

Non-EEA nationals, except in the cases listed

below, require an employment permit to work

in Ireland. The EEA comprises the Member

States of the European Union together with

Iceland, Norway and Liechtenstein.

Non-EEA nationals working in Ireland

and their employers may be committing

an offence if the former do not have an

employment permit and are required by the

Employment Permits Acts 2003 to 2014 to

do so. Employment permit holders can only

work for the employer, or as the case may be

the connected person or contractor, and in

the occupation named on the permit. If the

holder of an employment permit ceases, for

any reason, to be employed by the employer,

3 Commencing Employment

Workplace Relations Commission -

Guide to Employment, Labour and Equality Law

18

or as the case may be the connected person

or contractor, named on the permit during the

period of validity of the permit, the original

employment permit and the certied copy

held by the employer, or as the case may by,

the connected person or contractor, must be

returned immediately to the Department of

Business, Enterprise and Innovation.

The following non-EEA nationals do not

require an employment permit:

4 non-EEA workers legally employed in

one Member State who are temporarily

sent on a contract to another Member

State-the employer does not need

to apply for employment permits in

respect of the non-nationals for the

period of contract.

4 a Non-EEA national who has been

granted permission to remain in the

State on one of the following grounds:

4 permission to remain as spouse or a

dependant of an Irish/EEA national,

4 Permission to remain as the parent

of an Irish citizen,

4 Temporary leave to remain in the

State on humanitarian grounds,

having been in the Asylum process,

4

Explicit permission from the

Department of Justice and Equality to

remain resident and employed in the

State,

4 Permission to be in the State as a

registered student who is permitted

to work 20 hours during term time

and 40 hours during holiday periods,

4 Permission to be in the State

under the terms of the Diplomatic

Relations and Immunities Act 1967,

and are assigned to a Mission of a

country with whom the Government

has entered into a Working

Dependents Agreement,

4 Swiss Nationals: In accordance

with the terms of the European

Communities and Swiss

Confederation Act, 2001, which

came into operation on 1 June, 2002,

this enables the free movement

of worker between Switzerland

and Ireland, without the need for

Employment Permits.

Inspectors in the Workplace Relations

Commission are also appointed by the

Minister for Business Enterprise and

Innovation as authorised ofcers for the

purposes of the Employment Permits Acts.

Terms of Employment (Terms of

Employment (Information) Acts)

The Terms of Employment (Information) Acts

1994 to 2014 require employers to provide

employees with a written statement of

certain particulars of their employees’ terms

of employment. The Acts, in general, apply to

any person

4 working under a contract of

employment or apprenticeship

4 employed through an employment

agency or

4 in the service of the State (including

members of the Garda Siochana and

the Defence Forces, Civil Servants

and employees of any local authority,

health board, harbour authority, the

Health Service Executive or education

and training board).

The Acts do not apply to a person who

has been in the continuous service of the

employer for less than 1 month.

In the case of agency workers, the party

who is liable to pay the wages (employment

19

agency or client company) is the employer for

the purposes of the Acts and is responsible

for providing the written statement.

The employer must provide the written

statement of particulars within 2 months of

the date of commencement of employment.

In the case of employees whose employment

commenced before 16th May 1994, (the

commencement date of the Act) the written

statement must be provided by the employer

within two months of being requested to do

so by the employee.

The written statement, which is not, of

itself, a contract must include particulars

of the terms of employment relating to

the name and address of the employer, the

place of work, job title/nature of the work,

date of commencement of employment, the

expected duration of contract (if temporary

contract) or the date on which the contract

will expire (if xed term contract), rate or

method of calculation of pay, pay intervals,

hours of work (including overtime), statutory

rest period and rest break entitlements, paid

leave, incapacity for work due to sickness

or injury, pensions and pension schemes,

notice entitlements, registered employment

agreements, employment regulation orders

and collective agreements.

The statement must also indicate the

pay reference period for the purpose of

the National Minimum Wage Act 2000.

Furthermore, the statement of terms must

inform the employee that he/she is entitled

to ask for a statement of his/her average

hourly rate of pay for any pay reference

period falling with in the previous 12 months

as provided for in section 23 of the National

Minimum Wage Act 2000.

As an alternative to providing some of the

details in the statement, an employer may

use the statement to refer the employee

to certain other documents containing the

particulars, provided that the document is

reasonably accessible to the employee.

An employer is also required to notify an

employee of any changes to the particulars

contained in the written statement within 1

month after the change takes effect. Where

an employee is required to work outside the

State for a period of not less than 1 month,

the employer is obliged to add certain

particulars to the written statement and to

provide the statement prior to the employee’s

departure.

Regulations made under the Acts require

employers to give their employees who are

under18yearsofageacopyoftheofcial

summary of the Protection of Young Persons

(Employment) Act 1996 within one month of

taking up a job.

Complaints

The Acts provide a right of complaint to

the Workplace Relations Commission (WRC)

where an employee believes that his/her

employer has failed to provide a written

statement in accordance with the terms of

the Acts or failed to notify the employee of

changes to the particulars contained in the

statement. The relevant complaint form is

available on www.workplacerelations.ie or

by contacting the Commission’s Information

and Customer Services on

0818

80 80 90.

There is a right of appeal by either party to

the Labour Court from a decision of a WRC

AdjudicationOfcer.

20

Additional Information

See Explanatory Booklets on the Terms

of Employment (Information) Acts 1994

and 2001, Protection of Employees (Fixed-

Term Work) Act 2003, Unfair Dismissals

Acts 1977 to 2007 and Payment of Wages

Act 1991, copies of which are available

on request, or downloadable from

www.workplacerelations.ie.

Information on Employment Permit

requirements is available from the Department

of Business, Enterprise and Innovation,

Telephone: (01) 417 5333

LoCall:

0818

201 616

Email: employmentpermits@dbei.gov.ie

website: www.dbei.gov.ie

21

Organisation of Working Time

Act 1997

The Organisation of Working Time Act 1997

sets out statutory rights for employees in

respect of rest, maximum working time and

holidays. These rights apply either by law as

set out in the Act, in Regulations made under

the Act or through legally binding collective

agreements. These agreements may vary

the times at which rest is taken or vary the

averaging period over which weekly working

time is calculated.

The 1997 Act does not apply to Members of

the Defence Forces or of the Garda Siochana.

Part II of that Act (which deals with rest

periods, and weekly working hours) does not

apply to hospital doctor in training

1

, persons

engagedinsea-shingorotherworkatsea,

persons employed in the civil protection

services(e.g.prisons,reservices,IrishCoast

Guard)

2

those who control their own working

hours or persons employed by a close relative

in a private dwelling house or farm in or on

which both reside.

Certain sectors which were originally

excluded from the scope of the Organisation

of Working Time Act 1997 have now been

covered by working time rules by way of

several sets of Regulations made under

the European Communities Act. These

Regulations either brought a particular sector

within the scope of the 1997 Act or provided

for stand-alone rules for a particular sector

within a set of Regulations. These sectors

include transport workers (other than those

performing mobile road transport activities

and those in civil aviation which are covered

by separate working time Regulations made

under EU Directives related specically to

thosesectors),doctorsintraining,sea-shing

workers and offshore workers.

Maximum Weekly Working Time

The maximum average working week is 48

hours. Averaging may be balanced out over

a 4, 6 or 12 month period depending on the

circumstances.

4 Working Hours

1

See the European Communities (Workers on board Sea-going Fishing Vessels( Organisation of Working Time)

Regulations 2003 (SI No. 709 of 2003)

2

See the Organisation of Working Time (Exemption of Civil Protection Services) Regulations 1998 (SI No. 52 of 1998)

Workplace Relations Commission -

Guide to Employment, Labour and Equality Law

22

Shop employees who work more than 6

hours and whose hours of work include the

hours 11 .30am - 2.30pm must be allowed

a break of one hour which must commence

between the hours 11 .30am - 2.30pm.

These rest periods and rest intervals may

be varied if there is a collective agreement

in place approved by the Labour Court or if

a regulation has been made for a particular

sector. If there are variations in rest periods

Category of Worker

Employees who are night workers

Employees generally

Employees where work is subject to

seasonality, a foreseeable surge in activity

or where employees are directly involved in

ensuring continuity of service or production

Employees who enter into a collective

agreement with their employers which is

approved by the Labour Court

Young people under 18

2 months

4 months

6 months

Up to 12 months

HoursofworkarexedbytheProtectionofYoung

Persons (Employment) Act 1996.

Reference Period for averaging

Rest Type

Daily

Weekly

Rest Breaks

11 consecutive hours daily rest per 24 hour period.

One period of 24 hours rest per week preceded by

a daily rest period (11 consecutive hours).

15 minutes where more than 4 and half hours

havebeenworked;30minuteswheremorethan

6 hours have been worked which may include the

rstbreak.

Entitlement

The 48 hour net maximum working week can be averaged according to the following rules:

Rest

Every employee has a general entitlement to the following rest periods:

23

and rest intervals under agreements or in the

permitted sectors, equivalent compensatory

rest must be available to the employee.

Night Workers

Night time is the period between midnight

and 7 am the following day.

Night workers are employees who normally

work at least 3 hours of their daily working

time during night time and the annual

number of hours worked at night equals or

exceeds 50% of annual working time.

Maximum night working time

For nightworkers generally, the maximum

nighttime working hours are 8 hours per

night averaged over 2 months or a longer

period specied in a collective agreement

that must be approved by the Labour Court.

For nightworkers whose work involves

special hazards or heavy physical or mental

strain, there is an absolute limit of 8 hours

in a 24 hour period during which they may

perform night work.

Denitions, exemptions and

other features of the Working

Time Act

Working time is net working time i.e. exclusive

of breaks, on call or stand-by time. Working

timeisdenedintheActastimewhenthe

employee is at his or her place of work or at

the disposal of the employer and carrying out

the duties or activities of his/her employment.

Exceptional or Unforeseeable Circumstances

- The Act permits exemption from the rest

provisions if there are exceptional, unusual

and unforeseeable circumstances. Equivalent

compensatory rest must be taken within a

reasonable period of time.

Shift and Split Shift Working - The Act

provides for automatic exemption from

the daily and weekly rest period provisions

for shift workers when they change shift

and for workers on split shifts. Equivalent

compensatory rest must be taken within a

reasonable period of time.

Exemption by Regulation - Certain categories

may be exempted from the rest provisions by

regulation. Categories of employees in the

sectors set out in the Organisation of Working

Time (General Exemptions) Regulations,

1998 (S.I. No. 21 of 1998) may, subject to

receiving equivalent compensatory rest, be

exempted from the rest provisions of the

Act. S.I. No. 52 of 1998 (Exemption of Civil

Protection Services) provides exemptions

from the rest and maximum working week

provisions of the Act without a requirement

for equivalent compensatory rest.

Exemption by Collective Agreement - Any

sector or business may be exempted from the

statutory rest times by a collective agreement

approved of by the Labour Court, subject

to equivalent compensatory rest being

made available to the employee. Collective

agreements to vary the rest times may be

drawn up between management and a trade

union or other representative staff body in

any business, organisation or enterprise.

These exemptions are subject to equivalent

compensatory rest being made available to

the employee. This means that, although

employers may operate a exible system

24

of working, employees must not lose out

on rest. In these circumstances rest may be

postponed temporarily and taken within a

reasonable period of time

Holidays

Holiday pay is earned against time worked.

All employees, full-time, part-time, temporary

or casual earn holiday entitlements from

the time work is commenced. Note that,

for the purposes of determining holiday

entitlements, a day on which an employee

wason acertiedabsencedue toillness is

deemed to be a working day

3

.

The Organisation of Working Time Act 1997

provides that most employees are entitled to

4 weeks annual holidays for each leave year

with pro-rata entitlements for periods of

employment of less than a year. In the case

of employees working a normal 5 day week

this would work out at 1.66 days per month

worked or 20 days.

Depending on time worked, employees’

holiday entitlements should be calculated by

one of the following methods:

(i) 4 working weeks in a leave year in which

the employee works at least 1,365 hours

(unless it is a leave year in which he or

she changes employment).

(ii) 1/3 of a working week per calendar

month that the employee works at least

117 hours.

(iii) 8% of the hours an employee works in a

leave year (but subject to a maximum of

4 working weeks).

The time at which annual leave may be

taken is determined by the employer

having regard to work requirements, and

subject to the employer taking into account

the need for the employee to reconcile

work and family responsibilities, and the

opportunities for rest and recreation

available to the employee.

The Organisation of Working Time Act

provides that the employees concerned or

their trade unions are consulted at least 1

month in advance of the dates selected

by the employer for annual leave. The

employee’s annual leave must be taken

within the leave year to which it relates

or, with the employee’s consent, within 6

months of the next leave year. Where the

employeeis,duetocertiedabsencedueto

illness, unable to take all or part of the leave

during that period of 6 months, that leave

may be taken within 15 months of the end

of that leave year

4

.

The pay for the annual leave must be given

in advance of the commencement of the

employee’s annual leave, and is calculated at

the normal weekly rate.

Where an employee ceases to be employed

and annual leave remains to be taken, the

employee should receive compensation for

the loss of any untaken leave calculated

at the normal weekly pay rate or at a rate

proportionate to the normal weekly pay rate

that he/she would have received had he/she

been granted that leave.

3

See Section 19(1)(A) of the Organisation of Working Time Act, 1997 (as inserted by Section 86(1)(a) of the Workplace

Relations Act 2015)

4

See Section 20(1)(c) of the 1997 Act (as inserted by Section 86(1)(b) of the Workplace Relations Act 2015

25

Public Holidays

The Organisation of Working Time Act

1997 provides for the following nine public

holidays:

In respect of each public holiday, an employee

is entitled to:

(i) a paid day off on the holiday, or

(ii) a paid day off within a month, or

(iii) an extra day’s annual leave, or

(iv) an extra days pay

as the employer may decide.

If the public holiday falls on a day on which

the employee normally works, then the

employee is entitled to either a paid day off,

an additional day’s pay, a paid day off within a

month of the day, or an additional day of paid

annual leave for the public holiday.

If the public holiday falls on a day on which

the employee does not normally work, then

the employee is entitled to 1/5th of his/

her normal weekly wage for the day, which

rate of pay is paid if the employee receives

options (i) (ii) or (iv), above, as may be decided

by the employer.

If the employee is asked to work on the

public holiday, then he/she is entitled to

either an additional day’s pay for the day, or a

paid day off within a month of the day, or an

additional day of paid annual leave.

There is no service requirement in respect of

public holidays for whole-time employees.

Other categories of employees (part-time)

qualify for public holiday entitlement

provided they have worked at least 40 hours

during the 5 weeks ending on the day before

a public holiday.

(Note that this Act refers to public holidays

not bank holidays. Not every ofcial bank

holiday is a public holiday though in practice

most of them coincide.)

Sunday Premium

If not already included in the rate of pay,

employees are generally entitled to paid

time-off in lieu or a premium payment for

Sunday working. An employee is entitled to

the premium payment for Sunday working

payable to a comparable employee in a

collective agreement in force in a similar

industry or sector. This means that the

Sunday Premium, if not already paid, will be

equivalent to the closest applicable collective

agreement which applies to the same or

similar work under similar circumstances

and which provides for a Sunday premium.

The premium can be in the form of:

4 An allowance

4 Increased rate of pay

4 Paid time off

4 Combination of the above

Public Holidays

1st January (New Year’s Day)

St.Patrick’sDay;

EasterMonday;

therstMondayinMay;

therstMondayinJune;

therstMondayinAugust;

thelastMondayinOctober;

ChristmasDay;

St. Stephen’s Day.

26

Zero Hours

Employees will be entitled to be paid for 25%

of the time which they are required to be

available or 15 hours whichever is the lesser,

e.g. if an employee’s contract of employment

operates to require the employee to be

available for 48 hours in a week, he/she will

be entitled to a minimum payment of 12

hours even if not required to work that week.

The Zero Hours provision does not apply to

lay-offs, short-time, emergency or exceptional

circumstances, employee illness or employee

on-call.

Records

Records required to be kept by the

employer are prescribed by S.I. No. 473

of 2001, Organisation of Working Time

(Records) (Prescribed Form and Exemptions)

Regulations, 2001. These records must be

retained for 3 years and must be available

for inspection by Inspectors of the Workplace

Relations Commission.

The regulations provide that employers are

required to keep:

(i) a record of the number of hours

worked by employees (excluding

meals and rest breaks) on a daily and

weeklybasis;

(ii) a record of leave granted to

employees in each week by way of

annual leave or in respect of a public

holiday and payment made in respect

ofthatleave;

(iii)aweeklyrecordofthenotication

ofthestartingandnishingtimeof

employees.

In relation to (i) above, the Regulations

incorporate statutory Form OWT1 on which

employers who do not have electronic

means of recording must record the number

of hours worked by employees on a daily and

weekly basis.

The Regulations also require that an employer

keep a copy of the statement provided to each

employee under the provisions of the Terms

of Employment (Information) Acts 1994 to

2014 – See Terms of Employment -Section 3.

The Regulations provide for exemptions,

subject to certain conditions, in relation

to the keeping by employers of records

of rest breaks and rest periods under the

Organisation of Working Time Act 1997.

Complaints

The Acts provide a right of complaint

to the Workplace Relations Commission

(WRC) where an employee believes that

a contravention of the Organisation of

Working Time Act, 1997 has occurred. The

relevant complaint form is available on

www.workplacerelations.ie or by contacting

the Commission’s Information and Customer

Services on

0818

80 80 90. There is a right

of appeal by either party to the Labour Court

fromadecisionofaWRCAdjudicationOfcer.

Where a WRC inspector is satised

that certain contraventions under the

Organisation of Working Time Act 1997

have occurred, he/she may, in accordance

with Section 28 of the Workplace Relations

Act 2015, issue a Compliance Notice on the

employer setting out the compliance actions

tobetakenbyaspecieddate.Anemployer

may, not later than 42 days of the service of

the notice, appeal that notice to the Labour

Court. Failure to comply with a Compliance

Notice is an offence. Compliance Notices

may be issued in respect of the following

contraventions of the 1997 Act:

27

Additional Information

See, Explanatory Leaet on Sunday

Premium and Zero Hours, Explanatory

Leaet on Organisation of Working

Time Act 1997 or Code of Practice on

Compensatory Rest, copies of which are

available on request, or downloadable from

www.workplacerelations.ie.

Section of 1997 Act

Failure of employer to grant compensatory rest periods.

Failure of employer to grant a daily rest period

Failure of employer to grant rest breaks

Failure of employer to grant a weekly rest period

Failure of employer to compensate employee for Sunday work

Employer permitting employee to work more than maximum working week

Employer permitting a night worker to work more than the permissible

hours for a 24 hour period

Failure of employer to notify employee of working hours

Failure of employer to make a payment under Section 18(2) to an employee

with zero-based working hours.

Failure of employer to grant annual leave entitlements

Failureofemployertoreckonacertiedabsenceduetoillnessforthe

purpose of annual leave entitlement

Failure of employer to grant annual public holiday entitlements

Failure of employer to comply with public holiday supplementary provisions

Failure of employer to grant compensation on cessation of employment for

the loss of annual leave

Failure of employer to grant compensation on cessation of employment for

the loss of public holidays

Section 6(2)

Section 11

Section 12

Section 13

Section 14(1)

Section 15(1)

Section 16(2)

Section 17

Section 18

Section 19(1)

Section 19(1)(A)

Section 21

Section 22

Section 23(1)

Section 23(2)

Contravention

28

29

General

The Protection of Employees (Part-Time

Work) Act 2001 provides that

(i) Apart-timeemployee(asdened

below) cannot be treated in a

less favourable manner than a

comparable full-time employee in

relation to conditions of employment.

(ii) All employee protection legislation

applies to part-time employees in the

same manner as it already applies to

full-time employees. Any qualifying

conditions (with the exception of

any hours thresholds) applying to

full-time employees in any of that

legislation, also apply to part-time

employees.

THE 2001 ACT ALSO PROVIDES THAT

(i) A part-time employee may be treated

in a less favourable manner than

acomparable full-time employee

where such treatment can be

justiedonobjectivegrounds(see

denitionbelow).

(ii) A part-time employee may be treated

less favourably than a comparable

full-time employee in relation to

any pension scheme or arrangement

when his/her normal hours of work

constitute less than 20 per cent of

the normal hours of work of the

comparable full-time employee.

This provision does not prevent an

employer and a part-time employee

from entering into an agreement

whereby that employee may receive

thesamepensionbenetsasa

comparable full-time employee.

Who is Covered By The Act?

In general the Act applies to any part-time

employee

(i) working under a contract of

employment or apprenticeship

(ii) employed through an employment

agency, or

(iii)holdingofceunder,orintheservice

of, the State including members

of the Garda Siochana and the

Defence Forces, civil servants and

employees of any health board,

harbour authority, the Health

Service Executive, local authority or

education and training board.

In the case of agency workers, the party

who is liable to pay the wages (employment

5 Part-Time Employees

Workplace Relations Commission -

Guide to Employment, Labour and Equality Law

30

agency or client company) will, normally, be

deemed to be the employer for the purposes

of the Act and be responsible for ensuring

that a part-time employee is not treated in

a less favourable manner than a comparable

full-time employee.

Objective grounds

A ground would be considered as an objective

ground for treatment in a less favourable

manner, if it is based on considerations

other than the status of the employee as a

part-time worker and the less favourable

treatment is for the purpose of achieving a

legitimate objective of the employer and

such treatment is necessary for that purpose.

Part-Time Employee

A part-time employee means an employee

whose normal hours of work is less than

the normal hours of work of a comparable

employee in relation to him/her.

Full-Time Employee

A full-time employee means an employee

who is not a part-time employee.

Comparable Employee

A comparable employee is a full-time

employee (of the same or opposite sex) to

whom a part-time employee (dened in

the Act as a “relevant part-time employee”)

compares himself/herself where the

following conditions are met:

(a)

where the comparable employee and

the part-time employee are employed

by the same or associated employer

and one of the conditions referred to

in (i), (ii) or (iii) below is met,

(b) where (a) above does not apply

(including a case where the part-time

employee is the sole employee of the

employer), the full-time employee is

speciedinacollectiveagreement

to be a comparable employee in

relation to the part-time employee, or

(c)

where neither (a) or (b) above applies,

the full-time employee is employed

in the same industry or sector

of employment as the part-time

employee and one of the conditions

referred to in (i), (ii) or (iii) below is met.

The following are the conditions (i), (ii) and

(iii) referred to above –

(i) where both employees perform the

same work under the same or similar

conditions or each is interchangeable

with the other in relation to the work,

(ii) where the work performed by one

of the employees concerned is of

the same or a similar nature to

that performed by the other and

any differences between the work

performed or the conditions under

which it is performed by each, either

are of small importance in relation

to the work as a whole or occur

with such irregularity as not to be

signicant,and

(iii) the work performed by the part-time

employee is equal or greater in value

to the work performed by the other

employee concerned, having regard

to such matters as skill, physical or

mental requirements, responsibility

and working conditions.

31

Agency Worker

Agency worker means an individual who

agrees with another person, who is carrying

on the business of an employment agency, to

do or perform personally any work or service

for a third person (whether or not the third

person is party to the contract). A part-time

agency worker can only compare himself/

herself to a comparable employee who is also

an agency worker and a part-time employee,

who is not an agency worker, cannot compare

himself to an agency worker.

Complaints

The 2001 Act provides a right of complaint

to the Workplace Relations Commission

(WRC) where an employee believes that a

contravention of the Protection of Employees

(Part-Time Work) Act 2001 has occurred. The

relevant complaint form is available on

www.workplacerelations.ie or by contacting

the Commission’s Information and

Customer Services on

0818

80 80 90.

There is a right of appeal by either party to

the Labour Court fromadecisionofaWRC